UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018.

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-34246

SMARTHEAT INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

98 -0514768 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

60 East Ren-Min Road

Dachaidan

(Da Qaidam Administrative Committee)

XaiXi, Qinghai Province 817000

(Address of principal executive offices)

Registrant’s telephone number, including area code:

+86 (097) 782-8122

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.001 |

|

HEAT |

|

Grey |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☐ No ☑

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes ☐ No ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or, an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company”, in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☑ |

|

(Do not check if smaller reporting company) |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☑

The aggregate market value of voting common stock held by non-affiliates computed by reference to the price at which the common stock was last sold on June 30, 2018, was $0.0001 per share. Accordingly, effective as of June 30, 2018, the registrant’s aggregate market value was less than $50 million and the registrant qualifies for “smaller reporting company” status under Rule 12b-2 of the Exchange Act and is subject to the disclosure requirements and filing deadlines for smaller reporting companies.

As of July 1, 2019 there were 185,986,370 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

|

PART I |

||

|

|

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

14 |

|

|

Item 1B. |

30 |

|

|

Item 2. |

31 |

|

|

Item 3. |

31 |

|

|

Item 4. |

31 |

|

|

|

|

|

|

PART II |

||

|

|

|

|

|

Item 5. |

32 |

|

|

Item 6. |

32 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 |

|

Item 7A. |

44 |

|

|

Item 8. |

44 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

44 |

|

Item 9A. |

44 |

|

|

Item 9B. |

45 |

|

|

|

|

|

|

PART III |

||

|

|

|

|

|

Item 10. |

46 |

|

|

Item 11. |

51 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

53 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

54 |

|

Item 14. |

56 |

|

|

|

|

|

|

PART IV |

||

|

|

|

|

|

Item 15. |

57 |

|

|

Item 16. |

59 |

|

|

|

59 |

|

|

|

|

|

|

|

60 |

|

NOTE ABOUT FORWARD-LOOKING STATEMENTS

In this Annual Report on Form 10-K, references to “SmartHeat,” the “Company,” “we,” “us,” “our” and words of similar import refer to SmartHeat Inc., unless the context requires otherwise.

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this report. These factors include, among others:

● our ability to raise capital to develop our lithium carbonate business;

● successful commercialization of our pilot brine-based boron and lithium extraction process;

● anticipated timing and results of construction and development of additional brine-based extraction plants;

● estimates of the mineral resources and mineral reserves on the properties of our sole supplier of lithium and boron raw materials;

● demand for lithium and anticipated growth in the electric vehicle market;

● estimates of and unpredictable changes to the market prices for lithium and boric acid ;

● ability of our sole supplier to maintain mining, environmental and other permits or approvals;

● the impact of increasing competition in the lithium carbonate and boric acid production businesses;

● compliance with environmental laws and regulations and changes thereto;

● government regulation of mining and extraction operations and treatment under governmental and taxation regimes;

● declines in general economic conditions in the markets where we may compete; and,

● accuracy of current budget and construction estimates.

You should read any other cautionary statements made in this Annual Report as being applicable to all related forward-looking statements wherever they appear in this Annual Report. We cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate and therefore prospective investors are encouraged not to place undue reliance on forward-looking statements. You should read this Annual Report completely. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

Additional information on the various risks and uncertainties potentially affecting our operating results are discussed in this report and other documents we file with the Securities and Exchange Commission, or the SEC, or upon written request to our corporate secretary at: 60 East Ren-Min Road, Dachaidan, (Da Qaidam Administrative Committee), XaiXi, Qinghai Province, China 817000. We undertake no obligation to revise or update publicly any forward-looking statements for any reason, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements.

Our functional currency is the U.S. Dollar, or USD, while the functional currency of our subsidiaries in China are denominated in Chinese Yuan Renminbi, or RMB, the national currency of the People’s Republic of China, which we refer to as the PRC or China, and the functional currency of our subsidiary in Germany is denominated in Euros, or EUR. The functional currencies of our foreign operations are translated into USD for balance sheet accounts using the current exchange rates in effect as of the balance sheet date and for revenue and expense accounts using the average exchange rate during the fiscal year. See Note 2 of the consolidated financial statements included herein.

PART I

General

We are a boric acid manufacturing company in the PRC. Our strategy is to expand our existing boric acid manufacturing facilities to produce lithium carbonate for the rapidly growing electric vehicle ("EV") battery market in China. We have collaborated with our director, Xing Hai Li, to build a prototype production line that is capable of producing up to 1,000 tons of lithium carbonate and 2,000 tons of boric acid per year which we plan to expand to 30,000 tons of lithium carbonate and 60,000 tons of boric acid per year over the next five years which we expect to be funded by internal growth, debt and equity financing of approximately $180,000,000. According to Fastmarkets, the May 2019 price for battery grade lithium carbonate in China was between 70,000 – 77,000 RMB per ton (approximately $10,000 – $11,000 per ton) and between 4,530 and 4,620 RMB per ton (approximately $650 to $670 per ton). We source our ore and brine exclusively from our affiliated company located in nearby Dachaidan Lake and its surrounding areas.

We currently operate our production facility through our wholly owned subsidiary, Qing Hai Mid-Heaven Boron & Lithium Technology Company, Ltd. (“Qinghai Technology”). Qinghai Technology manufactures and sells boric acid and related compounds for industrial and consumer use. We purchase and process mineral rich ore and brine exclusively from our affiliated mining company Qing Hai Mid-Heaven Boron & Lithium Mining Company, Ltd. (“Qinghai Mining”) and are one of the leading producers of boric acid in China with a production capacity of approximately 15,000 tons per year of boric acid or approximately 62% of the output in the in Qinghai Province and 10.7% of total production in China according to an annual report published by the China Inorganic Salts Industry Association (CISIA). Our boric acid is sold to industries located throughout the PRC. We have a unique “one step production” methodology in China which we believe gives us a significant advantage over our competitors.

Our Strategy

We believe that growth in the Electric Vehicle (“EV”) industry will drive significant growth in the demand for lithium carbonate. Qinghai Technology successfully completed a pilot brine extraction project with a partner where it extracted and produced industrial grade lithium carbonate and boric acid from the mineral rich waters of Dachaidan Lake located approximately 8 kilometers from its manufacturing facility.

Qinghai Technology plans to process the deposits of lithium harvested from brine sourced out of Dachaidan Lake and its surrounding areas. We plan to leverage our position as leading producer of boric acid and boron in the Qinghai-Tibetan Plateau in China, leverage our knowledge of mineral processing in boric acid, boron and related minerals, develop our supply and sales chain for battery grade lithium carbonate and upgrade our facilities and production processes to produce lithium carbonate for batteries used in China’s rapidly growing EV’s. We will need to the funding for the first phase of our development to produce 10,000 tons of lithium carbonate per year will initially require approximately $20,000,000 and an additional $160,000,000 to expand to 30,000 tons of lithium carbonate and 60,000 tons of boric acid per year.

We believe our current production experience, exclusive access to local natural resources, and current financial condition uniquely position us to transition our business into being a unique, profitable, pure-play source of lithium to the China markets.

Our Headquarters in Haxi

(Source: Qinghai Technology)

Our Boron and Lithium Business

Boron

Qinghai Technology has the production capacity of approximately 15,000 tons of boric acid and related chemicals per year by using the traditional extraction processes of crushing ore and processing the resultant dust through its facilities. We believe our facility produced approximately 10.7% of the total national output in the PRC in 2018 according to an annual report produced by the CISA. We plan to replace the crushed ore processing with processing brine sourced from nearby Dachaidan Lake by the middle of 2020 subject to financing. We plan to expand current ore processing production capacity from 15,000 tons annually to 60,000 tons of boric acid annually.

China and the US are the largest consumers of boric acid. The major end users of boric acid are manufacturers of ceramic and tiles and fiberglass which accounts for nearly 50% of the global consumption of boric acid. Pharmaceuticals, agriculture, cosmetics, and wood preservation industries are the other end users of our boric acid. The global boric acid market is anticipated to grow at a CAGR of 5.55% during the period from 2018 to-2022.(Source: Tecnivo “Huge Demand in Boric Acid Compound Market 2019-2025”) There is a limited set of competitors in the boric acid and boron market because supplies are very limited which consist of Borax Morarji, Gujarat Boron Derivatives Private, Mizushima Ferroalloy, Russian Bor, Rio Tinto Group, Searles Valley Minerals and Tomiyama Pure. (Source: Tecnivo “Top 6 Vendors in the Global Boric Acid Market from 2016 to 2020”). We also plan to improve our production process to produce boron for will be hardened steel used in nuclear plants, heavy machinery cars, trucks and aircraft.

Qinghai Technology has historically sold all of the material it has produced, and we believe the trend will continue as it shifts its production away from crushed ore to the brine refinement process. In 2018, Qinghai Technology produced approximately 10,500 tons of boric acid from operations due to a two-month closure due to plant maintenance. It expects to sell all of the boric acid it produces in 2019. In addition, we believe that margins and purity will improve due to the lower cost of production, improved reclamation processes and reduction of hazardous waste material. Qinghai Technology’s boric acid in May of 2019 sold for approximately RMB 4,350 (USD 630) per ton which we expect to increase to approximately RMB 7,000 (USD 1,015) per ton due to improvement in the purity of our product with new production techniques.

Qinghai Technology uses the one-step method to produce boric acid. Boron ore is mixed with sulfuric acid, processed through a mixing process and heated until boric acid powder is produced. Qinghai Technology obtains sulfuric acid in both pure form and recycled sulfuric acid disposed as a hazardous waste product by industrial users.

The current consumption of boric acid in the Chinese market is about 550,000 tons per year with a market value of 1.7 billion yuan, or approximately $247 million with imports consisting of approximately 234,000 tons. (Source: Annual Report by CISIA). We currently distribute or boric acid through the following industrial distribution channels: Dingjia Zhixin (鼎佳智信), Sichuan Dawei (四川达威), Chengdu Fuyang (成都蜀阳), Del Bor Industry (德尔硼业), Jinchang Xi Li (金昌西立) and Xinjiang Huier Agricultural Group (新疆慧尔农业集团) which account for our largest customers.

Qinghai Technology’s Boric Acid Manufacturing Plant – Haxi

(Source: Qinghai Technology)

|

|

Lithium

Our Lithium business will be designed to produce lithium carbonate for the EV battery markets in China. We believe that when we establish our brine extraction manufacturing facilities that we will be a competitive source of low-cost producer lithium carbonate producer for use by battery manufactures in China. Most of our local competitors obtain raw materials typically consisting of spodumene (lithium ore) from outside of China in order to produce lithium carbonate. We believe we will be one of the few local China based lithium carbonate producers with a local supply of raw materials making us a pure-play China based lithium carbonate producer for the local EV battery market.

Production of battery grade lithium carbonate is a priority for China’s national industrial policy and is in line with the Qinghai province's economic development policy. Source: Qing Hai Province government’s guide document (2018 No 41)“The guideline for improvement of Lithium Industry in Qing Hai Province” issued by Qing Hai Province Government Office) It plays an important role and practical significance for promoting the development of the local economy and the extension of the industrial chain. We believe our lithium carbonate project will receive favorable tax incentives and be able to operate at high margins. We have inexpensive sources of electricity, coal, natural gas resources and labor resources to produce our products. Brine processing technology is also more environmentally friendly and reliable than processing ore obtained from traditional strip-mining methods which reduces our expenses for reclamation.

Qinghai Mining plans to transport evaporated brine from its brine pools to our processing plant. The brine will be treated with chemicals to separate the boron from the lithium and transferred to two different assembly lines where they are further processed into boric acid, boron and related compounds and into lithium carbonate. The process will be divided into two steps. In the first step, the boron extractant will be used to extract boron to produce crude boric acid, and then sent to the existing boric acid factory for finishing to produce refined boric acid; the second step will use lithium extractant to extract lithium, and after extracting lithium, the battery-grade lithium carbonate will be produced by precipitation method.

The extraction process of lithium from brine pools involve several transitions between ponds. First the brine material will be pumped from underground brine wells into a pond where itis expected to evaporate allowing it to concentrate. Then the concentrated brine will be pumped to another pond where sodium chloride will crystalize and precipitate. The brine is then moved to another ponds where more sodium chloride precipitation occurs and then slaked lime will be added they are depleted, leaving a brine consisting of approximately 0.5% lithium. The brine is transported by underground and over ground piping system to Qinghai Technology where lithium carbonate (Li2CO3) is extracted

Lithium is typically extracted from the mineral spodumene and from brine-lakes, salt-pan deposits or salt flats. The extraction process of lithium from brine-lakes requires less energy and lower production costs than spodumene ore deposits.

Local Brine Pool - - source of lithium and boron raw materials owned by Qinghai Mining

(Source – Qinghai Mining)

Pilot Brine Processing Assembly Line for Lithium Carbonate and Boric Acid

If we are successful in our funding efforts, we plan to locate the operations in a new, nearby facility located in the Boric Chemical Industrial Zone in Haxi. As a qualified business under the China Government’s strategy of Develop-the-West, from January 1, 2011 through December 31, 2020, all the qualified business including Qinghai Technology is subject to a reduced income tax rate of 15% compared to a national customary rate of 25%. Each of the three facilities will house brine processing plants expected to produce 10,000 tons of lithium carbonate and 20,000 tons of boric acid, boron and related compounds per year.

We received all of our environmental permits from Haixi Environmental Protection Bureau on April 2, 2011 (Xihuanzi (2011)( No. 63)and production permits to commence our new brine processing business in Haxi) We plan to initially establish a production line producing 3,000 tons of lithium carbonate and 6,000 tons of boron acid annually which will require initial funding of approximately $20,000,000. We expect to produce 10,000 tons of lithium carbonate and 20,000 tons of boric acid in 2020 if we are able to meet our funding target of an additional $40,000,000. In the third phase of our development plans, we plan to raise an additional $120,000,000 of financing to produce 30,000 tons of lithium carbonate for EV batteries and 60,000 tons of boric acid. According to Fastmarkets, the May 2019 price for battery grade lithium carbonate in China was between 70,000 – 77,000 RMB per ton (approximately $10,000 – $11,000 per ton) and between 4,530 and 4,620 RMB per ton (approximately $650 to $670 per ton) for boric acid.

First of Three Proposed New Manufacturing Facilities

(Source: Qinghai Technology)

Qinghai Mining

Qinghai Technology purchases all of its lithium and boron based raw materials consisting of ore and brine from our affiliated company Qinghai Mining. Our Chairman and the General Manager of Qinghai Technology owns approximately76% of Qinghai Mining and one of our principal stockholders and brother of our Chairman, Mr. Jian Zhang, owns approximately 21%.Qinghai Mining.

Qinghai Technology has signed an exclusive agreement with Qinghai Mining to purchase all of the boron and minerals produced by them. Under the terms of the agreement.….

Mid -Haven Mining has the exclusive right to mine minerals, including boron and lithium ore and brine, from an area of 35.6975 kilometers in Dichaidan (Haixi) in the Qinghai Province which is in the heart of the Quinghai-Tibet Plateau. The area is rich in boron, lithium, magnesium and bromide found in local ore deposits and in mineral rich brine pools. -Haven Mining has mining rights until 2034 for existing properties with an option to extend an additional 20 years. The properties are reviewed every five years to ensure compliance with the mining rights.

Topographical map of Haixi and Lake Dichaidan the location of the brine pools.

(Source Google Maps & Qinghai Mining)

Competition

The global lithium market consists of producers primarily located in the Americas, Asia and Australia. Our competitors supplying lithium compounds include Livent Corporation, Sociedad Quimica y Minera de Chile S.A., Sichuan Tianqi Lithium, and Jiangxi Ganfeng Lithium. Competition in the lithium market is largely based on product quality, product diversity, reliability of supply and customer service. In china our principal competitors are the Yahua Group, Tainqui Lithium and Gangfen Lithium

Expansion of our Production Capacities

Global electric vehicle sales grew from 1.2 million units in 2012 to 3.0 million units in 2017, representing a compound annual growth rate (CAGR) of 19%, and is expected to reach 8.6 million units by 2022, representing a CAGR of 23%, according to CRU International Limited. The Chinese government has also been focusing on developing the new-energy vehicle industry and has introduced generous incentives to encourage purchases of electric vehicles. From 2016 to 2017, the demand for lithium-based batteries shifted from a focus on quantity to quality and we believe there is a shortage in supply of high quality lithium batteries but an excess supply of low quality lithium batteries.

We plan to further modernize and expand our facilities, plant and brine extraction process at of Qinghai Technology to increase lithium carbonate production to 30,000 tons per year and boric acid production to approximately 60,000 tons per year. In order to reach these production targets, we and our subsidiaries will embark on a capital improvement project to raise approximately $180,000,000 in equity, debt, bank funding and government subsidies in order to open a new three building facility and production line located in the Boron Chemical Industrial Zone in Haixi.

Qinghai Technology and Qinghai Mining have received all necessary commercial, environmental and water extraction rights for the commercialization of lithium carbonate and boric acid from Dichaidan Lake.

As a qualified business under the China Government’s strategy of Develop-the-West, from January 1, 2011 through December 31, 2020, all the qualified business including Qinghai Technology is subject to a reduced income tax rate of 15% compared to a national customary rate of 25%.

Our History

We were originally incorporated as Pacific Goldrim Resources, Inc.on August 4, 2006, in the State of Nevada and, at that time, had little or no operations. On April 14, 2008 we changed our name to SmartHeat Inc. and acquired all of the equity interests in Shenyang Taiyu Machinery & Electronic Equipment Co., Ltd. (“Taiyu”), at that time a leading developer of plate heat exchangers and heat pumps in China. In December of 2014, we sold Taiyu to members of our former management team. Since that time the company serviced existing customers, sold existing inventory and wound down its heat pump business operations after filing for bankruptcy protection in the PRC in 2016.

On December 31, 2018, we acquired as our wholly owned subsidiary, Mid-Heaven Sincerity International Resources Investment Co., Ltd, and its wholly owned subsidiary Qinghai Technology in exchange for 141,919,034 shares of our Common Stock in a tax-free reorganization. We expect to discontinue or sell the remainder of our prior business operations during our 2019 fiscal year.

We were originally formed as a state owned entity in 1954 producing boron related products and filed for bankruptcy in 2000. Our Chief Executive Officer purchased the assets of the company and founded Qing-Hai Zhong Tian Boron & Lithium Mining Co., Ltd on March 6th 2001. Qinghai Technology was spun out of Qing-Hai Zhong Tian Boron & Lithium Mining Co., Ltd on December 20, 2018 and Qing-Hai Zhong Tian Boron & Lithium Mining Co., Ltd changed its name to Qing Hai Mid-Heaven Boron & Lithium Mining Company, Ltd.

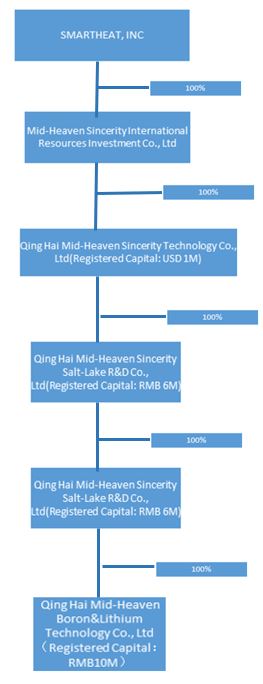

Our current corporate structure is set forth in the following diagram:

Regulation

We are subject to the following regulations of the SEC and applicable securities laws, rules and regulations:

Smaller Reporting Company

We are subject to the reporting requirements of Section 13 of the Exchange Act, and subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K applicable to larger companies

Sarbanes/Oxley Act

We are also subject to the Sarbanes/Oxley Act of 2002. The Sarbanes/Oxley Act created an independent accounting oversight board to oversee the conduct of auditors of public companies and strengthen auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; auditor attestation to management’s conclusions about internal controls; prohibits certain insider trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes/Oxley Act will substantially increase our legal and accounting costs.

Exchange Act Reporting Requirements

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to stockholders at special or annual meetings thereof or pursuant to a written consent will require us to provide our stockholders with the information outlined in Schedules 14A or 14C of Regulation 14; preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies of this information are forwarded to our stockholders.

We are also required to file Annual Reports on SEC Form 10-K and Quarterly Reports on SEC Form 10-Q with the SEC on a regular basis, and will be required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in a Current Report on SEC Form 8-K.

Laws of the Peoples Republic of China

Our subsidiaries located in China are subject to national, provincial and local laws of the PRC. The legal system in China is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, China began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in China and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic and commercial matters, but these recently enacted laws and regulations may not cover all aspects of business activities in China sufficiently. In particular, because these laws and regulations are relatively new, the interpretation and enforcement of these laws and regulations involve uncertainties, which may limit legal protections available to our subsidiaries. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, there may be certain instances when we may not be aware of our subsidiaries violation of these policies and rules until sometime after such violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

The PRC government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. Our subsidiaries’ ability to enforce commercial claims or to resolve commercial disputes under these laws and regulations is unpredictable, however, because the implementation, interpretation and enforcement of these laws and regulations is limited and, given their relative newness, involve uncertainties. For example, contracts governed by PRC law tend to contain less detail than those under U.S. law and generally are not as comprehensive in defining the rights and obligations of the contracting parties. Consequently, contracts in China are more vulnerable to disputes and legal challenges than those in the U.S. In addition, contract interpretation and enforcement in China is not as developed as in the U.S., and the result of any contract dispute is subject to significant uncertainties. Our subsidiaries currently are not subject to any contract dispute, but we cannot assure you that our subsidiaries will not be subject to future contract disputes with our suppliers, franchisees and other customers under contracts governed by PRC law, and if such disputes arise, we cannot assure you that our subsidiaries will prevail.

Industry Polices

Foreign investors and foreign-funded enterprises investing in China are required to comply with the Catalog for Guiding on Foreign Investments in Industries (《外商投資產業指導目錄》) which was initially promulgated by the National Planning Commission (國家計劃委員會), the State Economic and Trade Commission (國家經濟 貿易委員會) and the Ministry of Foreign Trade and Economic Cooperation (對外貿易經濟合作部) on June 28, 1995 and subsequently amended on December 31, 2001, March 11, 2002, November 30, 2004, October 31, 2007, December 24, 2011 and March 10, 2015. The latest amendment was made on June 28, 2017 and came into effect on July 28, 2017. The catalog for guiding on foreign investments has served as domestic management and guidance on foreign investments for a long time. It classifies industries into three basic types: Encouraged, Restricted and Prohibited. The Catalogue divides industries into three categories: “encouraged,” “restricted,” and “eliminated” for investment. Industries not listed in the Catalogue are generally deemed as falling into a fourth category, “permitted.”.

Domestic industry development mainly follows the guidance on relevant industry structures introduced by the NDRC. According to the Notice of the National Development and Reform Commission [2017] No. 1 —— Guiding Catalog of Key Products and Services for Strategic Emerging Industries (2016) (《國家發展和改革委員會公告2017年第1號——戰略性新興產業重點產品和服務指導目錄(2016版)》) promulgated and implemented by the National Development and Reform Commission on January 25, 2017 lithium and boron extracting from carbonate-type brine rich in lithium and boron fall into the key products and services in strategic emerging industries. According to the Guiding Catalog for Industrial Restructuring (2011 Edition) (《產業結構調整指導目錄(2011年本)》), which was promulgated by the National Development and Reform Commission on March 27, 2011, with the latest amendment on February 16, 2013, and was implemented on May 1, 2013, exploration and comprehensive use of scarce chemical mineral resources, such as lithium and boron fall into the state-encouraged industries.

Regulations on Tax

Our business operations are governed primarily by tax laws in the PRC. A description of the material tax consequences applicable to holders of our common shares may be found in the section titled “Item 10. Additional Information.-E. Taxation.” For more information regarding the impact of the PRC Enterprise Income Tax Law, see “Risk Factors — Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

Foreign Exchange Regulation

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations. Under the PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, may be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. By contrast, approval from or registration with appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of foreign currency-denominated loans or foreign currency is to be remitted into China under the capital account, such as a capital increase or foreign currency loans to our PRC subsidiaries.

In August 2008, SAFE issued the Circular on the Relevant Operating Issues Concerning the Improvement of the Administration of the Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or SAFE Circular 142, regulating the conversion by a foreign-invested enterprise of foreign currency-registered capital into RMB by restricting how the converted RMB may be used. In addition, SAFE promulgated Circular 45 on November 9, 2011 in order to clarify the application of SAFE Circular 142. Under SAFE Circular 142 and Circular 45, the RMB capital converted from foreign currency registered capital of a foreign-invested enterprise may only be used for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC. In addition, SAFE strengthened its oversight of the flow and use of the RMB capital converted from foreign currency registered capital of foreign-invested enterprises. The use of such RMB capital may not be changed without SAFE’s approval, and such RMB capital may not in any case be used to repay RMB loans if the proceeds of such loans have not been used.

In November 2012, SAFE promulgated the Circular of Further Improving and Adjusting Foreign Exchange Administration Policies on Foreign Direct Investment, which substantially amends and simplifies the current foreign exchange procedure. Pursuant to this circular, the opening of various special purpose foreign exchange accounts, such as pre-establishment expenses accounts, foreign exchange capital accounts and guarantee accounts, the reinvestment of RMB proceeds by foreign investors in the PRC, and remittance of foreign exchange profits and dividends by a foreign-invested enterprise to its foreign shareholders no longer require the approval or verification of SAFE, and multiple capital accounts for the same entity may be opened in different provinces, which was not possible previously. In addition, SAFE promulgated the Circular on Printing and Distributing the Provisions on Foreign Exchange Administration over Domestic Direct Investment by Foreign Investors and the Supporting Documents in May 2013, which specifies that the administration by SAFE or its local branches over direct investment by foreign investors in the PRC shall be conducted by way of registration and banks shall process foreign exchange business relating to the direct investment in the PRC based on the registration information provided by SAFE and its branches.

In July 2014, SAFE decided to further reform the foreign exchange administration system in order to satisfy and facilitate the business and capital operations of foreign invested enterprises, and issued the Circular on the Relevant Issues Concerning the Launch of Reforming Trial of the Administration Model of the Settlement of Foreign Currency Capital of Foreign-Invested Enterprises in Certain Areas, or Circular 36, on August 4, 2014. This circular suspends the application of Circular 142 in certain areas and allows a foreign-invested enterprise registered in such areas to use the Renminbi capital converted from foreign currency registered capital for equity investments within the PRC.

On March 30, 2015, SAFE released the Notice on the Reform of the Management Method for the Settlement of Foreign Exchange Capital of Foreign-invested Enterprises, or Circular 19, which has made certain adjustments to some regulatory requirements on the settlement of foreign exchange capital of foreign-invested enterprises, lifted some foreign exchange restrictions under Circular 142, and annulled Circular 142 and Circular 36. However, Circular 19 continues to, prohibit foreign-invested enterprises from, among other things, using Renminbi fund converted from its foreign exchange capitals for expenditure beyond its business scope, providing entrusted loans or repaying loans between non-financial enterprises.

On June 19, 2016, SAFE issued the Circular of the State Administration of Foreign Exchange on Reforming and Regulating Policies on the Control over Foreign Exchange Settlement of Capital Accounts, or Circular 16, which took effect on the same day. Compared to Circular 19, Circular 16 not only provides that, in addition to foreign exchange capital, foreign debt funds and proceeds remitted from foreign listings should also be subject to the discretional foreign exchange settlement, but also lifted the restriction, that foreign exchange capital under the capital accounts and the corresponding Renminbi capital obtained from foreign exchange settlement should not be used for repaying the inter-enterprise borrowings (including advances by the third party) or repaying the bank loans in Renminbi that have been sub-lent to the third party.

SAFE Circular 37

In July 2014, SAFE issued SAFE Circular 37, which supersedes SAFE Circular 75, and requires that PRC citizens or residents must register with the relevant local SAFE branch before making capital contribution to any offshore entity directly established or indirectly controlled by that PRC citizen or resident for the purpose of investment or financing and with onshore or offshore assets or equity interests legally owned by that PRC citizen or resident. In addition, the SAFE registrations are required to be updated with local SAFE branch with respect to that offshore special purpose company in connection with the change of its basic information, such as its company name, business term, shareholding by individual PRC citizens or residents, merger, or division and, with respect to the individual PRC citizens or residents in case of any increases or decreases of capital in that offshore special purpose company, or share transfers or swaps by the individual PRC citizens or residents.

Share Option Rules

Under the Administration Measures on Individual Foreign Exchange Control issued by the PBOC on December 25, 2006, all foreign exchange matters involved in employee share ownership plans and share option plans in which PRC citizens participate require approval from SAFE or its authorized branch. In addition, under the Notices on Issues concerning the Foreign Exchange Administration for Domestic Individuals Participating in Share Incentive Plans of Overseas Publicly-Listed Companies, or the Share Option Rules, issued by SAFE on February 15, 2012, PRC residents who are granted shares or share options by companies listed on overseas stock exchanges under share incentive plans are required to (i) register with SAFE or its local branches, (ii) retain a qualified PRC agent, which may be a PRC subsidiary of the overseas listed company or another qualified institution selected by the PRC subsidiary, to conduct the SAFE registration and other procedures with respect to the share incentive plans on behalf of the participants, and (iii) retain an overseas institution to handle matters in connection with their exercise of share options, purchase and sale of shares or interests and funds transfers. We will make efforts to comply with these requirements.

Regulation of Dividend Distribution

The principal laws, rules and regulations governing dividend distribution by foreign-invested enterprises in the PRC are the Company Law of the PRC, as amended, the Wholly Foreign-owned Enterprise Law and its implementation regulations and the Equity Joint Venture Law and its implementation regulations. Under these laws, rules and regulations, foreign-invested enterprises may pay dividends only out of their accumulated profit, if any, as determined in accordance with PRC accounting standards and regulations. Both PRC domestic companies and wholly-foreign owned PRC enterprises are required to set aside as general reserves at least 10% of their after-tax profit, until the cumulative amount of such reserves reaches 50% of their registered capital. A PRC company is not permitted to distribute any profits until any losses from prior fiscal years have been offset. Profits retained from prior fiscal years may be distributed together with distributable profits from the current fiscal year.

Labor Laws and Social Insurance

Pursuant to the PRC Labor Law and the PRC Labor Contract Law, employers must execute written labor contracts with full-time employees. All employers must comply with local minimum wage standards. Violations of the PRC Labor Contract Law and the PRC Labor Law may result in the imposition of fines and other administrative and criminal liability in the case of serious violations.

In addition, according to the PRC Social Insurance Law, employers in China must provide employees with welfare schemes covering pension insurance, unemployment insurance, maternity insurance, work-related injury insurance, medical insurance and housing funds.

PRC Laws and Regulations on Hazardous Chemicals

1. Administrative Measures for the Registration of Hazardous Chemicals (《危險化學品登記管理辦法)

According to the Administrative Measures for the Registration of Hazardous Chemicals (《危險化學品登記管理辦法》) promulgated by the State Administration of Work Safety of the People’s Republic of China (中華人民共和國國家安全生產監督管理總局) on July 1 , 2012 and effective from August 1 , 2012, a newly established production enterprise of hazardous chemicals shall proceed with the hazardous chemicals registration procedure before the completion and acceptance of the project. The Hazardous Chemicals Registration Certificate (危險化學品登記證) is valid for three years. The Hazardous Chemicals Registration Certificate (危險化學品登記證) should set out details such as the nature of the enterprise (hazardous chemicals producer, hazardous chemicals exporter or a hazardous chemicals producer and exporter), the registered products and the validity period. An enterprise which engages in the production and storage of hazardous chemicals and an enterprise using such quantities of hyper-toxic and other hazardous chemicals which constitute a material source of danger shall register the hazardous chemicals according to the national laws. The Registration Center for Chemicals under the State Administration of Work Safety shall undertake the specific work and technical management of registration of hazardous chemicals throughout the country. Hazardous chemicals registration offices or hazardous chemicals registration centers established by work safety supervision and administration departments under people’s governments of all provinces, autonomous regions and municipalities directly under the Central Government shall undertake the specific work and technical management of registration of hazardous chemicals within their respective administrative regions.

2. Regulations on Safety Management of Hazardous Chemicals (《危險化學品安全管理條例》)

The Regulations on Safety Management of Hazardous Chemicals (《危險化學品安全管理條例》) were promulgated by the State Council on January 26, 2002 and latest amended on December 7, 2013, which stipulate the administrative and supervisory rules for safety production, storage, use, operation and transportation of hazardous chemicals. Hazardous chemicals include hyper-toxic and other hazardous chemicals that are toxic, corrosive, explosive, flammable or accelerative, and that damage human health, facilities and environment. The relevant governmental authorities will promulgate and adjust the Catalog of Hazardous Chemicals from time to time. An enterprise which engages in the production of hazardous chemicals must obtain the Safety Production Permit for Hazardous Chemicals (危險化學品安全生產許可證) prior to the commencement of production. An enterprise producing hazardous chemicals listed in the Catalog of the Industrial Products that are subject to the production licensing system shall obtain the Production License for Industrial Products pursuant to the Regulations of the People’s Republic of China on Administration of Production Licensing of Industrial Products (《中華人民共和國工業產品生產許可證管理條例》). The safety conditions of newly built, altered or expanded construction projects for the production and storage of hazardous chemicals are subject to the scrutiny of the work safety administrative department. In the event that the enterprise undertaking such construction projects fails to meet the safety conditions, the relevant work safety administrative department shall order such enterprise to cease operation and rectify within the specified period. An enterprise which engages in the operation including storage and operation of hazardous chemicals must obtain the Operation Permit for Hazardous Chemicals prior to the commencement of production. If an enterprise engaging in the production of hazardous chemicals which is established according to the laws sells its hazardous chemicals produced by itself in the factory, there is no need to obtain the Operation Permit for Hazardous Chemicals (危險化學品經營許可). If a chemical enterprise uses hazardous chemicals for production and the quantities reaches the prescribed threshold, the enterprise shall obtain the Permits for Safety Use of Hazardous Chemicals (危險化學品安全使用許可證) pursuant to the Regulations on Safety Management of Hazardous Chemicals (《危險化學品安全管理條例》), save for those enterprises that belong to enterprises engaging in the production of hazardous chemicals. An enterprise which engages in road transportation of hazardous chemicals should comply with provisions of laws and administrative regulations on road transport, obtain the license for road transportation of hazardous chemicals, and proceed with registration procedures with the Administrative Department of Industry and Commerce (工商行政管理部門). An enterprise engaging in road transportation of hazardous chemicals should be equipped with full-time safety management personnel

3. Regulations of the People’s Republic of China on Administration of Production Licensing of Industrial Products (《中華人民共和國工業產品生產許可證管理條例》) and the Decision of the State Council on Adjusting the Catalog for Managing the Production License for Industrial Products and Piloting the Simplified Approval Procedure (《國務院關於調整工業產品生產許可證管理目錄和試行簡化審批程序的決定》)

The Regulations of the People’s Republic of China on Administration of Production Licensing of Industrial Products (《中華人民共和國工業產品生產許可證管理條例》) were promulgated by the State Council and became effective on September 1, 2005, and the Decision of the State Council on Adjusting the Catalog for Managing the Production License for Industrial Products and Piloting the Simplified Approval Procedure (《國務院關於調整工業產品生產許可證管理目錄和試行簡化審批程序的決定》) was promulgated by the State Council and became effective on June 24, 2017. According to the aforesaid regulations and Catalog, an enterprise which engages in the production of hazardous chemicals needs to obtain the Production License for Industrial Products (工業生產許可證).

4. Regulations on Safety Production Permit (《安全生產許可證條例》) and Measures for Implementation of 4. Safety Production Permit of Hazardous Chemicals Production Enterprises(《危險化學品生產企業安全生產許可證實施辦法》)

The Regulations on Safety Production Permit (《安全生產許可證條例》) were promulgated by the State Council and became effective on January 13, 2004 and were latest revised on July 29, 2014. The Measures for Implementation of Safety Production Permit of Hazardous Chemicals Production Enterprises (《危險化學品生產企業安全生產許可證實施辦法》) were promulgated by the State Administration of Work Safety of the PRC and became effective on December 1, 2011 and were revised on May 27, 2015 and March 6, 2017. According to the aforesaid regulations and measures, an enterprise which engages in the production of final products or intermediate products listed in the Catalog of Hazardous Chemicals (危險化學品目錄) must obtain the Safety Production Permit for Hazardous Chemicals (危險化學品安全生產許可證) prior to the commencement of production of hazardous chemicals.

PRC Laws and Regulations Relating to Environmental Protection

The Company may generate pollutants in its course of production, and shall be strictly abide by the environmental protection laws and regulations in the PRC.

1. Environmental Protection Law of the People’s Republic of China (《中華人民共和國環境保護法》)

According to the Environmental Protection Law of the People’s Republic of China (《中華人民共和國環境保護法》) promulgated by the SCNPC on December 26, 1989 and effective on the same day, and amended on April 24, 2014, the construction of any project that causes pollution to the environment must comply with the regulations on environment protection relating to the construction projects. The environmental protection facilities for construction projects shall be designed, constructed and put into operation simultaneously with the main works. The PRC government implements a system for administering licenses for the discharge of pollutants under the provisions of the laws. Enterprises, units and other production operators under the licensing management for pollutant discharge should only discharge pollutants which satisfy the requirements of pollutant discharge license. Those which have not yet obtained the pollutant discharge license may not discharge pollutants. Pollutant-discharging enterprises, units and other production operators shall pay sewage fees pursuant to the relevant provisions of the State.

2. Law of the People’s Republic of China on Environmental Impact Assessment (《中華人民共和國環境影響評價法》)

According to the Law of the People’s Republic of China on Environmental Impact Assessment (《中華人

民共和國環境影響評價法》) promulgated by the SCNPC on October 28, 2002 and latest amended on July 2, 2016, construction entities shall implement the following procedures for their construction projects in accordance with Classification of Construction Project Lists for Environmental Impact Assessments (建設項目環境影響評價分類管理名錄) promulgated by the Ministry of Environmental Protection: (i) in case the environmental impact is significant, full assessment reports of environmental impacts shall be prepared; (ii) in case the environmental impact is mild, reports containing environmental impact analyzes and specific assessments shall be prepared; and (iii) in case the environmental impact is minimal, environmental impacts registration forms shall be submitted without any assessments. The project in case construction may not proceed its environmental impact assessment documents fail to pass the review of the competent authority in accordance with the laws and regulations or which are disapproved after review.

3. Law of the People’s Republic of China on Prevention and Control of Water Pollution (《中華人民共和國水污染防治法》)

According to the Law of the People’s Republic of China on Prevention and Control of Water Pollution (《中華人民共和國水污染防治法》) promulgated by the SCNPC on May 15, 1996 and latest amended on June 27, 2017, an environmental impact assessment must be conducted lawfully in respect of all projects involving the construction, alternation or expansion of water facilities which discharge pollutions directly or indirectly into water. Facilities for prevention and control of water pollution of construction projects must be designed, constructed and put into use or operation simultaneously with the main facility.

4. Law of the People’s Republic of China on Prevention and Control of Atmospheric Pollution (《中華人民共和國大氣污染防治法》)

According to the Law of the People’s Republic of China on Prevention and Control of Atmospheric Pollution (《中華人民共和國大氣污染防治法》) promulgated by the SCNPC on September 5, 1987 and latest amended on August 29, 2015, when construction projects have an impact on atmospheric environment, enterprises and public institutions shall conduct environmental impact assessments and publish the environmental impact assessment documents according to the law; when discharging pollutants to the atmosphere, they shall conform to the atmospheric pollutant discharge standards and abide by the total quantity control requirements for the discharge of key atmospheric pollutants.

Our Offices

Our principal offices are located at 60 East Ren-Min Road, Dachaidan (Da Qaidam Administrative Committee) XaiXi, Qinghai Province 817000. Our telephone number is +86 (097) 782-8122. Our website is www.smartheatinc.com.[ Copies of our annual, quarterly and current reports and any amendments thereto filed with or furnished to the SEC are available free of charge through our website as soon as reasonably practicable after such reports are available on the SEC website at www.sec.gov. Furthermore, a copy of this Annual Report is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

Employees

Quig Hai Tech employs approximately 280 workers of which approximately 21 are employed in research and development. Some of our employees are provided living facilities through government sponsored programs [what are these?]. We also provide meals for our employees.

RISKS RELATING TO OUR INDUSTRY AND BUSINESS

We will require additional financing to implement our business plan, which may not be available on favorable terms or at all, and we may have to accept financing terms that would place restrictions on us.

We believe that we must raise not less than $20,000,000 in addition to current cash on hand to be able to execute the first stage of our business plan to move to our new facilities and build our production capacity of lithium carbonate to 10,000 tons per year and boric acid and related products to 20,000 tons per year. We believe that we must raise not less than $160,000,000 in addition to current cash on hand to be able to execute the first stage of our business plan to move to our new facilities and build our production capacity of lithium carbonate to 30,000 tons per year and boric acid and related products to 60,000 tons per year. We may not be able to obtain equity or debt financing on acceptable terms or at all to implement our growth strategy. As a result, adequate capital may not be available to finance our current development plan, take advantage of business opportunities or respond to competitive pressures. If we are unable to raise additional funds, we may be forced to curtail or even abandon our business plan.

Until such time, if ever, as we can generate substantial product income, we expect to finance our cash needs through a combination of equity offerings, debt financings and cash flow. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interest of existing stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of common stockholders. In addition, the terms of any future financings may impose restrictions on our right to declare dividends or on the manner in which we conduct our business. Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures, declaring dividends, or making acquisitions or significant asset sales.

We are heavily exposed to the market forces in the boric acid, boron and lithium industries, including the current and expected supply and demand of boric acid and lithium.

We are heavily exposed to the market forces in the boric acid and lithium industry, including the current and expected supply and demand of boric acid and lithium which is primarily based on resource availability, the competitive landscape of the boric acid and lithium industry, discovery of new mines, demand in end markets for products in which boric acid and lithium are used, technological developments, government policies as well as global and regional economic conditions.

The demand for boric acid, boron lithium are dependent on factors such as use of the compounds in end markets, new technological developments resulting in product or technology substitutions and general economic conditions.

The demand for our boric acid and boron is primarily driven by demand for construction material such as fiberglass, glass and boron steel used in nuclear reactors and ultra-high strength industrial and military applications. Demand for boric acid is dependent on the PRC’s construction industry’s demand for fiberglass and glass. The demand for boron is subject to general economic conditions for heavy industry’s use of high strength steel.

The increase in demand for lithium in recent years has been primarily driven by the explosive growth in demand for electric vehicle batteries and energy storage batteries. The global electric vehicle sales grew from 1.2 million units in 2012 to 3.0 million units in 2017, representing a CAGR of 19%, and is expected to reach 8.6 million units by 2022, representing a CAGR of 23%, according to CRU International Limited. The Chinese government has also been focusing on developing the new-energy vehicle industry and has introduced generous incentives to encourage purchases of electric vehicles. From 2016 to 2017, the demand for lithium-based batteries has shifted from a focus on quantity to quality and we believe there is a shortage in supply for high quality lithium batteries but an excess supply of low-quality lithium batteries. As we believe that the market for high quality lithium-based batteries has good growth potential, we have focused our R&D initiatives on producing lithium carbonate for EVs. However, there is no assurance that the demand for lithium batteries will continue to increase. In addition, if a more cost- effective substitute for lithium-based batteries gains market acceptance, our business, financial condition and results of operations may be materially and adversely affected.

We are exposed to market fluctuations of boric acid, boron and lithium compounds.

Changes in current and expected supply and demand volumes impact the current and expected future prices of boric acid, boron and lithium compounds. Declines in boric acid, boron and lithium compounds could materially and adversely affect our business, financial condition and results of operations. There is no assurance that a fall in prices of boric acid, boron and lithium compounds will not occur. Furthermore, as a result of boric acid, boron and lithium compounds declines, we may decide to reduce sales volumes of our products.

New legislation or changes in the PRC regulatory requirements regarding the end markets of our products may affect our business operations and prospects. Our products are used in the production of, or are incorporated into final products that are sold into a number of end markets, including battery-related and industrial and construction material. New legislation or changes in the PRC regulatory requirements regarding these end markets may affect our business, financial condition, results of operations and growth prospects. For example, the PRC government has promulgated, amended and updated a number of legislation in relation to the electric vehicles market. We may need to change or adapt our business focuses from time to time in response to the new rules and regulations regarding the end markets of our products, but we may not be able to do so timely and efficiently. Any new legislation or changes in the PRC regulatory requirements could materially and adversely affect our business, financial condition and results of operations.

We depend on our affiliate Qinghai Mining for all of our supply of boron and lithium; are subject to uncertainties surrounding their estimated resource and reserves as our raw material, and the volume and grade of lithium and boron raw material we produce may not conform to current estimates, and we may not be able to secure sufficient lithium and boron resource supply to meet our production needs.

We purchase all of our lithium and boron exclusively from our affiliate Qinghai Mining. Our largest stockholder and Chairman of the Board owns substantially all of Qinghai Mining. While we believe that our supply contract with Qinghai Mining has been negotiated on an arms-length basis, there is an inherent conflict of interest due to his ownership in both companies. We can not assure you that a conflict of interest may arise that will favor Qinghai Mining over Qinghai Technology and us.

Our estimated resources and supply of lithium, boric acid and boron from Qinghai Mining are based on a number of assumptions in accordance with relevant industry standards. There can be no assurance that our estimated supplies of lithium and boron resources will prove to be accurate or that Qinghai Mining will be able to mine or process our lithium resources as our raw material will be provided to us at a cost that will enable us to make a profit. Estimated resources and reserves of lithium and boron are inherently prone to variability. They involve expressions of judgment with regard to the presence and grade of brine and the ability to economically extract and process the brine. These judgments are based on a variety of factors, such as knowledge, experience and industry practice. The accuracy of these estimates may be affected by many factors, including the quality of the extraction, sampling results, analysis of the samples, the procedures adopted, and experience of the persons making the estimates. Brine extracted may be different from the estimated resources and reserves of lithium and boron in various ways, such as quality, volume, mining costs or processing costs. In addition, spodumene and brine may not ultimately be extracted at a profit. We record our lithium resources located in the PRC according to the Chinese National Standard.

If we encounter conditions different from those estimated based on historical examinations, such as governmental policies on export and tax rate, geopolitical relationships, natural disasters, transportation disruptions, we may have to adjust our production plans which could materially and adversely affect our business, financial condition and results of operations and reduce the estimated amount of resources and reserves available for production and expansion plans.

We face competition in our business.

The global lithium and boron compounds is a relatively orderly market protected by significant barriers to entry. The global lithium and boron compounds and metals market is dominated by a limited number of lithium companies. Our existing competitors endeavor to increase their market shares through measures, such as continued research and development efforts, optimized production process and active marketing campaigns. We expect to face competition from both existing and new competitors as we expand our business into new business lines and product categories. Competitive pressure could also have an adverse impact on the demand for and pricing of our products, which in turn affects our growth and market share. If we fail to compete effectively, we may be unable to build our lithium business and retain or expand our market share, which would have a material adverse effect on our business, results of operations and financial condition. We may not be successful in expanding our operations, managing our growth effectively or opening our new facilities in a timely manner.

We are undertaking future expansion projects based on our future business planning. The success of our future expansion projects depends on a few factors beyond our control, such as the progress of the construction conducted by the third party construction companies, local laws and regulations, government support, including in the form of tax breaks, and customer demand for our expanded production capacity. In addition, the integration of future expansion projects into our existing operations may be subject to unforeseeable delays, which may, among other things, increase our integration costs, strain our production capacity at other locations, decrease our production efficiency and cause delays in delivery of customer orders. Furthermore, as we expand our business operations in the future organically or by acquisition, we expect to incur additional depreciation and operational expenses. The depreciation and operational expenses can increase as a percentage of our revenue in the future and adversely affect our profitability if we cannot manage our growth effectively. Accordingly, we may not be able to achieve the expansion of our operations or the management of our growth in a timely or cost- effective manner. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive pressures which could have a material adverse effect on our results of operation and prospects

The mining rights that Qinghai Mining hold equity interests in have a limited life and these operations will entail costs and risks regarding monitoring, rehabilitation and compliance with environmental standards which could increase our costs.

The mines that Qinghai Mining holds in the PRC have limited lives and will eventually be depleted. We may need to replenish our lithium and boron supply sources from time to time in order to enhance our existing needs. Due to the limited supply of lithium and boron supply sources, there is no assurance that we will be able to acquire new and valuable lithium and boron supplies or resources, or that the actual production results may match the expected results. In the event of the closure of Qinghai Mining, we need to perform certain procedures to remedy and rehabilitate the environmental and social impact that the mining operations have had on local communities. We may experience a difficult closure, the consequences of which range from increased closure costs, handover delays and conflicts with local communities in relation to ongoing monitoring and environmental rehabilitation costs and damage to our reputation if desired outcomes cannot be achieved. In the event of a difficult closure, our business, financial condition and results of operations could be materially and adversely affected. Moreover, we have not made any provision for restoration or rehabilitation costs. Only mines that have commenced exploitation incur restoration or rehabilitation costs.

We may not possess all the licenses required to operate our business, or may fail to maintain the licenses we currently hold. This could subject us to fines and other penalties, which could have a material adverse effect on our results of operations.

In addition to a mining registration certificate held by Qinghai Mining and business certificate held by Qinghai Technology, they are required to hold a variety of other permits, licenses and certificates to conduct their business in China. They may not possess or receive all the permits, licenses and certificates required for our business or for which application has been made. In addition, there may be circumstances under which the approvals, permits, licenses or certificates granted by the governmental agencies are subject to change without substantial notice in advance. If we fail to obtain or to maintain such permits, licenses or certificates or renewals are granted with onerous conditions, we could be subject to fines and other penalties and be limited in the number or the quality of the products that we would be able to offer. As a result, our business, result of operations and financial condition could be materially and adversely affected.

We are subject to extensive environmental, chemical manufacturing, health and safety laws and regulations and production standards, and our compliance with these laws, regulations and standards may be onerous and costly.

Our business and/or operational activities, such as manufacturing and sale of our lithium carbonate, boric acid and boron products, storage of raw materials, transportation and exportation of our products and certain other activities are affected by laws and regulations, administrative determinations, court decisions and similar constraints, especially the extensive environmental, chemical manufacturing, health and safety laws and regulations and stringent standards of lithium compounds which are promulgated by the PRC Government and the governments of overseas jurisdictions in which we operate. For example, we are required to obtain and maintain valid licenses and certificates, including, among other things, those required for our production of lithium and boron products.

Qinghai Technology and Qinghai Mining are also required to comply with the restrictions and conditions imposed by various government authorities in order to conduct our business. If they fail to comply with any of the regulations or to satisfy any of the conditions required for the maintenance of our licenses and certificates, such licenses and certificates could be temporarily suspended or even revoked, rejected upon renewal or delayed for renewal, upon expiry of their original terms, which could materially and adversely affect our business, financial condition and results of operations. Meanwhile, to comply with the extensive environmental laws and regulations relating to air and water quality, waste management and public health and safety in the PRC, they must obtain the approval for the environmental impact assessment reports and the environmental acceptance approval of our projects in construction and mines, and undergo annual inspection of production facilities by relevant PRC authorities to ensure the safety of our equipment. If they fail to obtain such environmental approval or complete the annual inspection, our projects may be suspended and the relevant authorities may suspend our operation of the production facilities and may impose a fine on us or them.

Given the magnitude, complexity and continuous amendments to these laws and regulations, compliance therewith may be onerous and may involve substantial financial resources as well as other resources to establish efficient compliance and monitoring systems. The liabilities, costs, obligations and requirements associated with these laws and regulations may therefore be substantial and may delay the commencement of, or cause interruptions to, our operations. Non-compliance with the laws and regulations applicable to our operations may even result in substantial penalties or fines, suspension or revocation of our relevant licenses, termination of government contracts or suspension of their operations. Such events could impact on our results of operations, financial condition and reputation, all of which could adversely affect our ability to be profitable and attract new customers.

In addition, the environmental, chemical manufacturing, health and safety laws and regulations, administrative determinations and court decisions in the PRC which we are subject to continue to evolve, which may involve stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed mines or production facilities as well as a heightened degree of responsibility for companies and their officers, directors and employees. Any changes or amendments to such laws or regulations may cause us to incur additional capital expenditures, costs that may not be able to be passed on to customers, or other obligations or liabilities, which could decrease our capital and our ability to pursue developments in other areas. In the event that we fail to comply with applicable laws and regulations or fail to maintain, renew or obtain the necessary licenses or certificates, our qualification to conduct our various businesses may be adversely affected, which may adversely affect our business, financial condition and results of operations.

Our businesses are subject to operational difficulties, occupational and environmental hazards and other risks, which could damage our reputation, subject us to liability claims and result in substantial costs.

Our production businesses are exposed to various risks, including operational and transportation- related risks, as well as occupational and environmental hazards. We may experience various types of operational difficulties in connection with our production operations. Some of our raw materials and chemicals are hazardous (i.e., toxic or flammable) and their storage and usage in the production process involve inherent risks. Accidents could materially disrupt our production and may give rise to personal injuries and environmental hazards. Our operations may also be subject to production difficulties such as capacity constraints, mechanical and system failures, construction and upgrade delays and delays in the delivery of machinery, any of which could cause suspension of production and reduced output. Scheduled and unscheduled maintenance programs may also affect our production output. Any significant manufacturing disruption could adversely affect our ability to make and sell products, which could have a material adverse effect on our business, financial condition and results of operations.

Our production operations are dependent on our access to adequate transportation channels.

We rely on a combination of rail, sea and road transportation both in the PRC to deliver our products to customers. However, there can be no assurance that the existing or planned transportation systems will be sufficient to meet our transportation requirements. Any shortage, disruption or limitation of transportation capacity may limit the volume of products delivered to customers and may cause us to accumulate inventories and scale back production. Furthermore, any disruption to, or decrease in, the availability or capacity in the transportation networks, such as due to an earthquake, major rail or highway accidents, strikes, seasonal congestion during holidays, or any significant rise in transportation costs, could materially and adversely affect our ability to deliver our products to customers and have a material adverse effect on our overall production business and results of operations.