UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

þ

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to Section 240.14a-12

|

SmartHeat Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

|

þ

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

______________________________________________________________________________________

|

||

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

______________________________________________________________________________________

|

||

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

______________________________________________________________________________________

|

||

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

______________________________________________________________________________________

|

||

|

(5)

|

Total fee paid:

|

|

|

______________________________________________________________________________________

|

|

o

|

Fee paid previously with preliminary materials:

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

______________________________________________________________________________________

|

||

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

______________________________________________________________________________________

|

||

|

(3)

|

Filing Party:

|

|

|

______________________________________________________________________________________

|

||

|

(4)

|

Date Filed:

|

|

|

______________________________________________________________________________________

|

Copies of all communications to:

Robert Newman, Esq.

Newman & Morrison LLP

44 Wall Street, 12th Floor

New York, NY 10005

Tel. (212) 248-1001 Fax: (212) 202-6055

SMARTHEAT INC.

c/o Huajun Ai: Corporate Secretary

A-1, 10, Street 7

Shenyang Economic and Technological Development Zone

Shenyang, China 110141

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 30, 2014

_____________

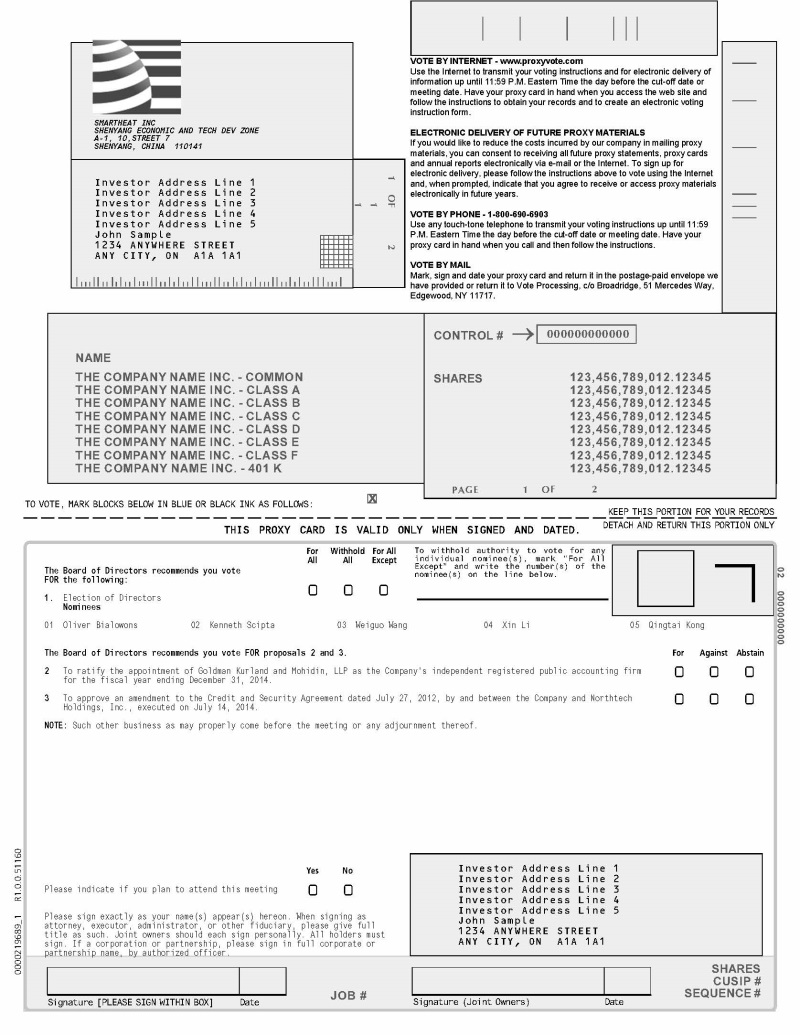

NOTICE IS HEREBY GIVEN that an Annual Meeting of the Stockholders of SmartHeat Inc., a Nevada corporation (the “Company”), will be held on September 30, 2014 at the Boardroom at the Langham Place, 555 Shanghai Street, Mongkok, Kowloon, Hong Kong, China, commencing at 1:30 pm (China Time) for the purposes of considering and acting upon the following proposals:

|

1.

|

To elect five directors to the Board of Directors (the “Board”) of Company to serve until the next annual meeting of stockholders or until their successors are elected and qualified;

|

|

|

2.

|

To ratify the appointment of Goldman Kurland and Mohidin, LLP as Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014;

|

|

|

3.

|

To approve an amendment to the Credit and Security Agreement dated July 27, 2012, by and between the Company and Northtech Holdings, Inc. (“Northtech”), executed on July 14, 2014;

|

|

|

4.

|

To transact such other business as may properly come before the Annual Meeting.

|

|

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

You are entitled to vote only if you were a SmartHeat stockholder as of the close of business on August 15, 2014 (the “Record Date”). You are entitled to attend the Annual Meeting only if you were a SmartHeat stockholder as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. Since seating is limited, admission to the meeting will be on a first-come, first-served basis. You should be prepared to present photo identification for admittance. If you are not a stockholder of record but hold shares through a broker, bank, trustee, or nominee (i.e., in street name), you should provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to the Record Date, a copy of the voting instruction card provided by your broker, bank, trustee, or nominee, or similar evidence of ownership.

2

If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting. For security reasons, you and your bags will be subject to search prior to your admittance to the meeting. Please let us know if you plan to attend the meeting by marking the appropriate box on the enclosed proxy card if you requested to receive printed proxy materials, or, if you vote by telephone or over the Internet, by indicating your plans when prompted.

The Annual Meeting will begin promptly at 1:30 pm (China Time). Check-in will begin at 1:15 pm (China Time), and you should allow ample time for the check-in procedures.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials (Notice) you received in the mail, the section entitled Questions and Answers About the Proxy Materials and the Annual Meeting beginning on page 4 of this proxy statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

By Order of the Board of Directors,

Mr. Oliver Bialowons

Director and President

This notice of Annual Meeting and proxy statement and form of proxy are being distributed and made available on or about September 19, 2014.

3

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 30, 2014

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Smartheat Inc. (“Smartheat”, the “Company”, “us”, “our”, or “we”) for use at the Annual Meeting of Stockholders to be held on September 30, 2014, at 1:30 p.m. local time at the Boardroom at the Langham Place, 555 Shanghai Street, Mongkok, Kowloon, Hong Kong, China (the “Annual Meeting”), including any adjournment or adjournments thereof, for the purposes set forth in the accompanying Notice of Meeting and Proxy.

The address and telephone number of the Company are c/o the Corporate Secretary who maintains the Company’s corporate records at:

Shenyang Economic and Technological Development Zone

Shenyang, China 110141

+86 (24) 2519-7699

We are providing you with this Proxy Statement together with the Company’s 2013 Annual Report on Form 10-K for the year ended December 31, 2013.

The proxy statement and form of proxy are being distributed and made available on or about September 19, 2014.

The costs of preparing, assembling and mailing this Proxy Statement and the other material enclosed and all clerical and other expenses of solicitation will be paid by Smartheat. In addition to the solicitation of proxies by use of the mails, directors, officers and employees of Smartheat, without receiving additional compensation, may solicit proxies by personal interview, mail, e-mail, telephone, facsimile or other means of communication. Smartheat also will request brokerage houses and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of Common Stock held of record by such custodians and will reimburse such custodians for their expenses in forwarding soliciting materials.

Neither the United States Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of the Equity Interest Purchase Agreement, passed upon the merits or fairness of the transactions contemplated thereby or passed upon the adequacy or accuracy of the disclosure in this Proxy Statement. Any representation to the contrary is a criminal offense.

4

GENERAL INFORMATION – THE ANNUAL MEETING OF STOCKHOLDERS

General

The enclosed proxy is solicited on behalf of the Board of Directors of Company for use at the Annual Meeting to be held at the Boardroom at the Langham Place, 555 Shanghai Street, Mongkok, Kowloon, Hong Kong, China on September 30, 2014.

The Company maintains its corporate records at the office of its Secretary located at A-1, 10, Street 7,Shenyang Economic and Technological Development Zone, Shenyang, China 110141, phone number +86 (24) 2519-7699.

This proxy statement and the accompanying proxy card will first made available on or about September 19, 2014 to all stockholders entitled to vote at the meeting.

Outstanding Stock and Voting Rights

Only stockholders of record at the close of business on August 15, 2014 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were issued and outstanding 6,783,399 shares of the Company’s Common Stock, $0.001 par value per share (the “Common Stock”), the Company’s only outstanding class of voting securities. Each share of Common Stock entitles the holder thereof to cast one vote on each matter submitted to a vote at the Annual Meeting.

Voting Procedures; Quorum

At the Annual Meeting, provided a quorum is present, the nominees for election as directors receiving the greatest number of votes cast, whether in person or represented by proxy and entitled to vote, up to the number of directors to be elected, which will be five, will be elected as directors of the Company.

Ratification of the appointment of Goldman Kurland and Mohidin, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

Approval of the Third Amendment to the Credit Agreement requires the affirmative vote of a majority of shares Common Stock present in person or by proxy and entitled to vote at the Annual Meeting.

As of the Record Date, the directors and executive officers of the Company and their affiliates owned approximately 3.8 % of the shares entitled to vote at the Annual Meeting.

All other matters to come before the Annual Meeting will be decided by the affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter presented in person or by proxy, provided a quorum is present. A quorum is present if at least a majority of the shares of Common Stock outstanding as of the Record Date are present in person or represented by proxy at the Annual Meeting. It is currently anticipated that votes will be counted and certified by an Inspector of Election (the “Inspector”) who is expected to be either an employee of the Company or its transfer agent. In accordance with Nevada law, abstentions will be treated as present for purposes of determining the presence of a quorum.

5

The Inspector will treat shares that are voted WITHHELD or ABSTAIN as being present and entitled to vote for purposes of determining the presence of a quorum but will not be treated as votes in favor of approving any matter submitted to the stockholders for a vote. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given on such proxies, the shares will be voted:

|

·

|

FOR the election of each of the nominees for directors of the Company specified herein;

|

||

|

·

|

FOR the Ratification of the appointment of Goldman Kurland and Mohidin, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014;

|

||

|

·

|

FOR the approval of the Third Amendment to the Credit Agreement and

|

||

|

·

|

upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof in the discretion of the proxies, but will not be voted other than as provided for the matters set forth above.

|

||

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. All of the matters scheduled to be voted on at the Annual Meeting are “non-routine,” except for the proposal to ratify the appointment of Goldman, Kurland and Mohidin, LLP as SmartHeat’s independent registered public accounting firm for the fiscal year ending December 31, 2014. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered votes cast on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

Abstentions are considered votes cast and thus will have the same effect as votes “Against” each of the matters scheduled to be voted on at the Annual Meeting.

Proposal 1. Election of directors: Broker non-votes will be deemed not entitled to vote on the subject matter as to which the non-vote is indicated. Broker non-votes will have no effect on the vote on the election of directors, nor are there any abstentions in the election of directors; rather stockholders may vote “for” each nominee or withhold such vote.

Proposal 2. Ratification of the appointment of Goldman Kurland and Mohidin, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014: Abstentions will have the same effect as a vote against this proposal. Broker are entitled to vote on this routine matter. Broker non-votes will be deemed not entitled to vote on the subject matter as to which the non-vote is indicated.

6

Proposal 3. Approval of Approval of Third Amendment to the Credit Agreement: A properly executed ballot marked ABSTAIN with respect to this proposal will not be counted, although it will be counted for purposes of determining whether there is a quorum. Since abstentions are not considered votes cast, they will have no effect on the outcome of this proposal. Broker non-votes will be deemed not entitled to vote on the subject matter as to which the non-vote is indicated. Broker non-votes also have the same effect as a vote against this proposal.

None of the proposals is conditioned on the outcome of any other proposal.

Revocability of Proxies

The enclosed proxies will be voted in accordance with the instructions thereon. Unless otherwise stated, all shares represented by such proxy will be voted as instructed. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date. Any stockholder who has executed a proxy but is present at the Annual Meeting, and who wishes to vote in person, may do so by revoking his or her proxy as described in the preceding sentence. Shares represented by valid proxies in the form enclosed, received in time for use at the Annual Meeting and not revoked at or prior to the Annual Meeting, will be voted at the Annual Meeting.

The entire cost of soliciting proxies, including the costs of preparing, assembling, printing and mailing this proxy statement, the proxy and any additional soliciting material furnished to stockholders, will be borne by the Company. Arrangements will be made with brokerage houses, banks and other custodians, nominees and fiduciaries to send proxies and proxy materials to the beneficial owners of stock, and the Company expects to reimburse such persons for their reasonable out-of-pocket expenses. Proxies may also be solicited by directors, officers or employees of the Company in person or by telephone, telegram or other means. No additional compensation will be paid to such individuals for these services.

Solicitation of Proxies

The Company will bear the entire cost of soliciting proxies from its stockholders. In addition to solicitation of proxies by mail, the Company will request that banks, brokers, and other record holders send proxies and proxy material to the beneficial owners of the Company Common Stock and secure their voting instructions. The Company will reimburse the record holders for their reasonable expenses in taking those actions. If necessary, the Company may use several of its regular employees, who will not be specially compensated, to solicit proxies from the Company stockholders, either personally or by telephone, facsimile, letter or other electronic means.

Voting

Each stockholder is entitled to one vote for each share held on the close of business on the Record Date, on each matter properly submitted for the vote of stockholders at the Annual Meeting. The right to vote is exercisable, in person or by properly executed proxy as described further below.

If you are a stockholder of record as of the Record Date, you may vote in person at the Annual Meeting or vote by proxy using the proxy card. Whether or not you plan to attend the Annual Meeting, the Company urges you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person if you have already voted by proxy. To vote in person, you may come to the Annual Meeting and the Company will give you a ballot when you arrive. To vote using the proxy card, simply complete, sign and date the proxy card (which is enclosed if you received this proxy statement by mail or that you may request or that the Company may elect to deliver at a later time), and return it promptly in the envelope provided. If you return your signed proxy card to the Company before the Annual Meeting, the Company will vote your shares as you direct.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in street name receive instructions for granting proxies from their banks, brokers or other agents, rather than the Company’s proxy card. If your shares are held in an account with a broker or bank please follow the instructions provided by such broker or bank.

7

MATTERS BEING SUBMITTED TO A VOTE OF SMARTHEAT’S STOCKHOLDERS

Proposal 1: Election of directors

At this year’s Annual Meeting, five nominees will be elected as directors, which number will constitute the entire Board of Directors. Each director will be elected to a one-year term and will hold office until the 2015 Annual Meeting and until his successor has been duly elected and qualified or until his earlier death, resignation or removal. The Board of Directors currently consists of five members, each of whom are standing for re-election at the Annual Meeting. Each of the nominees to the Board of Directors has been recommended by the Board of Directors. The Board of Directors has nominated Oliver Bialowons, Xin Li, Kenneth Scipta, Weiguo Wang and Qingtai Kong as directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF EACH OF THE NOMINEES SPECIFIED HEREIN.

Proposal 2: Ratification of appointment of independent registered public accounting firm Goldman Kurland and Mohidin, LLP.

At this year’s Annual Meeting, Company stockholders will be asked to ratify the appointment of Goldman Kurland and Mohidin, LLP as the independent registered public accounting firm to audit our consolidated financial statement for the fiscal year ending December 31, 2014.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF GOLDMAN KURLAND AND MOHIDIN, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2014.

Proposal 3: Third Amendment to the Credit Agreement

At this year’s Annual Meeting, Company stockholders will be asked to approve the Third Amendment to the Credit Agreement.

The terms of, reasons for and other aspects of the Third Amendment to the Credit Agreement are described in detail in the other sections in this proxy statement.

You should note that Company is seeking approval under the terms of the Third Amendment to the Credit Agreement, which, if not approved, will constitute an event of default.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE CREDIT AGREEMENT.

8

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Q: Why am I receiving these materials?

A: Our Board of Directors has delivered printed proxy materials to you, in connection with the solicitation of proxies for use at SmartHeat’s 2013 Annual Meeting of Stockholders, which will take place on September 30, 2014, at the Boardroom at the Langham Place, 555 Shanghai Street, Mongkok, Kowloon, Hong Kong, China, at 1:30 pm (China Time). As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this proxy statement.

Q: What information is contained in this proxy statement?

A: The information in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and most highly paid executive officers, corporate governance, and certain other required information.

Q: What items of business will be voted on at the Annual Meeting?

A: The items of business scheduled to be voted on at the Annual Meeting are:

|

1.

|

To elect five directors to the Board of Directors (the “Board”) of the Company to serve until the next annual meeting of stockholders or until their successors are elected and qualified;

|

|

|

2.

|

To ratify the appointment of Goldman Kurland and Mohidin, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014;

|

|

|

3.

|

To approve an amendment to the Credit and Security Agreement, dated July 27, 2012, by and between the Company and Northtech Holdings, Inc. (“Northtech”), executed on July 14, 2014; and

|

|

|

4.

|

To transact such other business as may properly come before the Annual Meeting.

|

|

Q: How does the Board of Directors recommend that I vote?

A: Our Board of Directors recommends that you vote your shares “For” each of the 3 proposals scheduled to be voted upon at the Annual Meeting.

9

Q: What shares can I vote?

A: Each share of SmartHeat Common Stock issued and outstanding as of the close of business on the Record Date for the 2014 Annual Meeting of Stockholders is entitled to be voted on all items being voted on at the Annual Meeting. You may vote all shares owned by you as of the Record Date, including (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. On the Record Date we had 6,783,399 shares of Common Stock issued and outstanding.

Q: How many votes am I entitled to per share?

A: Each holder is entitled to one vote for each share of Common Stock held as of the Record Date.

Q: What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A: Most SmartHeat stockholders hold their shares as a beneficial owner through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, Interwest Transfer Company, Inc., you are considered, with respect to those shares, the stockholder of record, and the Notice was sent directly to you by SmartHeat. As the stockholder of record, you have the right to grant your voting proxy directly to SmartHeat or to vote in person at the Annual Meeting. If you requested to receive printed proxy materials, SmartHeat has enclosed or sent a proxy card for you to use. You may also vote on the Internet or by telephone, as described in the Notice and below under the heading “How can I vote my shares without attending the Annual Meeting?”

Beneficial Owner

If your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, or other similar organization, like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name, and the Notice was forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or nominee how to vote your shares, and you are also invited to attend the Annual Meeting.

Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares at the meeting. If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy. You may vote by proxy over the Internet or by telephone, as described in the Notice and below under the heading “How can I vote my shares without attending the Annual Meeting?”

Q: How can I contact SmartHeat’s transfer agent?

A: Contact our transfer agent by either writing to Interwest Transfer Company, Inc., 1981 Murray Holladay Road, Suite 100, Salt Lake City, UT 84117, or by telephoning 801-272-9294.

Q: How can I attend the Annual Meeting?

A: You are entitled to attend the Annual Meeting only if you were a SmartHeat stockholder as of the Record Date or you hold a valid proxy for the Annual Meeting. Since seating is limited, admission to the meeting will be on a first-come, first-served basis. You must present photo identification for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you must also provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to the Record Date, a copy of the voting instruction card provided by your broker, bank, trustee, or nominee, or other similar evidence of ownership.

If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting. For security reasons, you and your bags will be subject to search prior to your admittance to the meeting.

Please let us know if you plan to attend the meeting by marking the appropriate box on the enclosed proxy card, or, if you vote by telephone or Internet, by indicating your plans when prompted.

The meeting will begin promptly at 1:30 pm (Local time). Check-in will begin at 1:15 pm (Local time), and you should allow ample time for the check-in procedures.

10

Q: How can I vote my shares in person at the Annual Meeting?

A: Shares held in your name as the stockholder of record may be voted by you in person at the Annual Meeting. Shares held beneficially in street name may be voted by you in person at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

Q: How can I vote my shares without attending the Annual Meeting?

A: Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail or telephone pursuant to instructions provided on the proxy card. If you hold shares beneficially in street name, you may also vote by proxy over the Internet by following the instructions provided in the Notice, or, by following the voting instruction card provided to you by your broker, bank, trustee, or nominee.

Q: Can I change my vote or revoke my proxy?

A: You may change your vote at any time prior to the taking of the vote at the Annual Meeting. If you are the stockholder of record, you may change your vote by (1) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method), (2) providing a written notice of revocation to SmartHeat’s Corporate Secretary at A-1, 10, Street 7, Shenyang Economic and Technological Development Zone, Shenyang China 110141, prior to your shares being voted, or (3) attending the Annual Meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

Q: Is my vote confidential?

A: Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within SmartHeat or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to SmartHeat management.

Q: How many shares must be present or represented to conduct business at the Annual Meeting?

A: The quorum requirement for holding the Annual Meeting and transacting business is majority of the voting power of the issued and outstanding Common Stock of SmartHeat as of the Record Date must be present in person or represented by proxy. Both abstentions and broker non-votes (described below) are counted for the purpose of determining the presence of a quorum.

Q: How are votes counted?

A: In the election of directors (proposal number 1), you may vote “For” all or some of the nominees or your vote may be “Withheld” with respect to one or more of the nominees.

For the other items of business, you may vote “For,” “Against,” or “Abstain.” If you elect to “Abstain,” the abstention has the same effect as a vote “Against.”

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are indicated, the shares will be voted as recommended by the Board of Directors.

Q: What is the voting requirement to approve each of the proposals?

A: In the election of directors, the five persons receiving the highest number of affirmative “For” votes at the Annual Meeting will be elected.

For Proposals 2, and 3, the affirmative “For” vote of a majority of those shares present in person or represented by proxy and entitled to vote on them at the Annual Meeting is required for approval.

11

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. All of the matters scheduled to be voted on at the Annual Meeting are “non-routine,” except for the proposal to ratify the appointment of Goldman, Kurland and Mohidin, LLP as SmartHeat’s independent registered public accounting firm for the fiscal year ending December 31, 2014. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered votes cast on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting, assuming that a quorum is obtained.

Abstentions are considered votes cast and thus will have the same effect as votes “Against” each of the matters scheduled to be voted on at the Annual Meeting.

Please note that the rules regarding how brokers may vote your shares have changed. Brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote so we encourage you to provide instructions to your broker regarding the voting of your shares.

Q: Is cumulative voting permitted for the election of directors?

A: No. You may not cumulate your votes for the election of directors.

Q: What happens if additional matters are presented at the Annual Meeting?

A: Other than the three items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the person named as proxy holder, Oliver Bialowons, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of the nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

Q: Who will serve as inspector of elections?

A: The inspector of elections will be either the transfer agent or an officer of the Company.

Q: Who will bear the cost of soliciting votes for the Annual Meeting?

A: SmartHeat will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and personnel, who will not receive any additional compensation for such solicitation activities.

Q: Where can I find the voting results of the Annual Meeting?

A: We will disclose voting results on a Form 8-K filed with the SEC within four business days after the Annual Meeting, which will also be available on our website.

12

Q: What is the deadline to propose actions for consideration at next year’s Annual Meeting of Stockholders or to nominate individuals to serve as directors?

A: Stockholder Proposals: Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to SmartHeat’s Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2015 Annual Meeting of Stockholders, the Corporate Secretary of SmartHeat must receive the written proposal at our principal executive offices no later than Friday, May 1, 2015; provided, however, that in the event that we hold our 2015 Annual Meeting of Stockholders more than 30 days before or after the one-year anniversary date of the 2014 Annual Meeting, we will disclose the new deadline by which stockholders proposals must be received under Item 5 of Part II of our earliest possible Quarterly Report on Form 10-Q or, if impracticable, by any means reasonably determined to inform stockholders. In addition, stockholder proposals must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (Exchange Act). Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to:

SmartHeat Inc.

Attn: Corporate Secretary

c/o

Newman & Morrison, LLP

44 Wall Street, 12th Floor

New York, NY 10005

For a stockholder who wishes to present a proposal before an annual meeting of stockholders but does not intend for the proposal to be included in our proxy statement must deliver a timely written notice to our Corporate Secretary. To be timely for our 2015 Annual Meeting of Stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

|

•

|

not later than the close of business on Monday, February 2, 2015.

|

In the event that we hold our 2015 Annual Meeting of Stockholders more than 30 days before or after the one-year anniversary date of the 2014Annual Meeting, then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received not later than the close of business on the earlier of the following two dates:

|

•

|

the 10th day following the day on which notice of the meeting date is mailed, or

|

|

•

|

the 10th day following the day on which public disclosure of the meeting date is made.

|

If a stockholder who has notified us of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we are not required to present the proposal for a vote at such meeting.

Nomination of Director Candidates: You may propose director candidates for consideration by our Nominating and Corporate Governance Committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board of Directors, and should be directed to the Corporate Secretary of SmartHeat at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Consideration of Director Nominees” on page 12 of this proxy statement.

Copy of Bylaw Provisions: You may contact our Corporate Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

13

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our current executive officers and directors and their ages, positions and biographical information are as follows:

|

Name

|

Position

|

Age

|

|||

|

Oliver Bialowons

|

President & Director

|

45 | |||

|

Yingkai Wang

|

Acting Chief Accountant

|

41 | |||

|

Kenneth Scipta

|

Director

|

72 | |||

|

Weiguo Wang

|

Director

|

48 | |||

|

Xin Li

|

Director

|

40 | |||

|

Qingtai Kong

|

Director

|

67 |

Our executive officers are appointed by, and serve at the discretion of, our Board of Directors. Each executive officer is a full time officer. Our directors hold office for one-year terms or until their successors have been elected and qualified. There are no family relationships between any of our directors, executive officers or other key personnel and any other of our directors, executive officers or key personnel. There are no arrangements or understandings between any of our directors or executive officers and any other persons pursuant to which such director or executive officer was selected in that capacity.

Oliver Bialowons, President and Director

Oliver Bialowons was appointed as a Director and as President of the Company on May 25, 2012, to fill the roles formerly held by Jun Wang. Mr. Bialowons brings more than 20 years of experience as a turnaround executive to the Board of Directors and management of the Company. Mr. Bialowons also serves as a Director of KarstadtQuelle AG, a German retailer. In 2009, Mr. Bialowons assumed the position of Chairman of Bowe Bell Howell Inc., a financially stressed U.S. based manufacturer of industrial logistics equipment with worldwide operations and distribution. Mr. Bialowons directed the restructuring of Boewe Bell Howell’s business and eventual sale of the Bell Howell business to Bell and Howell, LLC, a portfolio company of Versa Capital Management, LLC. Mr. Bialowons continued to serve as Chairman of Bowe Bell Howell in the United States until March of 2012. Since March of 2012, Mr. Bialowons has also served as the Chief Executive Officer of IHR Platz in Germany. From 2008 to 2010, Mr. Bialowons was Chief Executive Officer of Boewe Systec AG and Wanderer Werke AG, and from 2007-2008 he was Chief Operating Officer of neckermann.de GmBH. Prior to 2007, Mr. Bialowons held various management positions at Mitsubishi Motors Corp. and DaimlerChrysler AG.

Yingkai Wang, Acting Chief Accountant and Treasurer

Yingkai Wang was appointed as our Acting Chief Accountant on June 7, 2013. Mr. Wang has served as our subsidiaries financial manager since 2007, and has been responsible for our internal financial reporting, establishing a budget and for analyzing our subsidiaries’ overall financial position. Mr. Wang was previously the financial manager of Shenyang Zhong Zhijie Electric Equipment Co., Ltd. from 2004-2007, and Shenyang Materials Group from August 1996 – April 2004. Mr. Wang is acquainted with our subsidiaries’ operations and was appointed to serve our Acting Chief Accountant by our Board of Directors as we continue to search for a new Chief Financial Officer.

Huajun Ai, Corporate Secretary

Ms. Ai was appointed our Corporate Secretary on April 14, 2008. Ms. Ai joined Taiyu in 2002 as its Corporate Secretary. From December 2000 to October 2002, she served as an accountant at Shenyang Dongyu International Trade Co., Ltd. From July 1994 to November 2000, Ms. Ai served as an accountant at Northeast Jin Cheng Industrial Corp. Ms. Ai obtained her bachelor’s degree in Foreign Trade Accounting from Shenyang North Eastern University in 1994.

Kenneth Scipta, Director

Kenneth Scipta was appointed to our Board of Directors and as Chairman of our Audit Committee on July 10, 2012. Mr. Scipta, a certified public accountant, has over 35 years of relevant accounting experience, and has served on several boards of directors. From 1993 to 1996, Mr. Scipta was the president and a board member of Mid-West Springs Manufacturing Company, a NASDAQ traded company, where he was responsible for day to day operations, planning, administration and financial reporting. Upon Mr. Scipta’s resignation he assumed the duties of president of the special products division, which included catalog sales, die springs and the development of international sales. Previously, from 1979-1993, Mr. Scipta served in various positions such as president, vice president of finance and vice president of sales and marketing for Mid-West’s primary subsidiary. From 1998 to 2006, Mr. Scipta was the chief executive officer and a board member of First National Entertainment Company, a multi-million dollar company traded on NASDAQ.

14

Weiguo Wang, Director

Mr. Wang was appointed to our Board of Directors on June 19, 2008, and serves currently as the Chairman of our Compensation Committee and member of our Audit Committee and Nominating and Corporate Governance Committee. Mr. Wang brings over eight years of relevant industry oversight and extensive engineering experience to the Board. Mr. Wang has served as a Director of the China Special Equipment Inspection and Research Agency since 2006. Prior positions include serving as a supervisor of the Lanzhou Heat Transfer & Save Energy Engineering Center in 2006, Assistant Secretary General of the China Standardization Committee on Boilers and Pressure Vessels in 2005 and Deputy General Manager of Boilers Standard (Beijing) Technology Services Center Co., Ltd. in 2004. From July 2001 to December 2003, Mr. Wang was a teacher at Tianjin University, China. Mr. Wang holds a bachelor’s degree in Mechanics, a master’s degree in Fluid Mechanics and a PhD in Fluid Mechanics, all from Beijing University. His skills include business analysis, industry analysis, and long-range planning, especially as applied to manufacturing and standards implementation.

Xin Li, Director

Mr. Li was appointed to our Board of Directors on July 29, 2009, and serves as the Chairman of our Nominating and Corporate Governance Committee and member of our Audit Committee and Compensation Committee. Mr. Li brings more than a decade of corporate governance and industrial operations management experience to the Board. He is a renowned management consultant in China and currently serves as the general manager of Beijing ShengGao Consulting Co., Ltd., a strategic advisory firm founded by him more than 10 years ago that focuses on providing strategic guidance and management training to global companies. He also serves as an independent director and chairs the audit and various governance committees at several large Chinese domestic companies not listed in the United States. Mr. Li is a prolific writer in strategies and management issues. He has authored several books in the areas of management science and strategic planning. Mr. Li is proficient in Mandarin Chinese and English. He has an MBA and is a Research Fellow at the Management Science Center of Beijing University.

Qingtai Kong, Director

Mr. Kong was appointed to our Board of Directors on September 22, 2011, and serves as a member of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Mr. Kong is a senior engineer bringing over 20 years of management experience in the gas supply and heating industry in China to the Board, and he currently serves as commissioner of China’s Industrial Gas Committee. From 1995 to 2001, Mr. Kong served as Deputy Director overseeing district heating projects for the Qinhuangdao District Bureau of Municipal & Rural Construction in Hebei Province. From 1991 to 1995, Mr. Kong served as general manager of the state-owned utility Gas Supply Corporation of Qinhuangdao in Hebei Province. Mr. Kong’s career in the gas industry began in 1988 with his position as chief engineer of a gas network project in the city of Qinhuangdao.

Board Meetings

Our Board of Directors held two meetings during fiscal year 2013, which does not include actions taken by written consent or committee meetings. Each director attended at least 75% of the meetings of the Board of Directors held during the period for which he has been a director and the meetings of the Board committees on which he served during the periods that he served in fiscal year 2013. Under our Corporate Governance Guidelines, directors are expected to attend either in person or by telecommunication, all meetings of our Board of Directors, all meetings of any committee of which he is a member and the annual meeting of stockholders, in addition to spending the time necessary to discharge properly his respective duties and responsibilities. All members of the Board of Directors were in attendance at the Company’s 2013 Annual Meeting of Stockholders.

Board Leadership Structure and Role in Risk Oversight

Since filing our Form 10-Q for the quarter ended March 31, 2012, we significantly restructured our Board of Directors and management. Two directors, Jun Wang and Arnold Staloff, resigned, and two new directors, Oliver Bialowons and Kenneth Scipta, were appointed to our Board of Directors. Jun Wang resigned as Chairman and Chief Executive Officer of the parent company in order to focus his time and attention on our operations in China. He retained his positions as General Manager of several of our operating subsidiaries. Mr. Wen Sha and Xudong Wang also resigned from their respective positions with the parent company in order to focus their time and attention to their roles with our operating subsidiaries. Oliver Bialowons assumed the duties of President of the parent company on May 25, 2012, and Michael Wilhelm assumed the duties of Chief Financial Officer and Treasurer on July 10, 2012, following the end of our second quarter.

15

On February 23, 2013, Michael Wilhelm resigned from his position as our Chief Financial Officer due to being “named personally in a groundless stockholder suit, where the alleged (unproven) actions in question are alleged to have taken place long before his involvement with the company.” Mr. Wilhelm was added as a defendant to the class action lawsuit filed against the Company, its directors, and certain of its former officers, originally captioned Steven Leshinsky v. James Wang, et. al, now captioned Stream Sicav, Dharanedra Rai et al. v. James Jun Wang, Smartheat Inc. et al., in an amended complaint filed by the Rosen Law Firm on January 28, 2012. We have had difficulty in retaining a suitable replacement for Mr. Wilhelm due to this class action lawsuit.

In the interim, and so as to have a principal accounting officer that could sign the certifications under Sections 302(a) and 906 of the Sarbanes Oxley Act of 2002 necessary to complete and file our period reports with the Securities and Exchange Commission, we appointed Yangkai Wang as our Acting Chief Accountant on June 7, 2013. While Mr. Yingkai Wang has served as a financial manager to our subsidiaries since 2007, he has limited relevant education and training in U.S. GAAP and related SEC rules and regulations.

As part of its oversight functions, the Board of Directors is responsible for the oversight of risk management at the Company. Our Board of Directors delegates risk oversight to our Audit Committee, which considers and addresses risk assessment and risk management issues and concerns, and reviews with management the Company’s major risk exposures and the steps management has taken to monitor and control such exposures.

Director Independence

Our Board of Directors has determined that each of Messrs. Scipta, Wang, Li, and Kong are independent directors. We have established the following standing committees of the Board of Directors: Audit, Compensation and Nominating and Corporate Governance. All members of the Audit, Compensation and Nominating and Corporate Governance Committees satisfy the “independence” standards applicable to members of each such committee. The Board of Directors made this affirmative determination regarding these directors’ independence based on discussions with the directors and on its review of the directors’ responses to a standard questionnaire regarding employment and compensation history; affiliations, family and other relationships; and, on transactions by the directors with the Company, if any. The Board of Directors considered relationships and transactions between each director, or any member of his immediate family, and the Company, its subsidiaries and its affiliates. The purpose of the Board of Directors’ review with respect to each director was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent under the NASDAQ rules.

Nominating and Corporate Governance Committee

We established our Nominating and Corporate Governance Committee (the “Nominating Committee”) in April 2009. The Nominating Committee consists of Messrs. Wang, Li, Kong, and Scipta each of whom is an independent director. Mr. Li is the Chairman of the Nominating Committee. The Nominating Committee assists in the selection of director nominees, approves director nominations to be presented for stockholder approval at our annual meeting and fills any vacancies on our Board of Directors, considers any nominations of director candidates validly made by stockholders (the process for which is set forth herein under the section entitled “Stockholder Nominations for Directors”), and reviews and considers developments in corporate governance practices. The Nominating Committee held no meetings during fiscal year 2013, which does not include actions taken by written consent. The Board of Directors has adopted a written charter for the Nominating Committee, the current copy of which is available on our website at www.smartheatinc.com.

16

Consideration of Director Nominees

The policy of our Nominating and Corporate Governance Committee is to consider properly submitted recommendations for candidates to the Board of Directors from stockholders. In evaluating such recommendations, the Nominating and Corporate Governance Committee seeks to achieve a balance of experience, knowledge, integrity, and capability on the Board of Directors and to address the membership criteria set forth under “Director Qualifications” below. Any stockholder recommendations for consideration by the Nominating and Corporate Governance Committee should include the candidate’s name, biographical information, information regarding any relationships between the candidate and SmartHeat within the last three years, at least three personal references, a statement of recommendation of the candidate from the stockholder, a description of our shares beneficially owned by the stockholder, a description of all arrangements between the candidate and the recommending stockholder and any other person pursuant to which the candidate is being recommended, a written indication of the candidate’s willingness to serve on the Board of Directors, any other information required to be provided under securities laws and regulations, and a written indication to provide such other information as the Nominating and Corporate Governance Committee may reasonably request. There are no differences in the manner in which the Nominating and Corporate Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder or otherwise. Stockholder recommendations to the Board of Directors should be sent to:

SmartHeat Inc.

Attn: Corporate Secretary

A-1, 10, Street 7

Shenyang Economic and Technological Development Zone

Shenyang, China 110141

Director Qualifications

Our Nominating and Corporate Governance Committee will evaluate and recommend candidates for membership on the Board of Directors consistent with criteria established by our Board of Directors. While our Board of Directors has not adopted a formal diversity policy or specific standards with regard to the selection of director nominees, due to the global and complex nature of our business, the Board of Directors believes it is important to consider diversity of race, ethnicity, gender, age, education, cultural background, and professional experiences in evaluating board candidates.

Although our Board of Directors has not formally established any specific, minimum qualifications that must be met by each candidate for the Board of Directors or specific qualities or skills that are necessary for one or more of the members of the Board of Directors to possess, when considering a potential non-incumbent candidate, the Nominating and Corporate Governance Committee will factor into its determination the following qualities of a candidate: educational background, diversity of professional experience, including whether the person is a current or former chief executive officer or chief financial officer of a public company or the head of a division of a large international organization, knowledge of our business, integrity, professional reputation, independence, and ability to represent the best interests of our stockholders.

Our Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating nominees for directors. Our Nominating and Corporate Governance Committee regularly assesses the appropriate size and composition of the Board of Directors, the needs of the Board of Directors and the respective committees of the Board of Directors, and the qualifications of candidates in light of these needs. Candidates may come to the attention of the Nominating and Corporate Governance Committee through stockholders, management, current members of the Board of Directors, or search firms. The evaluation of these candidates may be based solely upon information provided to the committee or may also include discussions with persons familiar with the candidate, an interview of the candidate or other actions the committee deems appropriate, including the use of third parties to review candidates.

17

Audit Committee and Audit Committee Financial Expert

We have established a separately-designated standing audit committee in accordance with Section 3(a)(58)(A) of the Exchange Act. Our Audit Committee consists of Messrs. Scipta, Wang, Li, and Kong, each of whom is an independent director. Mr. Scipta, Chairman of the Audit Committee, is an “audit committee financial expert” as defined under Item 407(d)(5) of Regulation S-K. The purpose of the Audit Committee is to represent and assist our Board of Directors in its general oversight of our accounting and financial reporting processes, audits of the financial statements and internal control and audit functions. The Audit Committee held four meetings during fiscal year 2013, which does not include actions taken by written consent. As more fully described in its charter, a copy of which is available on our website at www.smartheatinc.com, the functions of the Audit Committee include the following:

|

·

|

appointment of independent auditors, determination of their compensation and oversight of their work;

|

|

·

|

review the arrangements for and scope of the audit by independent auditors;

|

|

·

|

review the independence of the independent auditors;

|

|

·

|

consider the adequacy and effectiveness of the internal controls over financial reporting;

|

|

·

|

pre-approve audit and non-audit services;

|

|

·

|

establish procedures regarding complaints relating to accounting, internal accounting controls, or auditing matters;

|

|

·

|

review and approve any related party transactions;

|

|

·

|

discuss with management our major financial risk exposures and our risk assessment and risk management policies; and

|

|

·

|

discuss with management and the independent auditors our draft quarterly interim and annual financial statements and key accounting and reporting matters.

|

Compensation Committee

We established our Compensation Committee in April 2009. The Compensation Committee consists of Messrs. Wang, Li, Kong and Scipta each of whom is an independent director. Dr. Wang is the Chairman of the Compensation Committee. The Compensation Committee is responsible for the design, review, recommendation and approval of compensation arrangements for our directors, executive officers and key personnel, and for the administration of our equity incentive plan, including the approval of grants under such plan to our directors, personnel and consultants. The Compensation Committee also reviews and determines compensation of our executive officers. The Compensation Committee may delegate its authority to subcommittees, but may not delegate its responsibilities for any matters involving executive compensation unless all members of such subcommittee qualify as independent directors. The Compensation Committee may consult with the members of management in the exercise of its duties. Notwithstanding such consultation, the Compensation Committee retains absolute discretion over all compensation decisions with respect to the executive officers. The Compensation Committee held no meetings during fiscal year 2013, which does not include actions taken by written consent. The Board of Directors has adopted a written charter for the Compensation Committee, the current copy of which is available on our website at www.smartheatinc.com.

The compensation of our executive officers and other personnel is composed of base compensation and equity compensation. The Compensation Committee has determined the compensation of all executive officers appointed subsequent to the establishment of our Compensation Committee in April 2009. The Compensation Committee will review base compensation of the executive officers, taking into consideration the Company’s overall financial position and the state of its business. The Compensation Committee will determine any increase in compensation, with respect to each officer, based on individual performance, level of responsibility, and skills and experience, taking into account the anticipated level of difficulty in replacing such officers with persons of comparable experience, skill and knowledge.

The Committee has the exclusive authority to hire compensation, accounting, legal or other advisors. In connection with any such hiring, the Committee can determine the scope of the consultant’s assignments and their fees. The scope of a consultant’s services may include providing the Committee with data regarding compensation trends, assisting the Committee in the preparation of market surveys or tally sheets or otherwise helping it evaluate compensation decisions. The Committee did not retain an outside compensation consultant in 2013.

18

Communications with the Board of Directors

Stockholders may contact the Board of Directors about bona fide issues or questions about SmartHeat by sending an email to info@smartheatinc.com or by writing the Corporate Secretary at the following address:

SmartHeat Inc.

Attn: Corporate Secretary

A-1, 10, Street 7

Shenyang Economic and Technological Development Zone

Shenyang, China 110141

Any matter intended for the Board of Directors, or for any individual member or members of the Board of Directors, should be directed to the email address or street address noted above, with a request to forward the communication to the intended recipient or recipients. In general, any stockholder communication delivered to the Corporate Secretary for forwarding to the Board of Directors or specified member or members will be forwarded in accordance with the stockholder’s instructions.

Legal Proceedings

Oliver Bialowons, our President, was an executive officer of Bowe Bell & Howell Company, a U.S. based manufacturer of industrial logistics equipment with worldwide operations and distribution, which filed for bankruptcy in April of 2011. Bowe Bell & Howell Company acted as debtor in possession and no external receiver was appointed in the bankruptcy proceeding. The bankruptcy proceeding was subsequently dismissed in March of 2012.

Mr. Bialowons also served as chief executive officer of Wanderer-Werke AG from December 2008 to March 2010, and Boewe Systec AG from December 2008 to November 2010. Wanderer-Werke AG and Boewe Systec AG filed for insolvency in Germany in May of 2010.

Other than as disclosed above during the past ten years, none of our directors or executive officers has been:

|

·

|

the subject of any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

|

|

·

|

convicted in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

·

|

subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities;

|

|

·

|

found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, that has not been reversed, suspended, or vacated;

|

|

·

|

subject of, or a party to, any order, judgment, decree or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of a federal or state securities or commodities law or regulation, law or regulation respecting financial institutions or insurance companies, law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

·

|

subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

None of our directors, officers or affiliates, or any beneficial owner of 5% or more of our Common Stock, or any associate of such persons, is an adverse party in any material proceeding to, or has a material interest adverse to, us or any of our subsidiaries.

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following sets forth information as of the Record Date, regarding the number of shares of our Common Stock beneficially owned by (i) each person that we know beneficially owns more than 5% of our outstanding Common Stock, (ii) each of our named executive officers, (iii) each of our directors and (iv) all of our named executive officers and directors as a group. The amounts and percentages of our Common Stock beneficially owned are reported on the basis of SEC rules governing the determination of beneficial ownership of securities. Under the SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has the right to acquire beneficial ownership within 60 days through the exercise of any stock option, warrant or other right. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest. Unless otherwise indicated, each of the stockholders named in the table below, or his or her family members, has sole voting and investment power with respect to such shares of our Common Stock. As of the Record Date, there were 6,783,399 shares of our Common Stock issued and outstanding.

Except as otherwise indicated, the address of each of the stockholders listed below is: c/o SmartHeat Taiyu (Shenyang) Energy A-1, 10, Street 7, Shenyang Economic and Technological Development Zone, Shenyang, China 110141.

|

Name of beneficial owner

|

Number of shares

|

Percent of class

|

|||||

|

5% Stockholders

|

|||||||

|

Northtech Holdings Inc.

Mill Mall 5, Wickhams Cay 1

P.O. Box 3085

Road Town, Tortola

British Virgin Islands

|

2,100,000

|

(3)(6)

|

31.9

|

%

|

|||

|

Beijing YSKN Machinery & Electronic Equipment Co., Ltd.

Rm 1106, Huapu International Plaza No.19,

Chaowai Street, Chaoyang District

Beijing, China

|

680,800

|

(1)

|

10.3

|

%

|

|||

|

Yang In Cheol

#630-5, Namchon-Dong

Namdong-Yu

Incheon, South Korea 302-405

|

384,800

|

(2)

|

5.9

|

%

|

|||

|

Directors and Named Executive Officers

|

|||||||

|

Oliver Bialowons

|

200,000

|

(4)

|

3.0

|

%

|

|||

|

Kenneth Scipta

|

50,000

|

(5)

|

0.8

|

%

|

|||

|

All Directors and Named Executive Officers as a Group (7 Persons)

|

250,000

|

3.8

|

%

|

||||

|

(1)

|

Disclosed on Amendment No. 1 to the Schedule 13D for Beijing YSKN Machinery & Electronic Equipment Co., Ltd (“Beijing YSKN”) filed on June 30, 2008, for beneficial ownership as of May 7, 2008. Beijing YSKN has sole power to vote and dispose of the shares owned by it. Jun Wang and Fang Li each hold 50% of the equitable and legal rights, title and interests in and to the share capital of Beijing YSKN and, as a result of such ownership, each of Messrs. Wang and Li has the shared power to vote and dispose of the shares held by Beijing YSKN.

|

|

(2)

|

Disclosed on the Schedule 13G for Yang In Cheol filed on April 25, 2008, for beneficial ownership as of April 14, 2008.

|

|

(3)

|

Disclosed on the Schedule 13D for Northtech Holdings filed on July 28, 2014.

|

|

(4)

|

Disclosed on the Form 4 for Oliver Bialowons filed on March 31, 2014.

|

|

(5)

|

Disclosed on the Form 4 and Form 3 for Kenneth Scipta filed on April 24, 2014 and March 31, 2014 respectively.

|

|

(6)

|

200,000 shares of Common Stock granted pursuant to Amendment No.3 to the Credit and Security Agreement.

|

We are not aware of any arrangements that could result in a change in control of the Company.

20

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers and directors and persons who own more than 10% of our Common Stock to file reports regarding ownership of, and transactions in, our securities with the Commission and to provide us with copies of those filings. Based solely on our review of the copies received by us and on the written representations of certain reporting persons, we believe that, all such Section 16(a) filing requirements were timely met during 2013, except for NorthTech Holdings, Inc. According to our records during the time period of December 21, 2012 through December 31, 2013 a Form 3 and Form 4 were not timely filed by NorthTech Holdings, Inc. in connection with the following transactions in the Company’s Common Stock: 1,300,000 shares issued as of December 21, 2012, 100,000 shares issued as of January 1, 2013, 200,000 shares issued as of August 23, 2013 and 100,000 shares issued September 17, 2013. A Form 3 and Form 4 for each of the above transactions were subsequently filed with the SEC on May 28, 2014.

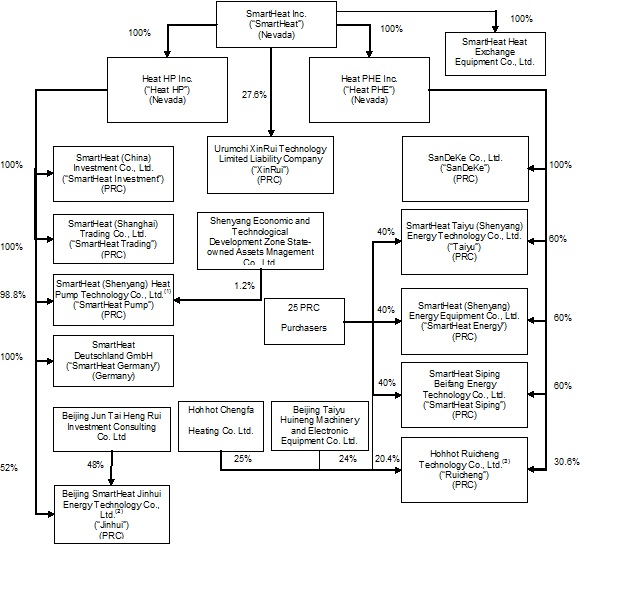

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On July 27, 2012, we entered into a secured revolving credit facility under the terms of a Secured Credit Agreement with Northtech Holdings, Inc., an entity owned by certain members of the Company’s former management, Jun Wang, our former Chief Executive Officer, Xudong Wang, our former Vice President of Strategy and Development, and Wen Sha, our former Vice President of Marketing. Huajun Ai, our current Corporate Secretary, is also a part owner of Northtech. As amended, the Credit Agreement provides for borrowings of up to $2,500,000 with any amounts borrowed maturing on April 30, 2014. Borrowings under the Credit Agreement are secured by 55% of the equity interest in each of our wholly-, directly-owned subsidiaries and are repayable, at our option, in shares of our Common Stock. On December 21, 2012, we elected to repay $1,301,300 of the $1,384,455 outstanding under the Credit Agreement with 1,300,000 restricted shares of our Common Stock, 26.5% of our total issued and outstanding shares of Common Stock, as authorized by the Credit Agreement and approved by our stockholders. On August 23, 2013, we entered into the August 2013 Amendment to the Credit Agreement dated July 27, 2012, as amended on December 21, 2012. The August 2013 Amendment decreases the interest rate payable on borrowings under the Credit Agreement effective January 1, 2013, to 10% annually, compounded and payable quarterly, from 1.25% per month, payable monthly. We agreed to pay an amendment fee of 100,000 restricted shares of the Company’s Common Stock, and to deliver to Northtech share certificates representing 55% of the issued and outstanding shares of Heat HP Inc. and Heat PHE Inc., discussed further below, to perfect Northtech’s security interest under the Credit Agreement. On August 23, 2013, we entered into an Assignment and Assumption Agreement with Northtech whereby Northtech agreed to assume a $100,000 obligation of the Company in exchange for 200,000 restricted shares of the Company’s Common Stock. On September 17, 2013 we issued Northtech 100,000 restricted shares of the Company’s Common Stock in consideration of its consent to use its proposal as a stalking horse proposal to solicit other potential purchasers of our subsidiaries’ assets. On March 26, 2014, we gave notice to Northtech pursuant to the terms of the Credit Agreement, extending the maturity date on the Credit Agreement from April 30, 2014 to January 3, 2015 and elected to pay the extension fee of 4% by issuing 200,000 shares of its Common Stock to Northtech. On July 10, 2014 we entered into the July 2014 Amendment to the Credit and Security Agreement and issued an additional 200,000 shares of our Common Stock as an extension fee.

On October 10, 2013, we entered in the EIPA, under the terms of which, Buyers agreed to purchase 40% of the Company’s equity interests in substantially all of the PHE segment subsidiaries in the consideration of RMB 5,000,000. Buyers consist of a group of 25 natural persons, all of whom are P.R.C. citizens, including Wen Sha, Jun Wang and Xudong Wang, managers of certain of the Company’s subsidiaries engaged in the PHE segment of its business, and Huajuan Ai and Yingkai Wang, the Company’s Corporate Secretary and Acting Chief Accountant, respectively. Huajuan Ai, Wen Sha, Jun Wang and Xudong Wang are also principals in Northtech Holdings Inc. On March 27, 2014, Buyers exercised their option to purchase an additional 40% of the equity interests in the PHE segment subsidiaries from the Company. The closing of transaction will be scheduled to occur after satisfaction of the conditions set forth in the EIPA, including, without limitation, approval of the transaction by a majority of the Company’s stockholders entitled to vote.

Except as disclosed above, there were no transactions with any related persons (as that term is defined in Item 404 in Regulation S-K) during 2012 or 2013, or any currently proposed transaction, in which we were or are to be a participant and the amount involved was in excess of $120,000 and in which any related person had a direct or indirect material interest.

21