UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21993

Oppenheimer Revenue Weighted ETF Trust

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

VTL Associates, LLC

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant's telephone number, including area code: (303) 768-3200

Date of fiscal year end: June 30

Date of reporting period: June 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| Annual Report | 6/30/16 |

Oppenheimer

Revenue Weighted

ETF Trust

Would you prefer to receive materials like this electronically? See inside front cover for details.

Receive investor materials electronically:

Shareholders may sign up for electronic delivery of investor materials. By doing so, you will receive the information faster and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

| 1. | Go to www.icsdelivery.com |

| 2. | Select the first letter of your brokerage firm’s name. |

| 3. | From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic delivery may not be available. Please contact your brokerage firm. |

| 4. | Complete the information requested, including the e-mail address where you would like to receive notifications for electronic documents. |

Your information will be kept confidential and will not be used for any purpose other than electronic delivery. If you change your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to www.icsdelivery.com, perform the first three steps above and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

TABLE OF CONTENTS

1

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

(UNAUDITED)

| Market Overview | June 30, 2016 |

One year trailing 6/30/16 the S&P 500 Index, which is a broad based index that represents 500 of the largest publicly traded securities in the U.S., returned a mere 3.99%. The primary driver for the S&P 500 index has been the information technology sector. The S&P 500 information technology sector has skyrocketed to a price to sales multiple, which is a ratio of the stock’s traded price divided by its 12 month trailing reported revenue figure, of 3.65. This has not been seen since just prior to the tech bubble burst, which was a phenomenon that occurred in the late 1990s where the information technology sector began to appreciate well beyond the suggested fundamentals of the companies that compromised the sector. After the turn of the century, and the hype from Y2K wore down, investors began realizing the information technology companies were not meeting their expected growth trajectory as those securities were trading so far and above their current sales and earnings; it made it nearly impossible to grow out of that overvaluation. The current trading environment around many of these technology companies has been predicated on the augmentation of product designs to enhance client demand, and subsequently drive sales. Given that U.S. year-over-year GDP is currently 1.2%, as well as the overall global economy looking bleak, it’s hard to expect information technology, or any sector for that matter, to sustain that kind of valuation. Looking back, after the tech bubble burst circa Q2 of 2000, the S&P 500 Value Index outperformed both the S&P 500 Growth Index and the S&P 500 broad-based index over the next five calendar years.

2

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — continued

(UNAUDITED)

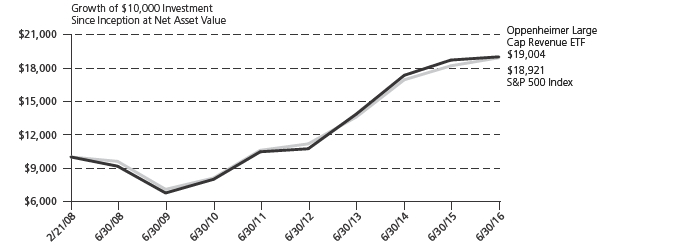

| Oppenheimer Large Cap Revenue ETF (Ticker: RWL) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming the total return performance of the S&P 500 Index (“S&P 500”) by attempting to replicate the RevenueShares Large Cap Index™, a custom index that is constructed by re-weighting the constituent securities of the S&P 500 according to revenue earned, subject to certain asset diversification requirements. The RevenueShares Large Cap Index™ generally contains the same securities as the S&P 500, but in different proportions. The S&P 500 is a stock market index comprised of a representative sample of common stocks of 500 leading companies in leading industries of the United States economy selected by S&P Dow Jones Indices LLC. An investor cannot invest directly in an index. Under normal circumstances, the Fund will invest at least 80% of its net assets in the securities of large capitalization companies included in the S&P 500 and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines large capitalization companies as companies that are included in the S&P 500 at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Oppenheimer Large Cap Revenue ETF (+1.55%) underperformed the S&P 500 (+3.99%) for the fiscal year ended 6/30/2016. The Fund underperformed in 8 of the 10 S&P 500 Global Industry Classification Standard (“GICS”) sectors for the fiscal year.

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three contributors to return were Amazon.com, Inc. (+63.61%), Exxon Mobil Corp. (+17.94%), and AT&T, Inc. (+28.20%), while the bottom three contributors in this group were Apple, Inc. (–22.94%), AmerisourceBergen Corp. (–25.27%), and Marathon Petroleum Corp. (–27.21%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | ||

| 1 Year | 5 Year | Since Inception* | |

| Fund | |||

| Large Cap NAV Return | 1.55% | 12.25% | 7.74% |

| Large Cap Market Price | 1.61% | 12.27% | 7.75% |

| Index | |||

| RevenueShares Large | |||

| Cap Index™ | 1.86% | 12.76% | 7.98% |

| S&P 500 Index | 3.99% | 12.06% | 7.32% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares Large Cap Index™ returns became publicly available on January 3, 2006. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.61% and the net expense ratio is 0.49%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 2/21/08, as opposed to the exchange list inception, which took place on 2/22/08. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

3

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — continued

(UNAUDITED)

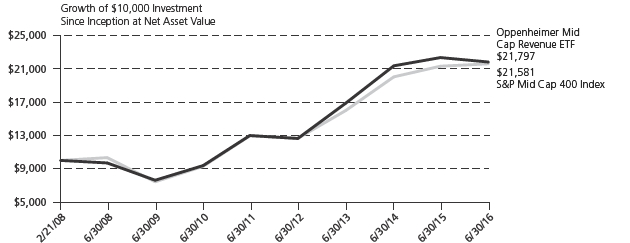

| Oppenheimer Mid Cap Revenue ETF (Ticker: RWK) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming the total return performance of the S&P Mid Cap 400 Index (“S&P Mid Cap 400”) by attempting to replicate the RevenueShares Mid Cap Index™, a custom index constructed by re-weighting the constituent securities of the S&P Mid Cap 400 by revenue earned, subject to certain asset diversification requirements. The RevenueShares Mid Cap Index™ generally contains the same securities as the S&P Mid Cap 400, but in different proportions. The S&P Mid Cap 400 is a stock market index comprised of common stock of 400 mid-sized companies selected by S&P Dow Jones Indices LLC. Under normal circumstances, the Fund will invest at least 80% of its net assets in the securities of mid capitalization companies included in the S&P Mid Cap 400 Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines mid capitalization companies as companies that are included in the S&P Mid Cap 400 at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Oppenheimer Mid Cap Revenue ETF (–2.39%) underperformed the S&P Mid Cap 400 (+1.32%) for the fiscal year ended 6/30/2016. The strong outperformance in the Information Technology sector relative to the S&P Mid Cap 400 was not enough to offset the underperformances in 7 of the other 9 GICS sectors.

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three contributors to return were Ingram Micro, Inc., Class A (+39.76%), Tech Data Corp. (+25.17%), and Computer Sciences Corp. (+60.24%), while the bottom three contributors in this group were Community Health Systems, Inc. (–76.76%), Office Depot, Inc. (–62.17%), and SUPERVALU, Inc. (–41.58%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | ||

| 1 Year | 5 Year | Since Inception* | |

| Fund | |||

| Mid Cap NAV Return | (2.39)% | 10.27% | 9.39% |

| Mid Cap Market Price | (2.38)% | 10.37% | 9.45% |

| Index | |||

| RevenueShares | |||

| Mid Cap Index™ | (1.89)% | 11.04% | 9.14% |

| S&P Mid Cap 400 Index | 1.32% | 10.50% | 8.53% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares Mid Cap Index™ returns became publicly available on January 3, 2006. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.68% and the net expense ratio is 0.54%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 2/21/08, as opposed to the exchange list inception, which took place on 2/22/08. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

4

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — continued

(UNAUDITED)

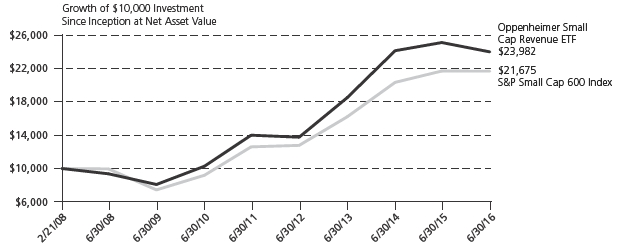

| Oppenheimer Small Cap Revenue ETF (Ticker: RWJ) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming the total return performance of the S&P Small Cap 600 Index (“S&P Small Cap 600”) by attempting to replicate the RevenueShares Small Cap Index™, a custom index constructed by re-weighting the constituent securities of the S&P Small Cap 600 according to revenue earned, subject to certain asset diversification requirements. The RevenueShares Small Cap Index™ generally contains the same securities as the S&P Small Cap 600, but in different proportions. The S&P Small Cap 600 is a stock market index comprised of 600 common stocks of small-cap companies selected by S&P Dow Jones Indices LLC based on inclusion criteria to ensure that they are investable and financially viable. Under normal circumstances, the Fund will invest at least 80% of its net assets in the securities of small capitalization companies included in the S&P Small Cap 600 Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines small capitalization companies as companies that are included in the S&P Small Cap 600 at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Oppenheimer Small Cap Revenue ETF (–4.46%) underperformed the S&P Small Cap 600 (–0.07%) for the fiscal year ended 6/30/2016. The Fund trailed in 7 of the 10 S&P Small Cap 600 GICS sectors for the fiscal year, including a large underperformance in the Consumer Discretionary sector.

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three contributors to return were AK Steel Holding Corp. (+22.31%), Synnex Corp. (+24.75%), and SkyWest, Inc. (+81.77%), while the bottom three contributors in this group were Group 1 Automotive, Inc. (–45.86%), Lithia Motors, Inc., Class A (–37.45%), and Sonic Automotive, Inc., Class A (–27.94%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | ||

| 1 Year | 5 Year | Since Inception* | |

| Fund | |||

| Small Cap NAV Return | (4.46)% | 10.85% | 10.72% |

| Small Cap Market Price | (4.51)% | 10.91% | 10.75% |

| Index | |||

| RevenueShares | |||

| Small Cap Index™ | (3.80)% | 11.57% | 9.79% |

| S&P Small Cap 600 Index | (0.07)% | 11.16% | 8.20% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares Small Cap Index™ returns became publicly available on January 3, 2006. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.67% and the net expense ratio is 0.54%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 2/21/08, as opposed to the exchange list inception, which took place on 2/22/08. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

5

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — continued

(UNAUDITED)

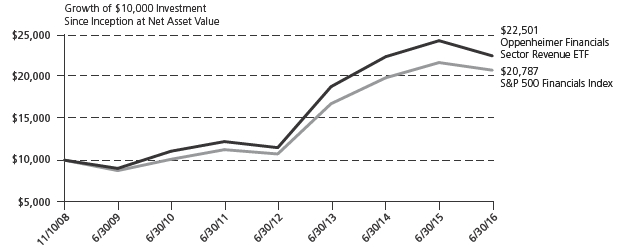

| Oppenheimer Financials Sector Revenue ETF (Ticker: RWW) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming the total return performance of the S&P 500 Financials Index by attempting to replicate the RevenueShares Financials Sector Index™, a custom index constructed by re-weighting the constituent securities of the S&P 500 Financials Index™ by revenue earned, subject to certain asset diversification requirements. The RevenueShares Financials Sector Index generally contains the same securities as the S&P 500 Financials Index, but in different proportions. The S&P 500 Financials Index is a stock market index comprised of large cap companies that S&P Dow Jones Indices LLC deems to be part of the Financials sector of the United States economy, using the GICS. It is a subset of the S&P 500 Index and includes companies involved in activities such as: banking; mortgage finance; consumer finance; specialized finance; investment banking and brokerage; asset management and custody; corporate lending; insurance; financial investment; and real estate, including real estate investment trusts (“REITs”). Under normal circumstances, the Fund will invest at least 80% of its net assets in Financials companies included in the S&P 500 Financials Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Financials companies as companies that are included in the S&P 500 Financials Index at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Oppenheimer Financials Sector Revenue ETF (–7.49%) underperformed the S&P 500 Financials Sector (–4.21%) for the fiscal year ended 6/30/2016.

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three contributors to return were Berkshire Hathaway, Inc., Class B (+5.29%), Chubb Ltd. (+33.29%), and The Travelers Cos., Inc. (+22.65%), while the bottom three contributors in this group were MetLife, Inc. (–27.15%), Bank of America Corp. (–21.93%), and Citigroup, Inc. (–23.56%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | ||

| 1 Year | 5 Year | Since Inception* | |

| Fund | |||

| Financials Sector | |||

| NAV Return | (7.49)% | 10.21% | 9.41% |

| Financials Sector | |||

| Market Price | (7.58)% | 10.21% | 9.40% |

| Index | |||

| RevenueShares Financials | |||

| Sector Index™ | (7.07)% | 10.77% | 4.86% |

| S&P 500 Financials Index | (4.21)% | 10.40% | 3.64% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares Financials Sector Index™ returns became publicly available on October 1, 2008. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.77% and the net expense ratio is 0.49%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 11/10/08, as opposed to the exchange list inception, which took place on 11/12/08. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

6

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — continued

(UNAUDITED)

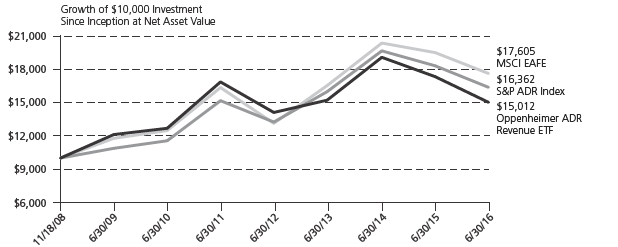

| Oppenheimer ADR Revenue ETF (Ticker: RTR) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming the total return performance of the S&P ADR Index by attempting to replicate the RevenueShares ADR Index™, a custom index constructed by re-weighting the constituent securities of the S&P ADR Index according to revenue earned, subject to certain asset diversification requirements. The RevenueShares ADR Index™ generally contains the same securities as the S&P ADR Index, but in different proportions. The S&P ADR Index is a U.S. dollar denominated version of the S&P Global 1200 Ex U.S. Index and is based on the non-U.S. stocks of the S&P Global 1200 Ex U.S. Index. American Depositary Receipts (“ADRs”) are certificates that represent a U.S. dollar denominated equity ownership in a foreign company and offer U.S. investors the same economic benefits enjoyed by the shareholders of that company. Typically, ADRs are listed and traded on U.S. exchanges and trade in U.S. dollars just like any other U.S.-domiciled security. Since not all foreign companies offer ADR programs, the S&P ADR Index is made up of those companies from the S&P Global 1200 Ex U.S. Index who make available ADRs that are offered or listed on a U.S. exchange, global shares or, in the case of Canadian equities, ordinary shares, all of which are traded on a U.S. exchange. Under normal circumstances, the Fund will invest at least 80% of its net assets in ADRs included in the S&P ADR Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Oppenheimer ADR Revenue ETF had an NAV return of (–13.32%) versus (–10.58%) for the S&P ADR Index for the fiscal year ended 6/30/2016.

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three performers were Nippon Telegraph & Telephone Corp. — ADR (+32.95%), Petroleo Brasileiro SA — ADR (+64.60%), and NTT DOCOMO, Inc. — ADR (+45.58%), while the bottom three contributors were PetroChina Co. Ltd. — ADR (–37.57%), Toyota Motor Corp. — ADR (–22.77%), and China Petroleum & Chemical Corp. — ADR (–13.02%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | ||

| 1 Year | 5 Year | Since Inception* | |

| Fund | |||

| ADR NAV Return | (13.32)% | (1.73)% | 5.87% |

| ADR Market Price | (13.47)% | (1.78)% | 5.83% |

| Index | |||

| RevenueShares | |||

| ADR Index™ | (13.06)% | (1.19)% | 2.01% |

| S&P ADR Index | (10.58)% | 0.40% | 2.53% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares ADR Index™ returns became publicly available on October 1, 2008. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.01% and the net expense ratio is 0.49%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 11/18/08, as opposed to the exchange list inception, which took place on 11/20/08. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

7

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — continued

(UNAUDITED)

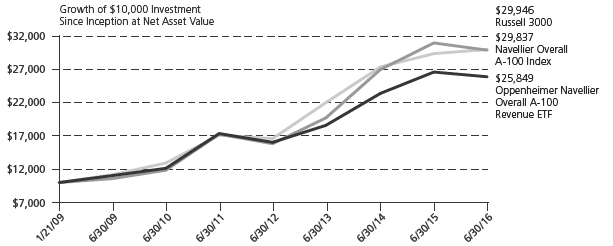

| Oppenheimer Navellier Overall A-100 Revenue ETF (Ticker: RWV) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming the total return performance of the Navellier Overall A-100 Index (“Index”) by attempting to replicate the RevenueShares Navellier Overall A-100 Index™, a custom index constructed by re-weighting the constituent securities of the Navellier Overall A-100 Index by revenue earned, subject to certain asset diversification requirements and a maximum 7% per company weighting. The RevenueShares Navellier Overall A-100 Index™ generally contains the same securities as the Navallier Overall A-100 Index, but in different proportions. The Navellier Overall A-100 Index is constructed from companies that are traded on the New York Stock Exchange, Nasdaq Stock Exchange or NYSE MKT Exchange that have over 2,500 shares traded daily, a closing price over $1, and that have been public for at least one year. This universe of companies is narrowed through a combination of quantitative and fundamental screens to select the top 100 of the total universe. This is accomplished by implementing a multi-factor model that encompasses nine factors, one of which is quantitative based and eight that are fundamental. The quantitative factor begins with a computer-driven analysis based on Modern Portfolio Theory. The Navellier Overall A-100 Index calculates reward (alpha) and risk (standard deviation) characteristics for the universe of approximately 5,000 stocks. Trailing 52-week “alphas” (measure of return independent of the market) are divided by trailing 52-week “standard deviations” (measure of volatility or risk) to create a “reward/risk” ratio. This factor has the highest weight in the Navellier Overall A-100 Index.

The Oppenheimer Navellier Overall A-100 Revenue ETF’s bias towards momentum and growth stocks resulted in an NAV return of (–2.67%) for the fiscal year ended 6/30/2016. In comparison, the Navellier Overall A-100 Index and the S&P 500 Index returned (+1.57%) and (+3.99%), respectively, for the same period.

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three contributors were NTT DOCOMO, Inc. — ADR (+35.76%), AT&T, Inc. (+12.40%), and Reynolds American, Inc. (+28.49%), while the bottom three contributors were Aetna, Inc. (–14.53%), Target Corp. (–11.27%), and McKesson Corp. (–10.33%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | ||

| 1 Year | 5 Year | Since Inception* | |

| Fund | |||

| Navellier NAV Return | (2.67)% | 8.57% | 13.80% |

| Navellier Market Price | (2.66)% | 8.53% | 13.80% |

| Index | |||

| RevenueShares Navellier | |||

| Overall A-100 Index™ | (1.80)% | 9.64% | 14.12% |

| Navellier Overall | |||

| A-100 Index | 1.57% | 9.00% | 12.38% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares Navellier Overall A-100 Index™ returns became publicly available on December 31, 2008. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.30% and the net expense ratio is 0.60%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 1/21/09, as opposed to the exchange list inception, which took place on 1/23/09. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

8

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — continued

(UNAUDITED)

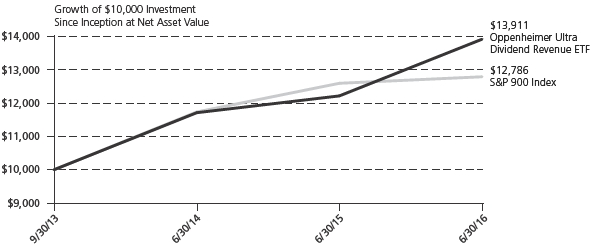

| Oppenheimer Ultra Dividend Revenue ETF (Ticker: RDIV) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming the total return performance of the S&P 900 Index by attempting to replicate the RevenueShares Ultra Dividend Index™, a custom index constructed by identifying the top 60 securities from the S&P 900® Index with the highest average of the 1-year trailing dividend yields for the current quarter and each of the past three quarters (excluding securities that have issued a special dividend over that time period), and re-weighting those securities according to the revenue earned by the companies, subject to certain asset diversification requirements and a maximum 5% per company weighting. The RevenueShares Ultra Dividend Index™ generally contains a subset of the securities in the S&P 900 Index, in different proportions. Under normal circumstances, the Fund will invest at least 80% of its net assets in the securities of companies included in the S&P 900 Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities.

The Oppenheimer Ultra Dividend Revenue ETF had an NAV return of (+13.91%) for the fiscal year ended 6/30/2016 compared to the S&P 900® Index return of (+3.77%).

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three contributors were Chevron Corp. (+34.86%), The Southern Co. (+33.97%), and Altria Group, Inc. (+27.51%), while the leading detractors were Kinder Morgan, Inc. (–51.92%), Williams Cos., Inc. (–59.05%), and Seagate Technology PLC (–26.03%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | |

| 1 Year | Since Inception* | |

| Fund | ||

| Ultra Dividend NAV Return | 13.91% | 12.91% |

| Ultra Dividend Market Price | 13.90% | 12.90% |

| Index | ||

| RevenueShares Ultra | ||

| Dividend Index™ | 15.26% | 13.85% |

| S&P 900 Index | 3.77% | 10.53% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares Ultra Dividend Index™ returns became publicly available on October 1, 2013. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.72% and the net expense ratio is 0.49%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 9/30/13, as opposed to the exchange list inception, which took place on 10/1/13. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

9

MANAGEMENT DISCUSSION OF FUND PERFORMANCE — concluded

(UNAUDITED)

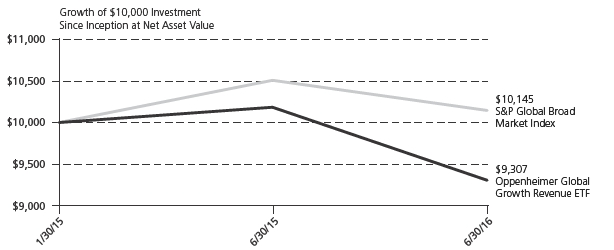

| Oppenheimer Global Growth Revenue ETF (Ticker: RGRO) | June 30, 2016 |

The Fund seeks to achieve its investment objective of outperforming to total return performance of the S&P Global Broad Market Index by attempting to replicate the portfolio of the RevenueShares Global Growth Index™, a custom index constructed by identifying the top five developed market (including the United States) and top five emerging market countries represented in the S&P Global Broad Market Index with the highest gross domestic product (“GDP”) growth (as measured by the 1-year trailing GDP growth rates as of the most recent two quarters). Each country will represent 10% of the RevenueShares Global Growth Index™. Once those ten countries are identified, the top ten securities in the S&P Global Broad Market Index from each of those countries are identified according to revenue earned by the companies. Those securities are then re-weighted according to the revenue earned by the companies, subject to certain asset diversification requirements and a maximum 5% per company weighting. The RevenueShares Global Growth Index™ generally contains a subset of the securities in the S&P Global Broad Market Index, in different proportions.

Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities (including common shares traded on local exchanges, American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”), European Depositary Receipts (“EDRs”) and global shares (“Global Shares”)) of companies included in the S&P Global Broad Market Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. ADRs, GDRs and EDRs represent ownership interests in shares of foreign companies that are held in financial institution custodial accounts, and are traded on exchanges in the United States and around the world. Global Shares are the actual (ordinary) shares of a non-U.S. company, which trade both in the home market and the U.S. and are represented by the same share certificate in both the U.S. and the home market. The Fund may invest in securities of companies of any market capitalization, including small and medium capitalization companies. The Fund will concentrate its investments in a particular industry or group of industries to approximately the same extent that the RevenueShares Global Growth Index™ is concentrated, meaning that it will invest more than 25% of its total assets in that industry or group of industries.

The Oppenheimer Global Growth Revenue ETF had an NAV return of (–8.60%) for the fiscal year ended 6/30/2016 compared to the S&P Global Broad Market Index® Index return of (–3.44%).

Among the top and bottom contributing Fund holdings for the fiscal year ended 6/30/2016, the top three contributors were San Miguel Corp. (+29.72%), Strabag SE (+38.20%), and Cencosud SA (+23.95%), while the top three detractors were JBS SA (–37.95%), Volkswagen AG (–47.98%), and Vienna Insurance Group AG (–43.12%).

| Fund Performance History (%) |

Average Annual Total Return As of June 30, 2016 | |

| 1 Year | Since Inception* | |

| Fund | ||

| Global Growth NAV Return | (8.60)% | (4.97)% |

| Global Growth Market Price | (6.93)% | (4.24)% |

| RevenueShares Global | ||

| Growth Index™ | (4.44)% | (0.55)% |

| S&P Global Broad Market Index | (3.44)% | 1.02% |

Performance reflects reinvestment of all dividend and capital gains distributions. During this period, some of the Fund’s fees were waived and/or expenses reimbursed; otherwise, the Fund’s performance would have been lower.

Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in Fund shares. Such fees, expenses and commissions reduce Fund returns. RevenueShares Global Growth Index™ returns became publicly available on October 16, 2014. Index returns do not represent Fund returns. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.94% and the net expense ratio is 0.70%. Since the Fund is new, “Other expenses” are based on estimated amounts. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has contractually agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the net expense ratio. This agreement is in effect until December 2, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance please visit www.revenueshares.com.

| * | The since inception return is calculated from NAV performance inception on 1/30/15, as opposed to the exchange list inception, which took place on 2/2/15. NAV performance inception represents when the Fund's NAV was struck for the first time. Exchange list inception represents when the Fund began trading. |

10

(UNAUDITED)

As a shareholder of an Oppenheimer ETF, you incur two types of costs: (1) transaction costs for purchasing and selling shares and (2) ongoing costs, including management fees and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The actual and hypothetical expense examples below are based on an investment of $1,000 held for the entire six-month period from January 1, 2016 to June 30, 2016.

Actual expenses

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Six Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line under each Fund in the table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under each Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value 01/01/2016 |

Ending Account Value 06/30/2016 |

Annualized Expense Ratios for the Six Month Period |

Expenses Paid During the Six Month Period1 | |

| Oppenheimer Large Cap Revenue ETF | ||||

| Actual | $1,000.00 | $1,037.40 | 0.49% | $2.48 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.43 | 0.49% | $2.46 |

| Oppenheimer Mid Cap Revenue ETF | ||||

| Actual | $1,000.00 | $1,061.20 | 0.54% | $2.77 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.18 | 0.54% | $2.72 |

| Oppenheimer Small Cap Revenue ETF | ||||

| Actual | $1,000.00 | $1,065.90 | 0.54% | $2.77 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.18 | 0.54% | $2.72 |

| Oppenheimer Financials Sector Revenue ETF | ||||

| Actual | $1,000.00 | $957.50 | 0.49% | $2.38 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.43 | 0.49% | $2.46 |

| Oppenheimer ADR Revenue ETF | ||||

| Actual | $1,000.00 | $1,053.40 | 0.49% | $2.50 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.43 | 0.49% | $2.46 |

| Oppenheimer Navellier Overall A-100 Revenue ETF | ||||

| Actual | $1,000.00 | $1,038.20 | 0.60% | $3.04 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.88 | 0.60% | $3.02 |

| Oppenheimer Ultra Dividend Revenue ETF | ||||

| Actual | $1,000.00 | $1,153.50 | 0.49% | $2.62 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.43 | 0.49% | $2.46 |

| Oppenheimer Global Growth Revenue ETF | ||||

| Actual | $1,000.00 | $1,050.20 | 0.70% | $3.57 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.38 | 0.70% | $3.52 |

| 1 | Expenses are calculated using each Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 182/366 (to reflect the six-month period). |

11

SCHEDULE OF INVESTMENTS SUMMARY TABLES

(UNAUDITED)

Oppenheimer Large Cap Revenue ETF

| Industry | % of Net Assets | ||

| Automobiles & Components | 3.6 | % | |

| Banks | 3.6 | ||

| Capital Goods | 7.9 | ||

| Commercial & Professional Services | 0.6 | ||

| Consumer Durables & Apparel | 1.6 | ||

| Consumer Services | 1.1 | ||

| Diversified Financials | 4.2 | ||

| Energy | 7.9 | ||

| Food & Staples Retailing | 10.4 | ||

| Food, Beverage & Tobacco | 4.3 | ||

| Health Care Equipment & Services | 11.8 | ||

| Household & Personal Products | 1.2 | ||

| Insurance | 4.1 | ||

| Materials | 3.1 | ||

| Media | 2.5 | ||

| Money Market Fund | 0.9 | ||

| Pharmaceuticals, Biotechnology | |||

| & Life Sciences | 3.6 | ||

| Real Estate | 0.8 | ||

| Retailing | 7.0 | ||

| Semiconductors & Semiconductor Equipment | 1.5 | ||

| Software & Services | 4.8 | ||

| Technology Hardware | |||

| & Equipment | 4.7 | ||

| Telecommunication Services | 3.3 | ||

| Transportation | 3.0 | ||

| Utilities | 3.2 | ||

| Total Investments | 100.7 | ||

| Liabilities in Excess of | |||

| Other Assets | (0.7 | ) | |

| Net Assets | 100.0 | % | |

Oppenheimer Mid Cap Revenue ETF

| Industry | % of Net Assets | ||

| Automobiles & Components | 0.8 | % | |

| Banks | 1.8 | ||

| Capital Goods | 10.8 | ||

| Commercial & Professional Services | 3.4 | ||

| Consumer Durables & Apparel | 3.9 | ||

| Consumer Services | 2.7 | ||

| Diversified Financials | 1.3 | ||

| Energy | 6.0 | ||

| Food & Staples Retailing | 2.9 | ||

| Food, Beverage & Tobacco | 3.1 | ||

| Health Care Equipment & Services | 8.2 | ||

| Household & Personal Products | 0.8 | ||

| Insurance | 6.0 | ||

| Materials | 8.1 | ||

| Media | 1.8 | ||

| Money Market Fund | 10.0 | ||

| Pharmaceuticals, Biotechnology | |||

| & Life Sciences | 1.0 | ||

| Real Estate | 2.6 | ||

| Retailing | 8.3 | ||

| Semiconductors & Semiconductor Equipment | 1.2 | ||

| Software & Services | 4.3 | ||

| Technology Hardware | |||

| & Equipment | 15.1 | ||

| Telecommunication Services | 0.4 | ||

| Transportation | 1.4 | ||

| Utilities | 3.8 | ||

| Total Investments | 109.7 | ||

| Liabilities in Excess of | |||

| Other Assets | (9.7 | ) | |

| Net Assets | 100.0 | % | |

Oppenheimer Small Cap Revenue ETF

| Industry | % of Net Assets | ||

| Automobiles & Components | 1.6 | % | |

| Banks | 2.8 | ||

| Capital Goods | 12.7 | ||

| Commercial & Professional Services | 7.0 | ||

| Consumer Durables & Apparel | 4.3 | ||

| Consumer Services | 3.5 | ||

| Diversified Financials | 1.9 | ||

| Energy | 3.1 | ||

| Food & Staples Retailing | 2.0 | ||

| Food, Beverage & Tobacco | 2.4 | ||

| Health Care Equipment & Services | 8.2 | ||

| Household & Personal Products | 0.5 | ||

| Insurance | 2.5 | ||

| Materials | 8.1 | ||

| Media | 1.0 | ||

| Money Market Fund | 9.4 | ||

| Pharmaceuticals, Biotechnology | |||

| & Life Sciences | 1.1 | ||

| Real Estate | 1.7 | ||

| Retailing | 14.4 | ||

| Semiconductors & Semiconductor | |||

| Equipment | 1.3 | ||

| Software & Services | 3.8 | ||

| Technology Hardware | |||

| & Equipment | 8.1 | ||

| Telecommunication Services | 2.0 | ||

| Transportation | 4.0 | ||

| Utilities | 1.8 | ||

| Total Investments | 109.2 | ||

| Liabilities in Excess of | |||

| Other Assets | (9.2 | ) | |

| Net Assets | 100.0 | % | |

Oppenheimer Financials Sector

Revenue ETF

| Industry | % of Net Assets | |||

| Banks | 28.4 | % | ||

| Capital Markets | 10.3 | |||

| Consumer Finance | 4.5 | |||

| Diversified Financial Services | 17.8 | |||

| Insurance | 32.2 | |||

| Money Market Fund | 0.1 | |||

| Real Estate Investment Trusts | 5.6 | |||

| Real Estate Management | ||||

| & Development | 0.7 | |||

| Total Investments | 99.6 | |||

| Other Assets in Excess | ||||

| of Liabilities | 0.4 | |||

| Net Assets | 100.0 | % | ||

Oppenheimer ADR Revenue ETF

| Industry | % of Net Assets | |||

| Automobiles & Components | 7.9 | % | ||

| Banks | 9.5 | |||

| Capital Goods | 1.4 | |||

| Consumer Durables & Apparel | 1.8 | |||

| Consumer Services | 0.4 | |||

| Diversified Financials | 2.7 | |||

| Energy | 32.1 | |||

| Food & Staples Retailing | 0.9 | |||

| Food, Beverage & Tobacco | 2.7 | |||

| Health Care Equipment & Services | 0.5 | |||

| Household & Personal Products | 2.7 | |||

| Insurance | 4.9 | |||

| Materials | 7.7 | |||

| Media | 1.4 | |||

| Money Market Fund | 26.0 | |||

| Pharmaceuticals, Biotechnology | ||||

| & Life Sciences | 4.1 | |||

| Semiconductors & Semiconductor Equipment | 0.9 | |||

| Software & Services | 0.6 | |||

| Technology Hardware | ||||

| & Equipment | 2.0 | |||

| Telecommunication Services | 11.8 | |||

| Transportation | 0.7 | |||

| Utilities | 2.2 | |||

| Total Investments | 124.9 | |||

| Liabilities in Excess of | ||||

| Other Assets | (24.9 | ) | ||

| Net Assets | 100.0 | % | ||

Oppenheimer Navellier Overall A-100 Revenue ETF

| Industry | % of Net Assets | |||

| Automobiles & Components | 0.9 | % | ||

| Banks | 4.4 | |||

| Capital Goods | 5.1 | |||

| Commercial & Professional Services | 2.2 | |||

| Consumer Durables & Apparel | 1.3 | |||

| Consumer Services | 1.5 | |||

| Diversified Financials | 1.6 | |||

| Food & Staples Retailing | 7.1 | |||

| Food, Beverage & Tobacco | 9.3 | |||

| Health Care Equipment & Services | 7.1 | |||

| Household & Personal Products | 0.9 | |||

| Insurance | 4.7 | |||

| Materials | 1.6 | |||

| Money Market Fund | 3.0 | |||

| Real Estate | 5.7 | |||

| Retailing | 3.4 | |||

| Semiconductors & Semiconductor Equipment | 1.1 | |||

| Software & Services | 13.4 | |||

| Technology Hardware | ||||

| & Equipment | 0.4 | |||

| Telecommunication Services | 24.6 | |||

| Transportation | 1.4 | |||

| Utilities | 1.7 | |||

| Total Investments | 102.4 | |||

| Liabilities in Excess of | ||||

| Other Assets | (2.4 | ) | ||

| Net Assets | 100.0 | % | ||

12

SCHEDULE OF INVESTMENTS SUMMARY TABLES

(UNAUDITED) — concluded

Oppenheimer Ultra Dividend Revenue ETF

| Industry | % of Net Assets | |||

| Automobiles & Components | 9.4 | % | ||

| Banks | 0.8 | |||

| Commercial & Professional Services | 2.8 | |||

| Consumer Durables & Apparel | 2.6 | |||

| Diversified Financials | 0.8 | |||

| Energy | 16.2 | |||

| Insurance | 0.8 | |||

| Materials | 2.0 | |||

| Media | 0.7 | |||

| Money Market Fund | 6.4 | |||

| Real Estate | 8.0 | |||

| Retailing | 22.2 | |||

| Technology Hardware | ||||

| & Equipment | 3.6 | |||

| Telecommunication Services | 16.8 | |||

| Utilities | 12.8 | |||

| Total Investments | 105.9 | |||

| Liabilities in Excess of | ||||

| Other Assets | (5.9 | ) | ||

| Net Assets | 100.0 | % | ||

Oppenheimer Global Growth Revenue ETF

| Industry |

% of | ||

| Automobiles & Components | 5.4 | % | |

| Banks | 3.6 | ||

| Capital Goods | 11.2 | ||

| Commercial & Professional Services | 0.5 | ||

| Diversified Financials | 3.3 | ||

| Energy | 21.5 | ||

| Food & Staples Retailing | 6.7 | ||

| Food, Beverage & Tobacco | 6.0 | ||

| Insurance | 8.8 | ||

| Materials | 7.8 | ||

| Money Market Fund | 0.7 | ||

| Pharmaceuticals, Biotechnology | |||

| & Life Sciences | 2.5 | ||

| Retailing | 1.3 | ||

| Semiconductors & Semiconductor | |||

| Equipment | 0.7 | ||

| Technology Hardware & Equipment | 7.4 | ||

| Telecommunication Services | 3.5 | ||

| Transportation | 1.5 | ||

| Utilities | 3.4 | ||

| Total Investments | 95.8 | ||

| Other Assets in Excess | |||

| of Liabilities | 4.2 | ||

| Net Assets | 100.0% | ||

13

SCHEDULE OF INVESTMENTS

OPPENHEIMER LARGE CAP REVENUE ETF

June 30, 2016

| Shares | Value | |||||||

| COMMON STOCKS—99.8% | ||||||||

| Automobiles & Components—3.6% | ||||||||

| BorgWarner, Inc. | 8,689 | $ | 256,499 | |||||

| Delphi Automotive PLC | 8,135 | 509,251 | ||||||

| Ford Motor Co. | 409,708 | 5,150,030 | ||||||

| General Motors Co. | 185,910 | 5,261,253 | ||||||

| Goodyear Tire & Rubber Co. (The) | 20,041 | 514,252 | ||||||

| Harley-Davidson, Inc. | 4,911 | 222,468 | ||||||

| Johnson Controls, Inc. | 28,746 | 1,272,298 | ||||||

| Total Automobiles & Components | 13,186,051 | |||||||

| Banks—3.6% | ||||||||

| Bank of America Corp. | 190,034 | 2,521,751 | ||||||

| BB&T Corp. | 9,142 | 325,547 | ||||||

| Citigroup, Inc. | 52,333 | 2,218,396 | ||||||

| Citizens Financial Group, Inc. | 6,499 | 129,850 | ||||||

| Comerica, Inc. | 1,657 | 68,152 | ||||||

| Fifth Third Bancorp | 11,808 | 207,703 | ||||||

| Huntington Bancshares, Inc. | 11,005 | 98,385 | ||||||

| JPMorgan Chase & Co. | 47,984 | 2,981,726 | ||||||

| KeyCorp | 11,884 | 131,318 | ||||||

| M&T Bank Corp. | 1,548 | 183,020 | ||||||

| People’s United Financial, Inc. | 2,345 | 34,378 | ||||||

| PNC Financial Services | ||||||||

| Group, Inc. (The) | 5,800 | 472,062 | ||||||

| Regions Financial Corp. | 19,112 | 162,643 | ||||||

| SunTrust Banks, Inc. | 6,854 | 281,562 | ||||||

| U.S. Bancorp | 15,658 | 631,487 | ||||||

| Wells Fargo & Co. | 59,754 | 2,828,157 | ||||||

| Zions Bancorporation | 2,592 | 65,137 | ||||||

| Total Banks | 13,341,274 | |||||||

| Capital Goods—7.9% | ||||||||

| 3M Co. | 6,282 | 1,100,104 | ||||||

| Acuity Brands, Inc. | 431 | 106,871 | ||||||

| Allegion PLC | 1,032 | 71,652 | ||||||

| AMETEK, Inc. | 3,021 | 139,661 | ||||||

| Boeing Co. (The) | 25,895 | 3,362,984 | ||||||

| Caterpillar, Inc. | 20,150 | 1,527,571 | ||||||

| Cummins, Inc. | 5,655 | 635,848 | ||||||

| Deere & Co. | 11,498 | 931,798 | ||||||

| Dover Corp. | 3,606 | 249,968 | ||||||

| Eaton Corp. PLC | 11,263 | 672,739 | ||||||

| Emerson Electric Co. | 13,846 | 722,207 | ||||||

| Fastenal Co.1 | 3,272 | 145,244 | ||||||

| Flowserve Corp. | 2,875 | 129,864 | ||||||

| Fluor Corp. | 11,903 | 586,580 | ||||||

| Fortune Brands Home & | ||||||||

| Security, Inc.1 | 11,892 | 689,379 | ||||||

| General Dynamics Corp. | 7,993 | 1,112,945 | ||||||

| General Electric Co. | 136,003 | 4,281,374 | ||||||

| Honeywell International, Inc. | 11,890 | 1,383,045 | ||||||

| Illinois Tool Works, Inc. | 4,380 | 456,221 | ||||||

| Ingersoll-Rand PLC | 7,352 | 468,175 | ||||||

| Jacobs Engineering Group, Inc.2 | 7,791 | 388,070 | ||||||

| L-3 Communications Holdings, Inc. | 2,742 | 402,224 | ||||||

| Lockheed Martin Corp. | 7,128 | 1,768,956 | ||||||

| Masco Corp. | 8,148 | 252,099 | ||||||

| Northrop Grumman Corp. | 3,859 | 857,778 | ||||||

| PACCAR, Inc. | 11,316 | 586,961 | ||||||

| Shares | Value | |||||||

| Parker-Hannifin Corp. | 3,563 | $ | 384,982 | |||||

| Pentair PLC | 3,699 | 215,615 | ||||||

| Quanta Services, Inc.2 | 10,882 | 251,592 | ||||||

| Raytheon Co. | 6,446 | 876,334 | ||||||

| Rockwell Automation, Inc. | 1,873 | 215,058 | ||||||

| Rockwell Collins, Inc. | 1,970 | 167,726 | ||||||

| Roper Technologies, Inc. | 622 | 106,088 | ||||||

| Snap-on, Inc. | 701 | 110,632 | ||||||

| Stanley Black & Decker, Inc. | 3,548 | 394,608 | ||||||

| Textron, Inc. | 12,222 | 446,836 | ||||||

| TransDigm Group, Inc.2 | 415 | 109,431 | ||||||

| United Rentals, Inc.2 | 2,551 | 171,172 | ||||||

| United Technologies Corp. | 18,965 | 1,944,861 | ||||||

| W.W. Grainger, Inc. | 1,483 | 337,012 | ||||||

| Xylem, Inc. | 3,069 | 137,031 | ||||||

| Total Capital Goods | 28,899,296 | |||||||

| Commercial & Professional Services—0.6% | ||||||||

| Cintas Corp. | 1,926 | 188,998 | ||||||

| Dun & Bradstreet Corp. (The) | 597 | 72,739 | ||||||

| Equifax, Inc. | 843 | 108,241 | ||||||

| Nielsen Holdings PLC | 4,023 | 209,075 | ||||||

| Pitney Bowes, Inc. | 5,894 | 104,913 | ||||||

| Republic Services, Inc. | 6,632 | 340,288 | ||||||

| Robert Half International, Inc. | 4,582 | 174,849 | ||||||

| Stericycle, Inc.1,2 | 1,092 | 113,699 | ||||||

| Tyco International PLC | 7,561 | 322,099 | ||||||

| Verisk Analytics, Inc.2 | 867 | 70,296 | ||||||

| Waste Management, Inc. | 7,562 | 501,134 | ||||||

| Total Commercial & Professional Services | 2,206,331 | |||||||

| Consumer Durables & Apparel—1.6% | ||||||||

| Coach, Inc.1 | 3,859 | 157,216 | ||||||

| D.R. Horton, Inc. | 12,888 | 405,714 | ||||||

| Garmin Ltd.1 | 2,565 | 108,807 | ||||||

| Hanesbrands, Inc. | 8,155 | 204,935 | ||||||

| Harman International Industries, Inc.1 | 2,857 | 205,190 | ||||||

| Hasbro, Inc. | 1,705 | 143,203 | ||||||

| Leggett & Platt, Inc. | 2,845 | 145,408 | ||||||

| Lennar Corp., Class A | 7,022 | 323,714 | ||||||

| Mattel, Inc. | 5,811 | 181,826 | ||||||

| Michael Kors Holdings Ltd.1,2 | 3,639 | 180,058 | ||||||

| Mohawk Industries, Inc.2 | 1,476 | 280,086 | ||||||

| Newell Brands, Inc. | 4,562 | 221,576 | ||||||

| NIKE, Inc., Class B | 21,215 | 1,171,068 | ||||||

| PulteGroup, Inc. | 11,403 | 222,245 | ||||||

| PVH Corp. | 2,991 | 281,842 | ||||||

| Ralph Lauren Corp. | 2,678 | 240,002 | ||||||

| Under Armour, Inc., Class A1,2 | 1,907 | 76,528 | ||||||

| Under Armour, Inc., Class C2 | 2,043 | 74,365 | ||||||

| VF Corp. | 6,995 | 430,123 | ||||||

| Whirlpool Corp. | 4,114 | 685,557 | ||||||

| Total Consumer Durables & Apparel | 5,739,463 | |||||||

| Consumer Services—1.1% | ||||||||

| Carnival Corp. | 11,623 | 513,737 | ||||||

| Chipotle Mexican Grill, Inc.1,2 | 423 | 170,368 | ||||||

| Darden Restaurants, Inc. | 3,770 | 238,792 | ||||||

| H&R Block, Inc. | 4,566 | 105,018 | ||||||

| Marriott International, Inc., Class A1 | 1,638 | 108,862 | ||||||

14

SCHEDULE OF INVESTMENTS — continued

OPPENHEIMER LARGE CAP REVENUE ETF

June 30, 2016

| Shares | Value | |||||||

| Consumer Services (continued) | ||||||||

| McDonald’s Corp. | 7,457 | $ | 897,375 | |||||

| Royal Caribbean Cruises Ltd. | 3,867 | 259,669 | ||||||

| Starbucks Corp. | 13,270 | 757,982 | ||||||

| Starwood Hotels & Resorts | ||||||||

| Worldwide, Inc. | 1,453 | 107,449 | ||||||

| Wyndham Worldwide Corp. | 2,701 | 192,392 | ||||||

| Wynn Resorts Ltd.1 | 1,456 | 131,972 | ||||||

| Yum! Brands, Inc. | 5,736 | 475,629 | ||||||

| Total Consumer Services | 3,959,245 | |||||||

| Diversified Financials—4.2% | ||||||||

| Affiliated Managers Group, Inc.2 | 458 | 64,473 | ||||||

| American Express Co. | 16,808 | 1,021,254 | ||||||

| Ameriprise Financial, Inc. | 4,029 | 362,006 | ||||||

| Bank of New York | ||||||||

| Mellon Corp. (The) | 12,387 | 481,235 | ||||||

| Berkshire Hathaway, Inc., Class B2 | 50,487 | 7,310,013 | ||||||

| BlackRock, Inc. | 1,188 | 406,926 | ||||||

| Capital One Financial Corp. | 9,406 | 597,375 | ||||||

| Charles Schwab Corp. (The) | 7,708 | 195,089 | ||||||

| CME Group, Inc. | 1,072 | 104,413 | ||||||

| Discover Financial Services | 4,516 | 242,012 | ||||||

| E*TRADE Financial Corp.2 | 2,823 | 66,312 | ||||||

| Franklin Resources, Inc. | 7,562 | 252,344 | ||||||

| Goldman Sachs Group, Inc. (The) | 6,810 | 1,011,830 | ||||||

| Intercontinental Exchange, Inc. | 627 | 160,487 | ||||||

| Invesco Ltd. | 6,417 | 163,890 | ||||||

| Legg Mason, Inc. | 2,282 | 67,296 | ||||||

| Leucadia National Corp. | 21,032 | 364,485 | ||||||

| Moody’s Corp. | 1,107 | 103,737 | ||||||

| Morgan Stanley | 44,296 | 1,150,810 | ||||||

| Nasdaq, Inc. | 1,654 | 106,964 | ||||||

| Navient Corp. | 5,609 | 67,027 | ||||||

| Northern Trust Corp. | 2,562 | 169,758 | ||||||

| S&P Global, Inc. | 1,702 | 182,556 | ||||||

| State Street Corp. | 6,065 | 327,025 | ||||||

| Synchrony Financial2 | 7,029 | 177,693 | ||||||

| T. Rowe Price Group, Inc. | 1,948 | 142,146 | ||||||

| Total Diversified Financials | 15,299,156 | |||||||

| Energy—7.9% | ||||||||

| Anadarko Petroleum Corp. | 5,532 | 294,579 | ||||||

| Apache Corp.1 | 3,456 | 192,396 | ||||||

| Baker Hughes, Inc. | 10,333 | 466,328 | ||||||

| Cabot Oil & Gas Corp. | 1,457 | 37,503 | ||||||

| Chesapeake Energy Corp.1,2 | 82,783 | 354,311 | ||||||

| Chevron Corp. | 39,343 | 4,124,327 | ||||||

| Cimarex Energy Co. | 319 | 38,063 | ||||||

| Columbia Pipeline Group, Inc. | 1,454 | 37,062 | ||||||

| Concho Resources, Inc.1,2 | 549 | 65,479 | ||||||

| ConocoPhillips | 20,481 | 892,972 | ||||||

| Devon Energy Corp. | 11,518 | 417,527 | ||||||

| Diamond Offshore Drilling, Inc.1 | 3,015 | 73,355 | ||||||

| EOG Resources, Inc. | 3,149 | 262,690 | ||||||

| EQT Corp. | 963 | 74,565 | ||||||

| Exxon Mobil Corp. | 86,488 | 8,107,385 | ||||||

| FMC Technologies, Inc.2 | 6,650 | 177,355 | ||||||

| Halliburton Co. | 15,675 | 709,921 | ||||||

| Helmerich & Payne, Inc.1 | 1,128 | 75,723 | ||||||

| Shares | Value | |||||||

| Hess Corp. | 3,178 | $ | 190,998 | |||||

| Kinder Morgan, Inc. | 27,112 | 507,537 | ||||||

| Marathon Oil Corp. | 10,913 | 163,804 | ||||||

| Marathon Petroleum Corp. | 58,180 | 2,208,513 | ||||||

| Murphy Oil Corp. | 2,508 | 79,629 | ||||||

| National Oilwell Varco, Inc.1 | 11,417 | 384,182 | ||||||

| Newfield Exploration Co.2 | 944 | 41,706 | ||||||

| Noble Energy, Inc. | 2,980 | 106,893 | ||||||

| Occidental Petroleum Corp. | 5,322 | 402,130 | ||||||

| ONEOK, Inc. | 5,696 | 270,275 | ||||||

| Phillips 661 | 34,659 | 2,749,845 | ||||||

| Pioneer Natural Resources Co. | 680 | 102,823 | ||||||

| Range Resources Corp. | 852 | 36,755 | ||||||

| Schlumberger Ltd. | 13,927 | 1,101,347 | ||||||

| Southwestern Energy Co.1,2 | 8,328 | 104,766 | ||||||

| Spectra Energy Corp.1 | 5,466 | 200,220 | ||||||

| Tesoro Corp. | 11,866 | 889,001 | ||||||

| Transocean Ltd.1 | 20,350 | 241,961 | ||||||

| Valero Energy Corp. | 52,890 | 2,697,390 | ||||||

| Williams Cos., Inc. (The) | 11,638 | 251,730 | ||||||

| Total Energy | 29,133,046 | |||||||

| Food & Staples Retailing—10.4% | ||||||||

| Costco Wholesale Corp. | 27,340 | 4,293,474 | ||||||

| CVS Health Corp. | 58,166 | 5,568,813 | ||||||

| Kroger Co. (The) | 107,421 | 3,952,018 | ||||||

| Sysco Corp. | 35,933 | 1,823,240 | ||||||

| Walgreens Boots Alliance, Inc. | 52,201 | 4,346,777 | ||||||

| Wal-Mart Stores, Inc. | 241,234 | 17,614,907 | ||||||

| Whole Foods Market, Inc. | 15,983 | 511,776 | ||||||

| Total Food & Staples Retailing | 38,111,005 | |||||||

| Food, Beverage & Tobacco—4.3% | ||||||||

| Altria Group, Inc. | 10,491 | 723,459 | ||||||

| Archer-Daniels-Midland Co. | 52,430 | 2,248,723 | ||||||

| Brown-Forman Corp., Class B | 1,106 | 110,335 | ||||||

| Campbell Soup Co. | 4,665 | 310,362 | ||||||

| Coca-Cola Co. (The) | 33,363 | 1,512,345 | ||||||

| ConAgra Foods, Inc. | 10,096 | 482,690 | ||||||

| Constellation Brands, Inc., Class A | 1,431 | 236,687 | ||||||

| Dr Pepper Snapple Group, Inc. | 2,304 | 222,635 | ||||||

| General Mills, Inc. | 9,483 | 676,328 | ||||||

| Hershey Co. (The) | 2,627 | 298,138 | ||||||

| Hormel Foods Corp. | 9,486 | 347,188 | ||||||

| JM Smucker Co. (The) | 2,024 | 308,478 | ||||||

| Kellogg Co. | 6,539 | 533,909 | ||||||

| Kraft Heinz Co. (The) | 9,002 | 796,497 | ||||||

| McCormick & Co., Inc. | 1,458 | 155,525 | ||||||

| Mead Johnson Nutrition Co. | 1,684 | 152,823 | ||||||

| Molson Coors Brewing Co., Class B | 1,058 | 106,996 | ||||||

| Mondelez International, Inc., Class A | 22,668 | 1,031,621 | ||||||

| Monster Beverage Corp.2 | 713 | 114,586 | ||||||

| PepsiCo, Inc. | 21,563 | 2,284,384 | ||||||

| Philip Morris International, Inc. | 9,334 | 949,454 | ||||||

| Reynolds American, Inc. | 7,882 | 425,076 | ||||||

| Tyson Foods, Inc., Class A | 23,540 | 1,572,237 | ||||||

| Total Food, Beverage & Tobacco | 15,600,476 | |||||||

15

SCHEDULE OF INVESTMENTS — continued

OPPENHEIMER LARGE CAP REVENUE ETF

June 30, 2016

| Shares | Value | |||||||

| Health Care Equipment & Services—11.8% | ||||||||

| Abbott Laboratories | 19,044 | $ | 748,620 | |||||

| Aetna, Inc. | 17,576 | 2,146,557 | ||||||

| AmerisourceBergen Corp. | 66,378 | 5,265,103 | ||||||

| Anthem, Inc. | 21,394 | 2,809,888 | ||||||

| Baxter International, Inc. | 6,572 | 297,186 | ||||||

| Becton Dickinson and Co. | 2,592 | 439,577 | ||||||

| Boston Scientific Corp.2 | 11,115 | 259,757 | ||||||

| C.R. Bard, Inc. | 489 | 114,993 | ||||||

| Cardinal Health, Inc. | 52,680 | 4,109,567 | ||||||

| Centene Corp.2 | 11,930 | 851,444 | ||||||

| Cerner Corp.2 | 2,581 | 151,247 | ||||||

| Cigna Corp. | 10,285 | 1,316,377 | ||||||

| Danaher Corp. | 7,719 | 779,619 | ||||||

| DaVita HealthCare Partners, Inc.2 | 6,709 | 518,740 | ||||||

| DENTSPLY SIRONA, Inc. | 1,717 | 106,523 | ||||||

| Edwards Lifesciences Corp.2 | 1,014 | 101,126 | ||||||

| Express Scripts Holding Co.2 | 47,120 | 3,571,696 | ||||||

| HCA Holdings, Inc.2 | 17,887 | 1,377,478 | ||||||

| Henry Schein, Inc.2 | 2,250 | 397,800 | ||||||

| Hologic, Inc.2 | 3,114 | 107,744 | ||||||

| Humana, Inc. | 10,359 | 1,863,377 | ||||||

| Intuitive Surgical, Inc.2 | 158 | 104,503 | ||||||

| Laboratory Corp. of | ||||||||

| America Holdings2 | 2,552 | 332,449 | ||||||

| McKesson Corp. | 36,178 | 6,752,624 | ||||||

| Medtronic PLC | 11,935 | 1,035,600 | ||||||

| Patterson Cos., Inc. | 3,684 | 176,427 | ||||||

| Quest Diagnostics, Inc. | 3,303 | 268,897 | ||||||

| St. Jude Medical, Inc. | 2,360 | 184,080 | ||||||

| Stryker Corp. | 3,174 | 380,340 | ||||||

| UnitedHealth Group, Inc. | 42,210 | 5,960,052 | ||||||

| Universal Health Services, Inc., | ||||||||

| Class B | 2,423 | 324,924 | ||||||

| Varian Medical Systems, Inc.2 | 1,214 | 99,827 | ||||||

| Zimmer Biomet Holdings, Inc. | 2,139 | 257,493 | ||||||

| Total Health Care Equipment | ||||||||

| & Services | 43,211,635 | |||||||

| Household & Personal Products—1.2% | ||||||||

| Church & Dwight Co., Inc. | 1,102 | 113,385 | ||||||

| Clorox Co. (The) | 1,673 | 231,526 | ||||||

| Colgate-Palmolive Co. | 7,600 | 556,320 | ||||||

| Estee Lauder Cos., Inc., (The), Class A | 4,385 | 399,123 | ||||||

| Kimberly-Clark Corp. | 5,018 | 689,875 | ||||||

| Procter & Gamble Co. (The) | 28,912 | 2,447,979 | ||||||

| Total Household & Personal Products | 4,438,208 | |||||||

| Insurance—4.1% | ||||||||

| Aflac, Inc. | 10,595 | 764,535 | ||||||

| Allstate Corp. (The) | 18,942 | 1,324,993 | ||||||

| American International Group, Inc. | 33,804 | 1,787,893 | ||||||

| Aon PLC | 3,668 | 400,656 | ||||||

| Arthur J. Gallagher & Co. | 3,767 | 179,309 | ||||||

| Assurant, Inc. | 4,297 | 370,874 | ||||||

| Chubb Ltd. | 6,094 | 796,547 | ||||||

| Cincinnati Financial Corp. | 2,560 | 191,718 | ||||||

| Hartford Financial | ||||||||

| Services Group, Inc. (The) | 14,191 | 629,797 | ||||||

| Lincoln National Corp. | 10,184 | 394,834 | ||||||

| Shares | Value | |||||||

| Loews Corp. | 11,888 | $ | 488,478 | |||||

| Marsh & McLennan Cos., Inc. | 7,143 | 489,010 | ||||||

| MetLife, Inc. | 55,108 | 2,194,952 | ||||||

| Principal Financial Group, Inc. | 10,308 | 423,762 | ||||||

| Progressive Corp. (The) | 23,539 | 788,556 | ||||||

| Prudential Financial, Inc. | 26,803 | 1,912,126 | ||||||

| Torchmark Corp. | 2,375 | 146,822 | ||||||

| Travelers Cos., Inc. (The) | 8,351 | 994,103 | ||||||

| Unum Group | 10,500 | 333,795 | ||||||

| Willis Towers Watson PLC | 1,445 | 179,628 | ||||||

| XL Group PLC1 | 11,997 | 399,620 | ||||||

| Total Insurance | 15,192,008 | |||||||

| Materials—3.1% | ||||||||

| Air Products & Chemicals, Inc. | 2,246 | 319,022 | ||||||

| Albemarle Corp. | 1,247 | 98,899 | ||||||

| Alcoa, Inc. | 76,996 | 713,753 | ||||||

| Avery Dennison Corp. | 2,832 | 211,692 | ||||||

| Ball Corp. | 3,875 | 280,124 | ||||||

| CF Industries Holdings, Inc. | 5,038 | 121,416 | ||||||

| Dow Chemical Co. (The) | 31,429 | 1,562,336 | ||||||

| E.I. du Pont de Nemours & Co. | 12,970 | 840,456 | ||||||

| Eastman Chemical Co. | 4,504 | 305,822 | ||||||

| Ecolab, Inc. | 3,944 | 467,758 | ||||||

| FMC Corp. | 2,205 | 102,113 | ||||||

| Freeport-McMoRan, Inc.1 | 46,563 | 518,712 | ||||||

| International Flavors & | ||||||||

| Fragrances, Inc. | 851 | 107,285 | ||||||

| International Paper Co.1 | 17,718 | 750,889 | ||||||

| LyondellBasell Industries NV, | ||||||||

| Class A | 13,617 | 1,013,377 | ||||||

| Martin Marietta Materials, Inc.1 | 595 | 114,240 | ||||||

| Monsanto Co. | 4,331 | 447,869 | ||||||

| Mosaic Co. (The)1 | 10,832 | 283,582 | ||||||

| Newmont Mining Corp. | 8,138 | 318,358 | ||||||

| Nucor Corp. | 10,829 | 535,061 | ||||||

| Owens-Illinois, Inc.2 | 11,177 | 201,298 | ||||||

| PPG Industries, Inc. | 5,023 | 523,145 | ||||||

| Praxair, Inc. | 3,210 | 360,772 | ||||||

| Sealed Air Corp. | 5,309 | 244,055 | ||||||

| Sherwin-Williams Co. (The) | 1,416 | 415,837 | ||||||

| Vulcan Materials Co. | 952 | 114,583 | ||||||

| WestRock Co. | 12,170 | 473,048 | ||||||

| Total Materials | 11,445,502 | |||||||

| Media—2.5% | ||||||||

| CBS Corp., Class B | 9,679 | 526,925 | ||||||

| Comcast Corp., Class A | 42,446 | 2,767,055 | ||||||

| Discovery Communications, Inc., | ||||||||

| Class A2 | 4,192 | 105,764 | ||||||

| Discovery Communications, Inc., | ||||||||

| Class C2 | 4,340 | 103,509 | ||||||

| Interpublic Group of Cos., Inc. (The) | 10,646 | 245,923 | ||||||

| News Corp., Class A | 12,664 | 143,736 | ||||||

| News Corp., Class B1 | 12,297 | 143,506 | ||||||

| Omnicom Group, Inc. | 6,135 | 499,941 | ||||||

| Scripps Networks Interactive, Inc., | ||||||||

| Class A | 1,716 | 106,855 | ||||||

| TEGNA, Inc. | 4,981 | 115,410 | ||||||

| Time Warner, Inc. | 13,385 | 984,333 | ||||||

16

SCHEDULE OF INVESTMENTS — continued

OPPENHEIMER LARGE CAP REVENUE ETF

June 30, 2016

| Shares | Value | |||||||

| Media (continued) | ||||||||

| Twenty-First Century Fox, Inc., | ||||||||

| Class A | 16,397 | $ | 443,539 | |||||

| Twenty-First Century Fox, Inc., | ||||||||

| Class B | 16,365 | 445,946 | ||||||

| Viacom, Inc., Class B1 | 10,440 | 432,947 | ||||||

| Walt Disney Co. (The) | 19,864 | 1,943,096 | ||||||

| Total Media | 9,008,485 | |||||||

| Pharmaceuticals, Biotechnology & Life Sciences—3.6% | ||||||||

| AbbVie, Inc. | 13,765 | 852,191 | ||||||

| Agilent Technologies, Inc. | 3,211 | 142,440 | ||||||

| Alexion Pharmaceuticals, Inc.2 | 810 | 94,576 | ||||||

| Allergan PLC2 | 2,125 | 491,066 | ||||||

| Amgen, Inc. | 4,956 | 754,055 | ||||||

| Biogen, Inc.2 | 1,472 | 355,959 | ||||||

| Bristol-Myers Squibb Co. | 8,054 | 592,372 | ||||||

| Celgene Corp.2 | 3,143 | 309,994 | ||||||

| Eli Lilly & Co. | 9,388 | 739,305 | ||||||

| Endo International PLC2 | 6,501 | 101,351 | ||||||

| Gilead Sciences, Inc. | 13,410 | 1,118,662 | ||||||

| Illumina, Inc.2 | 517 | 72,576 | ||||||

| Johnson & Johnson | 21,526 | 2,611,104 | ||||||

| Mallinckrodt PLC2 | 1,836 | 111,592 | ||||||

| Merck & Co., Inc. | 24,409 | 1,406,203 | ||||||

| Mylan NV1,2 | 7,370 | 318,679 | ||||||

| PerkinElmer, Inc. | 1,361 | 71,344 | ||||||

| Perrigo Co. PLC | 1,839 | 166,742 | ||||||

| Pfizer, Inc. | 52,738 | 1,856,905 | ||||||

| Regeneron Pharmaceuticals, Inc.2 | 410 | 143,184 | ||||||

| Thermo Fisher Scientific, Inc. | 4,045 | 597,689 | ||||||

| Vertex Pharmaceuticals, Inc.2 | 408 | 35,096 | ||||||

| Waters Corp.2 | 497 | 69,903 | ||||||

| Zoetis, Inc. | 3,755 | 178,212 | ||||||

| Total Pharmaceuticals, Biotechnology | ||||||||

| & Life Sciences | 13,191,200 | |||||||

| Real Estate—0.8% | ||||||||

| American Tower Corp. | 1,665 | 189,161 | ||||||

| Apartment Investment & | ||||||||

| Management Co., Class A | 892 | 39,391 | ||||||

| AvalonBay Communities, Inc. | 387 | 69,811 | ||||||

| Boston Properties, Inc. | 574 | 75,711 | ||||||

| CBRE Group, Inc., Class A2 | 13,476 | 356,844 | ||||||

| Crown Castle International Corp. | 1,547 | 156,912 | ||||||

| Digital Realty Trust, Inc.1 | 534 | 58,201 | ||||||

| Equinix, Inc. | 314 | 121,747 | ||||||

| Equity Residential | 1,684 | 115,994 | ||||||

| Essex Property Trust, Inc. | 188 | 42,881 | ||||||

| Extra Space Storage, Inc. | 413 | 38,219 | ||||||

| Federal Realty Investment Trust | 204 | 33,772 | ||||||

| General Growth Properties, Inc. | 3,939 | 117,461 | ||||||

| HCP, Inc. | 3,155 | 111,624 | ||||||

| Host Hotels & Resorts, Inc. | 11,846 | 192,024 | ||||||

| Iron Mountain, Inc. | 2,946 | 117,339 | ||||||

| Kimco Realty Corp. | 1,233 | 38,692 | ||||||

| Macerich Co. (The) | 457 | 39,023 | ||||||

| Prologis, Inc. | 1,476 | 72,383 | ||||||

| Public Storage | 363 | 92,779 | ||||||

| Realty Income Corp. | 517 | 35,859 | ||||||

| Simon Property Group, Inc. | 925 | 200,632 | ||||||

| Shares | Value | |||||||

| SL Green Realty Corp. | 639 | $ | 68,034 | |||||

| UDR, Inc. | 1,068 | 39,431 | ||||||

| Ventas, Inc. | 1,600 | 116,512 | ||||||

| Vornado Realty Trust | 758 | 75,891 | ||||||

| Welltower, Inc. | 1,937 | 147,541 | ||||||

| Weyerhaeuser Co. | 8,267 | 246,109 | ||||||

| Total Real Estate | 3,009,978 | |||||||

| Retailing—7.0% | ||||||||

| Advance Auto Parts, Inc. | 2,146 | 346,858 | ||||||

| Amazon.com, Inc.2 | 5,546 | 3,968,828 | ||||||

| AutoNation, Inc.1,2 | 14,566 | 684,311 | ||||||

| AutoZone, Inc.1,2 | 558 | 442,963 | ||||||

| Bed Bath & Beyond, Inc. | 9,234 | 399,093 | ||||||