| RevenueShares Large Cap Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares Large Cap Fund (the “Fund”) seeks to outperform the total return performance of the S&P 500® Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 12.73% of the average value of its portfolio. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares Large Cap IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements. The Underlying Index is rebalanced quarterly according to September 30 revenue weightings. The Underlying Index thus contains the same securities as the Benchmark Index, but in different proportions. Under normal circumstances, the Fund will invest at least 80% of its net assets in the securities of large capitalization companies included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines large capitalization companies as companies that are included in the Benchmark Index at the time of purchase. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||

Like all investments, investing in the Fund entails risks, including the risk that you may lose part or all of the money you invest. Investment Approach Risk The alternate weighting approach employed by the Underlying Index and the Fund, while designed to enhance potential returns compared to the Benchmark Index, may not produce the desired results. Using revenues as a weighting measure is no guarantee that the Underlying Index or the Fund will outperform the Benchmark Index, and may even cause the Underlying Index or the Fund to underperform the Benchmark Index. Stock Market Risk Stock market risk is the risk that broad movements in financial markets will adversely affect the price of the Fund’s investments, regardless of how well the companies in which the Fund invests perform. There is also a risk that the price of one or more of the securities or other instruments in the Fund’s portfolio will fall. Market Trading Risk There can be no assurance that an active trading market for Shares will develop or be maintained. Although it is expected that Shares will remain listed for trading on the NYSE Arca, Inc. (the “Exchange”), it is possible that an active trading market may not be maintained. Premium/Discount Risk As an ETF, Shares generally trade in the secondary market on the Exchange at market prices that change throughout the day. Although it is expected that the market price of Fund Shares will approximate the Fund’s NAV, there may be times when the market price and the NAV vary significantly. You may pay more than NAV when you buy Shares of the Fund on the Exchange, and you may receive less than NAV when you sell those Shares on the Exchange. Non-Correlation Risk The Fund’s return may not match the return of the Underlying Index. The Fund incurs a number of operating expenses that are not reflected in the Underlying Index, including the cost of buying and selling securities. Portfolio Turnover Risk Because the Fund is rebalanced quarterly, the Fund may experience portfolio turnover in excess of 100%. Portfolio turnover may involve the payment by the Fund of brokerage and other transaction costs on the sale of securities, as well as on the investment of the proceeds in other securities. The greater the portfolio turnover, the greater the transaction costs to the Fund, which could have an adverse effect on the Fund’s total rate of return, and the more likely the Fund is to generate capital gains that must be distributed to shareholders as taxable income. | |||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||

The performance information that follows shows the Fund’s performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by comparing the Fund’s performance with a broad measure of market performance and the index the Fund seeks to track. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at http://www.revenuesharesetfs.com. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. | |||||||||||||||||||||||||

| Annual Total Return as of December 31 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

During the periods shown in the bar chart above the Fund’s highest quarterly return was 18.95% (quarter ended June 30, 2009) and the Fund’s lowest quarterly return was -12.07% (quarter ended March 31, 2009). Year-to-date return (through September 30, 2011): -10.51% | |||||||||||||||||||||||||

| Average Annual Total Return as of December 31, 2010 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| RevenueShares Mid Cap Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares Mid Cap Fund (the “Fund”) seeks to outperform the total return performance of the S&P MidCap 400® Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 38.03% of the average value of its portfolio. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares Mid Cap IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements. The Underlying Index is rebalanced quarterly according to September 30 revenue weightings. The Underlying Index thus contains the same securities as the Benchmark Index, but in different proportions. Under normal circumstances, the Fund will invest at least 80% of its net assets in the securities of mid capitalization companies included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines mid capitalization companies as companies that are included in the Benchmark Index at the time of purchase. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||

Like all investments, investing in the Fund entails risks, including the risk that you may lose part or all of the money you invest. Investment Approach Risk The alternate weighting approach employed by the Underlying Index and the Fund, while designed to enhance potential returns compared to the Benchmark Index, may not produce the desired results. Using revenues as a weighting measure is no guarantee that the Underlying Index or the Fund will outperform the Benchmark Index, and may even cause the Underlying Index or the Fund to underperform the Benchmark Index. Stock Market Risk Stock market risk is the risk that broad movements in financial markets will adversely affect the price of the Fund’s investments, regardless of how well the companies in which the Fund invests perform. There is also a risk that the price of one or more of the securities or other instruments in the Fund’s portfolio will fall. Market Trading Risk There can be no assurance that an active trading market for Shares will develop or be maintained. Although it is expected that Shares will remain listed for trading on the NYSE Arca, Inc. (the “Exchange”), it is possible that an active trading market may not be maintained. Premium/Discount Risk As an ETF, Shares generally trade in the secondary market on the Exchange at market prices that change throughout the day. Although it is expected that the market price of Fund Shares will approximate the Fund’s NAV, there may be times when the market price and the NAV vary significantly. You may pay more than NAV when you buy Shares of the Fund on the Exchange, and you may receive less than NAV when you sell those Shares on the Exchange. Non-Correlation Risk The Fund’s return may not match the return of the Underlying Index. The Fund incurs a number of operating expenses that are not reflected in the Underlying Index, including the cost of buying and selling securities. Increased Volatility Risk Increased volatility may result from increased cash flows to the Fund and other market participants that continuously or systematically buy large holdings of small and medium capitalization companies, which can drive prices up and down more dramatically. Additionally, the announcement that a security has been added to a widely followed index or benchmark may cause the price of that security to increase. Conversely, the announcement that a security has been deleted from a widely followed index or benchmark may cause the price of that security to decrease. Medium Capitalization Stock Risk Medium capitalization companies may have an unproven or narrow technological base and limited product lines, distribution channels, markets and financial resources. Medium capitalization companies also may be dependent on entrepreneurial management, making the companies more susceptible to certain setbacks and reversals, and may also be more sensitive to changes in the economy, such as changes in the level of interest rates. As a result, the securities of medium capitalization companies may be subject to more abrupt or erratic price movements than securities of larger companies, may have limited marketability, and may be less liquid than securities of companies with larger capitalizations. Portfolio Turnover Risk Because the Fund is rebalanced quarterly, the Fund may experience portfolio turnover in excess of 100%. Portfolio turnover may involve the payment by the Fund of brokerage and other transaction costs on the sale of securities, as well as on the investment of the proceeds in other securities. The greater the portfolio turnover, the greater the transaction costs to the Fund, which could have an adverse effect on the Fund’s total rate of return, and the more likely the Fund is to generate capital gains that must be distributed to shareholders as taxable income. | |||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||

The performance information that follows shows the Fund’s performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by comparing the Fund’s performance with a broad measure of market performance and the index the Fund seeks to track. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at http://www.revenuesharesetfs.com. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. | |||||||||||||||||||||||||

| Annual Total Return as of December 31 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

During the periods shown in the bar chart above the Fund’s highest quarterly return was 26.71% (quarter ended June 30, 2009) and the Fund’s lowest quarterly return was -12.40% (quarter ended June 30, 2010). Year-to-date return (through September 30, 2011): -15.43% | |||||||||||||||||||||||||

| Average Annual Total Return as of December 31, 2010 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| RevenueShares Small Cap Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares Small Cap Fund (the “Fund”) seeks to outperform the total return performance of the S&P SmallCap 600® Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 33.72% of the average value of its portfolio. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares Small Cap IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements. The Underlying Index is rebalanced quarterly according to September 30 revenue weightings. The Underlying Index thus contains the same securities as the Benchmark Index, but in different proportions. Under normal circumstances, the Fund will invest at least 80% of its net assets in the securities of small capitalization companies included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines small capitalization companies as companies that are included in the Benchmark Index at the time of purchase. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||

Like all investments, investing in the Fund entails risks, including the risk that you may lose part or all of the money you invest. Investment Approach Risk The alternate weighting approach employed by the Underlying Index and the Fund, while designed to enhance potential returns compared to the Benchmark Index, may not produce the desired results. Using revenues as a weighting measure is no guarantee that the Underlying Index or the Fund will outperform the Benchmark Index, and may even cause the Underlying Index or the Fund to underperform the Benchmark Index. Stock Market Risk Stock market risk is the risk that broad movements in financial markets will adversely affect the price of the Fund’s investments, regardless of how well the companies in which the Fund invests perform. There is also a risk that the price of one or more of the securities or other instruments in the Fund’s portfolio will fall. Market Trading Risk There can be no assurance that an active trading market for Shares will develop or be maintained. Although it is expected that Shares will remain listed for trading on the NYSE Arca, Inc. (the “Exchange”), it is possible that an active trading market may not be maintained. Premium/Discount Risk As an ETF, Shares generally trade in the secondary market on the Exchange at market prices that change throughout the day. Although it is expected that the market price of Fund Shares will approximate the Fund’s NAV, there may be times when the market price and the NAV vary significantly. You may pay more than NAV when you buy Shares of the Fund on the Exchange, and you may receive less than NAV when you sell those Shares on the Exchange. Non-Correlation Risk The Fund’s return may not match the return of the Underlying Index. The Fund incurs a number of operating expenses that are not reflected in the Underlying Index, including the cost of buying and selling securities. Increased Volatility Risk Increased volatility may result from increased cash flows to the Fund and other market participants that continuously or systematically buy large holdings of small and medium capitalization companies, which can drive prices up and down more dramatically. Additionally, the announcement that a security has been added to a widely followed index or benchmark may cause the price of that security to increase. Conversely, the announcement that a security has been deleted from a widely followed index or benchmark may cause the price of that security to decrease. Small Capitalization Stock Risk Small capitalization companies may have an unproven or narrow technological base and limited product lines, distribution channels, markets and financial resources. Small capitalization companies also may be dependent on entrepreneurial management, making the companies more susceptible to certain setbacks and reversals, and may also be more sensitive to changes in the economy, such as changes in the level of interest rates. As a result, the securities of small capitalization companies may be subject to more abrupt or erratic price movements than securities of larger companies, may have limited marketability, and may be less liquid than securities of companies with larger capitalizations. Portfolio Turnover Risk Because the Fund is rebalanced quarterly, the Fund may experience portfolio turnover in excess of 100%. Portfolio turnover may involve the payment by the Fund of brokerage and other transaction costs on the sale of securities, as well as on the investment of the proceeds in other securities. The greater the portfolio turnover, the greater the transaction costs to the Fund, which could have an adverse effect on the Fund’s total rate of return, and the more likely the Fund is to generate capital gains that must be distributed to shareholders as taxable income. | |||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||

The performance information that follows shows the Fund’s performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by comparing the Fund’s performance with a broad measure of market performance and the index the Fund seeks to track. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at http://www.revenuesharesetfs.com. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. | |||||||||||||||||||||||||

| Annual Total Return as of December 31 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

During the periods shown in the bar chart above the Fund’s highest quarterly return was 36.55% (quarter ended June 30, 2009) and the Fund’s lowest quarterly return was -16.25% (quarter ended March 31, 2009). Year-to-date return (through September 30, 2011): -16.00% | |||||||||||||||||||||||||

| Average Annual Total Return as of December 31, 2010 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| RevenueShares Financials Sector Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares Financials Sector Fund (the “Fund”) seeks to outperform the total return performance of the S&P 500® Financials Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 15.99% of the average value of its portfolio. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares Financials Sector IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements. The Underlying Index is rebalanced quarterly according to September 30 revenue weightings. The Underlying Index thus contains the same securities as the Benchmark Index, but in different proportions. Under normal circumstances, the Fund will invest at least 80% of its net assets in financials companies included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines financials companies as companies that are included in the Benchmark Index at the time of purchase. Financials companies include companies involved in activities such as: banking; mortgage finance; consumer finance; specialized finance; investment banking and brokerage; asset management and custody; corporate lending; insurance; financial investment; and real estate, including real estate investment trusts. The Fund will concentrate its investments in the financial industry, consistent with its Underlying Index, meaning that it may invest more than 25% of its total assets in that industry. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. The Fund is non-diversified and therefore may invest a greater percentage of its assets in a particular issuer than a diversified Fund. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||

Like all investments, investing in the Fund entails risks, including the risk that you may lose part or all of the money you invest. Investment Approach Risk The alternate weighting approach employed by the Underlying Index and the Fund, while designed to enhance potential returns compared to the Benchmark Index, may not produce the desired results. Using revenues as a weighting measure is no guarantee that the Underlying Index or the Fund will outperform the Benchmark Index, and may even cause the Underlying Index or the Fund to underperform the Benchmark Index. Stock Market Risk Stock market risk is the risk that broad movements in financial markets will adversely affect the price of the Fund’s investments, regardless of how well the companies in which the Fund invests perform. There is also a risk that the price of one or more of the securities or other instruments in the Fund’s portfolio will fall. Financials Sector Risk Financial services companies are subject to extensive governmental regulation, which may limit both the amounts and types of loans and other financial commitments they can make, and the interest rates and fees they can charge. Profitability is largely dependent on the availability and cost of capital funds, and can fluctuate significantly when interest rates change or due to increased competition. Credit losses resulting from financial difficulties of borrowers and financial losses associated with investment activities can negatively impact the sector. Insurance companies may be subject to severe price competition. Deterioration of credit markets, such as that which occurred in 2008 and 2009, can have an adverse impact on a broad range of financial markets, causing certain financial services companies to incur large losses. In these conditions, financial services companies may experience significant declines in the valuation of their assets and even cease operations. Some financial services companies may also be required to accept or borrow significant amounts of capital from the U.S. government and may face future government imposed restrictions on their businesses or increased government intervention, although there is no guarantee that the U.S. government will provide such relief in the future. These actions may cause the securities of many financial services companies to decline in value. In response to the recent financial crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted into federal law on July 21, 2010, in large part to provide increased regulation of financial institutions. The Dodd-Frank Act will have broad impact on virtually all participants in the financial services industry for years to come, and may have adverse effects on certain issuers, such as decreased profits or revenues. Market Trading Risk There can be no assurance that an active trading market for Shares will develop or be maintained. Although it is expected that Shares will remain listed for trading on the NYSE Arca, Inc. (the “Exchange”), it is possible that an active trading market may not be maintained. Premium/Discount Risk As an ETF, Shares generally trade in the secondary market on the Exchange at market prices that change throughout the day. Although it is expected that the market price of Fund Shares will approximate the Fund’s NAV, there may be times when the market price and the NAV vary significantly. You may pay more than NAV when you buy Shares of the Fund on the Exchange, and you may receive less than NAV when you sell those Shares on the Exchange. Non-Correlation Risk The Fund’s return may not match the return of the Underlying Index. The Fund incurs a number of operating expenses that are not reflected in the Underlying Index, including the cost of buying and selling securities. Concentration Risk The Fund may be adversely affected by the performance of the securities in the financial industry and may be subject to increased price volatility and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting that market, industry, group of industries, sector or asset class than may be the case for a fund that was not concentrated in the financial industry. Non-Diversification Risk The Fund is non-diversified and, as a result, may have greater volatility than other diversified funds. Because a non-diversified fund may invest a larger percentage of its assets in securities of a single company than diversified funds, the performance of that company can have a substantial impact on Share price. Portfolio Turnover Risk Because the Fund is rebalanced quarterly, the Fund may experience portfolio turnover in excess of 100%. Portfolio turnover may involve the payment by the Fund of brokerage and other transaction costs on the sale of securities, as well as on the investment of the proceeds in other securities. The greater the portfolio turnover, the greater the transaction costs to the Fund, which could have an adverse effect on the Fund’s total rate of return, and the more likely the Fund is to generate capital gains that must be distributed to shareholders as taxable income. | |||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||

The performance information that follows shows the Fund’s performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by comparing the Fund’s performance with a broad measure of market performance and the index the Fund seeks to track. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at http://www.revenuesharesetfs.com. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Annual Total Return as of December 31 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

During the periods shown in the bar chart above the Fund’s highest quarterly return was 39.63% (quarter ended June 30, 2009) and the Fund’s lowest quarterly return was -26.62% (quarter ended March 31, 2009). Year-to-date return (through September 30, 2011): -30.02% | |||||||||||||||||||||||||

| Average Annual Total Return as of December 31, 2010 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| RevenueShares ADR Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares ADR Fund (the “Fund”) seeks to outperform the total return performance of the S&P ADR Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 37.11% of the average value of its portfolio. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares ADR IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements. The Underlying Index thus generally contains the same securities as the Benchmark Index, but in different proportions. Constituent securities that are added to or removed from the Benchmark Index during a calendar quarter are generally added to and removed from the Underlying Index on a quarterly basis, causing the Fund to make corresponding changes to its portfolio. Under normal circumstances, the Fund will invest at least 80% of its net assets in American Depositary Receipts (“ADRs”) included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund may concentrate its investments in a particular industry, such as the energy industry, consistent with its Underlying Index, meaning that it may invest more than 25% of its total assets in that industry. Energy companies develop and produce crude oil and natural gas and provide drilling and other energy resources production and distribution related services. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. The Fund is non-diversified and therefore may invest a greater percentage of its assets in a particular issuer than a diversified Fund. Foreign Securities The Fund holds the securities of foreign companies in the form of ADRs, global shares or, in the case of Canadian equities, ordinary shares. Global shares are the actual (ordinary) shares of a non-U.S. company, which trade both in the home market and the U.S. and are represented by the same share certificate in both the U.S. and the home market. Global shares may also be eligible to list on exchanges in addition to the United States and home country. ADRs are receipts typically issued by an American bank or trust company that evidence ownership of underlying securities issued by a foreign corporation. Generally, ADRs are designed for use in the U.S. securities markets. Separate registrars in the United States and home country are maintained. In most cases, purchases occurring on a U.S. exchange would be reflected on the U.S. Registrar. The underlying securities of the ADRs in the Fund’s portfolio are usually denominated or quoted in currencies other than the U.S. dollar. Global shares may trade in their home market in currencies other than the U.S. dollar. Changes in foreign currency exchange rates affect the value of the ADR or global shares and, therefore, the value of the Fund’s portfolio. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||

Like all investments, investing in the Fund entails risks, including the risk that you may lose part or all of the money you invest. Investment Approach Risk The alternate weighting approach employed by the Underlying Index and the Fund, while designed to enhance potential returns compared to the Benchmark Index, may not produce the desired results. Using revenues as a weighting measure is no guarantee that the Underlying Index or the Fund will outperform the Benchmark Index, and may even cause the Underlying Index or the Fund to underperform the Benchmark Index. Stock Market Risk Stock market risk is the risk that broad movements in financial markets will adversely affect the price of the Fund’s investments, regardless of how well the companies in which the Fund invests perform. There is also a risk that the price of one or more of the securities or other instruments in the Fund’s portfolio will fall. Foreign Securities Risk Changes in foreign currency exchange rates affect the value of the ADR or global shares and, therefore, the value of the Fund’s portfolio. Generally, when the U.S. dollar rises in value against a foreign currency, a security denominated in that currency loses value because the currency is worth fewer U.S. dollars. Conversely, when the U.S. dollar decreases in value against a foreign currency, a security denominated in that currency gains value because the currency is worth more U.S. dollars. Certain of the risks associated with foreign investments are heightened for investments in emerging market countries. In addition, although the ADRs, global shares and ordinary shares in which the Fund invests are listed on major U.S. exchanges, there can be no assurance that a market for these securities will be made or maintained or that any such market will be or remain liquid. If that happens, the Fund may have difficulty selling securities, or selling them quickly and efficiently at the prices at which they have been valued. Foreign Market Risk Since global shares and the underlying securities of ADRs in the Fund’s portfolio trade on foreign exchanges at times when the U.S. markets are not open for trading, the value of the ADRs representing those underlying securities may change materially at times when the U.S. markets are not open for trading, regardless of whether there is an active U.S. market for Shares. Energy Industry Risk Stock prices for energy companies are affected by supply and demand both for their specific product or service and for energy products in general. The price of oil and gas, exploration and production spending, government regulation, world events and economic conditions will likewise affect the performance of these companies. Energy companies may incur large cleanup and litigation costs relating to environmental damage such as oil spills. Market Trading Risk There can be no assurance that an active trading market for Shares will develop or be maintained. Although it is expected that Shares will remain listed for trading on the NYSE Arca, Inc. (the “Exchange”), it is possible that an active trading market may not be maintained. Premium/Discount Risk As an ETF, Shares generally trade in the secondary market on the Exchange at market prices that change throughout the day. Although it is expected that the market price of Fund Shares will approximate the Fund’s NAV, there may be times when the market price and the NAV vary significantly. You may pay more than NAV when you buy Shares of the Fund on the Exchange, and you may receive less than NAV when you sell those Shares on the Exchange. Non-Correlation Risk The Fund’s return may not match the return of the Underlying Index. The Fund incurs a number of operating expenses that are not reflected in the Underlying Index, including the cost of buying and selling securities. Concentration Risk The Fund may be adversely affected by the performance of the securities in a particular industry and may be subject to increased price volatility and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting that market, industry, group of industries, sector or asset class than may be the case for a fund that was not concentrated in a particular industry. Increased Volatility Risk Increased volatility may result from increased cash flows to the Fund and other market participants that continuously or systematically buy large holdings of small and medium capitalization companies (including those trading as global shares and ADRs), which can drive prices up and down more dramatically. Additionally, the announcement that a security has been added to a widely followed index or benchmark may cause the price of that security to increase. Conversely, the announcement that a security has been deleted from a widely followed index or benchmark may cause the price of that security to decrease. Small and Medium Capitalization Stock Risk Small and medium capitalization companies (including those trading as global shares and ADRs) may have an unproven or narrow technological base and limited product lines, distribution channels, markets and financial resources. Small and medium capitalization companies also may be dependent on entrepreneurial management, making the companies more susceptible to certain setbacks and reversals. Securities of small and medium capitalization companies may also be more sensitive to changes in the economy, such as changes in the level of interest rates. As a result, the securities of small and medium capitalization companies may be subject to more abrupt or erratic price movements than securities of larger companies, may have limited marketability, and may be less liquid than securities of companies with larger capitalizations. Non-Diversification Risk The Fund is non-diversified and, as a result, may have greater volatility than other diversified funds. Because a non-diversified fund may invest a larger percentage of its assets in securities of a single company than diversified funds, the performance of that company can have a substantial impact on Share price. Portfolio Turnover Risk Because the Fund is rebalanced and reconstituted quarterly, the Fund may experience portfolio turnover in excess of 100%. Portfolio turnover may involve the payment by the Fund of brokerage and other transaction costs on the sale of securities, as well as on the investment of the proceeds in other securities. The greater the portfolio turnover, the greater the transaction costs to the Fund, which could have an adverse effect on the Fund’s total rate of return, and the more likely the Fund is to generate capital gains that must be distributed to shareholders as taxable income. | |||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||

The performance information that follows shows the Fund’s performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by comparing the Fund’s performance with a broad measure of market performance and the index the Fund seeks to track. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at http://www.revenuesharesetfs.com. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

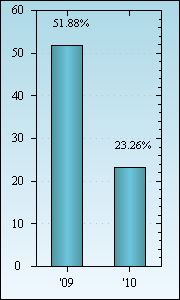

| Annual Total Return as of December 31 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

During the periods shown in the bar chart above the Fund’s highest quarterly return was 30.70% (quarter ended June 30, 2009) and the Fund’s lowest quarterly return was -15.95% (quarter ended June 30, 2010). Year-to-date return (through September 30, 2011): -18.01% | |||||||||||||||||||||||||

| Average Annual Total Return as of December 31, 2010 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| RevenueShares Navellier Overall A-100 Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares Navellier Overall A-100 Fund (the “Fund”) seeks to outperform the total return performance of the Navellier Overall A-100 Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 190.44% of the average value of its portfolio. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares Navellier Overall A-100 IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements and a maximum 7% per company weighting. The Underlying Index thus generally contains the same securities as the Benchmark Index, but in different proportions. The Underlying Index is rebalanced and reconstituted quarterly according to September 30 revenue weightings promptly following the rebalancing and reconstitution of the Benchmark Index. Under normal circumstances, the Fund will invest at least 80% of its net assets in companies included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. The Fund is non-diversified and therefore may invest a greater percentage of its assets in a particular issuer than a diversified Fund. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||

Like all investments, investing in the Fund entails risks, including the risk that you may lose part or all of the money you invest. Investment Approach Risk The alternate weighting approach employed by the Underlying Index and the Fund, while designed to enhance potential returns compared to the Benchmark Index, may not produce the desired results. Using revenues as a weighting measure is no guarantee that the Underlying Index or the Fund will outperform the Benchmark Index, and may even cause the Underlying Index or the Fund to underperform the Benchmark Index. Stock Market Risk Stock market risk is the risk that broad movements in financial markets will adversely affect the price of the Fund’s investments, regardless of how well the companies in which the Fund invests perform. There is also a risk that the price of one or more of the securities or other instruments in the Fund’s portfolio will fall. Market Trading Risk There can be no assurance that an active trading market for Shares will develop or be maintained. Although it is expected that Shares will remain listed for trading on the NYSE Arca, Inc. (the “Exchange”), it is possible that an active trading market may not be maintained. Premium/Discount Risk As an ETF, Shares generally trade in the secondary market on the Exchange at market prices that change throughout the day. Although it is expected that the market price of Fund Shares will approximate the Fund’s NAV, there may be times when the market price and the NAV vary significantly. You may pay more than NAV when you buy Shares of the Fund on the Exchange, and you may receive less than NAV when you sell those Shares on the Exchange. Non-Correlation Risk The Fund’s return may not match the return of the Underlying Index. The Fund incurs a number of operating expenses that are not reflected in the Underlying Index, including the cost of buying and selling securities. Increased Volatility Risk Increased volatility may result from increased cash flows to the Fund and other market participants that continuously or systematically buy large holdings of small and medium capitalization companies, which can drive prices up and down more dramatically. Additionally, the announcement that a security has been added to a widely followed index or benchmark may cause the price of that security to increase. Conversely, the announcement that a security has been deleted from a widely followed index or benchmark may cause the price of that security to decrease. Small and Medium Capitalization Stock Risk Small and medium capitalization companies may have an unproven or narrow technological base and limited product lines, distribution channels, markets and financial resources. Small and medium capitalization companies also may be dependent on entrepreneurial management, making the companies more susceptible to certain setbacks and reversals. Securities of small and medium capitalization companies may also be more sensitive to changes in the economy, such as changes in the level of interest rates. As a result, the securities of small and medium capitalization companies may be subject to more abrupt or erratic price movements than securities of larger companies, may have limited marketability, and may be less liquid than securities of companies with larger capitalizations. Non-Diversification Risk The Fund is non-diversified and, as a result, may have greater volatility than other diversified funds. Because a non-diversified fund may invest a larger percentage of its assets in securities of a single company than diversified funds, the performance of that company can have a substantial impact on Share price. Growth Style Investing Growth stock prices reflect projections of future earnings or revenues, and can therefore fall dramatically if the company fails to meet those projections. Growth stocks may be more expensive relative to their current earnings or assets compared to value or other stocks, and if earnings growth expectations moderate, their valuations may return to more typical levels, causing their stock prices to fall. Prices of these companies’ securities may be more volatile than other securities, particularly over the short term. Portfolio Turnover Risk Because the Fund is rebalanced and reconstituted quarterly, the Fund may experience portfolio turnover in excess of 100%. Portfolio turnover may involve the payment by the Fund of brokerage and other transaction costs on the sale of securities, as well as on the investment of the proceeds in other securities. The greater the portfolio turnover, the greater the transaction costs to the Fund, which could have an adverse effect on the Fund’s total rate of return, and the more likely the Fund is to generate capital gains that must be distributed to shareholders as taxable income. | |||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||

The performance information that follows shows the Fund’s performance information in a bar chart and an average annual total returns table. The information provides some indication of the risks of investing in the Fund by comparing the Fund’s performance with a broad measure of market performance and the index the Fund seeks to track. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance for the Fund is available at http://www.revenuesharesetfs.com. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Annual Total Return as of December 31 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

During the period shown in the bar chart above the Fund’s highest quarterly return was 15.95% (quarter ended December 31, 2010) and the Fund’s lowest quarterly return was -9.14% (quarter ended June 30, 2010). Year-to-date return (through September 30, 2011): -12.72% | |||||||||||||||||||||||||

| Average Annual Total Return as of December 31, 2010 | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| RevenueShares Consumer Discretionary Sector Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares Consumer Discretionary Sector Fund (the “Fund”) seeks to outperform the total return performance of the S&P 500® Consumer Discretionary Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares Consumer Discretionary Sector IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements. The Underlying Index is rebalanced quarterly according to September 30 revenue weightings. The Underlying Index thus contains the same securities as the Benchmark Index, but in different proportions. Under normal circumstances, the Fund will invest at least 80% of its net assets in Consumer Discretionary companies included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Consumer Discretionary companies as companies that are included in the Benchmark Index at the time of purchase. Consumer Discretionary companies include those in industries that tend to be the most sensitive to economic cycles, such as automotive; household durable goods; textiles and apparel; leisure equipment; hotels; restaurants and other leisure facilities; media production and services; and consumer retailing and services. The Fund will concentrate its investments in the Consumer Discretionary industry, consistent with its Underlying Index, meaning that it may invest more than 25% of its total assets in that industry. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. The Fund is non-diversified and therefore may invest a greater percentage of its assets in a particular issuer than a diversified Fund. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||

Like all investments, investing in the Fund entails risks, including the risk that you may lose part or all of the money you invest. Investment Approach Risk The alternate weighting approach employed by the Underlying Index and the Fund, while designed to enhance potential returns compared to the Benchmark Index, may not produce the desired results. Using revenues as a weighting measure is no guarantee that the Underlying Index or the Fund will outperform the Benchmark Index, and may even cause the Underlying Index or the Fund to underperform the Benchmark Index. Stock Market Risk Stock market risk is the risk that broad movements in financial markets will adversely affect the price of the Fund’s investments, regardless of how well the companies in which the Fund invests perform. There is also a risk that the price of one or more of the securities or other instruments in the Fund’s portfolio will fall. Market Trading Risk There can be no assurance that an active trading market for Shares will develop or be maintained. Although it is expected that Shares will be listed for trading on the NYSE Arca, Inc. (the “Exchange”), it is possible that an active trading market may not be maintained. Premium/Discount Risk As an ETF, Shares generally trade in the secondary market on the Exchange at market prices that change throughout the day. Although it is expected that the market price of Fund Shares will approximate the Fund’s NAV, there may be times when the market price and the NAV vary significantly. You may pay more than NAV when you buy Shares of the Fund on the Exchange, and you may receive less than NAV when you sell those Shares on the Exchange. Non-Correlation Risk The Fund’s return may not match the return of the Underlying Index. The Fund incurs a number of operating expenses that are not reflected in the Underlying Index, including the cost of buying and selling securities. Concentration Risk The Fund may be adversely affected by the performance of the securities in the Consumer Discretionary industry and may be subject to increased price volatility and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting that market, industry, group of industries, sector or asset class than may be the case for a fund that was not concentrated in the Consumer Discretionary industry. Non-Diversification Risk The Fund is non-diversified and, as a result, may have greater volatility than other diversified funds. Because a non-diversified fund may invest a larger percentage of its assets in securities of a single company than diversified funds, the performance of that company can have a substantial impact on Share price. Consumer Discretionary Sector Risk The success of consumer product manufacturers and retailers is tied closely to the performance of the overall domestic and international economy, interest rates and consumer confidence. Success depends heavily on disposable household income and consumer spending. Portfolio Turnover Risk Because the Fund is rebalanced quarterly, the Fund may experience portfolio turnover in excess of 100%. Portfolio turnover may involve the payment by the Fund of brokerage and other transaction costs on the sale of securities, as well as on the investment of the proceeds in other securities. The greater the portfolio turnover, the greater the transaction costs to the Fund, which could have an adverse effect on the Fund’s total rate of return, and the more likely the Fund is to generate capital gains that must be distributed to shareholders as taxable income. | |||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||

There is no performance information presented for the Fund because the Fund had not commenced investment operations as of the date of this Prospectus. | |||||||||||||||||||||||||

| RevenueShares Consumer Staples Sector Fund | |||||||||||||||||||||||||

| Investment Objective | |||||||||||||||||||||||||

RevenueShares Consumer Staples Sector Fund (the “Fund”) seeks to outperform the total return performance of the S&P 500® Consumer Staples Index, the Fund’s benchmark index (the “Benchmark Index”). For purposes of the Fund’s investment objective, “total return” refers to a combination of capital appreciation and income. | |||||||||||||||||||||||||

| Fees and Expenses | |||||||||||||||||||||||||

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund (“Shares”). You may also incur customary brokerage charges when buying or selling Fund Shares. | |||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of the Shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same, except that the Fund’s expenses are reduced during the first year by the fee waiver and expense reimbursement agreement described above. This example does not include the brokerage commission that you may pay to buy and sell exchange-traded Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| Portfolio Turnover | |||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities or other instruments. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. | |||||||||||||||||||||||||

| Principal Investment Strategies | |||||||||||||||||||||||||

The Fund is an exchange-traded fund (“ETF”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the RevenueShares Consumer Staples Sector IndexTM (the “Underlying Index”). The Underlying Index is constructed by re-weighting the constituent securities of the Benchmark Index according to the revenue earned by the companies in the Benchmark Index, subject to certain asset diversification requirements. The Underlying Index is rebalanced quarterly according to September 30 revenue weightings. The Underlying Index thus contains the same securities as the Benchmark Index, but in different proportions. Under normal circumstances, the Fund will invest at least 80% of its net assets in Consumer Staples companies included in the Benchmark Index, and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Consumer Staples companies as companies that are included in the Benchmark Index at the time of purchase. Consumer Staples companies include companies whose businesses are less sensitive to economic cycles, such as manufacturers and distributors of food, beverages and tobacco; producers of non-durable household goods and personal products; and food and drug retailing companies as well as hypermarkets and consumer super centers. The Fund will concentrate its investments in the Consumer Staples industry, consistent with its Underlying Index, meaning that it may invest more than 25% of its total assets in that industry. The Fund’s intention is to replicate the constituent securities of the Underlying Index as closely as possible. When a replication strategy could have adverse consequences to Fund shareholders, however, the Fund may utilize a “representative sampling” strategy whereby the Fund would hold a significant number of the component securities of the Underlying Index, but may not track that index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund does not seek temporary defensive positions when equity markets decline or appear to be overvalued. The Fund is non-diversified and therefore may invest a greater percentage of its assets in a particular issuer than a diversified Fund. | |||||||||||||||||||||||||

| Principal Risks | |||||||||||||||||||||||||