As filed with the Securities and Exchange Commission on November 28, 2022

1933 Act Registration No. 333-140895

1940 Act Registration No. 811-22019

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-1A

| Registration Statement Under the Securities Act of 1933 | [ ] |

| Pre-Effective Amendment No. __ | [ ] |

| Post-Effective Amendment No. 44 | [X] |

| and/or | |

| Registration Statement Under the Investment Company Act of 1940 | [ ] |

| Amendment No. 47 | [X] |

First Trust Exchange-Traded AlphaDEX® Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (800) 621-1675

W. Scott Jardine, Esq., Secretary

First Trust Exchange-Traded AlphaDEX® Fund

First Trust Advisors L.P.

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(Name and Address of Agent for Service)

Copy to:

Eric F. Fess, Esq.

Chapman and Cutler LLP

320 South Canal Street

Chicago, Illinois 60606

It is proposed that this filing will become effective (check appropriate box):

[ ] immediately upon filing pursuant to paragraph (b)

[X] on December 1, 2022 pursuant to paragraph (b)

[ ] 60 days after filing pursuant to paragraph (a)(1)

[ ] on (date) pursuant to paragraph (a)(1)

[ ] 75 days after filing pursuant to paragraph (a)(2)

[ ] on (date) pursuant to paragraph (a)(2) of Rule 485.

If appropriate, check the following box:

[ ] this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

Contents of Post-Effective Amendment No. 44

This Registration Statement comprises the following papers and contents:

The Facing Sheet

Part A - Prospectus for First Trust Consumer Discretionary AlphaDEX® Fund, First Trust Consumer Staples AlphaDEX® Fund, First Trust Energy AlphaDEX® Fund, First Trust Financials AlphaDEX® Fund, First Trust Health Care AlphaDEX® Fund, First Trust Industrials/Producer Durables AlphaDEX® Fund, First Trust Materials AlphaDEX® Fund, First Trust Technology AlphaDEX® Fund, First Trust Utilities AlphaDEX® Fund, First Trust Large Cap Core AlphaDEX® Fund, First Trust Large Cap Growth AlphaDEX® Fund, First Trust Large Cap Value AlphaDEX® Fund, First Trust Mid Cap Core AlphaDEX® Fund, First Trust Mid Cap Growth AlphaDEX® Fund, First Trust Mid Cap Value AlphaDEX® Fund, First Trust Multi Cap Growth AlphaDEX® Fund, First Trust Multi Cap Value AlphaDEX® Fund, First Trust Small Cap Core AlphaDEX® Fund, First Trust Small Cap Growth AlphaDEX® Fund and First Trust Small Cap Value AlphaDEX® Fund

Part B - Statement of Additional Information for First Trust Consumer Discretionary AlphaDEX® Fund, First Trust Consumer Staples AlphaDEX® Fund, First Trust Energy AlphaDEX® Fund, First Trust Financials AlphaDEX® Fund, First Trust Health Care AlphaDEX® Fund, First Trust Industrials/Producer Durables AlphaDEX® Fund, First Trust Materials AlphaDEX® Fund, First Trust Technology AlphaDEX® Fund, First Trust Utilities AlphaDEX® Fund, First Trust Large Cap Core AlphaDEX® Fund, First Trust Large Cap Growth AlphaDEX® Fund, First Trust Large Cap Value AlphaDEX® Fund, First Trust Mid Cap Core AlphaDEX® Fund, First Trust Mid Cap Growth AlphaDEX® Fund, First Trust Mid Cap Value AlphaDEX® Fund, First Trust Multi Cap Growth AlphaDEX® Fund, First Trust Multi Cap Value AlphaDEX® Fund, First Trust Small Cap Core AlphaDEX® Fund, First Trust Small Cap Growth AlphaDEX® Fund and First Trust Small Cap Value AlphaDEX® Fund

Part C - Other Information

Signatures

Index to Exhibits

Exhibits

|

First Trust

Exchange-Traded AlphaDEX® Fund |

|

FUND NAME |

TICKER SYMBOL |

EXCHANGE |

|

ALPHADEX® SECTOR FUNDS |

|

|

|

First Trust Consumer Discretionary AlphaDEX® Fund |

FXD |

NYSE Arca |

|

First Trust Consumer Staples AlphaDEX® Fund |

FXG |

NYSE Arca |

|

First Trust Energy AlphaDEX® Fund |

FXN |

NYSE Arca |

|

First Trust Financials AlphaDEX® Fund |

FXO |

NYSE Arca |

|

First Trust Health Care AlphaDEX® Fund |

FXH |

NYSE Arca |

|

First Trust Industrials/Producer Durables AlphaDEX® Fund |

FXR |

NYSE Arca |

|

First Trust Materials AlphaDEX® Fund |

FXZ |

NYSE Arca |

|

First Trust Technology AlphaDEX® Fund |

FXL |

NYSE Arca |

|

First Trust Utilities AlphaDEX® Fund |

FXU |

NYSE Arca |

|

ALPHADEX® STYLE FUNDS |

|

|

|

First Trust Large Cap Core AlphaDEX® Fund |

FEX |

Nasdaq |

|

First Trust Large Cap Growth AlphaDEX® Fund |

FTC |

Nasdaq |

|

First Trust Large Cap Value AlphaDEX® Fund |

FTA |

Nasdaq |

|

First Trust Mid Cap Core AlphaDEX® Fund |

FNX |

Nasdaq |

|

First Trust Mid Cap Growth AlphaDEX® Fund |

FNY |

Nasdaq |

|

First Trust Mid Cap Value AlphaDEX® Fund |

FNK |

Nasdaq |

|

First Trust Multi Cap Growth AlphaDEX® Fund |

FAD |

Nasdaq |

|

First Trust Multi Cap Value AlphaDEX® Fund |

FAB |

Nasdaq |

|

First Trust Small Cap Core AlphaDEX® Fund |

FYX |

Nasdaq |

|

First Trust Small Cap Growth AlphaDEX® Fund |

FYC |

Nasdaq |

|

First Trust Small Cap Value AlphaDEX® Fund |

FYT |

Nasdaq |

|

| |

|

AlphaDEX® Sector Funds

|

|

|

3 | |

|

11 | |

|

19 | |

|

27 | |

|

34 | |

|

41 | |

|

48 | |

|

55 | |

|

62 | |

|

AlphaDEX® Style Funds

|

|

|

69 | |

|

76 | |

|

84 | |

|

91 | |

|

98 | |

|

105 | |

|

112 | |

|

119 | |

|

126 | |

|

133 | |

|

140 | |

|

147 | |

|

149 | |

|

150 | |

|

159 | |

|

159 | |

|

161 | |

|

162 | |

|

162 | |

|

165 | |

|

165 | |

|

166 | |

|

166 | |

|

166 | |

|

168 | |

|

168 | |

|

176 | |

|

196 |

First Trust Consumer Discretionary AlphaDEX® Fund (FXD)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

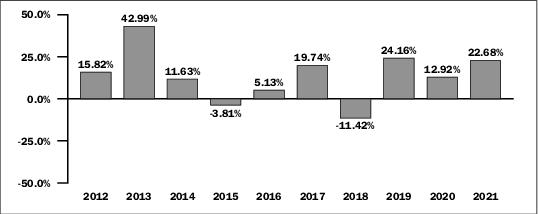

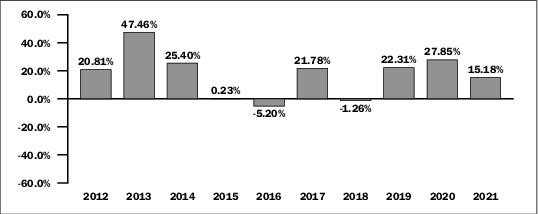

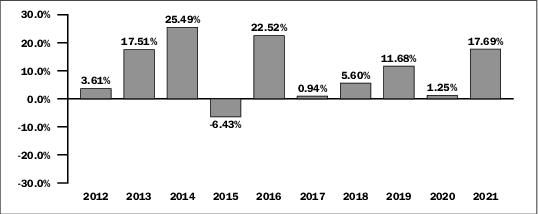

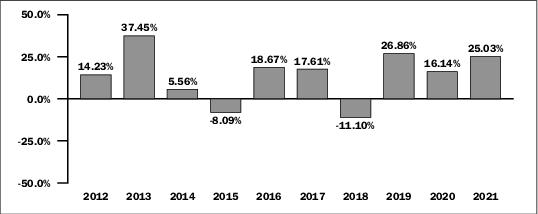

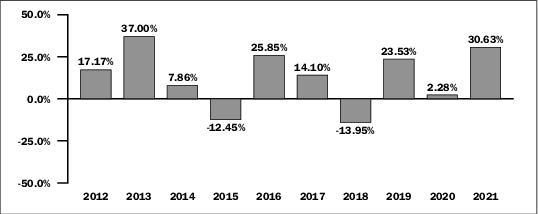

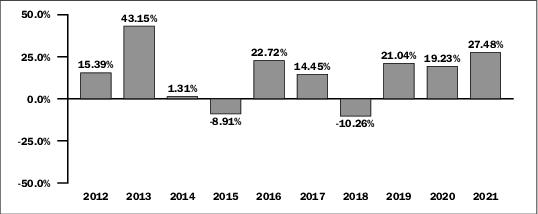

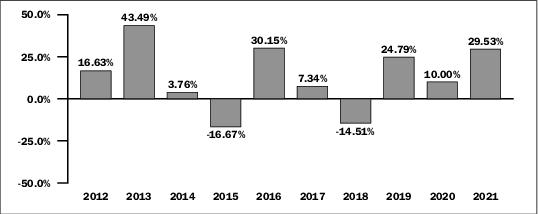

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Consumer Discretionary Index

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Consumer Discretionary Index (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Consumer Discretionary Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

First Trust Consumer Staples AlphaDEX® Fund (FXG)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Consumer Staples Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Consumer Staples Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Consumer Staples Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Energy AlphaDEX® Fund (FXN)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

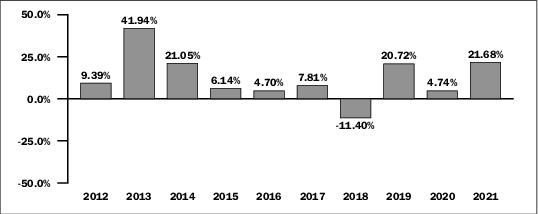

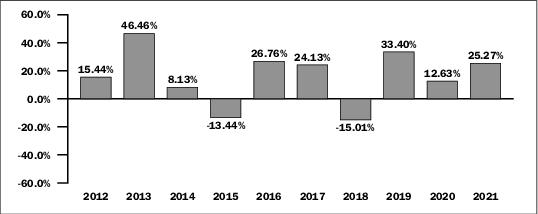

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

- |

- |

- |

|

|

Return After Taxes on Distributions |

|

- |

- |

- |

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

- |

- |

- |

|

|

StrataQuant® Energy Index (reflects no deduction

for fees, expenses or taxes) |

|

- |

- |

- |

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Energy Index (reflects no deduction for

fees, expenses or taxes) |

|

- |

|

|

|

|

Russell 1000® Energy Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

- |

|

|

|

First Trust Financials AlphaDEX® Fund (FXO)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Financials Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Financials Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Financials Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Health Care AlphaDEX® Fund (FXH)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

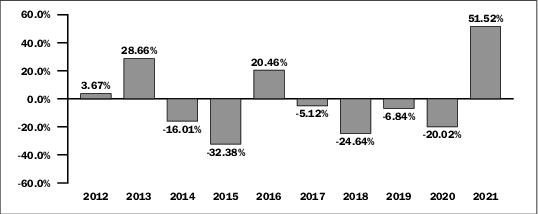

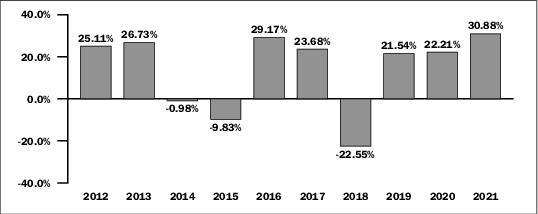

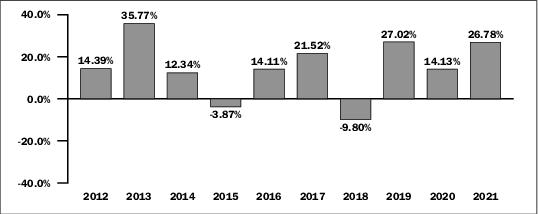

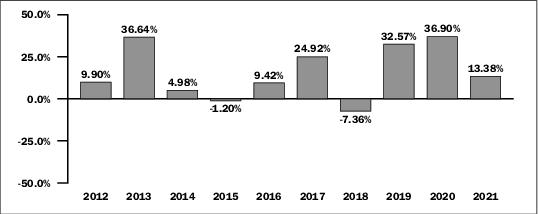

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Health Care Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Health Care Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Health Care Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Industrials/Producer Durables AlphaDEX® Fund (FXR)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Industrials Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Industrials Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Industrials Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Materials AlphaDEX® Fund (FXZ)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

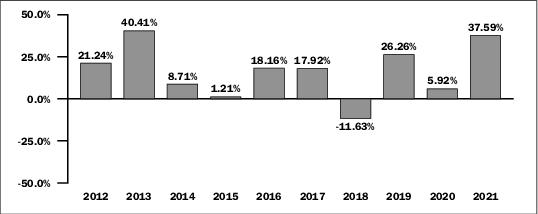

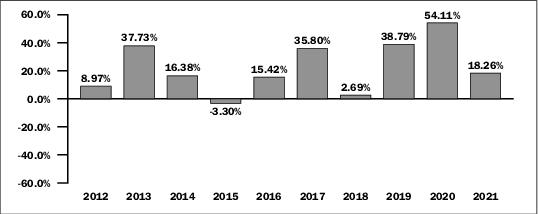

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Materials Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Materials Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Basic Materials Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Technology AlphaDEX® Fund (FXL)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Technology Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Information Technology Index (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Technology Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Utilities AlphaDEX® Fund (FXU)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

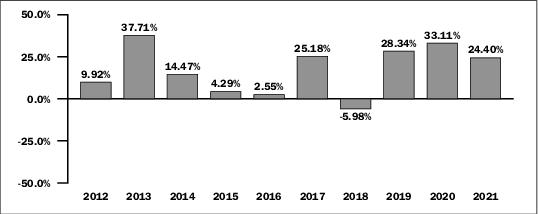

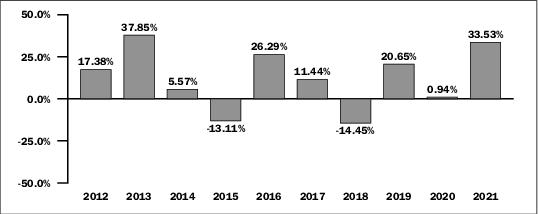

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

StrataQuant® Utilities Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Utilities Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

|

Russell 1000® Utilities Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Large Cap Core AlphaDEX® Fund (FEX)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Large Cap Core Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Nasdaq US 500 Large Cap IndexTM(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P 500® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

First Trust Large Cap Growth AlphaDEX® Fund (FTC)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Large Cap Growth Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US 500 Large Cap Growth Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P 500® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Growth Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

First Trust Large Cap Value AlphaDEX® Fund (FTA)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Large Cap Value Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US 500 Large Cap Value Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P 500® Index (reflects no deduction for fees,

expenses or taxes) |

|

|

|

|

|

|

S&P 500® Value Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

First Trust Mid Cap Core AlphaDEX® Fund (FNX)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

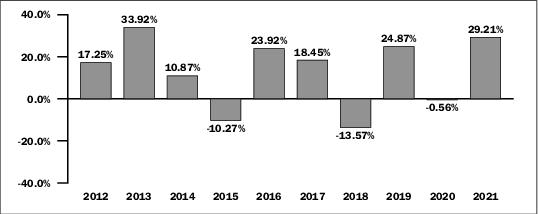

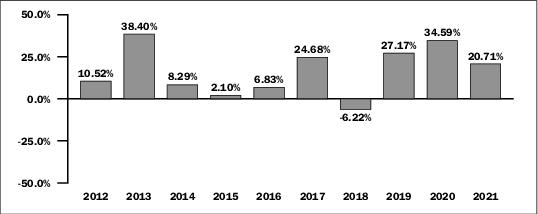

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Mid Cap Core Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Nasdaq US 600 Mid Cap IndexTM(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P MidCap 400® Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

First Trust Mid Cap Growth AlphaDEX® Fund (FNY)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Mid Cap Growth Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US 600 Mid Cap Growth Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P MidCap 400® Growth Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Mid Cap Value AlphaDEX® Fund (FNK)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Mid Cap Value Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US 600 Mid Cap Value IndexTM(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P MidCap 400® Value Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Multi Cap Growth AlphaDEX® Fund (FAD)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Multi Cap Growth Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US Multi Cap Growth Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P Composite 1500® Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

S&P Composite 1500® Growth Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Multi Cap Value AlphaDEX® Fund (FAB)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Multi Cap Value Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US Multi Cap Value Index(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P Composite 1500® Index (reflects no deduction

for fees, expenses or taxes) |

|

|

|

|

|

|

S&P Composite 1500® Value Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Small Cap Core AlphaDEX® Fund (FYX)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement(2) |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of Fund

Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Small Cap Core Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Nasdaq US 700 Small Cap IndexTM(1) (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P SmallCap 600® Index (reflects no deduction for

fees, expenses or taxes) |

|

|

|

|

|

First Trust Small Cap Growth AlphaDEX® Fund (FYC)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Small Cap Growth Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US 700 Small Cap Growth Index(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P SmallCap 600® Growth Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

First Trust Small Cap Value AlphaDEX® Fund (FYT)

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees(1) |

|

|

Distribution and Service (12b-1) Fees |

|

|

Other Expenses |

|

|

Acquired Fund Fees and Expenses |

|

|

Total Annual Fund Operating Expenses |

|

|

Fee Waiver and Expense Reimbursement |

|

|

Net Annual Fund Operating Expenses |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

$ |

$ |

$ |

$ |

Calendar Year Total Returns as of 12/31 (1)

|

|

|

|

|

|

|

|

|

|

|

|

1 Year |

5 Years |

10 Years |

Since

Inception |

Inception

Date |

|

Return Before Taxes |

|

|

|

|

|

|

Return After Taxes on Distributions |

|

|

|

|

|

|

Return After Taxes on Distributions and Sale of

Fund Shares |

|

|

|

|

|

|

Nasdaq AlphaDEX® Small Cap Value Index(1)

(reflects no deduction for fees, expenses or

taxes) |

|

|

|

|

|

|

Nasdaq US 700 Small Cap Value IndexTM(1) (reflects

no deduction for fees, expenses or taxes) |

|

|

|

|

|

|

S&P SmallCap 600® Value Index (reflects no

deduction for fees, expenses or taxes) |

|

|

|

|

|

|

Fund |

Annual

Management

Fee

(% of

average daily

net assets) |

Annual

Expense

Cap

(% of

average daily

net assets) |

Expense Cap

Termination

Date |

Management

Fee Paid for

the Year Ended

July31,2022

(% of average

daily net assets) |

|

First Trust Consumer Discretionary AlphaDEX® Fund (FXD) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Consumer Staples AlphaDEX® Fund (FXG) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Energy AlphaDEX® Fund (FXN) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Financials AlphaDEX® Fund (FXO) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Health Care AlphaDEX® Fund (FXH) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Industrials/Producer Durables

AlphaDEX® Fund (FXR) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Materials AlphaDEX® Fund (FXZ) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Technology AlphaDEX® Fund (FXL) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Utilities AlphaDEX® Fund (FXU) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Large Cap Core AlphaDEX® Fund (FEX) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Large Cap Growth AlphaDEX® Fund (FTC) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Large Cap Value AlphaDEX® Fund (FTA) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Mid Cap Core AlphaDEX® Fund (FNX) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Mid Cap Growth AlphaDEX® Fund (FNY) |

0.70% |

N/A |

N/A |

0.70% |

|

First Trust Mid Cap Value AlphaDEX® Fund (FNK) |

0.70% |

N/A |

N/A |

0.70% |

|

First Trust Multi Cap Growth AlphaDEX® Fund (FAD) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Multi Cap Value AlphaDEX® Fund (FAB) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Small Cap Core AlphaDEX® Fund (FYX) |

0.50% |

0.70% |

November 30, 2023 |

0.50% |

|

First Trust Small Cap Growth AlphaDEX® Fund (FYC) |

0.70% |

N/A |

N/A |

0.70% |

|

First Trust Small Cap Value AlphaDEX® Fund (FYT) |

0.70% |

N/A |

N/A |

0.70% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-18.43% |

6.63% |

10.17% |

6.97% |

37.85% |

163.43% |

179.01% |

|

Market Price |

-18.43% |

6.63% |

10.18% |

6.97% |

37.83% |

163.63% |

178.95% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Consumer Discretionary Index |

-17.99% |

7.27% |

10.88% |

7.70% |

42.05% |

180.91% |

209.66% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Consumer Discretionary Index |

-10.29% |

13.21% |

15.54% |

11.33% |

85.93% |

323.90% |

412.52% |

|

Russell 1000® Consumer Discretionary

Index(1) |

-15.50% |

13.10% |

15.04% |

N/A |

85.05% |

305.87% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

14.95% |

8.12% |

12.27% |

9.46% |

47.72% |

218.04% |

296.11% |

|

Market Price |

14.93% |

8.12% |

12.28% |

9.46% |

47.72% |

218.44% |

296.09% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Consumer Staples Index |

15.42% |

8.78% |

12.99% |

10.23% |

52.35% |

239.26% |

340.67% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

217.66% |

|

S&P 500® Consumer Staples Index |

7.43% |

9.37% |

10.73% |

9.95% |

56.49% |

177.23% |

324.31% |

|

Russell 1000® Consumer Staples Index(1) |

9.18% |

7.66% |

10.25% |

N/A |

44.65% |

165.31% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

65.76% |

6.71% |

0.88% |

0.23% |

38.39% |

9.21% |

3.51% |

|

Market Price |

65.83% |

6.70% |

0.89% |

0.22% |

38.32% |

9.22% |

3.46% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Energy Index |

67.28% |

7.42% |

1.47% |

0.86% |

43.02% |

15.75% |

13.85% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Energy Index |

67.44% |

8.47% |

4.83% |

4.17% |

50.16% |

60.26% |

86.39% |

|

Russell 1000® Energy Index(1) |

65.10% |

8.56% |

4.49% |

N/A |

50.79% |

55.15% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-2.52% |

9.60% |

13.28% |

6.87% |

58.15% |

247.81% |

174.90% |

|

Market Price |

-2.52% |

9.60% |

13.27% |

6.86% |

58.12% |

247.73% |

174.82% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Financials Index |

-1.93% |

10.36% |

14.07% |

7.71% |

63.70% |

272.95% |

209.79% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Financials Index |

-5.97% |

8.36% |

13.25% |

2.79% |

49.37% |

246.98% |

52.14% |

|

Russell 1000® Financials Index(1) |

-4.97% |

11.41% |

14.34% |

N/A |

71.65% |

282.09% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-11.03% |

10.16% |

13.77% |

11.80% |

62.24% |

263.32% |

446.48% |

|

Market Price |

-11.02% |

10.17% |

13.78% |

11.80% |

62.27% |

263.58% |

446.68% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Health Care Index |

-10.45% |

10.90% |

14.53% |

12.59% |

67.79% |

288.47% |

508.69% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Health Care Index |

1.82% |

12.72% |

15.23% |

10.89% |

81.95% |

312.59% |

382.92% |

|

Russell 1000® Health Care Index(1) |

-1.46% |

12.66% |

15.39% |

N/A |

81.48% |

318.55% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-9.16% |

9.71% |

12.72% |

7.57% |

58.95% |

231.17% |

203.93% |

|

Market Price |

-9.16% |

9.71% |

12.72% |

7.57% |

58.95% |

231.17% |

203.94% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Industrials Index |

-8.62% |

10.40% |

13.49% |

8.33% |

64.04% |

254.35% |

238.44% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Industrials Index |

-6.03% |

8.72% |

12.29% |

8.09% |

51.87% |

218.70% |

226.86% |

|

Russell 1000® Industrials Index(1) |

-13.07% |

7.73% |

12.06% |

N/A |

45.11% |

212.24% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

8.37% |

11.50% |

12.15% |

9.21% |

72.30% |

214.73% |

282.68% |

|

Market Price |

8.39% |

11.50% |

12.16% |

9.21% |

72.35% |

215.01% |

282.68% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Materials Index |

9.15% |

12.30% |

12.95% |

10.02% |

78.62% |

237.99% |

328.07% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Materials Index |

-5.06% |

9.71% |

10.70% |

6.92% |

58.92% |

176.35% |

176.92% |

|

Russell 1000® Basic Materials Index(1) |

-5.53% |

9.29% |

10.90% |

N/A |

55.93% |

181.33% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-16.64% |

18.53% |

17.91% |

11.77% |

134.00% |

419.23% |

444.84% |

|

Market Price |

-16.64% |

18.53% |

17.91% |

11.77% |

133.93% |

419.42% |

444.78% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Technology Index |

-16.16% |

19.26% |

18.64% |

12.57% |

141.24% |

452.25% |

506.77% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Information Technology Index |

-5.51% |

22.27% |

20.09% |

14.67% |

173.26% |

523.70% |

704.30% |

|

Russell 1000® Technology Index(1) |

-11.86% |

21.12% |

19.19% |

N/A |

160.71% |

478.78% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

13.69% |

7.45% |

9.69% |

6.77% |

43.20% |

152.21% |

171.19% |

|

Market Price |

13.72% |

7.45% |

9.70% |

6.77% |

43.25% |

152.28% |

171.24% |

|

Index Performance |

|

|

|

|

|

|

|

|

StrataQuant® Utilities Index |

14.57% |

8.14% |

10.50% |

7.60% |

47.89% |

171.48% |

205.26% |

|

Russell 1000® Index |

-6.87% |

12.55% |

13.69% |

9.00% |

80.64% |

260.92% |

271.66% |

|

S&P 500® Utilities Index |

15.58% |

10.43% |

10.79% |

7.70% |

64.20% |

178.53% |

209.67% |

|

Russell 1000® Utilities Index(1) |

14.55% |

9.66% |

9.49% |

N/A |

58.58% |

147.56% |

N/A |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-4.73% |

9.98% |

12.48% |

8.11% |

60.89% |

224.21% |

227.73% |

|

Market Price |

-4.72% |

9.98% |

12.49% |

8.11% |

60.94% |

224.36% |

227.82% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Large Cap Core Index(1) |

-4.19% |

10.66% |

N/A |

N/A |

65.92% |

N/A |

N/A |

|

Nasdaq US 500 Large Cap IndexTM (1) |

-6.69% |

12.74% |

N/A |

N/A |

82.13% |

N/A |

N/A |

|

S&P 500® Index |

-4.64% |

12.83% |

13.80% |

9.04% |

82.85% |

264.28% |

273.39% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-13.84% |

12.08% |

13.65% |

8.62% |

76.90% |

259.38% |

252.08% |

|

Market Price |

-13.81% |

12.08% |

13.65% |

8.62% |

76.89% |

259.36% |

252.17% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Large Cap Growth

Index(1) |

-13.37% |

12.76% |

N/A |

N/A |

82.31% |

N/A |

N/A |

|

Nasdaq US 500 Large Cap Growth Index(1) |

-10.86% |

14.99% |

N/A |

N/A |

101.01% |

N/A |

N/A |

|

S&P 500® Index |

-4.64% |

12.83% |

13.80% |

9.04% |

82.85% |

264.28% |

273.39% |

|

S&P 500® Growth Index |

-9.13% |

15.64% |

15.52% |

11.17% |

106.76% |

323.40% |

401.94% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

2.24% |

7.42% |

10.97% |

7.22% |

43.02% |

183.18% |

189.34% |

|

Market Price |

2.24% |

7.41% |

10.98% |

7.22% |

42.99% |

183.38% |

189.32% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Large Cap Value Index(1) |

2.85% |

8.10% |

N/A |

N/A |

47.61% |

N/A |

N/A |

|

Nasdaq US 500 Large Cap Value Index(1) |

-0.26% |

10.10% |

N/A |

N/A |

61.78% |

N/A |

N/A |

|

S&P 500® Index |

-4.64% |

12.83% |

13.80% |

9.04% |

82.85% |

264.28% |

273.39% |

|

S&P 500® Value Index |

-0.03% |

9.14% |

11.51% |

6.51% |

54.85% |

197.33% |

161.16% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-5.74% |

10.25% |

11.58% |

8.61% |

62.90% |

199.07% |

252.03% |

|

Market Price |

-5.72% |

10.25% |

11.59% |

8.61% |

62.90% |

199.33% |

252.04% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Mid Cap Core Index(1) |

-5.14% |

10.95% |

N/A |

N/A |

68.14% |

N/A |

N/A |

|

Nasdaq US 600 Mid Cap IndexTM (1) |

-12.59% |

8.88% |

N/A |

N/A |

53.04% |

N/A |

N/A |

|

S&P MidCap 400® Index |

-5.70% |

9.06% |

12.05% |

8.69% |

54.29% |

212.07% |

255.53% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/19/2011) |

5 Years |

10 Years |

Inception

(4/19/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-16.80% |

11.96% |

12.46% |

10.64% |

75.89% |

223.48% |

212.89% |

|

Market Price |

-16.78% |

11.95% |

12.45% |

10.64% |

75.86% |

223.26% |

212.84% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Mid Cap Growth

Index(1) |

-16.15% |

12.78% |

N/A |

N/A |

82.50% |

N/A |

N/A |

|

Nasdaq US 600 Mid Cap Growth Index(1) |

-22.83% |

9.21% |

N/A |

N/A |

55.35% |

N/A |

N/A |

|

S&P MidCap 400® Growth Index |

-11.26% |

8.92% |

11.80% |

10.26% |

53.28% |

205.18% |

200.96% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/19/2011) |

5 Years |

10 Years |

Inception

(4/19/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

1.31% |

7.56% |

10.05% |

8.80% |

43.99% |

160.61% |

158.94% |

|

Market Price |

1.40% |

7.57% |

10.04% |

8.80% |

44.05% |

160.32% |

159.04% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Mid Cap Value Index(1) |

2.04% |

8.37% |

N/A |

N/A |

49.46% |

N/A |

N/A |

|

Nasdaq US 600 Mid Cap Value IndexTM (1) |

-2.42% |

7.42% |

N/A |

N/A |

43.00% |

N/A |

N/A |

|

S&P MidCap 400® Value Index |

-0.05% |

8.79% |

11.98% |

10.42% |

52.37% |

209.92% |

205.88% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-14.91% |

11.68% |

12.99% |

8.72% |

73.72% |

239.21% |

257.10% |

|

Market Price |

-14.92% |

11.68% |

13.00% |

8.72% |

73.74% |

239.52% |

257.20% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Multi Cap Growth

Index(1) |

-14.36% |

12.44% |

N/A |

N/A |

79.73% |

N/A |

N/A |

|

Nasdaq US Multi Cap Growth Index(1) |

-12.09% |

14.27% |

N/A |

N/A |

94.81% |

N/A |

N/A |

|

S&P Composite 1500® Index |

-4.74% |

12.49% |

13.66% |

9.03% |

80.08% |

259.88% |

272.93% |

|

S&P Composite 1500® Growth Index |

-9.23% |

15.08% |

15.24% |

11.03% |

101.84% |

313.09% |

392.29% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

1.20% |

7.82% |

10.70% |

7.39% |

45.73% |

176.36% |

196.23% |

|

Market Price |

1.24% |

7.83% |

10.71% |

7.39% |

45.80% |

176.72% |

196.30% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Multi Cap Value Index(1) |

1.83% |

8.60% |

N/A |

N/A |

51.07% |

N/A |

N/A |

|

Nasdaq US Multi Cap Value Index(1) |

-0.69% |

9.89% |

N/A |

N/A |

60.28% |

N/A |

N/A |

|

S&P Composite 1500® Index |

-4.74% |

12.49% |

13.66% |

9.03% |

80.08% |

259.88% |

272.93% |

|

S&P Composite 1500® Value Index |

-0.10% |

9.09% |

11.57% |

6.68% |

54.50% |

198.79% |

167.55% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(5/8/2007) |

5 Years |

10 Years |

Inception

(5/8/2007) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-6.50% |

9.49% |

11.41% |

7.77% |

57.37% |

194.72% |

212.65% |

|

Market Price |

-6.49% |

9.49% |

11.41% |

7.77% |

57.34% |

194.71% |

212.55% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Small Cap Core Index(1) |

-5.92% |

10.22% |

N/A |

N/A |

62.65% |

N/A |

N/A |

|

Nasdaq US 700 Small Cap IndexTM (1) |

-14.49% |

8.38% |

N/A |

N/A |

49.57% |

N/A |

N/A |

|

S&P SmallCap 600® Index |

-6.24% |

9.06% |

12.42% |

8.61% |

54.29% |

222.32% |

251.73% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/19/2011) |

5 Years |

10 Years |

Inception

(4/19/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-14.81% |

9.47% |

11.70% |

10.46% |

57.19% |

202.45% |

207.19% |

|

Market Price |

-14.82% |

9.44% |

11.71% |

10.45% |

57.02% |

202.64% |

206.94% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Small Cap Growth

Index(1) |

-14.14% |

10.33% |

N/A |

N/A |

63.45% |

N/A |

N/A |

|

Nasdaq US 700 Small Cap Growth Index(1) |

-23.73% |

7.60% |

N/A |

N/A |

44.21% |

N/A |

N/A |

|

S&P SmallCap 600® Growth Index |

-10.19% |

9.51% |

12.70% |

11.53% |

57.49% |

230.64% |

242.63% |

Total Returns as of July 31, 2022

|

|

|

Average Annual |

Cumulative | ||||

|

|

1 Year |

5 Years |

10 Years |

Inception

(4/19/2011) |

5 Years |

10 Years |

Inception

(4/19/2011) |

|

Fund Performance |

|

|

|

|

|

|

|

|

Net Asset Value |

-2.06% |

8.64% |

10.65% |

9.39% |

51.35% |

175.02% |

175.14% |

|

Market Price |

-2.06% |

8.62% |

10.65% |

9.38% |

51.18% |

175.07% |

174.92% |

|

Index Performance |

|

|

|

|

|

|

|

|

Nasdaq AlphaDEX® Small Cap Value Index(1) |

-1.34% |

9.45% |

N/A |

N/A |

57.05% |

N/A |

N/A |

|

Nasdaq US 700 Small Cap Value IndexTM (1) |

-4.37% |

8.79% |

N/A |

N/A |

52.35% |

N/A |

N/A |

|

S&P SmallCap 600® Value Index |

-2.26% |

8.38% |

11.98% |

10.78% |

49.54% |

210.10% |

217.26% |

Sector Funds

For a share outstanding throughout each period

|

|

Year Ended July 31, | ||||

|

|

2022 |

2021 |

2020 |

2019 |

2018 |

|

Net asset value, beginning of period |

$61.36 |

$39.70 |

$43.40 |

$42.42 |

$37.53 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.52 |

0.20 |

0.36 |

0.37 |

0.43 |

|

Net realized and unrealized gain (loss) |

(11.78) |

21.61 |

(3.61) |

0.93 |

4.88 |

|

Total from investment operations |

(11.26) |

21.81 |

(3.25) |

1.30 |

5.31 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(0.53) |

(0.15) |

(0.45) |

(0.32) |

(0.42) |

|

Net asset value, end of period |

$49.57 |

$61.36 |

$39.70 |

$43.40 |

$42.42 |

|

Total Return (a) |

(18.43)% |

54.99% |

(7.39)% |

3.13% |

14.17% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$394,117 |

$1,948,136 |

$948,948 |

$384,117 |

$409,343 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.61% |

0.61% |

0.63% |

0.64% |

0.64% |

|

Ratio of net expenses to average net assets |

0.61% |

0.61% |

0.63% |

0.64% |

0.64% |

|

Ratio of net investment income (loss) to average net assets |

0.82% |

0.38% |

0.77% |

0.90% |

1.03% |

|

Portfolio turnover rate (b) |

76% |

88% |

115% |

97% |

101% |

Sector Funds

For a share outstanding throughout each period

|

|

Year Ended July 31, | ||||

|

|

2022 |

2021 |

2020 |

2019 |

2018 |

|

Net asset value, beginning of period |

$56.21 |

$48.76 |

$45.80 |

$46.50 |

$46.84 |

|

Income from investment operations: |

|

|

|

|

|

|

Net investment income (loss) |

0.81 |

0.79 |

0.84 |

0.70 |

1.00 |

|

Net realized and unrealized gain (loss) |

7.55 |

7.40 |

2.98 |

(0.32) |

(0.74) |

|

Total from investment operations |

8.36 |

8.19 |

3.82 |

0.38 |

0.26 |

|

Distributions paid to shareholders from: |

|

|

|

|

|

|

Net investment income |

(0.78) |

(0.74) |

(0.86) |

(1.08) |

(0.60) |

|

Net asset value, end of period |

$63.79 |

$56.21 |

$48.76 |

$45.80 |

$46.50 |

|

Total Return (a) |

14.95% |

16.88% |

8.46% |

0.83% |

0.53% |

|

Ratios/supplemental data: |

|

|

|

|

|

|

Net assets, end of period (in 000’s) |

$650,653 |

$247,311 |

$258,429 |

$329,792 |

$369,643 |

|

Ratios to average net assets: |

|

|

|

|

|

|

Ratio of total expenses to average net assets |

0.63% |

0.64% |

0.63% |

0.64% |

0.64% |

|

Ratio of net expenses to average net assets |

0.63% |

0.64% |

0.63% |

0.64% |

0.64% |

|

Ratio of net investment income (loss) to average net assets |

1.41% |

1.43% |

1.72% |

1.51% |

2.09% |

|

Portfolio turnover rate (b) |

88% |

94% |

113% |

90% |

107% |

Sector Funds

For a share outstanding throughout each period

|

|

Year Ended July 31, | ||||

|

|

2022 |

2021 |

2020 |

2019 |

2018 |

|

Net asset value, beginning of period |

$10.33 |

$6.54 |