Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

|

| |

¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

|

| |

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-35135

|

|

SEQUANS COMMUNICATIONS S.A. |

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

French Republic

(Jurisdiction of incorporation or organization)

15-55 Boulevard Charles de Gaulle

92700 Colombes, France

(Address of principal executive offices)

Georges Karam

Chairman and Chief Executive Officer

Sequans Communications S.A.

15-55 Boulevard Charles de Gaulle

92700 Colombes, France

Telephone: +33 1 70 72 16 00

Facsimile: +33 1 70 72 16 09

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

| | |

Title of each class | | Name of each exchange on which registered |

American Depositary Shares, each representing one ordinary share, nominal value €0.02 per share | | New York Stock Exchange |

Ordinary shares, nominal value €0.02 per share | | New York Stock Exchange* |

|

| |

* | Not for trading, but only in connection with the registration of American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary shares, nominal value €0.02 per share: 80,024,707 as of December 31, 2017

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated file, or a non-accelerated filer. See the definitions of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨

Indicate by check mark which basis for accounting the registrant has used to prepare the financing statements included in this filing:

|

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board þ | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

SEQUANS COMMUNICATIONS S.A.

________________________________________________

FORM 20-F

ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

_________________________________________________

TABLE OF CONTENTS

|

| | |

| |

| |

| | |

| | |

| | |

Item 1. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 4A. | | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 8. | | |

Item 9. | | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

| | |

| | |

| | |

Item 13. | | |

Item 14. | | |

Item 15. | | |

Item 16A. | | |

Item 16B. | | |

Item 16C. | | |

Item 16D. | | |

Item 16E. | | |

Item 16F. | | |

Item 16G. | | |

Item 16H. | | |

| | |

| | |

| | |

Item 17. | | |

Item 18. | | |

Item 19. | | |

| |

| |

| |

INTRODUCTION

Unless otherwise indicated, “Sequans Communications S.A.”, “Sequans Communications”, “the Company”, “we”, “us” and “our” refer to Sequans Communications S.A. and its consolidated subsidiaries.

In this annual report, references to the “euro” or “€” are to the euro currency of the European Union and references to “U.S. dollars” or “$” are to United States dollars.

Reference to “the Shares” are references to Sequans Communications’ Ordinary Shares, nominal value €0.02 per share, and references to “the ADSs” are to Sequans Communications’ American Depositary Shares (each representing one Ordinary Share), which are evidenced by American Depositary Receipts (ADRs).

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than present and historical facts and conditions contained in this annual report on Form 20-F, including statements regarding our future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These forward-looking statements include, but are not limited to, those concerning the following:

| |

• | forecasts and trends in the markets in which we compete and in which our products are sold, including statements regarding the LTE markets and the expansion of the Internet of Things market; |

| |

• | our expectations regarding our expenses, sales and operations; |

| |

• | our expectations regarding our operating results; |

| |

• | our expectations regarding our customer concentration; |

| |

• | trends and challenges in the markets in which we operate, including average selling price reductions, cyclicality in the wireless communications industry and transitions to new process technologies; |

| |

• | our ability to anticipate the future market demands and future needs of our customers; |

| |

• | or ability to keep pace with and anticipate evolving industry standards, including 5G; |

| |

• | our ability to achieve new design wins or for design wins to result in shipments of our products at levels and in the timeframes we currently expect; |

| |

• | our plans for future products and enhancements of existing products; |

| |

• | anticipated features and benefits of our current and future products; |

| |

• | the sources of future demand for our products; |

| |

• | our growth strategy elements and our growth rate; |

| |

• | our ability to enter into strategic alliances or partnerships; |

| |

• | our ability to develop or acquire complementary technologies or partner with others to bring to market solutions that integrate enhanced functionalities; |

| |

• | our ability to protect and defend our intellectual property against potential third party intellectual property infringement claims; |

| |

• | our ability to defend successfully against securities class-action litigation; |

| |

• | general economic conditions in our domestic and international markets; and |

| |

• | our future cash needs and our estimates regarding our capital requirements and our need for additional financing. |

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” as well as similar expressions. Forward-looking statements reflect our current views with respect to future events, are based on assumptions and are subject to risks, uncertainties and other important factors. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. We cannot assure you that our plans, intentions or expectations will be achieved. Our actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained in this annual report, including, but not limited to, those factors described in “Item 3.D—Risk Factors”, “Item 4—Information on the Company” and “Item 5—Operating and Financial Review and Prospects”. Given these risks, uncertainties and other important factors, you should not place undue reliance on these forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth in this annual report. Also, these forward-looking statements

represent our estimates and assumptions only as of the date such forward-looking statements are made. Except as required by law, we assume no obligation to update any forward-looking statements publicly, whether as a result of new information, future events or otherwise.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. Selected Financial Data

The following tables set forth our selected consolidated financial and other data. You should read the following selected consolidated financial data in conjunction with “Item 5 — Operating and Financial Review and Prospects” and our consolidated financial statements and the related notes appearing elsewhere in this annual report. Our historical results are not necessarily indicative of results to be expected for future periods. The consolidated statements of operations data for the years ended December 31, 2015, 2016 and 2017, the consolidated statements of financial position data at December 31, 2015, 2016 and 2017, and the consolidated statements of cash flow data for the years ended December 31, 2015, 2016 and 2017 have been derived from our audited Consolidated Financial Statements included elsewhere in this annual report. The consolidated statement of operations data for the years ended December 31, 2013 and 2014, consolidated statement of financial position data at December 31, 2013 and 2014, and the consolidated statement of cash flow data for the year ended December 31, 2013 and 2014, have been derived from our audited Consolidated Financial Statements not included in this annual report.

Our financial statements included in this annual report were prepared in U.S. dollars in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board.

|

| | | | | | | | | | | | | | | |

| Years ended December 31, |

| 2013 | 2014 | 2015 | 2016 | 2017 |

| (in thousands, except per share data) |

Consolidated Statements of Operations Data: | | | | | |

Revenue: | | | | | |

Product revenue | $ | 10,708 |

| $ | 19,836 |

| $ | 24,669 |

| $ | 34,581 |

| $ | 37,353 |

|

Other revenue | 3,004 |

| 2,766 |

| 7,863 |

| 10,998 |

| 10,910 |

|

Total revenue | 13,712 |

| 22,602 |

| 32,532 |

| 45,579 |

| 48,263 |

|

Cost of revenue(1): | | | | | |

Cost of product revenue | 8,616 |

| 15,435 |

| 17,970 |

| 22,574 |

| 24,725 |

|

Cost of other revenue | 205 |

| 346 |

| 1,481 |

| 3,022 |

| 2,397 |

|

Total cost of revenue | 8,821 |

| 15,781 |

| 19,451 |

| 25,596 |

| 27,122 |

|

Gross profit | 4,891 |

| 6,821 |

| 13,081 |

| 19,983 |

| 21,141 |

|

% of revenue | 36 | % | 30 | % | 40 | % | 44 | % | 44 | % |

Operating expenses(1): | | | | | |

Research and development | 28,357 |

| 28,634 |

| 25,305 |

| 26,334 |

| 25,202 |

|

Sales and marketing | 4,449 |

| 5,278 |

| 5,985 |

| 7,126 |

| 8,785 |

|

General and administrative | 7,528 |

| 6,969 |

| 5,428 |

| 6,267 |

| 6,679 |

|

Total operating expenses | 40,334 |

| 40,881 |

| 36,718 |

| 39,727 |

| 40,666 |

|

Operating income (loss) | (35,443 | ) | (34,060 | ) | (23,637 | ) | (19,744 | ) | (19,525 | ) |

Financial income (expense) | (1 | ) | 98 |

| (3,448 | ) | (4,759 | ) | (6,335 | ) |

Profit (Loss) before income taxes | (35,444 | ) | (33,962 | ) | (27,085 | ) | (24,503 | ) | (25,860 | ) |

Income tax expense (benefit) | 142 |

| 162 |

| 317 |

| 284 |

| 300 |

|

Profit (Loss) | $ | (35,586 | ) | $ | (34,124 | ) | $ | (27,402 | ) | $ | (24,787 | ) | $ | (26,160 | ) |

Basic earnings (loss) per share | $ | (0.78 | ) | $ | (0.58 | ) | $ | (0.46 | ) | $ | (0.39 | ) | $ | (0.34 | ) |

Diluted earnings (loss) per share | $ | (0.78 | ) | $ | (0.58 | ) | $ | (0.46 | ) | $ | (0.39 | ) | $ | (0.34 | ) |

Number of shares used for computing: | | | | | |

Basic | 45,456 |

| 59,142 |

| 59,145 |

| 63,805 |

| 77,668 |

|

Diluted | 45,456 |

| 59,142 |

| 59,145 |

| 63,805 |

| 77,668 |

|

|

| | | | | | | | | | | | | | | |

| At December 31, |

| 2013 | 2014 | 2015 | 2016 | 2017 |

| (in thousands) |

Consolidated Statements of Financial Position Data: | | | | |

Cash, cash equivalents and short-term deposit | $ | 37,244 |

| $ | 12,489 |

| $ | 8,681 |

| $ | 20,547 |

| $ | 3,295 |

|

Total current assets | 60,658 |

| 36,315 |

| 35,819 |

| 50,069 |

| 39,747 |

|

Total assets | 73,528 |

| 49,415 |

| 48,856 |

| 65,077 |

| 57,056 |

|

Current and non-current loans and borrowings | — |

| 5,846 |

| 26,482 |

| 29,310 |

| 30,655 |

|

Total current liabilities | 13,258 |

| 19,048 |

| 29,132 |

| 31,467 |

| 27,938 |

|

Total equity | 58,929 |

| 25,115 |

| (1,248 | ) | 8,860 |

| 4,148 |

|

|

| | | | | | | | | | | | | | | |

| Year ended December 31, |

| 2013 | 2014 | 2015 | 2016 | 2017 |

| (in thousands) |

Consolidated Statements of Cash Flow Data: | | | | |

Net cash flow used in operating activities | $ | (24,345 | ) | $ | (24,406 | ) | $ | (16,401 | ) | $ | (15,589 | ) | $ | (28,626 | ) |

Net cash flow used in investing activities | (3,956 | ) | (5,625 | ) | (5,345 | ) | (5,270 | ) | (6,477 | ) |

Net cash flow from financing activities | 36,791 |

| 5,121 |

| 17,710 |

| 32,778 |

| 17,838 |

|

Net foreign exchange difference | 3 |

| (5 | ) | (5 | ) | (5 | ) | 11 |

|

Cash and cash equivalents at January 1 | 28,751 |

| 37,244 |

| 12,329 |

| 8,288 |

| 20,202 |

|

Cash and cash equivalents at December 31 | 37,244 |

| 12,329 |

| 8,288 |

| 20,202 |

| 2,948 |

|

(1) Includes share-based compensation as follows:

|

| | | | | | | | | | | | | | | |

| Year ended December 31, |

| 2013 | 2014 | 2015 | 2016 | 2017 |

| (in thousands) |

Cost of revenue | $ | 112 |

| $ | 47 |

| $ | 17 |

| $ | 11 |

| $ | 7 |

|

Operating expenses | 2,052 |

| 1,230 |

| 850 |

| 1,111 |

| 1,631 |

|

Share-based compensation | $ | 2,164 |

| $ | 1,277 |

| $ | 867 |

| $ | 1,122 |

| $ | 1,638 |

|

Exchange Rate Information

In this annual report, for convenience only, we have translated the euro amounts reflected in our financial statements as of and for the year ended December 31, 2017 into U.S. dollars at the rate of €1.00 = $1.2022, the noon buying rate for euros in New York City, as certified for customs purposes by the Federal Reserve Bank of New York, on December 29, 2017. You should not assume that, on that or on any other date, one could have converted these amounts of euros into U.S. dollars at that or any other exchange rate.

The following table sets forth, for each period indicated, the low and high exchange rates for euros expressed in U.S. dollars, the exchange rate at the end of such period and the average of such exchange rates on the last day of each month during such period, based on the noon buying rate in the City of New York for cable transfers in euros as certified for customs purposes by the Federal Reserve Bank of New York. The source of the exchange rate is the H.10 statistical release of the Federal Reserve Board. The exchange rates set forth below demonstrate trends in exchange rates, but the actual exchange rates used throughout this annual report may vary.

|

| | | | | | | | | | | | | | | |

| | Year ended December 31, |

| | 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

High | | 1.3816 |

| | 1.3927 |

| | 1.2015 |

| | 1.1516 |

| | 1.2041 |

|

Low | | 1.2774 |

| | 1.2101 |

| | 1.0524 |

| | 1.0375 |

| | 1.0416 |

|

Period End | | 1.3779 |

| | 1.2101 |

| | 1.0859 |

| | 1.0552 |

| | 1.2022 |

|

Average Rate | | 1.3281 |

| | 1.3297 |

| | 1.1096 |

| | 1.1072 |

| | 1.1301 |

|

The following table sets forth, for each of the last six months, the low and high exchange rates for euros expressed in U.S. Dollars and the exchange rate at the end of the month based on the noon buying rate as described above. The source of the exchange rate is the H.10 statistical release of the Federal Reserve Board.

|

| | | | | | | | | | | | | | | | | | |

| | | Last Six Months |

| | October | November | | December | | January | | February | | March | |

High | | 1.1847 |

| 1.1936 |

| | 1.2022 |

| | 1.2488 |

| | 1.2482 |

| | 1.2440 |

| |

Low | | 1.1580 |

| 1.1577 |

| | 1.1725 |

| | 1.1922 |

| | 1.2211 |

| | 1.2216 |

| |

End of Month | | 1.1648 |

| 1.1898 |

| | 1.2022 |

| | 1.2428 |

| | 1.2211 |

| | 1.2320 |

| |

On April 6, 2018, the noon buying rate for euros in New York City, as certified for customs purposes by the Federal Reserve Bank of New York, was €1.00 = $1.2274.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business faces significant risks. You should carefully consider all of the information set forth in this annual report and in our other filings with the United States Securities and Exchange Commission (“SEC”), including the following risk factors which we face and which are faced by our industry. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. This report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this report and our other SEC filings. See “Special Note Regarding Forward-Looking Statements” on page 1.

Risks Related to Our Business and Industry

We have a history of losses and have experienced a significant decline in revenue from 2011, and we may not achieve or sustain profitability in the future, on a quarterly or annual basis.

We were established in 2003 and began operations in 2004, and have incurred losses on an annual basis since inception. We experienced net losses of $27.4 million, $24.8 million and $26.2 million in 2015, 2016 and 2017, respectively. At December 31, 2017, our accumulated deficit was $235.7 million. We expect to continue to incur significant expense related to the development of our LTE products and expansion of our business, including research and development and sales and administrative expenses. Additionally, we may encounter unforeseen difficulties, complications, product delays and other unknown factors that require additional expense. As a result of these expenditures, we will have to generate and sustain substantially increased revenue to achieve profitability. If we do not, we may not be able to achieve or maintain profitability, and we may continue to incur significant losses in the future.

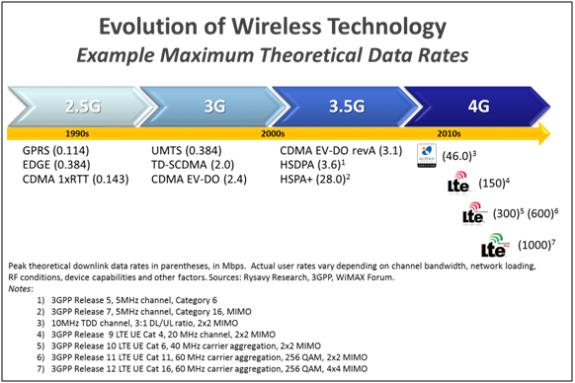

Our industry is subject to rapid technological change that could result in decreased demand for our products and those of our customers or result in new specifications or requirements on our products, each of which could negatively affect our revenues, margins and operating results.

The markets in which we and our customers compete or plan to compete are characterized by rapidly changing technologies and industry standards and technological obsolescence. Our ability to compete successfully depends on our ability to design, develop, manufacture, assemble, test, market and support new products and enhancements on a timely and cost-effective basis. A fundamental shift in technologies in any of our target markets could harm our competitive position within these markets. In addition, such shifts can cause a significant decrease in our revenues and adversely affect our operating results. Our failure to anticipate these shifts, to develop new technologies or to react to changes in existing technologies could materially delay our development of new products, which could result in product obsolescence, decreased revenue and a loss of design wins. The development of new technologies and products generally requires substantial investment before they are commercially viable. We intend to continue to make substantial investments in developing new technologies and products, including our LTE and 5G products, and it is possible that our development efforts will not be successful and that our new technologies and products will not be accepted by customers or result in meaningful revenue. If the semiconductor solutions we

develop fail to meet market or customer requirements or do not achieve market acceptance, our operating results and competitive position would suffer.

Our success and the success of our new products will depend on accurate forecasts of future technological developments, customer and consumer requirements and long-term market demand, as well as on a variety of specific implementation factors, including:

| |

• | accurate prediction of the size and growth of the LTE markets, and in particular the market for LTE-only, also referred to as single-mode LTE, products where no fall back to 2G or 3G technology is required; |

| |

• | accurate prediction of changes in device manufacturer requirements, technology, industry standards or consumer expectations, demands and preferences; |

| |

• | accurate prediction of the growth of the Internet of Things market and the adoption of industry standards allowing devices to connect and communicate with each other; |

| |

• | timely and efficient completion of process design and transfer to manufacturing, assembly and test, and securing sufficient manufacturing capacity to allow us to continue to timely and cost-effectively deliver products to our customers; |

| |

• | market acceptance, adequate consumer demand and commercial production of the products in which our semiconductor solutions are incorporated; |

| |

• | the quality, performance, functionality and reliability of our products as compared to competing products and technologies; and |

| |

• | effective marketing, sales and customer service. |

The markets for our semiconductor solutions are characterized by frequent introduction of next generation and new products with new features and functionalities, short product life cycles and significant price competition. If we or our customers are unable to manage product transitions in a timely and cost-effective manner, our business and results of operations would suffer. In addition, frequent technology changes and introduction of next generation products may result in inventory obsolescence, which could reduce our gross margins and harm our operating performance. If we fail to timely introduce new products that meet the demands of our customers or our target markets, or if we fail to penetrate new markets, our revenue will decrease and our financial condition would suffer.

Our LTE semiconductor solutions do not incorporate support for 2G or 3G protocols, and we currently focus on selling our solutions into the market for LTE-only devices. If the market for LTE-only devices materializes more slowly or at a lower volume level than we anticipate, our results of operations may be harmed.

Our semiconductor solutions support only 4G protocols. As a result, our LTE strategy focuses primarily on selling into the LTE-only device market. The growth rate and size of the market for LTE-only devices is dependent on a number of factors, including the degree of geographic and population coverage by LTE networks. If this coverage does not continue to materialize as quickly as we expect, if fewer LTE carriers than we expect offer comprehensive LTE coverage in their geographic operating areas, or if these LTE carriers require support for 2G or 3G protocols in a larger proportion of their overall device portfolio than we expect, then demand for LTE-only semiconductor solutions like ours would be lower and our results of operations would be harmed.

If we are unsuccessful in developing and selling new products on a timely and cost-effective basis or in penetrating new markets, in particular the single-mode LTE market, our business and operating results would suffer.

We or our customers may be required to obtain licenses for certain so-called “essential patents” in order to comply with applicable standards, which could require us to pay additional royalties on certain of our products. If we or our customers are unable to obtain such licenses, our business, results of operations, financial condition and prospects would be harmed.

We or our customers may be required to obtain licenses for third-party intellectual property. In particular, we may be required to obtain licenses to certain third-party patents, so-called “essential patents”, that claim features or functions that are incorporated into applicable industry standards and that we are required to provide in order to comply with the standard. If we need to license any third-party intellectual property, essential patents or other technology, we could be required to pay royalties on certain of our products. In addition, while the industry standards bodies and the antitrust laws in certain countries may require participating companies to license their essential patents on fair, reasonable, and nondiscriminatory terms, there can be no assurances that we will be able to obtain such licenses on commercially reasonable terms or at all. Although we have implemented a dedicated standard essential patents licensing-in reference policy, our inability to obtain required third-party intellectual property licenses on commercially reasonable terms or at all could harm our business, results of operations, financial condition or prospects. If our customers are required to obtain such licenses, there can be no assurances that their businesses will not be adversely affected. In addition, if our competitors have significant numbers of essential patents and/or

patent license rights, they could be at an advantage in negotiating with our customers or potential customers, which could influence our ability to win new business or could result in downward pressure on our average selling prices.

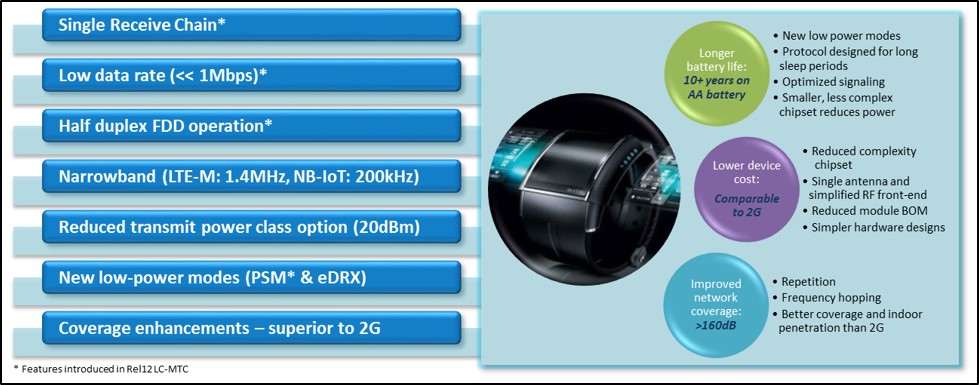

We depend on the commercial deployment of 4G wireless communications equipment, products and services to grow our business, and our business may be harmed if wireless carriers delay or are unsuccessful in the commercial deployment of 4G technology or the adoption of Cat M and NB-1 standards, or if they deploy technologies that are not supported by our solutions.

We depend upon the continued commercial deployment of 4G wireless communications equipment, products and services based on our technology. Deployment of new networks by wireless carriers requires significant capital expenditures, well in advance of any revenue from such networks. In the past, wireless carriers have cancelled or delayed planned deployments of new networks, including, for example, commercial retail service in the Indian market. If existing deployments are not commercially successful or do not continue to grow their subscriber base, or if new commercial deployments of 4G networks are delayed or unsuccessful, our business and financial results would be harmed.

During network deployment, wireless carriers often anticipate a certain rate of subscriber additions and, in response, operators typically procure devices to satisfy this forecasted demand. If the rate of deployment of new networks by wireless carriers is slower than we expect or if 4G technology is not as widely adopted by consumers as we expect, the rate of subscriber additions may be slower than expected, which will reduce the sales of our products and cause OEMs and ODMs to hold excess inventory. This would harm our sales and our financial results.

As we expand into the broader Internet of Things market, we will similarly depend on the commercial deployment of narrow band LTE variants, beginning with Cat M and, later, Cat NB-1. The adoption of the Cat M and Cat NB-1 standards is expected to expand the market for Internet of Things devices. If the Cat M or Cat NB-1 standards are not successfully adopted and deployed, or if competing standards for Internet of Things devices become favored by wireless carriers, we may not be able to successfully commercialize our Cat M (and, later, Cat NB-1) chipsets, which would harm our sales and our financial results.

In addition, wireless carriers may choose to deploy technologies not supported by our solutions. If a technology that is not supported by our semiconductor solutions gains significant market share or is favored by a significant wireless carrier, we could be required to expend a significant amount of time and capital to develop a solution that is compatible with that alternative technology. If we are not successful, we could lose design wins with respect to that technology and our business and financial results would be harmed. Moreover, once a competitor’s solution is chosen by a wireless carrier, OEM or ODM we will have difficulty supplanting those solutions with ours.

If we fail to successfully develop, commercialize, produce and sell our module product line, our business, revenue and operating results may be harmed.

In 2013, we introduced a new product module line. Our modules incorporate many components in addition to our chipsets. We may lack the purchasing power to acquire at competitive prices certain components required to produce modules, and we do not expect to be able to command selling prices for those modules that allow us to maintain traditional semiconductor-only margins for the full module. In the near future, modules could represent a large portion of our revenue mix, which could negatively impact our overall gross margin. Certain large customers may decide to buy the modules directly from the manufacturers who purchase our chipsets, rather than us, in order to reduce their costs. This may result in a reduction of our revenue and gross profit, but an improvement of overall gross margin percentage, compared to the case where we sell the modules ourselves.

Module components may be sourced from numerous different suppliers. Some of these components may periodically be in short supply or be subject to long lead times, which could affect our ability to meet customer demand for our modules, therefore delaying our revenue. In addition, we rely on various contract manufacturers to produce our modules. If these manufacturers encounter any issues with production capacity, quality or reliability of their products, it could adversely affect our revenue and our reputation in the market. If our ability to expand our product platform is significantly delayed or if we are unable to leverage our module as expected, our business and financial condition could be materially and adversely affected.

If customers request from us, and we agree to provide, a wide variety of module variants or stock-keeping units, or SKUs, to support different operators or different end-applications, our expenses associated with developing, sourcing and certifying our module products would increase. In addition, managing supply and demand across multiple SKUs may increase the possibility that we will under or over-forecast a given SKU, resulting in either delayed revenue or excess inventory.

Participating in the module business could create a perception among our customers that we are competing with them if they are also in the module business, which could impair our chipset business prospects with such customers. The module can be considered an end product with full LTE functionality; therefore, there is market pressure from manufacturers of products not normally incorporating a communication function for us to sell the module with essential IP indemnification. We generally negotiate license agreements for the module in order to offer standard indemnification to our manufacturing partners, but there can be no assurance that we will be successful in obtaining licenses on acceptable terms.

We have significant ongoing capital requirements that could have a material effect on our business and financial condition if we are unable to generate sufficient cash from operations.

Our business requires significant capital investment to carry out extensive research and development in order to remain competitive. At the same time, demand for our products is highly variable and there have been downturns. If our cash on hand, net proceeds from financing activities and cash generated from operations are not sufficient to fund our operations and capital requirements, we may be required to limit our growth, or enter into financing arrangements at unfavorable terms, any of which could harm our business and financial condition.

Additionally, we anticipate that that strategic alliances and partnerships will be an important source of revenue and possible financing for us going forward. If we are unable to develop alliances with or otherwise attract investment from strategic partners, or if strategic partners are not willing to enter into transactions with us on favorable terms, our business and financial condition could be harmed.

A portion of our software development and testing activity is outsourced to a third-party provider based in Kiev, Ukraine. If political developments in Ukraine and Russia escalate to open hostilities, some of our product development activities and some customer software support activities could be adversely affected.

While we have our key engineering competencies in-house, primarily in France, the United Kingdom and the United States, we outsource some software development and testing activities to an independent third-party provider of engineering services. We work with a dedicated team of 35 software engineers based in Kiev, Ukraine. As a result of the decision of the Russian government to annex the Crimea region of Ukraine, the United States and the European Community have imposed economic sanctions on Russia. If Ukraine experiences further political instability, these engineers may be unable to work for a sustained period of time, which could adversely impact our research and development operations. We also have our own electronic equipment physically in place in Kiev which could be at risk in the event of violence in the region. We have developed a contingency plan to trigger if the engineers in Kiev are unable to continue working on their projects for us, but if our contingency plan is not effective, we could suffer delays in product introduction or delays in resolution of customer software bugs, which could have a negative impact on our revenues.

We depend on a small number of customers for a significant portion of our revenue. If we fail to retain or expand customer relationships, our business could be harmed.

A significant amount of our total revenue is attributable to a small number of customers, and we anticipate that this will continue to be the case for the foreseeable future. These customers may decide not to purchase our semiconductor solutions at all, to purchase fewer semiconductor solutions than they did in the past or to alter the terms on which they purchase our products. In addition, to the extent that any customer represents a disproportionately high percentage of our accounts receivable, our exposure to that customer is further increased should they be unable or choose not to pay such accounts receivable on a timely basis or at all.

Our top ten customers accounted for 92%, 86% and 78% of our total revenue in 2015, 2016 and 2017, respectively. The following table summarizes customers representing a significant portion of total revenue:

|

| | | | | | | | | | | | |

Customer | | % of total revenues for the year ended December 31, | | % of our accounts receivable at December 31, |

| | 2015 | | 2016 | | 2017 | | 2017 |

Comtech | | — |

| | 29 | % | | 17 | % | | 26 | % |

ATM | | — |

| | Less than 10% |

| | 16 | % | | 19 | % |

Gemtek | | 14 | % | | 15 | % | | Less than 10% |

| | 1 | % |

Customer A (Taiwan-based) | | 27 | % | | Less than 10% |

| | — |

| | — |

|

AIT | | 16 | % | | — |

| | — |

| | — |

|

Comtech is a distributor who serves multiple customers in China and Taiwan. We expect that some of these customers, particularly those above 10% during 2017, could each continue to represent at least 10% of our revenue in 2018 as the market for single-mode LTE devices is in its early stages and still concentrated in a relatively small number of device makers. The loss of any significant customer, a significant reduction in sales we make to them in general or during any period, or any issues with collection of receivables from customers would harm our financial condition and results of operations. Furthermore, we must obtain orders from new customers on an ongoing basis to increase our revenue and grow our business. If we fail to expand our customer relationships, our business could be harmed.

We depend on one independent foundry to manufacture our products and do not have a long-term agreement with such foundry, and loss of this foundry or our failure to obtain sufficient foundry capacity would significantly delay our ability to ship our products, cause us to lose revenue and market share and damage our customer relationships.

Access to foundry capacity is critical to our business because we are a fabless semiconductor company. We depend on a sole independent foundry, Taiwan Semiconductor Manufacturing Company Limited, or TSMC, in Taiwan to manufacture our semiconductor wafers. Because we outsource our manufacturing to a single foundry, we face several significant risks, including:

| |

• | constraints in or unavailability of manufacturing capacity; |

| |

• | limited control over delivery schedules, quality assurance and control, manufacturing yields and production costs; and |

| |

• | the unavailability of, or potential delays in obtaining access to, key process technologies. |

If we do not accurately forecast our capacity needs, TSMC may not have available capacity to meet our immediate needs or we may be required to pay higher costs to fulfill those needs, either of which could harm our business, results of operations or financial condition.

The ability of TSMC to provide us with semiconductor wafers is limited at any given time by their available capacity and we do not have a guaranteed level of manufacturing capacity. We do not have any agreement with TSMC and place our orders on a purchase order basis. As a result, if TSMC raises its prices or is not able to satisfy our required capacity for any reason, including natural or other disasters, allocates capacity to larger customers or to different sectors of the semiconductor industry, experiences labor issues or shortages or delays in shipment of semiconductor equipment or materials used in the manufacture of our semiconductors, or if our business relationship with TSMC deteriorates, we may not be able to obtain the required capacity and would have to seek alternative foundries, which may not be available on commercially reasonable terms, in a timely manner, or at all.

Locating and qualifying a new foundry would require a significant amount of time, which would result in a delay in production of our products. In addition, using foundries with which we have no established relationship could expose us to unfavorable pricing and terms, delays in developing and qualifying new products, unsatisfactory quality or insufficient capacity allocation. We place our orders on the basis of our customers’ purchase orders and sales forecasts; however, foundries can allocate capacity to the production of other companies’ products and reduce deliveries to us on short notice. Many of the customers of TSMC, or foundries that we may use in the future, are larger than we are, or have long-term agreements with such foundries, and as a result those customers may receive preferential treatment from the foundries in terms of price, capacity allocation and payment terms. Any delay in qualifying a new foundry or production issues with any new foundry would result in lost sales and could damage our relationship with existing and future customers as well as our reputation in the market.

If our foundry vendor does not achieve satisfactory yields or quality, our reputation and customer relationships could be harmed.

The fabrication of semiconductor solutions such as ours is a complex and technically demanding process. Minor deviations in the manufacturing process can cause substantial decreases in yields, and in some cases, cause production to be suspended. TSMC, or foundries that we may use in the future, could, from time to time, experience manufacturing defects and reduced manufacturing yields. Changes in manufacturing processes or the inadvertent use of defective or contaminated materials by our foundry vendor could result in lower than anticipated manufacturing yields or unacceptable performance. Many of these problems are difficult to detect at an early stage of the manufacturing process and may be time consuming and expensive to correct. Poor yields from our foundry vendor, or defects, integration issues or other performance problems in our semiconductor solutions could cause us significant customer relations and business reputation problems, harm our financial results and result in financial or other damages to our customers. In addition, because we have a sole source of wafer supply, these risks are magnified because we do not have an alternative source to purchase from should these risks materialize. If TSMC fails to provide satisfactory product to us, we would be required to identify and qualify other sources, which could take a significant amount of time and would result in lost sales. In addition, we indemnify our customers for losses resulting from defects in our products, which costs could be substantial. A product liability or other indemnification claim brought against us, even if unsuccessful, would likely be time-consuming and costly to defend.

Our customers may cancel their orders, change production quantities or delay production, and if we fail to forecast demand for our products accurately, we may incur product shortages, delays in product shipments or excess or insufficient product inventory, which could harm our business.

We do not have firm, long-term purchase commitments from our customers. Substantially all of our sales are made on a purchase order basis, and in most cases our customers are not contractually committed to buy any quantity of products from us beyond firm purchase orders. Additionally, customers may cancel, change or delay purchase orders already in place with little or no notice to us. Because production lead times often exceed the amount of time required to fulfill orders, we often must manufacture in advance of orders, relying on an imperfect demand forecast to project volumes and product mix. Our ability to accurately forecast demand can be harmed by a number of factors, including inaccurate forecasting by our customers, changes in market conditions, changes in our product order mix and demand for our customers’ products. Even after an order is received, our customers may cancel these orders or request a decrease in production quantities. Any such cancellation or decrease subjects us to a number of risks, most notably that our projected sales will not materialize on schedule or at all, leading to unanticipated revenue shortfalls and excess or obsolete inventory, which we may be unable to sell to other customers. Alternatively, if we are unable to project customer requirements accurately, we may not manufacture enough semiconductor solutions, which could lead to delays in product shipments and lost sales opportunities in the near term, as well as force our customers to identify alternative sources, which could affect our ongoing relationships with these customers. We have in the past had customers significantly increase their requested production quantities with little or no advance notice. If we do not fulfill customer demands in a timely manner, our customers may cancel their orders and we may be subject to customer claims for cost of replacement. Underestimating or overestimating demand would lead to insufficient, excess or obsolete inventory and could harm our operating results, cash flow and financial condition, as well as our relationships with our customers and our reputation in the marketplace.

If customers do not design our semiconductor solutions into their product offerings or if our customers’ product offerings are not commercially successful, our revenue and our business would be harmed.

We sell our semiconductor solutions directly to OEMs who include them in their products, and to ODMs who include them in their products they supply to OEMs. As a result, we rely on OEMs to design our semiconductor solutions into the products they sell. Because our semiconductor solutions are generally a critical component of our customers’ products, they are typically incorporated into our customers’ products at the design stage and the sales cycle typically takes 12 months or more to complete. Without these design wins, our revenue and our business would be significantly harmed. We often incur significant expenditures on the development of a new semiconductor solution without any assurance that an OEM will select our semiconductor solution for design into its own product. Because the types of semiconductor solutions we sell are a critical aspect of an OEM’s product, once an OEM designs a competitor’s semiconductor into its product offering, it becomes significantly more difficult for us to sell our semiconductor solutions to that customer for a particular product offering because changing suppliers involves significant cost, time, effort and risk for the customer. Further, if we are unable to develop new products in a timely manner for inclusion in such products, or if major defects or errors that might significantly impair performance or standards compliance are found in our products after inclusion by an OEM, OEMs will be unlikely to include our semiconductor solutions into their products and our reputation in the market and future prospects would be harmed.

Furthermore, even if an OEM designs one of our semiconductor solutions into its product offering, we cannot be assured that its product will be commercially successful and that we will receive any revenue from that OEM. This risk is heightened because 4G technology is rapidly emerging and many of our customers, particularly in the Internet of Things market, do not have significant experience designing products utilizing 4G technology. If our customers’ products incorporating our semiconductor solutions fail to meet the demands of their customers or otherwise fail to achieve market acceptance, our revenue and business would be harmed.

If we are unable to compete effectively, we may not increase or maintain our revenue or market share, which would harm our business.

We may not be able to compete successfully against current or potential competitors. If we do not compete successfully, our revenue and market share may decline. In the LTE market, we face or expect to face competition from established semiconductor companies such as HiSilicon Technologies, Intel Corporation, Mediatek, Qualcomm Incorporated, Samsung Electronics Co. Ltd., Sony Corporation (after its acquisition of Altair Semiconductor in 2016) and Spreadtrum, as well as smaller actors in the market such as GCT Semiconductor. Many of our competitors have longer operating histories, significantly greater resources and name recognition, and a larger base of existing customers than us. In addition, recently there has been consolidation within the industry, notably the acquisition of smaller competitors by larger competitors. The significant resources of these larger competitors may allow them to respond more quickly than us to new or emerging technologies or changes in customer requirements or to bring new products to market in a more timely manner than us. For example, some competitors may have greater access or rights to complementary technologies, including GNSS (GPS), blue tooth, sensors, graphic processing, etc., and we may need to develop or acquire complementary technologies or partner with others to bring to market solutions that integrate enhanced functionalities. We expect to pursue such transactions or partnerships if appropriate opportunities arise. However, we may not be able to identify suitable transactions or partners in the future, or if we do identify such transactions or partners, we may not be able to complete them on commercially acceptable terms, or at all. In addition, these competitors may have greater credibility with our existing and potential customers. Further, many of these competitors are located in Asia or have a significant presence and operating history in Asia and, as a result, may be in a better position than we are to work with manufacturers and customers located in Asia. Moreover, many of our competitors have been doing business with customers for a longer period of time and have well-established relationships, which may provide them with advantages, including access to information regarding future trends and requirements that may not be available to us. In addition, some of our competitors may provide incentives to customers or offer bundled solutions with complementary products, which could be attractive to some customers, or adopt more aggressive pricing policies, which may make it difficult for us to gain or maintain market share.

Our ability to compete effectively will depend on a number of factors, including:

| |

• | our ability to anticipate market and technology trends and successfully develop products that meet market needs; |

| |

• | our ability to deliver products in large volume on a timely basis at competitive prices; |

| |

• | our success in identifying and penetrating new markets, applications and customers; |

| |

• | our ability to accurately understand the price points and performance metrics of competing products in the market; |

| |

• | our products’ performance and cost-effectiveness relative to those of our competitors; |

| |

• | our ability to develop and maintain relationships with key customers, wireless carriers, OEMs and ODMs; |

| |

• | our ability to secure sufficient high quality supply for our products; |

| |

• | our ability to conform to industry standards while developing new and proprietary technologies to offer products and features previously not available in the 4G market; |

| |

• | our ability to develop or acquire complementary technologies or to partner with others to bring to market products with enhanced functionalities; and |

| |

• | our ability to recruit design and application engineers with expertise in wireless broadband communications technologies and sales and marketing personnel. |

If we experience material changes to the competitive structure of our industry due to cooperation or consolidation among our competitors, we may not increase or sustain our revenue or market share, which would harm our business.

Our current or future competitors may establish cooperative relationships among themselves or with third parties. In addition, there has recently been consolidation within our industry, notably the acquisition of smaller competitors by larger competitors with significantly greater resources than ours. These events may result in the emergence of new competitors with greater resources and scale than ours that could acquire significant market share, which could result in a decline of our revenue and market share. Our ability to maintain our revenue and market share will depend on our ability to compete effectively despite material changes in industry structure. If we are unable to do so, we may not increase or sustain our revenue or market share, which would harm our business.

If we are unable to effectively manage our business through periods of economic or market slow-down and any subsequent future growth, we may not be able to execute our business plan and our operating results could suffer.

Our future operating results depend to a large extent on our ability to successfully manage our business through periods of economic or market slow-down and periods of subsequent expansion and growth. To manage our growth successfully and handle the responsibilities of being a public company, we believe we must, among other things, effectively:

| |

• | recruit, hire, train and manage additional qualified engineers for our research and development activities, especially in the positions of design engineering, product and test engineering, and applications engineering; |

| |

• | add additional sales personnel and expand sales offices; |

| |

• | add additional finance and accounting personnel; |

| |

• | implement and improve our administrative, financial and operational systems, procedures and controls; and |

| |

• | enhance our information technology support for enterprise resource planning and design engineering by adapting and expanding our systems and tool capabilities, and properly training new hires as to their use. |

Furthermore, to remain competitive and manage future expansion and growth, we must carry out extensive research and development, which requires significant capital investment. During periods of economic or market slow-down, we must also effectively manage our expenses to preserve our ability to carry out such research and development. With our initial success in introducing new LTE products and gaining design wins during 2015, we increased our investment in research and development in 2016, as well as sales and marketing, general and administrative and other functions to support the growth of our business and maintained them at about the same level in 2017. As our customer base broadens and as our customers launch products on more operators worldwide, we expect that operating expenses will increase somewhat in 2018. We are likely to incur these costs earlier than some of the anticipated benefits and the return on these investments, if any, may be lower, may develop more slowly than we expect, or may not materialize at all, which could harm our operating results.

If we are unable to manage our business during both periods of economic or market slow-down and growth effectively, we may not be able to take advantage of market opportunities or develop new products and we may fail to satisfy customer requirements, maintain product quality, execute our business plan or respond to competitive pressures, any of which could harm our operating results.

The average selling prices of our semiconductor solutions have historically decreased over time and will likely do so in the future, which could harm our gross profits and financial results.

Average selling prices of our semiconductor solutions have historically decreased over time, and we expect such declines to continue to occur. Our gross profits and financial results will suffer if we are unable to offset reductions in our average selling prices by reducing our costs, developing new or enhanced semiconductor solutions on a timely basis with higher selling prices or gross profits, or increasing our sales volumes. Even if we are successful in reducing our costs or improving sales volumes, such improvements may not be sufficient to offset declines in average selling prices in the future. Additionally, because we do not operate our own manufacturing, assembly or testing facilities, we may not be able to reduce our costs and our costs may even increase, either of which would reduce our margins. We have reduced the prices of our semiconductor solutions in line with and at times in advance of competitive pricing pressures, new product introductions by us or our competitors and other factors. We expect that we will have to do so again in the future.

Any increase in the manufacturing cost of our products would reduce our gross margins and operating profit.

The semiconductor business is characterized by ongoing competitive pricing pressure from customers and competitors. Accordingly, any increase in the cost of our products, whether by adverse purchase price or manufacturing cost variances or due to other factors, will reduce our gross margins and operating profit. We do not have long-term supply agreements with our manufacturing, test or assembly suppliers and we typically negotiate pricing on a purchase order by purchase order basis. Consequently, we may not be able to obtain price reductions or anticipate or prevent future price increases from our suppliers. Because we have a sole source of wafer supply and limited sources of test and assembly, we may not be able to negotiate favorable pricing terms from our suppliers. These and other related factors could impair our ability to control our costs and could harm our operating results.

The semiconductor and communications industries have historically experienced significant fluctuations with prolonged downturns, which could impact our operating results, financial condition and cash flows.

The semiconductor industry has historically been cyclical, experiencing significant downturns in customer demand. Because a significant portion of our expenses is fixed in the near term or is incurred in advance of anticipated sales, we may not be able to decrease our expenses rapidly enough to offset any unanticipated shortfall in revenue. If this situation occurs, it could

harm our operating results, cash flow and financial condition. Furthermore, the semiconductor industry has periodically experienced periods of increased demand and production constraints. If this occurs, we may not be able to obtain sufficient quantities of our semiconductor solutions to meet the increased demand, resulting in lost sales, loss of market share and harm to our customer relationships. We may also have difficulty in obtaining sufficient assembly and test resources from our subcontract manufacturers. Any factor adversely affecting the semiconductor industry in general, or the particular segments of the industry that we target, may harm our ability to generate revenue and could negatively impact our operating results.

The communications industry has experienced pronounced downturns, and these cycles may continue in the future. A future decline in global economic conditions could have adverse, wide-ranging effects on demand for our semiconductor solutions and for the products of our customers, particularly wireless communications equipment manufacturers or other participants in the wireless industry, such as wireless carriers. Inflation, deflation and economic recessions that harm the global economy and capital markets also harm our customers and our end consumers. Specifically, the continued deployment of new 4G networks requires significant capital expenditures and wireless carriers may choose not to undertake network expansion efforts during an economic downturn or time of other economic uncertainty. Our customers’ ability to purchase or pay for our semiconductor solutions and services, obtain financing and upgrade wireless networks could be harmed, and networking equipment providers may slow their research and development activities, cancel or delay new product development, reduce their inventories and take a cautious approach to acquiring our products, which would have a significant negative impact on our business. If such economic situations were to occur, our operating results, cash flow and financial condition could be harmed. In the future, any of these trends may also cause our operating results to fluctuate significantly from year to year, which may increase the volatility of the price of the ADSs.

Though we rely to a significant extent on proprietary intellectual property, we may not be able to obtain, or may choose not to obtain, sufficient intellectual property rights to provide us with meaningful protection or commercial advantage.

We depend significantly on intellectual property rights to protect our products and proprietary technologies against misappropriation by others. We generally rely on the patent, trademark, copyright and trade secret laws in Europe, the United States and certain other countries in which we operate or in which our products are produced or sold, as well as licenses and nondisclosure and confidentiality agreements, to protect our intellectual property rights.

We may have difficulty obtaining patents and other intellectual property rights, and the patents and other intellectual property rights we have and obtain may be insufficient to provide us with meaningful protection or commercial advantage. We currently do not apply for patent protection in all countries in which we operate. Instead we select and focus on key countries for each patent family. In addition, the protection offered by patents and other intellectual property rights may be inadequate or weakened for reasons or circumstances that are out of our control. For instance, we may not be able to obtain patent protection or secure other intellectual property rights in all the countries in which we have filed patent applications or in which we operate, and under the laws of such countries, patents and other intellectual property rights may be or become unavailable or limited in scope.

We may not be able to adequately protect or enforce our intellectual property against improper use by our competitors or others and our efforts to do so may be costly to us, which may harm our business, financial condition and results of operations.

Our patents and patent applications, or those of our licensors, could face challenges, such as interference proceedings, opposition proceedings, nullification proceedings and re-examination proceedings. Any such challenge, if successful, could result in the invalidation or narrowing of the scope of any such patents and patent applications. Any such challenges, regardless of their success, would also likely be time-consuming and expensive to defend and resolve, and would divert management time and attention. Further, our unpatented proprietary processes, software, designs and trade secrets may be vulnerable to disclosure or misappropriation by employees, contractors and other persons. While we generally enter into confidentiality agreements with such persons to protect our intellectual property, we cannot assure you that our confidentiality agreements will not be breached, that they will provide meaningful protection for our proprietary technology and trade secrets or that adequate remedies will be available in the event they are used or disclosed without our authorization. Also, intellectual property rights are difficult to enforce in the People’s Republic of China, or PRC, and certain other countries, particularly in Asia, where the application and enforcement of the laws governing such rights may not have reached the same level as compared to other jurisdictions where we operate, such as Europe and the United States. Consequently, because we operate in these countries and all of our manufacturing, test and assembly takes place in Taiwan and Singapore, we may be subject to an increased risk that unauthorized parties may attempt to copy or otherwise use our intellectual property or the intellectual property of our suppliers or other parties with whom we engage or have licenses.

There can be no assurance that we will be able to protect our intellectual property rights, that our intellectual property rights will not be challenged, invalidated, circumvented or rendered unenforceable, or that we will have adequate legal recourse

in the event that we seek legal or judicial enforcement of our intellectual property rights. Any inability on our part to adequately protect or enforce our intellectual property may harm our business, financial condition and results of operations. We may in the future initiate claims or litigation against third parties for infringement of our intellectual property rights to protect these rights or to determine the scope and validity of our proprietary rights or the proprietary rights of competitors. These claims could result in costly litigation and the diversion of our technical and management personnel, and we may not prevail in making these claims.

Assertions by third parties of infringement by us or our customers of their intellectual property rights could result in significant costs and cause our operating results to suffer.

The markets in which we compete are characterized by rapidly changing products and technologies and there is intense competition to establish intellectual property protection and proprietary rights to these new products and the related technologies. The semiconductor and wireless communications industries, in particular, are characterized by vigorous protection and pursuit of intellectual property rights and positions, which has resulted in protracted and expensive litigation for many companies.

We may be unaware of the intellectual property rights of others that may cover some of our technology, products and services. In addition, third parties may claim that we or our customers are infringing or contributing to the infringement of their intellectual property rights.

We have in the past received and, particularly as a public company operating in a highly competitive marketplace, we expect that in the future we will receive communications and offers from various industry participants and others alleging that we infringe or have misappropriated their patents, trade secrets or other intellectual property rights and/or inviting us to license their technology and intellectual property. Any lawsuits resulting from such allegations of infringement or invitations to license, including suits challenging LTE standards, could subject us to significant liability for damages and/or challenge our activities. Any potential intellectual property litigation also could force us to do one or more of the following:

| |

• | stop selling products or using technology that contain the allegedly infringing intellectual property; |

| |

• | lose the opportunity to license our technology to others or to collect royalty payments based upon successful protection and assertion of our intellectual property against others; |

| |

• | incur significant legal expenses; |

| |

• | pay substantial damages to the party whose intellectual property rights we may be found to be infringing; |

| |

• | redesign those products that contain the allegedly infringing intellectual property; or |

| |

• | attempt to obtain a license to the relevant intellectual property from third parties, which may not be available on reasonable terms or at all. |

Our customers could also become the target of litigation relating to the patents and other intellectual property rights of others. This could, in turn, trigger an obligation for us to provide technical support and/or indemnify such customers. These obligations could result in substantial expenses, including the payment by us of costs and damages relating to claims of intellectual property infringement. In addition to the time and expense required for us to provide support or indemnification to our customers, any such litigation could disrupt the businesses of our customers, which in turn could hurt our relationships with our customers and cause the sale of our products to decrease. We cannot assure you that claims for indemnification will not be made or that if made, such claims would not materially harm our business, operating results or financial conditions.

Any potential dispute involving our patents or other intellectual property could also include our industry partners and customers, which could trigger our indemnification obligations to them and result in substantial expense to us.

In any potential dispute involving our patents or other intellectual property, our licensees could also become the target of litigation, and certain customers have received notices of written offers from our competitors and others claiming to have patent rights in certain technology and inviting our customers to license this technology. Because we indemnify our licensees and customers for intellectual property claims made against them for products incorporating our technology, any litigation could trigger technical support and indemnification obligations in some of our license agreements, which could result in substantial payments and expenses by us. In addition to the time and expense required for us to supply support or indemnification to our licensees and customers, any such litigation could severely disrupt or shut down the business of our customers, which in turn could hurt our relations with our customers and cause the sale of our proprietary technologies and products to decrease.

Our failure to comply with obligations under open source licenses could require us to release our source code to the public or cease distribution of our products, which could harm our business, financial condition and results of operations.

Some of the software used with our products, as well as that of some of our customers, may be derived from so-called “open source” software that is generally made available to the public by its authors and/or other third parties. Such open source software is often made available to us under licenses, such as the GNU General Public License, which impose certain obligations on us in the event we were to make available derivative works of the open source software. These obligations may require us to make source code for the derivative works available to the public, and/or license such derivative works under a particular type of license, rather than the licenses we customarily use to protect our intellectual property. In addition, there is little or no legal precedent for interpreting the terms of certain of these open source licenses, including the determination of which works are subject to the terms of such licenses. While we believe we have complied with our obligations under the various applicable licenses for open source software, in the event the copyright holder of any open source software were to successfully establish in court that we had not complied with the terms of a license for a particular work, we could be required to release the source code of that work to the public and/or stop distribution of that work.

The complexity of our semiconductor solutions could result in unforeseen delays or expenses from undetected defects or design errors in hardware or software, which could reduce the market acceptance for our semiconductor solutions, damage our reputation with current or prospective customers and increase our costs.

Highly complex semiconductor solutions such as ours can contain defects and design errors, which, if significant, could impair performance or prevent compliance with industry standards. We have not in the past, but may in the future, experience such significant defects or design errors. In addition, our semiconductor solutions must be certified by individual wireless carriers that such solutions function properly on the carrier’s network before our solutions can be designed into a particular product. If any of our semiconductor solutions have reliability, quality or compatibility problems from defects or design errors we may not be able to successfully correct these problems in a timely manner, or at all. Furthermore, we may experience production delays and increased costs correcting such problems. Issues in the carrier certification process, which varies among carriers, may also create delays. Consequently, and because our semiconductor solutions are a critical component of our customers’ products, our reputation may be irreparably damaged and customers may be reluctant to buy our semiconductor solutions, which could harm our ability to retain existing customers and attract new customers and harm our financial results. In addition, these defects or design errors or delays in the carrier certification process could interrupt or delay sales to our customers. If any of these problems are not found until after we have commenced commercial production of a new semiconductor solution, we may be required to incur additional development costs and product recalls, repairs or replacement costs. Furthermore, we provide warranties on our products ranging from one to two years, and thus may be obligated to refund sales with respect to products containing defects, errors or bugs. These problems may also result in claims against us by our customers or others, all of which could damage our reputation and increase our costs.

We are subject to risks inherent in our international operations.

Our international revenues account for a substantial majority of our total revenues. As a result, we must provide significant service and support globally. We intend to maintain or expand our international operations and expect to incur costs doing so. We cannot assure you that we will be able to recover our investments in international markets. Our results of operations could be adversely affected by a variety of factors, including:

| |

• | the longer payment cycles associated with many foreign customers; |

| |

• | the typically longer periods from placement of orders to revenue recognition in certain international and emerging markets; |

| |

• | the difficulties in interpreting or enforcing our agreements and collecting receivables through many foreign countries’ legal systems; |

| |

• | unstable regional political and economic conditions or changes in restrictions on trade among countries; |

| |

• | changes in the political, regulatory, safety or economic conditions in a country or region; |

| |

• | the imposition by governments of additional taxes, tariffs, global economic sanctions programs or other restrictions on foreign trade; |

| |

• | any inability to comply with export or import laws and requirements or any violation of sanctions regulations, which may result in enforcement actions, civil or criminal penalties and restrictions on exports; |

| |

• | any increase in the cost of trade compliance functions to comply with changes to regulatory requirements; and |

| |

• | the possibility that it may be more difficult to protect our intellectual property in foreign countries. |

The loss of any of our key personnel could seriously harm our business, and our failure to attract or retain specialized technical, management or sales and marketing employees could impair our ability to grow our business.