As filed with the Securities and Exchange Commission on January 24, 2020

Registration No. 333-235540

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

(Amendment No. 1)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

TRXADE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5122 | 46-3673928 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

3840 Land O’ Lakes Boulevard

Land O’ Lakes, Florida 34639

(800) 261-0281

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Suren Ajjarapu

Chief Executive Officer

Trxade Group, Inc.

3840 Land O’ Lakes Boulevard

Land O’ Lakes, Florida 34639

(800) 261-0281

(Name, address, including zip code, and telephone number,

including area code, of agent for service of process)

| Copies To: | ||

| David M. Loev, Esq. | Darrin M. Ocasio, Esq. | |

| John S. Gillies, Esq. | Sichenzia Ross Ference LLP | |

| The Loev Law Firm, PC | 1185 Avenue of the Americas | |

| 6300 West Loop South, Suite 280 | 37th Floor | |

| Bellaire, Texas 77401 | New York, New York 10036 | |

| Telephone: (713) 524-4110 | Telephone: (212) 398-1493 | |

| Facsimile: (713) 524-4122 | Facsimile: (212) 930-9725 | |

| Email: dloev@loevlaw.com; | Email: dmocasio@srf.law | |

| john@loevlaw.com | ||

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [ ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [X] | Smaller reporting company [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Securities Being Registered | Proposed

Maximum Aggregate Offering Price(1)(2) | Amount

of Registration Fee(5) | ||||||

| Common Stock(3)(4) | $ | 6,900,000 | $ | 895.62 | ||||

| (1) | In accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”), the number of shares being registered and the proposed maximum offering price per share are not included in this table. |

| (2) | Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (3) | Pursuant to Rule 416 under the Securities Act, the shares registered hereby also include an indeterminate number of additional shares as may from time to time become issuable by reason of stock splits, distributions, recapitalizations or other similar transactions. |

| (4) | Includes shares the underwriters have the option to purchase to cover over-allotments, if any. |

| (5) | A total of $649.00 has previously been paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED JANUARY 24, 2020

TRXADE GROUP, INC.

806,452 Shares of Common Stock

We are offering up to 806,452 shares (based on an assumed offering price of $7.44 per share (which represents the Reverse Split (defined below) adjusted closing price of the common stock on January 23, 2020)) (the “Shares”) of common stock, $0.00001 par value, of Trxade Group, Inc., a Delaware corporation (the “Registrant”, “Trxade” or the “Company”) in a firm commitment underwritten public offering.

Our common stock is presently quoted on the OTCQB Market under the symbol “TRXD”. At present, there is a limited market for our common stock. We have applied to list our common stock on The NASDAQ Capital Market under the symbol “MEDS” simultaneously with the closing of this offering. It is a condition to the underwriter’s obligation to close that the common stock be listed on the NASDAQ Capital Market.

On January 23, 2020, the last reported sale price for our common stock on the OTCQB was $7.44 per share ($1.24 pre-Reverse Stock Split, as discussed below). Quotes of stock trading prices on an over-the-counter marketplace may not be indicative of the market price on a national securities exchange.

On October 9, 2019, our Board of Directors, and on October 15, 2019, stockholders holding a majority of our outstanding voting shares, approved resolutions authorizing a reverse stock split of the outstanding shares of our common stock in the range from one-for-two (1-for-2) to one-for-ten (1-for-10), and provided authority to our Board of Directors to select the ratio of the reverse stock split in their discretion (the “Stockholder Authority”). Although not yet effective, the Board of Directors has approved a stock split ratio of 1-for-6 (“Reverse Stock Split”) in connection with the Stockholder Authority. We anticipate filing a Certificate of Amendment to affect the Reverse Stock Split with the Secretary of State of Delaware prior to the uplisting of our common stock on the NASDAQ Capital Market and such Reverse Stock Split being effective on, or just before, the date our common stock is uplisted to the NASDAQ Capital Market. The reverse stock split is intended to allow us to meet the minimum share price requirement of the NASDAQ Capital Market.

Except as otherwise indicated and except in our financial statements and the notes thereto, all references to our common stock, share data, per share data and related information depict the Reverse Stock Split as if it was effective and as if it had occurred at the beginning of the earliest period presented. The Reverse Stock Split, when effective, will combine each six shares of our outstanding common stock into one share of common stock, without any change in the par value per share, and the Reverse Stock Split correspondingly will adjust, among other things, the number of shares of common stock issuable upon exercise of outstanding options and warrants and the exercise price of such options and warrants. No fractional shares will be issued in connection with the Reverse Stock Split, and any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for future filings.

Investing in our securities involves risks. You should carefully consider the risk factors beginning on page 10 of this prospectus and set forth in the documents incorporated by reference herein before making any decision to invest in our securities.

We are an “emerging growth company” under applicable federal securities laws and are subject to reduced public company reporting requirements. See “Risk Factors” starting on page 10. Prices of our common stock as reported on the OTCQB Market may not be indicative of the prices of our common stock if our common stock were traded on some other exchange. Accordingly, an investment in our common stock is considered an illiquid investment and subject to many risks.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ |

| (1) | We have also agreed to reimburse the underwriters for certain expenses. See “Underwriting” beginning on page 73 for a description of these arrangements. |

We have granted a 45-day option to the representative of the underwriters to purchase up to an additional 120,967 shares of common stock (based on an assumed offering price of $7.44 per share (which represents the Reverse Split adjusted closing price of the common stock on January 23, 2020)) solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in the offering on or about 2020.

Joint Book Runners

Aegis Capital Corp. WestPark Capital, Inc.

The date of this prospectus is , 2020.

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC” or the “Commission”).

Certain pharmaceutical industry terms used in this prospectus are defined in the “Glossary Of Pharmaceutical Industry Terms” in Annex A of this prospectus.

You should read this prospectus, together with additional information described under “Where You Can Find More Information”, beginning on page 80, before making an investment decision.

This prospectus does not contain all the information provided in the registration statement we filed with the SEC. For further information about us or our securities offered hereby, you should refer to that registration statement, which you can obtain from the SEC as described below under “Where You Can Find More Information”, beginning on page 80.

We will disclose any material changes in our affairs in a post-effective amendment to the registration statement of which this prospectus is a part, or a prospectus supplement. We do not imply or represent by delivering this prospectus that Trxade Group, Inc., or its business, financial condition or results of operations, are unchanged after the date on the front of this prospectus is correct at any time after such date, provided that we will amend or supplement this prospectus to disclose any material events which occur after the date of such prospectus to the extent required by applicable law.

Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside of the United States.

Our logo and some of our trademarks and tradenames are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of others. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus may appear without the ®, ™ and SM symbols. References to our trademarks, tradenames and service marks are not intended to indicate in any way that we will not assert to the fullest extent under applicable law our rights or the rights of the applicable licensors if any, nor that respective owners to other intellectual property rights will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosures contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” beginning on page 10 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates. Some market and other data included herein, as well as the data of competitors as they relate to Trxade Group, Inc., is also based on our good faith estimates.

Unless the context otherwise requires, references in this prospectus to “we,” “us,” “our,” the “Registrant”, the “Company,” “Trxade” and “Trxade Group” refer to Trxade Group, Inc. and its subsidiaries. In addition, unless the context otherwise requires, “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; and “Securities Act” refers to the Securities Act of 1933, as amended. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. You should read the entire prospectus before making an investment decision to purchase our securities.

| 1 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement contain certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” and the negative and plural forms of these words and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those statements appear in this prospectus, any accompanying prospectus supplement and the documents incorporated herein and therein by reference, particularly in the sections titled “Prospectus Summary” and “Risk Factors,” and include statements regarding the intent, belief or current expectations of the Company and management that are subject to known and unknown risks, uncertainties and assumptions.

This prospectus, any prospectus supplement and the information incorporated by reference in this prospectus and any prospectus supplement also contain statements that are based on the current expectations of our Company and management. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this prospectus, whether as a result of any new information, future events or otherwise.

You should also consider carefully the statements under “Risk Factors” and other sections of this prospectus, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus.

| 2 |

The following summary highlights material information found in more detail elsewhere in the prospectus. It does not contain all of the information you should consider. As such, before you decide to buy our common stock, in addition to the following summary, we urge you to carefully read the entire prospectus, especially the risks of investing in our common stock as discussed under “Risk Factors.” Unless otherwise indicated, except for our financial statements and the notes thereto, all references to our common stock, share data, per share data and related information depict as if the Reverse Stock Split was effective.

About Trxade Group, Inc.

We have designed and developed, and now own and operate, a business-to-business, web-based marketplace focused on the United States pharmaceutical industry. Our core service brings the nation’s independent pharmacies and accredited national suppliers of pharmaceuticals together to provide efficient and transparent buying and selling opportunities.

We began operations as Trxade Group, Inc., a Nevada corporation (“Trxade Nevada”) in August of 2010 and initially spent two years creating and enhancing our web-based services. Our services provide enhanced pricing transparency, purchasing capabilities and other value-added services on a single platform focusing on serving the nation’s approximately 22,000 independent pharmacies with an annual purchasing power of $76 billion (according to the National Community of Pharmacists Association’s 2018 Digest). Our national supplier partners are able to fulfill orders on our platform immediately and provide pharmacies with cost saving payment terms and next day delivery capabilities in compliance with all state boards of pharmacy and federal regulations. We have expanded rapidly since 2015 and now have over 10,000 registered pharmacy members purchasing products on our sales platform.

In December 2013, we launched a second service to help pharmaceutical distributors better source their pharmaceutical needs within a highly structured single platform. This solution is designed to help purchasers overcome pharmaceutical supply issues as a means to control costs on drugs with volatile pricing, as well as to help our buyers make better purchasing choices based on their needs. Additionally, we built and, in February 2014, launched a new desktop application, named “RxGuru”, to bring product information on a just-in-time basis to our member base. Our pharmacy members benefit from this application by gaining advanced data analytics at point of purchase and patient care. RxGuru has been upgraded to continue the benefit to the pharmacies.

In 2015 and 2016, through Westminster Pharmaceuticals, LLC, our former wholly-owned subsidiary and distribution division (“Westminster”), we launched a private label pharmaceutical product program and entered into various supply contracts with pharmaceutical manufacturers to supply Westminster with generic pharmaceutical products on a private label basis to sell to our customers. In connection with this expansion, Westminster received significant funding in late 2015 and early 2016. Westminster was not profitable and in December 2016 we sold this division and exited the private label distribution business.

In October 2018, we acquired 100 percent of Community Specialty Pharmacy, LLC (“CSP”) an accredited independent retail pharmacy with a focus on specialty medications. CSP operates with an innovative pharmacy model which offers home delivery services to any patient thereby providing convenience. We have continued CSP’s pharmacy model.

In late 2018, we launched Delivmeds.com, a consumer-based app to provide delivery of pharmaceutical products operating as part of Alliance Pharma Solutions, LLC (“Alliance”). In early 2019, as part of the SyncHealth MSO, LLC joint venture, technology was being developed to assist independent retail pharmacies to better compete with large national pharmacies on exposure, pricing, distribution and logistics. To date, we have not realized any income from the technology and presently we are in discussions to dissolve this relationship.

| 3 |

Our Principal Products and Services and their Markets.

Trxade.com is a web-based pharmaceutical marketplace engaged in promoting and enabling commerce among independent pharmacies and large pharmaceutical suppliers nationally. Our marketplace has hundreds of suppliers providing over 20,000 branded and generic drugs available for purchase by pharmacists. We already serve over 10,000 independent pharmacies with access to our proprietary pharmaceutical database, data analytics regarding medication pricing, and manufacturer return policies. We generate revenues from these services by charging a transaction fee to the seller of the products for sales conducted via our Trxade platform. The buyers do not bear the cost of transaction fees for the purchases which they make, nor do they pay a fee to join or register with our platform. Substantially all of our revenues since 2017, were from platform revenue generated on www.Trxade.com. For additional information, please visit us at http://www.trxadegroup.com, http://www.trxade.com, and http://www.delivmeds.com, information on our website is not incorporated by reference into this prospectus. Information contained on, or accessible through, our websites is not a part of, and are not incorporated by reference into, this prospectus.

Status of new products or services.

We have a number of products and services still in development, which are described below.

InventoryRx.com. InventoryRx, launched in the first quarter of 2014, is a web-based pharmaceutical exchange platform where wholesalers can buy and sell pharmaceuticals or over-the-counter medications with each other in a systematized online sales platform. The site offers these trading partners’ greater product availability and pricing transparency. The site may also substantially improve our customers buying efficiency and lower their cost of goods on a continuous basis. This product is built into the Trxade.com platform and, accordingly, we have not generated any independent revenue from this product.

Pharmabayonline. We formed Pharmabayonline to provide proprietary pharmaceutical data analytics and governmental reimbursement benchmarks analysis to United States-based independent pharmacies and pharmaceutical databases.

RxGuru. Our RxGuru application was launched in the first quarter of 2014 and underscores our commitment to deliver timely information to our customers at the moment before purchase. Our industry leading price prediction model, “RxGuru”, integrates product insight into pharmacy acquisition cost benchmarks (“PAC”) to ascertain trends and pricing variances which result in significant purchasing opportunities. “RX Guru” helps to predict prices and affords our members an opportunity to continuously benefit from real price purchasing opportunities that are often concealed from the rest of the industry. This product is built into the Trxade.com platform and, accordingly, this application works in conjunction with the Trxade platform but, to date, has not generated any independent revenue.

Integra Pharma Solutions, LLC. Integra is intended to serve as our logistics company for pharmaceutical distribution.

Community Specialty Pharmacy, LLC. We acquired CSP on October 15, 2018. CSP is an accredited pharmacy located in St. Petersburg, Florida and focuses upon specialty medications. The company operates with an innovative pharmacy model which offers home delivery services to any patient thereby providing convenience.

Delivmeds.com. Delivmeds.com was launched in late 2018 as a consumer-based app to provide delivery of pharmaceutical products associated with Alliance Pharma Solutions, LLC. To date, we have not generated any revenue from this product.

Trxademso Technology. Early 2019 as part of the SyncHealth MSO, LLC joint venture, technology development began that would assist independent retail pharmacies to compete better with large national pharmacies on exposure, pricing, distribution and logistics. To date, we have not realized any income from this product and currently we are in discussions to dissolve this relationship.

| 4 |

Bonum Health. In October 2019, we acquired certain telehealth assets and launched the “Bonum Health Hub”. The hub connects patients to board-certified medical care at any time, and from anywhere through the Bonum Health mobile app and website portal or by visiting Bonum Health Hubs at select independent pharmacy locations.

All our product offerings are focused on the United States markets. Some products are restricted just to certain states, depending upon the various applicable state regulations and guidelines pertaining to pharmaceuticals, particularly, and drug businesses, generally. Our services are distributed through our online platform and Bonum Health Hubs.

The Pharmaceutical Industry

According to the 2013-14 Economic Report on Retail, Mail, and Specialty Pharmacies by Adam J. Fein, Ph.D. (the “Fein Report”), United States pharmaceutical companies comprise a burgeoning $330 billion industry consisting of over 65,000 pharmacy facilities and 700 Drug Enforcement Administration (DEA)-registered (and 1,500 State-licensed) suppliers. Management believes that few platforms are currently in place to bring these participants together to share market knowledge, product pricing transparency and product availability. According to this, the pharmaceutical market is comprised primarily of three wholesalers that control an estimated approximately 92% of the market. Our management believes that this concentration has, over the years, led to a lack of price and cost transparency, thereby resulting in severe limitations on the purchasing choices of industry participants. These market dynamics have enabled these large wholesalers (McKesson, Cardinal Health and AmerisourceBergen), known as ADR distributors, to dominate the industry with respect to both generic and brand pharmaceuticals. The increasing concentration of generic medications (ANDA, or “Abbreviated New Drug Application”), however, with many more expected to go to market in the near future (approximately $80 billion in branded medications lost their patent protection from 2008 to 2018, according to an article in Drug Topics from August 2004, called “Big Pharma uses effective strategies to battle generic competitors”, by Martin Sipkoff), have enabled smaller suppliers’ access to an increasing number of medications at highly discounted prices. The market is slowly changing towards one where medications will become commoditized and influenced by price rather than the business relationships imposed by the dominant participants of the past.

To fuel this change, insurance companies (Pharmacy Benefits Management (“PBM”) and private health payers) and the federal government have recently initiated lower medication reimbursement payments to healthcare providers. We believe that pharmacies in due course will face increasing pressure to source medications as inexpensively as possible and improve operational efficiency. Trxade seeks to be in the forefront of solving these transparency and pricing concerns by providing independent, retail pharmacies with real-time, pharmacy acquisition cost (“PAC”) benchmarks to the National Drug Code (the “NDC”) standard. The NDC mark is a unique product identifier used in the United States for drugs intended for human use.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last completed fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements that are otherwise applicable generally to public companies. These reduced reporting requirements include:

| ● | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting; | |

| ● | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board, or PCAOB, may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; | |

| ● | reduced disclosure about our executive compensation arrangements; |

| 5 |

| ● | an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or stockholder approval of any golden parachute arrangements; | |

| ● | extended transition periods for complying with new or revised accounting standards; and | |

| ● | the ability to present more limited financial data, including presenting only three years of selected financial data in the registration statement, of which this prospectus is a part. |

We will remain an emerging growth company until the earliest to occur of: (i) the end of the first fiscal year in which our annual gross revenue is $1.07 billion or more; (ii) the end of the fiscal year in which the market value of our common stock that is held by non-affiliates is at least $700 million as of the last business day of our most recently completed second fiscal quarter; (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; and (iv) the last day of the end of our 2024 fiscal year (5 years from our first public offering). We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act.

We are choosing to irrevocably “opt out” of the extended transition periods available under Section 107 of the JOBS Act for complying with new or revised accounting standards, but we currently intend to take advantage of the other exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you invest.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those in the section entitled “Risk Factors” and elsewhere in this prospectus. These risks include, but are not limited to, the following:

| ● | Risks of our operations not being profitable; | |

| ● | Claims relating to alleged violations of intellectual property rights of others; | |

| ● | Technical problems with our websites; | |

| ● | Risks relating to implementing our acquisition strategies; | |

| ● | The need for additional financing; | |

| ● | Our ability to manage our growth; | |

| ● | Negative effects on our operations associated with the opioid pain medication health crisis; | |

| ● | Regulatory and licensing requirement risks; | |

| ● | Risks related to changes in the U.S. healthcare environment; | |

| ● | The status of our information systems, facilities and distribution networks; | |

| ● | Risks associated with the operations of our more established competitors; | |

| ● | Regulatory changes; | |

| ● | Healthcare fraud; | |

| ● | Changes in laws or regulations relating to our operations; | |

| ● | Privacy laws; | |

| ● | System errors; | |

| ● | Dependence on current management; | |

| ● | Our growth strategy; and | |

| ● | Other risks disclosed below under “Risk Factors”. |

Company Information

Our executive offices are located at 3840 Land O’ Lakes Boulevard, Land O’ Lakes, Florida 34639, and our telephone number is (800) 261-0281. Our corporate website addresses are http://www.trxadegroup.com, http://www.trxade.com, and http://www.delivmeds.com. Information contained on, or accessible through, our websites are not a part of, and are not incorporated by reference into, this prospectus.

| 6 |

NASDAQ Listing and Reverse Stock Split

We applied to list of our common stock on the NASDAQ Capital Market. If our application to the NASDAQ Capital Market is not approved or we otherwise determine that we will not be able to secure the listing of the common stock on the NASDAQ Capital Market, we will not complete the offering.

On October 9, 2019, our Board of Directors, and on October 15, 2019, stockholders holding a majority of our outstanding voting shares, approved resolutions authorizing a reverse stock split of the outstanding shares of our common stock in the range from one-for-two (1-for-2) to one-for-ten (1-for-10), and provided authority to our Board of Directors to select the ratio of the reverse stock split in their discretion (the “Stockholder Authority”). Although not yet effective, the Board of Directors has approved a stock split ratio of 1-for-6 (“Reverse Stock Split”) in connection with the Stockholder Authority. We anticipate filing a Certificate of Amendment to affect the Reverse Stock Split with the Secretary of State of Delaware prior to the approval of the uplisting of our common stock on the NASDAQ Capital Market and such Reverse Stock Split being effective on, or just before, the date our common stock is uplisted to the NASDAQ Capital Market. The reverse stock split is intended to allow us to meet the minimum share price requirement of the NASDAQ Capital Market.

Except as otherwise indicated and except in our financial statements and the notes thereto, all references to our common stock, share data, per share data and related information depict the Reverse Stock Split as if it was effective and as if it had occurred at the beginning of the earliest period presented. The Reverse Stock Split, when effective, will combine each six shares of our outstanding common stock into one share of common stock, without any change in the par value per share, and the Reverse Stock Split correspondingly will adjust, among other things, the number of shares of common stock issuable upon exercise of outstanding options and warrants and the exercise price of such options and warrants. No fractional shares will be issued in connection with the Reverse Stock Split, and any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share.

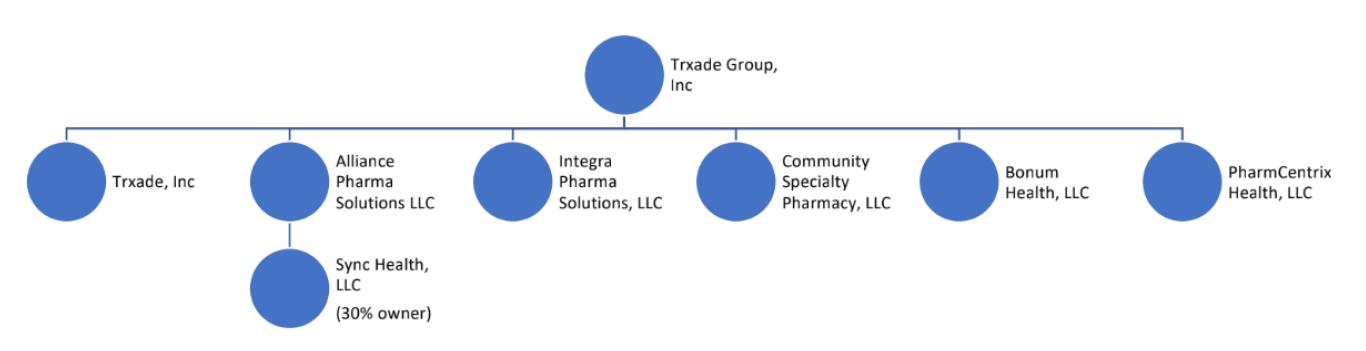

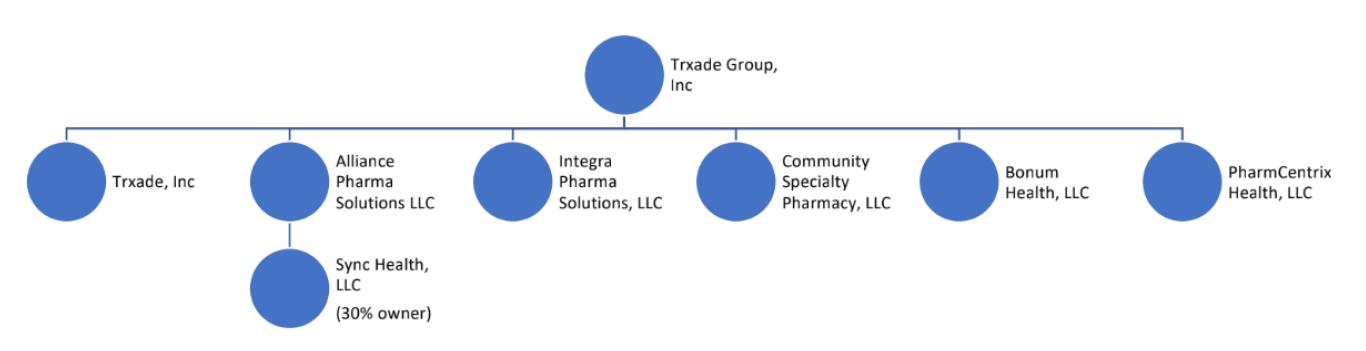

Organizational Structure

The diagram below depicts our current organizational structure:

| 7 |

| Issuer: | Trxade Group, Inc., a Delaware corporation. | |

| Securities offered by us: | Up to 806,452 shares of common stock (up to 927,419 shares of common stock if the underwriters exercise their over-allotment option in full) (based on an assumed offering price of $7.44 per share (which represents the Reverse Split adjusted closing price of the common stock on January 23, 2020). | |

| Over-allotment option: | We have granted to the underwriters an option to purchase up to an additional 120,967 shares of common stock exercisable solely to cover over-allotments, if any, at the applicable public offering price less the underwriting discounts and commissions shown on the cover page of this prospectus (based on an assumed offering price of $7.44 per share (which represents the Reverse Split adjusted closing price of the common stock on January 23, 2020). The underwriters may exercise this option in full or in part at any time and from time to time until 45 days after the date of this prospectus. | |

| Common stock outstanding before this offering: | 6,539,410 (39,236,459 pre-Reverse Stock Split) shares of common stock. | |

| Common stock to be outstanding after this offering (based on assumed offering price): | 7,345,862 (44,075,169 pre-Reverse Stock Split) shares of common stock. | |

| Use of Proceeds: | We expect to receive net proceeds from this offering of approximately $5.3 million (or approximately $6.1 million if the underwriters exercise in full their option to purchase additional shares of our common stock) after deducting estimated underwriting discounts and commissions, and after our offering expenses, estimated at $0.7 million, based on the sale of 806,452 shares in this offering at an assumed offering price of $7.44 per share (which represents the Reverse Split adjusted closing price of the common stock on January 23, 2020). We intend to use the net proceeds from this offering to fund working capital and general corporate purposes and possibly acquisitions of other companies, products or technologies. See “Use of Proceeds.” The estimate of net proceeds discussed above is illustrative only and will be adjusted based on the actual offering price and other terms of this offering determined at pricing. | |

| Risk factors: | The purchase of our common stock involves a high degree of risk. The common stock offered in this prospectus is for investment purposes only and currently only a limited market exists for our common stock. Please refer to the section entitled “Risk Factors” before making an investment in our common stock. | |

| Trading symbol: | Our common stock is presently quoted on the OTCQB under the trading symbol “TRXD”. | |

| Listing Application: | We have applied to list our common stock on the NASDAQ Capital Market under the symbol “MEDS”. The approval of our listing on the NASDAQ Capital Market is a condition of closing this offering. | |

| Dividend policy: | We do not anticipate declaring or paying any cash dividends on our common stock following our public offering. | |

| Reverse Stock Split: | Prior to the closing of this offering and/or concurrently with the closing thereof, we will affect a reverse stock split of the outstanding shares of our common stock in a ratio of 1-for-6, i.e., each six outstanding shares of common stock will be combined into one share of common stock. The reverse stock split was approved by our Board of Directors on October 9, 2019 and by our majority stockholders on October 15, 2019, with the final range of the reverse stock split (1-for-6) being approved by the Board of Directors prior to the date of this prospectus, provided that such reverse stock split is not yet effective and is not planned to become effective until just before our common stock is uplisted to the NASDAQ Capital Market. Except as otherwise indicated and except in our financial statements and the notes thereto, all references to our common stock, share data, per share data and related information depict the reverse stock split in a ratio of 1-for-6 as if it had occurred at the beginning of the earliest period presented. |

| 8 |

Unless we indicate otherwise, all information in this prospectus:

| ● | provides pro forma effect to the Reverse Stock Split of our outstanding shares of common stock, options and warrants and the corresponding adjustment of all common stock price per share and stock option and warrant exercise price data, except for the financial statements and the notes thereto; | |

| ● | is based on 6,539,410 (39,236,459 pre-Reverse Stock Split) shares of common stock issued and outstanding as of January 23, 2020; | |

| ● | assumes no exercise by the representatives of the underwriters of its option to purchase up to an additional 120,967 shares of common stock (based on an assumed offering price of $7.44 per share (which represents the Reverse Split adjusted closing price of the common stock on January 23, 2020)) to cover over-allotments, if any; | |

| ● | excludes 524,468 shares of our common stock issuable upon the exercise of warrants with exercise prices ranging from $0.06 to $9.00 per share; | |

| ● | excludes 346,975 shares of our common stock issuable upon the exercise of options with exercise prices ranging from $2.46 per share to $9.60 per share; | |

| ● | excludes 10,000 shares of our common stock issuable upon the exercise of warrants to purchase a total of 10,000 shares of our common stock with exercise prices of $3.00 per share (5,000 warrants) and $0.06 per share (5,000 warrants), due to consultants, 16,667 shares of our common stock issuable upon the exercise of options to purchase 16,667 shares of our common stock, vesting over five years (beginning in November 2019), with an exercise price of $7.50 per share, due to one of our directors, and 10,000 shares of our common stock issuable upon the exercise of options to purchase 10,000 shares of our common stock, vesting over five years (beginning in January 2020), with an exercise price of $7.50 per share, due to one of our employees, which the Company is contractually obligated to grant as of the date of this prospectus, but which the Company has not entered into formal warrant or option agreements in connection with, and which have not been formally granted or documented, as of the date of this prospectus; | |

| ● | excludes a maximum of 2,462,773 shares of our common stock which may be issued to PanOptic, subject to PanOptic and SyncHealth meeting certain revenue milestones, in connection with our Joint Venture, of which none of the milestones have been met to date and which none of the milestones are projected to be met. We are currently in discussions to dissolve this relationship. | |

| ● | excludes a maximum of 108,334 shares of our common stock which may be issued to Bonum Health, LLC, a Florida limited liability company if all of the milestones set forth in that certain Asset Purchase Agreement dated October 23, 2019 are met through October 23, 2020, in connection with the placement of in-store wellness kiosks. |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA

The following table presents our summary historical financial data for the periods indicated. The summary historical financial data for the years ended December 31, 2018 and 2017 and the balance sheet data as of December 31, 2018 and 2017 are derived from the audited financial statements. The summary historical financial data for the nine months ended September 30, 2019 and 2018 and the balance sheet data as of September 30, 2019 and 2018 are derived from our unaudited financial statements.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. You should read the following summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes appearing elsewhere in this prospectus.

| Year

Ended December 31, | Nine

Months Ended September 30, | |||||||||||||||

| 2018 | 2017 | 2019 | 2018 | |||||||||||||

| (unaudited) | ||||||||||||||||

| Statement of Operations Data | ||||||||||||||||

| Revenues | $ | 3,831,778 | $ | 2,931,280 | $ | 5,740,361 | $ | 2,538,082 | ||||||||

| Cost of sales | 449,049 | - | 2,119,894 | 2,345 | ||||||||||||

| Gross profit | 3,382,729 | 2,931,280 | 3,620,467 | 2,535,737 | ||||||||||||

| General administrative and expense | 3,470,345 | 2,536,185 | 3,138,150 | 2,313,734 | ||||||||||||

| Income (loss) from operations | (87,616 | ) | 395,095 | 482,317 | 222,003 | |||||||||||

| Total other income (expense) | 96,654 | (106,112 | ) | (271,542 | ) | (24,972 | ) | |||||||||

| Net income | $ | 9,038 | $ | 288,983 | $ | 210,775 | $ | 197,031 | ||||||||

| Net income per share, basic and diluted (not adjusted for the Reverse Stock Split) | $ | 0.00 | $ | 0.01 | $ | 0.01 | $ | 0.01 | ||||||||

| Balance Sheet Data (at period end) | ||||||||||||||||

| Cash and cash equivalents | $ | 869,557 | $ | 183,914 | $ | 3,359,288 | $ | 592,765 | ||||||||

| Working capital (1) | 605,710 | 82,119 | 3,359,130 | 538,142 | ||||||||||||

| Total assets | 2,227,587 | 617,476 | 5,854,523 | 1,230,997 | ||||||||||||

| Total liabilities | 1,382,919 | 929,409 | 1,963,974 | 905,407 | ||||||||||||

| Stockholders’ equity (deficit) | 844,668 | (311,933 | ) | 3,890,549 | 325,590 | |||||||||||

(1) Working capital represents total current assets less total current liabilities.

| 9 |

You should be aware that there are substantial risks for an investment in our common stock. You should carefully consider these risk factors, along with the other information included in this prospectus, before you decide to invest in our common stock.

If any of the following risks were to occur, such as our business, financial condition, results of operations or other prospects, any of these could materially affect our likelihood of success. If that happens, the market price of our common stock, if any, could decline, and prospective investors would lose all or part of their investment in our common stock.

Risks Related to the Business

Our business, financial condition and results of operations are subject to various risks and uncertainties, including those described below and elsewhere in this prospectus. This section discusses factors that, individually or in the aggregate, we think could cause our actual results to differ materially from expected and historical results. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. It is not possible to predict or identify all such factors. Consequently, the following description of Risk Factors is not a complete discussion of all potential risks or uncertainties applicable to our business.

We were recently unprofitable and we may incur losses in the future.

In 2017, we became profitable for the first time; in prior years, we were unprofitable and generated a net accumulated deficit of ($8,120,113). Our current business model has been in constant and improved development since 2010 with results that culminated in our first profit for the year ended December 31, 2017. Revenues generated from our consolidated operations for the years ended December 31, 2018 and 2017 were $3,831,778 and $2,931,280, respectively. Revenues generated from our consolidated operations for the nine-month periods ended September 30, 2019 and 2018 were $5,740,361 and $2,538,082, respectively.

We incurred positive net income for the years ended December 31, 2018 and 2017 of $9,038 and $288,983, respectively and $210,775 and $197,031 for the nine months ended September 30, 2019 and 2018, respectively. We may incur other losses in the foreseeable future due to the significant costs associated with our business development, including costs associated with maintaining compliance under SEC reporting standards. We cannot assure you that our operations will annually generate sufficient revenues to fund our continuing operations or to fully implement our business plan, and thereafter sustain profitability in any future period.

The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the start and growth of a business, the implementation and execution of our business plan, and the regulatory environment affecting the distribution of pharmaceuticals in which we operate.

| 10 |

We may be subject to claims that we violated intellectual property rights of others, which are extremely costly to defend and could require us to pay significant damages and limit our ability to operate.

Companies in the Internet and technology industries, and other patent and trademark holders seeking to profit from royalties in connection with grants of licenses, own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. There may be intellectual property rights held by others, including issued or pending patents and trademarks, that cover significant aspects of our technologies, content, branding or business methods. Any intellectual property claims against us, regardless of merit, could be time-consuming and expensive to settle or litigate and could divert our management’s attention and other resources. These claims also could subject us to significant liability for damages and could result in our having to stop using technology, content, branding or business methods found to be in violation of another party’s rights. We might be required or may opt to seek a license for rights to intellectual property held by others, which may not be available on commercially reasonable terms, or at all. If we cannot license or develop technology, content, branding or business methods for any allegedly infringing aspect of our business, we may be unable to compete effectively. Even if a license is available, we could be required to pay significant royalties, which could increase our operating expenses. We may also be required to develop alternative non-infringing technology, content, branding or business methods, which could require significant effort and expense and be inferior. Any of these results could harm our operating results.

Our websites may encounter technical problems and service interruptions.

Our websites may in the future experience slower response times or interruptions as a result of increased traffic or other reasons. These delays and interruptions resulting from failure to maintain Internet service connections to our site could frustrate visitors and reduce our future web site traffic, which could have a material adverse effect on our business.

If we do not successfully implement any acquisition strategies, our operating results and prospects could be harmed.

We face competition within our industry for acquisitions of businesses, technologies and assets, and, in the future, such competition may become more intense. As such, even if we are able to identify an acquisition that we would like to consummate, we may not be able to complete the acquisition on commercially reasonable terms or at all because of such competition. Furthermore, if we enter into negotiations that are not ultimately consummated, those negotiations could result in diversion of management time and significant out-of-pocket costs. Even if we are able to complete such acquisitions, we may additionally expend significant amounts of cash or incur substantial debt to finance them, which indebtedness could result in restrictions on our business and use of available cash. In addition, we may finance or otherwise complete acquisitions by issuing equity or convertible debt securities, which could result in dilution of our existing stockholders. If we fail to evaluate and execute acquisitions successfully, we may not be able to realize their benefits. If we are unable to successfully address any of these risks, our business, financial condition or operating results could be harmed.

If we do not obtain additional financing, our business, prospects, financial condition and results of operations will be adversely affected.

Management anticipates that we will require additional working capital to pursue continued development of products, services, and marketing operations. We cannot accurately predict the timing and amount of such capital requirements. Additional financing may not be available to us when needed or, if available, it may not be obtained on commercially reasonable terms. If we are not able to obtain the necessary additional financing on a timely or commercially reasonable basis, we will be forced to delay or scale down some or all of our development activities (or perhaps even cease the operation of our business).

We have no commitments for any additional financing, and such commitments may not be obtained on favorable terms, if at all. Any additional equity financing will be dilutive to our stockholders, and debt financing, if available, may involve restrictive covenants with respect to dividends, raising future capital, and other financial and operational matters. If we are unable to obtain additional financing as needed, we may be required to reduce the scope of our operations or our anticipated expansion, which could have a material adverse effect on us.

| 11 |

We have identified a material weakness in our internal control over financial reporting which could, if not remediated, adversely affect our ability to report our financial condition, cash flows and results of operations in a timely and accurate manner and/or increase the risk of future misstatements, which could have a material adverse effect on our business, financial condition, cash flows and results of operations and could cause the market value of our shares of common stock and/or debt securities to decline.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Exchange Act. Based on reviews conducted by management, we have concluded that a material weakness exists in the Company’s internal controls over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal controls over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

The Company has identified certain remediation actions and is in the process of implementing them, but such efforts are not complete and remain ongoing. If we do not complete our remediation in a timely manner or if our remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses in our internal controls are discovered or occur in the future, it may materially adversely affect our ability to report our financial condition and results of operations in a timely and accurate manner and there will continue to be an increased risk of future misstatements. Although we regularly review and evaluate internal controls systems to allow management to report on the effectiveness of our internal controls over financial reporting, we may discover additional weaknesses in our internal controls over financial reporting or disclosure controls and procedures. The next time we evaluate our internal controls over financial reporting and disclosure controls and procedures, if we identify one or more new material weaknesses or have been unable to timely remediate our existing material weaknesses, we would be unable to conclude that our internal controls over financial reporting or disclosure controls and procedures are effective. If we are unable to conclude that our internal controls over financial reporting or our disclosure controls and procedures are effective, or if our independent registered public accounting firm expresses an opinion that our internal controls over financial reporting is ineffective, we may not be able to report our financial condition and results of operations in a timely and accurate manner, which could have a material adverse effect on our business, financial condition, cash flows and results of operations and could cause the market value of our shares of common stock to decline. In addition, any potential future restatements could subject us to additional adverse consequences, including sanctions by the SEC, stockholder litigation and other adverse actions. Moreover, we may be the subject of further negative publicity focusing on such financial statement adjustments and resulting restatement and negative reactions from our stockholders, creditors or others with whom we do business. The occurrence of any of the foregoing could have a material adverse effect on our business, financial condition, cash flows and results of operations and could cause the market value of our shares of common stock to decline.

Failure to adequately manage our planned aggressive growth strategy may harm our business or increase our risk of failure.

For the foreseeable future, we intend to pursue an aggressive growth strategy for the expansion of our operations through increased product development and marketing. Our ability to rapidly expand our operations will depend upon many factors, including our ability to work in a regulated environment, market value-added products effectively to independent pharmacies, establish and maintain strategic relationships with suppliers, and obtain adequate capital resources on acceptable terms. Any restrictions on our ability to expand may have a materially adverse effect on our business, results of operations, and financial condition. Accordingly, we may be unable to achieve our targets for sales growth, and our operations may not be successful or achieve anticipated operating results.

| 12 |

Additionally, our growth may place a significant strain on our managerial, administrative, operational, and financial resources and our infrastructure. Our future success will depend, in part, upon the ability of our senior management to manage growth effectively. This will require us to, among other things:

| ● | implement additional management information systems; | |

| ● | further develop our operating, administrative, legal, financial, and accounting systems and controls; | |

| ● | hire additional personnel; | |

| ● | develop additional levels of management within our company; | |

| ● | locate additional office space; | |

| ● | maintain close coordination among our engineering, operations, legal, finance, sales and marketing, and client service and support organizations; and | |

| ● | manage our expanding international operations. |

As a result, we may lack the resources to deploy our services on a timely and cost-effective basis. Failure to accomplish any of these requirements could impair our ability to deliver services in a timely fashion or attract and retain new customers.

The public health crisis involving the abuse of prescription opioid pain medication could have a material negative effect on our business.

Our Pharmaceutical segment distributes prescription opioid pain medications. In recent years, the abuse of prescription opioid pain medication has become a public health crisis.

A significant number of counties, municipalities and other plaintiffs, including a number of state attorneys general, have filed lawsuits against pharmaceutical manufacturers, pharmaceutical wholesale distributors, retail chains and others relating to the manufacturing, marketing or distribution of prescription opioid pain medications. The defense and resolution of future lawsuits and events relating to these lawsuits could have a material adverse effect on our results of operations, financial condition, cash flows or liquidity or have adverse reputational or operational effects on our business.

Other legislative, regulatory or industry measures related to the public health crisis involving the abuse of prescription opioid pain medication and the distribution of these medications could affect our business in ways that we may not be able to predict. For example, several states have now adopted taxes or other fees on the sale of opioids, and several other states have proposed similar legislative initiatives. These laws and proposals vary in the tax amounts imposed and the means of calculation. Liabilities for taxes or assessments under any such laws could have an adverse impact on our results of operations unless we are able to mitigate them through operational changes or commercial arrangements where permitted.

Our business is subject to rigorous regulatory and licensing requirements.

As described in greater detail in the “Business” section, our business is highly regulated in the United States, at both the federal and state level, and in foreign countries. If we fail to comply with regulatory requirements, or if allegations are made that we fail to comply, our results of operations and financial condition could be adversely affected.

To lawfully operate our businesses, we are required to obtain and hold permits, product registrations, licenses and other regulatory approvals from, and to comply with operating and security standards of, numerous governmental bodies. For example, as a wholesale distributor of controlled substances, we must hold valid DEA registrations and state-level licenses, meet various security and operating standards, and comply with the Controlled Substances Act (CSA). Failure to maintain or renew necessary permits, product registrations, licenses or approvals, or to comply with required standards, could have an adverse effect on our results of operations and financial condition.

| 13 |

Products that we source and distribute must comply with regulatory requirements. Noncompliance or concerns over noncompliance may result in suspension of our ability to distribute or import products, product bans, recalls or seizures, or criminal or civil sanctions, which, in turn, could result in product liability claims and lawsuits, including class actions.

Changes to the U.S. healthcare environment may not be favorable to us.

Over a number of years, the U.S. healthcare industry has undergone significant changes designed to increase access to medical care, improve safety and patient outcomes, contain costs and increase efficiencies. These changes include adoption of the Patient Protection and Affordable Care Act (ACA), a general decline in Medicare and Medicaid reimbursement levels, efforts by healthcare insurance companies to limit or reduce payments to pharmacies and providers, the basis for payments beginning to transition from a fee-for-service model to value-based payments and risk-sharing models, and the industry shifting away from traditional healthcare venues like hospitals and into clinics, physician offices and patients’ homes.

We expect the U.S. healthcare industry to continue to change significantly in the future. Possible changes include repeal and replacement of major parts of the Patient Protection and Affordable Care Act, further reduction or limitations on governmental funding at the state or federal level, efforts by healthcare insurance companies to further limit payments for products and services or changes in legislation or regulations governing prescription pharmaceutical pricing, healthcare services or mandated benefits. These possible changes, and the uncertainty surrounding these possible changes, may cause healthcare industry participants to reduce the number of products and services they purchase from us or the price they are willing to pay for our products and services, which could adversely affect us.

Our business and operations depend on the proper functioning of information systems, critical facilities and distribution networks.

We rely on our and third-party service providers’ information systems for a wide variety of critical operations, including to obtain, rapidly process, analyze and manage data to:

| ● | facilitate the purchase and distribution of inventory items from distribution centers; | |

| ● | receive, process and ship orders on a timely basis; | |

| ● | manage accurate billing and collections for thousands of customers; | |

| ● | process payments to suppliers; and | |

| ● | generate financial information. |

Our business also depends on the proper functioning of our critical facilities and our distribution networks. Our results of operations could be adversely affected if our or a service provider’s information systems, critical facilities or distribution networks are disrupted (including disruption of access), are damaged or fail, whether due to physical disruptions, such as fire, natural disaster, pandemic or power outage, or due to cyber-security incidents, ransomware or other actions of third parties, including labor strikes, political unrest and terrorist attacks. Manufacturing disruptions also can occur due to regulatory action, production quality deviations, safety issues or raw material shortages or defects, or because a key product or component is manufactured at a single manufacturing facility with limited alternate facilities.

| 14 |

Consolidation in the U.S. healthcare industry may negatively impact our results of operations.

In recent years, U.S. healthcare industry participants, including distributors, manufacturers, suppliers, healthcare providers, insurers and pharmacy chains, have consolidated or formed strategic alliances. Consolidations create larger enterprises with greater negotiating power, and also could result in the possible loss of a customer where the combined enterprise selects one distributor from two incumbents. If this consolidation trend continues, it could adversely affect our results of operations.

Many of our competitors are better established and have resources significantly greater than we have, which may make it difficult to fend off competition.

We expect to compete with the three largest ADR distributors (McKesson, Cardinal Health and AmerisourceBergen), in addition to other pharmaceutical distributors, buying groups, software products, and various start-up drug companies. Many of these operations have substantially greater financial and manufacturer-backed resources, longer operating histories, greater name recognition and more established relationships in the industry than us. In addition, a number of these competitors may combine or form strategic partnerships. As a result, our competitors may establish a more favorable footing in the pharmaceutical industry with respect to pricing or other factors. Our failure to compete successfully with any of these companies would have a material adverse effect on our business and the trading price of our common stock.

The three distributors listed above have a strong control over our industry, as they have contracts with the 24,000 independent, retail pharmacies that limit the participants’ ability to purchase pharmaceuticals outside of those primary distributors. Additional restrictive elements exist within the pharmaceutical channels of distribution. For example, a number of the inventory management systems, either developed by the distributors or third-party vendors, have been developed to require compliance to these restrictive purchasing agreements. Management anticipates that other existing and prospective competitors will adopt technologies or business plans similar to ours, or seek other means to develop operations competitive with ours, particularly if our development of large-scale production progresses as scheduled.

We will need to expand our member base or our profit margins to attain profitability.

Currently, we are paid an administrative fee of up to 6 percent of the buying price on the generic pharmaceuticals sold to pharmacies and up to 1 percent on brand pharmaceuticals that pass through our pharmaceutical exchanges. Our management is aware that the competitiveness of the group of suppliers that participate in our system and price products on our exchange is a key factor in determining how many purchasing pharmacies and wholesalers will purchase products through our platforms. However, price is not the only factor that influences where retail pharmacies will obtain their product. Quality fulfillment services are also important, and retail pharmacies have historically received quality fulfillment services from the three major ADR distributors. In order to be more competitive, we must improve our customer service and wholesaler fulfillment efforts, because the independent, retail pharmacy has for years considered this element of the fulfillment process as important as price. Other factors influencing the pharmacies purchasing behavior in the future will be changes brought upon by the ACA, which regulates some aspects of pharmaceutical spending and pricing. Management believes that we should benefit substantially from our pricing and product knowledge that is offered by our platform.

Profitability may be further increased as a result of lower cost of goods should the Company build stronger relationships with manufacturers and other larger buying groups that serve wholesalers and distributors. On a larger scale, those margins are expected to drop depending upon the breadth of products provided in the market and the sale turn rates required. We are currently undertaking a significant effort to increase our membership base through attendance at annual conferences and other strategies. Trxade has an expanded e-mail marketing strategy based on our competitive price advantages and price trend analysis tools.

| 15 |

There are inherent risks associated with our operations within the Pharmaceutical Distribution Markets.

There are inherent risks involved with doing business within the pharmaceutical distribution market, including:

| ● | Improperly manufactured products may prove dangerous to the end consumer. | |

| ● | Products may become adulterated by improper warehousing methods or modes of shipment. | |

| ● | Counterfeit products or products with fake pedigree papers. | |

| ● | Unlicensed or unlawful participants in the distribution channel. | |

| ● | Risk with default and the assumption of credit loss. | |

| ● | Risk related to the loss of supply, or the loss of a number of suppliers. |

Although all of our end-user agreements require our customers to indemnify us and for any and all liabilities resulting from our participation in the pharmaceutical distribution industry, we cannot assure you that the parties required to provide such indemnification will have the financial resources to do so. Additionally, although we have evaluated appropriate state statutes and federal laws pertaining to pharmaceutical distribution in an effort to diminish our risks, the Board of Pharmacy for each state is responsible for interpreting their state laws, and their interpretations may not comport with our analysis. It is also possible that any third-party logistics arrangements may disrupt service, create a loss of income, or other unforeseen disruptions should the service provider experience any legal, financial or other difficulties of their own.

Regulatory changes that affect our distribution channels could also harm our business.

Certain states, including California, Florida, Nevada, New Mexico and Indiana, have enacted laws that prohibit lateral movement of pharmaceuticals within the distribution channel. These laws prohibit wholesalers from selling pharmaceuticals directly from or to other wholesalers where they maintain inventory. Other states may in the future enact similar laws that place restrictions in pharmaceutical trading within the Trxade platforms. At the federal level, the implementation of the track and trace legislation by 2017 requiring the use of pharmaceutical pedigree may, in the future, restrict and disrupt the movement of pharmaceuticals along the supply chain should the cost of complying with this new legislation be too burdensome for smaller suppliers. Changes in the United States healthcare industry and regulatory environment could have a material adverse impact on our results of operations.

Many of our products and services are intended to function within the structure of the healthcare financing and reimbursement system currently being used in the United States. In recent years, the healthcare industry in the United States has changed significantly in an effort to enhance efficiencies, reduce costs and improve patient outcomes. These changes have included cuts in Medicare and Medicaid reimbursement levels, changes in the basis for payments, shifting away from fee-for-service and towards value-based payments and risk-sharing models, increases in the use of managed care, and consolidation in the healthcare industry generally. We expect that the healthcare industry in the United States shall continue to change and evolve in the near future. Changes in the healthcare industry’s (or our pharmaceutical suppliers’) pricing, selling, inventory, distribution or supply policies or practices could significantly reduce our revenues and net income. Additionally, if we experience disruptions in our supply of generic drugs, our margins could be adversely affected.

We distribute generic pharmaceuticals, which can be subject to both price deflation and price inflation. Continued volatility in the availability, pricing trends or reimbursement of these generic drugs, or significant fluctuations in the nature, frequency and magnitude of generic pharmaceutical launches, could have a material adverse impact on our results of operations. Additionally, any future changes in branded and generics drug pricing could be significantly different than our projections. Generic drug manufacturers are increasingly challenging the validity or enforceability of patents on branded pharmaceutical products. During the pendency of these legal challenges, a generics manufacturer may begin manufacturing and selling a generic version of the branded product prior to the final resolution of its legal challenge over the branded product’s patent. To the extent we source, contract manufacture, and distribute such generic products, the brand-name company could assert infringement claims against us. While we generally obtain indemnification against such claims from generic manufacturers as a condition of distributing their products, these rights may not be adequate or sufficient to protect us.

| 16 |

The healthcare industry is highly regulated, and further regulation of our distribution businesses and technology products and services could impose increased costs, negatively impact our profit margins and the profit margins of our customers, delay the introduction or implementation of our new products, or otherwise negatively impact our business and expose us to litigation and regulatory investigations.

Healthcare fraud laws are often vague and uncertain, exposing us to potential liability.

We are subject to extensive, and frequently changing, local, state and federal laws and regulations relating to healthcare fraud, waste and abuse. Local, state and federal governments continue to strengthen their position and scrutiny over practices involving fraud, waste and abuse affecting Medicare, Medicaid and other government healthcare programs. Many of the regulations applicable to us, including those relating to marketing incentives, are vague or indefinite and have not been interpreted by the courts. The regulations may be interpreted or applied by a prosecutorial, regulatory, or judicial authority in a manner that could require us to make changes in our operations. If we fail to comply with applicable laws and regulations, we could become liable for damages and suffer civil and criminal penalties, including the loss of licenses or our ability to participate in Medicare, Medicaid and other federal and state healthcare programs.

Laws reducing reimbursements for pharmaceuticals could ruin our industry.