UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21985

Hatteras Core Alternatives TEI

Institutional Fund, L.P.

(Exact name of registrant as specified in charter)

8510 Colonnade Center Drive Suite 150

Raleigh, NC 27615

(Address of principal executive offices) (Zip code)

David B. Perkins

8510 Colonnade Center Drive Suite 150

Raleigh, NC 27615

(Name and address of agent for service)

919-846-2324

Registrant's telephone number, including area code

Date of fiscal year end: March 31, 2023

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

| (a) |

ANNUAL REPORT MARCH 31, 2023 |

Hatteras Core Alternatives Fund, L.P.

Hatteras Core Alternatives TEI Fund, L.P.

Hatteras Core Alternatives Institutional Fund, L.P.

Hatteras Core Alternatives TEI Institutional Fund, L.P.

Annual Review (unaudited)

OVERVIEW

Hatteras Investment Partners, LP (“Hatteras”) became a pioneer in the alternative investment space by designing a complete alternative investment solution for qualified clients in a registered fund format. The Hatteras Core Alternatives Funds (the “Funds”) provided investors with diversified exposure to Private Investments for potential return enhancement complemented by Hedged Investments for potential volatility and risk mitigation.

For a number of years, the Funds experienced a large number of investors who wanted to tender their investments. At the same time, a similar number of investors wanted to stay in the Funds. Hatteras took into consideration multiple options to provide liquidity for investors who wanted out while recognizing the needs of investors who wanted to remain in the Funds. While exploring options, Hatteras was approached by a buyer with interest in acquiring all of the Funds’ underlying assets (the “Adviser Funds”). Ultimately, Hatteras determined that a plan of liquidation was the best course of action for the Funds’ investors.

PLAN OF LIQUIDATION

On December 7, 2021, the Hatteras Master Fund, L.P. (the “Master Fund”) exchanged interests in the Adviser Funds for Beneficient Preferred Series B-2 Unit Accounts. The Beneficient Company Group, L.P. (“Beneficient”) is a Delaware limited partnership that provides private trust solutions, including a suite of lending and liquidity products, to owners of alternative assets in need of liquidity. Initially, the transaction’s Estimated Closing NAV utilized a reference date of September 30, 2021. The transaction’s Adjusted Closing NAV, reflecting the Adviser Funds’ net asset value as of December 31, 2021, was finalized on September 1, 2022, at a level +4.05% above the transaction’s Estimated Closing NAV. The Beneficient Preferred Series B-2 Unit Accounts earn a fixed, contractual rate of 5.0% per annum, gross of Fund level fees and compounded quarterly, and are intended to serve as an intermediate step towards providing final liquidity in the form of cash proceeds to the Master Fund.

On September 21, 2022, Beneficient agreed to go public via a business combination with Avalon Acquisition Inc (“Avalon”). Beneficient filed a Form S-4 registration statement related to the business combination on December 9, 2022, and subsequently filed amendments to Form S-4 on January 24, 2023, March 6, 2023, April 19, 2023, May 8, 2023, and May 11, 2023. The SEC declared Beneficient’s Form S-4 filing effective on May 12, 2023. The Beneficient Preferred Series B-2 Unit Accounts will convert to Beneficient Class A common stock following the completion of the business combination with Avalon.

On May 16, 2023, Avalon announced that it has set June 6, 2023, as the meeting date for the special meeting of stockholders to approve the business combination with Beneficient. If approved by shareholders, upon the closing of the business combination, on or around June 8, 2023, the Master Fund will be subject to the volatility of the publicly traded share price of the Beneficient Class A common stock for some period of time prior to selling the position and during the period while the Class A common stock is being sold. After Beneficient’s public listing, the market price for the security may be subject to significant fluctuations in response to numerous factors such as lack of liquidity, general market volatility, and numerous other factors unrelated to the operating performance of the issuer. An estimate of the market price or the extent of the market fluctuation cannot be made. The non-traditional aspects of the Plan of Liquidation provide an opportunity to maximize value to investors but lack the certainty of a defined date for when cash will be exchanged.

ANNUAL PERFORMANCE REVIEW

For the fiscal year ended March 31, 2023, on a net basis, the Core Alternatives Fund, L.P. returned +2.65%, the Core Alternatives TEI Fund, L.P. returned +3.01%, the Core Alternative Institutional Fund, L.P. returned +2.66%, and the Core Alternatives TEI Institutional Fund, L.P. returned +3.05%. Each Feeder Fund invests substantially all of its assets, directly or indirectly, in the Hatteras Master Fund, L.P. Returns of the Feeder Funds will differ since the Funds have different expenses. The Master Fund outperformed its benchmark, the HFRX Global Hedge Index, which returned -3.10% for the period.

Within the Master Fund, performance was driven by the Beneficient Preferred Series B-2 Unit Accounts, which contributed +4.97% gross-of-fees, or approximately +1.93% net-of-fees. Due to the transaction’s terms and finalization of the transaction’s valuation on September 1, 2022, Private Investments and Hedged Investments had little impact on performance within the Master Fund during the fiscal year. Private Investments detracted -0.17% gross-of-fees, or approximately -0.07% net-of-fees. Hedged Investments detracted -0.14% (Gross), or approximately -0.05% net-of-fees.

Disclosure: Net-of-fee contribution at the investment level is estimated using annual expenses for the Core Alternatives TEI Fund, L.P. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown.

2

Performance Summary1 (UNAUDITED)

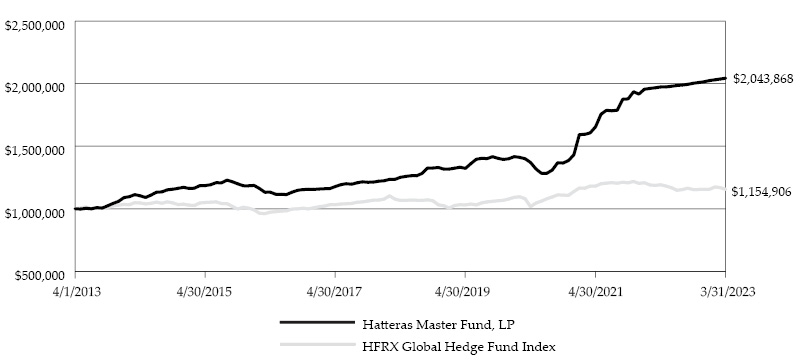

HATTERAS MASTER FUND, L.P. (INCEPTION DATE: JANUARY 1, 2005)

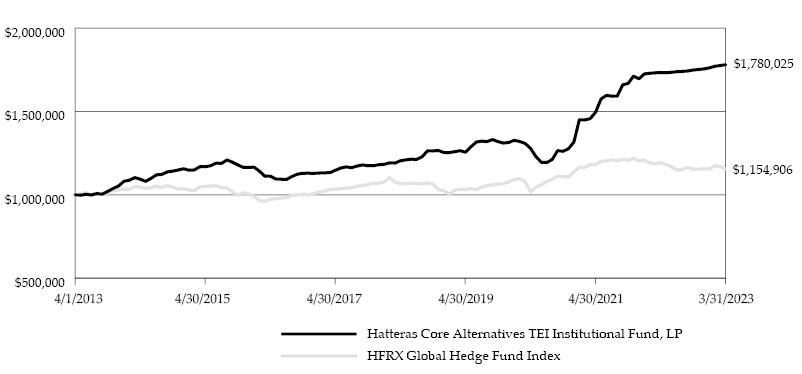

Growth of $1,000,000

(4/1/2013 - 3/31/2023)

| Returns | Fund | HFRXGL2 | ||||||||

1-Year | 3.71 | % | -3.10 | % | ||||||

5-Year (average annual) | 10.31 | % | 1.61 | % | ||||||

10-Year (average annual) | 7.41 | % | 1.45 | % | ||||||

|

1. |

Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. |

|

2. |

HFRX Global Hedge Fund Index (HFRXGL) data is sourced from Bloomberg. The index is an unmanaged portfolio of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

3

Performance Summary1 (UNAUDITED)

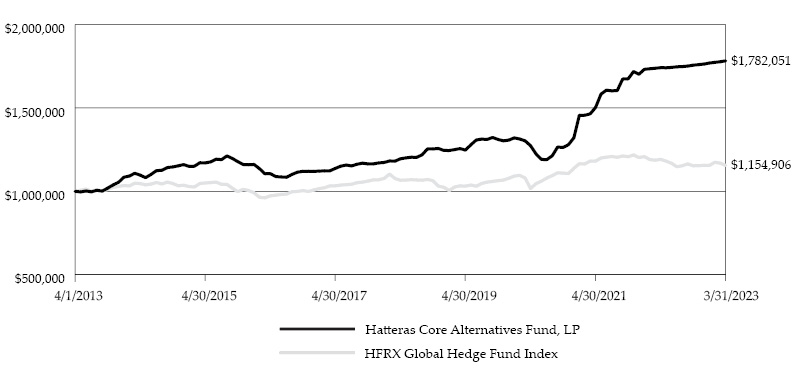

HATTERAS CORE ALTERNATIVES FUND, L.P. (INCEPTION DATE: APRIL 1, 2005)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2023 |

0.22% |

0.22% |

0.28% |

0.72% |

|||||||||

2022 |

0.20% |

0.16% |

-0.10% |

0.28% |

0.12% |

0.22% |

0.07% |

0.17% |

0.31% |

0.19% |

0.19% |

0.36% |

2.18% |

2021 |

0.03% |

0.55% |

9.70% |

-1.24% |

1.49% |

-0.26% |

0.13% |

4.29% |

0.05% |

2.61% |

-0.92% |

1.73% |

19.20% |

2020 |

-0.52% |

-0.83% |

-9.20% |

3.37% |

-2.75% |

-0.10% |

1.92% |

4.35% |

-0.24% |

1.35% |

3.24% |

10.19% |

10.24% |

2019 |

0.44% |

0.49% |

5.30% |

-3.32% |

2.25% |

0.39% |

-0.18% |

0.93% |

-0.90% |

-0.64% |

0.34% |

1.02% |

6.09% |

2018 |

0.78% |

-0.12% |

3.10% |

-1.31% |

0.34% |

-0.08% |

1.27% |

2.93% |

-0.05% |

0.25% |

-0.97% |

-0.02% |

6.20% |

2017 |

0.14% |

0.02% |

1.96% |

0.46% |

0.58% |

-0.44% |

0.87% |

0.57% |

-0.40% |

0.01% |

0.52% |

0.22% |

4.57% |

2016 |

-2.16% |

-2.72% |

-1.21% |

-0.29% |

-0.22% |

-0.19% |

1.58% |

1.21% |

0.47% |

0.04% |

-0.09% |

0.16% |

-3.44% |

2015 |

0.08% |

1.84% |

-0.11% |

0.53% |

1.39% |

-0.24% |

1.87% |

-1.25% |

-1.59% |

-1.46% |

-0.11% |

0.14% |

1.02% |

2014 |

0.60% |

1.54% |

-0.64% |

-1.38% |

1.39% |

2.07% |

0.16% |

1.47% |

0.34% |

0.57% |

0.67% |

-0.94% |

5.92% |

2013 |

1.16% |

-0.03% |

0.54% |

-0.39% |

0.59% |

-0.53% |

0.94% |

-0.50% |

1.81% |

1.88% |

1.50% |

2.94% |

10.31% |

2012 |

1.96% |

0.89% |

-0.18% |

0.07% |

-0.58% |

0.01% |

0.50% |

0.74% |

0.64% |

-0.04% |

0.08% |

0.94% |

5.10% |

2011 |

0.41% |

1.09% |

0.69% |

0.83% |

-0.22% |

-0.79% |

0.19% |

-2.37% |

-3.27% |

1.02% |

-0.96% |

-0.56% |

-3.97% |

2010 |

-0.30% |

0.06% |

1.72% |

0.94% |

-2.63% |

-1.13% |

0.34% |

-0.11% |

2.29% |

1.30% |

0.28% |

2.31% |

5.06% |

2009 |

0.17% |

-0.43% |

-0.50% |

0.49% |

3.69% |

0.79% |

2.20% |

1.20% |

2.39% |

0.11% |

0.85% |

0.95% |

12.50% |

2008 |

-2.89% |

1.86% |

-2.88% |

1.57% |

2.10% |

-0.48% |

-2.84% |

-1.53% |

-8.28% |

-7.54% |

-4.29% |

-1.01% |

-23.79% |

2007 |

0.97% |

0.67% |

1.60% |

1.86% |

2.01% |

0.78% |

-0.05% |

-1.85% |

1.93% |

2.71% |

-1.72% |

0.92% |

10.16% |

2006 |

2.80% |

-0.20% |

1.74% |

1.10% |

-1.97% |

-0.75% |

0.37% |

0.76% |

0.26% |

1.60% |

2.09% |

0.93% |

8.98% |

2005 |

-1.54% |

0.26% |

1.46% |

2.16% |

0.48% |

1.39% |

-1.46% |

1.35% |

1.85% |

6.04% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data (since inception) |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

0.72% |

7.50% |

0.00% |

Cumulative Return |

109.68% |

399.24% |

21.59% |

|

1-Year |

2.65% |

-7.73% |

-3.10% |

Standard Deviation4 |

6.04% |

15.27% |

5.39% |

|

3-Year (average annual) |

11.85% |

18.60% |

4.35% |

Largest Drawdown5 |

-24.98% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

8.32% |

11.19% |

1.61% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

5.95% |

12.24% |

1.45% |

|||||

Annualized Since Inception |

4.20% |

9.34% |

1.09% |

Growth of $1,000,000

(4/1/2013 - 3/31/2023)

|

1. |

Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives Fund, L.P. are 2.53% and 5.23%, respectively. The total expense ratio includes Acquired Fund Fees and Expenses of 2.70%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

|

2. |

Cumulative return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

|

3. |

S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The index is an unmanaged portfolio of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

4. |

Measurement of the investment’s volatility. |

|

5. |

The peak to trough decline of an investment. |

|

6. |

Number of months of a peak to trough decline of an investment. |

4

Performance Summary1 (UNAUDITED)

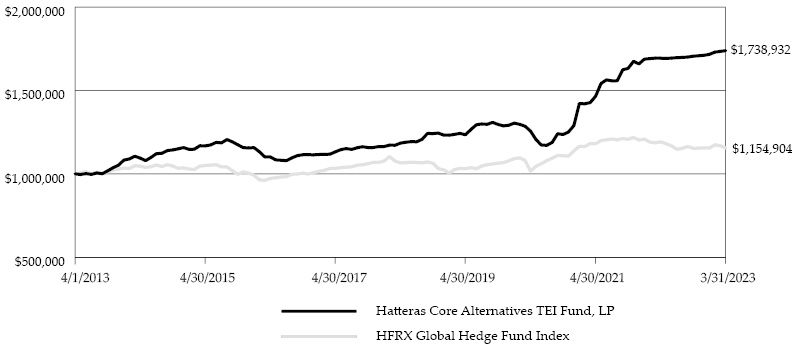

HATTERAS CORE ALTERNATIVES TEI FUND, L.P. (INCEPTION DATE: APRIL 1, 2005)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2023 |

0.78% |

0.24% |

0.27% |

1.29% |

|||||||||

2022 |

0.19% |

0.16% |

-0.35% |

0.24% |

0.11% |

0.19% |

0.05% |

0.15% |

0.29% |

0.16% |

0.16% |

0.33% |

1.70% |

2021 |

-0.07% |

0.48% |

9.70% |

-1.33% |

1.40% |

-0.36% |

0.04% |

4.21% |

0.52% |

2.61% |

-0.94% |

1.73% |

18.98% |

2020 |

-0.56% |

-0.87% |

-9.25% |

3.18% |

-2.78% |

-0.13% |

1.50% |

4.38% |

-0.38% |

1.22% |

3.10% |

10.20% |

8.96% |

2019 |

0.42% |

0.47% |

5.35% |

-3.35% |

2.24% |

0.40% |

-0.19% |

0.92% |

-0.94% |

-0.67% |

0.30% |

0.98% |

5.89% |

2018 |

0.72% |

-0.09% |

3.00% |

-1.33% |

0.32% |

-0.10% |

1.25% |

2.92% |

-0.07% |

0.23% |

-0.99% |

-0.04% |

5.90% |

2017 |

0.13% |

0.01% |

1.96% |

0.45% |

0.58% |

-0.46% |

0.85% |

0.56% |

-0.41% |

0.00% |

0.50% |

0.01% |

4.29% |

2016 |

-2.17% |

-2.73% |

-1.28% |

-0.31% |

-0.22% |

0.00% |

1.57% |

1.21% |

0.48% |

0.04% |

-0.09% |

0.17% |

-3.55% |

2015 |

0.08% |

1.83% |

-0.12% |

0.52% |

1.28% |

0.29% |

1.68% |

-1.14% |

-1.47% |

-1.48% |

-0.13% |

0.12% |

0.90% |

2014 |

0.59% |

1.52% |

-0.65% |

-1.40% |

1.39% |

2.06% |

0.14% |

1.48% |

0.35% |

0.57% |

0.67% |

-0.94% |

5.89% |

2013 |

1.15% |

-0.04% |

0.48% |

-0.39% |

0.59% |

0.00% |

0.92% |

-0.52% |

1.77% |

1.85% |

1.47% |

2.92% |

10.02% |

2012 |

1.94% |

0.88% |

-0.20% |

0.06% |

-0.59% |

0.00% |

0.49% |

0.73% |

0.63% |

-0.05% |

0.08% |

0.93% |

4.99% |

2011 |

0.41% |

1.09% |

0.68% |

0.83% |

-0.22% |

-0.79% |

0.19% |

-2.37% |

-3.28% |

1.01% |

-0.96% |

-0.59% |

-4.02% |

2010 |

-0.34% |

0.06% |

1.72% |

0.94% |

-2.63% |

-1.12% |

0.35% |

-0.12% |

2.27% |

1.28% |

0.26% |

2.29% |

4.95% |

2009 |

0.16% |

-0.44% |

-0.50% |

0.47% |

3.71% |

0.79% |

2.19% |

1.20% |

2.39% |

0.11% |

0.85% |

0.95% |

12.48% |

2008 |

-2.95% |

1.82% |

-2.92% |

1.53% |

2.08% |

-0.52% |

-2.88% |

-1.57% |

-8.33% |

-7.56% |

-4.31% |

-0.86% |

-23.98% |

2007 |

0.94% |

0.64% |

1.58% |

1.83% |

1.99% |

0.75% |

-0.07% |

-1.88% |

1.89% |

2.68% |

-1.74% |

0.87% |

9.79% |

2006 |

2.77% |

-0.20% |

1.72% |

1.09% |

-1.98% |

-0.75% |

0.37% |

0.72% |

0.23% |

1.57% |

2.05% |

0.90% |

8.73% |

2005 |

-1.54% |

0.26% |

1.46% |

2.16% |

0.48% |

1.39% |

-1.46% |

1.32% |

1.82% |

5.97% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data (since inception) |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

1.29% |

7.50% |

0.00% |

Cumulative Return |

102.09% |

399.24% |

21.59% |

|

1-Year |

3.01% |

-7.73% |

-3.10% |

Standard Deviation4 |

6.03% |

15.27% |

5.39% |

|

3-Year (average annual) |

11.44% |

18.60% |

4.35% |

Largest Drawdown5 |

-25.23% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

7.98% |

11.19% |

1.61% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

5.69% |

12.24% |

1.45% |

|||||

Annualized Since Inception |

3.99% |

9.34% |

1.09% |

Growth of $1,000,000

(4/1/2013 - 3/31/2023)

|

1. |

Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives TEI Fund, L.P. are 2.85% and 5.55%, respectively. The total expense ratio includes Acquired Fund Fees and Expenses of 2.70%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

|

2. |

Cumulative return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

|

3. |

S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The index is an unmanaged portfolio of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

4. |

Measurement of the investment’s volatility. |

|

5. |

The peak to trough decline of an investment. |

|

6. |

Number of months of a peak to trough decline of an investment. |

5

Performance Summary1 (UNAUDITED)

HATTERAS CORE ALTERNATIVES INSTITUTIONAL FUND, L.P. (INCEPTION DATE: JANUARY 1, 2007)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2023 |

0.21% |

0.22% |

0.28% |

0.71% |

|||||||||

2022 |

0.20% |

0.16% |

-0.10% |

0.27% |

0.13% |

0.22% |

0.07% |

0.17% |

0.32% |

0.19% |

0.19% |

0.36% |

2.20% |

2021 |

0.03% |

0.53% |

9.64% |

-1.24% |

1.50% |

-0.26% |

0.14% |

4.30% |

0.05% |

2.61% |

-0.91% |

1.73% |

19.14% |

2020 |

-0.52% |

-0.83% |

-9.17% |

3.37% |

-2.74% |

-0.09% |

1.92% |

4.36% |

-0.23% |

1.36% |

3.26% |

10.19% |

10.30% |

2019 |

0.44% |

0.51% |

5.33% |

-3.32% |

2.25% |

0.39% |

-0.18% |

0.93% |

-0.90% |

-0.64% |

0.34% |

1.02% |

6.14% |

2018 |

0.72% |

-0.07% |

3.01% |

-1.30% |

0.35% |

-0.08% |

1.27% |

2.94% |

-0.04% |

0.25% |

-0.97% |

-0.02% |

6.12% |

2017 |

0.14% |

0.04% |

1.97% |

0.45% |

0.59% |

-0.44% |

0.87% |

0.58% |

-0.40% |

0.01% |

0.53% |

0.21% |

4.65% |

2016 |

-2.09% |

-2.65% |

-1.20% |

-0.22% |

-0.14% |

-0.11% |

1.65% |

1.21% |

0.47% |

0.04% |

-0.09% |

0.17% |

-3.00% |

2015 |

0.14% |

1.72% |

-0.05% |

0.54% |

1.32% |

-0.15% |

1.76% |

-1.07% |

-1.38% |

-1.26% |

-0.04% |

0.19% |

1.66% |

2014 |

0.60% |

1.44% |

-0.52% |

-1.19% |

1.31% |

1.93% |

0.20% |

1.39% |

0.37% |

0.58% |

0.66% |

-0.79% |

6.09% |

2013 |

1.23% |

0.03% |

0.59% |

-0.32% |

0.65% |

-0.46% |

1.00% |

-0.43% |

1.87% |

1.94% |

1.57% |

2.75% |

10.87% |

2012 |

2.03% |

0.96% |

-0.12% |

0.13% |

-0.52% |

0.07% |

0.56% |

0.80% |

0.70% |

0.02% |

0.15% |

1.00% |

5.92% |

2011 |

0.47% |

1.15% |

0.75% |

0.89% |

-0.16% |

-0.72% |

0.25% |

-2.31% |

-3.20% |

1.09% |

-0.89% |

-0.50% |

-3.23% |

2010 |

-0.24% |

0.12% |

1.78% |

1.01% |

-2.57% |

-1.06% |

0.41% |

-0.04% |

2.36% |

1.36% |

0.34% |

2.37% |

5.89% |

2009 |

0.24% |

-0.36% |

-0.45% |

0.55% |

3.75% |

0.86% |

2.27% |

1.27% |

2.46% |

0.17% |

0.91% |

1.01% |

13.35% |

2008 |

-2.85% |

1.91% |

-2.81% |

1.63% |

2.14% |

-0.42% |

-2.78% |

-1.47% |

-8.22% |

-7.50% |

-4.23% |

-0.94% |

-23.27% |

2007 |

1.12% |

0.73% |

1.65% |

1.89% |

2.06% |

0.82% |

0.00% |

-1.89% |

2.00% |

2.75% |

-1.71% |

0.97% |

10.76% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data (since inception) |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

0.71% |

7.50% |

0.00% |

Cumulative Return |

93.01% |

302.13% |

7.21% |

|

1-Year |

2.66% |

-7.73% |

-3.10% |

Standard Deviation4 |

6.13% |

15.94% |

5.48% |

|

3-Year (average annual) |

11.88% |

18.60% |

4.35% |

Largest Drawdown5 |

-24.29% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

8.36% |

11.19% |

1.61% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

6.13% |

12.24% |

1.45% |

|||||

Annualized Since Inception |

4.13% |

8.94% |

0.43% |

Growth of $1,000,000

(4/1/2013 - 3/31/2023)

|

1 |

Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee or up-front placement fees, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives Institutional Fund, L.P. are 2.52% and 5.52%, respectively. The total expense ratio includes Acquired Fund Fees and Expenses of 2.70%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

|

2. |

Cumulative return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

|

3. |

S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The index is an unmanaged portfolio of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

4. |

Measurement of the investment’s volatility. |

|

5. |

The peak to trough decline of an investment. |

|

6. |

Number of months of a peak to trough decline of an investment. |

6

Performance Summary1 (UNAUDITED)

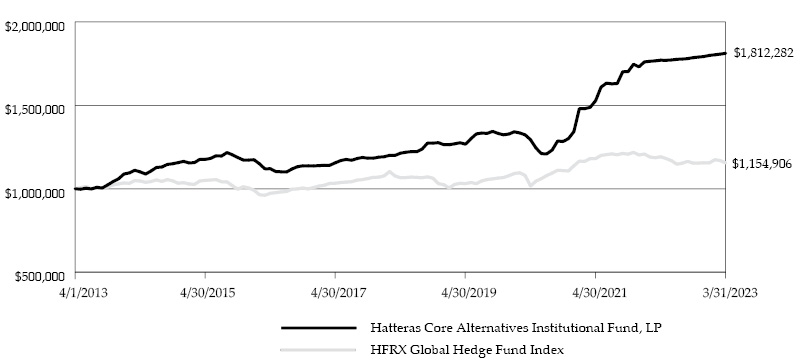

HATTERAS CORE ALTERNATIVES TEI INSTITUTIONAL FUND, L.P. (INCEPTION DATE: FEBRUARY 1, 2007)

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year2 |

2023 |

0.54% |

0.26% |

0.28% |

1.07% |

|||||||||

2022 |

0.21% |

0.17% |

-0.24% |

0.25% |

0.13% |

0.22% |

0.07% |

0.17% |

0.32% |

0.19% |

0.19% |

0.36% |

2.09% |

2021 |

-0.06% |

0.50% |

9.69% |

-1.32% |

1.42% |

-0.34% |

0.06% |

4.24% |

0.51% |

2.62% |

-0.93% |

1.74% |

19.14% |

2020 |

-0.56% |

-0.87% |

-9.23% |

3.32% |

-2.77% |

-0.11% |

1.54% |

4.41% |

-0.36% |

1.23% |

3.12% |

10.19% |

9.26% |

2019 |

0.42% |

0.48% |

5.31% |

-3.34% |

2.25% |

0.40% |

-0.19% |

0.92% |

-0.94% |

-0.67% |

0.30% |

0.99% |

5.90% |

2018 |

0.72% |

-0.07% |

3.01% |

-1.32% |

0.33% |

-0.09% |

1.26% |

2.93% |

-0.06% |

0.24% |

-0.98% |

-0.03% |

6.02% |

2017 |

0.14% |

0.03% |

1.98% |

0.46% |

0.59% |

-0.44% |

0.87% |

0.57% |

-0.40% |

0.01% |

0.52% |

0.20% |

4.63% |

2016 |

-2.09% |

-2.65% |

-1.24% |

-0.24% |

-0.14% |

-0.11% |

1.64% |

1.22% |

0.49% |

0.04% |

-0.08% |

0.18% |

-3.03% |

2015 |

0.14% |

1.72% |

-0.04% |

0.54% |

1.32% |

-0.15% |

1.75% |

-1.08% |

-1.39% |

-1.27% |

-0.05% |

0.18% |

1.62% |

2014 |

0.59% |

1.44% |

-0.52% |

-1.20% |

1.30% |

1.93% |

0.19% |

1.40% |

0.38% |

0.58% |

0.67% |

-0.79% |

6.10% |

2013 |

1.10% |

0.03% |

0.47% |

-0.29% |

0.59% |

-0.43% |

0.90% |

-0.41% |

1.67% |

1.73% |

1.40% |

2.71% |

9.84% |

2012 |

2.01% |

0.94% |

-0.13% |

0.13% |

-0.52% |

0.07% |

0.56% |

0.80% |

0.70% |

0.02% |

0.14% |

1.00% |

5.85% |

2011 |

0.48% |

1.16% |

0.69% |

0.81% |

-0.14% |

-0.65% |

0.23% |

-2.24% |

-3.21% |

1.07% |

-0.91% |

-0.51% |

-3.26% |

2010 |

-0.23% |

0.13% |

1.79% |

1.01% |

-2.56% |

-1.06% |

0.42% |

-0.05% |

2.34% |

1.35% |

0.33% |

2.36% |

5.88% |

2009 |

0.24% |

-0.36% |

-0.43% |

0.54% |

3.74% |

0.85% |

2.26% |

1.27% |

2.46% |

0.18% |

0.92% |

1.02% |

13.37% |

2008 |

-2.87% |

1.87% |

-2.83% |

1.59% |

2.09% |

-0.44% |

-2.82% |

-1.50% |

-8.26% |

-7.51% |

-4.24% |

-0.91% |

-23.48% |

2007 |

0.71% |

1.62% |

1.87% |

2.03% |

0.80% |

-0.04% |

-1.95% |

2.01% |

2.72% |

-1.76% |

0.96% |

9.23% |

10.76% |

Returns |

Fund |

S&P 5003 |

HFRXGL3 |

Historical Data (since inception) |

Fund |

S&P 5003 |

HFRXGL3 |

|

Year-to-date |

1.07% |

7.50% |

0.00% |

Cumulative Return |

85.78% |

296.14% |

0.34% |

|

1-Year |

3.05% |

-7.73% |

-3.10% |

Standard Deviation4 |

6.13% |

15.98% |

5.48% |

|

3-Year (average annual) |

11.66% |

18.60% |

4.35% |

Largest Drawdown5 |

-24.53% |

-50.95% |

-25.21% |

|

5-Year (average annual) |

8.13% |

11.19% |

1.61% |

Drawdown — # of months6 |

17 |

16 |

14 |

|

10-Year (average annual) |

5.94% |

12.24% |

1.45% |

|||||

Annualized Since Inception |

3.91% |

8.89% |

0.34% |

Growth of $1,000,000

(4/1/2013 - 3/31/2023)

|

1 |

Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 2% redemption fee or up-front placement fees, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Core Alternatives TEI Institutional Fund, L.P. are 2.80% and 5.50%, respectively. The total expense ratio includes Acquired Fund Fees and Expenses of 2.70%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

|

2. |

Cumulative return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

|

3. |

S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The index is an unmanaged portfolio of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

|

4. |

Measurement of the investment’s volatility. |

|

5. |

The peak to trough decline of an investment. |

|

6. |

Number of months of a peak to trough decline of an investment. |

7

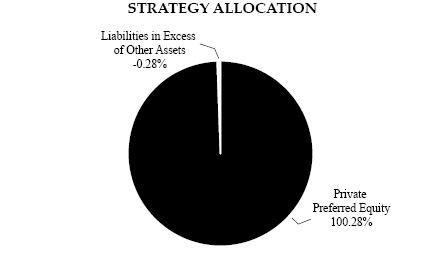

ALLOCATION AS A PERCENTAGE OF

TOTAL PARTNERS’ CAPITAL (Unaudited)

Category |

Percentage |

Private Preferred Equity |

100.28% |

Liabilities in Excess of Other Assets |

-0.28% |

Total |

100.00% |

8

Definitions (UNAUDITED)

HFRX Global Hedge Fund Index: Index data, sourced from Hedge Funds Research, Inc., is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. You cannot invest directly in an index. Benchmark performance should not be considered reflective of performance of the Funds.

S&P 500 Total Return Index: The Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. You cannot invest directly in an index. Benchmark performance should not be considered reflective of performance of the Funds.

9

Strategy Definitions (UNAUDITED)

Private Investments: Investing in equity-oriented securities through a privately negotiated process. The majority of private investment transactions involve companies that are not publicly traded. Private investments are used by companies that have achieved various stages of development. Most investors access this strategy by investing in private equity funds or private equity funds of funds.

Hedged Investments: Portfolio management that uses sophisticated investment tactics to minimize risk and provide positive returns. Hedged investments are generally set up as private investment partnerships and are not subject to registration under the Investment Company Act of 1940. As such, they may lack liquidity, be available only to certain high net worth investors and institutions, and may use strategies that employ leverage and shorts.

10

Safe Harbor and Forward-Looking Statements Disclosure (UNAUDITED)

Safe Harbor Statement: This presentation shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of, the securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction. Forward-Looking Statements: This presentation contains certain statements that may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are “forward-looking statements.” Included among “forward- looking statements” are, among other things, statements about our future outlook on opportunities based upon current market conditions. Although the company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this discussion. Other than as required by law, the company does not assume a duty to update these forward-looking statements. Past performance is no guarantee of future results. The illustrations are not intended to predict the performance of any specific investment or security. The past performance figures do not represent performance of any Hatteras security and there can be no assurance that any Hatteras security will achieve the past returns of the illustrative examples. This is not an offering to subscribe for units in any fund and is intended for informational purposes only. An offering can only be made by delivery of the Prospectus to “qualified clients” within the meaning of U.S. securities laws. Diversification does not assure a profit or protect against a loss.

Please carefully consider the investment objectives, risks, and charges and expenses of the Funds before investing. Please read the Prospectus carefully before investing as it contains important information on the investment objectives, composition, fees, charges and expenses, risks, suitability, and tax obligations of investing in the Funds. Copies of the Prospectus and performance data current to the most recent month-end may be obtained online at hatterasfunds.com or by contacting Hatteras at 866.388.6292. Past performance does not guarantee future results.

The Hatteras Core Alternatives Fund, L.P.; the Hatteras Core Alternatives TEI Fund, L.P; the Hatteras Core Alternatives Institutional Fund, L.P.; and the Hatteras Core Alternatives TEI Institutional Fund, L.P.(collectively referred to herein as the “Hatteras Core Alternatives Fund” or the “Fund”) are Delaware limited partnerships that are registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as non- diversified, closed-end management investment companies whose units are registered under the Securities Act of 1933, as amended. The Hatteras Core Alternatives Fund is a fund of alternative investments. As such, the Fund invests in private hedge funds and private equity investments. Hedge funds are speculative investments and are not suitable for all investors, nor do they represent a complete investment program. A hedge fund can be described generally as a private and unregistered investment pool that accepts investors’ money and employs hedging and arbitrage techniques using long and short positions, leverage and derivatives, and investments in many markets.

Key Risk Factors: The Fund, through an investment in the Master Fund, will invest substantially all of its assets in underlying funds that are generally not registered as investment companies under the 1940 Act and, therefore, the Fund will not have the benefit of various protections provided under the 1940 Act with respect to an investment in those underlying funds. The Fund can be highly volatile, carry substantial fees, and involve complex tax structures. Investments in the Fund involve a high degree of risk, including loss of entire capital. The underlying funds may engage in speculative investment strategies and practices, such as the use of leverage, short sales, and derivatives transactions, which can increase the risk of investment loss. The Fund provides limited liquidity, and units in the Fund are not transferable. Liquidity will be provided only through repurchase offers made by the Fund from time to time, generally on a quarterly basis upon prior written notice. The success of the Fund is highly dependent on the financial and managerial expertise of its principals and key personnel of the Fund’s investment manager. Although the investment manager for the Fund expects to receive detailed information from each underlying fund on a regular basis regarding its valuation, investment performance, and strategy, in most cases the investment manager has little or no means of independently verifying this information. The underlying funds are not required to provide transparency with respect to their respective investments. By investing in the underlying funds indirectly through the Fund, investors will be subject to a dual layer of fees, both at the Fund and underlying fund levels. Certain underlying funds will not provide final Schedule K-1s for any fiscal year before April 15th of the following year. Those funds, however, will endeavor to provide estimates of taxable income or losses with respect to their investments. Please see the Prospectus for a detailed discussion of the specific risks disclosed here and other important risks and considerations.

Securities offered through Hatteras Capital Distributors, LLC, member FINRA/SIPC. Hatteras Capital Distributors, LLC is affiliated with Hatteras Investment Partners, LP, by virtue of common control/ownership.

11

This page intentionally left blank.

Hatteras Core Alternatives Funds

Hatteras Core Alternatives Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives Institutional Fund, L.P.

(a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Institutional Fund, L.P.

(a Delaware Limited Partnership)

Financial Statements

As of and for the year ended March 31, 2023

Hatteras Core Alternatives Funds

As of and for the year ended March 31, 2023

Hatteras Core Alternatives Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives Institutional Fund, L.P. (a Delaware Limited Partnership)

Hatteras Core Alternatives TEI Institutional Fund, L.P. (a Delaware Limited Partnership)

Table of Contents

Statements of Assets, Liabilities and Partners’ Capital |

1 |

Statements of Operations |

2 |

Statements of Changes in Partners’ Capital |

3 |

Statements of Cash Flows |

4 |

Notes to Financial Statements |

5-15 |

Report of Independent Registered Public Accounting Firm |

16 |

Board of Directors (Unaudited) |

17 |

Fund Management (Unaudited) |

18 |

Other Information (Unaudited) |

19 |

Financial Statements of Hatteras Master Fund, L.P. |

20 |

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Statements of Assets, Liabilities and Partners’ Capital

March 31, 2023

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Assets |

||||||||||||||||

Investment in Hatteras Master Fund, L.P., at fair value |

$ | 49,210,441 | $ | 61,999,613 | $ | 58,810,381 | $ | 156,500,028 | ||||||||

Cash and cash equivalents |

14,446 | 4,191 | 4,205 | 8,760 | ||||||||||||

Receivable for withdrawals from Hatteras Master Fund, L.P. |

112,185 | 121,467 | 135,801 | 341,588 | ||||||||||||

Other receivables |

17 | 19 | 10 | 32 | ||||||||||||

Prepaid assets |

23,002 | 28,856 | 27,486 | 72,921 | ||||||||||||

Total assets |

$ | 49,360,091 | $ | 62,154,146 | $ | 58,977,883 | $ | 156,923,329 | ||||||||

Liabilities and partners’ capital |

||||||||||||||||

Servicing fees payable |

79,628 | 100,344 | 95,159 | 253,364 | ||||||||||||

Performance allocation payable |

112,185 | 121,467 | 135,801 | 341,588 | ||||||||||||

Professional fees payable |

39,000 | 35,600 | 38,900 | 37,700 | ||||||||||||

Accounting, administration and transfer agency fees payable |

20,688 | 31,203 | 24,604 | 42,986 | ||||||||||||

Other payables |

1,374 | 1,618 | 1,173 | 2,260 | ||||||||||||

Printing fees payable |

2,109 | 2,109 | 2,109 | 2,109 | ||||||||||||

Custodian fees payable |

1,206 | 2,602 | 1,206 | 2,602 | ||||||||||||

Withholding tax payable |

— | 3,125 | — | 3,125 | ||||||||||||

Total liabilities |

256,190 | 298,068 | 298,952 | 685,734 | ||||||||||||

Partners’ capital |

49,103,901 | 61,856,078 | 58,678,931 | 156,237,595 | ||||||||||||

Total liabilities and partners’ capital |

$ | 49,360,091 | $ | 62,154,146 | $ | 58,977,883 | $ | 156,923,329 | ||||||||

Components of partners’ capital |

||||||||||||||||

Paid-in capital |

$ | 3,911,469 | $ | 10,591,062 | $ | 4,088,792 | $ | (13,679,506 | ) | |||||||

Total distributable earnings |

45,192,432 | 51,265,016 | 54,590,139 | 169,917,101 | ||||||||||||

Partners’ capital |

$ | 49,103,901 | $ | 61,856,078 | $ | 58,678,931 | $ | 156,237,595 | ||||||||

Net asset value per unit |

$ | 166.14 | $ | 161.51 | $ | 175.21 | $ | 171.34 | ||||||||

Maximum offering price per unit** |

$ | 169.53 | $ | 164.81 | $ | 175.21 | $ | 171.34 | ||||||||

Number of authorized units |

7,500,000.00 | 7,500,000.00 | 10,000,000.00 | 7,500,000.00 | ||||||||||||

Number of outstanding units |

295,558.33 | 382,987.25 | 334,897.35 | 911,872.33 | ||||||||||||

|

* |

Consolidated Statement. See Note 2 in the notes to the financial statements. |

|

** |

The maximum sales load for the Hatteras Core Alternatives Fund, L.P. and the Hatteras Core Alternatives TEI Fund, L.P. is 2.00%. The remaining funds are not subject to a sales load. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

1

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Statements of Operations

For the Year Ended March 31, 2023

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Net investment income/(loss) allocated from Hatteras Master Fund, L.P. |

||||||||||||||||

Investment income |

$ | 2,082 | $ | 2,623 | $ | 2,487 | $ | 6,621 | ||||||||

Operating expenses |

(584,858 | ) | (737,238 | ) | (699,041 | ) | (1,861,830 | ) | ||||||||

Net investment income/(loss) allocated from Hatteras Master Fund, L.P. |

(582,776 | ) | (734,615 | ) | (696,554 | ) | (1,855,209 | ) | ||||||||

Feeder Fund investment income |

||||||||||||||||

Interest |

627 | 674 | 612 | 727 | ||||||||||||

Total Feeder Fund investment income |

627 | 674 | 612 | 727 | ||||||||||||

Feeder Fund expenses |

||||||||||||||||

Servicing fee |

315,545 | 396,021 | 377,083 | 1,001,219 | ||||||||||||

Accounting, administration and transfer agency fees |

80,963 | 123,151 | 97,571 | 171,342 | ||||||||||||

Insurance fees |

55,872 | 70,237 | 66,514 | 176,192 | ||||||||||||

Professional fees |

29,534 | 37,000 | 30,111 | 40,600 | ||||||||||||

Printing fees |

2,124 | 2,124 | 2,112 | 2,124 | ||||||||||||

Custodian fees |

6,232 | 6,121 | 6,144 | 6,092 | ||||||||||||

Withholding tax |

— | (222,298 | ) | — | (411,048 | ) | ||||||||||

Other expenses |

7,893 | 8,789 | 6,036 | 3,932 | ||||||||||||

Total Feeder Fund expenses |

498,163 | 421,145 | 585,571 | 990,453 | ||||||||||||

Net investment income/(loss) |

(1,080,312 | ) | (1,155,086 | ) | (1,281,513 | ) | (2,844,935 | ) | ||||||||

Net realized gain/(loss) and change in unrealized appreciation/depreciation on investments allocated from Hatteras Master Fund, L.P. |

||||||||||||||||

Net realized gain/(loss) from investments in Adviser Funds, securities and foreign exhange transactions |

24,289 | 30,693 | 29,014 | 77,328 | ||||||||||||

Net change in unrealized appreciation/depreciation on investments |

2,405,987 | 3,032,634 | 2,875,580 | 7,657,740 | ||||||||||||

Net realized gain/(loss) and change in unrealized appreciation/depreciation on investments allocated from Hatteras Master Fund, L.P. |

2,430,276 | 3,063,327 | 2,904,594 | 7,735,068 | ||||||||||||

Net increase/(decrease) in partners’ capital resulting from operations |

$ | 1,349,964 | $ | 1,908,241 | $ | 1,623,081 | $ | 4,890,133 | ||||||||

|

* |

Consolidated Statement. See Note 2 in the notes to the financial statements. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

2

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Statements of Changes in Partners’ Capital

For the years ended March 31, 2022 and 2023

Hatteras |

Hatteras |

Hatteras |

Hatteras |

|||||||||||||

|

Limited Partners |

Limited Partners |

Limited Partners |

Limited Partners |

||||||||||||

Partners’ Capital, at March 31, 2021 |

$ | 49,280,569 | $ | 62,554,821 | $ | 58,581,213 | $ | 155,421,056 | ||||||||

Capital contributions |

149,998 | 50,000 | — | — | ||||||||||||

Capital withdrawals |

(5,392,286 | ) | (7,181,758 | ) | (5,952,663 | ) | (15,740,472 | ) | ||||||||

Performance allocation |

(435,054 | ) | (530,480 | ) | (518,155 | ) | (1,366,795 | ) | ||||||||

Net investment income/(loss) |

(1,042,391 | ) | (1,497,594 | ) | (1,222,605 | ) | (3,353,120 | ) | ||||||||

Net realized gain/(loss) from investments in Adviser Funds, securities and foreign exchange transactions |

1,736,440 | 2,243,951 | 2,001,591 | 5,253,918 | ||||||||||||

Net change in unrealized appreciation/depreciation on investments in Adviser Funds, securites and foreign exchange translations |

3,539,147 | 4,409,846 | 4,266,690 | 11,401,374 | ||||||||||||

Partners’ Capital, at March 31, 2022 |

$ | 47,836,423 | $ | 60,048,786 | $ | 57,156,071 | $ | 151,615,961 | ||||||||

Capital contributions |

— | — | — | — | ||||||||||||

Capital withdrawals |

— | — | — | — | ||||||||||||

Performance allocation |

(82,486 | ) | (100,949 | ) | (100,221 | ) | (268,499 | ) | ||||||||

Net investment income/(loss) |

(1,080,312 | ) | (1,155,086 | ) | (1,281,513 | ) | (2,844,935 | ) | ||||||||

Net realized gain/(loss) from investments in Adviser Funds, securities and foreign exchange transactions |

24,289 | 30,693 | 29,014 | 77,328 | ||||||||||||

Net change in unrealized appreciation/depreciation on investments |

2,405,987 | 3,032,634 | 2,875,580 | 7,657,740 | ||||||||||||

Partners’ Capital, at March 31, 2023 |

$ | 49,103,901 | $ | 61,856,078 | $ | 58,678,931 | $ | 156,237,595 | ||||||||

|

* |

Consolidated Statement. See Note 2 in the notes to the financial statements. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

3

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Statements of Cash Flows

For the Year Ended March 31, 2023

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Cash flows from operating activities: |

||||||||||||||||

Net increase/(decrease) in partners’ capital resulting from operations |

$ | 1,349,964 | $ | 1,908,241 | $ | 1,623,081 | $ | 4,890,133 | ||||||||

Adjustments to reconcile net increase/(decrease) in partners’ capital resulting from operations to net cash used in operating activies: |

||||||||||||||||

Proceeds, net of change in withdrawals receivable, from Hatteras Master Fund, L.P. |

357,089 | 499,910 | 439,587 | 1,347,719 | ||||||||||||

Net investment (income)/loss allocated from Hatteras Master Fund, L.P. |

582,776 | 734,615 | 696,554 | 1,855,209 | ||||||||||||

Net realized (gain)/loss from investments in Adviser Funds, securities and foreign exchange transactions allocated from Hatteras Master Fund, L.P. |

(24,289 | ) | (30,693 | ) | (29,014 | ) | (77,328 | ) | ||||||||

Net change in unrealized (appreciation)/depreciation on investments allocated from Hatteras Master Fund, L.P. |

(2,405,987 | ) | (3,032,634 | ) | (2,875,580 | ) | (7,657,740 | ) | ||||||||

(Increase)/Decrease in receivable for withdrawals from Hatteras Master Fund, L.P. |

(82,485 | ) | (100,950 | ) | (100,220 | ) | (268,499 | ) | ||||||||

(Increase)/Decrease in other receivables |

(17 | ) | (19 | ) | (10 | ) | (32 | ) | ||||||||

(Increase)/Decrease in prepaid assets |

637 | 946 | 511 | 1,087 | ||||||||||||

Increase/(Decrease) in servicing fees payable |

53,605 | 67,686 | 64,066 | 170,895 | ||||||||||||

Increase/(Decrease) in professional fees payable |

(15,574 | ) | (244,908 | ) | (14,296 | ) | (456,167 | ) | ||||||||

Increase/(Decrease) in printing fees payable |

(993 | ) | (993 | ) | (993 | ) | (993 | ) | ||||||||

Increase/(Decrease) in accounting, administration and transfer agency fees payable |

(1,413 | ) | (1,284 | ) | (499 | ) | 129 | |||||||||

Increase/(Decrease) in custodian fees payable |

1,042 | 1,549 | 1,018 | 1,531 | ||||||||||||

Increase/(Decrease) in withholding tax payable |

— | 3,125 | — | 3,125 | ||||||||||||

Increase/(Decrease) in other payables |

91 | (5,400 | ) | — | (5,309 | ) | ||||||||||

Net cash used in operating activities |

(185,554 | ) | (200,809 | ) | (195,795 | ) | (196,240 | ) | ||||||||

Net change in cash and cash equivalents |

(185,554 | ) | (200,809 | ) | (195,795 | ) | (196,240 | ) | ||||||||

Cash and cash equivalents at beginning of year |

200,000 | 205,000 | 200,000 | 205,000 | ||||||||||||

Cash and cash equivalents at end of year |

$ | 14,446 | $ | 4,191 | $ | 4,205 | $ | 8,760 | ||||||||

Supplemental disclosure of withholding tax paid |

$ | — | $ | 17,977 | $ | — | $ | 44,686 | ||||||||

|

* |

Consolidated Statement. See Note 2 in the notes to the financial statements. |

See notes to financial statements and financial statements of Hatteras Master Fund, L.P.

4

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Notes to Financial Statements

As of and for the year ended March 31, 2023

|

1. |

ORGANIZATION |

The Hatteras Core Alternatives Funds, each a “Feeder Fund” and collectively the “Feeder Funds” are:

Hatteras Core Alternatives Fund, L.P.

Hatteras Core Alternatives TEI Fund, L.P.

Hatteras Core Alternatives Institutional Fund, L.P.

Hatteras Core Alternatives TEI Institutional Fund, L.P.

The Feeder Funds are organized as Delaware limited partnerships, and are registered under the Securities Act of 1933 (the “1933 Act”), as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), as closed-end, diversified, management investment companies. The primary investment objective of the Feeder Funds is to provide capital appreciation consistent with the return characteristic of the alternative investment portfolios of larger endowments. The Feeder Funds’ secondary objective is to provide capital appreciation with less volatility than that of the equity markets. To achieve their objectives, the Feeder Funds provide their investors with access to a broad range of investment strategies, asset categories and trading advisers (“Advisers”) and by providing overall asset allocation services typically available on a collective basis to larger institutions, through an investment of substantially all of their assets into the Hatteras Master Fund, L.P. (the “Master Fund” together with the Feeder Funds, the “Funds”), which is registered under the 1940 Act. Hatteras Investment Partners, LP (the “Investment Manager” or the “General Partner”), a Delaware limited liability company registered as an investment adviser under the Investment Advisers Act of 1940, as amended, serves as Investment Manager to the Master Fund. Investors who acquire units of limited partnership interest in the Feeder Funds (“Units”) are the limited partners (each, a “Limited Partner” and together, the “Limited Partners”) of the Feeder Funds.

The Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. each invest substantially all of their assets in the Hatteras Core Alternatives Offshore Fund, LDC and Hatteras Core Alternatives Offshore Institutional Fund, LDC, (each a “Blocker Fund” and collectively the “Blocker Funds”), respectively. The Blocker Funds are Cayman Islands limited duration companies with the same investment objectives as the Feeder Funds. The Blocker Funds serve solely as intermediate entities through which the Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. invest in the Master Fund. The Blocker Funds enable tax-exempt Limited Partners (as defined below) to invest without receiving certain income in a form that would otherwise be taxable to such tax-exempt Limited Partners regardless of their tax-exempt status. The Hatteras Core Alternatives TEI Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Core Alternatives Offshore Fund, LDC and the Hatteras Core Alternatives TEI Institutional Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Core Alternatives Offshore Institutional Fund, LDC. The Notes to Financial Statements discuss the Feeder Funds’ investment in the Master Fund for Hatteras Core Alternatives TEI Fund, L.P. and Hatteras Core Alternatives TEI Institutional Fund, L.P. assuming, and as stated previously in the paragraph, their investment in the Master Fund passes through the applicable Blocker Fund.

Each Feeder Fund is considered an investment company under the 1940 Act, following the accounting principles generally accepted in the United States of America (“GAAP”) and the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946, Financial Services - Investment Companies (“ASC 946”). The financial statements of the Master Fund, including the Schedule of Investments, are included elsewhere in this report and should be read with the Feeder Funds’ financial statements. The percentages of the Master Fund’s beneficial limited partnership interests owned by the Feeder Funds at March 31, 2023 are:

Hatteras Core Alternatives Fund, L.P. |

15.07% |

Hatteras Core Alternatives TEI Fund, L.P. |

18.99% |

Hatteras Core Alternatives Institutional Fund, L.P. |

18.01% |

Hatteras Core Alternatives TEI Institutional Fund, L.P. |

47.93% |

Each of the Feeder Funds has an appointed Board of Directors (collectively the “Board”), which has the rights and powers to monitor and oversee the business affairs of the Feeder Funds, including the complete and exclusive authority to oversee and establish policies regarding the management, conduct and operation of the Feeder Funds’ business.

5

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Notes to Financial Statements (Continued)

As of and for the year ended March 31, 2023

At the meeting of the Master Fund and Feeder Funds’ Board held on December 7, 2021, by a unanimous vote, the Board approved a Plan of Liquidation of the Master Fund and the Feeder Funds, and on December 7, 2021, the Master Fund exchanged interests in the Adviser Funds for Preferred Series B-2 Unit Accounts of The Beneficient Company Group, L.P. (see Note 8 of the Notes to Financial Statements for the Master Fund).

|

2. |

SIGNIFICANT ACCOUNTING POLICIES |

These financial statements have been prepared in accordance with GAAP and are expressed in United States (“U.S.”) dollars. The following is a summary of significant accounting and reporting policies used in preparing the financial statements.

|

a. |

Investment Valuation |

The Feeder Funds do not make direct investments in securities or financial instruments, and invest substantially all of their assets in the Master Fund. The Feeder Funds record their investment in the Master Fund at fair value, based on each Feeder Fund’s pro rata percentage of partners’ capital of the Master Fund. Valuation of securities held by the Master Fund, including the Master Fund’s disclosure of investments under the three-tier hierarchy, is also discussed in the notes to the Master Fund’s financial statements included elsewhere in this report.

|

b. |

Allocations from the Master Fund |

The Feeder Funds record their allocated portion of income, expense, realized gains and losses and change in unrealized appreciation and depreciation from the Master Fund.

|

c. |

Feeder Fund Income and Expenses |

Interest income on any cash or cash equivalents held by the Feeder Funds is recognized on an accrual basis. Expenses that are specifically attributed to the Feeder Funds are charged to each Feeder Fund. Because the Feeder Funds bear their proportionate share of the management fee of the Master Fund, the Feeder Funds pay no direct management fee to the Investment Manager or sub-adviser. The Feeder Funds’ specific expenses are recorded on an accrual basis.

|

d. |

Tax Basis Reporting |

Historically, the Master Fund invested primarily in investment funds treated as partnerships for U.S. Federal tax purposes. The tax character of each of the Feeder Fund’s allocated earnings is established dependent upon the tax filings of the investment vehicles operated by the trading advisers (“Adviser Funds”). The tax basis for the Adviser Funds carried over to the Beneficient Preferred Series B-2 Unit Accounts. Accordingly, the tax basis of these allocated earnings and the related balances are not available as of the reporting date. The tax basis for the Adviser Funds carried over to the Beneficient Preferred Series B-2 Unit Accounts.

|

e. |

Income Taxes |

For U.S. Federal income tax purposes, the Feeder Funds are treated as partnerships, and each Limited Partner in each respective Feeder Fund is treated as the owner of its proportionate share of the partners’ capital, income, expenses, and the realized and unrealized gains/(losses) of such Feeder Fund. Accordingly, no federal, state or local income taxes have been provided on profits of the Feeder Funds since the Limited Partners are individually liable for the taxes on their share of the Feeder Funds.

The Feeder Funds file tax returns as prescribed by the tax laws of the jurisdictions in which they operate. In the normal course of business, the Feeder Funds are subject to examination by federal, state, local and foreign jurisdictions, where applicable. For the Feeder Funds’ tax years ended December 31, 2019 through December 31, 2022, the Feeder Funds are open to examination by major tax jurisdictions under the statute of limitations.

Management has reviewed any potential tax positions as of March 31, 2023 and determined that the Feeder Funds do not have a liability for any unrecognized tax benefits. The Feeder Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the year ended March 31, 2023, the Feeder Funds did not incur any interest or penalties.

6

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Notes to Financial Statements (Continued)

As of and for the year ended March 31, 2023

|

2. |

SIGNIFICANT ACCOUNTING POLICIES (concluded) |

The Blocker Funds may be subject to withholding of U.S. Federal income tax at the current statutory rate of their allocable share of the Master Fund’s U.S.-source dividend income and other U.S.-source fixed, determinable annual or periodic gains, profits, or income, as defined in Section 881(a) of the Internal Revenue Code of 1986, as amended. This tax treatment differs in comparison to the tax treatment of most forms of interest income.

|

f. |

Cash and Cash Equivalents |

Cash and cash equivalents include amounts held in interest bearing demand deposit accounts. Such cash, at times, may exceed federally insured limits. The Feeder Funds have not experienced any losses in such accounts and do not believe they are exposed to any significant credit risk on such accounts.

|

g. |

Use of Estimates |

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in partners’ capital from operations during the reporting period. Actual results could differ from those estimates.

|

h. |

Consolidated Financial Statements |

The asset, liability, and equity accounts of the Hatteras Core Alternatives TEI Fund, L.P. and the Hatteras Core Alternatives TEI Institutional Fund, L.P. are consolidated with their respective Blocker Funds, as presented in the Statements of Assets, Liabilities and Partners’ Capital, Statements of Operations, Statements of Changes in Partners’ Capital, and Statements of Cash Flows. All intercompany accounts and transactions have been eliminated in consolidation.

|

3. |

ALLOCATION OF LIMITED PARTNERS’ CAPITAL |

Allocation Periods begin on the first calendar day of each month and end at the close of business on the last day of each month (“Allocation Period”). The Feeder Funds maintain a separate capital account (“Capital Account”) on their books for each Limited Partner. Net profits or net losses of the Feeder Funds for each Allocation Period will be allocated among and credited to or debited against the Capital Accounts of the Limited Partners. Net profits or net losses will be measured as the net change in the value of the Limited Partners’ capital of the Feeder Funds, which includes; net change in unrealized appreciation or depreciation of investments, realized gain/(loss), and net investment income/(loss) during an Allocation Period.

Each Limited Partner’s Capital Account will have an opening balance equal to the Limited Partner’s initial purchase of the Feeder Fund (i.e., the amount of the investment less any applicable sales load of up to 2.00% of the purchased amount for purchases of Units of Hatteras Core Alternatives Fund, L.P. and Hatteras Core Alternatives TEI Fund, L.P.), and thereafter, will be (i) increased by the amount of any additional purchases by such Limited Partner; (ii) decreased for any payments upon repurchase or sale of such Limited Partner’s Units or any distributions in respect of such Limited Partner; and (iii) increased or decreased as of the close of each Allocation Period by such Limited Partner’s allocable share of the net profits or net losses of the Feeder Fund.

|

Hatteras |

Hatteras |

Hatteras |

Hatteras |

||||||||||||

Ending Units, March 31, 2021 |

329,799.59 | 431,007.37 | 371,895.08 | 1,012,365.31 | ||||||||||||

Contributions |

1,001.45 | 344.33 | — | — | ||||||||||||

Withdrawals |

(35,242.71 | ) | (48,364.45 | ) | (36,997.73 | ) | (100,492.98 | ) | ||||||||

Ending Units, March 31, 2022 |

295,558.33 | 382,987.25 | 334,897.35 | 911,872.33 | ||||||||||||

Contributions |

— | — | — | — | ||||||||||||

Withdrawals |

— | — | — | — | ||||||||||||

Ending Units, March 31, 2023 |

295,558.33 | 382,987.25 | 334,897.35 | 911,872.33 | ||||||||||||

7

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Notes to Financial Statements (Continued)

As of and for the year ended March 31, 2023

|

4. |

RELATED PARTY TRANSACTIONS AND OTHER |

In consideration for fund services, each Feeder Fund will pay the Investment Manager (in such capacity, the “Servicing Agent”) a fund servicing fee charged at the annual rate of 0.65% of the month-end partners’ capital of each Feeder Fund. The respective Feeder Fund servicing fees payable to the Servicing Agent will be borne by all Limited Partners of the respective Feeder Fund on a pro-rata basis before giving effect to any repurchase of interests in the Master Fund effective as of that date, and will decrease the net profits or increase the net losses of the Master Fund that are credited to its interest holders, including each Feeder Fund.

The General Partner is allocated a performance allocation payable annually equal to 10% of the amount by which net new profits of the limited partner interests of the Master Fund exceed the “hurdle amount,” which is calculated as of the last day of the preceding calendar year of the Master Fund at a rate equal to the yield-to-maturity of the 90-day U.S. Treasury Bill for the last business day of the preceding calendar year (the “Performance Allocation”). The Performance Allocation is calculated for each Feeder Fund at the Master Fund level. The Performance Allocation is made on a “peak to peak,” or “high watermark” basis, which means that the Performance Allocation is made only with respect to new net profits. If the Master Fund has a net loss in any period followed by a net profit, no Performance Allocation will be made with respect to such subsequent appreciation until such net loss has been recovered. A Performance Allocation of $82,486, $100,949, $100,221, and $268,499 for the year ended March 31, 2023, was allocated to the Hatteras Core Alternatives Fund, L.P., Hatteras Core Alternatives TEI Fund, L.P., Hatteras Core Alternatives Institutional Fund, L.P. and Hatteras Core Alternatives TEI Institutional Fund, L.P., respectively.

Hatteras Capital Distributors, LLC (“HCD”), an affiliate of the Investment Manager, serves as the Feeder Funds’ distributor. HCD receives a servicing fee from the Investment Manager based on the partners’ capital of the Master Fund as of the last day of the month (before giving effect to any repurchase of interests in the Master Fund).

U.S. Bank, N.A. (“USB”) serves as custodian of the Feeder Funds’ cash balances and provides custodial services for the Feeder Funds. U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”), serves as the administrator and accounting agent to the Feeder Funds and provides certain accounting, record keeping and investor related services. The Feeder Funds pay a fee to the custodian and administrator based upon average total Limited Partners’ capital, subject to certain minimums.

The Master Fund has engaged a third party to provide compliance services including the appointment of the Funds’ Chief Compliance Officer. On April 7, 2022, the Funds’ compliance service provider, Cipperman Compliance Services (“Cipperman”) was acquired by Foreside Financial Group, LLC (“Foreside”). On May 31, 2022, the Funds’ compliance service provider, Foreside was acquired by Adviser Compliance Associates, LLC doing business as ACA Group (“ACA”). ACA is paid an annual fee of $63,000 for services provided, which is allocated among the Funds.

As of March 31, 2023, Limited Partners who are affiliated with the Investment Manager owned $2,062,988 (3.52% of partners’ capital) of Hatteras Core Alternatives Institutional Fund, L.P., $3,118 (0.01% of partners’ capital) of Hatteras Core Alternatives TEI Fund, L.P., and $802,048 (0.51% of partners’ capital) of Hatteras Core Alternatives TEI Institutional Fund, L.P.

|

5. |

RISK FACTORS |

An investment in the Feeder Funds involves significant risks that should be carefully considered prior to investment and should only be considered by persons financially able to maintain their investment and who can afford a loss of a substantial part or all of such investment. The Master Fund intends to invest substantially all of its available capital in securities of private investment companies. These investments will generally be restricted securities that are subject to substantial holding periods or are not traded in public markets at all, so that the Master Fund may not be able to resell some of its Adviser Fund holdings for extended periods, which may be several years. Limited Partners should refer to the Master Fund’s financial statements included in this report along with the applicable Feeder Fund’s prospectus, as supplemented and corresponding statement of additional information for a more complete list of risk factors. No guarantee or representation is made that the Feeder Funds’ investment objectives will be met.

8

HATTERAS CORE ALTERNATIVES FUNDS

(each a Delaware Limited Partnership)

Notes to Financial Statements (Continued)

As of and for the year ended March 31, 2023

|

6. |

REPURCHASE OF LIMITED PARTNERS’ UNITS |