Commission File Number 024-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 1-A

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

Cruzani, Inc.

(now known as)

bowmo, Inc.

(Exact Name of Registrant as Specified in its Governing Instruments)

99 Wall Street, Suite 891

New York, New York 10005

(212) 398-0002

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Edward Aizman

Director, Chief Executive Officer, Secretary and Treasurer

bowmo, Inc.

99 Wall Street, Suite 891

New York, New York 10005

(212) 398-0002

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copy to:

W. David Mannheim

Nelson Mullins Riley Scarborough LLP

GlenLake One

4140 Parklake Avenue, Suite 200

Raleigh, North Carolina 27612

(919) 329-3804

| 7371 | 26-4144571 | |

| (Primary Standard Industrial | (I.R.S. Employer | |

| Classification Code Number) | Identification Number) |

This Offering Circular shall only be qualified upon order of the United States Securities and Exchange Commission, unless a subsequent amendment is filed indicating the intention to become qualified by operation of the terms of Regulation A.

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR SUBJECT TO COMPLETION |

DATED NOVEMBER 1, 2022 |

Best Efforts Offering of a Maximum of 20,833,333,334 Shares of Common Stock

Price Range of $0.0036 - $0.0038 Per Share

Minimum Investment: $50,000

Maximum Offering: $75,000,000

We are offering up to 20,833,333,334 shares of Common Stock, $0.001 par value per share (“Common Stock”), of bowmo, Inc., a Wyoming corporation (the “Company,” “we,” “our,” or “us”), on a continuous basis in a “Tier 2” offering under Regulation A (this “Offering”). The price per share of Common Stock to be offered and sold in this Offering will be determined after qualification, and we have provided a bona fide estimate of the price range of $0.0036 - $0.0038 per share. The minimum purchase requirement for an investor to participate in this Offering is $50,000; however, we reserve the right to waive the minimum purchase requirement on a case-by-case basis in our sole discretion.

This Offering is being conducted on a “best-efforts” basis by our directors, officers and employees who will not be compensated for their efforts. We have not engaged, and do not intend to engage, any brokers, dealers, finders, underwriters or other agents in connection this Offering; however, we reserve the right to offer the Shares through broker-dealers who are registered with the Financial Industry Regulatory Authority (“FINRA”). See “Plan of Distribution.”

There is no minimum number of shares of our Common Stock that must be sold by us in this Offering for a closing to occur. Accordingly, we may receive no or minimal proceeds from this Offering. Subscriptions will be accepted on a rolling basis, and the proceeds from all accepted subscriptions will be immediately available for use by us. See “Use of Proceeds.” No proceeds will be placed in an escrow account during this Offering, and no proceeds will be returned to you once your subscription agreement has been accepted by us. We reserve the right to reject or limit the size of your subscription for any reason, and, if we do reject or limit the size of your subscription, we will promptly return your funds to you without deduction, offset or interest accrued thereon.

We expect to commence the sale of our Common Stock as of the date on which the Offering Statement, of which this Offering Circular is a part, is qualified by the United States Securities and Exchange Commission (the “SEC”). This Offering will terminate at the earliest of (i) the date upon which the maximum amount of shares of Common Stock has been sold, (ii) the date which is twelve (12) months after the date of qualification of this Offering, or (iii) the date on which this Offering is earlier terminated by us in our sole discretion. Notwithstanding the foregoing, this Offering may be extended in our sole discretion.

Our Common Stock is currently quoted on the OTC Markets - Pink Open Market under the ticker symbol “BOMO” and currently trades on a sporadic and limited basis. The closing price of our Common Stock on October 31, 2022 was $0.003.

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” on page 8 for a discussion of certain risks that you should consider in connection with an investment in our Common Stock.

| Price to the Public | Discount and commissions (1) | Proceeds to the Company (2) | Proceeds to Other Persons (3) | |||||||||||||

| Per Share | $ 0.0036 – 0.0038 | $ | — | $ 0.0036 – 0.0038 | $ | — | ||||||||||

| Minimum Investment | $ | 50,000 | $ | — | 50,000 | $ | — | |||||||||

| Maximum Offering | $ | 75,000,000 | $ | — | 75,000,000 | $ | — | |||||||||

| (1) | We have not engaged, and do not intend to engage, any brokers, dealers, finders, underwriters or other sales agents in connection this Offering; however, we reserve the right to offer the Shares through broker-dealers who are registered with the SEC and are members of the Financial Industry Regulatory Authority. |

| (2) | The amount shown is before deducting expenses we expect to incur in connection with this Offering, including costs, expenses and fees for legal, accounting, printing, due diligence, marketing, administrative, filing and other similar costs incurred in connection with this Offering which we currently estimate to be $300,000. See “Plan of Distribution.” |

| (3) | There are no finder’s fees or other similar fees being paid to third parties from the proceeds of this Offering. |

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The SEC does not pass upon the merits of or give its approval to any securities offered or the terms of this Offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the SEC; however, the SEC has not made an independent determination that the securities offered are exempt from registration.

The Company is following the “Offering Circular” format of disclosure of Part II of Form 1-A.

The date of this Offering Circular is , 2022

TABLE OF CONTENTS

| i |

TERMINOLOGY

As used in this Offering Circular, unless the context otherwise requires, references to “we,” “us,” “our,” the “Company” and similar references refer to bowmo, Inc., a Wyoming corporation, and its consolidated subsidiary, bowmo, Inc., a Delaware corporation. See “Summary – Cruzani, Our Merger, Our Name, Our Ticker Symbol and Our Trading Price” for more information regarding our corporate history.

GENERAL DISCLAIMERS

You should rely only upon the information contained in this Offering Circular. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely upon it.

You should assume that the information appearing in this Offering Circular is accurate only as of its date. Our assets, business, cash flows, financial condition, liquidity, management, prospects and results of operations may have changed since that date.

No action is being taken in any jurisdiction outside the United States to register, qualify or otherwise permit this Offering or the possession or distribution of this Offering Circular in that jurisdiction. Persons who come into possession of this Offering Circular in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to this Offering and the distribution of this Offering Circular applicable to those jurisdictions. We are not making an offer of our Common Stock in any jurisdiction where the offer is not permitted.

You should not interpret the contents of this Offering Circular to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our Common Stock.

“bowmo” and its logos and other trademarks referred to and included in this prospectus belong to us. Solely for convenience, we refer to our trademarks in this Offering Circular without the ® or the ™ or symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks. Other service marks, trademarks and trade names referred to in this prospectus, if any, are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks.

MARKET, INDUSTRY, AND OTHER DATA

We use market data throughout this Offering Circular which has generally obtained from publicly available information and industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but the accuracy and completeness of the information are not guaranteed. The market data includes forecasts and projections that are based on industry surveys and the preparers’ experiences in the industry, and there is no assurance that any of the projections or forecasts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information.

| 1 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains forward-looking statements. Forward-looking statements are not statements of historical or current fact nor are they assurances of future performance and generally can be identified by the use of forward-looking terminology, such as “may,” “will,” “anticipate,” “intend,” “could,” “should,” “would,” “believe,” “project,” “plan,” “goal,” “target,” “potential,” “pro-forma,” “seek,” “contemplate,” “expect,” “estimate,” “continue,” “project,” “anticipated,” “modeled” or “forecasted” or the negative thereof as well as other similar words and expressions of the future. These forward-looking statements include statements related to (i) our plans, objectives, strategies, operations, services, projected growth, anticipated future financial performance and management’s long-term performance goals.

Forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict as to timing, extent, likelihood and degree of occurrence, which could cause our actual results to differ materially from those anticipated in or by such statements. Potential risks and uncertainties include, but are not limited to, the following:

| · | our ability to continue as a going concern; |

| · | our ability to raise additional capital, if needed, to support our operations; |

| · | the effect of COVID-19 on our business and the national and global economies; |

| · | the rate and degree of market acceptance of our products and services; |

| · | our ability to expand our sales organization to address effectively existing and new markets that we intend to target; |

| · | impact from future regulatory, judicial, and legislative changes or developments in the U.S. and foreign countries; |

| · | our ability to compete effectively in a competitive industry; |

| · | our ability to achieve positive cash flow from operations; |

| · | our ability to meet our other financial operating objectives; |

| · | the availability of qualified employees for our business operations; |

| · | general business and economic conditions; |

| · | our ability to meet our financial obligations as they become due; |

| · | our relationships with our key customers; |

| · | our ability to secure intellectual property rights over our proprietary products or enter into license agreements to secure the legal use of certain patents an intellectual property; |

| · | our ability to be successful in new markets; |

| · | our ability to avoid infringement of intellectual property rights; |

| · | the positive cash flows and financial viability of our operations and new business opportunities; |

| · | continued demand for services of recruiters; |

| 2 |

| · | unanticipated costs, liabilities, charges or expenses resulting from violations of covenants under our existing or future financing agreements; |

| · | our ability to operate our virtual AI-and video-enabled hiring platform free of security breaches; and |

| · | our ability to retain and attract senior management and other key employees; |

| · | our ability to quickly and effectively respond to new technological developments; |

| · | our ability to identify suitable complimentary businesses and assets as potential acquisition targets or strategic partners, and to successfully integrate such businesses and /or assets with our business; and |

| · | those risks described in the section captioned “Risk Factors” in this Offering Circular. |

We caution readers that the foregoing list of factors is not exclusive, is not necessarily in order of importance and readers should not place undue reliance on any forward-looking statements, which should be read in conjunction with the other cautionary statements that are included elsewhere in this Offering Circular. Should one or more of the risks or uncertainties described above or elsewhere in this Offering Circular occur, or should underlying assumptions prove incorrect, actual results could differ materially and adversely from those expressed in any forward-looking statements. You are cautioned not to place undue reliance on these statements which speak only as of the date of this Offering Circular.

Additional factors that may cause actual results to differ materially from those contemplated by any forward-looking statements may arise or emerge after the date of this Offering Circular. Further, any forward-looking statement speaks only as of the date on which it is made, and we do not intend to and, except as required by law, disclaim any obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, unless required to do so under the federal securities laws.

| 3 |

This summary highlights certain material information contained elsewhere in this Offering Circular. Because this is a summary, it may not contain all of the information that is important to you when deciding whether to invest in our Common Stock. Accordingly, you should carefully read this Offering Circular in its entirety before investing. We urge you to pay special attention to the information contained in the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” of this Offering Circular as well as our financial statements and the notes thereto appearing elsewhere in this Offering Circular.

Cruzani, Our Merger, Our Name, Our Ticker Symbol and Our Trading Price

Cruzani, Inc., a Wyoming corporation that was incorporated on February 5, 1999 (“Cruzani”), was previously a franchise development company that built and represented popular franchise concepts, and other related businesses, throughout the United States as well as in international markets.

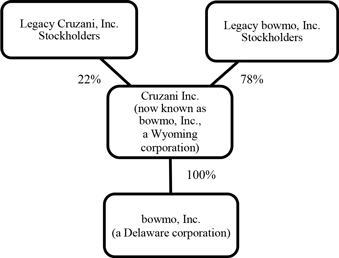

On April 29, 2022, Cruzani entered into an Agreement and Plan of Merger (the “Merger Agreement”) with bowmo Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Cruzani (“Merger Sub”), bowmo, Inc., a Delaware corporation that was incorporated on May 22, 2015 (“Target”), and Michael E. Lakshin on behalf of Target’s stockholders. Pursuant to the Merger Agreement, on May 4, 2022, Merger Sub was merged with and into Target with Target surviving the merger as the wholly owned subsidiary of Cruzani (the “Merger”). As consideration for the Merger, Cruzani received all of the issued and outstanding shares of capital stock of Target, and the legacy stockholders of Target received shares of Series G preferred stock of Cruzani having voting rights equivalent to 78% of the total voting rights of all holders of capital stock of Cruzani.

On June 16, 2022, Cruzani filed articles of amendment with the Secretary of State of the State of Wyoming to change its name to “bowmo, Inc.”

Our Common Stock is currently quoted on the OTC Markets - Pink Open Market under the ticker symbol “BOMO” and currently trades on a sporadic and limited basis. The closing price of our Common Stock on October 31, 2022 was $0.003.

Our Structure

The following chart shows the organizational structure of our Company as of the date of this Offering Circular but before giving effect to this Offering.

| 4 |

Our Business

Prior to the Merger, Cruzani was reassessing its business model and strategic goals. Upon completion of the Merger, however, we have decided to pursue our Vertically Integrated Business Model (“VIBM”) which is capable of providing services and added value to all segments of the human resources technology (“HR-Tech”) market globally. Our goal is to constantly improve our HR-Tech platform to address present and future market needs by offering a unique combination of proprietary artificial intelligence (“AI”) based technology with a do-it-yourself sourcing experience able to match candidates to jobs without having to use keyword searches or Boolean strings.

Our AI-driven platform will automate the end-to-end hiring processes with its AI-based matching engine while providing just-in-time content, resources, and tools, such as video interviewing and cultural and technical assessments so that hiring organizations can vet their candidates. We refer to this as Software as a Service (“SaaS”).

We expect to complete our VIBM by our Recruiting as a Service (“RaaS”) which allows clients to outsource the management of the recruiting process (“RPO”). Our RaaS offering will complement our improved HR-Tech platform by offering our clients with a choice of high-touch and high-tech services strategically geared to market needs and objectives.

In addition, our VIBM offers unique added value via e-learning programs by Interview Mastery® and Selecting Excellence®, designed by Michael R. Neece, one of the pioneers in the human resources e-learning field. Both programs have been continually improving in order to solve the challenges of today’s job-market realities for more than 20 years.

Our clients receive assistance across all recruiting functions, such as job-description development, branded career-page management, pre-employment and cultural assessments, and a video interview platform—all managed by a team of experienced recruiters.

With our HR-Tech platform as a foundation for our VIBM—performing matching and sourcing at the core—we are reshaping how businesses find talent and provide a quality on-demand experience.

Management

Our executives are seasoned professionals in internet-enabled businesses and the recruitment industry. Our management team has participated in multiple successful investments and transactions and has extensive business and financial acumen.

| · | Edward Aizman, Director, Chief Executive Officer, Secretary and Treasurer |

| · | Michael E. Lakshin, Chairman of the Board and President |

| · | Conrad Huss, Co-Chairman of the Board |

Recent Developments

On June 15, 2022, we entered into a Securities Purchase Agreement (the “SPA”) and warrant to purchase 1,500,000,000 shares of Common Stock (the “Warrant”) with an institutional investor in connection with the issuance of a convertible note by Cruzani in favor of the investor in the aggregate principal amount of $165,000 (the “Note”).

The Note bears interest at the rate of 12% per annum and has a maturity date of June 15, 2023. In the event of a qualifying public offering of common stock by the Company prior to the maturity date, such as this Offering, the Note shall be immediately payable from certain of the proceeds such offering.

The Warrant has a seven-year term from the date of issuance, is exercisable from the date of issuance, and includes “full-rachet” anti-dilution protection.

| 5 |

Convertible Note and Warrant

On October 12, 2022, the Company issued a $550,000 convertible promissory note (the “Convertible Note”) to Trillium Partners, LP (“Trillium”) in exchange for $500,000. The Convertible Note bears interest at 8%, per annum. All unpaid principal and accrued interest under the Convertible Note will be due and payable in full one year from issuance. The note converts at $0.0001 per common share and Trillium Partners LP may elect to convert 5,500,000,000 shares of the Company’s common stock at any time.

In connection with the issuance of the Convertible Note with Trillium, the Company also issued a common stock purchase warrant to purchase up to 2,500,000,000 shares of the Company’s common stock. These warrants have an exercise price per share of $0.0001 and expire in seven years.

Business and Roll-Up Strategy

Despite the increasing importance and the transformational effects of SaaS in the HR-Tech market, we believe that the human aspect of recruiting remains of paramount importance. We also believe that successful participants in the HR-Tech market will offer a curated mix of SaaS, RaaS (powered by SaaS) and “brick-n-mortar” recruiting and direct placement services to clients.

Accordingly, we consider our Roll-up Strategy as one of the fastest ways to grow our business and increase our market share before the HR-Tech industry reaches a competitive plateau. To implement our Roll-Up Strategy, we will seek to acquire target companies (“Targets”) that will be accretive to our SaaS, RaaS and recruiting/direct placement offerings based upon the following key-criteria:

| · | scalable business model that will, in turn, help us to grow our SaaS, RaaS and recruiting/direct placement offerings. |

| · | similar business vision and culture to that of our company. |

| · | value, history and estimated longevity of the Targets’ respective clients as well as the Targets’ respective business pipelines. |

| · | gross annual sales revenue ranging from $15 million to $30 million with at least 10% net operating income. |

| · | the management teams of the Targets must agree to receive capital stock and notes payable as deal consideration. |

Principal Executive Office

We currently do not have a principal executive office; rather, we operate virtually. Our business mailing address is 99 Wall Street, Suite 891 New York, New York 10005. Our telephone number is (212) 398-0002. The address of our website is www.bowmo.com. The inclusion of our website address in this Offering Circular does not include or incorporate by reference the information on our website into this Offering Circular.

| 6 |

THE OFFERING

| Issuer | bowmo, Inc. |

| Securities offered | Common Stock |

| Maximum Offering Amount | $75,000,000 |

| Price Per Share | $0.0036 – 0.0038 per share of Common Stock |

| Minimum Investment Amount | $50,000; however, we reserve the right to waive the minimum purchase requirement on a case-by-case basis in our sole discretion. |

| Common Stock Outstanding Before the Offering | 18,572,705,574 |

| Common Stock Outstanding After the Offering | 39,406,038,908(1) |

| Use of Proceeds | We estimate that the maximum net proceeds from the sale of shares of our Common Stock in this Offering will be approximately $74,700,000 after deducting the estimated offering expenses of $300,000 payable by us. We intend to use the net proceeds we receive from this Offering for research and development, technical support, payroll and selling, general and administrative expenses and other working capital needs as well as the repayment of the Note. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions, products, or businesses that complement our business. We reserve the right to reallocate portions of the net proceeds reserved for one category to another or to add additional categories, and we will have broad discretion in doing so. See “Use of Proceeds.” |

| Market for our Common Stock | Our Common Stock is currently quoted on the OTC Markets - Pink Open Market under the ticker symbol “BOMO” and currently trades on a sporadic and limited basis. |

| Risk Factors | See “Risk Factors” on page 8 for a discussion of factors you should consider carefully before deciding to invest in our Common Stock. |

| (1) | Assumes the maximum number of shares of Common Stock are sold in this Offering. |

| 7 |

An investment in our Common Stock involves certain risks. You should carefully consider the risk factors and other information included in this Offering Circular before making an investment decision. Our assets, business, cash flows, financial condition, liquidity, prospects and/or results of operations could be materially adversely affected by any of these risks. Additionally, the price of our Common Stock could decline due to any of these risks, and you may lose all or part of your investment.

This Offering Circular also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this Offering Circular. The prospectus supplement is qualified in its entirety by those risk factors.

Risk Factors Related to Our Business

Our existing financial resources are insufficient to pay for our ongoing operating expenses.

We currently have limited financial resources and other assets to pay for our ongoing operating expenses. In the short term, unless we are able to raise additional capital, including through this Offering, we will be unable to pay for our ongoing operating expenses and may not be able to continue as a going concern.

We may never achieve or sustain profitability or positive cash flow from operations.

As of June 30, 2022, we had an accumulated deficit of approximately $5.0 million. We expect to continue to incur substantial expenditures to develop and market our services and could continue to incur losses and negative operating cash flow for the foreseeable future. We may never achieve profitability or positive cash flow in the future, and even if we do, we may not be able to continue being profitable. Any failure to achieve and maintain profitability would continue to have an adverse effect on our stockholders’ deficit and working capital and could result in a decline in the price of our Common Stock or cause us to cease operations.

Because we have a limited operating history under our current platform, it is difficult to evaluate our business and future prospects which increases the risks associated with an investment in our Common Stock.

We launched the Company in May 2015 and operated our current HR-Tech platform powered by AI since October 2015, and we then put into a multi-year process of further development, integration, and branding. As a result, our platform and business model have not been fully proven, and we have only a limited operating history on which to evaluate our business and future prospects. We have encountered, and will continue to encounter, risks and difficulties frequently experienced by growing companies in rapidly changing industries, including our ability to achieve market acceptance of our platform and attract, retain and incentivize recruiters on our platform, as well as respond to competition and plan for and scale our operations to address future growth. We may not be successful in addressing these and other challenges we may face in the future, and our business and future prospects may be materially and adversely affected if we do not manage these and other risks successfully. Given our limited operating history, we may be unable to effectively implement our business plan which could materially harm our business or cause us to scale down or cease our operations.

Our business depends on a strong reputation and anything that harms our reputation will likely harm our results of operations.

As a provider of permanent staffing solutions as well as consulting and e-Learning services for the HR market, our reputation is dependent upon the performance of the employees we place with our clients and the services rendered by our consultants. We depend on our reputation and name recognition to secure engagements and to hire qualified employees and consultants. If our clients become dissatisfied with the performance of those employees or consultants or if any of those employees or consultants engage in or are believed to have engaged in conduct that is harmful to our clients, our ability to maintain or expand our client base will be harmed. Any of the foregoing is likely to materially adversely affect us.

| 8 |

We may be unable to find sufficient candidates for our staffing business.

Our staffing services business consists of the placement of individuals seeking employment. There can be no assurance that candidates for employment will continue to seek employment through us. Candidates generally seek positions through multiple sources, including the Company and our competitors. In the fall of 2019, unemployment rates were at historical lows. The COVID-19 pandemic has had a significant effect on unemployment in every state, industry, and major demographic group in the United States and peaked to unprecedented levels in April 2020. According to a release by the U.S. Bureau of Labor Statistics, State Employment and Unemployment Summary on June 17, 2022, (i) unemployment rates were lower in May 2022 in 16 states and stable in 34 states and the District of Columbia, (ii) all 50 states and the District of Columbia had jobless rate decreases from a year earlier, (iii) the national unemployment rate remained at 3.6% but was 2.2% points lower than in May 2021 and (iv) the U.S. economy finally climbed within 1 million jobs of pre-COVID levels with 390,000 jobs added in May 2022. The availability of qualified talent may change or become scarcer, depending on macro-economic conditions outside of the Company’s control. If finding sufficient eligible candidates to meet employers’ demands becomes more challenging due to falling unemployment rates or other talent availability issues, the Company may experience a shortage of qualified candidates. Any shortage of candidates could materially adversely affect the Company.

We may require additional capital to fund our business and support our growth, and our inability to generate and obtain such capital on acceptable terms, or at all, could harm our business, operating results, financial condition, and prospects.

We intend to continue to make substantial investments to fund our business and support our growth. In addition, we may require additional funds to respond to business challenges, including the need to develop new features or enhance our solutions, improve our operating infrastructure, or acquire or develop complementary businesses and technologies. As a result, in addition to the revenues we generate from our business, we may need to engage in additional equity or debt financings to provide the funds required for these and other business endeavors. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our Common Stock. Any debt financing that we may secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain such additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly impaired, and our business may be adversely impacted. In addition, our inability to generate or obtain the financial resources needed may require us to delay, scale back, or eliminate some or all of our operations, which may have a significant adverse impact on our business, operating results and financial condition.

If we fail to completely and successfully integrate the assets we acquired, we may not fully realize the anticipated benefits from the acquisition, and our results of operations would be materially and adversely affected.

We recently acquired Target and anticipate acquiring additional assets and businesses in the future. Our failure to successfully integrate the assets we acquire may be more difficult, costly or time-consuming than we anticipate, or we may not otherwise realize any of the anticipated benefits of this acquisition. Any of the foregoing could adversely affect our future results of operations or could cause our stock price to decline.

If our due diligence process with respect to acquisitions proves insufficient, we may make poor investment decisions.

Our management is opportunistic in its approach to mergers and acquisitions. We are actively looking to grow our base of clients, intellectual property, assets and suite of recruitment technology solutions. If our processes fail to identify risks and weaknesses of companies that we either acquire or purchase assets from, we may be harmed or have difficulties recouping our investments. Additionally, we may be unable to effectively integrate such assets into our existing business.

| 9 |

Our future growth depends on our ability to attract, retain and incentivize a community of recruiters and other talent acquisition professionals are needed for future growth, and the loss of such recruiters and talent acquisition professionals, or the failure to attract new ones, could adversely impact our business and future prospects.

The size of our community of employers on our platform is critical to our success. Our ability to achieve profitability in the future will depend, in large part, on our ability to attract new users to, and retain existing users on, our platform. Recruiters and other talent acquisition professionals on our Platform can generally decide to cease using our platform at any time. We have experienced growth in the number of recruiters and other talent acquisition professionals on our platform in recent months. This growth may not continue at the same pace in the future or at all. In addition, it is possible that the ongoing effects of COVID-19 may have a adverse effect on our user growth in the future. Achieving growth in our community of users may require us to engage in increasingly sophisticated and costly sales and marketing efforts that may not result in additional users. We may also need to modify our pricing model to attract and retain such users. If we fail to attract new users or fail to maintain or expand existing relationships in a cost-effective manner, our business and future prospects would be materially and adversely impacted.

If we are unable to respond to technological advancements and other changes in our industry by developing and releasing new services, or improving our existing services, in a timely and cost-effective manner or at all, our business could be materially and adversely affected.

Our industry is characterized by rapid technological change, frequent new service launches, changing user demands, and evolving industry standards. The introduction of new services based on technological advancements can quickly render existing services obsolete. We will need to expend substantial resources on researching and developing new services and enhancing our platform by incorporating additional features, improving functionality, and adding other improvements to meet our users’ evolving demands. We may not be successful in developing, marketing, and delivering in a timely and cost-effective manner enhancements or new features to our platform or any new services that respond to continued changes in the market. Furthermore, any enhancements or new features to our platform or any new services may contain errors or defects and may not achieve the broad market acceptance necessary to generate sufficient revenue. Moreover, even if we introduce new services, we may experience a decline in revenue from our existing services that is not offset by revenue from the new services.

If we experience errors, defects, or disruptions in our platform it could damage our reputation, which could in turn materially and adversely impact our operating results and growth prospects.

The performance and reliability of our platform is critical to our reputation and ability to attract and retain recruiters and clients. Any system error or failure, or other performance problems with our platform could harm our brand and reputation and may damage the businesses of users. Additionally, our platform requires frequent updates, which may contain undetected errors when first introduced or released. Any errors, defects, disruptions in service, or other performance or stability problems with our platform could result in negative publicity, loss of or delay in market acceptance of our platform, loss of competitive position, delay of payment to us or recruiters, or claims by users for losses sustained by them, which could adversely impact our brand and reputation, operating results and future prospects.

The continued operation of our business depends on the performance and reliability of the internet, mobile, and other infrastructures that are not under our control.

Our business depends on the performance and reliability of the internet, mobile, and other infrastructures that are not always under our control. Disruptions in such infrastructures, including as the result of power outages, telecommunications delay or failure, security breach, or computer virus, as well as failure by telecommunications network operators to provide us with the bandwidth we need to provide our products and offerings, could cause delays or interruptions to our products, offerings, and platform. Any of these events could damage our reputation, resulting in fewer recruiters actively using our platform, disrupt our operations, and subject us to liability, which could adversely affect our business, financial condition, and operating results.

| 10 |

We rely on third parties to host our platform, and any disruption of service from such third parties or material change to, or termination of, our arrangement with them could adversely affect our business.

We use third-party cloud infrastructure services providers and co-located data centers in the United States and abroad to host our platform. As of the date of this Offering Circular, we outsource developers from India and Switzerland, including the head of our AI Engineering, Damian Hischier, who is located in Switzerland. We do not control the physical operation of any of the data centers we use. These facilities are vulnerable to damage or interruption from earthquakes, hurricanes, floods, fires, cyber security attacks, terrorist attacks, power losses, telecommunications failures, and similar events. The occurrence of a natural disaster or an act of terrorism, a decision to close the facilities without adequate notice, or other unanticipated problems could result in lengthy interruptions to our platform. The facilities also could be subject to break-ins, computer viruses, sabotage, intentional acts of violence, and other misconduct. We may not carry sufficient business interruption insurance to compensate us for losses that may occur as a result of any events that cause interruptions in our service. We may not be able to maintain or renew our agreements or arrangements with these third-party service providers on commercially reasonable terms, or at all. If we are unable to renew our agreements on commercially reasonable terms, our agreements are terminated, or we add additional infrastructure providers, we may experience costs or downtime in connection with the transfer to, or the addition of, new data center providers. If these providers increase the cost of their services, we may have to increase the fees to use our platform, and our operating results may be adversely impacted.

Because we have arrangements with related parties affecting a significant part of our operations, such arrangements may not reflect terms that would otherwise be available from unaffiliated third parties.

We rely on arrangements with related parties for support of our operations, including technical support and employer of record services, and may engage in additional related party transactions in the future. Although we believe that the terms of our arrangements with related parties are reasonable and generally consistent with market standards, such terms do not necessarily reflect terms that we or such related parties would agree to in arms-length negotiations with an independent third party. Furthermore, potential conflicts of interest can exist if a related party is presented with an issue that may have conflicting implications for the Company and such related party. If a dispute arises in connection with any of these arrangements, which is not resolved to the satisfaction of the Company, our business could be materially and adversely affected.

The COVID-19 pandemic has resulted in a significant downturn in the global and United States economies and accordingly a decreased demand for recruitment and staffing services, which could have a material adverse effect on our business, financial condition and results of operations.

In late 2019, an outbreak of COVID-19 was first reported in Wuhan, China. In March 2020, the World Health Organization declared the COVID-19 outbreak a global pandemic. The COVID-19 pandemic has resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines and travel bans around the world aimed at controlling the spread of the virus. Businesses are also taking precautions, including requiring employees to work remotely or take leave, imposing travel restrictions and temporarily closing their facilities. Initial unemployment numbers have spiked. Uncertainties regarding the impact of COVID-19 on economic conditions are likely to result in sustained market turmoil and reduced demand for employees, which in its turn has had a negative impact on the recruitment and staffing industry. According to a June 2020 report from CEOToday, the U.S. staffing industry, which previously boasted a market size of $152 billion fell to roughly $119 billion since the COVID-19 outbreak; bringing it down to its lowest level since 2013. This represents a 21% decrease from 2019.

To date the economic impact of COVID-19 has resulted in certain reductions in the Company’s business and the Company has devoted efforts to shifting its focus in areas of hiring. As of the date of this filing, to the Company’s knowledge, no customer of the Company has gone out of business nor have any counterparties attempted to assert the existence of a force majeure clause, which excuses contractual performance. Because we depend on continued demand for recruitment services, a downturn in the recruitment and staffing industry would have a material adverse impact on our business and results of operations.

| 11 |

While to date the Company has not been required to stop operating, management is evaluating its use of its office space, virtual meetings and the like. We had reduced certain operating costs and expenses to respond to the current economic climate. Additionally, while we have experienced, and could continue to experience, a loss of clients as the result of the pandemic, we expect that the impact of such attrition would be mitigated by the addition of new clients resulting from our continued efforts to adjust the Company’s operations to address changes in the recruitment industry. The extent to which the COVID-19 pandemic will impact our operations, ability to obtain financing or future financial results is uncertain at this time. Due to the effects of COVID-19, the Company took steps to streamline certain expenses. Management also worked to reduce unnecessary expenditures and worked to improve certain other capital expenditures, while maintaining overall workforce levels. The Company has seen increased demand for its recruiting solutions in 2022 and has selectively increased salaries and marketing expenditures to support higher demand. The Company expects but cannot guarantee that demand will continue to improve in 2022, as certain clients re-open or accelerate their hiring initiatives, and new clients utilize our services. Overall, management has focused on effectively positioning the Company for a rebound in hiring which we believe has begun and will continue throughout 2022. Ultimately, the recovery may be delayed and the economic conditions may worsen. The Company continues to closely monitor the confidence of its recruiter users and customers, and their respective job requirement load through offline discussions and the Company’s Recruiter Index survey.

If internet search engines’ methodologies or other channels that we utilize to direct traffic to our website are modified, or our search result page rankings otherwise decline, it could negatively affect our future growth.

We depend in part on various internet search engines, such as Google, Yahoo, Bing and others, as well as other internet channels and referral partners to direct traffic to our website. Our ability to maintain the number of visitors directed to our website is not entirely within our control. For example, our competitors’ search engine optimization and other efforts may result in their websites receiving a higher search result page ranking than ours, internet search engines or other channels that we utilize to direct traffic to our website could revise their methodologies in a manner that adversely impacts traffic to our website, or we may make changes to our website that adversely impact our search engine optimization rankings and traffic. As a result, links to our website may not be prominent enough to drive sufficient traffic to our website, and we may not be able to influence the results. Any of these changes could have an adverse impact on our operating results and future growth.

If we or our third-party partners experience a security breach resulting in unauthorized access to our clients’ or recruiters’ data, our data, or our platform, networks, or other systems, our reputation would suffer, demand for our services may be reduced, our operations may be disrupted, we may incur significant legal liabilities, and our business could be materially and adversely affected.

Our business involves storage, processing, and transmission of our clients’ and recruiters’ proprietary, confidential, and personal information as well as the use of third-party partners who store, process, and transmit such proprietary, confidential, and personal information. We also maintain certain other proprietary and confidential information relating to our business and personal information of our employees. Any security breach or incident affecting us or third parties on which we rely, including resulting from computer viruses, malware, physical or electronic break-ins, or weakness resulting from intentional or unintentional service provider or employee actions, could result in unauthorized access to, misuse of, or unauthorized acquisition of our or our clients’ or recruiters’ data, the loss, corruption, or alteration of this data, interruptions in our operations, or damage to our computers or systems or those of our clients or recruiters. If an actual or perceived security breach affecting us or our third-party partners occurs, public perception of the effectiveness of our security measures would suffer, and result in attrition of recruiters on our platform or loss of clients. Any compromise of our or our third-party partners’ security could result in a violation of applicable privacy and other laws, regulatory or other governmental investigations, enforcement actions, and legal and financial exposure, including potential contractual liability. Any such compromise could also result in damage to our reputation and a loss of confidence in our security measures. Any of these effects could adversely impact our business, operating results and growth prospects.

| 12 |

Our platform contains open-source software components, and failure to comply with the terms of the underlying licenses could restrict our ability to market or operate our platform.

We incorporate many types of open-source software, frameworks and databases. Open-source licenses typically permit the use, modification, and distribution of software in source code form subject to certain conditions. Some open-source licenses require any person who distributes a modification or derivative work of such software to make the modified version subject to the same open source license. Accordingly, although we do not believe that we have used open-source software in a manner that would subject us to this requirement, we may be required to distribute certain aspects of our platform or make them available in source code form. Further, the interpretation of open-source licenses is legally complex. If we fail to comply with the terms of an applicable open source software license, we may need to seek licenses from third parties to continue offering our platform and the terms on which such licenses are available may not be economically feasible, to re-engineer our platform to remove or replace the open source software, to limit or stop offering our platform if re-engineering could not be accomplished on a timely or cost-effective basis, to pay monetary damages, or to make available the source code for aspects of our proprietary technology, any of which could adversely affect our business, operating results, and financial condition.

In addition, generally there are no warranties, assurances of title, performance, or non-infringement, or controls on the origin of the software provided for the open-source software. There is typically no support available for open-source software, and no guarantee of periodic updates to address security risks or continued development and maintenance.

Our future growth depends in part on our ability to form new and maintain existing strategic partnerships with third party solution providers and continued performance of such solution providers under the terms of our strategic partnerships with them.

As part of our growth strategy for the Company and, in particular, its enterprise solution offering, we establish and maintain strategic partnerships with large and established third party solution providers to employers, such as companies specializing in enterprise application software, human resources, payroll, talent, time management, tax and benefits administration. Our strategic partnerships include among other things, integration of our platform with those of our strategic partners, joint marketing and commercial alignment, including joint events, and sales of our services by our partners’ representatives. We may be unable to renew or replace our agreements with such strategic partners as and when they expire on comparable terms, or at all. Moreover, the parties with which we have strategic relationships may fail to devote the resources necessary to expand our reach and increase our distribution. In addition, our agreements with our strategic partners generally do not contain any covenants that would limit competing arrangements. Some of our strategic partners offer, or could in the future offer, competing products and services or have similar strategic relationships with our competitors, and may choose to favor our competitors’ solutions over ours. If we are unsuccessful in establishing or maintaining our relationships with third parties, our growth prospects could be impaired, and our operating results may be adversely impacted. Even if we are successful in establishing and maintaining these strategic relationships with third parties, they may not result in the growth of our client base or increased revenue.

Because we rely on a small number of customers for all of our revenue, the loss of any of these customers would have a material adverse effect on our operating results and cash flows.

We derive our revenue from a limited number of customers. Our relationships with these customers are fundamental to our success. For the six months ended June 30, 2022, ten (10) customers accounted for 100% of our total revenue. Any termination of a business relationship with, or a significant sustained reduction in business from, one or more of these customers would have a material adverse effect on our operating results and cash flows unless we are able to secure new customers with similar volume.

Failure to protect our intellectual property could adversely affect our business.

Our success depends in large part on our proprietary technology and data, including our trade secrets, software code, the content of our website, workflows, proprietary databases, registered domain names, registered and unregistered trademarks, trademark applications, copyrights, and inventions (whether or not patentable). In order to protect our intellectual property, we rely on a combination of copyright, trademark, and trade secrets, as well as confidentiality provisions and contractual arrangements.

| 13 |

Despite our efforts, third parties may infringe upon or misappropriate our intellectual property by copying or reverse-engineering information that we regard as proprietary, including our platform, to create products and services that compete with ours. Further, we may be unable to prevent competitors from acquiring domain names or trademarks that are similar to, infringe upon, or diminish the value of our domain names, trademarks, service marks, and other proprietary rights. Moreover, our trade secrets may be compromised by third parties or our employees, which would cause us to lose the competitive advantage derived from the compromised trade secrets. Additionally, effective intellectual property protection may not be available to us in every country in which our platform currently is or may in the future be available. Further, we may be unable to detect infringement of our intellectual property rights, and even if we detect such violations and decide to enforce our intellectual property rights, we may not be successful, and may incur significant expenses, in such efforts. In addition, any such enforcement efforts may be time-consuming, expensive and may divert management’s attention. Further, such enforcement efforts may result in a ruling that our intellectual property rights are unenforceable. Any failure to protect or any loss of our intellectual property may have an adverse effect on our ability to compete and may adversely affect our business, financial condition, and operating results.

We may become subject to intellectual property infringement claims and challenges by third parties.

Third parties may claim that certain aspects of our platform, content, and brand infringe on their intellectual property rights. Any claims or litigation, regardless of merit, could cause us to incur significant legal expenses and, if successfully asserted, could require us to pay substantial damages or make ongoing royalty payments, prevent us from offering certain aspects of our platform, comply with other terms that may be unfavorable to us, or require us to stop using technology that contains the allegedly infringing intellectual property.

Even if intellectual property claims do not result in litigation or are resolved in our favor, these claims typically involve large legal fees, and the time and resources necessary to resolve them could divert our management’s attention and adversely affect our business and operating results. Although the Company takes steps to ensure the validity and security of purchased assets, the purchase of assets or businesses may give rise to claims of intellectual property infringement.

We may become subject to marketing use, image, defamation, or representation claims and challenges by third parties.

We expect to increase our use of image- and video-based recruiting technology solutions, which function by the recording and capture of images and videos of individuals. We store and communicate these images and video to third parties, including the employers that desire to hire individuals as contractors and employees. In providing the transmission of user-generated content, which includes but is not limited to images and video, we may be exposed to certain litigation risks, including but not limited to the right-to-use, defamation, marketing-use, representation, and other claims by both employers and individuals.

If we or our clients are perceived to have violated or are found in violation of, the anti-discrimination laws and regulations as the result of the use of predictive technologies or external independent recruiters in the recruitment process, it may damage our reputation and have a material adverse effect on our business and results of operations.

We and our clients may be exposed to potential claims associated with the use of predictive algorithms and external recruiters in the recruitment process, including claims of age and gender discrimination. For example, Title VII of the Civil Rights Act of 1964 (“Title VII”) prohibits employers from limiting employment opportunities based on certain protected characteristics, including race, color, religion, sex, and national origin. The Age Discrimination in Employment Act of 1967 (the “ADA”) prohibits discrimination based on age. Certain social media companies, as well as employers purchasing targeted ads from such companies, have recently come under scrutiny for discriminatory advertising. In September 2019, the U.S. Equal Employment Opportunity Commission (the “EEOC”) ruled that several employers violated the ADA and Title VII by publicizing job openings on social media through the use of ads that targeted young men to the detriment of women and older workers. If we or our clients are perceived to have violated or are found in violation of, Title VII, the ADA, or any other anti-discrimination laws and regulations as the result of the use of predictive technologies in the recruitment process, it may damage our reputation and have a material adverse effect on our business and results of operations.

| 14 |

If we cannot manage our growth effectively, our results of operations would be materially and adversely affected.

We have experienced significant growth, including quarterly revenue increase of over 580% in the second quarter of 2022 compared to the second quarter of 2021. Businesses that grow rapidly often have difficulty managing their growth while maintaining their compliance and quality standards. If we continue to grow as rapidly as we anticipate, we will need to expand our management by recruiting and employing additional executive and key personnel capable of providing the necessary support. There can be no assurance that our management will be able to effectively manage our growth or meet our delivery requirements. Our failure to meet the challenges associated with rapid growth could materially and adversely affect our business and operating results.

If we are unable to maintain our relationships with payment and banking partners, our business could be materially and adversely affected.

We also rely on a network of disbursement partners to disburse funds to recruiters on our platform, including our banking partners and payment solution providers. We also rely on Amazon.com to send gift cards and merchandise from time to time to independent recruiters and members of our network and community, as incentives for various actions, including submission of qualified candidates and responding to surveys.

Relationships with our payment partners are critical to our business. We may not be able to maintain these relationships in the future on terms favorable to us or at all. Our payment partners may, among other things:

| · | be unable to effectively accommodate evolving service needs, including as the result of rapid growth or higher volume; |

| · | choose to terminate or not renew their agreements with us, or only be willing to renew on less advantageous terms; |

| · | change the scope of their services provided to us, cease doing business with us, or cease doing business altogether; or |

| · | experience delays, limitations, or closures of their own businesses, networks, or systems, resulting in their inability to process payments or disburse funds for certain periods of time. |

Alternatively, we may be forced to cease doing business with our payment processors if card association operating rules, certification requirements and laws, regulations, or rules governing electronic funds transfers to which we are subject change or are interpreted to make it more difficult or impossible for us to comply. If we are unable to maintain our current relationships with payment partners on favorable terms, or if we are unable to enter into new agreements with payment partners, our business may be material and adversely affected.

We operate in an intensively competitive industry, and we may not be able to compete successfully.

The HR-Tech, staffing and recruitment industry is intensely competitive and we face significant competition in all aspects of our business, and we expect such competition to increase, particularly in the market for online procurement of professional employee talent. Larger and more established companies may focus on our direct market and could directly compete with us. Smaller companies, including software developers, could also launch new services that compete with us that could gain market acceptance quickly.

Many of our current and potential competitors enjoy substantial competitive advantages, such as greater name recognition, longer operating histories, greater financial, technical, and other resources, that could allow them to respond more quickly and effectively than we do to new or changing opportunities, technologies, standards, regulatory conditions, or user preferences or requirements. These companies may use these advantages to offer products and services similar to ours at a lower price, develop different products and services to compete with our platform.

| 15 |

Moreover, current and future competitors may also make strategic acquisitions or establish cooperative relationships among themselves or with others, including our current or future third-party partners. By doing so, these competitors may increase their ability to meet the needs of existing or prospective users. These developments could limit our ability to obtain revenue from existing and new users. If we are unable to compete effectively against current and future competitors, our business and operating results would be materially and adversely impacted.

Our future success depends on our ability to retain and attract high-quality personnel, and the efforts, abilities and continued service of our senior management, and unsuccessful succession planning could adversely affect our business.

Our future success will depend in large part on our ability to attract and retain high-quality management, operations, and other personnel who are in high demand, are often subject to competing employment offers, and are attractive recruiting targets for our competitors. The loss of qualified executives and key employees, or inability to attract, retain, and motivate high-quality executives and employees required for the planned expansion of our business, may harm our operating results and impair our ability to grow.

We depend on the continued services of our key personnel, including Edward Aizman, a Director and our Chief Executive Officer, Secretary and Treasurer, Michael Lakshin, our President and Chairman of the Board of Directors, and Conrad Huss, our Co-Chairman of the Board of Directors. The Company has entered into employment agreements with each of these individuals. Our work with each of these key personnel are subject to changes and/or termination, and our inability to effectively retain the services of our key management personnel, could materially and adversely affect our operating results and future prospects.

If there are adverse changes in domestic and global economic conditions, it may negatively impact our business.

Our business depends on the continued demand for labor and on the economic health of current and prospective clients that use our platform and services. Any significant weakening of the economy in the United States or globally, more limited availability of credit, a reduction in business confidence and activity, economic uncertainty, financial turmoil affecting the banking system or financial markets, a more limited market for independent professional service providers or information technology services, and other adverse economic or market conditions may adversely impact our business and operating results. Global economic and political events or uncertainty may cause some of our current or potential clients to curtail spending on hiring and may ultimately result in new regulatory and cost challenges to our operations. The COVID-19 pandemic has had a negative effect on the global economic condition as well as the U.S. staffing industry. These adverse conditions could result in reductions in revenue, longer sales cycles, slower adoption of new technologies and increased competition, which could in turn materially and adversely affect our business, financial condition, and operating results.

The regulatory framework for privacy and data protection is complex and evolving, and changes in laws or regulations relating to privacy or the protection or transfer of personal data, or any actual or perceived failure by us to comply with such laws and regulations, could adversely affect our business.

During our day-to-day business operations we receive, collect, store, process, transfer, and use personal information and other user data. As the result, we are subject to numerous federal, state, local, and international laws and regulations regarding privacy, data protection, information security, and the collection, storing, sharing, use, processing, transfer, disclosure, and protection of personal information and other content. We are also subject to the terms of our privacy policies and obligations to third parties related to privacy, data protection, and information security. We strive to comply with applicable laws, regulations, policies, and other legal obligations relating to privacy, data protection, and information security to the extent possible. However, the regulatory framework for privacy and data protection both in the United States and abroad is, and is likely to remain for the foreseeable future, uncertain and complex, is changing, and the interpretation and enforcement of the rules and regulations that form part of this regulatory framework may be inconsistent among jurisdictions, or conflict with other laws and regulations. Such laws and regulations as they apply to us may be interpreted and enforced in a manner that we do not currently anticipate. Any significant change in the applicable laws, regulations, or industry practices regarding the collection, use, retention, security, or disclosure of user data, or their interpretation, or any changes regarding the manner in which the express or implied consent of users for the collection, use, retention, or disclosure of such data must be obtained, could increase our costs and require us to modify our platform and our products and services, in a manner that could materially affect our business.

| 16 |

The laws, regulations, and industry standards concerning privacy, data protection, and information security also continue to evolve. For example, in June 2018, California passed the California Consumer Privacy Act (the “CCPA”), effective January 1, 2020, which requires companies that process personal information of California residents to make new disclosures to consumers about such companies’ data collection, use, and sharing practices and inform consumers of their personal information rights such as deletion rights, allows consumers to opt out of certain data sharing with third parties, and provides a new cause of action for data breaches. The State of Nevada has also passed a law, effective October 1, 2019, that amends the state’s online privacy law to allow consumers to submit requests to prevent websites and online service providers from selling personally identifiable information that they collect through a website or online service. The costs of compliance with, and other burdens imposed by, the privacy and data protection laws and regulations may limit the use and adoption of our services and could have a material adverse impact on our business. As a result, we may need to modify the way we treat such information.

Any failure or perceived failure by us to comply with any privacy and data protection policies, laws, rules, and regulations could result in proceedings or actions against us by individuals, consumer rights groups, governmental entities or agencies, or others. We could incur significant costs investigating and defending such claims and, if found liable, significant damages. Further, public scrutiny of or complaints about technology companies or their data handling or data protection practices, even if unrelated to our business, industry, or operations, may lead to increased scrutiny of technology companies, including us, and may cause government agencies to enact additional regulatory requirements, or to modify their enforcement or investigation activities, which may increase our costs and risks.

If we sustain an impairment in the carrying value of long-lived assets and goodwill, it will negatively affect our operating results.

We may have a significant amount of long-lived intangible assets and goodwill on our consolidated balance sheet. Under the Generally Accepted Accounting Principles in the U.S. (“GAAP”), long-lived assets are required to be reviewed for impairment whenever events or changes in circumstances indicate that the book value of the asset may not be recoverable. If business conditions or other factors cause profitability and cash flows to decline, we may be required to record non-cash impairment charges. Goodwill must be evaluated for impairment at least annually or more frequently if events indicate it is warranted. If the carrying value of a reporting unit exceeds its current fair value, the goodwill is considered impaired. Events and conditions that could result in impairment in the value of our long-lived assets and goodwill include, but are not limited to, significant negative industry or economic trends, competition and adverse changes in the regulatory environment, significant decline in the Company’s stock price for a sustained period of time, limited funding, as well as or other factors leading to reduction in expected long-term revenues or profitability. If we record impairment charges related to our goodwill and long-lived assets, our operating results would likely be materially and adversely affected.

If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired. We have previously reported material weaknesses in both the design and effectiveness of our internal control over financial reporting.

We seek to maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, we have expended, and anticipate that we will continue to expend, significant resources, including accounting-related costs and significant management oversight.

Any failure to develop or maintain effective controls or any difficulties encountered in their implementation or improvement could cause us to fail to meet our reporting obligations and may result in a restatement of our financial statements for prior periods. If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired, which could result in loss of investor confidence and could have an adverse effect on our stock price.

| 17 |

Our management previously determined that we had material weaknesses in both the design and effectiveness of our internal control over financial reporting. A material weakness in internal controls is a deficiency in internal control, or combination of control deficiencies, that adversely affects our ability to initiate, authorize, record, process, or report external financial data reliably in accordance with GAAP such that there is more than a remote likelihood that a material misstatement of our annual or interim financial statements that is more than inconsequential will not be prevented or detected. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Evaluation of Disclosure Controls and Procedures.”

We are working to resolve the identified material weaknesses which, if not remediated, could result in erroneous or misstated financial statements and information and could have a material adverse effect on our assets, business, cash flows, cash flows, condition (financial or otherwise), liquidity, prospects, results of operations and stock price.

Risks Related to this Offering and Our Common Stock

Our Common Stock may be affected by limited trading volume and price fluctuations, which could adversely impact the value of our Common Stock.

To date there has been limited trading in our Common Stock and there can be no assurance that an active trading market in our Common Stock will either develop or be maintained. Our Common Stock is likely to experience significant price and volume fluctuations in the future, which could adversely affect the market price of our Common Stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets, including as the result of the COVID-19 pandemic and general economic weakness, could cause the price of our Common Stock to fluctuate substantially. These fluctuations may also cause short sellers to periodically enter the market in the belief that we will have poor results in the future. We cannot predict the actions of market participants and, therefore, can offer no assurances that the market for our Common Stock will be stable or appreciate over time.

Because we may issue preferred stock without the approval of our stockholders and have other anti-takeover defenses, it may be more difficult for a third party to acquire us and could depress our stock price.

In general, the Board may authorize, without a vote of our stockholders, an issuance of one or more additional series of preferred stock that have more than one vote per share, although the Company’s ability to designate and issue preferred stock is currently restricted by covenants under our agreements with prior investors. Without these restrictions, our Board could issue preferred stock to investors who support us and our management and give effective control of our business to our management. Additionally, issuance of preferred stock could block an acquisition resulting in both a drop in our stock price and a decline in interest of our Common Stock. This could cause the market price of our Common Stock shares to drop significantly, even if our business is performing well, and make it more difficult for shareholders to sell their Common Stock.

Because we can issue additional shares of Common Stock, our stockholders may experience dilution in the future.

We are authorized to issue up to 40,000,000,000 shares of Common Stock. As of August 15, 2022, we have 18,572,705,574 shares of Common Stock issued and outstanding. Our board of directors has the authority to cause us to issue additional shares of Common Stock without the consent of any of our stockholders. Consequently, you may experience more dilution in your ownership of our securities in the future.

The market price of our Common Stock may be volatile and could decline.