f10k2012_huixinwaste.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2012

|

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ___________

Commission file number 000-52339

Huixin Waste Water Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Cayman Islands

|

|

N/A

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

#99 Jianshe Road 3, Pengjiang District, Jiangmen City

Guangdong Province, 529000

People’s Republic of China

|

|

(Address of principal executive offices and Zip Code)

|

+86 (750) 395-9988

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

| |

|

|

Title of each class registered:

|

Name of each exchange on which registered:

|

|

None

|

None

|

| |

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

|

Ordinary Shares, par value $ 0.00018254172 per share

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes oNo x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes oNo o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

|

Accelerated filer

|

o

|

| |

|

|

|

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

o

|

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held non-affiliates: none.

As of March 29, 2013 the registrant has 21,126,695 ordinary shares, par value $0.00018254172 per share, issued and outstanding.

Documents Incorporated by Reference

None.

TABLE OF CONTENTS

|

Item Number and Caption

|

|

Page

|

| |

|

|

|

|

PART I

|

|

|

| |

|

|

|

|

Item 1.

|

|

|

1

|

| |

|

|

|

|

Item 1A.

|

|

|

16

|

| |

|

|

|

|

Item 1B.

|

|

|

34

|

| |

|

|

|

|

Item 2.

|

|

|

34

|

| |

|

|

|

|

Item 3.

|

|

|

47

|

| |

|

|

|

|

Item 4.

|

|

|

47

|

| |

|

|

|

|

PART II

|

|

|

| |

|

|

|

|

Item 5.

|

|

|

48

|

| |

|

|

|

|

Item 6.

|

|

|

50

|

| |

|

|

|

|

Item 7.

|

|

|

51

|

| |

|

|

|

|

Item 7A.

|

|

|

59

|

| |

|

|

|

|

Item 8.

|

|

|

59

|

| |

|

|

|

|

Item 9.

|

|

|

59

|

| |

|

|

|

|

Item 9A.

|

|

|

59

|

| |

|

|

|

|

Item 9B.

|

|

|

60

|

| |

|

|

|

|

PART III

|

|

|

| |

|

|

|

|

Item 10.

|

|

|

61

|

| |

|

|

|

|

Item 11.

|

|

|

66

|

| |

|

|

|

|

Item 12.

|

|

|

67

|

| |

|

|

|

|

Item 13.

|

|

|

69

|

| |

|

|

|

|

Item 14.

|

|

|

73

|

| |

|

|

|

|

PART IV

|

|

|

| |

|

|

|

|

Item 15.

|

|

|

F-1

|

| |

|

|

|

|

|

|

76

|

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of Huixin Waste Water Solutions, Inc. (“Huixin”) and its consolidated subsidiaries, Wealth Environmental Protection, Wealth Environmental Technology, Jiangmen Huiyuan, and its variable interest entities, Jiangmen Wealth Water, Guizhou Yufeng and Shanxi Wealth.

In addition, unless the context otherwise requires and for the purposes of this report only

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

●

|

“Guizhou Yufeng” refers to Guizhou Yufeng Melt Co., Ltd, a PRC limited company;

|

|

●

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

|

|

●

|

“Jiangmen Huiyuan” refers Jiangmen Huiyuan Environmental Protection Technology Consultancy Co. Ltd., a wholly foreign owned enterprise organized under the PRC laws;

|

|

●

|

“Jiangmen Wealth Water” refers to Jiangmen Wealth Water Purifying Agent Co., Ltd. , a PRC limited liability company;

|

|

●

|

“PRC”, “China”, and “Chinese” refer to the People’s Republic of China;

|

|

●

|

“PRC Operating Company” /”PRC Subsidiary” or “PRC Operating Companies” /”PRC Subsidiaries” refers to each of Jiangmen Huiyuan, Jiangmen Wealth Water, Guizhou Yufeng and Shanxi Wealth, individually or collectively;

|

|

●

|

“Renminbi” and “RMB” refer to the legal currency of China;

|

|

●

|

“SEC” refers to the United States Securities and Exchange Commission;

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended;

|

|

●

|

“Shanxi Wealth” refers to Shanxi Wealth Aluminate Materials Co., Ltd, a PRC limited company;

|

|

●

|

“Star Prince” refers to Star Prince Limited, a British Virgin Island company and a shareholder of Wealth Environmental Protection;

|

|

●

|

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States;

|

|

●

|

“Wealth Environmental Protection” refers to Wealth Environmental Protection Group, Inc., a British Virgin Islands company;

|

|

●

|

“Wealth Environmental Protection Shareholders” refers to all shareholders of Wealth Environmental Protection, a British Virgin Islands company; and

|

|

●

|

“Wealth Environmental Technology” refers to Wealth Environmental Technology Holding, Ltd., a Hong Kong company.

|

PART I

Overview

We are a leading producer and distributer of water purifying agents and High-performance Aluminate Calcium (“HAC”) powder, the core component of water purifying agents.

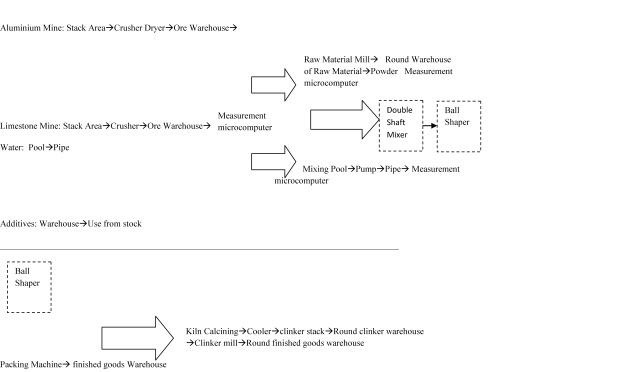

Jiangmen Wealth Water, our PRC Operating Company, is solely engaged in the production and sale of water purifying agents, while Guizhou Yufeng and Shanxi Wealth, the subsidiaries of Jiangmen Wealth Water, specialize in the production and sale of HAC powder. The core raw material of our water purifying agent is HAC powder, exclusively supplied by Guizhou Yufeng. Guizhou Yufeng manufactures HAC powder using the raw materials of aluminum ore and limestone from its own mines. While selling HAC powder to third party customers, it prioritizes the supply to Jiangmen Wealth Water over third party customers and ensures that its supply meets the demand of Jiangmen Wealth Water before its products are sold to other customers.

Jiangmen Wealth Water’s self-owned production facilities are located at Jiangmen City, Guangdong Province, southeast China, covering an aggregate area of 36.84 mu (approximately 264,361.63 square feet). To expand our sales network and avoid high transportation costs arising from the delivery of liquid purifying agents to customers located in different geographic areas, Jiangmen Wealth Water has established production entrustment agreements with four water purifying agent production lines located at Zhaoqing City, Guangdong Province, Yibin City, Sichuan Province, Nanchang City, Jiangxi Province and Hangzhou City, Zhejiang Province (individually, the “Entrusted Production Line,” and collectively, the “Entrusted Production Lines”), that solely produce water purifying agents using our raw materials and pursuant to our production guidance and quality control standards.

Corporate History and Background

We were organized under the laws of the Cayman Islands on September 27, 2006 as a blank check development stage company formed for the purpose of acquiring an operating business, through a stock exchange, asset acquisition or similar business combination. On December 15, 2010, we completed a reverse acquisition transaction through a share exchange with Wealth Environmental Protection whereby we acquired 100% of the issued and outstanding capital stock of Wealth Environmental Protection. As a result of the reverse acquisition, Wealth Environmental Protection became our wholly-owned subsidiary. As a result of our reverse acquisition of Wealth Environmental Protection, we have assumed the business and operations of Jiangmen Huiyuan with our principle activities engaged in the manufacture of water purifying agents which are distributed in the southern, south-western, mid-eastern, and eastern part of China.

Wealth Environmental Protection was incorporated under the laws of British Virgin Islands on June 3, 2010 to serve as an investment holding company, and Wealth Environmental Technology was incorporated under the laws of Hong Kong by Wealth Environmental Protection on June 18, 2010. Jiangmen Huiyuan was incorporated under the laws of PRC on July 22, 2010, as wholly-owned subsidiary of Wealth Environmental Technology.

On September 29, 2010, Jiangmen Huiyuan entered into a series of contractual agreements with Jiangmen Wealth Water, a company incorporated under the laws of the PRC, and its shareholders, in which Jiangmen Huiyuan effectively assumed management of the business activities of Jiangmen Wealth Water and has the right to appoint all executives and senior management and the members of the board of directors of Jiangmen Wealth Water. The contractual arrangements are comprised of a series of agreements, including an Exclusive Business Cooperation Agreement, Exclusive Option Agreement, Equity Interest Pledge Agreement and Power of Attorney, through which Jiangmen Huiyuan has the right to provide exclusive complete business support and technical and consulting service to Jiangmen Wealth Water for an annual fee in the amount of Jiangmen Wealth Water’s yearly net profits after tax. Additionally, Jiangmen Wealth Water’s shareholders have pledged their rights, titles and equity interest in Jiangmen Wealth Water as security for Jiangmen Huiyuan to collect consulting and services fees provided to Jiangmen Wealth Water through an Equity Pledge Agreement. In order to further reinforce Jiangmen Huiyuan’s rights to control and operate Jiangmen Wealth Water, the shareholders of Jiangmen Wealth Water have granted Jiangmen Huiyuan the exclusive right and option to acquire all of their equity interests in Jiangmen Wealth Water through an Exclusive Option Agreement. On December 27, 2010, Mr. Tan transferred all of his interest in Shanxi Wealth to Jiangmen Wealth Water, pursuant a share transfer agreement between Mr. Tan and Jiangmen Wealth Water, and Jiangmen Wealth Water became the sole shareholder of Guizhou Yufeng and Shanxi Wealth. As all of the companies are under common control, this has been accounted for as a reorganization of entities and the financial statements have been prepared as if the reorganization had occurred retroactively. We have consolidated the operating results, assets and liabilities of Jiangmen Wealth Water within our financial statements.

In August, 2010, Jiangmen Wealth Environmental Protection Co., Ltd. transferred (i) all its equity interests in Jiangmen Wealth Water to Mr. Minzhuo Tan and Ms. Hongyu Du and (ii) all its equity interests in Guizhou Yufeng to Jiangmen Wealth Water and, Jiangmen Wealth Water became the sole shareholder of Guizhou Yufeng. In September, 2010, Jiangmen Wealth Environmental Protection Stock Co., Ltd. and other minority shareholders of Shanxi Wealth transferred all their equity interests in Shanxi Wealth to Jiangmen Wealth Water and Jiangmen Wealth Water therefore became the 62% shareholder of Shanxi Wealth of which 38% equity interest were held by Mr. Mingzhuo Tan. In December 2010, Jiangmen Wealth Water became the 100% shareholder of Shanxi Wealth. Upon the completion of the said transfers, Jiangmen Wealth Environmental Protection Stock Co., Ltd. no longer held any equity interests in our PRC subsidiaries in the Corporate Structure.

As a result of our reverse acquisition of Wealth Environmental Protection, we have assumed the business and operations of Jiangmen Huiyuan with our principles activities engaged in the manufacture of water purifying agents which are distributed in the southern, south-western, mid-eastern, and eastern part of China.

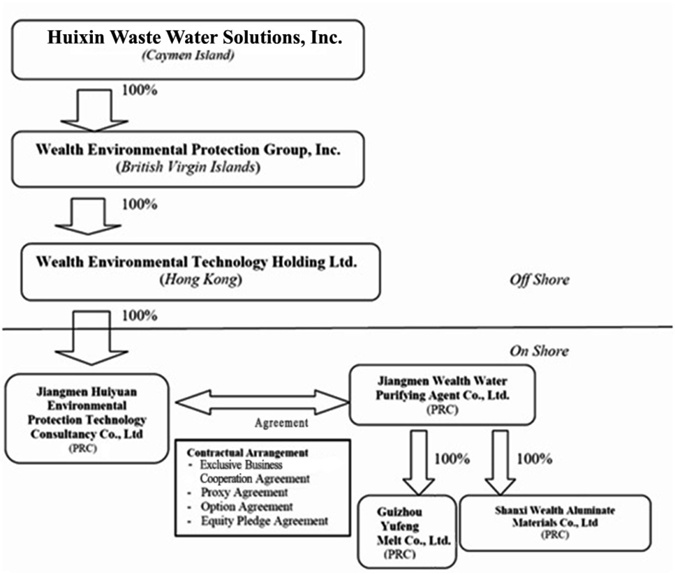

Our Corporate Structure

All of our business operations are conducted through our PRC subsidiaries. The chart below presents our corporate structure:

|

● Wealth Environmental Protection was incorporated under the laws of British Virgin Islands on June 3, 2010 to serve as an investment holding company.

|

|

● Wealth Environmental Technology was incorporated under the laws of Hong Kong by Wealth Environmental Protection on June 18, 2010.

|

|

● Jiangmen Huiyuan was incorporated under the laws of PRC on July 22, 2010 as a wholly foreign owned enterprise.

|

|

(1)

|

On September 29, 2010, Jiangmen Huiyuan entered into an Exclusive Business Cooperation Agreement with Jiangmen Wealth Water, pursuant to which Jiangmen Huiyuan will provide Jiangmen Wealth Water with exclusive and complete business support, and technical and consulting services related to the principal business of Jiangmen Wealth Water.

|

|

(2)

|

On September 29, 2010, each of Jiangmen Huiyuan and Jiangmen Wealth Water entered into an Equity Interest Pledge Agreement with Mr. Mingzhuo Tan and Ms. Hongyu Du, respectively, pursuant to which Mr. Tan and Ms. Du pledged all of their equity interest in Jiangmen Wealth Water to Jiangmen Huiyuan to secure Jiangmen Water Wealth’s obligations under the Exclusive Business Cooperation Agreement. On September 29, 2010, the pledges were registered with the Pengjiang Branch of Jiangmen Administration of Industry and Commerce.

|

|

(3)

|

On September 29, 2010, Jiangmen Huiyuan and Jiangmen Wealth Water entered into an Exclusive Option Agreement with Mr. Tan and Ms. Du, respectively, pursuant to which Jiangmen Huiyuan obtained the exclusive option to purchase or designate another qualified person to purchased part or all of the equity interest that Mr. Tan and Ms. Du hold in Jiangmen Wealth Water to the extent permitted by the PRC law.

|

|

(4)

|

On September 29, 2010, each of Mr. Tan and Ms. Du signed a power of attorney which provides that Jiangmen Huiyuan has the power to act as his/her exclusive agent with respect to all matters related to his/her equity interest in Jiangmen Wealth Water while he or she is a shareholder of Jiangmen Wealth Water.

|

|

(5)

|

On December 27, 2010, pursuant a share transfer agreement between Mr. Tan and Jiangmen Wealth Water, Mr. Tan transferred all of his interest in Shan Xi Wealth to Jiangmen Wealth Water for the consideration of a cash payment of RMB 1.9 million (representing $290,520, based upon a conversion rate of 6.54.)

|

Recent Development

Share Exchange

On December 15, 2010 (the “Closing Date”), we entered into a share exchange agreement (the “Exchange Agreement”) with Wealth Environmental Protection, and Wealth Environmental Protection Shareholders. Pursuant to the terms of the Exchange Agreement, Wealth Environmental Protection Shareholders transferred to us all of the issued and outstanding ordinary shares of Wealth Environmental Protection, in exchange for the issuance of a total of 17,500,000 ordinary shares, par value $0.00018254172 per share (after giving effect to the Reverse Split as defined below), or 96.15% of the ordinary shares of the Company issued and outstanding after the Closing Date (such transaction is hereinafter referred to as the “Share Exchange”). Pursuant to the Exchange Agreement, Wealth Environmental Protection became our wholly-owned subsidiary. Wealth Environmental Protection holds all of the issued and outstanding capital stock of Wealth Environmental Technology, a company incorporated under the laws of Hong Kong, which is the holding company of Jiangmen Huiyuan which controls Jiangmen Wealth Water, a company organized under the laws of PRC by a series of contractual agreements and arrangements with Jiangmen Wealth Water and/or its shareholders. As a result of the Share Exchange, we are now the holding company of Jiangmen Huiyuan, an indirect wholly-owned subsidiary of Wealth Environmental Protection organized in the PRC.

Private Placement

On December 15, 2010, we completed a private placement transaction with a group of accredited investors. Pursuant to the subscription agreement with the investors (the “Subscription Agreement”), we issued to the investors an aggregate of 222,402 units for a purchase price of $6,672,031, or $30.00 per unit (the “Unit”) (such transaction is hereinafter referred to as the “Private Placement”). Each Unit consists of two preference shares with each preference share convertible into five (5) (after giving effect to the Reverse Split as defined below and subject to customary adjustments for stock splits, combinations, or equity dividends on ordinary shares) ordinary shares (the “Preference Shares”) and a warrant to purchase five (5) ordinary shares (the “Warrants”) (after giving effect to the Reverse Split as defined below). The Warrants have a term of five (5) years, bear an exercise price of $4.50 per share (after giving effect to the Reverse Split as defined below and subject to customary adjustments), are exercisable on a net exercise or cashless basis and are exercisable by investors at any time after the Closing Date.

Registration Statement

Pursuant to the Subscription Agreement, we filed a registration statement on Form S-1 (the “Registration Statement”) covering the resale of the ordinary shares underlying the Preference Shares and the Warrants with the SEC. The Registration Statement was declared effective on February 13, 2012. No liquidated damages were due and payable related to registration rights under the Subscription Agreement as of December 31, 2012 and 2011.

Make Good Escrow Agreement

In connection with the Private Placement, we entered into a make good escrow agreement with Star Prince, and Access America Investments, LLC (“AAI”) as representative of the investors (the “Make Good Escrow Agreement”), pursuant to which Star Prince delivered into an escrow account share certificates evidencing 4,500,000 ordinary shares held by it (after giving effect to the Reverse Split defined below), to be held in favor of the investors in order to secure certain make good obligations (the “Escrow Shares”). Under the Make Good Escrow Agreement, we established minimum after tax net income thresholds (as determined in accordance with the United States Generally Accepted Accounting Principles (the “US GAAP”) and excluding any non-cash charges incurred related to the Share Exchange and the Private Placement as described here above) of $13.2 million for fiscal year 2010 and $18.09 million for fiscal year 2011 and minimum earnings per share thresholds (calculated on a fully diluted basis and including adjustment for any stock splits, stock combinations, stock dividends or similar transactions, and for shares issued in one public offering or pursuant to the exercise of any warrants, options, or other securities issued during or prior to the calculation period) of $0.58 for fiscal year 2010 and $0.66 for fiscal year 2011. If our after tax net income or earnings per share for either fiscal year 2010 or fiscal year 2011 is less than 90% of the applicable performance threshold, then the performance threshold will be deemed not to have been achieved, and the investors pro rata based on the number of units purchased by each Investor in the Offering, will be entitled to receive ordinary shares based upon a pre-defined formula which shall equate to the product of (A) the percentage difference between the applicable performance threshold and actual performance (if both applicable performance thresholds have not been achieved, then the applicable performance threshold yielding the greater difference from actual performance shall be used) times (B) the total number of the Escrow Shares. The parties agreed that, for purposes of determining whether or not any of the performance thresholds are met, the release of any of the escrowed shares and any related expense recorded under the GAAP shall not be deemed to be an expense, charge, or any other deduction from revenues even if the GAAP requires contrary treatment or the annual report for the respective fiscal years filed with the SEC by the Company may report otherwise. For the years ended December 31, 2011 and 2010, the Company achieved the performance thresholds, and none was due to investors under such Make Good Escrow Agreement.

Holdback Escrow Agreement

In connection with the Private Placement, on December 15, 2010, we entered into a Holdback Escrow Agreement with Anslow & Jaclin, LLP (“A&J”), the escrow agent, and AAI, as investor representative (the “Holdback Escrow Agreement”), pursuant to which $2,167,203 was deposited with the escrow agent to be distributed upon the satisfaction of certain covenants set forth in the Subscription Agreement. Pursuant to the Holdback Escrow Agreement, the $1,500,000 shall be released to the Company upon the hiring of a chief financial officer on terms acceptable to AAI (the “Chief Financial Officer Holdback”) and $667,203.20 shall be released to us upon appointment of the required independent directors to our board of directors. In March 2011, pursuant to the Holdback Escrow Agreement, $667,203.20 was released to us upon appointment of the required independent directors to our board of directors.

On May 20, 2011, the Holdback Escrow Agreement was amended to provide that as soon as practicable following the Offering, the Company shall employ a chief financial officer meeting certain requirements and to permit the “Lead Investor” (as defined in the Subscription Amendment) to authorize the escrow agent appointed pursuant to the Holdback Escrow Agreement to disburse a portion of the Chief Financial Officer Holdback, such portion not to exceed $750,000 in the aggregate, to the Company (a “Good Faith Disbursement”). Pursuant to Holdback Escrow Agreement, as amended on May 20, 2011, $750,000 was released to us as Good Faith Disbursement. On December 1, 2011, the Holdback Escrow Agreement was further amended to provide for a series of disbursements from the Chief Financial Officer Holdback to the Company of $100,000 commencing on December 1, 2011 and continuing on the first day of each successive month thereafter until the remaining balance of the Chief Financial Officer Holdback is disbursed to the Company (the “Monthly Disbursements”). As of December 31, 2012, all funds were released from the escrow account.

IR Escrow Agreement

On December 15, 2010, we also entered into an investor relations escrow agreement with A&J, the escrow agent, and AAI, as representative of the investors (the “IR Escrow Agreement”), pursuant to which $120,000 was deposited with the escrow agent to be distributed in incremental amounts to pay our investor relations firm, the choice of which is subject to the approval of AAI, which approval cannot be unreasonably withheld. On November 14, 2012, the IR Escrow Agreement was amended to change the escrow agent to Dai & Associates, P.C. Pursuant to the original IR Escrow Agreement, the entire IR Escrow Amount shall be returned to the Company within two years of the date of the IR Escrow Agreement if the funds have not been disbursed to hire any investor relations firm. As of December 31, 2012, all funds were released from the IR escrow account.

Lockup Agreements

In connection with the Private Placement, we also entered into lockup agreements, with Wealth Environmental Protection Shareholders, pursuant to which each of Wealth Environmental Protection Shareholders agreed not to transfer any of our capital stock held directly or indirectly by them for an eighteen-month period following the closing of the Private Placement, unless it is approved otherwise by AAI.

The foregoing description of the terms of the Exchange Agreement, the Warrant, the Subscription Agreement, the Make Good Escrow Agreement, the Holdback Escrow Agreement, the IR Escrow Agreement and the Lockup Agreement are qualified in their entirety by reference to the provisions of the agreements filed as Exhibits 2.1, 4.1, 10.1, 10.2, 10.3, 10.4, 10.5 and 10.6, respectively, to this report, which are incorporated by reference herein.

Reverse Split

On December 15, 2011 , we effectuated a 1:1.42610714 reverse stock split of the Company’s issued and outstanding ordinary shares such that the share capital of the Company was consolidated and increased from US $5,100 divided into 39,062,500 Ordinary Shares of US$0.000128 par value each and 781,250 Preference Shares of US$0.000128 par value each, to US $7,230.536 divided into 39,062,500 Ordinary Shares of US$0.00018254172 par value each and 781,250 Preference Shares of US$0.000128 par value each (the “Reverse Split”). After the adjustment for such Reverse Split, each Preference Shares will be convertible into 5 ordinary shares and the holder of each Warrant will be entitled to purchase 5 ordinary shares at an exercise price of $4.50 per share.

Industry and Market Overview

The annual amount of wastewater discharge in China has increased from 2006 to 2011 at a 2.9%- 5.6% growth rate per year. In 2011, the amount of wastewater discharge in China reached 65.21 billion tons (Source: China Environment Condition Report, 2011, released by PRC Environmental Protection Department in June 2012, available at http://jcs.mep.gov.cn/hjzl/zkgb/2011zkgb/201206/t20120606_231040.htm). Due to deterioration in both water quantity and quality, water resource protection became a concern on the top of the agenda for both the Chinese government and the Chinese public. The Chinese government has adopted regulations and policies listing waste water disposal and drinking water safety as two issues of priority importance for the mid-term and long-term national development plans. The Chinese government is focused on controlling wastewater disposal rates, increasing the wholesome water coverage rate, raising discharge standards for nitrogen and phosphorus, and raising standards for drinking water.

As an expected result from the above-mentioned governmental endeavors, the demand for water purifying products has increased over the years and is expected to continue to increase in the future for a relatively long period of time, considering China’s large population and the severity of China’s current environmental situation. Accordingly, we believe that there will be increasing market need for our water purifying products.

Current Products

Water Purifying Agents

Jiangmen Wealth Water manufactures a variety of water purification products, including dyeing purifying agent, purifying for paper making waste water, purifying agent of phosphorus removal, and discoloring agent, for industries such as printing and dyeing, paper making, municipal wastewater, phosphorus removal, and oil removal from washing water.

Traditional water purifying agents are usually produced for general purposes without tailoring to the needs of particular industrial requirements. Our water purifying agents, on the other hand, are specially developed by our research and development team and the institutions Tongji University and Chongqing University, with whom we work toward the goal of satisfying particular industrial situations and requirements. We entered into a technology development agreement with Tongji University in October 2003 (the “Tongji Agreement”) and, pursuant to the agreement, we have completed the research and development of the HAC powder which has been used in our water purifying agents. A copy of the Tongji Agreement was filed with the SEC on the Company’s current report on the amendment No. 1 to Form 8-K dated February 28, 2010. We have also been working with Chongqing University since 2005 on the research and development of water purifying technology, including developing flocculent for enhanced coagulation for drinking water, and we have not entered into any agreement in connection with such cooperation. With the technologies derived from our research and development, our products have been demonstrated satisfactory performance.

|

●

|

Dyeing Purifying Agent: The product is developed for the active dyes, acid dyes and direct dyes of the printing and dyeing wastewater, which is a polymeric flocculant made by a special synthetic polymer technology and added auxiliary decolorization agent. This product has a good decolorization and chemical oxygen demand (COD) removal effects, and is widely used in the treatment process of dyeing industrial wastewater. COD refers to the consumption of oxidizer when using strong oxidizer in water treatment process and indicates the amount of reducing substance in water which is the target to be removed by the purifying agent. COD removal effect refers to the performance of a purifying agent or equipment in removing reducing substance and is considered as an evaluating method of water treatment effect.

|

|

●

|

Purifying Agent for Paper Making Wastewater: The product is a new inorganic polymer flocculant, specially developed for purifying papermaking wastewater, which usually has a high concentration of micro fiber. It not only separates the water from pulp, but also kills the microorganism in the waste water and pulp, thus preventing the wastewater from turning stunk and waste pulp from nigrescence. The water and pulp are recyclable after the treatment.

|

|

●

|

Purifying Agent for Phosphorus Removal: Purifying agent for phosphorus removal is an inorganic polymer flocculant made by a special synthetic polymer technology with a good phosphorus removal effect for phosphorus-containing industrial and residential wastewater.

|

|

●

|

Discoloring Agent: The product is a cationic organic macromolecular compound with functions of discoloring, flocculating, COD degrading. The special cationic group of the dyeing discoloring agent can combine with the color substance anion group of the wastewater to form a hydrophobic insoluble salt, thereby eliminate the colors, and because of the polymer adsorption bridging role, it also has a great coagulation & sedimentation effect. The decolorization rate to the dyeing water is more than 95 %, the COD removal ratio is between 50% to 85%.

|

HAC Powder

Our HAC powder has high aluminum content.

We employ HAC powder to produce water purifying agent, while American and European water purifying agent manufacturers use aluminum hydroxide to produce water purifying agents. Aluminum hydroxide provides a similar level of efficiency for water purifying agent but generally has a higher cost than HAC powder. Using HAC powder as our core raw material, we believe our products possess quality similar to the comparable products produced by our American and European counterparts but with lower cost. Those cost savings, in turn, provide us a significant price advantage.

The main differences between HAC and aluminum hydroxide are as follows:

|

1)

|

Components. The main components of HAC that are effective component in water purifying agent are Al2O3、CaO、SiO2、Fe2O3 while the main components of Aluminum Hydroxide are Al2O3、H2O. CaO、SiO2、Fe2O3;

|

|

2)

|

High reaction activity. When HAC reacts with hydrochloric acid proportionally at normal temperature and pressure, aluminium polychlorid is produced as a result of the reaction. The heating process is quick and there is no need of external energy to react (one step to produce aluminium polychlorid). Aluminum hydroxide reacts with hydrochloric acid under the conditions of heating and pressurizing, and aluminium polychlorid is only produced after using alkali to adjust the basicity. External energy is needed in the reaction (two step to produce aluminium polychlorid) when using alumnmum hydroxide;

|

|

3)

|

Reaction conditions. The production of aluminium polychlorid from HAC can happen on the regular acid reaction pool by one step. There is no pressure requirement for the producing equipment and it is easy to operate. Comparatively, the production of aluminium polychlorid from aluminum hydroxide bases on the pressure-proof high temperature reactor and the reaction time is long. Moreover, alkali is needed to adjust the basicity. The production is comparatively complicated.

|

Raw Material and Suppliers

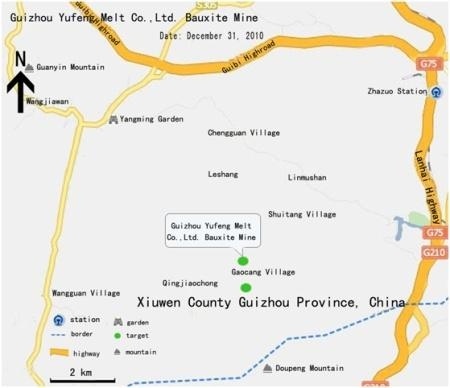

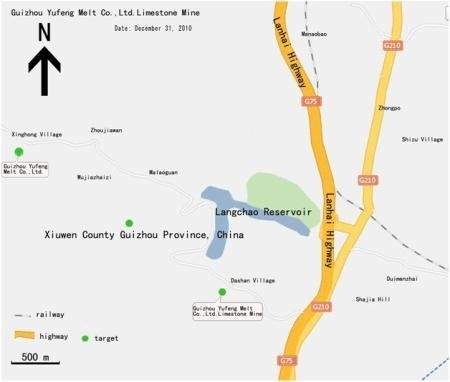

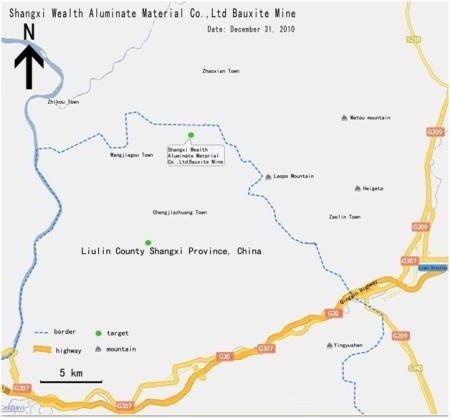

HAC powder is the core ingredient of water purifying agent. In Shanxi and Guizhou provinces, there are abundant bauxite resources. In 2010, we acquired 100% of all the equity interest of Guizhou Yufeng and Shanxi Wealth. Guizhou Yufeng and Shanxi Wealth each own one bauxite mine and one limestone mine.

|

●

|

Guizhou Yufeng is located in Xinghong Village, Zhazuo Town, Xiuwen County, Guizhou Province. As a PRC limited liability company, it has satisfied each of the enterprise annual inspections during the years from 2005 to 2012. The local business department granted Guizhou Yufeng operation rights from March 2005 to April 2018.

|

|

●

|

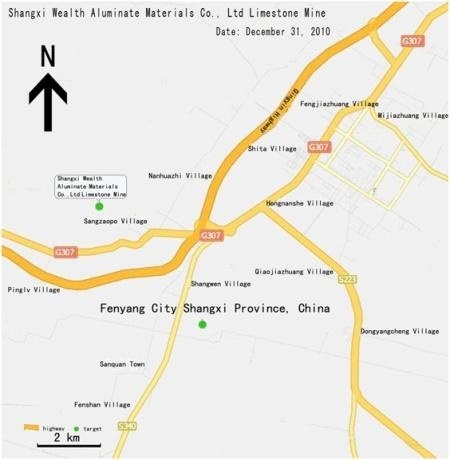

Shanxi Wealth is located in Dong Jia Bi Village, Sanquan Town Industrial Zone, Fenyang City of Shanxi Province. As a PRC limited liability company, it has satisfied each of the enterprise annual inspections during the years from the years of 2004 to 2012. The local business department granted Shanxi Wealth operation rights from April 2004 to January 2016.

|

Development of New Technologies

We are developing new technologies to enhance the quality of our current products and to introduce new products based upon our anticipation of the future market needs. We intend to introduce the following products and technologies to the market in the future:

Flocculent for Enhanced Coagulation for Drinking Water

In 2010 the Chinese government raised the standard for drinking water regarding turbidity, organic matter and a number of other indicators. Anticipating the future implementation of the stricter new drinking water standards, most Chinese water companies contemplate upgrading their technologies to meet the government’s requirements. Flocculent for enhanced coagulation is widely accepted in the industry as the response to the stricter requirements and solution to the upgrading. We were working with Chongqing University to develop flocculent for enhanced coagulation for drinking water. We have not entered into any agreement in connection with the cooperation with Chongqing University. We started our cooperation with Chongqing University in 2005 and have not paid considerations to Chongqing University in connection with such cooperation. We initially expected to put this new product on the market in mid-2011. However since the developed product did not have an outcome as expected. We did not officially launch this product.

HAC Powder with High Purity

With our current HAC powder technology, we can develop HAC powder with higher purity without compromising cost-efficiency. The purpose is to replace high-cost aluminum hydroxide currently used by European and American producers. Currently we have completed an initial testing of this technology and are in the process of second round testing. We expect to apply this technology to our production in the near future. However, since the developed product did not have an outcome as expected, we did not officially launch this product.

Sewage-source Heat Pump High-speed Water-purifying Technology

The development of renewable energy is among those on the top of the agenda for China’s mid-term and long-term science and technology planning programs. Currently a number of cities in China have used sewage water as conduit for cooling and heating. To meet this market demand, we are performing research on using flocculent and sewage-source heat pump in treating sewage and generating renewable energy. Currently we have completed the initial testing of this technology and are in the process of a second round testing. We expect to apply this technology to our production on a small scale in the near future. However, since the developed product did not have an outcome as expected, we did not officially launch this product.

High-concentration Organic Wastewater Treatment

Backed by the joint efforts of our research and development team and Tongji University in Shanghai, PRC, we are able to use the hydrothermal technology to transform organic matter in the wastewater into useful industrial materials such as H2, DME, and C2H5OH. H2 is the chemical formula of hydrogen which is the basic component of many chemicals and is used for combinations of carbinol, artificial petroleum, plastic resin etc. DME is short for DiMethyl Ether, which is a basic chemical raw material and, due to its specialties in compression, condensation and evaporation, it serves a unique role in production of medicine, fuel, pesticides and etc. C2H5OH is the chemical formula of ethanol which is mainly used to produce acetaldehyde, diethyl ether, ethyl acetate, ethylamine and to produce dyes, painting and detergent and etc. As of the date hereof, we have completed the initial testing of this technology and are in the process of second round testing. We expect to apply this technology to our production later in 2013.

Microbial Flocculent

Microbial flocculent is a highly efficient, non-toxic, pollution-free, self-degradable, and broadly applicable new generation of flocculent. It incarnates the latest development in modern biology and water treatment technology, and represents the trend of flocculent development. Our research and development on this subject focuses on wastewater discoloration and industrial water reuse for the food industry. Traditional flocculents have the issue of secondary pollution when used in water treatment process. Therefore, it is meaningful for people’s health and environmental protection to develop a new micro-organic flocculent that is non-toxic, highly active and without secondary pollution. However, this technology is in an initial testing phase and may have issues of instability and high cost. We expect to market this technology on a small scale in 2014.

Research & Development Activities

We incurred $622,684 and $604,549 of research and development cost during the years ended December 31, 2012 and 2011, respectively.

Research and development is critical to our business development. We have built a strong independent research team that includes 5 members with Ph.D. degrees, and 20 members with M.A. degrees. We have sophisticated laboratory facilities covering 1,000 square meters of land (1 square meter ≈ 10.78 square feet). The subjects of our research include, among others, HAC powder, bio-flocculent, industrial waste water purifying agent.

In addition to our independent research, we also collaborate with renowned research institutes in developing water purifying agents and other environment protection products. For example, we work with the College of Environmental Science and Engineering of Tongji University in setting up a post-doctoral research center focused on developing pollution prevention technology; and we work with Chongqing University on several environment-related research projects. Through collaboration with these institutions, we have further bolstered the research ability of our research and development team, expanded our experimental experience, and we expect to maintain our position in the water purifying industry in China. We have no expenses on research and development activities during each of the last two fiscal years.

Customer Concentration

Our customers place orders on an annual basis. It is our business practice to ascertain demand from our customers at the beginning of each year, pursuant to the annual needs placed in purchase agreements. Actual sales revenues generated from each customer may vary from the annual need thereto provided in such purchase agreements. No single customers accounted for more than 10% of our net revenues for the fiscal year of 2012. The following summarizes the net revenue of our largest ten customers for each of our two products, Water Purifying Agent, and HAC Powder for the year of 2012.

Water Purifying Agent

The following table sets forth the largest ten customers of our water purifying agent based upon the percentage of our water purifying agent net revenue for the year of 2012:

|

Rank

|

|

Amount (US Dollar)

|

|

|

% of Revenue

|

|

|

Customer 1

|

|

$ |

4,201,735.51

|

|

|

|

9.51

|

% |

|

Customer 2

|

|

|

3,160,499.67

|

|

|

|

7.15

|

% |

|

Customer 3

|

|

|

3,084,465.77

|

|

|

|

6.98

|

% |

|

Customer 4

|

|

|

3,006,854.42

|

|

|

|

6.80

|

% |

|

Customer 5

|

|

|

2,636,115.61

|

|

|

|

5.97

|

% |

|

Customer 6

|

|

|

2,142,840.28

|

|

|

|

4.85

|

% |

|

Customer 7

|

|

|

2,029,665.26

|

|

|

|

4.59

|

% |

|

Customer 8

|

|

|

2,001,917.26

|

|

|

|

4.53

|

% |

|

Customer 9

|

|

|

1,895,975.60

|

|

|

|

4.29

|

% |

|

Customer 10

|

|

|

1,788,109.87

|

|

|

|

4.05

|

% |

|

Total

|

|

$ |

25,948,179.25

|

|

|

|

58.72

|

% |

HAC Powder

The following table sets forth customer concentration of HAC Powder based upon the percentage of our HAC Powder net revenue for the year of 2012:

|

Rank

|

|

Amount (US Dollar)

|

|

|

% of Revenue

|

|

|

Customer 1 *

|

|

$ |

4,945,563.08

|

|

|

|

10.14

|

% |

|

Customer 2

|

|

|

2,330,538.69

|

|

|

|

4.77

|

% |

|

Customer 3

|

|

|

2,207,173.13

|

|

|

|

4.52

|

% |

|

Customer 4

|

|

|

2,147,096.30

|

|

|

|

4.41

|

% |

|

Customer 5

|

|

|

1,921,314.53

|

|

|

|

3.94

|

% |

|

Customer 6

|

|

|

1,884,712.50

|

|

|

|

3.87

|

% |

|

Customer 7

|

|

|

1,758,685.90

|

|

|

|

3.61

|

% |

|

Customer 8

|

|

|

1,481,471.45

|

|

|

|

3.04

|

% |

|

Customer 9

|

|

|

1,435,632.04

|

|

|

|

2.95

|

% |

|

Customer 10

|

|

|

1,246,104.84

|

|

|

|

2.56

|

% |

|

Total

|

|

$ |

21,358,292.46

|

|

|

|

43.81

|

% |

* This is Jiangmen Wealth Water, one of our operating subsidiaries in PRC, purchasing HAC powder from another subsidiaries of ours, Guizhou Yufeng,.

Sales Network and Sales Model

Water Purifying Agent

Our current sales network of water purifying agent covers four geographic areas of China, including the Southwest, South, Central, and East of China. These geographic regions include some of the most developed economic areas in China and, accordingly, the local governments pay great attention to environmental issues, such as purifying waste water. We adopt a “regional production and sales” model with each of our self-owned production facilities in Jiangmen City, Guangdong Province, and the four Entrusted Production Lines responsible for meeting the market demand within its covered selling areas in order to minimize transportation costs.

HAC Powder

Given that preservation and delivery of HAC powder does not generate high transportation costs compared to delivery of liquid water purifying agent, our sales of HAC powder adopt a “direct distribution” model with Guizhou Yufeng and Shanxi Wealth directly delivering HAC powder to our distribution centers which in turn deliver HAC powder to customers. Currently, we have approximately 6 HAC powder distribution centers covering 13 provinces in China, consisting of Guangdong, Guangxi, Guizhou, Hainan, Henan, Hunan, Jiangsu, Zhejiang, Jiangxi, Shandong, Sichuan, Tianjin and Yunnan.

Market

Market Opportunity

Currently, China is in the process of rapid economic growth and market reform led by nation-wide industrial development. Unfortunately, following in the footsteps of many mature economies, China’s rapid industrial expansion has brought with it an almost inevitable by-product: industrially generated pollution of water, air and the environment as a whole. It is estimated that approximately 80% of China’s environmental pollution results from industry-produced solid waste, waste water and waste gas emissions. During the 1990’s the degree of and the dangers posed by China’s increasing levels of environmental pollution became widely perceived both inside and outside China, and drew concerns from the Central Chinese Government. A nation-wide awakening to the environmental crisis has pushed the reduction and elimination of waste water and airborne pollutants to matters of priority importance in China’s next five-year economic plan. (For more information, please see http://zfs.mep.gov.cn/fg/gwyw/201202/t20120216_223549.htm)

With only approximately 2,200 cubic meters per person, or one-fourth the world average, China is a country with limited water resources. Conservation through the improvement of usage efficiency has been the fundamental way to resolve the tension between water supply and demand. China’s very high rate of industrial water consumption (as compared to that of developed countries) demands water conservation and water re-use programs. For example, the industries involved in the discharge of industrial waste water, our principal target market, consume large quantities of water and thereby call for new technology and products to increase efficiency in water usage, reduce water consumption, decrease environmental cleaning costs and thereby avoid possible governmental penalties that arise when they fail to meet one or more standards.

Marketing Plan for the Next Three Years

|

●

|

Expand the distribution coverage of our products;

|

|

●

|

Establish contract with clients in operating their wastewater treatment systems, and develop long term business relationship by sharing with them our pollution treatment experiences;

|

|

●

|

Take priority in addressing the market in the severely polluted, economically developed coastal areas, set up local factories for the largest purchasers, and cover the clients in the surrounding area; and

|

|

●

|

Establish and develop our presence in the oversea markets. As mentioned above, with access to lower-cost raw materials, we are positioned to compete with European and American companies in the same industry. We may consider acquiring foreign companies in the following years for the purpose of producing and distributing high calcium aluminate powder and water purifying agents locally to achieve cost-efficiency.

|

Competition

In China, there are various companies producing water purifying agents, which are mainly located in Guangdong, Jiangsu, Shandong, Henan, Shanghai, Beijing, Tianjin and Hebei. Generally speaking, these areas are more economically developed than the rest of the country. Most companies currently in the industry are generally small in scale. Since there has not been any official statistic report issued relating to the water purifying agent industry in China, no quantified description of the competitive conditions in the industry is currently available. Compared to other companies in the industry, our company has a complete production chain from raw material procurement to production and to sales and distribution, strong management team and specialized research and development team. Our management believes that we are in the leading position with respect to both of our products in domestic market of China. Our principle methods of competition are cost saving, scale effect and technology advancement, which methods enable us to gain competitive advantages set forth below.

Competitive Advantages

|

●

|

Cost advantages: In China, we are a high-tech enterprise possessing a complete industrial chain for the production of water purifying agent, with two subsidiaries, one in Guizhou province and the other in Shanxi province supplying aluminum and calcium carbonate. At the same time, we have unique technology for high aluminate calcium powder production to decease the cost by approximately 8% compared with other competitors in the same industry.

|

|

●

|

Scale advantages: We are a leading producer of water purifying agents and HAC powder in China, with an annual production and distribution of approximately 322,000 and 290,000 tons of water purifying agent and approximately 288,000 and 277,000 tons of HAC powder for the years ended December 31, 2012 and 2011, respectively. Our operating scale has given us considerable competitive advantages by reducing costs and developing new products to accommodate the ever-evolving demands of the market.

|

|

●

|

Technological advantages: we are applying our own “special addition” in HAC powder production, improving the traditional process to lower the purchasing and production cost and to enhance the aluminum content and activity. In addition, collaborating with Tongji University, we have spent substantial capital and more than one year developing high purity aluminate calcium production technology. The technology uses a heavy metal separation process to generate a high content of alumina, to meet international standards. The technology lowers production costs by 50 percent when compared to aluminum hydroxide.

|

|

●

|

Customized products: We have developed a series of industry-specific purifying agent to implement targeted treatment for different type of water qualities, which produce a better effect than universal products and can reduce water treatment cost by 20 percent or more per ton.

|

Employees

As of December 31, 2012, we have 429 employees and all of the 429 employees are full-time employees, among whom 396 employees hold a Bachelor’s Degree or lower degrees, 27 employees have a Master’s Degree, 5 employees have a Ph.D degree and 1 employee holds a Post-doctoral degree. Our employees are not represented by any collective bargaining agreement, and we have never experienced a work stoppage. We believe we have good relations with our employees.

Insurance

The Company has not carried any insurance as of the filing of this Form 10-K.

Environmental Protection, Quality Control, and Safety Measure

We strive to meet the requirements provided in environmental protection regulations, and regulations related to facility safety and quality control, throughout the design, maintenance and growth of our operation facilities and manufacturing process.

Environmental Protection

Our manufacturing facilities are subject to a series of pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. To date, we have not been advised of any violations of any environmental regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Quality Control

All of our factories have set up internal quality control systems to make sure our products meet IS09000 standards. ISO9000 is an international quality management standard made by Technical Committee of Quality Management and Insurance of International Standardization Organization, which is used to approve that an organization has the capability to provide products that can meet the customers’ requirements and applicable legal regulations.

Safety Measures

Guizhou Yufeng and Shanxi Wealth have set up specific production policy and principles to ensure workplace safety, including, but not limited to, onsite safety surveillance, mining safety training, regular worker health and skill inspection, site-specific hazard awareness training, overtime restriction, ventilation inspection, and damage control exercise. With full implementation of our safety policy, Guizhou Yufeng and Shanxi Wealth have had no significant workplace accidents since inception.

Litigation

From time to time, we may become involved in various lawsuits and legal proceedings. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

CHINA REGULATIONS

This section sets forth a summary of the most significant China regulations or requirements that may affect our business activities operated in China or our shareholders’ right to receive dividends and other distributions of profits from the PRC subsidiaries.

Foreign Investment in PRC Operating Companies

The current effective Foreign Investment Industrial Catalogue jointly promulgated by the China’s Ministry of Commerce (MOFCOM) and the National Development and Reform Commission (NDRC) in December 2011 classified various industries/businesses into three different categories: (i) encouraged for foreign investment; (ii) restricted to foreign investment; and (iii) prohibited from foreign investment. For any industry/business not covered by any of these three categories, they will be deemed industries/businesses permitted for foreign investment. Except for those expressly provided with restrictions, encouraged and permitted industries/businesses are usually 100% open to foreign investment and ownership. With regard to those industries/businesses restricted to or prohibited from foreign investment, there is always a limitation on foreign investment and ownership. The PRC Subsidiaries’ business does not fall under the industry categories that are restricted to, or prohibited from foreign investment and is not subject to limitation on foreign investment and ownership.

Regulation of Foreign Currency Exchange

Foreign currency exchange in the PRC is governed by a series of regulations, including the Foreign Currency Administrative Rules (1996), as amended, and the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), as amended. Under these regulations, the Renminbi is freely convertible for trade and service-related foreign exchange transactions, but not for direct investment, loans or investments in securities outside the PRC without the prior approval of State Administration of Foreign Exchange (SAFE). Pursuant to the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), foreign investment enterprises, or FIEs may purchase foreign exchange without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange, subject to a cap approved by SAFE, to satisfy foreign exchange liabilities or to pay dividends. However, the relevant Chinese government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside the PRC are still subject to limitations and require approvals from SAFE.

Regulation of FIEs’ Dividend Distribution

The principal laws and regulations in the PRC governing distribution of dividends by FIEs include:

|

(i)

|

The Sino-foreign Equity Joint Venture Law (1979), as amended, and the Regulations for the Implementation of the Sino-foreign Equity Joint Venture Law (1983), as amended;

|

|

(ii)

|

The Sino-foreign Cooperative Enterprise Law (1988), as amended, and the Detailed Rules for the Implementation of the Sino-foreign Cooperative Enterprise Law (1995), as amended;

|

|

(iii)

|

The Foreign Investment Enterprise Law (1986), as amended, and the Regulations of Implementation of the Foreign Investment Enterprise Law (1990), as amended.

|

| |

|

|

(iv)

|

The Company Law (2005).

|

Under these regulations, FIEs in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, the wholly owned foreign enterprises in the PRC are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds unless such reserve funds have reached 50% of their respective registered capital. These reserves are not distributable as cash dividends.

Regulation of a Foreign Currency’s Conversion into RMB and Investment by FIEs

On August 29, 2008, SAFE issued a Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises or Notice 142, to further regulate the foreign exchange of FIEs. According to Notice 142, FIEs shall obtain a verification report from a local accounting firm before converting its registered capital of foreign currency into Renminbi, and the converted Renminbi shall be used for the business within its permitted business scope. The Notice 142 explicitly prohibits FIEs from using RMB converted from foreign capital to make equity investments in the PRC, unless the domestic equity investment is within the approved business scope of the FIE and has been approved by SAFE in advance. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Violations of Notice 142 may result in severe penalties, including substantial fines as set forth in the SAFE rules.

Regulations on Offshore Financing

On October 21, 2005, SAFE issued Circular 75, which became effective as of November 1, 2005. Under Circular 75, prior registration with the local SAFE branch is required for PRC residents to establish or to control an offshore company for the purposes of financing that offshore company with assets or equity interests in an onshore enterprise located in the PRC. An amendment to registration or filing with the local SAFE branch by such PRC resident is also required for the injection of equity interests or assets of an onshore enterprise in the offshore company or overseas funds raised by such offshore company, or any other material change involving a change in the capital of the offshore company.

Under the relevant rules, failure to comply with the registration procedures set forth in Circular 75 may result in restrictions being imposed on the foreign exchange activities of the relevant onshore company, including the increase of its registered capital, the payment of dividends and other distributions to its offshore parent or affiliate and the capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations. Moreover, failure to comply with the various foreign exchange registration requirements described above could result in liabilities for such PRC subsidiary under PRC laws for evasion of applicable foreign exchange restrictions and individuals managing such PRC subsidiary who are held directly liable for any violation may be subject to criminal sanctions.

Regulation on Overseas Listing

On August 8, 2006, the PRC Ministry of Commerce (“MOFCOM”), joined by the State-owned Assets Supervision and Administration Commission of the State Council, the State Administration of Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission and SAFE, released a substantially amended version of the Provisions for Foreign Investors to Merge with or Acquire Domestic Enterprises (the “New M&A Regulations”), which took effect on September 8, 2006 and was further amended on June 22, 2009. These new rules significantly revised China’s regulatory framework governing onshore-to-offshore restructurings and foreign acquisitions of domestic enterprises. These new rules signify greater PRC government attention to cross-border merger, acquisition and other investment activities, by confirming MOFCOM as a key regulator for issues related to mergers and acquisitions in China and requiring MOFCOM approval of a broad range of merger, acquisition and investment transactions. Further, the new rules establish reporting requirements for acquisition of control by foreigners of companies in key industries, and reinforce the ability of the Chinese government to monitor and prohibit foreign control transactions in key industries. Among other things, the New M&A Regulations include new provisions that purport to require that an offshore special purpose vehicle, or SPV, formed for listing purposes and controlled directly or indirectly by PRC companies or individuals must obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange.

Regulations on Mineral Resources

Under the current Mineral Resources Law of the PRC (the “Mineral Resources Law”) promulgated on March 19, 1986 and amended on August 29, 1996, all mineral resources in China are owned by the State. The PRC Ministry of Land and Resources and its local counterparts are responsible for the supervision and administration of the mining and exploration of mineral resources nationwide and in the respective local area. Enterprises engaged in the exploitation of mineral resources must obtain mining rights. In addition to the mining right usage fees paid annually based on the size of the licensed area (i.e., RMB1,000 per square kilometer per year), an applicant who applies for the state-contributed exploration and has ascertained the mining right within the tenement area shall pay the purchase price for the mining rights which is formed by the state-contributed exploration and determined through an evaluation process.

A holder of a mining license has the right to and is also obligated to conduct mining activities in the area and within the time period designated in the mining license. A holder of a mining license has certain additional rights including, among others, rights to (i) set up necessary production and living facilities within the designated area; and (ii) acquire the land use rights necessary for production. A holder of a mining license has certain additional obligations including, among others, obligations to (i) conduct reasonable exploitation, and protect and fully utilize mineral resources; (ii) pay resources tax and resources compensation levy; (iii) comply with the laws and regulations relating to occupational safety, soil and water conservation, reclamation and environmental protection; and (iv) submit mineral resource reserve and utilization reports to relevant government authorities as required. Mining rights are transferable subject to the approvals of relevant geological and mineral resources and land bureaus of the PRC and upon satisfaction of other conditions as stipulated under PRC law and regulations.

Exploitation of mineral resources is subject to supervision by the PRC Ministry of Land and Resources and the relevant local mineral resource bureaus. Annual reports are required to be filed by the holders of mining license with the relevant administrative authorities that issue the permits.

It is unlawful for an entity or individual to conduct mining operations in areas previously authorized for exploitation by other mining operators. An entity whose mining operations cause harm to others in terms of production or living standards is liable to compensate the affected parties and to take necessary remedial measures. Pursuant to the Provisions for Implementation of the Mineral Resources Law, a mine operator must follow certain procedures in closing a mine, including, among other things, submitting a mine closure geology report to the regulatory authority that originally approved the opening of the mine.

Regulations on Work Safety

On June 29, 2002, the Work Safety Law (“WSL”) of the PRC was adopted by the Standing Committee of the 9th National People’s Congress and came into effect on November 1, 2002, as amended on August 27, 2009. The WSL provides general work safety requirements for entities engaging in manufacturing and business activities within the PRC. Additionally, Regulation on Work Safety Licenses (“RWSL”), as adopted by the State Council on January 7, 2004 and became effective on January 13, 2004, requires enterprises engaging in the manufacture of dangerous chemicals to obtain a work safety license with a term of three years. If a work safety license needs to be extended, the enterprise must go through extension procedures with authorities three months prior to its expiration. In addition, on August 5, 2011, the Measures for Implementation of Work Safety Licenses of Dangerous Chemicals Production was promulgated as implementing measures to the Regulation on Work Safety Licenses which provides that entities producing dangerous chemicals are required to obtain work safety licenses pursuant to specific requirements. Without work safety licenses, no entity may engage in the formal manufacture of dangerous chemicals.

The Regulations on the Safety Administration of Dangerous Chemicals (“RSADC”) was promulgated by the State Council on January 26, 2002 and amended in March 2011, effective as of December 1, 2011. It sets forth general requirements for manufacturing and storage of dangerous chemicals in China. The RSADC requires that companies manufacturing dangerous chemicals establish and strengthen their internal regulations and rules on safety control and fulfill the national standards and other relevant provisions of the State. In addition, according to the RSADC, companies that manufacture, store, transport or use dangerous chemicals shall be required to obtain corresponding approvals or licenses with the State Administration of Work Safety and its local branches and other proper authorities. Companies that manufacture or store dangerous chemicals without approval or registration with the proper authorities can be shut down, ordered to stop manufacturing or ordered to destroy the dangerous chemicals. Such companies can also be subject to fines. If criminal law is violated, the persons chiefly liable, along with other personnel directly responsible for such impropriety, shall be subject to relevant criminal liability.

Regulations on Environmental Protection

According to the Prevention and Control of Water Pollution Law, as adopted by the Standing Committee of the 10th National People’s Congress on February 28, 2008 and effective on June 1, 2008, China adopted a licensing system for pollutant discharge. Companies directly or indirectly responsible for discharge of industrial waste water or medical sewage to waters shall be required to obtain a pollutant discharge license. All companies are prohibited from discharging wastewater and sewage to waters without or in violation of the terms of the pollutant discharge license.

The Regulations on the Administration of Construction Projects Environmental Protection (“RACPEP”), as adopted by the State Council on November 18, 1998 and effective on November 29, 1998, governs construction projects and the impact such projects will have on the environment. Pursuant to the RACPEP, the governing body is responsible for supervising the implementation of a three tiered system that includes (i) reviewing and approving a construction project, (ii) overseeing the construction project, and (iii) to inspect the finished construction project and ensure that all harmful pollutants are disposed of correctly. Manufacturing companies are required to apply for inspection with environmental protection authorities upon completion of a construction project.

You should carefully consider the risks described below together with all of the other information included in this Form 10-K before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

OUR LIMITED OPERATING HISTORY MAKES EVALUATION OF OUR BUSINESS DIFFICULT.