UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 2, 2011

LUNAR GROWTH CORPORATION

(Exact name of registrant as specified in its charter)

Cayman Islands

(State or other jurisdiction of incorporation)

|

000-52342

|

N/A

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

Room 2416 Fuxing International Merchant Plaza,

186# Xinhua Rd, Wuhan,

People’s Republic of China, 430022

(Address of principal executive offices and zip code)

+86 027 85554007

(Registrant's telephone number including area code)

c/o Nautilus Global Partners

700 Gemini, Suite 100, Houston, TX 77056

(Registrant's former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Forward-Looking Statements

This Current Report on Form 8-K and other reports filed by Lunar Growth Corporation from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that is based upon beliefs of, and information currently available to, Lunar Growth Corporation’s management as well as estimates and assumptions made by management. When used in the Filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward-looking statements. Such statements reflect our current view with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to industry, our operations and results of operations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the audited consolidated financial statements of Fortune Health Management Limited for the fiscal years ended June 30, 2010, 2009 and 2008, and the related notes thereto, and the unaudited interim consolidated financial statements as of December 31, 2010, and for the six months ended December 31, 2009 and 2010, and the related notes thereto, filed as exhibits to this Form 8-K.

In this Form 8-K, references to “we,” “our,” “us,” or the “Company” refer to Lunar Growth Corporation, a Cayman Islands company, and its consolidated subsidiaries including Chongqing Jiafu Health Industry Co., Ltd. on a combined basis.

Item 1.01 Entry Into A Material Definitive Agreement

On May 2, 2011, the (“Closing Date”), we acquired Fortune Health Management Limited, a British Virgin Islands (“BVI”) company (“Fortune Health”) that, through its contractual arrangements with operating entities in the People’s Republic of China (the “PRC” or “China”), is in the business of franchising and operating a chain of foot massage spas in China.

On the Closing Date, pursuant to a share exchange agreement (the “Exchange Agreement”) by and among the Company, Fortune Health, the holders of all outstanding shares of Fortune Health (the “Fortune Health Shareholders”), we acquired all outstanding shares of Fortune Health (the “Fortune Health Shares”) from the Fortune Health Shareholders, and the Fortune Health Shareholders transferred all of Fortune Health Shares to us.

On the Closing Date, we issued 19,400,325 of our ordinary shares to the Fortune Health Shareholders and their designees, constituting 75% of all our outstanding shares on fully diluted basis. In addition, we have agreed to issue an additional 135,802,275 ordinary shares to the Fortune Health Shareholders and their designees, as soon as practicable after the Company effectuates an amendment to its Articles of Association to increase its authorized ordinary shares. Together the 19,400,325 ordinary shares and the 135,802,275 ordinary shares equal 155,202,600 ordinary shares, or 96% of our ordinary shares on a fully-diluted basis.

1

A copy of the Exchange Agreement is included as Exhibit 2.1 to this Current Report on Form 8-K and is hereby incorporated by reference. All references to the Exchange Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

Item 2.01 Completion of Acquisition or Disposition of Assets

Closing of Exchange Agreement

On the Closing Date, we entered into an agreement to acquire and completed the acquisition of Fortune Health, a BVI company that, through contractual arrangements with operating entities in the PRC, is in the business of franchising and operating foot massage spas in the PRC. These spas specialize in foot massage and also offer other therapeutic massage services, such as Chinese and Thai-style massages. Pursuant to the terms of the Exchange Agreement, the Fortune Health Shareholders transferred and contributed all Fortune Health Shares to us, and we issued 19,400,325 of our ordinary shares to the Fortune Health Shareholders and their designees, constituting 75% of all our outstanding shares on fully diluted basis. In addition, we have agreed to issue an additional 135,802,275 ordinary shares to the Fortune Health Shareholders and their designees, as soon as practicable after the Company effectuates an amendment to its Articles of Association to increase its authorized ordinary shares. Together the 19,400,325 ordinary shares and the 135,802,275 ordinary shares equal 155,202,600 ordinary shares, or 96% of our ordinary shares on a fully-diluted basis. On the Closing Date, pursuant to the terms of the Exchange Agreement, we completed the acquisition and acquired all the ownership of Fortune Health.

Prior to the Closing Date, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, pursuant to the requirements of Item 2.01(a)(f) of Form 8-K, set forth below is the information that would be required if we were filing a general form for registration of securities on Form 10 under the Exchange Act, reflecting our ordinary shares, which is the only class of our securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the transactions contemplated by the Exchange Agreement, with such information reflecting us and our securities upon consummation of the share exchange pursuant to the Exchange Agreement.

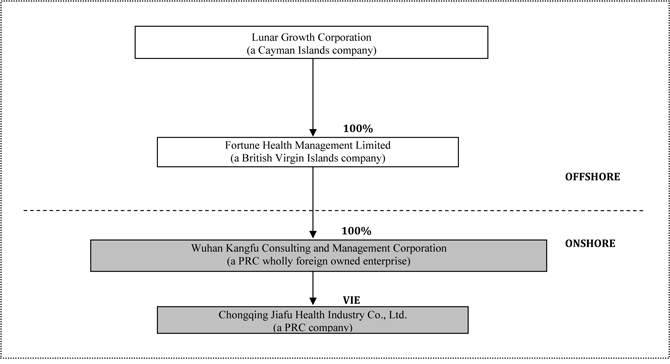

Our current corporate structure is set forth below:

2

We are a Cayman Islands company that was incorporated on September 27, 2006 as an exempted company with limited liability. On the Closing Date we acquired Fortune Health, a BVI company that was incorporated on September 8, 2010. Fortune Health acts as a holding company and its sole assets are the shares of Wuhan Kangfu Consulting and Management Corporation (“Kangfu Consulting”), a wholly foreign-owned enterprise in the PRC.

Our wholly owned subsidiary, Kangfu Consulting, has entered into a series of contractual arrangements with Chongqing Jiafu Health Industry Co., Ltd., a PRC company (“Jiafu Health”) and its shareholders, which enable us to:

· exercise effective control over the business management and shareholder voting rights of Jiafu Health;

· receive substantially all of the economic benefits of Jiafu Health through service fees and management fees, in consideration for the consulting services and the business management provided by Kangfu Consulting; and

· have an exclusive option to purchase all or part of the equity interests/assets/business in Jiafu Health when and to the extent permitted under PRC laws.

We do not have an equity interest in Jiafu Health. However, as a result of these contractual arrangements, we are considered the primary economic beneficiary of Jiafu Health and we treat it as a Variable Interest Entity (“VIE”) under the Generally Accepted Accounting Principles in the United States, or U.S. GAAP. Accordingly, we have consolidated the financial statements of Jiafu Health in our consolidated financial statements for the three years ended June 30, 2010, 2009 and 2008, and the six months ended December 31, 2010.

3

Incorporated in October of 2006, Jiafu Health owns and franchises foot massage spas in China. In 2004, Jiafu Health’s founder Mr. Jiafu Guo, founded Chongqing Jiafu Fuqiao Health Care Service Co., Ltd., (“Fuqiao Health”). Fuqiao Health started 64 spa franchises. Mr. Jiafu Guo later incorporated Jiafu Health as part of a reorganization to focus on not only franchising but also acquiring and operating proven franchises. Jiafu Health took over the franchise network of Fuqiao Health, and later acquired 56 of the 64 spas. In addition, from its founding through December 31, 2010, Jiafu Health has sold an additional 312 franchises, 164 of which it acquired. Jiafu Health has also acquired 20 spas that were not Fuqiao Health or Jiafu Health franchises. In total as of December 31, 2010, Jiafu Health has acquired 240 spas, which are referred as “Company Spas.” Jiafu Health receives all the revenues of the Company Spas and directly approves all significant expenses, and Jiafu Health can convert the spa licensing and direct ownership to Jiafu Health at any time. As of December 31, 2010, Jiafu Health also has 156 franchises, which are independently owned and operated.

Of the 240 Company Spas, 47 were originally owned by 43 PRC limited liability companies. Jiafu Health purchased the shares of these companies, which are now Jiafu Health subsidiaries. The names of the 43 limited liability companies are listed in the following table:

|

1.

|

Wuwei City Liangru District Qingmengxuan Trading Co., Ltd.

|

|

|

2.

|

Boxing County Boxing Hotel Co., Ltd.

|

|

|

3.

|

Wuhan Bofeng Hotel Management Co., Ltd.

|

|

|

4.

|

Beijing Shenggao Wanhe Spa Co., Ltd.

|

|

|

5.

|

Wuhan Bayufeng Health Care Co., Ltd.

|

|

|

6.

|

Ganzhou City Yi Chamber Health Care Co., Ltd,

|

|

|

7.

|

Xiamen Jianlan Foot Care Co., Ltd.

|

|

|

8.

|

Wuhan Huifu Culture Development Co., Ltd.

|

|

|

9.

|

Qingdao Jiafu Fuqiao Health Industry Co., Ltd.

|

|

|

10.

|

Changsha Jiafu Investment Consulting Co., Ltd.

|

|

|

11.

|

Chengdu Jinfuqiao Health Leisure Co., Ltd.

|

|

|

12.

|

Shenzhen City Yongkangfu Health Care Co., Ltd.

|

|

|

13.

|

Guangxi Jiafu Fuqiao Leisure Entertainment Co., Ltd.

|

|

|

14.

|

Xiamen Huamin Hotel Co., Ltd.

|

|

|

15.

|

Guangxi Nanning Fengzu Health Care Co., Ltd.

|

|

|

16.

|

Dazhou Fuyuda Trading Co., Ltd.

|

|

|

17.

|

Chongqing Shaping Jiafu Fuqiao Health Leisure Service Co., Ltd.

|

|

|

18.

|

Wuhan Fuyu Jiafu Fuqiao Leisure Service Co., Ltd.

|

|

|

19.

|

Wuhan Guoyu Jiafu Fuqiao Leisure Service Co., Ltd.

|

|

|

20.

|

Shanghai Giving Fufiao Foot Care Health Co., Ltd.

|

|

|

21.

|

Wuhan Shidai Chaoyang Foot Care Health Management Co., Ltd.

|

|

|

22.

|

Chongqing Kun'an Foot Care Service Co., Ltd.

|

|

|

23.

|

Chongqing Jiujie Industry Co., Ltd.

|

|

|

24.

|

Tongchuan Shengshijiaren Foot Care Health Service Co., Ltd.

|

|

|

25.

|

Chengdu City Jiafu Fuqiao Health Care Service Co., Ltd.

|

|

|

26.

|

Langfang City Green Sea Foot Massage Health Care Co., Ltd.

|

|

|

27.

|

Beijing Guo Shi Fuqiao Bathing Co., Ltd.

|

|

|

28.

|

Shanghai Pay Fuqiao Foot Massage Health Care Co., Ltd.

|

|

|

29.

|

Shanghai Fortune Fuqiao Foot Massage Health Care Co., Ltd.

|

|

|

30.

|

Shanghai Mansion Arbor Fuqiao Foot Massage Health Care Co., Ltd.

|

|

|

31.

|

Shanghai Lotus Fuqiao Foot Massage Health Care Co., Ltd.

|

|

|

32.

|

Shanghai Fourier Fuqiao Foot Massage Health Care Co., Ltd.

|

|

|

33.

|

Shanghai Mansion Fuqiao Foot Massage Health Care Co., Ltd.

|

|

|

34.

|

Shanghai Trust Fuqiao Foot Massage Health Care Co., Ltd.

|

4

|

35.

|

Beijing Shengye Antai Technique and Trading Co., Ltd.

|

|

|

36.

|

Beijing Chunfeng Foot Care Beauty and Hairdressing Co., Ltd.

|

|

|

37.

|

Beijing Guo Shi Fuqiao Eastern Door East Spa Co., Ltd.

|

|

|

38.

|

Beijing Green Water Ark Entertainment Club Co., Ltd.

|

|

|

39.

|

Eastern Rich (Beijing) Gym Club Co., Ltd.

|

|

|

40.

|

Putian City Chengxiang District Runyang Foot massage Health Care Co., Ltd.

|

|

|

41.

|

Ezhou City Jiafu Health Care Co., Ltd.

|

|

|

42.

|

Zibo Geat Restaurant Culture Co., Ltd.

|

|

|

43.

|

Guangxi Jiazhifu Health Care Co., Ltd.

|

For the remaining 193 Company Spas, 191 of which were originally formed as sole proprietorships, individually owned businesses or partnerships and two as branches of limited liability companies, Jiafu Health purchased the assets of such spas, but the parties agreed to leave the ownership of the business license unchanged and to have Jiafu Health control the respective spa's operations and financial benefits through management agreement in lieu of direct ownership of such spas. For these 193 spas, Jiafu Health receives all of the revenues and directs all expenses, and Jiafu Health can convert the spa license and ownership to reflect Jiafu Health at any time.

The following is a summary of the currently effective contracts among our subsidiary Kangfu Consulting, Jiafu Health and the respective shareholders of Jiafu Health. Each such agreement is governed by PRC law.

Entrusted Management Agreement

Pursuant to an entrusted management agreement (the “Entrusted Management Agreement”) among Jiafu Guo, Feng Wu, Xiangju Mu (collectively, the “Jiafu Health Shareholders”), Jiafu Health and Kangfu Consulting, Jiafu Health and the Jiafu Health Shareholders agreed to entrust the business operations and management of Jiafu Health to Kangfu Consulting until Kangfu Consulting acquires all of the assets or equity of Jiafu Health (as more fully described under “Exclusive Option Agreement” below). Pursuant to the Entrusted Management Agreement, Kangfu Consulting manages all of Jiafu Health’s operations, and controls all of Jiafu Health’s cash flow and assets through entrusted or designated bank accounts, and Kangfu Consulting assumes all the operation risks and bears all losses of Jiafu Health, including paying all Jiafu Health’s debts to the extent Jiafu Health is not able to pay such debts. Kangfu Consulting has right to collect a management fee from Jiafu Health, which shall be paid after payment of a certain service fee to Kangfu Consulting, as more fully described in the section entitled “Exclusive Technology Service Agreement,” below. Jiafu Health must appoint the persons designated by Kangfu Consulting to be its executive director or directors, general manager, chief financial officer and any other senior officers. The Entrusted Management Agreement will remain in effect until Kangfu Consulting acquires Jiafu Health or Jiafu Health is dissolved.

Shareholders’ Voting Proxy Agreement

Pursuant to a shareholders’ voting proxy agreement (the “Shareholders’ Voting Proxy Agreement”) between the Jiafu Health Shareholders and Kangfu Consulting, the Jiafu Health Shareholders irrevocably appointed the designee of Kangfu Consulting as their proxy to vote on all matters with respect to the Jiafu Health Shareholders’ shares of Kangfu Consulting. The Shareholders’ Voting Proxy Agreement may not be terminated prior to the completion of acquisition of all assets or equity of Jiafu Health by Kangfu Consulting.

5

Exclusive Option Agreement

Pursuant to the exclusive option agreement (the “Exclusive Option Agreement”) among the Jiafu Health Shareholders, Jiafu Health and Kangfu Consulting, the Jiafu Health Shareholders and Jiafu Health granted Kangfu Consulting an irrevocable, exclusive purchase option to purchase all or part of the shares of Jiafu Health held by the Jiafu Health Shareholders, and all the assets and business of Jiafu Health. The option is exercisable at any time but only to the extent that such purchase does not violate any PRC law then in effect. The exercise price will be the minimum price permitted under then applicable PRC law. Only the Kangfu Consulting has the power to terminate the Exclusive Option Agreement.

Exclusive Technology Service Agreement

Pursuant to the technology service agreement between Jiafu Health and Kangfu Consulting (the “Exclusive Technology Service Agreement”), Jiafu Health engaged Kangfu Consulting as the sole technology service provider relating to, among other things, consultation of corporate management, service technology, marketing, purchase of equipment and certain other business services required by Jiafu Health. Pursuant to the Exclusive Technology Service Agreement, Jiafu Health agreed to pay a service fee to Kangfu Consulting based on certain factors set forth in the agreement, and Jiafu Health agreed not to engage any third party for any of its technology services provided under the agreement. In addition, Kangfu Consulting exclusively owns all intellectual property rights resulting from the performance of this agreement. The Exclusive Technology Service Agreement will remain in effect until the acquisition of all assets or equity of Jiafu Health by Kangfu Consulting is completed or Jiafu Health is dissolved.

Call Option Agreements

Jiafu Guo, Feng Wu, Xiangju Mu, Mary Hu, Kaifu Cai, Li Liu (each of them, a “Purchaser”), have entered into call option agreements (collectively, the “Call Option Agreements”), dated as of April 26, 2011, with Tie Wang or Iwamatsu Reien (each of them, a “Seller”), who are owners of our corporate shareholders (each of them, a “Corporate Shareholder”), respectively as follows:

|

|

1.

|

By and between Tie Wang and Jiafu Guo, regarding 100% of the ordinary shares of Well Affluent Limited, held by Tie Wang;

|

|

|

2.

|

By and between Tie Wang and Feng Wu, regarding 100% of the ordinary shares of Thriving Riches Limited, held by Tie Wang;

|

|

|

3.

|

By and between Tie Wang and Mary Hu regarding 100% of the ordinary shares of Goal Fortune Limited, held by Tie Wang;

|

|

|

4.

|

By and between Iwanatsu Reien and Xiangju Mu regarding 100% of the ordinary shares of Solid Wise Limited, held by Iwamatsu Reien;

|

|

|

5.

|

By and between Tie Wang and Kaifu Cai regarding 5% of the ordinary shares of Lunar Growth Corporation, held by Tie Wang; and

|

|

|

6.

|

By and between Iwamatsu Reien and Li Liu regarding 4% of the ordinary shares of Lunar Growth Corporation, held by Iwamatsu Reien.

|

Pursuant to the Call Option Agreements, the Purchaser is entitled to purchase up to 100% the shares held by the respective holder (the “Seller’s Shares”) at a price of $0.0001 per share for a period, upon certain conditions being met, in two tranches of 50% each. Such conditions are as follows: (i) Jiafu Health and its subsidiaries achieving after-tax net income of at least US$2 million as determined under United States Generally Accepted Accounting Principles consistently applied (“US GAAP”) for the fiscal year ended June 30, 2011, and (ii) Jiafu Health and its subsidiaries achieving after-tax net income of at least US$4 million as determined under US GAAP for the fiscal year ended June 30, 2012.

6

The description of the Call Option Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Call Option Agreements, which are filed as Exhibits to this Current Report. The Call Option Agreements have been included to provide investors and security holders with information regarding their terms. They are not intended to provide any other factual information about the Company or the other parties thereto. The Call Option Agreements contain certain representations and warranties the parties thereto made the benefit of the other parties thereto. Accordingly, investors and security holders should not rely on the representations and warranties as characterizations of the current state of facts, since they were only made as of the date of such agreement and for the purposes set forth therein. Moreover, information concerning the subject matter of the representations and warranties may change after the date of such agreement, which subsequent information may or may not be fully reflected in our public disclosures.

All percentages above are based upon fully diluted number of shares as of this date, and will be diluted ratably by any future new issuances.

DESCRIPTION OF BUSINESS

Overview

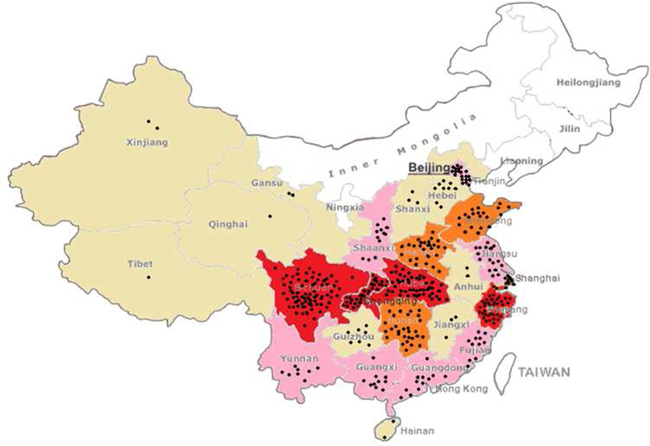

We own, operate, and franchise foot massage spas in the PRC. We also operate a massage training center, which specializes in training massage therapists for our spas. As of December 31, 2010, we owned 240 Company Spas and have 156 Franchise Spas, totaling 396 spas. Our spas are located in 19 out of 23 provinces in the PRC as well as all four municipalities and three autonomous regions. We believe we are the largest foot massage chain the PRC.

While foot massage has become commonplace all over the PRC, the foot massage industry in the PRC is highly fragmented, with many spas being individually owned and operated. We believe we have been able to establish a large national chain by providing consistent and high quality services at affordable prices. We believe that our Jiafu Fuqiao technique and our Jiafu Fuqiao massage therapists training center are key contributors for helping us to become a large national chain.

Our main service is foot massage, often referred to as reflexology. In the PRC, reflexology is widely believed to offer health and therapeutic benefits, based on ancient Chinese medical theories involving body energy system pathways and blockages that can develop, which can be reflected in other parts of the body as malady or discomfort. Western views on foot massage and massage in general are varied, with skeptics and several studies claiming little or no real therapeutic benefit. There is, however, near universal agreement that foot massage and massage are relaxing and rejuvenating.

In addition to health or rejuvenation benefits, foot massage has emerged in the PRC as a social activity. Friends and family enjoy conversing and enjoying television, beverages and simple foods while having a foot massage. In addition, business people often use foot massage spas for conversing and socializing with customers and fostering key relationships. We believe the social aspect of foot massage has been one of the major drivers of our growth in recent years.

Substantially all of our sales are done on a cash or prepaid basis. For our Company Spas, we receive all spa revenues and direct all expenses. For Franchise Spas, we typically receive a RMB 1 million (US$150,996) franchise fee for a fixed 5-year term, as well as the right to buy the Franchise Spa and convert it to a Company Spa, subject to successful pricing negotiations. In 2010, we implemented a networked Point of Sale (“POS”) system, which allows us to monitor transactions at our Company Spas in real time. We also have a centralized cash management system, in which Company Spa revenue is deposited into our central account on a daily basis, and all expenses at Company Spas are centrally approved and managed.

7

Over our past three fiscal years, our sales have averaged an annual increase of approximately 41.5% with an average net profit margin of approximately 19.7%. Our prices for foot massage range from RMB 68 (US$10.27)- RMB 88 (US$13.29), for Chinese full body massage our average price is RMB 258 (US$38.96) and for Thai full body massage our average price is RMB 128 (US$19.33). Our prices vary somewhat based on location, which allows us to maintain competitive pricing in local markets. For the fiscal year ended June 30, 2010, our average sale per customer was approximately RMB 113 (US17.06).

Industry Overview

According to the Chinese health practice known as “Reflexology,” each point on the sole of the foot corresponds (or “reflects”) to an internal organ, and applied therapy to these spots can have a healing effect on the corresponding organ. The belief is that the nerve ending in the sole of the foot is connected with internal organs of the body via invisible energy pathways, sometimes called meridians. The foot massage therapist applies varying amounts of high pressure to certain spots of the foot, over a time period typically ranging from 45-120 minutes. While foot massage is widely believed in China to have therapeutic benefit, often it is purchased as a leisure and/or social service, where groups of friends or business acquaintances may gather to enjoy a foot massage while socializing and having tea and simple food.

Most foot massage spas also offer Chinese and Thai style full body massage. In Chinese full body massage, the therapists can use arms, hands, fingers, elbows and knees to apply pressure to different parts of the body. According to Chinese beliefs, foot and body massages are seen as a moderate but valid therapy to treat illnesses and body discomfort. Thai full body massage has been widely adopted into Chinese culture and is offered at many massage spas throughout China. In Thai massage, therapists manipulate body parts by stretching them and applying gentle pressure. Thai massage is intended to be energizing and to stretch muscles and help retain or enhance flexibility.

Foot massage spas can be found in most Chinese cities and towns, as well as in moderate and upper class hotels, in airports and in shopping malls. Despite foot massage having become a mainstream service in the PRC, we are aware of no national associations or agencies that have collected national data on the foot massage industry. We believe that national foot massage data is scarce in large part because the business has traditionally been done on a small operator basis, with the typical owner having one store. Despite the lack of national industry data, we believe that it is common knowledge that foot massage has become a mainstream service that is offered widely throughout the country.

According to a September 8, 2008 article in the New York Times, there was an estimated 50,000-60,000 massage therapists in Beijing. In 2009, the Health and Recreation Specialty Council of the China Health Care Association reported that there were over 600,000 leisure and health enterprises in the PRC, and about three million companies producing related products, with combined annual revenues exceeding 200 billion RMB (US$26.5 billion). This category is wider than just massage parlors or spas and includes many other health and leisure companies.

8

Foot massage and full body massage are consumer services and are typically paid in cash. We believe that the consumption of massage has increased in step with increases in the PRC’s per capital incomes. The disposable income per capita for China’s urban residents has increased from RMB 10,493 in 2005 to RMB 19,109 in 2010, representing a compound annual growth rate of approximately 12.74% (National Bureau of Statistics of China). This added wealth has resulted in increased spending on a wide variety of products and services, massage services being one of them. The Company expects that continued gains in per capital incomes will create increased opportunity to provide massage services of higher quantity and quality. The Company also believes that the highly fragmented nature of the foot massage industry as well as the increase in consumer and business travel between cities in China create strong potential for the continued increase of national chains in the massage industry.

Competitive Strengths

We believe the following are our main competitive strengths:

We are a Leading National Foot Massage Chain

With 396 spas, we are one of the leading massage chains in the PRC. While data on other chains is subject to uncertainty, we believe that we are the largest chain in the PRC. See the section entitled “Competition”. We have spas located throughout 26 provinces, municipalities and autonomous regions in the PRC. Our size and growing reputation as one of the largest foot massage chains are key strengths that help us attract new franchisees, staff, and good locations.

Training Program and Service Consistency

We train approximately 4,000 massage therapists annually. These therapists are later placed at our spas. We have a full-time staff of approximately 21 expert instructors. Our training program helps ensure a consistent and high quality level of service throughout our spas.

Quality Service at Affordable Prices

We are building a brand known for quality and consistency while being affordable to mainstream Chinese living in urban centers. We provide value to our customers by pricing our services at competitively acceptable market prices, while assuring consistency and quality across our chain.

Centralized Store Oversight and Cash Management

A significant challenge for operating a large chain of foot massage spas is that the services are paid in cash, and thus cash control systems are key requirements. We have a central cash management system in which each spa’s sales are individually reported to our headquarters and the revenues are deposited in a central account each day. We also have a system for store oversight including the approval of various material expenses.

Business Strategies

We have the following business strategies:

Expand Market Presence

We plan to continue to increase the number of Franchise and Company Spas throughout the PRC. We intend to open spas in new regions as well as regions where we have an established market presence and strong brand recognition.

Convert more Franchise Spas to Company Spas

We plan to continue to purchase successful Franchise Spas and convert them to Company Spas From 2006 until December 31, 2010, we have purchased 240 spas, at an average purchase price of approximately RMB 3,969,625 (US$599,397) per store. We plan to continue to purchase more spas as our financial ability allows.

9

Enhance and Widen Customer Loyalty Program

We plan to enhance our customer loyalty program. We currently offer a Store Value Card, VIP Card and a Diamond Card – which offer prepaid customers various discounts and other benefits. Currently, these cards are only accepted at the store in which they were purchased, although we plan to implement a nationwide card acceptance system among Company Spas.

Enhance our IT and Store Management Systems

We plan to increase the functionality, tracking and reporting capability of our chain store management and accounting systems. Our current systems are focused on preventing leakage and assuring full cash collection. We plan to enhance our IT systems to give us more detailed reporting and allow us to more closely track and analyze trends across our business based on such things as geography, season, service types, customer type and price levels.

New Store Designs

We are currently introducing new store designs that feature more luxurious and modern layouts. The new designs are larger and have more luxurious decorations and accommodations. We believe this will improve our image as a high quality brand.

Our Services

We own, operate and franchise foot massage spas. The main services at our foot massage spas are Chinese foot massage, Chinese body massage, and Thai body massage. We also receive revenues from providing beverages including alcohol, tea, and juice, and simple foods including fruits, nuts, and dumplings. A majority of our revenues come from foot massage, which is our core service. We consider our other services and products as high margin add-on items, and we train and provide financial incentives for our local managers and massage therapists to promote these items.

We believe that our massage techniques are consistent with the principals of traditional Chinese Medicine. We collaborate with Hubei University of Chinese Medicine, a university that specializes in traditional Chinese medicine including reflexology. In our collaboration, we provide financial support to the University and allow University students to intern with us, and in turn, the University helps keep us apprised of key trends and other information in reflexology. We typically donate approximately RMB 200,000 (approximately US$30,700) per year to the University. We believe this collaboration helps our massage techniques. We refer to our own methods of massage as the Jiafu Technique. Our technique is a proprietary method developed by our founder and chairman, Mr. Jiafu Guo. This technique uses a rhythm and sequence that we believe is unique.

We seek to serve mainstream Chinese in urban centers, with a quality service at affordable prices. Our typical price for a 60-minute foot massage is 68 RMB (US$10.27). To achieve a consistent application of the Jiafu Technique across our chain, we operate two massage training centers in Chongqing that together train approximately 4,000 massage therapists annually. We have two separate training programs: one for foot massage and the other for full body massage, including Thai and Chinese body massage.

10

Franchise Spas

We typically sell single spa franchise rights for RMB 1 million. In considering new franchises, we examine the potential franchise owners’ ability to meet the capital requirements necessary to develop and successfully operate a franchise. We prefer to have franchise owners who have additional sources of revenue.

Our franchise agreements typically have a fixed term of 5-years and give us the right to buy the Franchise Spa, subject to successful purchase price negotiation. We do not offer perpetual franchise rights and our business strategy includes attracting entrepreneurs to start-up new Franchise Spas in their local area, with an eye toward eventually selling the franchise to us at a reasonable price once the spa is established and successful. Of the 312 franchise licenses that we have granted since 2006, we have acquired 164 of those Franchise Spas and converted them into Company Spas. As of December 31, 2010, 148 are still Franchise Spas. As Franchise Spas become proven and as our financial situation allows, we continually seek to acquire Franchise Spas and convert them to Company Spas.

We do not control the daily operations of the Franchise Spas. Our franchise agreements include no royalties; we only receive a one-time fee. The franchisee is responsible for all franchise costs including the lease, build-out and all costs of operations. We supply trained massage therapists to work at our franchises, and provide guidance and support to help the design, build-out and successful operation of the franchises. Our standard franchise agreement requires that the franchisee not perform any practices that cause material damage to our brand, which we believe helps us to ensure standardized pricing within geographic regions and a consistently high-quality level of service. Our regional managers periodically visit the Franchise Spas to give guidance and check on the cleanliness, service, pricing and other matters of importance to us, including when a Franchise Spa has matured into a business that we may want to purchase and convert to a Company Spa. Our trademark ,Jiafu Fuqiao, is licensed to our franchisees as part of our typical franchise agreement.

Company Spas

Over the past three fiscal years, over 95% of our revenues come from the Company Spas and less than 5% come from franchise fees. As of December 31, 2010, we had 240 Company Spas, 220 of which were formerly in our franchise network. The remaining 20 spas we acquired were not our franchises. At all our Company Spas, we direct and manage all aspects of the operations.

Store managers at Company Spas are responsible for reporting store results to our regional general managers on a daily basis. Our regional general managers have frequent contact with store managers to review customer count, sales, complaints and any special issues. We compare sales performance and cash collections against historical data to check for any inconsistencies or aberrations. We also send central management to visit Company Spas and on occasion we have supervisors test the massage standards and customer service professionalism. Each Company Spa typically also has a massage technician manager and a service manager, although smaller spas may only have a technician manager. Our technician managers are responsible for monitoring employees’ performance. They perform monthly reviews to assess therapists’ techniques and skills and are responsible for the overall quality of massages performed at our locations. Our service managers coordinate and manage our in-store food and drink services.

11

Of the 240 Company Spas, 47 were originally owned by 43 PRC limited liability companies. Jiafu Health purchased the shares of these limited liability companies and holds them directly. For the remaining 193 Company Spas, we purchased the assets but decided to leave the ownership of the business license in the names of the original owners, choosing to control each such spa’s operations through contractual arrangement. 191 of these spas are owned as sole proprietorships, individually owned businesses partnerships and two are branches of limited liability companies. While we can transfer ownership and the business license of these spas into our name at any time, at this time we have elected not to do so. Controlling these spas by contract simplifies our administration and creates a tax advantage because leaving the business ownership and license with the original franchisee enables the 191 Company Spas formed as sole proprietorships, individually owned businesses partnerships, to continue to be taxed in their respective localities as individually owned businesses, which have lower tax rates than businesses owned by corporations or limited liability companies. We have obtained letters from the Chongqing tax authorities, where Jiafu Health is registered, that for any profit distributed to Jiafu Health from a spa that is a subsidiary of Jiafu Health, an individually-owned business, sole proprietorship or a partnership, which has already been taxed per the local tax authority’s request shall not be deemed as taxable income to Jiafu Health. If PRC tax rules or interpretations ever change in this regard, we may convert some or all of the Company Spas into direct subsidiaries. For more information on the risks involved in our Company Spa ownership and control structure, please see the section of this Current Report entitled “Risk Factors.”

We seek to buy successful Franchise Spas and convert them to Company Spas continually throughout the year. Purchase prices are not pre-set and must be negotiated. However, the limited term of the franchise agreement creates an incentive for the franchisee to sell to us on reasonable terms. In addition, we typically pay all cash for these purchases, which is attractive to our franchisees as they can realize an attractive profit and are invited to start a new franchise. Thus far, our average purchase cost has been RMB 3,969,625 per store.

Spa Size and Location

Our spas vary in size. Our larger Company Spas range from about 2,000 to 5,500 square meters. Approximately 29 of our Company Spas are over 2,000 square meters, with an average staff of approximately 138 for each location. On average Company Spas have an average staff of approximately 77 and an average store size of approximately 1,305 square meters.

All of our spa locations are leased. We often help find our franchisees find appropriate locations. Each spa location is unique and we evaluate these locations on a case-by-case basis. Typically, leaseholds must be a minimum of 800 square meters. Franchisees pay for the build-out of the leasehold. We tend to favor locations that feature stable, positive economic conditions and larger populations. For smaller cities we pay special attention to economic output and the level of competition. We often look to place our spas in prominent city centers and highly trafficked areas such as Central Business Districts, and shopping centers

Geographic Breakdown

As of December 31, 2010, we had 240 Company Spas and 156 Franchise Spas, located throughout 26 provinces, municipalities and autonomous regions in the PRC. The map below illustrates our location presence in China as of December 31, 2010.

12

The table below lists the number of Company Spas and Franchise Spas according to store location, as of December 31, 2010.

|

Region

|

Number of

Company Spas

|

Number of

Franchise Spas

|

Total

|

|||

|

South Western

|

68

|

43

|

111

|

|||

|

Central China

|

80

|

28

|

108

|

|||

|

Eastern

|

25

|

47

|

72

|

|||

|

Northern

|

39

|

14

|

53

|

|||

|

South Eastern

|

16

|

19

|

35

|

|||

|

North Western

|

12

|

5

|

17

|

|||

|

Total

|

240

|

156

|

396

|

Sales and Marketing

Currently our marketing is local in focus. Individual store managers are responsible for spa promotions. This can include publishing of flyers and local newspaper as well as street sign advertising. We also market to businesses. We offer special packages to companies who frequently use massage as way to entertain their clients. Many companies in China have an entertainment budget to entertain customers, and massage is used to build or deepen business-customer relationships. We actively promote our services to China Mobile, Bank of China, Construction Bank of China, government ministries and large state-owned factories. As we grow, we plan to increase our marketing efforts on a larger scale. We plan to purchase TV and national magazine advertisements to help promote our brand on a national level.

13

Customer Loyalty Programs

We currently offer a Store Value Card, VIP Card and Diamond Card. Our Store Value Card is a prepaid massage card that provides customers priority services such as allowing them to book a massage room during peak hours and participate in card member only promotions. Customers that prepay 5,000 RMB (US$755) receive a VIP Card. The VIP Card entitles customers to a 10% discount as well as preferred customer services, such as preferred reservation times or the ability to reserve a particular massage therapist, as well as certain rewards at holidays and on the customer’s birthday. Customers that prepay 10,000 RMB (US$1,510), receive a Diamond Card. The Diamond Card entitles customers to a 15% discount, as well preferred customer services and promotions. When our customers purchase one of our cards, we record the customer’s name, age, gender, and business background.

We are in the process of implementing a new value card system. This system will allow use of our loyalty cards in all Company Spas, whereas currently our loyalty cards are only usable in the stores where issued. We also plan to collect more customer information and build a customer information database. We believe this information will allow us to better serve our customers. As of December 31, 2010, we have collected data on approximately 57,633 customers. We expect to complete program upgrades in 2011 and early 2012.

Pricing

We typically determine the prices of our services based on a variety of factors such as customer purchasing power, economic conditions and prices of competitors’ services. Our customers purchase our services with cash, debit card or credit card. A majority of our sales are made with cash. We target mainstream Chinese in urban centers through quality services at affordable prices.

Return policy

Our services are non-refundable. We rarely have a customer complaint. In the rare case of customer complaint, we may return a customer’s money to avoid conflict. We rarely experience any returns.

Supplies Procurement

Franchise Spas are responsible for handling their own supplies procurement. For our Company Spas, we purchase supplies in bulk, resulting in better purchase prices. We purchase goods on a weekly to bi-weekly basis. Suppliers ship the purchased goods directly to Company Spa locations. Our Company Spas have inventory managers assigned from headquarters. These inventory managers are responsible for filling out requests for materials and sending them to headquarters. The spa manager needs to sign off on all materials requests. Our category buyers at headquarters review the reasonableness of all requests and our buying director gives final approval. This process usually takes three days. Each Company Spa is given a budget to purchase fresh food products from nearby local markets. Our raw material suppliers give typically give 0-30 days credit.

14

Competition

The massage industry in the PRC is a highly fragmented market, composed of many small to medium-sized companies. There are relatively few national foot massage chains in China at this time. While most of our competition comes from small independent foot massage spas, the following chart shows lists the major foot massage chains in the PRC. The following table shows the name, headquarters location, number of stores, services price range and number of stores for our principal competitors, which we obtained by contacting these companies and/or reviewing their websites. We can not assure you of the validity of the data received from these competitors.

|

Company

|

Brand

|

Headquarters

|

Geographic

Strength

|

Price

Range

(RMB)

|

Stores

|

|||||

|

Hua Xia Liang Zi Ltd.

|

Hua Xia Liang Zi

|

Jinan

|

Shandong

|

138-300

|

301

|

|||||

|

Chongqing Fuqiao Health Caring Service Co., Ltd. (1)

|

Chongqing Fuqiao

|

Chongqing

|

Sichuan

|

128-368

|

250

|

|||||

|

Beijing Qian Zi Lian Investment Management Co., Ltd.

|

Qian Zi Lian

|

Beijing

|

Shanxi

Shanghai

Tianjin

Beijing

|

98-298

|

80

|

|||||

|

Chongqing Zu Zhi Le Health-care Ltd

|

Zu Zhi Le

|

Chongqing

|

Chongqing

|

68-158

|

83

|

(1) Chongqing Fuqiao Health Caring Service Co., Ltd., (“Chongqing Fuqiao”) is owned by the brothers of Mr. Jiafu Guo, Chairman and founder of Jiafu Health. Jiafu Guo was the original founder of Chongqing Fuqiao in 1998 and in 2000 his family members became partners. Jiafu Guo later separated from Chongqing Fuqiao. Jiafu Guo’s brothers and Chongqing Fuqiao have no ownership interest or activity in Jiafu Health, and Jiafu Guo and Jiafu Health has no ownership interest or activity in Chongqing Fuqiao.

We are not aware of any other company claiming to have more stores than us and believe we are the largest foot massage chain in China at this time. However as none of our competitors are publicly traded on any securities exchange, the information on our competitors is limited and may not be fully accurate.

Staffing

Our staff receive a base salary and many receive extra compensation based on the number of treatments and add-on services provided. We provide housing and three meals a day for many of our staff. Most of our Company and Franchise Spas operate 24 hours a day, seven days a week. The following chart shows the breakdown of our staffing as of December 31, 2010.

|

Staff Breakdown

|

||||

|

Massage Therapists

|

13,104 | |||

|

Quality Control Department

|

1,531 | |||

|

Research and Development

|

33 | |||

|

Sales and Marketing

|

1,019 | |||

|

Administration Department

|

506 | |||

|

Accounting/Finance Department

|

250 | |||

|

Senior Management

|

5 | |||

|

Human Resources Department

|

14 | |||

|

Warehouse Keeper

|

240 | |||

|

Other

|

1,213 | |||

|

Total

|

17,915 | |||

15

Intellectual Property Rights

As of December 31, 2010, we have two registered trademarks and no patents. We rely on trademarks protection laws in PRC and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our intellectual property. The Jiafu Fuqiao trademark “  ” , was registered on January 28, 2008 with a valid term of ten years, and the valid term is extendable upon application. The Ronghua Fugui trademark “

” , was registered on January 28, 2008 with a valid term of ten years, and the valid term is extendable upon application. The Ronghua Fugui trademark “ ” was registered on June 21, 2010 with a valid term of ten years and the valid term is extendable upon application. We also have registered our domain name: CQJFFQ.CN. Our trademark, Jiafu Fuqiao, is licensed to our franchisees as part of our typical franchise agreement.

” was registered on June 21, 2010 with a valid term of ten years and the valid term is extendable upon application. We also have registered our domain name: CQJFFQ.CN. Our trademark, Jiafu Fuqiao, is licensed to our franchisees as part of our typical franchise agreement.

” , was registered on January 28, 2008 with a valid term of ten years, and the valid term is extendable upon application. The Ronghua Fugui trademark “

” , was registered on January 28, 2008 with a valid term of ten years, and the valid term is extendable upon application. The Ronghua Fugui trademark “ ” was registered on June 21, 2010 with a valid term of ten years and the valid term is extendable upon application. We also have registered our domain name: CQJFFQ.CN. Our trademark, Jiafu Fuqiao, is licensed to our franchisees as part of our typical franchise agreement.

” was registered on June 21, 2010 with a valid term of ten years and the valid term is extendable upon application. We also have registered our domain name: CQJFFQ.CN. Our trademark, Jiafu Fuqiao, is licensed to our franchisees as part of our typical franchise agreement.Property

We do not own real property and all of our locations are leased. The average lease for our stores is eight to ten years and the average space leased is 1,305 square meters. Our executive management team is located at Fuxing Huiyu International Commerce Plaza, Xinhua Road, Wuhan City, China. We rent two office spaces at this location of approximately 120 square meters and 150 square meters for 9,000 RMB and 10,000 RMB respectively per month. Our training facility is located at No. 1 Haitang Xi New Street, Nan’an District, Chongqing City. This facility is approximately 2000 square meters and 15,000 RMB per month. This office is used for training staff and research.

Insurance

We do not currently have insurance. We believe this line with standards for foot massage companies in the PRC.

Legal Proceedings

We are not engaged in any material litigation, arbitration or claim, and no material litigation, arbitration or claim is known to be pending or threatened by or against us that would have a material adverse effect on our operation results or financial condition.

16

RISK FACTORS

Risks Related to Our Business and Industry

Our operating results have been in the past and will continue to be subject to a number of factors, many of which are largely outside our control. Any one or more of the factors set forth below could adversely impact our business, financial condition, and/or results of operations:

(i) Lower customer traffic or average value per transaction, which negatively impacts comparable store sales, net revenues, operating income, operating margins and earnings per share, due to:

|

|

·

|

the impact of initiatives by competitors and increased competition generally;

|

|

|

·

|

customers trading down to lower priced services within our Company stores, and/or shifting to competitors with lower priced services;

|

|

|

·

|

lack of customer acceptance of new services or price increases necessary to cover costs of new services and/or higher input costs;

|

|

|

·

|

the attractiveness of the venues to consumers and competition from comparable venues in terms of, among other things, accessibility and cost;

|

|

|

·

|

unfavorable general economic conditions in the markets in which we operate that adversely affect consumer spending; or

|

|

|

·

|

declines in general consumer demand for specialty services;

|

(ii) Cost increases that are either wholly or partially beyond our control, such as:

|

|

·

|

labor costs such as general market wage levels;

|

|

|

·

|

litigation against us;

|

|

|

·

|

construction costs associated with new store openings; or

|

|

|

·

|

information technology costs and other logistical resources necessary to maintain and support the growth of our business.

|

(iii) Delays in store openings for reasons beyond our control, or a lack of desirable real estate locations available for lease at reasonable rates, either of which could keep us from meeting annual store opening targets and, in turn, negatively impact net revenues, operating income and earnings per share.

Our limited operating history makes it difficult to evaluate our future business prospects and to make decisions based on our historical performance.

We have a limited operating history, which makes it difficult to evaluate our business on the basis of historical operations. As a consequence, it is difficult, to forecast our future results based upon our historical data. Reliance on our historical results may not be representative of the results we will achieve. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, product costs or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

17

If we have negative same-store sales, our business and results of operations may be adversely affected.

Our success depends, in part, upon our ability to maintain and improve sales, as well as both gross margins and operating margins. Comparable same-store sales are affected by average ticket and same-store customer visits. A variety of factors affect same-store customer visits, including healthcare trends, competition, current economic conditions, changes in our service assortment, the success of marketing programs and weather conditions. These factors may cause our comparable same-store sales results to differ materially from prior periods and from our expectations.

If we are unable to maintain and improve our comparable same-store sales on a long-term basis or offset the impact with operational savings, our financial results may be affected. Furthermore, continued declines in same-store sales performance may cause us to be in default of certain covenants in our financing arrangements.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly, year-to-date and annual expenses as a percentage of our revenues may differ significantly from our historical or projected rates. Our operating results in future quarters may fall below expectations. Any of these events could cause our stock price to fall. Each of the risk factors listed in Risk Factors and the following factors may affect our operating results:

|

|

·

|

Our ability to continue to attract customers to our stores;

|

|

|

·

|

Our ability to generate revenue from our members and customers for the services and products we offer;

|

|

|

·

|

The amount and timing of operating costs and capital expenditures related to the maintenance and expansion of our businesses, operations and infrastructure; and

|

|

|

·

|

Our focus on long-term goals over short-term results.

|

Because our business is changing and evolving, our historical operating results may not be useful to you in predicting our future operating results.

Our inability to continue to attract qualified franchisees could have a material adverse effect on our business.

The growth of our business is dependent, in part, upon our ability to attract new franchisees, and, should we decide to implement a royalty policy, to retain qualified franchisees. Although we evaluate prospective franchisees, there is no assurance that existing or future franchisees will have the business abilities or access to financial resources necessary to open new locations or that they will successfully develop and operate these massage spas in a manner consistent with our standards. The inability to retain qualified franchisees or attract new qualified franchisees could have a material adverse effect on our reputation, business, results of operations, and financial condition.

18

Increased competition for retail sites could have a material adverse effect on our business.

Our ability to grow depends upon our ability to obtain attractive retail sites for new Company stores and the ability of our franchisees to obtain attractive retail sites for new franchised stores. A store’s success depends significantly on the quality of the site selected for it. Both our Company stores and franchised stores face intense competition for retail sites from other companies operating in the massage industry and from retailers operating in other health and leisure industries. Our failure to procure and maintain adequate retail sites could have a material adverse effect on our business, results of operations and financial condition.

We may not be successful in implementing important strategic initiatives, which may have a material adverse impact on our business and financial results.

There is no assurance that we will be able to implement important strategic initiatives in accordance with our expectations, which may result in a material adverse impact on our business and financial results. These strategic initiatives are designed to drive long-term shareholder value and improve our company’s results of operations, and include:

|

|

·

|

ongoing initiatives to improve the current state of the business by focusing on the customer experience in the stores, new service offerings and store design elements;

|

|

|

·

|

balancing disciplined store growth while meeting target store-level unit economics in a given market; and

|

|

|

·

|

focusing on relevant innovation and profitable growth platforms.

|

Economic conditions in the PRC market could adversely affect our business and financial results.

As a leisure service provider that is dependent upon discretionary consumer spending, the results of our operations are sensitive to changes in macro-economic conditions. Our customers may have less money for discretionary purchases as a result of job losses, foreclosures, bankruptcies, reduced access to credit and falling home prices. Any resulting decreases in customer traffic or average value per transaction will negatively impact our financial performance as reduced revenues result in sales de-leveraging, which creates downward pressure on margins. There is also a risk that if negative economic conditions persist for a long period of time, consumers may make long-lasting changes to their discretionary purchasing behavior, including less frequent discretionary purchases on a more permanent basis.

Our success depends substantially on the value of our brand.

We believe we have built an excellent reputation nationally for the quality of our massage services, and for delivery of a consistently positive consumer experience. Brand value is based in part on consumer perceptions as to a variety of subjective qualities. Even isolated business incidents that erode consumer trust, particularly if the incidents receive considerable publicity or result in litigation, can significantly reduce brand value. Consumer demand for our services and brand equity could diminish significantly if we fail to preserve the quality of our massage services, or are perceived to act in an unethical or socially irresponsible manner, or fail to deliver a consistently positive consumer experience in each of our markets.

19

Liability for Service-related injuries and other potential claims could adversely affect us

The nature and use of services and the products we use to provide our services could give rise to liability for service-related injuries and other claims if a customer were injured while receiving one of our services (including those performed by students at our schools) or were to suffer adverse reactions following the service. Adverse reactions could be caused by various factors beyond our control, including hypoallergenic sensitivity with the products we use. Although service-related injuries lawsuits in the PRC are rare, and we have not, to date, incurred litigation expense involving service-related injuries, there is no guarantee that we will not face such liability in the future. As we do not carry insurance to help cover the costs of any such litigation or any judgments against us, such liability could be substantial and the occurrence of such loss or liability may have a material adverse effect on our business, financial condition and prospects.

Effectively managing our growth into new geographic areas will be challenging.

Effectively managing growth can be challenging, particularly as we expand into new markets geographically where we must balance the need for flexibility and a degree of autonomy for local management against the need for consistency with the our goals, philosophy and standards. Growth can make it increasingly difficult to locate and hire sufficient numbers of key employees to meet our financial targets, to maintain an effective system of internal controls, and to train employees nationally to deliver a consistently high quality service and customer experience.

We face risks related to maintaining our computer networks.

Our business relies to a significant extent on our computer networks, which control our point-of-sale system, which monitors our sales on a real-time basis. These networks may be vulnerable to service interruptions, delays or failures, including those related to unauthorized access, computer hackers, computer viruses and other security threats. The occurrence of any of these events could have a material adverse effect on our business, resulting adversely on our operations and financial condition. Any damage or failure that interrupts or delays our operations could have a material adverse effect on our business, results of operations and financial condition.

Another company uses “Fuqiao” in its branding, and this can cause customer confusion

Our chairman and his brothers used to be partners in a foot massage business called Chongqing Fuqiao Health Caring Service Co., Ltd. ("Chongqing Fuqiao"). Due to strategic differences, Jiafu Guo separated from Chongqing Fuqiao and started Fuqiao Health in 2004. In 2006, our chairman Jiafu Guo formed Jiafu Health in 2006. The two companies are separate and do not have common ownership or management. However, Chongqing Fuqiao uses the word "Fuqiao" in its branding. We also use Fuqaio in our branding. This situation can result in customer confusion.

To some degree, the success and growth of our business may have incidental benefit to Chongqing Fuqiao because of this confusion. Our customers may visit a Chongqing Fuqiao location under the mistaken impression that they were at one of our spas. Conversely, it is possible that a customer of Chongqing Fuqiao who had a negative experience at Chongqing Fuqiao could negatively affect our business by the accidental association with us.

20

We may face difficulties in protecting our intellectual property.

We have “Jiafu Fuqiao” and “Ronghua Fugui” trademarks registered in the PRC (Please refer to the section entitled “Intellectual Property Rights” in this Current Report). Although these intellectual properties are protected through registration, enforcement of measures for the protection of intellectual property rights in the PRC is currently not as certain or effective as compared to some developed countries. We believe our trademarks are critical to our success and that the success of our business depends in part upon our continued ability to use or further develop and increase brand awareness. The infringement of our trademarks would diminish the value of our brand and its market acceptance, as well as our competitive advantages.

Monitoring and preventing the unauthorized use of our intellectual property is difficult. The measures we take to protect our brand, trade names, copyrights and other intellectual property rights may not be adequate to prevent their unauthorized use by third parties. Furthermore, application of laws governing intellectual property rights in the PRC and abroad is uncertain and evolving and could involve substantial risks to us. If we are unable to adequately protect our brand, trademarks and other intellectual property rights, we may lose these rights and our business, results of operations, financial condition and prospects could be materially and adversely affected.

Although we have taken the necessary legal steps to register “Jiafu Fuqiao” as a trademark in the PRC, Chongqing Fuqiao is a competitive business that we believe may cause confusion to our customers, which may harm our business and results of operations. If existing customers were to have a negative experience at a Chongqing Fuqiao spa, while under the false impression that they were at a Jiafu Fuqiao spa, they may not return to a Jiafu Fuqiao spa, and they may share their negative impressions with their friends and acquaintances, resulting in further loss of business. Alternatively, if potential new customers were to visit Chongqing Fuqiao massage spas under the impression that they are at a Jiafu Fuqiao store, they may enjoy their experience and never become a customer of our branded spas.

We have imperfect documentation on some of our franchises, which may affect franchise agreement enforceability.

64 of franchises operating under the Jiafu Fuqiao brand began before the founding of Jiafu Health in October, 2006. These franchises were started by Fuqiao Health. Jiafu Health took over the franchises of Fuqiao Health and had these franchises sign new franchise agreements with Jiafu Health. To avoid double billing or any appearance that new franchise fees might be due or owing, or already-paid amounts, these new franchise agreements were dated with the subject spa’s original launch date. However, as these spas were started by Fuqiao Health, the original launch date was before the incorporation of Jiafu Health. If we ever end up in a legal dispute with one of these franchises, the new franchise agreement may be unenforceable, as it is dated before the date of Jiafu Health’s incorporation. As of December 31, 2010 we have acquired 56 of the 64 franchises taken over from Fuqiao Health, so this applies to only 10 active franchises.

We may be subject to administrative penalties because we have not yet completed the registration with the local commerce administration authority for our franchise program.

According to the Regulation on the Administration of Commercial Franchises issued by the PRC State Council as of February 6, 2007, a franchisor shall, within 15 days after having concluded a franchise contract for the first time, report it to the commercial administrative department. If a franchisor engages in any franchised operations within the scope of two or more provinces, such filing shall be made to the commercial administrative department of the State Council. Jiafu Health could be subject to RMB 100,000 fine for its failure to register and be required to complete such filings.

21

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our performance largely depends on the talents and efforts of highly skilled individuals, including massage instructors, store managers and massage therapists. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Our continued ability to compete effectively depends on our ability to train new employees, and to retain and motivate our existing employees.

The loss of key executives or difficulties recruiting and retaining qualified executives could jeopardize our ability to meet financial targets.

Our success depends substantially on the contributions and abilities of key executives. We must continue to recruit, retain and motivate key executives to maintain our current business and support our projected growth. A loss of a key executive could jeopardize our ability to meet financial targets.

We may need additional capital to execute our business plan and fund operations and may not be able to obtain such capital on acceptable terms or at all.

Capital requirements are difficult to plan in our rapidly changing industry. Although we currently expect to have sufficient funding for the next 12 months, we expect that we will need additional capital to fund our future expansion efforts.

Our ability to obtain additional capital on acceptable terms or at all is subject to a variety of uncertainties, including:

|

|

·

|

Investors’ perceptions of, and demand for, companies in our industry;

|

|

|

·

|

Investors’ perceptions of, and demand for, companies operating in China;

|

|

|

·

|

Conditions of the U.S. and other capital markets in which we may seek to raise funds;

|

|

|

·

|

Our future results of operations, financial condition, and cash flows; and

|

|

|

·

|

Governmental regulation of foreign investment in companies in particular countries.

|

We may be required to pursue sources of additional capital through various means, including debt or equity financings. There is no assurance that we will be successful in locating a suitable financing transaction in a timely fashion or at all. In addition, there is no assurance that we will be successful in obtaining the capital we require by any other means. Future financings through equity investments are likely to be dilutive to our existing shareholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses, and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition.

22

If we cannot raise additional funds on favorable terms or at all, we may not be able to carry out all or parts of our strategy to maintain our growth and competitiveness or to fund our operations. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

Our future performance is dependent on the PRC economy and, in particular, the level of growth of the PRC consumer market.

We derive substantial portion of our revenue from sales of our spa services in the PRC. The success of our business depends on the condition and growth of the PRC consumer market, which in turn depends on macro-economic conditions and individual income levels in the PRC. There is no assurance that projected growth rates of the PRC economy and the PRC consumer market will be realized under current economic situation. Any future slowdowns or declines in the PRC economy or consumer spending may adversely affect our business, operating results and financial condition.

Political, economic and social policies of the PRC government and PRC laws and regulations could affect our business and results of operations and may result in our inability to sustain our growth.

The economy of the PRC differs from the economies of most developed countries in a number of respects, including:

|

|

•

|

its structure;

|

|

|

•

|

level of government involvement;

|

|

|

•

|

level of development;

|

|

|

•

|

level of capital reinvestment;

|

|

|

•

|

control of capital reinvestment;

|

|

|

•

|

control of foreign exchange; and

|

|

|

•

|

allocation of resources.

|

Before its adoption of reform and open-door policies beginning in 1978, China was primarily a planned economy. Since then, the PRC government has been reforming the PRC’s economic system, and has begun reforming the government structure in recent years. These reforms have resulted in significant economic growth and social progress. Although the PRC government still owns a significant portion of the productive assets in the PRC, economic reform policies since the late 1970s have emphasized autonomous enterprises and the utilization of market mechanisms, especially where these policies apply to privately-owned businesses. Although we believe these reforms will have a positive effect on our overall and long-term development, we cannot predict whether changes in the PRC’s political, economic and social conditions, laws, regulations and policies will have an adverse impact on our current or future business, results of operations or financial condition.

Our ability to continue to expand our business is dependent on a number of factors, including general economic, capital market conditions and credit availability from banks or other lenders. In the past few years, the PRC government has articulated a need to control the rate of economic growth and may tighten its monetary policies, including increasing interest rates on bank loans and deposits and tightening the money supply to control growth in lending. Under current economic situation, financial institutions have tightened their lending. Stricter lending policies may, among other things, affect our ability to obtain financing, which may, in turn, adversely affect our growth and financial condition.

23