UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-21982

Guggenheim Strategic Opportunities Fund

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, 60606

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, 60606

(Name and address of agent for service)

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: May 31

Date of reporting period: June 1, 2016 - May 31, 2017

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Investment Company Act"), is as follows:

GUGGENHEIMINVESTMENTS.COM/GOF

... YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT GUGGENHEIM STRATEGIC OPPORTUNITIES FUND

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/gof, you will find:

|

•

|

Daily, weekly and monthly data on share prices, net asset values,

|

|

|

distributions and more

|

|

•

|

Portfolio overviews and performance analyses

|

|

•

|

Announcements, press releases and special notices

|

|

•

|

Fund and adviser contact information

|

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are continually updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

|

(Unaudited)

|

May 31, 2017

|

DEAR SHAREHOLDER

We thank you for your investment in the Guggenheim Strategic Opportunities Fund (the “Fund”). This report covers the Fund’s performance for the 12-month period ended May 31, 2017.

The Fund’s investment objective is to maximize total return through a combination of current income and capital appreciation. The Fund pursues a relative value-based investment philosophy. The Fund’s sub-adviser seeks to combine a credit-managed fixed-income portfolio with access to a diversified pool of alternative investments and equity strategies.

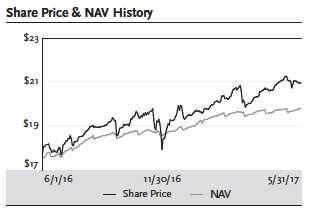

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended May 31, 2017, the Fund provided a total return based on market price of 33.33% and a total return based on NAV of 26.76%. NAV return includes the deduction of management fees, operating expenses, and all other Fund expenses.

As of May 31, 2017, the Fund’s market price of $20.94 represented a premium of 5.86% to its NAV of $19.78. The market value of the Fund’s shares fluctuates from time to time and may be higher or lower than the Fund’s NAV. Past performance is not a guarantee of future results.

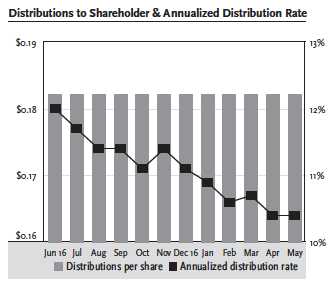

From June 2016 through May 2017, the Fund paid a monthly distribution of $0.1821. The latest distribution represents an annualized distribution rate of 10.44% based on the Fund’s closing market price of $20.94 on May 31, 2017. The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. Please see Note 2(i) on page 50 for more information on distributions for the period.

Guggenheim Funds Investment Advisors, LLC (the “Adviser”) serves as the investment adviser to the Fund. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Fund’s investment sub-adviser and is responsible for the management of the Fund’s portfolio of investments. Each of the Adviser and the Sub-Adviser is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 82 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a stable monthly distribution, the DRIP effectively provides an income averaging technique which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 3

|

DEAR SHAREHOLDER (Unaudited) continued

|

May 31, 2017

|

|

|

|

|

|

|

|

To learn more about the Fund’s performance and investment strategy, we encourage you to read the

|

|

|

Questions & Answers section of this report, which begins on page 5. You’ll find information on GPIM’s

|

|

|

investment philosophy, views on the economy and market environment, and detailed information about

|

|

|

the factors that impacted the Fund’s performance.

|

|

|

|

|

|

We appreciate your investment and look forward to serving your investment needs in the future. For the

|

|

|

most up-to-date information on your investment, please visit the Fund’s website at

|

|

|

guggenheiminvestments.com/gof.

|

|

|

|

|

|

Sincerely,

|

|

Donald C. Cacciapaglia

President and Chief Executive Officer

Guggenheim Strategic Opportunities Fund

June 30, 2017

4 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

QUESTIONS& ANSWERS (Unaudited)

|

May 31, 2017

|

Guggenheim Strategic Opportunities Fund (“Fund”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM”). This team includes B. Scott Minerd, Chairman of Guggenheim Investments and Global Chief Investment Officer; Anne B. Walsh, CFA, JD, Senior Managing Director and Assistant Chief Investment Officer; James W. Michal, Senior Managing Director and Portfolio Manager; and Steven H. Brown, CFA, Managing Director and Portfolio Manager. In the following interview, the investment team discusses the market environment and the Fund’s performance for the 12-month period ended May 31, 2017.

What is the Fund’s investment objective and how is it pursued?

The Fund seeks to maximize total return through a combination of current income and capital appreciation. The Fund pursues a relative value-based investment philosophy, which utilizes quantitative and qualitative analysis.

The Fund seeks to combine a credit-managed fixed-income portfolio with access to a diversified pool of alternative investments and equity strategies. The Fund seeks to achieve its investment objective by investing in a wide range of fixed-income and other debt and senior-equity securities (“Income Securities”) selected from a variety of credit qualities and sectors, including, but not limited to, corporate bonds, loans and loan participations, structured finance investments, U.S. government and agency securities, mezzanine and preferred securities and convertible securities, and in common stocks, limited liability company interests, trust certificates, and other equity investments (“Common Equity Securities,” exposure to which is obtained primarily by investing in exchange-traded funds, or ETFs) that GPIM believes offer attractive yield and/or capital appreciation potential, including employing a strategy of writing (selling) covered call and put options on such equities. GPIM believes the volatility of the Fund can be reduced by diversifying across a large number of sectors and securities, some of which historically have not been highly correlated to one another.

Under normal market conditions:

• The Fund may invest without limitation in fixed-income securities rated below investment grade (commonly referred to as “junk bonds”); the Fund may invest in below-investment grade income securities of any rating;

• The Fund may invest up to 20% of its total assets in non-U.S. dollar denominated fixed-income securities of corporate and governmental issuers located outside the U.S., including up to 10% of total assets in fixed-income securities of issuers located in emerging markets;

• The Fund may invest up to 50% of its total assets in common equity securities, and the Fund may invest in exchange-traded funds (“ETFs”) or other investment funds that track equity market indices and/or through derivative instruments that replicate the economic characteristics of exposure to Common Equity Securities; and

• The Fund may invest up to 30% of its total assets in investment funds that primarily hold (directly or indirectly) investments in which the Fund may invest directly, of which amount up to 30% of the Fund’s

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 5

|

QUESTIONS & ANSWERS (Unaudited) continued

|

May 31, 2017

|

|

|

total assets may be invested in investment funds that are registered as investment companies under the Investment Company Act of 1940 (the “1940 Act”) to the extent permitted by applicable law and related interpretations of the staff of the U.S. Securities and Exchange Commission.

|

GPIM’s process for determining whether to buy a security is a collaborative effort between various groups including: (i) economic research, which focus on key economic themes and trends, regional and country-specific analysis, and assessments of event-risk and policy impacts on asset prices, (ii) the Portfolio Construction Group, which utilize proprietary portfolio construction and risk modeling tools to determine allocation of assets among a variety of sectors, (iii) its Sector Specialists, who are responsible for identifying investment opportunities in particular securities within these sectors, including the structuring of certain securities directly with the issuers or with investment banks and dealers involved in the origination of such securities, and (iv) portfolio managers, who determine which securities best fit the Fund based on the Fund’s investment objective and top-down sector allocations. In managing the Fund, GPIM uses a process for selecting securities for purchase and sale that is based on intensive credit research and involves extensive due diligence on each issuer, region and sector. GPIM also considers macroeconomic outlook and geopolitical issues.

The Fund uses financial leverage (currently through borrowings and reverse repurchase agreements) to finance the purchase of additional securities. Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains earned on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, common shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of the financial leverage, common shareholders’ return will be less than if financial leverage had not been used.

What were the significant events affecting the economy and market environment over the past 12 months?

The period was marked by significant events in the political sphere, both in the U.S. and globally. In June 2016, Britain’s vote to depart the European Union shocked world markets, distressing the many market participants who had positioned themselves for the opposite outcome. The result was a sharp but brief market sell off at the end of the second quarter of 2016.

With the election of Donald Trump, the market began anticipating that reduced regulation and fiscal stimulus would lead to stronger economic growth in the U.S. and globally. With the potential to finance some of this stimulus increased Treasury issuance, nominal interest rates climbed higher by the end of 2016.

By spring 2017, markets were reassessing their optimistic economic outlooks after not seeing much progress on the legislative front. This helped bond prices to stabilize and the yield curve to flatten. With the rate rise in June and the U.S. Federal Reserve’s (the “Fed”) announcement about reducing the size of its balance sheet, after the period end, investors may see increased Treasury market volatility through the rest of the year.

6 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

May 31, 2017

|

Still, GPIM believes the global macroeconomic environment remains positive. China has stabilized, Europe is recovering, corporate earnings in the United States are rising, confidence measures are strong, and a U.S. recession appears unlikely before 2019. However, tracking estimates for first-quarter real Gross Domestic Product (“GDP”) growth gradually fell throughout the quarter despite strong gains in consumer and business sentiment since the election. GDP increased at an annual rate of 1.4% in the first quarter of 2017. The prospects for quarterly U.S. GDP growth are better going forward, and GPIM expects a bounce back in the second quarter.

GPIM’s medium-term growth outlook has dimmed marginally as a result of the minimal progress seen to date on the Trump administration’s fiscal policy initiatives. The ongoing struggle to create a healthcare bill has sapped early legislative momentum, and tax reform shows that work still needs to be done to put the agenda into effect in a timely manner—meaning markets may come to realize that the Trump rally may be long on promise and short on delivery.

With the Fed set to continue to raise interest rates—possibly at a faster pace than the market is pricing in—the shape of the yield curve going forward will remain a major theme in many portfolios. In addition to another potential rate hike this year, the Fed may raise rates three to four more times in 2018. The Fed’s strategy to reduce its balance sheet could pressure yields higher in the short end and belly of the curve, which is where most of the new Treasury issuance is likely to come. At the long end, rates are likely to stay low for some time. Recall that the last time the 10-year Treasury note traded below 3%, it lasted nearly 22 years (June 1934 through March 1956.)

By many measures, the stock and bond markets have rarely been more expensive and more stable in the second quarter of 2017. High-yield bonds were trading near their narrowest-ever spreads relative to treasuries in May 2017. At the same time, U.S. stock market indexes are continuing to make new highs while the Chicago Board Options Exchange Volatility Index (VIX), which measures option-implied S&P 500 volatility, is near its lowest level since 1993. The amount of complacency built into the markets argues for caution.

How did the Fund perform for the 12 months ended May 31, 2017?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended May 31, 2017, the Fund provided a total return based on market price of 33.33% and a total return based on NAV of 26.76%. NAV return includes the deduction of management fees, operating expenses, and all other Fund expenses.

As of May 31, 2017, the Fund’s market price of $20.94 represented a premium of 5.86% to its NAV of $19.78. As of May 31, 2016, the Fund’s market price of $17.61 represented a premium of 0.63% to its NAV of $17.50. The market value of the Fund’s shares fluctuates from time to time and may be higher or lower than the Fund’s NAV. Past performance is not a guarantee of future results.

What were the Fund’s distributions?

From June 2016 through May 2017, the Fund paid a monthly distribution of $0.1821. The latest distribution represents an annualized distribution rate of 10.44% based on the Fund’s closing market price of $20.94 on May 31, 2017. The Fund’s distribution rate is not constant and the amount of

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 7

|

QUESTIONS & ANSWERS (Unaudited) continued

|

May 31, 2017

|

distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. Please see Note 2(i) on page 50 for more information on distributions for the period.

Discuss performance over the period.

During the period, the Fund saw positive performance primarily attributable to the continued tightening of credit spreads across fixed income sectors, as well as the portfolio’s high carry. Carry refers to the income received net of borrowing costs from portfolio investments over a defined period. Returns from spread tightening during the period was chiefly driven by the portfolio’s investments in collateralized loan obligations (“CLO”), bank loans, and high yield corporate bonds.

During the risk-off atmosphere in the first quarter 2016, the Fund added to its credit exposure, including mezzanine CLOs, high yield corporate bonds and bank loans to help performance. The Fund has since reduced allocations as spreads have tightened over the period. This was not due to the default cycle, but rather continued relative overvaluation.

Spreads on bank loans and high-yield corporate bonds were driven to near-2014 lows by strong inflows from mutual funds and institutional investors. Tight spreads continue to reflect an optimistic outlook on corporate earnings and the promise of pro-growth fiscal policies. While earnings are improving as expected, fiscal policy uncertainty is rising, which may eventually be reflected in higher implied volatility. Implied volatility levels tend to be closely correlated with corporate bond spreads. If implied volatility rises this summer, GPIM expects to see some spread widening as well. This temporary spike in volatility should not be mistaken for fundamental deterioration in the leveraged credit space, however, as we continue to expect that defaults will decline through the end of the year.

In the CLO market, which has been dominated by refinancing and resets of 2014–2015 transactions, spreads have come in across all tranches to new three-year tights and approaching the post-crisis tights set in early 2013. Rising LIBOR rates also may make floating-rate assets more attractive than fixed rate, supporting further spread tightening.

The driving theme in the bank loan market continued to be the surge in refinancing activity, a trend GPIM expects will continue at least through the third quarter. Borrowers who completed a refinancing transaction in the first quarter reduced contractual spreads by almost 90 basis points. New issue volume has also been robust outside of refinancing activity, with institutional loan issuance totaling $96 billion in the first quarter of 2017, up from only $33 billion in the first quarter of 2016. This increase was accompanied by significant demand from CLOs and mutual funds.

Over half of the Fund’s portfolio is floating rate with limited interest rate duration risk, which should benefit given the anticipation of additional rate hikes in 2017 and 2018.

Discuss the Fund’s approach to duration.

Although the Fund has no set policy regarding portfolio duration or maturity, the Fund currently maintains a low-duration target, but adds opportunistically to attractive long duration assets when it can take advantage of short-term fluctuations in interest rates.

8 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

May 31, 2017

|

Discuss the Fund’s use of leverage

Since leverage adds to performance when the cost of leverage is less than the total return generated by investments, the use of leverage detracted from the Fund’s total return during this period. The purpose of leverage (borrowing and reverse repurchase agreements) is to fund the purchase of additional securities that provide increased income and potentially greater appreciation to common shareholders than could be achieved from an unlevered portfolio. Leverage results in greater NAV volatility and entails more downside risk than an unleveraged portfolio.

As of May 31, 2017, the amount of leverage was approximately 21% of managed assets (including the proceeds of leverage). GPIM employs leverage through two vehicles: reverse repurchase agreements, under which the Fund temporarily transfers possession of portfolio securities and receives cash which can be used for additional investments, and a committed financing facility through a leading financial institution. There is no guarantee that the Fund’s leverage strategy will be successful. The Fund’s use of leverage may cause the Fund’s NAV and market price of common shares to be more volatile and can magnify the effect of any losses.

Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure the performance of the broad economy, representing all major industries and is considered a representative of U.S. stock market.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

The Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

The Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury Bills with a remaining maturity of one to three months. U.S. Treasury Bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury and are generally regarded as being free of any risk of default.

Risks and Other Considerations

Investing involves risk, including the possible loss of principal and fluctuation of value.

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are expressed for informational purposes only and are subject to change at any time, based on market and other conditions, and may not come to pass. These views may differ from views of other investment professionals at Guggenheim and should not be construed as

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 9

|

QUESTIONS & ANSWERS (Unaudited) continued

|

May 31, 2017

|

research, investment advice or a recommendation of any kind regarding the fund or any issuer or security, do not constitute a solicitation to buy or sell any security and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific investor.

The views expressed in this report may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. Actual results or events may differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include general economic conditions such as inflation, recession and interest rates.

There can be no assurance that the Fund will achieve its investment objectives or that any investment strategies or techniques discussed herein will be effective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown.

Please see guggenheiminvestments.com/gof for a detailed discussion of the Fund’s risks and considerations.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

10 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

FUND SUMMARY (Unaudited)

|

May 31, 2017

|

|

|

|

|

Fund Statistics

|

|

|

Share Price

|

$20.94

|

|

Net Asset Value

|

$19.78

|

|

Premium to NAV

|

5.86%

|

|

Net Assets ($000)

|

$410,465

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

|

|

|

|

|

PERIOD ENDED MAY 31, 2017

|

|

|

|

|

|

|

|

|

|

Since

|

|

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(07/26/07)

|

|

Guggenheim Strategic Opportunities Fund

|

|

|

|

|

|

NAV

|

26.76%

|

10.77%

|

12.49%

|

11.92%

|

|

Market

|

33.33%

|

10.62%

|

11.32%

|

12.19%

|

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/gof. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

GMAC Commercial Mortgage Asset Corp., 6.36% due 09/10/44

|

1.0%

|

|

Cosmopolitan Hotel Trust 2016, 5.64% due 11/15/33

|

0.9%

|

|

MP CLO V Ltd., 7.06% due 07/18/26

|

0.9%

|

|

QBE Insurance Group Ltd., 7.50% due 11/24/43

|

0.8%

|

|

Flatiron CLO Ltd., 4.76% due 01/17/26

|

0.8%

|

|

Citigroup, Inc., 5.95%

|

0.8%

|

|

BBB Industries, LLC, 6.04% due 11/03/21

|

0.7%

|

|

Flagship CLO VIII Ltd., 6.36% due 01/16/26

|

0.7%

|

|

FDF II Ltd., 7.70% due 05/12/31

|

0.7%

|

|

Anchorage Credit Funding 1 Ltd., 6.30% due 07/28/30

|

0.7%

|

|

Top Ten Total

|

8.0%

|

|

“Ten Largest Holdings” excludes any temporary cash or derivative investments.

|

|

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 11

FUND SUMMARY (Unaudited) continued May 31, 2017

12 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

FUND SUMMARY (Unaudited) continued

|

May 31, 2017

|

|

|

|

|

|

|

|

Portfolio Breakdown

|

% of Net Assets

|

|

Investments:

|

|

|

Senior Floating Rate Interests

|

42.9%

|

|

Asset Backed Securities

|

35.0%

|

|

Corporate Bonds

|

30.6%

|

|

U.S. Government Securities

|

7.6%

|

|

Collateralized Mortgage Obligations

|

3.2%

|

|

Money Market Fund

|

2.2%

|

|

Foreign Government Bonds

|

1.5%

|

|

Preferred Stocks

|

1.5%

|

|

Common Stocks

|

0.5%

|

|

Municipal Bonds

|

0.5%

|

|

Call Options Purchased

|

0.2%

|

|

Put Options Purchased

|

0.1%

|

|

Warrants

|

0.0%*

|

|

Total Investments

|

125.8%

|

|

Call Options Written

|

-0.3%

|

|

Other Assets & Liabilities, net

|

-25.5%

|

|

Net Assets

|

100.0%

|

|

*Less than 0.1%

|

|

Holdings diversification and holdings are subject to change daily. For more information, please visit guggenheiminvestments.com/gof. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 13

|

FUND SUMMARY (Unaudited) continued

|

May 31, 2017

|

|

|

|

|

Portfolio Composition by Quality Rating*

|

|

|

|

|

|

|

% of Total

|

|

Rating

|

Investments

|

|

Fixed Income Instruments

|

|

|

AAA

|

6.0%

|

|

AA

|

0.5%

|

|

A

|

4.5%

|

|

BBB

|

14.5%

|

|

BB

|

13.7%

|

|

B

|

35.0%

|

|

CCC

|

3.9%

|

|

CC

|

0.6%

|

|

NR**

|

13.0%

|

|

Other Instruments

|

|

|

Other

|

0.6%

|

|

Short Term Investments

|

7.7%

|

|

Total Investments

|

100.0%

|

* Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities except for “NR”, or not rated, have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, which are all a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase and may change thereafter.

** NR securities do not necessarily indicate low credit quality.

14 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

SCHEDULE OF INVESTMENTS

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Shares

|

Value

|

|

COMMON STOCKS† – 0.5%

|

|

|

|

Energy – 0.3%

|

|

|

|

SandRidge Energy, Inc.*,1

|

41,086

|

$ 813,092

|

|

Approach Resources, Inc.*

|

112,884

|

286,725

|

|

Titan Energy LLC*,1

|

9,603

|

90,748

|

|

Total Energy

|

|

1,190,565

|

|

|

||

|

Technology – 0.2%

|

|

|

|

Aspect Software Parent, Inc.*,†††,2,14

|

40,745

|

609,980

|

|

Aspect Software Parent, Inc.*,†††,2,14

|

15,032

|

225,037

|

|

Qlik Technologies, Inc. A*,†††,2

|

56

|

55,840

|

|

Qlik Technologies, Inc. B*,†††,2

|

13,812

|

564

|

|

Qlik Technologies, Inc.*,††

|

3,600

|

–

|

|

Total Technology

|

|

891,421

|

|

|

||

|

Communications – 0.0%**

|

|

|

|

Cengage Learning Acquisitions, Inc.*,††

|

11,126

|

50,067

|

|

|

||

|

Consumer, Non-cyclical – 0.0%**

|

|

|

|

Targus Group International Equity, Inc.*,†††,2,14

|

13,409

|

20,113

|

|

|

||

|

Basic Materials – 0.0%**

|

|

|

|

Mirabela Nickel Ltd.*,†††,2

|

5,244,841

|

390

|

|

|

||

|

Consumer, Cyclical – 0.0%**

|

|

|

|

Deb Stores Holding LLC*,†††,2

|

9,389

|

1

|

|

|

||

|

Industrial – 0.0%**

|

|

|

|

Carey International, Inc.*,†††,2

|

5,666

|

1

|

|

Total Common Stocks

|

|

|

|

(Cost $4,709,480)

|

|

2,152,558

|

|

|

||

|

PREFERRED STOCKS† – 1.5%

|

|

|

|

Financial – 1.2%

|

|

|

|

Morgan Stanley

|

|

|

|

5.85%10

|

110,000

|

2,932,600

|

|

Public Storage

|

|

|

|

5.40%10

|

42,000

|

1,080,660

|

|

5.90%10

|

10,000

|

253,200

|

|

AgriBank FCB

|

|

|

|

6.88%1,10

|

4,000

|

435,500

|

|

Total Financial

|

|

4,701,960

|

|

|

||

|

Industrial – 0.3%

|

|

|

|

Seaspan Corp.

|

|

|

|

6.38%1,10

|

54,825

|

1,376,108

|

|

Total Preferred Stocks

|

|

|

|

(Cost $5,733,549)

|

|

6,078,068

|

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 15

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

Shares

|

Value

|

|

WARRANTS†† – 0.0%**

|

|

|

|

Comstock Resources, Inc.

|

|

|

|

expiring 09/06/18

|

3,575

|

$ 23,416

|

|

Total Warrants

|

|

|

|

(Cost $13,658)

|

|

23,416

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SHORT TERM INVESTMENTS†† – 9.8%

|

|

|

|

U.S. GOVERNMENT SECURITIES†† – 7.6%

|

|

|

|

United States Treasury Bill

|

|

|

|

0.75% due 06/22/171,3

|

5,900,000

|

$ 5,897,510

|

|

0.88% due 08/10/171,3

|

5,550,000

|

5,540,143

|

|

0.86% due 08/03/171,3

|

5,500,000

|

5,491,261

|

|

0.83% due 07/27/171,3

|

5,000,000

|

4,993,215

|

|

0.73% due 06/15/171,3

|

3,000,000

|

2,999,142

|

|

0.76% due 07/06/171,3

|

2,800,000

|

2,797,973

|

|

0.83% due 07/20/173

|

2,300,000

|

2,297,293

|

|

0.76% due 07/13/171,3

|

1,400,000

|

1,398,649

|

|

Total U.S. Government Securities

|

|

|

|

(Cost $31,416,894)

|

|

31,415,186

|

|

MONEY MARKET FUND† – 2.2%

|

|

|

|

Dreyfus Treasury Prime Cash Management Institutional Shares

|

|

|

|

0.65%4

|

|

|

|

(Cost $8,922,784)

|

8,922,784

|

8,922,784

|

|

Total Short Term Investments

|

|

|

|

(Cost $40,339,678)

|

|

40,337,970

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9%

|

|

|

|

Industrial – 9.1%

|

|

|

|

ILPEA Parent, Inc.

|

|

|

|

6.55% due 03/02/23

|

2,700,000

|

2,699,999

|

|

Advanced Integration Technology LP

|

|

|

|

6.54% due 04/03/23

|

2,542,500

|

2,567,924

|

|

Alion Science & Technology Corp.

|

|

|

|

5.54% due 08/19/21

|

2,456,250

|

2,454,211

|

|

Tronair Parent, Inc.

|

|

|

|

5.86% due 09/08/23

|

2,386,992

|

2,363,122

|

|

CareCore National LLC

|

|

|

|

5.04% due 03/05/21

|

2,335,208

|

2,352,723

|

|

American Bath Group LLC

|

|

|

|

6.40% due 09/30/23

|

2,194,486

|

2,217,353

|

|

SRS Distribution, Inc.

|

|

|

|

9.75% due 02/24/23

|

2,030,000

|

2,085,825

|

|

Transcendia Holdings, Inc.

|

|

|

|

5.00% due 05/09/24

|

2,000,000

|

2,010,000

|

See notes to financial statements.

16 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Industrial – 9.1% (continued)

|

|

|

|

Bioplan / Arcade

|

|

|

|

5.79% due 09/23/21

|

1,959,837

|

$ 1,923,913

|

|

Zodiac Pool Solutions LLC

|

|

|

|

5.65% due 12/20/23

|

1,546,125

|

1,553,856

|

|

National Technical

|

|

|

|

7.25% due 06/12/21†††,2

|

1,395,061

|

1,360,185

|

|

Thor Bidco (Morrison Utility)

|

|

|

|

5.33% due 09/20/23

|

1,000,000 GBP

|

1,288,394

|

|

HBC Hardware Holdings

|

|

|

|

7.65% due 03/30/20†††

|

1,293,750

|

1,267,875

|

|

ProAmpac PG Borrower LLC

|

|

|

|

9.67% due 11/18/24

|

1,000,000

|

1,015,000

|

|

Diversitech Holdings, Inc.

|

|

|

|

8.50% due 05/18/25

|

1,000,000

|

1,011,250

|

|

Pregis Holding I Corp.

|

|

|

|

4.65% due 05/20/21

|

1,000,000

|

1,003,130

|

|

ACA Compliance Group Holdings

|

|

|

|

5.75% due 02/01/21

|

1,000,000

|

1,002,500

|

|

SiteOne Landscaping LLC

|

|

|

|

4.53% due 04/29/22

|

990,025

|

996,213

|

|

Resource Label Group LLC

|

|

|

|

5.50% due 05/26/23

|

1,000,000

|

990,000

|

|

Amspec Services, Inc.

|

|

|

|

5.80% due 07/01/22

|

890,263

|

881,361

|

|

6.15% due 07/01/22

|

97,523

|

96,548

|

|

ICSH Parent, Inc.

|

|

|

|

5.18% due 04/29/24

|

847,059

|

844,941

|

|

Kuehg Corp. – Kindercare

|

|

|

|

4.92% due 08/12/22

|

744,269

|

747,990

|

|

GYP Holdings III Corp.

|

|

|

|

4.67% due 04/01/21

|

623,555

|

623,947

|

|

Duran, Inc.

|

|

|

|

4.75% due 03/21/24

|

550,000

|

548,625

|

|

SI Organization

|

|

|

|

5.90% due 11/22/19

|

494,146

|

497,442

|

|

Ranpak

|

|

|

|

8.25% due 10/03/22

|

435,556

|

433,378

|

|

Hunter Defense Technologies

|

|

|

|

7.16% due 08/05/19

|

365,333

|

335,650

|

|

NaNa Development Corp.

|

|

|

|

8.00% due 03/15/18

|

214,802

|

210,506

|

|

Doncasters Group Ltd.

|

|

|

|

9.50% due 10/09/20

|

101,379

|

97,493

|

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 17

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Industrial – 9.1% (continued)

|

|

|

|

Carey International, Inc.

|

|

|

|

9.00% due 05/23/20†††,2,13

|

47,834

|

$ 6,792

|

|

Total Industrial

|

|

37,488,146

|

|

Consumer, Non-cyclical – 8.8%

|

|

|

|

Copernicus Group, Inc.

|

|

|

|

6.15% due 08/15/22

|

2,983,377

|

2,983,377

|

|

Reddy Ice Holdings, Inc.

|

|

|

|

6.76% due 05/01/19

|

2,260,128

|

2,227,649

|

|

American Seafoods Group LLC / American Seafoods Finance, Inc.

|

|

|

|

6.07% due 08/19/21

|

2,026,255

|

2,030,470

|

|

0.88% due 08/19/21†††,2

|

25,000

|

22,381

|

|

AT Home Holding III

|

|

|

|

4.67% due 06/03/22

|

1,960,000

|

1,955,101

|

|

Give and Go Prepared Foods Corp.

|

|

|

|

6.65% due 07/29/23

|

1,841,249

|

1,859,661

|

|

Pelican Products, Inc.

|

|

|

|

5.40% due 04/10/20

|

1,779,646

|

1,777,422

|

|

Equian LLC

|

|

|

|

4.93% due 05/20/24

|

1,720,588

|

1,724,890

|

|

Chef’s Warehouse Parent LLC

|

|

|

|

6.79% due 06/22/22

|

1,624,273

|

1,644,576

|

|

BCPE Eagle Buyer LLC

|

|

|

|

5.34% due 03/18/24

|

1,200,000

|

1,197,000

|

|

Authentic Brands

|

|

|

|

5.15% due 05/27/21

|

1,175,692

|

1,181,570

|

|

IHC Holding Corp.

|

|

|

|

7.02% due 04/30/21†††,2

|

982,500

|

972,881

|

|

7.26% due 04/30/21†††,2

|

188,575

|

188,309

|

|

Sho Holding I Corp.

|

|

|

|

6.04% due 10/27/22

|

1,127,146

|

1,121,511

|

|

Chobani LLC

|

|

|

|

5.29% due 10/09/23

|

1,025,000

|

1,038,458

|

|

Endo Luxembourg Finance Co.

|

|

|

|

5.31% due 04/29/24

|

1,000,000

|

1,016,880

|

|

Hanger, Inc.

|

|

|

|

11.50% due 08/01/19

|

1,000,000

|

1,015,000

|

|

Arctic Glacier Group Holdings, Inc.

|

|

|

|

5.29% due 03/20/24

|

1,000,000

|

1,011,880

|

|

CPI Holdco LLC

|

|

|

|

5.15% due 03/21/24

|

1,000,000

|

1,005,000

|

|

CPM Holdings

|

|

|

|

5.29% due 04/11/22

|

984,868

|

995,130

|

|

Springs Industries, Inc.

|

|

|

|

7.50% due 06/01/21†††,2

|

992,500

|

992,500

|

See notes to financial statements.

18 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Consumer, Non-cyclical – 8.8% (continued)

|

|

|

|

Alegeus Technologies LLC

|

|

|

|

6.31% due 04/28/23

|

1,000,000

|

$ 990,000

|

|

Affordable Care Holding

|

|

|

|

5.79% due 10/24/22

|

987,500

|

987,500

|

|

American Tire Distributors, Inc.

|

|

|

|

5.29% due 09/01/21

|

970,938

|

973,366

|

|

ABB Concise Optical Group LLC

|

|

|

|

6.13% due 06/15/23

|

965,150

|

972,997

|

|

Lineage Logistics LLC

|

|

|

|

4.54% due 04/07/21

|

937,914

|

939,086

|

|

Amplify Snack Brands, Inc.

|

|

|

|

6.50% due 09/02/23

|

940,000

|

933,730

|

|

CTI Foods Holding Co. LLC

|

|

|

|

8.40% due 06/28/21

|

1,105,000

|

928,200

|

|

PT Intermediate Holdings III LLC

|

|

|

|

7.54% due 06/23/22†††,2

|

786,750

|

786,750

|

|

NES Global Talent

|

|

|

|

6.67% due 10/03/19

|

313,987

|

282,588

|

|

Packaging Coordinators Midco, Inc.

|

|

|

|

1.11% due 07/01/21†††,2

|

115,385

|

103,600

|

|

Rite Aid Corp.

|

|

|

|

5.75% due 08/21/20

|

100,000

|

100,333

|

|

Targus Group International, Inc.

|

|

|

|

15.00% due 12/31/19†††,2,14

|

64,198

|

64,198

|

|

14.00% due 05/24/16†††,2,12,14

|

155,450

|

–

|

|

Total Consumer, Non-cyclical

|

|

36,023,994

|

|

Consumer, Cyclical – 7.8%

|

|

|

|

BBB Industries, LLC

|

|

|

|

6.04% due 11/03/21

|

3,000,000

|

3,026,249

|

|

Accuride Corp.

|

|

|

|

8.15% due 11/17/23

|

2,615,000

|

2,634,612

|

|

Navistar Inc.

|

|

|

|

5.00% due 08/07/20

|

2,364,987

|

2,402,424

|

|

BIG JACK Holdings

|

|

|

|

5.25% due 04/05/24

|

2,375,000

|

2,389,843

|

|

LSF9 Robin Investments Ltd.

|

|

|

|

5.34% due 12/13/23

|

1,750,000 GBP

|

2,283,820

|

|

K & N Parent, Inc.

|

|

|

|

5.79% due 10/20/23

|

1,995,000

|

1,999,988

|

|

Blue Nile, Inc.

|

|

|

|

7.66% due 02/17/23

|

2,000,000

|

1,980,000

|

|

Mavis Tire

|

|

|

|

6.29% due 11/02/20†††,2

|

1,965,000

|

1,946,091

|

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 19

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Consumer, Cyclical – 7.8% (continued)

|

|

|

|

Boot Barn Holdings, Inc.

|

|

|

|

5.65% due 06/29/21†††,2

|

1,965,000

|

$ 1,882,666

|

|

Sears Holdings Corp.

|

|

|

|

5.54% due 06/30/18

|

1,916,128

|

1,878,765

|

|

LA Fitness International LLC

|

|

|

|

5.40% due 07/01/20

|

1,603,030

|

1,621,738

|

|

National Vision, Inc.

|

|

|

|

6.79% due 03/11/22

|

1,200,000

|

1,165,500

|

|

Belk, Inc.

|

|

|

|

5.91% due 12/12/22

|

1,324,584

|

1,135,421

|

|

Truck Hero, Inc.

|

|

|

|

5.16% due 05/16/24

|

1,000,000

|

993,440

|

|

MyEyeDoctor

|

|

|

|

7.40% due 08/16/21†††,2

|

985,399

|

978,491

|

|

Checkers Drive-In Restaurants, Inc.

|

|

|

|

5.41% due 04/25/24

|

900,000

|

894,943

|

|

Sky Bet Cyan Blue HoldCo

|

|

|

|

4.59% due 02/25/22

|

650,000 GBP

|

846,300

|

|

ABRA Auto Body

|

|

|

|

8.33% due 09/19/22

|

500,000

|

500,000

|

|

Amaya Holdings B.V.

|

|

|

|

4.65% due 08/01/21

|

496,212

|

497,080

|

|

Talbots, Inc.

|

|

|

|

5.54% due 03/19/20

|

457,871

|

424,447

|

|

Acosta, Inc.

|

|

|

|

3.65% due 09/26/19†††,2

|

317,778

|

298,141

|

|

CH Holding Corp.

|

|

|

|

8.29% due 02/03/25

|

200,000

|

204,750

|

|

Deb Stores Holding LLC

|

|

|

|

1.50% due 10/11/16†††,2,13

|

769,055

|

1

|

|

Total Consumer, Cyclical

|

|

31,984,710

|

|

Technology – 7.0%

|

|

|

|

TIBCO Software, Inc.

|

|

|

|

5.55% due 12/04/20

|

2,396,207

|

2,418,683

|

|

LANDesk Group, Inc.

|

|

|

|

5.30% due 01/20/24

|

2,270,000

|

2,272,837

|

|

Epicor Software

|

|

|

|

4.80% due 06/01/22

|

1,720,305

|

1,721,389

|

|

5.05% due 06/01/22

|

491,587

|

494,045

|

|

Insight Venture

|

|

|

|

7.25% due 07/15/21†††,2

|

1,650,000 GBP

|

2,101,507

|

|

Planview, Inc. (PHNTM Holdings, Inc.)

|

|

|

|

6.29% due 01/27/23†††,2

|

1,000,000

|

985,907

|

|

10.79% due 07/27/23†††,2

|

900,000

|

887,254

|

See notes to financial statements.

20 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Technology – 7.0% (continued)

|

|

|

|

EIG Investors Corp.

|

|

|

|

6.18% due 02/09/23

|

1,863,799

|

$ 1,867,303

|

|

PowerSchool, Inc.

|

|

|

|

6.03% due 07/30/21†††,2

|

985,000

|

985,000

|

|

6.15% due 07/30/21†††,2

|

580,650

|

580,650

|

|

6.53% due 07/30/21†††,2

|

248,750

|

248,750

|

|

Aspect Software, Inc.

|

|

|

|

11.02% due 05/25/2014

|

906,241

|

903,975

|

|

8.29% due 05/25/18†††,2,14

|

437,500

|

437,500

|

|

Solera LLC

|

|

|

|

3.38% due 03/03/21†††,2

|

1,456,983

|

1,303,000

|

|

Ministry Brands LLC

|

|

|

|

6.00% due 12/02/22

|

980,456

|

970,651

|

|

4.99% due 12/02/22

|

314,541

|

311,396

|

|

Touchtunes Interactive Network

|

|

|

|

5.90% due 05/28/21

|

884,250

|

886,461

|

|

5.75% due 05/28/21

|

360,000

|

360,900

|

|

Advanced Computer Software

|

|

|

|

10.67% due 01/31/23

|

1,250,000

|

1,140,625

|

|

6.67% due 03/18/22

|

99,745

|

97,002

|

|

MRI Software LLC

|

|

|

|

5.40% due 06/23/21

|

1,032,724

|

1,040,469

|

|

Kronos, Inc.

|

|

|

|

4.68% due 11/01/23

|

997,500

|

1,006,527

|

|

Masergy Holdings, Inc.

|

|

|

|

5.58% due 12/15/23

|

997,500

|

1,003,734

|

|

Palermo Finance Corp.

|

|

|

|

5.66% due 04/17/23

|

1,000,000

|

990,000

|

|

CPI Acquisition, Inc.

|

|

|

|

5.83% due 08/17/22

|

1,091,782

|

964,862

|

|

Sparta Holding Corp.

|

|

|

|

6.65% due 07/28/20†††,2

|

955,057

|

950,029

|

|

Cologix Holdings, Inc.

|

|

|

|

8.01% due 03/20/25

|

750,000

|

751,875

|

|

GlobalLogic Holdings, Inc.

|

|

|

|

5.65% due 06/20/22

|

491,189

|

494,259

|

|

Active Network LLC

|

|

|

|

6.00% due 11/13/20

|

442,612

|

445,931

|

|

Ceridian Corp.

|

|

|

|

4.54% due 09/15/20

|

250,697

|

250,071

|

|

Total Technology

|

|

28,872,592

|

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 21

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Basic Materials – 2.6%

|

|

|

|

Zep, Inc.

|

|

|

|

5.04% due 06/27/22

|

1,965,000

|

$ 1,969,914

|

|

PetroChoice Holdings

|

|

|

|

6.12% due 08/19/22

|

1,776,741

|

1,783,403

|

|

Niacet Corp.

|

|

|

|

5.65% due 02/01/24

|

1,700,000

|

1,691,500

|

|

Arch Coal, Inc.

|

|

|

|

5.04% due 03/07/24

|

1,600,000

|

1,601,200

|

|

EP Minerals LLC

|

|

|

|

5.50% due 08/20/20

|

1,550,000

|

1,550,000

|

|

Niacet B.V.

|

|

|

|

5.50% due 02/01/24

|

800,000 EUR

|

894,181

|

|

Hoffmaster Group, Inc.

|

|

|

|

5.50% due 11/21/23

|

598,500

|

605,233

|

|

PQ Corp.

|

|

|

|

5.29% due 11/04/22

|

597,997

|

604,629

|

|

Noranda Aluminum Acquisition Corp.

|

|

|

|

7.50% due 02/28/1912

|

580,010

|

20,300

|

|

Total Basic Materials

|

|

10,720,360

|

|

Financial – 2.5%

|

|

|

|

Misys Ltd.

|

|

|

|

4.50% due 04/26/24

|

2,000,000

|

2,003,839

|

|

American Stock Transfer & Trust

|

|

|

|

5.75% due 06/26/20

|

1,450,132

|

1,448,319

|

|

Hyperion Insurance

|

|

|

|

5.00% due 04/29/22

|

1,303,130

|

1,309,971

|

|

Americold Realty Operating Partnership, LP

|

|

|

|

4.79% due 12/01/22

|

1,147,538

|

1,159,736

|

|

Acrisure LLC

|

|

|

|

6.15% due 11/22/23

|

1,000,000

|

1,008,440

|

|

Integro Parent, Inc.

|

|

|

|

6.92% due 10/28/22

|

987,785

|

987,785

|

|

Virtus Investment Partners, Inc.

|

|

|

|

4.75% due 03/04/24

|

800,000

|

812,000

|

|

Magic Newco, LLC

|

|

|

|

12.00% due 06/12/19

|

750,000

|

771,098

|

|

Assured Partners, Inc.

|

|

|

|

3.50% due 10/21/22

|

390,000

|

390,164

|

|

Ryan LLC

|

|

|

|

6.79% due 08/07/20

|

312,910

|

310,955

|

|

Total Financial

|

|

10,202,307

|

See notes to financial statements.

22 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Communications – 1.7%

|

|

|

|

Anaren, Inc.

|

|

|

|

9.40% due 08/18/21

|

1,000,000

|

$ 985,000

|

|

5.65% due 02/18/21

|

931,056

|

931,056

|

|

Houghton Mifflin Co.

|

|

|

|

4.04% due 05/28/21

|

1,748,985

|

1,651,147

|

|

Cengage Learning Acquisitions, Inc.

|

|

|

|

5.25% due 06/07/23

|

1,714,007

|

1,613,103

|

|

Proquest LLC

|

|

|

|

10.01% due 12/15/22

|

772,000

|

747,875

|

|

5.29% due 10/24/21

|

396,932

|

401,727

|

|

Mcgraw-Hill Global Education Holdings LLC

|

|

|

|

5.04% due 05/04/22

|

500,000

|

494,145

|

|

Total Communications

|

|

6,824,053

|

|

Energy – 1.4%

|

|

|

|

Cactus Wellhead

|

|

|

|

7.15% due 07/31/20

|

1,969,832

|

1,871,340

|

|

Invenergy Thermal

|

|

|

|

6.65% due 10/19/22

|

1,590,921

|

1,527,284

|

|

PSS Companies

|

|

|

|

5.65% due 01/28/20

|

1,848,106

|

1,506,206

|

|

Exgen Texas Power LLC

|

|

|

|

5.90% due 09/18/2113

|

1,126,302

|

639,176

|

|

Associated Asphalt Partners LLC

|

|

|

|

6.29% due 04/05/24

|

200,000

|

203,000

|

|

Total Energy

|

|

5,747,006

|

|

Transportation – 1.0%

|

|

|

|

Travelport Finance Luxembourg Sarl

|

|

|

|

4.43% due 09/02/21

|

2,057,198

|

2,066,909

|

|

Capstone Logistics

|

|

|

|

5.50% due 10/07/21

|

1,084,176

|

1,076,045

|

|

Arctic Long Carriers

|

|

|

|

5.58% due 05/18/23

|

1,000,000

|

997,500

|

|

Total Transportation

|

|

4,140,454

|

|

Utilities – 1.0%

|

|

|

|

Panda Power

|

|

|

|

7.65% due 08/21/20

|

1,239,741

|

1,126,615

|

|

Lone Star Energy

|

|

|

|

5.45% due 02/22/21

|

1,137,372

|

955,393

|

|

Panda Moxie Patriot

|

|

|

|

6.90% due 12/19/20

|

895,500

|

816,400

|

|

Moss Creek Resources LLC

|

|

|

|

9.50% due 04/07/22†††,2

|

777,778

|

760,278

|

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 23

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

SENIOR FLOATING RATE INTERESTS††,5 – 42.9% (continued)

|

|

|

|

Utilities – 1.0% (continued)

|

|

|

|

Panda Temple II Power

|

|

|

|

7.25% due 04/03/19

|

495,236

|

$ 433,332

|

|

Total Utilities

|

|

4,092,018

|

|

Total Senior Floating Rate Interests

|

|

|

|

(Cost $177,126,868)

|

|

176,095,640

|

|

ASSET BACKED SECURITIES†† – 35.0%

|

|

|

|

Collateralized Loan Obligations – 28.9%

|

|

|

|

FDF II Ltd.

|

|

|

|

2016-2A, 7.70% due 05/12/311,6

|

3,000,000

|

3,010,132

|

|

FDF I Ltd.

|

|

|

|

2015-1A, 6.88% due 11/12/301,6

|

2,000,000

|

2,001,738

|

|

2015-1A, 7.50% due 11/12/306

|

1,000,000

|

1,001,919

|

|

Voya CLO Ltd.

|

|

|

|

2013-1A, 4.66% due 04/15/241,5,6

|

2,000,000

|

1,999,947

|

|

2014-4A, 7.16% due 10/14/265,6

|

1,950,000

|

1,810,251

|

|

2015-3A, 5.11% due 10/15/225,6

|

1,000,000

|

999,967

|

|

Anchorage Credit Funding 1 Ltd.

|

|

|

|

2015-1A, 6.30% due 07/28/306

|

3,000,000

|

3,003,068

|

|

Anchorage Credit Funding 4 Ltd.

|

|

|

|

2016-4A, 5.50% due 02/15/356

|

1,000,000

|

1,010,735

|

|

MP CLO V Ltd.

|

|

|

|

2014-1A, 7.06% due 07/18/265,6

|

3,750,000

|

3,493,955

|

|

KVK CLO Ltd.

|

|

|

|

2014-2A, 5.91% due 07/15/261,5,6

|

3,000,000

|

2,605,133

|

|

2013-1A, due 04/14/251,6,7

|

2,300,000

|

767,767

|

|

Flatiron CLO Ltd.

|

|

|

|

2013-1A, 4.76% due 01/17/261,5,6

|

3,300,000

|

3,299,716

|

|

CIFC Funding Ltd.

|

|

|

|

2014-5A, 7.71% due 01/17/275,6

|

2,000,000

|

1,875,201

|

|

2014-4A, 6.76% due 10/17/265,6

|

1,500,000

|

1,350,000

|

|

Flagship CLO VIII Ltd.

|

|

|

|

2014-8A, 6.36% due 01/16/261,5,6

|

3,250,000

|

3,014,139

|

|

Venture XVI CLO Ltd.

|

|

|

|

2014-16A, 4.61% due 04/15/261,5,6

|

3,000,000

|

2,971,169

|

|

Great Lakes CLO Ltd.

|

|

|

|

2015-1A, 4.91% due 07/15/265,6

|

1,500,000

|

1,459,679

|

|

2012-1A, due 01/15/231,7,8

|

2,500,000

|

1,001,679

|

|

2014-1A, 5.36% due 04/15/255,6

|

500,000

|

484,777

|

|

OCP CLO Ltd.

|

|

|

|

2015-9A, 7.56% due 07/15/275,6

|

2,250,000

|

2,015,353

|

|

2015-8A, 7.16% due 04/17/275,6

|

1,000,000

|

885,378

|

|

Saranac CLO II Ltd.

|

|

|

|

2014-2A, 6.32% due 02/20/251,5,6

|

3,000,000

|

2,814,497

|

See notes to financial statements.

24 l GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

ASSET BACKED SECURITIES†† – 35.0% (continued)

|

|

|

|

Collateralized Loan Obligations – 28.9% (continued)

|

|

|

|

AMMC CLO XII Ltd.

|

|

|

|

2013-12A, 6.23% due 05/10/255,6

|

3,000,000

|

$ 2,795,479

|

|

Denali Capital CLO X Ltd.

|

|

|

|

2013-1A, 6.92% due 04/28/255,6

|

3,000,000

|

2,794,619

|

|

Newstar Trust

|

|

|

|

2012-2I, 7.78% due 01/20/235

|

3,000,000

|

2,781,286

|

|

Sound Point CLO III Ltd.

|

|

|

|

2013-2A, 6.51% due 07/15/251,5,6

|

2,875,000

|

2,689,770

|

|

Octagon Investment Partners XVI Ltd.

|

|

|

|

2013-1A, 6.66% due 07/17/255,6

|

3,000,000

|

2,670,817

|

|

Newstar Commercial Loan Funding LLC

|

|

|

|

2017-1A, 6.14% due 03/20/275,6

|

2,000,000

|

1,984,662

|

|

2014-1A, 5.91% due 04/20/255,6

|

500,000

|

489,660

|

|

Dryden 30 Senior Loan Fund

|

|

|

|

2013-30A, 6.68% due 11/15/251,5,6

|

2,500,000

|

2,254,007

|

|

Jamestown CLO III Ltd.

|

|

|

|

2013-3A, 4.46% due 01/15/265,6

|

2,250,000

|

2,207,567

|

|

Carlyle Global Market Strategies CLO Ltd.

|

|

|

|

2012-3A, due 10/04/246,7

|

2,600,000

|

2,027,142

|

|

Avery Point II CLO Ltd.

|

|

|

|

2013-3X COM, due 01/18/257

|

2,399,940

|

2,017,398

|

|

Fortress Credit Opportunities V CLO Ltd.

|

|

|

|

2017-5A, 5.70% due 10/15/265,6

|

2,000,000

|

2,005,552

|

|

Fortress Credit Opportunities VI CLO Ltd.

|

|

|

|

2015-6A, 6.11% due 10/10/265,6

|

2,000,000

|

1,973,349

|

|

Golub Capital Partners CLO 24M Ltd.

|

|

|

|

2015-24A, 5.42% due 02/05/275,6

|

2,000,000

|

1,910,212

|

|

Ares XXXIII CLO Ltd.

|

|

|

|

2015-1A, 7.60% due 12/05/255,6

|

2,000,000

|

1,866,582

|

|

WhiteHorse VI Ltd.

|

|

|

|

2013-1A, 7.67% due 02/03/251,5,6

|

2,000,000

|

1,818,673

|

|

OHA Credit Partners IX Ltd.

|

|

|

|

2013-9A, due 10/20/256,7

|

2,000,000

|

1,801,006

|

|

Treman Park CLO Ltd.

|

|

|

|

2015-1A, due 04/20/276,7

|

2,000,000

|

1,761,732

|

|

Cent CLO 19 Ltd.

|

|

|

|

2013-19A, 4.47% due 10/29/251,5,6

|

1,750,000

|

1,736,931

|

|

Monroe Capital CLO 2014-1 Ltd.

|

|

|

|

2014-1A, 5.88% due 10/22/261,5,6

|

1,750,000

|

1,707,789

|

|

THL Credit Wind River CLO Ltd.

|

|

|

|

2015-2A, 8.96% due 10/15/275,6

|

1,725,000

|

1,700,134

|

|

Mountain Hawk II CLO Ltd.

|

|

|

|

2013-2A, 4.31% due 07/22/241,5,6

|

1,750,000

|

1,648,044

|

|

Cent CLO 22 Ltd.

|

|

|

|

2014-22A, 7.58% due 11/07/265,6

|

1,750,000

|

1,564,626

|

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES FUND ANNUAL REPORT l 25

|

SCHEDULE OF INVESTMENTS continued

|

|

May 31, 2017

|

|

|

||

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

ASSET BACKED SECURITIES†† – 35.0% (continued)

|

|

|

|

Collateralized Loan Obligations – 28.9% (continued)

|

|

|

|

Ares XXVI CLO Ltd.

|

|

|

|

2013-1A, due 04/15/256,7

|

3,700,000

|

$ 1,541,306

|

|

Race Point VII CLO Ltd.

|

|

|

|

2012-7A, 5.43% due 11/08/241,5,6

|

1,500,000

|

1,499,907

|

|

Atlas Senior Loan Fund II Ltd.

|

|

|

|

2012-2A, due 01/30/241,6,7

|

2,600,000

|

1,494,581

|

|

Catamaran CLO Ltd.

|

|

|

|

2014-1A, 6.91% due 04/20/261,5,6

|

1,600,000

|

1,488,107

|

|

Fortress Credit Opportunities

|

|

|

|

2005-1A, 1.41% due 07/15/191,5,8

|

1,421,434

|

1,394,440

|

|

Madison Park Funding XI Ltd.

|

|

|

|

2013-11A, 6.30% due 10/23/255,6

|

1,500,000

|

1,391,439

|

|

Avery Point IV CLO Ltd.

|

|

|

|

2014-1A, 6.16% due 04/25/261,5,6

|

1,430,000

|

1,230,022

|

|

NewStar Arlington Senior Loan Program LLC

|

|

|

|

2014-1A, 5.41% due 07/25/251,5,6

|

750,000

|

718,670

|

|

2014-1A, 5.97% due 07/25/251,6

|

500,000

|

500,918

|

|

Finn Square CLO Ltd.

|

|

|

|

2012-1A, due 12/24/236,7

|

2,500,000

|

1,206,138

|

|

Babson CLO Ltd.

|

|