Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT

Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2015

People’s United Financial, Inc.

(Exact name of registrant as specified in its charter)

001-33326

(Commission File Number)

| Delaware | 20-8447891 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

850 Main Street

Bridgeport, Connecticut 06604

(Address of principal executive offices, including zip code)

(203) 338-7171

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $0.01 par value per share |

NASDAQ Global Select Market | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant, based upon the last reported sales price of its common stock as of the last business day of the registrant’s most recently completed second quarter on the NASDAQ Global Select Market was $5,023,144,734.

As of February 17, 2016, there were 310,440,469 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on April 21, 2016, are incorporated by reference into Part III.

Table of Contents

PEOPLE’S UNITED FINANCIAL, INC.

2015 FORM 10-K

Table of Contents

| Item 1. | Business |

General

People’s United Financial, Inc. (“People’s United” or the “Company”) is a bank holding company and a financial holding company registered under the Bank Holding Company Act of 1956 (the “BHC Act”), as amended, and is incorporated under the state laws of Delaware. People’s United is the holding company for People’s United Bank, National Association (the “Bank”), a national banking association headquartered in Bridgeport, Connecticut. Prior to February 23, 2015, People’s United was a savings and loan holding company within the meaning of the Home Owners’ Loan Act and the Bank was a federally-chartered savings bank. These changes primarily affect the manner in which both People’s United and the Bank are regulated, and did not have a material effect on either People’s United’s or the Bank’s financial condition or results of operations.

The principal business of People’s United is to provide, through the Bank and its subsidiaries, commercial banking, retail banking and wealth management services to individual, corporate and municipal customers. Traditional banking activities are conducted primarily within New England and southeastern New York, and include extending secured and unsecured commercial and consumer loans, originating mortgage loans secured by residential and commercial properties, and accepting consumer, commercial and municipal deposits.

In addition to traditional banking activities, the Bank provides specialized financial services tailored to specific markets including: personal, institutional and employee benefit trust; cash management; and municipal banking and finance. Through its non-banking subsidiaries, the Bank offers: brokerage, financial advisory services, investment management services and life insurance through People’s Securities, Inc. (“PSI”); equipment financing through People’s Capital and Leasing Corp. (“PCLC”) and People’s United Equipment Finance Corp. (“PUEFC”); and other insurance services through People’s United Insurance Agency, Inc. (“PUIA”).

This full range of financial services is delivered through a network of 396 branches located in Connecticut, southeastern New York, Massachusetts, Vermont, New Hampshire and Maine, including 84 full-service Stop & Shop supermarket branches throughout Connecticut and 66 in southeastern New York that provide customers with seven-day-a-week banking. The Bank’s distribution network includes investment and brokerage offices, commercial banking offices, online banking and investment trading, a 24-hour telephone banking service and participation in a worldwide ATM network. PCLC and PUEFC maintain a sales presence in 14 states to support equipment financing operations throughout the United States. The Bank maintains a mortgage warehouse lending group located in Kentucky and a national credits group that has participations in commercial loans and commercial real estate loans to borrowers in various industries on a national scale.

People’s United’s operations are divided into three primary operating segments that represent its core businesses: Commercial Banking; Retail Banking; and Wealth Management. In addition, the Treasury area manages People’s United’s securities portfolio, short-term investments, brokered deposits and wholesale borrowings.

The Company’s operating segments have been aggregated into two reportable segments: Commercial Banking and Retail Banking. Commercial Banking consists principally of commercial real estate lending, commercial and industrial lending, and commercial deposit gathering activities. This segment also includes the equipment financing operations of PCLC and PUEFC, as well as cash management, correspondent banking and municipal banking. In addition, Commercial Banking consists of institutional trust services, corporate trust, insurance services provided through PUIA and private banking. Retail Banking includes, as its principal business lines, consumer lending (including residential mortgage and home equity lending) and consumer deposit gathering activities. In addition, Retail Banking includes brokerage, financial advisory services, investment management services and life insurance provided by PSI and non-institutional trust services.

Further discussion of People’s United’s business and operations appears on pages 22 through 78.

1

Table of Contents

Supervision and Regulation—People’s United Financial, Inc.

General

As a bank holding company and a financial holding company, People’s United is regulated under the BHC Act and is subject to supervision, examination and regulation by the Board of Governors of the Federal Reserve System (the “FRB”). Among other things, this authority permits the FRB to restrict or prohibit activities that are determined to be a serious risk to the subsidiary bank. A bank holding company should have sufficient capital and an effective capital planning process, consistent with its overall risk profile and considering the size, scope, and complexity of its operations, to ensure its safe and sound operation. In addition, the FRB evaluates a bank holding company’s capital planning and capital distribution processes, and its capital sufficiency in light of relevant regulations and supervisory guidance applicable to bank holding companies.

Activities Restrictions Applicable to Bank Holding Companies. The activities of a bank holding company, including People’s United, must be financially-related activities permissible for a bank holding company, unless the bank holding company has elected to be treated as a financial holding company. A bank holding company that has made a financial holding company election may also engage in activities permissible under section 4(k) of the BHC Act.

Federal law prohibits a bank holding company directly or indirectly, from acquiring:

| • | control (as defined under the BHC Act) of another bank (or a holding company parent) without prior FRB approval; |

| • | through merger, consolidation or purchase of assets, another bank or a holding company thereof, or acquiring all or substantially all of the assets of such institution or holding company without prior approval by the FRB or the Office of the Comptroller of the Currency (the “OCC”); or |

| • | control of any depository institution not insured by the Federal Deposit Insurance Corporation (the “FDIC”) (except through a merger with and into the holding company’s bank subsidiary that is approved by the OCC). |

The BHC Act prohibits a bank holding company (directly or indirectly, or through one or more subsidiaries) from acquiring another bank or holding company thereof without prior written approval of the FRB; acquiring or retaining, with certain exceptions, more than 5% of a non-subsidiary bank, a non-subsidiary holding company or a non-subsidiary company engaged in activities other than those permitted by the BHC Act; or acquiring or retaining control of a depository institution that is not federally insured. In evaluating applications by holding companies to acquire banks, the FRB must consider the financial and managerial resources and future prospects of the company and institution involved, the effect of the acquisition on the risk to the Deposit Insurance Fund (the “DIF”), the convenience and needs of the community and competitive factors.

Federal Securities Law

People’s United’s common stock is registered with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934 (the “Exchange Act”), as amended. People’s United is subject to the information, proxy solicitation, insider trading, and other requirements and restrictions of the Exchange Act.

Delaware Corporation Law

People’s United is incorporated under the laws of the State of Delaware and is, therefore, subject to regulation by the state of Delaware. The rights of People’s United’s stockholders are governed by the Delaware General Corporation Law.

2

Table of Contents

Regulatory Capital Requirements

Bank holding companies and national banks are subject to various regulations regarding capital requirements administered by U.S. banking agencies. The FRB (in the case of a bank holding company) and the OCC (in the case of a bank) may initiate certain actions if a bank holding company or a bank fails to meet minimum capital requirements. In addition, under its prompt corrective action regulations, the OCC is required to take certain supervisory actions (and may take additional discretionary actions) with respect to an undercapitalized bank. These actions could have a direct material effect on a bank’s financial statements. People’s United and the Bank are subject to regulatory capital requirements administered by the FRB and the OCC, respectively.

In December 2010, the Basel Committee on Banking Supervision released its final framework for capital requirements (the “Basel framework” or “Basel III”). Final interagency rules to address implementation of the Basel III framework for U.S. financial institutions, including the Company and the Bank, became effective on January 1, 2015. When fully phased-in, these rules will: (i) set forth changes in the calculation of risk-weighted assets; (ii) introduce limitations on what is permissible for inclusion in Tier 1 capital; and (iii) require bank holding companies and their bank subsidiaries to maintain substantially more capital, with a greater emphasis on common equity.

See Management’s Discussion & Analysis—Regulatory Capital Requirements beginning on page 72 for a further discussion regarding capital requirements.

Dividends and Capital Distributions

People’s United is dependent upon dividends from the Bank to provide funds for the payment of dividends to shareholders and other general corporate purposes. People’s United’s ability to pay cash dividends is governed by federal law and regulations, including requirements to maintain adequate capital above regulatory minimums and safety and soundness practices.

The National Bank Act and OCC regulations impose limitations upon dividend payments by national banks. A national bank must file an application with the OCC if the total amount of its dividends for the applicable calendar year exceeds the national bank’s net income for that year plus its retained net income for the preceding two years. The Bank may not pay dividends to People’s United if, after paying those dividends, it would fail to meet the required minimum levels under risk-based capital guidelines or if the OCC notified the Bank that it was in need of more than normal supervision.

In addition, a national bank is required to file an application with the OCC for the redemption of subordinated debt under certain circumstances, as well as for reductions in permanent capital.

Under the Federal Deposit Insurance Act (the “FDI Act”), an insured depository institution, such as the Bank, is prohibited from making capital distributions, including the payment of dividends, if, after making such distribution, the institution would become “undercapitalized” (as such term is used in the FDI Act). Payment of dividends by the Bank also may be restricted at any time at the discretion of the appropriate regulator if it deems the payment to constitute an unsafe and unsound banking practice. See Note 12 to the Consolidated Financial Statements for a further discussion on capital distributions.

3

Table of Contents

People’s United Bank, N.A.

General

The Bank is subject to regulation, examination, supervision and reporting requirements by the OCC as its primary regulator, by the FDIC as the deposit insurer and by the Consumer Financial Protection Bureau (the “CFPB”) with respect to compliance with designated consumer financial laws. Its deposit accounts are insured up to applicable limits by the FDIC under the DIF.

The Bank files reports with the OCC concerning its activities and financial condition, and must obtain regulatory approval from the OCC prior to entering into certain transactions, such as mergers with, or acquisitions of, other depository institutions. The OCC conducts periodic examinations to assess compliance with various regulatory requirements. The OCC has substantial discretion to impose enforcement action on a national bank that fails to comply with applicable regulatory requirements, particularly with respect to capital requirements imposed on national banks. In addition, the FDIC has the authority to recommend to the OCC that enforcement action be taken with respect to a particular national bank and, if action is not taken by the OCC, the FDIC has authority to take such action under certain circumstances.

This regulation and supervision establishes a comprehensive framework of activities in which a national bank can engage and is intended primarily for the protection of the DIF, depositors and consumers. The regulatory structure also gives the regulatory authorities extensive discretion in connection with their supervisory and enforcement activities and examination policies, including policies with respect to the classification of assets and the establishment of adequate loan loss reserves for regulatory purposes. Any change in such laws and regulations or interpretations thereof, whether by the OCC, the FDIC, and the CFPB or through legislation, could have a material adverse impact on the Bank and its operations.

The Bank’s brokerage subsidiary, PSI, is regulated by the SEC, the Financial Industry Regulatory Authority and state securities regulators. PUIA is subject to regulation by applicable state insurance regulators.

Activity Powers. National association banks derive their lending, investment and other activity powers primarily from the National Bank Act and the regulations of the OCC thereunder. Under these laws and regulations, national banks generally may invest in:

| • | real estate mortgages; |

| • | consumer and commercial loans; |

| • | certain types of debt securities; and |

| • | certain other assets. |

The ability of a national bank to invest in debt securities is limited to those securities that are readily marketable, investment grade and primarily non-speculative. OCC regulations also impose limits on the amount of investments in certain types of debt securities.

4

Table of Contents

Safety and Soundness Standards. Each federal banking agency, including the OCC, has adopted guidelines establishing general standards relating to internal controls, information and internal audit systems, loan documentation, credit underwriting, interest rate exposure, asset growth, asset quality, earnings and compensation, fees and benefits. In general, the guidelines require, among other things, appropriate systems and practices to identify and manage the risks and exposures specified in the guidelines.

In addition, the OCC adopted regulations to require a national bank that is given notice by the OCC that it is not satisfying any of such safety and soundness standards to submit a compliance plan to the OCC. If, after being so notified, a national bank fails to submit an acceptable compliance plan or fails in any material respect to implement an accepted compliance plan, the OCC may issue an order directing corrective and other actions of the types to which a significantly undercapitalized institution is subject under the “prompt corrective action” provisions of the Federal Deposit Insurance Corporation Improvement Act (“FDICIA”). If a national bank fails to comply with such an order, the OCC may seek to enforce the order in judicial proceedings and to impose civil monetary penalties.

Prompt Corrective Action. FDICIA also established a system of prompt corrective action to resolve the problems of undercapitalized institutions. Under this system, federal bank regulators, including the OCC, are required to take certain, and authorized to take other, supervisory actions against undercapitalized institutions, based upon five categories of capitalization which FDICIA created: “well-capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” and “critically undercapitalized.”

The severity of the action authorized or required to be taken under the prompt corrective action regulations increases as a bank’s capital decreases within the three undercapitalized categories. All banks are prohibited from paying dividends or other capital distributions or paying management fees to any controlling person if, following such distribution, the bank would be undercapitalized. The OCC is required to monitor closely the condition of an undercapitalized savings bank and to restrict the growth of its assets. An undercapitalized bank is required to file a capital restoration plan within 45 days of the date the bank receives notice or is deemed to have notice that it is within any of the three undercapitalized categories, and the plan must be guaranteed by any parent holding company.

The aggregate liability of a parent holding company is limited to the lesser of:

| • | an amount equal to 5% of the bank’s total assets at the time it became “undercapitalized”; and |

| • | the amount that is necessary (or would have been necessary) to bring the bank into compliance with all capital standards applicable with respect to such bank as of the time it fails to comply with a capital restoration plan. |

If a bank fails to submit an acceptable plan, it is treated as if it were “significantly undercapitalized.” Banks that are significantly or critically undercapitalized are subject to a wider range of regulatory requirements and restrictions. Under OCC regulations, generally, a national bank is treated as “well-capitalized” if its Total risk-based capital ratio is 10% or greater, its Tier 1 risk-based capital ratio is 8% or greater, its Common Equity Tier 1 (“CET1”) capital ratio is 6.5% and its Tier 1 leverage ratio is 5% or greater, and it is not subject to any order or directive by the OCC to meet a specific capital level. As of December 31, 2015, the Bank’s regulatory capital ratios exceeded the OCC’s numeric criteria for classification as a “well-capitalized” institution. Basel III also revised the prompt corrective action framework by incorporating new regulatory capital minimums, including a requirement for tangible common equity.

5

Table of Contents

Insurance Activities. National banks are generally permitted to engage in certain insurance and annuity activities through subsidiaries. However, federal banking laws prohibit depository institutions from conditioning the extension of credit to individuals upon either the purchase of an insurance product or annuity from an entity affiliated with the depository institution or an agreement by the consumer not to purchase an insurance product or annuity from an entity that is not affiliated with the depository institution. Applicable regulations also require prior disclosure of this prohibition to potential insurance product or annuity customers.

Federal banking agencies, including the OCC, also require depository institutions that offer non-deposit investment products, such as certain annuity and related insurance products, to disclose to the consumer that the products are not federally insured, are not guaranteed by the institution and are subject to investment risk including possible loss of principal. These disclosure requirements apply if the institution offers the non-deposit investment products directly or through affiliates or subsidiaries.

Deposit Insurance. The Bank is a member of, and pays its deposit insurance assessments to, the DIF.

The FDIC has established a system for setting deposit insurance premiums based upon the risks a particular bank poses to the DIF. The assessment is based on a bank’s average consolidated total assets minus average tangible equity (defined as Tier 1 capital). The size of the DIF is targeted at 2% of insured deposits. A reduced assessment rate schedule applies once the DIF reaches 1.15% of insured deposits, with additional reductions when the DIF reaches 2% and 2.5% of insured deposits, respectively. The FDIC applies a scorecard-based assessment system for financial institutions with more than $10 billion in assets (such as the Bank). One of the financial ratios used in the scorecard is the ratio of “higher risk” assets to Tier 1 capital and reserves. The classification of assets such as commercial and industrial loans, securities and consumer loans as “higher risk” is determined in accordance with applicable FDIC regulations and guidance.

In October 2015, the FDIC issued a proposed rule that would impose an annual assessment surcharge of 4.5 basis points on banks with $10 billion or more in total assets once the DIF reserve ratio reaches 1.15%. The surcharge will apply until the DIF reserve ratio reaches 1.35% of insured deposits. The Company is currently evaluating the impact of the proposed surcharge on the Company’s Consolidated Financial Statements. See Management’s Discussion & Analysis — Non-Interest Expense beginning on page 43 for a further discussion regarding the proposed rule.

In addition, all FDIC-insured institutions are required to pay assessments to the FDIC at an annual rate of approximately 0.006% of insured deposits to fund interest payments on bonds issued by the Financing Corporation, an agency of the federal government established to recapitalize the predecessor to the Savings Association Insurance Fund. These assessments will continue until the Financing Corporation bonds mature between 2017 and 2019.

Under the FDI Act, the FDIC may terminate the insurance of an institution’s deposits upon a finding that the institution has engaged in unsafe or unsound practices, is in an unsafe or unsound condition to continue operations or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC.

Transactions with Affiliates. National banks are subject to the affiliate and insider transaction rules set forth in Sections 23A, 23B, 22(g) and 22(h) of the Federal Reserve Act, and their implementing regulations, Regulation W and Regulation O, issued by the FRB. Affiliated transaction provisions, among other things, prohibit or limit a national bank from extending credit to, or entering into certain transactions with, its affiliates and principal stockholders, directors and executive officers.

In addition, national banks are prohibited from making a loan to an affiliate that is engaged in non-bank holding company activities and purchasing or investing in securities issued by an affiliate that is not a subsidiary. The FRB and the OCC require each depository institution that is subject to the affiliate transaction restrictions of Sections 23A and 23B of the Federal Reserve Act to implement policies and procedures to ensure compliance with Regulation W.

6

Table of Contents

In addition to the insider transaction limitations of Sections 22(g) and 22(h) of the Federal Reserve Act, Section 402 of the Sarbanes-Oxley Act of 2002 prohibits the extension of personal loans to directors and executive officers of issuers (as defined in the Sarbanes-Oxley Act). The prohibition, however, does not apply to mortgage loans advanced by an insured depository institution, such as the Bank, that are subject to the insider lending restrictions of Section 22(h) of the Federal Reserve Act.

Privacy Standards. The Bank is subject to OCC regulations implementing statutorily-mandated privacy protection. These regulations require the Bank to disclose its privacy policy, including identifying with whom it shares “non-public personal information,” to customers at the time of establishing the customer relationship and annually thereafter. In addition, the Bank is required to provide its customers with the ability to “opt-out” of having the Bank share their non-public personal information with unaffiliated third parties before the Bank can disclose such information, subject to certain exceptions.

In addition to certain state laws governing protection of customer information, the Bank is subject to federal regulatory guidelines establishing standards for safeguarding customer information. The guidelines describe the agencies’ expectations for the creation, implementation and maintenance of an information security program, which would include administrative, technical and physical safeguards appropriate to the size and complexity of the institution and the nature and scope of its activities. The standards set forth in the guidelines are intended to ensure the security and confidentiality of customer records and information, protect against any anticipated threats or hazards to the security or integrity of such records and protect against unauthorized access to or use of such records or information that could result in substantial harm or inconvenience to any customer. Federal guidelines also impose certain customer disclosures and other actions in the event of unauthorized access to customer information.

Community Reinvestment Act. Under the Community Reinvestment Act (the “CRA”), as implemented by the OCC regulations, any national bank, including the Bank, has a continuing and affirmative obligation consistent with its safe and sound operation to help meet the credit needs of its entire community, including low and moderate income neighborhoods. The CRA does not establish specific lending requirements or programs for financial institutions nor does it limit an institution’s discretion to develop the types of products and services that it believes are best suited to its particular community. The CRA requires the OCC, in connection with its examination of a federally-chartered savings bank, to assess the depository institution’s record of meeting the credit needs of its community and to take such record into account in its evaluation of certain applications by such institution.

Current CRA regulations rate an institution based on its actual performance in meeting community needs. In particular, the evaluation system focuses on three tests:

| • | a lending test, to evaluate the institution’s record of making loans in its service areas; |

| • | an investment test, to evaluate the institution’s record of investing in community development projects, affordable housing and programs benefiting low or moderate income individuals and businesses; and |

| • | a service test, to evaluate the institution’s delivery of services through its branches, ATMs and other offices. |

The CRA also requires all institutions to make public disclosure of their CRA ratings. The Bank received a “satisfactory” rating in its most recent CRA examination for the evaluation period ending June 30, 2013. The federal banking agencies adopted regulations implementing the requirements under the Gramm-Leach-Bliley Act that insured depository institutions publicly disclose certain agreements that are in fulfillment of the CRA. The Bank has no such agreements in place at this time.

7

Table of Contents

Loans to One Borrower. Generally, national banks may not make a loan or extend credit, including credit associated with derivatives and securities financing transactions, to a single or related group of borrowers in excess of 15% of the institution’s unimpaired capital and surplus. Additional amounts may be loaned, not in excess of 10% of unimpaired capital and surplus, if such loans or extensions of credit are secured by readily-marketable collateral. The Bank is in compliance with applicable loans to one borrower limitations.

Nontraditional Mortgage Products. The federal banking agencies have issued guidance for institutions that originate or service nontraditional or alternative mortgage products, defined to include all residential mortgage loan products that allow borrowers to defer repayment on principal or interest, such as interest-only mortgages and payment option adjustable-rate mortgages. A portion of the Bank’s adjustable-rate residential mortgage loans represent interest-only residential mortgage loans. None of these loans permit negative amortization or optional payment amounts.

Recognizing that alternative mortgage products expose institutions to increased risks as compared to traditional loans where payments amortize or reduce the principal amount, the guidance requires increased scrutiny for alternative mortgage products. Institutions that originate or service alternative mortgages should have: (i) strong risk management practices that include maintenance of capital levels and allowance for loan losses commensurate with the risk; (ii) prudent lending policies and underwriting standards that address a borrower’s repayment capacity; and (iii) programs and practices designed to ensure that consumers receive clear and balanced information to assist in making informed decisions about mortgage products. The guidance also recommends heightened controls and safeguards when an institution combines an alternative mortgage product with features that compound risk, such as a simultaneous second-lien or the use of reduced documentation to evaluate a loan application. The Bank complies with the guidance on non-traditional mortgage products as it is interpreted and applied by the OCC.

Liquidity. The Bank maintains sufficient liquidity to ensure its safe and sound operation, in accordance with applicable OCC regulations.

Assessments. The OCC charges assessments to recover the cost of examining national banks and their affiliates. These assessments are based on three components: (i) the size of the institution on which the basic assessment is based; (ii) the institution’s supervisory condition, which results in an additional assessment based on a percentage of the basic assessment for any savings institution with a composite rating of 3, 4 or 5 in its most recent safety and soundness examination; and (iii) the complexity of the institution’s operations, which results in an additional assessment based on a percentage of the basic assessment for any savings institution that managed over $1 billion in trust assets, serviced for others loans aggregating more than $1 billion, or had certain off-balance-sheet assets aggregating more than $1 billion.

Branching. Under OCC branching regulations, the Bank is generally authorized to open branches nationwide. The Bank is required to submit an application to the OCC and publish a public notice prior to establishing a new branch or relocating an existing branch. OCC authority preempts any state law purporting to regulate branching by national banks.

Anti-Money Laundering and Customer Identification. The Bank is subject to OCC and Financial Crimes Enforcement Network regulations implementing the Bank Secrecy Act, as amended by the USA PATRIOT Act. The USA PATRIOT Act gives the federal government powers to address terrorist threats through enhanced domestic security measures, expanded surveillance powers, increased information sharing and broadened anti-money laundering requirements. By way of amendments to the Bank Secrecy Act, Title III of the USA PATRIOT Act takes measures intended to encourage information sharing among banks, regulatory agencies and law enforcement bodies. Further, certain provisions of Title III impose affirmative reporting obligations on a broad range of financial institutions, including national banks like the Bank.

8

Table of Contents

Federal Home Loan Bank System. The Bank is a member of the Federal Home Loan Bank (“FHLB”) system, which consists of twelve regional FHLBs, each subject to supervision and regulation by the Federal Housing Finance Agency. The FHLB system provides a central credit facility primarily for member institutions as well as other entities involved in home mortgage lending. It is funded primarily from proceeds derived from the sale of consolidated obligations of the FHLBs. It makes loans or advances to members in accordance with policies and procedures, including collateral requirements, established by the respective boards of directors of the FHLBs. These policies and procedures are subject to the regulation and oversight of the Federal Housing Finance Agency, which has also established standards of community or investment service that members must meet to maintain access to long-term advances.

The Bank, as a member of the FHLB of Boston, is currently required to purchase and hold shares of capital stock in the FHLB of Boston in an amount equal to 0.35% of the Bank’s Membership Stock Investment Base plus an Activity Based Stock Investment Requirement. The Activity Based Stock Investment Requirement is equal to 3.0% of any outstanding principal for overnight advances, 4.0% of any outstanding principal for term advances with an original term of two days to three months and 4.5% of any outstanding principal for term advances with an original term greater than three months. The Bank is in compliance with these requirements. As a result of its acquisition of the Bank of Smithtown in 2010, the Bank also holds shares of capital stock in the FHLB of New York. The Bank, as a member of the Federal Reserve Bank system, is currently required to purchase and hold shares of capital stock in the Federal Reserve Bank of New York (the “FRB-NY”) in an amount equal to 6% of its capital and surplus.

Reserve Requirements. FRB reserve regulations require banks to maintain reserves against their transaction accounts (primarily negotiable order of withdrawal and demand deposit accounts). Institutions must maintain a reserve of 3% against aggregate transaction account balances between $15.2 million and $110.2 million (subject to adjustment by the FRB) plus a reserve of 10% (subject to adjustment by the FRB within specific limits) against that portion of total transaction account balances in excess of $110.2 million. The first $15.2 million of otherwise reservable balances is exempt from the reserve requirements. The Bank is in compliance with the foregoing requirements. The required reserves must be maintained in the form of vault cash, or an interest-bearing account at a Federal Reserve Bank, or a pass-through account as defined by the FRB.

Market Area and Competition

People’s United’s primary market areas are New England and southeastern New York, with Connecticut, Massachusetts, New York and Vermont having the largest concentration of its loans, deposits and branches. At December 31, 2015, 27%, 20%, 17% and 6% of the Company’s loans by outstanding principal amount were to customers located within Connecticut, New York, Massachusetts and Vermont, respectively. Loans to customers located in the New England states as a group represented 59% of total loans at December 31, 2015. However, substantially the entire equipment financing portfolio (97% at December 31, 2015) was to customers located outside of New England. At December 31, 2015, 34% of the equipment financing portfolio was to customers located in Texas, California, Louisiana and New York and no other state exposure was greater than 5%.

As of June 30, 2015, People’s United had: (i) the largest market share of deposits in Fairfield County, Connecticut; (ii) the second largest market share of deposits in the state of Connecticut; and (iii) the largest market share of deposits in the state of Vermont. People’s United competes for deposits, loans and financial services with commercial banks, savings institutions, commercial and consumer finance companies, mortgage banking companies, insurance companies, credit unions and a variety of other institutional lenders and securities firms.

9

Table of Contents

As People’s United’s predominant market, Connecticut is one of the most attractive banking markets in the United States. With a total population of approximately 3.6 million and a median household income of $70,077, Connecticut ranks fourth in the United States, well above the U.S. median household income of $55,551, according to U.S. Census data and SNL Financial. The median household income in New York, which has the Company’s second highest number of branches, was $60,445, according to U.S. Census data and SNL Financial. The median household income in Massachusetts and Vermont, which have the Company’s third and fourth highest number of branches, was $69,807 and $58,048, respectively, according to U.S. Census data and SNL Financial.

The principal basis of competition for deposits is the interest rate paid for those deposits and related fees, the convenience of access to services through traditional and non-traditional delivery alternatives, and the quality of services to customers. The principal basis of competition for loans is through the interest rates and loan fees charged and the development of relationships based on the efficiency, convenience and quality of services provided to borrowers. Further competition has been created through the rapid acceleration of commerce conducted over the Internet. This has enabled institutions, including People’s United, to compete in markets outside their traditional geographic boundaries.

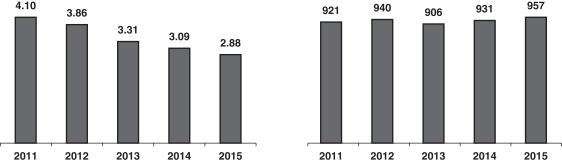

Personnel

As of December 31, 2015, People’s United had 4,652 full-time and 487 part-time employees.

Access to Information

As a public company, People’s United is subject to the informational requirements of the Exchange Act, as amended and, in accordance therewith, files reports, proxy and information statements and other information with the SEC. Such reports, proxy and information statements and other information can be inspected and copied at prescribed rates at the public reference room maintained by the SEC at 100 F Street N.E., Washington, D.C. 20549 and are available on the SEC’s EDGAR database on the internet at www.sec.gov. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. People’s United’s common stock is listed on the NASDAQ Global Select Market under the symbol “PBCT”.

Copies of many of these reports are also available through People’s United’s website at www.peoples.com.

People’s United currently provides website access to the following reports:

Form 10-K (most recent filing and any related amendments)

Form 10-Q (four most recent filings and any related amendments)

Form 8-K (all filings in most recent 12 months and any related amendments)

Annual Report to Shareholders (two most recent years)

Proxy Statement for Annual Meeting of Shareholders (two most recent years)

XBRL Interactive Data (most recent 12 months)

10

Table of Contents

| Item 1A. | Risk Factors |

Changes in Interest Rates Could Adversely Affect Our Results of Operations and Financial Condition

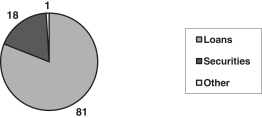

People’s United makes most of its earnings based on the difference between interest it earns compared to interest it pays. This difference is called the “interest spread.” People’s United earns interest on loans and to a much lesser extent on securities and short-term investments. These are called “interest-earning assets.” People’s United pays interest on some forms of deposits and on funds it borrows from other sources. These are called “interest-bearing liabilities.”

People’s United’s interest spread can change depending on when interest rates earned on interest-earning assets change, compared to when interest rates paid on interest-bearing liabilities change. Some rate changes occur while these assets or liabilities are still on People’s United’s books. Other rate changes occur when these assets or liabilities mature and are replaced by new interest-earning assets or interest-bearing liabilities at different rates. It may be difficult to replace interest-earning assets quickly, since customers may not want to borrow money when interest rates are high, or People’s United may not be able to make loans that meet its lending standards. People’s United interest spread may also change based on the mix of interest-earning assets and interest-bearing liabilities.

People’s United’s interest spread may be lower if the timing of interest rate changes is different for its interest-earning assets compared to its interest-bearing liabilities. For example, if interest rates go down, People’s United could earn less on some of its interest-earning assets while it is still obligated to pay higher rates on some of its interest-bearing liabilities. On the other hand, if interest rates go up, People’s United might have to pay more on some of its interest-bearing liabilities while it continues to receive lower rates on some of its interest-earning assets.

People’s United manages this risk using many different techniques. If unsuccessful in managing this risk, People’s United may be less profitable.

Changes in Our Asset Quality Could Adversely Affect Our Results of Operations and Financial Condition

Asset quality measures the performance of a borrower in repaying a loan, with interest, on time. While we believe we have benefited from relatively stable asset quality, there are elements of our loan portfolio that inherently present greater credit risk, such as interest-only and stated income residential mortgage loans, home equity loans and lines with incomplete first lien data and commercial real estate loans. Each of these portfolio risk elements, where potentially material in the context of our overall loan portfolio, are discussed in greater detail within Management’s Discussion & Analysis—Asset Quality beginning on page 55. While the Company believes that it manages asset quality through prudent underwriting practices and collection operations, it is possible that our asset quality could deteriorate, depending upon economic conditions and other factors.

The Success of Our Stop & Shop Branches Depends on the Success of the Stop & Shop Brand

One element of our strategy is to focus on increasing deposits by providing a wide range of convenient services to our customers. An integral component of this strategy is the Bank’s supermarket banking initiative, pursuant to which, as of December 31, 2015, the Bank has established 150 full-service Stop & Shop branches throughout Connecticut and southeastern New York, most of which are in close proximity to our traditional branches, which provide customers with the convenience of seven-day-a-week banking. At December 31, 2015, 38% of the Bank’s branches were located in Stop & Shop supermarkets and 15% of our total deposits at that date were held in Stop & Shop branches.

11

Table of Contents

The Bank currently has exclusive branching rights in Stop & Shop supermarkets in the state of Connecticut and certain counties in the state of New York, in the form of licensing agreements between The Stop & Shop Supermarket Company and the Bank, which provides for the leasing of space to the Bank within Stop & Shop supermarkets for branch use. The Bank has the exclusive right to branch in these supermarkets until 2027, provided that the Bank does not default on its obligations under the licensing agreement.

Under the terms of the licensing agreements, the Bank has the obligation to open branches in new Stop & Shop locations, even if Stop & Shop’s market share declines or the value of the Stop & Shop brand is diminished. The licensing agreements do not stipulate the number of branch openings per year but, rather, apply only to those new Stop & Shop locations that meet or exceed specified thresholds as to size (square footage) and/or customer traffic. Based on our experience, we would expect the application of these thresholds to result in the opening of approximately 3-5 new branches per year in Stop & Shop locations.

Stop & Shop is a leading grocery store in Connecticut. The success of the Bank’s supermarket branches is dependent, in part, on the success of the Stop & Shop supermarkets in which they are located. A drop in Stop & Shop’s market share, a decrease in the number of Stop & Shop locations or customers, or a decline in the overall quality of Stop & Shop supermarkets could result in decreased business for the Stop & Shop branches, in the form of fewer loan originations, lower deposit generation and fewer overall branch transactions, and could influence market perception of the Bank’s Stop & Shop supermarket branches as convenient banking locations.

We Depend on Our Executive Officers and Key Personnel to Continue Implementing Our Long-Term Business Strategy and Could Be Harmed by the Loss of Their Services

We believe that our continued growth and future success will depend in large part upon the skills of our management team. The competition for qualified personnel in the financial services industry can be intense, and the loss of our key personnel or an inability to continue to attract, retain and motivate key personnel could adversely affect our business.

Our Business Is Affected by the International, National, Regional and Local Economies in Which We Operate

Changes in international, national, regional and local economic conditions affect our business. If economic conditions change significantly or quickly, our business operations could suffer, and we could become weaker financially as a result.

As a result of the financial crisis that existed for much of the period from 2008 through 2012, the housing and real estate markets, as well as the broader economy, experienced declines, both nationally and locally. Housing market conditions in the New England region, where much of our lending activity occurs, were adversely impacted, leading to a reduced level of sales, increasing inventories of houses on the market, declining house prices and an increase in the length of time houses remained on the market. No assurance can be given that these conditions will not be repeated or that such conditions will not result in a decrease in our interest income, an increase in our non-performing loans, an increase in our provision for loan losses or an adverse impact on our loan losses.

Significant volatility in the financial and capital markets during this time led to credit and liquidity concerns, a recessionary economic environment and, in turn, weakness within the commercial sector. Our loan portfolio is not immune to potential negative consequences arising as a result of general economic weakness and, in particular, a prolonged downturn in the housing market on a national scale. Decreases in real estate values could adversely affect the value of property used as collateral for loans. In addition, adverse changes in the economy could have a negative effect on the ability of borrowers to make scheduled loan payments, which would likely have an adverse impact on earnings. Further, an increase in loan delinquencies may serve to decrease interest income and adversely impact loan loss experience, resulting in an increased provision and allowance for loan losses.

12

Table of Contents

International economic uncertainty continues to have an impact on the U.S. financial markets, potentially suppressing stock prices and adding to volatility. Our foreign country exposure, which is defined as the aggregation of exposure maintained with financial institutions, companies or individuals in a given country outside of the United States, is minimal and indirect, with the majority of such exposure comprised of corporate debt securities. Our sovereign credit exposure is comprised of an immaterial amount of government bonds issued by a single non-European sovereign.

The Geographic Concentration of Our Loan Portfolio Could Make Us Vulnerable to a Downturn in the Economies in Which We Operate

At December 31, 2015, 27%, 20% and 17% of the Company’s loans by outstanding principal amount were to customers located within Connecticut, New York and Massachusetts, respectively. Loans to people and businesses located in the New England states as a group represented 59% of total loans at that date. How well our business performs depends very much on the health of these regional and local economies. We could experience losses in our real estate-related loan portfolios if the prices for housing and other kinds of real estate decreased significantly in New England or southeastern New York.

If the economic environment deteriorates, or negative trends emerge with respect to the financial markets, the New England and southeastern New York economies could suffer more than the national economy. This would be especially likely in Fairfield County, Connecticut (where the Company is headquartered) as well as the suburban communities of New York City and Boston as a result of the significant number of people living in these areas who also work in the financial services industry.

In addition, our ability to continue to originate real estate loans may be impaired by adverse changes in the local and regional economic conditions in these real estate markets. Decreases in real estate values could adversely affect the value of property used as collateral for our loans. Adverse changes in the economy may also have a negative effect on the ability of our borrowers to make timely repayments of their loans, which would have an adverse impact on our earnings. In addition, if poor economic conditions result in decreased demand for real estate loans, our profits may decrease because our alternative investments may earn less income for us than real estate loans.

Our equipment financing business, which operates nationally, could be negatively affected by adverse changes in the national economy, even if those changes have no significant effect on the local and regional economies in which our other businesses operate.

No assurance can be given that such conditions will not occur or that such conditions will not result in a decrease in our interest income, an increase in our non-performing loans, an increase in our provision for loan losses or an adverse impact on our loan losses.

In Response to Competitive Pressures, Our Costs Could Increase if We Were Required to Increase Our Service and Convenience Levels or Our Margins Could Decrease if We Were Required to Increase Deposit Rates or Lower Interest Rates on Loans

People’s United faces significant competition for deposits and loans. In deciding where to deposit their money, many people look first at the interest rate they will earn. They also might consider whether a bank offers other kinds of services they might need and, if they have been a customer of a bank before, what their experience was like. People also like convenience, so the number of offices and banking hours may be important. Some people also prefer the availability of on-line services.

13

Table of Contents

People’s United competes with other banks, credit unions, brokerage firms and money market funds for deposits. Some people may decide to buy bonds or similar kinds of investments issued by companies or by federal, state and local governments and agencies, instead of opening a deposit account.

In making decisions about loans, many people consider the interest rate they will have to pay. They also consider any extra fees they might have to pay in order to get the loan. Many business loans are more complicated because there may not be a standard type of loan that meets all of the customer’s needs. Business borrowers consider many different factors that are not all financial in nature, including the type and amount of security the lender wants and other terms of the loan that do not involve the interest rate.

People’s United competes with other banks, credit unions, credit card issuers, finance companies, mortgage lenders and mortgage brokers for loans. Insurance companies also compete with People’s United for some types of commercial loans.

Several of People’s United’s competitors have branches in the same market area as it does, some of which are much larger than it is. The New England region, including Connecticut, which is People’s United’s predominant market, and specifically Fairfield County, where People’s United is headquartered, is an attractive banking market. As locally-based banks continue to be acquired by large regional and national companies, there are not as many bank competitors in our market as there used to be, but the remaining ones are usually larger and have more resources than the banks they acquired.

People’s United also has competition from outside its own market area. A bank that does not have any branches in our primary markets can still have customers there by providing banking services on-line. It costs money to set up and maintain a branch system. Banks that do not spend as much money as People’s United does on branches might be more profitable than it is, even if they pay higher interest on deposits and charge lower interest on loans.

Changes in Federal and State Regulation Could Adversely Affect Our Results of Operations and Financial Condition

The banking business is heavily regulated by the federal and state governments. Banking laws and rules are for the most part intended to protect depositors, not stockholders.

Banking laws and rules can change at any time. The government agencies responsible for supervising People’s United’s businesses can also change the way they interpret these laws and rules, even if the rules themselves do not change. We need to make sure that our business activities comply with any changes in these rules or the interpretation of the rules. We might be less profitable if we have to change the way we conduct business in order to comply. Our business might suffer in other ways as well.

Changes in state and federal tax laws or the accounting standards we are required to follow can make our business less profitable. Changes in the government’s economic and monetary policies may hurt our ability to compete for deposits and loans. Changes in these policies can also make it more expensive for us to do business.

The government agencies responsible for supervising our business can take drastic action if they think we are not conducting business safely or are too weak financially. They can force People’s United to hold additional capital, pay higher deposit insurance premiums, stop paying dividends, stop making certain kinds of loans or stop offering certain kinds of deposits. If the agencies took any of these steps or other similar steps, it would probably make our business less profitable.

14

Table of Contents

Enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “DFA”) has resulted in significant changes in the financial regulatory landscape, many of which affect us. Among the more significant provisions of the DFA, as well as their actual or anticipated impact, if quantifiable, are:

| • | Changes to the regulatory landscape, including: |

| (i) | creation of the CFPB, which is empowered to promulgate new consumer protection regulations and revise existing regulations in many areas of consumer protection, and exercise exclusive authority over our consumer compliance examinations; and |

| (ii) | restrictions on the ability of federal bank regulatory authorities to preempt the application of state consumer protection laws and regulations. |

| • | Limitations on the amount of interchange fees that an issuer of debit cards may charge or receive: |

| • | The DFA limits the amount of interchange fee that an issuer of debit cards may charge or receive to an amount that is “reasonable and proportional” to the cost of the transaction. The DFA further provides that a debit card issuer may not restrict the number of payment card networks on which a debit card transaction may be processed to a single network or limit the ability of a merchant to direct the routing of debit card payments for processing. |

| • | Changes impacting the financial products and services we offer to our customers: |

| • | All federal prohibitions on the ability of financial institutions to pay interest on demand deposit accounts were repealed as part of the DFA. As of December 31, 2015, the Bank’s non-interest bearing deposits totaled $6.2 billion, or 22% of total deposits. The Company’s interest expense may increase and net interest margin may decrease if it begins to offer higher rates of interest than are currently offered on demand deposits. |

| • | Stricter capital requirements for bank holding companies: |

| • | The DFA imposes stringent capital requirements on bank holding companies by, among other things, imposing leverage ratios on holding companies and prohibiting the inclusion of new trust preferred issuances in Tier I capital. The DFA also increases regulation of derivatives and hedging transactions, which could limit the ability of People’s United to enter into, or increase the costs associated with, interest rate and other hedging transactions. |

| • | Mortgage rules promulgated by the CFPB: |

| • | The CFPB has issued a series of final rules to implement provisions in the DFA related to mortgage origination and mortgage servicing. These rules, which went into effect in January 2014 and which may increase the cost of originating and servicing residential mortgage loans, include: |

| • | A rule to implement the requirement that creditors make a reasonable, good faith determination of a consumer’s ability to repay any consumer credit transaction secured by a dwelling and establish certain protections from liability under this requirement for “qualified mortgages”; and |

| • | A rule addressing mortgage servicers’ obligations to: correct errors asserted by mortgage loan borrowers; provide certain information requested by such borrowers; and provide protections to such borrowers in connection with force-placed insurance. Additionally, this final rule addresses servicers’ obligations to: provide information about mortgage loss mitigation options to delinquent borrowers; establish policies and procedures for providing delinquent borrowers with continuity of contact with servicer personnel capable of performing certain functions; and evaluate borrowers’ applications for available loss mitigation options. |

15

Table of Contents

While it is difficult to fully quantify the increase in our regulatory compliance burden, we do believe that costs associated with regulatory compliance, including the need to hire additional compliance personnel, will continue to increase. Because certain other provisions of the DFA still require regulatory rulemaking, it is not clear how those new regulations will affect People’s United.

If People’s United’s Allowance for Loan Losses Is Not Sufficient to Cover Actual Loan Losses, Our Earnings Would Decrease

People’s United is exposed to the risk that customers will not be able to repay their loans. This risk is inherent in the lending business. There is also the risk that the customer’s collateral will not be sufficient to cover the balance of their loan, as underlying collateral values fluctuate with market changes. People’s United records an allowance for loan losses to cover probable losses inherent in the existing loan portfolio. The allowance for loan losses is established through provisions for loan losses charged to income. Losses on loans, including impaired loans, are charged to the allowance for loan losses when all or a portion of a loan is deemed to be uncollectible. Recoveries of loans previously charged off are credited to the allowance for loan losses when realized.

People’s United maintains the allowance for loan losses at a level that is deemed to be appropriate to absorb probable losses inherent in the respective loan portfolios, based on a quarterly evaluation of a variety of factors. These factors include, but are not limited to: People’s United’s historical loan loss experience and recent trends in that experience; risk ratings assigned by lending personnel to commercial real estate loans, commercial and industrial loans and equipment financing loans, and the results of ongoing reviews of those ratings by People’s United’s independent loan review function; an evaluation of delinquent and non-performing loans and related collateral values; the probability of loss in view of geographic and industry concentrations and other portfolio risk characteristics; the present financial condition of borrowers; and current economic conditions.

While People’s United seeks to use the best available information to make these evaluations and, at December 31, 2015, believed that the allowance for loan losses was appropriate to cover probable losses inherent in the existing loan portfolio, it is possible that borrower defaults could exceed the current estimates for loan losses, which would reduce earnings. In addition, future increases to the allowance for loan losses may be necessary based on changes in economic conditions, results of regulatory examinations, further information obtained regarding known problem loans, increasing charge-offs of existing problem loans, or the identification of additional problem loans and other factors, which would also reduce earnings. See Note 1 to the Consolidated Financial Statements for additional information concerning People’s United’s allowance for loan losses.

Our Goodwill May be Determined to be Impaired at a Future Date Depending on the Results of Periodic Impairment Evaluations

People’s United evaluates goodwill for impairment on an annual basis (or more frequently, if necessary). According to applicable accounting requirements, acceptable valuation methods include present-value measurements based on multiples of earnings or revenues, or similar performance measures. If the quoted market price for People’s United common stock were to decline significantly, or if it was determined that the carrying amount of our goodwill exceeded its implied fair value, we would be required to write down the asset recorded for goodwill as reflected in the Consolidated Statements of Condition. This, in turn, would result in a charge to earnings and, thus, a reduction in stockholders’ equity. See Notes 1 and 5 to the Consolidated Financial Statements for additional information concerning People’s United’s goodwill and the required impairment test.

16

Table of Contents

People’s United May Fail To Successfully Integrate Acquired Companies and Realize All of the Anticipated Benefits of an Acquisition

The ultimate success of an acquisition will depend, in part, on the ability of People’s United to realize the anticipated benefits from combining the businesses of People’s United with those of an acquired company. If People’s United is not able to successfully combine the businesses, the anticipated benefits of a merger may not be realized fully or at all or may take longer to realize than expected.

A Failure In or Breach Of Our Operational or Security Systems or Infrastructure, or Those of Our Third Party Vendors and Other Service Providers, Including as a Result of Cyber-Attacks, Could Disrupt Our Business, Result in the Disclosure or Misuse of Confidential or Proprietary Information, Damage Our Reputation, Increase Our Costs and Cause Losses

We depend upon our ability to process, record and monitor a large number of customer transactions on a continuous basis. As customer, public and regulatory expectations regarding operational and information security have increased, our operational systems and infrastructure must continue to be safeguarded and monitored for potential failures, disruptions and breakdowns.

Information security risks for financial institutions, such as ours, have generally increased in recent years in part because of the proliferation of new technologies, the use of the internet and telecommunications technologies to conduct financial transactions and the increased sophistication and activities of organized crime, hackers, terrorists, activists and other external parties. As noted above, our operations rely on the secure processing, transmission and storage of confidential information in our computer systems and networks.

Our business operations rely on our digital technologies, computer and email systems, software and networks to conduct their operations. In addition, to access our products and services, our customers may use electronic devices that are beyond our control systems. Although we have information security procedures and controls in place, our technologies, systems, networks and our customers’ devices may become the target of cyber-attacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss or destruction of our or our customers’ confidential, proprietary and other information, or otherwise disrupt our or our customers’ or other third parties’ business operations.

Third parties with whom we do business or that facilitate our business activities, including exchanges, clearing houses, financial intermediaries or vendors that provide services or security solutions for our operations, could also be sources of operational and information security risk to us, including from breakdowns or failures of their own systems or capacity constraints.

Although to date we have not experienced any material losses relating to cyber-attacks or other information security breaches, there can be no assurance that we will not suffer such losses in the future. Our risk and exposure to these matters remains heightened because of, among other things, the evolving nature of these threats, the size and scale of People’s United, our plans to continue to implement our internet banking and mobile banking channel strategies and develop additional remote connectivity solutions to serve our customers when and how they want to be served, our expanded geographic footprint, the outsourcing of some of our business operations and the continued uncertain global economic environment. As a result, cybersecurity and the continued development and enhancement of our controls, processes and practices designed to protect our systems, computers, software, data and networks from attack, damage or unauthorized access remain a focus for us. As threats continue to evolve, we may be required to expend additional resources to continue to modify or enhance our protective measures or to investigate and remediate information security vulnerabilities.

17

Table of Contents

Disruptions or failures in the physical infrastructure or operating systems that support our business and customers, or cyber-attacks or security breaches of the networks, systems or devices that our customers use to access our products and services could result in customer attrition, regulatory fines, penalties or intervention, reputational damage, reimbursement or other compensation costs, and/or additional compliance costs, any of which could materially adversely affect our results of operations or financial condition.

Availability of First Lien Data With Respect to Our Home Equity Loans and Lines of Credit Could Delay Our Response to Any Deterioration in the Borrower’s Credit

We do not currently have statistics for our entire portfolio of home equity loans and lines of credit with respect to first liens serviced by third parties that have priority over our junior liens, as we did not historically capture that data on our loan servicing systems. As a result, we may therefore be unaware that the loan secured by the first lien is not performing, which could delay our response to an apparent deterioration in the borrower’s creditworthiness. As of December 31, 2015, full and complete first lien position data was not readily available for 38% of the home equity portfolio which, in turn, represented 3% of our overall loan portfolio at that date.

We are actively working with a third-party vendor to obtain the missing first lien information and have, in certain cases, obtained the data through information reported to credit bureaus when the borrower defaults. This data collection effort, however, can be more difficult in cases where more than one mortgage is reported in a borrower’s credit report and/or there is not a corresponding property address associated with a reported mortgage, in which case we are often unable to associate a specific first lien with our junior lien. Please see the discussion in Management’s Discussion and Analysis—Asset Quality—Portfolio Risk Elements—Home Equity Lending beginning on page 57 for more detail, including steps we are taking to otherwise address this issue.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

People’s United’s corporate headquarters is located in Bridgeport, Connecticut. The headquarters building had a net book value of $57 million at December 31, 2015 and People’s United occupies 87% of the building; all other available office space is leased to an unrelated party. People’s United delivers its financial services through a network of 396 branches located throughout Connecticut, southeastern New York, Massachusetts, Vermont, New Hampshire and Maine. People’s United’s branch network is primarily concentrated in Connecticut, where it has 154 offices (including 84 located in Stop & Shop supermarkets). People’s United also has 101 branches in southeastern New York (including 66 located in Stop & Shop supermarkets), 48 branches in Massachusetts, 40 branches in Vermont, 27 branches in New Hampshire and 26 branches in Maine. People’s United owns 105 of its branches, which had an aggregate net book value of $52 million at December 31, 2015. People’s United’s remaining banking operations are conducted in leased locations. Information regarding People’s United’s operating leases for office space and related rent expense appears in Note 19 to the Consolidated Financial Statements.

| Item 3. | Legal Proceedings |

The information required by this item appears in Note 19 to the Consolidated Financial Statements.

| Item 4. | Mine Safety Disclosures |

None.

18

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The common stock of People’s United is listed on the NASDAQ Global Select Market under the symbol “PBCT”. On February 17, 2016, the closing price of People’s United common stock was $14.68. As of that date, there were approximately 18,100 record holders of People’s United common stock.

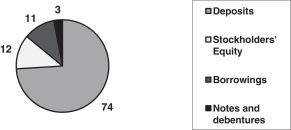

Five-Year Performance Comparison

The following graph compares total shareholder return on People’s United common stock over the last five fiscal years with: (i) the Standard & Poor’s 500 Stock Index (the “S & P 500 Stock Index”); (ii) the Russell Midcap Index; and (iii) the SNL Mid Cap U.S. Bank & Thrift Index (the “SNL Mid Cap Index”). Index values are as of December 31 of the indicated year.

The graph assumes $100 invested on December 31, 2010 in each of People’s United’s common stock, the S&P 500 Stock Index, the Russell Midcap Index and the SNL Mid Cap Index. The graph also assumes reinvestment of all dividends.

The Russell Midcap Index is a market-capitalization weighted index comprised of 800 publicly-traded companies which are among the 1,000 largest U.S. companies (by market capitalization) but not among the 200 largest such companies. People’s United is included as a component of the Russell Midcap Index. The SNL Mid Cap Index is an index prepared by SNL Securities comprised of 85 financial institutions (including People’s United) located throughout the United States.

19

Table of Contents

Issuer Purchases of Equity Securities

The following table provides information with respect to purchases made by People’s United of its common stock during the three months ended December 31, 2015:

| Period |

Total number of shares purchased |

Average price paid per share |

Total number of shares purchased as part of publicly announced plans or programs |

Maximum number of shares that may yet be purchased under the plans or programs |

||||||||||||

| October 1—31, 2015: |

||||||||||||||||

| Tendered by employees (1) |

1,464 | $ | 15.90 | — | — | |||||||||||

| November 1—30, 2015: |

||||||||||||||||

| Tendered by employees (1) |

3,461 | $ | 16.43 | — | — | |||||||||||

| December 1—31, 2015: |

||||||||||||||||

| Tendered by employees (1) |

434 | $ | 16.78 | — | — | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total: |

||||||||||||||||

| Tendered by employees (1) |

5,359 | $ | 16.32 | — | — | |||||||||||

| (1) | All shares listed were tendered by employees of People’s United in satisfaction of their related minimum tax withholding obligations upon the vesting of restricted stock awards granted in prior periods and/or in payment of the exercise price and satisfaction of their related minimum tax withholding obligations upon the exercise of stock options granted in prior periods. The average price paid per share is equal to the average of the high and low trading price of People’s United’s common stock on The NASDAQ Stock Market on the vesting or exercise date or, if no trades took place on that date, the most recent day for which trading data was available. There is no limit on the number of shares that may be tendered by employees of People’s United in the future for these purposes. Shares acquired in payment of the option exercise price or in satisfaction of minimum tax withholding obligations are not eligible for reissuance in connection with any subsequent grants made pursuant to equity compensation plans maintained by People’s United. All shares acquired in this manner are retired by People’s United, resuming the status of authorized but unissued shares of People’s United’s common stock. |

Additional information required by this item is included in Part III, Item 12 of this report, and Notes 12 and 24 to the Consolidated Financial Statements.

20

Table of Contents

| Item 6. | Selected Financial Data |

| As of and for the years ended December 31 (dollars in millions, except per share data) |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Earnings Data: |

||||||||||||||||||||

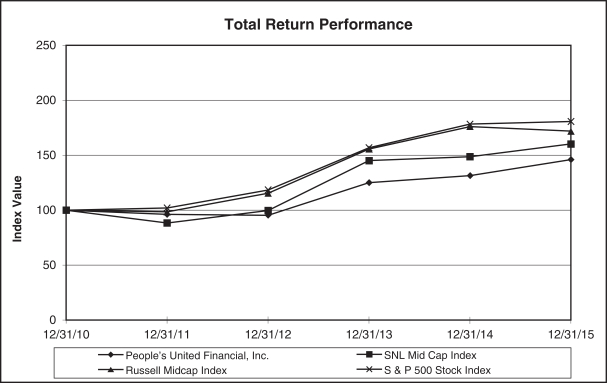

| Net interest income (fully taxable equivalent) |

$ | 957.3 | $ | 931.1 | $ | 905.8 | $ | 940.4 | $ | 921.2 | ||||||||||

| Net interest income |

932.1 | 911.9 | 888.6 | 928.7 | 913.4 | |||||||||||||||

| Provision for loan losses |

33.4 | 40.6 | 43.7 | 49.2 | 63.7 | |||||||||||||||

| Non-interest income |

352.4 | 350.8 | 341.7 | 320.4 | 314.3 | |||||||||||||||

| Non-interest expense (1) |

860.6 | 841.5 | 839.0 | 830.6 | 871.9 | |||||||||||||||

| Operating non-interest expense (1) |

847.7 | 832.0 | 826.3 | 817.9 | 815.1 | |||||||||||||||

| Income before income tax expense |

390.5 | 380.6 | 347.6 | 369.3 | 292.1 | |||||||||||||||

| Net income |

260.1 | 251.7 | 232.4 | 245.3 | 192.4 | |||||||||||||||

| Operating earnings (1) |

262.5 | 244.5 | 241.1 | 253.9 | 230.7 | |||||||||||||||

| Selected Statistical Data: |

||||||||||||||||||||

| Net interest margin |

2.88 | % | 3.09 | % | 3.31 | % | 3.86 | % | 4.10 | % | ||||||||||

| Return on average assets |