UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

For the fiscal year ended

For the transition period from ______ to ______

Commission File No.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

(Address of principal executive offices)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days:

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of the voting and non-voting

common stock held by non-affiliates of the registrant as of August 31, 2023 was approximately $

The number of outstanding common

shares of the registrant as of May 3, 2024 was

NOTE ABOUT REFERENCES

In this Annual Report on Form 10-K (the “Annual Report”), the “Company,” “we,” “us” and “our” refer to Saratoga Investment Corp. and its wholly owned subsidiaries, Saratoga Investment Funding LLC, Saratoga Investment Funding II LLC, Saratoga Investment Corp. SBIC LP, Saratoga Investment Corp. SBIC II LP, and Saratoga Investment Corp. SBIC III LP, unless the context otherwise requires. We refer to Saratoga Investment Advisors, LLC, our investment adviser, as “Saratoga Investment Advisors,” the “Investment Adviser” or the “Manager.”

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Some of the statements in this Annual Report constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will” and “would” or the negative of these terms or other comparable terminology.

We have based the forward-looking statements included in this Annual Report information available to us on the date of this Annual Report, and we assume no obligation to update any such forward-looking statements. Actual results could differ materially from those anticipated in our forward-looking statements, and future results could differ materially from historical performance. We undertake no obligation to revise or update any forward-looking statements occurring after the date of this Annual Report, whether as a result of new information, future events or otherwise, unless required by law or SEC rule or regulation. You are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

The forward-looking statements contained in this Annual Report involve risks and uncertainties, including statements as to:

| ● | our future operating results; |

| ● | the introduction, withdrawal, success and timing of business initiatives and strategies; |

| ● | changes in political, economic or industry conditions, the interest rate environment or financial and capital markets, which could result in changes in the value of our assets; |

| ● | the relative and absolute investment performance and operations of our Manager; |

| ● | the impact of increased competition; |

| ● | our ability to turn potential investment opportunities into transactions and thereafter into completed and successful investments; |

| ● | the unfavorable resolution of any future legal proceedings; |

| ● | our business prospects and the operational and financial performance of our portfolio companies, including their ability to achieve our respective objectives as a result of the current economic conditions caused by, among other things, elevated levels of inflation, and a rising interest rate environment, and the effects of the disruptions caused thereby on our ability to continue to effectively manage our business; |

i

| ● | the impact of investments that we expect to make and future acquisitions and divestitures; |

| ● | our contractual arrangements and relationships with third parties; |

| ● | the dependence of our future success on the general economy and its impact on the industries in which we invest; |

| ● | the ability of our portfolio companies to achieve their objectives; |

| ● | our expected financings and investments; |

| ● | our regulatory structure and tax treatment, including our ability to operate as a business development company (“BDC”), or to operate our small business investment company (“SBIC”) subsidiaries, and to continue to qualify to be taxed as a regulated investment company (“RIC”); |

| ● | the adequacy of our cash resources and working capital; |

| ● | the timing of cash flows, if any, from the operations of our portfolio companies; |

| ● | the impact of interest rate volatility, including the replacement of LIBOR with alternative reference rates, on our results, particularly because we use leverage as part of our investment strategy; |

| ● | the impact of supply chain constraints and labor difficulties on our portfolio companies and the global economy; |

| ● | the elevated level of inflation, and its impact on our portfolio companies and on the industries in which we invest; |

| ● | the impact of legislative and regulatory actions and reforms and regulatory, supervisory or enforcement actions of government agencies relating to us or our Manager; |

| ● | the impact of changes to tax legislation and, generally, our tax position; |

| ● | our ability to access capital and any future financings by us; |

| ● | the ability of our Manager to attract and retain highly talented professionals; and |

| ● | the ability of our Manager to locate suitable investments for us and to monitor and effectively administer our investments. |

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new loans and investments, borrowing costs and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Annual Report should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described in “Risk Factors” in this Annual Report under Item 1A. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Annual Report.

ii

iii

PART I

ITEM 1. BUSINESS

General

We are a specialty finance company that provides customized financing solutions to U.S middle-market businesses. Our investment objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from our investments. We primarily invest in senior and unitranche leveraged loans and mezzanine debt and, to a lesser extent, equity issued by private U.S. middle-market companies, which we define as companies having annual earnings before interest, taxes, depreciation and amortization (“EBITDA”) of between $2 million and $50 million, both through direct lending and through participation in loan syndicates. Our investments generally provide financing for change of ownership transactions, strategic acquisitions, recapitalizations, and growth initiatives in partnership with business owners, management teams and financial sponsors. Our investment activities are externally managed and advised by Saratoga Investment Advisors, LLC, a New York-based investment firm affiliated with Saratoga Partners, a middle-market private equity investment firm.

Our portfolio is comprised primarily of investments in leveraged loans issued by middle-market companies. Leveraged loans are generally senior debt instruments that rank ahead of subordinated debt with below investment grade or “junk” ratings or, if not rated, would be rated below investment grade or “junk” and, as a result, carry a higher risk of default. Leveraged loans also have the benefit of security interests on the assets of the portfolio company, which may rank ahead of, or be junior to, other security interests. Term loans are loans that do not allow the borrowers to repay all or a portion of the loans prior to maturity and then re-borrow such repaid amounts under the loan again. We also invest in mezzanine debt and make equity investments in middle-market companies. Mezzanine debt is typically unsecured and subordinated to senior debt of the portfolio company.

While our primary focus is to generate current income and capital appreciation from our debt and equity investments in middle-market companies, we may invest up to 30.0% of our portfolio in opportunistic investments in order to seek to enhance returns to stockholders. Such investments may include investments in distressed debt, including securities of companies in bankruptcy, foreign debt, private equity, securities of public companies that are not thinly traded, joint ventures and structured finance vehicles such as collateralized loan obligation funds. Although we have no current intention to do so, to the extent we invest in private equity funds, we will limit our investments in entities that are excluded from the definition of “investment company” under Section 3(c)(1) or Section 3(c)(7) of Investment Company Act of 1940, as amended (“1940 Act”), which includes private equity funds, to no more than 15% of our net assets.

As of February 29, 2024, we had total assets of $1,191.2 million and investments in 55 portfolio companies, excluding an investment in the subordinated notes of one collateralized loan obligation fund, Saratoga Investment Corp. CLO 2013-1, Ltd. (“Saratoga CLO”), which had a fair value of $9.5 million as of February 29, 2024, investments in the Class F-2-R-3 Note of the Saratoga CLO which as of February 29, 2024 had a fair value of $8.9 million, and investments in the Saratoga Senior Loan Fund I JV LLC (“SLF JV”) and its subsidiaries, a joint venture which as of February 29, 2024 had a fair value of $25.2 million. The overall portfolio composition as of February 29, 2024 consisted of 85.7% of first lien term loans, 1.6% of second lien term loans, 1.4% of unsecured loans, 2.7% of structured finance securities and 8.6% of equity interests. As of February 29, 2024, the weighted average yield on all of our investments, including our investment in the subordinated notes of Saratoga CLO and Class F-2-R-3 Note was approximately 11.4%. The weighted average yield of our investments is not the same as a return on investment for our stockholders and, among other things, is calculated before the payment of our fees and expenses. As of February 29, 2024, our total return based on market value was -3.92% and our total return based on net asset value (“NAV”) per share was 4.20%. As of February 28, 2023, our total return based on market value was 10.35% and our total return based on NAV was 9.46%. Total return based on market value is the change in the ending market value of the Company’s common stock plus dividends distributed during the period assuming participation in the Company’s dividend reinvestment plan divided by the beginning market value of the Company’s common stock. Total return based on NAV is the change in ending NAV per share plus dividends distributed per share paid during the period assuming participation in the Company’s dividend reinvestment plan divided by the beginning NAV per share. While total return based on NAV and total return based on market value reflect fund expenses, they do not reflect any sales load that may be paid by investors. As of February 29, 2024, approximately 99.4% of our first lien debt investments were fully collateralized in the sense that the portfolio companies in which we held such investments had an enterprise value or our investment had an asset coverage equal to or greater than the principal amount of the related debt investment. The Company uses enterprise value to assess the level of collateralization of its portfolio companies. The enterprise value of a portfolio company is determined by analyzing various factors, including EBITDA, cash flows from operations less capital expenditures and other pertinent factors, such as recent offers to purchase a portfolio company’s securities or other liquidation events. As a result, while we consider a portfolio company to be collateralized if its enterprise value exceeds the amount of our loan, we do not hold tangible assets as collateral in our portfolio companies that we would obtain in the event of a default. Our investment in the subordinated notes of Saratoga CLO represents a first loss position in a portfolio that, at February 29, 2024, was composed of $640.8 million in aggregate principal amount of predominantly senior secured first lien term loans. A first loss position means that we will suffer the first economic losses if losses are incurred on loans held by the Saratoga CLO. As a result, this investment is subject to unique risks. See Part I. Item 1A. “Risk Factors—Our investment in Saratoga CLO constitutes a leveraged investment in a portfolio of subordinated notes representing the lowest-rated securities issued by a pool of predominantly senior secured first lien term loans and is subject to additional risks and volatility. All losses in the pool of loans will be borne by our subordinated notes and only after the value of our subordinated notes is reduced to zero will the higher-rated notes issued by the pool bear any losses.”

1

We are an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the 1940 Act. As a BDC, we are required to comply with various regulatory requirements, including limitations on our use of debt. We finance our investments through borrowings. However, as a BDC, we are only generally allowed to borrow amounts such that our asset coverage, as defined in the 1940 Act, equals at least 200% after such borrowing, or 150% if we obtain the required approvals from our directors who are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Company (“independent directors”) and/or stockholders. On April 16, 2018, our board of directors, including, a majority of our independent directors, approved of us becoming subject to a minimum asset coverage ratio of 150% under Sections 18(a)(1) and 18(a)(2) of the 1940 Act. The 150% asset coverage ratio became effective on April 16, 2019.

We have elected to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”), under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). As a RIC, we generally will not be subject to U.S. federal income tax on any net ordinary income or capital gains that we timely distribute to our stockholders if we meet certain source-of-income, annual distribution and asset diversification requirements.

In addition, we have had three wholly owned subsidiaries that are each licensed as a small business investment company (“SBIC”) and regulated by the Small Business Administration (“SBA”). On March 28, 2012, our wholly owned subsidiary, Saratoga Investment Corp. SBIC LP (“SBIC LP”), received an SBIC license from the Small Business Administration (the “SBA”). On August 14, 2019, our wholly owned subsidiary, Saratoga Investment Corp. SBIC II LP (“SBIC II LP”), also received an SBIC license from the SBA. On September 29, 2022, our wholly owned subsidiary, Saratoga Investment Corp. SBIC III LP (“SBIC III LP” and, together with SBIC LP and SBIC II LP, the “SBIC Subsidiaries”), also received an SBIC license from the SBA, which provides up to $175.0 million in additional long-term capital in the form of SBA-guaranteed debentures. As a result, Saratoga’s SBA relationship increased from $325.0 million to $350.0 million of committed capital. For two or more SBICs under common control, the maximum amount of outstanding SBA debentures cannot exceed $350.0 million. Our wholly owned SBIC Subsidiaries are able to borrow funds from the SBA against the SBIC’s regulatory capital (which generally approximates equity capital in the respective SBIC) and is subject to customary regulatory requirements, including, but not limited to, periodic examination by the SBA. Following the debentures being fully repaid to the SBA, SBIC LP surrendered its license on January 3, 2024, providing the Company access to all undistributed capital of SBIC LP, and SBIC LP subsequently merged with and into the Company. See “Item 1. Business—Small Business Investment Company Regulations.”

We received exemptive relief from the U.S. Securities and Exchange Commission (the “SEC”) to permit us to exclude the senior securities issued by the SBIC Subsidiaries from the definition of senior securities in the asset coverage requirement under the 1940 Act. This allows the Company increased flexibility under the asset coverage requirement by permitting it to borrow up to $350.0 million more than it would otherwise be able to absent the receipt of this exemptive relief.

The Company has established wholly owned subsidiaries, SIA-AAP, Inc., SIA-ARC, Inc., SIA-Avionte, Inc., SIA-AX, Inc., SIA-G4, Inc., SIA-GH, Inc., SIA-MAC, Inc., SIA-MDP, Inc., SIA-PP Inc., SIA-SZ, Inc., SIA-TG, Inc., SIA-TT, Inc., SIA-Vector, Inc. and SIA-VR, Inc., which are structured as Delaware entities that are treated as corporations for U.S. federal income tax purposes and are intended to facilitate the Company’s compliance with the requirements to be treated as a RIC under the Code by holding equity or equity-like investments in portfolio companies organized as limited liability companies, or LLCs (or other forms of pass through entities). These entities are consolidated for accounting purposes but are not consolidated for U.S. federal income tax purposes and may incur U.S. federal income tax expenses as a result of their ownership of portfolio companies. In February 2022, SIA-GH, Inc., SIA-TT Inc. and SIA-VR, Inc. was liquidated following the sale of equity held by each of the portfolio companies and will be dissolved following the end of the entity’s indemnification period.

2

On October 26, 2021, the Company and TJHA JV I LLC (“TJHA”) entered into a Limited Liability Company Agreement (the “LLC Agreement”) to co-manage SLF JV. SLF JV is invested in Saratoga Investment Corp Senior Loan Fund 2021-1 Ltd (“SLF 2021”), which is a wholly owned subsidiary of SLF JV. SLF 2021 was formed for the purpose of making investments in a diversified portfolio of broadly syndicated first lien and second lien term loans or bonds in the primary and secondary markets. The Company and TJHA have equal voting interest on all material decisions with respect to SLF JV, including those involving its investment portfolio, and equal control of corporate governance. No management fee is charged to SLF JV as control and management of SLF JV is shared equally. The Company and TJHA have committed to provide up to a combined $50.0 million of financing to SLF JV through cash contributions, with the Company providing $43.75 million and TJHA providing $6.25 million, resulting in an 87.5% and 12.5% ownership between the two parties. The financing is issued in the form of an unsecured note and equity. The unsecured note will pay a fixed rate of 10.0% per annum and is due and payable in full on October 20, 2033. As of February 29, 2024, the Company and TJHA’s investment in SLF JV consisted of an unsecured note of $17.6 million and $2.5 million, respectively; and membership interest of $17.6 million and $2.5 million, respectively. For the year ended February 29, 2024, the Company earned $1.8 million of interest income related to SLF JV, which is included in interest income. SLF JV’s initial investment in SLF 2022 was in the form of an unsecured loan. The unsecured loan paid a floating rate of LIBOR plus 7.00% per annum and was due and payable in full on June 9, 2023. The unsecured loan was repaid in full on October 28, 2022, as part of the CLO closing. The Company has determined that SLF JV is an investment company under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services—Investment Companies; however, in accordance with such guidance the Company will generally not consolidate its investment in a company other than a wholly owned investment company subsidiary. SLF JV is not a wholly owned investment company subsidiary as the Company and TJHA each have an equal 50% voting interest in SLF JV and thus neither party has a controlling financial interest. Furthermore, ASC Topic 810, Consolidation, concludes that in a joint venture where both members have equal decision-making authority, it is not appropriate for one member to consolidate the joint venture since neither has control. Accordingly, the Company does not consolidate SLF JV.

Corporate Information

We commenced operations, at the time known as GSC Investment Corp., on March 23, 2007 and completed an initial public offering of shares of common stock on March 28, 2007. Prior to July 30, 2010, we were externally managed and advised by GSCP (NJ), L.P., an entity affiliated with GSC Group, Inc. In connection with the consummation of a recapitalization transaction on July 30, 2010, we engaged Saratoga Investment Advisors to replace GSCP (NJ), L.P. as our investment adviser and changed our name to Saratoga Investment Corp.

Our corporate offices are located at 535 Madison Avenue, New York, New York 10022. Our telephone number is (212) 906-7800. We maintain a website on the Internet at www.saratogainvestmentcorp.com. Information contained on our website is not incorporated by reference into this Annual Report, and you should not consider that information to be part of this Annual Report.

Saratoga Investment Advisors

General

Our Investment Adviser was formed in 2010 as a Delaware limited liability company and became our investment adviser in July 2010. Our Investment Adviser is led by four principals, Christian L. Oberbeck, Michael J. Grisius, Thomas V. Inglesby, and Charles G. Phillips, with 36, 34, 37 and 27 years of experience in leveraged finance, respectively, and the Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary, Henri J. Steenkamp, who has 25 years of experience in financial services and leveraged finance. Our Investment Adviser is affiliated with Saratoga Partners, a middle-market private equity investment firm. Saratoga Partners was established in 1984 to be the middle-market private investment arm of Dillon Read & Co. Inc. and has been independent of Dillon Read & Co. Inc. and its successor entity, SBC Warburg Dillon Read, since 1998. Saratoga Partners has a 35-year history of private investments in middle-market companies and focuses on public and private equity, preferred stock, and senior and mezzanine debt investments.

3

Our Relationship with Saratoga Investment Advisors

We utilize the personnel, infrastructure, relationships and experience of Saratoga Investment Advisors to enhance the growth of our business. We currently have no employees and each of our executive officers is also an officer of Saratoga Investment Advisors.

We have entered into an investment advisory and management agreement (the “Management Agreement”) with Saratoga Investment Advisors. Pursuant to the 1940 Act, the initial term of the Management Agreement was for two years from its effective date of July 30, 2010, and will remain in effect on a year-to-year basis if approved annually at an in-person meeting of the board of directors, a majority of whom must be independent directors. Most recently, our board of directors approved the renewal of the Management Agreement for an additional one-year term at an in-person meeting held on July 6, 2023. Pursuant to the Management Agreement, Saratoga Investment Advisors implements our business strategy on a day-to-day basis and performs certain services for us under the direction of our board of directors. Saratoga Investment Advisors is responsible for, among other duties, performing all of our day-to-day functions, determining investment criteria, sourcing, analyzing and executing investment transactions, asset sales, financings and performing asset management duties.

Saratoga Investment Advisors has formed an investment committee to advise and consult with its senior management team with respect to our investment policies, investment portfolio holdings, financing and leveraging strategies and investment guidelines. We believe that the collective experience of the investment committee members across a variety of fixed income asset classes will benefit us. The investment committee must unanimously approve all investments in excess of $1.0 million made by us. In addition, all sales of our investments must be approved by all four of our investment committee members. The current members of the investment committee are Messrs. Oberbeck, Grisius, Inglesby, and Phillips.

We have also entered into a separate Administration Agreement (the “Administration Agreement”) with Saratoga Investment Advisors pursuant to which Saratoga Investment Advisors furnishes us with office facilities, equipment and clerical, bookkeeping and record keeping services. The Administration Agreement has an initial term of two years from its effective date of July 30, 2010, and will remain in effect on a year-to-year basis, subject to annual approval by our board of directors, a majority of whom must be our independent directors. Most recently, on July 6, 2023, our board of directors approved the renewal of the Administration Agreement for an additional one-year term and determined to increase the cap on the payment or reimbursement of expenses by the Company from $3.275 million to $4.3 million effective August 1, 2023. Under the Administration Agreement, Saratoga Investment Advisors also performs, or oversees the performance of our required administrative services, which include, among other things, being responsible for the financial records which we are required to maintain, preparing reports for our stockholders and reports required to be filed with the SEC. Payments under the Administration Agreement will be equal to an amount based upon the allocable portion of Saratoga Investment Advisors’ overhead in performing its obligations under the Administration Agreement, including rent and the allocable portion of the cost of our officers and their respective staffs relating to the performance of services under the Administration Agreement.

Investments

Our portfolio is comprised primarily of investments in leveraged loans (both first and second lien term loans) issued by middle-market companies. Investments in middle-market companies are generally less liquid than equivalent investments in companies with larger capitalizations. These investments are sourced in both the primary and secondary markets through a network of relationships with commercial and investment banks, commercial finance companies and financial sponsors. The leveraged loans that we purchase are generally used to finance buyouts, strategic acquisitions, growth initiatives, recapitalizations and other types of transactions. Leveraged loans are generally senior debt instruments that rank ahead of subordinated debt which are invested by companies with below investment grade or “junk” ratings or, if not rated, would be rated below investment grade or “junk” and, as a result, carry a higher risk of default. Leveraged loans also have the benefit of security interests on the assets of the portfolio company, which may rank ahead of, or be junior to, other security interests. For a discussion of the risks pertaining to our secured investments, see Part I. Item 1A. “Risk Factors—Our investments may be risky, and you could lose all or part of your investment.”

4

As part of our long-term strategy, we also invest in mezzanine debt and make equity investments in middle-market companies. Mezzanine debt is typically unsecured and subordinated to senior debt of the portfolio company. See Part I. Item 1A. “Risk Factors—If we make unsecured debt investments, we may lack adequate protection in the event our portfolio companies become distressed or insolvent and will likely experience a lower recovery than more senior debtholders in the event our portfolio companies default on their indebtedness.”

Substantially all of the debt investments held in our portfolio hold a non-investment grade rating by one or more rating agencies or, if not rated, would be rated below investment grade if rated, which are often referred to as “junk.” As of February 29, 2024, 77.8% of our debt portfolio at fair value consisted of debt securities for which issuers were not required to make principal payments until the maturity of such debt securities, which could result in a substantial loss to us if such issuers are unable to refinance or repay their debt at maturity. Such “interest-only” loans are structured such that the borrower makes only interest payments throughout the life of the loan and makes a large, “balloon payment” at the end of the loan term. The ability of a borrower to make or refinance a balloon payment may be affected by a number of factors, including the financial condition of the borrower, prevailing economic conditions, higher interest rates, and collateral values. If the interest-only loan borrower is unable to make or refinance a balloon payment, we may experience greater losses than if the loan were structured as amortizing. As of February 29, 2024, 19.7% of our interest-only loans provided for contractual PIK interest, which represents contractual interest added to a loan balance and due at the end of such loan’s term, and 49.6% of such investments elected to pay a portion of interest due in PIK. In addition, 99.5% of our debt investments at February 29, 2024, had variable interest rates that reset periodically based on benchmarks such as BSBY, SOFR and the prime rate. As a result, significant increases in such benchmarks in the future may make it more difficult for these borrowers to service their obligations under the debt investments that we hold.

As a BDC, we are required to comply with certain regulatory requirements. For instance, as a BDC, we may not acquire any assets other than “qualifying assets” as specified in the 1940 Act unless, at the time of and after giving effect to such acquisition, at least 70% of our total assets are qualifying assets. See “Business—Business Development Company Regulations – Qualifying Assets.”

While our primary focus is to generate current income and capital appreciation from our debt and equity investments in middle-market companies, we may invest up to 30.0% of the portfolio in opportunistic investments in order to seek to enhance returns to stockholders. Such investments may include investments in distressed debt, private equity, securities of public companies that are not thinly traded, joint ventures and structured finance vehicles such as collateralized loan obligation funds. Although we have no current intention to do so, to the extent we invest in private equity funds, we will limit our investments in entities that are excluded from the definition of “investment company” under Section 3(c)(1) or Section 3(c)(7) of the 1940 Act, which includes private equity funds, to no more than 15% of its net assets.

Leveraged loans

Our leveraged loan portfolio is comprised primarily of first lien and second lien term loans. First lien term loans are secured by a first priority perfected security interest on all or substantially all of the assets of the borrower and typically include a first priority pledge of the capital stock of the borrower. First lien term loans hold a first priority with regard to right of payment. Generally, first lien term loans offer floating rate interest payments, have a stated maturity of five to seven years, and have a fixed amortization schedule. First lien term loans generally have restrictive financial and negative covenants. Second lien term loans are secured by a second priority perfected security interest on all or substantially all of the assets of the borrower and typically include a second priority pledge of the capital stock of the borrower. Second lien term loans hold a second priority with regard to right of payment. Second lien term loans offer either floating rate or fixed rate interest payments, generally have a stated maturity of five to eight years and may or may not have a fixed amortization schedule. Second lien term loans that do not have fixed amortization schedules require payment of the principal amount of the loan upon the maturity date of the loan. Second lien term loans have less restrictive financial and negative covenants than those that govern first lien term loans.

5

Mezzanine debt

Mezzanine debt usually ranks subordinate in priority of payment to senior debt and is often unsecured. However, mezzanine debt ranks senior to common and preferred equity in a borrowers’ capital structure. Mezzanine debt typically has fixed rate interest payments and a stated maturity of six to eight years and does not have fixed amortization schedules.

In some cases, our debt investments may provide for a portion of the interest payable to be payment-in-kind interest (“PIK”). To the extent interest is PIK, it will be payable through the increase of the principal amount of the obligation by the amount of interest due on the then-outstanding aggregate principal amount of such obligation.

Equity Investments

Equity investments may consist of preferred equity that is expected to pay dividends on a current basis in the form of cash or additional equity or preferred equity that does not pay current dividends. Preferred equity at times may also have PIK interest payable. Preferred equity generally has a preference over common equity as to distributions on liquidation and dividends. In some cases, we may acquire common equity. In general, our equity investments are not control-oriented investments and we expect that in many cases we will acquire equity securities as part of a group of private equity investors in which we are not the lead investor.

Opportunistic Investments

Opportunistic investments may include investments in distressed debt, which may include securities of companies in bankruptcy, debt and equity securities of public companies that are not thinly traded, emerging market debt, structured finance vehicles such as collateralized loan obligation funds and debt of middle-market companies located outside the United States. See Note 4 and Note 5 for more information about Saratoga CLO and SLF JV and SLF 2022.

On January 22, 2008, GSC Group, Inc., as asset manager, with Lehman Brothers raising the financing, entered into a collateral management agreement with Saratoga CLO. Saratoga CLO was structured with five tranches of debt, plus residual notes. Saratoga CLO’s five tranches of debt were purchased by a wide variety of CLO debt market participants. In addition, we purchased for $30.0 million all of the outstanding subordinated notes of Saratoga CLO.

Pursuant to its terms, the investment period for Saratoga CLO ended in January 2013, and certain restrictions in such terms limited portfolio reinvestment. As a result, the Company determined that it was in its best interest to refinance Saratoga CLO given its investment attractiveness, and has refinanced this multiple times since then. The Company did not originate any of the loan assets included in the formation of Saratoga CLO, nor has it done so since the subsequent refinancing transactions. Moreover, the Company does not expect to originate any of the loans in the Saratoga CLO portfolio prospectively. The Company has from time to time co-invested in loans with the Saratoga CLO. The Company currently has no co-investments between it and Saratoga CLO.

With respect to our advisory services to Saratoga CLO, and in particular the underwriting standards used when determining which investments qualify for inclusion in the Saratoga CLO, they are substantially similar to the process employed in selecting the Company’s investments. All of the credit metrics for a Saratoga CLO investment are reviewed and documented in the same manner as they would be for an investment for the Company, with some minor differences. For example, the Saratoga CLO investment process also includes multiple rating agency review and analysis of the loan investment and the assigned corporate ratings, which typically does not apply to a prospective investment of the Company. Lastly, a Saratoga CLO investment also considers the likely secondary liquidity of the loan in considering the investment, whereas the Company’s investments are generally illiquid.

6

The Saratoga CLO investment period was initially refinanced in October 2013 and its reinvestment period extended to October 2016. On November 15, 2016, we completed a second refinancing of the Saratoga CLO with its reinvestment period extended to October 2018. On December 14, 2018, we completed a third refinancing and upsize of the Saratoga CLO (the “2013-1 Reset CLO Notes”). This refinancing, among other things, extended the non-call period and reinvestment period to January 20, 2020 and January 20, 2021, respectively, and extended its legal final date to January 20, 2030. Following this refinancing, the Saratoga CLO portfolio increased from approximately $300.0 million in aggregate principal amount to approximately $500.0 million of predominantly senior secured first lien term loans. As part of the refinancing of its liabilities, we also purchased $2.5 million in aggregate principal amount of the Class F-R-2 and $7.5 million aggregate principal amount of the Class G-R-2 notes tranches of the Saratoga CLO at par, with a coupon of LIBOR plus 8.75% and LIBOR plus 10.00%, respectively. We also redeemed our existing $4.5 million aggregate principal amount of the Class F Notes tranche of the Saratoga CLO at par. The Class F-R-2 Notes and Class G-R-2 Notes tranches are the seventh and eighth tranches in the capital structure of Saratoga CLO and are subordinated to the other debt classes of Saratoga CLO, respectively. The Class F-R-2 and Class G-R-2 tranches are senior to the subordinated notes, which is effectively the equity position in Saratoga CLO. As a result, the other tranches of debt in Saratoga CLO rank ahead of the $2.5 million Class F-R-2 tranche and $7.5 million Class G-R-2 tranche and ahead of the aggregate principal amount of our position in the subordinated notes, with respect to priority of payments in the event of a default or a liquidation. We also purchased an aggregate principal amount of $39.5 million of subordinated notes, which is in addition to the $30.0 million of subordinated notes issued in 2013 that were reset with an extended legal final date to January 20, 2030. Following the refinancing, Saratoga Investment Corp. owns 100% of the Class F-R-2, Class G-R-2 and the subordinated notes of the Saratoga CLO. On February 11, 2020, we entered into an unsecured loan agreement (“CLO 2013-1 Warehouse 2 Loan”) with Saratoga Investment Corp. CLO 2013-1 Warehouse 2, Ltd (“CLO 2013-1 Warehouse 2”), a wholly owned subsidiary of Saratoga CLO, pursuant to which CLO 2013-1 Warehouse 2 may borrow from time to time up to $20.0 million from the Company in order to provide capital necessary to support warehouse activities. On October 23, 2020, the CLO 2013-1 Warehouse 2 Loan was increased to $25.0 million availability, which was immediately fully drawn. The interest rate was also amended to be based on a pricing grid, starting at an annual rate of 3M USD LIBOR + 4.46%. On February 26, 2021, the Company completed the fourth refinancing of the Saratoga CLO. This refinancing, among other things, extended the Saratoga CLO reinvestment period to April 2024, and extended its legal maturity to April 2033. A non-call period ending February 2022 was also added. In addition, and as part of the refinancing, the Saratoga CLO has also been upsized from $500 million in assets to approximately $650 million. As part of this refinancing and upsizing, the Company invested an additional $14.0 million in all of the newly issued subordinated notes of the Saratoga CLO, and purchased $17.9 million in aggregate principal amount of the Class F-R-3 Notes tranche at par. Concurrently, the existing $2.5 million of Class F-R-2 Notes, $7.5 million of Class G-R-2 Notes and $25.0 million CLO 2013-1 Warehouse 2 Loan were repaid. The Company also paid $2.6 million of transaction costs related to the refinancing and upsizing on behalf of the Saratoga CLO, to be reimbursed from future equity distributions. On August 9, 2021, the Company exchanged its existing $17.9 million Class F-R-3 Notes for $8.5 million Class F-1-R-3 Notes and $9.4 million Class F-2-R-3 Notes at par. On August 11, 2021, the Company sold its Class F-1-R-3 Notes to third parties, resulting in a realized loss of $0.1 million. At August 31, 2021, the outstanding receivable of $2.6 million was repaid in full. After the current end of the reinvestment period in April 2024, the Company continues to consider refinancing the Saratoga CLO, subject to market conditions. A refinancing transaction entails finding existing and new investors that are willing to provide debt financing to Saratoga CLO which extends the investment period of the CLO on terms that are acceptable to it and in an amount sufficient to allow it to repay all of its existing debt holders. Prior to refinancing Saratoga CLO’s indebtedness after, Saratoga CLO will be required to use investment repayments by portfolio companies received after April 2024 to repay its outstanding indebtedness.

At February 29, 2024, the aggregate fair value of our investments in Saratoga Investment Corp. CLO 2013-1 F-2-R-3 Notes and subordinated notes of the Saratoga CLO was $8.9 million and $9.5 million, respectively.

The terms of the subordinated notes of Saratoga CLO entitles the Company to the residual net interest income in Saratoga CLO, which is paid on a quarterly basis after payment of all expenses, assuming that the Saratoga CLO remains in compliance with its various debt and rating agency compliance tests. The Company’s investment in the subordinated notes of Saratoga CLO can be sold or transferred at any time. The Company has held 100% of the subordinated notes of Saratoga CLO since the inception of Saratoga CLO.

Generally, the interests of the holders of the various classes of securities issued by the Saratoga CLO are aligned with the interests of the Company as holder of the subordinated notes. The investors in the various debt tranches of the securities issued by the Saratoga CLO are interested in the regular payment of interest income from the Saratoga CLO and the overcollateralization of the underlying loan assets relative to the Saratoga CLO debt issued. On the other hand, the subordinated note holders might prefer purchasing higher yielding riskier assets that could increase returns while the returns of the holders of the debt securities remain unchanged.

7

With respect to the collateral management agreement that the Company has entered into with Saratoga CLO, while the agreement is similar to the investment advisory and management agreement between the Company and Saratoga Investment Advisors in that it is an asset management agreement, there are material differences between the two. For example, pursuant to Section 15 of the 1940 Act, the Management Agreement with Saratoga Investment Advisors has an initial term of two years, with annual renewals to be approved at an in-person meeting of the Company’s board of directors. The contract can be terminated by the Company’s board of directors or stockholders with 60 days’ notice, with no penalty for termination. The collateral management agreement that the Company has entered into with Saratoga CLO, on the other hand, has no renewal requirement. The Saratoga CLO collateral management agreement may be terminated for cause at the direction of a majority of the most senior class of the Saratoga CLO securities then outstanding, excluding any securities held by the Company or any affiliate thereof or any other entity over which the Company or an affiliate thereof has discretionary authority over voting such securities, which securities are disregarded for this purpose. If the Saratoga CLO collateral management agreement is terminated, the manager remains in place until a new manager is appointed by the issuer at the direction of either (i) a majority of the Saratoga CLO subordinated notes, and not rejected by a majority of the most senior class of CLO securities then outstanding, or (ii) a majority of the most senior class of CLO securities then outstanding, and not rejected by a majority of the Saratoga CLO subordinated notes, in each case within 20 days of notice of a vote regarding the successor manager. If no successor investment manager shall have been appointed within 120 days after the date of notice of resignation by the investment manager, the resigning investment manager, a majority of the controlling class or a majority of the subordinated notes may petition any court of competent jurisdiction for the appointment of a successor investment manager without the approval of the holders of the notes. We receive a base management fee of 0.10% per annum and a subordinated management fee of 0.40% per annum of the outstanding principal amount of Saratoga CLO’s assets, paid quarterly to the extent of available proceeds. Prior to the second refinancing and the issuance of the 2013-1 Amended CLO Notes, we received a base management fee of 0.25% per annum and a subordinated management fee of 0.25% per annum of the outstanding principal amount of Saratoga CLO’s assets, paid quarterly to the extent of available proceeds. Following the third refinancing and the issuance of the 2013-1 Reset CLO Notes on December 14, 2018, we are no longer entitled to an incentive management fee equal to 20.0% of excess cash flow to the extent the Saratoga CLO subordinated notes receive an internal rate of return paid in cash equal to or greater than 12.0%.

The securities issued by the Saratoga CLO do not have any external credit enhancement features that would minimize the potential losses to the subordinated notes. Saratoga CLO recognized realized losses on extinguishment of debt of approximately $3.0 million, $1.2 million, $6.1 million and $3.4 million in the fiscal years ended February 28, 2021, February 28, 2019, February 28, 2017 and February 28, 2014, respectively, related to the February 2021, December 2018, November 2016 and October 2013 refinancing, primarily as a result of repurchasing securities at par at the refinancing that was previously issued at a discount, as well as the acceleration of the amortization of the legal and accounting costs associated with the refinancing. The cost of the refinancing was effectively borne by the Company as the holder of the subordinated notes in Saratoga CLO. The indenture for the Saratoga CLO contemplates the issuance of additional securities from time to time, pursuant to an amendment to the indenture and subject to various requirements and conditions, including the consent of the Company (in its capacity as investment manager) and the consent of the of the holders of a majority of the subordinated notes (all of which are held by the Company) and, except in certain limited circumstances, the consent of the holders of a majority (by principal amount) the Class A-1 Notes. The Saratoga CLO could also issue additional securities pursuant to a refinancing of the existing securities. The costs of any such future refinancing would effectively be borne by the Company as the holder of the subordinated notes in Saratoga CLO. On August 9, 2021, the Company exchanged its existing $17.9 million Class F-R-3 Notes for $8.5 million Class F-1-R-3 Notes and $9.4 million Class F-2-R-3 Notes at par. On August 11, 2021, the Company sold its Class F-1-R-3 Notes to third parties, resulting in a realized loss of $0.1 million.

The Company does not believe that any representations or warranties made by the Company as manager of Saratoga CLO or investor in the subordinated notes could materially affect the Company. However, because the Company acts as the collateral manager to Saratoga CLO, it may be subject to claims by third-party investors in Saratoga CLO for alleged or actual negligent acts, errors or omissions or breach of fiduciary duties committed in the scope of performing its services as the collateral manager.

8

As of February 29, 2024, the Saratoga CLO portfolio consisted of $640.8 million in aggregate principal amount of primarily senior secured first lien term loans. At February 29, 2024, 94.8% of the Saratoga CLO portfolio consisted of such loans to 347 borrowers with an average exposure to each borrower of $1.8 million. The weighted average maturity of the portfolio is 4.07 years. In addition, Saratoga CLO held $12.1 million in cash at February 29, 2024. Our investments in the Saratoga CLO falls into our 30% “bucket” of non-qualifying assets under the 1940 Act and currently has an aggregate cost basis of approximately $32.3 million, which is net of all principal payments made by Saratoga CLO on the Company’s total investment in the subordinate notes of Saratoga CLO is $57.8 which consists of additional investments of $30 million in January 2008, $13.8 million in December 2018 and $14.0 million in February 2021.

On October 26, 2021, the Company and TJHA JV I LLC entered into the LLC Agreement to co-manage SLF JV. SLF JV is a joint venture that invests in the debt or equity interests of collateralized loan obligations, loans, notes and other debt instruments. As of February 29, 2024, the Company has membership interests with a fair value of $9.4 million and an unsecured loan with a fair value of $15.8 million in the SLF JV, and an investment in the Class E notes of the SLF JV’s wholly owned CLO (“SLF 2022”) with a fair value of $12.3 million. As of February 29, 2024, the SLF JV has an investment in the subordinated debt of SLF 2022 with a fair value of $30.7 million.

Prospective portfolio company characteristics

Our Investment Adviser generally selects portfolio companies with one or more of the following characteristics:

| ● | a history of generating stable earnings and strong free cash flow; |

| ● | well-constructed balance sheets with the ability to withstand industry cycles, supported by sustainable enterprise values; |

| ● | reasonable debt-to-cash flow multiples; |

| ● | exceptional management with meaningful stake; |

| ● | industry leadership with competitive advantages and sustainable market shares and growth prospects in attractive and healthy sectors; and |

| ● | capital structures that provide appropriate terms and reasonable covenants. |

Investment selection

In managing us, Saratoga Investment Advisors employs the same investment philosophy and portfolio management methodologies used by Saratoga Partners. Through this investment selection process, based on quantitative and qualitative analysis, Saratoga Investment Advisors seeks to identify portfolio companies with superior fundamental risk-reward profiles and strong, defensible business franchises with the goal of minimizing principal losses while maximizing risk-adjusted returns. Saratoga Investment Advisors’ investment process emphasizes the following:

| ● | bottom-up, company-specific research and analysis; |

| ● | capital preservation, low volatility and minimization of downside risk; and |

| ● | investing with experienced management teams that hold meaningful equity ownership in their businesses. |

Our Investment Adviser’s investment process generally includes the following steps:

| ● | Initial screening. A brief analysis identifies the investment opportunity and reviews the merits of the transaction. The initial screening memorandum provides a brief description of the company, its industry, competitive position, capital structure, financials, equity sponsor and deal economics. If the deal is determined to be attractive by the senior members of the deal team, the opportunity is fully analyzed. |

9

| ● | Full analysis. A full analysis includes: |

| ● | Business and Industry analysis—a review of the company’s business position, competitive dynamics within its industry, cost and growth drivers and technological and geographic factors. Business and industry research often includes meetings with industry experts, consultants, other investors, customers and competitors. |

| ● | Company analysis—a review of the company’s historical financial performance, future projections, cash flow characteristics, balance sheet strength, liquidation value, legal, financial and accounting risks, contingent liabilities, market share analysis and growth prospects. |

| ● | Structural/security analysis—a thorough legal document analysis including but not limited to an assessment of financial and negative covenants, events of default, enforceability of liens and voting rights. |

| ● | Approval of the investment committee. The investment is then presented to the investment committee for approval. The investment committee must unanimously approve all investments in excess of $1 million made by us. In addition, all sales of our investments must be approved by all four of our investment committee members. The members of our investment committee are Christian L. Oberbeck, Michael J. Grisius, Thomas V. Inglesby, and Charles G. Phillips. |

Investment structure

In general, our Investment Adviser intends to select investments with financial covenants and terms that reduce leverage over time, thereby enhancing credit quality. These methods include:

| ● | maintenance leverage covenants requiring a decreasing ratio of debt to cash flow; |

| ● | maintenance cash flow covenants requiring an increasing ratio of cash flow to the sum of interest expense and capital expenditures; and |

| ● | debt incurrence prohibitions, limiting a company’s ability to re-lever. |

In addition, limitations on asset sales and capital expenditures should prevent a company from changing the nature of its business or capitalization without our consent.

Our Investment Adviser seeks, where appropriate, to limit the downside potential of our investments by:

| ● | requiring a total return on our investments (including both interest and potential equity appreciation) that compensates us for credit risk; |

| ● | requiring companies to use a portion of their excess cash flow to repay debt; |

| ● | selecting investments with covenants that incorporate call protection as part of the investment structure; and |

| ● | selecting investments with affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights, including either observation or participation rights. |

10

Valuation process

We account for our investments at fair value in accordance with FASB ASC Topic 820, Fair Value Measurement (“ASC 820”), as determined in good faith using written policies and procedures adopted by our board of directors. Investments for which market quotations are readily available are recorded in our consolidated financial statements at such market quotations subject to any decision by our board of directors to approve a fair value determination to reflect significant events affecting the value of these investments. We value investments for which market quotations are not readily available at fair value as determined in good faith by our board of directors based on input from Saratoga Investment Advisors, our audit committee and an independent valuation firm engaged by our board of directors. We use multiple techniques for determining fair value based on the nature of the investment and experience with those types of investments and specific portfolio companies. The selections of the valuation techniques and the inputs and assumptions used within those techniques often require subjective judgements and estimates. These techniques include market comparables, discounted cash flows and enterprise value waterfalls. Fair value is best expressed as a range of values from which the Company determines a single best estimate. The types of inputs and assumptions that may be considered in determining the range of values of our investments include the nature and realizable value of any collateral, the portfolio company’s ability to make payments, market yield trend analysis and volatility in future interest rates, call and put features, the markets in which the portfolio company does business, comparison to publicly traded companies, discounted cash flows and other relevant factors.

We undertake a multi-step valuation process each quarter when valuing investments for which market quotations are not readily available, as described below:

| ● | each investment is initially valued by the responsible investment professionals of Saratoga Investment Advisors and preliminary valuation conclusions are documented and discussed with the senior management; and |

| ● | an independent valuation firm engaged by our board of directors independently reviews a selection of these preliminary valuations each quarter so that the valuation of each investment for which market quotes are not readily available is reviewed by the independent valuation firm at least once each fiscal year. We use a third-party independent valuation firm to value our investment in the subordinated notes of Saratoga CLO, the Class F-2-R-3 Notes tranche of the Saratoga CLO and the Class E Notes tranche of the SLF 2022 every quarter. |

In addition, all our investments are subject to the following valuation process:

| ● | the audit committee of our board of directors reviews and approves each preliminary valuation and our Investment Adviser and independent valuation firm (if applicable) will supplement the preliminary valuation to reflect any comments provided by the audit committee; and |

| ● | our board of directors discusses the valuations and approves the fair value of each investment in good faith based on the input of our Investment Adviser, independent valuation firm (to the extent applicable) and the audit committee of our board of directors. |

Our investment in Saratoga CLO is carried at fair value, which is based on a discounted cash flow model that utilizes prepayment, re-investment and loss assumptions based on historical experience and projected performance, economic factors, the characteristics of the underlying cash flow, and comparable yields for equity interests in collateralized loan obligation funds similar to Saratoga CLO, when available, as determined by Saratoga Investment Advisors and recommended to our board of directors. Specifically, we use Intex cash flow models, or an appropriate substitute, to form the basis for the valuation of our investment in Saratoga CLO. The models use a set of assumptions including projected default rates, recovery rates, reinvestment rates and prepayment rates in order to arrive at estimated valuations. The assumptions are based on available market data and projections provided by third parties as well as management estimates. We use the output from the Intex models (i.e., the estimated cash flows) to perform a discounted cash flow analysis on expected future cash flows to determine a valuation for our investment in Saratoga CLO.

Because such valuations, and particularly valuations of private investments and private companies, are inherently uncertain, they may fluctuate over short periods of time and may be based on estimates. The determination of fair value may differ materially from the values that would have been used if a ready market for these investments existed. Our NAV could be materially affected if the determinations regarding the fair value of our investments were materially higher or lower than the values that we ultimately realize upon the disposal of such investments.

11

Rule 2a-5 under the 1940 Act (“Rule 2a-5”) establishes a regulatory framework for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 permits boards, subject to board oversight and certain other conditions, to designate the investment adviser to perform fair value determinations. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must determine the fair value of a security. Rule 31a-4 under the 1940 Act (“Rule 31a-4”) provides the recordkeeping requirements associated with fair value determinations. While our board of directors has not elected to designate Saratoga Investment Advisors as the valuation designee, the Company has adopted certain revisions to its valuation policies and procedures in order comply with the applicable requirements of Rule 2a-5 and Rule 31a-4.

Ongoing relationships with and monitoring of portfolio companies

Saratoga Investment Advisors will closely monitor each investment we make and, when appropriate, will conduct a regular dialogue with both the management team and other debtholders and seek specifically tailored financial reporting. In addition, in certain circumstances, senior investment professionals of Saratoga Investment Advisors may take board seats or board observation seats.

Distributions

Our distributions, if any, will be determined by our board of directors and paid out of assets legally available for distribution. Any such distributions generally will be taxable to our stockholders, including to those stockholders who receive additional shares of our common stock pursuant to our dividend reinvestment plan. Prior to January 2009, we paid quarterly dividends to our stockholders. However, in January 2009, we suspended the practice of paying quarterly dividends to our stockholders and thereafter paid five annual dividend distributions (December 2013, 2012, 2011, 2010 and 2009) to our stockholders since such time, which distributions were made with a combination of cash and the issuance of shares of our common stock as discussed more fully below.

On September 24, 2014, we announced the recommencement of quarterly dividends to our stockholders and have subsequently made distributions under this new policy. We have adopted a dividend reinvestment plan (“DRIP”) that provides for reinvestment of our dividend distributions on behalf of our stockholders unless a stockholder elects to receive cash. As a result, if our board of directors authorizes, and we declare, a cash dividend, then our stockholders who have not “opted out” of the DRIP by the dividend record date will have their cash dividends automatically reinvested into additional shares of our common stock, rather than receiving the cash dividends. We have the option to satisfy the share requirements of the DRIP through the issuance of new shares of common stock or through open market purchases of common stock by the DRIP plan administrator.

In order to maintain our tax treatment as a RIC, we generally must, among other things, for each fiscal year, timely distribute an amount equal to at least 90% of our ordinary net taxable income and realized net short-term capital gains in excess of realized net long-term capital losses, if any, reduced by deductible expenses. In addition, we will be subject to a non-deductible 4% U.S. federal excise tax to the extent we do not distribute during the calendar year at least (1) 98% of our net ordinary income for the calendar year, (2) 98.2% of our capital gain net income for the one year period ending on October 31 of the calendar year and (3) any net ordinary income and capital gain net income that we recognized for preceding years, but were not distributed during such years, and on which we paid no U.S. federal income tax. For the 2023 calendar year, the Company did not make sufficient distributions such that we did incur the U.S. federal excise tax. We may elect to not distribute a portion of our ordinary income for the 2024 calendar year and/or portion of the capital gains in excess of capital losses realized during the one-year period ending October 31, 2024, if any, and, if we do so, we would expect to incur U.S. federal taxes as a result.

12

We may distribute taxable dividends that are payable in cash or shares of our common stock at the election of each stockholder. Under certain applicable provisions of the Code and the Treasury regulations and a revenue procedure issued by the Internal Revenue Service (“IRS”), a RIC may treat a distribution of its own stock as fulfilling its RIC distribution requirements if each stockholder may elect to receive his or her entire distribution in either cash or stock of the RIC. The IRS has issued a revenue procedure indicating that this rule will apply if the total amount of cash to be distributed is not less than 20% of the total distribution. Under the revenue procedure, if too many stockholders elect to receive their distributions in cash, the cash available for distribution must be allocated among the stockholders electing to receive cash (with the balance of the distribution paid in stock). In no event will any stockholder, electing to receive cash, receive the lesser of (a) the portion of the distribution such shareholder has elected to receive in cash or (b) an amount equal to his or her entire distribution times the percentage limitation on cash available for distribution. If these and certain other requirements are met, for U.S. federal income tax purposes, the amount of the dividend paid in stock will be equal to the amount of cash that could have been received instead of stock. Stockholders receiving such distributions will be required to include the full amount of the dividend as ordinary income (or as long-term capital gain or qualified dividend income to the extent such distribution is properly reported as such) to the extent of our current and accumulated earnings and profits for U.S. federal income tax purposes. As a result of receiving distributions in the form of our common stock, a U.S. stockholder may be required to pay tax with respect to such distributions in excess of any cash received. If a U.S. stockholder sells the stock he or she receives as a dividend in order to pay this tax, the sales proceeds may be less than the amount included in income with respect to the dividend, depending on the market price of our stock at the time of the sale. Furthermore, with respect to non-U.S. stockholders, we may be required to withhold U.S. federal tax with respect to such dividends, including in respect of all or a portion of such dividend that is payable in stock. In addition, if a significant number of our stockholders determine to sell shares of our stock in order to pay taxes owed on dividends, it may put downward pressure on the trading price of our stock.

Competition

Our primary competitors in providing financing to private middle-market companies include public and private investment funds (including private equity funds, mezzanine funds, BDCs and SBICs), commercial and investment banks and commercial financing companies. Additionally, alternative investment vehicles, such as hedge funds, frequently invest in middle-market companies. As a result, competition for investment opportunities at middle-market companies can be intense, and in the past couple of years we believe there has been an increase in the amount of debt capital available on average. This has resulted in a somewhat more competitive environment for making new investments. Many middle-market companies are still unable to raise senior debt financing through traditional large financial institutions, and we believe this approach to financing remains difficult as implementation of U.S. and international financial reforms, such as Basel 3, limits the capacity of large financial institutions to hold non-investment grade leveraged loans on their balance sheets. We believe that many of these financial institutions have deemphasized their service and product offerings to middle-market companies in particular.

Many of our competitors are substantially larger and have considerably greater financial and marketing resources than us. For example, some competitors may have access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which may allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a BDC or that the Code imposes on us as a RIC. We use the industry information available to the investment professionals of Saratoga Investment Advisors to assess investment risks and determine appropriate pricing for our investments in portfolio companies. In addition, we believe that the investment professionals of our Investment Adviser enable us to learn about, and compete effectively for, financing opportunities with attractive leveraged companies in the industries in which we seek to invest.

For additional information concerning the competitive risks we face, please see Part I. Item 1A. “Risk Factors—We operate in a highly competitive market for investment opportunities.”

Staffing

We do not currently have any employees and do not expect to have any employees in the future. Services necessary for our business are provided by individuals who are employees of Saratoga Investment Advisors, pursuant to the terms of the Management Agreement and the Administration Agreement. For a discussion of the Management Agreement, see “Business—Investment Advisory and Management Agreement” below. We reimburse Saratoga Investment Advisors for our allocable portion of expenses incurred by it in performing its obligations under the Administration Agreement, including rent and our allocable portion of the cost of our officers and their respective staffs, subject to certain limitations. For a discussion of the Administration Agreement, see “Business—Administration Agreement” below.

13

Investment Advisory and Management Agreement

Saratoga Investment Advisors serves as our investment adviser. Our Investment Adviser was formed in 2010 as a Delaware limited liability company and became our investment advisor in July 2010. Subject to the overall supervision of our board of directors, Saratoga Investment Advisors manages our day-to-day operations and provides investment advisory and management services to us. Under the terms of the Management Agreement, Saratoga Investment Advisors:

| ● | determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| ● | identifies, evaluates and negotiates the structure of the investments we make (including performing due diligence on our prospective portfolio companies); |

| ● | closes and monitors the investments we make; and |

| ● | determines the securities and other assets that we purchase, retain or sell. |

Saratoga Investment Advisors services under the Management Agreement are not exclusive, and it is free to furnish similar services to other entities.

Management Fee and Incentive Fee

Pursuant to the Management Agreement with Saratoga Investment Advisors, we pay Saratoga Investment Advisors a fee for investment advisory and management services consisting of two components—a base management fee and an incentive fee.

The base management fee is paid quarterly in arrears, and equals 1.75% per annum of our gross assets (other than cash or cash equivalents but including assets purchased with borrowed funds) and calculated at the end of each fiscal quarter based on the average value of our gross assets (other than cash or cash equivalents but including assets purchased with borrowed funds) as of the end of such fiscal quarter and the end of the immediate prior fiscal quarter. As a result, Saratoga Investment Advisors will benefit as we incur debt or use leverage to purchase assets. Our board of directors will monitor the conflicts presented by this compensation structure by approving the amount of leverage that we may incur. Base management fees for any partial month or quarter are appropriately pro-rated.

The incentive fee has the following two parts:

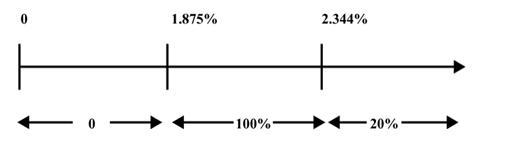

The first part is calculated and payable quarterly in arrears based on our pre-incentive fee net investment income for the immediately preceding fiscal quarter. Pre-incentive fee net investment income means interest income, dividend income and any other income (including any other fees such as commitment, origination, structuring, diligence, managerial and consulting fees or other fees that we receive from portfolio companies) accrued during the fiscal quarter, minus our operating expenses for the quarter (including the base management fee, expenses payable under the Administration Agreement, and any interest expense and dividends paid on any issued and outstanding preferred stock or debt security, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as market discount, debt instruments with PIK interest, preferred stock with PIK dividends and zero-coupon securities), accrued income that we have not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses, unrealized capital appreciation or depreciation or realized gains or losses resulting from the extinguishment of our own debt. Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets (defined as total assets less liabilities) at the end of the immediately preceding fiscal quarter, is compared to a “hurdle rate” of 1.875% per quarter, subject to a “catch up” provision. The base management fee is calculated prior to giving effect to the payment of any incentive fees.

14

We pay Saratoga Investment Advisors an incentive fee with respect to our pre-incentive fee net investment income in each fiscal quarter as follows:

| ● | no incentive fee in any fiscal quarter in which our pre-incentive fee net investment income does not exceed the quarterly hurdle rate of 1.875%; |

| ● | 100.0% of our pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 2.344% in any fiscal quarter is payable to Saratoga Investment Advisors; |

| ● | 20.0% of the amount of our pre-incentive fee net investment income, if any, that exceeds 2.344% in any fiscal quarter. We refer to the amount specified in clause (B) as the “catch-up.” The “catch-up” provision is intended to provide Saratoga Investment Advisors with an incentive fee of 20.0% on all of our pre-incentive fee net investment income as if a hurdle rate did not apply when our pre-incentive fee net investment income exceeds 2.344% in any fiscal quarter. Notwithstanding the foregoing, with respect to any period ending on or prior to December 31, 2010, Saratoga Investment Advisors was only entitled to 20.0% of the amount of our pre-incentive fee net investment income, if any, that exceeded 1.875% in any fiscal quarter without any catch-up provision. These calculations are appropriately pro-rated when such calculations are applicable for any period of less than three months. |