Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |||

Aviat Networks, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each Class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule: 0-11:

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

AVIAT NETWORKS, INC.

5200 Great America Parkway, Santa Clara CA 95054

Notice of 2011 Annual Meeting of Stockholders

To Be Held on November 17, 2011

TO THE HOLDERS OF COMMON STOCK OF AVIAT NETWORKS, INC.

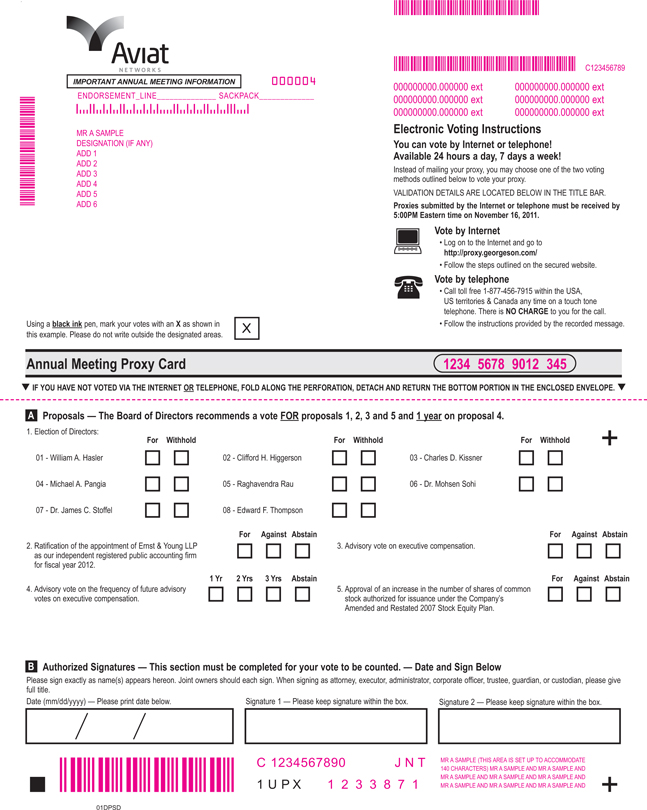

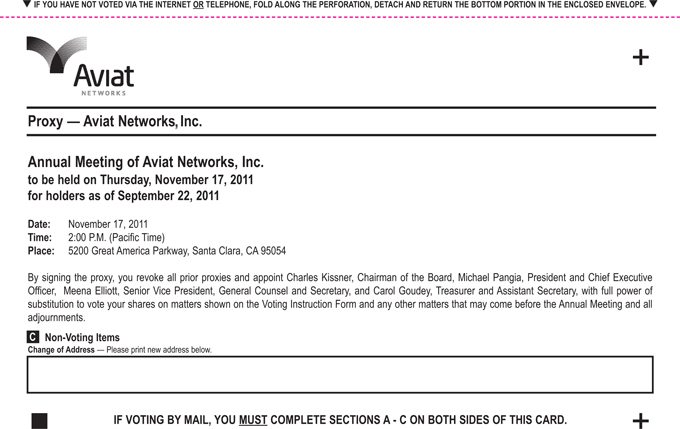

NOTICE IS HEREBY GIVEN that the 2011 Annual Meeting of Stockholders of Aviat Networks, Inc. (the “Company”) will be held at our facilities, located at 5200 Great America Parkway, Santa Clara, California, on Thursday, November 17, 2011 at 2:00 p.m., local time, for the following purposes:

1. To elect eight directors to serve until the next annual meeting of stockholders or until their successors have been duly elected and qualified.

2. To vote on the ratification of the appointment by our Audit Committee of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2012.

3. To hold an advisory vote on executive compensation.

4. To hold an advisory vote on the frequency of future advisory votes on executive compensation.

5. To vote on the approval of an increase in the number of shares of common stock authorized for issuance under the Company’s Amended and Restated 2007 Stock Equity Plan from 10,400,000 to 16,400,000 shares.

6. To transact such other business as may properly come before the annual meeting, or any adjournments or postponements thereof.

Only holders of common stock of record at the close of business on September 22, 2011 are entitled to notice of and to vote at the Annual Meeting and all adjournments or postponements thereof.

Whether or not you expect to attend in person, we urge you to submit a proxy to vote your shares in accordance with the instructions that we provide to you and as set forth in the proxy statement for the 2011 Annual Meeting. This will help ensure the presence of a quorum at the meeting.

| By Order of the Board of Directors |

| /s/ Meena L. Elliott |

| Senior Vice President, General Counsel and Secretary |

October 3, 2011

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on November 17, 2011

This proxy statement and our 2011 Annual Report are available at

http://www.proxydocs.com/AVNW

Your vote is important regardless of the number of shares you own. The Board of Directors urges you to show your support for Aviat by signing, dating and delivering the enclosed WHITE proxy card by mail (using the enclosed postage-paid envelope), as promptly as possible or by voting electronically or by telephone as described in the attached proxy statement. If you have any questions or need assistance in voting your shares, please contact our proxy solicitor, Georgeson Inc., toll-free at (800) 733-6198.

Table of Contents

i

Table of Contents

TABLE OF CONTENTS

(continued)

| Page | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 39 | ||||

| 39 | ||||

| PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

40 | |||

| 41 | ||||

| PROPOSAL NO. 4: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION |

41 | |||

| 42 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| A-1 | ||||

ii

Table of Contents

AVIAT NETWORKS, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 17, 2011

This proxy statement (“Proxy Statement”) applies to the solicitation of proxies by the Board of Directors (“Board”) of Aviat Networks, Inc. (which we refer to as “Aviat,” the “Company,” “we,” “our,” and “ours”) for use at the 2011 Annual Meeting of Stockholders, to be held at 2:00 p.m., local time, November 17, 2011, and any adjournments or postponements thereof. The annual meeting will be held at our facilities located at 5200 Great America Parkway, Santa Clara, California. The telephone number at that location is (408) 567-7000. These proxy materials will be available over the Internet, and for those that have requested to receive the materials in hard copy, the proxy materials are being mailed on or about October 6, 2011 to our stockholders entitled to notice of and to vote at the annual meeting.

What is the purpose of the meeting?

The purpose of the 2011 Annual Meeting of Stockholders is to obtain stockholder action on the matters outlined in the notice of meeting included with this Proxy Statement. All holders of shares of common stock of record at the close of business on September 22, 2011 are entitled to notice of and to vote at the Annual Meeting and all adjournments or postponements thereof. At the meeting, our stockholders will vote to elect eight directors, vote on the ratification of the appointment by our Audit Committee of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2012, hold an advisory vote on the approval of executive compensation, hold an advisory vote on the frequency of future advisory votes on executive compensation and vote on the approval of an increase in the number of shares of common stock authorized for issuance under the Company’s Amended and Restated 2007 Stock Equity Plan from 10,400,000 to 16,400,000 shares. In addition, management will report on its 2011 performance and respond to stockholders’ questions at the annual meeting.

What is the record date, and who is entitled to vote at the meeting?

The record date for the stockholders entitled to vote at the annual meeting is September 22, 2011. The record date was established by the Board as required by the Delaware General Corporation Law, or DGCL, and our Bylaws. Owners of record of shares of our common stock at the close of business on the record date are entitled to receive notice of the annual meeting and to vote at the annual meeting, and at any adjournments or postponements thereof. You may vote all shares that you owned as of the record date.

What are the voting rights of the holders of Aviat common stock at the meeting?

Each outstanding share of our common stock is entitled to one vote on each matter considered at the annual meeting. As of the record date of September 22, 2011, the number of outstanding shares of common stock was 60,524,922.

Who can attend the Annual Meeting?

Subject to space availability, all stockholders as of the record date, or their duly appointed proxies, may attend the meeting. Since seating is limited, admission to the meeting will be on a first-come, first-served basis.

If your shares are held in “street name” (that is, through a bank, broker or other holder of record) and you wish to attend the annual meeting, you must bring a copy of a bank or brokerage statement reflecting your stock ownership as of the record date to the annual meeting.

Table of Contents

Stockholders of record can direct their votes by proxy as follows:

| • | Via the Internet: Stockholders may submit voting instructions to the proxy holders through the Internet by following the instructions included with the proxy card. |

| • | By Telephone: Stockholders may submit voting instructions to the proxy holders by telephone by following the instructions included with the proxy card. |

| • | By Mail: Stockholders may sign, date and return proxy cards in the pre-addressed, postage-paid envelope that will be provided if a printed proxy statement is requested. |

| • | At the Meeting: If you attend the annual meeting, you may vote in person by ballot, even if you have previously returned a proxy card. |

If you are the beneficial owner of shares held in street name, the nominee holding your shares will send you separate instructions describing the procedure for voting your shares. Street name stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

Pursuant to SEC rules, we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request delivery of annual meeting proxy materials in printed form by mail or electronically by email on an ongoing basis.

How can I access the proxy materials and annual report on the Internet?

This Proxy Statement, the form of proxy card, the Notice and our annual report on SEC Form 10-K for the fiscal year ended July 1, 2011 are available at www.proxydocs.com/AVNW.

Why are we soliciting proxies?

In lieu of personally attending and voting at the annual meeting, you can appoint a proxy to vote on your behalf. We are soliciting your vote so all shares of our common stock may be voted at the annual meeting and have designated proxy holders to whom you may submit your voting instructions. The proxy holders for the annual meeting are Charles Kissner, Chairman of the Board, Michael Pangia, President and Chief Executive Officer, Meena L. Elliott, Senior Vice President, General Counsel and Secretary, and Carol Goudey, Treasurer and Assistant Secretary.

If the shares of common stock are held in your name, you may revoke your proxy given pursuant to this solicitation at any time before your shares are voted by:

| • | delivering a written notice of revocation to the Company’s Secretary, Meena L. Elliott, at 5200 Great America Parkway, Santa Clara, CA 95054; |

| • | executing and delivering a proxy card bearing a later date to the Company’s Secretary at the same address; |

| • | submitting another proxy by Internet or telephone (the latest dated proxy will control); or |

| • | attending the annual meeting and voting in person. |

2

Table of Contents

If your shares are held in street name, you should follow the directions provided by the nominee institution that holds your shares regarding proxy revocation. Your attendance at the annual meeting after having executed and delivered a valid proxy card will not in and of itself constitute revocation of your proxy.

What vote is required to approve each item?

| • | Proposal No. 1 (election of directors): The director nominees will be elected by a plurality of the votes cast. Our stockholders may not cumulate votes in the election of the director nominees. The director nominees receiving the highest number of affirmative votes of the shares present in person or by proxy at the annual meeting and entitled to vote will be elected. The Board recommends a vote “FOR” all nominees. |

| • | Proposals No. 2 (ratification of Ernst & Young LLC as our independent registered public accounting firm), No. 3 (advisory vote on executive compensation) and No. 5 (increase in number of shares authorized for issuance under our Amended and Restated 2007 Stock Equity Plan): An affirmative vote of the majority of the stockholders present in person or by proxy at the annual meeting and entitled to vote is necessary for approval of Proposals No. 2, No. 3 and No. 5. The Board recommends a vote “FOR” each of the Proposals No. 2, No. 3 and No. 5. |

| • | Proposal No. 4 (advisory vote on frequency of future advisory votes on executive compensation): The frequency with which the Company asks stockholders for an advisory vote on executive compensation that receives the most votes will be considered the advisory preference of the stockholders. The Board recommends a vote for “EVERY YEAR” for the frequency of advisory votes on executive compensation under Proposal No. 4. |

What constitutes a quorum, abstention, and broker “non-votes”?

The presence at the annual meeting either in person or by proxy of a majority of the outstanding shares of our common stock will constitute a quorum for the transaction of business at the annual meeting.

Under the DGCL, an abstaining vote and a broker “non-vote” are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at the annual meeting. An abstention occurs when a stockholder does not vote for or against a proposal but specifically abstains from voting. A broker “non-vote” occurs when a broker or other nominee holding shares in street name for a beneficial owner signs and submits a proxy or votes with respect to shares of common stock held in a fiduciary capacity, but does not vote on a particular matter because the nominee does not have the discretionary voting power with respect to that matter and has not received instructions from the beneficial owner or because the broker elects not to vote on a matter as to which it does have discretionary voting power. Under the rules governing brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, such as Proposal No. 2 (the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm), but not on non-routine matters, such as Proposals No. 1 (election of directors), No. 3 (advisory vote on executive compensation), No. 4 (advisory vote on frequency of future advisory votes on executive compensation) and No. 5 (increase in number of shares authorized for issuance under our Amended and Restated 2007 Stock Equity Plan). Broker “non-votes” and abstentions have no effect on the votes regarding proposals No. 1 and No. 4. Only “FOR” and “WITHHOLD” votes are counted for purposes of determining the votes received in connection with Proposal No. 1 relating to the election of directors. Proposal No. 4 is an advisory vote on stockholder preference, with the selection receiving the most votes considered to represent such advisory preference. In the case of Proposals No. 2, No. 3 and No. 5, which require the affirmative vote of a majority of the shares present at the meeting and entitled to vote, broker “non-votes” will have no effect on the number of votes cast or on whether the proposal has been passed because broker “non-votes” are excluded from the tabulation of votes cast, but abstentions will have the same effect as a negative vote because they will be counted as a vote cast with respect to the proposal but not counted as a vote for approval.

3

Table of Contents

Who pays for the cost of solicitation?

We will bear the entire cost of solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy card, and any additional solicitation materials that may be furnished to our stockholders and the maintenance and operation of the website providing Internet access to these proxy materials. We will reimburse brokerage firms and other custodians, nominees, and fiduciaries for reasonable expenses incurred in sending proxy materials to beneficial owners of our common stock and maintaining the Internet access for such materials and the submission of proxies. We may supplement the original solicitation of proxies by mail, by solicitation by telephone, telegram, or other means by our directors, officers and employees. No additional compensation will be paid to these individuals for any such services.

In addition, the Company has retained Georgeson Inc. to assist in the solicitation of proxies. The Company has agreed that Georgeson will be paid a fee of $18,500, plus reimbursement for their reasonable out-of-pocket expenses. The Company has also agreed to indemnify Georgeson against certain liabilities and expenses, including certain liabilities and expenses under the federal securities laws.

What is the deadline for submitting proposals and director nominations for the 2012 Annual Meeting?

In order for any stockholder nominations or proposals to be considered properly brought before our 2012 annual meeting, a stockholder of record must submit a written notice thereof which must be received by our Secretary at the address of our principal executive offices, not less than 60 days nor more than 90 days prior to the meeting. However, in the event that we give less than 70 days prior notice or public disclosure of the annual meeting date, the notice must be received by our Secretary at the address noted above no less than 10 days following the date of our notice or public disclosure of the meeting. The full requirements for the notice for nominations and proposals are in Article II, Sections 13 and 14, respectively, of our Bylaws, which are available for review at our website, www.aviatnetworks.com. In addition, if a stockholder wishes the proposal or nomination to be considered for inclusion in our proxy materials for the 2012 annual meeting under SEC Rule 14a-8, written notice thereof must be received by our Secretary at the address noted above by June 5, 2012.

The proxies to be solicited by the Board for the 2012 annual meeting will confer discretionary authority on the proxy holders to vote on any stockholder proposal presented at such annual meeting if the Company fails to receive notice of such stockholder’s proposal for the meeting in accordance with the periods specified above.

Georgeson Inc. will tabulate the votes cast by proxy. The Company has retained an independent inspector of elections in connection with Aviat’s solicitation of proxies for the Annual Meeting. Aviat intends to notify shareholders of the results of the solicitation for the Annual Meeting by filing with the SEC a Current Report on Form 8-K.

4

Table of Contents

We believe in and are committed to sound corporate governance principles. Consistent with our commitment to and continuing evolution of corporate governance principles, we adopted a Code of Business Ethics, Governance and Nominating Committee, Audit Committee and Compensation Committee charters and corporate governance guidelines. Each of our Board committees is required to conduct an annual review of its charter and applicable guidelines.

The authorized size of our Board of Directors is currently nine. Directors are nominated by the Governance and Nominating Committee of the Board. Except for Mr. Rau, who was elected to the Board of Directors on November 9, 2010, and Mr. Pangia, who was elected to the Board of Directors on July 18, 2011, all current directors have held office as directors since January 26, 2007, the date of the contribution by Harris Corporation of the Microwave Communications Division of Harris, or MCD, and our merger with Stratex Networks, Inc., or Stratex. The Board is chaired by Mr. Kissner. Mr. Evans, a current director, has informed us of his decision not to stand for re-election upon the expiration of his current term as a member of the Board of Directors for personal reasons. Accordingly, the Board of Directors, pursuant to the Company’s Bylaws, has authorized a reduction in the number of directors that shall constitute the whole Board of Directors from nine (9) to eight (8), with such reduction effective upon the conclusion of the Corporation’s 2011 annual meeting of stockholders.

| Name |

Title and Positions | |

| Charles D. Kissner |

Director, Chairman of the Board | |

| Eric C. Evans |

Director | |

| William A. Hasler |

Director | |

| Clifford H. Higgerson |

Director | |

| Michael A. Pangia |

Director, President and CEO | |

| Raghavendra Rau |

Director | |

| Dr. Mohsen Sohi |

Director | |

| Dr. James C. Stoffel |

Lead Independent Director | |

| Edward F. Thompson |

Director |

The Board has determined that as of the date of this Proxy Statement, each of our current directors and director nominees except Mr. Kissner and Mr. Pangia has no material relationship with the Company and is independent in accordance with listing rules of the NASDAQ stock market (the “NASDAQ Listing Rules”).

All directors are requested to attend the annual meeting of stockholders. Except for Mr. Pangia, who was not then a director, all of our current directors attended last year’s annual meeting.

Board and Committee Meetings and Attendance

During fiscal year 2011, the Board held 8 meetings. Each of the board members attended at least 88% percent of the total number of Board meetings and at least 94% percent of the total number of meetings of the committee or committees on which the member served during the fiscal year.

Our Board believes that its members should encompass a range of talent, skill and expertise enabling it to provide sound guidance with respect to the Company’s operations and interest. Our Board prefers a variety of professional experiences and backgrounds among its members and in addition to considering a candidate’s experiences and background, candidates are reviewed in the context of the current composition of the Board and evolving needs of our businesses. In particular, the Board has sought to include members that have experience in establishing, growing and leading communications companies in senior management positions and serving on the

5

Table of Contents

board of directors of other companies. In determining that each of the members of the Board is qualified to be a director, the Board has relied on the attributes listed below and, where applicable, on the direct personal knowledge of each of the members’ prior service on the Board.

The following is a brief description of the business experience and background of each nominee for director, including the capacities in which each has served during the past five years:

Mr. Charles D. Kissner, age 64, currently serves as our Chairman of the Board and a part-time employee with advisory responsibilities. Mr. Kissner served as Chief Executive Officer and Chairman of the Board of Aviat from July 2010 to July 2011. He was Chief Executive Officer of Stratex from July 1995 through May 2000, and again from October 2001 to May 2006. He was elected a director of Stratex in July 1995 and Chairman in August 1996, a position which he held through 2006. Mr. Kissner also served as Vice President and General Manager of M/A-COM, Inc., a manufacturer of radio and microwave communications products, from July 1993 to July 1995. Prior to that, he was President and CEO of Aristacom International Inc., a communications software company, and Executive Vice President and a Director of Fujitsu Network Switching, Inc. He also held a number of executive positions at AT&T (now Alcatel-Lucent). Mr. Kissner currently serves on the board of directors of Shoretel, Inc., an IP business telephony systems company. He served on the board of directors of SonicWALL, Inc., a provider of Internet security solutions, and Meru Networks Inc., a provider of advanced enterprise wireless networking systems. Mr. Kissner also serves on the Advisory Board of Santa Clara University’s Leavey School of Business, and on the board of Northern California Public Broadcasting, a non-profit organization.

Mr. Kissner brings extensive knowledge of our company’s business, having served on our Board as non-executive Chairman for over three years. He also brings nearly fifteen years of relevant chief executive officer experience having served in that capacity at technology driven companies such as Stratex and Aristacom. Mr. Kissner also brings extensive public company directorship and committee experience to the Board which has been an invaluable resource as our company regularly assesses its corporate governance, corporate compliance and risk management obligations. Mr. Kissner has also directly supervised nearly thirty merger and acquisition activities, which experience has been vital to our company in the assessment and integration of acquisition opportunities.

Mr. William A. Hasler, age 69, served as a member of the Stratex board of directors from August 2001 through January 2007, and was Chairman of the Nominating and Corporate Governance Committee and a member of the Audit Committee. Mr. Hasler served as Chairman of the Board of Directors of Solectron Corporation from 2003 to 2007 and was a member of that board from 1998 to 2007. He was co-Chief Executive Officer and a Director of Aphton Corp., a biopharmaceutical company, from 1998 to 2003. From 1991 to 1998, Mr. Hasler was Dean of both the Graduate and Undergraduate Schools of Business at the University of California, Berkeley. Prior to his deanship at UC Berkeley, Mr. Hasler was Vice Chairman of KPMG Peat Marwick. Mr. Hasler also serves on the boards of Ditech Networks Corp., a supplier of telecommunications equipment, Globalstar, Inc., a supplier of satellite communication services, and Mission West Properties Inc., a REIT engaged in the management, leasing, marketing, development and acquisition of commercial R&D properties. He is also a trustee of the Schwab Funds.

Mr. Hasler’s current and prior service on the boards of several technology-driven companies, including Ditech and Globalstar, and his prior service as Chairman of a large publicly traded company provide him with an extensive knowledge base of complex management, financial, operational and governance issues faced by public companies with international operations. He is a member of the audit committee of various public and private companies. Mr. Hasler has extensive experience in Silicon Valley companies and this experience brings our Board important knowledge and expertise related to corporate finance and accounting, strategic planning, manufacturing, and operations. He brings valuable financial expertise, including extensive knowledge of accounting, auditing and investments in both public and private companies. Additionally, through his service on public company boards, Mr. Hasler has gained an understanding and expertise in public company governance.

6

Table of Contents

Mr. Clifford H. Higgerson, age 71, served as a member of the Stratex board of directors from March 2006 to January 2007 and served on the Compensation and Strategic Business Development Committees. He has more than 40 years experience in research, consulting, planning and venture investing primarily in the telecommunications industry, with an emphasis on carrier systems and equipment. In 2006, he became a partner with Walden International, a global venture capital firm focused on four key industry sectors: communications, electronics/digital consumer, software and IT services, and semiconductors. Mr. Higgerson was a founding partner of ComVentures from 1986 to 2005, and has been a general partner with Vanguard Venture Partners since 1991. He currently serves as a member of the board of directors of Kotura Inc., Xtera Communications Inc., Ygnition Networks, Inc., Ormet Circuits, Inc., and Geronimo Windpower. He previously served as a member of the board of directors of Hatteras Networks Inc. and World of Good.

Mr. Higgerson has more than 35 years of experience in research, consulting, planning and venture investing. He has served on the boards of other public companies and served as a Chair of the Audit Committee for publicly listed companies. His prior Board experience and his experience in research, strategic planning and corporate finance in technology driven companies provide him with extensive knowledge of complex issues involved in new product development, strategic planning, financial and governance issues faced by publicly listed companies. His extensive experience with private equity firms and investing provides him with critical experience related to capital raising, economic analysis and mergers and acquisitions.

Mr. Michael A Pangia, age 50, has been our President and Chief Executive Officer and a member of the Board since July 18, 2011. From March 2009 to July 2011, he served as the Chief Sales Officer where he was responsible for company-wide operations of the Global Sales and Services organization. Prior to joining Aviat Networks, Mr. Pangia served as senior vice president, Global Sales Operations and Strategy at Nortel, where he was responsible for all operational aspects of the Global Sales function. Prior to that, he was president of Nortel’s Asia region where his key responsibilities included sales and overall business management for all countries where Nortel did business in the region.

Mr. Pangia’s current and prior service as a senior executive officer with large technology driven companies with international operations provide him with an extensive knowledge base of complex management, financial, operational and governance issues faced by public companies competing in the global arena. He also brings a high level of financial literacy to the Board through both formal education and over 15 years experience in multiple finance functional areas including cost accounting, financial planning and analysis, and mergers and acquisitions.

Mr. Raghavendra Rau, age 62, has served as a member of the Board of Directors since November 2010. He is a strategic advisor specializing in global marketing and business strategy and venture capital and market development for high-technology, early revenue companies. Mr. Rau currently serves as a member on the board of directors of SeaChange International Inc., a manufacturer of digital video systems and provider of related services to cable, telecommunications and broadcast television companies worldwide, Previously, Mr. Rau served as a member of the Board of Directors of Microtune, Inc., prior to its acquisition by Zoran, Inc., from May 2010 to December 2010. Mr. Rau served as Senior Vice President of the Mobile TV Solutions Business of Motorola, Inc. (“Motorola”) from May 2007 until January 2008, and as Senior Vice President of Strategy and Business Development, Networks & Enterprise of Motorola from March 2006 until May 2007. Mr. Rau served as Corporate Vice President of Global Marketing and Strategy for Motorola from 2005 until 2006 and as Corporate Vice President, Marketing and Professional Services, from 2001 until 2005. From October 1992 until 2001, Mr. Rau served in various positions within Motorola, including as Vice President of Strategic Business Planning and Vice President of Sales and Operations and held positions in Asia and Europe. Mr. Rau is a former Chairman of the QuEST Forum, a collaboration of service providers and suppliers dedicated to telecom supply chain quality and performance, and was a Director of the Center for Telecom Management at the University of Southern California. Mr. Rau also served on the Motorola Partnership Board of France Telecom.

7

Table of Contents

Mr. Rau’s financial and business expertise, including a diversified background in global marketing and business strategy and venture capital and market development for communications and high-technology companies, provides him with the qualifications and skills to serve as a director.

Dr. Mohsen Sohi, age 52, currently serves as a managing partner of Freudenberg & Co., a German technology and manufacturing company. From 2003 through May 2010, Dr. Sohi served as President and Chief Executive Officer of Freudenberg-NOK, a privately-held joint venture partnership between Freudenberg and NOK Corp. of Japan, the world’s largest producer of elastomeric seals and custom molded products for automotive and other applications. From 2001 through 2003 he served as President, Retail Store Automation Division, NCR Corporation. From 1986 through 2001 he served in various key positions at Honeywell/Allied Signal Inc., including President, Honeywell Electronic Materials and President, Honeywell Commercial Vehicle Systems. Dr. Sohi currently serves on the board of directors of Steris Corporation, a provider of infection prevention and contamination control products and services, and is also a member of its Compliance Committee. He previously served on the board of directors of Hayes Lemmerz International, Inc., a leading worldwide producer of aluminum and steel wheels for cars and trucks.

Dr. Sohi’s current and prior service as a senior executive officer with large technology driven companies with international operations provide him with an extensive knowledge base of complex management, financial, operational and governance issues faced by public companies with global operations. His engineering, technical and business education has also provided him with knowledge and experience related to research and development, new product introductions, strategic planning, manufacturing, operations, and corporate finance. Dr. Sohi also has gained an understanding of public company governance and executive compensation through his service on public company boards.

Dr. James C. Stoffel, age 65, currently serves as our lead independent director. Presently, Dr. Stoffel is on the Board of Directors of Harris Corporation, of which he has been a member since August 2003, and is also a member of its Finance Committee and the Management Development and Compensation Committee. Additionally, he serves as General Partner of Trillium Group, LLC, a private equity company, and is a senior advisor to other private equity companies. Prior to his retirement, Dr. Stoffel was Senior Vice President, Chief Technical Officer and Director of Research and Development of Eastman Kodak Company. He held this position from 2000 to April 2005. He joined Kodak in 1997 as Vice President and Director, Electronic Imaging Products Research and Development, and became Director of Research and Engineering in 1998. Prior to joining Kodak, he was with Xerox Corporation, where he began his career in 1972. His most recent position with Xerox was Vice President, Corporate Research and Technology. Dr. Stoffel is also a trustee of the George Eastman House museum. He serves on the Advisory Board for Research and Graduate Studies at the University of Notre Dame and is a member of the advisory board of the Applied Science and Technology Research Institute, Hong Kong.

Dr. Stoffel’s prior service as a senior executive of large, publicly traded, technology driven companies, and his more than 30 years experience focused on technology development, provide him with an extensive knowledge of complex technical research and development projects, management, financial and governance issues faced by a public company with international operations. This experience brings our Board important knowledge and expertise related to research and development, new product introductions, strategic planning, manufacturing, operations, and corporate finance. His experience as an advisor to private equity firms also provides him with additional knowledge related to strategic planning, capital raising, mergers and acquisitions and economic analysis. Dr. Stoffel also has gained an understanding of public company governance and executive compensation through his service on public company boards, including as a lead independent director.

Mr. Edward F. Thompson, age 73, served as a member of the Stratex board of directors from November 2002 through January 2007, where he was Chairman of the Audit Committee, and served on the Nominating and Corporate Governance Committee. Mr. Thompson has been a consultant to Fujitsu Labs of America since 1995. From 1976 to 1994, he held various positions at Amdahl Corporation, a multinational manufacturer of large scale computer systems, including Chief Financial Officer and Corporate Secretary, as well as Chairman and CEO of

8

Table of Contents

Amdahl Capital Corporation. Mr. Thompson also held positions at U.S. Leasing International, Inc., Computer Sciences Corporation, International Business Machines and Lockheed Missiles and Space Company. Mr. Thompson has contributed as a director or advisor to a number of companies including Fujitsu, Ltd. and several of its subsidiaries, and SonicWALL Inc., a provider of Internet security solutions. He is currently a member of the board of directors of Shoretel, Inc., an IP business telephony systems company, and InnoPath Software, Inc. He is on the Advisory Board of Santa Clara University’s Leavey School of Business.

Mr. Thompson brings a high level of financial literacy to the Board and substantial public company directorship and committee experience. He is currently designated as an audit committee financial expert and is the audit committee chair on both public company boards on which he is a member, as well as privately held InnoPath Software. Mr. Thompson’s experience with accounting principles, financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of publicly traded companies makes him an invaluable asset to the Board. Mr. Thompson also brings to the Board significant experience in international operations based upon his past experience as a senior advisor to Fujitsu, as a director of several Fujitsu subsidiaries and portfolio companies and as chief financial officer of Amdahl.

Agreement with Certain Entities and Individuals Associated with Ramius LLC

On September 14, 2010, the Company entered into an agreement (the “Agreement”) with certain entities and individuals associated with Ramius LLC (collectively, the “Ramius Group”), as further described in the Form 8-K filed by the Company with the Securities and Exchange Commission on September 16, 2010.

Pursuant to the Agreement, the Company agreed to nominate one individual recommended by the Ramius Group who is independent of the Ramius Group for election to the Board at the 2010 annual meeting of stockholders.

The Ramius Group agreed to support the Company’s Board nominations at the 2010 annual meeting. Additionally, the Ramius Group agreed to certain limited standstill restrictions which expired on September 5, 2011.

After review by the Company’s Governance and Nominating Committee, the Board nominated Mr. Rau, who was previously recommended by the Ramius Group, for election as a director at our 2010 annual meeting of stockholders and at such meeting, Mr. Rau was elected as a director.

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. When the CEO also serves as Chairman of the Board, our Corporate Governance Guidelines provide for the appointment of a lead independent director. Accordingly, when our Chairman Charles Kissner was appointed CEO, the Board appointed James Stoffel, an independent director, as lead independent director, with the following duties and responsibilities:

| • | Advise the Chairman of the Board as to an appropriate schedule of board meetings, seeking to ensure that independent directors can perform their duties while not interfering with the flow of company operations; |

| • | Provide the Chairman of the Board with input as to the preparation of the agendas for board and committee meetings; |

| • | Advise the Chairman of the Board as to the quality, quantity and timeliness of the flow of information from management that is necessary for the independent directors to effectively and responsibly perform |

9

Table of Contents

| their duties; although management is responsible for the preparation of materials for the board, the lead independent director may specifically request the inclusion of certain material; |

| • | Interview, along with the Nominating Committee, all Board candidates and make recommendations to the Nominating Committee and the Board; |

| • | Preside at all meetings of the board at which the Chairman of the Board is not present (including executive sessions of independent directors); |

| • | Coordinate, develop the agenda for, and preside at executive sessions of the independent directors; the lead director shall have the authority to call meetings of independent directors; |

| • | If requested by major shareholders and if determined by the Board as appropriate, be available for consultation and direct communication with such shareholders; |

| • | Evaluate, along with the members of the Compensation Committee and the full Board, the Chief Executive Officer’s performance and meet with the Chief Executive Officer to discuss the Board’s evaluation; and |

| • | Consult with the Corporate Governance Committee regarding the membership of various board committees, as well as selection of committee chairs. |

The Board believes that appointing a lead independent director to serve along with a combined Chief Executive Officer and Chairman of the Board has enhanced the Board’s oversight of, and independence from, Company management, the ability of the Board to carry out its roles and responsibilities on behalf of our stockholders and our overall corporate governance. Although Mr. Kissner is no longer Chief Executive Officer, he continues as an employee, on a part-time basis, with advisory responsibilities. On the recommendation of the Governance and Nominating Committee, the Board determined to continue the role of the lead independent director for the present.

The Board’s Role in Risk Oversight

Assessing and managing risk is the responsibility of the management of the Company. The Board, through the Governance and Nominating Committee, oversees and reviews certain aspects of the Company’s risk management efforts, focusing on the adequacy of the Company’s risk management and risk mitigation processes. At the Board’s request, management proposed a process for identifying, evaluating and monitoring material risks and such process has been approved by the Board and is currently in effect. This risk management program is overseen by senior management who, in connection with their regular review of the overall business, identify and prioritize a broad range of material risks (e.g., financial, strategic, compliance and operational). Senior management also discusses mitigation plans to address such material risks. Prioritized risks and management’s plans for mitigating such risks are regularly presented to the full Board for discussion and in order to ensure monitoring. In addition to the risk management program, the Board encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations.

A discussion of risk factors in the Company’s compensation design can be found below under the heading “Risk Considerations in Our Compensation Program”.

Our Board of Directors maintains an Audit Committee, a Compensation Committee and a Governance and Nominating Committee. Copies of the charters for the Audit Committee, the Compensation Committee and the Governance and Nominating Committee are available on our website www.investors.aviatnetworks.com/documents.cfm.

10

Table of Contents

The following table shows, for fiscal year 2011, the Chairman and members of each committee, the number of committee meetings held and the principal functions performed by each committee.

| Committee |

Number of Meetings in Fiscal 2011 |

Members |

Principal Functions | |||

| Audit | 16 | Edward F. Thompson* Eric C. Evans William A. Hasler Raghavendra Rau |

• Selects our independent registered public accounting firm

• Reviews reports of our independent registered public accounting firm

• Reviews and pre-approves the scope and cost of all services, including all non-audit services, provided by the firm selected to conduct the audit

• Monitors the effectiveness of the audit process

• Reviews management’s assessment of the adequacy of financial reporting and operating controls

• Monitors corporate compliance program | |||

| Compensation | 8 | Dr. James C. Stoffel* Clifford H. Higgerson Dr. Mohsen Sohi |

• Reviews our executive compensation policies and strategies

• Oversees and evaluates our overall compensation structure and programs | |||

| Governance and Nominating | 4 | William A. Hasler* James C. Stoffel Clifford H. Higgerson |

• Develops and implements policies and practices relating to corporate governance

• Reviews and monitors implementation of our policies and procedures

• Reviews the process by which management identifies and mitigates key areas of risk and reviews critical risk areas with the Board of Directors

• Assists in developing criteria for open positions on the Board of Directors

• Reviews and recommends nominees for election of directors to the Board

• Reviews and recommends policies, if needed for selection of candidates for directors | |||

| * | Chairman of Committee |

The Audit Committee is primarily responsible for selecting, and approving the services performed by, our independent registered public accounting firm, as well as reviewing our accounting practices, corporate financial reporting and system of internal controls over financial reporting. The Audit Committee currently consists of Messrs. Thompson (Chairman), Evans, Hasler and Rau. No material amendments to the Audit Committee Charter were made during fiscal year 2011. The Audit Committee is comprised of independent, non-employee members of our Board who are “financially sophisticated” under the NASDAQ Listing Rules.

The Board has determined that each of Messrs. Thompson and Hasler qualifies as an “audit committee financial expert,” as defined under Item 407(d)(5)(i) of Regulation S-K under the Securities Act of 1933 and the

11

Table of Contents

Securities Exchange Act of 1934, but that status does not impose on either of them duties, liabilities or obligations that are greater than the duties, liabilities or obligations otherwise imposed on them as members of our Audit Committee and the Board.

The Compensation Committee has the authority and responsibility to approve our overall executive compensation strategy, to administer our annual and long-term compensation plans and to review and make recommendations to the Board regarding executive compensation. The Compensation Committee is comprised of independent, non-employee members of the Board in accordance with NASDAQ Listing Rules. During fiscal year 2011, the Compensation Committee utilized Pearl Meyer & Partners as an independent, third-party consulting firm.

Compensation Committee Interlock and Insider Participation

The Compensation Committee currently consists of Messrs. Stoffel (Chairman), Higgerson and Sohi. None of these individuals is an officer or employee or former officer of the Company.

Governance and Nominating Committee

The Governance and Nominating Committee currently consists of Messrs. Hasler (Chairman), Higgerson, and Stoffel. Each member of the committee meets the independence requirements of the NASDAQ Listing Rules.

The Governance and Nominating Committee develops and implements policies and practices related to corporate governance consistent with sound corporate governance principles. The committee also reviews the process by which management identifies and mitigates key areas of risk and reviews critical risk areas with the Board.

The Governance and Nominating Committee also recommends candidates to the Board and periodically reviews whether a more formal selection policy should be adopted. There is no difference in the manner in which the committee members evaluate nominees for director based on whether the nominee is recommended by a stockholder. We currently do not pay a third party to identify or assist in identifying or evaluating potential nominees, although we may in the future utilize the services of such third parties.

In reviewing potential candidates for the Board, the Governance and Nominating Committee considers the individual’s experience and background. Candidates for the position of director should exhibit proven leadership capabilities, high integrity, exercise high level responsibilities within their chosen career, and possess an ability to quickly grasp complex principles of business, finance, international transactions and communications technologies. In general, candidates who have held an established executive level position in business, finance, law, education, research, government or civic activity will be preferred.

While the Governance and Nominating Committee has not adopted a formal diversity policy with regard to the selection of director nominees, diversity is one of the factors that the committee considers in identifying director nominees. When identifying and recommending director nominees, the committee views diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoint, professional experience, education, skill and other qualities or attributes that contribute to board diversity. As part of this process, the committee evaluates how a particular candidate would strengthen and increase the diversity of the Board in terms of how that candidate may contribute to the Board’s overall balance of perspectives, backgrounds, knowledge, experience, skill sets and expertise in substantive matters pertaining to the Company’s business.

12

Table of Contents

In making its recommendations, the Governance and Nominating Committee bears in mind that the foremost responsibility of a director of a corporation is to represent the interests of the stockholders as a whole. The committee intends to continue to evaluate candidates for election to the Board on the basis of the foregoing criteria.

Stockholder Communications with the Board

Stockholders who wish to communicate directly with the Board may do so by submitting a comment via the Company’s website at http://www.investors.aviatnetworks.com/contactBoard.cfm or by sending a letter addressed to: Aviat Networks, Inc., c/o Corporate Secretary, 5200 Great America Parkway, Santa Clara, CA 95054. The Corporate Secretary monitors these communications and provides a summary of all received messages to the Board at its regularly scheduled meetings. When warranted by the nature of communications, the Corporate Secretary will request prompt attention by the appropriate committee or independent director of the Board, independent advisors, or management. The Corporate Secretary may decide in her judgment whether a response to any stockholder communication is appropriate.

We implemented our Code of Conduct effectively on January 26, 2007. All of our employees, including the Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer, are required to abide by the Code of Conduct to help ensure that our business is conducted in a consistently ethical and legal manner. The Audit Committee has adopted a written policy, and management has implemented a reporting system, intended to encourage our employees to bring to the attention of management and the Audit Committee any complaints regarding the integrity of our internal system of controls over financial reporting, or the accuracy or completeness of financial or other information related to our financial statements.

TRANSACTIONS WITH RELATED PERSONS

During fiscal 2011, we believe there were no transactions, or series of similar transactions, to which we were or are to be a party in which the amount exceeded $120,000, and in which any of our directors or executive officers, any holders of more than 5% of our common stock or any members of any such person’s immediate family, had or will have a direct or indirect material interest, other than compensation described in the sections titled “Director Compensation and Benefits” and “Executive Compensation”.

It is the policy and practice of our Board to review and assess information concerning transactions involving related persons. Related persons include our directors and executive officers and their immediate family members. If the determination is made that a related person has a material interest in a transaction involving us, then the disinterested members of our Board would review and approve or ratify it, and we would disclose the transaction in accordance with SEC rules and regulations. If the related person is a member of our Board, or a family member of a director, then that director would not participate in any discussion involving the transaction at issue.

Our Code of Conduct prohibits all employees, including our executive officers, from benefiting personally from any transactions with us other than approved compensation benefits.

13

Table of Contents

DIRECTOR COMPENSATION AND BENEFITS

The form and amount of director compensation is reviewed and assessed from time to time by the Compensation Committee with changes, if any, recommended to the Board for action. Director compensation may take the form of cash, equity, and other benefits ordinarily available to directors.

Directors who are not employees of ours currently receive the following fees, as applicable, for their services on our Board:

| • | $60,000 basic annual cash retainer, payable on a quarterly basis, which a director may elect to receive in the form of shares of common stock; |

| • | $10,000 annual cash retainer, payable on a quarterly basis, for service as Chairman of the Board; |

| • | $10,000 annual cash retainer, payable on a quarterly basis, for service as Chairman of the Audit Committee; |

| • | $5,000 annual cash retainer, payable on a quarterly basis, for service as Chairman of the Governance and Nominating Committee of our Board; |

| • | $8,000 annual cash retainer, payable on a quarterly basis, for service as Chairman of the Compensation Committee; |

| • | Annual grant of restricted shares of common stock valued (based on market price on the last trading day preceding the date of grant) at $30,000, with 100 percent vesting in one year, subject to continuing service as a director; |

| • | Annual grant of options to purchase common stock valued (based on U.S. GAAP values of the options on the date of grant) at $30,000, with an exercise price per share equal to the market price on the date of grant and with 100 percent vesting in one year, subject to continuing service as a director; |

| • | Annual grant of shares of common stock, for service as Chairman of the Board, valued (based on market price on the date of grant) at $40,000, with a one-year vesting period with 25 percent of the grant vesting per quarter; and |

| • | $18,000 annual cash retainer, payable on a quarterly basis, for service as the lead independent director of our Board. |

Mr. Kissner’s agreement for part-time employment provides that, in his capacity as a director, he will receive grants of restricted stock and options on the same terms as non-employee directors. So long as his compensation as a part-time employee continues, Mr. Kissner will not receive cash retainers as a director or as a Chairman.

In addition to the foregoing, non-employee directors are entitled to receive a 50% higher level of compensation during such director’s first year of membership on the Board of Directors. As such, Mr. Rau, a non-employee director currently in the first year of his membership on the Board of Directors, is entitled to receive during calendar year 2011 a $90,000 basic annual cash retainer, an annual grant of restricted shares of common stock valued (based on market prices on the date of grant) at $45,000, with 100 percent vesting in one year, subject to continuing service as a director and an annual grant of options to purchase common stock valued (based on U.S. GAAP value of the options on the date of grant) at $45,000, with an exercise price per share equal to the market prices on the date of grant and with 100 percent vesting in one year, subject to continuing service as a director.

Directors are eligible to defer payment of all or a portion of the retainer fees and restricted stock awards that are payable to them. Directors may choose either a lump sum or installment distribution of such fees and awards. Installment distributions are payable in annual installments over a period no longer than 10 years.

We reimburse each non-employee director for reasonable travel expenses incurred and in connection with attendance at Board and committee meetings on our behalf, and for expenses such as supplies, continuing director education costs, including travel for one course per year. Employee directors are not compensated for service as a director.

14

Table of Contents

Fiscal 2011 Compensation of Non-Employee Directors

Our non-employee directors received the following aggregate amounts of compensation in respect of the fiscal year ended July 1, 2011.

| Name |

Fees Earned or Paid in Cash |

Stock Awards(1) |

Option Awards(1) |

Non-Equity Incentive Plan Compensation |

Changes in Pension Value and Non- Qualified Deferred Compensation Earnings |

All Other Compensation |

Total | |||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||

| Eric C. Evans |

60,000 | 30,588 | 30,465 | — | — | — | 121,053 | |||||||||||||||||||||

| William A. Hasler |

65,000 | 30,588 | 30,465 | — | — | — | 126,053 | |||||||||||||||||||||

| Clifford H. Higgerson |

60,000 | 30,588 | 30,465 | — | — | — | 121,053 | |||||||||||||||||||||

| Raghavendra Rau |

45,000 | 45,884 | 45,700 | — | — | — | 136,584 | |||||||||||||||||||||

| Dr. Mohsen Sohi |

60,000 | 30,588 | 30,465 | — | — | — | 121,053 | |||||||||||||||||||||

| Dr. James C. Stoffel |

87,000 | 30,588 | 30,465 | — | — | — | 148,053 | |||||||||||||||||||||

| Edward F. Thompson |

70,000 | 30,588 | 30,465 | — | — | — | 131,053 | |||||||||||||||||||||

| (1) | The amounts shown in this column reflect the aggregate grant date fair value of the stock awards and option awards granted to our non-employee directors computed in accordance with FASB ASC Topic 718. The assumptions made in determining the fair values of our stock awards and option awards are set forth in Notes 1 and 10 to our fiscal 2011 Consolidated Financial Statements in Part II, Item 8 of our Annual Report on Form 10-K filed with the SEC on September 12, 2011. |

As of July 1, 2011, our non-employee directors held the following numbers of unvested restricted shares of common stock and stock options granted under the 2007 Stock Equity Plan, as Amended and Restated Effective November 19, 2009:

| Name |

Unvested Stock Awards |

Unvested Option Awards | ||

| Eric C. Evans |

5,905 | 11,764 | ||

| William A. Hasler |

5,905 | 11,764 | ||

| Clifford H. Higgerson |

5,905 | 11,764 | ||

| Raghavendra Rau |

8,858 | 17,647 | ||

| Dr. Mohsen Sohi |

5,905 | 11,764 | ||

| Dr. James C. Stoffel |

5,905 | 11,764 | ||

| Edward F. Thompson |

5,905 | 11,764 |

Our Bylaws require us to indemnify each of our directors and officers with respect to their activities as a director, officer, or employee of ours, or when serving at our request as a director, officer, or trustee of another corporation, trust, or other enterprise, against losses and expenses (including attorney fees, judgments, fines, and amounts paid in settlement) incurred by them in any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, to which they are, or are threatened to be made, a party(ies) as a result of their service to us. In addition, we carry directors’ and officers’ liability insurance, which includes similar coverage for our directors and executive officers. We will indemnify each such director or officer for any one or a combination of the following, whichever is most advantageous to such director or officer:

| • | The benefits provided by our Bylaws in effect on the date of the indemnification agreement or at the time expenses are incurred by the director or officer; |

15

Table of Contents

| • | The benefits allowable under Delaware law in effect on the date the indemnification bylaw was adopted, or as such law may be amended; |

| • | The benefits available under liability insurance obtained by us; and |

| • | Such benefits as may otherwise be available to the director or officer under our existing practices. |

Under our Bylaws, each director or officer will continue to be indemnified even after ceasing to occupy a position as an officer, director, employee or agent of ours with respect to suits or proceedings arising from his or her service with us.

16

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock as of September 22, 2011 by each person or entity known by us to beneficially own more than 5 percent of our common stock, by our directors, by our named executive officers and by all our directors and executive officers as a group. Except as indicated in the footnotes to this table, and subject to applicable community property laws, the persons listed in the table below have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them. Unless otherwise indicated, the address of each of the beneficial owners identified is c/o Aviat Networks, Inc., 5200 Great America Parkway, Santa Clara, CA 95054. As of September 22, 2011, there were 60,524,922 shares of our common stock outstanding.

| Shares Beneficially Owned as of September 22, 2011(1) |

||||||||

| Number of Shares of Common Stock(2) |

Percentage of Voting Power of Common Stock |

|||||||

| Name and Address of Beneficial Owner |

||||||||

| Dimensional Fund Advisors LP 6300 Bee Cave Road Building One Austin, Texas 78746 |

3,398,595 | (3) | 5.56 | % | ||||

| BlackRock, Inc. 40 East 52nd Street New York, New York 10022 |

3,303,900 | (4) | 5.41 | % | ||||

| NAMED EXECUTIVE OFFICERS AND DIRECTORS |

||||||||

| Thomas L. Cronan III |

134,100 | (5) | * | |||||

| Eric C. Evans |

45,216 | (6) | * | |||||

| William A. Hasler |

52,434 | (6) | * | |||||

| Clifford H. Higgerson |

176,041 | (7) | * | |||||

| Paul A. Kennard |

292,808 | (8) | * | |||||

| Charles D. Kissner |

407,746 | (9) | * | |||||

| Michael Pangia |

486,398 | (10) | * | |||||

| Raghavendra Rau |

8,858 | * | ||||||

| Dr. Mohsen Sohi |

43,895 | (6) | * | |||||

| Dr. James C. Stoffel |

43,746 | (6) | * | |||||

| Heinz H. Stumpe |

240,707 | (11) | * | |||||

| Edward F. Thompson |

46,246 | (6) | * | |||||

| All directors and executive officers as a group (15 persons) |

2,414,563 | (12) | 3.95 | % | ||||

| * | Less than one percent |

| (1) | Beneficial ownership is determined under the rules and regulations of the SEC, and generally includes voting or dispositive power with respect to such shares. |

| (2) | Shares of common stock that a person has the right to acquire within 60 days are deemed to be outstanding and beneficially owned by that person for the purpose of computing the total number of shares beneficially owned by that person and the percentage ownership of that person, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person or group. Accordingly, the amounts in the table include shares of common stock that such person has the right to acquire within 60 days of September 22, 2011 by the exercise of stock options. |

| (3) | Based upon a Form 13F filing by Dimensional Fund Advisors LP with the Securities and Exchange Commission on August 5, 2011. |

| (4) | Based upon Form 13F filings by BlackRock, Inc. and its affiliates with the Securities and Exchange Commission on July 12, 2011, reporting ownership of 1,921,375 shares by BlackRock Investment Trust Company, N.A., and 1,382,525 shares by BlackRock Fund Advisors. |

17

Table of Contents

| (5) | Includes options to purchase 129,188 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. |

| (6) | Includes options to purchase 8,720 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. |

| (7) | Includes options to purchase 8,720 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. Includes 107,895 shares held by, or in trusts for, members of Mr. Higgerson’s family. Also includes 24,400 shares held by Higgerson Investments. Mr. Higgerson disclaims beneficial ownership of the shares held in trust and held by Higgerson Investments. |

| (8) | Includes options to purchase 162,842 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. |

| (9) | Includes options to purchase 101,470 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. Includes 103,499 shares held by, or in trusts for, members of Mr. Kissner’s family. Mr. Kissner disclaims beneficial ownership of the shares held in trust. |

| (10) | Includes options to purchase 122,228 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. |

| (11) | Includes options to purchase 118,701 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. |

| (12) | Includes options to purchase 851,243 shares of common stock that are currently exercisable or will become exercisable within 60 days of September 22, 2011. |

18

Table of Contents

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee currently consists of four members of the Board, each of whom is independent of the Company and its management, as defined in the NASDAQ Listing Rules. The Board has adopted, and periodically reviews, the Audit Committee charter. The charter specifies the scope of the Audit Committee’s responsibilities and how it carries out those responsibilities.

The Audit Committee reviews management’s procedures for the design, implementation, and maintenance of a comprehensive system of internal controls over financial reporting and disclosure controls and procedures focused on the accuracy of our financial statements and the integrity of our financial reporting systems. The Audit Committee provides the Board with the results of its examinations and recommendations and reports to the Board as it may deem necessary to make the Board aware of significant financial matters requiring the attention of the Board.

The Audit Committee does not conduct auditing reviews or procedures. The Audit Committee monitors management’s activities and discusses with management the appropriateness and sufficiency of our financial statements and system of internal control over financial reporting. Management has primary responsibility for the Company’s financial statements, the overall reporting process and our system of internal control over financial reporting. Our independent registered public accounting firm audits the financial statements prepared by management, expresses an opinion as to whether those financial statements fairly present our financial position, results of operations and cash flows in conformity with accounting principles generally accepted in the United States, or U.S. GAAP, and discusses with the Audit Committee any issues they believe should be raised with us.

The Audit Committee reviews reports from our independent registered public accounting firm with respect to their annual audit and approves in advance all audit and non-audit services provided by our independent auditors in accordance with applicable regulatory requirements. The Audit Committee also considers, in advance of the provision of any non-audit services by our independent registered public accounting firm, whether the provision of such services is compatible with maintaining their independence.

In accordance with its responsibilities, the Audit Committee has reviewed and discussed with management the audited financial statements for the year ended July 1, 2011 and the process designed to achieve compliance with Section 404 of the Sarbanes-Oxley Act of 2002. The Audit Committee has also discussed with our independent registered public accounting firm, Ernst & Young LLP, the matters required to be discussed by SAS No. 114, Communication with Audit Committees, as adopted by the Public Company Accounting Oversight Board or PCAOB, in Rule 3200T. The Audit Committee has received the written disclosures and letter from Ernst & Young LLP required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as adopted by the PCAOB in Rule 3600T, and has discussed with Ernst & Young LLP its independence, including whether Ernst & Young LLP’s provision of non-audit services is compatible with its independence.

Based on these reviews and discussions, the Audit Committee recommended to the Board that the Company’s audited financial statements for the year ended July 1, 2011 be included in Company’s Annual Report on Form 10-K.

Audit Committee of the Board of Directors

Edward F. Thompson, Chairman

Eric C. Evans

William A. Hasler

Raghavendra Rau

19

Table of Contents

Ernst & Young LLP has been approved by our Audit Committee to act as our independent registered public accounting firm for the fiscal year ending June 29, 2012. Representatives of Ernst & Young LLP will be present at the 2011 Annual Meeting of Stockholders, will have the opportunity to make a statement should they so desire, and will be available to respond to appropriate questions.

Audit and other fees billed to us by Ernst & Young LLP for the fiscal years ended July 1, 2011 and July 2, 2010 are as follows:

| 2011 | 2010 | |||||||

| Audit Fees(1) |

$ | 3,370,293 | $ | 2,828,255 | ||||

| Audit-Related Fees(2) |

— | 47,112 | ||||||

| Tax Fees(3) |

92,716 | 114,943 | ||||||

| All Other Fees(4) |

— | — | ||||||

|

|

|

|

|

|||||

| Total Fees for Services Provided |

$ | 3,463,009 | $ | 2,990,310 | ||||

|

|

|

|

|

|||||

| (1) | Audit Fees include fees associated with the annual audit, as well as reviews of our quarterly reports on Form 10-Q, SEC registration statements, accounting and reporting consultations and statutory audits required internationally for our subsidiaries. |

| (2) | Audit-related fees include fees for completion of certain statutory registration requirements. |

| (3) | Tax Fees were for services related to tax compliance and tax planning services. |

| (4) | No professional services were rendered or fees billed for other services not included within Audit Fees, Audit-Related Fees, or Tax Fees in fiscal 2011 or fiscal 2010. |

Ernst & Young LLP did not perform any professional services related to financial information systems design and implementation for us in fiscal 2011 or fiscal 2010.

The Audit Committee has determined in its business judgment that the provision of non-audit services described above is compatible with maintaining Ernst & Young LLP’s independence.

20

Table of Contents

Compensation Discussion and Analysis

Overview and Summary

This Compensation Discussion and Analysis, which has been prepared by management, is intended to help our stockholders understand our executive compensation philosophy, objectives, elements, policies, practices, and decisions. It is also intended to provide context for the compensation information for our CEO, CFO and the three other most highly compensated executive officers (our “named executive officers”) detailed in the Summary Compensation Table below and in the other tables and narrative discussion that follow.

To understand our approach to executive compensation, you should read the entire Compensation Discussion and Analysis that follows. The following brief summary introduces the major topics covered:

| • | the objectives of our executive compensation program are to reward superior performance, motivate our executives to achieve our goals and attract and retain a world-class management team. |

| • | our executive compensation program is overseen by the Compensation Committee of our Board of Directors, which makes recommendations on the program to the full Board. The Compensation Committee is composed solely of independent directors. In its work, the Compensation Committee is assisted by independent compensation consultants engaged by the Compensation Committee. |

| • | in reviewing the elements of our executive compensation program—base salary, annual incentives, long-term incentives and post-termination compensation—our Compensation Committee reviews market data relating to each element at similar companies. |

| • | the general goal of our executive compensation program is to set compensation at the 50th percentile of compensation at peer group companies. |

| • | our annual incentive program is based on specific Company financial performance goals for the fiscal year, and includes provisions to “claw back” any excess amounts paid in the event of a later correction or restatement of our financial statements. |

Compensation Philosophy and Objectives

Our total executive compensation program was developed with primary objectives being recruiting, retaining, and developing exceptional executives, enabling those individuals to achieve strategic and financial goals, rewarding superior performance and aligning the interests of our executives with our stockholders. The following principles guide our overall compensation program:

reward superior performance;

motivate our executives to achieve strategic, operational, and financial goals; and

enable us to attract and retain a world-class management team.

The Compensation Committee conducts an annual review of the executive compensation program in an effort to ensure our executive compensation policies and programs remain appropriately aligned with evolving business needs, and to consider best compensation practices.

Executive Compensation Process

The Compensation Committee has oversight responsibility for the establishment and implementation of compensation policies and programs for our executive officers in a manner consistent with our compensation objectives and principles. The Compensation Committee, which is comprised solely of independent directors, reviews and approves the features and design of our executive compensation program, and approves the

21

Table of Contents

compensation levels, individual objectives and financial targets for our executive officers other than our CEO. The Board of Directors approves the compensation level, individual objectives, and financial targets for our CEO. The Compensation Committee also monitors executive succession planning and monitors our performance as it relates to overall compensation policies for employees, including benefit and savings plans.