Exhibit 99.5

Keegan Resources Inc.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED MARCH 31, 2012

DATED AS OF JUNE 28, 2012

700 – 1199 WEST HASTINGS STREET

VANCOUVER, BRITISH COLUMBIA

V6E 3T5

TABLE OF CONTENTS

| PRELIMINARY NOTES | 2 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 2 |

| DOCUMENTS INCORPORATED BY REFERENCE | 4 |

| CORPORATE STRUCTURE | 5 |

| NAME, ADDRESS AND INCORPORATION | 5 |

| INTER-CORPORATE RELATIONSHIPS | 6 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 7 |

| BUSINESS DESCRIPTION | 10 |

| GENERAL | 10 |

| RISK FACTORS | 14 |

| MINERAL PROJECTS | 23 |

| ESAASE GOLD PROPERTY | 23 |

| THE ASUMURA PROPERTY | 59 |

| DIVIDENDS | 63 |

| DESCRIPTION OF CAPITAL STRUCTURE | 63 |

| COMMON SHARES | 63 |

| STOCK OPTIONS | 64 |

| MARKET FOR SECURITIES | 64 |

| TRADING PRICE AND VOLUME | 64 |

| PRIOR SALES | 65 |

| ESCROWED SECURITIES | 65 |

| DIRECTORS AND EXECUTIVE OFFICERS | 66 |

| NAME, OCCUPATION AND SECURITY HOLDING | 66 |

| CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS | 67 |

| CONFLICTS OF INTEREST | 68 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 68 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 69 |

| TRANSFER AGENT AND REGISTRAR | 69 |

| MATERIAL CONTRACTS | 69 |

| INTERESTS OF EXPERTS | 69 |

| CONTROLS AND PROCEDURES | 70 |

| AUDIT COMMITTEE, CODE OF ETHICS, ACCOUNTANT FEES AND EXEMPTIONS | 71 |

| ADDITIONAL INFORMATION | 72 |

- 2 -

PRELIMINARY NOTES

In this Annual Information Form (the “AIF”), (i) references to “we”, “us”, “our”, the “Company” or “Keegan” mean Keegan Resources Inc. and its subsidiaries, unless the context requires otherwise; (ii) we use the United States dollar as our reporting currency and, unless otherwise specified, all dollar amounts are expressed in United States dollars and references to “$” mean United States dollar and references to “C$” mean Canadian dollar; and (iii) our financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”); and (iv) this is the first time that the Company has prepared its financial statements in accordance with IFRS. Previously, the Company prepared its annual consolidated financial statements in accordance with Canadian Generally Accepted Accounting Principles (“GAAP”); and (v) Note 21 describes the impact of the transition to IFRS on the Company’s reported financial position and financial performance, including the nature and effect of significant changes in accounting policies from those used in its GAAP consolidated financial statements as at April 1, 2010 and March 31, 2011, and for the year ended March 31, 2011.

All information in this AIF is at March 31, 2012, unless otherwise indicated.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Keegan cautions readers regarding forward looking statements found in this document and in any other statement made by, or on the behalf of the Company. Such statements may constitute “forward looking information” within the meaning of United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward- looking statements include, but are not limited to, statements with respect to the future price of gold, the estimation of Mineral Reserves (as defined below) and Mineral Resources (as defined below), the realization of Mineral Reserve estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, timing and possible outcome of pending litigation, title disputes or claims and limitations on insurance coverage.

Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Keegan’s control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by or on the Company’s behalf. Although Keegan has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully and readers should not place undue reliance on Keegan’s forward-looking statements. Examples of such forward-looking statements within this AIF include statements relating to: the future price of minerals, future capital expenditures, success of exploration activities, mining or processing issues, government regulation of mining operations and environmental risks. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “estimates”, “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “might” or “occur”. Forward-looking statements are made based on management’s beliefs, estimates and opinions and are given only as of the date of this AIF. The Company undertakes no obligation to update forward-looking information if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law.

- 3 -

The Company’s management reviews periodically information reflected in forward-looking statements. The Company has and continues to disclose in its Management’s Discussion and Analysis and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking statements and to the validity of the statements themselves, in the period the changes occur.

Forward-looking statements reflect Keegan’s current views with respect to expectations, beliefs, assumptions, estimates and forecasts about the Company’s business and the industry and markets in which the Company operates. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions, which are difficult to predict. Assumptions underlying the Company’s expectations regarding forward-looking statements or information contained in this AIF include, among others, the Company’s ability to comply with applicable governmental regulations and standards, the Company’s success in implementing its strategies, achieving the Company’s business objectives, the Company’s ability to raise sufficient funds from equity financings in future to support its operations, and general business and economic conditions. The foregoing list of assumptions is not exhaustive.

Persons reading this AIF are cautioned that forward-looking statements are only predictions, and that the Company’s actual future results or performance are subject to certain risks and uncertainties including:

|

·

|

risks associated with outstanding litigation;

|

|

·

|

risks associated with project development;

|

|

·

|

risks related to the need for additional financing;

|

|

·

|

operational risks associated with mining and mineral processing;

|

|

·

|

risks associated with fluctuations in metal prices;

|

|

·

|

risks associated with title matters;

|

|

·

|

uncertainties and risks related to carrying on business in foreign countries;

|

|

·

|

risks associated with environmental liability claims and insurance;

|

|

·

|

risks associated with reliance on key personnel;

|

|

·

|

the potential for conflicts of interest among certain officer, directors or promoters of the registrant with certain other projects;

|

|

·

|

risks associated with the absence of dividends;

|

|

·

|

risks associated with currency fluctuations;

|

|

·

|

risks associated with competition;

|

|

·

|

risks associated with dilution;

|

|

·

|

risks associated with the volatility of the Company’s common share price and volume;

|

|

·

|

risks associated with tax consequences to U.S. Shareholders; and

|

- 4 -

|

·

|

other factors described under the heading “Risk Factors” in this AIF.

|

NOTE TO US READERS - DIFFERENCES REGARDING THE DEFINITIONS OF RESOURCE

AND RESERVE ESTIMATES IN THE U.S. AND CANADA

|

Mineral Reserve

|

The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” used in Keegan Resources Inc.’s (“Keegan” or the “Company”) disclosure are Canadian mining terms that are defined in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Best Practice Guidelines for the Estimation of Mineral Resource and Mineral Reserves (the “CIM Standards”), adopted by the CIM Council on November 23, 2003. These definitions differ from the definitions in the United States Securities and Exchange Commission (the “SEC”) Industry Guide 7 under the Securities Act of 1933, as amended (the “Securities Act”). Under Industry Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

|

|

Mineral Resource

|

The terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource” used in the Registrant’s disclosure are Canadian mining terms that are defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards; however, these terms are not defined terms under Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically mineable.

|

Accordingly, information contained in this report containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

DOCUMENTS INCORPORATED BY REFERENCE

This AIF should be read in conjunction with the following documents, which are incorporated by reference and form part of this AIF, which is prepared in accordance with Form 51-102F2 Annual Information Form. These documents may be accessed using the System for Electronic Documents Analysis and Retrieval (“SEDAR”) on the Internet at www.sedar.com.

|

·

|

Annual consolidated financial statements and notes to them for the years ended March 31, 2012 and 2011.

|

- 5 -

|

·

|

Management discussion and analysis of the Company’s consolidated financial results as at and for the year ended March 31, 2012.

|

|

·

|

The Notice of Meeting and Management Information Circular dated as of August 19, 2011 (the “Information Circular”) regarding the annual general meeting of shareholders of the Company held on September 27, 2011, and filed on SEDAR on September 1, 2011.

|

|

·

|

The short form prospectus dated and filed on SEDAR on February 11, 2011 with regard to the Company’s offering of 24,700,000 common shares of the Company at a price of $7.50 per common share for gross proceeds of $185,250,000 (the “Prospectus”).

|

|

·

|

Technical report dated September 22, 2011, titled “Esaase Gold Project, Ghana / 43-101 Technical Report” prepared by qualified persons Brian Wolfe, B Sc Hons (Geol), Post Grad Cert (Geostats), (MAusIMM), Christopher Waller, B AppSc (MAusIMM), and Harry Warries, M Eng (MAusIMM), as required under National Instrument 43-010, Standards of Disclosure for Mineral Projects, (“NI 43-101”), filed on SEDAR on November 4, 2011 (the “43-101 Report”).

|

|

·

|

Technical report dated December 16, 2010 and amended February 4, 2011, titled “Esaase, Ghana, West Africa / Esaase Gold Deposit Resource Estimation Update incorporating the May 2010 Preliminary Economic Assessment” prepared by qualified persons Brian Wolfe, B Sc Hons (Geol), Post Grad Cert (Geostats), (MAusIMM), Christopher Waller, B AppSc (MAusIMM), and Harry Warries, M Eng (MAusIMM), as required under National Instrument 43-010, Standards of Disclosure for Mineral Projects, (“NI 43-101”), filed on SEDAR on February 9, 2011 (the “Esaase Gold Deposit Resource Estimation Update incorporating the May 2010 Preliminary Economic Assessment Report”).

|

|

·

|

Technical report dated December 16, 2010, titled “Esaase, Ghana, West Africa / Esaase Gold Deposit Resource Estimation” prepared by qualified persons Brian Wolfe, B Sc Hons (Geol), Post Grad Cert (Geostats), (MAusIMM), Christopher Waller, B AppSc (MAusIMM), and Harry Warries, M Eng (MAusIMM), as required under National Instrument 43-010, Standards of Disclosure for Mineral Projects, (“NI 43-101”), filed on SEDAR on January 12, 2011 (the “Esaase Gold Deposit Resource Estimation Report”).

|

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated as “Quicksilver Ventures Inc.” on September 23, 1999 under the Company Act (British Columbia) (now the British Columbia Business Corporation Act). Pursuant to a resolution passed at a meeting of the shareholders of the Company that was held on August 13, 2004, the Company changed its name from Quicksilver Ventures Inc. to Keegan Resources Inc. The Company’s registered and records office is located at 1500 Royal Centre, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, V6E 4N7. The Company’s head office is located at Suite 700-1199 West Hastings Street, Vancouver, British Columbia, V6E 3T5. Keegan is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland.

On January 2, 2008, the Company’s common shares began trading on the American Stock Exchange (now the NYSE MKT Equities Exchange). On December 22, 2008, the Company graduated from the TSX Venture Exchange (the “TSX-V”) to the Toronto Stock Exchange (the “TSX”) and commenced trading under the trading symbol “KGN”.

- 6 -

Inter-corporate Relationships

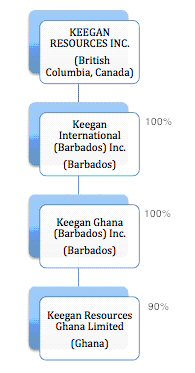

The Company has a 90% ownership of Keegan Resources Ghana Limited, incorporated under the laws of Ghana, through it’s two wholly owned subsidiaries, Keegan International (Barbados) Inc. and Keegan Ghana (Barbados) Inc., incorporated under the laws of Barbados.

Figure 1. Organizational chart as at March 31, 2012 and June 26, 2012

- 7 -

GENERAL DEVELOPMENT OF THE BUSINESS

Corporate Development

Keegan became a public company on June 22, 2001 as a “Capital Pool Company”.

Under the TSX-V Policy 2.4, a company with only minimal working capital is allowed to list on the TSX-V for the purposes of negotiating an acquisition of, or the participation in, assets or businesses, known as a Qualifying Transaction (“QT”). Such companies are classified as a “Capital Pool Company”, or “CPC”, and are governed by a specific set of rules and regulations.

The sole purpose of a CPC is to identify and evaluate existing businesses or assets for possible acquisition, which if acquired, would provide the company for a full listing on the TSX-V. The only business a CPC is allowed to conduct prior to its Initial Public Offering and listing on the TSX-V is to prepare for its offering. This typically consists of raising a limited amount of seed capital, establishing a management team and board of directors, as well as hiring professionals to assist in the offering, including an auditor, legal counsel, and an agent for the offering.

As Keegan had not completed a “QT” by December 2003, the directors of the Company scheduled an extraordinary general meeting of its shareholders to request shareholder approval to the proposed listing of Keegan’s shares on the NEX Exchange. The NEX Exchange is a separate board of the TSX-V for companies previously listed on the TSX-V or the TSX, which have failed to maintain compliance with the ongoing financial listing standards of either of these stock exchanges. Shareholder approval was obtained and Keegan’s common shares began trading on the NEX Exchange on February 12, 2004.

On September 7, 2004, Keegan entered into agreements with the Hunter Dickinson Group, Inc. (“HDG”), Anaconda Gold Corp. and Barrick Gold Exploration Inc. whereby it acquired the right to earn an interest in the Horse Mountain Project located in Nevada.

On January 31, 2005, Keegan announced that the TSX-V had accepted the transaction pertaining to the Horse Mountain Project as the “Qualifying Transaction” for the Company and that it no longer considered Keegan to be a Capital Pool Company. Keegan was reclassified by the TSX-V as a “Gold Ore Mining” company. On March 1, 2005, the Company began trading on the TSX-V under the name “Keegan Resources Inc.” with the stock symbol of “KGN”.

On March 11, 2005, Keegan announced that it had entered into an option agreement with GTE Ventures Limited, an unrelated privately held Ghanaian company, to acquire the Asumura gold project located in West Ghana (the “Asumura Property”). The option agreement allowed Keegan to acquire 100% of the private interest in the Asumura Property, subject to a 3.5% net smelter return (“NSR”) royalty, 50% of which could be purchased by Keegan for US$2,000,000, Keegan’s interest could be earned by performing work expenditures totaling US$1,000,000, delivering cash payments totaling US$100,000 and delivering shares of Keegan totaling US$100,000 in value over a period of three years. During the year ended March 31, 2008, the Company acquired an option to purchase the remaining 50% of the NSR royalty for an additional US$4,000,000. Keegan’s interest in the Asumura Property is also subject to the government of Ghana’s 10% carried interest. See “Item 4.D Property, Plant and Equipment - Asumura Property”.

During the fiscal year ended March 31, 2006, management announced that it had decided not to pursue the Company’s option to earn an interest in the Horse Mountain Claims and, as a result, $1,018,587 in acquisition and deferred exploration expenditures associated with the property were written-off. Management took this action because, due to limited financial resources, it determined to concentrate the Company’s efforts on its Ghana properties.

- 8 -

On May 3, 2006, Keegan entered into an option agreement, as amended on June 1, 2006, to purchase a 100% interest in the mining lease for the “Esaase Concession” on the Company’s material property in Ghana, known as the “Esaase Property”, subject to certain royalties and government obligations (see “Item 4.D Property, Plant and Equipment - Esaase Gold Property”). Under this option agreement, Keegan made payments of US$700,000 during 2006 and 2007, including an advance payment of US$200,000 due upon production at the Esaase Property. Keegan also agreed to issue 780,000 common shares over a three year period, and 40,000 shares were issued in 2006. The balance of the shares to be issued under the option agreement was renegotiated, and a tripartite agreement was signed on May 29, 2007 (see “Item 4.D Property, Plant and Equipment - Esaase Gold Property”). In June 2006, the Company entered into an agreement whereby the Company paid US$10,000 and issued 4,000 common shares to Eric Ewen as a finder's fee with respect to the acquisition of Esaase Concession. In May 2007, the Company paid another finder's fee of US$85,000 and issued 4,000 common shares to Eric Ewen in connection with the renegotiation of the option agreement.

In 2007, Keegan terminated its interests under two option agreements that it had entered into in 2005 with respect to mineral properties in Nevada, in order to focus on its properties in Ghana. During the fiscal year ended March 31, 2006, Keegan had terminated its option on a third mineral property in Nevada, also acquired in 2005, after the results of preliminary exploration work indicated that further work was not warranted on the property.

In March 2008, Keegan acquired a 100% interest in the mining lease for the Jeni River Concession for consideration of US$50,000 to the Bonte Liquidation Committee and US$50,000 paid to the Minerals Commission of Ghana to transfer title, subject to a 3.5% NSR royalty and the government of Ghana’s 10% carried interest (see “Item 4.D Property, Plant and Equipment - Esaase Property”).

During the year ended March 31, 2011, the Company made a payment of $600,000 plus certain acquisition costs to acquire a 100% interest in the Dawohodo prospecting concession, a mineral concession adjacent to the Esaase Gold property, and accrued a further $500,000 payable pursuant to this agreement. The $500,000 was paid during the year ended March 31, 2012.

On December 1, 2011, the Company entered into a purchase agreement with Tetollas Mining Enterprise to acquire an 100% interest in the Asuowin Concession situated contiguous to and directly south of the Esaase Gold property. In accordance with the purchase agreement, the Company made payments totaling $400,000 in exchange for the transfer of title.

During the year ended March 31, 2012, the Company paid $110,000 pursuant to an option agreement with Sky Gold Mines Limited (“SGM”) whereby the Company was granted the exclusive option by SGM to acquire 100% interest in a four-part concession adjacent to the Esaase Gold property. The concession is subject to a 2% net smelter returns royalty (“NSR”) payable to SGM. Pursuant to the agreement the Company is required to make staged payments totaling $150,000 in addition to the total of $250,000 already paid, and issue in stages a total of 40,000 shares of the Company. In July 2011, the Company received Ministerial approval of the option agreement and in January 2012 issued 20,000 shares of the Company at a cost of $156,009. The remaining 20,000 shares will be issued at the Company’s option, in 10,000 share tranches on the second and third anniversaries of this option agreement.

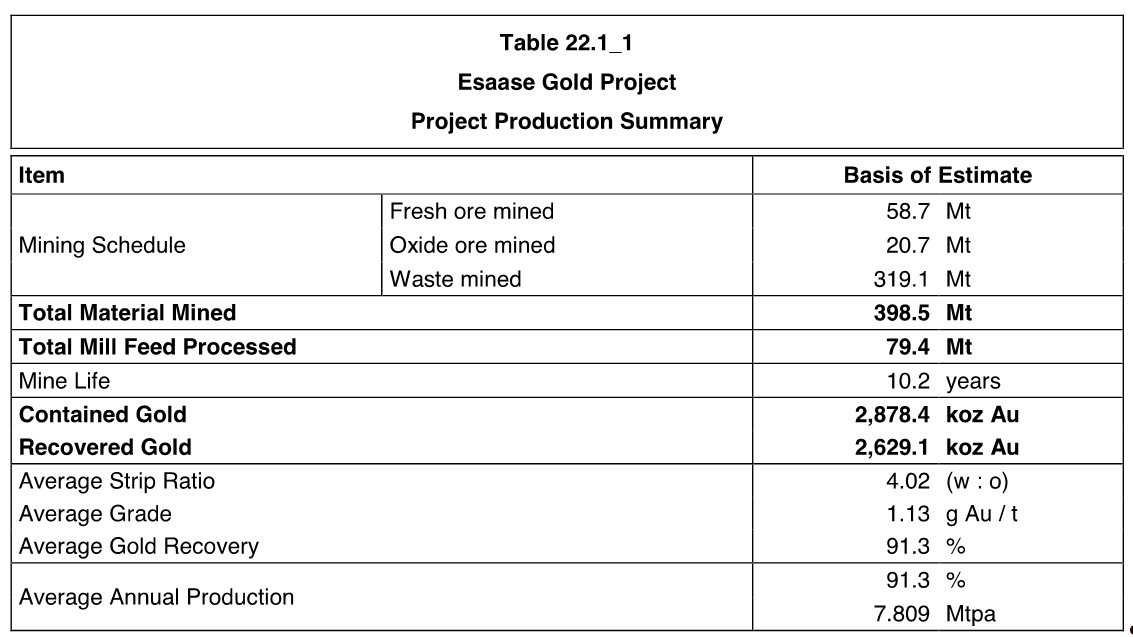

On September 22, 2011 the Company announced the results of a Pre-Feasibility Study (“PFS”). Highlights of the PFS are as follows:

|

-

|

2.6 million ounces of gold produced over a 10.2 year mine life.

|

|

-

|

Plant capacity of 7.5 million tonnes per annum, with capacity to treat 9.0 million tonnes per year in early years of production when processing 100% oxide ore.

|

- 9 -

|

-

|

330,000 oz gold produced in Year 1, with a Life of Mine (“LOM”) average of 258,000 oz/yr.

|

|

-

|

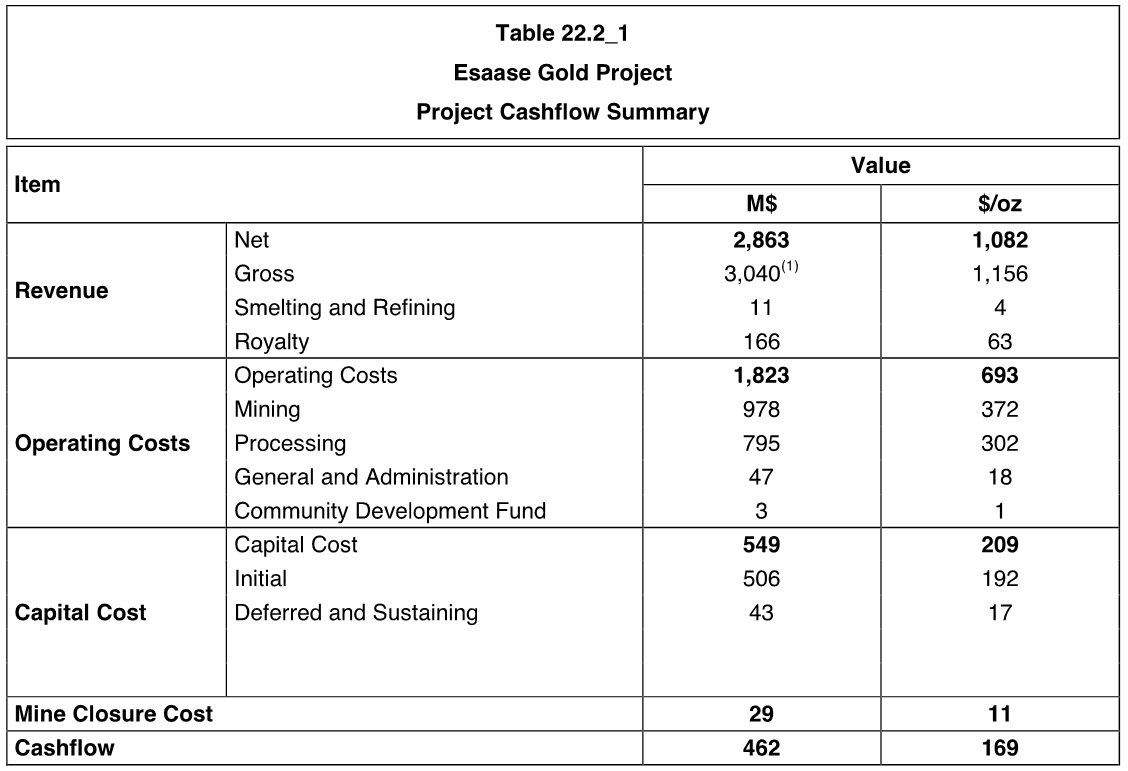

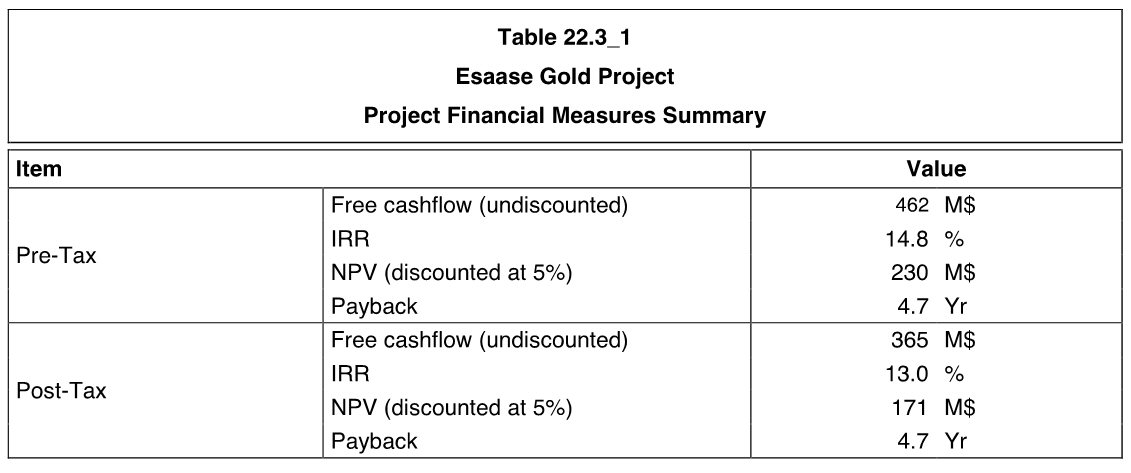

$639 million after-tax Net Present Value (“NPV”) discounted at 5% and an Internal Rate of Return (“IRR”) of 32% (100% equity basis at $1,500/oz gold revenue applied to a $1,150/oz gold pit shell).

|

|

-

|

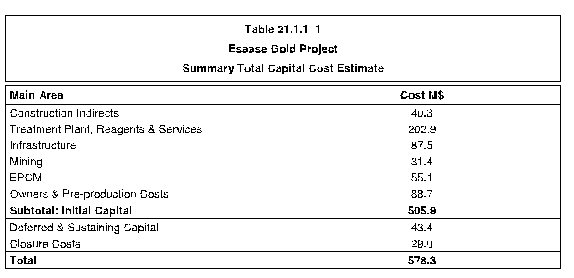

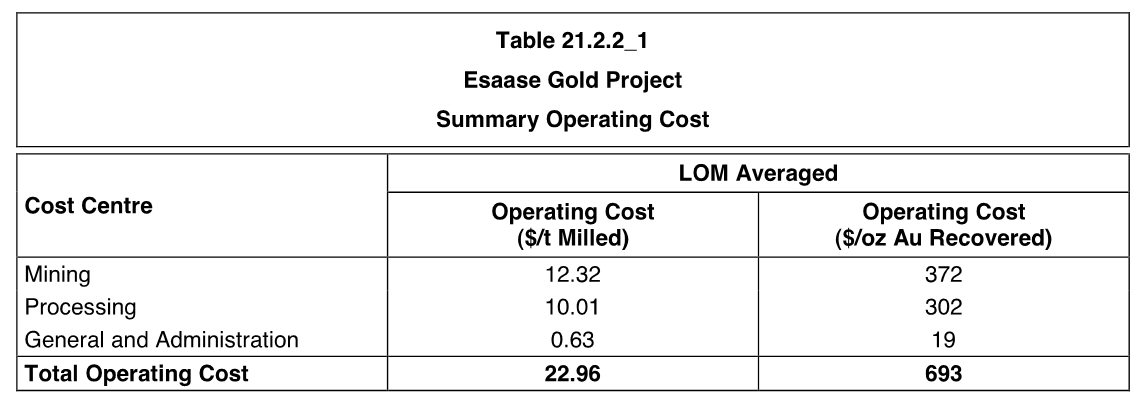

Capital cost of $506 million, utilizing a leased mining fleet. Cash costs of $693/oz gold produced including leasing costs for mining equipment (approximately $55/oz).

|

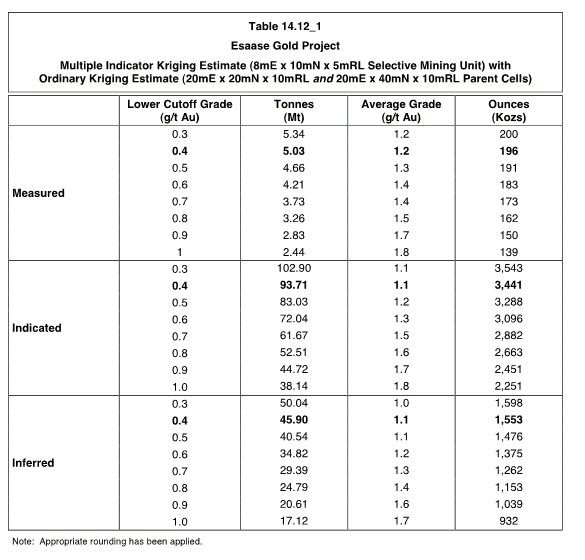

Based on the positive results of the PFS, a portion of the Measured and Indicated Mineral Resources were converted to Proven and Probable (“P&P") Mineral Reserves with highlights as follows:

|

-

|

Total P&P Reserves of 79.4 million tonnes grading 1.1 g/t gold and containing 2.88 million ounces of gold (based on $1,150/oz gold pit shell).

|

Following the completion of the PFS, the Company continued to advance a Definitive Feasibility Study (“DFS”) based on the same project scope as the PFS. In May 2012 the Company decided to defer work on the DFS as the macro economic situation and world equity markets deteriorated to the point where the Company felt that financing options available for the project were not accretive to shareholders.

In June 2012, the Company re-focused its development plan for Esaase looking at a staged development concept for the project, which could include:

|

-

|

an improved mine plan featuring higher grade feed to the processing plant and a lower strip ratio in the early years of the mine life, and

|

|

-

|

an initial processing plant with a reduced capacity and improved process design to substantially reduce the upfront capital requirements for the project.

|

The Company has engaged Minxcon and DRA, both South African based consultancy firms, to review the mine plan and processing plant design, respectively.

Financings

The Company has financed its operations through funds raised in public/private placements of common shares and shares issued upon exercise of stock options and share purchase warrants. Over the past three fiscal years, the Company raised funds through the issuance of the following common shares:

|

Fiscal Year

|

Nature of Share Issuance

|

Number of Shares

|

Amount

|

||||||

|

Fiscal 2010

|

Bought deal share offering, net of share issue costs

|

8,000,000 | $ | 16,158,671 | |||||

|

Brokered private placement, net of share issue costs

|

7,015,000 | $ | 37,045,855 | ||||||

|

Exercise of share purchase warrants

|

162,667 | $ | 478,197 | ||||||

|

Exercise of share purchase options

|

1,289,903 | $ | 2,172,064 | ||||||

|

Fiscal 2011

|

Bought deal share offering, net of share issue costs

|

28,405,000 | $ | 205,278,353 | |||||

|

Exercise of share purchase warrants

|

237,333 | $ | 724,373 | ||||||

|

Exercise of share purchase options

|

1,195,132 | $ | 3,617,373 | ||||||

| Fiscal 2012 | Exercise of share purchase options | 641,250 | $ | 2,331,271 | |||||

- 10 -

Capital Expenditures

The Company’s principal capital expenditures (there have been no material divestitures) over the three fiscal years ended March 31 are as follows:

|

Year

|

Resource property acquisition costs

|

Deferred development costs

|

Plant and equipment

|

Total

|

|

2010

|

$nil

|

$nil

|

$675,679

|

$675,679

|

| 2011 | $1,181,982 | $nil | $1,016,630 | $2,198,612 |

|

2012

|

$2,166,009

|

$11,830,057

|

$1,721,250

|

$15,717,316

|

Exploration and Evaluation Expenditures

The Company’s exploration and evaluation expenditures over the three fiscal years ended March 31 are as follows:

|

Year

|

||||

|

2010

|

$ | 9,439,434 | ||

|

2011

|

$ | 26,114,646 | ||

| 2012 | $ | 18,414,774 | ||

BUSINESS DESCRIPTION

General

Keegan is a natural resource company currently engaged in the acquisition and exploration of mineral resources in West Ghana.

Our Properties

Keegan’s mineral properties are in the exploration and development stage. Keegan’s primary property is the Esaase project where on September 22, 2011, the Company published the results of its preliminary feasibility study whereby it was able to establish proven and probable mineral reserves. The Company is focused on advancing the Esaase Gold Project through definitive feasibility and to commercial production. In addition to its principal project, the Company holds a portfolio of other Ghanaian gold concessions in various stages of exploration.

The Company’s material properties currently consist of the Asumura Property and the Esaase Property, both in West Ghana, Africa. See Item 4.D “Property, Plant and Equipment” below for more information relating to these properties.

- 11 -

Plan of Operations

Keegan’s plan of operations for fiscal 2013 is to:

|

(a)

|

re-focus its development plan for Esaase looking at a staged development concept for the project, by reviewing the mine plan and the processing plant design;

|

|

(b)

|

continue working with local communities, the Ghanaian government and the EPA to both advance community relations and the permitting of the Esaase project.

|

Source of Funds for Fiscal 2013

Keegan’s primary source of funds since incorporation has been through the issuance of common shares.

As at March 31, 2012, the Company had cash and cash equivalents of $197,608,106. The Company believes it currently has sufficient working capital on hand to meet its expected capital requirements for fiscal 2013 and 2014. Additional funds may be received through the exercise of currently outstanding common stock warrants and options or through the sale of additional common shares either as a private placement or public common stock offering.

Additional capital may also be obtained through the exercise of outstanding share purchase options and share purchase warrants. There is no guarantee, however, that any of these share purchase options and share purchase warrants will be exercised.

Keegan has sufficient funds to pursue its business plans for the next 24 months. Additional financing will be required going forward. However, there can be no assurance that any such financing will be obtained.

Use of Funds for Fiscal 2013

For the Fiscal 2013, the Company has budgeted $15.4 for the nine months ended December 31, 2012 for general and administrative expenses and property development, exploration and acquisition costs predominantly on the Esaase gold project.

The Company intends to change its year-end from March 31, 2013 to December 31, 2012 and therefore has budget for the nine-month period as opposed to twelve.

Anticipated Changes to Facilities/Employees

Management of Keegan does not anticipate adding or reducing it current employee level or facilities in the near future as the Company advances the development of its Esaase Gold project.

In May 2012, the Company deferred work on its definitive feasibility study due to the macro-economic situation and its effect on the ability of companies to finance large capital-intensive projects. As a result, the Company laid-off approximately 75 staff primary in Ghana to conserve cash as it reviews strategic alternatives.

- 12 -

Material Effects of Government Regulations

The current and anticipated future operations of Keegan including further exploration activities and potential mine development, require permits from various Ghanaian governmental agencies. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on Keegan and cause increases in capital expenditures which could result in a cessation of operations by Keegan. Keegan has had no material costs related to compliance and/or permits in recent years, and anticipates no material costs in the next year, apart from those related to mine development which have not been fully assessed at this time.

Specialized Skill and Knowledge

Various aspects of the Company’s mining business require specialized skills and knowledge. Such skills and knowledge include the areas of permitting, geology, drilling, metallurgy, logistical planning and implementation of exploration programs as well as finance and accounting. Much of the specialized skill and knowledge is provided by the Company’s management team and board of directors. The Company also retains outside consultants as additional specialized skills and knowledge are required. However, it is possible that delays and increased costs may be experienced by the Company in locating and/or retaining skilled and knowledgeable employees and consultants in order to proceed with its planned exploration and development at its mineral properties.

Competitive Conditions

Keegan competes with other mineral resource exploration companies for financing, for the acquisition of new mineral properties and for the recruitment and retention of qualified employees and other personnel. Many of the mineral resource exploration and development companies with which Keegan competes have greater financial and technical resources. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could have an adverse impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our properties.

Cycles

The mining business is subject to mineral price cycles. The marketability of minerals and mineral concentrates is also affected by worldwide economic cycles. At the present time, the significant demand for minerals in many countries is driving increased commodity prices, but it is difficult to assess how long such demand may continue. Fluctuations in supply and demand in various regions throughout the world are common.

As Keegan’s operations and exploration business is in the development stage, Keegan’s revenues, if any, are not currently significantly affected by changes in commodity demand and prices. As it does not carry on production activities, Keegan’s ability to fund ongoing exploration and development is affected by the availability of financing which, in turn, is affected by the strength of the economy and other general economic factors.

- 13 -

Economic Dependence

The Company’s business is not substantially dependent on any contract such as a contract to sell the major part of its product or services or to purchase the major part of its requirements for goods, services or its raw materials, or any franchise or license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

Changes to Contracts

Keegan does not anticipate that it will be affected in the current financial year by renegotiation or termination of contracts that could materially affect the Company’s business plan.

Environmental Protection

The Company’s properties are subject to stringent laws and regulations governing environmental quality. Such laws and regulations can increase the cost of planning, designing, installing and operating facilities on our properties. However, it is anticipated that, absent the occurrence of an extraordinary event, compliance with existing laws and regulations governing the release of materials in the environment or otherwise relating to the protection of the environment, will not have a material effect upon the Company’s current operations, capital expenditures, earnings or competitive position.

Employees

Keegan currently has approximately 165 full time employees. No management functions of the Company are performed to any substantial degree by a person other than the directors and officers of the Company.

Foreign Operations

All of the Company’s operations are currently conducted in a foreign jurisdiction, Ghana, and, as such, the Company’s operations are exposed to various levels of political, economic and other such risks and uncertainties as: military repression; extreme fluctuations in currency exchange rates; high rates of inflation; labour unrest; war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; changes in taxation policies; restrictions on foreign exchange and repatriation; and changing political conditions, currency controls and governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

In the past, Ghana has been subject to political instability, changes and uncertainties, which may cause changes to existing governmental regulations affecting mineral exploration and mining activities. Ghana’s status as a developing country may make it more difficult for the Company to obtain any required financing for its projects.

Keegan’s operations and properties are subject to a variety of governmental regulations governing worker health and safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species and other matters.

Keegan’s mineral exploration and develpoment activities in Ghana may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that increase the costs related to the Company’s activities or the maintenance of its properties.

- 14 -

Changes, if any, in mining or investment policies or shifts in political attitude may adversely affect the Company’s operations and financial condition. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the Company’s operations and financial condition. Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could negatively impact current or planned exploration and development activities on the Esaase Property or in respect of any other projects in which the Company becomes involved. Any failure to comply with applicable laws and regulations, even if inadvertent, could result in the interruption of exploration and development operations or material fines, penalties or other liabilities.

Risk Factors

An investment in securities of the Company involves significant risks, which should be carefully considered by prospective investors before purchasing such securities. Management of the Company considers the following risks to be most significant for potential investors in the Company, but such risks do not necessarily comprise all those associated with an investment in the Company. Additional risks and uncertainties not currently known to management of the Company may also have an adverse effect on the Company’s business. If any of these risks actually occur, the Company’s business, financial condition, capital resources, results and/or future operations could be materially adversely affected.

In addition to the other information set forth elsewhere in this AIF, the following risk factors should be carefully considered when considering risks related to Keegan’s business.

Risks Relating to Our Business

Quantitative Information about Market Risk

Market risk represents the risk of changes in the value of a financial instrument caused by fluctuations in interest rates, foreign exchange rates, commodity prices and equity prices.

As at March 31, 2012, the Company’s financial instruments consist of cash and cash equivalents, receivables, and accounts payable and accrued liabilities. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant credit, liquidity, or market risks arising from these financial instruments. The risk exposure is summarized as follows:

(a) Credit risk

Credit risk is the risk of an unexpected loss if a customer or a financial instrument fails to meet its contractual obligations. The Company is subject to credit risk on the cash and cash equivalent balances at banks in each of Canada and Ghana. The majority of the Company’s cash is held in Canadian based banking institutions, authorized under the Bank Act (Canada) to accept deposits. As at March 31, 2012, the receivables excluding refundable sales tax consist primarily of interest receivable of $112,638 (March 31, 2011 - $72,423) and other receivables of $7,825 (March 31, 2011 - $23,393), neither of which are considered past due.

- 15 -

(b) Liquidity risk

The Company’s approach to managing liquidity is to ensure that it will have sufficient liquidity to settle obligations and liabilities when due. As at March 31, 2012 the Company had a cash and cash equivalents balance of $197,608,106 (March 31, 2011 – $236,329,452) to settle current liabilities of $4,813,773 (March 31, 2011 - $5,236,343) that mainly consist of accounts payable that are considered short term and expected to be settled within 30 days.

(c) Market risk

(i) Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates.

The Company’s cash and cash equivalents attract interest at floating rates and have maturities of 90 days or less or maturity over ninety days but redeemable on demand without penalty. The interest is typical of Canadian banking rates, which are at present low, however the conservative investment strategy mitigates the risk of deterioration to the investment. A sensitivity analysis suggests that a change of 100 basis points in the interest rates would result in a corresponding increase or decrease in loss for the year ended March 31, 2012 of approximately $1,976,081 (year ended March 31, 2011 - $2,363,294).

(ii) Foreign currency risk

The Company is exposed to the financial risk related to the fluctuation of foreign exchange rates. The Company has offices in Canada and Ghana and holds cash in Canadian, United States and Ghanaian Cedi currencies in line with forecasted expenditures.

A significant change in the currency exchange rates between the US dollar relative to Canadian dollar (“CAD”), Ghanaian Cedi and the Australian dollar (“AUS”) could have an effect on the Company’s results of operations, financial position or cash flows. At March 31, 2012 and March 31, 2011, the Company had no hedging agreements in place with respect to foreign exchange rates.

The Company is exposed to currency risk through the following financial assets and liabilities denominated in foreign currencies, expressed below in US dollar equivalents:

|

March 31, 2012

|

March 31, 2011

|

|||||||||||||||||||||||

|

CAD

|

Ghana Cedis

|

AUD

|

CAD

|

Ghana Cedis

|

AUD

|

|||||||||||||||||||

|

Cash and cash equivalents

|

$ | 37,758,640 | $ | - | $ | - | $ | 171,881,945 | $ | 348,177 | $ | - | ||||||||||||

|

Accounts payable

|

(707,148 | ) | (300,132 | ) | (669,309 | ) | (238,338 | ) | (482,569 | ) | (398,862 | ) | ||||||||||||

|

Net exposure

|

$ | 37,051,493 | $ | (300,132 | ) | $ | (669,309 | ) | $ | 171,643,607 | $ | (134,392 | ) | $ | (398,862 | ) | ||||||||

A 10% appreciation or deprecation of the above mentioned currencies compared with the US dollar would result in a corresponding increase or decrease in net assets of approximately $3,608,205 as at March 31, 2012 (March 31, 2011 - $17,111,035).

- 16 -

(iii) Other price risk

Other price risk is the risk that the future cash flows of a financial instrument will fluctuate because of changes in market prices, other than those arising from currency risk or interest rate risk. As at March 31, 2012 and 2011, the Company was not exposed to other price risk.

(d) Fair value

The carrying values of cash and cash equivalents, receivables and accounts payable and accrued liabilities approximate their respective fair values due to the short-term nature of these instruments.

Qualitative Information about Market Risk

The Company manages its cash and cash equivalents, common shares, share-based options and share purchase warrants as capital. As the Company is in the exploration stage, its principal source of funds for its operations is from the issuance of common shares. The issuance of common shares requires approval of the Board of Directors. It is the Company’s objective to safeguard its ability to continue as a going concern, so that it can continue to explore and develop its Asumura and Esaase properties for the benefit of its stakeholders. The Company uses share-based options primarily to retain and provide future incentives to key employees and members of the management team. The granting of share-based options is primarily determined by the Board of Directors.

The Company has been judicious in its protection of the capital it has on hand. The Company has been investing only in Bankers’ Acceptance Notes and Guaranteed Investment Certificates and has no investments in asset-backed commercial paper.

High Metal Prices Increasing the Demand For, and Cost Of, Exploration, Development and Construction Services and Equipment

The strength of metal prices in recent years has encouraged increases in mining exploration, development and construction activities around the world, which has resulted in increased demand for, and cost of, exploration, development and construction services and equipment. The costs of such services and equipment may continue to increase if current trends continue. Increased demand for services and equipment could result in delays if services or equipment cannot be obtained in a timely manner due to an inadequate availability, and may cause scheduling difficulties due to the need to coordinate the availability of services or equipment, any of which could materially increase project exploration, development and/or construction costs.

Political, Economic and Social Risks and Uncertainties

The Company’s operations through Esaase and Asumura are located in Ghana and, as such, its operations are exposed to various levels of political, economic and other risks and uncertainties. Risks and uncertainties of operating in Ghana vary from time to time, but are not limited to terrorism, hostage taking, extreme fluctuations in currency exchange rates, high rates of inflation, labour unrest, the risk of civil unrest, expropriation and nationalization, renegotiation or nullification of existing concessions, licenses, permits and contracts, illegal mining, changes in taxation policies, restrictions on foreign exchange and repatriation and changing political conditions and governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from a particular jurisdiction.

Changes, if any, in mining investment or investment policies or shifts in political attitude in Ghana or any other relevant jurisdiction in which the Company operates may adversely affect Keegan’s operations or profitability. Operations may be affected in varying degrees by government

- 17 -

regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, water use and mine safety. Failure to comply with applicable laws, regulations and local practices relating to mineral rights applications and tenure, could result in a loss, reduction or expropriation of entitlements. The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the Company’s operations or profitability.

Environmental Regulatory Risks

Keegan’s operations are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation and regulation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner, which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Future legislation and regulations could cause additional expenses, capital expenditures, restrictions, liabilities and delays in the development of Keegan’s properties, the extent of which cannot be predicted. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Properties May be Subject to Defects in Title

Keegan has investigated its rights to explore and exploit the Esaase Property and the Asumura Property and, to the best of its knowledge, its rights are in good standing. However, no assurance can be given that such rights will not be revoked, or significantly altered, to Keegan’s detriment. There can also be no assurance that Keegan’s rights will not be challenged or impugned by third parties.

Some Keegan mineral claims may overlap with other mineral claims owned by third parties, which may be considered senior in title to the Keegan mineral claims. The junior claim is only invalid in the areas where it overlaps a senior claim. Keegan has not determined which, if any, of the Keegan mineral claims is junior to a mineral claim held by a third party.

Although Keegan is not aware of any existing title uncertainties with respect to the Esaase Property and the Asumura Property, there is no assurance that such uncertainties will not result in future losses or additional expenditures, which could have an adverse impact on Keegan’s future cash flows, earnings, results of operations and financial condition.

Key Personnel

Keegan’s senior officers are critical to its success. In the event of the departure of a senior officer, Keegan believes that it will be successful in attracting and retaining qualified successors but there can be no assurance of such success. Recruiting qualified personnel as Keegan grows is critical to its success. The number of persons skilled in the acquisition, exploration and development of mining properties is limited and competition for such persons is intense. As Keegan’s business activity grows, it will require additional key financial, administrative, mining and exploration personnel, and potentially additional operations staff. If Keegan is not successful in attracting and training qualified personnel, the efficiency of its operations could be affected, which could have an adverse impact on future cash flows, earnings, results of operations and the financial condition of Keegan.

- 18 -

Legal and Litigation Risks

All industries, including the mining industry, are subject to legal claims, with and without merit. Defense and settlement costs of legal claims can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding to which the Company may become subject could have a material adverse effect on the Company’s business, prospects, financial condition, and operating results. Defense and settlement of costs of legal claims can be substantial.

Possible Loss of Interests in Exploration Properties; Possible Failure to Obtain Mining Licenses

The agreements pursuant to which Keegan acquired its interests in certain of its properties provide that the Company must make a series of payments in cash and/or Common Shares over certain time periods, expend certain minimum amounts on the exploration of the properties or contribute its share of ongoing expenditures. If the Company fails to make such payments or expenditures in a timely fashion, the Company may lose its interest in those properties. Further, even if Keegan does complete exploration activities, it may not be able to obtain the necessary licenses or permits to conduct mining operations on its properties, and thus would realize no benefit from its exploration activities on its properties.

Increased Costs and Compliance Risks as a Result of Being a Public Company

Legal, accounting and other expenses associated with public company reporting requirements have increased significantly in the past few years. Keegan anticipates that costs may continue to increase with corporate governance related requirements, including, without limitation, requirements under National Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings, National Instrument 52-110 Audit Committees and National Instrument 58-101 Disclosure of Corporate Governance Practices and the conversion to International Financial Reporting Standards.

The Company also expects these rules and regulations may make it more difficult and more expensive for it to obtain director and officer liability insurance, and it may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for the Company to attract and retain qualified individuals to serve on its board of directors or as executive officers.

Risks Relating to Statutory and Regulatory Compliance

Keegan’s current and future operations, from exploration through development activities and commercial production, if any, are and will be governed by applicable laws and regulations governing mineral claims acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities, generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. The Company has received all necessary permits for the exploration work it is presently conducting; however, there can be no assurance that all permits which the Company may require for future exploration, construction of mining facilities and conduct of mining operations, if any, will be obtainable on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any project which Keegan may undertake.

- 19 -

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. The Company is not currently covered by any form of environmental liability insurance. See “Insurance Risk”, below.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or require abandonment or delays in exploration.

Insurance Risk

Keegan is subject to many risks that are not insurable and, as a result, Keegan will not be able to recover losses through insurance should such uninsurable liabilities occur. Hazards such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and development. Keegan may become subject to liability for pollution, cave-ins or hazards against which it cannot insure. The payment of such liabilities could result in a material adverse effect on Keegan’s financial position and its results of operations. Although Keegan maintains liability insurance in an amount which it considers adequate, the nature of these risks is such that the liabilities might exceed policy limits and the liabilities and hazards might not be insurable against.

There is no assurance that the foregoing risks and hazards will not result in damage to, or destruction of, the properties of Keegan, personal injury or death, environmental damage or, regarding the exploration or development activities of Keegan, increased costs, monetary losses and potential legal liability and adverse governmental action, all of which could have an adverse impact on Keegan’s future cash flows, earnings, results of operations and financial condition. The payment of any such liabilities would reduce the funds available to the Company. If Keegan is unable to fully fund the cost of remedying an environmental problem, it might be required to suspend operations or enter into costly interim compliance measures pending completion of a permanent remedy.

No assurance can be given that insurance to cover the risks to which Keegan’s activities are subject will be available at all or at commercially reasonable premiums. The Company is not currently covered by any form of environmental liability insurance, since insurance against environmental risks (including liability for pollution) or other hazards resulting from exploration and development activities is unavailable or prohibitively expensive. This lack of environmental liability insurance coverage could have an adverse impact on Keegan’s future cash flows, earnings, results of operations and financial condition.

Currency risk

Keegan’s operations are subject to fluctuations in currency exchange rates, which could materially adversely affect its financial position. Keegan maintains most of its working capital in United States dollars with a minimum reserve of six months of projected expenditures in Canadian dollars and Ghanaian Cedis. Keegan converts United States dollars funds to foreign currencies in anticipation of foreign currency denominated obligations. Accordingly, Keegan is subject to fluctuations in the rates of currency exchange between United States dollar and these foreign currencies, and these fluctuations could materially affect the Company’s financial position and results of operations. A significant portion of the operating costs at Esaase and Asumura is based on the US dollar and the Ghanaian Cedi.

- 20 -

Competition Risks

Keegan operates in a competitive industry and compete with other better established companies which have greater financial resources. Keegan faces strong competition from other mining companies in connection with exploration and the acquisition of properties producing, or capable of producing precious metals. Many of these companies have greater financial resources, operational experience and technical capabilities than us. As a result of this competition, Keegan may be unable to maintain or acquire attractive mining properties on terms we consider acceptable or at all. Consequently, our operations and financial condition could be materially adversely affected.

There can be no assurance that necessary funds can be raised by the Company or that any projected work will be completed.

Mining, processing, development and exploration activities depend on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important requirements, which affect capital and operating costs. Unusual or infrequent weather, phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company’s future operations, financial condition and results of operations.

Potential Joint Ventures

Due to the cost of establishing and operating mining operations, Keegan may enter into joint ventures on one or more of its properties. Any failure of such joint venture partners to meet their obligations to Keegan or to third parties could have a material adverse effect on the joint ventures and Keegan as a result. In addition, Keegan may be unable to exert influence over strategic decisions made in respect of such properties or may be unable to satisfy its own obligations under such joint ventures which could result in dilution of Keegan’s interests in its properties.

Limited Business History

Keegan has only recently commenced operations and has no history of operating earnings. The likelihood of success of Keegan must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the establishment of any business. Keegan has limited financial resources and there is no assurance that additional funding will be available to it for further operations or to fulfill its obligations under applicable agreements. There is no assurance that Keegan will ultimately generate revenues, operate profitably, or provide a return on investment, or that it will successfully implement its plans.

Conflicts of Interest

Keegan’s directors and officers are or may become directors or officers of other mineral resource companies or reporting issuers or may acquire or have significant shareholdings in other mineral resource companies and, to the extent that such other companies may participate in ventures in which Keegan may, or may also wish to participate, the directors and officers of Keegan may have a conflict of interest with respect to such opportunities or in negotiating and concluding terms respecting the extent of such participation. Keegan and its directors and officers will attempt to minimize such conflicts. In the event that such a conflict of interest arises at a meeting of the directors of Keegan, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In appropriate cases Keegan will establish a special

- 21 -

committee of independent directors to review a matter in which several directors, or officers, may have a conflict. In determining whether or not Keegan will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the potential benefits to Keegan, the degree of risk to which Keegan may be exposed and its financial position at that time. Other than as indicated, Keegan has no other procedures or mechanisms to deal with conflicts of interest.

Claims by Investors Outside of Canada

The Company is incorporated under the laws of British Columbia and its head office is located in Vancouver, British Columbia. The majority of the Company’s directors and officers, and some of the experts named herein, are residents of Canada or otherwise reside outside of the United States, and all or a substantial portion of their assets, and a substantial portion of the Company’s assets, are located outside of the United States. As a result, it may be difficult for investors in the United States or outside of Canada to bring an action against directors, officers or experts who are not resident in the United States. It may also be difficult for an investor to enforce a judgment obtained in a United States court or a court of another jurisdiction of residence predicated upon the civil liability provisions of federal securities laws or other laws of the United States or any state thereof or the equivalent laws of other jurisdictions of residence against those persons or the Company.

Risks Relating to Our Shares

Changes in the Market Price of Common Shares may be Unrelated to the Company’s Results of Operations and could have an Adverse Impact on the Company

The Company’s Common Shares are listed on the Exchange. The price of Keegan’s Common Shares is likely to be significantly affected by short-term changes in the gold price or in its financial condition or results of operations as reflected in its quarterly earnings reports. Other factors unrelated to the Company’s performance that may have an effect on the price of the Company’s Common Shares and may adversely affect an investors’ ability to liquidate an investment and consequently an investor’s interest in acquiring a significant stake in the Company include: a reduction in analytical coverage by investment banks with research capabilities; a drop in trading volume and general market interest in the Company’s securities; a failure to meet the reporting and other obligations under relevant securities laws or imposed by applicable stock exchanges could result in a delisting of Keegan’s Common Shares and a substantial decline in the price of the Common Shares that persists for a significant period of time.

As a result of any of these factors, the market price of Keegan’s Common Shares at any given point in time may not accurately reflect their long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Company may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

Price Volatility of Publicly Traded Securities

The market price of a publicly traded stock, especially a resource issuer like Keegan, is affected by many variables in addition to those directly related to exploration successes or failures. Such factors include the general condition of market for resource stocks, the strength of the economy generally, the availability and attractiveness of alternative investments and the breadth of the public market for the stock. The effect of these and other factors on the market price of Keegan’s common shares suggests Keegan’s shares will continue to be volatile. Therefore, investors could suffer significant losses if Keegan’s shares are depressed or illiquid when an investor seeks liquidity and needs to sell Keegan shares.

- 22 -

Resale of Offered Shares

The continued operation of Keegan will be dependent upon its ability to have exploration success and to procure additional financing. There can be no assurance that any such exploration success can be achieved or that other financing can be obtained. If Keegan is unable to achieve such success or obtain such additional financing, any investment in Keegan may be lost.

Future Sales May Affect the Market Price of the Common Shares

In order to finance future operations, the Company may raise funds through the issuance of additional Common Shares or the issuance of debt instruments or other securities convertible into Common Shares. Keegan cannot predict the size of future issuances of Common Shares or the issuance of debt instruments or other securities convertible into Common Shares or the dilutive effect, if any, that future issuances and sales of the Company’s securities will have on the market price of the Common Shares.

Dividend Policy

No dividends on the Common Shares of the Company have been paid by the Company to date. Payment of any future dividends, if any, will be at the discretion of the Company 's board of directors after taking into account many factors, including the Company's operating results, financial condition, and current and anticipated cash needs.

- 23 -

MINERAL PROJECTS

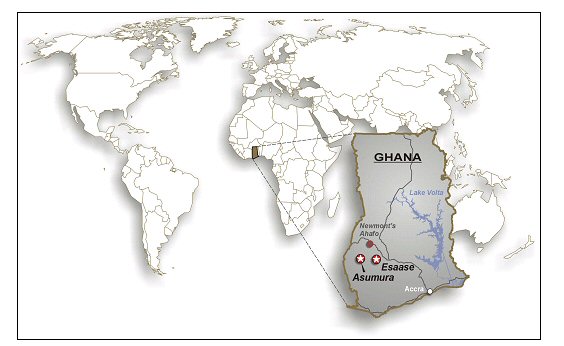

As at the date of this AIF, the Company’s mineral properties are the Esaase Property and the Asumura Property, both located in West Ghana, Africa.

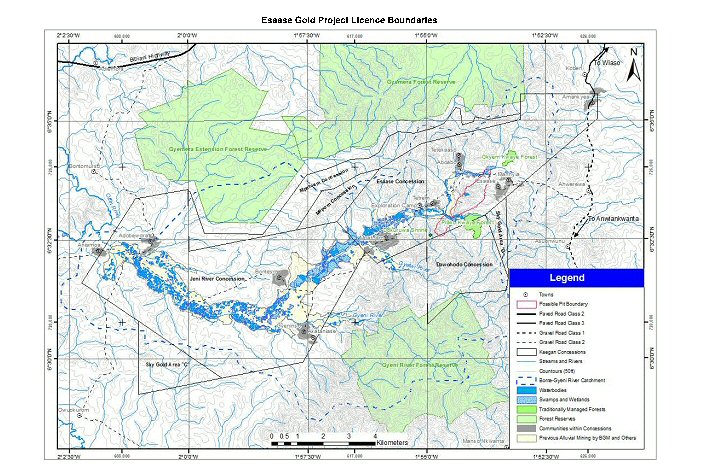

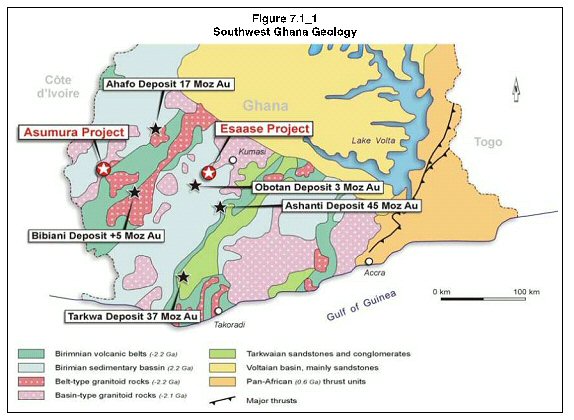

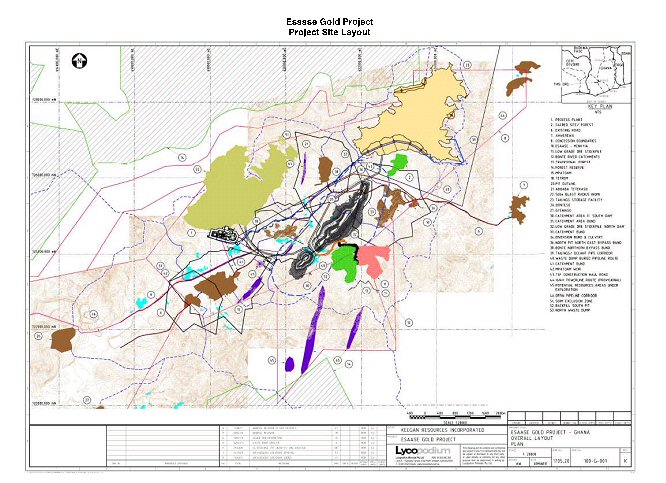

Esaase Gold Property

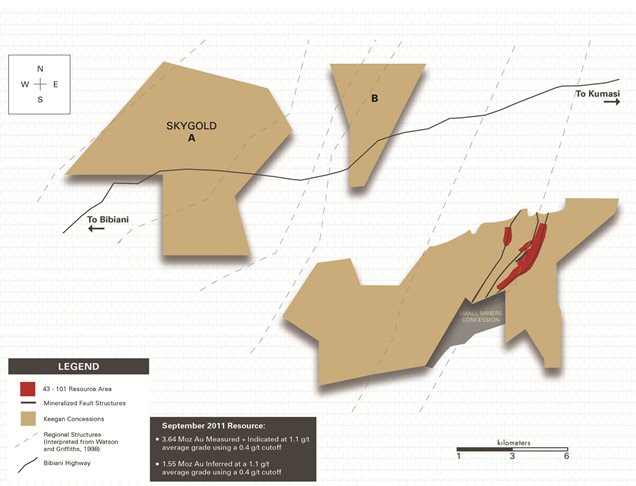

The Esaase Gold Property is a development stage property located in the Amansi East District of Ghana, approximately 35km south west of the regional capital Kumasi. The property consists of several mining concessions of which the three largest are the Esaase Concession, Jeni River Concession and Sky Gold Concession. The Esaase Concession is approximately 10km in a northeast direction by 4km in a northwest direction covering 42.32 square kilometers.

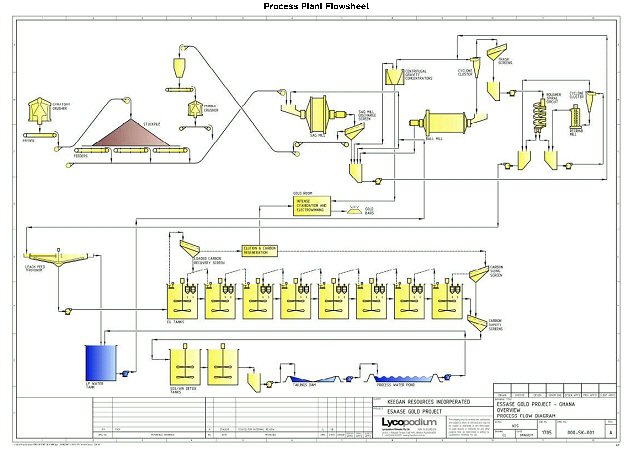

A PFS of the Project was completed in September 2011. The PFS was based on a gold price of $1,150 per ounce and a mill throughput rate of 9.0Mtpa for oxide material and 7.5Mtpa for fresh material.

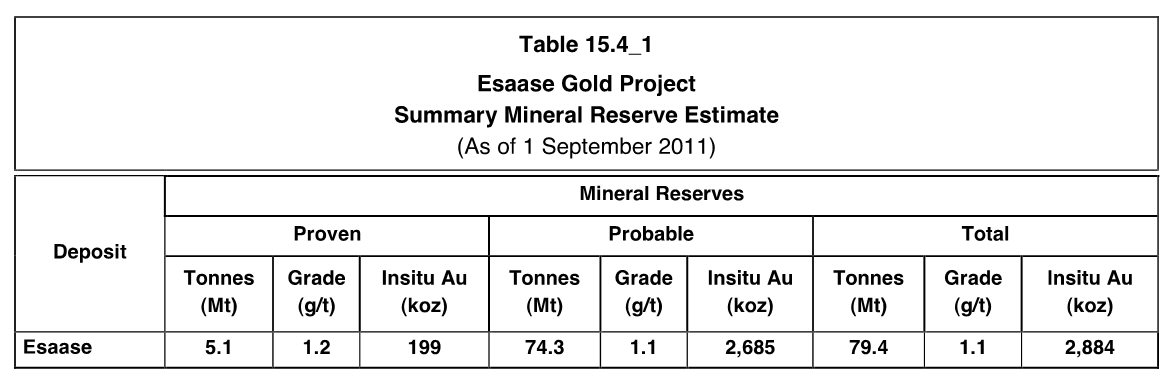

Development of the Project, with an estimated initial capital expenditure of $506M, will take an estimated 33 months from full project go-ahead to first gold production, followed by just over 10 years of process plant operations and one to two years of closure and rehabilitation activities. The Project is anticipated to recover 2.6Moz of gold at an average cash cost, inclusive of refining costs and royalties, of $772/oz. With the completion of the PFS, the Company established its first mineral reserves as follows:

|

Deposit

|

Mineral Reserves

|

||||||||

|

Proven

|

Probable

|

Total

|

|||||||

|

Tonnes

(Mt)

|

Grade

(g/t)

|

Insitu Au (koz)

|

Tonnes

(Mt)

|

Grade

(g/t)

|

Insitu Au

(koz)

|

Tonnes (Mt)

|

Grade

(g/t)

|

Insitu Au

(koz)

|

|

|

Esaase

|

5.1

|

1.2

|

199

|

74.3

|

1.1

|

2,685

|

79.4

|

1.1

|

2,884

|

Unless stated otherwise, information of a technical or scientific nature related to the Esaase Gold Property contained herein is summarized or extracted from a technical report dated September 22, 2011, titled “Esaase Gold Project, Ghana / 43-101 Technical Report” prepared by qualified persons Brian Wolfe, B Sc Hons (Geol), Post Grad Cert (Geostats), (MAusIMM), Christopher Waller, B AppSc (MAusIMM), and Harry Warries, M Eng (MAusIMM), as required under National Instrument 43-010, Standards of Disclosure for Mineral Projects, (“NI 43-101”), filed on SEDAR on November 4, 2011 (the “43-101 Report”).

Acquisition of Interest

On May 3, 2006, the Company entered into an option agreement with Sametro Co. Ltd. (“Sametro”) to purchase a 100% interest in the Esaase gold property in southwest Ghana, subject to the underlying 10% interest, 3% NSR of the Ghanaian government in all mining projects in Ghana, and a 0.5% NSR owed to the Bonte Liquidation Committee. Under the terms of the agreement, the Company was to make a series of cash payments totaling $890,000, issue 780,000 common shares and incur minimum exploration expenditures of $2,250,000 over a three year period.

During the year ended March 31, 2008, after having already made cash payments of $500,000, issued 40,000 common shares and completed the full exploration expenditure requirement, the Company renegotiated the option agreement so that all further cash and share payments were no longer owed. In lieu of these payments, the Company paid $850,000 to a creditor of Sametro and issued 40,000 additional common shares to Sametro. Subsequent to these payments, the Company was granted the full Esaase Mining Lease by the Minerals Commission and Minister of Mines, Lands and Forestry with no further obligation to any party aside from the NSR and government commitments.

- 24 -

During the year ended March 31, 2008, the Company purchased 100% private ownership of the Jeni Concession mining lease and exploration rights. The Jeni Concession lies directly to the southwest and contiguous to the Esaase Gold property. In consideration for the acquisition of the mining lease, Keegan paid $50,000 to the Bonte Liquidation Committee (“BLC”) and $50,000 to the Minerals Commission of Ghana for the title transfer. The Ghanaian government retains a standard 10% carried interest and 5% revenue royalty and the BLC retains a 0.5% NSR.

Both concessions are governed by mining leases that grant the Ghanaian government a standard 10% carried interest and a 5% royalty and the Bonte Liquidation Committee a 0.5% royalty. Subsequent to the granting of these mining leases, the Ghanaian government amended the royalty scheme in Ghana. (See Ghanaian mining royalties in this section).

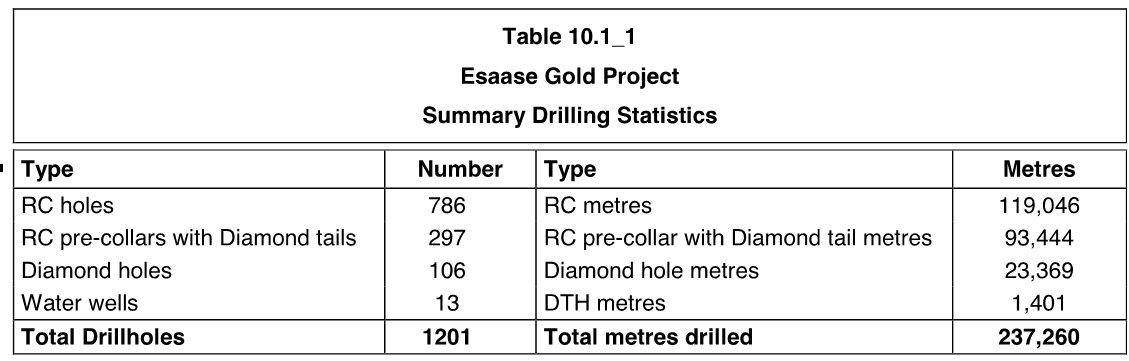

For the year ended March 31, 2012, the Company incurred $18.4 million of exploration and evaluation expenditures on its Esaase Gold Property. These costs were spent on continuing the exploration and evaluation drill program, further defining the existing resource through infill and exploration drilling and engineering, geotechnical and metallurgical drill programs and development and engineering studies in support of the Company’s pre-feasibility and feasibility studies.

A summary of the exploration and evaluation expenditures (including non-cash stock-based compensation) for the years ended March 31, 2012 and 2011 is presented as follows:

- 25 -

Summary of exploration and evaluation expenditures

|

2012

|

2011

|

|||||||

|

Esaase:

|

||||||||

|

Camp operations

|

$ | 1,091,202 | $ | 555,438 | ||||

|

Development support costs

|

559,643 | 1,879,304 | ||||||

|

Equipment and infrastructure

|

951,673 | 588,700 | ||||||

|

Engineering studies

|

2,989,662 | 2,020,526 | ||||||

|

Exploration drilling

|

2,933,027 | 4,479,279 | ||||||

|

Exploration support costs

|

1,703,947 | 4,218,925 | ||||||

|

Health and environmental

|

1,102,038 | 1,072,582 | ||||||

|

Technical and in-fill drilling

|

3,570,062 | 4,883,243 | ||||||

| Share-based compensation | 2,379,808 | 3,296,932 | ||||||

|

VAT receivable allowance

|

1,133,712 | 1,665,108 | ||||||

| $ | 18,414,774 | $ | 24,660,037 | |||||

The results of the PFS for the Esaase project indicate the technical feasibility and commercial viability of the extraction of mineral resources in the area. As per the Company’s accounting policy for exploration and evaluation expenditures (refer to note 3(g) in the annual consolidated financial statements as at and for the year ended March 31, 2012), once the technical feasibility and commercial viability of the extraction of mineral resources in an area of interest are demonstrable, further cost incurred for the development of the project are capitalized as mineral interests. Based on the positive result of the PFS the Company now has Proven and Probable Mineral reserves and effective October 1, 2011 began capitalizing costs associated with the development of the Esaase project. In the six months ended March 31, 2012 the Company capitalized $11.8 million of development costs to mineral interests.

|

Reconciliation of mineral interests

|

Year ended

|

Year ended

|

||||||

|

March 31, 2012

|

March 31, 2011

|

|||||||

|

Opening balance

|

$ | 10,581,692 | $ | 2,234,420 | ||||

|

Additions:

|

||||||||

|

Acquisition costs, Esaase

|

2,166,009 | 1,181,982 | ||||||

|

Development costs, Esaase

|

11,830,057 | - | ||||||

|

Asset retirement obligation

|

1,244,976 | 7,165,290 | ||||||

| 15,241,042 | 8,347,272 | |||||||

|

Closing balance

|

$ | 25,822,734 | $ | 10,581,692 | ||||

- 26 -

Acquisitions

Concession acquisitions during the year ended March 31, 2012