Galiano Gold Inc.: Exhibit 99.2 - Filed by newsfilecorp.com

GALIANO GOLD INC.

MANAGEMENT'S DISCUSSION AND ANALYSIS

For the three months ended March 31, 2023 and 2022

(Expressed in United States dollars)

TABLE OF CONTENTS

This Management's Discussion and Analysis ("MD&A") of Galiano Gold Inc. ("Galiano" or the "Company") has been prepared by management as of May 4, 2023 and should be read in conjunction with the Company's unaudited condensed consolidated interim financial statements and the notes thereto for the three months ended March 31, 2023 and 2022, the audited consolidated annual financial statements and the notes thereto for the year ended December 31, 2022 and the related MD&A. The unaudited condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard 34 - Interim Financial Reporting of the International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board.

Galiano was incorporated on September 23, 1999 under the Business Corporations Act of British Columbia, Canada.

Additional information on the Company, including its most recent Annual Information Form ("AIF"), is available under the Company's profile at www.sedar.com and the Company's website: www.galianogold.com.

All dollar amounts herein are expressed in United States dollars ("US dollars") unless stated otherwise. References to $ means US dollars and C$ are to Canadian dollars.

This MD&A contains forward-looking statements and should be read in conjunction with the risk factors described in sections "12. Risks and uncertainties" and "15. Cautionary statements" at the end of this MD&A.

1. First quarter 2023 highlights

The Asanko Gold Mine ("AGM") is a 50:50 joint venture ("JV") with Gold Fields Limited ("Gold Fields"), which is managed and operated by Galiano. Galiano owns a 45% equity interest in the entity that holds the AGM mining licenses.

1.1 Key Metrics of the AGM JV (on a 100% basis)

-

Safety: On February 6, 2023, the Company reported that two contractors had been fatally injured following an incident near the tailings storage facility ("TSF"). The Company has taken actions to further reinforce the Company's sustained commitment to Zero Harm and industry best practices in safety culture.

-

Production performance: Gold production of 32,678 ounces during the first quarter, in line with 2023 production guidance of 100,000 to 120,000 ounces.

-

Milling performance: Achieved milling throughput of 1.6 million tonnes ("Mt") of ore at a grade of 0.9 g/t during the quarter. Metallurgical recovery averaged 73% for the quarter, which was lower than prior periods due to processing lower grade stockpiles during Q1 2023.

-

Cost performance and cash flow: Total cash costs1 of $1,083/oz and AISC1 of $1,268/oz for the three months ended March 31, 2023. Additionally, the JV generated positive cash flow from operations of $18.9 million and Free Cash Flow1 of $12.0 million during the quarter.

-

Revised AISC guidance: 2023 AISC1 guidance for the AGM has been revised from between $1,900/oz to $1,975/oz to between $1,650/oz to $1,750/oz due to strong operational cost performance in Q1 2023.

-

Financial performance: Gold revenue of $65.1 million generated from 35,174 gold ounces sold at an average realized price of $1,850/oz for the quarter. Net income of $20.6 million during the quarter and Adjusted EBITDA1 of $22.9 million.

-

Exploration focus: Advanced the first phase of an exploration drilling program at Nkran South Extension with the aim of increasing mineral reserves by converting inferred mineral resources to indicated mineral resources between the current Nkran Cut 3 reserve shell and the $1,800/oz resource shell, as well as to test for new mineralization along the southern margin of the deposit.

-

Robust liquidity: $102.8 million in cash and cash equivalents, $7.0 million in gold sales receivables, $1.8 million in gold on hand and no debt as of March 31, 2023.

1.2 Highlights of the Company

-

Improved long-term outlook at the AGM: The Company published the details of a new life-of-mine (“LOM”) plan for the AGM on March 28, 2023 in a technical report titled “NI 43-101 Technical Report and Feasibility Study for Asanko Gold Mine, Ghana” with an effective date of December 31, 2022 (“2023 Technical Report”). The 2023 Technical Report was prepared independently by SRK Consulting (Canada) Inc. and includes the reinstatement of Mineral Reserves at the AGM. The new LOM plan identifies four main open-pit mining areas: Abore, Miradani North, Nkran and Esaase, and two satellite deposits: Dynamite Hill and Adubiaso (refer to section “2. Business overview”).

-

Stable balance sheet: Cash and cash equivalents of $56.2 million as at March 31, 2023, while remaining debt-free.

-

Positive earnings: Net income of $8.5 million or $0.04 per common share during the quarter, which includes the Company's share of the JV's net earnings for the quarter.

-

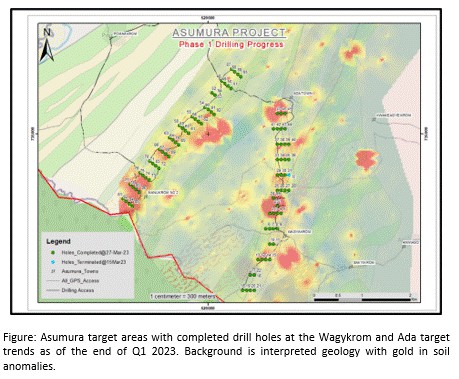

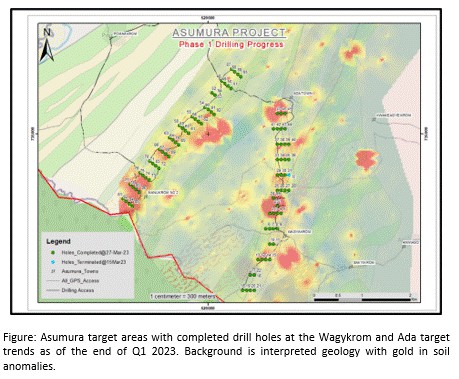

Generative exploration: During the quarter, the Company completed Phase 1 of its drilling program on its wholly owned Asumura property on the Sefwi gold belt in Ghana, designed to test for gold mineralization along two interpreted structural trends with coincident surface gold anomalies identified through soil sampling. A total of 95 holes were drilled for 12,467 metres in Phase 1, comprising 9,045 metres of reverse circulation drilling and 3,422 metres of diamond drilling.

___________________________

1 See "8. Non-IFRS measures"

2. Business overview

Galiano owns a 45% equity interest in the entity that holds the AGM mining licenses and gold exploration tenements (collectively the "joint venture" or "JV") on the Asankrangwa Gold Belt in the Republic of Ghana ("Ghana"), West Africa. Galiano is the operator of the JV and currently receives a gross annual service fee from the JV of $7.1 million. Gold Fields also owns a 45% equity interest in the AGM, with the Government of Ghana owning a 10% free-carried interest.

The AGM consists of four main open-pit mining areas: Abore, Miradani North, Nkran and Esaase, multiple satellite deposits and a carbon-in-leach (CIL) processing plant, with a current capacity of 5.8 Mt per annum.

In addition to its interest in the AGM, the Company holds the 100% owned Asumura property in Ghana.

Galiano is focused on creating a sustainable business capable of value creation for all stakeholders through production, exploration, accretive business acquisitions and disciplined deployment of its financial resources. The Company's shares are listed on the Toronto Stock Exchange and the NYSE American Exchange under the symbol "GAU".

2.1 Updated NI 43-101 Technical Report

On March 28, 2023, the Company published an updated National Instrument 43-101 ("NI 43-101") Technical Report for the AGM, which included the reinstatement of Mineral Reserves and demonstrated an improved long-term outlook for the mine. The adoption and implementation of the new LOM plan remains subject to approval pursuant to the JV agreement. Highlights of the 2023 Technical Report, on a 100% basis, include:

-

Proven Mineral Reserves of 7.2 Mt at 0.67 g/t for 0.2 million ounces ("Moz") gold contained and Probable Mineral Reserves of 41.7 Mt at 1.43 g/t for 1.9 Moz gold contained. Mineral Reserves were reported assuming a gold price of $1,500/oz.

-

Measured Mineral Resources of 7.4 Mt at 0.67 g/t for 0.2 Moz gold contained and Indicated Mineral Resources of 75.0 Mt at 1.39 g/t for 3.3 Moz gold contained, inclusive of Mineral Reserves. Mineral Resources were reported assuming a gold price of $1,800/oz.

-

Inferred Mineral Resources of 25.1 Mt at 1.34 g/t for 1.1 Moz gold contained.

-

21% increase in total Measured and Indicated ounces and a 251% increase in total Inferred ounces compared to the previous technical report dated February 28, 2022.

- Diversified feed source with 4 main open-pit mining areas: Abore, Miradani North, Esaase and Nkran, and 2 satellite deposits: Dynamite Hill and Adubiaso.

-

Robust mine economics with a $343 million after-tax NPV5% and a $478 million pre-tax NPV5%, applying a $1,700/oz gold price.

-

Low cash costs: $905/oz average total cash costs1 and $1,143/oz average AISC1 over the LOM.

-

Increased production profile: annual average gold production of 254,000 ounces from 2025 to 2030, inclusive, and LOM average annual production of 217,000 ounces per year.

-

Mining to recommence in 2023: mining contractors expected to be in operation at Abore during the fourth quarter.

For further information regarding the Mineral Reserve and Mineral Resource Estimates and to review scientific and technical information contained in the 2023 Technical Report, readers are encouraged to read the entire 2023 Technical Report found under the Company's SEDAR profile at www.sedar.com.

2.2 Key business developments in 2023

a) Mining Restart at the AGM

Several workstreams are ongoing to support a planned mining restart at the AGM during the fourth quarter of 2023, as scheduled in the 2023 Technical Report. The AGM has initiated a request for proposal for the mining contracts of the Abore, Miradani North and Esaase deposits to five contractors for competitive tender.

At Abore, crop compensation, engineering works for infrastructure, environmental management plans, engagement with catchment communities, and permitting with regulatory bodies are all well advanced. At Miradani North, preparatory works are still in early phases.

As Esaase was previously mined from 2018 to 2022, all infrastructure and permits are already in place.

Discussions remain ongoing with JV partners regarding approval of the AGM's 2023 operating plan.

2.3 Financial and operating highlights

| |

|

Three months ended March 31, |

|

| (All amounts in 000's of US dollars, unless otherwise stated) |

|

2023 |

|

|

2022 |

|

| Galiano Gold Inc. |

|

|

|

|

|

|

| Net income (loss) |

|

8,493 |

|

|

(1,537 |

) |

| Adjusted EBITDA1 |

|

6,739 |

|

|

(1,534 |

) |

| Cash and cash equivalents |

|

56,173 |

|

|

50,384 |

|

| |

|

|

|

|

|

|

| Asanko Gold Mine (100% basis) |

|

|

|

|

|

|

| Financial results |

|

|

|

|

|

|

| Revenue |

|

65,193 |

|

|

77,532 |

|

| Income from mine operations |

|

24,657 |

|

|

10,552 |

|

| Net income (loss) |

|

20,614 |

|

|

(13,638 |

) |

| Adjusted net income1 |

|

20,614 |

|

|

7,362 |

|

| Adjusted EBITDA1 |

|

22,863 |

|

|

13,105 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents |

|

102,750 |

|

|

45,298 |

|

| Cash generated from operating activities |

|

18,943 |

|

|

3,925 |

|

| Free cash flow1 |

|

11,959 |

|

|

(3,363 |

) |

| AISC margin1 |

|

20,471 |

|

|

12,034 |

|

| |

|

|

|

|

|

|

| Key mine performance data |

|

|

|

|

|

|

| Gold produced (ounces) |

|

32,678 |

|

|

42,343 |

|

| Gold sold (ounces) |

|

35,174 |

|

|

41,929 |

|

| |

|

|

|

|

|

|

| Average realized gold price ($/oz) |

|

1,850 |

|

|

1,846 |

|

| |

|

|

|

|

|

|

| Total cash costs ($ per gold ounce sold)1 |

|

1,083 |

|

|

1,361 |

|

| AISC ($ per gold ounce sold)1 |

|

1,268 |

|

|

1,559 |

|

2.4 Environmental, Social and Corporate Governance ("ESG")

Sustainability is at the core of the Company's business strategy. The Company believes that a comprehensive sustainability strategy is integral to meeting its strategic objectives as it will assist the JV to positively support relationships with its local and external stakeholders, improve its risk management, reduce the AGM's cost of production and both directly and indirectly benefit the catchment communities that the JV and the Company operate in, beyond the life of the JV's mines.

The Company implements its sustainability strategy with a focus on four key areas: (1) protecting human rights; (2) occupational health and safety of our employees and local communities; (3) advancing the socio-economic welfare and health of local catchment communities; and (4) managing environmental impacts of our operations. For further details on the Company's sustainability strategy, refer to the Company's 2021 Sustainability Report published on August 23, 2022 and which is available on the Company's website at www.galianogold.com.

In March 2022, the United States Securities and Exchange Commission ("SEC") announced plans to enhance and standardize climate-related disclosures for reporting issuers. The proposed disclosure rules would require reporting issuers to disclose both climate-related risks that are reasonably likely to have a material impact on their business, results of operations or financial condition, in addition to Scope 1, Scope 2 and certain Scope 3 emissions. The SEC has yet to finalize its ESG disclosure rules for reporting issuers, however it is expected that the rules and an implementation plan will be announced in 2023.

In October 2021, the Canadian Securities Administrators ("CSA") published proposed climate-related disclosure rules, the foundation of which are aligned with the Task Force for Climate-Related Financial Disclosure ("TCFD") recommendations. The CSA is currently reviewing comment letters received on its proposed climate-related disclosure rules, as well as analyzing key differences between its proposed rules and those of the SEC.

During the first quarter of 2023, the Company advanced its Climate-Related Financial Disclosure assessment in alignment with the TCFD recommendations and remains on track for completion this year. For further information on the Company's approach and policies on ESG, refer to the Company's MD&A for the year ended December 31, 2022 which is available on www.sedar.com and the Company's website.

2.5 Macroeconomic factors

During the three months ended March 31, 2023, the average London PM gold price was $1,890/oz while gold prices traded in a range from $1,805/oz to $2,010/oz. With inflation readings in Canada and the US declining, market expectations for further central bank rate increases have reduced significantly. The Bank of Canada has already communicated that it will pause its rate hiking cycle while the effects of higher interest rates filter through the economy. In the US, market participants are pricing in rate cuts by the US Federal Reserve by the end of 2023. In response to the rate cut expectations, the yield on US 10-year Treasuries declined from a high 4.09% in Q1 2023 to 3.47% at March 31, 2023. Declining US Treasury yields has put further downward pressure on the US dollar, which is generally viewed as a positive for gold prices.

Rising gold prices benefitted the JV's operating performance during the quarter, and consequently the Company's share of the JV's net income. Management continues to evaluate opportunities to hedge the JV's gold price risk, particularly in light of an expected capital intensive period in the second half of 2023 in anticipation of a restart of mining operations at the AGM by Q4 2023.

3. Guidance and outlook

3.1 2023 Guidance for the AGM JV (100% basis)

The Company provided preliminary guidance for 2023 based on the new LOM plan for the AGM, which outlined production of between 100,000 to 120,000 ounces at AISC1 between $1,900/oz and $1,975/oz. Given the strong performance in Q1 2023, AISC1 is now expected to be between $1,650/oz to $1,750/oz. AISC1 is still anticipated to be elevated in 2023 compared to the LOM average primarily due to waste stripping necessary to restart mining at Abore, which will benefit future years production, as well as higher expenditures on the TSF.

The Company is not adjusting capital guidance, and it continues to work on obtaining the necessary joint venture approvals and develop a detailed mining restart plan that may impact the timing of capital expenditures in 2023. It is currently expected that $38 million of sustaining capital expenditures, excluding capitalized waste stripping, will be spent on the TSF Stage 7 expansion, plant infrastructure and water management in 2023 (spend as of March 31, 2023: $4.9 million). Additionally, development capital of $24 million is expected to be spent on Abore and Miradani North site establishments (spend as of March 31, 2023: $0.9 million).

For 2023, the exploration budget at the AGM is estimated at $15 million (spend as of March 31, 2023: $3.5 million), which includes approximately 40,000 metres of drilling, as well as ground geophysics, trenching, soil sampling and regional mapping. The 2023 exploration program is focused on targeting discoveries on underexplored greenfield areas of the AGM tenements, as well as increasing the Mineral Reserve and Mineral Resources at known deposits.

___________________________

1 See "8. Non-IFRS measures"

4. Results of the AGM

All results of the AGM in this section are on a 100% basis, unless otherwise noted. The Company's attributable equity interest in the AGM is 45%.

4.1 Operating performance

The following table and subsequent discussion provide a summary of the operating performance of the AGM (on a 100% basis) for the three months ended March 31, 2023 and 2022, unless otherwise noted.

| |

|

Three months ended March 31, |

|

| Key mine performance data of the AGM (100% basis) |

|

2023 |

|

|

2022 |

|

| Mining |

|

|

|

|

|

|

| Ore tonnes mined (000 t) |

|

- |

|

|

1,075 |

|

| Waste tonnes mined (000 t) |

|

- |

|

|

5,279 |

|

| Total tonnes mined (000 t) |

|

- |

|

|

6,354 |

|

| Strip ratio (W:O) |

|

- |

|

|

4.9 |

|

| Average gold grade mined (g/t) |

|

- |

|

|

1.3 |

|

| Mining cost ($/t mined) |

|

- |

|

|

4.64 |

|

| |

|

|

|

|

|

|

| Ore transportation |

|

|

|

|

|

|

| Ore transportation from Esaase (000 t) |

|

1,367 |

|

|

1,304 |

|

| Ore transportation cost ($/t trucked) |

|

5.51 |

|

|

5.82 |

|

| |

|

|

|

|

|

|

| Processing |

|

|

|

|

|

|

| Tonnes milled (000 t) |

|

1,566 |

|

|

1,482 |

|

| Average mill head grade (g/t) |

|

0.9 |

|

|

1.3 |

|

| Average recovery rate (%) |

|

73% |

|

|

69% |

|

| Processing cost ($/t milled) |

|

9.78 |

|

|

9.46 |

|

| G&A costs ($/t milled)2 |

|

4.09 |

|

|

6.17 |

|

| Gold produced (ounces) |

|

32,678 |

|

|

42,343 |

|

| Gold sold (ounces) |

|

35,174 |

|

|

41,929 |

|

| |

|

|

|

|

|

|

| All-in sustaining costs1 |

|

|

|

|

|

|

| AISC ($ per gold ounce sold)1 |

|

1,268 |

|

|

1,559 |

|

| AISC margin ($ per gold ounce sold)1 |

|

582 |

|

|

287 |

|

2 Excludes Galiano's service fee for the three months ended March 31, 2023 and 2022, and for the three months ended March 31, 2022 severance costs associated with the AGM's workforce restructuring.

a) Health and safety

On February 6, 2023, the Company reported that two contractors had been fatally injured following an incident near the TSF. The Company has taken actions to further reinforce the Company's sustained commitment to Zero Harm and industry best practices in safety culture. For the three months ended March 31, 2023, the lost-time injury ("LTI") and total recordable injury ("TRI") frequency rates were 0.00 and 3.38 per million employee hours worked, respectively. The 12-month rolling LTI and TRI frequency rates are 0.00 and 1.02 per million employee hours worked, respectively. The Company reports recordable LTI and TRI cases in accordance with the International Council on Mining and Metals principles.

b) Mining

As previously communicated, the AGM processed ore from existing stockpiles during the quarter and as such there was no mining activity. The AGM did incur $2.2 million of ore rehandle and mining overhead costs during the quarter.

c) Ore transportation

During the quarter, 1.4 Mt of stockpiled ore was trucked from the Esaase pit to the processing plant, compared to 1.3 Mt in Q1 2022.

d) Processing

The AGM produced 32,678 ounces of gold during Q1 2023, as the processing plant achieved milling throughput of 1.6 Mt of ore at a grade of 0.9 g/t with metallurgical recovery averaging 73%. Recovery was lower than prior periods due mainly to processing of lower grade stockpiles and was in line with expectations.

The 1.6 Mt of low grade stockpiled ore processed during the quarter had no accounting book value, and as such had no mining cost attributed to it. Stockpiled ore fed to the processing plant during the quarter yielded ounces that were in line with expectations, keeping the AGM on track to achieve its production guidance for the year of 100,000oz to 120,000oz. The nature of stockpiled ore, however, can result in highly variably grades; therefore, the current quarter performance may not be indicative of future performance.

Processing cost per tonne for Q1 2023 was $9.78 compared to $9.46 in Q1 2022. Processing costs were higher in Q1 2023 due to inflationary pressures on key reagents and consumables ($2.4 million increase from Q1 2022). This was partly offset by lower labour costs in Q1 2023 resulting from the restructuring of the AGM's workforce at the end of Q1 2022 ($1.3 million decrease).

e) Total cash costs and AISC

For the three months ended March 31, 2023, total cash costs1 were $1,083/oz compared to the three months ended March 31, 2022 of $1,361/oz. Although gold sales volumes decreased by 16% in Q1 2023, total cash costs per ounce1 were lower in Q1 2023 compared to Q1 2022 as a result of lower mining contractor costs and the processing of ore that had no carrying value for accounting purposes. In addition, labour costs were lower in Q1 2023 ($4.5 million decrease) as a result of the AGM's workforce restructuring completed at the end of Q1 2022. These factors were partly offset by general inflationary pressures on key reagents and other consumables.

Relative to Q4 2022, total cash costs1 were higher in Q1 2023, increasing by 5% from $1,031/oz to $1,083/oz. Total cash costs per ounce1 were higher in Q1 2023 due to the mill feed being sourced solely from Esaase, which resulted in an increase to ore transportation costs ($4.4 million increase). This was partly offset by a reduction in ore rehandle costs ($1.4 million decrease) in Q1 2023 as processed ore was trucked directly from Esaase to the primary crusher and a 3% increase in gold ounces sold.

For the three months ended March 31, 2023, AlSC1 for the AGM amounted to $1,268/oz compared to $1,559/oz for the three months ended March 31, 2022. The decrease in AlSC1 from Q1 2022 to Q1 2023 was predominantly due to the decrease in total cash costs per ounce1 mentioned above and lower sustaining lease payments ($105/oz decrease) resulting from the temporary cessation of mining since the end of Q2 2022. This was partly offset by an increase in sustaining capital expenditures ($92/oz increase) relating to a TSF lift.

Relative to Q4 2022, AlSC1 increased by 6% from $1,191/oz to $1,268/oz. The increase in AISC1 was primarily due to the increase in total cash costs per ounce1 mentioned above. In addition, sustaining capital expenditures were $27/oz higher in Q1 2023 primarily related to a TSF lift.

For the three months ended March 31, 2023, the AGM incurred non-sustaining capital and exploration expenditures (net of changes in payables) of $4.4 million compared to $3.4 million in Q1 2022. Non-sustaining capital expenditures during Q1 2023 amounted to $0.9 million and related primarily to developing the AGM's new LOM plan and early works at Abore, while $3.5 million of non-sustaining exploration expenditures were incurred related to drilling at Nkran South and Miradani Central.

4.2 Exploration update

The JV holds a district-scale land package of 476km2 on the prospective and underexplored Asankrangwa Gold Belt. The following exploration programs were undertaken during the period to evaluate the current and potential expanded mineralization of each deposit to improve the mineral resource estimate and to assess the broader potential of each deposit.

- Nkran South - Drilling at Nkran South Extension has an objective of increasing mineral reserves by converting inferred mineral resources to indicated mineral resources between the current Nkran Cut 3 reserve shell and the $1,800/oz resource shell, as well as to test for new mineralization along the southern margin of the deposit. This initial phase consists of a planned 15 holes totaling 6,000m and will be drilled as part of 8 vertical fences spaced approximately 35m apart immediately along strike to the south of the current Nkran reserve shell. As of March 31, 2023, 12 holes have been completed for 6,228m.

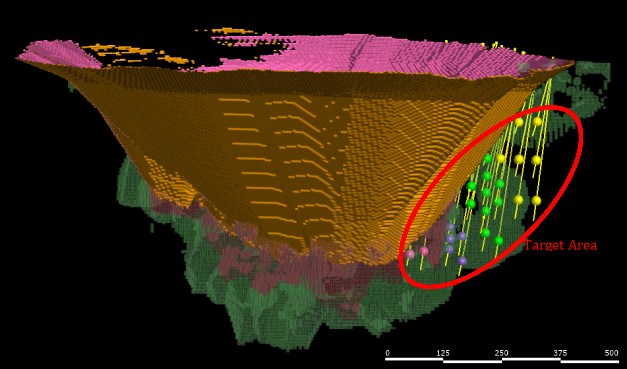

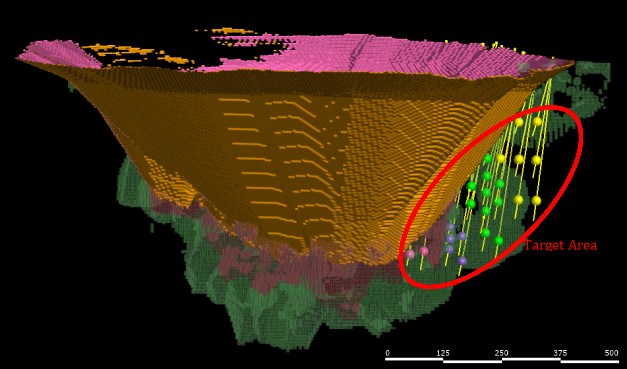

Figure: Targeted exploration pierce points for Nkran South extension drilling.

-

Miradani Central - Drilling at Miradani Central is focused on closing off the gap between the Miradani North resource and the Miradani Central deposit. During the quarter, the JV completed 7 holes for 1,450m. While mineralization was intersected in several holes at the Miradani Central target, the potential for economically viable mineralization is considered limited and no further work is planned in this area at this time.

-

Kaniago West - Drilling at Kaniago West is aimed at evaluating the strike and depth extent of the deposit in order to assess potential economic viability. During the quarter, the JV drilled 375m of a planned 7,200m.

-

Abore Sterilization - Sterilization drilling in areas of planned future mining infrastructure at Abore is underway. During the quarter, the JV drilled 961m of a planned 2,960m.

In addition to the drill programs above, the JV also initiated geophysical surveys and soil sampling programs on the AGM's other deposits to identify potential drilling targets.

4.3 Financial results

The following table presents excerpts of the financial results of the JV for the three months ended March 31, 2023 and 2022. These results are presented on a 100% basis.

Three months ended March 31, 2023 and 2022

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars) |

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

| Revenue |

|

65,193 |

|

|

77,532 |

|

| |

|

|

|

|

|

|

| Cost of sales: |

|

|

|

|

|

|

| Production costs |

|

(34,942 |

) |

|

(53,225 |

) |

| Depreciation and depletion |

|

(2,329 |

) |

|

(9,878 |

) |

| Royalties |

|

(3,265 |

) |

|

(3,877 |

) |

| Income from mine operations |

|

24,657 |

|

|

10,552 |

|

| |

|

|

|

|

|

|

| Exploration and evaluation expenditures |

|

(1,770 |

) |

|

(2,858 |

) |

| General and administrative expenses |

|

(726 |

) |

|

(21,881 |

) |

| Income (loss) from operations |

|

22,161 |

|

|

(14,187 |

) |

| Finance expense |

|

(1,234 |

) |

|

(727 |

) |

| Finance income |

|

939 |

|

|

30 |

|

| Foreign exchange (loss) gain |

|

(1,252 |

) |

|

1,246 |

|

| Net income (loss) for the period |

|

20,614 |

|

|

(13,638 |

) |

| Adjusted net income for the period1 |

|

20,614 |

|

|

7,362 |

|

| |

|

|

|

|

|

|

| Average realized price per gold ounce sold ($) |

|

1,850 |

|

|

1,846 |

|

| Average London PM fix ($/oz) |

|

1,890 |

|

|

1,877 |

|

| Gold sold (ounces) |

|

35,174 |

|

|

41,929 |

|

a) Revenue

During Q1 2023, the AGM sold 35,174 ounces of gold at an average realized gold price of $1,850/oz for total revenue of $65.2 million (including $0.1 million of by-product silver revenue). During Q1 2022, the AGM sold 41,929 ounces of gold at an average realized gold price of $1,846/oz for total revenue of $77.5 million (including $0.1 million of by-product silver revenue). The decrease in revenue quarter-on-quarter was primarily a function of a 16% reduction in sales volumes relative to Q1 2022.

The AGM continues to sell all the gold it produces to a special purpose vehicle of Red Kite Opportunities Master Fund Limited ("Red Kite") under an offtake agreement (the "Offtake Agreement). The terms of the Offtake Agreement require the AGM to sell 100% of its gold production up to a maximum of 2.2 million ounces to Red Kite. As of March 31, 2023, 1,502,279 gold ounces have been delivered to Red Kite under the Offtake Agreement (December 31, 2022 - 1,467,105 gold ounces delivered).

During the three months ended March 31, 2023, the AGM sold a portion of its production to the Bank of Ghana under the country's gold buying program. As agreed with Red Kite, gold ounces sold to the Bank of Ghana were considered delivered under the Offtake Agreement, and in consideration the AGM paid to Red Kite a "make whole" payment which was calculated in a similar manner to a nine‐day quotational period. The "make whole" payments made to Red Kite were recognized as a reduction of revenues.

b) Production costs and royalties

During the three months ended March 31, 2023, the AGM incurred production costs of $34.9 million compared to $53.2 million in the comparative period of 2022.

Production costs were lower in Q1 2023 primarily due to 16% fewer gold ounces sold, lower mining contractor costs and processing ore that had no carrying value for accounting purposes. Additionally, labour costs were lower in Q1 2023 resulting from the restructuring of the AGM's workforce completed at the end of Q1 2022 ($4.5 million decrease). These factors were partly offset by inflationary pressures on key reagents and other consumables as previously discussed.

The Ghanaian government charges a 5% royalty on revenues earned through sales of minerals from the AGM's concessions. The AGM's Akwasiso mining concession is also subject to a further 2% net smelter return royalty payable to the previous owner of the mineral tenement; additionally, the AGM's Esaase concession is also subject to a 0.5% net smelter return royalty payable to the Bonte Liquidation Committee, both of which are presented in production costs. Royalties payable to the Government of Ghana are presented as a component of cost of sales and amounted to $3.3 million for the three months ended March 31, 2023 (three months ended March 31, 2022 - $3.9 million). Royalty expense was lower in Q1 2023 due to lower revenues.

c) Depreciation and depletion

Depreciation and depletion on mineral properties, plant and equipment ("MPP&E") recognized during Q1 2023 was $2.3 million compared to $9.9 million for Q1 2022. Depreciation and depletion expense was lower in Q1 2023 due to fewer gold ounces sold; lower depreciation on mining related assets resulting from the temporary cessation of mining at the end of Q2 2022; processing existing stockpiles that had no carrying value for accounting purposes; and lower depreciation on capitalized leases ($3.0 million decrease). These factors were partly offset by a $63.2 million impairment reversal on MPP&E recorded at December 31, 2022.

d) Exploration and evaluation ("E&E") expenditures

During the three months ended March 31, 2023, the AGM incurred E&E expenses of $1.8 million (see 4.2 "Exploration update") compared to $2.9 million of E&E expenses in the comparative period of 2022. E&E expenses were higher in Q1 2022 as drilling programs were undertaken at Miradani to support the AGM's updated Mineral Reserve and Mineral Resource estimates, as well as to assess the underground potential at Nkran.

e) General and administrative ("G&A") expenses

During the three months ended March 31, 2023, the AGM incurred G&A expenses of $0.7 million compared to $21.9 million in Q1 2022. G&A expense was higher in Q1 2022 due to the recognition of a $21.0 million severance provision related to the AGM's workforce restructuring.

f) Finance expense

Finance expense for the three months ended March 31, 2023 was higher than the comparative period due to $0.5 million of unrealized losses on gold hedging instruments. During the quarter, the AGM entered into zero cost gold collar ("ZCCs") hedges for a portion of its forecast 2023 production. All gold hedges related to Q1 2023 production expired unutilized. In Q1 2022, the AGM did not have any gold hedging instruments.

g) Finance income

Finance income for the three months ended March 31, 2023 was higher than the comparative period due to higher interest rates earned on cash balances and short-term investments (maturities of 90 days or less).

h) Legal provision

A services provider of the AGM filed a dispute with an arbitration tribunal alleging the AGM breached the terms of a services agreement and claimed approximately $25 million in damages. A provision of $2.0 million has been recorded as of March 31, 2023 as management's best estimate to settle the claim. While the Company cannot reasonably predict the ultimate outcome of these actions, and inherent uncertainties exist in predicting such outcomes, the Company believes the estimated provision is reasonable based on the information currently available.

4.4 Cash flows

The following table provides a summary of cash flows for the AGM on a 100% basis for the three months ended March 31, 2023 and 2022:

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars) |

|

$ |

|

|

$ |

|

| Cash provided by (used in): |

|

|

|

|

|

|

| Operating activities |

|

18,943 |

|

|

3,925 |

|

| Investing activities |

|

(6,609 |

) |

|

(2,456 |

) |

| Financing activities |

|

(428 |

) |

|

(4,937 |

) |

| Impact of foreign exchange on cash and cash equivalents |

|

(427 |

) |

|

(445 |

) |

| Increase (decrease) in cash and cash equivalents during the period |

|

11,479 |

|

|

(3,913 |

) |

| Cash and cash equivalents, beginning of period |

|

91,271 |

|

|

49,211 |

|

| Cash and cash equivalents, end of period |

|

102,750 |

|

|

45,298 |

|

a) Cash flows from operating activities

During Q1 2023, the AGM generated cash flows from operations of $18.9 million due to strong AISC margins1 of $582/oz (three months ended March 31, 2022 - $287/oz).

b) Cash used in investing activities

During Q1 2023, the AGM invested $7.5 million in additions to MPP&E and earned $0.9 million of interest on cash balances. Total cash expenditure on MPP&E during the quarter included $4.9 million in sustaining capital related primarily to raising the height of the TSF and development capital expenditure was $2.6 million primarily from a drilling program at Nkran South, early works at Abore and costs associated with developing the AGM's LOM plan.

The increase in cash flows invested in MPP&E in Q1 2023 resulted from higher sustaining capital expenditures ($2.9 million increase) related to raising the height of the TSF, and higher development capital ($2.1 million increase) related to a drilling program at Nkran South, early works at Abore and updating the AGM's LOM plan.

c) Cash used in financing activities

During Q1 2023, $0.4 million of cash used in financing activities related primarily to lease payments on the JV's ore haulage contracts. This compares to $4.9 million of cash used in financing activities in Q1 2022, which related to lease payments on the JV's services and mining contractor lease agreements. The decrease in cash used in financing activities in Q1 2023 was due to the temporary cessation of mining activities at the end of Q2 2022 resulting in lower lease payments.

d) Liquidity position

In October 2019, the JV entered into a $30.0 million revolving credit facility ("RCF") with Rand Merchant Bank. During the year ended December 31, 2022, the maturity date of the RCF was extended to September 30, 2023 (with utilization subject to credit review) and the AGM will pay a facility maintenance fee of 0.70% per annum. As at March 31, 2023, the balance drawn under the RCF was nil (December 31, 2022 - nil).

As at March 31, 2023, the JV held cash and cash equivalents of $102.8 million, $7.0 million in receivables from gold sales and $1.8 million in gold on hand. This compares to December 31, 2022 when the JV held $91.3 million in cash and cash equivalents, $2.7 million in receivables from gold sales and $3.6 million in gold on hand.

The Company does not control the funds of the JV. The liquidity of the Company is further discussed in section "7. Liquidity and capital resources".

e) Gold price hedges

During the quarter, the AGM entered into ZCCs to mitigate gold price risk and protect AISC1 margins. The ZCCs cover approximately 50% of the AGM's forecast 2023 gold production with put strikes between $1,750/oz to $1,900/oz and call strikes between $2,036/oz to $2,222/oz. All gold hedges related to Q1 2023 production expired unutilized.

5. Results of the Company

5.1 Financial performance

The following table is a summary of the Consolidated Interim Statements of Operations and Comprehensive Income (Loss) of the Company for the three months ended March 31, 2023 and 2022.

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars, except per share amounts) |

|

$ |

|

|

$ |

|

| Share of net income related to joint venture |

|

9,307 |

|

|

- |

|

| Service fee earned as operators of joint venture |

|

1,418 |

|

|

1,307 |

|

| General and administrative expenses |

|

(3,850 |

) |

|

(2,752 |

) |

| Exploration and evaluation expenditures |

|

(1,413 |

) |

|

(137 |

) |

| Income (loss ) from operations and joint venture |

|

5,462 |

|

|

(1,582 |

) |

| Finance income |

|

3,016 |

|

|

43 |

|

| Finance expense |

|

(6 |

) |

|

(9 |

) |

| Foreign exchange gain |

|

21 |

|

|

11 |

|

| Net income (loss) and comprehensive income (loss) for the period |

|

8,493 |

|

|

(1,537 |

) |

| |

|

|

|

|

|

|

| Weighted average number of shares outstanding: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Basic |

|

224,943,453 |

|

|

224,943,453 |

|

| Diluted |

|

224,944,779 |

|

|

224,943,453 |

|

| |

|

|

|

|

|

|

| Net income (loss) per share: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Basic |

|

0.04 |

|

|

(0.01 |

) |

| Diluted |

|

0.04 |

|

|

(0.01 |

) |

a) Share of net income related to the AGM JV

For the three months ended March 31, 2023, the Company recognized its 45% interest in the JV's net earnings which amounted to $9.3 million. For the three months ended March 31, 2022, the Company did not recognize its share of the JV's net loss as the carrying value of the Company's investment in the JV was nil as at March 31, 2022.

b) Service fee earned as operators of the AGM JV

Under the terms of the Joint Venture Agreement ("JVA"), the Company is the operator of the AGM and, in consideration for managing the operations of the mine, currently receives a gross annual service fee from the JV of $7.1 million (originally $6.0 million per annum, but adjusted annually for inflation). For the three months ended March 31, 2023, the Company earned a gross service fee of $1.8 million (less withholding taxes payable in Ghana of $0.4 million).

During the three months ended March 31, 2022, the Company earned a gross service fee of $1.6 million (less withholding taxes of $0.3 million). The increase in the gross service fee during Q1 2023 was due to an annual inflationary adjustment made in Q3 2022.

c) G&A expenses

G&A expenses for the three months ended March 31, 2023 and 2022 comprised the following:

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars) |

|

$ |

|

|

$ |

|

| Wages, benefits and consulting |

|

(1,491 |

) |

|

(2,364 |

) |

| Office, rent and administration |

|

(314 |

) |

|

(299 |

) |

| Professional and legal |

|

(153 |

) |

|

(149 |

) |

| Share-based compensation |

|

(1,597 |

) |

|

182 |

|

| Travel, marketing, investor relations and regulatory |

|

(259 |

) |

|

(85 |

) |

| Depreciation |

|

(36 |

) |

|

(37 |

) |

| Total G&A expense |

|

(3,850 |

) |

|

(2,752 |

) |

G&A expenses in Q1 2023 were $1.1 million higher than Q1 2022 primarily due to a $1.8 million increase in share-based compensation expense resulting from deferred share units granted during the quarter and an increase in the fair value of long-term incentive plan awards linked to the Company's share price. Additionally, travel and marketing costs increased by $0.2 million as the new management team were heavily focused on external stakeholder engagement. These factors were partially offset by a $0.9 million decrease in wages, benefits, and consulting expense as the prior period contained costs related to corporate development initiatives.

d) E&E expenditures

E&E expenses for the three months ended March 31, 2023 were $1.3 million higher than Q1 2022 due to a Phase 1 drilling campaign undertaken on the Company's wholly owned Asumura property in Ghana. During the comparative period, E&E expenses primarily related to holding costs on the Company's wholly owned Mali properties.

e) Finance income

Finance income includes changes in the fair value of the Company's preferred share investment in the JV and interest earned on cash balances and short-term investments with maturities less than 90 days. For the three months ended March 31, 2023, the Company recognized a $2.3 million upward fair value adjustment on its preferred shares in the JV (three months ended March 31, 2022 - nil). The upward fair value adjustment on preferred shares in Q1 2023 related to the unwinding of the discount rate.

Interest earned on cash balances and short-term investments was also $0.6 million higher during the three months ended March 31, 2023, relative to Q1 2022, due to rising interest rates.

5.2 Exploration update

During the quarter, the Company completed a Phase 1 drilling program on its wholly owned Asumura property on the Sefwi gold belt in Ghana, designed to test for gold mineralization along two interpreted structural trends with coincident surface gold anomalies identified through soil sampling. Drilling consisted of reverse circulation ("RC") pre-collars through regolith and saprolite followed by diamond drill ("DD") tails to an average depth of approximately 150m. The diamond core is oriented and will be critical for gaining an understanding of the local lithologies, structure and alteration in this area. As of March 31, 2023, a total of 95 holes were drilled for 12,467m, comprising 9,045m of RC and 3,422m of DD.

The Company is currently evaluating an extension of the Phase 1 program with additional targets identified for drilling.

6. Selected quarterly financial data

The following table provides a summary of unaudited financial data for the last eight quarters. Except for basic and diluted income (loss) per share, the totals in the following table are presented in thousands of US dollars.

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

|

Q1 |

|

|

Q4 |

|

|

Q3 |

|

|

Q2 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Share of net income (loss) related to joint venture |

|

9,307 |

|

|

46,517 |

|

|

- |

|

|

- |

|

|

- |

|

|

(74,063 |

) |

|

3,448 |

|

|

5,713 |

|

| Service fee earned as operators of joint venture |

|

1,418 |

|

|

1,418 |

|

|

1,381 |

|

|

1,307 |

|

|

1,307 |

|

|

1,307 |

|

|

1,284 |

|

|

1,240 |

|

| General and administrative expenses |

|

(3,850 |

) |

|

(2,854 |

) |

|

(3,490 |

) |

|

(2,004 |

) |

|

(2,752 |

) |

|

(3,109 |

) |

|

(2,665 |

) |

|

(3,779 |

) |

| Exploration and evaluation expenditures |

|

(1,413 |

) |

|

(938 |

) |

|

(281 |

) |

|

(55 |

) |

|

(137 |

) |

|

(121 |

) |

|

(148 |

) |

|

(373 |

) |

| Income (loss) from operations and joint venture |

|

5,462 |

|

|

44,143 |

|

|

(2,390 |

) |

|

(752 |

) |

|

(1,582 |

) |

|

(75,986 |

) |

|

1,919 |

|

|

2,801 |

|

| Impairment reversal (loss) on investment in joint venture |

|

- |

|

|

7,631 |

|

|

- |

|

|

- |

|

|

- |

|

|

(7,631 |

) |

|

- |

|

|

- |

|

| Impairment of exploration and evaluation assets |

|

- |

|

|

(1,628 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Other income (expense) |

|

3,031 |

|

|

(21,646 |

) |

|

3,670 |

|

|

13,318 |

|

|

45 |

|

|

(7,416 |

) |

|

2,199 |

|

|

2,203 |

|

| Net income (loss) for the period |

|

8,493 |

|

|

28,500 |

|

|

1,280 |

|

|

12,566 |

|

|

(1,537 |

) |

|

(91,033 |

) |

|

4,118 |

|

|

5,004 |

|

| Basic and diluted income (loss) per share |

|

$0.04 |

|

|

$0.13 |

|

|

$0.01 |

|

|

$0.06 |

|

|

($0.01 |

) |

|

($0.40 |

) |

|

$0.02 |

|

|

$0.02 |

|

| Adjusted net income (loss) for the period1 |

|

8,493 |

|

|

(6,010 |

) |

|

1,280 |

|

|

12,566 |

|

|

(1,537 |

) |

|

(14,478 |

) |

|

4,118 |

|

|

5,004 |

|

| Adjusted basic and diluted income (loss) per share1 |

|

$0.04 |

|

|

($0.03 |

) |

|

$0.01 |

|

|

$0.06 |

|

|

($0.01 |

) |

|

($0.06 |

) |

|

$0.02 |

|

|

$0.02 |

|

| EBITDA1 |

|

5,519 |

|

|

50,205 |

|

|

(2,378 |

) |

|

(727 |

) |

|

(1,534 |

) |

|

(83,553 |

) |

|

1,946 |

|

|

2,876 |

|

The results of the Company are heavily influenced by its share of profits and losses related to the JV, which is directly related to the underlying performance of the AGM.

From Q2 2021 to Q3 2021, results reflected the gold price environment and the grade of deposits being mined.

The net loss in Q4 2021 was due to the Company recognizing its 45% interest in the $153.2 million impairment recorded by the JV associated with the AGM not being in a position to declare a mineral reserve at December 31, 2021. Additionally, the Company recorded a $7.6 million impairment on its equity investment in the AGM JV during Q4 2021 again due to the inability of the AGM to declare mineral reserves as a result of metallurgical uncertainty of the material mined from Esaase at that time.

Other expense for Q4 2021 includes a $7.5 million negative fair value adjustment on the Company's preference shares in the JV which resulted from the aforementioned impairment indicators.

From Q1 2022 to Q3 2022, the Company did not recognize its share of the JV's net earnings as the recoverable amount of the Company's equity investment in the JV was nil at March 31, 2022, June 30, 2022 and September 30, 2022. Other income for Q2 2022 and Q3 2022 includes a $13.2 million and a $3.4 million positive fair value adjustment on the Company's preference shares in the JV, respectively, largely driven by strong operating performance resulting in improved working capital of the AGM.

During Q4 2022, as a result of the JV's reinstatement of mineral reserves in the AGM's 2023 Technical Report, the Company recommenced the recognition of its share of the JV's net earnings and also recognized a $7.6 million impairment reversal on its equity investment in the JV, leading to a significant increase in net income over the prior quarters. Other expense in Q4 2022 includes a $22.2 million negative fair value adjustment on the Company's preference shares in the JV resulting from a change in the timing of expected cash distributions and applying a higher discount rate to forecast preference share redemptions. Additionally, the Company also recognized a $1.6 million impairment on its wholly owned Mali exploration assets in Q4 2022.

During Q1 2023, improvements in net income and EBITDA over prior periods are reflective of the JV's underlying performance and rising gold price environment. In addition, other income contains a $2.3 million upward fair value adjustment on the Company's preference shares in the JV resulting from the recognition of accretion income.

___________________________

1 See "8. Non-IFRS measures"

7. Liquidity and capital resources

A key financial objective of the Company is to actively manage its cash balance and liquidity in order to meet the Company's strategic plans, as well as those of the JV in accordance with the JVA. The Company shares control of the JV and aims to manage the JV in such a manner as to generate positive cash flows from the AGM's operating activities in order to fund its operating, capital and project development requirements. A summary of the Company's net assets and key financial ratios related to liquidity are presented in the table below. Note that the March 31, 2023 and December 31, 2022 balances below do not include any assets or liabilities of the JV.

| |

|

March 31, 2023 |

|

|

December 31, 2022 |

|

| (in thousands of US dollars, except outstanding shares and options) |

|

$ |

|

|

$ |

|

| Cash and cash equivalents |

|

56,173 |

|

|

56,111 |

|

| Other current assets |

|

1,239 |

|

|

2,494 |

|

| Non-current assets |

|

132,933 |

|

|

121,289 |

|

| Total assets |

|

190,345 |

|

|

179,894 |

|

| |

|

|

|

|

|

|

| Current liabilities |

|

7,480 |

|

|

5,804 |

|

| Non-current liabilities |

|

442 |

|

|

399 |

|

| Total liabilities |

|

7,922 |

|

|

6,203 |

|

| |

|

|

|

|

|

|

| Total equity |

|

182,423 |

|

|

173,691 |

|

| |

|

|

|

|

|

|

| Working capital |

|

49,932 |

|

|

52,801 |

|

| |

|

|

|

|

|

|

| Total common shares outstanding |

|

224,943,453 |

|

|

224,943,453 |

|

| Total stock options outstanding |

|

8,497,170 |

|

|

8,497,170 |

|

| |

|

|

|

|

|

|

| Key financial ratios |

|

|

|

|

|

|

| Current ratio |

|

7.68 |

|

|

10.10 |

|

| Total liabilities -to-equity |

|

0.04 |

|

|

0.04 |

|

Subsequent to the JV transaction with Gold Fields, other than the JV service fee, the Company has no current direct sources of revenue and any cash flows generated by the AGM are not within the Company's exclusive control as the disposition of cash from the JV is governed by the JVA. The JVA provides that "Distributable Cash" will be calculated and distributed quarterly, if available. Further information regarding the definition of "Distributable Cash" is included in section "8.3 EBITDA and Adjusted EBITDA". However, given the Company's cash balance and interest earned thereon, zero debt and ongoing service fee receipts from the JV, the Company believes it is in a position to meet all working capital requirements, contractual obligations and commitments as they fall due (see "Commitments" below) during the next 24 months.

On December 21, 2022, the Company filed a final short form base shelf prospectus (the "Prospectus") under which the Company may sell from time-to-time common shares, warrants, subscription receipts, units, debt securities and/or share purchase contracts of the Company, up to an aggregate of $300 million. The Prospectus has a term of 25-months from the filing date. As of the date of this MD&A, no securities have been issued under the Prospectus.

7.1 Commitments

The following table summarizes the Company's contractual obligations as at March 31, 2023 and December 31, 2022. Note the following table excludes commitments and liabilities of the JV for the periods presented.

| (in thousands of US dollars) |

|

Within 1 year |

|

|

1 - 3 years |

|

|

4 - 5 years |

|

|

Over 5 years |

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

| Accounts payable, accrued liabilities and payable due to related party |

|

3,559 |

|

|

- |

|

|

- |

|

|

- |

|

|

3,559 |

|

|

3,173 |

|

| Long-term incentive plan (cash-settled awards) |

|

3,807 |

|

|

268 |

|

|

|

|

|

|

|

|

4,075 |

|

|

2,716 |

|

| Corporate office leases |

|

129 |

|

|

188 |

|

|

- |

|

|

- |

|

|

317 |

|

|

348 |

|

| Total |

|

7,495 |

|

|

456 |

|

|

- |

|

|

- |

|

|

7,951 |

|

|

6,237 |

|

In addition to the above commitments, the Company has provided various parent company guarantees related to the unfunded portion of the AGM's reclamation bonds in the amount of $5.9 million (December 31, 2022 - $5.9 million).

7.2 Contingencies

Due to the nature of its business, the Company and/or the JV may from time to time be subject to regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of its business. While the Company cannot reasonably predict the ultimate outcome of any such actions, and inherent uncertainties exist in predicting such outcomes, the Company believes that the ultimate resolution of these actions is not reasonably likely to have a material adverse effect on the Company's or the JV's financial condition or future results of operations.

7.3 Cash flows

The following table provides a summary of the Company's cash flows for the three months ended March 31, 2023 and 2022:

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars) |

|

$ |

|

|

$ |

|

| Cash provided by (used in): |

|

|

|

|

|

|

| Operating activities |

|

(543 |

) |

|

(3,165 |

) |

| Investing activities |

|

644 |

|

|

42 |

|

| Financing activities |

|

(31 |

) |

|

(34 |

) |

| Impact of foreign exchange on cash and cash equivalents |

|

(8 |

) |

|

20 |

|

| Increase (decrease) in cash and cash equivalents during the period |

|

62 |

|

|

(3,137 |

) |

| Cash and cash equivalents, beginning of period |

|

56,111 |

|

|

53,521 |

|

| Cash and cash equivalents, end of period |

|

56,173 |

|

|

50,384 |

|

a) Cash used in operating activities

During Q1 2023, the Company utilized cash flows in operations of $0.5 million (three months ended March 31, 2022 - utilized cash flows in operations of $3.2 million) due to corporate head office expenses which were largely offset by a $1.6 million positive working capital movement relating to collection of the Company's service fee receivable from the JV.

The reduction in cash used in operating activities from Q1 2022 to Q1 2023 was driven by working capital movements, specifically related to the Company's service fee receivable from the JV.

b) Cash provided by investing activities

During the three months ended March 31, 2023, cash provided by investing activities amounted to $0.6 million and related to interest earned on cash balances and short-term investments (with maturities less than 90 days).

The increase in cash provided by operating activities during Q1 2023 was due to higher interest rates earned on cash balances and short-term investments.

8. Non-IFRS measures

The Company has included certain non-IFRS performance measures throughout this MD&A. These performance measures are employed by management to assess the Company's operating and financial performance and to assist in business decision-making. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors and other stakeholders use this information to evaluate the Company's operating and financial performance; however, as explained elsewhere herein, these non-IFRS performance measures do not have any standardized meaning and therefore may not be comparable to similar measures presented by other issuers. Accordingly, these performance measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

The JV does not calculate this information for use by both JV partners, rather it is calculated by the Company solely for the Company's own disclosure purposes.

8.1 Operating cash costs and total cash costs per gold ounce

The Company has included the non-IFRS performance measures of operating cash costs per ounce and total cash costs per ounce on a by-product basis throughout this MD&A. In the gold mining industry, this is a common performance measure but does not have any standardized meaning. The Company follows the recommendations of the Gold Institute Production Cost Standard. The Gold Institute, which ceased operations in 2002, was a non-regulatory body and represented a global group of suppliers of gold and gold products. The production cost standard developed by the Gold Institute remains the generally accepted standard of reporting cash costs of production by many gold mining companies. Management uses operating cash costs per ounce and total cash costs per ounce to monitor the operating performance of the JV. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, some investors use this information to evaluate the Company's performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate operating cash costs and total cash costs per ounce differently.

The following table provides a reconciliation of operating and total cash costs per gold ounce sold of the AGM to production costs of the AGM on a 100% basis (the nearest IFRS measure) as presented in the notes to the unaudited condensed consolidated interim financial statements of the Company for the three months ended March 31, 2023 and 2022.

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars, except per ounce amounts) |

|

$ |

|

|

$ |

|

| Production costs as reported |

|

34,942 |

|

|

53,225 |

|

| Share-based compensation expense included in production costs |

|

(10 |

) |

|

65 |

|

| By-product revenue |

|

(107 |

) |

|

(120 |

) |

| Total operating cash costs |

|

34,825 |

|

|

53,170 |

|

| Royalties |

|

3,265 |

|

|

3,877 |

|

| Total cash costs |

|

38,090 |

|

|

57,047 |

|

| Gold ounces sold |

|

35,174 |

|

|

41,929 |

|

| Operating cash costs per gold ounce sold ($/oz) |

|

990 |

|

|

1,268 |

|

| Total cash costs per gold ounce sold ($/oz) |

|

1,083 |

|

|

1,361 |

|

8.2 AISC per gold ounce

In June 2013, the World Gold Council, a non-regulatory association of many of the world's leading gold mining companies established to promote the use of gold to industry, provided guidance for the calculation of "AISC per gold ounce" in an effort to encourage improved understanding and comparability of the total costs associated with mining an ounce of gold. The Company has adopted the reporting of "AISC gold ounce", which is a non-IFRS performance measure. The Company believes that the AISC per gold ounce measure provides additional insight into the costs of producing gold by capturing all of the expenditures required for the discovery, development and sustaining of gold production and allows the Company to assess its ability to support capital expenditures to sustain future production from the generation of operating cash flows. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, some investors use this information to evaluate the JV's performance and ability to generate cash flow, disposition of which is subject to the terms of the JVA. Other companies may calculate AISC per ounce differently. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

AISC adjust "Total cash costs" for G&A expenses, reclamation cost accretion, sustaining capitalized stripping costs (excludes operating pits which have not achieved steady-state operations), sustaining capital expenditures and lease payments and interest expense on the AGM's mining and service lease agreements. Sustaining capital expenditures, capitalized stripping costs, reclamation cost accretion and lease payments and interest expense on lease agreements are not line items on the AGM's financial statements. Sustaining capital expenditures are defined as those capital expenditures which do not materially benefit annual or life of mine gold ounce production at a mine site. A material benefit to a mine site is considered to be at least a 10% increase in annual or life of mine production, net present value, or reserves compared to the remaining life of mine of the operation. As such, sustaining costs exclude all expenditures at the AGM's 'new projects' and certain expenditures at the AGM's operating sites which are deemed expansionary in nature. Capitalized stripping costs represent costs incurred at steady-state operations during the period; these costs are generally not considered expansionary in nature as the stripping phase is expected to take less than 12 months and resulting ore production is of a short-term duration. Reclamation cost accretion represents the growth in the AGM's decommissioning provision due to the passage of time. This amount does not reflect cash outflows, but it is considered to be representative of the periodic costs of reclamation and remediation. Lease payments on mining and service lease agreements represent cash outflows while interest expense represents the financing component inherent in the lease. Reclamation cost accretion and lease interest are included in finance expense in the AGM's results as disclosed in the notes to the unaudited condensed consolidated interim financial statements of the Company for the three months ended March 31, 2023 and 2022.

All-in sustaining margin per ounce is calculated as the difference between the average realized gold price for the period and AISC per gold ounce sold. All-in sustaining margin is calculated as all-in sustaining margin per ounce multiplied by the number of gold ounces sold during the period.

The following table provides a reconciliation of AISC of the AGM to production costs and various operating expenses of the AGM on a 100% basis (the nearest IFRS measure), as presented in the notes to the unaudited condensed consolidated interim financial statements of the Company for the three months ended March 31, 2023 and 2022.

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars except per ounce amounts) |

|

$ |

|

|

$ |

|

| Total cash costs (as reconciled above) |

|

38,090 |

|

|

57,047 |

|

| General and administrative expenses - JV 4 |

|

716 |

|

|

918 |

|

| Sustaining capital expenditures (see table below) |

|

4,897 |

|

|

1,996 |

|

| Reclamation cost accretion |

|

511 |

|

|

486 |

|

| Sustaining lease payments (see table below) |

|

375 |

|

|

4,832 |

|

| Interest on lease liabilities |

|

7 |

|

|

103 |

|

| All-in sustaining cost |

|

44,596 |

|

|

65,382 |

|

| Gold ounces sold |

|

35,174 |

|

|

41,929 |

|

| All-in sustaining cost per gold ounce sold ($/oz) - JV |

|

1,268 |

|

|

1,559 |

|

| Average realized price per gold ounce sold ($/oz) |

|

1,850 |

|

|

1,846 |

|

| All-in sustaining margin ($/oz) |

|

582 |

|

|

287 |

|

| All-in sustaining margin |

|

20,471 |

|

|

12,034 |

|

4 Excluded from G&A costs of the AGM is $10 of share-based compensation expense for the three months ended March 31, 2023 (three months ended March 31, 2022 - excludes $21.0 million of severance charges and a $37 credit of share-based compensation expense).

For the three months ended March 31, 2023, the Company incurred corporate G&A expenses, net of the JV service fee, of $0.8 million which excludes share-based compensation expense and depreciation expense totaling $1.6 million (three months ended March 31, 2022 - G&A expenses, net of the JV service fee, of $1.6 million which excludes share‐based compensation expense, depreciation expense and severance payouts totaling $0.1 million).

The Company's attributable gold ounces sold for the three months ended March 31, 2023 were 15,828 (three months ended March 31, 2022 - 18,868 gold ounces), resulting in additional AISC for the Company of $50/oz in addition to the AGM's AISC presented in the above table (three months ended March 31, 2022 - $84/oz).

The following table reconciles sustaining capital expenditures to cash flows used in investing activities of the AGM on a 100% basis (the nearest IFRS measure), as presented in the notes to the unaudited condensed consolidated interim financial statements of the Company for the three months ended March 31, 2023 and 2022.

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars) |

|

$ |

|

|

$ |

|

| Cash used in investing activities - JV |

|

6,609 |

|

|

2,456 |

|

| Less: |

|

|

|

|

|

|

| Non-sustaining capital expenditures |

|

(2,651 |

) |

|

(448 |

) |

| Change in AP related to capital expenditures not included in AISC |

|

- |

|

|

(42 |

) |

| Interest earned on cash balances |

|

939 |

|

|

30 |

|

| Total sustaining capital expenditures |

|

4,897 |

|

|

1,996 |

|

The majority of the non-sustaining capital expenditures during the three months ended March 31, 2023 related to a drilling program at Nkran South extension, early works at Abore and developing the AGM's new LOM plan.

The following table reconciles sustaining lease payments to cash flows used in financing activities of the AGM on a 100% basis (the nearest IFRS measure), as presented in the notes to the unaudited condensed consolidated interim financial statements of the Company for the three months ended March 31, 2023 and 2022.

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars) |

|

$ |

|

|

$ |

|

| Cash used in financing activities - JV |

|

428 |

|

|

4,937 |

|

| Less: |

|

|

|

|

|

|

| Interest and fees paid on RCF |

|

(53 |

) |

|

(105 |

) |

| Total sustaining lease payments |

|

375 |

|

|

4,832 |

|

8.3 EBITDA and Adjusted EBITDA

Earnings before interest, taxes, depreciation and amortization ("EBITDA") provides an indication of the Company's continuing capacity to generate income from operations before considering the Company's financing decisions and costs of amortizing capital assets. Accordingly, EBITDA comprises net income excluding interest expense, interest income, amortization and depletion and income taxes. Adjusted EBITDA adjusts EBITDA to exclude non-recurring items and non-cash items and includes the calculated Adjusted EBITDA of the JV ("Adjusted EBITDA"). Other companies may calculate EBITDA and Adjusted EBITDA differently. The JV does not calculate this information for use by both JV partners, rather it is calculated by the Company solely for the Company's own disclosure purposes.

The following table provides a reconciliation of EBITDA and Adjusted EBITDA attributable to the Company based on its economic interest in the JV to net income (the nearest IFRS measure) of the Company per the unaudited condensed consolidated interim financial statements of the Company for the three months ended March 31, 2023 and 2022. All adjustments are shown net of estimated income tax.

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars ) |

|

$ |

|

|

$ |

|

| Net income (loss) for the period |

|

8,493 |

|

|

(1,537 |

) |

| Add back (deduct): |

|

|

|

|

|

|

| Depreciation expense |

|

36 |

|

|

37 |

|

| Finance income |

|

(3,016 |

) |

|

(43 |

) |

| Finance expense |

|

6 |

|

|

9 |

|

| EBITDA for the period |

|

5,519 |

|

|

(1,534 |

) |

| Add back (deduct): |

|

|

|

|

|

|

| Adjustment for non-cash long-term incentive plan compensation |

|

239 |

|

|

- |

|

| Share of net income related to joint venture |

|

(9,307 |

) |

|

- |

|

| Galiano's attributable interest in JV Adjusted EBITDA (below) |

|

10,288 |

|

|

- |

|

| Adjusted EBITDA for the period |

|

6,739 |

|

|

(1,534 |

) |

The following table reconciles the JV's EBITDA and Adjusted EBITDA for the three months ended March 31, 2023 and 2022 to the results of the JV as disclosed in note 6 to the Company's unaudited condensed consolidated interim financial statements for the three months ended March 31, 2023 and 2022.

| |

|

Three months ended March 31, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands of US dollars) |

|

$ |

|

|

$ |

|