ASANKO GOLD INC.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2017

DATED AS OF MARCH 15, 2018

SUITE 680 – 1066 WEST HASTINGS STREET

VANCOUVER,

BRITISH COLUMBIA

V6E 3X2

TABLE OF CONTENTS

PRELIMINARY NOTES

In this Annual Information Form (the “AIF”):

| (i) | references to “we”, “us”, “our”, the “Company” or “Asanko” mean Asanko Gold Inc. and its subsidiaries, unless the context requires otherwise; | |

| (ii) | we use the United States dollar as our reporting currency and, unless otherwise specified, all dollar amounts are expressed in United States dollars and any references to “$” mean United States dollars and any references to “C$” mean Canadian dollars; | |

| (iii) | our financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board; and | |

| (iv) | production results are in metric units, unless otherwise indicated. |

All information in this AIF is at December 31, 2017, unless otherwise indicated.

CAUTIONARY NOTE TO US INVESTORS REGARDING DISCLOSURE OF

MINERAL

RESERVE AND RESOURCE ESTIMATES

This AIF has been prepared in accordance with the requirements of Canadian provincial securities laws, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all reserve and resource estimates included in this AIF have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the 2014 CIM Definition Standards on Mineral Resources and Reserves (the “CIM Definition Standards”) adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM Council”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

This AIF includes mineral reserve estimates that have been calculated in accordance with NI 43-101 and CIM Standards, as required by Canadian securities regulatory authorities. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and CIM standards. These definitions differ from the definitions adopted by the United States Securities and Exchange Commission (the “SEC”) in the SEC’s Industry Guide 7.

In addition, this AIF uses the terms “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” to comply with the reporting standards in Canada. We advise investors that while those terms are recognized and required by Canadian regulations, these terms are not defined terms under SEC Industry Guide 7, are not recognized by the SEC and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into either NI 43-101 or SEC defined mineral reserves. These terms have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility.

Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of the inferred resources exist. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in rare cases.

3

It cannot be assumed that all or any part of measured mineral resources, indicated mineral resources, or inferred mineral resources will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the reported measured mineral resources, indicated mineral resources, or inferred mineral resources in this AIF is economically or legally mineable.

Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

For the above reasons, information contained in this AIF containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

The Company cautions readers regarding forward-looking statements found in this AIF and in any other statement made by, or on the behalf of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, “estimates”, “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, or “might” occur. Forward-looking statements are made based on management’s beliefs, estimates and opinions and are given only as of the date of this AIF. Such statements may constitute “forward-looking information” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation.

Forward-looking statements include, but are not limited to, statements with respect to:

| • |

the future price of gold, | |

|

| ||

| • |

the estimation of Mineral Reserves (as defined below) and Mineral Resources (as defined below), | |

|

| ||

| • |

the realization of Mineral Reserve estimates, | |

|

| ||

| • |

the timing and amount of estimated future production from the Asanko Gold Mine (the “AGM”), including production rates and gold recovery, | |

|

| ||

| • |

operating costs with respect to the operation of the AGM, | |

|

| ||

| • |

capital expenditures that are required to sustain and expand mining activities, | |

|

| ||

| • |

the timing and costs associated with the Company’s expansion plans for the AGM, | |

|

| ||

| • |

the availability of capital to fund the Company’s expansion plans, | |

|

| ||

| • |

the timing of the development of new deposits, | |

|

| ||

| • |

success of exploration activities, | |

|

| ||

| • |

permitting time lines, | |

|

| ||

| • |

hedging practices, |

4

| • |

currency exchange rate fluctuations, | |

|

| ||

| • |

requirements for additional capital, | |

|

| ||

| • |

government regulation of mining operations, | |

|

| ||

| • |

environmental risks and remediation measures, | |

|

| ||

| • |

unanticipated reclamation expenses, | |

|

| ||

| • |

title disputes or claims, and | |

|

| ||

| • |

limitations on insurance coverage. |

Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward-looking statements reflect the Company’s current views with respect to expectations, beliefs, assumptions, estimates and forecasts about the Company’s business and the industry and markets in which the Company operates. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions, which are difficult to predict. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of the Company. The Company’s actual future results or performance are subject to certain risks and uncertainties including but not limited to:

| • |

the value of the Company’s reserves and its outlook for profitable mining from its operations is dependent on gold prices continuing to be around $1,250 and on the Company achieving planned production rates and life-of-mine all-in sustaining costs per ounce of gold sold. Gold prices are driven by many factors including industrial demand and jewellery use, but gold also has speculative investment demand and so prices have been historically volatile and can be subject to long periods of depressed prices; | |

| • |

the estimation of mineral resources and reserves is, to a significant degree, a subjective process, the accuracy of which is a function of the quantity and quality of available data and the assumptions made in the engineering and geological interpretation of that data and such assumptions and judgment, may prove mistaken. The Company’s estimates of resources and reserves may be subject to revision based on various factors, some of which are beyond our control, for example due to natural variations in underground structures and future gold price fluctuations; | |

| • |

risks inherent in project developments, especially in a developing economy such as Ghana’s, including the risk of cost overruns, the inherent uncertainty of feasibility studies, the actual performance of production and recovery equipment deviating from expectations; | |

| • |

developing economy risks including, but not limited to, uncertainties related to the taxation and royalty regimes, the recovery of value-added taxes, security of title/tenure regime, labour laws, foreign ownership restrictions, foreign exchange and capital repatriation restrictions, indigenous population concerns and export regulations; | |

| • |

operational risks associated with mining and mineral processing including experiencing lower grades than estimated, lower metal recovery than projected, lower metals prices than anticipated, unavailability of power and energy and health, safety and environmental risks; |

5

| • |

development and operational risks that may result in financial losses and the need to seek additional capital which may result in dilution to shareholders or the application of funds to debt repayment; | |

| • |

general mining risks including environmental liability claims, risk of accident, unexpected ground conditions, and other risks for which insurance may not be available or affordable; | |

| • |

other mining risks which affect all companies in the industry to various degrees include impact and cost of compliance with environmental regulations and the actions of groups opposed to mining, adverse changes in mining and reclamation laws and compliance with increasingly complex worker health and safety rules; and | |

| • |

the risk factors described under the heading “Risk Factors” in, or incorporated by reference in, this AIF. |

Forward-looking statements are necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. Assumptions underlying the Company’s expectations regarding forward-looking statements or information contained in this AIF include, among others:

| • |

the price of gold will not decline significantly or for a protracted period of time, | |

| • |

the AGM will not experience any significant production disruptions that would materially affect revenues, | |

| • |

the Company’s ability to comply with applicable governmental regulations and standards, | |

| • |

the Company’s success in implementing its strategies and achieving its business objectives, | |

| • |

the Company will have sufficient working capital necessary to sustain operations on an ongoing basis, | |

| • |

the Company’s ability to raise sufficient funds from future equity financings to support its operations, and general business and economic conditions. |

The foregoing list of assumptions cannot be considered exhaustive.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors including the risk factors contained in this AIF should be considered carefully and readers should not place undue reliance on the Company’s forward-looking statements. The Company undertakes no obligation to update forward-looking information if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law.

GLOSSARY

We use the following defined terms in this AIF:

6

| AARL |

Anglo American Research Laboratories |

| AGM |

Our principal asset, the Asanko Gold Mine located in Ghana, West Africa. The AGM is also known as the “Project”. |

| AISC/oz (all-in sustaining cost per ounce of gold) |

This is a non-GAAP financial measurement which the Company has adopted using World Gold Council's guidance for calculation of this number. AISC include total cash costs, corporate overhead expenses, sustaining capital expenditure, capitalized stripping costs and reclamation cost accretion for each ounce of gold sold. AISC is intended to assist the comparability of the Company’s operations with those of other gold producers who disclose operating results using the same or similar guidance standards. |

| Asanko or the “Company” |

Asanko Gold Inc. |

| Asanko Gold Ghana |

Asanko Gold Ghana Limited, a 90% owned Ghanaian subsidiary of Asanko Gold. The Government of Ghana has a 10% free carried interest in the Project under Section 8 of the Ghanaian Mining Act. |

| Au |

Chemical symbol for gold. |

| Base Case or Phase 1 |

Phase 1 of the Project refers to the initial development of the Project to supply a 3Mtpa mill feed from the Nkran pit and four satellite deposits which entered into commercial production on April 1, 2016. |

| BCBCA |

Business Corporations Act (British Columbia). |

| brownfields |

a reference to a mining project situated in an existing mining area with the result that environmental approval procedures are generally expedited (as contrasted with a “greenfields” project which is a mine proposed for a previously non- mining area or an altogether undisturbed area. |

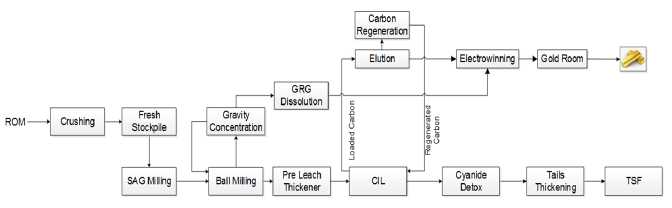

| Carbon-in-leach process or “CIL” |

a process used to recover dissolved gold inside a cyanide leach circuit. Coarse activated carbon particles are introduced in the leaching circuit and are moved counter-current to the slurry, absorbing dissolved gold in solution as they pass through the circuit. Loaded carbon is removed from the slurry by screening. Gold is recovered from the loaded carbon by stripping in a caustic cyanide solution followed by electrolysis. CIL is a process similar to CIP (carbon-in- pulp) except that the gold leaching and the gold absorption are done simultaneously in the same stage compared with CIP where the gold-absorption stage follows the gold-leaching stage. |

| CFPOA |

Corruption of Foreign Public Officials Act of 1998, a law in force in Canada. |

| concentrate |

a product containing the valuable metal and from which most of the waste material in the ore has been eliminated. |

| contained ounces |

ounces in the mineralized rock without reduction due to mining loss or processing loss. |

7

| CSA |

CSA Global Pty Ltd., a geological, mining and management consulting company operating in numerous prominent mining jurisdictions. |

| CSR |

corporate social responsibility. |

| cut-off grade |

the lowest grade of mineralized material considered economic; used in the estimation of mineral reserves in a given deposit. |

| DCF Model |

discounted cash flow model |

| depletion |

the decrease in quantity of mineral reserves in a deposit or property resulting from extraction or production during a particular period. |

| DFS and 12/17 DFS |

the “Definitive Feasibility Study” technical report for the Asanko Gold Mine originally filed on SEDAR on July 18, 2017, which was subsequently amended and restated on December 20, 2017 (the latter version is herein the “12/17 DFS”). |

| DSFA |

the Definitive Senior Facilities Agreement with Red Kite, which was fully drawn for a total of $150 million plus $13.9 million in unpaid interest that was accrued up to May 2016. |

| dilution |

an estimate of the amount of waste or low-grade mineralized rock which will be mined with the ore as part of normal mining practices in extracting an ore body. |

| EPA |

the Ghanaian Environmental Protection Agency |

| ESIA |

Environmental and Social Impact Assessment |

| Exchange Act |

The United States Securities Exchange Act of 1934, as amended |

| FCPA |

The Foreign Corrupt Practices Act of 1977, a United States federal law |

| FEED |

Front End Engineering and Design for the plant upgrade and the overland conveyor associated with P5M and P10M. |

| Ghana |

The Republic of Ghana |

| g/t Au |

Reference to ore grade in terms of grams of gold per tonne (1 gm/t is equivalent to one part per million) |

| grade |

the relative quantity or percentage of metal or mineral content. |

| H1 |

the first half of our fiscal year |

| H2 |

the second half of our fiscal year |

| hedge |

a risk management technique used to manage commodity price, interest rate, foreign currency exchange or other exposures arising from regular business transactions. |

| hedging |

a future transaction made to protect the price of a commodity as revenue or cost and secure cash flows. |

8

| IFRS |

International Financial Reporting Standards. |

| IRR |

internal rate of return |

| IT |

information technology |

| LoM |

Life of mine |

| LTIFR |

rolling lost time injury frequency rate per million man-hours worked. |

| Moz |

million ounces. |

| MRE |

Mineral Resource Estimate |

| MRev |

Mineral Reserve Estimate |

| Mt |

Million tonnes |

| Mtpa |

Mt per annum |

| NI 43-101 |

Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators |

| NPV |

net present value |

| NSR |

net smelter returns. |

| NYSE American |

The NYSE American, formerly known as the NYSE MKT and prior to that the NYSE Amex |

| ounce |

refers to one troy ounce, which is equal to 31.1035 grams |

| Phase 1 or Base Case |

Phase 1 of the Project refers to the initial development of the Project to supply a 3Mtpa mill feed from the Nkran pit and four satellite deposits which entered into commercial production on April 1, 2016 |

| PMI |

PMI Gold Corp. which was acquired by Asanko in 2014 and which previously developed the Obotan deposit. |

| Project |

the Asanko Gold Mine, also known as the “AGM” |

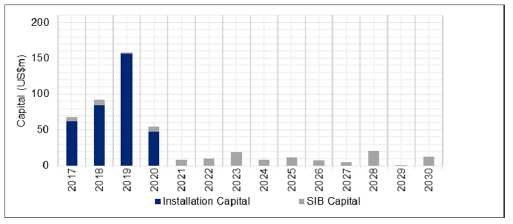

| Project 5M or P5M |

Project 5M (or “P5M”) is a two-stage planned upgrade to the AGM with first stage being the upgrade of the CIL plant’s throughput to 5Mtpa and the second stage to expand mining operations to integrate the Esaase deposit, including the construction of a 27-kilometer overland ore conveyor. Stage one has an estimated capital cost of $22 million and the stage two cost is estimated in the 12/17 DFS at $128 million. In addition, management expects to install a permanent secondary crusher ($4.0 million) and upgraded mill motors ($1.0 Million) in 2018, which are not contemplated in the 12/17 DFS. |

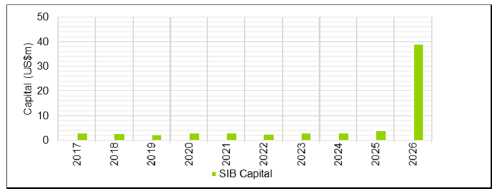

| Project 10M or P10M |

Project 10M (or “P10M”) means a future expansion project of the AGM which has the potential to increase production from about 200,000 ounces per annum to over 450,000 ounces per annum. Project 10M requires the construction of an additional 5Mtpa CIL plant to double throughput from 5Mtpa to 10Mtpa at an estimated cost of some $200 million. |

9

| Q |

refers to a fiscal quarter. |

| QA/QC |

quality-assurance/quality control. |

| Qualified Person |

an individual who is an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geosciences, or engineering, relating to mineral exploration or mining who has at least five years of experience in mineral exploration, mine development or operation, or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice, and who has experience relevant to the subject matter of the mineral project or technical report, and who is in good standing with a professional association, as more fully referenced in NI 43-101 |

| RC |

reversed circulation (a method of drilling) |

| recovery |

the proportion of valuable material obtained during mining or processing, generally expressed as a percentage of the material recovered compared to the total material present |

| Red Kite |

a special purpose vehicle of RK Mine Finance Trust I, the counterparty to the DSFA |

| ROM |

run of mine |

| royalty |

cash payment or physical payment (in-kind) generally expressed as a percentage of NSR or mine production. |

| RQD |

rock quality designation. |

| SAG |

semi-autogenous grinding (ore is tumbled to smash against itself) |

| SEDAR |

System for Electronic Document Analysis and Retrieval available on the Internet at www.sedar.com, (the Canadian securities regulatory filings website) |

| SEC |

the United States Securities and Exchange Commission |

| SIB |

Stay-in-business Capital |

| SMBS |

Sodium Meta Bi Sulfate |

| stripping |

in mining, the process of removing overburden or waste rock to expose ore |

| SO2 |

Sulfur dioxide |

| Spot price |

the current price of a metal for immediate delivery. |

| tailings |

the material that remains after metals or minerals considered economic have been removed from ore during processing |

| Tailings Storage Facility or TSF tonne |

a containment area used to deposit tailings from milling commonly referred to as the metric ton in the United States, is a metric unit of mass equal to 1,000 kilograms; it is equivalent to approximately 2,204.6 pounds, 1.102 short tons (US) or 0.984 long tons (imperial). |

10

| TSX | Toronto Stock Exchange |

| U.S. Securities Act | The United States Securities Act of 1933, as amended |

| volatility | propensity for variability. A market or share is volatile when it records rapid variations. |

| WAD | weak acid dissociable, often used with reference to cyanide concentration |

GLOSSARY OF CERTAIN TECHNICAL TERMS

This AIF uses the certain technical terms presented below as they are defined in accordance with the CIM Definition Standards. Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this Prospectus have been prepared in accordance with the CIM Standards, as required by NI 43-101. The following definitions are reproduced from the latest version of the CIM Standards, which were adopted by the CIM Council on May 10, 2014:

| feasibility study |

A comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study. The Company uses the term “12/17 DFS” to describe its current definitive feasibility study. |

| indicated mineral resource |

That part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve. |

| inferred mineral resource |

That part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and may not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

| measured mineral resource |

That part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

11

| mineral reserve |

The economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre- Feasibility or Feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a Pre-Feasibility Study or Feasibility Study. |

| mineral resource |

A concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

| modifying factors |

Considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

| pre- feasibility study |

A comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the Modifying Factors and the evaluation of any other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be converted to a Mineral Reserve at the time of reporting. A Pre-Feasibility Study is at a lower confidence level than a Feasibility Study. |

| probable mineral reserve |

The economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. |

| proven mineral reserve |

The economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. |

12

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated on September 23, 1999 as a British Columbia corporation under the Business Corporations Act (British Columbia) (the “BCBCA.”) The Company changed its corporate name to Asanko Gold Inc. on February 23, 2013. The Company completed the acquisition of PMI Gold Corporation (“PMI”) on February 6, 2014 by way of a court approved plan of arrangement transaction.

The Company’s primary asset is its AGM located on the Asankrangwa gold belt in Ghana.

The Company’s common shares trade in Canada on the Toronto Stock Exchange (the “TSX”) and in the United States on the NYSE American, each under the symbol “AKG”. The Company is a reporting issuer in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador. The Company’s common shares are registered under Section 12(b) of the United States Securities Exchange Act of 1934, as amended.

The Company’s registered and records office is located at Suite 1500 Royal Centre, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, V6E 4N7. The Company’s Canadian head office is located at Suite 680 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X2.

Inter-corporate Relationships

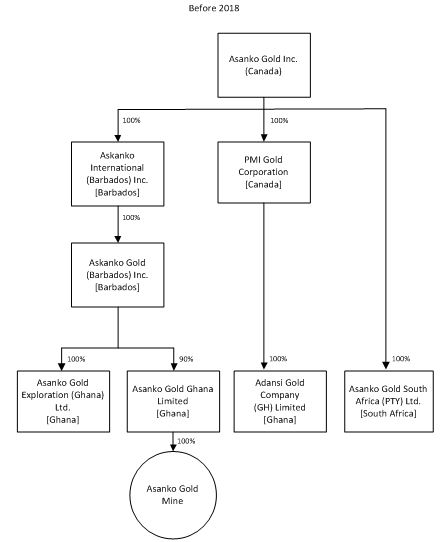

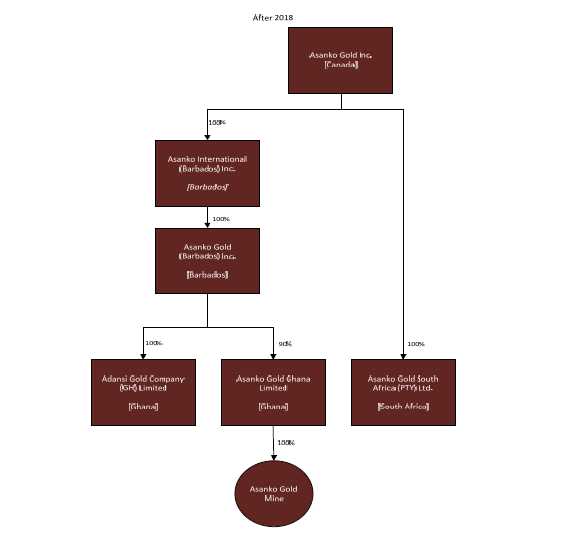

The Company had the following subsidiaries as at December 31, 2017:

| Subsidiary name | Jurisdiction | Ownership |

| Asanko Gold Ghana Limited | Ghana | 90% (10% owned by Ghanaian Government) |

| Adansi Gold Company (GH) Limited | Ghana | 100% |

| Asanko Gold Exploration (Ghana) Limited | Ghana | 100% |

| Asanko Gold South Africa (PTY) Ltd. | South Africa | 100% |

| Asanko International (Barbados) Inc. | Barbados | 100% |

| Asanko Gold (Barbados) Inc. | Barbados | 100% |

| PMI Gold Corporation | Canada | 100% |

13

The Company’s inter-corporate relationships with its subsidiaries as at December 31, 2017 is illustrated in the chart below:

Reorganization of Corporate Structure

During early 2018, the Company commenced a reorganization of its corporate group structure which existed since its acquisition of the previously publicly traded PMI in 2014. The simplification is not expected to have material tax or financial consequences to shareholders, but is expected to result in some cost savings through elimination of redundant corporate entities and a more efficient structure. The reorganization is expected to be completed in Q1 2018 and is subject to approval by the government of Ghana.

The restructuring, once completed, is expected to include:

| 1. |

The amalgamation of Asanko Gold Inc. and PMI Gold Corp. | |

| 2. |

The assignment of unsecured subordinate intercompany debt (owing from Asanko Gold Ghana Limited to Adansi Gold Company (GH) Limited) from Adansi Gold Company (GH) Limited to Asanko Gold Inc. | |

| 3. |

The transfer of Asanko Gold Inc.’s 100% interest in Adansi Gold Company (GH) Limited to Asanko Gold (Barbados) Inc. |

14

Following the completion of the restructuring, the Company’s inter-corporate relationships with its subsidiaries are expected to be as follows:

DESCRIPTION AND GENERAL DEVELOPMENT OF THE BUSINESS

Summary

The Company is a Canadian-incorporated and headquartered gold producer with gold mining operations in Ghana. The Company’s vision is to become a mid-tier mining company as a producer of gold via open pit mining and conventional processing of gold ores.

The Company’s principal asset is the AGM located in Ghana, West Africa. The AGM was created in 2014 through the combination of the Company’s Esaase Gold Project with PMI’s Obotan Gold Project following the Company’s acquisition of PMI. The AGM is a multi-deposit complex, with two main deposits, Nkran and Esaase, and nine satellite deposits. The mine is being developed in phases. The first phase comprised the construction of a 3 million tonne per annum (“Mtpa”) carbon-in-leach (“CIL”) processing facility and bringing the first pit, Nkran, into production (“Phase 1”). Phase 1 was funded by cash on hand and a $150 million debt facility (see section “General Development of the Business – Debt Facilities with Red Kite” below) and was completed in early 2016 within budget and ahead of schedule. Gold production commenced in January 2016, commencement of commercial production was declared on April 1, 2016, and the operation reached steady-state production levels by the end of the second quarter of 2016.

15

General Development of the Business

Debt Facilities with Red Kite

In 2013, the Company entered into a Definitive Senior Facilities Agreement (“DSFA”) with a special purpose vehicle of RK Mine Finance Trust I (“Red Kite”). The DSFA is presently fully drawn in the total outstanding principal amount of $150.0 million. Interest on the DSFA is calculated in advance on a quarterly basis at a rate of LIBOR +6%, subject to a floor LIBOR rate of 1%. The Company can elect to repay the DSFA, or a portion thereof, early without penalty. During Q2 2016, the DSFA was amended in order to defer the repayment of the principal for two years (being the principal deferral period). The amendment provided that the first principal repayment of approximately $18.0 million would be payable on July 1, 2018 after which the facility was scheduled to be repaid in nine equal quarterly installments, with the last repayment on July 1, 2020. On February 22, 2018, the Company agreed to a new term sheet with Red Kite (the “RK Term Sheet”), whereby the Company would be able to defer the repayment of principal associated with the long-term debt by up to three years (repayment commencing on July 2021). An initial one-year deferral is subject primarily to fees and the finalization of definitive documentation, while a further two-year deferral is subject to additional customary conditions precedent which would have to be complied with by June 30, 2019. The Company would continue to pay quarterly interest on the loan facility during the principal deferral period.

Performance under the DSFA is fully secured by the assets of the Company’s Ghanaian subsidiaries and guaranteed by the Company. There are no gold hedging provisions, cash sweep requirements or other restrictions usually associated with traditional project finance facilities of this nature.

Offtake Agreement

In October 2013, the Company entered into an offtake agreement with Red Kite in connection with the DSFA, as amended in July 2014 (the “Offtake Agreement”), pursuant to which Red Kite is entitled to purchase at market, 100% of the future gold production of the AGM to a maximum of 2.2 million ounces. The gold sale price will be a spot price selected during a nine-day quotational period following shipment. A provisional payment of 90% of the estimated value of the gold is made one business day after delivery, with the remaining balance payable 10 business days after shipment. The Company can terminate the Offtake Agreement prior to satisfaction of the conditions precedent for the Project Facility by repaying all amounts outstanding under the DSFA, subject to the payment of a termination fee in an amount dependent upon the total funds drawn under the DSFA as well as the amount of gold delivered under the Offtake Agreement at the time of termination.

During the years ended December 31, 2017 and 2016, the Company sold 206,079 ounces and 147,950 ounces to Red Kite under the Offtake Agreement and recorded revenue of $243.4 million and $184.5 million, respectively.

Fiscal 2015 (Year ended December 31, 2015)

In February 2015, the Company completed a bought deal public offering of 22,770,000 common shares of the Company for gross proceeds of approximately $36.4 million (approximately C$46 million). The Company used the proceeds from the offering, together with cash on hand and the Debt Facilities, to advance Phase 1 of the Project.

During 2015, the Company focused on the development of Phase 1 of the AGM, to achieve commercial mining operations at a steady state of 190,000 ounces of gold per annum with the first gold pour in Q1 2016.

16

As at December 31, 2015, pre-stripping of the Nkran pit neared completion, with over 19Mt of material mined.

Ore mined to December 31, 2015 had been mostly from zones that were in the inferred category, which did not form an integral part of the mine plan, and were located peripheral to the main orebodies, which were exposed as the mining pushback advanced. Further mineralized zones of the main Nkran orebody were exposed in places along the western flank of the pit and were made available to support the ore production levels required as the AGM was commissioned and ramped up to steady-state. The ore from these zones was verified by RC grade control drilling where access permitted.

Commencing in 2015, mining rates were in line with long-term steady state mining plans. The mining of the ore zones encountered during the pre-strip was selective due to the generally narrow and discontinuous nature of those zones, but geological mapping and grade control drilling provided a steady source of this ore. As mining advanced and deepened on the western flank of the Nkran deposit, ore domains continued to be exposed giving continuity along strike, at depth and considerably greater widths.

An RC drilling program commenced in April 2015. The RC drilling was aligned to the 3 meters flitch and 6 meters mining bench plans and was developed on 10 x 5 meter intervals. Additional inclined holes were drilled to 22.5 and 45meter depths and sampled at 1.5meter intervals. This pattern provided cover for 6 benches (36 vertical meters), which was equivalent to approximately 6 months of mining.

During the pre-stripping operation, the reversed circulation (“RC”) drilling program evaluated the inferred resources and peripheral zones of mineralization that were located outside the main ore domains. As at December 31, 2015, 1,735 grade control drill holes had been drilled for 50,679 meters and 41,321 gold assays. In addition, 1,523 meters of rip-lines had been analyzed and mapped. These activities culminated in over 290,000 tonnes of ore (split into oxide, transition and fresh stockpiles) being placed on stockpile as at the end of 2015.

Commissioning of the crusher was achieved with waste on December 10, 2015.

The tailings pipeline and return water system components of the tailings storage facility (the “TSF”) were completed and the Ghanaian Environmental Protection Agency (the “EPA”) conducted its final inspection of the TSF and confirmed that all conditions of the permit had been met.

The Company also advanced engineering of the next phase of development of the project (which would ultimately become the basis of the P5M and P10M expansion plans, as discussed below).

Fiscal 2016 (Year ended December 31, 2016)

The Company completed the finalization of capital expenditures on Phase 1 of the AGM for $292 million, approximately $3 million under the budget of $295 million.

Ore commissioning of the milling and CIL circuits was completed in Q1 2016. On April 1, 2016, the Company declared commercial production for Phase 1 of the AGM, a full quarter ahead of schedule. Commercial production was declared as a result of the mine achieving a number of key milestones including the mill processing at 111% of design capacity and gold recovery exceeding design during the month of March. Steady state production was achieved at the AGM by the end of Q2 2016.

During the second quarter of 2016, the DSFA was amended in order to defer the repayment of the principal for two years (being the principal deferral period). The amendment provides that the first principal repayment will now be payable on July 1, 2018 after which the facility will be repaid in nine equal quarterly installments, with the last repayment on July 1, 2020. The Company will continue to pay quarterly interest on the loan facility during the principal deferral period. There are no other changes to the existing debt facility terms. A deferral fee of 2% of the loan principal was paid commensurate with signing the amendment. The amendments were considered to be a modification of the previous DSFA; the deferral fee of $3.275 million was paid during the second quarter 2016 and was deferred to the loan balance and is being amortized with previously deferred debt financing costs over the remaining life of the DSFA based on the revised effective interest rate of 10.6% .

17

The Company completed the acquisition of a new exploration target, Akwasiso, located 9kms north-east of the processing facility. The Company completed 10,000 metres of drilling over 81 holes with visible gold intercepts and extensive mineralized intersections of similar style to the main Nkran pit. The results of the drill program would be included in the definitive feasibility study that was published on July 18, 2017 (the “DFS”) and subsequently amended and restated on December 20, 2017 (the latter the “12/17 DFS”).

During September 2016, a mobile crusher was commissioned to mitigate a bottleneck in the primary crushing complex and the processing plant operated at 20% above design capacity.

On October 25, 2016, the Company received the Environmental Invoice (a pre-cursor to receiving the final Environmental Permit) from the relevant Ghanaian regulatory authorities for the development of the new Esaase mine. Following the receipt of the Environmental Invoice, the Board of Directors gave approval to proceed with P5M, and the Company commenced with front-end engineering design (“FEED”) for the plant upgrade and the overland conveyor associated with P5M and P10M.

Mined ore grade increased steadily during the three quarters post the commencement of commercial production (2.0g/t average mined grade in Q4 2016) as the central mineralized domains in the Nkran pit were exposed.

A total of 147,501 ounces of gold were produced following the commencement of commercial production (a nine-month period ending December 31, 2016), and 147,950 ounces were sold at an average price of $1,247/ounce for gross gold revenue of $184.5 million.

The 2016 near mine exploration program yielded success with the delineation of Mineral Resources and Reserves at the Adubiaso Extension and Nkran Extension, results of the which would be included in the 12/17 DFS.

In December 2016, Asanko received the Ghana Mining Industry Awards 2016 Corporate Social Investment Project of the Year for the Obotan Cooperative Credit Union project, an initiative aimed to increase access to financial capital and other financial services to assist small businesses address the challenge of access to credit and to support the development of economic growth in and around the AGM catchment area.

Fiscal 2017 (Year ended December 31, 2017)

During January 2017 the EPA issued its environmental permit for mining operations at Esaase and the overland conveyor to the AGM processing facility. This critical step was achieved following the EPA’s approval of the Environmental Impact Statement. The Minerals Commission also issued the mine operating permit for the Esaase mine.

An updated Mineral Resource Estimate (“MRE”) and Mineral Reserve Estimate (“MRev”) for the AGM was published on February 24, 2017, for the three near-mine exploration deposits, Akwasiso, Nkran Extension and Adubiaso Extension. See: “Mineral Resource and Mineral Reserve Estimates” and “Asanko Gold Mine Mineral Reserve Statement”.

18

During Q1 2017, there was a partial failure on the western wall of the Nkran pit, however due to the mitigation measures which have been put in place, as well as the slope stability radar (which has been instrumental in predicting geotechnical issues in the walls of the pit since mining began) there was no impact on either production or safety in the pit.

The Cut 2 pushback of the Nkran pit commenced during the Q2 2017 and initially focused on the western wall sequence, which included an additional 1.1Mt of waste material to align updated side wall designs to geotechnical recommendations received from SRK in the slump area. Once the required design elevation was reached on the western wall, the southeast sequence of the cut commenced, which continued in this area throughout the remainder of 2017.

Mining operations adopted the new MRE and grade control estimation processes during Q1 2017, which were fully implemented by the end of April 2017. The new MRE and associated grade control processes have been operational since May 2017.

During the year, the Company refined its mining reconciliation process relative to the reserve model and, as a result, identified blast movements were impacting ore losses and dilution. In response, blast movement monitoring technology was deployed in the Nkran pit to address the issue and align ore losses and dilution to design levels.

Pre-stripping and mining activities commenced at Akwasiso in June 2017. Early ore mining operations experienced higher levels of previously disturbed surface material from historic artisanal workings than expected which resulted in less oxide tonnes and lower grades reporting to the mill. As a result of the deeper levels of historic artisanal workings at Akwasiso, combined with the recently identified ore loss and dilution metrics at the Nkran pit, the Company revised its 2017 guidance to 205,000 to 225,000 ounces (compared to the previous guidance of from 230,00 to 240,000 ounces) at all-in sustaining cost per ounce of gold (“AISC”) of $920 to $960/oz.

At Dynamite Hill, the second satellite pit to be brought into production, site establishment commenced during the period in preparation of mining operations which commenced in Q4 2017. This included 3,096m of grade control drilling which validated the resource model and confirmed the mine plan and oxide ore volumes.

On July 18, 2017, the Company published its DFS for the AGM, which included an updated MRE with an updated Mineral Resource constraining pit shell assuming a gold price of $1,500/oz. The AGM reserves were unchanged and included 101Mt at 1.57 g/t for 5.1 million ounces of contained gold, based on a $1,300/oz gold price.

The Company acquired the Miradani Mining Lease (the “Miradani Project”), which is adjacent to the AGM, from AngloGold Ashanti.

Commissioning and ramping up to name plate capacity of the P5M volumetric upgrades (part of the first stage of P5M) was completed during the period, ahead of schedule and under budget. The processing facility continued to operate above expectations, processing 3.7Mt during 2017, with a feed grade of 1.8 g/t. Importantly, the processing plant achieved record milling rates of 1.1Mt for Q4 2017 including an annualized milling rate of 5Mtpa for the month of December.

During 2017, the Company produced 205,047 ounces, in line with the revised 2017 production guidance of 205,000 – 225,000 ounces.

The Company achieved an industry-leading safety record of 0.17 LTIFR, despite one lost time injury occurring during Q1 2017.

The Company did not complete any significant acquisitions during the year ended December 31, 2017.

19

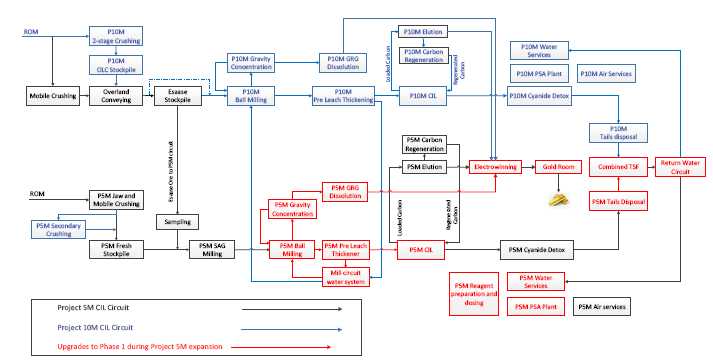

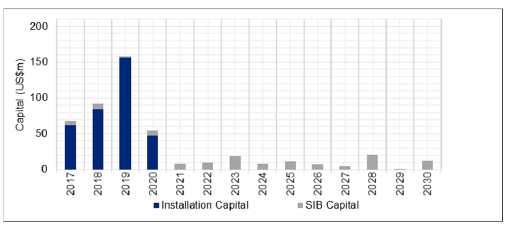

Expansion Plans

The Company has developed plans for two production expansions at the AGM, which combined have the potential to increase production from the current capacity of approximately 205,000 to 225,000 ounces per annum to about 450,000 ounces per annum. These two production expansion projects are known as the “Project 5M” or “P5M” and the “Project 10M” or “P10M”. These projects are named with reference to their projected throughput of ore so that Project 5M will upgrade the existing CIL plant’s throughput from 3.6Mtpa to 5Mtpa. The second stage of Project 5M includes the construction of a 27km overland conveyor to integrate the nearby Esaase deposit, which, along with the development of the Esaase deposit, is estimated to have a total capital cost of $128 million and may vary due to future foreign exchange differences. In addition, management expects to install a permanent secondary crusher ($4.0 million) and upgraded mill motors ($1.0 Million) in 2018, which are not contemplated in the 12/17 DFS.

A second planned expansion project, known as Project 10M, comprises the construction of an additional 5Mtpa CIL ore processing plant in order to double plant capacity from 5Mtpa to 10Mtpa. The timing of the second stage of Project 5M or Project 10M will be at the Board’s discretion and is also dependent on the Company’s balance sheet, financing opportunities as well as favourable market conditions. No determination has been made to date to proceed with the P10M expansion plan, and any decision to proceed will be contingent upon the Company securing the required additional financing to fund the required capital cost.

These two expansion projects were originally analyzed in a technical report called “Asanko Gold Mine– Definitive Feasibility Study – National Instrument 43-101 Technical Report” with an effective date of June 5, 2017. This report was amended and restated to clarify certain of its contents and filed on SEDAR on December 27, 2017. (the amended version being herein the “12/17 DFS”). The 12/17 DFS is the primary source for the current technical information referenced in this Prospectus. The summary of the 12/17 DFS is re-produced below under “Mineral Properties”.

The first stage of P5M, the brownfield modifications and upgrades to the CIL processing plant to increase throughput to 5Mtpa, was approved in November 2016. The Company completed the volumetric upgrades to the plant under budget and ahead of schedule. Since the volumetric upgrades were fully commissioned in December 2017, the processing plant has been operating at a 5Mtpa annualized milling rate. Installation and commissioning of the P5M recovery circuit upgrades are expected to be completed in Q1 2018.

The second stage of P5M is the construction of an overland conveyor and development of the Esaase deposit. The estimated capital cost of the second stage of P5M per the 12/17 DFS has been estimated at $128 million. The decision to proceed with the second stage of P5M has been deferred until such time as the Red Kite senior debt restructuring in accordance with the RK Term Sheet is completed. The timing of P10M will be at the Board’s discretion and dependent on the Company’s balance sheet, financing opportunities as well as favourable market conditions.

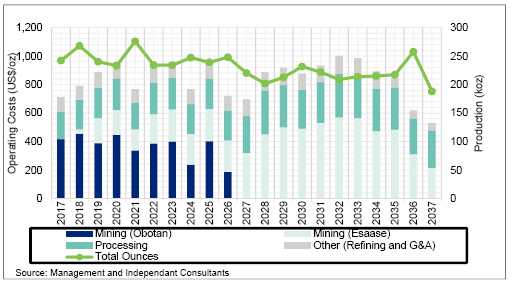

5-Year Outlook (2019 - 2023)

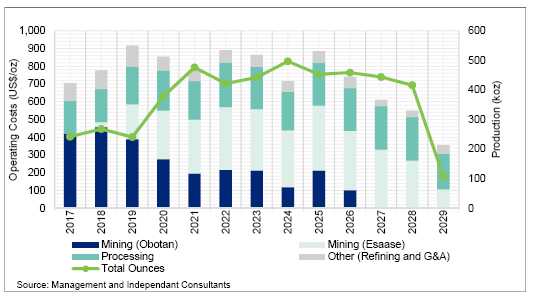

The Company's current mine optimization plan, using current mine operating data, has improved the multi-pit schedule and reduced the overall strip ratio to deliver competitive AISC over a life of mine of 19 years under the P5M scenario. Average annual production over the outlook period (2019 - 2023) of 253,000 ounces at AISC of $860/oz, an increase in ounces and improvement in AISC versus previous P5M pre-optimized plan of 243,000 ounces at AISC of $1,007/oz

The optimized plan generates improved cashflows to provide the Company with sufficient liquidity during the period of capital spend on Esaase, the installation of the overland conveyor and subsequent debt repayment period.

Specialized Skill and Knowledge

Various aspects of the Company’s mining business require specialized skills and knowledge, including skills and knowledge in the areas of permitting, geology, drilling, metallurgy, logistical planning, mine design, engineering, construction and implementation of exploration programs as well as finance, risk management and accounting. Much of the specialized skill and knowledge is provided by the Company’s management and operations team. The Company also retains outside consultants with additional specialized skills and knowledge, as required. However, it is possible that delays and increased costs may be experienced by the Company in locating and/or retaining skilled and knowledgeable employees and consultants in order to proceed with its planned exploration and development at its mineral properties.

20

Competitive Conditions

Asanko competes with other mineral resource exploration companies for financing, for the acquisition of new mineral properties, for the recruitment and retention of qualified employees and other personnel, as well as operating supplies. Many of the mineral resource exploration and development companies with which Asanko competes have greater financial and technical resources. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development.

Cycles

The mining business is subject to mineral price cycles. The marketability of minerals is also affected by worldwide economic cycles. At the present time, the significant demand for minerals in many countries is driving commodity prices, but it is difficult to assess how long such demand may continue. Fluctuations in supply and demand in various regions throughout the world are common.

Asanko’s revenues may be significantly affected by changes in commodity demand and prices. The Company’s ability to fund ongoing exploration and development is impacted by the sale of gold produced by the mine and the proceeds of such sales. As market fluctuations affect the price of gold, proceeds from the sale of the gold produced by the Company can be reflected accordingly. As well, the ability of the Company to continue development, exploration and increased production is affected by the availability of financing which, in turn, is affected by the strength of the economy and other general economic factors.

Economic Dependence

As a producer of gold, the Company is not considered to be dependent on any particular sales contract as the market for gold is deep and worldwide. In fact, under the terms of the DSFA, the Company is required to sell all of its production to Red Kite (up to a maximum of 2.2 million ounces of gold). The Company could be considered to be significantly dependent upon its DSFA with Red Kite, as well key operational contracts associated with mining services, fuel supply and processing consumables. Asanko and Red Kite are currently finalizing definitive documentation associated with the refinancing of the current debt facility to support the second stage of its P5M growth plan with a contemplated extension of the principal repayment date of up to three years. As the Company’s gold production increases and sales of its produced minerals continue to add value, the Company is expected to be in a position to augment its working capital with its sales and lessen the Company’s reliance on debt financing. The Company also believes that each of these supplier arrangements could be, if necessary, replaced by other suppliers. The current debt and supplier arrangements are set out below.

The Company’s properties are subject to stringent laws and regulations governing environmental quality. Such laws and regulations can increase the cost of planning, designing, installing and operating facilities on our properties. However, it is anticipated that, absent the occurrence of an extraordinary event, compliance with existing laws and regulations governing the release of emissions in the environment or otherwise relating to the protection of the environment, will not have a material effect upon the Company’s current operations, capital expenditures, earnings or competitive position.

Employees

At December 31, 2017, the Company had approximately 396 full-time employees, and 50 temporary workers employed across its site operations and corporate and regional offices.

21

Foreign Operations

All of the Company’s mine development operations are currently conducted in Ghana, a foreign jurisdiction, and as such, the Company’s operations are exposed to various levels of political, economic and other such risks and uncertainties as: military repression; extreme fluctuations in currency exchange rates; high rates of inflation; labour unrest; war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; changes in taxation policies; restrictions on foreign exchange and repatriation; changes to export regulations and changing political conditions, currency controls and governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

In the past, Ghana has been subject to political instability, changes and uncertainties, which if such instability were to recur, may cause changes to existing governmental regulations affecting mineral exploration and mining activities. Ghana’s status as a developing country may make it more difficult for the Company to obtain any required financing for its projects.

Asanko’s operations and properties are subject to a variety of governmental regulations governing worker health and safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species and other matters.

Asanko’s mineral exploration and development activities in Ghana may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that increase the costs related to the Company’s activities or the maintenance of its properties.

Changes, if any, in mining or investment policies or shifts in political attitude may adversely affect the Company’s operations and financial condition. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the Company’s operations and financial condition. Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could negatively impact current or planned exploration and development activities on the Asanko Gold Mine or in respect of any other projects in which the Company becomes involved. Any failure to comply with applicable laws and regulations, even if inadvertent, could result in the interruption of exploration and development operations or material fines, penalties or other liabilities.

Free Carried Interest to the Ghanaian Government

Section 43.1 of the Ghanaian Minerals and Mining Act of 2006 (the “Ghanaian Mining Act”), (Government Participation in Mining Lease) provides: Where a mineral right is for mining or exploitation, the Government shall acquire a ten percent free carried interest in the rights and obligations of the mineral operations in respect of which financial contribution shall not be paid by Government.

In order to achieve this legislative objective, 10% of the common shares of Asanko Gold Ghana, the Company’s Ghanaian subsidiary which owns the Obotan and Esaase properties, have been issued into the name of the Government of Ghana. The government has a nominee on the board of this subsidiary. There is no shareholder agreement between the Asanko Gold Ghana and any of its shareholders, as the 10% ownership stake of the Government of Ghana represents a non-participating interest where the Ghanaian Government is entitled to 10% of declared dividends from the net profit of Asanko Gold Ghana, but does not have to contribute to its capital investment.

22

Ghanaian Mining Royalties and Taxes

On March 19, 2010, the government of Ghana amended section 25 of the Ghanaian Mining Act which stipulates the royalty rates on mineral extraction payable by mining companies in Ghana. The Ghanaian Mining Act now requires the holder of a mining lease, restricted mining lease, or small-scale mining license to pay a royalty in respect of minerals obtained from its mining operations to Ghana at the rate of 5% of the total revenue earned from minerals obtained by the holder.

Changes to the Ghanaian tax system were announced and substantively enacted during the year ended March 31, 2012. Corporate tax rates rose from 25% to 35% and capital deductions were reduced from an 80% deduction in year one to a straight-line depreciation of 20% per year over 5 years.

Social and Environmental Policies

CSR Policy

Asanko believes that corporate social responsibility is integral to meeting our strategic objectives as it will ensure we maintain our social license to operate, enhance our reputation with all our stakeholders, improve our risk management, reduce our cost of production and both directly and indirectly benefit the communities we operate in beyond the life of our mines.

The Company’s approach to its corporate social responsibility (“CSR”) is based on the following principles:

| • |

Complying with our corporate governance principles, national and international laws, industry codes and being a responsible corporate citizen. | |

|

| ||

| • |

Mitigating our impact on the environment. | |

|

| ||

| • |

Maintaining a high-level Health and Safety performance. | |

|

| ||

| • |

Actively identifying opportunities to make a positive and meaningful contribution to the communities we operate in beyond the life of our mines. | |

|

| ||

| • |

Contributing to the economic and social development of our host countries. | |

|

| ||

| • |

Developing our employees. | |

|

| ||

| • |

Adhering to our values and demonstrating them in our behavior. |

The Company follows the following guidelines in our CSR conduct:

| • |

We embrace the objectives of the African Mining Vision and are guided by the Global Reporting Initiative in our CSR reporting. | |

| • |

We regularly engage with our stakeholders and take into consideration their perspectives, concerns, customs and cultural heritage before we act. | |

| • |

We work closely with landowners prior to commencing activities on the ground, and negotiate fair compensation for such activities where appropriate. | |

| • |

We hire local, regional and national residents and use goods and services from our local communities wherever possible, without compromising our quality and efficiency standards. |

23

| • |

We uphold fundamental human rights and do not interfere or take sides in politics or social issues. | |

| • |

We work with unified local committees to identify and prioritize community development projects intended to promote long-lasting livelihood improvements. | |

| • |

We do not tolerate any unethical behavior by any stakeholder involved in our business. |

Social Investment Initiative

On November 3, 2016, the Company announced it had been awarded the Ghana Mining Industry Awards 2016 Corporate Social Investment Project of the Year, for the Obotan Cooperative Credit Union (“OCCU”) initiative. The OCCU aims to increase access to financial capital and other financial services to assist small businesses address the challenge of access to credit and to support the development of economic growth in and around the Asanko Gold Mine catchment area. The OCCU was launched in December 2015, before the Asanko Gold Mine had poured first gold, and now has over 1,700 members and more than GHS790,000 in assets. The OCCU is sponsored by Asanko and the German government-backed development organization, Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH, and is also an affiliate member of the Credit Union Association of Ghana.

Environmental Policy

Asanko aspires to provide safe, responsible and profitable operations whilst ensuring sustainable natural resources development for the benefit of our employees, shareholders and host communities. We endeavour to protect and conserve the natural environment for future generations.

In adopting the following principles, Asanko intends to drive continuous improvement and excellence in environmental performance:

| • |

Asanko will communicate its commitment to excellence in environmental performance to our employees, contractors, government agencies and the community. | |

| • |

Asanko will comply with host country laws and regulations, and will augment these with appropriate international guidelines and best practice environmental management. | |

| • |

Asanko will allocate the necessary resources to ensure we meet our reclamation and environmental obligations. | |

| • |

Asanko will strive to prevent pollution of air, land and water, and will implement appropriate waste management practices. | |

| • |

Asanko will strive to be energy efficient in everything we do. | |

| • |

Asanko will explore opportunities with government agencies and communities to remediate and mitigate historic mining impacts on acquired properties. | |

| • |

Asanko will develop and utilize an Environmental Management System that ensures prioritization, planning, implementation, monitoring, review and transparent reporting. | |

| • |

Asanko will routinely set and review environmental targets and performance for each project and report on progress to our employees, shareholders, government agencies and the community. |

24

MINERAL PROPERTIES

The Asanko Gold Mine

The following is a summary description of the project known as the AGM and is a direct extract and reproduction of the summary, without material modification, contained in the National Instrument 43-101 Technical Report entitled “Asanko Gold Mine Definitive Feasibility Study (Amended and Restated)” with an effective date of June 5, 2017, amended and restated December 20, 2017. The 12/17 DFS was prepared on behalf of Asanko by Charles Muller, B.Sc. Hons (Geology), Malcolm Titley, BSc (Geology and Chemistry), MAIG; MAusIMM, Phil Bentley, MSc (Geology), MSc (Mineral Exploration) Pr. Sci. Nat. SACNASP, Thomas Kwabena Obiri-Yeboah, B.Sc Eng (Mining), PrEng, Glenn Bezuidenhout, National Diploma (Extractive Metallurgy), FSIAMM, Dave Morgan, M.Sc. Eng (Civil), CP Eng, Douglas Heher, B.Sc Eng (Mechanical), PrEng and Godknows Njowa, M.Sc Eng (Mining), PrEng, each of whom is an independent Qualified Person. The work and conclusions of the 12/17 DFS are disclosed in accordance with NI 43-101.

Asanko is intending to develop the AGM in two phases, with the first phase being largely based on the Obotan Project as initiated by PMI. It was envisioned by the Company that the Esaase pit would be assessed for development in a second phase. The construction of the first phase was completed in early 2016. Gold production commenced in January 2016, commercial production was declared on April 1, 2016, and the operation reached steady-state production levels by the end of the second quarter of 2016. The Company completed the volumetric upgrades associated with P5M during 2017 and expects to complete the P5M recovery upgrades in 2018. The balance of P5M is expected to be carried out in late 2018/2019, dependent on the Company’s balance sheet, financing opportunities as well as favourable market conditions.

The 12/17 DFS

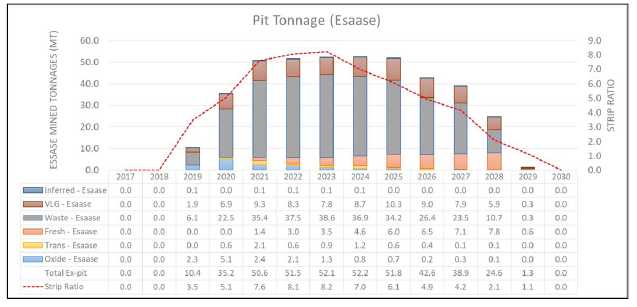

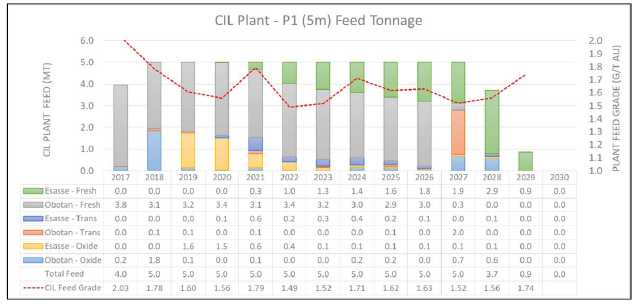

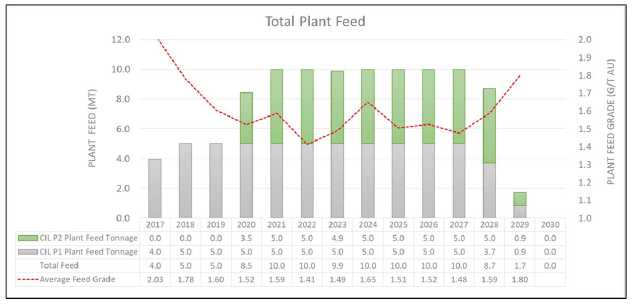

The 12/17 DFS evaluates the expansion of the AGM from the current open pit mining and processing operation to include an expanded processing facility and to bring the Esaase deposit into production, with construction expected to start in Q2 2017. The status of the Company’s determinations as to proceeding with these expansion plan scenarios is discussed above under “Description and General Development of the Business – Expansion Plans”. The 12/17 DFS evaluated the Project in the following three scenarios:

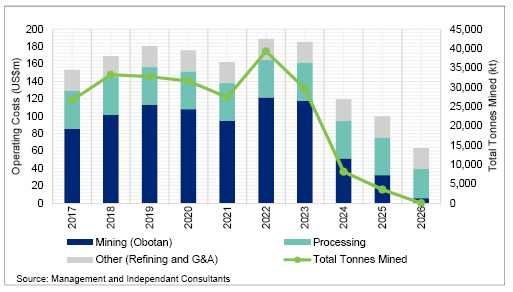

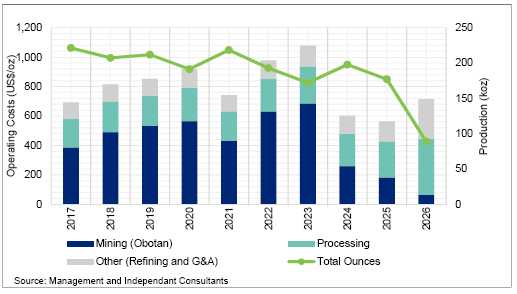

Base Case: Current operation (previously referred to as Phase 1) - as commissioned in Q1 2016:

| • |

CIL processing facility, located at the Obotan project site, operating at 3.6Mtpa (design was originally 3Mtpa) | |

| • |

Tailings Storage Facility (“TSF”) | |

| • |

Life of Mine (“LoM”) approximately 10 years to 2026 | |

| • |

Ore sources: Nkran and Satellite pits |

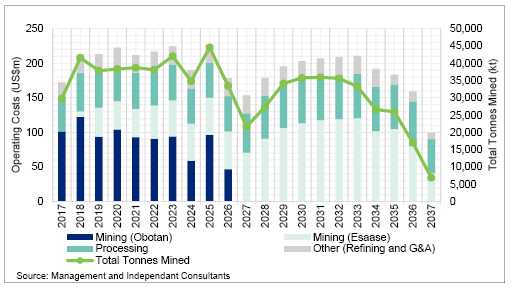

P5M Expansion

| • |

Existing CIL processing facility at Obotan upgraded from the current 3.6Mtpa to 5Mtpa (Brownfields expansion) |

25

| • |

Overland conveyor constructed from Esaase to Obotan o Power line from Obotan to Esaase constructed | |

| • |

Esaase deposit brought into production at 2Mtpa run of mine (“ROM”) | |

| • |

Ore sources: Nkran, Satellite pits and Esaase, upon commissioning of the conveyor | |

| • |

On a standalone basis, LoM approximately 20 years to 2037 |

P10M Expansion

| • |

Second CIL plant constructed, adjacent to the current plant at Obotan, with a capacity of 5Mtpa, thereby doubling processing capacity to 10Mtpa | |

|

| ||

| • |

Production from Esaase pit ramped up to 7Mtpa ROM | |

|

| ||

| • |

Resettlement of the village of Tetrem, comprising 250 structures o Expansion of the footprint of the existing TSF | |

|

| ||

| • |

Ore sources: Esaase, Nkran, Satellite pits o LoM approximately 10 years to 2027 |

All defined terms used in the summary below have the meaning ascribed to them in the 12/17 DFS, and as a result may differ from the defined terms used elsewhere throughout this AIF. The below summary is subject to all the assumptions, qualifications and procedures set out in the 12/17 DFS and is qualified in its entirety with reference to the full text of the 12/17 DFS, which has been filed on July 18, 2017, is available for review under the Company’s profile at www.sedar.com.

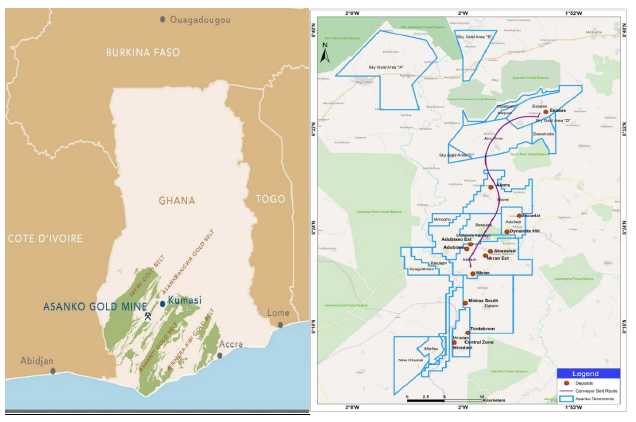

Project Description, Location and Access

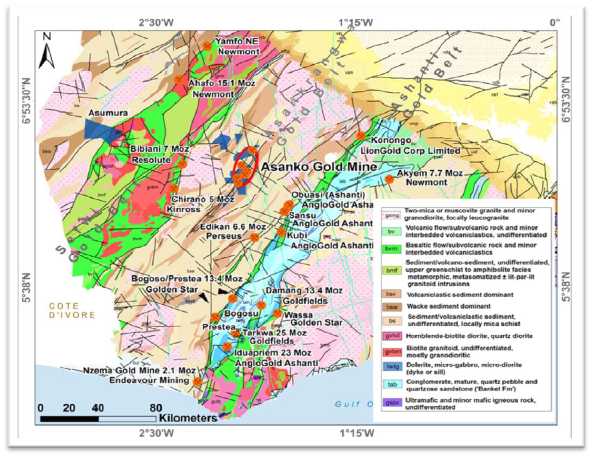

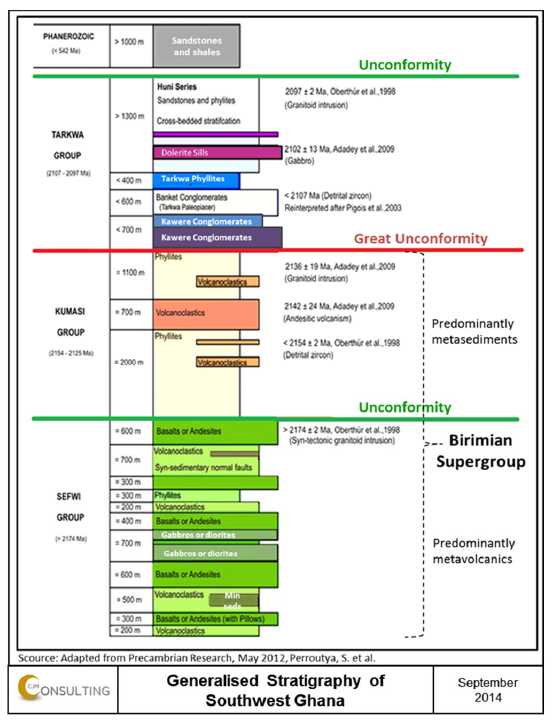

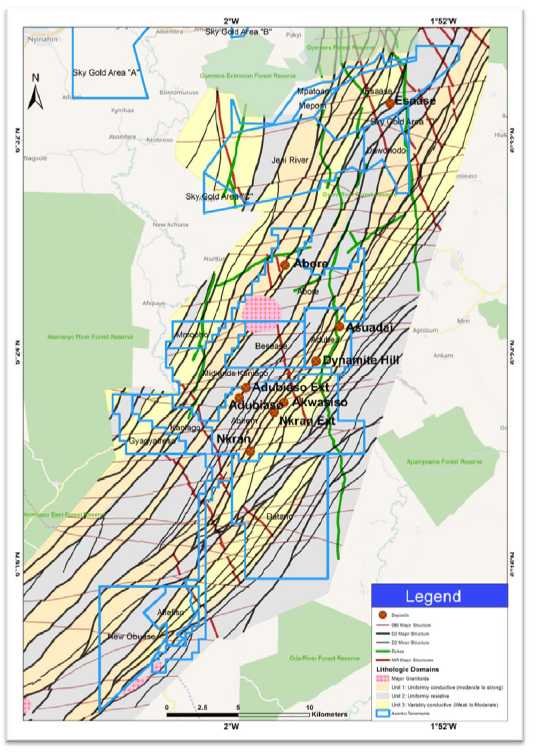

The AGM concessions, the Obotan and Esaase project areas, are located in the Amansie West District of the Ashanti Region of Ghana (Figure 1-2). The Project concessions are owned 100% by Asanko Gold Ghana, a 90% owned Ghanaian subsidiary of the Company. The Government of Ghana has a 10% free carried interest in Asanko Gold Ghana under Section 8 of the Ghanaian Mining Act.

Asanko Gold holds seven mining leases (Table 1-1), as well as prospecting and reconnaissance licenses, which collectively make up the AGM and span 30 km strike length of the Asankrangwa Gold Belt. The mining lease concessions cover an area of approximately 213.2 km2, between latitudes 6° 11' 54.985" N and 6° 35' 33.074" N, and longitudes 2° 4' 59.195" W and 1° 51' 25.040" W.

The Esaase, Abore, Abirem, Datano, Jeni River and Adubea Mining Leases contain all of the mineral resources defined to date. All other concessions held by Asanko Gold in the area contain exploration potential defined to date and in some instances locations for infrastructure. The Ghana EPA grants permits on a perennial basis to conduct exploration. With respect to the AGM concession areas, all permitting within the afore-mentioned governmental permitting structure is up to date and accounted for.

26

Figure 1-2: The AGM Location and location of the various tenements making up the AGM (Source: 12/17 DFS)

Table 1-1: The Asanko Gold Mine Mining Licenses (Source: 12/17 DFS)

| Tenement name | Licence Category | 100%

owned title holder |

Minerals Commission file |

Status of licence | Area Km² |

| Datano | Mining Lease | Asanko Gold Ghana – 100% | PL 6/32/Vol 3 | Valid-ML renewal | 53.78 |

| Abore | Mining Lease | Asanko Gold Ghana – 100% | PL 6/303 | Valid-ML received | 28.47 |

| Abirem | Mining Lease | Asanko Gold Ghana – 100% | PL 6/303 | Valid-ML received | 47.13 |

| Adubea | Mining Lease | Asanko Gold Ghana – 100% | PL 6/310 | Valid-ML received | 13.38 |

| Esaase | Mining Lease | Asanko Gold Ghana – 100% | PL 6/8/Vol.8 | Valid-ML received | 27.03 |

| Jeni River | Mining Lease | Asanko Gold Ghana – 100% | RL 6/21 | Valid | 43.41 |

| Miradani | Mining Lease | Asanko Gold Ghana – 100% | RL 6/22 | Valid | 14.98 |

All concessions carry a 10% free carried interest in favour of the Ghanaian government. The government interest is reflected in a 10% ownership of Asanko Gold Ghana, and the government has a right to 10% of any dividends paid by the subsidiary. The leases are also subject to a 5% royalty on the value of metals sold payable to the government of Ghana. In addition, the Adubea concession is also subject to an additional 0.5% royalty to the original concession owner. The Esaase mining lease is also subject to an additional 0.5% royalty to the Bonte Liquidation Committee.

There is no environmental liability held over Asanko for any of the AGM concessions relating to the Obotan project area, with the exception of project works to date. There is a potential environmental liability on the Company’s Jeni River concession which was inherited with the acquisition of the Esaase concession and is reported in the Company’s December 31, 2017 financial statements as an Asset Retirement Obligation.

27

Accessibility, Climate, Infrastructure and Physiography

The AGM concessions are located in the Amansie West district of the Ashanti region of Ghana, approximately 250 km northwest of the capital Accra, and about 50 to 80 km southwest of the regional capital of Kumasi. There are several local villages near the AGM site; the closest to the plant site is the Manso Nkran village, while the villages of Tetrem and Esaase are in close proximity to the Esaase deposit.

Mining personnel are readily available in Ghana with a highly skilled workforce and numerous mining operations in the country.

There are daily flights from Accra to Kumsi flown by several different airlines. In addition, there is a small airstrip located adjacent to the Obotan project site infrastructure west of the Nkran village, which is used by the AGM to transport staff and service providers to and from Accra. Existing road access to the site is available from the west, south and east, but the main access used will be from the ports of Tema and Takoradi to the south via Kumasi, or Obuasi. Total distance from Tema to the project site, via Kumasi is approximately 400 km.

The AGM is located in hilly terrain dissected by broad, flat drainages that typically form swamps in the wet season between May and late October. Hill tops are generally at very similar elevations, reflecting the elevation of a previous erosional peneplane that is now extensively eroded. Maximum elevations are around 80m above sea level, but the areas impacted by the AGM deposits generally lie at less than 50m elevation. Despite the subdued topography, hill slopes are typically steep. Ecologically the AGM area is situated in the wet evergreen forest zone.

Project Infrastructure

Current site infrastructure consists of:

| • |

an administration block, training facilities, exploration offices, core storage area, clinic and laboratory | |

|

| ||

| • |

senior and junior accommodation facilities located to the west of the Obotan mine | |

|

| ||

| • |

an exploration camp and office at Esaase | |

|

| ||

| • |

an established mining operation at Obotan with various structures like offices, stores, workshops and fuel storage facilities | |

|

| ||

| • |

a new CIL Plant at Obotan with various structures like offices, stores, workshops and reagent buildings | |

|

| ||

| • |

a TSF | |

|

| ||

| • |

Multiple boreholes sunk for water supply | |

|

| ||

| • |

a 161-kV incoming power line fed from the Asawinso sub-station | |

|

| ||

| • |

Communications currently available at the site are good due to the erection of an additional Vodafone tower at the Obotan camp. |

28

History

Nkran Area

Nkran is important from the view point of historical artisanal gold mining that dates back many generations and remains quite extensive to the present day.