UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of | (I.R.S. Employer | |

( | ||

(Address, including zip code, of registrant’s principal executive offices) | (Telephone number, including area code, of registrant’s principal executive offices) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act

Large accelerated filer | ◻ | ☒ | |

Smaller reporting company | |||

Non-accelerated filer | ◻ | Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act of 1934). Yes

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of July 31, 2020, there were

PROTAGONIST THERAPEUTICS, INC.

FORM 10-Q

TABLE OF CONTENTS

Page | ||

1 | ||

2 | ||

3 | ||

4 | ||

6 | ||

Notes to Unaudited Condensed Consolidated Financial Statements | 7 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 26 | |

40 | ||

41 | ||

41 | ||

41 | ||

82 | ||

83 | ||

83 | ||

83 | ||

83 | ||

86 |

PART I. – FINANCIAL INFORMATION

ITEM 1.FINANCIAL STATEMENTS

PROTAGONIST THERAPEUTICS, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands, except share and per share data)

June 30, | December 31, | |||||

| 2020 |

| 2019 | |||

Assets | ||||||

Current assets: | ||||||

Cash and cash equivalents | $ | | $ | | ||

Marketable securities | | | ||||

Restricted cash - current | | | ||||

Receivable from collaboration partner and contract asset - related party | | | ||||

Research and development tax incentive receivable | | — | ||||

Prepaid expenses and other current assets | | | ||||

Total current assets | | | ||||

Property and equipment, net | | | ||||

Restricted cash - noncurrent | | | ||||

Operating lease right-of-use asset | | | ||||

Deferred tax asset | — | | ||||

Total assets | $ | | $ | | ||

Liabilities and Stockholders’ Equity | ||||||

Current liabilities: |

| |||||

Accounts payable | $ | | $ | | ||

Payable to collaboration partner - related party | | | ||||

Accrued expenses and other payables | | | ||||

Deferred revenue - related party - current | | | ||||

Operating lease liability - current | | | ||||

Total current liabilities | | | ||||

Long-term debt, net | — | | ||||

Deferred revenue - related party - noncurrent | | | ||||

Operating lease liability - noncurrent | | | ||||

Other liability - noncurrent | | — | ||||

Total liabilities | | | ||||

Commitments and contingencies | ||||||

Stockholders’ equity: | ||||||

Preferred stock, $ | ||||||

Common stock, $ | ||||||

Additional paid-in capital | | | ||||

Accumulated other comprehensive loss | ( | ( | ||||

Accumulated deficit | ( | ( | ||||

Total stockholders’ equity | | | ||||

Total liabilities and stockholders’ equity | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1

PROTAGONIST THERAPEUTICS, INC.

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except share and per share data)

Three Months Ended | Six Months Ended | |||||||||||

June 30, | June 30, | |||||||||||

| 2020 |

| 2019 |

| 2020 |

| 2019 | |||||

License and collaboration revenue - related party | $ | | $ | ( | $ | | $ | ( | ||||

Operating expenses: | ||||||||||||

Research and development | | | | | ||||||||

General and administrative |

| |

| |

| |

| | ||||

Total operating expenses |

| |

| |

| |

| | ||||

Loss from operations |

| ( |

| ( |

| ( |

| ( | ||||

Interest income |

| |

| |

| | | |||||

Interest expense | ( | — | ( | — | ||||||||

Loss on early repayment of debt | ( | — | ( | — | ||||||||

Other income (expense), net | | ( | | ( | ||||||||

Loss before income tax (expense) benefit | ( | ( | ( | ( | ||||||||

Income tax (expense) benefit | ( | | ( | | ||||||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Net loss per share, basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Weighted-average shares used to compute net loss per share, basic and diluted |

| |

|

| |

| |

|

| | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

PROTAGONIST THERAPEUTICS, INC.

Condensed Consolidated Statements of Comprehensive Loss

(Unaudited)

(In thousands)

Three Months Ended | Six Months Ended | |||||||||||

June 30, | June 30, | |||||||||||

| 2020 |

| 2019 |

| 2020 |

| 2019 | |||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Other comprehensive loss: |

|

| ||||||||||

(Loss) gain on translation of foreign operations |

| ( |

| ( |

| |

| ( | ||||

Gain (loss) on marketable securities |

| |

| |

| ( |

| | ||||

Comprehensive loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

PROTAGONIST THERAPEUTICS, INC.

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(In thousands, except share data)

Accumulated | |||||||||||||||||

Additional | Other | Total | |||||||||||||||

Common | Paid-In | Comprehensive | Accumulated | Stockholders' | |||||||||||||

Stock | Capital | Gain (Loss) | Deficit | Equity | |||||||||||||

Three months ended June 30, 2020 |

| Shares |

| Amount |

|

|

|

|

| ||||||||

Balance at March 31, 2020 |

| |

| $ | — | $ | |

| $ | | $ | ( |

| $ | | ||

Issuance of common stock pursuant to public offering, net of issuance costs | | — | | — | — | | |||||||||||

Issuance of common stock pursuant to at-the-market offering, net of issuance costs | | — | | — | — | | |||||||||||

Issuance of common stock under equity incentive and employee stock purchase plans |

| |

|

| — |

| |

|

| — |

| — |

|

| | ||

Stock-based compensation expense |

| — |

|

| — |

| |

|

| — |

| — |

|

| | ||

Other comprehensive gain (loss) |

| — |

|

| — |

| — |

|

| ( |

| — |

|

| ( | ||

Net loss |

| — |

|

| — |

| — |

|

| — |

| ( |

|

| ( | ||

Balance at June 30, 2020 |

| |

| $ | — | $ | |

| $ | ( | $ | ( |

| $ | | ||

Accumulated | |||||||||||||||||

Additional | Other | Total | |||||||||||||||

Common | Paid-In | Comprehensive | Accumulated | Stockholders' | |||||||||||||

Stock | Capital | Gain (Loss) | Deficit | Equity | |||||||||||||

Three months ended June 30, 2019 |

| Shares |

| Amount |

|

|

|

|

| ||||||||

Balance at March 31, 2019 | | $ | — | $ | | $ | ( | $ | ( | $ | | ||||||

Issuance of common stock pursuant to at-the-market offering, net of issuance costs | | — | | — | — | | |||||||||||

Issuance of common stock pursuant to exercise of Exchange Warrants | | — | — | — | — | — | |||||||||||

Issuance of common stock under equity incentive and employee stock purchase plans | |

|

| — |

| |

|

| — |

| — |

|

| | |||

Stock-based compensation expense |

| — |

|

| — |

| |

|

| — |

| — |

|

| | ||

Other comprehensive gain (loss) |

| — |

|

| — |

| — |

|

| |

| — |

|

| | ||

Net loss |

| — |

|

| — |

| — |

|

| — |

| ( |

|

| ( | ||

Balance at June 30, 2019 |

| |

| $ | — | $ | |

| $ | ( | $ | ( |

| $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

PROTAGONIST THERAPEUTICS, INC.

Condensed Consolidated Statements of Stockholders’ Equity (continued)

(Unaudited)

(In thousands, except share data)

Accumulated | |||||||||||||||||

Additional | Other | Total | |||||||||||||||

Common | Paid-In | Comprehensive | Accumulated | Stockholders' | |||||||||||||

Stock | Capital | Gain (Loss) | Deficit | Equity | |||||||||||||

Six months ended June 30, 2020 |

| Shares |

| Amount |

|

|

|

|

| ||||||||

Balance at December 31, 2019 |

| |

| $ | — | $ | |

| $ | ( | $ | ( |

| $ | | ||

Issuance of common stock pursuant to public offering, net of issuance costs | | — | | — | — | | |||||||||||

Issuance of common stock pursuant to at-the-market offering, net of issuance costs | | — | | — | — | | |||||||||||

Issuance of common stock under equity incentive and employee stock purchase plans |

| |

|

| — |

| |

|

| — |

| — |

|

| | ||

Stock-based compensation expense |

| — |

|

| — |

|

|

| — |

| — |

|

| ||||

Other comprehensive gain (loss) |

| — |

|

| — |

| — |

|

| |

| — |

|

| | ||

Net loss |

| — |

|

| — |

| — |

|

| — |

| ( |

|

| ( | ||

Balance at June 30, 2020 |

| |

| $ | — | $ | |

| $ | ( | $ | ( |

| $ | | ||

Accumulated | |||||||||||||||||

Additional | Other | Total | |||||||||||||||

Common | Paid-In | Comprehensive | Accumulated | Stockholders' | |||||||||||||

Stock | Capital | Gain (Loss) | Deficit | Equity | |||||||||||||

Six months ended June 30, 2019 |

| Shares |

| Amount |

|

|

|

|

| ||||||||

Balance at December 31, 2018 | | $ | — | $ | | $ | ( | $ | ( | $ | | ||||||

Issuance of common stock pursuant to at-the-market offering, net of issuance costs | | — | | — | — | | |||||||||||

Issuance of common stock pursuant to exercise of Exchange Warrants | | — | — | — | — | — | |||||||||||

Issuance of common stock under equity incentive and employee stock purchase plans | |

|

| — |

| |

|

| — |

| — |

|

| | |||

Stock-based compensation expense |

| — |

|

| — |

| |

|

| — |

| — |

|

| | ||

Other comprehensive gain (loss) |

| — |

|

| — |

| — |

|

| |

| — |

|

| | ||

Net loss |

| — |

|

| — |

| — |

|

| — |

| ( |

|

| ( | ||

Balance at June 30, 2019 |

| |

| $ | — | $ | |

| $ | ( | $ | ( |

| $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

PROTAGONIST THERAPEUTICS, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

Six Months Ended June 30, | ||||||

| 2020 |

| 2019 | |||

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

| |||

Net loss | $ | ( | $ | ( | ||

Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

Stock-based compensation | | | ||||

Change in deferred tax asset | | ( | ||||

Operating lease right-of-use asset amortization | | | ||||

Loss on early repayment of debt | | — | ||||

Depreciation and amortization | | | ||||

Amortization of debt issuance costs and accretion of debt discount | | — | ||||

Accretion of discount on marketable securities, net of premium amortization | ( | ( | ||||

Changes in operating assets and liabilities: | ||||||

Research and development tax incentive receivable | ( | — | ||||

Receivable from collaboration partner - related party | | ( | ||||

Prepaid expenses and other assets | ( | ( | ||||

Accounts payable | | ( | ||||

Payable to collaboration partner - related party | ( | ( | ||||

Accrued expenses and other payables | | ( | ||||

Deferred revenue - related party | ( | | ||||

Operating lease liability | ( | ( | ||||

Other liability | | — | ||||

Net cash used in operating activities | ( | ( | ||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

Proceeds from maturities of marketable securities | | | ||||

Purchase of marketable securities | ( | ( | ||||

Purchases of property and equipment | ( | ( | ||||

Net cash provided by (used) in investing activities | | ( | ||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

Proceeds from public offering of common stock, net of issuance costs | | — | ||||

Proceeds from at-the-market offering, net of issuance costs | | | ||||

Proceeds from issuance of common stock upon under equity incentive and employee stock purchase plans | | | ||||

Issuance costs related to long-term debt | ( | — | ||||

Early repayment of long-term debt | ( | — | ||||

Net cash provided by financing activities | | | ||||

Effect of exchange rate changes on cash, cash equivalents and restricted cash | | ( | ||||

Net increase (decrease) in cash, cash equivalents and restricted cash | | ( | ||||

Cash, cash equivalents and restricted cash, beginning of period |

| |

| | ||

Cash, cash equivalents and restricted cash, end of period | $ | | $ | | ||

SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING AND INVESTING INFORMATION: | ||||||

Issuance costs related to public offering of common stock included in accrued liabilities and other payables | $ | | $ | — | ||

Issuance costs related to at-the-market offering of common stock included in prepaid expenses and other assets at the end of the previous year | $ | | $ | — | ||

Issuance costs related to public offering of common stock included in prepaid expenses and other assets at the end of the previous year | $ | | $ | — | ||

Purchases of property and equipment in accounts payable and accrued liabilities | $ | | $ | | ||

Tenant improvement allowance reimbursement | $ | — | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

PROTAGONIST THERAPEUTICS, INC.

Notes to Unaudited Condensed Consolidated Financial Statements

Note 1. Organization and Description of Business

Protagonist Therapeutics, Inc. (the “Company”) was incorporated in the state of Delaware on August 22, 2006 and is headquartered in Newark, California. The Company is a clinical-stage biopharmaceutical company that utilizes a proprietary technology platform to discover and develop novel peptide-based drugs to transform existing treatment paradigms for patients with significant unmet medical needs. Protagonist Pty Limited (“Protagonist Australia”) is a wholly-owned subsidiary of the Company and is located in Brisbane, Queensland, Australia. Protagonist Australia was incorporated in Australia in September 2001. The Company manages its operations as a operating segment.

Liquidity

The Company has incurred net losses from operations since inception and has an accumulated deficit of $

Risks and Uncertainties

The Company is subject to risks and uncertainties as a result of the COVID-19 pandemic. The extent of the impact of the COVID-19 pandemic on the Company's activities is highly uncertain and difficult to predict, as the response to the pandemic is in its early stages and information is rapidly evolving. Capital markets and economies worldwide have also been negatively impacted by the COVID-19 pandemic, which has contributed to the current global economic recession. Such economic disruption could have a material adverse effect on our business. Policymakers around the globe have responded with fiscal policy actions to support the healthcare industry and economy as a whole. The magnitude and overall effectiveness of these actions remains uncertain.

The severity of the impact of the COVID-19 pandemic on the Company's activities will depend on a number of factors, including, but not limited to, the duration and severity of the pandemic and the extent and severity of the impact on the Company's existing and planned clinical trials and collaboration activities and operations, all of which are uncertain and cannot be predicted. The Company's future results of operations and liquidity could be adversely impacted by further and extended delays in existing and planned clinical trials and collaboration activities, difficulty in recruiting patients for these clinical trials, supply chain disruptions, the effect of the impact on employees, and the impact of any initiatives or programs that the Company may undertake to address financial and operational challenges. As of the date of issuance of these condensed consolidated financial statements, the extent to which the COVID-19 pandemic may materially impact the Company's future financial condition, liquidity or results of operations is uncertain.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and applicable rules and regulations of the SEC regarding interim financial reporting. As permitted under those rules, certain footnotes or other financial information that are normally required by GAAP have been condensed or omitted, and accordingly the condensed consolidated balance sheet as of December 31, 2019 has been derived from the Company’s audited consolidated financial statements at that date but does not include all of the information required by GAAP for complete consolidated financial statements. These unaudited interim condensed consolidated financial statements have been prepared on the same basis as the Company’s annual consolidated financial statements and, in the opinion of

7

management, reflect all adjustments (consisting of normal recurring adjustments) that are necessary for a fair presentation of the Company’s consolidated financial statements. The results of operations for the three and six months ended June 30, 2020 are not necessarily indicative of the results to be expected for the year ending December 31, 2020 or for any other interim period or for any other future year.

The accompanying condensed consolidated financial statements and related financial information should be read in conjunction with the audited consolidated financial statements and the related notes thereto for the year ended December 31, 2019 included in the Company’s Annual Report on Form 10-K, filed with the SEC on March 10, 2020.

Principles of Consolidation

The accompanying unaudited interim condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiary. All intercompany transactions and balances have been eliminated upon consolidation.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates, assumptions and judgments that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. On an ongoing basis, management evaluates its estimates, including those related to revenue recognition, accruals for research and development activities, stock-based compensation, income taxes, marketable securities and leases. Estimates related to revenue recognition include actual costs incurred versus total estimated costs of the Company’s deliverables to determine percentage of completion in addition to the application and estimates of potential revenue constraints in the determination of the transaction price under its license and collaboration agreements. Management bases these estimates on historical and anticipated results, trends, and various other assumptions that the Company believes are reasonable under the circumstances, including assumptions as to forecasted amounts and future events.

Due to the COVID-19 pandemic, there has been uncertainty and disruption in the global economy and financial markets. The Company has taken into consideration any known COVID-19 impacts in its accounting estimates to date and is not aware of any additional specific events or circumstances that would require any additional updates to its estimates or judgments or a revision of the carrying value of its assets or liabilities as of the date of issuance of this Quarterly Report on Form 10-Q. These estimates may change as new events occur and additional information is obtained. Actual results could differ materially from these estimates under different assumptions or conditions.

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to a concentration of credit risk consist of cash, cash equivalents and marketable securities. Substantially all of the Company’s cash is held by

8

Cash Equivalents

Cash equivalents that are readily convertible to cash are stated at cost, which approximates fair value. The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Restricted Cash

Restricted cash consists of cash balances primarily held as security in connection with a letter of credit related to the Company’s facility lease entered into in March 2017 and the Company’s corporate credit card.

Cash as Reported in Condensed Consolidated Statements of Cash Flows

Cash as reported in the condensed consolidated statements of cash flows includes the aggregate amounts of cash and cash equivalents and the restricted cash as presented on the condensed consolidated balance sheets.

Cash as reported in the condensed consolidated statements of cash flows consists of (in thousands):

June 30, | ||||||

| 2020 |

| 2019 | |||

Cash and cash equivalents | $ | | $ | | ||

Restricted cash - current |

| |

| | ||

Restricted cash - noncurrent |

| |

| | ||

Cash balance in consolidated statements of cash flows | $ | | $ | | ||

Marketable Securities

All marketable securities have been classified as “available-for-sale” and are carried at estimated fair value as determined based upon quoted market prices or pricing models for similar securities. Management determines the appropriate classification of its marketable securities at the time of purchase and reevaluates such designation as of each balance sheet date. Short-term marketable securities have maturities greater than three months but no longer than 365 days as of the balance sheet date. Long-term marketable securities have maturities of 365 days or longer as of the balance sheet date. Unrealized gains and losses are excluded from earnings and are reported as a component of comprehensive loss. Realized gains and losses and declines in fair value judged to be other than temporary, if any, on available-for-sale securities are included in interest income. The cost of securities sold is based on the specific-identification method. Interest on marketable securities is included in interest income.

Revenue Recognition

The Company follows Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (“ASC 606”). Under ASC 606, the Company recognizes revenue when its customer obtains control of promised goods or services, in an amount that reflects the consideration which the Company expects to receive in exchange for those goods or services. To determine revenue recognition for arrangements that the Company determines are within the scope of ASC 606, the Company performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the Company satisfies a performance obligation. The Company applies the five-step model to contracts when it is probable that the Company will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer. At contract inception, the Company assesses the goods or services promised within each contract, determines those that are performance obligations, and assesses whether each promised good or service is distinct. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligations when (or as) the performance obligations are satisfied. The Company constrains its estimate of the transaction price up to the amount (the “variable consideration constraint”) that a significant reversal of recognized revenue is not probable.

9

Licenses of intellectual property: If a license to the Company’s intellectual property is determined to be distinct from the other performance obligations identified in an arrangement, the Company recognizes revenue from non-refundable, upfront fees allocated to the license when the license is transferred to the customer and the customer is able to use and benefit from the license. For licenses that are bundled with other promises, the Company utilizes judgment to assess the nature of the combined performance obligation to determine whether the combined performance obligation is satisfied over time or at a point in time and, if over time, the appropriate method of measuring proportional performance for purposes of recognizing revenue from non-refundable, upfront fees. The Company evaluates the measure of proportional performance each reporting period and, if necessary, adjusts the measure of performance and related revenue recognition.

Milestone payments: At the inception of each arrangement or amendment that includes development, regulatory or commercial milestone payments, the Company evaluates whether the milestones are considered probable of being reached and estimates the amount to be included in the transaction price. ASC 606 suggests two alternatives to use when estimating the amount of variable consideration: the expected value method and the most likely amount method. Under the expected value method, an entity considers the sum of probability-weighted amounts in a range of possible consideration amounts. Under the most likely amount method, an entity considers the single most likely amount in a range of possible consideration amounts. Whichever method is used, it should be consistently applied throughout the life of the contract; however, it is not necessary for the Company to use the same approach for all contracts. The Company expects to use the most likely amount method for development and regulatory milestone payments. If it is probable that a significant revenue reversal would not occur, the associated milestone value is included in the transaction price. Milestone payments that are not within the control of the Company or the licensee, such as regulatory approvals, are not considered probable of being achieved until those approvals are received. If there is more than

Royalties: For arrangements that include sales-based royalties, including milestone payments based on the level of sales, and the license is deemed to be the predominant item to which the royalties relate, the Company recognizes revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied (or partially satisfied).

Upfront payments and fees are recorded as deferred revenue upon receipt or when due and may require deferral of revenue recognition to a future period until the Company performs its obligations under these arrangements. Amounts payable to the Company are recorded as accounts receivable when the Company’s right to consideration is unconditional. Amounts payable to the Company and not yet billed to the collaboration partner are recorded as contract assets. The Company does not assess whether a contract has a significant financing component if the expectation at contract inception is such that the period between payment by the customer and the transfer of the promised goods or services to the customer will be one year or less.

Contractual cost sharing payments made to a customer or collaboration partner are accounted for as a reduction to the transaction price if such payments are not related to distinct goods or services received from the customer or collaboration partner.

Contracts may be amended to account for changes in contract specifications and requirements. Contract modifications exist when the amendment either creates new, or changes existing, enforceable rights and obligations. When contract modifications create new performance obligations and the increase in consideration approximates the standalone selling price for goods and services related to such new performance obligations as adjusted for specific facts and circumstances of the contract, the modification is considered to be a separate contract. If a contract modification is not accounted for as a separate contract, the Company accounts for the promised goods or services not yet transferred at the date of the contract modification (the remaining promised goods or services) prospectively, as if it were a termination of the existing contract and the creation of a new contract, if the remaining goods or services are

10

distinct from the goods or services transferred on or before the date of the contract modification. The Company accounts for a contract modification as if it were a part of the existing contract if the remaining goods or services are not distinct and, therefore, form part of a single performance obligation that is partially satisfied at the date of the contract modification. In such case the effect that the contract modification has on the transaction price, and on the entity’s measure of progress toward complete satisfaction of the performance obligation, is recognized as an adjustment to revenue (either as an increase in or a reduction of revenue) at the date of the contract modification (the adjustment to revenue is made on a cumulative catch-up basis).

The period between when the Company transfers control of promised goods or services and when the Company receives payment is expected to be one year or less, and that expectation is consistent with the Company’s historical experience. Upfront payment contract liabilities resulting from the Company’s license and collaboration agreements do not represent a financing component as the payment is not financing the transfer of goods and services, and the technology underlying the licenses granted reflects research and development expenses already incurred by the Company. As such, the Company does not adjust its revenues for the effects of a significant .

Research and Development Costs

Research and development costs are expensed as incurred, unless there is an alternate future use in other research and development projects or otherwise. Research and development costs include salaries and benefits, stock-based compensation expense, laboratory supplies and facility-related overhead, outside contracted services including clinical trial costs, manufacturing and process development costs for both clinical and pre-clinical materials, research costs, development milestone payments under license and collaboration agreements, and other consulting services.

The Company accrues for estimated costs of research and development activities conducted by third-party service providers, which include the conduct of pre-clinical studies and clinical trials, and contract manufacturing activities. The Company records the estimated costs of research and development activities based upon the estimated services provided but not yet invoiced and includes these costs in accrued expenses and other payables in the condensed consolidated balance sheets and within research and development expense in the condensed consolidated statements of operations. The Company accrues for these costs based on factors such as estimates of the work completed and in accordance with agreements established with its third-party service providers. As actual costs become known, the Company adjusts its accrued liabilities. The Company has not experienced any material differences between accrued liabilities and actual costs incurred. However, the status and timing of actual services performed, number of patients enrolled, the rate of patient enrollment and number of locations of sites activated may vary from the Company’s estimates, resulting in adjustments to expense in future periods. Changes in these estimates that result in material changes to the Company’s accruals could materially affect the Company’s results of operations.

The Company has received orphan drug designation from the U.S. Food and Drug Administration (“FDA”) for its clinical asset PTG-300 for the treatment of polycythemia vera and beta-thalassemia and may qualify for a 25% U.S. Federal income tax credit on qualifying clinical study expenditures.

Research and Development Tax Incentive

The Company is eligible under the AusIndustry research and development tax incentive program to obtain either a refundable cash tax incentive or a taxable credit in the form of a non-cash tax incentive from the Australian Taxation Office (“ATO”). The refundable cash tax incentive is available to the Company on the basis of specific criteria with which the Company must comply. Specifically, the Company must have annual turnover of less than AUD

11

Net Loss per Share

Basic net loss per share is calculated by dividing the Company’s net loss by the weighted average number of shares of common stock and Exchange Warrants outstanding during the period, without consideration of potentially dilutive securities. In accordance with Accounting Standards Codification Topic 260, Earnings Per Share, the Exchange Warrants are included in the computation of basic net loss per share because the exercise price is negligible, and they are fully vested and exercisable after the original issuance date. Diluted net loss per share is the same as basic net loss per share for all periods presented since the effect of potentially dilutive securities is anti-dilutive given the net loss of the Company in each period. See Note 10. Stockholder’s Equity for additional information regarding the Exchange Warrants.

Recently Adopted Accounting Pronouncements

In August 2018, the FASB issued ASU No. 2018-13, Fair Value Measurement (Topic 820) – Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement, which modifies the disclosure requirements on fair value measurements and is intended to improve the effectiveness of disclosures, including the consideration of costs and benefits. The Company adopted this guidance as of January 1, 2020. The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements or disclosures.

In November 2018, the FASB issued ASU No. 2018-18, Collaborative Arrangements (Topic 808): Clarifying the Interaction Between Topic 808 and Topic 606, which is intended to clarify the circumstances under which certain transactions in collaborative arrangements should be accounted for under the revenue recognition standard. Certain transactions between collaboration arrangement participants should be accounted for as revenue under ASC Topic 606 when the collaborative arrangement participant is a customer in the context of a unit of account. This guidance is effective for fiscal years and interim periods within those years beginning after December 15, 2019. The Company adopted this guidance as of January 1, 2020. The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements and disclosures.

Recently Issued Accounting Pronouncements Not Yet Adopted as of June 30, 2020

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326), which is intended to provide financial statement users with more useful information about expected credit losses on financial assets held by a reporting entity at each reporting date. The new standard replaces the existing incurred loss impairment methodology with a methodology that requires consideration of a broader range of reasonable and supportable forward-looking information to estimate all expected credit losses. This guidance was originally effective for fiscal years and interim periods within those years beginning after December 15, 2019, with early adoption permitted for fiscal years and interim periods within those years beginning after December 15, 2018. In November 2019, the FASB issued ASU No. 2019-10, Financial Instruments – Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842): Effective Dates, which amended the mandatory effective date of ASU No. 2016-13 to fiscal years and interim periods beginning after December 15, 2022. The Company is currently evaluating the impact of this new guidance on its consolidated financial statements and disclosures.

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes, which removes certain exceptions and amends certain requirements in the existing income tax guidance to ease accounting requirements. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020 and must be applied on a retrospective basis. The Company is currently evaluating the impact of this new guidance on its consolidated financial statements and disclosures.

12

Note 3. License and Collaboration Agreement

Agreement Terms

On May 26, 2017, the Company and Janssen Biotech, Inc., (“Janssen”), one of the Janssen Pharmaceutical Companies of Johnson & Johnson, entered into an exclusive license and collaboration agreement (the “Janssen License and Collaboration Agreement”) for the development, manufacture and potential commercialization of PTG-200 worldwide for the treatment of Crohn’s disease (“CD”) and ulcerative colitis (“UC”). Janssen is a related party to the Company as Johnson & Johnson Innovation - JJDC, Inc., a significant stockholder of the Company, and Janssen are both subsidiaries of Johnson & Johnson. PTG-200 is the Company’s orally delivered gut-restricted Interleukin 23 receptor (“IL 23R”) antagonist drug candidate currently in development. The Janssen License and Collaboration Agreement became effective on July 13, 2017. Upon the effectiveness of the agreement, the Company received a non-refundable, upfront cash payment of $

Under the Janssen License and Collaboration Agreement, the Company granted to Janssen an exclusive worldwide license to develop, manufacture and commercialize PTG-200 and related IL 23R antagonist compounds for all indications, including CD and UC. The Company was responsible, at its own expense, for the conduct of the Phase 1 clinical trial for PTG-200, and Janssen is responsible for the conduct of the Phase 2 clinical trial for PTG-200 in CD, including filing the U.S. Investigational New Drug application (“IND”). Development costs for the Phase 2 clinical trial are shared between the parties on an

The Company entered into an amendment (the “First Amendment”) to the Janssen License and Collaboration Agreement effective May 7, 2019. The First Amendment builds upon the Company’s ongoing development collaboration with Janssen for PTG-200 and, upon the effectiveness of the First Amendment, the Company became eligible to receive a $

As part of the services added in the First Amendment, Janssen will pay certain costs and milestones related to advancing pre-clinical candidates from the second-generation research program through Phase 1 studies, including funding of a certain number of full-time equivalent employees (“FTEs”) at the Company for a set period of time. The Company will pay

Prior to the effectiveness of the First Amendment, the Company had been eligible to receive a $

Pursuant to the First Amendment, the Company will be eligible to receive clinical development, regulatory and sales milestones, if and as achieved, and/or payments relating to Janssen’s elections to maintain or expand its license rights. The next anticipated such payment is a $

13

| ● | Janssen can elect to advance PTG-200 into Phase 2b following receipt of the top line results of the CD Phase 2a clinical trial for PTG-200 by paying a $ |

| ● | Janssen would make a $ |

Janssen can also then elect to receive exclusive, world-wide commercial rights for both PTG-200 and second-generation products following the Phase 2b completion date for PTG-200 or a second-generation product by paying a $

Pursuant to the First Amendment, the Company will be eligible to receive tiered royalties on net product sales at percentages ranging from mid-single digits to

The Janssen License and Collaboration Agreement remains in effect until the royalty obligations cease following patent and regulatory expiry, unless terminated earlier. Upon a termination of the Janssen License and Collaboration Agreement, all rights revert back to the Company, and in certain circumstances, if such termination occurs during ongoing clinical trials, Janssen would, if requested, provide certain financial and operational support to the Company for the completion of such trials.

Revenue Recognition

The Company concluded that the amended Janssen License and Collaboration Agreement continued to contain a single performance obligation including the development license; second-generation compound research services; Phase 1 development services for PTG-200 and potential second-generation compounds; the Company’s services associated with Phase 2 development for PTG-200 until Phase 2a; the Company’s services associated with Phase 2 development for a second-generation product until the dosing of the third patient in Phase 2b; and all other such services that the Company may perform at the request of Janssen to support the development of PTG-200, second-generation research services, or the development of a second-generation compound. The Company concluded that the Amended First Opt-in Election and the Amended Second Opt-in Election options are not considered to be material rights.

The Company determined that the license was not distinct from the added research and development services within the context of the agreement because the added research and development services significantly increase the utility of the intellectual property. The Company also determined that the remaining research and development services are not distinct from the partially delivered combined promise comprised under the agreement prior to the First Amendment of the development license and PTG-200 services, including compound supply and other services. Therefore, the First Amendment is treated as if it were part of the original Janssen License and Collaboration Agreement. The First Amendment was accounted for as if it were an extension of services under the initial Janssen License and Collaboration Agreement by applying a cumulative catch-up adjustment to revenue. As of the effective date of the First Amendment, the Company calculated the adjusted cumulative revenue under the amended Janssen License and Collaboration Agreement by updating the transaction price for the incremental consideration to be received, net of the incremental development cost reimbursement to be paid to Janssen, and an updated percentage complete, which resulted in a cumulative adjustment recorded during the year ended December 31, 2019 that reduced revenue by $

The contract duration is defined as the period in which parties to the contract have present enforceable rights and obligations. For revenue recognition purposes, the Company determined that the duration of the Janssen License and Collaboration Agreement, as amended, began on the effective date of July 13, 2017 and ends upon the later of end of Phase 2a for PTG-200 or upon dosing of the third patient in Phase 2b for a second-generation compound.

14

The Company uses the most likely amount method to estimate variable consideration included in the transaction price. Variable consideration after the First Amendment consists of future milestone payments and cost sharing payments from Janssen for agreed upon services offset by Phase 2 development costs reimbursement payable to Janssen. Cost sharing payments from Janssen relate to the agreed upon services for Phase 2 activities that the Company performs within the duration of the contract are included in the transaction price at an amount equal to

The Company concluded that the transaction price of the initial performance obligation under the Janssen License and Collaboration Agreement was $

The Company re-evaluates the transaction price, including variable consideration, at the end of each reporting period and as uncertain events are resolved or other changes in circumstances occur. The Company and Janssen make quarterly cost sharing payments to one another in amounts necessary to ensure that each party bears its contractual share of the overall shared costs incurred.

The Company utilizes a cost-based input method to measure proportional performance and to calculate the corresponding amount of revenue to recognize. In applying the cost-based input methods of revenue recognition, the Company uses actual costs incurred relative to expected costs to fulfill the combined performance obligation. These costs consist primarily of internal FTE effort and third-party contract costs. Revenue will be recognized based on actual costs incurred as a percentage of total estimated costs as the Company completes its performance obligations. A cost-based input method of revenue recognition requires management to make estimates of costs to complete the Company’s performance obligations. The Company believes this is the best measure of progress because other measures do not reflect how the Company transfers its performance obligation to Janssen. In making such estimates, significant judgment is required to evaluate assumptions related to cost estimates. The cumulative effect of revisions to estimated costs to complete the Company’s performance obligations will be recorded in the period in which changes are identified and amounts can be reasonably estimated. A significant change in these assumptions and estimates could have a material impact on the timing and amount of revenue recognized in future periods.

For the three and six months ended June 30, 2020, the Company recognized license and collaboration revenue of $

15

For the three months ended June 30, 2019, the Company recorded a $

The following tables present changes in the Company’s contract assets and liabilities during the periods presented (in thousands):

Balance at | Balance at | |||||||||||

Beginning of | End of | |||||||||||

Six Months Ended June 30, 2020 |

| Period | Additions |

| Deductions |

| Period | |||||

Contract assets: | ||||||||||||

Receivable from collaboration partner - related party | $ | | $ | | $ | ( | $ | | ||||

Contract asset - related party | $ | | $ | | $ | ( | $ | — | ||||

Contract liabilities: | ||||||||||||

Deferred revenue - related party | $ | | $ | | $ | ( | $ | | ||||

Payable to collaboration partner - related party | $ | | $ | | $ | ( | $ | | ||||

Balance at | Balance at | |||||||||||

Beginning of | End of | |||||||||||

Six Months Ended June 30, 2019 |

| Period | Additions |

| Deductions |

| Period | |||||

Contract assets: | ||||||||||||

Receivable from collaboration partner - related party | $ | | $ | | $ | ( | $ | | ||||

Contract asset - related party | $ | | $ | — | $ | ( | $ | — | ||||

Contract liabilities: | ||||||||||||

Deferred revenue - related party | $ | | $ | | $ | ( | $ | | ||||

Payable to collaboration partner - related party | $ | | $ | | $ | ( | $ | | ||||

During the three and six months ended June 30, 2020, the Company recognized revenue of $

Note 4. Fair Value Measurements

Financial assets and liabilities are recorded at fair value. The accounting guidance for fair value provides a framework for measuring fair value, clarifies the definition of fair value and expands disclosures regarding fair value measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the reporting date. The accounting guidance establishes a three-tiered hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value as follows:

Level 1—Inputs are unadjusted quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2—Inputs (other than quoted market prices included in Level 1) are either directly or indirectly observable for the asset or liability through correlation with market data at the measurement date and for the duration of the instrument’s anticipated life.

16

Level 3—Inputs reflect management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs to the model.

In determining fair value, the Company utilizes quoted market prices, broker or dealer quotations, or valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible and considers counterparty credit risk in its assessment of fair value.

The following table presents the fair value of the Company’s financial assets determined using the inputs defined above (in thousands).

June 30, 2020 | ||||||||||||

| Level 1 |

| Level 2 |

| Level 3 |

| Total | |||||

Assets: | ||||||||||||

Money market funds | $ | | $ | — | $ | — |

| $ | | |||

Commercial paper |

| — |

| |

| — |

|

| | |||

Corporate debt securities |

| — |

| |

| — |

|

| | |||

U.S. Treasury and agency securities |

| — |

| |

|

| — |

|

| | ||

Total financial assets | $ | | $ | |

| $ | — |

| $ | | ||

December 31, 2019 | ||||||||||||

| Level 1 |

| Level 2 |

| Level 3 |

| Total | |||||

Assets: | ||||||||||||

Money market funds | $ | | $ | — | $ | — |

| $ | | |||

Commercial paper |

| — |

| |

| — |

|

| | |||

Corporate debt securities |

| — |

| |

|

| — |

|

| | ||

U.S. Treasury and agency securities |

| — |

| |

|

| — |

|

| | ||

Total financial assets | $ | | $ | |

| $ | — |

| $ | | ||

The Company’s commercial paper, corporate debt securities and U.S. Treasury and agency securities are classified as Level 2 as they were valued based upon quoted market prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active and model-based valuation techniques for which all significant inputs are observable in the market or can be corroborated by observable market data for substantially the full term of the assets.

17

Note 5. Cash Equivalents and Marketable Securities

Cash equivalents and marketable securities consisted of the following (in thousands):

June 30, 2020 | ||||||||||||

Amortized | Gross Unrealized |

| ||||||||||

| Cost |

| Gains |

| Losses |

| Fair Value | |||||

Money market funds | $ | | $ | — |

| $ | — | $ | | |||

Commercial paper |

| |

| |

|

| — |

| | |||

Corporate debt securities |

| |

| |

|

| — |

| | |||

U.S. Treasury and agency securities |

| |

| |

|

| ( |

| | |||

Total cash equivalents and marketable securities | $ | | $ | |

| $ | ( | $ | | |||

Classified as: |

|

|

| |||||||||

Cash equivalents |

|

|

| $ | | |||||||

Marketable securities |

|

|

|

| | |||||||

Total cash equivalents and marketable securities |

|

|

| $ | | |||||||

December 31, 2019 | ||||||||||||

Amortized | Gross Unrealized |

| ||||||||||

| Cost |

| Gains |

| Losses |

| Fair Value | |||||

Money market funds | $ | | $ | — |

| $ | — | $ | | |||

Commercial paper |

| |

| |

|

| ( |

| | |||

Corporate debt securities |

| |

| |

|

| ( |

| | |||

U.S. Treasury and agency securities |

| |

| |

|

| ( |

| | |||

Total cash equivalents and marketable securities | $ | | $ | |

| $ | ( | $ | | |||

Classified as: |

|

|

| |||||||||

Cash equivalents |

|

|

| $ | | |||||||

Marketable securities |

|

|

|

| | |||||||

Total cash equivalents and marketable securities |

|

|

| $ | | |||||||

All marketable securities held as of June 30, 2020 and December 31, 2019 had contractual maturities of less than one year. There were no material realized gains or realized losses on marketable securities for the periods presented. The Company has not experienced any material credit losses on its investments. The Company does not intend to sell its securities that are in an unrealized loss position, and it is unlikely that the Company will be required to sell its securities before recovery of their amortized cost basis, which may be maturity. Factors considered in determining whether a loss is temporary include the length of time and extent to which the fair value has been less than the amortized cost basis and whether the Company intends to sell the security or whether it is more likely than not that the Company would be required to sell the security before recovery of the amortized cost basis.

Note 6. Accrued Expenses and Other Payables

Accrued expenses and other payables consisted of the following (in thousands):

June 30, | December 31, | |||||

| 2020 | 2019 | ||||

Accrued clinical and research related expenses | $ | | $ | | ||

Accrued employee related expenses |

| |

| | ||

Accrued professional service fees | | | ||||

Accrued interest payable | — | | ||||

Other |

| |

| | ||

Total accrued expenses and other payables | $ | | $ | | ||

18

Note 7. Research Collaboration and License Agreement

In October 2013, the Company’s former collaboration partner decided to abandon a collaboration program with the Company and, pursuant to the terms of the agreement between the Company and the former collaboration partner, the Company elected to assume responsibility for the development and commercialization of the product. Upon the former collaboration partner’s abandonment, it assigned to the Company certain intellectual property that relates to the products arising from the collaboration. Milestone payments to collaboration partners are recorded as research and development expenses in the period that the expense is incurred.

Note 8. Government Programs

Research and Development Tax Incentive

During the three and six months ended June 30, 2020, the Company recognized AUD

Small Business Innovation Research (“SBIR”) Grants

The Company has received SBIR grants from the National Institutes of Health (“NIH”) in support of research aimed at its product candidates. The Company recognizes a reduction to research and development expenses when expenses related to the grants have been incurred and the grant funds become contractually due from NIH. The Company recorded $

Note 9. Debt

On October 30, 2019, the Company entered into a Credit and Security Agreement, dated as of October 30, 2019 (the “Closing Date”) by and among the Company, MidCap Financial Trust, as a lender, Silicon Valley Bank, as a lender, the other lenders party thereto from time to time and MidCap Financial Trust, as administrative agent and collateral agent (“Agent”) (the “Term Loan Credit Agreement”), which provides for a $

The Term Loans are subject to an origination fee of

19

amount prepaid if the prepayment occurs through and including the first anniversary of the Closing Date,

The Term Loan Credit Agreement requires the Company to maintain cash and cash equivalents of at least

The Company’s long-term debt balance was as follows for the periods presented (dollars in thousands):

Annual | June 30, | December 31, | ||||||||

| Interest Rate | 2020 | 2019 | |||||||

Term loan (matures October 1, 2023) | $ | -- | $ | | ||||||

Debt issuance costs, net of amortization |

| -- |

| ( | ||||||

Accrued final payment fee | -- | | ||||||||

Long-term debt, net | $ | -- | $ | | ||||||

Note 10. Stockholders’ Equity

In September 2017, the Company filed a registration statement on Form S-3 with the Securities and Exchange Commission (File No. 333-220314) that was declared effective as of October 5, 2017 and permits the offering, issuance, and sale by the Company of up to a maximum aggregate offering price of $

In August 2018, the Company entered into a Securities Purchase Agreement with certain accredited investors (each, an “Investor” and, collectively, the “Investors”), pursuant to which the Company sold an aggregate of

20

basis. In connection with the issuance and sale of the common stock and Warrants, the Company granted the Investors certain registration rights with respect to the Warrants and the Warrant Shares. The common stock and warrants are classified as equity in accordance with Accounting Standards Codification Topic 480, Distinguishing Liabilities from Equity (“ASC 480”), and the net proceeds from the transaction were recorded as a credit to additional paid-in capital. As of June 30, 2020,

In December 2018, the Company entered into an exchange agreement (the “Exchange Agreement”) with an Investor and its affiliates (the “Exchanging Stockholders”), pursuant to which the Company exchanged an aggregate of

In October 2019, the Company filed a registration statement on Form S-3 (File No. 333-234414) that was declared effective as of November 22, 2019 and permits the offering, issuance, and sale by the Company of up to a maximum aggregate offering price of $

Note 11. Equity Plans

Equity Incentive Plan

In July 2016, the Company’s board of directors and stockholders approved the Company’s 2016 Equity Incentive Plan (the “2016 Plan”) to replace the 2007 Stock Option Plan. The 2016 Plan is administered by the board of directors or a committee appointed by the board of directors, which determines the types of awards to be granted, including the number of shares subject to the awards, the exercise price and the vesting schedule. Awards granted under the 2016 Plan expire no later than

Inducement Plan

In May 2018, the Company’s board of directors approved the 2018 Inducement Plan, a non-stockholder approved stock plan, under which it reserved and authorized up to

21

order to award options and restricted stock unit awards to persons that were not previously employees or directors of the Company, or following a bona fide period of non-employment, as an inducement material to such persons entering into employment with the Company, within the meaning of Rule 5635(c)(4) of the NASDAQ Listing Rules. The 2018 Inducement Plan is administered by the board of directors or the Compensation Committee of the board, which determines the types of awards to be granted, including the number of shares subject to the awards, the exercise price and the vesting schedule. Awards granted under the 2018 Inducement Plan expire no later than

Stock Options

Stock option activity under the Company’s equity incentive and inducement plans is set forth below:

Weighted- | Weighted- | |||||||||

Average | Average | |||||||||

Exercise | Remaining | Aggregate | ||||||||

Options | Price Per | Contractual | Intrinsic | |||||||

| Outstanding |

| Share |

| Life (years) |

| Value (1) | |||

(in millions) | ||||||||||

Balances at December 31, 2019 |

| |

| $ | |

|

| |||

Options granted |

| | |

|

|

|

| |||

Options exercised |

| ( | |

|

| |||||

Options forfeited | ( | | ||||||||

Balances at June 30, 2020 |

| |

| $ | |

| $ | | ||

Options exercisable – June 30, 2020 | |

| $ | |

| $ | | |||

Options vested and expected to vest – June 30, 2020 | | $ | |

| $ | | ||||

| (1) | The aggregate intrinsic values were calculated as the difference between the exercise price of the options and the closing price of the Company’s common stock on June 30, 2020. The calculation excludes options with an exercise price higher than the closing price of the Company’s common stock on June 30, 2020. |

During the six months ended June 30, 2020, the estimated weighted-average grant-date fair value of common stock underlying options granted to employees was $

Stock Options Valuation Assumptions

The fair value of employee stock option awards was estimated at the date of grant using a Black-Scholes option-pricing model with the following assumptions:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||

2020 | 2019 | 2020 | 2019 | |||||

Expected term (in years) |

|

|

| |||||

Expected volatility |

| |||||||

Risk-free interest rate |

| |||||||

Dividend yield |

| — |

| — | — |

| — | |

In determining the fair value of the options granted, the Company uses the Black-Scholes option-pricing model and assumptions discussed below. Each of these inputs is subjective, and expected volatility generally requires significant judgment to determine.

22

Expected Term—The Company’s expected term represents the period that the Company’s options granted are expected to be outstanding and is determined using the simplified method (based on the mid-point between the vesting date and the end of the contractual term). The Company has limited historical information to develop reasonable expectations about future exercise patterns and post-vesting employment termination behavior for its stock option grants.

Expected Volatility— Prior to January 1, 2020, the Company’s expected volatility was estimated based on the average volatility for comparable publicly traded biopharmaceutical companies over a period equal to the expected term of the stock option grants. Beginning January 1, 2020, the Company’s expected volatility was estimated based upon a mix of

Risk-Free Interest Rate—The risk-free interest rate is based on the U.S. Treasury zero coupon issues in effect at the time of grant for periods corresponding with the expected term of option.

Expected Dividend—The Company has never paid dividends on its common stock and has no plans to pay dividends on its common stock. Therefore, the Company used an expected dividend yield of zero.

Restricted Stock Units

Restricted stock unit activity under the Company’s equity incentive plans is set forth below:

Weighted | |||||

Average | |||||

Number of | Grant Date | ||||

| Shares |

| Fair Value | ||

Unvested at December 31, 2019 | | $ | | ||

Granted |

| |

| | |

Vested |

| ( |

| | |

Forfeited | ( | | |||

Unvested at June 30, 2020 | | $ | | ||

Employee Stock Purchase Plan

The 2016 Employee Stock Purchase Plan (“2016 ESPP”) allows eligible employees to purchase shares of the Company’s common stock at a discount through payroll deductions of up to

Stock-Based Compensation

Total stock-based compensation expense was as follows (in thousands):

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||

| 2020 |

| 2019 |

| 2020 |

| 2019 | |||||

Research and development | $ | | $ | | $ | | $ | | ||||

General and administrative |

| |

| |

| |

| | ||||

Total stock-based compensation expense | $ | | $ | | $ | | $ | | ||||

As of June 30, 2020, total unrecognized stock-based compensation expense was approximately $

23

Note 12. Income Taxes

The Company recorded income tax expense of $

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) was enacted and signed into law in response to the COVID-19 pandemic. GAAP requires recognition of the tax effects of new legislation during the reporting period that includes the enactment date. The CARES Act includes changes to the tax provisions that benefits business entities and makes certain technical corrections to the 2017 Tax Cuts and Jobs Act. The tax relief measures for businesses include a

On June 29, 2020, California Assembly Bill 85 was signed into law. The legislation suspends the California net operating loss deductions for 2020, 2021, and 2022 for certain taxpayers and imposes a limitation of certain California tax credits for 2020, 2021, and 2022. The legislation disallows the use of California net operating loss deductions if the taxpayer recognizes business income and its adjusted gross income is greater than $

24

Note 13. Net Loss per Share

As the Company had net losses for the three and six months ended June 30, 2020 and 2019, respectively, all potential common shares were determined to be anti-dilutive. The following table sets forth the computation of basic and diluted net loss per share (in thousands, except share and per share data):

Three Months Ended | Six Months Ended | |||||||||||

June 30, | June 30, | |||||||||||

| 2020 |

| 2019 |

| 2020 |

| 2019 | |||||

Numerator: |

| |||||||||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Denominator: |

| |||||||||||

Weighted-average shares used to compute net loss per common share, basic and diluted |

| |

| |

| |

|

| | |||

Net loss per shares, basic and diluted | $ | ( | ( | $ | ( | $ | ( | |||||

The following outstanding shares of potentially dilutive securities have been excluded from diluted net loss per share computations for the periods presented because their inclusion would be anti-dilutive:

June 30, | ||||

| 2020 |

| 2019 | |

Options to purchase common stock | |

| | |

Common stock warrants | | | ||

Restricted stock units | | | ||

ESPP shares | | | ||

Total |

| |

| |

Note 14. Restructuring

On May 7, 2020, the Company approved a limited reduction in force plan affecting approximately

25

ITEM 2.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations together with our Unaudited Condensed Consolidated Financial Statements and related notes included in Part I, Item 1 of this quarterly report (this “Quarterly Report”) on Form 10-Q and with our Audited Consolidated Financial Statements and related notes thereto for the year ended December 31, 2019, included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 10, 2020.

Forward-Looking Statements

This Quarterly Report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events, are based on assumptions, and are subject to risks, uncertainties and other important factors. In particular, statements, whether expressed or implied, concerning, among other things, the potential for our programs, the timing of our clinical trials, the potential for eventual regulatory approval and commercialization of our product candidates and our potential receipt of milestone payments and royalties under our collaboration agreements, future operating results or the ability to generate sales, income or cash flow, and the impact of the recent and evolving COVID-19 pandemic are forward-looking statements. They involve risks, uncertainties and assumptions that are beyond our ability to control or predict, including those discussed in Part II, Item 1A, of this Quarterly Report. While we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Given these risks, uncertainties and other important factors, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this Quarterly Report. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future. “Protagonist,” the Protagonist logo and other trademarks, service marks and trade names of Protagonist are registered and unregistered marks of Protagonist Therapeutics, Inc. in the United States and other jurisdictions.

Overview

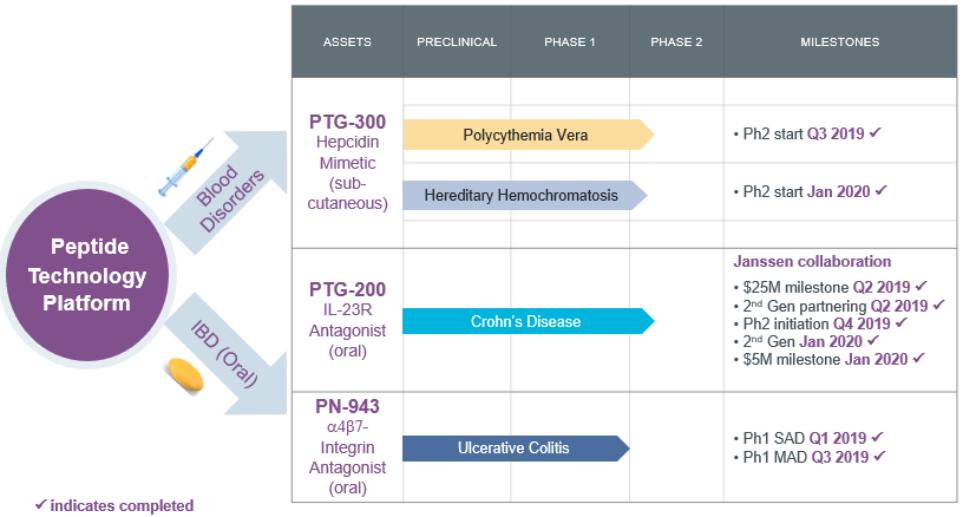

We are a clinical-stage biopharmaceutical company that utilizes a proprietary technology platform to discover and develop novel peptide-based drugs to address significant unmet medical needs and transform existing treatment paradigms for patients. We have three assets in various stages of clinical development derived from this platform.

26

Our Product Pipeline

Our most advanced clinical asset, PTG-300, is an injectable hepcidin mimetic in development for the potential treatment of erythrocytosis, iron overload and other blood disorders. Hepcidin is a key hormone in regulating iron equilibrium and is critical to the proper development of red blood cells. PTG-300 mimics the effect of the natural hormone hepcidin, but with greater potency, solubility and stability. We initiated a Phase 2 study in polycythemia vera (“PV”) in the third quarter of 2019 and a Phase 2 study in hereditary hemochromatosis (“HH”) in January 2020. Preliminary and early results from our initial Phase 2 PV efficacy data from a small number of patients demonstrates the ability of PTG-300 to eliminate the need for phlebotomy by controlling hematocrit levels below 45% on an individual patient basis. PTG-300 has a unique mechanism of action in the potential treatment of PV, which allows it to decrease and maintain hematocrit levels within the range of recommended clinical guidelines without causing the iron deficiency that may occur with frequent phlebotomy. We have announced the selection of PV as our first indication for a potential pivotal study to begin in 2021. In June 2020, the U.S. Food and Drug Administration granted orphan drug designation for PTG-300 for the treatment of PV. We are discontinuing development of PTG-300 for beta-thalassemia and myelodysplastic syndromes and will redirect the majority of our PTG-300 efforts to the PV indication, while also continuing our exploration of PTG-300 in HH.

Our clinical assets PTG-200 and PN-943 are orally delivered drugs currently in development for inflammatory bowel disease (“IBD”), a gastrointestinal (“GI”) disease consisting primarily of ulcerative colitis (“UC”) and Crohn’s disease (“CD”), that block biological pathways currently targeted by marketed injectable antibody drugs. Our orally stable peptide approach offers targeted delivery to the GI tissue compartment. We believe that, compared to antibody drugs, these product candidates have the potential to provide improved safety due to minimal exposure in the blood, increased convenience and compliance due to oral delivery, and the opportunity for the earlier introduction of targeted oral therapy. As a result, if approved, they may transform the existing treatment paradigm for IBD.

PTG-200 (also referenced as JNJ-67864238) is an orally delivered gut-restricted Interleukin-23 receptor (“IL-23R”) antagonist for the treatment of IBD. In May 2017, we entered into a worldwide license and collaboration agreement with Janssen Biotech, Inc. (“Janssen”), a Johnson & Johnson company, to co-develop and co-detail PTG-200 and certain related compounds for all indications, including IBD. The agreement with Janssen was amended in May 2019 to expand the collaboration by supporting efforts towards second-generation IL-23R antagonists, triggering a

27

$25.0 million milestone payment to us. In January 2020, as part of the expanded research collaboration, we announced the identification and nomination of an orally delivered, gut-restricted IL-23R antagonist peptide as a second-generation development candidate, triggering a $5.0 million milestone payment to us. See Note 3 to the condensed consolidated financial statements included elsewhere in this report for additional information. Janssen initiated a global Phase 2 clinical study for PTG-200 in moderate-to-severe Crohn’s disease in the fourth quarter of 2019. Because of the COVID-19 pandemic, we have suspended guidance on a timeline for study completion. Joint research efforts are underway to identify second-generation oral IL-23 receptor antagonists for multiple indications.

PN-943 is an orally delivered, gut-restricted, alpha-4-beta-7 (“α4β7”) specific integrin antagonist. We developed PN-943 as a potentially more potent orally delivered, gut-restricted α4β7 backup compound to PTG-100, our first-generation orally delivered gut-restricted α4β7 inhibitor that was being developed for treatment of IBD. In 2019, we completed a Phase 1 single ascending dose (“SAD”) and multiple ascending dose (“MAD”) clinical study of PN-943 in healthy volunteers to evaluate safety, pharmacokinetics and pharmacodynamics. The pharmacodynamic results indicated that the administration of PN-943 was well tolerated with results of target engagement that were supportive of the higher potency of PN-943 as compared to PTG-100. We submitted a U.S. IND for PN-943 in December 2019, which took effect in January 2020, and anticipate initiating a Phase 2 proof of concept (“POC”) study in UC. In light of the COVID-19 pandemic, we are continuing to review all aspects of the planned Phase 2 study and are suspending guidance on a timeline for study initiation. We are maintaining readiness to initiate the study as soon as conditions allow for safe accrual of subjects for the study.