00013769869/30X12024Q1False—P2Y0M0DP4Y0M0D00013769862023-10-012023-12-3100013769862023-12-31xbrli:sharesiso4217:USD00013769862022-10-012022-12-3100013769862023-09-300001376986tve:PowerProgramAppropriationInvestmentMember2023-09-300001376986tve:PowerProgramRetainedEarningsMember2023-09-300001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2023-09-300001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-3000013769862022-09-3000013769862022-12-310001376986tve:PowerProgramAppropriationInvestmentMember2022-09-300001376986tve:PowerProgramRetainedEarningsMember2022-09-300001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2022-09-300001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001376986tve:PowerProgramAppropriationInvestmentMember2022-10-012022-12-310001376986tve:PowerProgramRetainedEarningsMember2022-10-012022-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2022-10-012022-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012022-12-310001376986tve:PowerProgramAppropriationInvestmentMember2022-12-310001376986tve:PowerProgramRetainedEarningsMember2022-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2022-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001376986tve:PowerProgramAppropriationInvestmentMember2023-10-012023-12-310001376986tve:PowerProgramRetainedEarningsMember2023-10-012023-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2023-10-012023-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012023-12-310001376986tve:PowerProgramAppropriationInvestmentMember2023-12-310001376986tve:PowerProgramRetainedEarningsMember2023-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2023-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001376986us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001376986us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001376986us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMember2023-12-310001376986us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMember2023-09-3000013769862019-01-012023-09-300001376986tve:CumberlandMember2023-10-012023-12-310001376986tve:CumberlandMember2023-01-012023-12-310001376986us-gaap:OtherNoncurrentAssetsMember2023-12-310001376986us-gaap:OtherNoncurrentAssetsMember2023-09-300001376986us-gaap:OtherNoncurrentAssetsMember2023-12-310001376986us-gaap:OtherNoncurrentAssetsMember2023-09-300001376986srt:MinimumMembertve:EnergyRightMember2023-10-012023-12-310001376986srt:MaximumMembertve:EnergyRightMember2023-10-012023-12-310001376986tve:EnergyRightMember2023-10-012023-12-310001376986us-gaap:AccountsReceivableMember2023-12-310001376986us-gaap:AccountsReceivableMember2023-09-300001376986tve:EnergyRightLoanReserveMember2023-12-310001376986tve:EnergyRightLoanReserveMember2023-09-300001376986tve:EconomicDevelopmentLoanCollectiveReserveMember2023-12-310001376986tve:EconomicDevelopmentLoanCollectiveReserveMember2023-09-300001376986tve:EconomicDevelopmentLoanSpecificLoanReserveMember2023-12-310001376986tve:EconomicDevelopmentLoanSpecificLoanReserveMember2023-09-300001376986tve:UnrealizedLossesOnInterestRateDerivativesMember2023-12-310001376986tve:UnrealizedLossesOnInterestRateDerivativesMember2023-09-300001376986us-gaap:DeferredDerivativeGainLossMember2023-12-310001376986us-gaap:DeferredDerivativeGainLossMember2023-09-300001376986us-gaap:DeferredFuelCostsMember2023-12-310001376986us-gaap:DeferredFuelCostsMember2023-09-300001376986us-gaap:OtherRegulatoryAssetsLiabilitiesMember2023-12-310001376986us-gaap:OtherRegulatoryAssetsLiabilitiesMember2023-09-300001376986us-gaap:PensionCostsMember2023-12-310001376986us-gaap:PensionCostsMember2023-09-300001376986tve:NonNuclearDecommissioningMember2023-12-310001376986tve:NonNuclearDecommissioningMember2023-09-300001376986tve:NuclearDesommissioningCostsMember2023-12-310001376986tve:NuclearDesommissioningCostsMember2023-09-300001376986tve:OtherNonCurrentRegulatoryAssetsMember2023-12-310001376986tve:OtherNonCurrentRegulatoryAssetsMember2023-09-300001376986us-gaap:DeferredIncomeTaxChargesMember2023-12-310001376986us-gaap:DeferredIncomeTaxChargesMember2023-09-300001376986us-gaap:DeferredFuelCostsMember2023-12-310001376986us-gaap:DeferredFuelCostsMember2023-09-300001376986us-gaap:DeferredDerivativeGainLossMember2023-12-310001376986us-gaap:DeferredDerivativeGainLossMember2023-09-300001376986us-gaap:PostretirementBenefitCostsMember2023-12-310001376986us-gaap:PostretirementBenefitCostsMember2023-09-300001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2012-09-300001376986tve:JsccgMember2012-09-300001376986tve:HoldcoMember2012-09-300001376986tve:SCCGMember2013-09-3000013769862013-09-30xbrli:pure0001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-10-012023-12-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-10-012022-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMember2023-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-09-300001376986tve:NuclearMember2023-09-300001376986tve:NonNuclearMember2023-09-300001376986tve:NuclearMember2023-10-012023-12-310001376986tve:NonNuclearMember2023-10-012023-12-310001376986tve:NuclearMember2023-12-310001376986tve:NonNuclearMember2023-12-310001376986tve:A2009SeriesBJunePaymentMember2023-10-012023-12-310001376986tve:TotalMember2023-12-310001376986us-gaap:RevolvingCreditFacilityMember2023-12-31tve:Credit_facilities0001376986us-gaap:LetterOfCreditMember2023-12-310001376986us-gaap:LetterOfCreditMember2023-09-300001376986us-gaap:LineOfCreditMember2023-12-310001376986us-gaap:OtherRegulatoryAssetsLiabilitiesMemberus-gaap:InterestRateSwapMember2023-10-012023-12-310001376986us-gaap:OtherRegulatoryAssetsLiabilitiesMemberus-gaap:InterestRateSwapMember2022-10-012022-12-310001376986us-gaap:OtherRegulatoryAssetsLiabilitiesMembertve:CommodityContractUnderFHPMember2023-10-012023-12-310001376986us-gaap:OtherRegulatoryAssetsLiabilitiesMembertve:CommodityContractUnderFHPMember2022-10-012022-12-310001376986us-gaap:InterestRateSwapMember2023-10-012023-12-310001376986tve:FuelExpenseMembertve:CommodityContractUnderFHPMember2023-10-012023-12-310001376986tve:CommodityContractUnderFHPMembertve:PurchasedPowerExpenseMember2023-10-012023-12-310001376986tve:FuelExpenseMembertve:CommodityContractUnderFHPMember2022-10-012022-12-310001376986tve:CommodityContractUnderFHPMembertve:PurchasedPowerExpenseMember2022-10-012022-12-310001376986tve:A250MillionSterlingCurrencySwapMember2023-12-310001376986tve:A250MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-12-310001376986tve:A250MillionSterlingCurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001376986tve:A250MillionSterlingCurrencySwapMember2023-09-300001376986tve:A250MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-09-300001376986tve:A250MillionSterlingCurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-09-300001376986tve:A150MillionSterlingCurrencySwapMember2023-12-310001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-12-310001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001376986tve:A150MillionSterlingCurrencySwapMember2023-09-300001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-09-300001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-09-300001376986tve:A10BillionNotionalInterestRateSwapMember2023-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2023-12-310001376986tve:InterestPayableCurrentMembertve:A10BillionNotionalInterestRateSwapMember2023-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2023-12-310001376986tve:A10BillionNotionalInterestRateSwapMember2023-09-300001376986us-gaap:OtherCurrentAssetsMembertve:A10BillionNotionalInterestRateSwapMember2023-09-300001376986tve:InterestPayableCurrentMembertve:A10BillionNotionalInterestRateSwapMember2023-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2023-09-300001376986tve:A476MillionNotationalInterestRateSwapMember2023-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A476MillionNotationalInterestRateSwapMember2023-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A476MillionNotationalInterestRateSwapMember2023-12-310001376986tve:A476MillionNotationalInterestRateSwapMember2023-09-300001376986tve:A476MillionNotationalInterestRateSwapMemberus-gaap:OtherCurrentAssetsMember2023-09-300001376986tve:InterestPayableCurrentMembertve:A476MillionNotationalInterestRateSwapMember2023-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A476MillionNotationalInterestRateSwapMember2023-09-300001376986us-gaap:CommodityContractMember2023-12-310001376986us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CommodityContractMember2023-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMember2023-12-310001376986us-gaap:CommodityContractMember2023-09-300001376986us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMember2023-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CommodityContractMember2023-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMember2023-09-300001376986tve:CommodityContractUnderFHPMember2023-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:CommodityContractUnderFHPMember2023-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:CommodityContractUnderFHPMember2023-12-310001376986tve:CommodityContractUnderFHPMember2023-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:CommodityContractUnderFHPMember2023-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:CommodityContractUnderFHPMember2023-09-3000013769862023-03-31tve:Bond_issues0001376986tve:A250MillionSterlingCurrencySwapMembersrt:MinimumMember2023-10-012023-12-310001376986tve:A150MillionSterlingCurrencySwapMembersrt:MaximumMember2023-10-012023-12-310001376986us-gaap:CommodityContractMember2023-10-012023-12-310001376986tve:CommodityContractUnderFHPMember2023-10-012023-12-310001376986us-gaap:InterestRateSwapMember2023-12-310001376986us-gaap:InterestRateSwapMember2023-09-300001376986us-gaap:CurrencySwapMember2023-12-310001376986us-gaap:CurrencySwapMember2023-09-300001376986tve:InterestSwapCollateralMember2023-12-310001376986tve:InterestRateSwapCollateralMember2023-09-300001376986us-gaap:FairValueInputsLevel2Member2023-12-310001376986us-gaap:FairValueInputsLevel2Member2023-09-300001376986us-gaap:CreditRiskMember2023-12-310001376986us-gaap:CollateralizedSecuritiesMember2023-12-310001376986tve:CreditOfCustomersMember2023-10-012023-12-31tve:Customers0001376986srt:MoodysA2RatingMember2023-10-012023-12-310001376986srt:MoodysB1RatingMember2023-10-012023-12-310001376986srt:MoodysA1RatingMember2023-10-012023-12-310001376986tve:NdtMember2023-12-310001376986tve:ArtMember2023-12-31tve:Units0001376986tve:NdtMemberus-gaap:PrivateEquityFundsMember2023-12-310001376986tve:NdtMemberus-gaap:RealEstateFundsMember2023-12-310001376986tve:NdtMembertve:PrivateCreditMember2023-12-310001376986tve:ArtMemberus-gaap:PrivateEquityFundsMember2023-12-310001376986us-gaap:RealEstateFundsMembertve:ArtMember2023-12-310001376986tve:PrivateCreditMembertve:ArtMember2023-12-310001376986tve:NdtMember2023-10-012023-12-310001376986tve:NdtMember2022-10-012022-12-310001376986tve:ArtMember2023-10-012023-12-310001376986tve:ArtMember2022-10-012022-12-310001376986tve:SerpMember2023-10-012023-12-310001376986tve:SerpMember2022-10-012022-12-310001376986tve:LTDCPMember2023-10-012023-12-310001376986tve:LTDCPMember2022-10-012022-12-310001376986tve:RPMember2023-10-012023-12-310001376986us-gaap:FairValueInputsLevel1Member2023-12-310001376986us-gaap:FairValueInputsLevel3Member2023-12-310001376986us-gaap:FairValueInputsLevel1Membertve:CommodityContractUnderFHPMember2023-12-310001376986us-gaap:FairValueInputsLevel2Membertve:CommodityContractUnderFHPMember2023-12-310001376986us-gaap:FairValueInputsLevel3Membertve:CommodityContractUnderFHPMember2023-12-310001376986us-gaap:FairValueInputsLevel1Member2023-09-300001376986us-gaap:FairValueInputsLevel3Member2023-09-300001376986us-gaap:FairValueInputsLevel1Membertve:CommodityContractUnderFHPMember2023-09-300001376986us-gaap:FairValueInputsLevel2Membertve:CommodityContractUnderFHPMember2023-09-300001376986us-gaap:FairValueInputsLevel3Membertve:CommodityContractUnderFHPMember2023-09-300001376986stpr:AL2023-10-012023-12-310001376986stpr:AL2022-10-012022-12-310001376986stpr:GA2023-10-012023-12-310001376986stpr:GA2022-10-012022-12-310001376986stpr:KY2023-10-012023-12-310001376986stpr:KY2022-10-012022-12-310001376986stpr:MS2023-10-012023-12-310001376986stpr:MS2022-10-012022-12-310001376986stpr:NC2023-10-012023-12-310001376986stpr:NC2022-10-012022-12-310001376986stpr:TN2023-10-012023-12-310001376986stpr:TN2022-10-012022-12-310001376986stpr:VA2023-10-012023-12-310001376986stpr:VA2022-10-012022-12-310001376986tve:LpcsDomain2023-10-012023-12-310001376986tve:LpcsDomain2022-10-012022-12-310001376986tve:IndustriesdirectlyservedDomain2023-10-012023-12-310001376986tve:IndustriesdirectlyservedDomain2022-10-012022-12-310001376986tve:FederalagenciesandotherDomain2023-10-012023-12-310001376986tve:FederalagenciesandotherDomain2022-10-012022-12-310001376986tve:A20yearTerminationNoticeMember2023-10-012023-12-310001376986tve:A5yearterminationnoticeMember2023-12-310001376986tve:A5yearterminationnoticeMember2023-10-012023-12-310001376986us-gaap:PensionPlansDefinedBenefitMember2023-10-012023-12-310001376986us-gaap:PensionPlansDefinedBenefitMember2022-10-012022-12-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-10-012023-12-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-012022-12-310001376986us-gaap:OtherPensionPlansDefinedBenefitMembersrt:MinimumMember2023-10-012023-12-310001376986us-gaap:OtherPensionPlansDefinedBenefitMember2023-10-012023-12-310001376986tve:A401KMember2023-10-012023-12-310001376986tve:RebatesMember2023-10-012023-12-310001376986tve:SerpMember2023-10-012023-12-310001376986srt:ScenarioForecastMember2022-10-012026-09-30tve:Insurance_layerstve:reactorstve:Procedures0001376986us-gaap:EnvironmentalRemediationMember2023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13, 15(d), OR 37 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2023

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (I.R.S. Employer Identification No.) |

| |

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

(Registrant's telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x Smaller reporting company o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

Number of shares of common stock outstanding at January 29, 2024: N/A

| | | | | |

| Table of Contents |

| | |

| | Page |

GLOSSARY OF COMMON ACRONYMS...................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................ | |

| | |

|

| | |

ITEM 1. FINANCIAL STATEMENTS............................................................................................................................................. | |

| |

| |

| |

| |

| |

| |

| | |

| |

Executive Overview............................................................................................................................................................... | |

Results of Operations............................................................................................................................................................ | |

Liquidity and Capital Resources............................................................................................................................................ | |

| |

| |

| |

| |

Critical Accounting Estimates................................................................................................................................................ | |

| |

| |

| | |

| |

| | |

ITEM 4. CONTROLS AND PROCEDURES.................................................................................................................................. | |

| |

| |

| | |

|

| | |

ITEM 1. LEGAL PROCEEDINGS.................................................................................................................................................. | |

| |

ITEM 1A. RISK FACTORS............................................................................................................................................................ | |

| | |

| |

| |

ITEM 6. EXHIBITS........................................................................................................................................................................ | |

| | |

SIGNATURES............................................................................................................................................................................... | |

| | | | | | | | |

| GLOSSARY OF COMMON ACRONYMS |

Following are definitions of some of the terms or acronyms that may be used in this Quarterly Report on Form 10-Q for the quarter ended December 31, 2023 (the "Quarterly Report"): |

| |

| Term or Acronym | | Definition |

| | |

| | |

| | |

| | |

| AOCI | | Accumulated other comprehensive income (loss) |

| ARO | | Asset retirement obligation |

| ART | | Asset Retirement Trust |

| Bonds | | Bonds, notes, or other evidences of indebtedness |

| Bull Run | | Bull Run Fossil Plant |

| | |

| | |

| | |

| | |

| CCR | | Coal combustion residuals |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Cumberland | | Cumberland Fossil Plant |

| CVA | | Credit valuation adjustment |

| | |

| | |

| CY | | Calendar year |

| | |

| DCP | | Deferred Compensation Plan |

| | |

| | |

| | |

| | |

| | |

| | |

| EO(s) | | Executive Order(s) |

| | |

| | |

| | |

| | |

| FERC | | Federal Energy Regulatory Commission |

| | |

| FHP | | Financial Hedging Program |

| | |

| GAAP | | Accounting principles generally accepted in the United States of America |

| GAC | | Grid access charge |

| GEH | | GE Hitachi Nuclear Energy |

| | |

| | |

| | |

| | |

| | |

| Holdco | | John Sevier Holdco LLC |

| Jacobs | | Jacobs Engineering Group, Inc. |

| JSCCG | | John Sevier Combined Cycle Generation LLC |

| | |

| kWh | | Kilowatt hours |

| LPCs | | Local power company customers |

| | |

| | |

| | |

| MLGW | | Memphis Light, Gas and Water Division |

| mmBtu | | Million British thermal unit(s) |

| Moody's | | Moody's Investors Service, Inc. |

| MtM | | Mark-to-market |

| | |

| | |

| | |

| NAV | | Net asset value |

| NDT | | Nuclear Decommissioning Trust |

| NEIL | | Nuclear Electric Insurance Limited |

| | |

| | |

| NES | | Nashville Electric Service |

| | |

| | |

| NRC | | Nuclear Regulatory Commission |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PPA(s) | | Power Purchase Agreement(s) |

| | |

| | |

| | |

| | |

| RFP(s) | | Request(s) for proposals |

| RP | | Restoration Plan |

| SCCG | | Southaven Combined Cycle Generation LLC |

| | |

| SEC | | Securities and Exchange Commission |

| | |

| SERP | | Supplemental Executive Retirement Plan |

| SHLLC | | Southaven Holdco LLC |

| | |

| | |

| | |

| | |

| | |

| | |

| TVA | | Tennessee Valley Authority |

| TVA Act | | Tennessee Valley Authority Act of 1933, as amended |

| TVA Board | | TVA Board of Directors |

| | |

| | |

| U.S. Treasury | | United States Department of the Treasury |

| | |

| | |

| VIE | | Variable interest entity |

| | |

| XBRL | | eXtensible Business Reporting Language |

FORWARD-LOOKING INFORMATION

This Quarterly Report contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," "project," "plan," "predict," "assume," "forecast," "estimate," "objective," "possible," "probably," "likely," "potential," "speculate," "aim," "aspiration," "goal," "seek," "strategy," "target," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying any forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in any forward-looking statements. These factors include, among other things:

•New, amended, or existing laws, regulations, executive orders ("EOs"), or administrative orders or interpretations, including those related to climate change and other environmental matters, and the costs of complying with these laws, regulations, EOs, or administrative orders or interpretations;

•The cost of complying with known, anticipated, or new environmental requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective or result in their removal from service, perhaps permanently;

•Federal legislation aimed specifically at curtailing TVA's activities, including legislation that may cause TVA to lose its protected service territory, its sole authority to set rates, or its authority to manage the Tennessee River system or the real property currently entrusted to TVA; subject TVA to additional environmental regulation or additional requirements of the North American Electric Reliability Corporation ("NERC") or Federal Energy Regulatory Commission ("FERC"); require the divestiture of TVA or the sale of certain of TVA's assets; lower the debt ceiling on bonds, notes, or other evidences of indebtedness (collectively, "Bonds") specified in the Tennessee Valley Authority Act of 1933, as amended, ("TVA Act"); or restrict TVA's access to its funds;

•Cyber attacks on TVA's assets or the assets of third parties upon which TVA relies;

•The failure of TVA's information technology systems;

•Significant delays and additional costs, and/or inability to obtain necessary regulatory approvals, licenses, or permits, for major projects, including for assets that TVA needs to serve its existing and future load and to meet its carbon reduction aspirations;

•Limitations on TVA's ability to borrow money, which may result from, among other things, TVA's approaching or substantially reaching the debt ceiling or TVA's losing access to the debt markets, and which may impact TVA's ability to make planned capital investments;

•Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, or decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, or cause TVA to forego future construction at these or other facilities;

•Risks associated with the operation of nuclear facilities or other generation and related facilities, including coal combustion residuals ("CCR") facilities;

•Inability to continue to operate certain assets, especially nuclear facilities, including due to the inability to obtain, or loss of, regulatory approval for the operation of assets;

•Significant additional costs for TVA to manage and operate its CCR facilities;

•Physical attacks, threats, or other interference causing damage to TVA's facilities or interfering with TVA's operations;

•The failure of TVA's generation, transmission, navigation, flood control, and related assets and infrastructure, including CCR facilities and spent nuclear fuel storage facilities, to operate as anticipated, resulting in lost revenues, damages, or other costs that are not reflected in TVA's financial statements or projections, including due to aging or technological issues;

•Costs or liabilities that are not anticipated in TVA's financial statements for third-party claims, natural resource damages, environmental cleanup activities, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure;

•Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, or damage to the property of others;

•Events that negatively impact TVA's reliability, including problems at other utilities or at TVA facilities or the increase in intermittent sources of power;

•Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid;

•Disruption of supplies of fuel, purchased power, or other critical items or services, which may result from, among other things, economic conditions, weather conditions, physical or cyber attacks, political developments, international trade restrictions or tariffs, legal actions, mine closures or reduced mine production, increases in fuel exports, environmental regulations affecting TVA's suppliers, transportation or delivery constraints, including limited transmission availability, shortages of raw materials, supply chain difficulties, labor shortages, strikes, inflation, or similar events and which may, among other things, hinder TVA's ability to operate its assets and to complete projects on time and on budget;

•Circumstances that cause TVA to change its determinations regarding the appropriate mix of generation assets;

•Costs or other challenges resulting from a failure by TVA to meet its carbon reduction aspirations;

•Actions taken, or inaction, by the United States ("U.S.") government relating to the national debt ceiling or automatic spending cuts in government programs;

•Inability to respond quickly enough to current or potential customer demands or needs or to act solely in the interest of ratepayers;

•Negative outcomes of current or future legal or administrative proceedings;

•Other unforeseeable occurrences negatively impacting TVA assets or their supporting infrastructure;

•The need for significant future contributions associated with TVA's pension plans, other post-retirement benefit plans, or health care plans;

•Increases in TVA's financial liabilities for decommissioning its nuclear facilities and retiring other assets;

•The requirement or decision to make additional contributions to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART");

•Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred;

•An increase in TVA's cost of capital, which may result from, among other things, changes in the market for Bonds, disruptions in the banking system or financial markets, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit;

•The inaccuracy of certain assumptions about the future, including economic forecasts, anticipated energy and commodity prices, cost estimates, construction schedules, power demand forecasts, the appropriate generation mix to meet demand, and assumptions about potential regulatory environments;

•Significant decline in the demand for electricity that TVA produces, which may result from, among other things, economic downturns or recessions, loss of customers, reductions in demand for electricity generated from non-renewable sources or centrally located generation sources, increased utilization of distributed energy resources, increased energy efficiency and conservation, or improvements in alternative generation and energy storage technologies;

•Changes in customer preferences for energy produced from cleaner generation sources;

•Addition or loss of customers by TVA or TVA's local power company customers ("LPCs");

•Potential for increased demand for energy resulting from, among other things, an increase in the population of TVA's service area;

•Changes in technology, which, among other things, may affect relationships with customers and require TVA to change how it conducts its operations;

•Changes in the economy and volatility in financial markets;

•Reliability or creditworthiness of counterparties including but not limited to customers, suppliers, renewable resource providers, and financial institutions;

•Changes in the market price of commodities such as purchased power, coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, or emission allowances;

•Changes in the market price of equity securities, debt securities, or other investments;

•Changes in interest rates, currency exchange rates, or inflation rates;

•Failure to attract or retain an appropriately qualified, diverse, and inclusive workforce;

•Changes in the membership of the TVA Board of Directors ("TVA Board") or TVA senior management, which may impact how TVA operates;

•Weather conditions, including changing weather patterns, extreme weather conditions, and other events such as flooding, droughts, wildfires, heat waves, and snow or ice storms that may result from climate change, which may hamper TVA's ability to supply power, cause customers' demand for power to exceed TVA's then-present power supply, or otherwise negatively impact net revenue;

•Events affecting the supply or quality of water from the Tennessee River system or Cumberland River system, or elsewhere, which could interfere with TVA's ability to generate power;

•Catastrophic events, such as fires, earthquakes, explosions, solar events, electromagnetic pulses, geomagnetic disturbances, droughts, floods, hurricanes, tornadoes, polar vortexes, icing events, pipeline explosions, or other casualty events, wars, national emergencies, terrorist activities, pandemics, widespread public health crises, geopolitical events, or other similar destructive or disruptive events;

•Inability to use regulatory accounting for certain costs;

•Ineffectiveness of TVA's financial control system to control issues and instances of fraud or to prevent or detect errors;

•Ineffectiveness of TVA's disclosure controls and procedures or its internal control over financial reporting;

•Adverse effects from regional health emergencies;

•Inability of TVA to implement its business strategy successfully, including due to the increased use in the public of distributed energy resources or energy-efficiency programs;

•Inability of TVA to adapt its business model to changes in the utility industry and customer preferences and to remain cost competitive;

•Inability of TVA to achieve or maintain its cost reduction goals, which may require TVA to increase rates and/or issue more debt than planned;

•The emergence of artificial intelligence and its potential application to various business practices, including TVA's operations and the operations of TVA's stakeholders;

•Loss of quorum of the TVA Board, which may limit TVA's ability to adapt to meet changing business conditions;

•Negative impacts on TVA's reputation; or

•Other unforeseeable events.

See also Part I, Item 1A, Risk Factors, and Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations in TVA's Annual Report on Form 10-K for the year ended September 30, 2023 (the "Annual Report"), and Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations in this Quarterly Report for a discussion of factors that could cause actual results to differ materially from those in any forward-looking statement. New factors emerge from time to time, and it is not possible for TVA to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA's business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made, except as required by law.

GENERAL INFORMATION

Fiscal Year

References to years (2024, 2023, etc.) in this Quarterly Report are to TVA's fiscal years ending September 30. Years that are preceded by "CY" are references to calendar years.

Notes

References to "Notes" are to the Notes to Consolidated Financial Statements contained in Part I, Item 1, Financial Statements in this Quarterly Report.

Available Information

TVA files annual, quarterly, and current reports with the Securities and Exchange Commission ("SEC") under Section 37 of the Securities Exchange Act of 1934 (the "Exchange Act"). TVA's SEC filings are available to the public at www.tva.com, free of charge, as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. Information contained on or accessible through TVA's website shall not be deemed to be incorporated into, or to be a part of, this Quarterly Report or any other report or document that TVA files with the SEC. All TVA SEC reports are available to the public without charge from the website maintained by the SEC at www.sec.gov.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

Three Months Ended December 31

(in millions)

| | | | | | | | | | | | | | | |

| | | |

| | 2023 | | 2022 | | | | |

| Operating revenues | | | | | | | |

| Revenue from sales of electricity | $ | 2,731 | | | $ | 2,963 | | | | | |

| Other revenue | 34 | | | 52 | | | | | |

| Total operating revenues | 2,765 | | | 3,015 | | | | | |

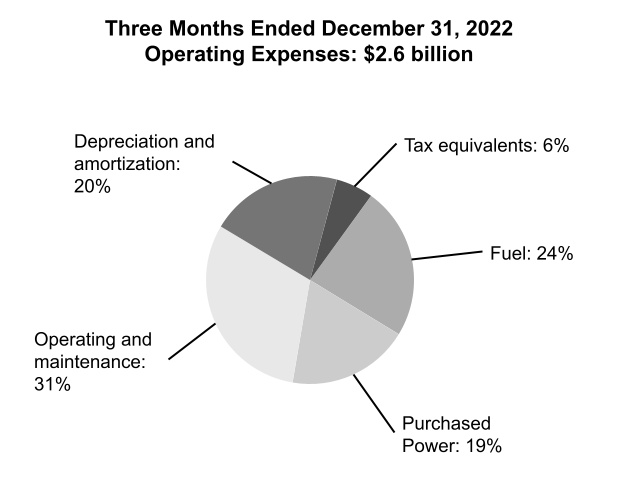

| Operating expenses | | | | | | | |

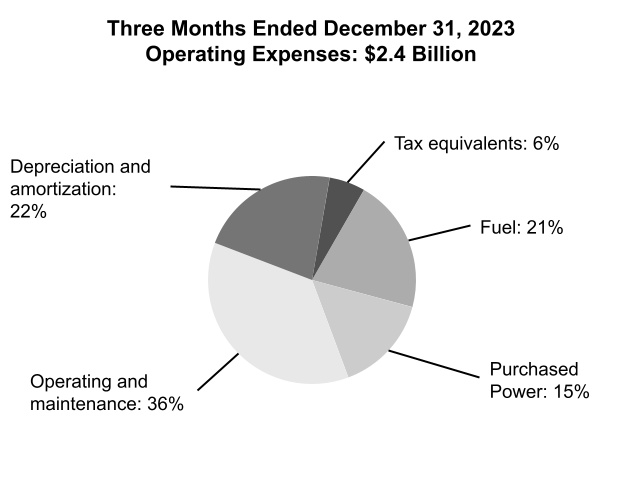

| Fuel | 496 | | | 615 | | | | | |

| Purchased power | 359 | | | 491 | | | | | |

| Operating and maintenance | 867 | | | 827 | | | | | |

| Depreciation and amortization | 521 | | | 533 | | | | | |

| Tax equivalents | 133 | | | 151 | | | | | |

| Total operating expenses | 2,376 | | | 2,617 | | | | | |

| Operating income | 389 | | | 398 | | | | | |

| Other income, net | 23 | | | 16 | | | | | |

| Other net periodic benefit cost | 23 | | | 51 | | | | | |

| Interest expense | 262 | | | 262 | | | | | |

| Net income | $ | 127 | | | $ | 101 | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

Three Months Ended December 31

(in millions)

| | | | | | | | | | | | | | | |

| | | |

| | 2023 | | 2022 | | | | |

| Net income | $ | 127 | | | $ | 101 | | | | | |

| Other comprehensive income (loss) | | | | | | | |

| Net unrealized gain on cash flow hedges | 20 | | | 71 | | | | | |

| Net unrealized gain reclassified to earnings from cash flow hedges | (19) | | | (34) | | | | | |

| Total other comprehensive income | 1 | | | 37 | | | | | |

| Total comprehensive income | $ | 128 | | | $ | 138 | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| ASSETS |

| | December 31, 2023 | | September 30, 2023 |

| Current assets | | | |

| Cash and cash equivalents | $ | 498 | | | $ | 501 | |

| | | |

| | | |

| Accounts receivable, net | 1,593 | | | 1,745 | |

| Inventories, net | 1,182 | | | 1,108 | |

| Regulatory assets | 251 | | | 178 | |

| Other current assets | 152 | | | 134 | |

| Total current assets | 3,676 | | | 3,666 | |

| | | |

| Property, plant, and equipment | | | |

| Completed plant | 67,073 | | | 68,199 | |

| Less accumulated depreciation | (34,445) | | | (35,871) | |

| Net completed plant | 32,628 | | | 32,328 | |

| Construction in progress | 3,425 | | | 3,238 | |

| Nuclear fuel | 1,364 | | | 1,344 | |

| Finance leases | 562 | | | 572 | |

| Total property, plant, and equipment, net | 37,979 | | | 37,482 | |

| | | |

| Investment funds | 4,472 | | | 4,123 | |

| | | |

| Regulatory and other long-term assets | | | |

| Regulatory assets | 5,551 | | | 5,566 | |

| Operating lease assets, net of amortization | 258 | | | 177 | |

| Other long-term assets | 312 | | | 330 | |

| Total regulatory and other long-term assets | 6,121 | | | 6,073 | |

| | | |

| Total assets | $ | 52,248 | | | $ | 51,344 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| LIABILITIES AND PROPRIETARY CAPITAL |

| December 31, 2023 | | September 30, 2023 |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 2,451 | | | $ | 2,618 | |

| | | |

| Accrued interest | 268 | | | 272 | |

| Asset retirement obligations | 275 | | | 272 | |

| | | |

| | | |

| Regulatory liabilities | 259 | | | 222 | |

| Short-term debt, net | 1,042 | | | 432 | |

| Current maturities of power bonds | 1,022 | | | 1,022 | |

| Current maturities of long-term debt of variable interest entities | 35 | | | 35 | |

| | | |

| Total current liabilities | 5,352 | | | 4,873 | |

| | | |

| Other liabilities | | | |

| Post-retirement and post-employment benefit obligations | 2,457 | | | 2,527 | |

| Asset retirement obligations | 7,295 | | | 7,217 | |

| Finance lease liabilities | 571 | | | 576 | |

| Other long-term liabilities | 1,488 | | | 1,211 | |

| | | |

| Regulatory liabilities | 103 | | | 107 | |

| Total other liabilities | 11,914 | | | 11,638 | |

| | | |

| Long-term debt, net | | | |

| Long-term power bonds, net | 17,867 | | | 17,844 | |

| Long-term debt of variable interest entities, net | 933 | | | 933 | |

| | | |

| Total long-term debt, net | 18,800 | | | 18,777 | |

| | | |

| Total liabilities | 36,066 | | | 35,288 | |

| | | |

Contingencies and legal proceedings (Note 20) | | | |

| | | |

| Proprietary capital | | | |

| Power program appropriation investment | 258 | | | 258 | |

| Power program retained earnings | 15,429 | | | 15,302 | |

| Total power program proprietary capital | 15,687 | | | 15,560 | |

| Nonpower programs appropriation investment, net | 523 | | | 525 | |

| Accumulated other comprehensive loss | (28) | | | (29) | |

| Total proprietary capital | 16,182 | | | 16,056 | |

| | | |

| Total liabilities and proprietary capital | $ | 52,248 | | | $ | 51,344 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the Three Months Ended December 31

(in millions)

| | | | | | | | | | | |

| | 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net income | $ | 127 | | | $ | 101 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | |

Depreciation and amortization(1) | 527 | | | 538 | |

| Amortization of nuclear fuel cost | 99 | | | 88 | |

| Non-cash retirement benefit expense | 33 | | | 63 | |

| | | |

| Other regulatory amortization and deferrals | 46 | | | (69) | |

| | | |

| | | |

| | | |

| Changes in current assets and liabilities | | | |

| Accounts receivable, net | 153 | | | 256 | |

| Inventories and other current assets, net | (105) | | | (216) | |

| Accounts payable and accrued liabilities | (289) | | | (86) | |

| Accrued interest | (2) | | | (16) | |

| | | |

| Pension contributions | (75) | | | (75) | |

| | | |

| | | |

| | | |

| Other, net | (121) | | | (145) | |

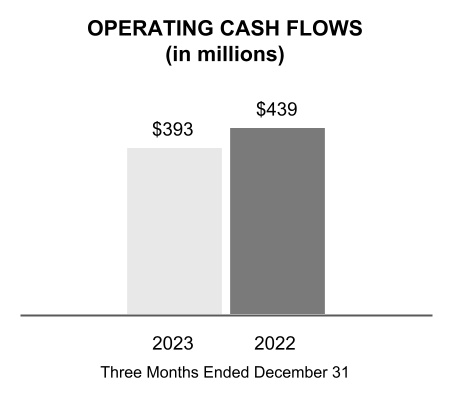

| Net cash provided by operating activities | 393 | | | 439 | |

| | | |

| Cash flows from investing activities | | | |

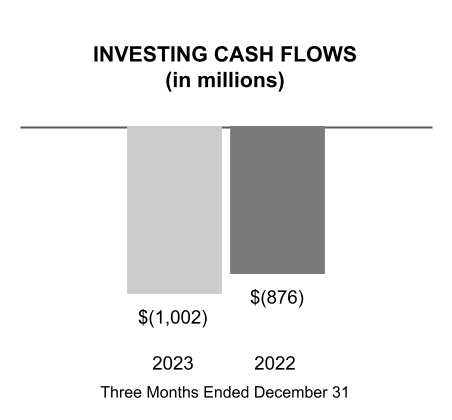

| Construction expenditures | (863) | | | (605) | |

| | | |

| Nuclear fuel expenditures | (146) | | | (192) | |

| Purchases of investments | (1) | | | — | |

| Acquisition of leasehold interests in combustion turbine assets | — | | | (78) | |

| Loans and other receivables | | | |

| Advances | (4) | | | — | |

| Repayments | 2 | | | 3 | |

| Other, net | 10 | | | (4) | |

| Net cash used in investing activities | (1,002) | | | (876) | |

| | | |

| Cash flows from financing activities | | | |

| Long-term debt | | | |

| | | |

| | | |

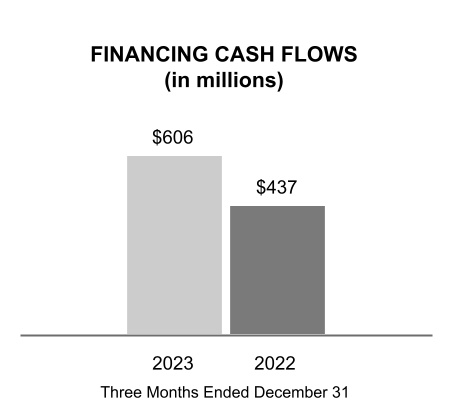

| Redemptions and repurchases of power bonds | (1) | | | (1) | |

| | | |

| | | |

| Short-term debt issues, net | 610 | | | 446 | |

| Payments on leases and leasebacks | (10) | | | (10) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | 7 | | | 2 | |

| Net cash provided by financing activities | 606 | | | 437 | |

| Net change in cash, cash equivalents, and restricted cash | (3) | | | — | |

| Cash, cash equivalents, and restricted cash at beginning of period | 521 | | | 520 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 518 | | | $ | 520 | |

| | | |

| | | |

| | | |

| | | |

| | | |

Note (1) Includes amortization of debt issuance costs and premiums/discounts. |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Three Months Ended December 31, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | |

Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated

Other

Comprehensive

Income (Loss) | |

Total |

| Balance at September 30, 2022 | $ | 258 | | | $ | 14,800 | | | $ | 533 | | | $ | (86) | | | $ | 15,505 | |

| Net income (loss) | — | | | 103 | | | (2) | | | — | | | 101 | |

| Total other comprehensive income | — | | | — | | | — | | | 37 | | | 37 | |

| Return on power program appropriation investment | — | | | (1) | | | — | | | — | | | (1) | |

| | | | | | | | | |

Balance at December 31, 2022 | $ | 258 | | | $ | 14,902 | | | $ | 531 | | | $ | (49) | | | $ | 15,642 | |

| | | | | | | | | |

| Balance at September 30, 2023 | $ | 258 | | | $ | 15,302 | | | $ | 525 | | | $ | (29) | | | $ | 16,056 | |

| Net income (loss) | — | | | 129 | | | (2) | | | — | | | 127 | |

| Total other comprehensive income | — | | | — | | | — | | | 1 | | | 1 | |

| Return on power program appropriation investment | — | | | (2) | | | — | | | — | | | (2) | |

Balance at December 31, 2023 | $ | 258 | | | $ | 15,429 | | | $ | 523 | | | $ | (28) | | | $ | 16,182 | |

The accompanying notes are an integral part of these consolidated financial statements. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions except where noted)

| | | | | | | | | | | |

| Note | Page |

| 1 | | Summary of Significant Accounting Policies | |

| 2 | | Impact of New Accounting Standards and Interpretations | |

| 3 | | Accounts Receivable, Net | |

| 4 | | Inventories, Net | |

| 5 | | Other Current Assets | |

| 6 | | Plant Closures | |

| | | |

| 7 | | Other Long-Term Assets | |

| 8 | | Regulatory Assets and Liabilities | |

| 9 | | Variable Interest Entities | |

| 10 | | Other Long-Term Liabilities | |

| 11 | | Asset Retirement Obligations | |

| 12 | | Debt and Other Obligations | |

| | | |

| 13 | | Risk Management Activities and Derivative Transactions | |

| 14 | | Fair Value Measurements | |

| 15 | | Revenue | |

| 16 | | Other Income, Net | |

| 17 | | Supplemental Cash Flow Information | |

| 18 | | Benefit Plans | |

| 19 | | Collaborative Arrangement | |

| 20 | | Contingencies and Legal Proceedings | |

| | | |

1. Summary of Significant Accounting Policies

Basis of Presentation

The Tennessee Valley Authority ("TVA") prepares its consolidated interim financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") for consolidated interim financial information. Accordingly, TVA's consolidated interim financial statements do not include all of the information and notes required by GAAP for annual financial statements. As such, they should be read in conjunction with the audited financial statements for the year ended September 30, 2023, and the notes thereto, which are contained in TVA's Annual Report on Form 10-K for the year ended September 30, 2023 (the "Annual Report"). In the opinion of management, all adjustments (consisting of items of a normal recurring nature) considered necessary for fair presentation are included on the consolidated interim financial statements.

The accompanying consolidated interim financial statements, which have been prepared in accordance with GAAP, include the accounts of TVA and variable interest entities ("VIEs") of which TVA is the primary beneficiary. See Note 9 — Variable Interest Entities. Intercompany balances and transactions have been eliminated in consolidation.

Fiscal Year

TVA's fiscal year ends September 30. Years (2024, 2023, etc.) refer to TVA's fiscal years unless they are preceded by "CY," in which case the references are to calendar years.

Cash, Cash Equivalents, and Restricted Cash

Cash includes cash on hand, non-interest bearing cash, and deposit accounts. All highly liquid investments with original maturities of three months or less are considered cash equivalents. Cash and cash equivalents that are restricted, as to withdrawal or use under the terms of certain contractual agreements, are recorded in Other long-term assets on the Consolidated Balance Sheets. Restricted cash and cash equivalents include cash held in trusts that are currently restricted for TVA economic development loans and for certain TVA environmental programs in accordance with agreements related to compliance with certain environmental regulations.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported on the Consolidated Balance Sheets and Consolidated Statements of Cash Flows:

| | | | | | | | | | | |

Cash, Cash Equivalents, and Restricted Cash (in millions) |

| | At December 31, 2023 | | At September 30, 2023 |

| Cash and cash equivalents | $ | 498 | | | $ | 501 | |

| | | |

| Restricted cash and cash equivalents included in Other long-term assets | 20 | | | 20 | |

| Total cash, cash equivalents, and restricted cash | $ | 518 | | | $ | 521 | |

Allowance for Uncollectible Accounts

TVA recognizes an allowance that reflects the current estimate for credit losses expected to be incurred over the life of the financial assets based on historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amounts. The appropriateness of the allowance is evaluated at the end of each reporting period.

To determine the allowance for trade receivables, TVA considers historical experience and other currently available information, including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements by the due date. TVA's corporate credit department also performs an assessment of the financial condition of customers and the credit quality of the receivables. In addition, TVA reviews other reasonable and supportable forecasts to determine if the allowance for uncollectible amounts should be further adjusted in accordance with the accounting guidance for Current Expected Credit Losses.

To determine the allowance for loans receivables, TVA aggregates loans into the appropriate pools based on the existence of similar risk characteristics such as collateral types and internal assessed credit risks. In situations where a loan exhibits unique risk characteristics and is no longer expected to experience similar risks to the rest of its pool, the loan will be evaluated separately. TVA derives an annual loss rate based on historical loss and then adjusts the rate to reflect TVA's consideration of available information on current conditions and reasonable and supportable future forecasts. This information may include economic and business conditions, default trends, and other internal and external factors. For periods beyond the reasonable and supportable forecast period, TVA uses the current calculated long-term average historical loss rate for the remaining life of the loan portfolio.

The allowance for uncollectible accounts was less than $1 million at both December 31, 2023, and September 30, 2023, for trade accounts receivable. Additionally, loans receivable of $105 million and $104 million at December 31, 2023, and September 30, 2023, respectively, are included in Accounts receivable, net and Other long-term assets, for the current and long-term portions, respectively. Loans receivables are reported net of allowances for uncollectible accounts of $3 million at both December 31, 2023 and September 30, 2023.

Pre-Commercial Plant Operations

As part of the process of completing the construction of a generating unit, the electricity produced is used to serve the demands of the electric system. TVA estimates revenues earned during pre-commercial operations at the fair value of the energy delivered based on TVA's hourly incremental dispatch cost. Pre-commercial plant operations began on Paradise Combustion Turbine Units 5-7 in the first quarter of 2024, and the units became operational on December 29, 2023. Estimated revenue of $3 million related to this project was capitalized to offset project costs for the three months ended December 31, 2023. TVA also capitalized related fuel costs for this project of $3 million for the three months ended December 31, 2023.

Depreciation

TVA accounts for depreciation of its properties using the composite depreciation convention of accounting. Under the composite method, assets with similar economic characteristics are grouped and depreciated as one asset. Depreciation is generally computed on a straight-line basis over the estimated service lives of the various classes of assets. The estimation of asset useful lives requires management judgment, supported by external depreciation studies of historical asset retirement experience. Depreciation rates are determined based on external depreciation studies that are updated approximately every five years, with the latest study implemented during the first quarter of 2022. Depreciation expense was $452 million and $466 million for the three months ended December 31, 2023 and 2022, respectively. See Note 6 — Plant Closures for a discussion of the impact of plant closures.

2. Impact of New Accounting Standards and Interpretations

The following are accounting standard updates issued by the Financial Accounting Standards Board that TVA adopted during 2024:

| | | | | |

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

Accounting for Contract Assets and Contract Liabilities from Contracts with Customers |

| Description | This guidance requires an entity (acquirer) to recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with revenue with customers. It is expected that an acquirer will generally recognize and measure acquired contract assets and contract liabilities in a manner consistent with how the acquiree recognized and measured contract assets and contract liabilities in the acquiree’s financial statements. The entity should apply the standard prospectively to business combinations occurring on or after the effective date of the standard. |

| Effective Date for TVA | TVA adopted the standard on October 1, 2023, on a prospective basis. |

| Effect on the Financial Statements or Other Significant Matters | Adoption of this standard did not have a material impact on TVA's financial condition, results of operations, or cash flows. |

|

|

| |

| |

| |

|

|

| |

| |

| |

| | | | | |

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

Troubled Debt Restructurings and Vintage Disclosures |

| Description | This guidance eliminates the recognition and measurement guidance on troubled debt restructuring for creditors that have adopted Financial Instruments-Credit Losses and requires enhanced disclosures about loan modifications for borrowers experiencing financial difficulty. Additionally, the guidance requires public business entities to present current-period gross write-offs by year of origination in their vintage disclosures. The entity should apply the standard prospectively except for the transition method related to the recognition and measurement of troubled debt restructuring. For the transition method, an entity has the option to apply a modified retrospective transition method, resulting in a cumulative-effect adjustment to retained earnings in the period of adoption. |

| Effective Date for TVA | TVA adopted the standard on October 1, 2023, on a prospective basis. |

| Effect on the Financial Statements or Other Significant Matters | Adoption of this standard did not have a material impact on TVA's financial condition, results of operations, or cash flows. |

|

|

| |

| |

| |

|

|

| |

| |

| |

The following accounting standard has been issued but as of December 31, 2023, was not effective and has not been adopted by TVA:

| | | | | |

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

| Improvements to Reportable Segment Disclosures |

| Description | This guidance improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The amendment requires a public entity to disclose, on an annual and interim basis, significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit and loss. It also requires a public entity that has a single reportable segment to provide all of the disclosures required by the amendment and all existing segment disclosures. The amendment is effective for public entities for fiscal years beginning after December 15, 2023, and interim periods in fiscal years beginning after December 15, 2024. The amendment should be adopted retrospectively unless it is impracticable to do so. Upon adoption, a public entity will adopt the amendment as of the beginning of the earliest period presented. |

| Effective Date for TVA | October 1, 2024 |

| Effect on the Financial Statements or Other Significant Matters | TVA is currently reviewing and evaluating this standard. TVA does not expect the adoption of this standard to have a material impact on TVA's financial condition, results of operations, or cash flows. |

|

|

| |

| |

| |

|

|

| |

| |

| |

3. Accounts Receivable, Net

Accounts receivable primarily consist of amounts due from customers for power sales. The table below summarizes the types and amounts of TVA's accounts receivable:

| | | | | | | | | | | |

Accounts Receivable, Net (in millions) |

| | At December 31, 2023 | | At September 30, 2023 |

| Power receivables | $ | 1,451 | | | $ | 1,627 | |

| Other receivables | 142 | | | 118 | |

| | | |

Accounts receivable, net(1) | $ | 1,593 | | | $ | 1,745 | |

Note

(1) Allowance for uncollectible accounts was less than $1 million at both December 31, 2023, and September 30, 2023, and therefore is not represented in the table above.

4. Inventories, Net

The table below summarizes the types and amounts of TVA's inventories:

| | | | | | | | | | | |

Inventories, Net (in millions) |

| | At December 31, 2023 | | At September 30, 2023 |

| Materials and supplies inventory | $ | 884 | | | $ | 849 | |

| Fuel inventory | 354 | | | 313 | |

| Renewable energy certificates/emissions allowance inventory, net | 16 | | | 15 | |

| Allowance for inventory obsolescence | (72) | | | (69) | |

| Inventories, net | $ | 1,182 | | | $ | 1,108 | |

5. Other Current Assets

Other current assets consisted of the following:

| | | | | | | | | | | |

Other Current Assets (in millions) |

| | At December 31, 2023 | | At September 30, 2023 |

| Inventory work-in-progress | $ | 47 | | | $ | 28 | |

| Prepaid software maintenance | 36 | | | 18 | |

| Commodity contract derivative assets | 19 | | | 21 | |

| Prepaid insurance | 16 | | | 16 | |

| Current portion of prepaid long-term service agreements | 10 | | | 25 | |

| Other | 24 | | | 26 | |

| Other current assets | $ | 152 | | | $ | 134 | |

Commodity Contract Derivative Assets. TVA enters into certain derivative contracts for natural gas that require physical delivery of the contracted quantity of the commodity as well as certain financial derivative contracts to hedge exposure to the price of natural gas. Commodity contract derivative assets classified as current include deliveries or settlements that will occur within 12 months or less. See Note 13 — Risk Management Activities and Derivative Transactions — Derivatives Not Receiving Hedge Accounting Treatment — Commodity Derivatives and — Commodity Derivatives under the FHP for a discussion of TVA's commodity contract derivatives.

6. Plant Closures

Background

TVA must continuously evaluate all generating assets to ensure an optimal energy portfolio that provides safe, clean, and reliable power while maintaining flexibility and fiscal responsibility to the people of the Tennessee Valley. Based on results of assessments presented to the TVA Board of Directors ("TVA Board") in 2019, the retirement of Bull Run Fossil Plant ("Bull Run") by December 2023 was approved, and as of September 30, 2023, the facility was retired. In January 2023, TVA issued its Record of Decision to retire the two coal-fired units at Cumberland Fossil Plant ("Cumberland") by the end of CY 2026 and CY 2028. In addition, TVA is evaluating the impact of retiring the balance of the coal-fired fleet by 2035, and that evaluation includes environmental reviews, public input, and TVA Board approval.

Financial Impact

TVA's policy is to adjust depreciation rates to reflect the most current assumptions, ensuring units will be fully depreciated by the applicable retirement dates. As a result of TVA's decision to accelerate the retirement of Bull Run, TVA recognized a cumulative $659 million of accelerated depreciation from the second quarter of 2019 through September 30, 2023. Of this amount, $36 million was recognized for Bull Run during the three months ended December 31, 2022. TVA's decision to retire the two units at Cumberland is estimated to result in approximately $16 million of additional depreciation quarterly, which does not include any potential impact from additions or retirements to net completed plant. TVA estimates it has recognized a cumulative $64 million of additional depreciation since January 2023, related to this decision.

7. Other Long-Term Assets

The table below summarizes the types and amounts of TVA's other long-term assets:

| | | | | | | | | | | |

Other Long-Term Assets (in millions) |

| At December 31, 2023 | | At September 30, 2023 |

| | | |

| Loans and other long-term receivables, net | $ | 101 | | | $ | 97 | |

EnergyRight® receivables, net | 46 | | | 47 | |

| Prepaid long-term service agreements | 44 | | | 64 | |

| Prepaid capital assets | 21 | | | 28 | |

| Commodity contract derivative assets | 12 | | | 12 | |

| | | |

| | | |

| | | |

| Other | 88 | | | 82 | |

| Total other long-term assets | $ | 312 | | | $ | 330 | |

Loans and Other Long-Term Receivables. TVA's loans and other long-term receivables primarily consist of economic development loans for qualifying organizations and a receivable for reimbursements to recover the cost of providing long-term, on-site storage for spent nuclear fuel. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At December 31, 2023 and September 30, 2023, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was $4 million and $7 million, respectively.

EnergyRight® Receivables. In association with the EnergyRight® program, TVA's local power company customers ("LPCs") offer financing to end-use customers for the purchase of energy-efficient equipment. Depending on the nature of the energy-efficiency project, loans may have a maximum term of five years or 10 years. TVA purchases the resulting loans receivable from its LPCs. The loans receivable are then transferred to a third-party bank with which TVA has agreed to repay in full any loans receivable that have been in default for 180 days or more or that TVA has determined are uncollectible. Given this continuing involvement, TVA accounts for the transfer of the loans receivable as secured borrowings. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At December 31, 2023, and September 30, 2023, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was $13 million and $12 million, respectively. See Note 10 — Other Long-Term Liabilities for information regarding the associated financing obligation.

Allowance for Loan Losses. The allowance for loan loss is an estimate of expected credit losses, measured over the estimated life of the loan receivables, that considers reasonable and supportable forecasts of future economic conditions in addition to information about historical experience and current conditions. See Note 1 — Summary of Significant Accounting Policies — Allowance for Uncollectible Accounts.

The allowance components, which consist of a collective allowance and specific loans allowance, are based on the risk characteristics of TVA's loans. Loans that share similar risk characteristics are evaluated on a collective basis in measuring credit losses, while loans that do not share similar risk characteristics with other loans are evaluated on an individual basis.

| | | | | | | | | | | |

Allowance Components (in millions) |

| At December 31, 2023 | | At September 30, 2023 |

EnergyRight® loan reserve | $ | 1 | | | $ | 1 | |

| Economic development loan collective reserve | 1 | | | 1 | |

| Economic development loan specific loan reserve | 1 | | | 1 | |

| | | |

| Total allowance for loan losses | $ | 3 | | | $ | 3 | |

Prepaid Long-Term Service Agreements. TVA has entered into various long-term service agreements for major maintenance activities at certain of its combined cycle plants. TVA uses the direct expense method of accounting for these arrangements. TVA accrues for parts when it takes ownership and for contractor services when they are rendered. Under certain of these agreements, payments made exceed the value of parts received and services rendered. The current and long-term portions of the resulting prepayments are reported in Other current assets and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At December 31, 2023, and September 30, 2023, prepayments of $10 million and $25 million, respectively, were recorded in Other current assets.

Commodity Contract Derivative Assets. TVA enters into certain derivative contracts for natural gas that require physical delivery of the contracted quantity of the commodity as well as certain financial derivative contracts to hedge exposure to the

price of natural gas. See Note 13 — Risk Management Activities and Derivative Transactions — Derivatives Not Receiving Hedge Accounting Treatment — Commodity Derivatives and — Commodity Derivatives under the FHP for a discussion of TVA's commodity contract derivatives.

8. Regulatory Assets and Liabilities

TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. As such, certain items that would generally be reported in earnings or that would impact the Consolidated Statements of Operations are recorded as regulatory assets or regulatory liabilities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. Components of regulatory assets and regulatory liabilities are summarized in the table below.

| | | | | | | | | | | |

Regulatory Assets and Liabilities (in millions) |

| | At December 31, 2023 | | At September 30, 2023 |

| Current regulatory assets | | | |

| | | |

| Unrealized losses on interest rate derivatives | $ | 37 | | | $ | 31 | |

| | | |

| Unrealized losses on commodity derivatives | 213 | | | 136 | |

| | | |

| | | |

| Fuel cost adjustment receivable | — | | | 11 | |

| Other current regulatory assets | 1 | | | — | |

| Total current regulatory assets | 251 | | | 178 | |

| | | |

| Non-current regulatory assets | | | |

| Retirement benefit plans deferred costs | 1,438 | | | 1,440 | |

| Non-nuclear decommissioning costs | 2,838 | | | 2,922 | |

| | | |

| Unrealized losses on interest rate derivatives | 459 | | | 272 | |

| Nuclear decommissioning costs | 543 | | | 728 | |

| | | |

| Unrealized losses on commodity derivatives | 98 | | | 52 | |

| | | |

| | | |

| Other non-current regulatory assets | 175 | | | 152 | |

| Total non-current regulatory assets | 5,551 | | | 5,566 | |

| Total regulatory assets | $ | 5,802 | | | $ | 5,744 | |

| | | |

| Current regulatory liabilities | | | |

| Fuel cost adjustment tax equivalents | $ | 190 | | | $ | 201 | |

| Fuel cost adjustment | 50 | | | — | |

| Unrealized gains on commodity derivatives | 19 | | | 21 | |

| Total current regulatory liabilities | 259 | | | 222 | |

| | | |

| Non-current regulatory liabilities | | | |

| Retirement benefit plans deferred credits | 91 | | | 95 | |

| Unrealized gains on commodity derivatives | 12 | | | 12 | |

| Total non-current regulatory liabilities | 103 | | | 107 | |

| | | |

| Total regulatory liabilities | $ | 362 | | | $ | 329 | |

9. Variable Interest Entities

A VIE is an entity that either (i) has insufficient equity to permit the entity to finance its activities without additional subordinated financial support or (ii) has equity investors who lack the characteristics of owning a controlling financial interest. When TVA determines that it has a variable interest in a VIE, a qualitative evaluation is performed to assess which interest holders have the power to direct the activities that most significantly impact the economic performance of the entity and have the obligation to absorb losses or receive benefits that could be significant to the entity. The evaluation considers the purpose and

design of the business, the risks that the business was designed to create and pass along to other entities, the activities of the business that can be directed and which party can direct them, and the expected relative impact of those activities on the economic performance of the business through its life. TVA has the power to direct the activities of an entity when it has the ability to make key operating and financing decisions, including, but not limited to, capital investment and the issuance of debt. Based on the evaluation of these criteria, TVA has determined it is the primary beneficiary of certain entities and as such is required to account for the VIEs on a consolidated basis.

John Sevier VIEs

In 2012, TVA entered into a $1.0 billion construction management agreement and lease financing arrangement with John Sevier Combined Cycle Generation LLC ("JSCCG") for the completion and lease by TVA of the John Sevier Combined Cycle Facility ("John Sevier CCF"). JSCCG is a special single-purpose limited liability company formed in January 2012 to finance the John Sevier CCF through a $900 million secured note issuance (the "JSCCG notes") and the issuance of $100 million of membership interests subject to mandatory redemption. The membership interests were purchased by John Sevier Holdco LLC ("Holdco"). Holdco is a special single-purpose entity, also formed in January 2012, established to acquire and hold the membership interests in JSCCG. A non-controlling interest in Holdco is held by a third party through nominal membership interests, to which none of the income, expenses, and cash flows are allocated.

The membership interests held by Holdco in JSCCG were purchased with proceeds from the issuance of $100 million of secured notes (the "Holdco notes") and are subject to mandatory redemption pursuant to a schedule of amortizing, semi-annual payments due each January 15 and July 15, with a final payment due in January 2042. The payment dates for the mandatorily redeemable membership interests are the same as those of the Holdco notes. The sale of the JSCCG notes, the membership interests in JSCCG, and the Holdco notes closed in January 2012. The JSCCG notes are secured by TVA's lease payments, and the Holdco notes are secured by Holdco's investment in, and amounts receivable from, JSCCG. TVA's lease payments to JSCCG are equal to and payable on the same dates as JSCCG's and Holdco's semi-annual debt service payments. In addition to the lease payments, TVA pays administrative and miscellaneous expenses incurred by JSCCG and Holdco. Certain agreements related to this transaction contain default and acceleration provisions.

Due to its participation in the design, business activity, and credit and financial support of JSCCG and Holdco, TVA has determined that it has a variable interest in each of these entities. Based on its analysis, TVA has concluded that it is the primary beneficiary of JSCCG and Holdco and, as such, is required to account for the VIEs on a consolidated basis. Holdco's membership interests in JSCCG are eliminated in consolidation.

Southaven VIE

In 2013, TVA entered into a $400 million lease financing arrangement with Southaven Combined Cycle Generation LLC ("SCCG") for the lease by TVA of the Southaven Combined Cycle Facility ("Southaven CCF"). SCCG is a special single-purpose limited liability company formed in June 2013 to finance the Southaven CCF through a $360 million secured notes issuance (the "SCCG notes") and the issuance of $40 million of membership interests subject to mandatory redemption. The membership interests were purchased by Southaven Holdco LLC ("SHLLC"). SHLLC is a special single-purpose entity, also formed in June 2013, established to acquire and hold the membership interests in SCCG. A non-controlling interest in SHLLC is held by a third party through nominal membership interests, to which none of the income, expenses, and cash flows of SHLLC are allocated.

The membership interests held by SHLLC were purchased with proceeds from the issuance of $40 million of secured notes (the "SHLLC notes") and are subject to mandatory redemption pursuant to a schedule of amortizing, semi-annual payments due each February 15 and August 15, with a final payment due on August 15, 2033. The payment dates for the mandatorily redeemable membership interests are the same as those of the SHLLC notes, and the payment amounts are sufficient to provide returns on, as well as returns of, capital until the investment has been repaid to SHLLC in full. The rate of return on investment to SHLLC is seven percent, which is reflected as interest expense in the Consolidated Statements of Operations. SHLLC is required to pay a pre-determined portion of the return on investment to Seven States Southaven, LLC on each lease payment date as agreed in SHLLC's formation documents (the "Seven States Return"). The current and long-term portions of the Membership interests of VIE subject to mandatory redemption are included in Accounts payable and accrued liabilities and Other long-term liabilities, respectively.