UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2022

OR

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

(Exact name of registrant as specified in its charter)

A corporate agency of the (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

(Address of principal executive offices) | (Zip Code) | ||||||||||

(Registrant's telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| N/A | N/A | N/A | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

1

| Table of Contents | |||||

| Page | |||||

GLOSSARY OF COMMON ACRONYMS...................................................................................................................................... | |||||

FORWARD-LOOKING INFORMATION......................................................................................................................................... | |||||

GENERAL INFORMATION............................................................................................................................................................ | |||||

ITEM 1. FINANCIAL STATEMENTS............................................................................................................................................. | |||||

Executive Overview............................................................................................................................................................... | |||||

Results of Operations............................................................................................................................................................ | |||||

Liquidity and Capital Resources............................................................................................................................................ | |||||

Critical Accounting Estimates........................................................................................................................... | |||||

New Accounting Standards and Interpretations.................................................................................................................... | |||||

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.............................................................. | |||||

ITEM 4. CONTROLS AND PROCEDURES.................................................................................................................................. | |||||

Changes in Internal Control over Financial Reporting.......................................................................................................... | |||||

ITEM 1. LEGAL PROCEEDINGS.................................................................................................................................................. | |||||

ITEM 6. EXHIBITS........................................................................................................................................................................ | |||||

SIGNATURES............................................................................................................................................................................... | |||||

2

| GLOSSARY OF COMMON ACRONYMS | ||||||||

Following are definitions of some of the terms or acronyms that may be used in this Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 (the "Quarterly Report"): | ||||||||

| Term or Acronym | Definition | |||||||

| ACE | Affordable Clean Energy | |||||||

| ACM | Assessment of Corrective Measures | |||||||

| AOCI | Accumulated other comprehensive income (loss) | |||||||

| ARO | Asset retirement obligation | |||||||

| ART | Asset Retirement Trust | |||||||

| Bonds | Bonds, notes, or other evidences of indebtedness | |||||||

| BTA | Best technology available | |||||||

| BVUA | Bristol Virginia Utilities Authority | |||||||

| CAA | Clean Air Act | |||||||

| Caledonia CC | Caledonia Combined Cycle Plant | |||||||

| CCR | Coal combustion residuals | |||||||

| CERCLA | Comprehensive Environmental Response, Compensation, and Liability Act | |||||||

CO2 | Carbon dioxide | |||||||

| COVID-19 | Coronavirus Disease 2019 | |||||||

| CSAPR | Cross-State Air Pollution Rule | |||||||

| CTs | Combustion turbine unit(s) | |||||||

| CVA | Credit valuation adjustment | |||||||

| CWA | Clean Water Act | |||||||

| CWIS | Cooling Water Intake Structures | |||||||

| CY | Calendar year | |||||||

| DCP | Deferred Compensation Plan | |||||||

| DER | Distributed energy resources | |||||||

| DOE | Department of Energy | |||||||

| EIS | Environmental Impact Statement | |||||||

| ELGs | Effluent Limitation Guidelines | |||||||

| EMPs | Electromagnetic pulses | |||||||

| EO(s) | Executive Order(s) | |||||||

| EPA | Environmental Protection Agency | |||||||

| ETS | Emergency Temporary Standard | |||||||

| EV | Electric Vehicle | |||||||

| FERC | Federal Energy Regulatory Commission | |||||||

| FGD | Flue gas desulfurization | |||||||

| FHP | Financial Hedging Program | |||||||

| GAAP | Accounting principles generally accepted in the United States of America | |||||||

| GAC | Grid access charge | |||||||

| GHG | Greenhouse gas | |||||||

| GMD | Geomagnetic disturbances | |||||||

| HAP | Hazardous Air Pollutants | |||||||

| Holdco | John Sevier Holdco LLC | |||||||

| JSCCG | John Sevier Combined Cycle Generation LLC | |||||||

| kWh | Kilowatt hours | |||||||

| LPCs | Local power company customers | |||||||

| LTA | Long-Term Agreement | |||||||

| MATS | Mercury and Air Toxics Standards | |||||||

3

| MD&A | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| MLGW | Memphis Light, Gas and Water Division | |||||||

| mmBtu | Million British thermal unit(s) | |||||||

| MtM | Mark-to-market | |||||||

| MW | Megawatts | |||||||

| MWh | Megawatt hours | |||||||

| NAAQS | National Ambient Air Quality Standards | |||||||

| NAV | Net asset value | |||||||

| NDT | Nuclear Decommissioning Trust | |||||||

| NEIL | Nuclear Electric Insurance Limited | |||||||

| NEPA | National Environmental Policy Act | |||||||

| NERC | North American Electric Reliability Corporation | |||||||

| NES | Nashville Electric Service | |||||||

NOx | Nitrogen oxide | |||||||

| NPDES | National Pollutant Discharge Elimination System | |||||||

| NRC | Nuclear Regulatory Commission | |||||||

| Nuclear Development | Nuclear Development, LLC | |||||||

| NWP | Nationwide Permit | |||||||

| OMB | Office of Management and Budget | |||||||

| PPA(s) | Power Purchase Agreement(s) | |||||||

| QTE | Qualified technological equipment and software | |||||||

| RCRA | Resource Conservation and Recovery Act | |||||||

| RECs | Renewable Energy Certificates | |||||||

| RFP(s) | Request(s) for proposals | |||||||

| SCCG | Southaven Combined Cycle Generation LLC | |||||||

| SCRs | Selective catalytic reduction systems | |||||||

| SEC | Securities and Exchange Commission | |||||||

| SERP | Supplemental Executive Retirement Plan | |||||||

| SHLLC | Southaven Holdco LLC | |||||||

| SIPs | State implementation plans | |||||||

| SMR | Small modular reactor(s) | |||||||

SO2 | Sulfur dioxide | |||||||

| TDEC | Tennessee Department of Environment and Conservation | |||||||

| TVA | Tennessee Valley Authority | |||||||

| TVA Act | The Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee | |||||||

| TVA Board | TVA Board of Directors | |||||||

| TVARS | Tennessee Valley Authority Retirement System | |||||||

| U.S. Treasury | United States Department of the Treasury | |||||||

| USACE | U.S. Army Corps of Engineers | |||||||

| VIE | Variable interest entity | |||||||

| WOTUS | Waters of the United States | |||||||

| XBRL | eXtensible Business Reporting Language | |||||||

4

FORWARD-LOOKING INFORMATION

This Quarterly Report contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," "project," "plan," "predict," "assume," "forecast," "estimate," "objective," "possible," "probably," "likely," "potential," "speculate," "aim," "goal," "seek," "strategy," "target," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying any forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in any forward-looking statements. These factors include, among other things:

•The continuing impact of the Coronavirus Disease 2019 ("COVID-19") pandemic on TVA's operating results, financial condition, and cash flows, the demand for electricity, TVA's workforce and operations, the availability of fuel and critical parts, supplies, and services, the financial markets, and the business and financial condition of TVA's customers and counterparties;

•The duration and severity of the COVID-19 pandemic, actions taken to contain its spread and mitigate its effects, and broader impacts of the COVID-19 pandemic on economic and market conditions, including impacts on interest rates, commodity prices, investment performance, and foreign currency exchange rates;

•New, amended, or existing laws, regulations, executive orders ("EOs"), or administrative orders or interpretations, including those related to climate change and other environmental matters, and the costs of complying with these laws, regulations, EOs, or administrative orders or interpretations;

•The cost of complying with known, anticipated, or new environmental requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective or result in their removal from service, perhaps permanently;

•Significant reductions in demand for electricity produced through non-renewable or centrally located generation sources that may result from, among other things, economic downturns, increased energy efficiency and conservation, increased utilization of distributed generation and microgrids, and improvements in alternative generation and energy storage technologies;

•Changes in customer preferences for energy produced from cleaner generation sources;

•Changes in technology;

•Actions taken, or inaction, by the United States ("U.S.") government relating to the national or TVA debt ceiling or automatic spending cuts in government programs;

•Costs or liabilities that are not anticipated in TVA's financial statements for third-party claims, natural resource damages, environmental cleanup activities, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure;

•Addition or loss of customers by TVA or TVA's local power company customers ("LPCs");

•Significant delays, cost increases, or cost overruns associated with the construction and maintenance of generation, transmission, navigation, flood control, or related assets;

•Requirements or decisions changing the amount or timing of funding obligations associated with TVA's pension plans, other post-retirement benefit plans, or health care plans;

•Increases in TVA's financial liabilities for decommissioning its nuclear facilities or retiring other assets;

•Risks associated with the operation of nuclear facilities or other generation and related facilities, including coal combustion residuals ("CCR") facilities;

•Physical attacks on TVA's assets;

•Cyber attacks on TVA's assets or the assets of third parties upon which TVA relies;

•The outcome of legal or administrative proceedings;

•The failure of TVA's generation, transmission, navigation, flood control, and related assets and infrastructure, including CCR facilities and spent nuclear fuel storage facilities, to operate as anticipated, resulting in lost revenues, damages, or other costs that are not reflected in TVA's financial statements or projections;

•Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred;

•Weather conditions including changing weather patterns, extreme weather conditions, and other events such as flooding, droughts, wildfires, and snow or ice storms that may result from climate change;

•Catastrophic events such as fires, earthquakes, explosions, solar events, electromagnetic pulses ("EMPs"), geomagnetic disturbances ("GMDs"), droughts, floods, hurricanes, tornadoes, or other casualty events or pandemics, wars, national emergencies, terrorist activities, or other similar events, especially if these events occur in or near TVA's service area;

•Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, and damage to the property of others;

•Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid;

•Disruption of fuel supplies, which may result from, among other things, economic conditions, weather conditions, production or transportation difficulties, labor challenges, cyber attacks, mine closures or reduced mine production, an increase in fuel exports, or environmental laws or regulations affecting TVA's fuel suppliers or transporters;

5

•Purchased power price volatility and disruption of purchased power supplies;

•Events which affect the supply of water for TVA's generation facilities;

•Changes in TVA's determinations of the appropriate mix of generation assets;

•Ineffectiveness of TVA's efforts at adapting its organization to an evolving marketplace and remaining cost competitive;

•Inability to use regulatory accounting or loss of regulatory accounting approval for certain costs;

•Inability to obtain, or loss of, regulatory approval for the construction or operation of assets;

•The requirement or decision to make additional contributions to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART");

•Limitations on TVA's ability to borrow money which may result from, among other things, TVA's approaching or substantially reaching the limit on bonds, notes, and other evidences of indebtedness (collectively, "Bonds") specified in the Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee ("TVA Act");

•An increase in TVA's cost of capital that may result from, among other things, changes in the market for TVA's debt securities, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit;

•Changes in the economy and volatility in financial markets;

•Reliability or creditworthiness of counterparties;

•Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, electricity, or emission allowances;

•Changes in the market price of equity securities, debt securities, or other investments;

•Changes in interest rates, currency exchange rates, or inflation rates;

•Ineffectiveness of TVA's disclosure controls and procedures or its internal control over financial reporting;

•Inability to eliminate identified deficiencies in TVA's systems, standards, controls, or corporate culture;

•Inability to attract or retain a skilled workforce;

•Inability to respond quickly enough to current or potential customer demands or needs, including the potential for increased demand for energy resulting from an increase in the population in TVA's service territory;

•Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, or decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, or cause TVA to forego future construction at these or other facilities;

•Loss of quorum of the TVA Board of Directors ("TVA Board");

•Changes in the priorities of the TVA Board or TVA senior management; or

•Other unforeseeable events.

See also Item 1A, Risk Factors, and Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations in TVA's Annual Report on Form 10-K for the year ended September 30, 2021 (the "Annual Report"), and Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations in this Quarterly Report for a discussion of factors that could cause actual results to differ materially from those in any forward-looking statement. New factors emerge from time to time, and it is not possible for TVA to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA's business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made, except as required by law.

6

GENERAL INFORMATION

Fiscal Year

References to years (2022, 2021, etc.) in this Quarterly Report are to Tennessee Valley Authority's ("TVA's") fiscal years ending September 30. Years that are preceded by "CY" are references to calendar years.

Notes

References to "Notes" are to the Notes to Consolidated Financial Statements contained in Part I, Item 1, Financial Statements in this Quarterly Report.

Available Information

TVA's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, are available on TVA's website, free of charge, as soon as reasonably practicable after such reports are electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). TVA's website is www.tva.com. Information contained on or accessible through TVA's website shall not be deemed to be incorporated into, or to be a part of, this Quarterly Report or any other report or document that TVA files with the SEC. All TVA SEC reports are available to the public without charge from the website maintained by the SEC at www.sec.gov.

7

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| ASSETS | |||||||||||

| June 30, 2022 | September 30, 2021 | ||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Accounts receivable, net | |||||||||||

| Inventories, net | |||||||||||

| Regulatory assets | |||||||||||

| Other current assets | |||||||||||

| Total current assets | |||||||||||

| Property, plant, and equipment | |||||||||||

| Completed plant | |||||||||||

| Less accumulated depreciation | ( | ( | |||||||||

| Net completed plant | |||||||||||

| Construction in progress | |||||||||||

| Nuclear fuel | |||||||||||

| Finance leases | |||||||||||

| Total property, plant, and equipment, net | |||||||||||

| Investment funds | |||||||||||

| Regulatory and other long-term assets | |||||||||||

| Regulatory assets | |||||||||||

| Operating lease assets, net of amortization | |||||||||||

| Other long-term assets | |||||||||||

| Total regulatory and other long-term assets | |||||||||||

| Total assets | $ | $ | |||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||

8

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| LIABILITIES AND PROPRIETARY CAPITAL | |||||||||||

| June 30, 2022 | September 30, 2021 | ||||||||||

| Current liabilities | |||||||||||

| Accounts payable and accrued liabilities | $ | $ | |||||||||

| Accrued interest | |||||||||||

| Asset retirement obligations | |||||||||||

| Current portion of leaseback obligations | |||||||||||

| Regulatory liabilities | |||||||||||

| Short-term debt, net | |||||||||||

| Current maturities of power bonds | |||||||||||

| Current maturities of long-term debt of variable interest entities | |||||||||||

| Total current liabilities | |||||||||||

| Other liabilities | |||||||||||

| Post-retirement and post-employment benefit obligations | |||||||||||

| Asset retirement obligations | |||||||||||

| Finance lease liabilities | |||||||||||

| Other long-term liabilities | |||||||||||

| Regulatory liabilities | |||||||||||

| Total other liabilities | |||||||||||

| Long-term debt, net | |||||||||||

| Long-term power bonds, net | |||||||||||

| Long-term debt of variable interest entities, net | |||||||||||

| Total long-term debt, net | |||||||||||

| Total liabilities | |||||||||||

Contingencies and legal proceedings (Note 20) | |||||||||||

| Proprietary capital | |||||||||||

| Power program appropriation investment | |||||||||||

| Power program retained earnings | |||||||||||

| Total power program proprietary capital | |||||||||||

| Nonpower programs appropriation investment, net | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ( | |||||||||

| Total proprietary capital | |||||||||||

| Total liabilities and proprietary capital | $ | $ | |||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||

9

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(in millions)

| Three Months Ended June 30 | Nine Months Ended June 30 | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Operating revenues | |||||||||||||||||||||||

| Revenue from sales of electricity | $ | $ | $ | $ | |||||||||||||||||||

| Other revenue | |||||||||||||||||||||||

| Total operating revenues | |||||||||||||||||||||||

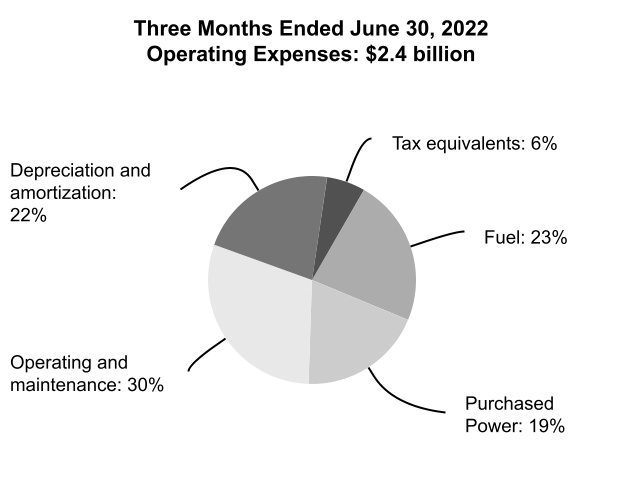

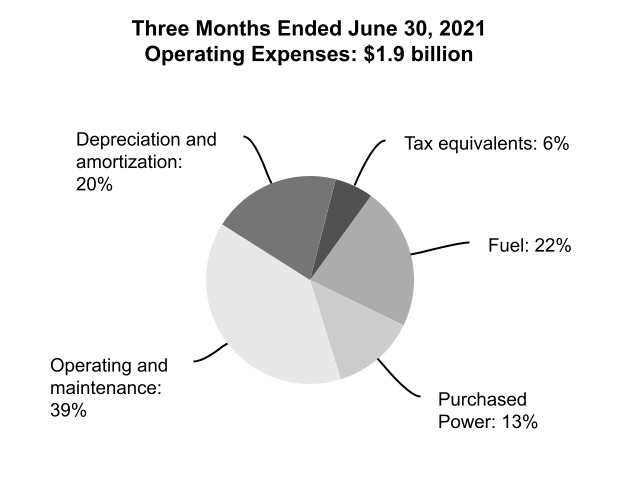

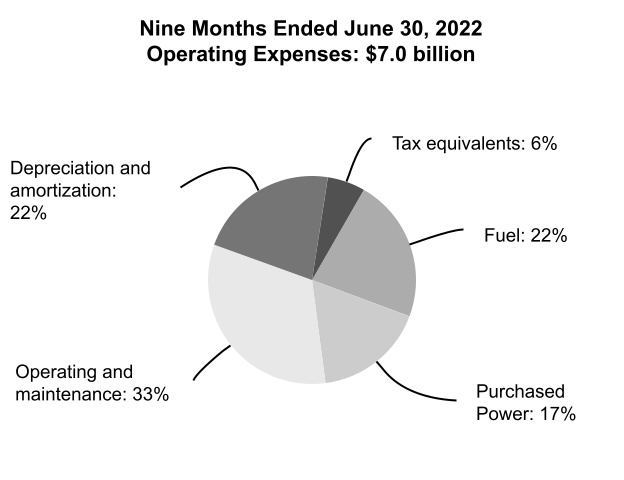

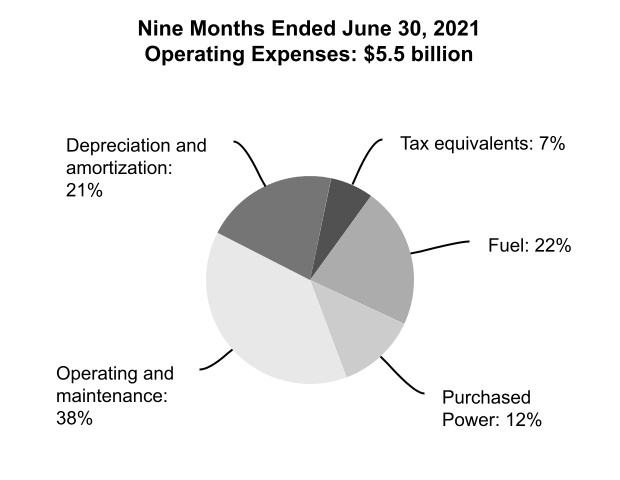

| Operating expenses | |||||||||||||||||||||||

| Fuel | |||||||||||||||||||||||

| Purchased power | |||||||||||||||||||||||

| Operating and maintenance | |||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

| Tax equivalents | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| Operating income | |||||||||||||||||||||||

| Other income (expense), net | ( | ||||||||||||||||||||||

| Other net periodic benefit cost | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||||||||||||||

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(in millions)

| Three Months Ended June 30 | Nine Months Ended June 30 | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Other comprehensive income (loss) | |||||||||||||||||||||||

| Net unrealized gain (loss) on cash flow hedges | ( | ( | |||||||||||||||||||||

| Net unrealized (gain) loss reclassified to earnings from cash flow hedges | ( | ( | |||||||||||||||||||||

| Total other comprehensive income | ( | ( | |||||||||||||||||||||

| Total comprehensive income | $ | $ | $ | $ | |||||||||||||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||||||||||||||

10

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the Nine Months Ended June 30

(in millions)

| 2022 | 2021 | ||||||||||

| Cash flows from operating activities | |||||||||||

| Net income | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities | |||||||||||

Depreciation and amortization(1) | |||||||||||

| Amortization of nuclear fuel cost | |||||||||||

| Non-cash retirement benefit expense | |||||||||||

| Other regulatory amortization and deferrals | ( | ( | |||||||||

| Changes in current assets and liabilities | |||||||||||

| Accounts receivable, net | ( | ||||||||||

| Inventories and other current assets, net | ( | ( | |||||||||

| Accounts payable and accrued liabilities | |||||||||||

| Accrued interest | ( | ( | |||||||||

| Pension contributions | ( | ( | |||||||||

| Other, net | ( | ( | |||||||||

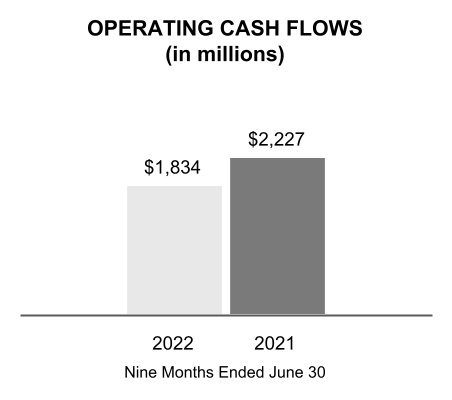

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities | |||||||||||

| Construction expenditures | ( | ( | |||||||||

| Nuclear fuel expenditures | ( | ( | |||||||||

| Loans and other receivables | |||||||||||

| Advances | ( | ( | |||||||||

| Repayments | |||||||||||

| Other, net | |||||||||||

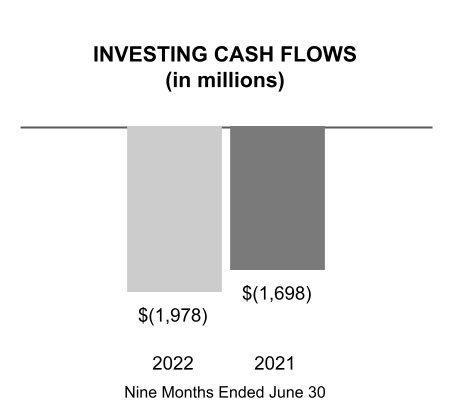

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities | |||||||||||

| Long-term debt | |||||||||||

| Redemptions and repurchases of power bonds | ( | ( | |||||||||

| Redemptions of debt of variable interest entities | ( | ( | |||||||||

| Short-term debt issues (redemptions), net | |||||||||||

| Payments on leases and leasebacks | ( | ( | |||||||||

| Other, net | |||||||||||

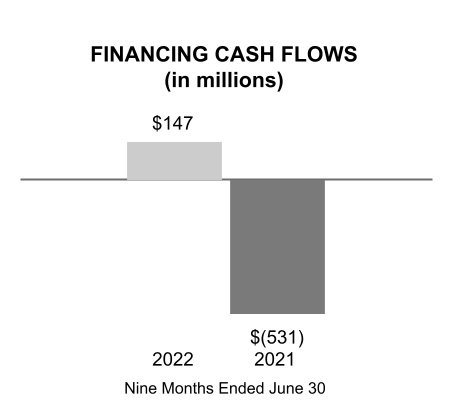

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Net change in cash, cash equivalents, and restricted cash | ( | ||||||||||

| Cash, cash equivalents, and restricted cash at beginning of period | |||||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | $ | |||||||||

Note (1) Includes amortization of debt issuance costs and premiums/discounts. | |||||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||

11

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Three Months Ended June 30, 2022 and 2021

(in millions)

| Power Program Appropriation Investment | Power Program Retained Earnings | Nonpower Programs Appropriation Investment, Net | Accumulated Other Comprehensive Income (Loss) | Total | |||||||||||||||||||||||||

| Balance at March 31, 2021 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Net income (loss) | ( | ||||||||||||||||||||||||||||

| Total other comprehensive income (loss) | ( | ( | |||||||||||||||||||||||||||

| Return on power program appropriation investment | ( | ( | |||||||||||||||||||||||||||

Balance at June 30, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

| Net income (loss) | ( | ||||||||||||||||||||||||||||

| Total other comprehensive income (loss) | ( | ( | |||||||||||||||||||||||||||

| Return on power program appropriation investment | ( | ( | |||||||||||||||||||||||||||

Balance at June 30, 2022 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||||||||||||||||||||

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Nine Months Ended June 30, 2022 and 2021

(in millions)

| Power Program Appropriation Investment | Power Program Retained Earnings | Nonpower Programs Appropriation Investment, Net | Accumulated Other Comprehensive Income (Loss) | Total | |||||||||||||||||||||||||

| Balance at September 30, 2020 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

| Net income (loss) | ( | ||||||||||||||||||||||||||||

| Total other comprehensive income (loss) | |||||||||||||||||||||||||||||

| Return on power program appropriation investment | ( | ( | |||||||||||||||||||||||||||

| Implementation of Financial Instruments - Credit Losses Standard | ( | ( | |||||||||||||||||||||||||||

Balance at June 30, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

| Balance at September 30, 2021 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

| Net income (loss) | ( | ||||||||||||||||||||||||||||

| Total other comprehensive income (loss) | |||||||||||||||||||||||||||||

| Return on power program appropriation investment | ( | ( | |||||||||||||||||||||||||||

Balance at June 30, 2022 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||||||||||||||||||||

12

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions except where noted)

| Note | Page | ||||||||||

| 1 | Summary of Significant Accounting Policies | ||||||||||

| 2 | Impact of New Accounting Standards and Interpretations | ||||||||||

| 3 | Accounts Receivable, Net | ||||||||||

| 4 | Inventories, Net | ||||||||||

| 5 | Other Current Assets | ||||||||||

| 6 | Plant Closures | ||||||||||

| 7 | Other Long-Term Assets | ||||||||||

| 8 | Regulatory Assets and Liabilities | ||||||||||

| 9 | Variable Interest Entities | ||||||||||

| 10 | Other Long-Term Liabilities | ||||||||||

| 11 | Asset Retirement Obligations | ||||||||||

| 12 | Debt and Other Obligations | ||||||||||

| 13 | Accumulated Other Comprehensive Income (Loss) | ||||||||||

| 14 | Risk Management Activities and Derivative Transactions | ||||||||||

| 15 | Fair Value Measurements | ||||||||||

| 16 | Revenue | ||||||||||

| 17 | Other Income (Expense), Net | ||||||||||

| 18 | Supplemental Cash Flow Information | ||||||||||

| 19 | Benefit Plans | ||||||||||

| 20 | Contingencies and Legal Proceedings | ||||||||||

| 21 | Subsequent Events | ||||||||||

1. Summary of Significant Accounting Policies

General

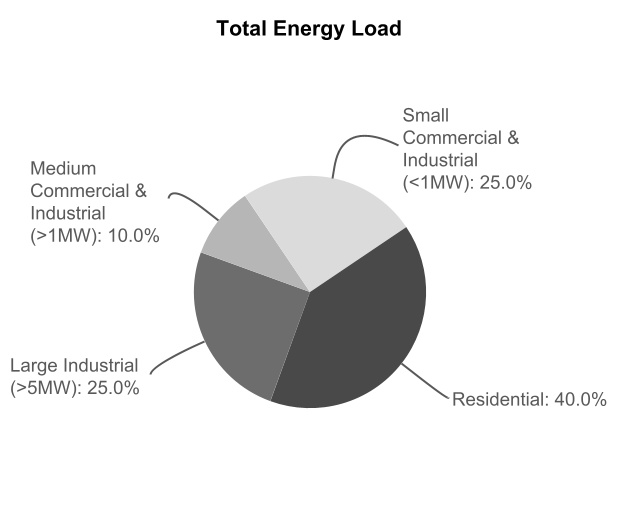

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by federal legislation in response to a proposal by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA's service area in the southeastern U.S., and sell the electricity generated at the facilities TVA operates. Today, TVA operates the nation's largest public power system and supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of approximately 10 million people.

TVA also manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system and public lands to provide recreational opportunities, adequate water supply, improved water quality, cultural and natural resource protection, and economic development. TVA performs these management duties in cooperation with other federal and state agencies that have jurisdiction and authority over certain aspects of the river system. In addition, the TVA Board of Directors ("TVA Board") has established two councils — the Regional Resource Stewardship Council and the Regional Energy Resource Council — to advise TVA on its stewardship activities in the Tennessee Valley and its energy resource activities.

The power program has historically been separate and distinct from the stewardship programs. It is required to be self-supporting from power revenues and proceeds from power financings, such as proceeds from the issuance of bonds, notes, or other evidences of indebtedness (collectively, "Bonds"). Although TVA does not currently receive Congressional appropriations, it is required to make annual payments to the United States Department of the Treasury ("U.S. Treasury") as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"). In the 1998 Energy and Water Development Appropriations Act, Congress directed TVA to fund essential stewardship activities related to its management of the Tennessee River system and nonpower or stewardship properties with power revenues in the event that there were insufficient appropriations or other available funds to pay for such activities in any fiscal year. Congress has not provided any appropriations to TVA to fund such activities since 1999. Consequently, during 2000, TVA began paying for essential stewardship activities primarily with power revenues, with the remainder funded with user fees and other forms of

13

Fiscal Year

TVA's fiscal year ends September 30. Years (2022, 2021, etc.) refer to TVA's fiscal years unless they are preceded by "CY," in which case the references are to calendar years.

Cost-Based Regulation

Since the TVA Board is authorized by the TVA Act to set rates for power sold to its customers, TVA is self-regulated. Additionally, TVA's regulated rates are designed to recover its costs. Based on current projections, TVA believes that rates, set at levels that will recover TVA's costs, can be charged and collected. As a result of these factors, TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. TVA assesses whether the regulatory assets are probable of future recovery by considering factors such as applicable regulatory changes, potential legislation, and changes in technology. Based on these assessments, TVA believes the existing regulatory assets are probable of recovery. This determination reflects the current regulatory and political environment and is subject to change in the future. If future recovery of regulatory assets ceases to be probable, or TVA is no longer considered to be a regulated entity, then costs would be required to be written off. All regulatory asset write-offs would be required to be recognized in earnings in the period in which future recovery ceases to be probable.

Basis of Presentation

TVA prepares its consolidated interim financial statements in conformity with GAAP for consolidated interim financial information. Accordingly, TVA's consolidated interim financial statements do not include all of the information and notes required by GAAP for annual financial statements. As such, they should be read in conjunction with the audited financial statements for the year ended September 30, 2021, and the notes thereto, which are contained in TVA's Annual Report on Form 10-K for the year ended September 30, 2021 (the "Annual Report"). In the opinion of management, all adjustments (consisting of items of a normal recurring nature) considered necessary for fair presentation are included on the consolidated interim financial statements.

14

Cash, Cash Equivalents, and Restricted Cash

Cash includes cash on hand, non-interest bearing cash, and deposit accounts. All highly liquid investments with original maturities of three months or less are considered cash equivalents. Cash and cash equivalents that are restricted, as to withdrawal or use under the terms of certain contractual agreements, are recorded in Other long-term assets on the Consolidated Balance Sheets. Restricted cash and cash equivalents include cash held in trusts that are currently restricted for TVA economic development loans and for certain TVA environmental programs in accordance with agreements related to compliance with certain environmental regulations. See Note 20 — Contingencies and Legal Proceedings — Legal Proceedings — Environmental Agreements.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported on the Consolidated Balance Sheets and Consolidated Statements of Cash Flows:

Cash, Cash Equivalents, and Restricted Cash (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash and cash equivalents included in Other long-term assets | |||||||||||

| Total cash, cash equivalents, and restricted cash | $ | $ | |||||||||

Allowance for Uncollectible Accounts

TVA recognizes an allowance that reflects the current estimate for credit losses expected to be incurred over the life of the financial assets based on historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amounts. The appropriateness of the allowance is evaluated at the end of each reporting period. TVA continues to monitor the impact of the coronavirus disease 2019 ("COVID-19") pandemic on accounts and loans receivable balances to evaluate the allowance for uncollectible accounts.

To determine the allowance for trade receivables, TVA considers historical experience and other currently available information, including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements by the due date. TVA's corporate credit department also performs an assessment of the financial condition of customers and the credit quality of the receivables. In addition, TVA reviews other reasonable and supportable forecasts to determine if the allowance for uncollectible amounts should be further adjusted in accordance with the accounting guidance for Current Expected Credit Losses.

To determine the allowance for loans receivables, TVA aggregates loans into the appropriate pools based on the existence of similar risk characteristics such as collateral types and internal assessed credit risks. In situations where a loan exhibits unique risk characteristics and is no longer expected to experience similar risks to the rest of its pool, the loan will be evaluated separately. TVA derives an annual loss rate based on historical loss and then adjusts the rate to reflect TVA's consideration of available information on current conditions and reasonable and supportable future forecasts. This information may include economic and business conditions, default trends, and other internal and external factors. For periods beyond the reasonable and supportable forecast period, TVA uses the current calculated long-term average historical loss rate for the remaining life of the loan portfolio.

The allowance for uncollectible accounts was less than $1 128 million and $99 million at June 30, 2022, and September 30, 2021, respectively, are included in Accounts receivable, net and Other long-term assets, for the current and long-term portions, respectively. Loans receivables are reported net of allowances for uncollectible accounts of $4

Revenues

TVA recognizes revenue from contracts with customers to depict the transfer of goods or services to customers in an amount to which the entity expects to be entitled in exchange for those goods or services. For the generation and transmission of electricity, this is generally at the time the power is delivered to a metered customer delivery point for the customer's consumption or distribution. As a result, revenues from power sales are recorded as electricity is delivered to customers. In addition to power sales invoiced and recorded during the month, TVA accrues estimated unbilled revenues for power sales provided to five customers whose billing date occurs prior to the end of the month. Exchange power sales are presented in the accompanying Consolidated Statements of Operations as a component of sales of electricity. Exchange power sales are sales of excess power after meeting TVA native load and directly served requirements. Native load refers to the customers on whose behalf a company, by statute, franchise, regulatory requirement, or contract, has undertaken an obligation to serve. TVA engages in other arrangements in addition to power sales. Certain other revenue from activities related to TVA's overall mission is recorded in Other revenue. Revenues that are not related to the overall mission are recorded in Other income (expense), net.

15

Depreciation

TVA accounts for depreciation of its properties using the composite depreciation convention of accounting. Under the composite method, assets with similar economic characteristics are grouped and depreciated as one asset. Depreciation is generally computed on a straight-line basis over the estimated service lives of the various classes of assets. The estimation of asset useful lives requires management judgment, supported by external depreciation studies of historical asset retirement experience. Depreciation rates are determined based on external depreciation studies that are updated approximately every five years. During the first quarter of 2022, TVA implemented a new depreciation study related to its completed plant. The new study included a decline in the service life estimates of TVA's coal-fired plants based on current planning assumptions to potentially retire the remainder of the coal-fired fleet by 2035.

Property, Plant, and Equipment Depreciation Rates (percent) | |||||||||||

Implemented Rates(1) | At September 30, 2021 | ||||||||||

| Asset Class | |||||||||||

| Nuclear | |||||||||||

| Coal-fired | |||||||||||

| Hydroelectric | |||||||||||

| Gas and oil-fired | |||||||||||

| Transmission | |||||||||||

| Other | |||||||||||

Note

(1) Implemented rates represent average rates for each asset class as determined by the depreciation study and were applicable beginning October 1, 2021.

16

2. Impact of New Accounting Standards and Interpretations

| Lessor-Certain Leases with Variable Lease Payments | |||||

| Description | This guidance amends the lessor lease classification for leases that have variable lease payments that are not based on an index or rate. If the lease meets the criteria for classification as either (1) a sale-type or (2) a direct finance lease, and application of the lease guidance would result in recognition of a day-one selling loss, then the lease should be classified as an operating lease. There are two transition methods provided by the guidance for entities that have adopted the standard: •Retrospective application to leases that commenced or were modified after the beginning of the period in which the standard was adopted, or •Prospective application to leases that commence or are modified subsequent to the date that amendments in the guidance are first applied. | ||||

| Effective Date for TVA | October 1, 2021 | ||||

| Effect on the Financial Statements or Other Significant Matters | TVA adopted this standard on a prospective basis. Adoption of this standard did not have a material impact on TVA's financial condition, results of operations, or cash flows. | ||||

Reference Rate Reform | |||||

| Description | This guidance provides temporary optional expedients and exceptions to the guidance in GAAP on contract modifications and hedge accounting to ease the financial reporting burdens related to the expected market transition from the London Interbank Offered Rate ("LIBOR") and other interbank offered rates to alternative reference rates, such as the Secured Overnight Financing Rates ("SOFR"). | ||||

| Effective Date for TVA | December 31, 2021 | ||||

| Effect on the Financial Statements or Other Significant Matters | TVA had interest rate swap contracts that totaled a notional value of $ | ||||

The following accounting standards have been issued but, at June 30, 2022, were not effective and had not been adopted by TVA:

Accounting for Contract Assets and Contract Liabilities from Contracts with Customers | |||||

| Description | This guidance requires an entity (acquirer) to recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with revenue with customers. It is expected that an acquirer will generally recognize and measure acquired contract assets and contract liabilities in a manner consistent with how the acquiree recognized and measured contract assets and contract liabilities in the acquiree’s financial statement. | ||||

| Effective Date for TVA | This new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2023. While early adoption is permitted, TVA does not currently plan to adopt this standard early. | ||||

| Effect on the Financial Statements or Other Significant Matters | TVA does not expect the adoption of this standard to have a material impact on its financial condition, results of operations, or cash flows. | ||||

Troubled Debt Restructurings and Vintage Disclosures | |||||

| Description | This guidance eliminates the recognition and measurement guidance on troubled debt restructuring for creditors that have adopted Financial Instruments-Credit Losses and requires enhanced disclosures about loan modifications for borrowers experiencing financial difficulty. Additionally, the guidance requires public business entities to present current-period gross write-offs by year of origination in their vintage disclosures. | ||||

| Effective Date for TVA | This new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2023. While early adoption is permitted, TVA does not currently plan to adopt this standard early. | ||||

| Effect on the Financial Statements or Other Significant Matters | TVA does not expect the adoption of this standard to have a material impact on its financial condition, results of operations, or cash flows. | ||||

17

3. Accounts Receivable, Net

Accounts receivable primarily consist of amounts due from customers for power sales. The table below summarizes the types and amounts of TVA's accounts receivable:

Accounts Receivable, Net (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Power receivables | $ | $ | |||||||||

| Other receivables | |||||||||||

Accounts receivable, net(1) | $ | $ | |||||||||

Note

4. Inventories, Net

The table below summarizes the types and amounts of TVA's inventories:

Inventories, Net (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Materials and supplies inventory | $ | $ | |||||||||

| Fuel inventory | |||||||||||

| Renewable energy certificates/emissions allowance inventory, net | |||||||||||

| Allowance for inventory obsolescence | ( | ( | |||||||||

| Inventories, net | $ | $ | |||||||||

5. Other Current Assets

Other current assets consisted of the following:

Other Current Assets (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Commodity contract derivative assets | $ | $ | |||||||||

| Other | |||||||||||

| Other current assets | $ | $ | |||||||||

6. Plant Closures

Background

TVA must continuously evaluate all generating assets to ensure an optimal energy portfolio that provides safe, clean, and reliable power while maintaining flexibility and fiscal responsibility to the people of the Tennessee Valley. Based on results of assessments presented to the TVA Board in 2019, the retirement of Bull Run Fossil Plant ("Bull Run") by December 2023 was approved. In addition, TVA is evaluating the impact of retiring the balance of the coal-fired fleet by 2035, and that evaluation includes environmental reviews, public input, and TVA Board approval. Due to these evaluations, certain planning assumptions were updated, and their financial impacts are discussed below.

18

Financial Impact

TVA's policy is to adjust depreciation rates to reflect the most current assumptions, ensuring units will be fully depreciated by the applicable retirement dates. As a result of TVA's decision to accelerate the retirement of Bull Run, TVA has recognized a cumulative $447 million of accelerated depreciation since the second quarter of 2019. Of this amount, $35 million was recognized for Bull Run during both the three months ended June 30, 2022 and the three months ended June 30, 2021, and $105 million and $102 million were recognized during the nine months ended June 30, 2022 and the nine months ended June 30, 2021, respectively.

In addition, service lives for Cumberland Fossil Plant, Gallatin Fossil Plant, Kingston Fossil Plant ("Kingston"), and Shawnee Fossil Plant were lowered in a new depreciation study implemented during the first quarter of 2022 to reflect current planning assumptions to potentially retire the remainder of the coal-fired fleet by 2035. As a result, TVA recognized an estimated $253 million of additional depreciation related to these four coal-fired plants during the nine months ended June 30, 2022. This estimate represents the effect of using the new depreciation rates on the property, plant, and equipment balances at June 30, 2021, and does not include any potential impact from additions to or retirements of net completed plant that occurred since June 30, 2021.

During the nine months ended June 30, 2022, TVA also recognized $17 million in Operating and maintenance expense related to additional inventory reserves and write-offs for the coal-fired fleet, including Bull Run. Of this amount, $6 million was recognized during the three months ended June 30, 2022.

7. Other Long-Term Assets

The table below summarizes the types and amounts of TVA's other long-term assets:

Other Long-Term Assets (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Loans and other long-term receivables, net | $ | $ | |||||||||

EnergyRight® receivables, net | |||||||||||

| Prepaid long-term service agreements | |||||||||||

| Commodity contract derivative assets | |||||||||||

| Other | |||||||||||

| Total other long-term assets | $ | $ | |||||||||

Loans and Other Long-Term Receivables. TVA's loans and other long-term receivables primarily consist of economic development loans for qualifying organizations and a receivable for reimbursements to recover the cost of providing long-term, on-site storage for spent nuclear fuel. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At both June 30, 2022 and September 30, 2021, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was approximately $3 million.

EnergyRight® Receivables. In association with the EnergyRight® program, TVA's local power company customers ("LPCs") offer financing to end-use customers for the purchase of energy-efficient equipment. Depending on the nature of the energy-efficiency project, loans may have a maximum term of five years or 10 years. TVA purchases the resulting loans receivable from its LPCs. The loans receivable are then transferred to a third-party bank with which TVA has agreed to repay in full any loans receivable that have been in default for 180 days or more or that TVA has determined are uncollectible. Given this continuing involvement, TVA accounts for the transfer of the loans receivable as secured borrowings. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At June 30, 2022, and September 30, 2021, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was approximately $13 million and $15 million, respectively. See Note 10 — Other Long-Term Liabilities for information regarding the associated financing obligation.

Allowance for Loan Losses. The allowance for loan loss is an estimate of expected credit losses, measured over the estimated life of the loan receivables, that considers reasonable and supportable forecasts of future economic conditions in addition to information about historical experience and current conditions. See Note 1 — Summary of Significant Accounting Policies — Allowance for Uncollectible Accounts.

The allowance components, which consist of a collective allowance and specific loans allowance, are based on the risk characteristics of TVA's loans. Loans that share similar risk characteristics are evaluated on a collective basis in measuring credit losses, while loans that do not share similar risk characteristics with other loans are evaluated on an individual basis.

19

Allowance Components (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

EnergyRight® loan reserve | $ | $ | |||||||||

| Economic development loan collective reserve | |||||||||||

| Economic development loan specific loan reserve | |||||||||||

| Total allowance for loan losses | $ | $ | |||||||||

Prepaid Long-Term Service Agreements. TVA has entered into various long-term service agreements for major maintenance activities at certain of its combined cycle plants. TVA uses the direct expense method of accounting for these arrangements. TVA accrues for parts when it takes ownership and for contractor services when they are rendered. Under certain of these agreements, payments made exceed the value of parts received and services rendered. The current and long-term portions of the resulting prepayments are reported in Other current assets and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At both June 30, 2022, and September 30, 2021, prepayments of $12

Commodity Contract Derivative Assets. TVA enters into certain derivative contracts for natural gas that require physical delivery of the contracted quantity of the commodity. TVA also reinstated the FHP in December 2021, and hedging activity began under the program in the second quarter of 2022. See Note 14 — Risk Management Activities and Derivative Transactions — Derivatives Not Receiving Hedge Accounting Treatment — Commodity Derivatives and — Commodity Derivatives under the FHP for a discussion of TVA's commodity contract derivatives.

20

8. Regulatory Assets and Liabilities

Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. Components of regulatory assets and regulatory liabilities are summarized in the table below.

| Regulatory Assets and Liabilities | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Current regulatory assets | |||||||||||

| Unrealized losses on interest rate derivatives | $ | $ | |||||||||

| Unrealized losses on commodity derivatives | |||||||||||

| Fuel cost adjustment receivable | |||||||||||

| Total current regulatory assets | |||||||||||

| Non-current regulatory assets | |||||||||||

| Deferred pension costs and other post-retirement benefits costs | |||||||||||

| Non-nuclear decommissioning costs | |||||||||||

| Unrealized losses on interest rate derivatives | |||||||||||

| Nuclear decommissioning costs | |||||||||||

| Unrealized losses on commodity derivatives | |||||||||||

| Other non-current regulatory assets | |||||||||||

| Total non-current regulatory assets | |||||||||||

| Total regulatory assets | $ | $ | |||||||||

| Current regulatory liabilities | |||||||||||

| Fuel cost adjustment tax equivalents | $ | $ | |||||||||

| Unrealized gains on commodity derivatives | |||||||||||

| Total current regulatory liabilities | |||||||||||

| Non-current regulatory liabilities | |||||||||||

| Unrealized gains on commodity derivatives | |||||||||||

| Total non-current regulatory liabilities | |||||||||||

| Total regulatory liabilities | $ | $ | |||||||||

TVA reinstated the FHP in December 2021, and hedging activity began under the program in the second quarter of 2022. Currently, TVA is hedging exposure to the price of natural gas under the FHP. Deferred gains and losses relating to TVA’s FHP are included as part of unrealized gains and losses on commodity derivatives. TVA defers all mark-to-market ("MtM") unrealized gains or losses as regulatory liabilities or assets, respectively, and records the realized gains or losses in fuel and purchased power expense as the contracts settle to match the delivery period of the underlying commodity. This accounting treatment reflects TVA's ability and intent to include the realized gains or losses of these commodity contracts in future periods through the fuel cost adjustment. Net unrealized gains and losses for any settlements that occur within 12 months or less are classified as a current regulatory liability or asset. See Note 14 — Risk Management Activities and Derivative Transactions.

9. Variable Interest Entities

21

John Sevier VIEs

In 2012, TVA entered into a $1.0 billion construction management agreement and lease financing arrangement with John Sevier Combined Cycle Generation LLC ("JSCCG") for the completion and lease by TVA of the John Sevier Combined Cycle Facility ("John Sevier CCF"). JSCCG is a special single-purpose limited liability company formed in January 2012 to finance the John Sevier CCF through a $900 million secured note issuance (the "JSCCG notes") and the issuance of $100 million of membership interests subject to mandatory redemption. The membership interests were purchased by John Sevier Holdco LLC ("Holdco"). Holdco is a special single-purpose entity, also formed in January 2012, established to acquire and hold the membership interests in JSCCG. A non-controlling interest in Holdco is held by a third party through nominal membership interests, to which none of the income, expenses, and cash flows are allocated.

The membership interests held by Holdco in JSCCG were purchased with proceeds from the issuance of $100 million of secured notes (the "Holdco notes") and are subject to mandatory redemption pursuant to a schedule of amortizing, semi-annual payments due each January 15 and July 15, with a final payment due in January 2042. The payment dates for the mandatorily redeemable membership interests are the same as those of the Holdco notes. The sale of the JSCCG notes, the membership interests in JSCCG, and the Holdco notes closed in January 2012. The JSCCG notes are secured by TVA's lease payments, and the Holdco notes are secured by Holdco's investment in, and amounts receivable from, JSCCG. TVA's lease payments to JSCCG are equal to and payable on the same dates as JSCCG's and Holdco's semi-annual debt service payments. In addition to the lease payments, TVA pays administrative and miscellaneous expenses incurred by JSCCG and Holdco. Certain agreements related to this transaction contain default and acceleration provisions.

Due to its participation in the design, business activity, and credit and financial support of JSCCG and Holdco, TVA has determined that it has a variable interest in each of these entities. Based on its analysis, TVA has concluded that it is the primary beneficiary of JSCCG and Holdco and, as such, is required to account for the VIEs on a consolidated basis. Holdco's membership interests in JSCCG are eliminated in consolidation.

Southaven VIE

In 2013, TVA entered into a $400 million lease financing arrangement with Southaven Combined Cycle Generation LLC ("SCCG") for the lease by TVA of the Southaven Combined Cycle Facility ("Southaven CCF"). SCCG is a special single-purpose limited liability company formed in June 2013 to finance the Southaven CCF through a $360 million secured notes issuance (the "SCCG notes") and the issuance of $40 million of membership interests subject to mandatory redemption. The membership interests were purchased by Southaven Holdco LLC ("SHLLC"). SHLLC is a special single-purpose entity, also formed in June 2013, established to acquire and hold the membership interests in SCCG. A non-controlling interest in SHLLC is held by a third party through nominal membership interests, to which none of the income, expenses, and cash flows of SHLLC are allocated.

The membership interests held by SHLLC were purchased with proceeds from the issuance of $40 million of secured notes (the "SHLLC notes") and are subject to mandatory redemption pursuant to a schedule of amortizing, semi-annual payments due each February 15 and August 15, with a final payment due on August 15, 2033. The payment dates for the mandatorily redeemable membership interests are the same as those of the SHLLC notes, and the payment amounts are sufficient to provide returns on, as well as returns of, capital until the investment has been repaid to SHLLC in full. The rate of return on investment to SHLLC is 7.0 percent, which is reflected as interest expense in the Consolidated Statements of Operations. SHLLC is required to pay a pre-determined portion of the return on investment to Seven States Southaven, LLC on each lease payment date as agreed in SHLLC's formation documents (the "Seven States Return"). The current and long-term portions of the Membership interests of VIE subject to mandatory redemption are included in Accounts payable and accrued liabilities and Other long-term liabilities, respectively.

The payment dates for the mandatorily redeemable membership interests are the same as those of the SHLLC notes. The SCCG notes are secured by TVA's lease payments, and the SHLLC notes are secured by SHLLC's investment in, and amounts receivable from, SCCG. TVA's lease payments to SCCG are payable on the same dates as SCCG's and SHLLC's semi-annual debt service payments and are equal to the sum of (i) the amount of SCCG's semi-annual debt service payments, (ii) the amount of SHLLC's semi-annual debt service payments, and (iii) the amount of the Seven States Return. In addition to the lease payments, TVA pays administrative and miscellaneous expenses incurred by SCCG and SHLLC. Certain agreements related to this transaction contain default and acceleration provisions.

In the event that TVA were to choose to exercise an early buy out feature of the Southaven facility lease, in part or in whole, TVA must pay to SCCG amounts sufficient for SCCG to repay or partially repay on a pro rata basis the membership interests held by SHLLC, including any outstanding investment amount plus accrued but unpaid return. TVA also has the right, at any time and without any early redemption of the other portions of the Southaven facility lease payments due to SCCG, to fully repay SHLLC's investment, upon which repayment SHLLC will transfer the membership interests to a designee of TVA.

22

TVA participated in the design, business activity, and financial support of SCCG and has determined that it has a direct variable interest in SCCG resulting from risk associated with the value of the Southaven CCF at the end of the lease term. Based on its analysis, TVA has determined that it is the primary beneficiary of SCCG and, as such, is required to account for the VIE on a consolidated basis.

Impact on Consolidated Financial Statements

The financial statement items attributable to carrying amounts and classifications of JSCCG, Holdco, and SCCG at June 30, 2022, and September 30, 2021, as reflected on the Consolidated Balance Sheets, are as follows:

Summary of Impact of VIEs on Consolidated Balance Sheets (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Current liabilities | |||||||||||

| Accrued interest | $ | $ | |||||||||

| Accounts payable and accrued liabilities | |||||||||||

| Current maturities of long-term debt of variable interest entities | |||||||||||

Total current liabilities | |||||||||||

| Other liabilities | |||||||||||

| Other long-term liabilities | |||||||||||

| Long-term debt, net | |||||||||||

| Long-term debt of variable interest entities, net | |||||||||||

| Total liabilities | $ | $ | |||||||||

Interest expense of $13 million for both the three months ended June 30, 2022 and 2021, and $38 million and $39 million for the nine months ended June 30, 2022 and 2021, respectively, is included in the Consolidated Statements of Operations related to debt of VIEs and membership interests of VIEs subject to mandatory redemption.

Creditors of the VIEs do not have any recourse to the general credit of TVA. TVA does not have any obligations to provide financial support to the VIEs other than as prescribed in the terms of the agreements related to these transactions.

10. Other Long-Term Liabilities

Other long-term liabilities consist primarily of liabilities related to certain derivative agreements as well as liabilities related to operating leases. The table below summarizes the types and amounts of Other long-term liabilities:

Other Long-Term Liabilities (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021(1) | ||||||||||

| Interest rate swap liabilities | $ | $ | |||||||||

| Operating lease liabilities | |||||||||||

| Currency swap liabilities | |||||||||||

EnergyRight® financing obligation | |||||||||||

| Long-term deferred compensation | |||||||||||

| Advances for construction | |||||||||||

| Long-term deferred revenue | |||||||||||

| Accrued long-term service agreements | |||||||||||

| Other | |||||||||||

| Total other long-term liabilities | $ | $ | |||||||||

Note

(1) At September 30, 2021, $5 million and $19 million previously classified as Long-term deferred revenue (a component of Other long-term liabilities) and Other (a

component of Other long-term liabilities), respectively, have been reclassified to Advances for construction (a component of Other long-term liabilities) to conform

with current year presentation.

Interest Rate Swap Liabilities. TVA uses interest rate swaps to fix variable short-term debt to a fixed rate. The values of these derivatives are included in Accounts payable and accrued liabilities, Accrued interest, and Other long-term liabilities on the Consolidated Balance Sheets. At June 30, 2022, and September 30, 2021, the carrying amount of the interest rate swap

23

liabilities recorded in Accounts payable and accrued liabilities and Accrued interest was $72 million and $115 million, respectively. See Note 14 — Risk Management Activities and Derivative Transactions — Derivatives Not Receiving Hedge Accounting Treatment — Interest Rate Derivatives for information regarding the interest rate swap liabilities.

Operating Lease Liabilities. TVA's operating leases consist primarily of railcars, equipment, real estate/land, and power generating facilities. At June 30, 2022 and September 30, 2021, the current portion of TVA's operating leases recorded in Accounts payable and accrued liabilities was $60 million and $40 million, respectively.

Currency Swap Liabilities. To protect against exchange rate risk related to British pound sterling denominated Bond transactions, TVA entered into foreign currency hedges. The values of these derivatives are included in Accounts payable and accrued liabilities and Other long-term liabilities on the Consolidated Balance Sheets. At June 30, 2022 and September 30, 2021, the carrying amount of the currency swap liabilities reported in Accounts payable and accrued liabilities was $10 million and $7 million, respectively. See Note 14 — Risk Management Activities and Derivative Transactions — Cash Flow Hedging Strategy for Currency Swaps for more information regarding the currency swap liabilities.

EnergyRight® Financing Obligation. TVA purchases certain loans receivable from its LPCs in association with the EnergyRight® program. The current and long-term portions of the resulting financing obligation are reported in Accounts payable and accrued liabilities and Other long-term liabilities, respectively, on TVA's Consolidated Balance Sheets. At June 30, 2022, and September 30, 2021, the carrying amount of the financing obligation recorded in Accounts payable and accrued liabilities was $15 million and $16 million, respectively. See Note 7 — Other Long-Term Assets for information regarding the associated loans receivable.

Long-Term Deferred Compensation. TVA provides compensation arrangements to engage and retain certain employees, both executive and non-executive, which are designed to provide participants with the ability to defer compensation to future periods. The current and long-term portions are recorded in Accounts payable and accrued liabilities and Other long-term liabilities, respectively, on TVA’s Consolidated Balance Sheets. At June 30, 2022 and September 30, 2021, the current amount of deferred compensation recorded in Accounts payable and accrued liabilities was $46 million and $51 million, respectively.

Advances for Construction. TVA receives refundable and non-refundable advances for construction that are generally intended to defray all or a portion of the costs of building or extending TVA’s existing power assets. Amounts received are deferred as a liability with the long-term portion representing amounts that will not be recognized within the next 12 months. As projects meet milestones or other contractual obligations, the refundable portion is refunded to the customer and the non-refundable portion is recognized as contributions in aid of construction and offsets the cost of plant assets. At June 30, 2022 and September 30, 2021, the current amount of advances for construction recorded in Accounts payable and accrued liabilities was $35 million and $38 million, respectively.

Long-Term Deferred Revenue. Long-term deferred revenue represents payments received that exceed services rendered resulting in the deferral of revenue. This long-term portion represents amounts that will not be recognized within the next 12 months primarily related to fiber and transmission agreements. The current and long-term portions of the deferral are recorded in Accounts payable and accrued liabilities and Other long-term liabilities, respectively, on TVA’s Consolidated Balance Sheets. At June 30, 2022 and September 30, 2021, the current amount of deferred revenue recorded in Accounts payable and accrued liabilities was $14 million and $17 million, respectively.

Accrued Long-Term Service Agreements. TVA has entered into various long-term service agreements for major maintenance activities at certain of its combined cycle plants. TVA uses the direct expense method of accounting for these arrangements. TVA accrues for parts when it takes ownership and for contractor services when they are rendered. Under certain of these agreements, parts received and services rendered exceed payments made. The current and long-term portions of the resulting obligation are recorded in Accounts payable and accrued liabilities and Other long-term liabilities, respectively, on TVA's Consolidated Balance Sheets. At June 30, 2022 and September 30, 2021, the current amount of accrued long-term service agreements recorded in Accounts payable and accrued liabilities was $38 million and $28 million, respectively.

11. Asset Retirement Obligations

24

| Asset Retirement Obligation Activity | ||||||||||||||||||||

| Nuclear | Non-Nuclear | Total | ||||||||||||||||||

Balance at September 30, 2021 | $ | $ | $ | (1) | ||||||||||||||||

| Settlements | ( | ( | ( | |||||||||||||||||

| Revisions in estimate | ||||||||||||||||||||

| Accretion (recorded as regulatory asset) | ||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | $ | (1) | ||||||||||||||||

Note

(1) Includes $313 million and $266 million at June 30, 2022, and September 30, 2021, respectively, recorded in Current liabilities.

The revisions in non-nuclear estimates increased the liability balance by $237 million for the nine months ended June 30, 2022. TVA implemented revised depreciation rates during the first quarter of 2022 applicable to its completed plant as a result of the completion of a new depreciation study. The study included a decline in the service life estimates of TVA’s coal-fired plants based on current planning assumptions to potentially retire the remainder of the coal-fired fleet by 2035. As a result of the change in the service life estimates reflected in the depreciation study, TVA performed an assessment of the assumptions used in the timing of cash flows related to its non-nuclear AROs. Based on the assessment, TVA identified changes to its projections of timing of certain asset retirement activities, resulting in an increase of $47 million to the ARO. In addition, TVA completed an engineering review of its cost estimates for closure of certain areas containing coal fines at Paradise Fossil Plant, resulting in an increase of $119 million due to expected cost increases for necessary changes in activities associated with proper completion of the closure. During the second quarter of 2022, based on refined project cost assumptions and scope changes, TVA revised its AROs for the closure of certain coal yards at its fossil plants, resulting in an increase to AROs of $57 million. During the third quarter, coal combustion residual ("CCR") closure liabilities at Paradise and Cumberland Fossil Plants increased $82 million due to new vendor bids, modified closure designs, and revised estimates for construction costs. Partially offsetting these increases, was a reduction in expected CCR post-closure care costs for maintenance and monitoring at Paradise, Shawnee, and Colbert Fossil Plants resulting in a decrease in these liabilities of $53 million.

12. Debt and Other Obligations

Debt Outstanding

Total debt outstanding at June 30, 2022, and September 30, 2021, consisted of the following:

Debt Outstanding (in millions) | |||||||||||

| At June 30, 2022 | At September 30, 2021 | ||||||||||

| Short-term debt | |||||||||||

| Short-term debt, net | $ | $ | |||||||||

| Current maturities of power bonds issued at par | |||||||||||

| Current maturities of long-term debt of VIEs issued at par | |||||||||||

| Total current debt outstanding, net | |||||||||||

| Long-term debt | |||||||||||

Long-term power bonds(1) | |||||||||||

| Long-term debt of VIEs, net | |||||||||||

| Unamortized discounts, premiums, issue costs, and other | ( | ( | |||||||||

| Total long-term debt, net | |||||||||||

| Total debt outstanding | $ | $ | |||||||||

Note

(1) Includes net exchange gain from currency transactions of $110 million and $58 million at June 30, 2022, and September 30, 2021, respectively.

25

Debt Securities Activity