00013769869/30X12021Q2false—00013769862020-10-012021-03-31xbrli:shares00013769862021-03-3100013769862021-01-012021-03-31iso4217:USD00013769862020-01-012020-03-3100013769862019-10-012020-03-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-10-012021-03-3100013769862020-09-3000013769862019-09-3000013769862020-03-310001376986tve:PowerProgramAppropriationInvestmentMember2019-12-310001376986tve:PowerProgramRetainedEarningsMember2019-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2019-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-3100013769862019-12-310001376986tve:PowerProgramAppropriationInvestmentMember2020-01-012020-03-310001376986tve:PowerProgramRetainedEarningsMember2020-01-012020-03-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2020-01-012020-03-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001376986tve:PowerProgramAppropriationInvestmentMember2020-03-310001376986tve:PowerProgramRetainedEarningsMember2020-03-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2020-03-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001376986tve:PowerProgramAppropriationInvestmentMember2020-12-310001376986tve:PowerProgramRetainedEarningsMember2020-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2020-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100013769862020-12-310001376986tve:PowerProgramAppropriationInvestmentMember2021-01-012021-03-310001376986tve:PowerProgramRetainedEarningsMember2021-01-012021-03-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2021-01-012021-03-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001376986tve:PowerProgramAppropriationInvestmentMember2021-03-310001376986tve:PowerProgramRetainedEarningsMember2021-03-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2021-03-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001376986tve:PowerProgramAppropriationInvestmentMember2019-09-300001376986tve:PowerProgramRetainedEarningsMember2019-09-300001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2019-09-300001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-300001376986tve:PowerProgramAppropriationInvestmentMember2019-10-012020-03-310001376986tve:PowerProgramRetainedEarningsMember2019-10-012020-03-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2019-10-012020-03-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-10-012020-03-310001376986tve:PowerProgramAppropriationInvestmentMember2020-09-300001376986tve:PowerProgramRetainedEarningsMember2020-09-300001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2020-09-300001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001376986tve:PowerProgramAppropriationInvestmentMember2020-10-012021-03-310001376986tve:PowerProgramRetainedEarningsMember2020-10-012021-03-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2020-10-012021-03-31tve:People0001376986us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2021-03-310001376986us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2020-09-3000013769862019-04-012021-03-310001376986us-gaap:OtherNoncurrentAssetsMember2021-03-310001376986us-gaap:OtherNoncurrentAssetsMember2020-09-300001376986us-gaap:OtherNoncurrentAssetsMember2021-03-310001376986us-gaap:OtherNoncurrentAssetsMember2020-09-300001376986srt:MinimumMembertve:EnergyRightMember2020-10-012021-03-310001376986tve:EnergyRightMembersrt:MaximumMember2020-10-012021-03-310001376986tve:EnergyRightMember2020-10-012021-03-310001376986us-gaap:AccountsReceivableMember2021-03-310001376986us-gaap:AccountsReceivableMember2020-09-300001376986tve:EnergyRightLoanReserveMember2021-03-310001376986tve:EconomicDevelopmentLoanCollectiveReserveMember2021-03-310001376986tve:EconomicDevelopmentLoanSpecificLoanReserveMember2021-03-310001376986tve:UnrealizedLossesOnInterestRateDerivativesMember2021-03-310001376986tve:UnrealizedLossesOnInterestRateDerivativesMember2020-09-300001376986us-gaap:DeferredDerivativeGainLossMember2021-03-310001376986us-gaap:DeferredDerivativeGainLossMember2020-09-300001376986us-gaap:DeferredFuelCostsMember2021-03-310001376986us-gaap:DeferredFuelCostsMember2020-09-300001376986us-gaap:PensionCostsMember2021-03-310001376986us-gaap:PensionCostsMember2020-09-300001376986tve:NonNuclearDecommissioningMember2021-03-310001376986tve:NonNuclearDecommissioningMember2020-09-300001376986tve:NuclearDesommissioningCostsMember2021-03-310001376986tve:NuclearDesommissioningCostsMember2020-09-300001376986tve:OtherNonCurrentRegulatoryAssetsMember2021-03-310001376986tve:OtherNonCurrentRegulatoryAssetsMember2020-09-300001376986us-gaap:DeferredIncomeTaxChargesMember2021-03-310001376986us-gaap:DeferredIncomeTaxChargesMember2020-09-300001376986us-gaap:DeferredDerivativeGainLossMember2021-03-310001376986us-gaap:DeferredDerivativeGainLossMember2020-09-300001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2012-09-300001376986tve:JsccgMember2012-09-300001376986tve:HoldcoMember2012-09-300001376986tve:SCCGMember2013-09-3000013769862013-09-30xbrli:pure0001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-03-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-09-300001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-03-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-01-012020-03-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-10-012021-03-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-10-012020-03-310001376986us-gaap:OtherNoncurrentLiabilitiesMember2021-03-310001376986us-gaap:OtherNoncurrentLiabilitiesMember2020-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMember2021-03-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMember2020-09-300001376986tve:NuclearMember2020-09-300001376986tve:NonNuclearMember2020-09-300001376986tve:NuclearMember2020-10-012021-03-310001376986tve:NonNuclearMember2020-10-012021-03-310001376986tve:NuclearMember2021-03-310001376986tve:NonNuclearMember2021-03-310001376986tve:A2009SeriesBMember2020-07-012020-09-300001376986tve:A2009SeriesBMember2020-09-300001376986tve:A2009SeriesBMember2020-10-012020-12-310001376986tve:A2009SeriesBMember2020-12-310001376986tve:DebtOfVariableInterestEntitiesMember2019-06-300001376986tve:TotalMember2021-03-31tve:Credit_facilities0001376986us-gaap:RevolvingCreditFacilityMember2021-03-310001376986us-gaap:LetterOfCreditMember2021-03-310001376986us-gaap:LetterOfCreditMember2020-09-300001376986us-gaap:LineOfCreditMember2021-03-310001376986us-gaap:InterestRateSwapMember2021-01-012021-03-310001376986us-gaap:InterestRateSwapMember2020-01-012020-03-310001376986us-gaap:InterestRateSwapMember2020-10-012021-03-310001376986us-gaap:InterestRateSwapMember2019-10-012020-03-310001376986us-gaap:CommodityContractMember2021-01-012021-03-310001376986us-gaap:CommodityContractMember2020-01-012020-03-310001376986us-gaap:CommodityContractMember2020-10-012021-03-310001376986us-gaap:CommodityContractMember2019-10-012020-03-310001376986us-gaap:CurrencySwapMember2021-03-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CurrencySwapMember2021-03-310001376986us-gaap:CurrencySwapMember2020-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CurrencySwapMember2020-09-300001376986tve:A250MillionSterlingCurrencySwapMember2021-03-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A250MillionSterlingCurrencySwapMember2021-03-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A250MillionSterlingCurrencySwapMember2021-03-310001376986tve:A250MillionSterlingCurrencySwapMember2020-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A250MillionSterlingCurrencySwapMember2020-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A250MillionSterlingCurrencySwapMember2020-09-300001376986tve:A150MillionSterlingCurrencySwapMember2021-03-310001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2021-03-310001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2021-03-310001376986tve:A150MillionSterlingCurrencySwapMember2020-09-300001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2020-09-300001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-09-300001376986tve:A10BillionNotionalInterestRateSwapMember2021-03-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2021-03-310001376986tve:InterestPayableCurrentMembertve:A10BillionNotionalInterestRateSwapMember2021-03-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2021-03-310001376986tve:A10BillionNotionalInterestRateSwapMember2020-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2020-09-300001376986tve:InterestPayableCurrentMembertve:A10BillionNotionalInterestRateSwapMember2020-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2020-09-300001376986us-gaap:InterestRateSwapMember2021-03-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:InterestRateSwapMember2021-03-310001376986tve:InterestPayableCurrentMemberus-gaap:InterestRateSwapMember2021-03-310001376986us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateSwapMember2021-03-310001376986us-gaap:InterestRateSwapMember2020-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:InterestRateSwapMember2020-09-300001376986tve:InterestPayableCurrentMemberus-gaap:InterestRateSwapMember2020-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateSwapMember2020-09-300001376986tve:A42MillionNotionalInterestRateSwapMember2021-03-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A42MillionNotionalInterestRateSwapMember2021-03-310001376986tve:InterestPayableCurrentMembertve:A42MillionNotionalInterestRateSwapMember2021-03-310001376986tve:A42MillionNotionalInterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2021-03-310001376986tve:A42MillionNotionalInterestRateSwapMember2020-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A42MillionNotionalInterestRateSwapMember2020-09-300001376986tve:A42MillionNotionalInterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-09-300001376986us-gaap:CommodityContractMember2021-03-310001376986us-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMember2021-03-310001376986us-gaap:OtherNoncurrentAssetsMemberus-gaap:CommodityContractMember2021-03-310001376986us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMember2021-03-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CommodityContractMember2021-03-310001376986us-gaap:CommodityContractMember2020-09-300001376986us-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMember2020-09-300001376986us-gaap:OtherNoncurrentAssetsMemberus-gaap:CommodityContractMember2020-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:CommodityContractMember2020-09-300001376986tve:A28MillionNotionalMember2021-03-310001376986tve:A14MillionNotionalMember2021-03-31tve:Bond_issues00013769862020-06-300001376986srt:MinimumMember2020-10-012021-03-310001376986srt:MaximumMember2020-10-012021-03-31tve:Years0001376986srt:NaturalGasReservesMember2021-03-310001376986srt:NaturalGasReservesMember2020-09-300001376986us-gaap:InterestRateContractMember2021-03-310001376986us-gaap:InterestRateContractMember2020-09-300001376986us-gaap:FairValueInputsLevel2Member2021-03-310001376986us-gaap:FairValueInputsLevel2Member2020-09-300001376986us-gaap:CollateralizedSecuritiesMember2021-03-31tve:megawatts0001376986us-gaap:LongTermContractForPurchaseOfElectricPowerDomain2021-03-310001376986srt:MoodysA1RatingMember2020-10-012021-03-310001376986srt:MoodysCaa1RatingMember2020-10-012021-03-310001376986us-gaap:EquityFundsMember2021-03-310001376986us-gaap:RealEstateFundsMember2021-03-310001376986us-gaap:CreditMember2021-03-310001376986us-gaap:PrivateEquityFundsMember2021-03-310001376986tve:PrivateRealEstateFundsMember2021-03-310001376986tve:PrivateCreditMember2021-03-310001376986tve:NdtMember2021-01-012021-03-310001376986tve:NdtMember2020-01-012020-03-310001376986tve:NdtMember2020-10-012021-03-310001376986tve:NdtMember2019-10-012020-03-310001376986tve:ArtMember2021-01-012021-03-310001376986tve:ArtMember2020-01-012020-03-310001376986tve:ArtMember2020-10-012021-03-310001376986tve:ArtMember2019-10-012020-03-310001376986tve:SerpMember2021-01-012021-03-310001376986tve:SerpMember2020-01-012020-03-310001376986tve:SerpMember2020-10-012021-03-310001376986tve:SerpMember2019-10-012020-03-310001376986tve:LTDCPMember2021-01-012021-03-310001376986tve:LTDCPMember2020-01-012020-03-310001376986tve:LTDCPMember2020-10-012021-03-310001376986tve:LTDCPMember2019-10-012020-03-310001376986us-gaap:FairValueInputsLevel1Member2021-03-310001376986us-gaap:FairValueInputsLevel3Member2021-03-310001376986us-gaap:FairValueInputsLevel1Member2020-09-300001376986us-gaap:FairValueInputsLevel3Member2020-09-300001376986us-gaap:CommodityContractMember2019-12-310001376986us-gaap:CommodityContractMember2019-09-300001376986us-gaap:CommodityContractMember2020-01-012020-03-310001376986us-gaap:CommodityContractMember2020-10-012021-03-310001376986us-gaap:CommodityContractMember2020-03-310001376986us-gaap:CommodityContractMember2020-09-300001376986stpr:AL2021-01-012021-03-310001376986stpr:AL2020-01-012020-03-310001376986stpr:AL2020-10-012021-03-310001376986stpr:AL2019-10-012020-03-310001376986stpr:GA2021-01-012021-03-310001376986stpr:GA2020-01-012020-03-310001376986stpr:GA2020-10-012021-03-310001376986stpr:GA2019-10-012020-03-310001376986stpr:KY2021-01-012021-03-310001376986stpr:KY2020-01-012020-03-310001376986stpr:KY2020-10-012021-03-310001376986stpr:KY2019-10-012020-03-310001376986stpr:MS2021-01-012021-03-310001376986stpr:MS2020-01-012020-03-310001376986stpr:MS2020-10-012021-03-310001376986stpr:MS2019-10-012020-03-310001376986stpr:NC2021-01-012021-03-310001376986stpr:NC2020-01-012020-03-310001376986stpr:NC2020-10-012021-03-310001376986stpr:NC2019-10-012020-03-310001376986stpr:TN2021-01-012021-03-310001376986stpr:TN2020-01-012020-03-310001376986stpr:TN2020-10-012021-03-310001376986stpr:TN2019-10-012020-03-310001376986stpr:VA2021-01-012021-03-310001376986stpr:VA2020-01-012020-03-310001376986stpr:VA2020-10-012021-03-310001376986stpr:VA2019-10-012020-03-310001376986tve:LpcsDomain2021-01-012021-03-310001376986tve:LpcsDomain2020-01-012020-03-310001376986tve:LpcsDomain2020-10-012021-03-310001376986tve:LpcsDomain2019-10-012020-03-310001376986tve:IndustriesdirectlyservedDomain2021-01-012021-03-310001376986tve:IndustriesdirectlyservedDomain2020-01-012020-03-310001376986tve:IndustriesdirectlyservedDomain2020-10-012021-03-310001376986tve:IndustriesdirectlyservedDomain2019-10-012020-03-310001376986tve:FederalagenciesandotherDomain2021-01-012021-03-310001376986tve:FederalagenciesandotherDomain2020-01-012020-03-310001376986tve:FederalagenciesandotherDomain2020-10-012021-03-310001376986tve:FederalagenciesandotherDomain2019-10-012020-03-31tve:Units00013769862020-10-012021-09-300001376986tve:A20yearTerminationNoticeMember2021-01-012021-03-310001376986tve:A5yearterminationnoticeMember2021-03-310001376986tve:A5yearterminationnoticeMember2021-01-012021-03-310001376986tve:A20yearTerminationNoticeMember2020-10-012021-03-310001376986tve:A5yearterminationnoticeMember2020-10-012021-03-31tve:plans0001376986us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-03-310001376986us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-03-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-03-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-03-310001376986us-gaap:PensionPlansDefinedBenefitMember2020-10-012021-03-310001376986us-gaap:PensionPlansDefinedBenefitMember2019-10-012020-03-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-10-012021-03-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-10-012020-03-310001376986us-gaap:OtherPensionPlansDefinedBenefitMembersrt:MinimumMember2021-01-012021-03-310001376986us-gaap:OtherPensionPlansDefinedBenefitMember2020-10-012021-03-310001376986tve:A401KMember2020-10-012021-03-310001376986tve:RebatesMember2020-10-012021-03-310001376986tve:SerpMember2021-01-012021-03-31tve:Insurance_layerstve:reactorstve:Procedures0001376986tve:GeneralMember2021-03-31tve:Agreements0001376986tve:EnvironmentalAgreementsMember2020-10-012021-03-31tve:Groups0001376986tve:EnvironmentalAgreementsMember2021-03-310001376986tve:GeneralMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2021-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13, 15(d), OR 37 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2021

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (I.R.S. Employer Identification No.) |

| |

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

(Registrant's telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x Smaller reporting company o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

| | | | | |

| Table of Contents |

| | |

| | Page |

GLOSSARY OF COMMON ACRONYMS...................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................ | |

| | |

|

| | |

ITEM 1. FINANCIAL STATEMENTS............................................................................................................................................. | |

| Consolidated Statements of Operations (Unaudited)............................................................................................................ | |

| Consolidated Statements of Comprehensive Income (Loss) (Unaudited)............................................................................ | |

| Consolidated Balance Sheets (Unaudited)........................................................................................................................... | |

| Consolidated Statements of Cash Flows (Unaudited).......................................................................................................... | |

| Consolidated Statements of Changes in Proprietary Capital (Unaudited)............................................................................ | |

| Notes to Consolidated Financial Statements (Unaudited).................................................................................................... | |

| | |

| ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS... | |

Executive Overview............................................................................................................................................................... | |

Results of Operations............................................................................................................................................................ | |

Liquidity and Capital Resources............................................................................................................................................ | |

| Key Initiatives and Challenges.............................................................................................................................................. | |

| Environmental Matters.......................................................................................................................................................... | |

| Legal Proceedings................................................................................................................................................................ | |

| Off-Balance Sheet Arrangements.......................................................................................................................................... | |

| |

| |

| Legislative and Regulatory Matters....................................................................................................................................... | |

| | |

| |

| | |

ITEM 4. CONTROLS AND PROCEDURES.................................................................................................................................. | |

| Disclosure Controls and Procedures..................................................................................................................................... | |

| Changes in Internal Control over Financial Reporting.......................................................................................................... | |

| | |

|

| | |

ITEM 1. LEGAL PROCEEDINGS.................................................................................................................................................. | |

| | |

ITEM 1A. RISK FACTORS............................................................................................................................................................ | |

| |

ITEM 5. OTHER INFORMATION.................................................................................................................................................. | |

| |

ITEM 6. EXHIBITS........................................................................................................................................................................ | |

| | |

SIGNATURES............................................................................................................................................................................... | |

| | | | | | | | |

| GLOSSARY OF COMMON ACRONYMS |

Following are definitions of some of the terms or acronyms that may be used in this Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 (the "Quarterly Report"): |

| |

| Term or Acronym | | Definition |

| | |

| ACE | | Affordable Clean Energy |

| ANI | | American Nuclear Insurers |

| AOCI | | Accumulated other comprehensive income (loss) |

| ARO | | Asset retirement obligation |

| ART | | Asset Retirement Trust |

| Bonds | | Bonds, notes, or other evidences of indebtedness |

| CAA | | Clean Air Act |

| CCR | | Coal combustion residuals |

| CEL | | Chilling Effect Letter |

| CERCLA | | Comprehensive Environmental Response, Compensation, and Liability Act |

| CME | | Chicago Mercantile Exchange |

CO2 | | Carbon dioxide |

| COVID-19 | | Coronavirus Disease 2019 |

| CPP | | Clean Power Plan |

| CSAPR | | Cross-State Air Pollution Rule |

| CTs | | Combustion turbine unit(s) |

| CVA | | Credit valuation adjustment |

| CY | | Calendar year |

| DCP | | Deferred Compensation Plan |

| DER | | Distributed energy resources |

| DOE | | Department of Energy |

| EIS | | Environmental Impact Statement |

| ELGs | | Effluent Limitation Guidelines |

| EMP | | Electromagnetic pulses |

| EO | | Executive Order |

| EPA | | Environmental Protection Agency |

| EPRI | | Electric Power Research Institute |

| EPU | | Extended Power Uprate |

| ESPA | | Early Site Permit Application |

| FASB | | Financial Accounting Standards Board |

| FERC | | Federal Energy Regulatory Commission |

| FTP | | Financial Trading Program |

| GAAP | | Accounting principles generally accepted in the United States of America |

| GHG | | Greenhouse gas |

| GMDs | | Geomagnetic disturbances |

| HAP | | Hazardous Air Pollutants |

| IRP | | Integrated Resource Plan |

| JSCCG | | John Sevier Combined Cycle Generation LLC |

| kW | | Kilowatts |

| kWh | | Kilowatt hours |

| LPCs | | Local power company customers |

| LTA | | Long-Term Agreement |

| MATS | | Mercury and Air Toxics Standards |

| MD&A | | Management's Discussion and Analysis of Financial Condition and Results of Operations |

| | | | | | | | |

| MLGW | | Memphis Light, Gas and Water Division |

| mmBtu | | Million British thermal unit(s) |

| MtM | | Mark-to-market |

| MW | | Megawatts |

| NAAQS | | National Ambient Air Quality Standards |

| NAV | | Net asset value |

| NDT | | Nuclear Decommissioning Trust |

| NEIL | | Nuclear Electric Insurance Limited |

| NEPA | | National Environmental Policy Act |

| NERC | | North American Electric Reliability Corporation |

| NES | | Nashville Electric Service |

NOx | | Nitrogen oxide |

| NPDES | | National Pollutant Discharge Elimination System |

| NRC | | Nuclear Regulatory Commission |

| NSR | | New Source Review |

| NWP | | Nationwide Permit |

| OCI | | Other comprehensive income (loss) |

| OMB | | Office of Management and Budget |

| PARRS | | Putable Automatic Rate Reset Securities |

| PM | | Particulate matter |

| QTE | | Qualified technological equipment and software |

| RCRA | | Resource Conservation and Recovery Act |

| RECs | | Renewable Energy Certificates |

| SCCG | | Southaven Combined Cycle Generation LLC |

| SCRs | | Selective catalytic reduction systems |

| SEC | | Securities and Exchange Commission |

| SELC | | Southern Environmental Law Center |

| SERP | | Supplemental Executive Retirement Plan |

| SHLLC | | Southaven Holdco LLC |

| SIPs | | State implementation plans |

| SMR | | Small modular reactor(s) |

SO2 | | Sulfur dioxide |

| SPC | | Summer Place Complex |

| SSSL | | Seven States Southaven LLC |

| TDEC | | Tennessee Department of Environment and Conservation |

| TVA Act | | The Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee |

| TVARS | | Tennessee Valley Authority Retirement System |

| U.S. Treasury | | United States Department of the Treasury |

| VIE | | Variable interest entity |

| XBRL | | eXtensible Business Reporting Language |

FORWARD-LOOKING INFORMATION

This Quarterly Report contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," "project," "plan," "predict," "assume," "forecast," "estimate," "objective," "possible," "probably," "likely," "potential," "speculate," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying any forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in any forward-looking statements. These factors include, among other things:

•The impact of the Coronavirus Disease 2019 ("COVID-19") pandemic on TVA's operating results, financial condition, and cash flows, the demand for electricity, TVA's workforce and operations, the availability of fuel and critical parts, supplies, and services, the financial markets, and the business and financial condition of TVA's customers and counterparties;

•The duration and severity of the COVID-19 pandemic, actions taken to contain its spread and mitigate its effects, and broader impacts of the COVID-19 pandemic on economic and market conditions, including impacts on interest rates, commodity prices, investment performance, and foreign currency exchange rates;

•New, amended, or existing laws, regulations, executive orders, or administrative orders or interpretations, including those related to environmental matters, and the costs of complying with these laws, regulations, executive orders, or administrative orders or interpretations;

•The cost of complying with known, anticipated, or new emissions reduction requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective or result in their removal from service, perhaps permanently;

•Significant reductions in demand for electricity produced through non-renewable or centrally located generation sources that may result from, among other things, economic downturns, increased energy efficiency and conservation, increased utilization of distributed generation and microgrids, and improvements in alternative generation and energy storage technologies;

•Changes in customer preferences for energy produced from cleaner generation sources;

•Changes in technology;

•Actions taken, or inaction, by the United States ("U.S.") government relating to the national or TVA debt ceiling or automatic spending cuts in government programs;

•Costs or liabilities that are not anticipated in TVA's financial statements for third-party claims, natural resource damages, environmental cleanup activities, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure;

•Addition or loss of customers by TVA or TVA's local power company customers ("LPCs");

•Significant delays, cost increases, or cost overruns associated with the construction and maintenance of generation, transmission, navigation, flood control, or related assets;

•Requirements or decisions changing the amount or timing of funding obligations associated with TVA's pension plans, other post-retirement benefit plans, or health care plans;

•Increases in TVA's financial liabilities for decommissioning its nuclear facilities or retiring other assets;

•Risks associated with the operation of nuclear facilities or other generation and related facilities, including coal combustion residuals ("CCR") facilities;

•Physical attacks on TVA's assets;

•Cyber attacks on TVA's assets or the assets of third parties upon which TVA relies;

•The outcome of legal or administrative proceedings;

•The failure of TVA's generation, transmission, navigation, flood control, and related assets and infrastructure, including CCR facilities and spent nuclear fuel storage facilities, to operate as anticipated, resulting in lost revenues, damages, or other costs that are not reflected in TVA's financial statements or projections;

•Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred;

•Weather conditions;

•Catastrophic events such as fires, earthquakes, explosions, solar events, electromagnetic pulses ("EMPs"), geomagnetic disturbances ("GMDs"), droughts, floods, hurricanes, tornadoes, or other casualty events or pandemics, wars, national emergencies, terrorist activities, or other similar events, especially if these events occur in or near TVA's service area;

•Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, and damage to the property of others;

•Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid;

•Disruption of fuel supplies, which may result from, among other things, economic conditions, weather conditions, production or transportation difficulties, labor challenges, or environmental laws or regulations affecting TVA's fuel suppliers or transporters;

•Purchased power price volatility and disruption of purchased power supplies;

•Events which affect the supply of water for TVA's generation facilities;

•Changes in TVA's determinations of the appropriate mix of generation assets;

•Ineffectiveness of TVA's efforts at adapting its organization to an evolving marketplace and remaining cost competitive;

•Inability to use regulatory accounting or loss of regulatory accounting approval for certain costs;

•Inability to obtain, or loss of, regulatory approval for the construction or operation of assets;

•The requirement or decision to make additional contributions to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART");

•Limitations on TVA's ability to borrow money which may result from, among other things, TVA's approaching or substantially reaching the limit on bonds, notes, and other evidences of indebtedness (collectively, "Bonds") specified in the Tennessee Valley Authority Act of 1933, as amended ("TVA Act");

•An increase in TVA's cost of capital that may result from, among other things, changes in the market for TVA's debt securities, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit;

•Changes in the economy and volatility in financial markets;

•Reliability or creditworthiness of counterparties;

•Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, electricity, or emission allowances;

•Changes in the market price of equity securities, debt securities, or other investments;

•Changes in interest rates, currency exchange rates, or inflation rates;

•Ineffectiveness of TVA's disclosure controls and procedures or its internal control over financial reporting;

•Inability to eliminate identified deficiencies in TVA's systems, standards, controls, or corporate culture;

•Inability to attract or retain a skilled workforce;

•Inability to respond quickly enough to current or potential customer demands or needs;

•Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, or decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, or cause TVA to forego future construction at these or other facilities;

•Loss of quorum of the TVA Board of Directors ("TVA Board");

•Changes in the priorities of the TVA Board or TVA senior management; or

•Other unforeseeable events.

See also Item 1A, Risk Factors, and Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations in TVA's Annual Report on Form 10-K for the year ended September 30, 2020 (the "Annual Report"), and Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Part II, Item 1A, Risk Factors in this Quarterly Report for a discussion of factors that could cause actual results to differ materially from those in any forward-looking statement. New factors emerge from time to time, and it is not possible for TVA to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA's business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made.

GENERAL INFORMATION

Fiscal Year

References to years (2021, 2020, etc.) in this Quarterly Report are to TVA's fiscal years ending September 30. Years that are preceded by "CY" are references to calendar years.

Notes

References to "Notes" are to the Notes to Consolidated Financial Statements contained in Part I, Item 1, Financial Statements in this Quarterly Report.

Available Information

TVA's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, are available on TVA's website, free of charge, as soon as reasonably practicable after such reports are electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). TVA's website is www.tva.gov. Information contained on TVA's website shall not be deemed to be incorporated into, or to be a part of, this Quarterly Report. All TVA SEC reports are available to the public without charge from the website maintained by the SEC at www.sec.gov.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31 | | Six Months Ended March 31 |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Operating revenues | | | | | | | |

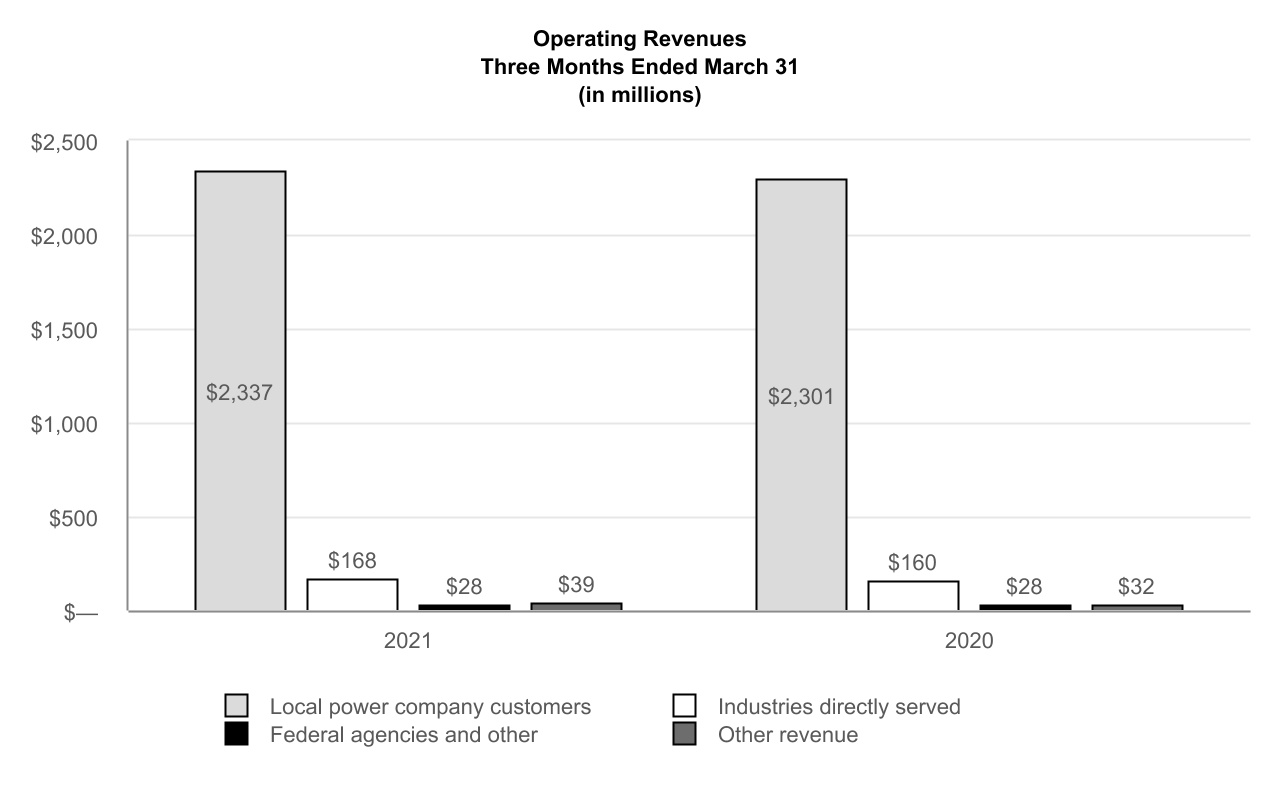

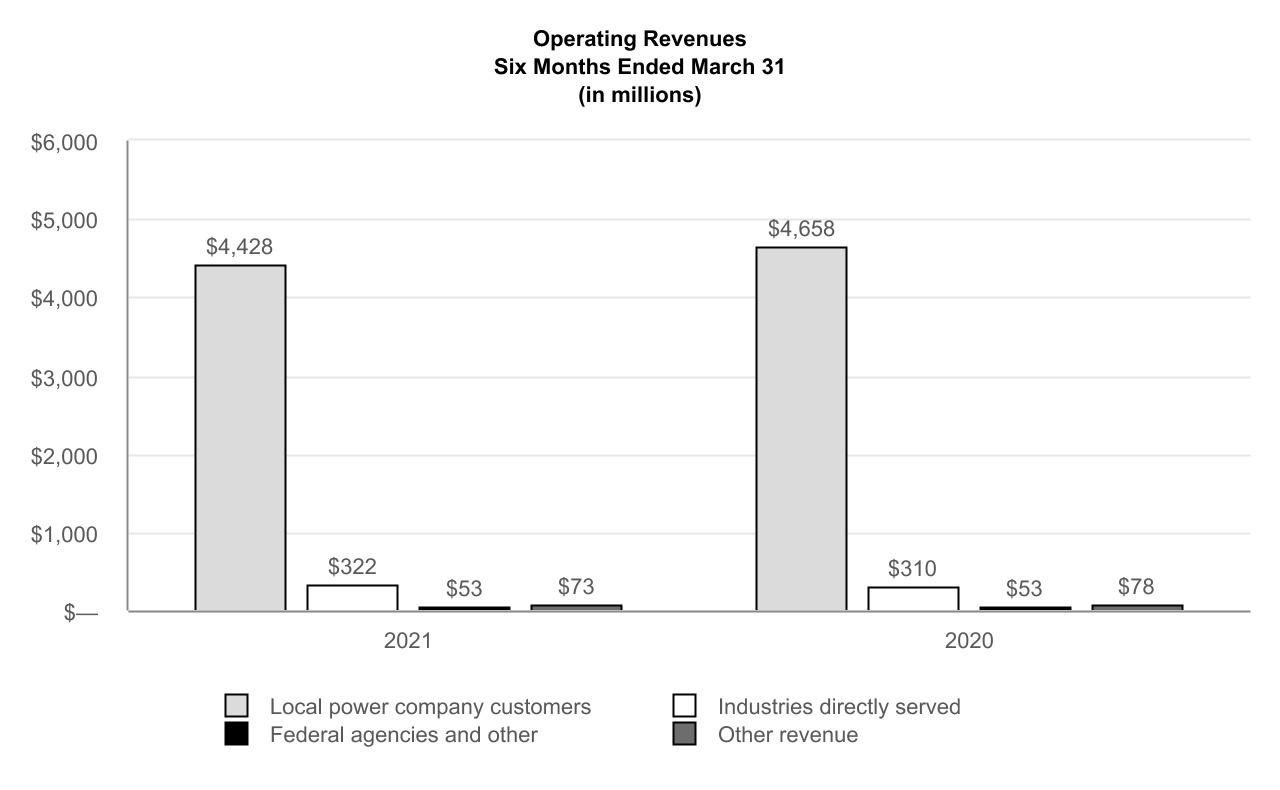

| Revenue from sales of electricity | $ | 2,533 | | | $ | 2,489 | | | $ | 4,803 | | | $ | 5,021 | |

| Other revenue | 39 | | | 32 | | | 73 | | | 78 | |

| Total operating revenues | 2,572 | | | 2,521 | | | 4,876 | | | 5,099 | |

| Operating expenses | | | | | | | |

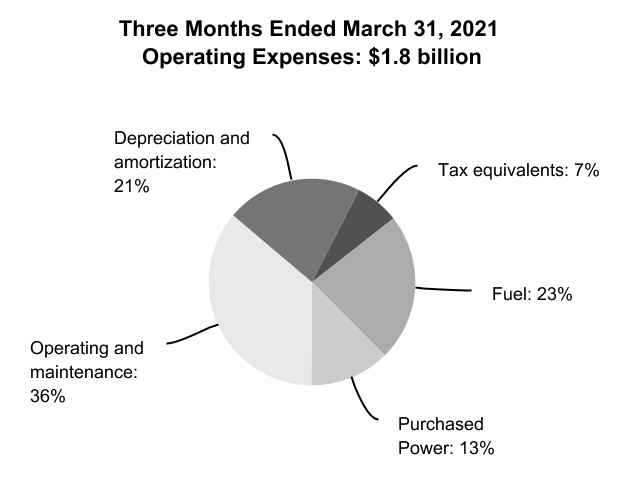

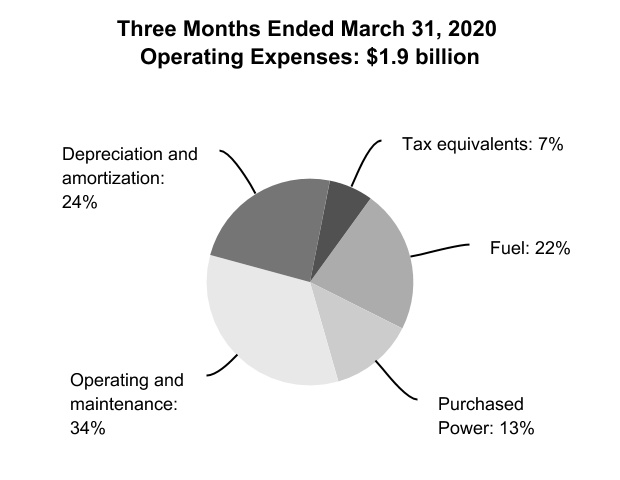

| Fuel | 413 | | | 429 | | | 782 | | | 852 | |

| Purchased power | 225 | | | 252 | | | 431 | | | 471 | |

| Operating and maintenance | 644 | | | 644 | | | 1,359 | | | 1,333 | |

| Depreciation and amortization | 381 | | | 457 | | | 759 | | | 1,041 | |

| Tax equivalents | 124 | | | 132 | | | 245 | | | 263 | |

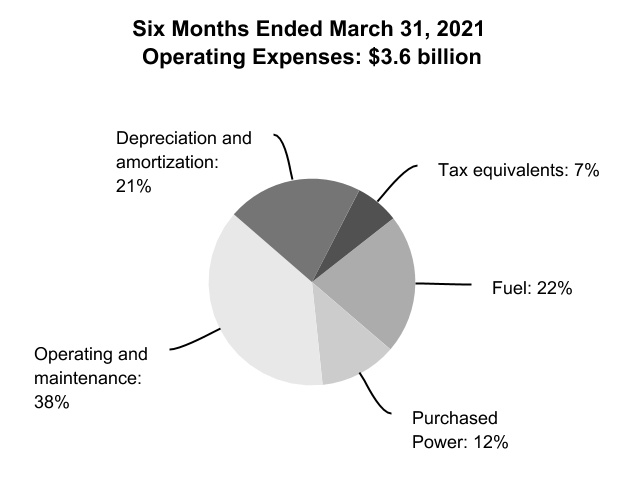

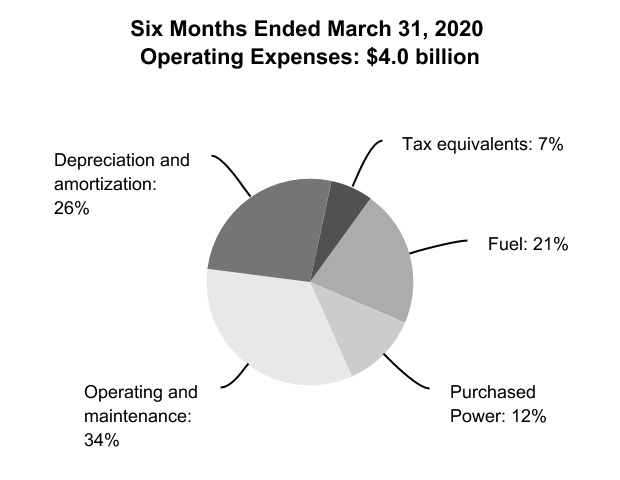

| Total operating expenses | 1,787 | | | 1,914 | | | 3,576 | | | 3,960 | |

| Operating income | 785 | | | 607 | | | 1,300 | | | 1,139 | |

| Other income (expense), net | 11 | | | (1) | | | 26 | | | 11 | |

| Other net periodic benefit cost | 64 | | | 62 | | | 129 | | | 127 | |

| Interest expense | 276 | | | 289 | | | 557 | | | 576 | |

| Net income (loss) | $ | 456 | | | $ | 255 | | | $ | 640 | | | $ | 447 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31 | | Six Months Ended March 31 |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Net income (loss) | $ | 456 | | | $ | 255 | | | $ | 640 | | | $ | 447 | |

| Other comprehensive income (loss) | | | | | | | |

| Net unrealized gain (loss) on cash flow hedges | 22 | | | (163) | | | 123 | | | (87) | |

| Net unrealized (gain) loss reclassified to earnings from cash flow hedges | (5) | | | 56 | | | (50) | | | (3) | |

| Total other comprehensive income (loss) | 17 | | | (107) | | | 73 | | | (90) | |

| Total comprehensive income (loss) | $ | 473 | | | $ | 148 | | | $ | 713 | | | $ | 357 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| ASSETS |

| | March 31, 2021 | | September 30, 2020 |

| Current assets | | | |

| Cash and cash equivalents | $ | 500 | | | $ | 500 | |

| | | |

| | | |

| Accounts receivable, net | 1,284 | | | 1,529 | |

| Inventories, net | 1,014 | | | 1,003 | |

| Regulatory assets | 155 | | | 130 | |

| Other current assets | 123 | | | 84 | |

| Total current assets | 3,076 | | | 3,246 | |

| | | |

| Property, plant, and equipment | | | |

| Completed plant | 65,679 | | | 64,970 | |

| Less accumulated depreciation | (34,172) | | | (33,550) | |

| Net completed plant | 31,507 | | | 31,420 | |

| Construction in progress | 2,250 | | | 2,139 | |

| Nuclear fuel | 1,471 | | | 1,504 | |

| Finance leases | 725 | | | 516 | |

| Total property, plant, and equipment, net | 35,953 | | | 35,579 | |

| | | |

| Investment funds | 3,723 | | | 3,198 | |

| | | |

| Regulatory and other long-term assets | | | |

| Regulatory assets | 9,230 | | | 10,245 | |

| Operating lease assets, net of amortization | 182 | | | 232 | |

| Other long-term assets | 318 | | | 325 | |

| Total regulatory and other long-term assets | 9,730 | | | 10,802 | |

| | | |

| Total assets | $ | 52,482 | | | $ | 52,825 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| LIABILITIES AND PROPRIETARY CAPITAL |

| March 31, 2021 | | September 30, 2020 |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 1,786 | | | $ | 1,844 | |

| | | |

| Accrued interest | 302 | | | 298 | |

| Asset retirement obligations | 271 | | | 345 | |

| Current portion of leaseback obligations | 87 | | | 198 | |

| | | |

| Regulatory liabilities | 141 | | | 141 | |

| Short-term debt, net | 1,241 | | | 57 | |

| Current maturities of power bonds | 304 | | | 1,787 | |

| Current maturities of long-term debt of variable interest entities | 42 | | | 41 | |

| | | |

| Total current liabilities | 4,174 | | | 4,711 | |

| | | |

| Other liabilities | | | |

| Post-retirement and post-employment benefit obligations | 6,407 | | | 6,617 | |

| Asset retirement obligations | 6,647 | | | 6,440 | |

| Finance lease liabilities | 720 | | | 525 | |

| Other long-term liabilities | 1,867 | | | 2,548 | |

| Leaseback obligations | — | | | 25 | |

| | | |

| | | |

| Regulatory liabilities | 5 | | | 23 | |

| Total other liabilities | 15,646 | | | 16,178 | |

| | | |

| Long-term debt, net | | | |

| Long-term power bonds, net | 17,995 | | | 17,956 | |

| Long-term debt of variable interest entities, net | 1,028 | | | 1,048 | |

| | | |

| Total long-term debt, net | 19,023 | | | 19,004 | |

| | | |

| Total liabilities | 38,843 | | | 39,893 | |

| | | |

Contingencies and legal proceedings (Note 19) | | | |

| | | |

| Proprietary capital | | | |

| Power program appropriation investment | 258 | | | 258 | |

| Power program retained earnings | 12,815 | | | 12,177 | |

| Total power program proprietary capital | 13,073 | | | 12,435 | |

| Nonpower programs appropriation investment, net | 544 | | | 548 | |

| Accumulated other comprehensive income (loss) | 22 | | | (51) | |

| Total proprietary capital | 13,639 | | | 12,932 | |

| | | |

| Total liabilities and proprietary capital | $ | 52,482 | | | $ | 52,825 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the Six Months Ended March 31

(in millions)

| | | | | | | | | | | |

| | 2021 | | 2020 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 640 | | | $ | 447 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities | | | |

Depreciation and amortization(1) | 770 | | | 1,052 | |

| Amortization of nuclear fuel cost | 193 | | | 194 | |

| Non-cash retirement benefit expense | 166 | | | 162 | |

| | | |

| Other regulatory amortization and deferrals | (39) | | | 83 | |

| | | |

| | | |

| | | |

| Changes in current assets and liabilities | | | |

| Accounts receivable, net | 246 | | | 475 | |

| Inventories and other current assets, net | (43) | | | (101) | |

| Accounts payable and accrued liabilities | (70) | | | (218) | |

| Accrued interest | 6 | | | 13 | |

| | | |

| Pension contributions | (155) | | | (155) | |

| | | |

| | | |

| | | |

| Other, net | (144) | | | (82) | |

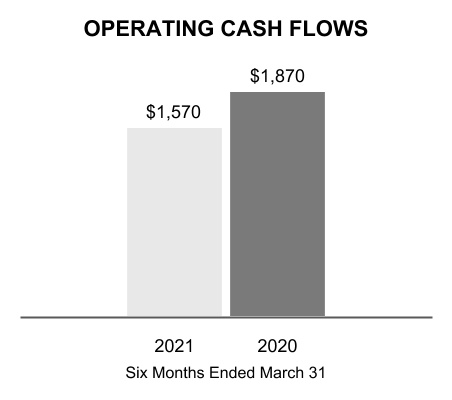

| Net cash provided by operating activities | 1,570 | | | 1,870 | |

| | | |

| Cash flows from investing activities | | | |

| Construction expenditures | (975) | | | (840) | |

| | | |

| Nuclear fuel expenditures | (129) | | | (184) | |

| | | |

| Loans and other receivables | | | |

| Advances | (7) | | | (3) | |

| Repayments | 2 | | | 4 | |

| Other, net | 17 | | | 13 | |

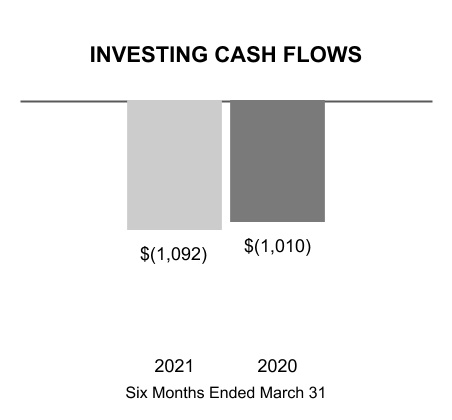

| Net cash used in investing activities | (1,092) | | | (1,010) | |

| | | |

| Cash flows from financing activities | | | |

| Long-term debt | | | |

| | | |

| | | |

| Redemptions and repurchases of power bonds | (1,501) | | | (1,218) | |

| | | |

| Redemptions of debt of variable interest entities | (20) | | | (20) | |

| Short-term debt issues (redemptions), net | 1,184 | | | 953 | |

| Payments on leases and leasebacks | (154) | | | (43) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | 11 | | | 4 | |

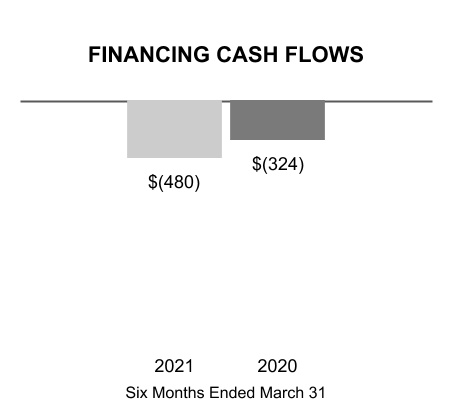

| Net cash (used in) provided by financing activities | (480) | | | (324) | |

| Net change in cash, cash equivalents, and restricted cash | (2) | | | 536 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 521 | | | 322 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 519 | | | $ | 858 | |

| | | |

| | | |

| | | |

| | | |

| | | |

Note (1) Includes amortization of debt issuance costs and premiums/discounts. |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Three Months Ended March 31, 2021 and 2020

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | |

Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated

Other

Comprehensive

Income (Loss) | |

Total |

| Balance at December 31, 2019 | $ | 258 | | | $ | 11,015 | | | $ | 554 | | | $ | 5 | | | $ | 11,832 | |

| Net income (loss) | — | | | 257 | | | (2) | | | — | | | 255 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | (107) | | | (107) | |

| Return on power program appropriation investment | — | | | (1) | | | — | | | — | | | (1) | |

| | | | | | | | | |

Balance at March 31, 2020 | $ | 258 | | | $ | 11,271 | | | $ | 552 | | | $ | (102) | | | $ | 11,979 | |

| | | | | | | | | |

| Balance at December 31, 2020 | $ | 258 | | | $ | 12,358 | | | $ | 546 | | | $ | 5 | | | $ | 13,167 | |

| Net income (loss) | — | | | 458 | | | (2) | | | — | | | 456 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | 17 | | | 17 | |

| Return on power program appropriation investment | — | | | (1) | | | — | | | — | | | (1) | |

Balance at March 31, 2021 | $ | 258 | | | $ | 12,815 | | | $ | 544 | | | $ | 22 | | | $ | 13,639 | |

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Six Months Ended March 31, 2021 and 2020

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | |

Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated

Other

Comprehensive

Income (Loss) | |

Total |

Balance at September 30, 2019 | $ | 258 | | | $ | 10,823 | | | $ | 556 | | | $ | (12) | | | $ | 11,625 | |

| Net income (loss) | — | | | 451 | | | (4) | | | — | | | 447 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | (90) | | | (90) | |

| Return on power program appropriation investment | — | | | (3) | | | — | | | — | | | (3) | |

| | | | | | | | | |

Balance at March 31, 2020 | $ | 258 | | | $ | 11,271 | | | $ | 552 | | | $ | (102) | | | $ | 11,979 | |

| | | | | | | | | |

Balance at September 30, 2020 | $ | 258 | | | $ | 12,177 | | | $ | 548 | | | $ | (51) | | | $ | 12,932 | |

| Net income (loss) | — | | | 644 | | | (4) | | | — | | | 640 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | 73 | | | 73 | |

| Return on power program appropriation investment | — | | | (2) | | | — | | | — | | | (2) | |

Implementation of new accounting standard(1) | — | | | (4) | | | — | | | — | | | (4) | |

Balance at March 31, 2021 | $ | 258 | | | $ | 12,815 | | | $ | 544 | | | $ | 22 | | | $ | 13,639 | |

Note (1) See Note 2 — Impact of New Accounting Standards and Interpretations. |

The accompanying notes are an integral part of these consolidated financial statements. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions except where noted)

| | | | | | | | | | | |

| Note | Page |

| 1 | | Summary of Significant Accounting Policies | |

| 2 | | Impact of New Accounting Standards and Interpretations | |

| 3 | | Accounts Receivable, Net | |

| 4 | | Inventories, Net | |

| 5 | | Plant Closures | |

| | | |

| 6 | | Other Long-Term Assets | |

| 7 | | Regulatory Assets and Liabilities | |

| 8 | | Variable Interest Entities | |

| 9 | | Other Long-Term Liabilities | |

| 10 | | Asset Retirement Obligations | |

| 11 | | Debt and Other Obligations | |

| 12 | | Accumulated Other Comprehensive Income (Loss) | |

| 13 | | Risk Management Activities and Derivative Transactions | |

| 14 | | Fair Value Measurements | |

| 15 | | Revenue | |

| 16 | | Other Income (Expense), Net | |

| 17 | | Supplemental Cash Flow Information | |

| 18 | | Benefit Plans | |

| 19 | | Contingencies and Legal Proceedings | |

| | | |

1. Summary of Significant Accounting Policies

General

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by federal legislation in response to a proposal by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA's service area in the southeastern U.S., and sell the electricity generated at the facilities TVA operates.

Today, TVA operates the nation's largest public power system and supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of approximately 10 million people.

TVA also manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system and public lands to provide recreational opportunities, adequate water supply, improved water quality, cultural and natural resource protection, and economic development.

The power program has historically been separate and distinct from the stewardship programs. It is required to be self-supporting from power revenues and proceeds from power financings, such as proceeds from the issuance of bonds, notes, or other evidences of indebtedness (collectively, "Bonds"). Although TVA does not currently receive congressional appropriations, it is required to make annual payments to the United States Department of the Treasury ("U.S. Treasury") as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"). In the 1998 Energy and Water Development Appropriations Act, Congress directed TVA to fund essential stewardship activities related to its management of the Tennessee River system and nonpower or stewardship properties with power revenues in the event that there were insufficient appropriations or other available funds to pay for such activities in any fiscal year. Congress has not provided any appropriations to TVA to fund such activities since 1999. Consequently, during 2000, TVA began paying for essential stewardship activities primarily with power revenues, with the remainder funded with user fees and other forms of revenues derived in connection with those activities. The activities related to stewardship properties do not meet the criteria of an operating segment under accounting principles generally accepted in the United States of America ("GAAP"). Accordingly, these assets and properties are included as part of the power program, TVA's only operating segment.

Power rates are established by the TVA Board of Directors (the "TVA Board") as authorized by the Tennessee Valley Authority Act of 1933, as amended ("TVA Act"). The TVA Act requires TVA to charge rates for power that will produce gross revenues sufficient to provide funds for operation, maintenance, and administration of its power system; payments to states and counties in lieu of taxes ("tax equivalents"); debt service on outstanding indebtedness; payments to the U.S. Treasury in repayment of and as a return on the Power Program Appropriation Investment; and such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding Bonds in advance of maturity, additional reduction of the Power Program Appropriation Investment, and other purposes connected with TVA's power business. TVA fulfilled its requirement to repay $1.0 billion of the Power Program Appropriation Investment with the 2014 payment; therefore, this item is no longer a component of rate setting. In setting TVA's rates, the TVA Board is charged by the TVA Act to have due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible. Rates set by the TVA Board are not subject to review or approval by any state or other federal regulatory body.

Fiscal Year

TVA's fiscal year ends September 30. Years (2021, 2020, etc.) refer to TVA's fiscal years unless they are preceded by "CY," in which case the references are to calendar years.

Cost-Based Regulation

Since the TVA Board is authorized by the TVA Act to set rates for power sold to its customers, TVA is self-regulated. Additionally, TVA's regulated rates are designed to recover its costs. Based on current projections, TVA believes that rates, set at levels that will recover TVA's costs, can be charged and collected. As a result of these factors, TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. TVA assesses whether the regulatory assets are probable of future recovery by considering factors such as applicable regulatory changes, potential legislation, and changes in technology. Based on these assessments, TVA believes the existing regulatory assets are probable of recovery. This determination reflects the current regulatory and political environment and is subject to change in the future. If future recovery of regulatory assets ceases to be probable, or any of the other factors described above cease to be applicable, TVA would no longer be considered to be a regulated entity and would be required to

write off these costs. All regulatory asset write-offs would be required to be recognized in earnings in the period in which future recovery ceases to be probable.

Basis of Presentation

TVA prepares its consolidated interim financial statements in conformity with GAAP for consolidated interim financial information. Accordingly, TVA's consolidated interim financial statements do not include all of the information and notes required by GAAP for annual financial statements. As such, they should be read in conjunction with the audited financial statements for the year ended September 30, 2020, and the notes thereto, which are contained in TVA's Annual Report on Form 10-K for the year ended September 30, 2020 (the "Annual Report"). In the opinion of management, all adjustments (consisting of items of a normal recurring nature) considered necessary for fair presentation are included on the consolidated interim financial statements.

The accompanying consolidated interim financial statements, which have been prepared in accordance with GAAP, include the accounts of TVA and variable interest entities ("VIEs") of which TVA is the primary beneficiary. See Note 8 — Variable Interest Entities. Intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements requires TVA to estimate the effects of various matters that are inherently uncertain as of the date of the consolidated financial statements. Although the consolidated financial statements are prepared in conformity with GAAP, TVA is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the amounts of revenues and expenses, including impacts from the Coronavirus Disease 2019 ("COVID-19") pandemic, reported during the reporting period. Each of these estimates varies in regard to the level of judgment involved and its potential impact on TVA's financial results. Estimates are considered critical either when a different estimate could have reasonably been used, or where changes in the estimate are reasonably likely to occur from period to period, and such use or change would materially impact TVA's financial condition, results of operations, or cash flows.

Cash, Cash Equivalents, and Restricted Cash

Cash includes cash on hand, non-interest bearing cash, and deposit accounts. All highly liquid investments with original maturities of three months or less are considered cash equivalents. Cash and cash equivalents that are restricted, as to withdrawal or use under the terms of certain contractual agreements, are recorded in Other long-term assets on the Consolidated Balance Sheets. Restricted cash and cash equivalents includes cash held in trusts that are currently restricted for TVA economic development loans and for certain TVA environmental programs in accordance with agreements related to compliance with certain environmental regulations. See Note 19 — Contingencies and Legal Proceedings — Legal Proceedings — Environmental Agreements.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported on the Consolidated Balance Sheets and Consolidated Statements of Cash Flows:

| | | | | | | | | | | |

| Cash, Cash Equivalents, and Restricted Cash |

| | At March 31, 2021 | | At September 30, 2020 |

| Cash and cash equivalents | $ | 500 | | | $ | 500 | |

| | | |

| Restricted cash and cash equivalents included in Other long-term assets | 19 | | | 21 | |

| Total cash, cash equivalents, and restricted cash | $ | 519 | | | $ | 521 | |

Due to higher volatility in the financial markets associated with the COVID-19 pandemic, TVA increased its target balance of Cash and cash equivalents beginning in March 2020. TVA may continue to hold higher balances in future periods due to potential market volatility.

Allowance for Uncollectible Accounts

As described in Note 2 — Impact of New Accounting Standards and Interpretations, TVA adopted Financial Instruments - Credit Losses on October 1, 2020, using a modified retrospective method through a cumulative-effect adjustment to retained earnings. The standard, Current Expected Credit Losses ("CECL"), requires TVA to recognize an allowance that reflects the current estimate for credit losses expected to be incurred over the life of the financial assets based on historical experience, current conditions, and reasonable and supportable forecasts that affect the collectibility of the reported amounts. TVA has reviewed the current portfolio of financial receivables and developed a methodology to reasonably measure the estimate of credit losses for each major financial receivable type. The appropriateness of the allowance is evaluated at the end of each reporting period. TVA continues to monitor the impact of the COVID-19 pandemic on accounts and loans receivable balances to evaluate the allowance for uncollectible accounts.

To determine the allowance for trade receivables, TVA considers historical experience and other currently available information, including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements by the due date. TVA's corporate credit department also performs an assessment of the financial condition of customers and the credit quality of the receivables. In addition, TVA reviews other reasonable and supportable forecasts to determine if the allowance for uncollectible amounts should be further adjusted in accordance with the accounting guidance for CECL.

To determine the allowance for loans receivables, TVA aggregates loans into the appropriate pools based on the existence of similar risk characteristics such as collateral types and internal assessed credit risks. In situations where a loan exhibits unique risk characteristics and is no longer expected to experience similar risks to the rest of its pool, the loan will be evaluated separately. TVA derives an annual loss rate based on historical loss and then adjusts the rate to reflect TVA's consideration of available information on current conditions and reasonable and supportable future forecasts. This information may include economic and business conditions, default trends, and other internal and external factors. For periods beyond the reasonable and supportable forecast period, TVA uses the current calculated long-term average historical loss rate for the remaining life of the loan portfolio.

The allowance for uncollectible accounts was less than $1 million at both March 31, 2021, and September 30, 2020, for trade accounts receivable. Additionally, loans receivable of $117 million and $105 million at March 31, 2021, and September 30, 2020, respectively, are included in Accounts receivable, net and Other long-term assets, for the current and long-term portions, respectively. Loans receivables are reported net of allowances for uncollectible accounts of $5 million and less than $1 million at March 31, 2021, and September 30, 2020, respectively. The increase in allowances for uncollectible accounts is due to the adoption of CECL. See Note 2 - Impact of New Accounting Standards and Interpretations.

Revenues

TVA recognizes revenue from contracts with customers to depict the transfer of goods or services to customers in an amount to which the entity expects to be entitled in exchange for those goods or services. For the generation and transmission of electricity, this is generally at the time the power is delivered to a metered customer delivery point for the customer's consumption or distribution. As a result, revenues from power sales are recorded as electricity is delivered to customers. In addition to power sales invoiced and recorded during the month, TVA accrues estimated unbilled revenues for power sales provided to five customers whose billing date occurs prior to the end of the month. Exchange power sales are presented in the accompanying Consolidated Statements of Operations as a component of sales of electricity. Exchange power sales are sales of excess power after meeting TVA native load and directly served requirements. Native load refers to the customers on whose behalf a company, by statute, franchise, regulatory requirement, or contract, has undertaken an obligation to serve. TVA engages in other arrangements in addition to power sales. Certain other revenue from activities related to TVA's overall mission is recorded in Other revenue. Revenues that are not related to the overall mission are recorded in Other income (expense), net.

Depreciation

TVA accounts for depreciation of its properties using the composite depreciation convention of accounting. Under the composite method, assets with similar economic characteristics are grouped and depreciated as one asset. Depreciation is generally computed on a straight-line basis over the estimated service lives of the various classes of assets. The estimation of asset useful lives requires management judgment, supported by external depreciation studies of historical asset retirement experience. Depreciation rates are determined based on the external depreciation studies. These studies are updated approximately every five years, with a study currently being performed in 2021. Depreciation expense was $346 million and $407 million for the three months ended March 31, 2021 and 2020, respectively. Depreciation expense was $691 million and $946 million for the six months ended March 31, 2021 and 2020, respectively. See Note 5 — Plant Closures for a discussion of the impact of plant closures.

2. Impact of New Accounting Standards and Interpretations

The following are accounting standard updates issued by the Financial Accounting Standards Board ("FASB") that TVA adopted during 2021:

| | | | | | | | | | | | | | |

| Financial Instruments - Credit Losses |

| Description | This guidance eliminates the probable initial recognition threshold in current GAAP and, instead, requires an allowance to be recorded for all expected credit losses for certain financial assets that are not measured at fair value. The allowance for credit losses is based on historical information, current conditions, and reasonable and supportable forecasts. The new standard also makes revisions to the other than temporary impairment model for available-for-sale debt securities. |

| Effective Date for TVA | October 1, 2020 |

| Effect on the Financial Statements or Other Significant Matters | TVA adopted this standard on a modified retrospective method through a cumulative-effect adjustment to retained earnings on October 1, 2020. TVA recorded an initial transition adjustment of $4 million to retained earnings. The adoption of this standard did not materially impact TVA's financial condition, results of operations, or cash flows. |

|

| Fair Value Measurement Disclosure |

| Description | This guidance changes certain disclosure requirements for fair value measurements. It removes certain disclosure requirements, such as the amount of and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy; the policy for timing of the transfers between levels; and the valuation processes for Level 3 fair value measurements. Some disclosure requirements are added, such as the change in unrealized gains and losses included in other comprehensive income for recurring Level 3 fair value measurements and the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements. |

| Effective Date for TVA | October 1, 2020 |

| Effect on the Financial Statements or Other Significant Matters | Adoption of this standard did not have a material impact on TVA's financial condition, results of operations, or cash flows. |

The following accounting standard has been issued but at March 31, 2021, was not effective and had not been adopted by TVA:

| | | | | |

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

| Reference Rate Reform |

| Description | This guidance provides temporary optional expedients and exceptions to the guidance in GAAP on contract modifications and hedge accounting to ease the financial reporting burdens related to the expected market transition from the London Interbank Offered Rate ("LIBOR") and other interbank offered rates to alternative reference rates, such as the Secured Overnight Financing Rates. |

| Effective Date for TVA | The new standard is effective for adoption at any time between March 12, 2020, and December 31, 2022. TVA currently plans to adopt the standard by December 31, 2022. |

| Effect on the Financial Statements or Other Significant Matters | TVA continues to review this standard and evaluate the impact of using an alternative reference rate instead of LIBOR in its interest rate swap contracts. TVA does not expect the adoption of this standard to have a material impact on TVA's financial condition, results of operations, or cash flows. |

|

|

| |

| |

| |

|

|

| |

| |

| |

3. Accounts Receivable, Net

Accounts receivable primarily consist of amounts due from customers for power sales. The table below summarizes the types and amounts of TVA's accounts receivable:

| | | | | | | | | | | |

| Accounts Receivable, Net |

| | At March 31, 2021 | | At September 30, 2020 |

| Power receivables | $ | 1,204 | | | $ | 1,401 | |

| Other receivables | 80 | | | 128 | |

| | | |

Accounts receivable, net(1) | $ | 1,284 | | | $ | 1,529 | |

Note

(1) Allowance for uncollectible accounts was less than $1 million at March 31, 2021, and September 30, 2020, and therefore is not represented in the table

above. The allowance at March 31, 2021 includes the impact from adopting CECL on October 1, 2020.

In response to the COVID-19 pandemic, the TVA Board approved the Public Power Support and Stabilization Program in 2020. Through this program, TVA offered up to $1.0 billion of credit support to local power company customers ("LPCs") that demonstrated the need for temporary financial relief, through the deferral of a portion of LPCs' wholesale power payments owed to TVA. The program ended on December 31, 2020, with a total of $1 million of credit support approved under the program. As of March 31, 2021, the $1 million had been fully repaid.

4. Inventories, Net

The table below summarizes the types and amounts of TVA's inventories:

| | | | | | | | | | | |

Inventories, Net |

| | At March 31, 2021 | | At September 30, 2020 |

| Materials and supplies inventory | $ | 767 | | | $ | 770 | |

| Fuel inventory | 263 | | | 253 | |

| Renewable energy certificates inventory, net | 18 | | | 15 | |

| Allowance for inventory obsolescence | (34) | | | (35) | |

| Inventories, net | $ | 1,014 | | | $ | 1,003 | |

5. Plant Closures

Background

TVA must continuously evaluate all generating assets to ensure an optimal energy portfolio that provides safe, clean, and reliable power while maintaining flexibility and fiscal responsibility to the people of the Tennessee Valley. During 2019, the TVA Board approved the Integrated Resource Plan, which recommended an action to evaluate the engineering end-of-life of aging fossil units. These assessments consider material condition, plant performance, system flexibility needs, environmental impacts, grid support, and other factors. Based on results of assessments presented to the TVA Board in 2019, the retirement of Paradise Fossil Plant ("Paradise") Unit 3 by December 2020 and Bull Run Fossil Plant ("Bull Run") by December 2023 was approved. Subsequent to the TVA Board approval, TVA determined that Paradise would not be restarted after January 2020 due to the plant's material condition. Paradise Fossil Plant Unit 3 was taken offline on February 1, 2020, effectively retiring the plant.

Financial Impact

TVA's policy is to adjust depreciation rates to reflect the most current assumptions, ensuring units will be fully depreciated by the applicable retirement dates. As a result of TVA's decision to accelerate the retirements of Paradise and Bull Run, TVA has recognized a cumulative $1.0 billion of accelerated depreciation. Of this amount, $34 million and $91 million was recognized during the three months ended March 31, 2021 and 2020, respectively, and $67 million and $316 million was recognized during the six months ended March 31, 2021 and 2020, respectively.

6. Other Long-Term Assets

The table below summarizes the types and amounts of TVA's other long-term assets:

| | | | | | | | | | | |

Other Long-Term Assets (in millions) |

| At March 31, 2021 | | At September 30, 2020 |

| | | |

| Loans and other long-term receivables, net | $ | 109 | | | $ | 100 | |

EnergyRight® receivables, net | 62 | | | 69 | |

| Prepaid long-term service agreements | 54 | | | 42 | |

| Commodity contract derivative assets | 5 | | | 23 | |

| Restricted cash and cash equivalents | 19 | | | 21 | |

| Prepaid capacity payments | 8 | | | 11 | |

| | | |

| Other | 61 | | | 59 | |

| Total other long-term assets | $ | 318 | | | $ | 325 | |

EnergyRight® Receivables, Net. In association with the EnergyRight® program, TVA's LPCs offer financing to end-use customers for the purchase of energy-efficient equipment. Depending on the nature of the energy-efficiency project, loans may have a maximum term of five years or 10 years. TVA purchases the resulting loans receivable from its LPCs. The loans receivable are then transferred to a third-party bank with which TVA has agreed to repay in full any loans receivable that have been in default for 180 days or more or that TVA has determined are uncollectible. Given this continuing involvement, TVA accounts for the transfer of the loans receivable as secured borrowings. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At March 31, 2021, and September 30, 2020, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was approximately $16 million and $18 million, respectively. See Note 9 — Other Long-Term Liabilities for information regarding the associated financing obligation.

In response to the COVID-19 pandemic, customers experiencing financial hardship could request a deferral of EnergyRight® loan payments for a period of up to six months. The deferral option began in April 2020 and ended October 31, 2020. As of March 31, 2021, all EnergyRight® loans approved for the deferral period had resumed payments. The deferred loans did not accrue interest during the deferral months and totaled less than $1 million.

Allowance for Loan Losses. As described in Note 2 — Impact of New Accounting Standards and Interpretations, TVA adopted CECL on October 1, 2020 to determine its allowance for loan loss. The allowance for loan loss is an estimate of expected credit losses, measured over the estimated life of the loan receivables, that considers reasonable and supportable forecasts of future economic conditions in addition to information about historical experience and current conditions. See Note 1 — Summary of Significant Accounting Policies — Allowance for Uncollectible Accounts.