Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13, 15(d), OR 37 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

|

| | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (IRS Employer Identification No.) |

|

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

(Registrant’s telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company o Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

|

| |

Table of Contents |

| |

| |

GLOSSARY OF COMMON ACRONYMS...................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................ | |

| |

|

| |

ITEM 1. FINANCIAL STATEMENTS............................................................................................................................................. | |

| |

Consolidated Statements of Comprehensive Income (Loss) (unaudited)............................................................................. | |

Consolidated Balance Sheets (unaudited)............................................................................................................................ | |

| |

| |

| |

| |

| |

Executive Overview............................................................................................................................................................... | |

Results of Operations............................................................................................................................................................ | |

Liquidity and Capital Resources............................................................................................................................................ | |

Key Initiatives and Challenges.............................................................................................................................................. | |

Environmental Matters.......................................................................................................................................................... | |

Legal Proceedings................................................................................................................................................................ | |

Off-Balance Sheet Arrangements......................................................................................................................................... | |

| |

| |

Corporate Governance.......................................................................................................................................................... | |

Legislative and Regulatory Matters....................................................................................................................................... | |

| |

| |

| |

ITEM 4. CONTROLS AND PROCEDURES.................................................................................................................................. | |

| |

| |

| |

|

| |

ITEM 1. LEGAL PROCEEDINGS.................................................................................................................................................. | |

| |

ITEM 1A. RISK FACTORS........................................................................................................................................................... | |

| |

ITEM 6. EXHIBITS....................................................................................................................................................................... | |

| |

SIGNATURES............................................................................................................................................................................... | |

| |

EXHIBIT INDEX............................................................................................................................................................................ | |

|

| | |

GLOSSARY OF COMMON ACRONYMS |

Following are definitions of terms or acronyms that may be used in this Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 (the “Quarterly Report”): |

|

Term or Acronym | | Definition |

AFUDC | | Allowance for funds used during construction |

AOCI | | Accumulated other comprehensive income (loss) |

ARO | | Asset retirement obligation |

ART | | Asset Retirement Trust |

ASLB | | Atomic Safety and Licensing Board |

CAA | | Clean Air Act |

CAIR | | Clean Air Interstate Rule |

CCR | | Coal combustion residuals |

CME | | Chicago Mercantile Exchange |

CO2 | | Carbon dioxide |

COL | | Combined construction and operating license |

COLA | | Cost-of-living adjustment |

CSAPR | | Cross-State Air Pollution Rule |

CT | | Combustion turbine unit |

CVA | | Credit valuation adjustment |

CY | | Calendar year |

DCP | | Deferred Compensation Plan |

DOE | | Department of Energy |

EPA | | Environmental Protection Agency |

ESPA | | Early Site Permit Application |

FASB | | Financial Accounting Standards Board |

FCM | | Futures Commission Merchant |

FERC | | Federal Energy Regulatory Commission |

FTP | | Financial Trading Program |

GAAP | | Accounting principles generally accepted in the United States of America |

GAO | | Government Accountability Office |

GHG | | Greenhouse gas |

GWh | | Gigawatt hour(s) |

IRP | | Integrated Resource Plan |

JSCCG | | John Sevier Combined Cycle Generation LLC |

kWh | | Kilowatt hour(s) |

LIBOR | | London Interbank Offered Rate |

LPC | | Local power company customer of TVA |

MATS | | Mercury and Air Toxics Standards |

MD&A | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

MISO | | Midcontinent Independent System Operator, Inc. |

mmBtu | | Million British thermal unit(s) |

MtM | | Mark-to-market |

MW | | Megawatt |

NAAQS | | National Ambient Air Quality Standards |

NAV | | Net asset value |

NDT | | Nuclear Decommissioning Trust |

NEPA | | National Environmental Policy Act |

NERC | | North American Electric Reliability Corporation |

NOx | | Nitrogen oxide |

|

| | |

NPDES | | National Pollutant Discharge Elimination System |

NRC | | Nuclear Regulatory Commission |

OCI | | Other comprehensive income (loss) |

PM | | Particulate matter |

QER | | Quadrennial Energy Review |

QTE | | Qualified technological equipment and software |

REIT | | Real Estate Investment Trust |

SCCG | | Southaven Combined Cycle Generation LLC |

SCRs | | Selective catalytic reduction systems |

SEC | | Securities and Exchange Commission |

SERP | | Supplemental Executive Retirement Plan |

SHLLC | | Southaven Holdco LLC |

SMR | | Small modular reactor(s) |

SO2 | | Sulfur dioxide |

TCWN | | Tennessee Clean Water Network |

TDEC | | Tennessee Department of Environment & Conservation |

TOU | | Time-of-use |

TVARS | | Tennessee Valley Authority Retirement System |

U.S. Treasury | | United States Department of the Treasury |

VIE | | Variable interest entity |

XBRL | | eXtensible Business Reporting Language |

FORWARD-LOOKING INFORMATION

This Quarterly Report contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," “project,” "plan," “predict," "assume," "forecast," "estimate," "objective,” "possible," "probably," "likely," "potential," "speculate," or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying the forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in the forward-looking statements. These factors include, among other things:

| |

• | New, amended, or existing laws, regulations, or administrative orders, including those related to environmental matters, and the costs of complying with these laws, regulations, and administrative orders; |

| |

• | The cost of complying with known, anticipated, and new emissions reduction requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective and result in their removal from service, perhaps permanently; |

| |

• | Actions taken, or inaction, by the U.S. government relating to the national debt ceiling or automatic spending cuts in government programs; |

| |

• | Costs and liabilities that are not anticipated in TVA’s financial statements for third-party claims, natural resource damages, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure as well as for environmental clean-up activities; |

| |

• | Addition or loss of customers by TVA or the local power company customers of TVA ("LPCs"); |

| |

• | Significant reductions in demand for electricity produced through non-renewable or centrally located generation sources which may result from, among other things, economic downturns, increased energy efficiency and conservation, increased utilization of distributed generation, and improvements in alternative generation and energy storage technologies; |

| |

• | Changes in customer preferences for energy produced from cleaner generation sources; |

| |

• | Significant delays, cost increases, or cost overruns associated with the construction and maintenance of generation or transmission assets; |

| |

• | Changes in the timing or amount of pension and health care obligations and related funding; |

| |

• | Increases in TVA's financial liabilities for decommissioning its nuclear facilities or retiring other assets; |

| |

• | Physical or cyber attacks on TVA's assets; |

| |

• | The outcome of legal or administrative proceedings; |

| |

• | The failure of TVA's generation, transmission, flood control, and related assets, including coal combustion residuals ("CCR") facilities, to operate as anticipated, resulting in lost revenues, damages, and other costs that are not reflected in TVA’s financial statements or projections; |

| |

• | Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred; |

| |

• | Catastrophic events such as fires, earthquakes, explosions, solar events, electromagnetic pulses, geomagnetic disturbances, droughts, floods, hurricanes, tornadoes, pandemics, wars, national emergencies, terrorist activities, and other similar events, especially if these events occur in or near TVA's service area; |

| |

• | Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, and damage to the property of others; |

| |

• | Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid; |

| |

• | Disruption of fuel supplies, which may result from, among other things, counterparty reliability, economic conditions, weather conditions, production or transportation difficulties, labor challenges, or environmental laws or regulations affecting TVA's fuel suppliers or transporters; |

| |

• | Purchased power price volatility and disruption of purchased power supplies; |

| |

• | Events which affect the supply of water for TVA's generation facilities; |

| |

• | Changes in TVA's determinations of the appropriate mix of generation assets; |

| |

• | Ineffectiveness of TVA's efforts at adapting its organization to an evolving marketplace and remaining cost competitive; |

| |

• | Inability to obtain, or loss of, regulatory approval for the construction or operation of assets; |

| |

• | The requirement or decision to make additional contributions to TVA's pension or other post-retirement benefit plans or to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART"); |

| |

• | Limitations on TVA's ability to borrow money which may result from, among other things, TVA's approaching or substantially reaching the limit on bonds, notes, and other evidences of indebtedness specified in the Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee (the “TVA Act”); |

| |

• | An increase in TVA's cost of capital which may result from, among other things, changes in the market for TVA's debt securities, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit; |

| |

• | Changes in the economy and volatility in financial markets; |

| |

• | Reliability and creditworthiness of counterparties; |

| |

• | Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, electricity, and emission allowances; |

| |

• | Changes in the market price of equity securities, debt securities, and other investments; |

| |

• | Changes in interest rates, currency exchange rates, and inflation rates; |

| |

• | Ineffectiveness of TVA's disclosure controls and procedures or its internal control over financial reporting; |

| |

• | Inability to eliminate identified deficiencies in TVA's systems, standards, controls, or corporate culture; |

| |

• | Inability to attract or retain a qualified workforce; |

| |

• | Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, and decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, and cause TVA to forego future construction at these or other facilities; |

| |

• | Loss of quorum of the TVA Board of Directors; and |

| |

• | Other unforeseeable events. |

See also Item 1A, Risk Factors, and Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations in TVA’s Annual Report on Form 10-K for the year ended September 30, 2016 (the “Annual Report”), and

Part I, Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations in this Quarterly Report for a discussion of factors that could cause actual results to differ materially from those in a forward-looking statement. New factors emerge from time to time, and it is not possible for TVA to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA’s business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made.

GENERAL INFORMATION

Fiscal Year

References to years (2017, 2016, etc.) in this Quarterly Report are to TVA’s fiscal years ending September 30. Years that are preceded by “CY” are references to calendar years.

Notes

References to “Notes” are to the Notes to Consolidated Financial Statements contained in Part I, Item 1, Financial Statements in this Quarterly Report.

Available Information

TVA's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, as well as all amendments to those reports, are available on TVA's web site, free of charge, as soon as reasonably practicable after such reports are electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). TVA's web site is www.tva.gov. Information contained on TVA’s web site shall not be deemed to be incorporated into, or to be a part of, this Quarterly Report. All TVA SEC reports are available to the public without charge from the web site maintained by the SEC at www.sec.gov.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(in millions) |

| | | | | | | | | | | | | | | |

| Three Months Ended June 30 | | Nine Months Ended June 30 |

| 2017 | | 2016 | | 2017 | | 2016 |

Operating revenues | | | | | | | |

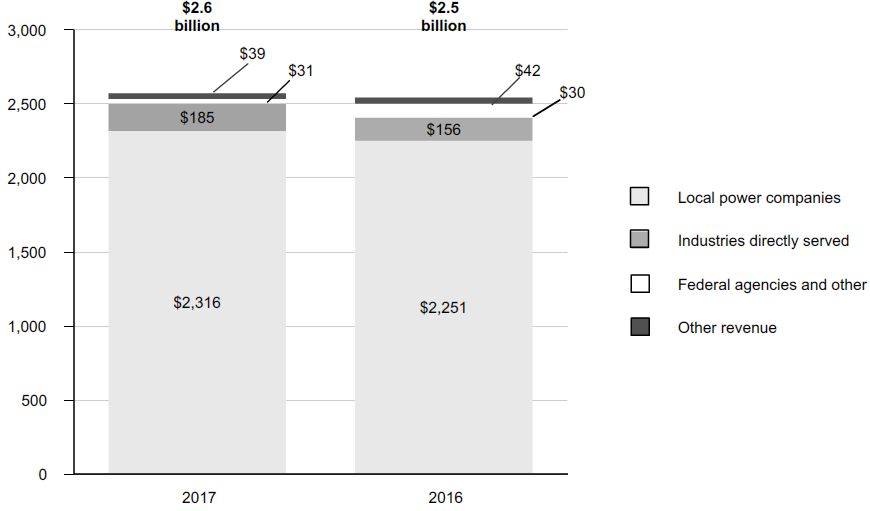

Revenue from sales of electricity | $ | 2,532 |

| | $ | 2,437 |

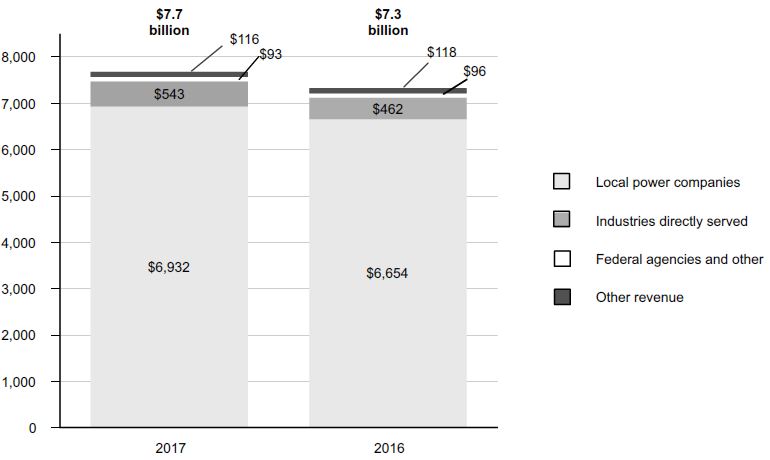

| | $ | 7,548 |

| | $ | 7,212 |

|

Other revenue | 39 |

| | 42 |

| | 116 |

| | 118 |

|

Total operating revenues | 2,571 |

| | 2,479 |

| | 7,664 |

| | 7,330 |

|

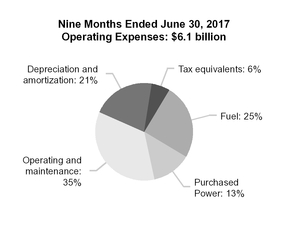

Operating expenses | |

| | |

| | |

| | |

|

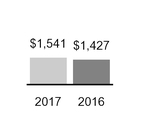

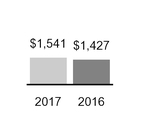

Fuel | 470 |

| | 463 |

| | 1,541 |

| | 1,427 |

|

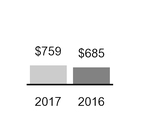

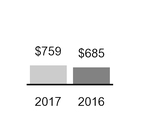

Purchased power | 273 |

| | 201 |

| | 759 |

| | 685 |

|

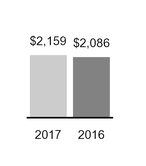

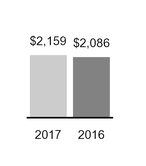

Operating and maintenance | 719 |

| | 677 |

| | 2,159 |

| | 2,086 |

|

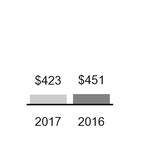

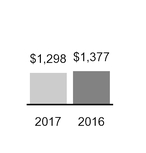

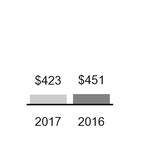

Depreciation and amortization | 423 |

| | 451 |

| | 1,298 |

| | 1,377 |

|

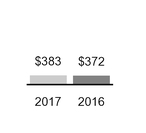

Tax equivalents | 125 |

| | 121 |

| | 383 |

| | 372 |

|

Total operating expenses | 2,010 |

| | 1,913 |

| | 6,140 |

| | 5,947 |

|

Operating income | 561 |

| | 566 |

| | 1,524 |

| | 1,383 |

|

Other income (expense), net | 12 |

| | 9 |

| | 39 |

| | 29 |

|

Interest expense | |

| | |

| | |

| | |

|

Interest expense | 340 |

| | 343 |

| | 1,017 |

| | 1,015 |

|

Allowance for funds used during construction | — |

| | (59 | ) | | — |

| | (175 | ) |

Net interest expense | 340 |

| | 284 |

| | 1,017 |

| | 840 |

|

Net income (loss) | $ | 233 |

| | $ | 291 |

| | $ | 546 |

| | $ | 572 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(in millions)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30 | | Nine Months Ended June 30 |

| 2017 | | 2016 | | 2017 | | 2016 |

| | | | | | | |

Net income (loss) | $ | 233 |

| | $ | 291 |

| | $ | 546 |

| | $ | 572 |

|

Other comprehensive income (loss) | | | | | | | |

Net unrealized gain (loss) on cash flow hedges | 14 |

| | (90 | ) | | 31 |

| | (144 | ) |

Reclassification to earnings from cash flow hedges | (29 | ) | | 63 |

| | (3 | ) | | 109 |

|

Total other comprehensive income (loss) | (15 | ) | | (27 | ) | | 28 |

| | (35 | ) |

Total comprehensive income (loss) | $ | 218 |

| | $ | 264 |

| | $ | 574 |

| | $ | 537 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

|

| | | | | | | |

ASSETS |

| June 30, 2017 |

| September 30, 2016 |

Current assets | |

| |

Cash and cash equivalents | $ | 301 |

| | $ | 300 |

|

Accounts receivable, net | 1,462 |

| | 1,747 |

|

Inventories, net | 1,151 |

| | 993 |

|

Regulatory assets | 413 |

| | 536 |

|

Other current assets | 86 |

| | 68 |

|

Total current assets | 3,413 |

| | 3,644 |

|

| | | |

Property, plant, and equipment | |

| | |

|

Completed plant | 58,366 |

| | 51,564 |

|

Less accumulated depreciation | (28,180 | ) | | (27,592 | ) |

Net completed plant | 30,186 |

| | 23,972 |

|

Construction in progress | 2,692 |

| | 8,458 |

|

Nuclear fuel | 1,373 |

| | 1,450 |

|

Capital leases | 164 |

| | 163 |

|

Total property, plant, and equipment, net | 34,415 |

| | 34,043 |

|

| | | |

Investment funds | 2,459 |

| | 2,257 |

|

| | | |

Regulatory and other long-term assets | |

| | |

|

Regulatory assets | 9,328 |

| | 10,164 |

|

Other long-term assets | 376 |

| | 386 |

|

Total regulatory and other long-term assets | 9,704 |

| | 10,550 |

|

| | | |

Total assets | $ | 49,991 |

| | $ | 50,494 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

|

| | | | | | | |

LIABILITIES AND PROPRIETARY CAPITAL |

| June 30, 2017 | | September 30, 2016 |

Current liabilities | | | |

Accounts payable and accrued liabilities | $ | 1,780 |

| | $ | 2,163 |

|

Accrued interest | 329 |

| | 363 |

|

Current portion of leaseback obligations | 61 |

| | 58 |

|

Current portion of energy prepayment obligations | 100 |

| | 100 |

|

Regulatory liabilities | 156 |

| | 154 |

|

Short-term debt, net | 1,005 |

| | 1,407 |

|

Current maturities of power bonds | 2,682 |

| | 1,555 |

|

Current maturities of long-term debt of variable interest entities | 35 |

| | 35 |

|

Current maturities of notes payable | 28 |

| | 27 |

|

Total current liabilities | 6,176 |

| | 5,862 |

|

| | | |

Other liabilities | | | |

Post-retirement and post-employment benefit obligations | 6,718 |

| | 6,929 |

|

Asset retirement obligations | 3,989 |

| | 3,840 |

|

Other long-term liabilities | 2,305 |

| | 2,776 |

|

Leaseback obligations | 348 |

| | 409 |

|

Energy prepayment obligations | 35 |

| | 110 |

|

Total other liabilities | 13,395 |

| | 14,064 |

|

| | | |

Long-term debt, net | | | |

Long-term power bonds, net | 20,226 |

| | 20,901 |

|

Long-term debt of variable interest entities, net | 1,182 |

| | 1,199 |

|

Long-term notes payable | 21 |

| | 48 |

|

Total long-term debt, net | 21,429 |

| | 22,148 |

|

Total liabilities | 41,000 |

| | 42,074 |

|

| | | |

Commitments and contingencies | | | |

| | | |

Proprietary capital | | | |

Power program appropriation investment | 258 |

| | 258 |

|

Power program retained earnings | 8,143 |

| | 7,594 |

|

Total power program proprietary capital | 8,401 |

| | 7,852 |

|

Nonpower programs appropriation investment, net | 574 |

| | 580 |

|

Accumulated other comprehensive income (loss) | 16 |

| | (12 | ) |

Total proprietary capital | 8,991 |

| | 8,420 |

|

| | | |

Total liabilities and proprietary capital | $ | 49,991 |

| | $ | 50,494 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the Nine Months Ended June 30

(in millions)

|

| | | | | | | |

| 2017 | | 2016 |

Cash flows from operating activities | | | |

Net income (loss) | $ | 546 |

| | $ | 572 |

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities | |

| | |

|

Depreciation and amortization (including amortization of debt issuance costs and premiums/discounts) | 1,332 |

| | 1,411 |

|

Amortization of nuclear fuel cost | 243 |

| | 205 |

|

Noncash retirement benefit expense | 253 |

| | 245 |

|

Prepayment credits applied to revenue | (75 | ) | | (75 | ) |

Fuel cost adjustment deferral | 76 |

| | (105 | ) |

Fuel cost tax equivalents | 1 |

| | (24 | ) |

Changes in current assets and liabilities | |

| | |

|

Accounts receivable, net | 286 |

| | 122 |

|

Inventories and other current assets, net | (93 | ) | | (11 | ) |

Accounts payable and accrued liabilities | (200 | ) | | (133 | ) |

Accrued interest | (34 | ) | | (43 | ) |

Regulatory assets costs | (27 | ) | | (24 | ) |

Pension contributions | (230 | ) | | (143 | ) |

Other, net | (99 | ) | | (119 | ) |

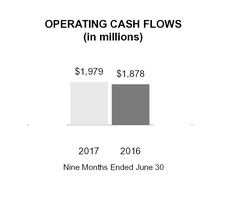

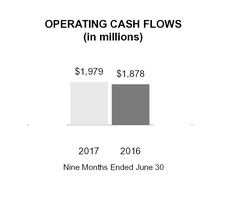

Net cash provided by operating activities | 1,979 |

| | 1,878 |

|

Cash flows from investing activities | |

| | |

|

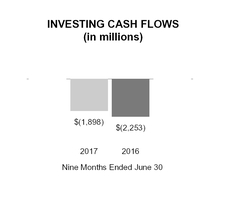

Construction expenditures | (1,672 | ) | | (2,072 | ) |

Nuclear fuel expenditures | (230 | ) | | (161 | ) |

Loans and other receivables | |

| | |

|

Advances | (10 | ) | | (5 | ) |

Repayments | 3 |

| | 5 |

|

Other, net | 11 |

| | (20 | ) |

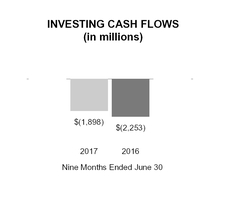

Net cash used in investing activities | (1,898 | ) | | (2,253 | ) |

Cash flows from financing activities | |

| | |

|

Long-term debt | |

| | |

|

Issues of power bonds | 999 |

| | — |

|

Redemptions and repurchases of power bonds | (558 | ) | | (35 | ) |

Redemptions of variable interest entities debt | (17 | ) | | (16 | ) |

Redemptions of notes payable | (26 | ) | | — |

|

Short-term debt issues (redemptions), net | (407 | ) | | 506 |

|

Payments on leases and leasebacks | (61 | ) | | (81 | ) |

Financing costs, net | (4 | ) | | — |

|

Payments to U.S. Treasury | (3 | ) | | (4 | ) |

Other, net | (3 | ) | | 6 |

|

Net cash provided by (used in) financing activities | (80 | ) | | 376 |

|

Net change in cash and cash equivalents | 1 |

| | 1 |

|

Cash and cash equivalents at beginning of period | 300 |

| | 300 |

|

Cash and cash equivalents at end of period | $ | 301 |

| | $ | 301 |

|

| | | |

Supplemental disclosures | | | |

Significant noncash transactions | | | |

Accrued capital and nuclear fuel expenditures | $ | 340 |

| | $ | 438 |

|

Capital lease obligations incurred | 10 |

| | 85 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Three Months Ended June 30, 2017 and 2016

(in millions)

|

| | | | | | | | | | | | | | | | | | | |

| Power Program Appropriation Investment | | Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated Other Comprehensive Income (Loss) from Net Gains (Losses) on Cash Flow Hedges | | Total |

Balance at March 31, 2016 | $ | 258 |

| | $ | 6,640 |

| | $ | 585 |

| | $ | (10 | ) | | $ | 7,473 |

|

Net income (loss) | — |

| | 293 |

| | (2 | ) | | — |

| | 291 |

|

Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (27 | ) | | (27 | ) |

Return on power program appropriation investment | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) |

Balance at June 30, 2016 | $ | 258 |

| | $ | 6,932 |

| | $ | 583 |

| | $ | (37 | ) | | $ | 7,736 |

|

| | | | | | | | | |

Balance at March 31, 2017 | $ | 258 |

| | $ | 7,908 |

| | $ | 576 |

| | $ | 31 |

| | $ | 8,773 |

|

Net income (loss) | — |

| | 235 |

| | (2 | ) | | — |

| | 233 |

|

Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (15 | ) | | (15 | ) |

Balance at June 30, 2017

| $ | 258 |

| | $ | 8,143 |

| | $ | 574 |

| | $ | 16 |

| | $ | 8,991 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Nine Months Ended June 30, 2017 and 2016

(in millions)

|

| | | | | | | | | | | | | | | | | | | |

| Power Program Appropriation Investment | | Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated Other Comprehensive Income (Loss) from Net Gains (Losses) on Cash Flow Hedges | | Total |

Balance at September 30, 2015 | $ | 258 |

| | $ | 6,357 |

| | $ | 590 |

| | $ | (2 | ) | | $ | 7,203 |

|

Net income (loss) | — |

| | 579 |

| | (7 | ) | | — |

| | 572 |

|

Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (35 | ) | | (35 | ) |

Return on power program appropriation investment | — |

| | (4 | ) | | — |

| | — |

| | (4 | ) |

Balance at June 30, 2016 | $ | 258 |

| | $ | 6,932 |

| | $ | 583 |

| | $ | (37 | ) | | $ | 7,736 |

|

| | | | | | | | | |

Balance at September 30, 2016 | $ | 258 |

| | $ | 7,594 |

| | $ | 580 |

| | $ | (12 | ) | | $ | 8,420 |

|

Net income (loss) | — |

| | 552 |

| | (6 | ) | | — |

| | 546 |

|

Total other comprehensive income (loss) | — |

| | — |

| | — |

| | 28 |

| | 28 |

|

Return on power program appropriation investment | — |

| | (3 | ) | | — |

| | — |

| | (3 | ) |

Balance at June 30, 2017

| $ | 258 |

| | $ | 8,143 |

| | $ | 574 |

| | $ | 16 |

| | $ | 8,991 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions except where noted)

|

| | | |

Note No. | Page No. |

| | Nature of Operations and Summary of Significant Accounting Policies | |

| | | |

| | | |

| | | 17 |

| | | |

| | | |

7 | | Variable Interest Entities | |

8 | | | |

9 | | | |

10 | | Debt and Other Obligations | |

11 | | Accumulated Other Comprehensive Income (Loss) | |

12 | | | |

13 | | | |

14 | | | |

15 | | | |

16 | | | |

17 | | Subsequent Events | |

1. Nature of Operations and Summary of Significant Accounting Policies

General

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by legislation enacted by the U.S. Congress in response to a request by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA's service area in the southeastern United States, and sell the electricity generated at the facilities TVA operates.

Today, TVA operates the nation's largest public power system and supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of over nine million people.

TVA also manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system and public lands to provide recreational opportunities, adequate water supply, improved water quality, cultural and natural resource protection, and economic development.

The power program has historically been separate and distinct from the stewardship programs. It is required to be self-supporting from power revenues and proceeds from power financings, such as proceeds from the issuance of bonds, notes, or other evidences of indebtedness ("Bonds"). Although TVA does not currently receive congressional appropriations, it is required to make annual payments to the United States Department of the Treasury ("U.S. Treasury") as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"). In the 1998 Energy and Water Development Appropriations Act, Congress directed TVA to fund essential stewardship activities related to its management of the Tennessee River system and nonpower or stewardship properties with power revenues in the event that there were insufficient appropriations or other available funds to pay for such activities in any fiscal year. Congress has not provided any appropriations to TVA to fund such activities since 1999. Consequently, during 2000, TVA began paying for essential stewardship activities primarily with power revenues, with the remainder funded with user fees and other forms of revenues derived in connection with those activities. The activities related to stewardship properties do not meet the criteria of an operating segment under accounting principles generally accepted in the United States of America ("GAAP"). Accordingly, these assets and properties are included as part of the power program, TVA's only operating segment.

Power rates are established by the TVA Board of Directors (the "TVA Board") as authorized by the Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee (the “TVA Act”). The TVA Act requires TVA to charge rates for power that will produce gross revenues sufficient to provide funds for operation, maintenance, and administration of its power

system; payments to states and counties in lieu of taxes ("tax equivalents"); debt service on outstanding indebtedness; payments to the U.S. Treasury in repayment of and as a return on the Power Program Appropriation Investment; and such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding Bonds in advance of maturity, additional reduction of the Power Program Appropriation Investment, and other purposes connected with TVA's power business. In setting TVA's rates, the TVA Board is charged by the TVA Act to have due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible. Rates set by the TVA Board are not subject to review or approval by any state or other federal regulatory body.

Fiscal Year

TVA's fiscal year ends September 30. Years (2017, 2016, etc.) refer to TVA's fiscal years unless they are preceded by “CY,” in which case the references are to calendar years.

Cost-Based Regulation

Since the TVA Board is authorized by the TVA Act to set rates for power sold to its customers, TVA is self-regulated. Additionally, TVA's regulated rates are designed to recover its costs. Based on current projections, TVA believes that rates, set at levels that will recover TVA's costs, can be charged and collected. As a result of these factors, TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. TVA assesses whether the regulatory assets are probable of future recovery by considering factors such as applicable regulatory changes, potential legislation, and changes in technology. Based on these assessments, TVA believes the existing regulatory assets are probable of future recovery. This determination reflects the current regulatory and political environment and is subject to change in the future. If future recovery of regulatory assets ceases to be probable, or any of the other factors described above cease to be applicable, TVA would no longer be considered to be a regulated entity and would be required to write off these costs. All regulatory asset write offs would be required to be recognized in earnings in the period in which future recovery ceases to be probable.

Basis of Presentation

TVA prepares its consolidated interim financial statements in conformity with GAAP for consolidated interim financial information. Accordingly, TVA's consolidated interim financial statements do not include all of the information and notes required by GAAP for annual financial statements. As such, they should be read in conjunction with the audited financial statements for the year ended September 30, 2016, and the notes thereto, which are contained in TVA's Annual Report on Form 10-K for the year ended September 30, 2016 (the “Annual Report”). In the opinion of management, all adjustments (consisting of items of a normal recurring nature) considered necessary for fair presentation are included in the consolidated interim financial statements.

The accompanying consolidated interim financial statements, which have been prepared in accordance with GAAP, include the accounts of TVA, two wholly-owned direct subsidiaries, and three variable interest entities ("VIE") of which TVA is the primary beneficiary. See Note 7. Intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements requires TVA to estimate the effects of various matters that are inherently uncertain as of the date of the consolidated financial statements. Although the consolidated financial statements are prepared in conformity with GAAP, TVA is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the amounts of revenues and expenses reported during the reporting period. Each of these estimates varies in regard to the level of judgment involved and its potential impact on TVA's financial results. Estimates are considered critical either when a different estimate could have reasonably been used, or where changes in the estimate are reasonably likely to occur from period to period, and such use or change would materially impact TVA's financial condition, results of operations, or cash flows.

Reclassifications

Certain historical amounts have been reclassified in the Consolidated Statement of Cash Flows for the nine months ended June 30, 2017. Amounts previously presented in Cash flows from operating activities as Insurance recoveries of $7 million for the nine months ended June 30, 2016, are currently reported in Other, net.

Allowance for Uncollectible Accounts

The allowance for uncollectible accounts reflects TVA's estimate of probable losses inherent in its accounts and loans receivable balances. TVA determines the allowance based on known accounts, historical experience, and other currently available information including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements. It also reflects TVA's corporate credit department's assessment of the financial condition of customers and the credit quality of the receivables.

The allowance for uncollectible accounts receivable was $1 million at both June 30, 2017, and September 30, 2016. Additionally, loans receivable of $169 million and $141 million at June 30, 2017, and September 30, 2016, respectively, are included in Accounts receivable, net and Other long-term assets, for the current and long-term portions, respectively, and reported net of allowances for uncollectible accounts of $8 million at June 30, 2017, and September 30, 2016.

Pre-Commercial Plant Operations

As part of the process of completing the construction of a generating unit, the electricity produced is used to serve the

demands of the electric system. TVA estimates revenue from such pre-commercial generation based on the guidance provided by Federal Energy Regulatory Commission ("FERC") regulations. Watts Bar Nuclear Plant ("Watts Bar") Unit 2 commenced pre-commercial plant operations on June 3, 2016, and commercial operations began on October 19, 2016. In addition, the Paradise Combined Cycle Plant commenced pre-commercial plant operations on October 10, 2016, and commercial operations began on April 7, 2017. Estimated revenue of $20 million related to these projects was capitalized to offset project costs and is included in Revenue from sales of electricity as a contra-revenue amount on the consolidated statement of operations for the nine months ended June 30, 2017. No such revenue was capitalized during the three months ended June 30, 2017. TVA also capitalized related fuel costs for these two construction projects of approximately $13 million during the nine months ended June 30, 2017.

Depreciation

Depreciation expense was $322 million and $353 million for the three months ended June 30, 2017 and 2016, respectively, and $994 million and $1.1 billion for the nine months ended June 30, 2017 and 2016, respectively. Depreciation rates are determined based on an external depreciation study. TVA concluded and implemented the results of a new study effective October 1, 2016. Implementation of the new depreciation rates resulted in an estimated decrease of approximately $56 million and $168 million in depreciation and amortization expense during the three and nine months ended June 30, 2017, respectively, as compared to the same periods of the prior year. This estimated decrease represents the impact of implementing the new depreciation rates only and does not include any impact of other possible changes, including additions to or retirements of net completed plant that occurred during the same period. The decrease in depreciation expense as a result of the new depreciation rates is primarily attributable to the external depreciation study's incorporation of TVA's current generation plans, which resulted in changes in retirement date assumptions for coal-fired plants, and changes in the estimated service lives for transmission assets.

Allowance for Funds Used During Construction

TVA may capitalize interest on eligible projects as allowance for funds used during construction ("AFUDC"), based on the average interest rate of TVA’s outstanding debt. The allowance is applicable to construction in progress related to eligible projects with (1) an expected total project cost of $1.0 billion or more, and (2) an estimated construction period of at least three years in duration. TVA capitalized $59 million and $175 million of AFUDC for the three and nine months ended June 30, 2016, respectively, related to the Watts Bar Unit 2 project which went into service in October 2016. No AFUDC was capitalized for comparable periods in the current year.

Blended Low-Enriched Uranium Program

Under the blended low-enriched uranium ("BLEU") program, TVA, the U.S. Department of Energy ("DOE"), and certain nuclear fuel contractors have entered into agreements providing for the DOE's surplus of enriched uranium to be blended with other uranium down to a level that allows the blended uranium to be fabricated into fuel that can be used in nuclear power plants. Under the terms of an interagency agreement between TVA and the DOE, in exchange for supplying highly enriched uranium materials to the appropriate third-party fuel processors for processing into usable BLEU fuel for TVA, the DOE participates to a degree in the savings generated by TVA’s use of this blended nuclear fuel. Over the life of the program, TVA projects that the DOE’s share of savings generated by TVA’s use of this blended nuclear fuel could result in payments to the DOE of as much as $160 million. TVA accrues an obligation with each BLEU reload batch related to the portion of the ultimate future payments estimated to be attributable to the BLEU fuel currently in use. At June 30, 2017, TVA had paid out approximately $151 million for this program, and the obligation recorded was $9 million.

2. Impact of New Accounting Standards and Interpretations

The following accounting standard update issued by the Financial Accounting Standards Board ("FASB") was adopted by TVA during 2017. |

| |

Consolidation |

Description | This guidance amends the consolidation analysis for VIEs as well as voting interest entities. The standard reduces the number of consolidation models through the elimination of the indefinite deferral for certain entities that was previously allowed and places more emphasis on risk of loss when determining a controlling financial interest. This guidance allows for either a full retrospective or a modified retrospective application.

|

Effective Date for TVA | October 1, 2016 |

Effect on the Financial Statements or Other Significant Matters | The adoption of the standard did not materially impact TVA's financial condition, results of operations, or cash flows. |

The following accounting standards have been issued but as of June 30, 2017, were not effective and had not been adopted by TVA.

|

| |

Defined Benefit Costs |

Description | This guidance changes how information about defined benefit costs for pension plans and other post-retirement benefit plans is presented in employer financial statements. The guidance requires employers that present a measure of operating income in their statement of income to include only the service cost component of net periodic pension cost and net periodic postretirement benefit cost in operating expenses (together with other employee compensation costs). The other components of net benefit cost, including amortization of prior service cost/credit and settlement and curtailment effects, are to be included in nonoperating expenses. Additionally, the guidance stipulates that only the service cost component of net benefit cost is eligible for capitalization in assets. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2018. While early adoption is permitted, TVA does not currently plan to adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | TVA is currently evaluating the potential impact of these changes on its consolidated financial statements and related disclosures.

|

|

Revenue Recognition |

Description | In 2014, the FASB issued new guidance related to revenue from contracts with customers. The guidance, including subsequent amendments, replaces the existing accounting standard and industry specific guidance for revenue recognition with a five-step model for recognizing and measuring revenue from contracts with customers. The underlying principle of the guidance is to recognize revenue to depict the transfer of goods or services to customers at the amount expected to be collected. The objective of the new standard is to provide a single, comprehensive revenue recognition model for all contracts with customers to improve comparability within industries and across industries. The new standard also requires enhanced disclosures regarding the nature, amount, timing, and uncertainty of revenue and the related cash flows arising from contracts with customers. At adoption, companies must also select a transition method to be applied either retrospectively to each prior reporting period presented or retrospectively with a cumulative effect adjustment to retained earnings at the date of initial adoption. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2018. While early adoption is permitted, TVA does not currently plan to adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | While TVA expects most of its revenue to be included in the scope of the new guidance, it has not completed its evaluation of all such arrangements. TVA’s current efforts in evaluating the impact of the standard are focused on scoping of revenue streams and evaluating contracts with local power companies, which represent the majority of TVA's revenues. TVA is also conducting ongoing evaluations of how the new guidance impacts other transactions, including sales to directly served industrial customers, sales to federal agencies, purchase power agreements, contributions in aid of construction, fuel cost adjustments, and other revenue streams. In addition, the power and utilities industry is currently addressing certain industry-specific issues which have not yet been finalized. As the ultimate impact of the new standard has not yet been determined, TVA has not yet elected its transition method. |

|

Inventory Valuation |

Description | This guidance changes the model used for the subsequent measurement of inventory from the previous lower of cost or market model to the lower of cost or net realizable value. The guidance applies only to inventory valued using methods other than last-in, first out or the retail inventory method (for example, first-in, first-out or average cost). This amendment is intended to simplify the subsequent measurement of inventory. When the standard becomes effective, it includes interim periods within the fiscal year that begins on that date and is required to be applied prospectively. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2017. While early adoption is permitted, TVA does not currently plan to adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | TVA does not expect the adoption of this standard to have a material impact on TVA's financial condition, results of operations, or cash flows. |

|

| |

Lease Accounting |

Description | This guidance changes the provisions of recognition in both the lessee and lessor accounting models. The standard requires entities that lease assets — referred to as "lessees" — to recognize on the balance sheet the assets and liabilities for the rights and obligations created by leases with terms of more than 12 months. The recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification as a finance (similar to current capital leases) or operating lease. However, unlike current lease accounting rules — which require only capital leases to be recognized on the balance sheet — the new standard will require both types of leases to be recognized on the balance sheet. Operating leases will result in straight-line expense, while finance leases will result in recognition of interest on the lease liability separate from amortization expense. The accounting for the owner of the assets leased by the lessee — also known as lessor accounting — will remain largely unchanged from current lease accounting rules. The standard allows for certain practical expedients to be elected related to lease term determination, separating lease and non-lease elements, reassessment of existing leases, and short-term leases. When the standard becomes effective, it will include interim periods within that fiscal year, and will be required to be applied using a modified retrospective transition. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2019. While early adoption is permitted, TVA does not currently plan to adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | TVA is currently evaluating the potential impact of these changes on its consolidated financial statements and related disclosures. TVA expects the new standard to impact financial position as adoption is expected to increase the amount of assets and liabilities recognized on TVA’s consolidated balance sheets. TVA expects the new standard to have no material impact on results of operations or cash flows. TVA plans to elect certain of the practical expedients included in the new standard. TVA is also continuing to monitor unresolved industry implementation issues, including items related to renewables and purchased power agreements, easements and rights-of-way, and will analyze the related impacts to lease accounting. |

|

Financial Instruments |

Description | This guidance applies to the recognition and measurement of financial assets and liabilities. The standard requires all equity investments to be measured at fair value with changes in the fair value recognized through net income (other than those accounted for under the equity method of accounting or those that result in consolidation of the investee). The standard also amends presentation requirements related to certain changes in the fair value of a liability and eliminates certain disclosure requirements of significant assumptions for financial instruments measured at amortized cost on the balance sheet. Public entities must apply the amendments by means of a cumulative-effect adjustment to the balance sheet as of the beginning of the fiscal year of adoption. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2018. Early adoption is not permitted unless specific early adoption guidance is applied. TVA does not currently plan to adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | TVA currently measures all of its equity investments (other than those that result in the consolidation of the investee) at fair value, with changes in the fair value recognized through net income. The TVA Board has authorized the use of regulatory accounting for changes in fair value of certain equity investments, and as a result, those changes in fair value are deferred as regulatory assets or liabilities. TVA currently discloses significant assumptions around its estimates of fair value for financial instruments carried at amortized cost on its consolidated balance sheet. TVA is currently evaluating the potential impact of the changes in this new guidance on its consolidated financial statements and related disclosures. |

|

Derivatives and Hedging |

Description | This guidance clarifies the requirements for assessing whether contingent call or put options that can accelerate the payment of principal on debt instruments are clearly and closely related to their debt hosts. An entity performing the assessment under the amendments in this update is required to assess the embedded call or put options solely in accordance with a four-step decision sequence. When the standard becomes effective, it will include interim periods within that fiscal year, and will be required to be applied using a modified retrospective transition. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2017. While early adoption is permitted, TVA does not currently plan to adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | TVA has two issues of Putable Automatic Rate Reset Securities (“PARRS”) outstanding. After a fixed-rate period of five years, the coupon rate on the PAARS may automatically be reset downward under certain market conditions on an annual basis. The coupon rate reset on the PARRS is based on a calculation. If the coupon rate is going to be reset, holders may request, for a limited period of time, redemption of the Bonds at par value, with repayment of principal on the reset date. This put option is otherwise not available. For both series of PARRS, the coupon rate will reset downward on the reset date if the rate calculated is below the then-current coupon rate on the Bond. TVA plans to assess whether these contingent put options that can accelerate the payment of principal on the PARRS continue to be clearly and closely related to their debt hosts under the new guidance. TVA plans to assess the put options in accordance with the four-step decision sequence clarified in the guidance. While a preliminary assessment indicates that TVA does not believe the new guidance will impact its current assessment, TVA will continue to evaluate the potential impact of the new guidance on its consolidated balance sheet. |

3. Accounts Receivable, Net

Accounts receivable primarily consist of amounts due from customers for power sales. The table below summarizes the types and amounts of TVA’s accounts receivable:

|

| | | | | | | |

Accounts Receivable, Net |

| At June 30, 2017 | | At September 30, 2016 |

Power receivables | $ | 1,390 |

| | $ | 1,637 |

|

Other receivables | 73 |

| | 111 |

|

Allowance for uncollectible accounts | (1 | ) | | (1 | ) |

Accounts receivable, net | $ | 1,462 |

| | $ | 1,747 |

|

4. Inventories, Net

The table below summarizes the types and amounts of TVA’s inventories:

|

| | | | | | | |

Inventories, Net |

| At June 30, 2017 | | At September 30, 2016 |

Materials and supplies inventory | $ | 756 |

| | $ | 673 |

|

Fuel inventory | 426 |

| | 345 |

|

Emission allowance inventory, net | 14 |

| | 14 |

|

Allowance for inventory obsolescence | (45 | ) | | (39 | ) |

Inventories, net | $ | 1,151 |

| | $ | 993 |

|

5. Other Long-Term Assets

The table below summarizes the types and amounts of TVA’s other long-term assets:

|

| | | | | | | |

Other Long-Term Assets |

| At June 30, 2017 | | At September 30, 2016 |

Loans and other long-term receivables, net | $ | 165 |

| | $ | 136 |

|

EnergyRight® receivables | 102 |

| | 112 |

|

Prepaid capacity payments | 36 |

| | 42 |

|

Commodity contract derivative assets | 1 |

| | 3 |

|

Other | 72 |

| | 93 |

|

Other long-term assets | $ | 376 |

| | $ | 386 |

|

In association with the EnergyRight® Solutions program, local power company customers of TVA ("LPCs") offer financing to end-use customers for the purchase of energy-efficient equipment. Depending on the nature of the energy-efficiency project, loans may have a maximum term of five years or ten years. TVA purchases the resulting loans receivable from its LPCs. The loans receivable are then transferred to a third-party bank with which TVA has agreed to repay in full any loan receivable that has been in default for 180 days or more or that TVA has determined is uncollectible. Given this continuing involvement, TVA accounts for the transfer of the loans receivable as secured borrowings. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA’s consolidated balance sheets. As of June 30, 2017, and September 30, 2016, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was approximately $26 million and $29 million, respectively. See Note 8 for information regarding the associated financing obligation.

6. Regulatory Assets and Liabilities

Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferrals of gains that will be credited to customers in future periods. Components of regulatory assets and regulatory liabilities are summarized in the table below:

|

| | | | | | | |

Regulatory Assets and Liabilities |

| At June 30, 2017 | | At September 30, 2016 |

Current regulatory assets | | | |

Deferred nuclear generating units | $ | 237 |

| | $ | 237 |

|

Unrealized losses on commodity derivatives | 98 |

| | 122 |

|

Fuel cost adjustment receivable | 22 |

| | 98 |

|

Environmental agreements | 10 |

| | 34 |

|

Environmental cleanup costs - Kingston ash spill | 43 |

| | 42 |

|

Other current regulatory assets | 3 |

| | 3 |

|

Total current regulatory assets | 413 |

| | 536 |

|

| | | |

Non-current regulatory assets | |

| | |

|

Deferred pension costs and other post-retirement benefits costs | 5,213 |

| | 5,385 |

|

Unrealized losses on interest rate derivatives | 1,102 |

| | 1,547 |

|

Nuclear decommissioning costs | 860 |

| | 938 |

|

Deferred nuclear generating units | 814 |

| | 850 |

|

Non-nuclear decommissioning costs | 789 |

| | 819 |

|

Environmental cleanup costs - Kingston ash spill | 273 |

| | 299 |

|

Unrealized losses on commodity derivatives | 22 |

| | 56 |

|

Environmental agreements | 14 |

| | 18 |

|

Other non-current regulatory assets | 241 |

| | 252 |

|

Total non-current regulatory assets | 9,328 |

| | 10,164 |

|

Total regulatory assets | $ | 9,741 |

| | $ | 10,700 |

|

| | | |

Current regulatory liabilities | |

| | |

|

Fuel cost adjustment tax equivalents | $ | 149 |

| | $ | 148 |

|

Unrealized gains on commodity derivatives | 7 |

| | 6 |

|

Total current regulatory liabilities | 156 |

| | 154 |

|

| | | |

Non-current regulatory liabilities | |

| | |

|

Unrealized gains on commodity derivatives | — |

| | 3 |

|

Total regulatory liabilities | $ | 156 |

| | $ | 157 |

|

Deferred Nuclear Generation Units. On November 14, 2016, following a public auction, TVA entered into a contract to sell substantially all of the Bellefonte Nuclear Plant ("Bellefonte") site for $111 million. The net book value of the Bellefonte assets to be sold and the related asset retirement costs are collectively $121 million and are included in Regulatory asset — Deferred nuclear generating units on TVA’s Consolidated Balance Sheet at June 30, 2017, as approved by the TVA Board. TVA received $22 million on November 14, 2016, which is recorded as a long-term liability on TVA’s Consolidated Balance Sheet at June 30, 2017, with the remaining $89 million due at closing. The buyer has up to two years from November 14, 2016, to close on the property. The closing is subject to, among other conditions, a determination by TVA's Chief Executive Officer that potential environmental impacts have been appropriately addressed or are acceptable. Proceeds received from the sale will be recorded as a reduction to the regulatory asset upon closing and will reduce amounts collected in future rates. Any subsequent losses resulting from the disposition or impairment of Bellefonte will be recovered in future rates until fully recovered based upon the TVA Board-approved recovery of the Regulatory asset — Deferred nuclear generating units in future rates at an amount of $237 million per year until fully recovered.

7. Variable Interest Entities

A VIE is an entity that either (i) has insufficient equity to permit the entity to finance its activities without additional subordinated financial support or (ii) has equity investors who lack the characteristics of owning a controlling financial interest. When TVA determines that it has a variable interest in a variable interest entity, a qualitative evaluation is performed to assess which interest holders have the power to direct the activities that most significantly impact the economic performance of the entity and have the obligation to absorb losses or receive benefits that could be significant to the entity. The evaluation considers the purpose and design of the business, the risks that the business was designed to create and pass along to other entities, the activities of the business that can be directed and which party can direct them, and the expected relative impact of those activities on the economic performance of the business through its life. TVA has the power to direct the activities of an entity when it has the ability to make key operating and financing decisions, including, but not limited to, capital investment and the issuance of debt. Based on the evaluation of these criteria, TVA has determined it is the primary beneficiary of three entities and as such is required to account for the VIEs on a consolidated basis.

John Sevier VIEs

In 2012, TVA entered into a $1.0 billion construction management agreement and lease financing arrangement with John Sevier Combined Cycle Generation LLC ("JSCCG") for the completion and lease by TVA of the John Sevier Combined Cycle Facility ("John Sevier CCF"). JSCCG is a special single-purpose limited liability company formed in January 2012 to finance the John Sevier CCF through a $900 million secured note issuance (the “JSCCG notes”) and the issuance of $100 million of membership interests subject to mandatory redemption. The membership interests were purchased by John Sevier Holdco LLC ("Holdco"). Holdco is a special single-purpose entity, also formed in January 2012, established to acquire and hold the membership interests in JSCCG. A non-controlling interest in Holdco is held by a third party through nominal membership interests, to which none of the income, expenses, and cash flows are allocated.

The membership interests held by Holdco in JSCCG were purchased with proceeds from the issuance of $100 million of secured notes (the “Holdco notes") and are subject to mandatory redemption pursuant to a schedule of amortizing, semi-annual payments due each January 15 and July 15, with a final payment due in January 2042. The payment dates for the mandatorily redeemable membership interests are the same as those of the Holdco notes. The sale of the JSCCG notes, the membership interests in JSCCG, and the Holdco notes closed in January 2012. The JSCCG notes are secured by TVA’s lease payments, and the Holdco notes are secured by Holdco's investment in, and amounts receivable from, JSCCG. TVA’s lease payments to JSCCG are equal to and payable on the same dates as JSCCG’s and Holdco’s semi-annual debt service payments. In addition to the lease payments, TVA pays administrative and miscellaneous expenses incurred by JSCCG and Holdco. Certain agreements related to this transaction contain default and acceleration provisions.

Southaven VIE

In 2013, TVA entered into a $400 million lease financing arrangement with Southaven Combined Cycle Generation LLC ("SCCG") for the lease by TVA of the Southaven Combined Cycle Facility ("Southaven CCF"). SCCG is a special single-purpose limited liability company formed in June 2013 to finance the Southaven CCF through a $360 million secured notes issuance (the “SCCG notes”) and the issuance of $40 million of membership interests subject to mandatory redemption. The membership interests were purchased by Southaven Holdco LLC ("SHLLC"). SHLLC is a special single-purpose entity, also formed in June 2013, established to acquire and hold the membership interests in SCCG. A non-controlling interest in SHLLC is held by a third party through nominal membership interests, to which none of the income, expenses, and cash flows of SHLLC are allocated.

The membership interests held by SHLLC were purchased with proceeds from the issuance of $40 million of secured notes (the "SHLLC notes") and are subject to mandatory redemption pursuant to a schedule of amortizing, semi-annual payments due each February 15 and August 15, with a final payment due on August 15, 2033. The payment dates for the mandatorily redeemable membership interests are the same as those of the SHLLC notes and the payment amounts are sufficient to provide returns on, as well as returns of, capital until the investment has been repaid to SHLLC in full. The rate of return on investment to SHLLC is 7.0 percent, which is reflected as interest expense in the consolidated statements of operations. SHLLC is required to pay a pre-determined portion of the return on investment to Seven States Southaven, LLC on each lease payment date as agreed in SHLLC's formation documents (the "Seven States Return"). The current and long-term portions of the Membership interests of VIE subject to mandatory redemption are included in Accounts payable and accrued liabilities and Other long-term liabilities, respectively.

The payment dates for the mandatorily redeemable membership interests are the same as those of the SHLLC notes. The SCCG notes are secured by TVA’s lease payments, and the SHLLC notes are secured by SHLLC’s investment in, and amounts receivable from, SCCG. TVA’s lease payments to SCCG are payable on the same dates as SCCG’s and SHLLC’s semi-annual debt service payments and are equal to the sum of (i) the amount of SCCG’s semi-annual debt service payments, (ii) the amount of SHLLC’s semi-annual debt service payments, and (iii) the amount of the Seven States Return. In addition to the lease payments, TVA pays administrative and miscellaneous expenses incurred by SCCG and SHLLC. Certain agreements related to this transaction contain default and acceleration provisions.

In the event that TVA were to choose to exercise an early buy out feature of the Southaven Facility Lease, in part or in whole, TVA must pay to SCCG amounts sufficient for SCCG to repay or partially repay on a pro rata basis the membership interests held by SHLLC, including any outstanding investment amount plus accrued but unpaid return. TVA also has the right, at any time and without any early redemption of the other portions of the Southaven Facility Lease payments due to SCCG, to fully repay SHLLC's investment, upon which repayment SHLLC will transfer the membership interests to a designee of TVA.

Impact on Consolidated Financial Statements

The financial statement items attributable to carrying amounts and classifications of JSCCG, Holdco, and SCCG as of June 30, 2017, and September 30, 2016, as reflected in the consolidated balance sheets are as follows:

|

| | | | | | | |

Summary of Impact of VIEs on Consolidated Balance Sheets |

| At June 30, 2017 | | At September 30, 2016 |

Current liabilities | | | |

|

Accrued interest | $ | 26 |

| | $ | 11 |

|

Accounts payable and accrued liabilities | 2 |

| | 2 |

|

Current maturities of long-term debt of variable interest entities | 35 |

| | 35 |

|

Total current liabilities | 63 |

| | 48 |

|

Other liabilities | | | |

Other long-term liabilities | 31 |

| | 33 |

|

Long-term debt, net | | | |

Long-term debt of variable interest entities, net | 1,182 |

| | 1,199 |

|

Total liabilities | $ | 1,276 |

| | $ | 1,280 |

|

Interest expense of $15 million for the three months ended both June 30, 2017 and 2016 and $45 million and $46 million for the nine months ended June 30, 2017 and 2016, respectively, is included in the Consolidated Statements of Operations related to debt of variable interest entities and membership interests of variable interest entities subject to mandatory redemption.

Creditors of the VIEs have no recourse to the general credit of TVA. TVA does not have any obligations to provide financial support to the VIEs other than as prescribed in the terms of the agreements related to these transactions.

8. Other Long-Term Liabilities

Other long-term liabilities consist primarily of liabilities related to certain derivative instruments as well as liabilities under agreements related to compliance with certain environmental regulations (see Note 16 — Legal Proceedings — Environmental Agreements). The table below summarizes the types and amounts of Other long-term liabilities:

|

| | | | | | | |

Other Long-Term Liabilities |

| At June 30, 2017 | | At September 30, 2016 |

Interest rate swap liabilities | $ | 1,492 |

| | $ | 1,938 |

|

Capital lease obligations | 184 |

| | 177 |

|

Currency swap liabilities | 131 |

| | 162 |

|

EnergyRight® financing obligation | 118 |

| | 130 |

|

Membership interests of VIE subject to mandatory redemption | 31 |

| | 33 |

|

Commodity contract derivative liabilities | 22 |

| | 49 |

|

Environmental agreements liability | 14 |

| | 18 |

|

Other | 313 |

| | 269 |

|

Total other long-term liabilities | $ | 2,305 |

| | $ | 2,776 |

|

EnergyRight® Financing Obligation. TVA purchases certain loans receivable from its LPCs in association with the EnergyRight® Solutions program. The current and long-term portions of the resulting financing obligation are reported in Accounts payable and accrued liabilities and Other long-term liabilities, respectively, on TVA’s consolidated balance sheets. As of June 30, 2017, and September 30, 2016, the carrying amount of the financing obligation reported in Accounts payable and accrued liabilities was approximately $30 million and $33 million, respectively. See Note 5 for information regarding the associated loans receivable and for details regarding the EnergyRight® Solutions program.

9. Asset Retirement Obligations

During the nine months ended June 30, 2017, TVA's total asset retirement obligation ("ARO") liability increased $80 million as a result of revisions in estimates and periodic accretion, partially offset by settlement projects that were conducted during these periods. The nuclear and non-nuclear accretion expense was deferred as regulatory assets. During the nine months ended June 30, 2017, $108 million of the related non-nuclear regulatory assets were amortized into expense as these amounts were collected in rates. See Note 6. TVA maintains investment trusts to help fund its decommissioning obligations. See Note 13 and Note 16 — Contingencies — Decommissioning Costs for a discussion of the trusts' objectives and the current balances of the trusts.

|

| | | | | | | | | | | |

Asset Retirement Obligation Activity |

| Nuclear | | Non-Nuclear | | Total |

Balance at September 30, 2016 | $ | 2,492 |

| | $ | 1,560 |

| | $ | 4,052 |

|

Settlements | — |

| | (90 | ) | | (90 | ) |

Revisions in estimate | — |

| | 57 |

| | 57 |

|

Additional obligations | — |

| | 1 |

| | 1 |

|

Accretion (recorded as regulatory asset) | 87 |

| | 25 |

| | 112 |

|

Balance at June 30, 2017 | $ | 2,579 |