^^TVE-09.30.2014-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

x ANNUAL REPORT PURSUANT TO

13, 15(d), OR 37 OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

|

| | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (IRS Employer Identification No.) |

|

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13, Section 15(d), or Section 37 of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x Smaller reporting company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

|

| |

Table of Contents |

GLOSSARY OF COMMON ACRONYMS....................................................................................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................................................................................ | |

| |

| |

| |

ITEM 1. BUSINESS...................................................................................................................................................................................................................................... | |

The Corporation................................................................................................................................................................................................................................. | |

Service Area....................................................................................................................................................................................................................................... | |

Customers.......................................................................................................................................................................................................................................... | |

Rates.................................................................................................................................................................................................................................................. | |

Power Supply...................................................................................................................................................................................................................................... | |

Cleaner Energy Initiatives.................................................................................................................................................................................................................. | |

Fuel Supply......................................................................................................................................................................................................................................... | |

Transmission...................................................................................................................................................................................................................................... | |

Weather and Seasonality.................................................................................................................................................................................................................... | |

Competition........................................................................................................................................................................................................................................ | |

Research and Development............................................................................................................................................................................................................... | |

Flood Control Activities....................................................................................................................................................................................................................... | |

Environmental Stewardship Activities................................................................................................................................................................................................. | |

Economic Development Activities...................................................................................................................................................................................................... | |

Regulation.......................................................................................................................................................................................................................................... | |

Taxation and Tax Equivalents............................................................................................................................................................................................................. | |

Environmental Matters....................................................................................................................................................................................................................... | |

Employees.......................................................................................................................................................................................................................................... | |

| |

ITEM 1A. RISK FACTORS............................................................................................................................................................................................................................ | |

| |

ITEM 1B. UNRESOLVED STAFF COMMENTS............................................................................................................................................................................................ | |

| |

ITEM 2. PROPERTIES.................................................................................................................................................................................................................................. | |

Generating Properties........................................................................................................................................................................................................................ | |

Transmission Properties..................................................................................................................................................................................................................... | |

Natural Resource Stewardship Properties......................................................................................................................................................................................... | |

Buildings............................................................................................................................................................................................................................................. | |

Disposal of Property........................................................................................................................................................................................................................... | |

| |

| |

ITEM 3. LEGAL PROCEEDINGS.................................................................................................................................................................................................................. | |

| |

ITEM 4. MINE SAFETY DISCLOSURES...................................................................................................................................................................................................... | |

| |

| |

| |

| |

| |

ITEM 6. SELECTED FINANCIAL DATA........................................................................................................................................................................................................ | |

| |

| |

Overview............................................................................................................................................................................................................................................. | |

Business and Mission......................................................................................................................................................................................................................... | |

Executive Overview............................................................................................................................................................................................................................ | |

Results of Operations......................................................................................................................................................................................................................... | |

Liquidity and Capital Resources......................................................................................................................................................................................................... | |

Off-Balance Sheet Arrangements....................................................................................................................................................................................................... | |

Key Initiatives and Challenges........................................................................................................................................................................................................... | |

Critical Accounting Policies and Estimates......................................................................................................................................................................................... | |

Fair Value Measurements................................................................................................................................................................................................................... | |

New Accounting Standards and Interpretations................................................................................................................................................................................. | |

Legislative and Regulatory Matters.................................................................................................................................................................................................... | |

Environmental Matters....................................................................................................................................................................................................................... | |

Legal Proceedings.............................................................................................................................................................................................................................. | |

Risk Management Activities............................................................................................................................................................................................................... | |

| |

| |

| |

| |

Consolidated Balance Sheets............................................................................................................................................................................................................ | |

Consolidated Statements of Operations............................................................................................................................................................................................. | |

|

| |

Consolidated Statements of Comprehensive Income (Loss)............................................................................................................................................................. | |

Consolidated Statements of Cash Flows........................................................................................................................................................................................... | |

| |

Notes to Consolidated Financial Statements..................................................................................................................................................................................... | |

| |

| |

| |

| |

ITEM 9A. CONTROLS AND PROCEDURES............................................................................................................................................................................................... | |

Disclosure Controls and Procedures.................................................................................................................................................................................................. | |

Internal Control over Financial Reporting........................................................................................................................................................................................... | |

| |

| |

ITEM 9B. OTHER INFORMATION................................................................................................................................................................................................................ | |

| |

| |

| |

| |

Directors.............................................................................................................................................................................................................................................. | |

Executive Officers............................................................................................................................................................................................................................... | |

Disclosure and Financial Code of Ethics............................................................................................................................................................................................. | |

Committees of the TVA Board............................................................................................................................................................................................................. | |

| |

ITEM 11. EXECUTIVE COMPENSATION..................................................................................................................................................................................................... | |

Compensation Discussion and Analysis.............................................................................................................................................................................................. | |

| |

Retirement and Pension Plans............................................................................................................................................................................................................ | |

| |

Other Agreements............................................................................................................................................................................................................................... | |

Director Compensation........................................................................................................................................................................................................................ | |

| |

Compensation Committee Report....................................................................................................................................................................................................... | |

| |

| |

| |

| |

Director Independence........................................................................................................................................................................................................................ | |

Related Party Transactions................................................................................................................................................................................................................. | |

| |

| |

| |

| |

| |

| |

| |

SIGNATURES................................................................................................................................................................................................................................................ | |

EXHIBIT INDEX............................................................................................................................................................................................................................................. | |

|

| | |

GLOSSARY OF COMMON ACRONYMS |

Following are definitions of terms or acronyms frequently used in this Annual Report on Form 10-K for the fiscal year ended September 30, 2014 (the “Annual Report”): |

|

Term or Acronym | | Definition |

AFUDC | | Allowance for funds used during construction |

ARO | | Asset retirement obligation |

ART | | Asset Retirement Trust |

ASLB | | Atomic Safety and Licensing Board |

BEST | | Bellefonte Efficiency and Sustainability Team |

BREDL | | Blue Ridge Environmental Defense League |

CAA | | Clean Air Act |

CAIR | | Clean Air Interstate Rule |

CCOLA | | Combined construction and operating license application |

CCP | | Coal combustion products |

CCR | | Coal combustion residual |

CCW | | Coal combustion waste |

CERCLA | | Comprehensive Environmental Response, Compensation, and Liability Act |

CME | | Chicago Mercantile Exchange |

CO2 | | Carbon dioxide |

CO2e | | Carbon dioxide equivalent |

COLA | | Cost of living adjustment |

CSAPR | | Cross State Air Pollution Rule |

CTs | | Combustion turbine unit(s) |

CVA | | Credit valuation adjustment |

CY | | Calendar year |

DER | | Distributed energy resources |

EPA | | Environmental Protection Agency |

FASB | | Financial Accounting Standards Board |

FERC | | Federal Energy Regulatory Commission |

FPA | | Federal Power Act |

FTP | | Financial Trading Program |

GAAP | | Accounting principles generally accepted in the United States of America |

GAO | | U.S. Government Accountability Office |

GHG | | Greenhouse gas |

GWh | | Gigawatt hour(s) |

IRP | | Integrated Resource Plan |

IRUs | | Indefeasible rights of use |

JSCCG | | John Sevier Combined Cycle Generation LLC |

kWh | | Kilowatt hour(s) |

LIBOR | | London Interbank Offered Rate |

LPC | | Local power company customer of TVA |

MD&A | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

mmBtu | | Million British thermal unit(s) |

MtM | | Mark-to-market |

MW | | Megawatt |

NAAQS | | National Ambient Air Quality Standards |

NAV | | Net asset value |

NDT | | Nuclear Decommissioning Trust |

NEIL | | Nuclear Electric Insurance Limited |

|

| | |

NEPA | | National Environmental Policy Act |

NERC | | North American Electric Reliability Corporation |

NOx | | Nitrogen oxides |

NPDES | | National Pollutant Discharge Elimination System |

NRC | | Nuclear Regulatory Commission |

NRP | | Natural Resource Plan |

NSPS | | New Source Performance Standards |

NSR | | New Source Review |

OCI | | Other comprehensive income (loss) |

PARRS | | Putable Automatic Rate Reset Securities |

PM | | Particulate matter |

PSD | | Prevention of Significant Deterioration |

QTE | | Qualified technological equipment and software |

SACE | | Southern Alliance for Clean Energy |

SCCG | | Southaven Combined Cycle Generation, LLC |

SCRs | | Selective catalytic reduction systems |

SEC | | Securities and Exchange Commission |

SERP | | Supplemental Executive Retirement Plan |

Seven States | | Seven States Power Corporation |

SMR | | Small modular reactor(s) |

SO2 | | Sulfur dioxide |

SSSL | | Seven States Southaven, LLC |

TCWN | | Tennessee Clean Water Network |

TDEC | | Tennessee Department of Environment & Conservation |

TOU | | Time-of-use |

TVARS | | Tennessee Valley Authority Retirement System |

TWQCB | | Tennessee Water Quality Control Board |

USEC | | United States Enrichment Corporation |

VIE | | Variable interest entity |

XBRL | | eXtensible Business Reporting Language |

WCD | | Waste Confidence Decision |

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K ("Annual Report") contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “intend,” “project,” “plan,” “predict,” “assume,” “forecast,” “estimate,” “objective,” “possible,” “probably,” “likely,” “potential,” "speculate," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying the forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in the forward-looking statements. These factors include, among other things:

| |

• | New or amended, or existing, laws, regulations, or administrative orders, including those related to environmental matters, and the costs of complying with these laws, regulations, and administrative orders; |

| |

• | The cost of complying with known, anticipated, and new emissions reduction requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective and result in their removal from service, perhaps permanently; |

| |

• | Actions taken, or inaction, by the U.S. government relating to the national debt ceiling or automatic spending cuts in government programs; |

| |

• | Costs and liabilities that are not anticipated in TVA’s financial statements for third-party claims, natural resource damages, or fines or penalties associated with events such as the Kingston Fossil Plant ("Kingston") ash spill as well as for environmental clean-up activities; |

| |

• | Addition or loss of customers; |

| |

• | Significant changes in demand for electricity which may result from, among other things, economic downturns, increased energy efficiency and conservation, and improvements in distributed generation and other alternative generation technologies; |

| |

• | Significant delays, cost increases, or cost overruns associated with the construction of generation or transmission assets; |

| |

• | Changes in the timing or amount of pension and health care costs; |

| |

• | Increases in TVA's financial liabilities for decommissioning its nuclear facilities and retiring other assets; |

| |

• | Physical or cyber attacks on TVA's assets; |

| |

• | The outcome of legal and administrative proceedings; |

| |

• | The failure of TVA's generation, transmission, flood control, and related assets, including coal combustion residual ("CCR") facilities, to operate as anticipated, resulting in lost revenues, damages, and other costs that are not reflected in TVA’s financial statements or projections; |

| |

• | Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred; |

| |

• | Catastrophic events such as fires, earthquakes, explosions, solar events, electromagnetic pulses, droughts, floods, hurricanes, tornadoes, pandemics, wars, national emergencies, terrorist activities, and other similar events, especially if these events occur in or near TVA's service area; |

| |

• | Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, and damage to the property of others; |

| |

• | Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid; |

| |

• | Disruption of fuel supplies, which may result from, among other things, weather conditions, production or transportation difficulties, labor challenges, or environmental laws or regulations affecting TVA's fuel suppliers or transporters; |

| |

• | Purchased power price volatility and disruption of purchased power supplies; |

| |

• | Events which affect the supply of water for TVA's generation facilities; |

| |

• | Changes in TVA's determinations of the appropriate mix of generation assets; |

| |

• | TVA's organizational transformation efforts or cost reduction efforts not being fully successful; |

| |

• | Inability to obtain, or loss of, regulatory approval for the construction or operation of assets, including Watts Bar Unit 2; |

| |

• | The requirement or decision to make additional contributions to TVA's pension or other post-retirement benefit plans or to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART"); |

| |

• | Limitations on TVA's ability to borrow money which may result from, among other things, TVA's approaching or substantially reaching the limit on bonds, notes, and other evidences of indebtedness specified in the Tennessee Valley Authority Act of 1933, as amended; |

| |

• | An increase in TVA's cost of capital which may result from, among other things, changes in the market for TVA's debt securities, changes in the credit rating of TVA or the U.S. government, and an increased reliance by TVA on alternative financing arrangements as TVA approaches its debt ceiling; |

| |

• | Changes in the economy and volatility in financial markets; |

| |

• | Reliability and creditworthiness of counterparties; |

| |

• | Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, electricity, and emission allowances; |

| |

• | Changes in the market price of equity securities, debt securities, and other investments; |

| |

• | Changes in interest rates, currency exchange rates, and inflation rates; |

| |

• | Ineffectiveness of TVA's disclosure controls and procedures and its internal control over financial reporting; |

| |

• | Inability to eliminate identified deficiencies in TVA's systems, standards, controls, and corporate culture; |

| |

• | Inability to attract or retain a skilled workforce; |

| |

• | Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, and decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, negatively affect the cost and schedule for completing Watts Bar Nuclear Plant ("Watts Bar") Unit 2 and preserving Bellefonte Nuclear Plant ("Bellefonte") Unit 1 for possible completion, or cause TVA to forego future construction at these or other facilities; |

| |

• | Loss of quorum of the TVA Board of Directors; and |

See also Item 1A, Risk Factors, and Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations. New factors emerge from time to time, and it is not possible for management to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA’s business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made.

GENERAL INFORMATION

Fiscal Year

References to years (2014, 2013, etc.) in this Annual Report are to TVA’s fiscal years ending September 30 except for references to years in the biographical information about directors and executive officers in Item 10, Directors, Executive Officers and Corporate Governance, as well as to years that are preceded by “CY,” which references are to calendar years.

Notes

References to “Notes” are to the Notes to Consolidated Financial Statements contained in Item 8, Financial Statements and Supplementary Data in this Annual Report.

Property

TVA does not own real property. TVA acquires real property in the name of the United States, and such legal title in real property is entrusted to TVA as the agent of the United States to accomplish the purpose of the Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee (the “TVA Act”). TVA acquires personal property in the name of TVA. Accordingly, unless the context indicates the reference is to TVA’s personal property, any statement in this Annual Report referring to TVA property shall be read as referring to the real property of the United States which has been entrusted to TVA as its agent.

Available Information

TVA's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports are available on TVA's web site, free of charge, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). TVA's web site is www.tva.gov. Information contained on TVA’s web site shall not be deemed to be incorporated into, or to be a part of, this Annual Report. TVA's SEC reports are also available to the public without charge from the web site maintained by the SEC at www.sec.gov.

PART I

ITEM 1. BUSINESS

The Corporation

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by legislation enacted by the U.S. Congress in response to a request by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA’s service area in the southeastern United States, and sell the electricity generated at the facilities TVA operates.

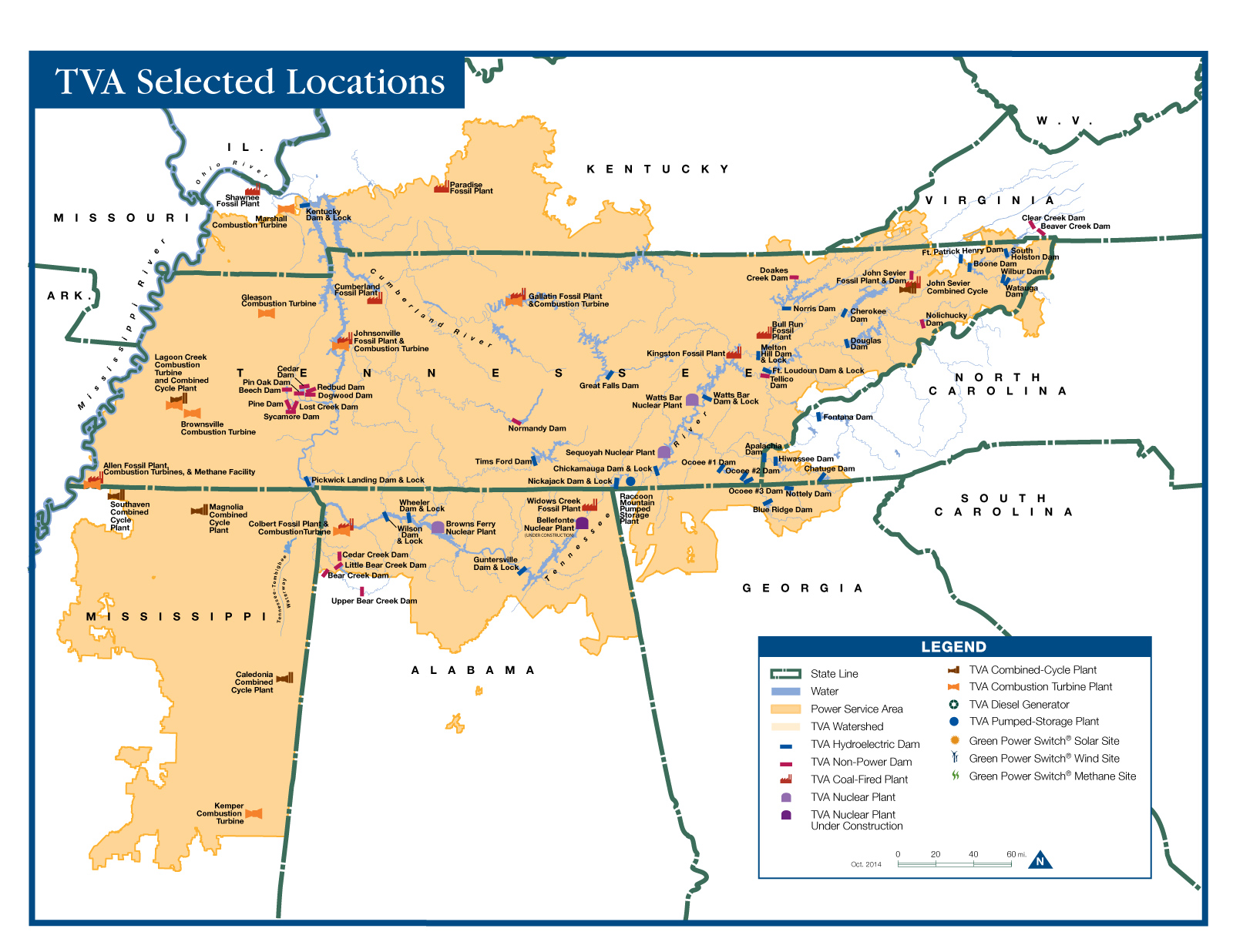

Today, TVA operates the nation’s largest public power system and supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of over nine million people. In 2014, the revenues generated from TVA’s electricity sales were $11.0 billion and accounted for virtually all of TVA’s revenues.

TVA manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system to provide recreational opportunities, adequate water supply, improved water quality, natural resource protection, and economic development. TVA performs these management duties in cooperation with other federal and state agencies which have jurisdiction and authority over certain aspects of the river system. In addition, the TVA Board of Directors (the "TVA Board") established two councils — the Regional Resource Stewardship Council and the Regional Energy Resource Council — under the Federal Advisory Committee Act to advise TVA on its stewardship activities in the Tennessee Valley and its energy resource activities.

Initially, all TVA operations were funded by federal appropriations. Direct appropriations for the TVA power program ended in 1959, and appropriations for TVA’s stewardship, economic development, and multipurpose activities ended in 1999. Since 1999, TVA has funded all of its operations almost entirely from the sale of electricity and power system financings. TVA’s power system financings consist primarily of the sale of debt securities and secondarily of alternative forms of financing such as lease arrangements. As a wholly-owned government corporation, TVA is not authorized to issue equity securities.

Service Area

The area in which TVA sells power, its service area, is defined by the TVA Act. Under the TVA Act, subject to certain minor exceptions, TVA may not, without specific authorization from the U.S. Congress, enter into contracts that would have the effect of making it, or the local power company customers of TVA ("LPCs") which distribute TVA power, a source of power supply outside the area for which TVA or its LPCs were the primary source of power supply on July 1, 1957. This provision is referred to as the “fence” because it bounds TVA’s sales activities, essentially limiting TVA to power sales within a defined service area.

In addition, the Federal Power Act ("FPA") includes a provision that helps protect TVA’s ability to sell power within its service area. This provision, called the "anti-cherrypicking" provision, prevents the Federal Energy Regulatory Commission ("FERC") from ordering TVA to provide access to its transmission lines to others to deliver power to customers within TVA’s defined service area. As a result, the anti-cherrypicking provision reduces TVA’s exposure to loss of customers.

TVA’s revenues by state for each of the last three years are detailed in the table below.

|

| | | | | | | | | | | |

Operating Revenues By State For the years ended September 30 (in millions) |

| 2014 | | 2013 | | 2012 |

Alabama | $ | 1,611 |

| | $ | 1,551 |

| | $ | 1,556 |

|

Georgia | 268 |

| | 260 |

| | 234 |

|

Kentucky | 680 |

| | 1,019 |

| | 1,230 |

|

Mississippi | 1,056 |

| | 1,029 |

| | 1,038 |

|

North Carolina | 58 |

| | 52 |

| | 69 |

|

Tennessee | 7,246 |

| | 6,818 |

| | 6,889 |

|

Virginia | 51 |

| | 53 |

| | 49 |

|

Subtotal | 10,970 |

| | 10,782 |

| | 11,065 |

|

Sale for resale and other | 29 |

| | 47 |

| | 21 |

|

Subtotal | 10,999 |

| | 10,829 |

| | 11,086 |

|

Other revenues | 138 |

| | 127 |

| | 134 |

|

Operating revenues | $ | 11,137 |

| | $ | 10,956 |

| | $ | 11,220 |

|

Note

See Power Supply — Coal-Fired for a discussion of idled coal-fired units.

Customers

TVA is primarily a wholesaler of power. It sells power to LPCs which then resell power to their customers at retail rates. TVA’s LPCs consist of (1) municipalities and other local government entities ("municipalities") and (2) customer-owned entities ("cooperatives"). These municipalities and cooperatives operate public power electric systems whose primary purpose is not to make a profit but to supply electricity to the general public or its members. TVA also sells power to directly served customers, consisting primarily of federal agencies and customers with large or unusual loads. In addition, power in excess of the needs of the TVA system may, where consistent with the provisions of the TVA Act, be sold under exchange power arrangements with other electric systems.

|

| | | | | | | | | | | |

Operating Revenues by Customer Type For the years ended September 30 (in millions) |

| 2014 | | 2013 | | 2012 |

Revenue from sales of electricity | | | | | |

Local power companies | $ | 10,062 |

| | $ | 9,463 |

| | $ | 9,506 |

|

Industries directly served | 780 |

| | 1,199 |

| | 1,442 |

|

Federal agencies and other | 157 |

| | 167 |

| | 138 |

|

Total sales of electricity | 10,999 |

| | 10,829 |

| | 11,086 |

|

Other revenues | 138 |

| | 127 |

| | 134 |

|

Operating revenues | $ | 11,137 |

| | $ | 10,956 |

| | $ | 11,220 |

|

Local Power Company Customers

Revenues from LPCs accounted for 90 percent of TVA’s total operating revenues in 2014. At September 30, 2014, TVA had wholesale power contracts with 155 LPCs. Each of these contracts requires the LPCs to purchase from TVA all of its electric power and energy consumed within the TVA service area. All LPCs purchase power under contracts that require five, ten, twelve, or fifteen years notice to terminate.

The number of LPCs with the contract arrangements described above, the revenues derived from such arrangements in 2014, and the percentage of TVA’s 2014 total operating revenues represented by these revenues are summarized in the table below.

|

| | | | | | | | | |

TVA Local Power Company Customer Contracts At September 30, 2014 |

Contract Arrangements(1) | Number of LPCs | | Sales to LPCs in 2014 | | Percentage of Total Operating Revenues in 2014 |

| | | (in millions) | | |

15-year termination notice | 6 |

| | $ | 159 |

| | 1.4 | % |

12-year termination notice | 1 |

| | $ | 25 |

| | 0.2 | % |

10-year termination notice | 48 |

| | 3,376 |

| | 30.3 | % |

5-year termination notice | 100 |

| | 6,502 |

| | 58.4 | % |

Total | 155 |

| | $ | 10,062 |

| | 90.3 | % |

Note

(1) Ordinarily the LPCs and TVA have the same termination notice period; however, in contracts with five of the LPCs with five-year termination notices, TVA has a 10-year termination notice (which becomes a five-year termination notice if TVA loses its discretionary wholesale rate-setting authority). Two of the LPCs have five-year termination notices or a shorter period if any act of Congress, court decision, or regulatory change requires or permits that election. Also, under TVA’s contract with Bristol Virginia Utilities, a five-year termination notice may not be given by the LPC until January 2018.

TVA’s two largest LPCs — Memphis Light, Gas and Water Division ("MLGW") and Nashville Electric Service ("NES") — have contracts with five-year and 10-year termination notice periods, respectively. Although no single customer accounted for 10 percent or more of TVA’s total operating revenues in 2014, sales to MLGW and NES accounted for nine percent and eight percent, respectively.

The power contracts between TVA and LPCs provide for purchase of power by LPCs at the wholesale rates established by the TVA Board. Under Section 10 of the TVA Act, the TVA Board is authorized to regulate LPCs to carry out the purposes of the TVA Act through contract terms and conditions as well as through rules and regulations. TVA regulates LPCs primarily through the provisions of TVA’s wholesale power contracts. All of the power contracts between TVA and the LPCs require that power purchased from TVA be sold and distributed to the ultimate consumer without discrimination among consumers of the same class, and prohibit direct or indirect discriminatory rates, rebates, or other special concessions. In addition, there are a number of wholesale power contract provisions through which TVA seeks to ensure that the electric system revenues of the LPCs are used only for electric system purposes. Furthermore, almost all of these contracts specify the specific resale rates and

charges at which the LPC must resell TVA power to their customers. These rates are revised from time to time, subject to TVA approval, to reflect changes in costs, including changes in the wholesale cost of power. The regulatory provisions in TVA’s wholesale power contracts are designed to carry out the objectives of the TVA Act, including the objective of providing for an adequate supply of power at the lowest feasible rates. See Rates — Rate Methodology below.

TVA also regulates LPC policies for deposits, termination, information to consumers, and billing through service practice standards that were adopted in 1979. On November 6, 2014, the TVA Board approved a revised service practice policy framework. The new framework provides for enhanced, consistent regulatory policy for ratepayers across the Tennessee Valley, while both upholding the intent of the original standards and recognizing local considerations.

Other Customers

Revenues from directly served industrial customers accounted for seven percent of TVA’s total operating revenues in 2014. Contracts with these customers are subject to termination by the customer or TVA upon a minimum notice period that varies according to the customer’s contract demand and the period of time service has been provided.

Rates

Rate Authority

The TVA Act gives the TVA Board sole responsibility for establishing the rates TVA charges for power. These rates are not subject to judicial review or to review or approval by any state or federal regulatory body.

Under the TVA Act, TVA is required to charge rates for power which will produce gross revenues sufficient to provide funds for:

| |

• | Operation, maintenance, and administration of its power system; |

| |

• | Payments to states and counties in lieu of taxes ("tax equivalents"); |

| |

• | Debt service on outstanding indebtedness; |

| |

• | Payments to the U.S. Treasury in repayment of and as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"); and |

| |

• | Such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding bonds, notes, or other evidences of indebtedness ("Bonds") in advance of maturity, additional reduction of the Power Program Appropriation Investment, and other purposes connected with TVA’s power business. |

In setting TVA’s rates, the TVA Board is charged by the TVA Act to have due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible.

Rate Methodology

In view of demand for electricity, the level of competition, and other relevant factors, it is reasonable to assume that rates, set at levels that will recover TVA's costs, can be charged and collected from customers. Further, the TVA Board has the discretion to determine when costs will be recovered in rates. As a result of these factors, TVA records certain assets and liabilities that result from the self-regulated ratemaking process that could not otherwise be so recorded under accounting principles generally accepted in the United States. See Note 1 — Cost-Based Regulation and Note 8.

In setting rates to cover the costs set out in the TVA Act, TVA uses a wholesale rate structure that is comprised of a base rate and a fuel rate that is automatically determined by the operation of the fuel cost adjustment formula each month. In setting the base rates, TVA uses a debt-service coverage ("DSC") methodology to derive annual revenue requirements in a manner similar to that used by other public power entities that also use the DSC rate methodology. Under the DSC methodology, rates are calculated so that an entity will be able to cover its operating costs and to satisfy its obligations to pay principal and interest on debt. This ratemaking approach is particularly suitable for use by entities financed primarily, if not entirely, by debt capital, such as TVA.

TVA's revenue requirements for costs or projected costs (other than the fuel, purchased power, and related costs covered by the fuel rate) are calculated under the DSC methodology as the sum of the following components:

| |

• | Operating and maintenance costs; |

| |

• | Tax equivalents (other than the amount attributable to fuel cost-related revenues); |

| |

• | Other costs in accordance with the TVA Act; and |

This methodology reflects the cause-and-effect relationship between TVA's costs and the corresponding rates it charges for its regulated products and services. Once the revenue requirements (or projected costs) are determined, they are compared to the projected revenues for the year in question, at existing rates, to arrive at the shortfall or surplus of revenues as compared to the projected costs. Power rates are adjusted by the TVA Board to a level deemed to be sufficient to produce revenues approximately equal to projected costs (exclusive of the costs collected through the fuel rate).

TVA's wholesale and retail rate structures include time-of-use ("TOU") and seasonal demand and energy ("SDE") rate structures. These rate structures provide price signals intended to incentivize LPCs and end-use customers to shift energy usage from high-cost generation periods to less expensive generation periods. The rates are intended to more closely align TVA's revenues with its costs.

For LPCs, the default wholesale rate structure is seasonal TOU. The wholesale rate provisions originally specified that the SDE option expired in September 2012. In April 2012, the TVA Board approved optional enhanced TOU and SDE structures which became effective in October 2012. TVA allowed LPCs to elect one of these wholesale rate structures and make retail adjustments consistent with their wholesale elections. LPC elections as of October 1, 2014, were as follows: 148 were served under the enhanced TOU structure, two were served under the default seasonal TOU structure, and five were served under the enhanced SDE structure.

TVA's rates also include a fuel cost recovery mechanism that automatically adjusts its rates each month to recover its fuel costs, which include the costs of natural gas, fuel oil, purchased power, coal, emission allowances, nuclear fuel, and other fuel-related commodities; realized gains and losses on derivatives purchased to hedge the costs of such commodities; and tax equivalents associated with the fuel cost adjustments.

On August 22, 2013, the TVA Board approved a five-year extension of the environmental adjustment (which commenced in 2004), which reflects the need to collect revenue for environmental expenditures to further TVA's environmental performance, as well as comply with new, more stringent air, water, and waste regulations. The environmental adjustment recovered approximately $437 million in 2014. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations — Key Initiatives and Challenges — Ratemaking. On August 21, 2014, the TVA Board approved a non-fuel base rate increase of 2.61 percent on wholesale rates. It is anticipated this will increase base revenues by approximately $199 million for 2015.

Power Supply

General

Power generating facilities operated by TVA at September 30, 2014, included 29 conventional hydroelectric sites, one pumped-storage hydroelectric site, 10 coal-fired sites, three nuclear sites, 14 natural gas and/or oil-fired sites, one diesel generator site, 16 solar energy sites, digester gas cofiring capacity at one coal-fired site, biomass cofiring potential (located at coal-fired sites), and one wind energy site, although certain of these facilities were out of service as of September 30, 2014. See Net Capability for a discussion of these out-of-service facilities. TVA also acquires power under power purchase agreements of varying durations as well as short-term contracts of less than 24-hours in duration.

The following table summarizes TVA’s net generation in millions of kilowatt hours ("kWh") by generating source and the percentage of all electric power generated by TVA for the years indicated:

|

| | | | | | | | | | | | | | | | | | |

Power Supply from TVA-Operated Generation Facilities For the years ended September 30 (millions of kWh) |

| 2014 | | 2013 | | 2012 | |

Coal-fired | 62,525 |

| | 44 | % | | 62,519 |

| | 43 | % | | 58,584 |

| | 41 | % | |

Nuclear | 53,778 |

| | 38 | % | | 52,100 |

| | 36 | % | | 55,244 |

| | 38 | % | |

Hydroelectric | 13,228 |

| | 9 | % | | 18,178 |

| | 12 | % | | 12,817 |

| | 9 | % | |

Natural gas and/or oil-fired | 12,615 |

| | 9 | % | | 13,102 |

| | 9 | % | | 16,650 |

| | 12 | % | |

Renewable resources (non-hydro) | 5 |

| (1) | <1% |

| | 9 |

| (1) | <1% |

| | 25 |

| | <1% |

| |

Total | 142,151 |

| | 100 | % | | 145,908 |

| | 100 | % | | 143,320 |

| | 100 | % | |

Note

(1) Operation and maintenance issues reduced the available renewable generation during 2014 and 2013 from several facilities, including those utilizing methane, solar, and wind.

Net Capability

The following table summarizes TVA's summer net capability in megawatts ("MW") at September 30, 2014:

|

| | | | | | | | | | | | | |

SUMMER NET CAPABILITY(1) At September 30, 2014 |

Source of Capability | Location | | Number of Units | | Summer Net Capability (MW) | | Date First Unit Placed in Service | | Date Last Unit Placed in Service |

TVA-Operated Generating Facilities | | | | | | | |

| | |

|

Coal-Fired | | | | | | | |

| | |

|

Allen(2) | Tennessee | | 3 |

| | 741 |

| | 1959 |

| | 1959 |

|

Bull Run | Tennessee | | 1 |

| | 863 |

| | 1967 |

| | 1967 |

|

Colbert(2),(3) | Alabama | | 4 |

| | 712 |

| | 1955 |

| | 1965 |

|

Cumberland | Tennessee | | 2 |

| | 2,470 |

| | 1973 |

| | 1973 |

|

Gallatin | Tennessee | | 4 |

| | 976 |

| | 1956 |

| | 1959 |

|

Johnsonville | Tennessee | | 4 |

| | 428 |

| | 1951 |

| | 1959 |

|

Kingston | Tennessee | | 9 |

| | 1,398 |

| | 1954 |

| | 1955 |

|

Paradise | Kentucky | | 3 |

| | 2,201 |

| | 1963 |

| | 1970 |

|

Shawnee | Kentucky | | 9 |

| | 1,206 |

| | 1953 |

| | 1955 |

|

Widows Creek(4),(5) | Alabama | | 2 |

| | 938 |

| | 1954 |

| | 1965 |

|

Total Coal-Fired | | | 41 | | 11,933 |

| | |

| | |

|

Nuclear | | | |

| | |

| | |

| | |

|

Browns Ferry | Alabama | | 3 |

| | 3,309 |

| | 1974 |

| | 1977 |

|

Sequoyah | Tennessee | | 2 |

| | 2,292 |

| | 1981 |

| | 1982 |

|

Watts Bar | Tennessee | | 1 |

| | 1,123 |

| | 1996 |

| | 1996 |

|

Total Nuclear | | | 6 |

| | 6,724 |

| | |

| | |

|

Hydroelectric | | | |

| | |

| | |

| | |

|

Conventional Plants | Alabama | | 36 |

| | 1,178 |

| | 1925 |

| | 1962 |

|

| Georgia | | 2 |

| | 33 |

| | 1931 |

| | 1956 |

|

| Kentucky | | 5 |

| | 223 |

| | 1944 |

| | 1948 |

|

| North Carolina | | 6 |

| | 492 |

| | 1940 |

| | 1956 |

|

| Tennessee | | 60 |

| | 1,876 |

| | 1912 |

| | 1972 |

|

Pumped-Storage(6) | Tennessee | | 4 |

| | 1,616 |

| | 1978 |

| | 1979 |

|

Total Hydroelectric | | | 113 |

| | 5,418 |

| | |

| | |

|

Natural Gas and/or Oil-Fired(7),(8) | | | |

| | |

| | |

| | |

|

Simple-Cycle Combustion Turbine | | | | | | | | | |

Allen | Tennessee | | 20 |

| | 456 |

| | 1971 |

| | 1972 |

|

Brownsville | Tennessee | | 4 |

| | 468 |

| | 1999 |

| | 1999 |

|

Colbert | Alabama | | 8 |

| | 392 |

| | 1972 |

| | 1972 |

|

Gallatin | Tennessee | | 8 |

| | 600 |

| | 1975 |

| | 2000 |

|

Gleason(9) | Tennessee | | 3 |

| | 465 |

| | 2000 |

| | 2000 |

|

Johnsonville | Tennessee | | 20 |

| | 1,133 |

| | 1975 |

| | 2000 |

|

Kemper | Mississippi | | 4 |

| | 312 |

| | 2002 |

| | 2002 |

|

Lagoon Creek | Tennessee | | 12 |

| | 941 |

| | 2001 |

| | 2002 |

|

Marshall County | Kentucky | | 8 |

| | 621 |

| | 2002 |

| | 2002 |

|

Subtotal Simple-Cycle Combustion Turbine | | | 87 |

| | 5,388 |

| | |

| | |

|

Combined-Cycle Combustion Turbine | | | | | | | | | |

Caledonia(10) | Mississippi | | 3 |

| | 765 |

| | 2003 |

| | 2003 |

|

John Sevier(11) | Tennessee | | 1 |

| | 870 |

| | 2012 |

| | 2012 |

|

Lagoon Creek(12) | Tennessee | | 1 |

| | 525 |

| | 2010 |

| | 2010 |

|

Magnolia | Mississippi | | 3 |

| | 920 |

| | 2003 |

| | 2003 |

|

Southaven | Mississippi | | 3 |

| | 774 |

| | 2003 |

| | 2003 |

|

Subtotal Combined-Cycle Combustion Turbine | | | 11 |

| | 3,854 |

| | | | |

Total Natural Gas and/or Oil-Fired | | | 98 |

| | 9,242 |

| | | | |

| | | | | | | | | |

|

| | | | | | | | | | | | | |

Diesel Generator | | | |

| | |

| | |

| | |

|

Meridian | Mississippi | | 5 |

| | 9 |

| | 1998 |

| | 1998 |

|

Total Diesel Generators | | | 5 |

| | 9 |

| | |

| | |

|

TVA Renewable Resources (non-hydro)(13) | | | |

| | < 1 |

| | |

| | |

|

Total TVA-Operated Generating Facilities | | | |

| | 33,326 |

| | |

| | |

|

Contract Renewable Resources(14),(15) | | | |

| | 139 |

| | |

| | |

|

Power Purchase and Other Agreements | | | |

| | 3,882 |

| | |

| | |

|

Total Summer Net Capability | | | |

| | 37,347 |

| | |

| | |

|

Notes

(1) Net capability is defined as the ability of an electric system, generating unit, or other system component to carry or generate power for a specified time period and

does not include operational limitations such as derates.

(2) Eight MW of cofired methane at Allen and seven MW of cofired biomass at Colbert are accounted for as coal generation as opposed to TVA Renewable

Resources.

(3) Colbert Unit 5 was idled on October 1, 2013.

(4) Widows Creek Units 3 and 5 were retired on July 31, 2013, and Units 1, 2, 4, and 6 were retired on July 31, 2014.

(5) Widows Creek Unit 8 was mothballed on October 1, 2014.

(6) As of September 30, 2014, three of the four Raccoon Mountain Pumped-Storage Plant units were in service. The return to service date for the fourth unit is estimated to be in the third quarter of 2015.

(7) See Item 2, Properties for a discussion of TVA-operated natural gas and/or oil-fired facilities subject to leaseback and long-term lease arrangements.

(8) Peak firing of simple-cycle combustion turbine units accounts for an additional 257 MW of short-term capability.

(9) The units at the Gleason Simple-Cycle Facility were derated to 360 MW as of September 30, 2014, pending maintenance.

(10) Caledonia is currently a leased facility operated by TVA.

(11) John Sevier Combined Cycle Facility is a single steam cycle unit driven by three gas turbines (3x1 configuration).

(12) Lagoon Creek Combined Cycle Facility is a single steam cycle unit driven by two gas turbines (2x1 configuration).

(13) TVA's three wind turbines (2 MW nameplate capacity) at its Buffalo Mountain Site in Tennessee were not operational as of September 30, 2014, and do not appear to be economical for returning to operation. TVA owns 0.4 MW of solar installations at 16 sites.

(14) Contract Renewable Resources include Generation Partners, Renewable Standard Offer, and 15 wind turbine generators located on Buffalo Mountain. See Power Supply — Purchased Power and Other Agreements for information on renewable energy power purchase contracts.

(15) Solar and wind resouces are listed at nameplate capacity.

Coal-Fired

TVA began its coal-fired plant construction program in the 1940s, and its coal-fired units were placed in service between 1951 and 1973. Coal-fired units are either active or inactive. TVA considers units to be in an active state when the unit is generating, available for service, or temporarily unavailable due to equipment failures, inspections, or repairs. As of September 30, 2014, TVA had 10 coal-fired plants consisting of 41 active units, accounting for 11,933 MW of summer net capability. As of September 30, 2014, TVA had 18 inactive units. Inactive units may be in three categories: retired, mothballed, or inactive reserve. Retired units are unavailable for service and are not expected to return to service in the future. As of September 30, 2014, TVA had 11 retired units: John Sevier Fossil Plant ("John Sevier") Units 1-4, Shawnee Fossil Plant ("Shawnee") Unit 10, and Widows Creek Fossil Plant ("Widows Creek") Units 1-6. Mothballed units are unavailable for service but can be brought back into service after some maintenance with an appropriate amount of notification, typically weeks or months. As of September 30, 2014, TVA had seven mothballed units: Johnsonville Fossil Plant ("Johnsonville") Units 5-10 and Colbert Fossil Plant ("Colbert") Unit 5. Inactive reserve units are unavailable for service but can be brought back into service after some repairs in a relatively short duration of time, typically measured in days. As of September 30, 2014, TVA had no units in inactive reserve. TVA refers to units which are in inactive reserve or mothballed status as idled. In addition, as of October 1, 2014, TVA mothballed Widows Creek Unit 8.

During 2014, the TVA Board took several actions related to the retirement of certain coal-fired units. Upon the completion of a natural gas-fired generation facility at the Paradise Fossil Plant ("Paradise") site, coal-fired Units 1 and 2 at Paradise with a summer net capability of 1,230 MW will be retired, and upon the completion of a natural gas-fired generation facility at the Allen Fossil Plant ("Allen") site, coal-fired Units 1-3 at Allen with a summer net capability of 741 MW will be retired. The TVA Board also approved the retirement of Colbert Units 1-4 and 5 with a total summer net capability of 1,184 MW no later than June 30, 2016, and December 31, 2015, respectively, as well as the retirement of Widows Creek Unit 8 with a summer net capability of 465 MW in the future. See Cleaner Energy Initiatives — Natural Gas-Fired Generation.

Coal-fired plants have been subject to increasingly stringent regulatory requirements over the last few decades, including those of the Clean Air Act ("CAA") and subsequent laws and regulations. Increasing regulatory costs require consideration of whether or not to make the required capital investments to continue operating these facilities. In April 2011, TVA entered into two agreements (collectively, the "Environmental Agreements") to address a dispute under the CAA. The first agreement is a Federal Facilities Compliance Agreement with the Environmental Protection Agency ("EPA"). The second agreement is with Alabama, Kentucky, North Carolina, Tennessee, and three environmental advocacy groups: the Sierra Club, National Parks Conservation Association, and Our Children’s Earth Foundation. Under the Environmental Agreements, TVA agreed to retire 18 of its 59 coal-fired units by the end of 2017 and was generally absolved from any liability, subject to certain limitations and exceptions, under the New Source Review ("NSR") requirements of the CAA for maintenance, repair, and component replacement projects that were commenced at TVA's coal-fired units prior to the execution of the agreements. Failure to comply with the terms of the Environmental Agreements would subject TVA to penalties stipulated in the agreements. TVA is taking the actions necessary to comply with the Environmental Agreements. TVA is confident that it has adequate capacity to meet the needs of its customers after these units are retired.

The following table summarizes the retirement actions TVA is required to take under the Environmental Agreements, and the status of those actions.

|

| | | | |

Fossil Plant | Total Units | Existing Scrubbers and SCRs(1) | Requirements Under Environmental Agreements | Retirements Implemented or Planned to be Implemented by TVA as a Result of Environmental Agreements |

John Sevier | 2 | None | · Retire two units no later than December 31, 2012 | · Retired Units 1 and 2 on December 31, 2012 |

Johnsonville | 10 | None | · Retire six units no later than December 31, 2015 · Retire four units no later than December 31, 2017 | · Retire six units by December 31, 2015 · Retire four units by December 31, 2017 · Idled Units 7 and 8 effective March 1, 2012 · Idled Units 5 and 6 and Units 9 and 10 on October 1, 2013 |

Widows Creek | 6 | Scrubbers and SCRs on Units 7 and 8 | · Retire two of Units 1-6 no later than July 31, 2013 · Retire two of Units 1-6 no later than July 31, 2014 · Retire two of Units 1-6 no later than July 31, 2015 | · Idled Units 1-6 in October 2011 · Retired Units 3 and 5 on July 31, 2013 · Retired Units 1, 2, 4, and 6 on July 31, 2014 |

Note

(1) Selective catalytic reduction systems ("SCR").

The following table summarizes the additional actions TVA is required to take under the Environmental Agreements, and other coal-fired generation actions taken or to be taken by TVA.

|

| | | | |

Fossil Plant | Units Impacted | Existing Scrubbers and SCRs | Requirements Under Environmental Agreements | Other Actions Taken or Planned to be Taken by TVA |

Allen | 3 | SCRs on all three units | · Install scrubbers or retire no later than December 31, 2018 | · The Board approved the construction of a gas-fired plant at the current location of the Allen coal-fired site · · Retire Units 1-3 after completion of the gas-fired plant |

Bull Run | 1 | Scrubber and SCRs on unit | · Continuously operate current and any new emission control equipment | · Continuously operate existing emission control equipment |

Colbert | 5 | SCR on Unit 5 | · Remove from service, control(1), convert(2), or retire Units 1-4 no later than June 30, 2016 · Remove from service, control(1), or retire Unit 5 no later than December 31, 2015 · Control or retire removed from service units within three years | · Idled Unit 5 in October 2013 · Retire Units 1-4 no later than June 30, 2016 · Retire Unit 5 no later than December 31, 2015 |

Cumberland | 2 | Scrubbers and SCRs on both units | · Continuously operate existing emission control equipment | · Continuously operate existing emission control equipment |

Gallatin | 4 | None | · Control(1), convert(2), or retire all four units no later than December 31, 2017 | · Add scrubbers and SCRs on all four units by December 31, 2017 |

John Sevier | 2 | None | · Remove from service two units no later than December 31, 2012 and control(1), convert(2), or retire those units no later than December 31, 2015 | · Idled Units 3 and 4 in December 2012 · Retired Units 3 and 4 on June 25, 2014 |

Kingston | 9 | Scrubbers and SCRs on all nine units | Continuously operate existing emission control equipment | Continuously operate existing emission control equipment |

Paradise | 3 | Scrubbers and SCRs on all three units | · Upgrade scrubbers on Units 1 and 2 no later than December 31, 2013 · Continuously operate emission control equipment on Units 1-3 | · Upgraded scrubbers on Units 1 and 2 in 2012 · Continuously operate emission control equipment on Units 1-3 · The Board approved the construction of a gas-fired plant at the current location of the Paradise coal-fired plant · Retire Units 1 and 2 after completion of the gas-fired plant |

Shawnee | 2 | None | · Control(1), convert, or retire(2) Units 1 and 4 no later than December 31, 2017 | · Still evaluating what actions to take with respect to Units 1 and 4 · Idled Unit 10 in October 2010 · Retired Unit 10 on June 30, 2014 |

Widows Creek | 2 | Scrubbers and SCRs on Units 7 and 8 | · Continuously operate existing emissions control equipment on Units 7 and 8 | · Continuously operate existing emissions control equipment on Units 7 and 8 · Idled Unit 8 on October 1, 2014 · Retire Unit 8 in the future |

Notes

(1) If TVA decides to add emission controls to these units, TVA must continuously operate the emission controls once they are installed.

(2) Convert to renewable biomass.

As of September 30, 2010, TVA had 14,573 MW (summer net capability) of coal-fired generation. After actions taken to comply with the Environmental Agreements and actions by the TVA Board during 2014, TVA will have 8,089 MW (summer net capability) of coal-fired generation.

TVA is moving towards a more balanced generation plan with lower-cost and cleaner energy generation technologies. TVA’s long-range plans will continue to consider the costs and benefits of significant environmental investments at its remaining coal-fired plants. TVA expects to decide whether to control, convert, or retire its remaining Shawnee units.

Transmission upgrades may be required to maintain reliability when some coal-fired units become inactive. TVA invested $215 million in such upgrades between 2011 and 2014, and estimates future expenditures for transmission upgrades to accommodate inactive coal-fired units to be approximately $230 million for 2015 to 2020. Upgrades may include enhancements to existing lines and substations or new installations as necessary to provide adequate power transmission capacity, maintain voltage support, and ensure generating plant and transmission system stability.

Nuclear

TVA has three nuclear sites consisting of six units in operation. The units at Browns Ferry Nuclear Plant ("Browns Ferry") are boiling water reactor units, and the units at Sequoyah Nuclear Plant ("Sequoyah") and Watts Bar Nuclear Plant ("Watts Bar") are pressurized water reactor units. Statistics for each of these units are included in the table below.

|

| | | | | | | | | |

TVA Nuclear Power At September 30, 2014 |

Nuclear Unit | Status | | Nameplate Capacity (MW) | | Net Capacity Factor for 2014 | | Date of Expiration of Operating License | | Date of Expiration of Construction Permits |

Sequoyah Unit 1 | Operating | | 1,221 | | 85.8 | | 2020* | | — |

Sequoyah Unit 2 | Operating | | 1,221 | | 86.5 | | 2021* | | — |

Browns Ferry Unit 1 | Operating | | 1,264 | | 95.2 | | 2033 | | — |

Browns Ferry Unit 2 | Operating | | 1,190 | | 93.5 | | 2034 | | — |

Browns Ferry Unit 3 | Operating | | 1,190 | | 86.1 | | 2036 | | — |

Watts Bar Unit 1 | Operating | | 1,270 | | 85.0 | | 2035 | | — |

Watts Bar Unit 2 | Under construction | | 1,220 | | — | | — | | 2016 |

* An extension request has been submitted to the Nuclear Regulatory Commission. See Sequoyah License Renewal below.

Extended Power Uprate. TVA is undertaking an Extended Power Uprate ("EPU") project at Browns Ferry that is expected to increase the amount of electrical generation capacity of its reactors. The NRC license for each reactor must be modified to allow reactor operation at the higher power level.

Because the license amendment requests ("LARs") submitted by TVA at the beginning of this project have been under review for an extended time, TVA’s recent discussions with the NRC on selected technical issues concluded that a more effective strategy to address these issues would be to withdraw the original requests and to resubmit new LARs that would more thoroughly address the issues. The eventual conclusion of the discussions with NRC regarding the technical issues may impact the actual amount of power level increase resulting from the EPU.

Completion of the licensing process will determine the final implementation schedule. TVA expects to begin implementing the EPU project starting in the spring of 2018 for Browns Ferry Unit 3, the fall of 2018 for Unit 1, and spring of 2019 for Unit 2 and expects to complete the project in 2020. The project not only involves engineering analyses, but modification and replacement of certain existing plant components to enable the units to produce the additional power requested by the license amendments. These improvements will be ongoing in parallel with the NRC’s license amendment review process. The project is estimated to cost approximately $380 million.

Sequoyah License Renewal. TVA submitted the license renewal applications for Sequoyah Units 1 and 2 to the NRC on January 7, 2013. If approved, the licenses for both units would be extended by an additional 20 years to 2040 for Unit 1 and 2041 for Unit 2. The NRC's review of the applications is expected to take up to three years after their submission.

On August 26, 2014, the NRC approved a final rule on the environmental effects of continued storage of spent nuclear fuel and terminated a two-year suspension of final licensing actions for nuclear power plants and renewals. Issuance of this rule may help alleviate some issues in the relicensing processes related to Sequoyah. See Note 21 — Legal Proceedings — Case Involving the NRC Waste Confidence Decision on Spent Nuclear Fuel Storage for additional information, which information is incorporated herein by reference.

Operational Challenges. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources and Key Initiatives and Challenges —Generation Resources, for a discussion of challenges associated with the nuclear program, which discussions are incorporated herein by reference.

Other Nuclear Matters. See Fuel Supply — Nuclear Fuel below for a discussion of spent nuclear fuel and low-level

radioactive waste, Note 21 — Contingencies for a discussion of TVA's nuclear decommissioning liabilities and the related trust and nuclear insurance, and Note 21 — Legal Proceedings for a discussion of legal and administrative proceedings related to TVA's nuclear program, which discussions are incorporated herein by reference.

Hydroelectric and Other Renewable Energy Resources

Conventional Hydroelectric Dams. TVA maintains 29 conventional hydroelectric dams with 109 generating units throughout the Tennessee River system and one pumped-storage facility for the production of electricity. At September 30, 2014, these units accounted for 5,418 MW of summer net capability. The amount of electricity that TVA is able to generate from its hydroelectric plants depends on a number of factors, including the amount of precipitation and runoff, initial water levels, and

the need for water for competing water management objectives. The amount of electricity generated also depends on the availability of TVA's hydroelectric generation plants. When these factors are unfavorable, TVA must increase its reliance on higher cost generation plants and purchased power. In addition, eight U.S. Army Corps of Engineers dams on the Cumberland River contribute to the TVA power system. See Weather and Seasonality and Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations — Key Initiatives and Challenges — Dam Safety Assurance Initiatives.

In 1992, TVA began a Hydro Modernization Program to address reliability issues related to its conventional hydroelectric units and Raccoon Mountain Pumped-Storage Plant ("Raccoon Mountain"). At September 30, 2014, modernization had been completed on 56 conventional hydroelectric units and four pumped-storage units. These modernization projects resulted in 427 MW of increased capacity on the conventional units, with an average efficiency gain of approximately five percent. Hydroelectric generation will continue to be an important part of TVA's energy mix. TVA, through its Hydro Modernization Program, continues to assess its remaining conventional hydroelectric units for opportunities to improve reliability and increase capacity.

Raccoon Mountain Pumped-Storage Plant. The four units at Raccoon Mountain were placed in service during 1978 and 1979. The units, with a total net summer capability of 1,616 MW, are utilized to balance the transmission system as well as generate power.

Units 1-4 were taken out of service for maintenance activities in 2012 after an inspection of the turbines in each unit identified cracking in the rotor poles and the rotor rims. All four units have subsequently completed maintenance overhauls to correct these cracking problems. However, an unrelated issue was identified in certain oil-filled power cables which convey power out of the facility, resulting in TVA limiting service to three units until the issue is resolved. As of September 30, 2014, three of the four Raccoon Mountain units were in service. The return to service date for the fourth unit is estimated to be in the third quarter of 2015.

Other Renewable Energy Resources. TVA's renewable energy portfolio includes both TVA-owned assets and renewable energy purchases. TVA owns 16 solar sites, capability for digester gas and biomass cofiring, and three wind turbines. At September 30, 2014, the wind turbines were not operational and were not available to provide any summer net capability. The Electric Power Research Institute ("EPRI") is currently undertaking a research project to assess the condition of the three TVA-owned turbines and to evaluate options for the future of the wind turbines. Results of the project are expected to be completed in the first quarter of 2015. The digester gas cofiring capability is accounted for as coal-fired generation summer net capability. The solar sites provide less than one MW of summer net capability.

Natural Gas and/or Oil-Fired