UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended May 31, 2013

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number: 000-53462

Tierra Grande Resources

Inc.

(Exact name of registrant as specified in its

charter)

| Nevada | 98-054-3851 |

| (State or Other Jurisdiction of Incorporation of | (I.R.S. Employer Identification No.) |

| Organization) | |

| Cnr Stirling Hwy & Fairlight St. | |

| Mosman Park, Western Australia 6012 | |

| Australia | +61 8 9384 6835 |

| (Address of Principal Executive Offices) | (Registrant’s Telephone Number, Including |

| Area Code) | |

| Securities Registered Pursuant to Section 12(b) of the Act: None | |

| Securities Registered Pursuant to Section 12(g) of the Act: Common Stock | |

Indicate by check mark whether the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act)

Yes [ ] No

[X]

The aggregate market value of the voting and non-voting common equity of the registrant held by non-affiliates of the registrant at November 30, 2012 was approximately $1,575,394

The number of shares of common stock of the registrant outstanding at September 13, 2013 was 78,769,712 shares.

TABLE OF CONTENTS

PART I

Item 1. Description of Business Forward-Looking Statements

The statements in this annual report that are not reported financial results or other historical information are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements appear in a number of different places in this report and can be identified by words such as “estimates”, “projects”, “expects”, “intends”, “believes”, “plans”, or their negatives or other comparable words. Also look for discussions of strategy that involve risks and uncertainties. Forward-looking statements include, among others, statements regarding our business plans and availability of financing for our business.

You are cautioned that any such forward-looking statements are not guarantees and may involve risks and uncertainties. Our actual results may differ materially from those in the forward-looking statements due to risks facing us or due to actual facts differing from the assumptions underlying our estimates. Some of these risks and assumptions include those set forth in reports and other documents we have filed with or furnished to the United States Securities and Exchange Commission (“SEC”). We advise you that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to us or persons acting on our behalf. Unless required by law, we do not assume any obligation to update forward-looking statements based on unanticipated events or changed expectations. However, you should carefully review the reports and other documents we file from time to time with the SEC.

Presentation of Information

As used in this annual report, the terms "we", "us", "our" and the “Company” mean Tierra Grande Resources Inc. and its subsidiaries, unless the context requires otherwise.

All dollar amounts in this annual report refer to US dollars unless otherwise indicated.

Overview

We were incorporated as a Nevada company on April 4, 2006. We have been engaged in the acquisition and exploration of mineral properties since our inception. We have not generated any revenues and have incurred losses since inception.

We currently own a 100% interest in the Dome mineral properties, located in the Province of British Columbia, Canada. In addition, we own a 100% interest in two mineral properties (known as the Byng and Tramp claims) also located in the Province of British Columbia, Canada. We owned an option to acquire a 100% interest in the Lady Ermalina mineral properties, located in the Province of British Columbia, Canada, which has expired. As the Byng and Tramp claims are located adjacent to the Lady Ermalina claims, we plan to dispose of our interest in these properties going forward. We have conducted limited exploration work on our mineral properties and none of our properties has been determined to contain any mineral resources or reserves of any kind.

The following table sets forth information relating to our material mineral properties:

2

| Name of Property | Location | Nature of Interest | Status |

| Dome Claims | Beaverdell Area, Greenwood Mining Division in British Columbia, Canada | 100% interest. | Exploration permit has been obtained. |

Our strategy is to identify, acquire and develop assets that present near term cash-flow opportunities with the emphasis on creating early cash flow to enable our company to consider other corporate opportunities.

We continue reviewing what we believe to be opportunities with potential in Peru, South America through our strategic alliance with ExploAndes S.A.C. (“ExploAndes”). ExploAndes is a leading firm of geology consultants and project logistics managers located in Peru assisting in the identification, assessment and development of projects in South America. ExploAndes has a proven track record of delivering professional services to the South American mining industry from mineral project review and assessment to project management.

We expect our strategic alliance with ExploAndes to lead to potential opportunities in South America in line with our strategy. In that regard, in February 2013, we acquired all of the outstanding shares of Tierra Grande Resources S.A.C., a Peruvian company, through which we plan to conduct operations in South America.

In July 2013, we entered into a Letter of Intent to acquire the Buldibuyo Gold Project in Peru. The Buldibuyo Gold Project offers us the opportunity to deliver near term gold production and cash flow. It is our intention to acquire 100% of the gold project, which has produced high grade ore in the past. With support from our strategic relationships and personnel in Peru, we are currently engaged in due diligence to qualify future expectations and timelines.

We have also entered a strategic alliance with Mining Plus Pty Ltd (“Mining Plus”), a leading firm of mining and geoscience consultants with offices in Australia, Canada and Peru, to assist in the identification, assessment and development of projects. We expect the alliance with Mining Plus to lead to other potential opportunities in line with our strategy. Via the strategic alliance with Mining Plus, we have ready access to over 50 seasoned mining industry professionals to assist in the potential development of projects.

Our plan of operations for the next 12 months is to continue to seek out, acquire, explore and potentially develop projects with an emphasis on creating early cash flow for our business, whether by way of acquisition of full ownership, joint venture or other acceptable structure. We also plan to dispose of the Byng and Tramp claims and may conduct a small exploration project on our Dome mineral claims. We anticipate we will require approximately $5 million to carry out our plans over the next 12 months. As at May 31, 2013, we had cash of $39,983 and working capital of $36,400 and will require significant financing to pursue our exploration plans. There can be no assurance that we will obtain the required financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, our business may fail. An investment in our securities involves significant risks and you could lose your entire investment.

Development of Business

We were incorporated under the laws of the State of Nevada in April 2006.

3

On January 29, 2010, we entered into an option agreement (the “Lady Ermalina Option Agreement”) with Argus Metals Corp. (“Argus”) in relation to three mining claims known as the Lady Ermalina Chemainus Claims located on Vancouver Island, British Columbia, Canada (the “Lady Ermalina Property”).

Pursuant to the Lady Ermalina Option Agreement, we agreed to issue an aggregate of 1,500 shares of our common stock and to pay an aggregate of $5,000 in cash in consideration for the grant of the sole and exclusive right and option to acquire a 100% undivided interest in the Lady Ermalina Property. Further, we agreed to incur not less than $600,000 in expenditures related to exploration and development on the Lady Ermalina Property before January 6, 2012. We issued 250 shares to Argus under the Lady Ermalina Option Agreement in February 2010. The option agreement has expired and we no longer have an interest in these claims.

On July 9, 2010, we received stockholder approval to effect a one-for-four hundred reverse stock split of our issued and outstanding common stock, which would take effect upon FINRA approval. The number of shares that we are authorized to issue did not change as a result of the reverse stock split. On July 22, 2010, we received approval from FINRA and the reverse stock split took effect on July 23, 2010.

On August 23, 2010, 0887717 B.C. Ltd. (“0887717”), our wholly-owned subsidiary which we incorporated in British Columbia, Canada on August 9, 2010, entered into an option agreement (the “Dome Option Agreement”) with Murray Scott Morrison, pursuant to which 0887717 had the right to acquire 100% interest in the mineral property known as the Dome Claim Group located on Mount Vallace in the Beaverdell Area, Greenwood Mining Division in the Province of British Columbia, Canada (the “Dome Property”).

In accordance with the provisions of the Dome Option Agreement, 0887717 paid $5,000 to Mr. Morrison on the date of the agreement, was required to incur not less than $10,000 in expenditures related to exploration and development on the Dome Property prior to September 30, 2010 (incurred) and was required to pay $1,000 to Mr. Morrison on or before November 30, 2010 (paid). Pursuant to the terms of the Dome Option Agreement, 0887717 granted to Mr. Morrison stock options (the “Stock Options”) to purchase up to 10% of its total issued and outstanding share capital at a total price of $1.00, which may be exercised when a probable mineral reserve is discovered on the property. The Stock Options expired 36 months after the date of the Dome Option Agreement.

In October 2010, we changed our independent auditors from Manning Elliott LLP to MaloneBailey, LLP. See our Current Report on Form 8-K filed with the SEC on October 13, 2010 for more information.

In December 2010, we completed the sale of 15,000,000 units at a price of $0.01 per unit, with each unit comprised of one share of common stock and one-half of one common stock purchase warrant, with each full warrant exercisable at a price of $0.10 per share for 12 months, for gross proceeds of $150,000, to an investor resident in Australia that acquired the securities for investment purposes. This represented a change-in-control of our Company. In connection with the offering, we appointed Simon Eley as a director of our company. Mr. Eley is a director of the investor in the private placement and was appointed as a director of our company as a result of the investment.

In December 2010, the holders of a majority of our issued and outstanding common stock approved an amendment to our bylaws to make them more comprehensive, as well as an increase in our authorized capital from 80,000,000 shares of common stock, par value $0.0001, to 300,000,000 shares of common stock, par value $0.0001 to better position us to attract financing. The number of shares of preferred stock we are authorized to issue did not change as a result of the authorized capital Increase.

4

In February 2011, we completed the sale of 35,000,000 units at a price of $0.01 per unit, with each unit comprised of one share of common stock and one-half of one common stock purchase warrant, with each full warrant exercisable at a price of $0.10 per share for 12 months, for gross proceeds of $350,000, to certain off-shore investors that acquired the securities for investment purposes.

In April 2011, we and Christopher Robin Relph, our President and Chief Executive Officer, mutually agreed to the termination of the management agreement between us and Mr. Relph, effective December 1, 2010 pursuant to the terms of the management agreement. Under the terms of the management agreement, Mr. Relph had agreed to act as our principal officer in consideration of a salary of $20,000 per month. We have agreed to pay Mr. Relph CDN$24,000 for his services for the quarter ended February 28, 2011 and to pay Mr. Relph CDN$8,000 per month for his services going forward. No early termination penalties were incurred as a result of the termination of the Management Agreement. Mr. Relph resigned as a director and officer of our company in September 2012.

Effective April 18, 2011, we completed the conversion of an aggregate of approximately $66,332 in debt owed by us to six offshore lenders into shares of our common stock at a price of $0.01 per share. As a result, we issued an aggregate of 6,633,200 shares of our common stock to the six lenders.

In September 2011, we acquired title to the Byng and Tramp mining claims adjacent to our Lady Ermalina claims in consideration for 150,000 shares of our common stock. As the Byng and Tramp claims are located adjacent to the Lady Ermalina claims in which our interest has expired, we plan to dispose of our interest in the Byng and Tramp properties going forward.

In September 2011, we appointed Simon Eley, a director of our company, as our President and Chief Executive Officer, in place of Christopher Robin Relph. Mr. Relph, a director of our company at the time, was appointed as Chairman of our board of directors. Mr. Relph resigned as a director and officer of our company in September 2012.

In September 2011, we acquired all rights, title and interest in and to the domain name “Buckingham.com” and related property rights, including all intellectual property rights and rights related to website and internet traffic associated with the domain name, from Mr. Relph for consideration of $10,000.

In October 2011, we raised capital of $715,000 by issuing 14,300,000 shares of common stock at a price of $0.05 per share primarily to off-shore investors.

In December 2011, we extended the exercise period for our outstanding warrants to February 11, 2013. In January 2013, we further extended the exercise period for our outstanding warrants to February 11, 2014. All other terms of the warrants remain the same, including the exercise price of the warrants of $0.10 per share.

In January 2012, we entered into a Strategic Alliance Agreement with Mining Plus to assist in the identification, assessment and development of mining projects, with an emphasis to potentially create early cash flow enabling us to develop and grow our project pipeline. Under the terms of the Strategic Alliance Agreement, we appointed Benjamin Auld, a director of Mining Plus, as a director of our company. In connection with his appointment, we issued 500,000 restricted shares of common stock to Mr. Auld as a one-time incentive for joining our board of directors and other contributions to date.

5

In May 2012, we raised further capital of $431,777 by issuing 4,317,776 shares of common stock at a price of $0.10 per share to certain off-shore investors.

In July 2012, we entered into a Strategic Alliance Agreement with ExploAndes to assist in the identification, assessment and development of mining projects in South America, with an emphasis to potentially create early cash flow enabling us to develop and grow our project pipeline.

In July 2012, we issued an aggregate of 2,750,000 shares of common stock to certain of our directors, officers and employees as compensation for services rendered to us from January 1, 2012 to June 30, 2012 to conserve capital.

In August 2012, Benjamin Auld resigned as a director of our company for personal reasons. We expect to continue working with Mr. Auld as a director of Mining Plus.

In September 2012, Christopher Robin Relph resigned as a director and the Chairman and Chief Financial Officer of our company and we appointed Simon Eley, our current President and Chief Executive Officer, as interim Chief Financial Officer. In December 2012, we appointed Allister Blyth as our Chief Financial Officer. Mr. Blyth is a Certified Practicing Accountant in Australia with over 10 years of experience with both the public and private companies and specializes in financial management, reporting and strategic corporate planning.

In February 2013, we appointed Andrew Gasmier as a director of our company. Mr. Gasmier has extensive experience in the assessment, evaluation and feasibility of mineral projects throughout the globe.

In April 2013, we (i) completed our name change to Tierra Grande Resources Inc. and our ticker symbol changed to “TGRI”, (ii) increased the number of authorized shares of our common stock to 500 million shares, and (iii) adopted a stock incentive plan. See our Schedule 14C filed with the SEC on March 18, 2013 for more information relating to these corporate actions.

In May 2013, we appointed Brad Evans as a director of our company. Mr Evans has been the General Manager of Mining Plus Pty Ltd., for the past five years and has more than 15 years of experience in the mining industry in a diverse range of roles, from production, planning and management of mine sites, to organizational leadership.

In June 2013, we appointed Mark Kalajzich as President and Chief Executive Officer of our company in place of Simon Eley. Mr. Eley was appointed as Chairman of our company. Mr. Kalajzich has held senior executive roles in the Telecommunications, Workforce Management and Finance sectors in Australia and Asia over the past decade, has substantial global resources and commodities experience in equity capital markets and has been heavily involved in the operation and listing of resource companies for the past 2 years.

In line with our plans, we expect to appoint additional directors and officers to manage our growth going forward.

6

Subsidiaries

We currently have two wholly-owned subsidiaries, 0887717 BC Ltd. which is incorporated under the laws of the Province of British Columbia, Canada, and Tierra Grande Resources SAC which is incorporated in Peru.

Competition

We are an exploration stage mineral resource exploration company that competes with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties. We also compete with other mineral exploration companies for financing from a limited number of investors that are prepared to make investments in mineral exploration companies. The presence of competing mineral exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We also compete with other mineral companies for available resources, including, but not limited to, professional geologists, camp staff, mineral exploration supplies and drill rigs.

Intellectual Property

We currently do not own any intellectual property other than copyright in the contents of a website, www.buckingham.com.

Research and Development Expenditures

We have not engaged in any research and development activities since our inception.

Environmental Laws

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. Although we intend to substantially comply with all applicable laws and regulations, because these rules and regulations frequently are amended or interpreted, we cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulations could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the costs of which could materially adversely affect our results of operations and financial condition. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

7

Our operations and properties are subject to extensive federal, state, provincial and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released in the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas, (iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations.

There are no costs to us at the present time in connection with compliance with environmental laws. However, since we do anticipate engaging in natural resource projects, these costs could occur and any significant liability could materially adversely affect our business, financial condition and results of operations.

Employees

We have three part time employees, in addition to our officers. We do not intend to hire any other employees until our financial condition improves.

Item 1A. Risk Factors

Not Applicable.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our head office is currently located at Cnr Stirling Hwy & Fairlight St., Mosman Park, Western Australia 6012 Australia from where we oversee our business activities. We currently do not pay any costs for use of these premises.

Dome Claim Group Property

On August 23, 2010, through our wholly owned subsidiary 0887717 B.C. Ltd., we entered into the Dome Option Agreement, pursuant to which we acquired a 100% interest in mining claims known as Dome Claim Group located on Mount Vallace in Beaverdell Area, Greenwood Mining Division in British Columbia, Canada.

Location

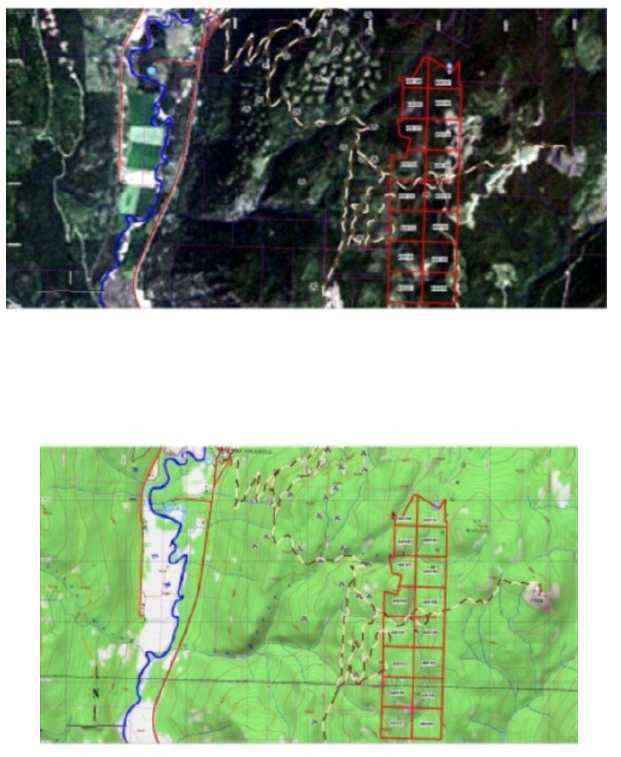

Figures 1 and 2: Location of the Dome Claims in Beaverdel Area, British Columbia.

8

9

Ownership Interest

On August 23, 2010, 0887717 B.C. Ltd., our wholly owned subsidiary, entered into the Dome Option Agreement with Murray Scott Morrison, pursuant to which 0887717 acquired a 100% interest in the mineral property known as the Dome Claim Group located on Mount Vallace in the Beaverdell Area, Greenwood Mining Division in the Province of British Columbia, Canada.

In accordance with the provisions of the Dome Option Agreement, 0887717 paid $5,000 to Mr. Morrison on the date of the agreement, was required to incur not less than $10,000 in expenditures related to exploration and development on the Dome Property prior to September 30, 2010 (incurred) and was required to pay $1,000 to Mr. Morrison on or before November 30, 2010 (paid). Pursuant to the terms of the Dome Option Agreement, 0887717 granted to Mr. Morrison Stock Options to purchase up to 10% of its total issued and outstanding share capital at a total price of $1.00, which may be exercised when a probable mineral reserve is discovered on the property. The Stock Options expire 36 months after the date of the Dome Option Agreement.

History of Operations

The Dome property is comprised of sixteen mineral claims covering approximately 360 hectares (890 acres), located four (4) kilometreres southeast of Beaverdell, B.C. in the heart of the historic Beaverdell Mining Camp. The Dome mineral claims cover the historic workings of the Nepanee prospect that, according to the B. C. Minister of Mines Annual Reports, was worked intermittently between 1904 to 1935. In more recent years, sulphide mineralization including galena and sphalerite has been located near the old workings. The property is accessible by logging roads.

Present Condition of the Property and Current State of Exploration

No material exploration work has been carried out on the Dome Property. A sampling and drilling program was conducted in 1989, however the property was determined to be uneconomical due to the the price of gold at the time. A small mapping project was undertaken on the property in 2009 to prepare the ground for further work.

The property will require prospecting and geological mapping on the western edge of the Dome property where granodiorite is known to outcrop with concentration on known skarn zones and mineralized shear zones that were followed with underground workings on several of the old properties that lie immediately west of the Dome property. Such old workings include those on District Lots 1091s, 1195s and 2939. Further mapping of the Tertiary cover on the eastern portion of the property will also be conducted in an attempt to determine the thickness of the cover. All known historic work will be compiled into a single system at a scale of at least 1:2500 and cross sections prepared for selected target areas.

Regional Geology

The Dome Property lies in the western portion of the Boundary District of south central British Columbia and is centred within south the historic Beaverdell Mining Camp. In broad terms the area is a graben-derived terrane consisting of Triassic-Jurassic volcanics and sediments enclosed within and/or intruded by Jurassic-Cretaceous and Tertiary granitic rocks. Regionally, the Dome Project lies near the southern end of the Omineca Crystalline Belt.

10

The Boundary District is situated within the mid-Jurassic accreted Quesnellia terrane. Pre-existing Proterozoic to Palaeozoic North American basement rocks do however exist within the rafted Quesnellia terrane (Kettle and Okanagan metamorphic core complexes). During the Eocene, these core complexes were uplifted separated from the overlying lithologies. The oldest of the accreted rocks in the district are the Pre-Jurassic Wallace Formation.

Broadly speaking, the lithologies (and general ages) are broken into the following Formations and units:

1. Wallace Formation [Pre-Jurassic - Quesnellia Terrane]

a. Wallace Formation undivided

b. Crouse Creek Greenstone Member

c. Larse Creek Limestone Member

2. West Kettle batholiths [Jurassic]

3. Various intrusive stocks [Tertiary]

a. Beaverdell stock - 58.2 ± 2 Ma

b. Eugene Creek stock - 54.5 ± 1.9 Ma

c. Tuzo Creek stock - 49.5 ± 2 Ma

4. Crosscutting porphyry dykes [Tertiary] 61.9 ± 2.2 Ma and 50.6 ± 1.5 Ma

Geology

Granodiorite of the West Kettle batholith underlies much of the area within and surrounding the Dome Property. This batholith has been repeatedly intruded by stocks of quartz monzonite (the Beaverdell stock), and hosts pendants/screens of metamorphosed country rock (Wallace Formation). The Curry-Creek tuffs and conglomerates (Oligocene age) as well as mafic Miocene flows (Nipple Mountain Volcanics), unconformably overlie all these units.

In the Beaverdell Mining Camp, where the Dome Property lies, silver-lead-zinc ores have predominated historical production. In order of historical importance (production), there are two (2) distinct types of ore:

1) the Beaverdell –Type – Silver rich Vein Deposits

2) The Carmi-Type Gold Rich vein deposits.

The West Kettle batholith is intruded by the Beaverdell stock in the west of the Beaverdell Camp and is overlain by Wallace Formation in the eastern portions of the Camp. Mineralization occurs within structurally controlled fissure related quartz (+/- carbonate) veins predominantly striking northeast. In order of decreasing abundance, the main metallic minerals are galena, sphalerite, pyrite, arsenopyrite, tetrahedrite, pyrargyrite, chalcopyrite, polybasite, acanthite, native silver and pyrrhotite.

11

In the more northern portions of the Camp, sphalerite, pyrite and galena are the main minerals in the vein deposits with a gangue of quartz.

The Dome Property represents an epithermal vein (gold-silver +/- base metals) exploration target. Precious metal epithermal deposit exploration techniques will be applied to substantiate this assessment.

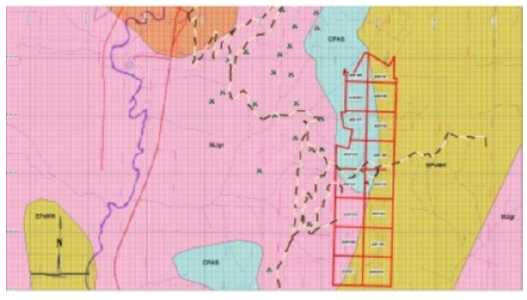

Figure 3: Geology of the Dome Claims

Mineralization

In the Beaverdell Mining Camp silver-lead-zinc ores have predominated historical production. In order of historical importance (production), there are two (2) distinct types of ore:

A. Beaverdell type – Silver Rich Deposits

B. Carmi type – Gold Rich Deposits

In the former case mineralization is typically composed of galena, sphalerite and pyrite with lesser amounts of arsenopyrite, tetrahedrite, pyrargyrite, chalcopyrite, polybasite, acanthite, native silver and pyrrhotite in a gangue of mainly quartz with lesser amounts of calcite and fluorite. In the latter, roughly equivalent with native gold in place of native silver. Both these types of mineralization are noted in the Dome Property:

12

- Beaverdell-Type silver-rich veins in the West Kettle Batholith

- Contact metasomatism related mineralization (within contact zone between West Kettle Batholith and the Wallace Formation

In general the mineralization in the Beaverdell District can be described as hosted within granodiorite of the Westkettle batholith, grading to quartz diorite and diorites with the Permian Wallace Formation metavolcanics and metasediments as roof pendants hosting the mineralization in the northen portions of the Property.

Shear zone related mineralization is the dominant geological control on the Dome Property mineralization and is commonly noted on surface and underground workings in the Beaverdell area. These shear zones are variable in widths from showing to showing, however the widths of these shear zone in the larger, well developed showings (like the Inyo-Ackworth) average approximately two metres and are well defined by rusty fault gouge and vuggy quartz and manganese staining. Lengths of these shear zones are equally as variable from showing to showing, with the larger more productive shear zones defined over 300 metres in length. The shear zones also have variable strikes however a general east-west (075-090 degree) trend can be estimated as the main control of Property mineraliztion.

In general the shear zone related mineralization is associated with vuggy quartz-calcite veins, on the order of 5 to 50 centimetres wide, and commonly carry pyrite, galena, sphalerite, tetrahedrite and native silver mineralization. Strong sericitic alteration and kaolin are known to be associated with mineralization throughout the Property.

Beaverdell silver-rich veins are found in a 3.0 by 0.8 kilometre belt, referred to as the Beaverdell silver-lead-zinc vein camp. The mineralized veins are fissure-hosted, formed along east-trending faults in the west portion of the Beaverdell camp and northeast- trending faults in the east portion of the camp. Faults have been classified into five types based on their orientation, with each type having common orientation, kind of movement and age relationship. The northeast-striking, high-angle normal faults pose the greatest obstacle to systematic exploration and mining, as these faults are commonly spaced a few metres apart dividing veins into short segments in a northwest-downward direction.

Vein-type mineralization of the Beaverdell camp is characterized by a high silver content. Mineralization is composed of galena, sphalerite and pyrite with lesser amounts of arsenopyrite, tetrahedrite, pyrargyrite, chalcopyrite, polybasite, acanthite, native silver and pyrrhotite. The gangue minerals in veins are mainly quartz with lesser amounts of calcite, fluorite and sericite with rare barite.

Item 3. Legal Proceedings

We are not a party to any pending material legal proceedings and are not aware of any material legal proceedings threatened against us or of which our property is the subject. None of our directors, officers or affiliates: (i) are a party adverse to us in any legal proceedings, or (ii) have an adverse interest to us in any legal proceedings.

Item 4. Mine Safety Disclosures

Not applicable.

13

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is listed for trading on the OTC Bulletin Board (“OTCBB”) under the trading symbol “TGRI.OB”. Trading in stocks listed on the OTCBB is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little or no connection to a company’s operations or business activities. We cannot assure you there will be a market for our common stock in the future.

The table below sets forth the high and low bid prices for our common stock on the OTCBB for the periods indicated. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Period | High ($) |

Low ($) |

| June 1, 2013 – August 30, 2013 | 0.02 | 0.01 |

| March 1, 2013 – May 31, 2013 | 0.04 | 0.01 |

| December 1, 2012 – February 28, 2013 | 0.04 | 0.01 |

| September 1, 2012 – November 30, 2012 | 0.05 | 0.02 |

| June 1, 2012 – August 30, 2012 | 0.11 | 0.05 |

| March 1, 2012 – May 31, 2012 | 0.15 | 0.11 |

| December 1, 2011 – February 28, 2012 | 0.18 | 0.08 |

| September 1, 2011 – November 30, 2011 | 0.15 | 0.08 |

| June 1, 2011 – August 31, 2011 | 0.09 | 0.14 |

Holders

As of September 13, 2013, there were 209 holders of record of our common stock.

Dividends

To date, we have not paid any dividends on our common stock and do not expect to declare or pay any dividends on our common stock in the foreseeable future. Payment of any dividends will depend upon future earnings, if any, our financial condition, and other factors as deemed relevant by our Board of Directors.

Equity Compensation Plans

We implemented two equity compensation plans in November 2007: a 2007 Stock Compensation Plan and 2007 Non-Qualified Stock Option Plan. Both plans have been terminated by our board in accordance with their terms.

14

In April 2013, we adopted a 2012 Stock Incentive Plan (the “Plan”). The purpose of the Plan is to promote the long-term success of our company and the creation of stockholder value by encouraging the attraction and retention of qualified employees and non-employee directors, encouraging them to focus on critical long-range objectives of our company and linking their interests directly to stockholder interests through increased stock ownership. The Plan seeks to achieve this purpose by providing for various types of incentive awards to participants. We believe it is important to have flexibility to grant various types of equity awards to our employees so that we can react appropriately to the changing environment. No securities have been issued under the Plan to date.

The Plan shall be administered by our Board until the appointment of an appropriate committee (the “Committee”). The Committee has the discretion to determine the types and terms of awards made under the Plan. The Plan allows the Company to grant stock options; restricted stock rights; restricted stock; performance shares; performance share units; and stock appreciation rights to employees, officers, consultants to, and non-employee directors of, our company on the grant date of the award. The total number of shares subject to all awards under the Plan is fifteen million, subject to adjustment as provided in the Plan for stock splits, dividends, distributions, recapitalizations and other similar transactions or events. The maximum number of shares that may be granted to a participant in any year is three million. If any shares subject to an award are forfeited, expire, lapse or otherwise terminate without issuance of such shares, such shares shall, to the extent of such forfeiture, expiration, lapse or termination, again be available for issuance under the Plan.

The Plan may be amended, terminated or modified with shareholder approval to the extent required by applicable rules, other than for non-substantive amendments to the Plan. The Plan also sets out provisions relating to a change in control of the Company, the non-transferability of awards, the forfeiture and substitution of awards, as well as other provisions customary for plans of this type.

Federal Income Tax Consequences of Awards

The following summary is not intended to (and does not) constitute tax advice, is not intended to be exhaustive and, among other things, does not describe state, local or foreign tax consequences.

There will be no U.S. federal income tax consequences to the participant or us upon the grant of an option under the Plan. Upon exercise of an option that is not an incentive stock option, a participant generally will recognize ordinary income in an amount equal to (i) the fair market value, on the date of exercise, of the acquired shares, less (ii) the exercise price of the option. We will generally be entitled to a tax deduction in the same amount.

Upon the exercise of an incentive stock option, a participant recognizes no immediate taxable income. Income recognition is deferred until the participant sells the shares. If the option is exercised no later than three months after the termination of the participant’s employment, and the participant does not dispose of the shares acquired pursuant to the exercise of the option within two years from the date the option was granted and within one year after the exercise of the option, the gain on the sale will be treated as long-term capital gain. We are not entitled to any tax deduction with respect to the grant or exercise of incentive stock options, except that if the shares are not held for the full term of the holding period outlined above, the gain on the sale of such shares, being the lesser of: (i) the fair market value of the shares on the date of exercise minus the option price or (ii) the amount realized on disposition minus the exercise price, will be taxed to the participant as ordinary income and, we will generally be entitled to a deduction in the same amount. The excess of the fair market value of the shares acquired upon exercise of an incentive stock option over the exercise price therefor constitutes a tax preference item for purposes of computing the “alternative minimum tax” under the Code.

15

There will be no U.S. federal income tax consequences to either the participant or us upon the grant of a stock appreciation right (“SAR”). However, the participant generally will recognize ordinary income upon the exercise of an SAR in an amount equal to the aggregate amount of cash and the fair market value of the shares received upon exercise. We will generally be entitled to a deduction equal to the amount includible in the participant’s income.

Unless a participant makes a “Section 83(b) election” under the Code, there will be no U.S. federal income tax consequences to either the participant or us upon the grant of restricted stock until expiration of the restricted period and the satisfaction of any other conditions applicable to the restricted stock. At that time, the participant generally will recognize taxable income equal to the then fair market value for the shares. We will generally be entitled to a corresponding tax deduction.

There generally will be no U.S. federal income tax consequences to the participant or us upon the grant of performance awards (unless the participant makes a “Section 83(b) election” under the Code) or restricted stock units. Participants generally will recognize taxable income at the time when such awards are paid or settled in an amount equal to the aggregate amount of cash and the fair market value of shares acquired. We will generally be entitled to a tax deduction equal to the amount includible in the participant’s income.

The Plan is intended to provide for Awards that are exempt from, or comply with

Section 409A of the Code to the extent that such section would apply to any Award under the Plan. Section 409A of the Code governs the taxation of deferred compensation. Any participant that is granted an Award that is deemed to be deferred compensation, such as a grant of restricted stock rights or units that does not qualify for an exemption from Section 409A of the Code, and does not comply with Section 409A of the Code, could be subject to taxation on the Award as soon as the Award is no longer subject to a substantial risk of forfeiture (even if the Award is not exercisable) and an additional 20% excise tax (and a penalty based upon an amount of interest determined under Section 409A of the Code) on the value of the Award.

Importance of Consulting Tax Advisor

The information set forth above is a summary only and does not purport to be complete. In addition, the information is based upon current Federal income tax rules and therefore is subject to change when those rules change. Moreover, because the tax consequences to any recipient will depend on his or her particular situation, each recipient should consult his or her tax adviser as to the Federal, state, local, foreign and other tax consequences of the grant or exercise of an Award or the disposition of shares acquired as a result of an Award.

The foregoing summary of the Plan is qualified in its entirety by reference to the full text of the Plan, a copy of which is attached as an exhibit to our Form 8-K filed April 11, 2013.

16

Equity Compensation Plan Information

| As of May 31, 2013 | |||

| Number of Common Shares Issued or to be Issued Under Equity Compensation Plans |

Weighted- Average Exercise Price of Outstanding Options, Warrants and Rights ($) |

Number of Common Shares Remaining Available for Future Issuance Under Equity Compensation Plans | |

| Equity compensation plans not approved by shareholders | |||

| Equity compensation plans approved by shareholders | 0 | - | 15,000,000 |

| Total | 0 | - | 15,000,000 |

Recent Sales of Unregistered Securities

There are no previously unreported sales of our unregistered securities.

Item 6. Selected Financial Data

Not applicable.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our audited financial statements, including the notes thereto, appearing elsewhere in this annual report, as well as the section in this annual report entitled “Description of Business”. These financial statements have been prepared in accordance with U.S. GAAP and are presented in U.S. dollars.

We are an exploration stage company with limited operations and no revenues from our business operations since inception in April 2006. Our auditors have issued a going concern opinion relating to our business which means that our auditors believe there is substantial doubt that we can continue as an ongoing business for the next twelve months unless we obtain additional financing to fund our operations.

We currently own a 100% interest in the Dome mineral properties, located in the Province of British Columbia, Canada. In addition, we own a 100% interest in two mineral properties (known as the Byng and Tramp claims) also located in the Province of British Columbia, Canada. We owned an option to acquire a 100% interest in the Lady Ermalina mineral properties, located in the Province of British Columbia, Canada, which has expired. As the Byng and Tramp claims are located adjacent to the Lady Ermalina claims, we plan to dispose of our interest in these properties going forward. We have conducted limited exploration work on our mineral properties and none of our properties has been determined to contain any mineral resources or reserves of any kind.

17

Our strategy is to identify, acquire and develop assets that present near term cash-flow opportunities with the emphasis on creating early cash flow to enable our company to consider other corporate opportunities.

We continue reviewing what we believe to be opportunities with potential in Peru, South America through our strategic alliance with ExploAndes S.A.C. (“ExploAndes”). ExploAndes is a leading firm of geology consultants and project logistics managers located in Peru assisting in the identification, assessment and development of projects in South America. ExploAndes has a proven track record of delivering professional services to the South American mining industry from mineral project review and assessment to project management.

We expect our strategic alliance with ExploAndes to lead to potential opportunities in South America in line with our strategy. In that regard, in February 2013, we acquired all of the outstanding shares of Tierra Grande Resources S.A.C., a Peruvian company, through which we plan to conduct operations in South America.

In July 2013, we entered into a Letter of Intent to acquire the Buldibuyo Gold Project in Peru. The Buldibuyo Gold Project offers us the opportunity to deliver near term gold production and cash flow. It is our intention to acquire 100% of the gold project, which has produced high grade ore in the past. With support from our strategic relationships and personnel in Peru, we are currently engaged in due diligence to qualify future expectations and timelines.

We have also entered a strategic alliance with Mining Plus Pty Ltd (“Mining Plus”), a leading firm of mining and geoscience consultants with offices in Australia, Canada and Peru, to assist in the identification, assessment and development of projects. We expect the alliance with Mining Plus to lead to other potential opportunities in line with our strategy. Via the strategic alliance with Mining Plus, we have ready access to over 50 seasoned mining industry professionals to assist in the potential development of projects.

Our plan of operations for the next 12 months is to continue to seek out, acquire, explore and potentially develop projects with an emphasis on creating early cash flow for our business, whether by way of acquisition of full ownership, joint venture or other acceptable structure. We also plan to dispose of the Byng and Tramp claims and may conduct a small exploration project on our Dome mineral claims. We anticipate we will require approximately $5 million to carry out our plans over the next 12 months. As at May 31, 2013, we had cash of $39,983 and working capital of $36,400 and will require significant financing to pursue our exploration plans. There can be no assurance that we will obtain the required financing, on terms acceptable to us or at all. In the event we are unable to obtain the required financing, our business may fail. An investment in our securities involves significant risks and you could lose your entire investment.

Results of Operations

Lack of Revenues

We have earned no revenues and have sustained operational losses since our inception on April 4, 2006 to May 31, 2013. As of May 31, 2013, we had an accumulated deficit of $9,016,554. We anticipate that we will not earn any revenues during the current fiscal year or in the foreseeable future as we are an exploration stage company.

18

Expenses

From April 4, 2006 (inception) to May 31, 2013, our total expenses were $3,906,101, comprised of $709,504 in professional fees, $187,131 in mineral property costs and $3,009,466 in general and administrative expenses.

Our total expenses decreased to $388,084 for the year ended May 31, 2013 from $1,028,220 for the year ended May 31, 2012, due to decreased business activities. General and administrative expenses decreased to $333,780 in fiscal 2013 from $824,834 in fiscal 2012 primarily due to reduced due diligence conducted on mineral properties. Mineral property costs decreased to $10,911 in fiscal 2013 from $154,689 in fiscal 2012 primarily due to decreased costs relating to the review of properties for acquisition. Professional fees decreased to $43,393 in fiscal 2013 from $48,697 in fiscal 2012 primarily due to reduced business activity.

Our net loss from continuing operations was $388,084 for the year ended May 31, 2013, compared to $1,028,220 for the prior period.

Net Loss

For the year ended May 31, 2013, we recognized a net loss of $388,084, compared to a net loss of $1,028,220 for the year ended May 31, 2012.

Liquidity and Capital Resources

As of May 31, 2013, we had cash of $39,983, working capital of $36,400, total current assets of $39,983, total liabilities of $3,583 and an accumulated deficit of $9,016,554.

We have funded our operations primarily through private placements of our common stock, as well as advances from related parties and loans. From April 4, 2006 (date of inception) to May 31, 2013, financing activities provided cash of $5,546,053, primarily from the sale of our common stock. During the fiscal year ended May 31, 2013, $23,344 was used in financing activities for advances made to a related party and payments received from related party, net and proceeds from the sale of common stock, compared to $1,116,777 provided by financing activities in the year ended May 31, 2012 from sales of our common stock.

Operating activities used cash of $376,523 for the year ended May 31, 2013, compared to $732,974 for the year ended May 31, 2012. A decrease in accounts payable and accrued liabilities used cash of $106,981 in the year ended May 31, 2013, compared to an increase in same providing cash of $323,281 in the prior year. A decrease in other receivables provided cash of $451 in the current year, compared to $2,978 in the prior year. A decrease in amounts due to related parties used cash of $2,778 in the current year, compared to $101,222 in the prior year. A decrease in prepaid expenses and other current assets provided cash of $10,000 in the current year, compared to an increase in same using cash of $18,451 in prior year.

Investing activities during the year ended May 31, 2013 used cash of $6,773 due to web site development costs and the purchase of property and equipment, compared to $1,993 in the prior year due to the purchase of property and equipment.

We expect that our total expenses will increase over the next year as we increase our business activities. We do not anticipate generating any revenues for the foreseeable future.

19

Our plan of operations for the next 12 months is to continue to seek out, acquire, explore and potentially develop projects with an emphasis on creating early cash flow for our business, whether by way of acquisition of full ownership, joint venture or other acceptable structure. We also plan to dispose of the Byng and Tramp claims and may conduct a small exploration project on our Dome mineral claims. We anticipate we will require approximately $5 million to carry out our plans over the next 12 months. As at May 31, 2013, we had cash of $39,983 and working capital of $36,400 and will require significant financing to pursue our exploration plans.

We intend to raise additional capital for the next 12 months from the sale of our equity securities or loans from related and other parties. If we are unsuccessful in raising sufficient capital through such efforts, we may consider other financing avenues such as bank financing. There is no assurance that any financing will be available to us or if available, on terms that will be acceptable to us. If we are unable to raise additional capital, our business may fail. An investment in our securities involves significant risks and you could lose your entire investment.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Going Concern

Our financial statements for the period ended May 31, 2013 have been prepared on a going concern basis and Note 2 to the statements identifies issues that raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We have not generated any revenues, have achieved losses since our inception, and rely upon the sale of our common stock and loans from related and other parties to fund our operations. We do not anticipate generating any revenues in the foreseeable future, and if we are unable to raise equity or secure alternative financing, we may not be able to pursue our plans and our business may fail.

Critical Accounting Policies

Our financial statements are impacted by the accounting policies used and the estimates and assumptions made by management. A complete summary of these policies is included in Note 3 of the notes to our financial statements. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Use of Estimates

The preparation of these financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The company regularly evaluates estimates and assumptions related to long lived assets, stock-based compensation expense, and deferred income tax asset allowances. The company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the company may differ materially and adversely from the company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

20

Mineral Property Costs

The company has been in the exploration stage since its inception on April 4, 2006 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized. The company assesses the carrying costs for impairment under ASC 360, Property, Plant, and Equipment at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs then incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations.

Stock-Based Compensation

The company records stock-based compensation in accordance with ASC 718,

Compensation – Stock Based Compensation, and ASC 505, Equity based payments to non employees, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. Equity instruments issued to employees and the cost of the services received as consideration are measured and recognized based on the fair value of the equity instruments issued.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Not Applicable.

21

Item 8. Financial Statements and Supplementary Data

Tierra Grande Resources Inc.

(Formerly Buckingham

Exploration Inc.)

(An Exploration Stage Company)

May 31,

2013

22

Report of Independent Registered Public Accounting Firm

To the Board of Directors

Tierra Grande Resources, Inc

(Formerly Buckingham Exploration Inc.)

(An Exploration Stage

Company)

Mosman Park, Australia

We have audited the accompanying consolidated balance sheets of Tierra Grande Resources, Inc (Formerly Buckingham Exploration Inc.) and its subsidiaries, an exploration stage company, (collectively, the “Company” ) as of May 31, 2013 and 2012, and the related consolidated statements of expenses, stockholders’ equity (deficit) and cash flows for the years then ended and the period from April 4, 2006 (inception) through May 31, 2013. The financial statements for the period from April 4, 2006 (inception) through May 31, 2010 were audited by other auditors whose report expressed an unqualified opinion on those financial statements. The financial statements for the period from April 4, 2006(inception) through May 31, 2010 include no revenue and an accumulated net loss of $7,321,429. Our opinion on the statements of expenses, stockholders’ deficit, and cash flows for the year then ended, in so far as it relates to amounts for prior periods through May 31, 2010 is based solely on the report of the other auditor. These financial statements are the responsibility of Tierra Grande Resources, Inc (Formerly Buckingham Exploration Inc.) management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Tierra Grande Resources, Inc (Formerly Buckingham Exploration Inc.) internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Tierra Grande Resources, Inc (Formerly Buckingham Exploration Inc.) and its subsidiaries as of May 31, 2013 and 2012 and the results of their operations and their cash flows for the years then ended and the period from April 4, 2006 (inception) through May 31, 2013 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has suffered recurring losses from operations, which raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters are described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey,

LLP

www.malonebailey.com

Houston, Texas

September 11, 2013

F-1

Tierra Grande Resources Inc.

(Formerly Buckingham

Exploration Inc.)

(An Exploration Stage Company)

Consolidated Balance

Sheets

| May 31, | May 31, | |||||

| 2013 | 2012 | |||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash | $ | 39,983 | $ | 446,623 | ||

| Other receivables | – | 451 | ||||

| Subscription receivable | – | 30,000 | ||||

| Advances to related parties | – | 10,000 | ||||

| Prepaid expense | – | 10,000 | ||||

| Total Current Assets | 39,983 | 497,074 | ||||

| Property and Equipment, net accumulated depreciation of $3,585 and $1,893, respectively | 1,651 | 2,070 | ||||

| Website Development Costs, net amortization of $-0- | 5,500 | – | ||||

| Total Assets | $ | 47,134 | $ | 499,144 | ||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||

| Current Liabilities | ||||||

| Accounts payable | $ | 3,583 | $ | 110,564 | ||

| Accounts payable – related parties | – | 2,778 | ||||

| Accrued liabilities | – | 240,625 | ||||

| Total Liabilities | 3,583 | 353,967 | ||||

| Stockholders’ Equity | ||||||

| Preferred Stock, 20,000,000 shares

authorized, $0.0001 par value, None issued and outstanding |

– | – | ||||

| Common Stock, 500,000,000 shares authorized, $0.0001 par

value 78,769,712 and 76,019,712 shares issued and outstanding, respectively |

7,877 | 7,602 | ||||

| Additional Paid-in Capital | 9,052,228 | 8,766,045 | ||||

| Deficit Accumulated During the Exploration Stage | (9,016,554 | ) | (8,628,470 | ) | ||

| Total Stockholders’ Equity | 43,551 | 145,177 | ||||

| Total Liabilities and Stockholders’ Equity | $ | 47,134 | $ | 499,144 |

The accompanying notes are an integral part of these consolidated financial statements

F-2

Tierra Grande Resources Inc.

(Formerly Buckingham

Exploration Inc.)

(An Exploration Stage Company)

Consolidated Statements

of Expenses

| Accumulated | |||||||||

| For the | For the | from April 4, | |||||||

| Year | Year | 2006 | |||||||

| Ended | Ended | (Date of Inception) | |||||||

| May 31, | May 31, | to May 31, | |||||||

| 2013 | 2012 | 2013 | |||||||

| Expenses | |||||||||

| General and administrative | $ | 333,780 | $ | 824,834 | $ | 3,009,466 | |||

| Exploration mineral property costs | 10,911 | 154,689 | 187,131 | ||||||

| Professional fees | 43,393 | 48,697 | 709,504 | ||||||

| Total Expenses | 388,084 | 1,028,220 | 3,906,101 | ||||||

| Net Loss Before Other Expenses | (388,084 | ) | (1,028,220 | ) | (3,906,101 | ) | |||

| Other Income (Expenses) | |||||||||

| Interest income | – | – | 2,276 | ||||||

| Miscellaneous income | – | – | 1,467 | ||||||

| Interest expense | – | – | (59,588 | ) | |||||

| Accretion of convertible debenture discount | – | – | (31,396 | ) | |||||

| Gain on disposal of property and equipment | – | – | 7,277 | ||||||

| Total Other Income (Expenses) | – | – | (79,964 | ) | |||||

| Net Loss From Continuing Operations | (388,084 | ) | (1,028,220 | ) | (3,986,065 | ) | |||

| Results from discontinued operations | – | – | (5,030,489 | ) | |||||

| Net Loss | $ | (388,084 | ) | $ | (1,028,220 | ) | $ | (9,016,554 | ) |

| Net Loss Per Share – Basic and Diluted | (0.00 | ) | (0.02 | ) | |||||

| Weighted Average Shares Outstanding | 78,393,000 | 66,379,000 |

The accompanying notes are an integral part of these consolidated financial statements

F-3

Tierra Grande Resources Inc.

(Formerly Buckingham

Exploration Inc.)

(An Exploration Stage Company)

Consolidated Statements

of Cash Flows

| For the | For the | Accumulated | |||||||

| Year | Year | from April 4, 2006 | |||||||

| Ended | Ended | (Date of Inception) | |||||||

| May 31, | May 31, | to May 31, | |||||||

| 2013 | 2012 | 2013 | |||||||

| Operating Activities | |||||||||

| Net loss | $ | (388,084 | ) | $ | (1,028,220 | ) | $ | (9,016,554 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities | |||||||||

| Accretion of convertible debenture discount | – | – | 31,396 | ||||||

| Depreciation and amortization | 1,692 | 1,160 | 3,585 | ||||||

| Shares issued for mineral property costs | – | 22,500 | 2,323,600 | ||||||

| Impairment of mineral property costs | – | – | 2,230,125 | ||||||

| Stock-based compensation | 45,833 | 65,000 | 718,953 | ||||||

| Gain on disposal of property and equipment | – | – | (7,277 | ) | |||||

| Loss from discontinued operations | – | – | 37,785 | ||||||

| Bad debt expense | 63,344 | – | 63,344 | ||||||

| Changes in operating assets and liabilities | |||||||||

| Accounts payable and accrued liabilities | (106,981 | ) | 323,281 | 579,884 | |||||

| Other receivables | 451 | 2,978 | (2,288 | ) | |||||

| Prepaid expenses and other current assets | 10,000 | (18,451 | ) | (11,043 | ) | ||||

| Due to related parties | (2,778 | ) | (101,222 | ) | (202,229 | ) | |||

| Net Cash Used in Operating Activities | (376,523 | ) | (732,974 | ) | (3,250,719 | ) | |||

| Investing Activities | |||||||||

| Acquisition of mineral properties | – | – | (2,230,125 | ) | |||||

| Acquisition of property and equipment | (1,273 | ) | (1,933 | ) | (89,969 | ) | |||

| Proceeds from disposition of subsidiaries | – | – | 32,970 | ||||||

| Proceeds from disposal of property and equipment | – | – | 24,777 | ||||||

| Proceeds from disposal of property and equipment in discontinued operations | – | – | 12,496 | ||||||

| Website development costs | (5,500 | ) | – | (5,500 | ) | ||||

| Net Cash Used in Investing Activities | (6,773 | ) | (1,933 | ) | (2,255,351 | ) | |||

| Financing Activities | |||||||||

| Advances from related parties | – | – | 196,671 | ||||||

| Repayments to related parties | – | – | (59,026 | ) | |||||

| Advances to related party receivable | (63,344 | ) | – | (63,344 | ) | ||||

| Proceeds from related party receivable | 10,000 | – | 10,000 | ||||||

| Proceeds from notes payable | – | – | 61,694 | ||||||

| Repayment of note payable | – | – | (73,362 | ) | |||||

| Proceeds from loans payable | – | – | 387,218 | ||||||

| Repayment of loans payable | – | – | (25,000 | ) | |||||

| Proceeds from the issuance of common stock | – | 1,116,777 | 5,278,352 | ||||||

| Proceeds from common stock subscription | 30,000 | – | 40,350 | ||||||

| Share issuance costs | – | – | (207,500 | ) | |||||

| Net Cash Provided by (Used in) Financing Activities | (23,344 | ) | 1,116,777 | 5,546,053 | |||||

| (Decrease) Increase In Cash | (406,640 | ) | 381,870 | 39,983 | |||||

| Cash - Beginning of Period | 446,623 | 64,753 | – | ||||||

| Cash – End of Period | $ | 39,983 | $ | 446,623 | $ | 39,983 | |||

| Non-Cash Investing and Financing Activities: | |||||||||

| Convertible debt issued to settle loans payable | $ | – | $ | – | $ | 350,000 | |||

| Convertible debt issued to settle related party advances | $ | – | $ | – | $ | 150,000 | |||

| Common stock issued for mineral property acquisitions | $ | – | $ | – | $ | 2,201,100 | |||

| Common stock issued for finders fee | $ | – | $ | – | $ | 100,000 | |||

| Common stock issued for prior period accrued services | $ | 240,625 | $ | – | $ | 412,625 | |||

| Disposal of property and equipment for debt settlement | $ | – | $ | – | $ | 16,952 | |||

| Conversion of debt to stock | $ | – | $ | – | $ | 66,332 | |||

| Issuance of stock for settlement of accrued interest | $ | – | $ | – | $ | 477,661 | |||

| Supplemental Disclosures: | |||||||||

| Interest paid | $ | – | $ | – | $ | 21,897 | |||

| Income tax paid | $ | – | $ | – | $ | – |

The accompanying notes are an integral part of these consolidated financial statements

F-4

Tierra Grande Resources Inc.

(Formerly Buckingham

Exploration Inc.)

(An Exploration Stage Company)

Consolidated Statement of

Stockholders’ Equity (Deficit)

For the Period from April 4, 2006 (Inception)

to May 31, 2013

| Deficit | ||||||||||||||||||

| Accumulated | ||||||||||||||||||

| Common | Additional | During the | ||||||||||||||||

| Common Stock | Stock | Paid-in | Exploration | |||||||||||||||

| Shares | Par Value | Subscribed | Capital | Stage | Total | |||||||||||||

| # | $ | $ | $ | $ | $ | |||||||||||||

| Balance – April 4, 2006 (Date of Inception) | – | – | – | – | – | – | ||||||||||||

| May 8, 2006 - issuance of common shares for cash proceeds at $0.04 per share | 50,000 | 5 | – | 1,995 | – | 2,000 | ||||||||||||

| May 20, 2006 - issuance of common shares for cash proceeds at $0.04 per share | 2,500 | – | – | 100 | – | 100 | ||||||||||||

| May 26, 2006 - issuance of common shares for cash proceeds at $0.04 per share | 2,500 | – | – | 100 | – | 100 | ||||||||||||

| May 31, 2006 - common shares subscribed at $40 per share | – | – | 10,350 | – | – | 10,350 | ||||||||||||

| Net loss for the period | – | – | – | – | (6,416 | ) | (6,416 | ) | ||||||||||

| Balance – May 31, 2006 | 55,000 | 5 | 10,350 | 2,195 | (6,416 | ) | 6,134 | |||||||||||

| July 1, 2006 - issuance of common shares for cash proceeds at $40 per share | 1,318 | – | (10,350 | ) | 52,725 | – | 42,375 | |||||||||||

| August 8, 2006 - issuance of common shares for acquisition of mineral property at $40 per share | 5,000 | 1 | – | 199,999 | – | 200,000 | ||||||||||||

| September 28, 2006 - issuance of common shares for transfer agent expenses at $40 per share | 300 | – | – | 12,000 | – | 12,000 | ||||||||||||

| May 7, 2007 - issuance of common shares for cash proceeds at $40 per share | 50 | – | – | 2,000 | – | 2,000 | ||||||||||||

| May 7, 2007 - issuance of common shares for cash proceeds at $40 per share | 500 | – | – | 20,000 | – | 20,000 | ||||||||||||

| May 7, 2007 - issuance of common shares for acquisition of mineral property at $40 per share | 12,500 | 1 | – | 499,999 | – | 500,000 | ||||||||||||

| May 11, 2007 - issuance of common shares for mineral property finders fee at $40 per share | 2,500 | – | – | 100,000 | – | 100,000 | ||||||||||||

| May 16, 2007 - issuance of common shares for cash proceeds at $100 per share | 10,750 | 1 | – | 1,074,999 | – | 1,075,000 | ||||||||||||

| May 16, 2007 - issuance of common shares for finders fee at $100 per share | 538 | – | – | 53,750 | – | 53,750 | ||||||||||||

| Stock-based compensation | – | – | – | 134,999 | – | 134,999 | ||||||||||||

| Share issuance expenses | – | – | – | (53,750 | ) | – | (53,750 | ) | ||||||||||

| Net loss for the year | – | – | – | – | (1,663,949 | ) | (1,663,949 | ) | ||||||||||

| Balance – May 31, 2007 | 88,456 | 8 | – | 2,098,916 | (1,670,365 | ) | 428,559 | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements

F-5

Tierra Grande Resources Inc.

(Formerly Buckingham

Exploration Inc.)

(An Exploration Stage Company)

Consolidated Statement of

Stockholders’ Equity (Deficit)

For the Period from April 4, 2006 (Inception)

to May 31, 2013

| Deficit | ||||||||||||||||||

| Accumulated | ||||||||||||||||||

| Common | Additional | During the | ||||||||||||||||

| Common Stock | Stock | Paid-in | Exploration | |||||||||||||||

| Shares | Par Value | Subscribed | Capital | Stage | Total | |||||||||||||

| # | $ | $ | $ | $ | $ | |||||||||||||

| Balance – May 31, 2007 | 88,456 | 8 | – | 2,098,916 | (1,670,365 | ) | 428,559 | |||||||||||

| August 10, 2007 - issuance of common shares for cash proceeds at $200 per share | 8,750 | 1 | – | 1,749,999 | – | 1,750,000 | ||||||||||||

| September 4, 2007 - issuance of common shares for cash proceeds at $200 per share | 500 | – | – | 100,000 | – | 100,000 | ||||||||||||

| September 12, 2007 - issuance of common shares for cash proceeds at $200 per share | 1,000 | – | – | 200,000 | – | 200,000 | ||||||||||||

| September 12, 2007 - issuance of common shares for cash proceeds at $200 per share | 125 | – | – | 25,000 | – | 25,000 | ||||||||||||

| September 25, 2007 - issuance of common shares for cash proceeds at $200 per share | 500 | – | – | 100,000 | – | 100,000 | ||||||||||||

| October 5, 2007 - issuance of common shares for cash proceeds at $200 per share | 750 | – | – | 150,000 | – | 150,000 | ||||||||||||

| October 18, 2007 - issuance of common shares for cash proceeds at $200 per share | 500 | – | – | 100,000 | – | 100,000 | ||||||||||||

| November 6, 2007 - issuance of common shares for cash proceeds at $200 per share | 500 | – | – | 100,000 | – | 100,000 | ||||||||||||

| January 8, 2008 - issuance of common shares for mineral property at $200 per share | 7,500 | 1 | – | 1,499,999 | – | 1,500,000 | ||||||||||||

| April 18, 2008 - issuance of common shares for consulting fees at $356 per share | 125 | – | – | 44,500 | – | 44,500 | ||||||||||||

| April 21, 2008 - issuance of common shares for cash proceeds at $200 per share | 75 | – | – | 15,000 | – | 15,000 | ||||||||||||

| May 7, 2008 - issuance of common shares for investor relations at $180 per share | 625 | – | – | 112,500 | – | 112,500 | ||||||||||||

| Stock-based compensation | – | – | – | 337,490 | – | 337,490 | ||||||||||||

| Share issuance expenses | – | – | – | (207,500 | ) | – | (207,500 | ) | ||||||||||

| Net loss for the year | – | – | – | – | (4,769,456 | ) | (4,769,456 | ) | ||||||||||

| Balance – May 31, 2008 | 109,406 | 10 | – | 6,425,904 | (6,439,821 | ) | (13,907 | ) | ||||||||||

| October 9, 2008 - cancellation of common shares issued for investor relations at $180 per share | (625 | ) | – | – | (68,339 | ) | – | (68,339 | ) | |||||||||

| September 24, 2008 - Fair value of warrants issued with convertible debentures | – | – | – | 111,556 | – | 111,556 | ||||||||||||

| December 9, 2008 - issuance of common shares for consulting services at $12 per share | 1,250 | – | – | 15,000 | – | 15,000 | ||||||||||||

| Net loss for the year | – | – | – | – | (622,429 | ) | (622,429 | ) | ||||||||||

| Balance – May 31, 2009 | 110,031 | 10 | – | 6,484,121 | (7,062,250 | ) | (578,119 | ) | ||||||||||

The accompanying notes are an integral part of these consolidated financial statements

F-6

Tierra Grande Resources Inc.

(Formerly Buckingham

Exploration Inc.)

(An Exploration Stage Company)

Consolidated Statement of