Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________to __________

Commission file number 001-35887

MIMEDX GROUP, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Florida | | 26-2792552 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification Number) |

| | |

1775 West Oak Commons Court, NE Marietta, GA | | 30062 |

(Address of principal executive offices) | | (Zip Code) |

(770) 651-9100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.001 per share

Securities registered pursuant to Section 12(g) of the Act: None

(Title of class)

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229,405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting Company o |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of Common Stock held by non-affiliates on June 30, 2016, based upon the last sale price of the shares as reported on the NASDAQ on such date, was approximately $787,686,000.

There were 108,840,839 shares of Common Stock outstanding as of February 15, 2017.

Documents Incorporated by Reference

Portions of the proxy statement relating to the 2017 Annual Meeting of Shareholders, to be filed within 120 days after the end of the fiscal year to which this report relates, are incorporated by reference in Part III of this Report.

Table of Contents

|

| | |

Part I |

Item | Description | Page |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

| | |

Part II |

Item 5. | Market for Registrants' Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

| | |

Part III |

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accounting Fees and Services | |

| | |

Part IV |

Item 15. | Exhibits, Financial Statement Schedules | |

Item 16. | Form 10-K Summary | |

Signatures | | |

PART I

This Form 10-K and certain information incorporated herein by reference contain forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, acceptance of our products by the market, and management’s plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “expectation,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should,” and other words or expressions of similar meaning are intended by us to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are found at various places throughout this report and in the documents incorporated herein by reference. These statements are based on our current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

Forward-looking statements include, but are not limited to, the following:

| |

• | the advantages of our products; |

| |

• | the regulatory pathway for our products; |

| |

• | our belief regarding the growth of our direct sales force resulting in increased revenues; |

| |

• | expectations regarding Government and other third-party reimbursement for our products; |

| |

• | our beliefs regarding our relationships with significant distributors; |

| |

• | expectations regarding future revenue growth; |

| |

• | our ability to procure sufficient supplies of human tissue to manufacture and process our products; |

| |

• | market opportunities for our products and future products; |

| |

• | prospects for obtaining additional patents covering our proprietary technology as well as successfully defending our existing patents and prohibiting infringement thereof by third-parties; |

| |

• | the outcome of pending litigation and investigations; and |

| |

• | our ability to compete effectively. |

Actual results and outcomes may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause such a difference include, but are not limited to, those discussed in Part I, Item 1A, “Risk Factors,” below. Except as expressly required by the federal securities laws, we undertake no obligation to update any such factors, or to publicly announce the results of, or changes to any of the forward-looking statements contained herein to reflect future events, developments, changed circumstances, or for any other reason.

As used herein, the terms “MiMedx,” “the Company,” “we,” “our” and “us” refer to MiMedx Group, Inc., a Florida corporation, and its consolidated subsidiaries as a combined entity, except where it is clear that the terms mean only MiMedx Group, Inc.

Item 1. Business

Overview

MiMedx® is an integrated developer, processor and marketer of patent protected and proprietary regenerative biomaterial products and bioimplants processed from human placental tissue, skin and bone. "Innovations in Regenerative Biomaterials" is the framework behind our mission to provide physicians with innovative products that help the body heal itself. MiMedx is the leading global supplier of amniotic tissue products, having supplied over 700,000 allografts to date in Wound Care, Burns, Surgery, Orthopedics, Spine, Sports Medicine, Ophthalmology and Dentistry.

Through our donor program, a mother who is scheduled to deliver a healthy full-term baby via Caesarean section can elect to donate her placental tissue in lieu of having it discarded as medical waste. MiMedx’s procurement network collects the donated human placental tissue which is converted into safe, effective and sterile product at our fully integrated manufacturing facility utilizing our proprietary PURION® Process.

Our biomaterial platform technologies include AmnioFix®, EpiFix®, OrthoFlo, Physio®, and CollaFix™. AmnioFix and EpiFix are our tissue technologies for homologous use processed from human amniotic membrane derived from donated placental tissue. OrthoFlo is our amniotic fluid-derived allograft for homologous use. Physio is a bone grafting material comprised of 100% bone tissue with no added carrier. CollaFix is the next technology platform we plan to commercialize. It is derived from collagen fiber technology designed to mimic the natural composition, structure and mechanical properties of musculoskeletal tissues in order to augment their repair. CollaFix is the only known biological, biodegradable, biomimetic technology that matches human tendon in strength and stiffness.

Our strategic plan aims to provide a more balanced revenue mix and expands our Surgical, Sports Medicine and Orthopedics offerings to include the treatment of joint, ligament and tendon pain in the physician’s office.

Our History

Our current business began on February 8, 2008, when Alynx, Co., our predecessor company, acquired MiMedx, Inc., a Florida-based, privately-held, development-stage medical device company, the assets of which included licenses to two development-stage medical device technology platforms- HydroFix® and CollaFix. On March 31, 2008, Alynx, Co. merged into MiMedx Group, Inc., a Florida corporation and wholly-owned subsidiary that had been formed on February 28, 2008, for purposes of the merger. MiMedx Group, Inc. was the surviving corporation in the merger. In 2010, we commercialized the first medical device product using our HydroFix technology. In 2011 and 2012, we launched additional versions of our HydroFix product line. In January 2011, the Company acquired all of the outstanding equity interests of Surgical Biologics, LLC (“Surgical Biologics”). The acquisition of Surgical Biologics expanded our business by adding allografts and other products processed from human amniotic membrane to our existing medical device product lines based on our HydroFix technology. In 2013, we changed the name of Surgical Biologics to MiMedx Tissue Services, LLC. Due to the relatively small size of the addressable market for our HydroFix product line, we decided to discontinue that product line in the fourth quarter of 2013. Although we have yet to commercialize any products using our CollaFix technology, we continue to believe that technology presents a significant opportunity in the orthopedic and sports medicine markets.

On January 13, 2016, we acquired all of the outstanding common stock of Stability Inc. d/b/a Stability Biologics. The acquisition of Stability was effected by the merger of Stability Inc. into a newly created wholly owned subsidiary of the Company. The new subsidiary was the surviving company in the merger and was subsequently renamed Stability Biologics, LLC ("Stability"). We are working to improve Stability’s manufacturing processes and procedures and integrate its product offerings with our existing surgical, spine and orthopedics portfolio.

For financial information concerning our operating performance, please refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 7 of this report and our Consolidated Financial Statements in Part II, Item 8 of this report.

Our Technology and Products

We are the leading supplier of allografts processed from amniotic tissue, having supplied over 700,000 allografts to date for application in Wound Care, Burns, Surgery, Orthopedics, Spine, Sports Medicine, Ophthalmology and Dentistry. Our amniotic membrane products include our own brands, AmnioFix and EpiFix, as well as products that we supply on a private label or “OEM” basis. We continue to research new opportunities for amniotic tissue, and currently have several additional offerings in various stages of conceptualization and development.

Amniotic membrane is considered immunoprivileged and does not elicit an immune response. Natural human amniotic membrane is composed of multiple layers that contain:

| |

• | Structural proteins; including: |

| |

◦ | Collagen types I, III, IV, V, and VII |

| |

• | Specialized extracellular matrix proteins; including: |

| |

• | TIMPs 1,2,4, Tissue Inhibitor of Metalloproteinase 1, 2, 4 |

| |

• | At least 226 Growth Factors; including but not limited to: |

| |

◦ | Epidermal Growth Factor (EGF) |

| |

◦ | Transforming Growth Factor Beta (TGF-B) |

| |

◦ | Fibroblast Growth Factor (FGF) |

| |

◦ | Platelet Derived Growth Factors AA & BB (PDGF AA&BB) |

Published scientific studies show our proprietary technique for processing allografts from amniotic tissue preserves more of the natural characteristics of the tissue than the processes used by many of our competitors. We operate a licensed tissue bank that is registered as a tissue establishment with the United States Food and Drug Administration ("FDA"). We are an accredited member of the American Association of Tissue Banks (“AATB”). We partner with physicians and hospitals to recover donated placental tissue. After consent for donation is obtained, donors are screened for eligibility and the donated

tissue is tested for safety in compliance with federal regulations and AATB standards on communicable disease transmission. All donor records and test results are reviewed by our Medical Director prior to the release of the tissue for processing.

Over several years, we have developed a unique and proprietary technique for processing allografts from the donated placental tissue. The PURION Process produces an allograft that is easy to use and effective. This unique processing technique specifically focuses on preserving the tissue’s bioactive growth factor content, and maintaining the structure and collagen matrix of the tissue. The PURION Process also allows the allograft to be stored at room temperature and have a five-year shelf life. Additionally, each sheet allograft incorporates specialized visual embossments that assist the health care practitioner with proper allograft placement and orientation.

MiMedx is dedicated to providing easy to use, effective allografts that exceed customer expectations. To better satisfy the requirements and expectations of our customers, we maintain strict controls on quality at each step of the process beginning at the time of procurement. We have developed and implemented a Quality Management System in compliance with both FDA regulations and AATB standards.

EpiFix

Our EpiFix allograft is configured for external use. It is used to enhance healing as well as to modulate inflammation. The EpiFix platform has been used to treat chronic wounds, including diabetic foot ulcers, venous stasis ulcers, arterial ulcers and pressure ulcers, burns and surgical wounds. We offer EpiFix in a sheet form as well as a micronized powder form. The powder can be packed into wounds and is particularly useful for tunneling wounds. Some physicians also choose to mix the powder with saline to inject it into the wound bed and wound margins.

AmnioFix

Our AmnioFix allografts are configured for internal use. Currently, our AmnioFix product line consists of three main configurations, AmnioFix, AmnioFix Wrap and AmnioFix Injectable:

| |

• | AmnioFix is provided in a sheet form. It is used to modulate inflammation, enhance healing and to minimize scar tissue formation. It has been used in spine, urology and general surgeries. |

| |

• | AmnioFix Wrap also is supplied in a sheet form and is configured for the same purposes as AmnioFix, but is optimized for use as a “wrap” for nerves, tendons or ligaments. |

| |

• | AmnioFix Injectable is supplied in micronized powder form used to reduce inflammation while enhancing healing. AmnioFix Injectable has been used to treat conditions such as tendonitis, including plantar fasciitis, lateral epicondylitis, and medial epicondylitis, bursitis, strains and sprains. |

EpiCord

EpiCord is a minimally manipulated, dehydrated, non-viable cellular umbilical cord allograft that provides a connective tissue matrix to replace or supplement damaged or inadequate integumental tissue.

AmnioCord

AmnioCord is a minimally manipulated, dehydrated, non-viable cellular umbilical cord allograft for homologous use that provides a protective environment for the healing process.

AmnioFill

AmnioFill is a minimally manipulated, non-viable cellular tissue matrix allograft that contains multiple extracellular matrix proteins, growth factors, cytokines, and other specialty proteins present in placental tissue to help enhance healing.

OEM Products

Currently, allografts for ophthalmic surgery and dental applications are sold on an OEM basis pursuant to agreements whereby we have granted third parties exclusive licenses to some of our technology for use in those fields in specified markets. As further discussed below, we also sell products on a non-exclusive OEM basis to Medtronic for spinal procedures and Zimmer Biomet for spine and orthopedic procedures.

OrthoFlo

OrthoFlo is a human tissue allograft that is derived from amniotic fluid. Amniotic fluid is the liquid contained within the amniotic sac during pregnancy, which protects, cushions, and enhances the mobility of the fetus, and modulates inflammation. Key elements of amniotic fluid include growth factors, carbohydrates, proteins, lipids, electrolytes, and hyaluronic acid. OrthoFlo is provided lyophilized.

CollaFix

Our CollaFix technology combines an innovative means of creating fibers from soluble collagen and a specialized cross-linking process and products from this platform are likely to be classified as medical devices. Initial laboratory and animal testing shows that the cross-linked collagen fibers produce a very strong, biocompatible, and durable construct that can be transformed into biomechanical constructs intended to treat a number of orthopedic soft-tissue trauma and disease disorders. The technology is licensed from Shriners Hospitals for Children and University of South Florida Research Foundation, Inc. pursuant to an exclusive, world-wide license to practice and use the technology and to manufacture, have manufactured, market, offer for sale and sell products incorporating the technology. The license of the technology is perpetual, except that the license terminates on a country-by-country basis as to any patent or portion thereof included in the licensed technology upon the expiration of such patent or portion thereof in the applicable country. We are currently working to develop and commercialize products using our CollaFix technology and continue to evaluate how best to exploit this technology. We may license rights to specific aspects of our collagen technology to third parties for use in applications and indications that we choose not to exploit ourselves.

We are required to pay a royalty of 3% on all commercial sales revenue from the sale of products incorporating the licensed technology. We also are obligated to pay a $50,000 minimum annual royalty payment over the life of the license.

Physio

Physio is a bone grafting material comprised of 100% bone tissue with no added carrier.

Intellectual Property

Our intellectual property includes owned and licensed patents, owned and licensed patent applications and patents pending, proprietary manufacturing processes and trade secrets, and trademarks associated with our technology. Furthermore, we require employees, consultants and advisors to sign Proprietary Information and Inventions Agreements, as well as Nondisclosure Agreements that assign to us and protect the intellectual property existing and generated from their work or that we may otherwise use or own. We believe that our patents, proprietary manufacturing processes, trade secrets, trademarks, and technology licensing rights provide us with important competitive advantages.

Patents and Patent Applications

Because of the substantial expertise and investment of time, effort and financial resources required to bring new regenerative biomaterial products and implants to the market, the importance of obtaining and maintaining patent protection for significant new technologies, products and processes cannot be underestimated. As of the date of this Form 10-K, we own 33 U.S. patents related to our amniotic tissue technology and products. Approximately, 80 additional patent applications covering aspects of this technology are pending at the United States Patent and Trademark Office and with various international patenting agencies.

Worldwide, our CollaFix and HydroFix technologies are protected with 45 and 14 issued patents, respectively. Additionally, in the U.S. and internationally, there are 30 patent applications pending covering our CollaFix technology.

The vast majority of our domestic patents covering our core amniotic tissue technology and products will not begin to expire until August of 2027.

See discussion below- “Risk Factors” under the heading “Risks Related to Our Intellectual Property.”

Market Overview

Domestic sales currently account for most of our revenue, and we are actively pursuing international expansion. In the United States, Wound Care, Burns, Surgery, Orthopedics, Spine, Sports Medicine, Ophthalmology and Dentistry are our key

markets. For information on the amount of revenues attributed to our Wound Care products and our SSO products for the past three fiscal years, see the discussion of our results of operations in Item 7 of this Form 10-K.

Wound Care

The wound care market includes traditional dressings such as bandages, gauzes and ointments, which are used to treat non-severe wounds and advanced wound care products such as mechanical devices, advanced dressings and biologics, which are used to treat severe wounds or chronic wounds that have not appropriately closed after 45 weeks of treatment with traditional dressings.

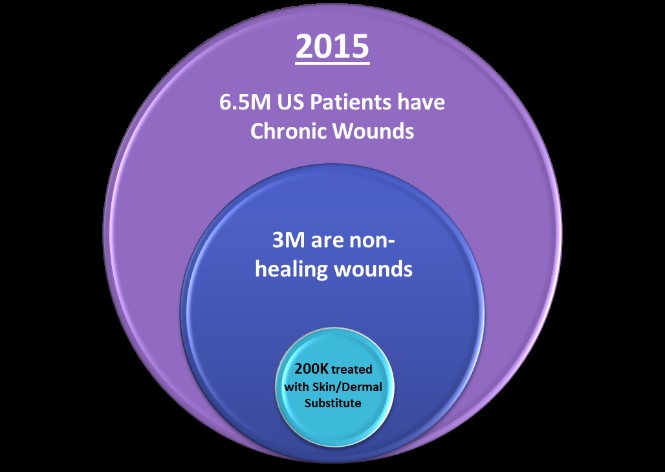

In the United States in 2015, there were 6.5 million1 reported cases of patients suffering from a hard to heal wound with 3.0 million1 of these patients being a candidate for treatment with an advanced wound care product. Of these 3.0 million patients, MiMedx estimates that 1.4 million suffered from either a diabetic foot ulcer or a venous leg ulcer. The overall cost of treating chronic wounds is rising sharply and in the United States, the current annual estimated cost exceeds $25 billion1 dollars.

United States Wound Care Market 2015

Source: BioMedGPS LLC

Wound Biologics, which includes Skin and Dermal Substitutes, Topical Delivery/Drugs and Collagen/Active Dressings, is the largest segment of the Advanced Wound Care Market. In the United States in 2015, Wound Biologics sales reached $957 million1 with Skin and Dermal Substitute Products1 achieving sales of $587 million1. Skin and Dermal Substitute Products represent the largest segment of the Advanced Wound Care Market. In 2015, in the United States, there were 589,0001 applications of a Skin and Dermal Substitute Product accounting for treatment of approximately 200,0001 of the 3.0 million chronic non-healing wounds. Also in 2015, Amniotic Tissue replaced Xenograft1 as the largest product category in the Skin and Dermal Substitute Market.

In the United States, Skin and Dermal Substitute Market growth is expected to primarily be driven by (a) the aging population (b) the rising incidence of obesity, diabetes and other diseases that compromise blood flow and (c) acceleration in the shift away from using traditional wound care products to using advanced wound care products. We believe physician education and increased understanding of the benefits of new wound care technologies, supported by a growing library of Level 1 Scientific Evidence and the emergence of updated clinical practice guidelines that improve patient care and outcomes, will be the main drivers of this shift. MiMedx estimates that in 2020 the Domestic Skin and Dermal Substitute Market will reach sales of $1.1 billion with Amniotic Tissue capturing 49% market share up from 29%1 in 2014.

Traditional dressings such as bandages, gauzes and ointments currently represent the “standard of care” for treating chronic wounds such as diabetic foot ulcers, venous leg ulcers, pressure ulcers and arterial ulcers. If after four weeks of use,

the wound has not responded appropriately to “standard of care” therapy, clinical research has shown that Advanced Therapy such as a Skin and Dermal Substitute should be introduced into the patient’s treatment plan. According to market data provided by BioMedGPS, MiMedx’s EpiFix is the current product of choice for physicians choosing to use a Skin and Dermal Substitute Product. EpiFix contains essential wound healing factors, extracellular matrix proteins and inflammatory mediators to help modulate inflammation, enhance healing, and reduce scar tissue formation and, unlike some competing technologies, is not limited to a specific wound type. EpiFix stores at ambient temperature for up to five years compared to certain cultured skin substitutes currently on the market that require cryogenic freezer storage and expire within days to months from time of processing. In addition, we market multiple sizes of EpiFix (from 1.5cm2 to 49cm2) which minimizes product waste and reduces the overall cost to closure when compared to former market leading products.

Surgical, Sports Medicine and Orthopedics

Our AmnioFix tissue allografts have been used to enhance healing in patients undergoing surgical procedures to help to reduce scar tissue formation in a variety of applications including, but not limited to, plastic surgery, general surgery, gynecological, urology, orthopedics, spine, and sports medicine.

AmnioFix can be used as a barrier membrane in procedures where scar tissue formation may be problematic. AmnioFix Wrap is applied by wrapping target tissues (ligaments, tendons, and or nerves) to create a barrier, which performs two functions: it acts as a neo-sheath to protect the target tissue and provides extracellular matrix proteins, cytokines and chemokines to enhance the wound healing process. AmnioFix provides additional benefits, including anti-inflammatory agents and growth factors that may assist with healing.

Spine/Orthopedics

There are approximately 1.47 million spinal surgeries per year2 and most of them potentially could use AmnioFix to reduce scarring and modulate inflammation during the primary procedure, which may reduce time during revisions or follow-up surgeries. A reduction of scar tissue is beneficial if the patient needs to have an additional surgical procedure in the future, as it may facilitate the re-access to the surgical site, as well as help with minimizing scar attachment to the spinal dura in spine surgery. In addition to spinal surgeries, the AmnioFix offerings have been used in Arthoplasty (total joint replacement) of the knee, hip, shoulder, ankle, hand and elbow.

Sports Medicine

There are an estimated 90,0003 peripheral nerve injuries which require repair each year and an estimated 8.44 million patients who have tendinopathy associated with inflammation who potentially could benefit from our AmnioFix products. AmnioFix Wrap is a surgical implant that has multiple features desired by surgeons to support the repair and replacement of ligaments, tendons and repaired nerves. AmnioFix Injectable and AmnioFix Sports Med address the chronic sports/work soft tissue injury market, including but not limited to tennis elbow, golfers elbow, plantar fasciitis, tendonitis, bursitis and sprains. Soft tissue injuries are often caused by either trauma or overuse of the affected area. Micro-tears in the tissue form and become inflamed. Scar tissue may form and impede a full recovery. Steroids are often used as a first line to help the patient cope with the pain and assist with recovery. There are a number of patients who do not get relief with steroids or do not want to use steroids, and over-use of steroids can cause long-term damage to the tissue. AmnioFix Injectable and AmnioFix Sports Med may be used to modulate inflammation and reduce scar tissue formation, while enhancing healing.

Physician Office Pain Management

OrthoFlo, AmnioFix Injectable and AmnioFix Sports Med address chronic pain caused by osteoarthritis or inflammation of and/or damage to a ligament or tendon. After oral non-habit forming pain medication fails to relieve a patient's pain, injecting medicine into the affected joint, ligament or tendon is the next most common treatment option to help a patient cope with their pain. In the United States in 2015, 14.9 million1 injections were performed to treat pain in the shoulder, spine, foot, ankle, knee, and elbow The majority of these injections were into the knee (7.8 million1) and elbow (3.2 million1) with steroid (85%1) being the most commonly injected product.

Source: BioMedGPS LLC

Because a number of patients do not get relief from steroid injections or do not want to use steroids given their potential to damage human tissue, the pain market is searching for new products that are as effective as steroid in treating these patients but safer. MiMedx OrthoFlo, AmnioFix Injectable and AmnioFix Sports Med lubricate, modulate inflammation and reduce scar tissue formation, while enhancing healing, and are being investigated as potential product candidates for this market.

Market overview numbers derived from the following sources:

| |

1. | BioMedGPS SmartTRAK Business Intelligence |

| |

2. | iData 2012, U.S. Market for Spinal Implants |

| |

3. | Stabenfeldt, SE, Garcia, AJ, LaPlaca, MC. Thermoreversible laminin-functionalized hydrogel for neural tissue engineering. J of Bio Materials Research. Part A, 2006. 77: p. 718-725 |

| |

4. | Millenium 2013, clinical articles and management internal estimates |

| |

5. | Sheehan P., Jones P., Caselli A., Giurini JM., Veves A. Percent change in wound area of diabetic foot ulcers over a 4-week period is a robust predictor of complete healing in a 12-week prospective trial. Diabetes Care 2003;26:1879-1882 [PubMed] |

Marketing and Sales

As of February 2017, our field sales force is comprised of approximately 320 sales professionals who call on hospitals, wound care clinics, physician offices and federal health care facilities such as Department of Veterans Affairs and Department of Defense Hospitals. Our direct sales force focuses on the Wound Care market and the SSO (Surgical, Sports Medicine and Orthopedics) market, though, on the SSO side, we have continued to maintain a network of independent sales agents and distributors to sell sports medicine and orthopedic spine specialties lines.

We continue to pursue private label or “OEM” relationship, to date the most notable of which are Medtronic and Zimmer Biomet. In September 2013, we entered into a non-exclusive distribution agreement with Medtronic, Inc. and its wholly-owned subsidiary, SpinalGraft Technologies, LLC (SGT). Under the agreement, MiMedx provides our PURION Processed grafts to Medtronic to be marketed by SGT under the RDX2® brand name for spinal applications throughout the United States.

In September 2014, we entered into a non-exclusive distribution agreement with Zimmer Biomet to distribute AmnioFix under its private label brand, AmnioRepair®. Under the agreement, Zimmer markets AmnioRepair for reconstructive, sports medicine, trauma, extremities and spine applications in the U.S. These partnerships allow us to leverage

the sales and distribution resources of significant industry companies. In the ophthalmic and dental markets, our products are still marketed exclusively through licensee companies in each such field.

Reimbursement

A significant portion of our products are purchased for U.S. Government accounts, which do not depend on reimbursement from third parties. With the exception of Government accounts, most users of our products are physicians, hospitals or ambulatory surgery centers that rely on reimbursement by third-party payers. Accordingly, our growth substantially depends on adequate levels of third-party reimbursement for our products from these payers. In the U.S., such payers include U.S. Governmental programs (e.g., Medicare and Medicaid), private insurance plans, managed care programs and workers’ compensation plans. Governmental payment programs have prescribed coverage criteria and reimbursement rates for medical products, services and procedures. Similarly, private third-party payers have their own coverage criteria and negotiate payment levels for medical products, services and procedures. In addition, in the U.S., an increasing percentage of insured individuals are receiving their medical care through managed care programs, which monitor and may require pre-approval of the products and services that a member receives.

EpiFix Sheet Products and EpiCord

Medicare Coverage

By far, the largest third party payer in the United States is the Medicare program, which is a federally-funded program that provides healthcare coverage for senior citizens and the disabled. The Medicare program is administered by the Centers for Medicare and Medicaid Services (CMS). The CMS has appointed eight Medicare Administrative Contractors (MACs), which are private insurance companies that serve as agents of the CMS in the administration of the Medicare program, including making coverage decisions and paying claims for the designated Medicare jurisdiction. Each MAC has its own standards and process for determining coverage and reimbursement for a procedure or product. Private payers often follow the lead of Governmental payers in making coverage and reimbursement determinations. Therefore, achieving favorable Medicare coverage and reimbursement is usually a significant gating factor for successful coverage and reimbursement for a new product by the private payer.

The coverage and reimbursement framework for products under Medicare is determined in accordance with the Social Security Act and pursuant to regulations promulgated by the CMS, as well as the agency’s regulatory coverage and reimbursement determinations. Ultimately, however, each of the MACs determine whether and on what conditions they will provide coverage for the product. Such decisions are based on their assessments of the science and efficacy of the applicable product. As noted below under the heading “Research and Development,” we have devoted significant resources to clinical studies to provide data to the MACs, as well as other payers, in order to demonstrate the efficacy and clinical effectiveness of our EpiFix sheet products. As of the date of this report, our EpiFix sheet products are eligible for coverage by all eight of the Medicare Contractors.

For Medicare reimbursement purposes, our EpiFix sheet products are classified as “skin substitutes.” Current reimbursement methodology varies between the hospital outpatient department (HOPD) and ambulatory surgery center (ASC) setting versus the physician office. Our EpiFix sheet allografts come in many sizes to appropriately fit the size of the patient’s wound. Some competitive products come in one size only with the product size significantly larger than the wounds they are used to treat. The provider has to cut these products to fit the wound size, with the rest of the product discarded, and, therefore, wasted. Formerly, reimbursement for these products was based on the size of the graft and the Medicare payment for these grafts was costly. In 2014, CMS implemented a new reimbursement methodology in the HOPD and ASC, in part to combat this wastage. Currently, skin substitutes are reimbursed under a “packaged” or “bundled” methodology along with the related application procedure under a two-tier payment system. Thus, in the HOPD setting, providers receive a single payment that reimburses for the application of the product as well as the product itself. CMS also classifies skin substitutes into low cost or high cost groups, based on a weighted per square centimeter average. In 2016, the weighted average mean unit cost to determine the high and low cost group was $25 per sq. cm. The national average packaged rate was $1,371 in 2014, $1,407 in 2015, $1,411 in 2016, and $1,427 in 2017. All skin substitute products administered in the HOPD setting are bundled except for those that have been approved by CMS for pass-through status. This "bundled" payment structure applies only to the HOPD and ASC settings.

Currently, providers that administer EpiFix allografts and other skin substitutes in the physician office setting are reimbursed based on the size of the graft, computed on a per square centimeter basis. The payment rate is calculated using the manufacturer’s reported average sales price (ASP) submitted quarterly to CMS. This payment methodology applies only to physician offices. The Medicare payment rates are updated quarterly based on this ASP information. The skin substitute Medicare payment rate established by statute is ASP plus 6%.

We believe the current payment methodology in the physician office setting at ASP plus 6%, coupled with our success in gaining payer coverage with Medicaid and commercial payers will provide us with opportunities to increase our market share in 2017.

Beginning April 1, 2013 Medicare payments for all items and services, including EpiFix sheet products, have been reduced by 2% under the sequestration required by the Budget Control Act of 2011, Pub. L. No. 112-25, as amended by the American Taxpayer Relief Act of 2012, Pub. L. 112-240. This sequestration is subject to change with the new administration, and is currently under review.

In January 2017, EpiCord was included in the CMS Q Code, Q4131, which is also the Q code specified for EpiFix.

Private Payers

We continue to devote considerable resources to clinical trials to support coverage and reimbursement of our products and have confirmed an increasing number of private payers that reimburse for EpiFix in the physician office, the HOPD, and the ASC settings. Coverage and reimbursement varies according to the patient’s health plan and related benefits. More than 800 health plans currently provide coverage for EpiFix for the treatment of Diabetic Foot Ulcers (DFUs). Venous Leg Ulcers (VLUs) are also covered by a series of payers. At the close of 2016, we reported coverage of over 298 million lives, including all of the Medicare MACs, and over 36 State Medicaid plans. We have established and continue to grow a reimbursement support group to educate and assist providers and patients with regard to reimbursement for our products.

Hospital Use

EpiFix products administered in the hospital setting are bundled when submitted as part of the hospital’s claim under a diagnosis-related group (DRG). In these cases, we continue to educate the hospital that the product is both efficacious, resulting in positive healing outcomes and a reduced length-of-stay, as well as cost-effective.

AmnioFix Sheet Products

Our AmnioFix surgical products are also bundled under a DRG as part of a hospital’s claim related to the length-of-stay. As noted above, with respect to EpiFix, the ability to sell products in the hospital market is dependent upon demonstrating to the hospital that the product’s efficacy results in positive healing outcomes, provides the potential for a reduced length-of-stay, and is cost-effective.

EpiFix and AmnioFix Micronized Products

Currently, our micronized products are available for coverage by only a limited number of commercial and state Medicaid plans.

Other Products

There is currently no specific third-party reimbursement available for OrthoFlo, AmnioCord, AmnioFill or Physio, except to the extent such products are bundled as part of a hospital’s claim under a DRG.

See discussion below- “Risk Factors” under the heading “Our revenues depend on adequate reimbursement from public and private insurers and health systems.”

Customer Concentration

We have significant sales to Government accounts. Some of the Company’s sales to Government accounts, including the Department of Veterans Affairs, are made through a distributor relationship with AvKARE, Inc. ("AvKARE") which is a veteran-owned General Services Administration Federal Supply Schedule (FSS) contractor. The Company's agreement with AvKARE expires, subject to certain for-cause termination rights, on June 30, 2017. The Company may also elect to terminate

the agreement without cause and pay a termination fee to AvKARE as specified in the agreement. Upon termination of the agreement, the parties may mutually agree to extend the agreement or the Company has an obligation to repurchase AvKARE’s remaining inventory, if any, within ninety (90) days in accordance with the terms of the agreement. At the end of the term, the parties expect AvKARE’s inventory to be minimal, based upon AvKARE's obligation to use commercially reasonable efforts to achieve target sales levels over the remaining term of the agreement.

See discussion below- “Risk Factors” under the heading “A significant portion of our revenues and accounts receivable come from Government accounts”.

Competition

Competition in the regenerative medicine field is intense and subject to rapid technological change. Companies within the industry compete on the basis of product efficacy, pricing, and ease of handling/logistics. However, the most important factor is third-party reimbursement, which is difficult to obtain as it is a time-consuming and expensive process. We believe our success in obtaining third-party reimbursement for our products is a significant competitive advantage.

We compete in multiple areas of clinical treatment where regenerative biomaterials may be employed to modulate inflammation, enhance healing and reduce scar tissue formation: advanced wound care treatment, spine, orthopedic, surgery and sports medicine. The EpiFix product line is promoted primarily for external use such as advanced wound healing, while the AmnioFix products are positioned for healing of surgical wounds and have been used in spine, orthopedics, surgical and sports medicine applications.

Advanced wound care therapies employ technologies to aid in wound healing in cases where the healing has stalled or stopped. The primary competitive products in this space include other amniotic membrane allografts, tissue-engineered living skin equivalents, and porcine- or bovine-derived collagen matrix products, among others. In 2016, our main competitor was Organogenesis, Inc., the manufacturer of Dermagraft®, Apligraf® and PuraPly®. These products are tissue-engineered living skin equivalents that require special shipping and/or storage in freezers. The Organogenesis products also come in only one large size each, which is significantly larger than the median wound size for the wounds they are used to treat, resulting in a high cost product, much of which is wasted. We have competed effectively against Dermagraft and Apligraf based on clinical efficacy, cost effectiveness, ease of use and storage of our products. Other smaller competitors include the Osiris Therapeutics, Inc. product Grafix® and other single-layer amnion products.

Smith & Nephew’s Oasis® is the primary competitive product among the porcine- or bovine- derived collagen matrix products. As a collagen it can help with providing a matrix in the wound; however, it offers limited growth factors to enhance healing and due to the porcine origin may cause an immune response in the patient.

The primary competitive products in the SSO market are other amniotic membrane allografts and injectable solutions.

See discussion below- “Risk Factors” under the heading “We are in a highly competitive and evolving field and face competition from well-established tissue processors and medical device manufacturers, as well as new market entrants.”

Government Regulation

FDA Premarket Clearance and Approval Requirements

Tissue Products

The products manufactured and processed by the Company are derived from human tissue. As discussed below, some tissue-based products are regulated solely under Section 361 of the Public Health Service Act as human cells, tissues and cellular and tissue-based products, or HCT/Ps, which do not require premarket clearance or approval by the FDA. Other tissue products are regulated as biologics and, in order to be lawfully marketed in the United States, require an FDA-approved biologics application (BLA).

Products Regulated as HCT/Ps

The FDA has specific regulations governing human cells, tissues and cellular and tissue-based products, or HCT/Ps. An HCT/P is a product containing or consisting of human cells or tissue intended for transplantation into a human patient. HCT/Ps that meet the criteria for regulation solely under Section 361 of the Public Health Service Act (so-called “361 HCT/Ps”) are not subject to any premarket clearance or approval requirements but are subject to post-market regulatory requirements.

To be a 361 HCT/P, a product generally must meet all four of the following criteria:

| |

• | It must be minimally manipulated; |

| |

• | It must be intended for homologous use; |

| |

• | Its manufacture must not involve combination with another article, except for water, crystalloids or a sterilizing, preserving or storage agent; and |

| |

• | It must not have a systemic effect and must not be dependent upon the metabolic activity of living cells for its primary function. |

If an HCT/P meets all the above criteria, no FDA review for safety and effectiveness under a drug, device, or biological product marketing application is required. We believe that our amniotic tissue allografts are 361 HCT/Ps, including the micronized versions of EpiFix and AmnioFix.

However, on August 28, 2013, the FDA issued an Untitled Letter alleging that our micronized amniotic tissue allografts do not meet the criteria for regulation solely under Section 361 of the Public Health Service Act and that, as a result, MiMedx would need a biologics license to lawfully market those micronized products. Since the issuance of the Untitled Letter, we have been in discussions with the FDA to communicate its disagreement with the FDA's assertion that our allografts are more than minimally manipulated. To date, the FDA has not changed its position that our micronized products are not eligible for marketing solely under Section 361 of the Public Health Service Act. We continue to market the micronized products but are also pursuing the Biologics License Application (“BLA”) process for certain of our micronized products.

On December 22, 2014, the FDA issued for comment “Draft Guidance for Industry and FDA Staff: Minimal Manipulation of Human Cells, Tissues, and Cellular and Tissue-Based Products.” Essentially the Minimal Manipulation draft guidance takes the same position with respect to micronized amniotic tissue that it took in the Untitled Letter to MiMedx 16 months earlier. We submitted comments asserting that the Minimal Manipulation draft guidance represents agency action that goes far beyond the FDA’s statutory authority, is inconsistent with existing HCT/ P regulations and the FDA’s prior positions, and is internally inconsistent and scientifically unsound.

On October 28, 2015, the FDA issued for comment, "Draft Guidance for Industry and FDA Staff: Homologous Use of Human Cells, Tissues, and Cellular and Tissue-Based Products." We submitted comments on this Homologous Use draft guidance as well. On September 12 and 13, 2016, the FDA held a public hearing to obtain input on the Homologous Use draft guidance and the previously released Minimal Manipulation draft guidance, as well as other recently issued guidance documents on HCT/Ps. The Company awaits further decision from FDA on the draft guidances, but anticipates this will be a lengthy process.

See discussion below- “Risk Factors” under the heading “To the extent our products do not qualify for regulation as human cells, tissues and cellular and tissue-based products under Section 361 of the Public Health Service Act, this could result in removal of the applicable products from the market, would make the introduction of new tissue products more expensive and significantly delay the expansion of our tissue product offerings and subject us to additional post-market regulatory requirements.”

Products Regulated as Biologics- The Biologics License Application (BLA) Pathway

The typical steps for obtaining FDA approval of a BLA to market a biologic product in the U.S. include:

| |

• | Completion of preclinical laboratory tests, animal studies and formulations studies under the FDA’s good laboratory practices regulations; |

| |

• | Submission to the FDA of an Investigational New Drug Application (IND) for human clinical testing, which must become effective before human clinical trials may begin and which must include independent Institutional Review Board (IRB) approval at each clinical site before the trials may be initiated; |

| |

• | Performance of adequate and well-controlled clinical trials in accordance with Good Clinical Practices to establish the safety and efficacy of the product for each indication; |

| |

• | Submission to the FDA of a BLA for marketing the product, which includes, among other things, reports of the outcomes and full data sets of the clinical trials, and proposed labeling and packaging for the product; |

| |

• | Satisfactory review of the contents of the BLA by the FDA, including the satisfactory resolution of any questions raised during the review; |

| |

• | Satisfactory completion of an FDA Advisory Committee review, if applicable; |

| |

• | Satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with Current Good Manufacturing Practices (cGMP) regulations, to assure that the facilities, methods and controls are adequate to ensure the product’s identity, strength, quality and purity; and |

| |

• | FDA approval of the BLA, including agreement on post-marketing commitments, if applicable. |

Generally, clinical trials are conducted in three phases, though the phases may overlap or be combined. Phase I trials typically involve a small number of healthy volunteers and are designed to provide information about the product safety and to evaluate the pattern of drug distribution and metabolism within the body. Phase II trials are conducted in a larger but limited group of patients afflicted with a particular disease or condition in order to determine preliminary efficacy, dosage tolerance and optimal dosing and to identify possible adverse effects and safety risks. Dosage studies are designated as Phase IIA and efficacy studies are designated as Phase IIB. Phase III clinical trials are generally large-scale, multi-center, comparative trials conducted with patients who have a particular disease or condition in order to provide statistically valid proof of efficacy, as well as safety and potency. In some cases, the FDA will require Phase IV, or post-marketing trials, to collect additional data after a product is on the market. All phases of clinical trials are subject to extensive record keeping, monitoring, auditing, and reporting requirements. As indicated above, the Company is pursuing the Biologics License Application (“BLA”) process for certain of its micronized products. On July 22, 2014, we filed our first IND application with the FDA. In response to the IND application, the FDA agreed we had sufficient data to begin a Phase IIB clinical trial of our micronized product for a specified indication of use in anticipation of a BLA, which we expect to submit at a future date. The clinical trial was initially powered to enroll approximately 150 patients in 10 - 20 clinical sites in the U.S. We initiated the trial in March of 2015, and have now nearly completed the study, with 13 sites currently enrolling out of a total of 20 engaged. We submitted an Annual Report and Interim Analysis Report to FDA on October 22, 2016. If the endpoint change is accepted by FDA, no additional subjects would be required to complete the enrollment phase of study. Enrollment is otherwise scheduled to be completed within the second quarter of 2017. Preliminary safety information, including laboratory testing in a cohort of participants, continues to demonstrate safety of the product in standard use. The Company anticipates moving ahead with a Phase III filing within the second quarter of 2017.

The process of obtaining an approved BLA requires the expenditure of substantial time, effort and financial resources and may take years to complete. The fee for filing a BLA and the annual user fees payable with respect to any establishment that manufactures biologics and with respect to each approved product are substantial.

See discussion below- “Risk Factors” under the heading “Obtaining and maintaining the necessary regulatory approvals for certain products will be expensive and time-consuming and may impede our ability to fully exploit our technologies.”

Medical Devices

Products from our CollaFix product platform are likely to be classified by the FDA as medical devices. Medical Devices are classified as I, II and III in the U.S., with Class II and III requiring either a 510(k) clearance or Premarket Approval (“PMA”) from the FDA prior to marketing. Devices deemed substantially equivalent to legally marketed devices are deemed to pose relatively less risk and are deemed Class I and II. Manufacturers are required to submit a premarket notification requesting clearance for commercial distribution. This is known as 510(k) clearance, which indicates that the device is substantially equivalent to devices already legally on the market. Most Class I devices are considered very low risk and are exempted from this requirement. Devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or devices deemed not substantially equivalent to a previously 510(k) cleared device or a pre-amendment Class III device for which PMA applications have not been required, are placed in Class III, requiring PMA. Although we may be able to obtain approval for some products through the 510(k) clearance process, in order to fully exploit the CollaFix technology, one or more PMA applications would likely be required.

Like the process of obtaining an approved BLA, the process of obtaining a PMA requires the expenditure of substantial time, effort and financial resources and may take years to complete.

FDA Post Market Regulation

Tissue processors are required to register as an establishment with the FDA. As a registered establishment, we are required to comply with regulations regarding labeling, record keeping, donor eligibility, and screening and testing, process the tissue in accordance with established Good Tissue Practices, and report any adverse reactions attributed to our tissue. Our facilities are also subject to periodic inspections to assess our compliance with the regulations.

Products covered by a BLA, 510(k) clearance, or a PMA are subject to numerous additional regulatory requirements, which include, among others, compliance with cGMP, which imposes certain procedural, substantive and record keeping requirements, labeling regulations, the FDA’s general prohibition against promoting products for unapproved or “off-label” uses, and additional adverse event reporting.

Other Regulation Specific to Tissue Products

We are accredited by the American Association of Tissue Banks (AATB), which has issued operating standards for tissue banking. Compliance with these standards is a requirement in order to become a licensed tissue bank. In addition, some states have their own tissue banking regulations.

In addition, procurement of certain human organs and tissue for transplantation is subject to the restrictions of the National Organ Transplant Act (“NOTA”), which prohibits the transfer of certain human organs, including skin and related tissue, for valuable consideration, but permits reasonable payment associated with the removal, transportation, implantation, processing, preservation, quality control and storage of human tissue and skin. We reimburse tissue banks, hospitals and physicians for their services associated with the recovery, storage and transportation of donated human tissue.

See discussion below- “Risk Factors” under the heading "Our business is subject to continuing regulatory compliance by the FDA and other authorities, which is costly and our failure to comply could result in negative effects on our business".

Fraud, Abuse and False Claims

We are directly and indirectly subject to various federal and state laws governing relationships with healthcare providers and pertaining to healthcare fraud and abuse, including anti-kickback laws. In particular, the federal healthcare program Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing, arranging for or recommending a good or service for which payment may be made in whole or part under federal healthcare programs, such as the Medicare and Medicaid programs. Penalties for violations include criminal penalties and civil sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal healthcare programs. The Anti-Kickback Statute is broad and prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. In implementing the statute, the Office of Inspector General of the U.S. Department of Health and Human Services (“OIG”) has issued a series of regulations, known as the “safe harbors.” These safe harbors set forth provisions that, if all their applicable requirements are met, will assure healthcare providers and other parties that they will not be prosecuted under the Anti-Kickback Statute. The failure of a transaction or arrangement to fit precisely within one or more safe harbors does not necessarily mean that it is illegal or that prosecution will be pursued. However, conduct and business arrangements that do not fully satisfy each applicable element of a safe harbor may result in increased scrutiny by Government enforcement authorities, such as the OIG. Many states have laws similar to the federal law.

AdvaMed is one of the primary voluntary U.S. trade associations for medical device manufacturers. This association has established guidelines and protocols for medical device manufacturers in their relationships with healthcare professionals on matters including research and development, product training and education, grants and charitable contributions, support of third-party educational conferences, and consulting arrangements. Adoption of the AdvaMed Code by a medical device manufacturer is voluntary, and while the OIG and other federal and state healthcare regulatory agencies encourage its adoption and may look to the AdvaMed Code, they do not view adoption of the AdvaMed Code as proof of compliance with applicable laws. As part of a Company-wide compliance plan, we have incorporated the principles of the AdvaMed Code in our standard operating procedures, sales force training programs, and relationships with health care professionals. Key to the underlying principles of the AdvaMed Code is the need to focus the relationships between manufacturers and healthcare professionals on matters of training, education and scientific research, and limit payments between manufacturers and healthcare professionals to fair market value for legitimate services provided and payment of modest meal, travel and other expenses for a healthcare professional under limited circumstances. We have incorporated these principles into our relationships with healthcare professionals under our consulting agreements, and our policies regarding payment of travel and lodging expenses, research and educational grant procedures and sponsorship of third-party conferences.

See discussion below- “Risk Factors” under the heading “We and our sales representatives, whether employees or independent contractors, must comply with various federal and state anti-kickback, self-referral, false claims and similar laws, any breach of which could cause a material adverse effect on our business, financial condition and results of operations.”

Manufacturing (Processing)

In early 2014, we expanded our production capacity from one location in Kennesaw, Georgia, by adding a second and significantly larger, manufacturing facility within our headquarters building in Marietta, Georgia. Effective January 2014, our main processing operations were relocated to the Marietta, Georgia facility. The Kennesaw facility serves as a secondary processing site. We also perform research and early stage product and process development activities in our Marietta and Kennesaw, Georgia, locations. Stability maintains a facility in San Antonio, Texas for tissue processing.

We are registered with the FDA as a tissue establishment and are subject to the FDA’s quality system regulations, state regulations, and regulations promulgated by the European Union. Our facilities are subject to periodic unannounced inspections by regulatory authorities, and may undergo compliance inspections conducted by the FDA and corresponding state and foreign agencies.

Placental Donation Program

We have a comprehensive network of hospitals that participate in our placenta donation program. We have a dedicated staff that works at these hospitals, collecting donated placentas from mothers who undergo Cesarean section births and consent to donation. We believe that we will be able to procure an adequate supply of tissue to meet anticipated demand. However, see discussion below- “Risk Factors” under the heading “Our products are dependent on the availability of sufficient quantities of tissue from human donors, and any disruption in supply could adversely affect our business."

Research and Development

Our research and development group has extensive experience in developing products related to our field of interest, and works to design products that are intended to improve patient outcomes, simplify techniques, shorten procedures, reduce hospitalization and rehabilitation times and, as a result, reduce costs. Clinical trials that demonstrate the safety, efficacy and cost effectiveness of our products are key to obtaining broader reimbursement for our products. In addition to our internal staff, we contract with outside labs and physicians who aid us in our research and development process. See Part II, Item 7 below for information regarding expenditures for research and development in each of the last three fiscal years.

In addition to the numerous published scientific studies, our allograft is the first and only dHACM product to meet the requirements of the USP (United States Pharmacopeia) Monograph for amniotic membrane allografts. This monograph includes both EpiFix and AmnioFix sheet products, and is the culmination of several years of work to define specifications, review, and test those specifications to ensure they accurately define the dHACM product with high manufacturing standards.

Environmental Matters

Our tissue preservation activities generate some chemical and biomedical wastes, consisting primarily of diluted alcohols and acids, and human and animal pathological and biological wastes, including human and animal tissue and body fluids removed during laboratory procedures. The chemical and biomedical wastes generated by our tissue processing operations are placed in appropriately constructed and labeled containers and are segregated from other wastes. We contract with third parties for transport, treatment, and disposal of waste. We strive to remain compliant with applicable laws and regulations promulgated by the Resource Conservation and Recovery Act, the U.S. Environmental Protection Agency and similar state agencies.

Employees

As of December 31, 2016, we had approximately 690 employees. We consider our relationships with our employees to be satisfactory. None of our employees is covered by a collective bargaining agreement.

Available Information

Our website address is www.mimedx.com. We make available on this website under “Investors - SEC Filings,” free of charge, our proxy statements, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. In addition, we post filings of Forms 3, 4, and 5 filed by our directors, executive officers and ten percent or more

shareholders. We also make available on this website under the heading “Investors - Corporate Governance” our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee Charters as well as our Code of Business Conduct and Ethics.

The reference to our website does not constitute incorporation by reference of any information contained at that site.

Item 1A. Risk Factors

Risks Related to Our Business and Industry

Our operating results may fluctuate significantly as a result of a variety of factors, many of which are outside of our control.

We are subject to the following factors, among others, that may negatively affect our operating results:

| |

• | The announcement or introduction of new products by our competitors; |

| |

• | Failure of Government and private health plans to adequately and timely reimburse the users of our products; |

| |

• | Removal of our products from the Federal Supply Schedule or change in the prices that Government accounts will pay for our products; |

| |

• | Our ability to upgrade and develop our systems and infrastructure to accommodate growth; |

| |

• | Our ability to attract and retain key personnel in a timely and cost effective manner; |

| |

• | The amount and timing of operating costs and capital expenditures relating to the expansion of our business, operations and infrastructure; |

| |

• | Regulation by federal, state or local Governments; and |

| |

• | General economic conditions as well as economic conditions specific to the healthcare industry. |

We have based our current and future expense levels largely on our investment plans and estimates of future events, although certain of our expense levels are, to a large extent, fixed. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenue relative to our planned expenditures would have an immediate adverse effect on our business, results of operations and financial condition. Further, as a strategic response to changes in the competitive environment, we may from time to time make certain pricing, service or marketing decisions that could have a material and adverse effect on our business, results of operations and financial condition. Due to the foregoing factors, our revenue and operating results are and will remain difficult to forecast.

We are in a highly competitive and evolving field and face competition from well-established tissue processors and medical device manufacturers, as well as new market entrants.

Our business is in a very competitive and evolving field. Competition from other tissue processors, medical device companies and from research and academic institutions is intense, expected to increase, subject to rapid change, and could be significantly affected by new product introductions. In addition, consolidation in the healthcare industry continues to lead demands for price concessions or to the exclusion of some suppliers from certain of our markets, which could have an adverse effect on our business, results of operations or financial condition. The presence of this competition in our market may lead to pricing pressure, which would make it more difficult to sell our products at a price that will make us profitable or prevent us from selling our products at all. Our failure to compete effectively would have a material and adverse effect on our business, results of operations and financial condition.

Rapid technological change could cause our products to become obsolete and if we do not enhance our product offerings through our research and development efforts, we may be unable to effectively compete.

The technologies underlying our products are subject to rapid and profound technological change. Competition intensifies as technical advances in each field are made and become more widely known. We can give no assurance that others will not develop services, products, or processes with significant advantages over the products, services, and processes that we offer or are seeking to develop. Any such occurrence could have a material and adverse effect on our business, results of operations and financial condition.

We plan to enhance and broaden our product offerings in response to changing customer demands and competitive pressure and technologies. The success of any new product offering or enhancement to an existing product will depend on numerous factors, including our ability to:

| |

• | properly identify and anticipate physician and patient needs; |

| |

• | develop and introduce new products or product enhancements in a timely manner; |

| |

• | adequately protect our intellectual property and avoid infringing upon the intellectual property rights of third parties; |

| |

• | demonstrate the safety and efficacy of new products; and |

| |

• | obtain the necessary regulatory clearances or approvals for new products or product enhancements. |

If we do not develop and, when necessary, obtain regulatory clearance or approval for new products or product enhancements in time to meet market demand, or if there is insufficient demand for these products or enhancements, our results of operations will suffer. Our research and development efforts may require a substantial investment of time and resources before we are adequately able to determine the commercial viability of a new product, technology, material or other innovation. In addition, even if we are able to successfully develop enhancements or new generations of our products, these enhancements or new generations of products may not produce sales in excess of the costs of development and they may be quickly rendered obsolete by changing customer preferences or the introduction by our competitors of products embodying new technologies or features.

Our products are dependent on the availability of tissue from human donors, and any disruption in supply could adversely affect our business.

The success of our human tissue products depends upon, among other factors, the availability of tissue from human donors. Any failure to obtain tissue from our sources will interfere with our ability to effectively meet demand for our products incorporating human tissue. The processing of human tissue into our products is very labor-intensive and it is therefore difficult to maintain a steady supply stream. The availability of donated tissue could also be adversely impacted by regulatory changes, public opinion of the donor process as well as our own reputation in the industry. The challenges we may face in obtaining adequate supplies of human tissue involve several risks, including limited control over availability, quality and delivery schedules. In addition, any interruption in the supply of any human tissue component could materially harm our ability to manufacture our products until a new source of supply, if any, could be found. We may be unable to find a sufficient alternative supply channel in a reasonable time period or on commercially reasonable terms, if at all, which would have a material adverse effect on our business, results of operations and financial condition.

The products we manufacture and process are derived from human tissue and therefore have the potential for disease transmission.

The utilization of human tissue creates the potential for transmission of communicable disease, including, but not limited to, human immunodeficiency virus (“HIV”), viral hepatitis, syphilis and other viral, fungal or bacterial pathogens. We are required to comply with federal and state regulations intended to prevent communicable disease transmission.

Although we maintain strict quality controls over the procurement and processing of our tissue, there is no assurance that these quality controls will be adequate. In addition, negative publicity concerning disease transmission from other companies' improperly processed donated tissue could have a negative impact on the demand for our products.

We depend on key personnel.

Our success will depend, in part, upon our ability to attract and retain skilled personnel, including sales, managerial and technical personnel. There can be no assurance that we will be able to find and attract additional qualified employees to support our expected growth or retain any such personnel. Our inability to hire and retain qualified personnel or the loss of services of our key personnel may have a material and adverse effect on our business and results of operations.

A significant portion of our revenues and accounts receivable come from Government accounts.

We have significant sales to the Government (whether we are selling our products directly to Government Accounts or through our current or another distributor ). Any disruption of our products on the FSS or a change in the way the Government purchases products like ours or the price it is willing to pay for our products, could materially and adversely affect our business, results of operations and financial condition.

In order to grow revenues from certain of our products, we must expand our relationships with distributors and independent sales representatives, whom we do not control.

We derive significant revenues through our relationships with distributors and independent sales representatives, though, other than our distributor for Government accounts, no one distributor comprised over 5% of our revenues. If such

relationships were terminated for any reason, it could materially and adversely affect our ability to generate revenues and profits. Because the independent distributor often controls the customer relationships within its territory, there is a risk that if our relationship with the distributor ends, our relationship with the customer will be lost. Also, because we do not control a distributor's field sales agents, there is a risk we will be unable to ensure that our sales processes, compliance, and other priorities will be consistently communicated and executed by the distributor. If we fail to maintain relationships with our key distributors, or fail to ensure that our distributors adhere to our sales processes, compliance, and other priorities, this could have an adverse effect on our operations.

We intend to obtain the assistance of additional distributors and independent sales representatives to continue our sales growth with respect to certain of our products. Our success is partially dependent upon our ability to retain and motivate our distributors, independent sales agencies, and their representatives to sell our products in certain territories. They may not be successful in implementing our marketing plans. Some of our distributors and independent sales agencies do not sell our products exclusively and may offer similar products from other companies. Our distributors and independent sales agencies may terminate their contracts with us, may devote insufficient sales efforts to our products, or may focus their sales efforts on other products that produce greater commissions for them, which could have an adverse effect on our operations and operating results. We also may not be able to find additional distributors and independent sales representatives who will agree to market and/or distribute those products on commercially reasonable terms, if at all. If we are unable to establish new distribution and independent sales representative relationships or renew current distribution and sales agency agreements on commercially acceptable terms, our business, financial condition and results of operations could be materially and adversely affected.

We continue to invest significant capital in expanding our internal sales force, and there can be no assurance that these efforts will continue to result in significant increases in sales.