UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | ||

| For the Fiscal Year Ended December 31, 2017 | ||

| OR | ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | ||

| For the transition period from ____ to ____ |

COMMISSION FILE NO. 001-34647

CHINANET ONLINE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 20-4672080 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

No. 3 Min Zhuang Road, Building 6,

Yu Quan Hui Gu Tuspark, Haidian District, Beijing, PRC

(Address of principal executive offices)

+86-10-6084-6616

(Issuer’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange On which Registered |

| $0.001 Common Stock | Nasdaq Capital Market |

Securities Registered Pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined

in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted

on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a “smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☐ Non-Accelerated Filer ☐ Smaller Reporting Company ☒ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of the 7,691,481 shares of common equity stock held by non-affiliates of the Registrant was approximately $9,537,436 on the last business day of the Registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $1.24 per share, as reported on the Nasdaq Capital Market.

The number of shares outstanding of the Registrant’s common stock, $0.001 par value as of April 13, 2018 was 16,132,543.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement relating to the Registrant’s 2018 Annual Meeting of Stockholders, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates”, “believes”, “expects”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predict”, “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions. Uncertainties and other factors, including the risks outlined under Risk Factors contained in Item 1A of this Form 10-K, may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the filing date to conform these statements to actual results, unless required by law.

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy and information statements and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended. You may read and copy these materials at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding us and other companies that file materials with the SEC electronically. You may also obtain copies of reports filed with the SEC, free of charge, via a link included on our website at www.chinanet-online.com.

| ITEM 1. | BUSINESS |

We are a holding company that conducts our primary businesses through our PRC subsidiaries and operating entities (the “VIEs”). We primarily operate a one-stop services for our clients on our integrated service platform, primarily including Omni-channel precision advertising and marketing system, CloudX and data analysis management system. Our Omni-channel precision advertising and marketing system, primarily consists of digital advertising and marketing portals, include internet and mobile, and our other non-digital advertising units, such as TV. We provide and monitor varieties of advertising and marketing campaigns through this service system which generates effective sales leads through the combination of the Internet, mobile, content and others, including TV and schemes, we also provide search engine marketing services through this system to maximize market exposure and effectiveness for our clients. Our data analysis management system is an information and data analysis portal for small and medium-sized enterprises (“SMEs”) or entrepreneurs who plan to start their own business, helping them for a higher survival and faster deal closing rate. It is built to further expand our service and data-link to assist our clients in developing their sales both online and offline, so that the overall service platform can create a traceable looped online to offline (O2O) ecosystem for our clients in their ground sales expansion throughout the cities in the PRC.

We derive our revenue principally by:

| • | providing search engine marketing services to increase the sales lead conversion rate for our clients’ business promotion on both mobile and PC searches; |

| • | selling internet advertising space on our web portals and providing related data service and other value-added services to our clients through the internet advertising management systems and platforms developed and managed by us; |

| • | selling effective sales lead information; and |

| • | selling advertising time slots on our television shows. |

We generated total revenues of US$46.6 million for the year ended December 31, 2017, compared with US$34.8 million in 2016. Excluding net loss incurred from the discontinued operation, i.e. our brand management and sale channel building business segment, which was terminated in the fourth quarter of 2015, of approximately US$0.06 million for the year ended December 31, 2016, we incurred a net loss (before allocation to the noncontrolling interest shareholders) of US$10.0 million for the year ended December 31, 2017, compared with a net loss (before allocation to the noncontrolling interest shareholders) of US$6.3 million in 2016.

In January 2018, we announced our strategic partnership with Wuxi Jingtum Network Technology ("Jingtum”), the credible blockchain ecology builder and announced the expansion into the blockchain industry and the related technology. This strategic partnership between Jingtum and us is focused on blockchain technology to build a credible, fair and transparent platform for business opportunities and transactions. We will aim to develop credible, traceable, and highly secured blockchain applications for the large demand from the SMEs. We believe that the application of blockchain in the field of business development and marketing can help SMEs to build a new business ecosystem based on algorithmic trust. With the introduction of blockchain technology, the platform-centric services in the past will gradually shift towards decentralization, solving trust issues in business cooperation and services and enhancing user vitality and stickiness. We will also gradually shift from information services to transaction services for business opportunities to create a multi-industry cross-chain value-based internet sharing entity.

| 2 |

Our Corporate History, Subsidiaries, Variable Interest Entities (VIEs) and Equity Investment Affiliates

As of December 31, 2017, our corporate structure is set forth below:

We were incorporated in the State of Texas in April 2006 and re-domiciled to become a Nevada corporation in October 2006. From the date of our incorporation until June 26, 2009, when we consummated the Share Exchange (as defined below), our business development activities were primarily concentrated in web server access and company branding in hosting web based e-games.

Our wholly owned subsidiary, China Net Online Media Group Limited, was incorporated in the British Virgin Islands on August 13, 2007 (“China Net BVI”). On April 11, 2008, China Net BVI became the parent holding company of a group of companies comprised of CNET Online Technology Limited, a Hong Kong company (“China Net HK”), which established, and is the parent company of, Rise King Century Technology Development (Beijing) Co., Ltd., a wholly foreign-owned enterprise (“WFOE”) established in the People's Republic of China (“Rise King WFOE”). We refer to the transactions that resulted in China Net BVI becoming an indirect parent company of Rise King WFOE as the “Offshore Restructuring.”

| 3 |

Restructuring

In October 2008, a restructuring plan was developed (the “Restructuring”). The Restructuring was accomplished in two steps. The first step was for Rise King WFOE to acquire control over Business Opportunity Online (Beijing) Network Technology Co., Ltd. (“Business Opportunity Online”) and Beijing CNET Online Advertising Co., Ltd. (“Beijing CNET Online”) (collectively the “PRC Operating Entities” or the “VIEs”) by entering into a series of contracts (the “Contractual Agreements” or the “VIE Agreements”), which enabled Rise King WFOE to operate the business and manage the affairs of the PRC Operating Entities. Both of the PRC Operating Entities at that time were, and currently are, owned by Messrs. Handong Cheng, Xuanfu Liu and Ms. Li Sun (the “PRC Shareholders” or the “Control Group”). Mr. Cheng is now our Chief Executive Officer. After the PRC Restructuring was consummated, the second step was for China Net BVI to enter into and complete a transaction with a U.S. public reporting company, whereby that company would acquire China Net BVI, China Net HK and Rise King WFOE, and control the PRC Operating Entities (the “China Net BVI Companies”). Business Opportunity Online and Beijing CNET Online were incorporated on December 8, 2004 and January 27, 2003, respectively.

Legal Structure of the PRC Restructuring

The PRC Restructuring was consummated in a manner so as not to violate PRC laws relating to restrictions on foreign ownership of businesses in certain industries in the PRC and the PRC M&A regulations.

The Foreign Investment Industrial Guidance Catalogue jointly issued by the Ministry of Commerce (“MOFCOM”) and the National Development and Reform Commission in 2007, which latest amendment became effective on July 28, 2017, classified various industries/business into three different categories: (i) encouraged for foreign investment, (ii) restricted to foreign investment and (iii) prohibited from foreign investment. For any industry/business not covered by any of these three categories, they will be deemed to be industries/business permitted to have foreign investment. Except for those expressly provided restrictions, encouraged and permitted industries/businesses are usually open to foreign investment and ownership. With regard to those industries/businesses restricted to or prohibited from foreign investment, there is always a limitation on foreign investment and ownership.

The business of the PRC Operating Entities falls under the class of a business that provides Internet content or information services, a type of value-added telecommunication services, for which restrictions upon foreign ownership apply. The latest Foreign Investment Industrial Guidance Catalogue, which became effective in July 2017, retains the restrictions on foreign ownership related to value-added telecommunication services. As a result, Rise King WFOE is not allowed to do the business the PRC Operating Entities companies are currently pursuing. Advertising business is open to foreign investment but used to require that the foreign investors of a WFOE should have been carrying out advertising business for over three years pursuant to the Foreign Investment Advertising Measures as amended by MOFCOM and the State Administration of Industry and Commerce (“SAIC”) on August 22, 2008, which was repealed in June 29, 2015. Rise King WFOE was not allowed to engage in the advertising business because its shareholder, China Net HK, did not meet such requirements. In order to control the business and operations of the PRC Operating Entities, and consolidate the financial results of the two companies in a manner that does not violate the related PRC laws, Rise King WFOE executed the Contractual Agreements with the PRC Shareholders and each of the PRC Operating Entities. The Contractual Agreements allow us, through Rise King WFOE, to, among other things, secure significant rights to influence the two companies’ business operations, policies and management, approve all matters requiring shareholder approval, and receive 100% of the income earned by the PRC Operating Entities. In return, Rise King WFOE provides consulting services to the PRC Operating Entities. In addition, to ensure that the PRC Operating Entities and the PRC Shareholders perform their obligations under the Contractual Arrangements, the PRC Shareholders have pledged all of their equity interests in the PRC Operating Entities to Rise King WFOE. They have also entered into an option agreement with Rise King WFOE which provides that at such time as when the related restrictions under PRC law on foreign ownership of Chinese companies engaging in the Internet content or information services in China are lifted, Rise King WFOE may exercise its option to purchase the equity interests in the PRC Operating Entities, directly.

Each of the PRC Shareholders entered into a share transfer agreement (the “Share Transfer Agreement”) with Mr. Yang Li, the sole shareholder of Rise King Investment Limited, a British Virgin Islands company (“Rise King BVI”), which was a 55% shareholder of China Net BVI at that time. In entering into the Share Transfer Agreement, Ms. Li Sun was acting as the nominee of Mr. Zhige Zhang, our chief financial officer. Mr. Zhang did not report his indirect ownership of ChinaNet BVI’s common stock by virtue of Ms. Li acting as his nominee on his original Form 3 filed with the SEC. The PRC Shareholders were granted the incentive options for the contributions that they made and continue to make to Rise King BVI. Under the Share Transfer Agreements Mr. Li granted each of the PRC Shareholders an option to acquire, in the aggregate 10,000 shares of Rise King BVI, representing 100% of the issued and outstanding shares of Rise King BVI, provided that certain financial performance thresholds were met by the China Net BVI Companies. The Share Transfer Agreement was formalized and entered into on April 28, 2009. There is no prohibition under PRC laws for the PRC Shareholders to earn an interest in Rise King BVI after the PRC Restructuring is consummated in compliance with PRC law.

| 4 |

On March 30, 2011, Ms. Li Sun transferred the Option Shares held by her to Mr. Zhang. On March 30, 2011, pursuant to the terms of the Share Transfer Agreement, each of Mr. Cheng, Mr. Liu and Mr. Zhang exercised their rights to acquire the Option Shares. Due to the fact that the China Net BVI Companies had achieved the performance targets set forth in the Share Transfer Agreement, each of Mr. Cheng, Mr. Liu and Mr. Zhang paid an exercise price of $1.00 per share to Mr. Yang Li. As a result of this exercise, Mr. Cheng, Mr. Liu and Mr. Zhang became the shareholders of Rise King BVI. As of April 12, 2018, through Rise King BVI, Mr. Cheng, Mr. Liu and Mr. Zhang collectively hold 18% of the issued and outstanding shares of our common stock.

Summary of the material terms of the VIE Agreements:

Exclusive Business Cooperation Agreements:

Pursuant to the Exclusive Business Cooperation Agreements entered into by and between Rise King WFOE and each of the PRC Operating Entities, Rise King WFOE has the exclusive right provide to the PRC Operating Entities complete technical support, business support and related consulting services during the term of these agreements, which includes but is not limited to technical services, business consultations, equipment or property leasing, marketing consultancy, system integration, product research and development, and system maintenance. In exchange for such services, each PRC Operating Entity has agreed to pay a service fee to Rise King WFOE equal to 100% of the net income of each PRC Operating Entity. Adjustments may be made upon approval by Rise King WFOE based on services rendered by Rise King WFOE and operational needs of the PRC Operating Entities. The payment shall be made on a monthly basis, if at year end, after an audit of the financial statements of any PRC Operating Entities, there is determined to be any shortfall in the payment of 100% of the annual net income, such PRC Operating Entity shall pay such shortfall to Rise King WFOE. Each agreement has a ten-year term. The term of these agreements may be extended if confirmed in writing by Rise King WFOE, prior to the expiration of the term. The extended term shall be determined by Rise King WFOE, and the PRC Operating Entities shall accept such extended term unconditionally.

Exclusive Option Agreements:

Under the Exclusive Option Agreements entered into by and among Rise King WFOE, each of the PRC Shareholders irrevocably granted to Rise King WFOE, or its designated person, an exclusive option to purchase, to the extent permitted by PRC law, a portion or all of their respective equity interest in any PRC Operating Entities for a purchase price of RMB10, or a purchase price to be adjusted to be in compliance with applicable PRC laws and regulations. Rise King WFOE, or its designated person, has the sole discretion to decide when to exercise the option, whether in part or in full. Each of these agreements has a ten-year term, subject to renewal at the election of Rise King WFOE.

Equity Pledge Agreements:

Under the Equity Pledge Agreements entered into by and among Rise King WFOE, the PRC Operating Entities and each of the PRC Shareholders, the PRC Shareholders pledged all of their equity interests in the PRC Operating Entities to guarantee the PRC Operating Entities’ performance of its obligations under the Exclusive Business Cooperation Agreements. If the PRC Operating Entities or any of the PRC Shareholders breaches its/his/her respective contractual obligations under these agreements, or upon the occurrence of one of the events regarded as an event of default under each such agreement, Rise King WFOE, as pledgee, will be entitled to certain rights, including the right to dispose of the pledged equity interests. The PRC Shareholders of the PRC Operating Entities agreed not to dispose of the pledged equity interests or take any actions that would prejudice Rise King WFOE's interest, and to notify Rise King WFOE of any events or upon receipt of any notices which may affect Rise King WFOE's interest in the pledge. Each of the equity pledge agreements will be valid until all the payments related to the services provided by Rise King WFOE to the PRC Operating Entities due under the Exclusive Business Cooperation Agreements have been fulfilled. Therefore, the equity pledge agreements shall only be terminated when the payments related to the ten-year Exclusive Business Cooperation Agreement are paid in full and the WFOE does not intend to extend the term of the Exclusive Business Cooperation Agreement.

| 5 |

Irrevocable Powers of Attorney:

The PRC Shareholders have each executed an irrevocable power of attorney to appoint Rise King WFOE as their exclusive attorneys-in-fact to vote on their behalf on all PRC Operating Entities matters requiring shareholder approval. The term of each power of attorney is valid so long as such shareholder is a shareholder of the respective PRC Operating Entity.

As a result of these VIE Agreements, we through our wholly-owned subsidiary, Rise King WFOE, was granted with unconstrained decision making rights and power over key strategic and operational functions that would significantly impact the PRC Operating Entities or the VIEs’ economic performance, which includes, but is not limited to, the development and execution of the overall business strategy; important and material decision making; decision making for merger and acquisition targets and execution of merger and acquisition plans; business partnership strategy development and execution; government liaison; operation management and review; and human resources recruitment and compensation and incentive strategy development and execution. Rise King WFOE also provides comprehensive services to the VIEs for their daily operations, such as operational technical support, OA technical support, accounting support, general administration support and technical support for products and services. As a result of the Exclusive Business Cooperation Agreements, the Equity Pledge Agreements and the Exclusive Option Agreements, we will bear all of the VIEs’ operating costs in exchange for 100% of the net income of the VIEs. Under these agreements, we have the absolute and exclusive right to enjoy economic benefits similar to equity ownership through the VIE Agreements with our PRC Operating Entities and their shareholders.

Accounting Treatment of the Restructuring:

The Restructuring is accounted for as a transaction between entities under common control in a manner similar to pooling of interests, with no adjustment to the historical basis of the assets and liabilities of the PRC Operating Entities. The operations of the PRC Operating Entities are consolidated as if the current corporate structure had been in existence throughout the period presented in the audited financial statements. The Restructuring is accounted for in this manner because, pursuant to an Entrustment Agreement dated June 5, 2009 (the “Entrustment Agreement”) between Rise King BVI and the PRC Shareholders, Rise King BVI granted to the PRC Shareholders, on a collective basis, managerial control over each of the China Net BVI Companies by delegating the PRC Shareholders its shareholder rights, including the right to vote, and its rights to designate management of China Net BVI. The Entrustment Agreement, together with the Contractual Arrangements demonstrates the ability of the PRC Shareholders to continue to control Business Opportunity Online and Beijing CNET Online, which are under our common control. On March 30, 2011, in connection with the exercise of the options pursuant to the Share Transfer Agreement, the Entrustment Agreement was terminated.

Share Exchange and Name Change

On June 26, 2009, we entered into a Share Exchange Agreement (the “Exchange Agreement”), with (i) ChinaNet BVI, (ii) ChinaNet BVI’s shareholders, who together own shares constituting 100% of the issued and outstanding ordinary shares of ChinaNet BVI (the “ChinaNet BVI Shares”), and (iii) G. Edward Hancock, the former principal stockholder of the Company. Pursuant to the terms of the Exchange Agreement, the ChinaNet BVI Shareholders transferred to the Company all of the ChinaNet BVI Shares in exchange for the issuance of 13,790,800 (the “Exchange Shares”) shares of Common Stock (the “Share Exchange”). As a result of the Share Exchange, ChinaNet BVI became a wholly owned subsidiary of our company. Prior to July 14, 2009, our company name was Emazing Interactive, Inc. On July 14, 2009, our company formed a corporation under the laws of the State of Nevada called ChinaNet Online Holdings, Inc. (the "Merger Sub") and acquired one hundred shares of its common stock for cash. As such, Merger Sub was merged with and into our company. As a result of the merger, the separate corporate existence of the Merger Sub ceased. As a further result of the merger, our corporate name was changed to “ChinaNet Online Holdings, Inc.” We are the surviving corporation in the merger and, except for the name change provided for in the Agreement and Plan of Merger, there was no change in our directors, officers, capital structure or business.

| 6 |

Our VIEs, VIEs’ subsidiaries and other investment affiliates

As discussed above, through Rise King WFOE we beneficially own two VIEs: Business Opportunities Online and Beijing CNET Online. Business Opportunities Online is primarily engaged in providing internet advertising, O2O precision marketing and related data service to the SMEs. Beijing CNET Online is primarily engaged in providing TV advertising services to the SMEs.

As of December 31, 2017, Business Opportunity Online has the following directly or indirectly wholly-owned subsidiaries: Business Opportunity Online (Hubei) Network Technology Co., Ltd. (“Business Opportunity Online Hubei”), Hubei CNET Advertising Media Co., Ltd. (“Hubei CNET”), Sheng Tian Network Technology (Hubei) Co., Ltd. (“Sheng Tian Hubei”), Beijing Chuang Shi Xin Qi Advertising Media Co., Ltd. (“Beijing Chuang Shi Xin Qi”), Beijing Hong Da Shi Xing Network Technology Co., Ltd. (“Beijing Hong Da Shi Xing”) and Beijing Shi Ji Cheng Yuan Advertising Media Co., Ltd. (“Beijing Shi Ji Cheng Yuan”). Business Opportunity Online also beneficially owns 51% equity interest in Beijing Chuang Fu Tian Xia Network Technology Co., Ltd. (“Beijing Chuang Fu Tian Xia”). Except Hubei CNET, Sheng Tian Hubei and Chuang Shi Xin Qi, which are currently dormant, the rest subsidiaries of Business Opportunity Online are all engaged in providing internet advertising, O2O precision marketing and related data service and other value-added services to the SMEs.

As of December 31, 2017, Business Opportunities Online also beneficially owns 23.18%, 25.5% and 19% equity interest in Shenzhen City Mingshan Network Technology Co., Ltd. (“Shenzhen Mingshan”), Zhao Shang Ke Network Technology (Hubei) Co., Ltd. (“Zhao Shang Ke Hubei”) and Guohua Shiji (Beijing) Communication Co., Ltd. (“Guohua Shiji”), respectively. Guohua Shiji is primarily engaged in providing internet and information technical services. The business of Shenzhen Mingshan and Zhao Shang Ke Hubei are currently dormant.

As of December 31, 2017, Beijing CNET Online beneficially owns 10% equity interest in Beijing Saturday Education Technology Co., Ltd. (“Beijing Saturday”), which is primarily engaged in children’s playground operation management and franchise business and 10% equity interest in Chuangshi Meiwei (Beijing) International Investment Management Co., Ltd. (“Chuangshi Meiwei”), which is primarily engaged in franchise investment consulting and management business. The business of Beijing Saturday and Chuangshi Meiwei are currently dormant. Beijing CNET Online also beneficially owns 51% equity interest in Shanghai Borongdingsi Computer Technology Co., Ltd. (“Shanghai Borongdingsi”), primarily engaged in providing bank kiosks advertising services, which business we had exited in late 2015.

As of December 31, 2017, we also control two wholly-owned investment holding companies, ChinaNet Investment Holding Ltd, a British Virgin Islands company (“ChinaNet Investment BVI”), and ChinaNet Online Holdings Co., Ltd., a PRC company (“ChinaNet Online PRC”). ChinaNet Online PRC co-incorporated ChinaNet Chuang Tou (Shenzhen) Co., Ltd. (“ChinaNet Chuang Tou”) with two unaffiliated individuals and beneficially own 19% equity interest in ChinaNet Chuang Tou. ChinaNet Investment BVI co-incorporated ChinaNet Online Holdings Korea (“ChinaNet Korea”) with four unaffiliated individuals and beneficially own 15% equity interest in ChinaNet Korea. The business of ChinaNet Koran is currently dormant.

Recent development

We consummated a registered direct offering of 2,150,001 shares of common stock of the Company to three institutional investors at a purchase price of $5.15 per share. As part of the transaction, the Company also issued to the investors warrants for the purchase of up to 645,000 shares of common stock of the Company at an exercise price of $6.60 per share. The warrants have a term of 30 months from the date of issuance. The closing took place on January 17, 2018 and we received gross proceeds of approximately $11.1 million.

| 7 |

Industry and Market Overview

Overview of the Advertising Market in China

According to Dentsu Aegis Network in January 2018, the global advertising market will reach US$589.5 billion in 2018 as growth accelerates to 3.6%, up from 3.1% in 2017. China’s advertising market is slowing in step with its economy, however, still remains one of the key drivers of global growth. China is projected to account for 22.8% of the total growth of global advertising spending in 2018, which amounts to approximately US$4.6 billion. Dentsu Aegis Network also forecasts that China’s advertising spending will grow by 5.4% in 2018 and is expected to reach US$89.6 billion, or 15.2% of the global advertising market in the year. In 2019, driven by digital media and outdoor media, China's advertising spending is expected to grow another 5.3%.

The growth of China’s advertising market is driven by a number of factors, including the sustained economic growth and increases in disposable income and consumption in China. China was the second largest economy in the world in terms of gross domestic product (“GDP”), which amounted to US$12.3 trillion in 2017. According to the National Bureau of Statistics of China, the annual disposable income per capita in urban households increased to RMB36,396 in 2017, adjusted by the price factors, the actual increase was 6.5%.

Overview of the Internet Advertising Industry

According to Dentsu Aegis Network, digital media channels continue to disrupt advertising spending in 2018:

| • | Digital media channels will continue to power advertising spending growth, growing globally by 12.6% in 2018, versus 15% in 2017, to reach US$220.3 billion. |

| • | Mobile will go from strength to strength, reaching US$121.1 billion having overtaken desktop as a share of total digital spend in 2017. |

| • | Digital overtakes TV, digital advertising spending will account for 38.3% share of total advertising spending, TV 35.5%. |

Within China, the internet advertising market growth is expected to stem primarily from a higher internet penetration rate of just 55.8% by the end of 2017. (The 41st China Internet Network Development Statistical Report issued by China Internet Network Information Center (the “CNNIC”), January 2018), the use of search engine, rich media and video and game embedded advertisements. According to the 41st CNNIC report, as of December 2017, the mobile internet user reached 753 million people, which accounted for 97.5% of the total internet users, as compared with 95.1% as of December 2016.

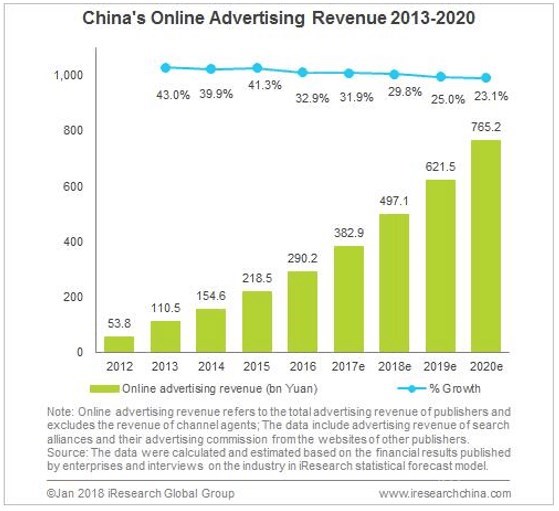

According to iResearch Consulting Group (January 2018), China online advertising revenue reached RMB290.2 billion Yuan (approximately US$44 billion) in 2016 and is estimated to hit RMB382.9 billion Yuan (approximately US$58.6 billion) in 2017, up 31.9% year-over-year. Its growth is forecasted to slow in step with its economy in the next few years. China’s mobile advertising revenue reached RMB175.02 billion Yuan (approximately US$26.3 billion) in 2016 and it’s estimated to hit RMB264.88 billion Yuan (approximately US$40.5 billion) in 2017, jumping 51.3% year-over-year. China’s mobile advertising revenue is expected to top 485 billion Yuan by 2019. As the sector matures, its growth will also stabilize in the few years to come. The latest data from iResearch show that mobile advertising will account for an increasing share of online advertising revenue in the following few years, which is projected to approach 80% by 2019.

| 8 |

The diagram below depicts the Market Scale of China’s Online Advertising from 2013 to 2020:

High Demand for the Internet Advertising from SMEs and O2O Business in China

We believe that the Internet advertising market in China also has significant potential for future growth due to high demand from the rapid development of SMEs and O2O business.

The development of the SME market is still in its early stages in China and since their sales channels and distribution networks are still underdeveloped, they are driven to search for new participants by utilizing Internet advertising and precision marketing. The SMEs tend to be smaller, less-developed brands primarily focused on restaurants, garments, building materials, home appliances, and entertainment with low start-up costs. The Chinese government has promulgated a series of laws and regulations to protect and promote the development of SMEs which appeals to entrepreneurs looking to benefit from the central government’s support of increased domestic demand. SMEs are now responsible for about 60% of China’s industrial output and employment of approximately 80% of the urban Chinese workforce. SMEs are creating new urban jobs, and they are the main destination for new graduates entering the workforce and workers laid-off from state-owned enterprises (SOEs) that re-enter the workforce.

In recent years, the capital market, internet giants and traditional offline services business in China have all accelerated their O2O business arrangement and development. With the advent of the mobile Internet era, the innovation of user needs and applications have become the main trend of the Internet, including online payments, location-based services, online and offline interaction and more. Due to the decline of China’s economy since the second half of 2011, the competitive market pressure within the local life services industry has increased. Under these circumstances, more and more traditional offline service providers started to use the internet (PC, tablet and mobile) to market and promote their products and services. The rapid development of social media and tools, such as: Wechat and Webo, also have had a very important influence on the development of the O2O market, using social media and tools to promote brands and maintain customer relationships has become an important adverting and marketing tool for all offline business.

| 9 |

Rapid development of Big Data Marketing

Massive amounts of data profoundly changed the way people describe objective things, but also provided people with new tools to explore the objective laws behind the data. Advertising as a marketing activity based on in-depth analysis on a target audience to locate, process and precisely release the related information, has resulted in strong sensitivity to the value of Big Data application. According to Gfk, one of the largest international market research companies, 62% of marketing service providers have begun to change their role and use the new Big Data tools for marketing, and 86% said that in future will continue to rely on Big Data for market development planning and execution.

Our Principal Products and Services

Internet Advertising, Precision Marketing and Related Data and Value-added Services

Founded in 2003, 28.com is a leading Internet portal for information relating to small business opportunities in China, which is one of the earliest entrants in this sector. Besides 28.com, we also have Internet advertising portals including liansuo.com etc., which in the aggregate enable our customers to invest in their online advertising and marketing campaign through multi-channel to maximize market exposure and effectiveness. In the past few years, we further developed and upgraded the system and tools of our website portals, including customer user interface, and integrated our mobile function and cloud-based search engine marketing and optimization in preparation for mobile search marketing and mobile search optimization.

Our internet advertising, precision marketing and related data and value-added services provide advertisers with tools to build sales channels directly in the form of franchisees, sales agents, distributors, and/or resellers, and have the following features which enable them to be attractive to the advertisers:

| · | Allowing potential entrepreneurs interested in inexpensive franchise and other business ventures to find in-depth details about these businesses in various industries and business categories, with real-time and online assistance through an instant messenger; |

| · | Providing one-stop integrated internet marketing and advertising services for SMEs by offering customized services such as design, website and mini-site setup, and advertisement placement on various communication channels through intelligent based promotion systems; |

| · | Generating effective sales leads information; and |

| · | Bundling with advanced traffic generation techniques, search-engine optimization and marketing and other internet advertising management tools to assist our clients with monitoring, analyzing and managing their advertising and data collected on our web portal. |

We typically charge our clients a fixed monthly or annual membership fee for the internet advertising services and the related data and value-added services that we provide. For search engine marketing service, we charge our clients a certain percentage as service fee based on the related direct cost consumed for providing this service. A certain group of our clients also purchase effective sales lead information collected by our online advertising system. Separately, we charge a fixed fee, which varies for different business types, for each effective sales lead information delivered to clients. As of December 31, 2017, we have approximately 800 clients who used our internet advertising, marketing and data services. During 2017, we continued to place a persistent effort in integrating and upgrading our internet advertising, marketing and data services to our SME clients. we optimized our online promotion analysis and cost control system to provide more data and feedback to our users, which is especially helpful to our larger clients, we also optimized our online promotion tactics to improve cost efficiency, which helped our clients achieve more accurate promotion and placement effects with acceptable costs, thereby increasing sales lead conversion rate and overall client satisfaction with our services. We also continued to invest in developing new services for our clients. We believe that the launch of new services in future periods will help to increase our market penetration in the SME segment, thereby increasing our recurring revenues in the future. We achieved approximately US$46.3 million and US$34.8 million of internet advertising, marketing and the related data and value-added services net revenue for the years ended December 31, 2017 and 2016, respectively. The overall gross profit margin of this business segment decreased to 10% for the year ended December 31, 2017 from 22% for the year ended December 31, 2016, due to a higher proportion of revenues from search engine marketing service with relatively lower gross margin generated in 2017.

| 10 |

Television Advertising

As part of our advertising and marketing services, we produced and distributed television shows that were comprised of advertisements similar to infomercials. Our clients paid us for advertising spots, production and editorial coverage. The shows produced by our TV unit are distributed during airtime purchased from provincial satellite television stations. Due to the rapid development of Internet and mobile advertising and the further restriction on content, air time and duration of these infomercials imposed by the State Administration of Press, Publication, Radio, Film and Television of the PRC in recent years, the demands of our TV advertising service decreased accordingly. For the year ended December 31, 2017, we recognized approximately US$0.34 million TV advertising revenues. We did not generate any TV advertising revenue in 2016. We will continue to monitor our clients’ needs of this service. In consideration of the sustained and steady development of Internet advertising and the rapid development in mobile advertising, we expect future revenues contributed from this segment will be insignificant.

Our Competitive Strengths

Over our fifteen-year operating history, we believe that we have built a strong track record of significant competitive strengths. We believe that these competitive strengths include:

Innovative Operations

| · | Client-based innovation. Our advertising, marketing and data services are intended to be a one-stop shop for advertising and marketing solutions to our clients. These services are based on the needs of our existing clients. All of our value-added services, including lead generation and capture, online messaging and consulting, search engine marketing and optimization, mini-site hosting, content management, marketing and operational management tools and related data services, simplify the business process for our clients by allowing them to effectively allocate their resources and budget for various advertising and marketing tools and channels. |

| · | Target market innovation and expansion of audience base. We believe that by offering a multichannel communication platform, we enable SMEs to reach a wide range of consumers with complementary and mutually reinforcing advertising and marketing campaigns. We are better able to attract business owners who want to reach targeted consumer groups through a number of different advertising channels in different venues and regions, and at different times of the day. |

Strong Technological Advantages

| · | Advanced campaign tracking, monitoring & data collection and analysis tools. We have deployed advanced tracking, search engine optimization, resource scheduling and content management and ad campaign management tools to achieve effective and efficient advertising effects. We have also deployed cloud technology and Big Data collection and analysis technology into our intelligent operation and marketing data service applications to provide effective and efficient precision marketing and O2O sales channel expansion services to our clients. |

| · | Valuable intellectual property. We have twenty-four copyright certificates in connection with the online advertising, marketing and data service business, most of which were developed by our research and development team. |

| 11 |

| · | Experienced management team. We have an experienced management team. In particular, Handong Cheng, our founder, chairman and chief executive officer has over fifteen years’ experience in management. He demonstrated his entrepreneurship and business leadership by starting our business and he has successfully grown our business to become a leader in online media marketing and advertising services. George Chu, our Chief Operating Officer, has diversified and international industry experience that will help us to scale to the next level. Zhige Zhang, our Chief Financial Officer has over fifteen years’ experience in software development and Internet ad technology. |

First Mover Advantages

We have over twelve years of operations as a vertically integrated ad portal and ad agency. We have fifteen years of experience as an Internet advertising agency. We commenced our Internet advertising services business in 2003 and were among the first companies in China to create a site and a business focused on Internet advertising. We rapidly established a sizeable national network, secured a significant market share and enhanced awareness of our brand. Our early entry into the market has also enabled us to accumulate a significant amount of knowledge, experience and data in this segment of the advertising industry to be able to maintain a strong market share position. We are also the first company that is providing O2O (online-to-offline) sales channel expansion services in China to small business.

Growth Strategy

Our objectives are to strengthen our position as the leading diversified one-stop O2O sales channel expansion, precision marketing and related data services provider to SMEs and entrepreneurial management and network services provider for entrepreneurs in China, and to continue to achieve sustainable and healthy growth on a consistent basis. We expect to grow from a business opportunities platform to a comprehensive one on one digital advertising, precision marketing and related data services provider, with a total solution for the business to business to customer (“B2b2c”) ecosystem, helping businesses expand sales and customers through mobile and the Internet. We intend to achieve these objectives by implementing the following strategies:

Continue expanding the size of our potential client base with online advertising and marketing solution provided by us

We have been expanding our target client group to the non-franchised SMEs in recent years with a focus on enterprises which have been in the manufacturing and exporting business. These businesses all experienced sharp decline in sales account of slow economic recovery and lower consumption demand in Europe and United States. We estimate that there are four million businesses that fall into the category of non-franchised SMEs, and we aim to assist them in expanding their business nationally in China.

Monetizing the existing customer base through the addition of cloud technology based mobile services and management tools

Due to the overall decline of Chinese economy in recent years, the competitive market pressure within the local life services industry has increased. Under these circumstances, more and more traditional offline services providers started to use the Internet to market and promote their products and services. Using social media and tools, like WeChat, to promote brands and maintain customer relationships has become an important adverting and marketing tool for all offline business. With the advent to mobile Internet era, we intend to launch integrated cloud technology based mobile services, intelligent marketing management tools and/or solutions to our existing clients. These tools include, among other things, elite point of sales (POS), inventory supply chain management, office automation (OA) and customer relationship management (CRM) and related data collection, storage and analysis solutions. These services are intended to increase our recurring revenues and enhance the loyalty and service satisfaction of our clients.

| 12 |

Building up a competitive barrier by means of technology and strategic partnerships with key internet and mobile players in China or globally

Technology and strategic partnerships will allow us to solidify our industry’s leading position and broaden our client base through higher customer satisfaction and market awareness for our services. It will also enhance our ability to target discrete consumer groups. These technologies include mobile advertising with location based functionality, advertising tracking and conversion, database mining and management. Strategic partnerships include partnerships with key Internet and mobile search engines in China, key social media platforms as well as other Internet portals.

Gradually grow to comprehensive one on one digital advertising and marketing services provider with a total solution for the B2b2c ecosystem through Big Data Collecting and Analysis System

We intend to launch more value-added services to our existing and potential clients, including cloud technology based mobile services, intelligent marketing management tools and/or solutions to enable our clients to experience multi-channel, management systems and data collection and analysis based advertising and marketing services. We expect that launching these services will increase our recurring revenues and service satisfaction from clients. Most importantly, it will enable us to build our Big Data collection and analysis system, which is intended to collect all relevant information from clients, franchisers and entrepreneurs to form effective and reliable research reports to be further utilized by our clients to physically expand their business and client base offline.

Sales and Marketing

For the year ended December 31, 2017, we derived 99.3% of total net revenues from our Internet advertising and the provision of related data services, compared with 100% for the year ended December 31, 2016.

The following table sets forth a breakdown of our revenue from Internet advertising and related technical services, by industry, for the year ended December 31, 2017:

| Industry | Percentage of total revenue | |||

| Food and Beverage | 51.2 | % | ||

| Women Accessories | 0.4 | % | ||

| Footwear, Apparel and Garments | 2.1 | % | ||

| Home Goods and Construction Materials | 19.6 | % | ||

| Environmental Protection Equipment | 12.8 | % | ||

| Cosmetic and Health Care | 1.0 | % | ||

| Education Network | 3.0 | % | ||

| Others | 9.9 | % | ||

| Total | 100 | % | ||

We employ experienced advertising sales people. We provide in-house education and training to our sales people to ensure that they provide our current and prospective clients with comprehensive information about our services, the benefits of using our advertising, marketing and data services and relevant information regarding the advertising industry. We also market our advertising services from time to time by placing advertisements on television and other well-known portals in China, participating in domestic and international franchise exhibitions in China and other countries and acting as a sponsor to third-party programming and shows.

We believe our clients derive substantial value from our ability to provide advertising, marketing and data services targeted at specific segments of consumer markets. Market research is an important part of evaluating the effectiveness and value of our business to our clients. We conduct market research, consumer surveys, demographic analysis and other advertising industry research for internal use to evaluate new and existing advertising and marketing channels. We also purchase or commission studies containing relevant market data from reputable third-party market research firms when necessary. We typically consult such studies to assist us in evaluating the effectiveness of our network to our advertisers. A number of these studies contain research on the numbers and socio-economic and demographic profiles of the people who visit our network.

| 13 |

Suppliers

Our suppliers are major search engines, other internet gateways and regional television stations. Among these suppliers, for the year ended December 31, 2017, resources purchased from two of the largest search engines in China counted for approximately 64% and 26% of our internet resource cost, respectively, compared with both 39% for the year ended December 31, 2016, respectively. For television, we had one provincial satellite television station which supplied us with television airtime in 2017. We did not finalize any advertising resources contracts with suppliers in 2016.

Research and Development

We intend to continue to optimize our Standard Operating Environment (the “SOE”) technology in order to reduce costs and the time to deploy, configure, maintain, support and manage computer servers and systems. Whether we continue to further deploy newer technology will depend upon cost and network security. We also continue to develop proprietary software and systems in connection with the operation of and provision of services through our portal websites, mobile advertising applications and intelligent operation and marketing data service applications to enhance ease of use by both operators and clients. We focus on enhancing related software systems enabling us to track and monitor advertiser demands and the related data collection and analysis. With the introduction of cloud-compute technology, we will continue to integrate this technology into our online marketing management tool services through self-development and also by entering into alliances, partnerships, and/or mergers and acquisitions. In the next few years, we intend to move our research and development efforts to mobile-based application system and data collection and analysis tools more aggressively.

In accordance with our strategic layout, we target to expand into blockchain industry and the related technology in 2018, as a result, we will invest in the research and development activities in this area to utilize the blockchain technology and develop related applications for the large demand from the SMEs.

Intellectual Property

As of December 31, 2017, we had twenty-four software copyright certificates issued by the State Copyright Office of the PRC (“SCO”), including, but not limited to, software systems covering monitoring and management platforms on internet advertising effects, analysis systems on internet traffic statistics and internet user behavior, analysis systems on log-based visit hotspot and browsing trails, analysis systems on search engine marketing, mobile advertising platform and cloud-compute technology.

With this intellectual property, we can continue to provide value-added services that are in demand by our clients and can track end users and process and analyze data collected to help our clients assess and adjust their marketing strategies and enhance the effectiveness and efficiency of their advertisements placed through our multi-channel advertising and marketing service platforms on both PC and mobile devices.

We plan to continue increasing expenditures to enhance the safety of our hardware and server which we depend on to support our network and manage and monitor programs on the network. We also plan to continue increasing investment in research and development as we continue to expand, optimize and enhance the technologies of our portal websites and mobile advertising platform, upgrade our advertising and internet management software and the related data analysis and cloud-compute technologies.

Competition

We compete with other internet advertising companies for business opportunities in China, including companies that operate Internet advertising portals, such as u88.cn, 3158.com and 78.cn. We compete for clients primarily on the basis of network size and coverage, location, price, the range of services that we offer and our brand name. We also compete for overall advertising spending with other alternative advertising media companies, such as wireless telecommunications, street furniture, billboards, frame and public transport advertising companies, and with traditional advertising media, such as newspapers, magazines and radio.

| 14 |

Government Regulation

The PRC government imposes extensive controls and regulations over the media industry, including on internet, television, radio, newspapers, magazines, advertising, media content production, and the market research industry. This section summarizes the principal PRC regulations that are relevant to our lines of business.

Regulations on the Value-added Telecommunication Services and Advertising Industry in China

Foreign Investments in Value-added Telecommunication Services

The Foreign Investment Industrial Guidance Catalogue restricts foreign investments in value-added telecommunication services, including providing Internet information services (“ICP”). In accordance with the Regulations for the Administration of Foreign-Invested Telecommunications Enterprises (“FITE Regulations”), which were issued by the State Council of the PRC on December 11, 2001, became effective on January 1, 2002 and was subsequently amended on September 10, 2008 and February 6, 2016, respectively. The FITE Regulations stipulate that foreign invested telecommunications enterprises in the PRC (“FITEs”) must be established as Sino-foreign equity joint ventures. Under the FITE Regulations and in accordance with WTO-related agreements, the foreign party to a FITE engaging in value-added telecommunications services may hold up to 50% of the equity of the FITE, with no geographic restrictions on the FITE’s operations. On June 30, 2016, the MIIT issued an Announcement of the Ministry of Industry and Information Technology (the “MIIT”) on Issues concerning the Provision of Telecommunication Services in the Mainland by Service Providers from Hong Kong and Macao, which provides that investors from Hong Kong and Macau may hold more than 50% of the equity in FITEs engaging in certain specified categories of value-added telecommunications services.

For a FITE to acquire any equity interest in a value-added telecommunications business in China, it must satisfy a number of stringent performance and operational experience requirements, including demonstrating a track record and experience in operating a value-added telecommunications business overseas. FITEs that meet these requirements must obtain approvals from the MIIT and the MOFCOM or their authorized local counterparts, which retain considerable discretion in granting approvals.

On July 13, 2006, the Notice of the Ministry of Information Industry on Intensifying the Administration of Foreign Investment in Value-added Telecommunications Services (the “MIIT Notice”), which reiterates certain provisions of the FITE Regulations, was issued. Under the MIIT Notice, if a FITE intends to invest in a PRC value-added telecommunications business, the FITE must be established and must apply for a telecommunications business license applicable to the business. Under the MIIT Notice, a domestic company that holds a license for the provision of Internet content services, or an ICP license, is considered to be a type of value-added telecommunications business in China, and is prohibited from leasing, transferring or selling the license to foreign investors in any form, and from providing any assistance, including providing resources, sites or facilities, to foreign investors to conduct value-added telecommunications businesses illegally in China. Trademarks and domain names that are used in the provision of Internet content services must be owned by the ICP license holder or its shareholders. On November 27, 2017, the MIIT promulgated the Notice Regulating the Use of Domain Names in the Provision of Internet-based Information Services, or the Domain Names Notice, which became effective on January 1, 2018. Under the Domain Names Notice, a domain name used by a provider of Internet-based information services must be registered and owned by the provider or, if the provider is an entity, by a shareholder or senior management of the provider.

Foreign Investments in Advertising

In accordance with the Administrative Provision on Foreign Investment in the Advertising Industry, jointly promulgated by the SAIC and MOFCOM on August 22, 2008 and became effective on October 1, 2008, foreign investors can invest in PRC advertising companies either through wholly owned enterprises or joint ventures with Chinese parties. However, the foreign investor must have at least three years of direct operations outside China in the advertising industry as its core business. This requirement was reduced to two years if foreign investment in the advertising company is in the form of a joint venture. The Administrative Provision on Foreign Investment in the Advertising Industry was subsequently repealed by the SAIC and MOFCOM on June 29, 2015.

In consideration of the above discussed restrictions on foreign investments in ICP and advertising business, our whole-owned subsidiary in China, Rise King WFOE, is ineligible to apply for the required licenses for providing Internet information services and was ineligible to apply for the required licenses for providing advertising services in China before June 29, 2015. Our ICP business and advertising business are operated by Business Opportunity Online and Beijing CNET Online in China. We have been, and are expected to continue to be, dependent on these companies to operate our ICP business and advertising business. We do not have any equity interest in our PRC Operating Entities, but Rise King WFOE, receives the economic benefits of the same through the Contractual Arrangements.

| 15 |

We have been advised by our PRC counsel, that each of the Contractual Agreements complies, and immediately after the completion of the transactions contemplated herein, with all existing applicable PRC laws and regulations and does not violate, breach, contravene or otherwise conflict with any existing applicable PRC laws, rules or regulations.

However, there exist substantial uncertainties regarding the application, interpretation and enforcement of current and future PRC laws and regulations and their potential effect on corporate structure and contractual arrangements. The MOFCOM published a discussion draft of the proposed Foreign Investment Law (the “Draft”) in January 2015 aiming to, upon its enactment, replace the trio of existing laws regulating foreign investment in China. The Draft embodies an expected PRC regulatory trend to rationalize its foreign investment regulatory regime in line with prevailing international practice and the legislative efforts to unify the corporate legal requirements for both foreign and domestic investments. The Draft, if enacted as proposed, may materially impact the viability of our current corporate structure, corporate governance and business operations. The Draft expands the definition of foreign investment and introduces the principle of "actual control" in determining whether a company is considered a Foreign Investment Enterprise (“FIE”). Under the Draft, VIEs that are controlled via contractual arrangement would be deemed as FIEs, if they are ultimately "controlled" by foreign investors. Therefore, for any companies with a VIE structure in an industry category that falls under restricted to foreign investment or prohibited from foreign investment, the VIE structure may be deemed legitimate only if the ultimate controlling person(s) is/are of PRC nationality (either PRC companies or PRC citizens). Conversely, if the actual controlling person(s) is/are of foreign nationalities, then the VIEs will be treated as FIEs and any operation in the industry category falls under restricted to foreign investment or prohibited from foreign investment, without market entry clearance may be considered as illegal. Moreover, for the enterprises which are not incorporated under the laws of China (foreign investors) but are "controlled" by Chinese investors, they may submit documentary evidence to apply for identifying their investment as the investment by Chinese investors when they applying for the market entry clearance to engage in any investment as set out in industries restricted to foreign investment or prohibited from foreign investment in China. The competent authorities of foreign investment will grant the review opinion on whether the said investment is identified as the investment by Chinese investors. In conclusion, if the Draft enacted as proposed, it is possible that the conduct of certain of our operations and businesses through the VIEs could be found by PRC authorities to be in violation of PRC laws and regulations prohibiting or restricting foreign ownership of companies that engage in such operations and businesses.

The MOFCOM is currently soliciting comments on the Draft and substantial uncertainties exist with respect to its enactment timetable, interpretation and implementation, in accordance with relevant legislative requirements in the PRC, the next step is for MOFCOM to gather comments, revise the Draft EIT Law and prepare the Draft EIT Law for examination. MOFCOM will then prepare a bill, which will be deliberated and revised by the National Peoples’ Congress, and finally put forward for a vote. If the bill is passed, it will become law. Therefore, we do not anticipate the above discussed proposed provisions in this Draft will have an immediate impact on our current VIE arrangements in the next two to three years. However, we cannot assure you the progress of the promulgation and implementation of the Draft will be consistent with our expectations. We are currently evaluating the potential impacts of this Draft to our business and our company and looking at all of the options available with respect to eliminate the adverse impacts could be resulted from the proposed new law.

Business License and permits for ICP and Advertising Companies

All PRC legal entities may commence operations only upon obtaining a business license from the relevant local branch of the SAIC.

| 16 |

On October 27, 1994, the Tenth Session of the Standing Committee of the Eighth National People’s Congress adopted the Advertising Law, which became effective on February 1, 1995, and was subsequently amended on April 24, 2015 by the Fourteenth Session of the Standing Committee of the Twelfth National People’s Congress, which adopted the Revised Advertising Law. The Revised Advertising Law became effective on September 1, 2015. According to the Revised Advertising Law and its various implementing rules, companies engaging in advertising activities must obtain from the SAIC or its local branches a business license which specifically includes within its scope the operation of an advertising business. Companies conducting advertising activities without such a license may be subject to penalties, including fines, confiscation of advertising income and orders to cease advertising operations. The business license of an advertising company is valid for the duration of its existence, unless the license is suspended or revoked due to a violation of any relevant law or regulation. We have obtained such a business license from the local branches of the SAIC as required by existing PRC regulations. We do not expect to encounter any difficulties in maintaining the business license. However, if we seriously violate the relevant advertising laws and regulations, the SAIC or its local branches may revoke our business licenses.

On September 25, 2000, the State Council issued the Measures for the Administration of Internet Information Services (“ICP Measures”). Under the ICP Measures, entities that provide information to online users on the Internet, or ICPs, are obliged to obtain an operating permit from the “MIIT or its local branch. ICP permits are subject to annual inspection. Our PRC operating VIEs engaged in ICP business have obtained their respective ICP permits and comply with the annual inspection and other related provisions. We do not expect to encounter any difficulties in maintaining the ICP operating permits. However, if we seriously violate the relevant ICP laws and regulations, the SAIC or its local branches may revoke our permits.

Advertising Content

PRC advertising laws, rules and regulations set forth certain content requirements for advertisements in China including, among other things, prohibitions on false or misleading content, superlative wording, socially destabilizing content or content involving obscenities, superstition, violence, discrimination or infringement of the public interest. Advertisements for anesthetic, psychotropic, toxic or radioactive drugs are prohibited. There are also specific restrictions and requirements regarding advertisements that relate to matters such as patented products or processes, pharmaceutical products, medical procedures, alcohol, tobacco, and cosmetics. In addition, all advertisements relating to pharmaceuticals, medical instruments, agrochemicals and veterinary pharmaceuticals, together with any other advertisements which are subject to censorship by administrative authorities according to relevant laws or regulations, must be submitted to relevant authorities for content approval prior to dissemination.

Advertisers, advertising operators, including advertising agencies, and advertising distributors are required by PRC advertising laws and regulations to ensure that the content of the advertisements they prepare or distribute is true and in full compliance with applicable laws. In providing advertising services, advertising operators and advertising distributors must review the supporting documents provided by advertisers for advertisements and verify that the content of the advertisements complies with applicable PRC laws, rules and regulations. Prior to distributing advertisements that are subject to government censorship and approval, advertising distributors are obligated to verify that such censorship has been performed and approval has been obtained. Violation of these regulations may result in penalties, including fines, confiscation of advertising income, orders to cease dissemination of the advertisements and orders to publish an advertisement correcting the misleading information. In circumstances involving serious violations, the SAIC or its local branches may revoke violators’ licenses or permits for their advertising business operations. Furthermore, advertisers, advertising operators or advertising distributors may be subject to civil liability if they infringe on the legal rights and interests of third parties in the course of their advertising business.

In October 2013, the SARFT issued a notice to enhance the management of TV shopping infomercials broadcasted in provincial satellite television stations, which further restricts the contents, air time and duration of these infomercials. These restrictions have had and may continue to have a negative impact on our TV advertising business.

We do not believe that advertisements containing content subject to restriction or censorship comprise a material portion of the advertisements displayed on our media network. However, there can be no assurance that each advertisement displayed on our network complies with relevant PRC advertising laws and regulations. Failure to comply with PRC laws and regulations relating to advertisement content restrictions governing the advertising industry in China may result in severe penalties.

| 17 |

Regulation on Intellectual Property

Regulation on Trademark

The Trademark Law of the PRC was adopted at the 24th meeting of the Standing Committee of the Fifth National People’s Congress on August 23, 1982 and amended on February 22, 1993, October 27, 2001 and August 30, 2013, respectively. The Trademark Law sets out the guidelines on administration of trademarks and protection of the exclusive rights of trademark owners. In order to enjoy an exclusive right to use a trademark, one must register the trademark with the Trademark Bureau of the SAIC and obtain a registration certificate.

Regulation on Patents

The Patent Law of the PRC was adopted at the 4th Meeting of the Standing Committee of the Sixth National People’s Congress on March 12, 1984 and subsequently amended in 1992 and 2000 and 2008. The Patent Law extends protection to three kinds of patents: invention patents, utility patents and design patents. According to the Implementing Regulations of the Patent Law, promulgated by the State Council of the PRC on June 15, 2001, and subsequently amended in December 28, 2002 and January 9, 2010, respectively, an invention patent refers to a new technical solution relating to a product, a process or improvement. When compared to existing technology, an invention patent has prominent substantive features and represents notable progress. A utility patent refers to any new technical solution relating to the shape, the structure, or their combination, of a product. Utility patents are granted for products only, not processes. A design patent (or industrial design) refers to any new design of the shape, pattern or color of a product or their combinations, which creates an aesthetic feeling and are suitable for industrial application. Inventors or designers must register with the State Intellectual Property Office to obtain patent protection. The term of protection is twenty years for invention patents and ten years for utility patents and design patents. Unauthorized use of patent constitutes an infringement and the patent holders are entitled to claims of damages, including royalties, to the extent reasonable, and lost profits.

Regulation on Copyright

The Copyright Law of the PRC was adopted at the 15th Meeting of the Standing Committee of the Seventh National People’s Congress on September 7, 1990 and amended on October 27, 2001and February 26, 2010, respectively. Unlike patent and trademark protection, copyrighted works do not require registration for protection in China. However, copyright owners may wish to voluntarily register with China’s National Copyright Administration to establish evidence of ownership in the event enforcement actions become necessary. Consent from the copyright owners and payment of royalties are required for the use of copyrighted works. Copyrights of movies or other audio or video works usually expire fifty years after their first publication. The amended Copyright Law extends copyright protection to Internet activities, products disseminated over the Internet and software products. The amended Copyright Law also requires registration of the pledge of a copyright.

Regulations on Foreign Currency Exchange

Foreign Currency Exchange

Pursuant to the Foreign Currency Administration Rules promulgated on August 25, 2008 and various regulations issued by SAFE and other relevant PRC government authorities, the Renminbi is freely convertible only to the extent of current account items, such as trade-related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investment, require the prior approval from SAFE or its local branch for conversion of the Renminbi into a foreign currency, such as U.S. dollars, and remittance of the foreign currency outside the PRC. Payments for transactions that take place within the PRC must be made in Renminbi. Domestic companies or individuals can repatriate foreign currency payments received from abroad or deposit these payments abroad subject to applicable regulations that expressly require repatriation within certain period. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by SAFE or its local branch. Foreign currencies received under current account items can be either retained or sold to financial institutions engaged in the foreign exchange settlement or sales business without prior approval from SAFE by complying with relevant regulations. Foreign exchange income under capital account can be retained or sold to financial institutions engaged in foreign exchange settlement and sales business, with prior approval from SAFE unless otherwise provided.

| 18 |

Our business operations, which are subject to the foreign currency exchange regulations, have all been implemented in accordance with these regulations. We will take steps to ensure that our future operations comply with these regulations.

Dividend Distribution

The principal laws, rules and regulations governing dividends paid by PRC operating subsidiaries and VIEs include the Company Law of the PRC (1993), as amended in 2013, the Foreign Investment Enterprise Law (1986), as amended in 2016, and the Foreign Investment Enterprise Law Implementation Rules (1990), as amended in 2014. Under these laws and regulations, PRC subsidiaries and VIEs, including wholly owned foreign enterprises, or WFOEs, and domestic companies in China, may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, its PRC significant subsidiaries and VIEs, including WFOEs and domestic companies, are required to set aside at least 10% of their after-tax profit based on PRC accounting standards each year to their statutory capital reserve fund until the cumulative amount of such reserve reaches 50% of their respective registered capital. These reserves are not distributable as cash dividends.

Tax