UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2014

or

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to_____________

Commission File Number 000-54881

LITHIUM EXPLORATION GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 06-1781911 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| 3800 N Central Avenue, Suite 820, Phoenix, AZ 85012 | 85012 |

| (Address of principal executive offices) | (Zip Code) |

480.641.4790

(Registrant’s telephone number,

including area code)

N/A

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[X] YES [ ] NO

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

[X] YES [ ] NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act)

[ ] YES

[X] NO

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant has filed all documents and

reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act

after the distribution of securities under a plan confirmed by a

court.

[ ] YES [ ] NO

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the

issuer’s classes of common stock, as of the latest practicable date.

685,639,724 common shares issued and outstanding as of November 11,

2014.

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2014

TABLE OF CONTENTS

2

PART I – FINANCIAL INFORMATION

| Item 1. | Financial Statements |

Our unaudited condensed consolidated financial statements for the three month period ended September 30, 2014 form part of this quarterly report. They are stated in United States Dollars (US$) and are prepared in accordance with United States generally accepted accounting principles.

3

LITHIUM EXPLORATION GROUP, INC.

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

September 30, 2014

(Unaudited)

4

Lithium Exploration Group, Inc.

Condensed

Consolidated Balance Sheets

| September 30, | June 30, | |||||

| 2014 | 2014 | |||||

| (Unaudited) | ||||||

| ASSETS | ||||||

| Current | ||||||

| Cash and cash equivalents | $ | 177,820 | $ | 69,732 | ||

| Receivable | 22,272 | 26,419 | ||||

| Loan receivable | 20,000 | 20,000 | ||||

| Prepaid expenses | 2,886 | 21,862 | ||||

| Total current assets | 222,978 | 138,013 | ||||

| Investment in unconsolidated affiliate (Note 11) | 973,176 | 924,753 | ||||

| Total Assets | $ | 1,196,154 | $ | 1,062,766 | ||

| LIABILITIES AND DEFICIT | ||||||

| Current | ||||||

| Accounts payable and accrued liabilities | $ | 115,911 | $ | 14,520 | ||

| Derivative liability – convertible promissory notes (Note 6) | 404,937 | 2,832,989 | ||||

| Due to related party (Note 7) | 45,332 | 45,332 | ||||

| Convertible promissory notes | ||||||

| (net of discount of $1,934,881 and $2,797,850) (Note 6) | 942,378 | 450,057 | ||||

| Accrued interest – convertible promissory notes (Note 6) | 127,427 | 75,004 | ||||

| Total Current Liabilities | 1,635,985 | 3,417,902 | ||||

| Commitments and contingencies | ||||||

| DEFICIT | ||||||

| Lithium Explorations Group, Inc. Stockholders’ Deficit | ||||||

| Capital stock (Note 3) | ||||||

| Authorized: 100,000,000 preferred shares, $0.001 par value 2,000,000,000 (June 30, 2014 - 500,000,000) common shares, $0.001 par value Issued and outstanding: Nil preferred shares (June 30, 2014 – Nil) |

- |

- |

||||

| 366,244,918 common shares (June 30, 2014 – 191,958,118) | 366,248 | 191,961 | ||||

| Additional paid-in capital | 40,079,009 | 38,381,943 | ||||

| Accumulated other comprehensive loss | (7,633 | ) | (5,769 | ) | ||

| Accumulated deficit | (40,703,255 | ) | (40,821,871 | ) | ||

| Total Lithium Exploration Group, Inc. Stockholders’ Deficit | (265,631 | ) | (2,253,736 | ) | ||

| Non-controlling interest | (174,200 | ) | (101,400 | ) | ||

| Total Deficit | (439,831 | ) | (2,355,136 | ) | ||

| Total Liabilities and Stockholders’ Deficit | $ | 1,196,154 | $ | 1,062,766 |

5

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| Lithium Exploration Group, Inc. |

| Condensed Consolidated Statements of Operations And Comprehensive Income (Loss) |

| (Unaudited) |

| Three Months Ended September 30, | ||||||

| 2014 | 2013 | |||||

| Revenue | $ | 16,067 | $ | - | ||

| Operating Expenses: | ||||||

| Mining (Notes 3 & 5) | 15,000 | 10,128 | ||||

| Selling, general and administrative (Notes 3 & 5) | 502,629 | 285,693 | ||||

| Total operating expenses | 517,629 | 295,821 | ||||

| Loss from operations | (501,562 | ) | (295,821 | ) | ||

| Other income (expenses) | ||||||

| Interest expense (Note 6) | (1,562,421 | ) | (258,218 | ) | ||

| Gain (loss) on change in the fair value of derivative liability (Note 6) | 2,458,446 | (23,152 | ) | |||

| Fair value of warrants issued | (397,070 | ) | (18,333 | ) | ||

| Equity in income of unconsolidated affiliate | 48,423 | - | ||||

| Income (loss) before income taxes | 45,816 | (595,524 | ) | |||

| Provision for Income Taxes (Note 4) | - | - | ||||

| Net income (loss) | 45,816 | (595,524 | ) | |||

| Less: Net loss attributable to the non-controlling interest | (72,800 | ) | - | |||

| Net Income (Loss) attributable to Lithium Exploration Group, Inc. Common shareholders | $ | 118,616 | $ | (595,524 | ) | |

| Basic and Diluted Income (Loss) per Common Share | $ | 0.00 | $ | (0.01 | ) | |

| Basic and Diluted Weighted Average Number of Common Shares Outstanding | 253,441,532 | 60,190,254 | ||||

| Comprehensive income (loss): | ||||||

| Net income (loss) | $ | 45,816 | $ | (595,524 | ) | |

| Foreign currency translation adjustment | (1,864 | ) | - | |||

| Comprehensive income (loss) | 43,952 | (595,524 | ) | |||

| Comprehensive loss attributable to non-controlling interest | (72,800 | ) | - | |||

| Comprehensive income (loss) attributable to Lithium Exploration Group, Inc. | $ | 116,752 | $ | (595,524 | ) | |

6

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| Lithium Exploration Group, Inc. |

| Condensed Consolidated Statements of Changes in Stockholders’ Equity (Deficit) |

| Preferred Shares | Common Shares | ||||||||||||||||||||||||||

Number of Shares |

Amount |

Number of Shares |

Amount |

Additional Paid-in Capital |

Accumulated Other Comprehensive Loss |

Accumulated Deficit |

Non- controlling interest |

Stockholders’ Equity (Deficit) |

|||||||||||||||||||

| Balance – June 30, 2014 | - | - | 191,958,118 | 191,962 | 38,381,942 | (5,769 | ) | (40,821,871 | ) | (101,400 | ) | (2,355,136 | ) | ||||||||||||||

| Common shares issued for consulting fees | - | - | 2,503,817 | 2,504 | 84,496 | - | - | - | 87,000 | ||||||||||||||||||

| Common shares issued for debt conversion | - | - | 99,674,935 | 99,675 | 918,002 | - | - | - | 1,017,677 | ||||||||||||||||||

| Common shares issued for exercise of warrants | - | - | 72,108,048 | 72,108 | 694,568 | - | - | - | 766,676 | ||||||||||||||||||

| Foreign exchange translation | - | - | - | - | - | (1,864 | ) | - | - | (1,864 | ) | ||||||||||||||||

| Net income (loss) for the period | - | - | - | - | - | - | 118,616 | (72,800 | ) | 45,816 | |||||||||||||||||

| Balance – September 30, 2014 | - | $ | - | 366,244,918 | $ | 366,248 | $ | 40,079,008 | $ | (7,633 | ) | $ | (40,703,255 | ) | $ | (174,200 | ) | $ | (439,831 | ) | |||||||

7

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| Lithium Exploration Group, Inc. |

| Condensed Consolidated Statements of Cash Flows |

| (Unaudited) |

| Three Months Ended | Three Months Ended | |||||

| September 30, | September 30, | |||||

| 2014 | 2013 | |||||

| Cash Flows from Operating Activities | ||||||

| Net income (loss) | $ | 45,816 | $ | (595,524 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

| Equity in income (loss) of unconsolidated affiliate | (48,423 | ) | - | |||

| Common shares issued for consulting fees | 87,000 | 82,167 | ||||

| Common shares issued for interest expenses | 31,642 | - | ||||

| Interest expense | 1,478,356 | 258,218 | ||||

| (Gain) loss on change in the fair value of derivative liability | (2,458,446 | ) | 23,152 | |||

| Fair value of warrants issued | 397,070 | 18,333 | ||||

| Changes in operating assets and liabilities: | ||||||

| Receivable | 4,147 | - | ||||

| Prepaid expenses | 18,976 | 2,412 | ||||

| Accrued interest | 52,423 | - | ||||

| Accounts payable and accrued liabilities | 101,391 | 816 | ||||

| Net cash used in operating activities | (290,048 | ) | (210,426 | ) | ||

| Cash Flows from Investing Activities | ||||||

| Deposit applied for acquisition of subsidiary | - | (343,740 | ) | |||

| Net cash used in investing activities | - | (343,740 | ) | |||

| Cash Flows from Financing Activities | ||||||

| Proceed from issuance of convertible promissory notes | 400,000 | 425,000 | ||||

| Net cash provided by financing activities | 400,000 | 425,000 | ||||

| Effect of foreign exchange | (1,864 | ) | - | |||

| Increase (decrease) in cash and cash equivalents | 108,088 | (129,166 | ) | |||

| Cash and cash equivalents - beginning of period | 69,732 | 248,624 | ||||

| Cash and cash equivalents - end of period | $ | 177,820 | $ | 119,458 | ||

| Supplementary disclosure of cash flow information: | ||||||

| Cash paid during the period for: | ||||||

| Interest | $ | - | $ | - | ||

| Income taxes | $ | - | $ | - | ||

| Supplementary non- cash Investing and Financing Activities: | ||||||

| Non-cash investing and financing activities: | ||||||

| Common stock issued for debt conversion | $ | 986,034 | $ | 572,681 | ||

| Transfer of beneficial conversion feature to fair value of note | $ | 215,385 | $ | - | ||

| Common stock issued on cashless exercise of warrants | $ | 766,675 | $ | - |

8

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

1. Organization

Lithium Exploration Group, Inc. (formerly Mariposa Resources, Ltd.) (the “Company”) was incorporated on May 31, 2006 in the State of Nevada, U.S.A. It is based in Scottsdale, Arizona, USA. The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America, and the Company’s fiscal year end is June 30.

Effective November 30, 2010, the Company changed its name to “Lithium Exploration Group, Inc.,” by way of a merger with its wholly-owned subsidiary Lithium Exploration Group, Inc., which was formed solely for the change of name.

A wholly owned subsidiary, 1617437 Alberta Ltd. was incorporated in the province of Alberta, Canada on July 8, 2011. Effective October 2, 2013, the subsidiary changed its name to Alta Disposal Ltd.

On October 18, 2013, the Company acquired 51% interest in Alta Disposal Morinville Ltd. (formerly Blue Tap Resources Ltd.).

On March 1, 2014, the Company acquired 50% interest in Tero Oilfield Services Ltd.

The Company is engaged principally in the acquisition, exploration, and development of resource properties. Prior to June 25, 2009, the Company had the right to conduct exploration work on 20 mineral mining claims in Esmeralda County, Nevada, U.S.A. On July 31, 2009, the Company acquired an option to enter into a joint venture for the management and ownership of the Jack Creek Project, a mining project located in Elko County, Nevada. On September 25, 2009, the joint venture was terminated and the Company entered into an agreement with Beeston Enterprises Ltd., under which the Company was granted an option to acquire an undivided 50% interest in eight mineral claims located in the Clinton Mining District of British Columbia, Canada. On December 16, 2010, the Company entered into an Assignment Agreement to acquire an undivided 100% right, title and interest in and to certain mineral permits located in the Province of Alberta, Canada (see Note 5). On November 8, 2011, the Company entered into a letter agreement with Glottech-USA. Pursuant to the terms of the agreement, the Company was granted an exclusive license to use and distribute the technology within the Swan Hills region of Alberta as well as a non-exclusive right to distribute the technology within Canada.

9

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

2. Significant Accounting Policies

Basis of presentation and consolidation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America.

These interim financial statements as of and for the three months ended September 30, 2014 and 2013 are unaudited; however, in the opinion of management, such statements include all adjustments (consisting of normal recurring accruals) necessary to present fairly the financial position, results of operations and cash flows of the Company for the periods presented. The results for the three months ended September 30, 2014 are not necessarily indicative of the results to be expected for the year ending June 30, 2015 or for any future period. All references to September 30, 2014 and 2013 in these footnotes are unaudited.

These unaudited condensed consolidated financial statements should be read in conjunction with our audited financial statements and the notes thereto for the year ended June 30, 2014, included in the Company’s annual report on Form 10-K filed with the SEC on October 14, 2014.

The condensed balance sheet as of June 30, 2014 has been derived from the audited financial statements at that date but do not include all disclosures required by the accounting principles generally accepted in the United States of America.

Principal of Consolidation

The consolidated financial statements include the accounts of the Company, its wholly-owned subsidiary Alta Disposal Ltd. and its 51% owned subsidiary Alta Disposal Morinville Ltd. (formerly Blue Tap Resources Ltd.). Intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s periodic filings with the Securities and Exchange Commission include, where applicable, disclosures of estimates, assumptions, uncertainties and markets that could affect the financial statements and future operations of the Company. Significant estimates that may materially change in the near term include the valuation of derivative liabilities and the underlying warrants, as well as fair value of investments.

10

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

Cash and Cash Equivalents

Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with original maturities of less than three months, which are readily convertible to known amounts of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value. The Company had $177,820 and $69,732 in cash and cash equivalents at September 30, 2014 and June 30, 2014, respectively.

Concentration of Risk

The Company maintains cash balances at a financial institution which, from time to time, may exceed Federal Deposit Insurance Corporation insured limits for banks located in the US. As of September 30, 2014 and June 30, 2014, the Company had $Nil and $Nil, respectively, in deposits in excess of federally insured limits in its US bank. The Company has not experienced any losses with regard to its bank accounts and believes it is not exposed to any risk of loss on its cash in bank accounts.

Prepaid expenses

Prepaid expenses mainly consist of legal retainers and deposit for office lease. Legal retainers and deposit for office lease will be expensed in the period when services are completed.

Start-Up Costs

In accordance with FASC 720-15-20 “Start-Up Costs,” the Company expenses all costs incurred in connection with the start-up and organization of the Company.

11

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

2. Significant Accounting Policies - Continued

Mineral Acquisition and Exploration Costs

The Company has been in the exploration stage since its formation on May 31, 2006. It is primarily engaged in the acquisition, exploration, and development of mining properties. Mineral property acquisition and exploration costs are expensed as incurred. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserves.

Concentrations of Credit Risk

The Company’s financial instruments that are exposed to concentrations of credit risk primarily consist of its cash and cash equivalents and related party payables it will likely incur in the near future. The Company places its cash and cash equivalents with financial institutions of high credit worthiness. At times, its cash and cash equivalents with a particular financial institution may exceed any applicable government insurance limits. The Company’s management plans to assess the financial strength and credit worthiness of any parties to which it extends funds, and as such, it believes that any associated credit risk exposures are limited.

Net Income or (Loss) per Share of Common Stock

The Company has adopted FASC Topic No. 260, “Earnings Per Share,” (“EPS”) which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic earnings (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period.

Potentially dilutive securities are not presented in the computation of EPS since their effects are anti-dilutive.

Foreign Currency Translations

The Company’s functional and reporting currency is the US dollar. All transactions initiated in other currencies are translated into US dollars using the exchange rate prevailing on the date of transaction. Monetary assets and liabilities denominated in foreign currencies are translated into the US dollar at the rate of exchange in effect at the balance sheet date. Unrealized exchange gains and losses arising from such transactions are deferred until realization and are included as a separate component of stockholders’ equity (deficit) as a component of comprehensive income or loss. Upon realization, the amount deferred is recognized in income in the period when it is realized.

No significant realized exchange gain or losses were recorded as September 30, 2014 and June 30, 2014.

12

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

2. Significant Accounting Policies - Continued

Foreign Currency Translations – Continued

Translation of Foreign Operations

The financial results and position of foreign operations whose functional currency is different from the Company’s presentation currency are translated as follows: - assets and liabilities are translated at period-end exchange rates prevailing at that reporting date; and - income and expenses are translated at average exchange rates for the period.

Exchange differences arising on translation of foreign operations are transferred directly to the Company’s accumulated other comprehensive loss in the consolidated balance sheets. Transaction gains and losses arising from exchange rate fluctuation on transactions denominated in a currency other than the functional currency are included in the consolidated statements of operations.

The relevant translation rates are as follows: For the period ended September 30, 2014 closing rate at 0.8922 CND$:US$, average rate at 0.91804 CND$: US$ and for year ended June 30, 2014 closing rate at 0.9367 CND$: US$ average rate at 0.9341 CND$: US$

Comprehensive Income (Loss)

FASC Topic No. 220, “Comprehensive Income,” establishes standards for reporting and display of comprehensive income and its components in a full set of general-purpose financial statements. As at September 30, 2014 and June 30, 2014, the Company had no material items of other comprehensive income except for the foreign currency translation adjustment.

Risks and Uncertainties

The Company operates in the resource exploration industry that is subject to significant risks and uncertainties, including financial, operational, technological, and other risks associated with operating a resource exploration business, including the potential risk of business failure.

Environmental Expenditures

The operations of the Company have been, and may in the future be, affected from time to time in varying degree by changes in environmental regulations, including those for future reclamation and site restoration costs. Both the likelihood of new regulations and their overall effect upon the Company vary greatly and are not predictable. The Company's policy is to meet or, if possible, surpass standards set by relevant legislation by application of technically proven and economically feasible measures.

Environmental expenditures that relate to ongoing environmental and reclamation programs are charged against earnings as incurred or capitalized and amortized depending on their future economic benefits. All of these types of expenditures incurred since inception have been charged against earnings due to the uncertainty of their future recoverability. Estimated future reclamation and site restoration costs, when the ultimate liability is reasonably determinable, are charged against earnings over the estimated remaining life of the related business operation, net of expected recoveries.

13

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

2. Significant Accounting Policies - Continued

Warrants

The Company values its warrants with provisions resulting in derivative liabilities at fair value using the lattice model according to ASC-815-10-55. The Company revalue its warrants at the end of every period at fair value and record the difference in other income (expense) in the condensed consolidated statements of operations.

Convertible Debentures and Convertible Promissory Notes

The Company values its convertible debentures and convertible promissory notes with provisions resulting in beneficial conversion features from the embedded derivative at fair value according to ASC-480-10-25-14, rather than have its conversion feature bifurcated and reported separately due to ASC-815-15-25-1b. Because the value of the derivative related to the warrant exceeds the proceeds of the loan, the Company allocated 100% of the proceeds to the warrant derivative and took a day one loss for the difference between the proceeds and the fair value of the warrants, resulting in a debt discount on the full fair value of the debenture because no proceeds were available to be allocated to the debt or its beneficial conversion feature. That debt discount is accreted to interest expense over the stated life of the note using the interest method in accordance with ASC 470-20-35-7a and ASC 835-30-35-2. Unaccreted debt discount on the date of conversion is accreted to interest expense on that date.

Fair Value of Financial Instruments

ASC 820, “Fair Value Measurements and Disclosures” requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1 - Quoted prices in active markets for identical assets or liabilities;

Level 2 - Inputs other than quoted prices included within Level 1 that are either directly or indirectly observable; and

Level 3 - Unobservable inputs that are supported by little or no market activity, therefore requiring an entity to develop its own assumptions about the assumptions that market participants would use in pricing.

The carrying amounts of the Company’s financial assets and liabilities, such as cash and cash equivalents, prepaid expenses, deposit, accounts payable and accrued liabilities, and due to a related party approximate their fair values because of the short maturity of these instruments.

The Company’s Level 3 financial liabilities consist of the liability of the Company’s secured convertible promissory notes and debentures issued to investors, and the derivative warrants issued in connection with these convertible promissory notes and debentures. There is no current market for these securities such that the determination of fair value requires significant judgment or estimation. The Company used a fair value model which incorporates transaction details such as Company stock price, contractual terms, maturity, risk free rates, as well as assumptions about future financings, volatility, and holder behavior as of the date of issuance and each balance sheet date.

14

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

2. Significant Accounting Policies – Continued

Revenue Recognition

The Company has generated little revenues to date. It is the Company’s policy that revenue from product sales or services will be recognized in accordance with ASC 605 “Revenue Recognition”. Four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. The Company will defer any revenue for which the product/services was not delivered or is subject to refund until such time that the Company and the customer jointly determine that the product/service has been delivered or no refund will be required.

Sales comprise the fair value of the consideration received or receivable for the sale of goods and rendering of services in the ordinary course of the Company’s activities. Sales are presented, net of tax, rebates and discounts, and after eliminating intercompany sales. The Company recognizes revenue when the amount of revenue and related cost can be reliably measured and it is probable that the collectability of the related receivables is reasonably assured.

Receivables

Trade and other receivables are customer obligations due under normal trade terms and are recorded at face value less any provisions for uncollectible amounts considered necessary. The Company includes any balances that are determined to be uncollectible in its overall allowance for doubtful accounts.

Investment in Unconsolidated Affiliate

Investments in affiliates that are not controlled by the Company, but over which it has significant influence, are accounted for using the equity method. The Company’s share of net income from its unconsolidated affiliate is reflected in the Consolidated Statements of Operations and Comprehensive Loss and Equity investment in Unconsolidated Affiliate.

Recent Accounting Pronouncements

15

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

2. Significant Accounting Policies - Continued

FASB Statements:

In June 2009 the FASB established the Accounting Standards Codification ("Codification" or "ASC") as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in accordance with generally accepted accounting principles in the United States ("GAAP"). Rules and interpretive releases of the Securities and Exchange Commission ("SEC") issued under authority of federal securities laws are also sources of GAAP for SEC registrants. Existing GAAP was not intended to be changed as a result of the Codification, and accordingly the change did not impact our financial statements. The ASC does change the way the guidance is organized and presented.

Accounting Standards Updates ("ASUs") through ASU No. 2014-08 which contain technical corrections to existing guidance or affect guidance to specialized industries or entities were recently issued. These updates have no current applicability to the Company or their effect on the financial statements would not have been significant.

3. Capital Stock

Authorized Stock

At inception, the Company authorized 100,000,000 common shares and 100,000,000 preferred shares, both with a par value of $0.001 per share. Each common share entitles the holder to one vote, in person or proxy, on any matter on which action of the stockholders of the corporation is sought.

Effective April 8, 2009, the Company increased the number of authorized shares to 600,000,000 shares, of which 500,000,000 shares are designated as common stock par value $0.001 per share, and 100,000,000 shares are designated as preferred stock, par value $0.001 per share.

On October 25, 2012, the Company designated 20,000,000 series A convertible preferred stock with a par value of $0.001 per share and stated value of $100 per share. The designated preferred stock is convertible at the option of the holder, at any time beginning one year from the date such shares are issued, into common stock of the Company with a par value of $0.001. All shares of common stock of the Company, shall be of junior rank to all series A preferred stock in respect to the preferences as to distributions and payments upon the liquidation, dissolution and winding up of the Company. All other shares of preferred stock shall be of junior rank to all series A preferred shares in respect to the preferences as to distributions and payments upon the liquidation, dissolution and winding up of the Company.

On January 3, 2014, the Company designated 2,000,000 series B convertible preferred stock with a par value $0.001 per share, issuable only in consideration of the extinguishment of existing debt convertible in to the Company’s common stock with a par value of $0.001. The designated preferred stock shall be issued on the basis of 1 preferred stock for each $1 of convertible debt. The series B convertible preferred stock shall be subordinate to and rank junior to all indebtedness of the Company now or hereafter outstanding.

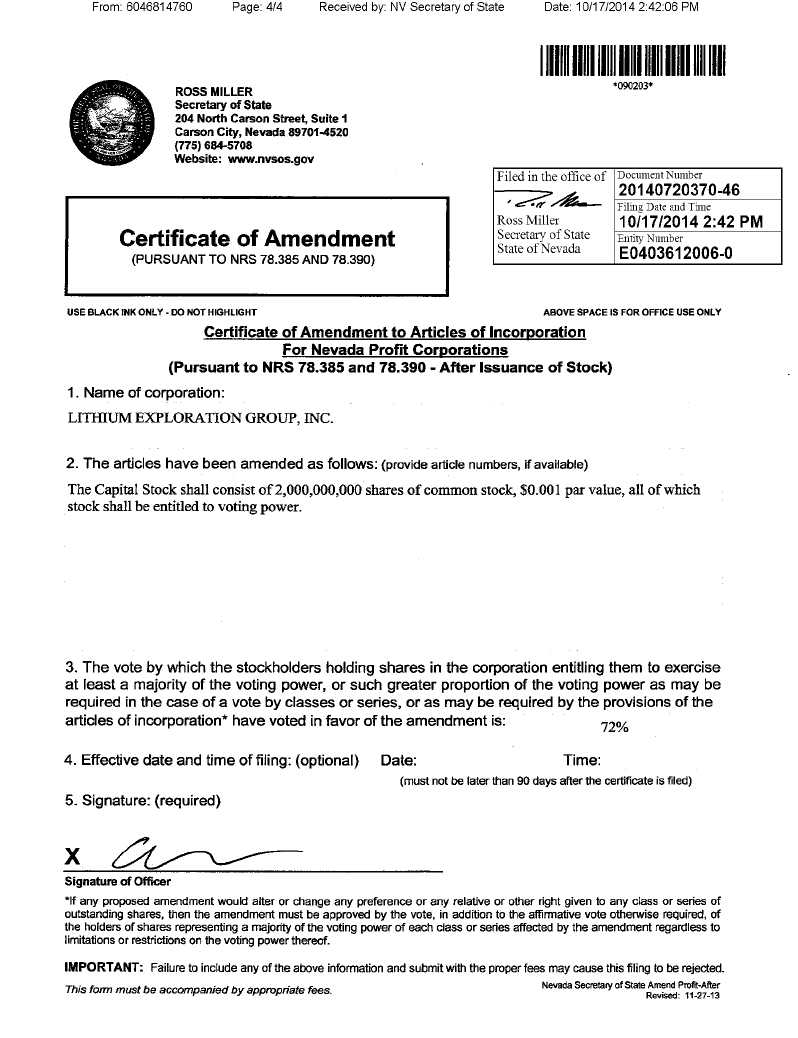

On October 17, 2014, the Company amended its Articles of Incorporation, which amendment was filed with the Nevada Secretary of State on October 17, 2014, to increase the authorized capital of its common shares from 500,000,000 common shares, par value $0.001 to 2,000,000,000 common shares, par value $0.001. The Company’s authorized capital consists of 2,000,000,000 common shares and 100,000,000 preferred shares, all with a par value of $0.001.

16

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

3. Capital Stock – Continued

Share Issuances

Common Stock Issuance

For the period ended September 30, 2014:

On July 1, 2014, the Company issued 199,557 common shares at a market price of $0.05 per share for consulting fees.

On July 4, 2014, the Company issued 541,517 common shares at a market price of $0.06 per share for consulting fees.

On July 9, 2014, the Company issued 9,713,996 common shares at a deemed price of $0.01 per share for warrants exercise of $117,962 (Note 6).

On July 16, 2014, the Company issued 1,800,000 common shares at a deemed price of $0.002 per share for promissory note and interest conversion of $46,769 (Note 6).

On July 30, 2014, the Company issued 18,113,654 common shares at a deemed price of $0.02 per share for warrants exercise of $386,433 (Note 6).

On August 1, 2014, the Company issued 1,062,687 common shares at a deemed price of $0.02 per share for promissory note and interest conversion of $25,000 (Note 6).

On August 1, 2014, the Company issued 245,232 common shares at a market price of $0.04 per share for consulting fees.

On August 5, 2014, the Company issued 20,645,463 common shares at a deemed price of $0.002 per share for warrants exercise of $41,244 (Note 6).

On August 8, 2014, the Company issued 8,904,569 common shares at a deemed price of $0.02 per share for warrants exercise of $136,555 (Note 6).

On August 12, 2014, the Company issued 3,200,066 common shares at a deemed price of $0.02 per share for warrants exercise of $59,953 (Note 6).

On August 28, 2014, the Company issued 10,390,546 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $205,984 (Note 6).

On September 1, 2014, the Company issued 350,195 common shares at a market price of $0.03 per share for consulting fees.

On September 1, 2014, the Company issued 1,167,316 common shares at a market price of $0.03 per share for consulting fees.

On September 3, 2014, the Company issued 3,000,000 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $42,135 (Note 6).

On September 3, 2014, the Company issued 500,000 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $9,717 (Note 6).

17

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

3. Capital Stock – Continued

Share Issuances - Continued

On September 4, 2014, the Company issued 909,091 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $20,000 (Note 6).

On September 4, 2014, the Company issued 583,333 common shares at a deemed price of $0.003 per share for warrants exercise of $2,322 (Note 6).

On September 8, 2014, the Company issued 1,106,273 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $20,510 (Note 6).

On September 10, 2014, the Company issued 6,734,235 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $62,375 (Note 6).

On September 10, 2014, the Company issued 1,538,462 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $20,000 (Note 6).

On September 11, 2014, the Company issued 2,607,721 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $30,777 (Note 6).

On September 11, 2014, the Company issued 5,599,010 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $39,712 (Note 6).

On September 11, 2014, the Company issued 1,652,893 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $20,000 (Note 6).

On September 12, 2014, the Company issued 9,900,990 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $100,000 (Note 6).

On September 12, 2014, the Company issued 2,869,240 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $30,781(Note 6).

On September 15, 2014, the Company issued 5,584,158 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $54,804 (Note 6).

On September 15, 2014, the Company issued 1,914,321 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $20,529 (Note 6).

On September 15, 2014, the Company issued 10,946,967 common shares at a deemed price of $0.002 per share for warrants exercise of $22,207 (Note 6).

On September 16, 2014, the Company issued 3,810,301 common shares at a deemed price of $0.01 per share for promissory note and interest conversion of $40,447 (Note 6).

On September 17, 2014, the Company issued 1,414,141 common shares at a deemed price of $0.005 per share for promissory note and interest conversion of $14,000 (Note 6).

On September 23, 2014, the Company issued 1,477,873 common shares at a deemed price of $0.003 per share for promissory note and interest conversion of $9,311 (Note 6).

18

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

3. Capital Stock – Continued

Share Issuances - Continued

On September 23, 2014, the Company issued 3,846,154 common shares at a deemed price of $0.003 per share for promissory note and interest conversion of $25,000 (Note 6).

On September 23, 2014, the Company issued 1,818,181 common shares at a deemed price of $0.003 per share for promissory note and interest conversion of $7,692 (Note 6).

On September 23, 2014, the Company issued 10,000,000 common shares at a deemed price of $0.003 per share for promissory note and interest conversion of $55,000 (Note 6).

On September 24, 2014, the Company issued 9,090,909 common shares at a deemed price of $0.003 per share for promissory note and interest conversion of $48,585 (Note 6).

On September 29, 2014, the Company issued 6,047,749 common shares at a deemed price of $0.003 per share for promissory note and interest conversion of $37,050 (Note 6).

On September 29, 2014, the Company issued 5,000,000 common shares at a deemed price of $0.003 per share for promissory note and interest conversion of $31,500 (Note 6).

19

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

3. Capital Stock – Continued

Share Issuances - Continued

As at September 30, 2014, 16,061,592 (June 30, 2014 - 13,557,775) were issued to directors and officers of the Company. 18,516,037 (June 30, 2014 - 18,516,037) were issued to independent investors. 872,375 (June 30, 2014 - 872,375) were issued for mining expenses. 768,840 (June 30, 2014 - 768,840) were issued for related party consulting expenses. 948,604 (June 30, 2014 - 948,604) were issued for investor relation expenses. 200,000 (June 30, 2014 - 200,000) were issued for debt settlement. 43,001,127 (June 30, 2014 - 43,001,127) were issued for debenture and interest conversion. 1,028,113 (June 30, 2014 - 1,028,113) were issued for exercise of warrants attached to convertible debentures. 120,940,746 (June 30, 2014 - 21,265,811) were issued for promissory note and interest conversions. 81,307,589 (June 30, 2014 - 9,193,541) were issued for exercise of warrants attached to convertible promissory notes. 954,461 (June 30, 2014 - 954,461) were issued for note payable conversion. 2,000,000 (June 30, 2014 - 2,000,000) were issued for a mining option settlement. 20,000,000 (June 30, 2014 - 20,000,000) were issued for the conversion of Series A Convertible Preferred shares. 59,645,434 (June 30, 2014 - 59,645,434) were issued for the conversion of Series B Convertible Preferred shares. The Company has no stock option plan, warrants or other dilutive securities, other than warrants issued to acquire 37,959,395 shares of the Company regarding convertible promissory notes (Note 6).

On January 3, 2014, the Company entered into a convertible debt settlement agreement with one investor. Pursuant to the terms of the agreement, the investor acquired 1,134,500 convertible Series B Preferred Shares to extinguish the balance of convertible debts with an aggregate principal amount of $1,134,500. The conversion price of the Series B Preferred Shares shall be the lower of 50% of the lowest reported sale price of the common stock for the 20 trading days immediately prior to (i) the closing date of the applicable convertible debt instrument of the Corporation from which the applicable Series B Preferred Shares were converted, or (ii) 50 % of the lowest reported sale price for the 20 days prior to the conversion date of the Series B Preferred Shares.

As at June 30, 2014, all of the Series B Preferred Shares issued on the January 3, 2014 debt settlement agreement were converted into 59,645,434 common shares of the Company for a total fair value of $3,639,623 of which a gain of $331,127 was recorded.

20

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

4. Provision for Income Taxes

The Company recognizes the tax effects of transactions in the year in which such transactions enter into the determination of net income, regardless of when reported for tax purposes. Deferred taxes are provided in the financial statements under FASC 740-20-20 to give effect to the resulting temporary differences which may arise from differences in the bases of fixed assets, depreciation methods, allowances, and start-up costs based on the income taxes expected to be payable in future years.

Exploration stage deferred tax assets arising as a result of net operating loss carryforwards have been offset completely by a valuation allowance due to the uncertainty of their utilization in future periods. Operating loss carryforwards generated during the period from May 31, 2006 (date of inception) through September 30, 2014 of approximately $11,850,000 will begin to expire in 2026. Accordingly, deferred tax assets were offset by the valuation allowance that increased by approximately $418,562 and $536,536 during the periods ended September 30, 2014 and June 30, 2014, respectively.

The Company follows the provisions of uncertain tax positions as addressed in FASC 740-10-65-1. The Company recognized approximately no increase in the liability for unrecognized tax benefits.

The Company has no tax position at September 30, 2014 for which the ultimate deductibility is highly certain but for which there is uncertainty about the timing of such deductibility. The Company recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in operating expenses. No such interest or penalties were recognized during the periods presented. The Company had no accruals for interest and penalties at September 30, 2014. The Company’s utilization of any net operating loss carry forward may be unlikely as a result of its intended exploration stage activities. The tax years for June 30, 2014, June 30, 2013, June 30, 2012 and June 30, 2011 are still open for examination by the Internal Revenue Service (IRS).

21

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

4. Provision for Income Taxes - Continued

| For the three months ended September 30, 2014 | ||||||

| Amount | Tax Effect (35%) | |||||

| Net income | $ | (45,816 | ) | $ | (16,036 | ) |

| Shares issued for consulting fees, mining expenses, investor relation and director fees | (87,000 | ) | (30,450 | ) | ||

| Shares issued for interest expenses | (31,642 | ) | (11,075 | ) | ||

| Accretion of beneficial conversion feature | (1,478,355 | ) | (517,425 | ) | ||

| Gain on change in the fair value of derivative liability and fair | ||||||

| value of warrant issued | 2,061,376 | 721,482 | ||||

| Total | 418,562 | 146,497 | ||||

| Valuation allowance | (418,562 | ) | (146,497 | ) | ||

| Net deferred tax asset (liability) | $ | - | $ | - | ||

| For the three months ended September 30, 2013 | ||||||

| Amount | Tax Effect (35%) | |||||

| Net loss | $ | 595,524 | $ | 1208,433 | ||

| Shares issued for consulting fees, mining expenses, investor relation and director fees | (82,167 | ) | (28,758 | ) | ||

| Accretion of beneficial conversion feature | (258,218 | ) | (90,376 | ) | ||

| Gain on derivative liability | 41,485 | 14,520 | ||||

| Total | 296,624 | 103,818 | ||||

| Valuation allowance | (296,624 | ) | (103,818 | ) | ||

| Net deferred tax asset (liability) | $ | - | $ | - | ||

5. Mineral Property Costs

Mineral Claims, Clinton Mining District

On September 25, 2009, and amended June 24, 2010, the Company entered into an Option Agreement under which the Company was granted an option to acquire an undivided 50% interest in eight mineral claims located in the Clinton Mining District, Province of British Columbia, Canada (the “Claims”), which Claims total in excess of 3,900 hectares, in consideration of the issuance of 1,500,000 common shares of the Company on or before December 31, 2010. The Claims were subject to a two percent net smelter royalty which can be paid out for the sum of $1,000,000 (CAD). The Company can earn an undivided 50% interest in the Claims by carrying out a $100,000 (CAD) exploration and development program on the Claims on or before December 31, 2010, plus an additional $200,000 (CAD) exploration and development program on the Claims on or before September 25, 2011.

In the event that the Company acquires an interest in the Claims, the Company and the Optionor have further agreed, at the request of either party, to negotiate a joint venture agreement for further exploration and development of the Claims.

22

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

5. Mineral Property Costs - Continued

On April 29, 2011, the Company entered into a mutual release agreement. The Company is released from any obligations related to the Claims for considerations of a cash payment of CDN $54,624 (US$57,901) and the issuance of 200,000 common shares of the Company. The shares have been valued at a market price of $3.70 for a total of $740,000. The total amount of $797,901 has been recorded as mining expenses during the year ended June 30, 2011.

Mineral Permit

On December 16, 2010, the Company entered into an Assignment Agreement to acquire the following:

| a. ) | An undivided 100% right, title and interest in and to certain mineral permits located in the Province of Alberta, Canada. |

|

| b. ) | All of the assignor’s right, title and interest in and to the Option Agreement. |

In consideration for the Assignment, the Company agreed to pay US$90,000 by way of cash or stock of equal value (consisting of amounts previously paid by the Assignor pursuant to the Option Agreement). The full $90,000 (consisting of option payments ‘i’ and ‘v’ below) was expensed and included in the December 31, 2011 accounts payable balance. The Option shall be in good standing and exercisable by the Company by paying the following amounts on or before the dates specified in the following schedule:

| i. ) | CDN $40,000 (paid) upon execution of the agreement; |

|

| ii. ) | CDN $60,000 (paid) on or before January 1, 2012; |

|

| iii. ) | CDN $100,000 on or before January 1, 2013 (amended); |

|

| iv. ) | CDN $300,000 on or before January 1, 2014; and |

|

| v. ) | Paying all such property payments as may be required to maintain the mineral permits in good standing. |

The Optionee shall provide a refundable amount of CDN$50,000 (paid) to the Optionor by November 2, 2010, which shall be applied by the Optionor towards work assessment expenses acceptable to the Government of Alberta, with any unused portion to be applied against payments required to maintain the permits underlying the property in good standing.

On December 31, 2012, the Company entered into an agreement to amend the original payment requirement of CDN$100,000 due on January 1, 2013 to the following payments: CDN $20,000 (paid) cash payment due on January 1, 2013 and CDN $80,000 by a 15% one year promissory note starting January 1, 2013. The promissory note is interest free until March 31, 2013. After then, interest will accrue on the principal balance then in arrears at the rate of 15% per annum. No payments shall be payable until December 31, 2013. At any time, the Optionor may elect to convert the remaining balance of CDN $80,000 plus accrued interest into common shares of the Company at 75% of the closing market price of the Company’s common shares on the election day. The full CDN$100,000 (US$95,008) (consisting of cash payment of CDN$20,000 (US$19,164) and note payable of CDN$80,000 (US$75,844) was expensed. The note is subject to be measured at its fair value in accordance with ASC 480-10-25-14. The fair value at issuance was CDN$106,667 (US$101,125) as of June 30, 2013. An additional $26,667 was charged to mining expense during the year June 30, 2013. An interest expense of CDN$3,058 (US$2,899) was accrued as at June 30, 2013. On July 3, 2013, the Optionor elected to convert the promissory note of CDN $80,000 (US$75,844) plus accrued interest of CDN$3,058 (US$2,899) for the total amount of CDN $83,058 (US$78,743) into 954,461 common shares of the Company at a price of US$0.0825 per share.

23

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

5. Mineral Property Costs - Continued

Glottech Technology

On March 17, 2011 and subsequently amended on November 18, 2011, the Company entered into a letter agreement to acquire one initial unit of proprietary and patented mechanical ultrasound technology for use in water purification, inclusive of its process of separating from water, as the primary fluid stock, the salt and other minerals and by –products contained therein, with Glottech – USA.

To acquire the unit, the Company must make the following payments:

| a) | US$25,000 upon execution of the agreement (paid); |

|

| b) | US$75,000 within 180 days of execution of the agreement (paid); |

|

| c) | US$700,000 within 10 days of receipt of invoice from Glottech –USA LLC if the payment in b) is made (paid). |

|

| d) | The Company also granted an option to acquire 2,000,000 shares for $1.00 to Glottech – USA upon receipt of the operational ultrasonic generator that they are building for Lithium Exploration Group. The 2,000,000 shares are to be paid from outstanding shares owned by Alex Walsh, company CEO. During the year ended June 30, 2011, the option resulting in additional mining expenses of $4,940,000 was valued using the fair market value of the shares to be issued. On October 1, 2012, Alex Walsh and GD International entered into an agreement to transfer 2,000,000 common shares owned by Alex Walsh to GD International. The shares were received by GD International on October 29, 2012. |

Commencing as of the end of an initial sixty day testing and training period following satisfactory delivery and physical setup of the technology, and continuing thereafter for as long as the technology remains in the possession of the Company, the Company shall pay continuing monthly royalties in an amount equal to $2.00 per physical ton of water processed pursuant to the usage of the technology.

On June 12, 2012, the Company filed a complaint with the court of common pleas of Chester County, Pennsylvania against Glottech – USA, LLC, Eldredge, Inc., and the Eldredge Companies, Inc. The complaint seeks an order of the court granting possession of the unit, in its current state, to the Company.

Effective August 14, 2012, the Company entered into an option agreement with GD Glottech-International, Limited (“GD International”) to protect our license and distribution rights in the event that GD-Glottech-USA, LLC (“GD USA”) is unable to perform and honor the obligations contingent to a letter agreement dated November 8, 2011.

Pursuant to the terms of the option agreement, we are required to provide an initial deposit of $150,000 to be held in escrow for the option to obtain a license on the patent rights, as set forth in the option agreement. A further $15,000 was required for exercising the option agreement and it will be credited to future fees when patents rights are exercised. We exerised this option agreement on September 1, 2012 and released the funds to GD International.

On October 1, 2012, the Company entered into a sales agency agreement with GD International. The agreement shall replace all agreements entered previously. Pursuant to the agreement, the Company is appointed as GD International’s sales agent for the technology within the territory. As a consideration, 2,000,000 common shares of the Company shall be issued to GD International (issued: see d) above). GD International retains all right, title and interest in the technology. The term of this agreement will be an initial period of five years. The term shall be automatically renewable thereafter for successive five year periods provided that the Company has sold not less than 25 or more technology units during each applicable five year period.

24

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

5. Mineral Property Costs - Continued

On May 2, 2013, the Company entered into an agreement to retain the future use of the unit. Pursuant to the agreement, the Company must make the following payments:

| a) | US$20,000 within three days of execution of the agreement (paid); |

|

| b) | US$30,000 within three days upon the testing of the unit has been successfully completed. |

6. Convertible Promissory Notes

Summary of convertible promissory note at September 30, 2014 and June 30, 2014 is as follows:

| June 30, | Fair value | Fair value | Fair value | September | |||||||||||

2014 |

issued |

converted |

repaid |

30, 2014 |

|||||||||||

| February 13, 2013 | $ | 461,754 | $ | - | $ | (147,469 | ) | $ | - | $ | 314,285 | ||||

| February 27, 2014 | 200,000 | - | (200,000 | ) | - | - | |||||||||

| February 27, 2014 | 150,000 | - | (36,000 | ) | - | 114,000 | |||||||||

| February 28, 2014 | 100,000 | - | (90,250 | ) | - | 9,750 | |||||||||

| February 28, 2014 | 200,000 | - | (45,000 | ) | - | 155,000 | |||||||||

| February 28, 2014 | 220,000 | - | (55,000 | ) | - | 165,000 | |||||||||

| March 3, 2014 | 100,000 | - | (100,000 | ) | - | - | |||||||||

| March 3, 2014 | 200,000 | - | (100,000 | ) | - | 100,000 | |||||||||

| March 3, 2014 | 100,000 | - | (94,810 | ) | - | 5,190 | |||||||||

| March 3, 2014 | 230,000 | - | - | - | 230,000 | ||||||||||

| March 3, 2014 | 440,000 | - | (109,812 | ) | - | 330,188 | |||||||||

| March 15, 2014 | 846,154 | - | (7,692 | ) | - | 838,462 | |||||||||

| July 22, 2014 | - | 461,538 | - | 461,538 | |||||||||||

| August 22, 2014 | - | 153,846 | - | 153,846 | |||||||||||

| $ | 3,247,908 | $ | 615,384 | $ | (986,033 | ) | $ | - | $ | 2,877,259 | |||||

| Less: Debt discount | 2,797,850 | 1,934,881 | |||||||||||||

| Net Convertible promissory Note | 450,057 | 942,378 | |||||||||||||

| Current portion | $ | 450,057 | $ | 942,378 | |||||||||||

| Long term portion | $ | - | $ | - |

On February 13, 2013, the Company entered into a securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $1,100,000, at an issuance discount of $100,000; resulting in $1,000,000 net proceeds to the Company.

As of September 30, 2014, total net proceeds of $675,000 (June 30, 2014 - $675,000) were received with an issuance discount of $67,500 (June 30, 2014 - $67,500) for an aggregate face value of $742,500 (June 30, 2014 - $742,500). During the period ended September 30, 2014, $109,375 (June 30, 2014 - $419,272) in face value of the note including interest was converted to 11,461,697 (June 30, 2014 -14,164,584) common shares in accordance with the terms of the agreement.

25

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

6. Convertible Promissory Notes - Continued

There is no guarantee the investor will make additional payments. The note of $314,286 is due on February 13, 2016 and carries a one-time interest rate of 5% over the term of note, with an effective interest rate of 171.61% . The note is convertible at the lower of $0.25 and 70% of the lowest reported sales price of the common stock for the 20 days immediately prior to conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $1,060,714. During the period ended September 30, 2014, an interest expense of $5,977 (June 30, 2014 - $7,409) was accrued.

Effective February 27, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $100,000 due on August 27, 2014 and carries an interest rate of 12% per annum over the term of note, with an effective interest rate of 1220.64% . The note is convertible at the lower of 50% discount to the average of the three lowest bids on the 20 days before the date this note executed and 50% discount to the average of the three lowest bids during the 20 days prior to conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $200,000. During the period ended September 30, 2014, $105,984 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 10,390,546 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. The note was fully converted during the period.

Effective February 28, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $50,000 due on August 28, 2015 and carries a one-time interest rate of 15% over the term of note, with an effective interest rate of 268.24% . The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $100,000. During the period ended September 30, 2014, $57,697 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 10,544,536 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $18,500 (June 30, 2014 - $1,667) was accrued.

26

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

6. Convertible Promissory Notes - Continued

Effective February 27, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $75,000 due on February 27, 2015 and carries an interest rate of 10% per annum over the term of the note, with an effective interest rate of 1303.72% . The convertible note is convertible at the investor’s option at any time after 180 days at a price equal to 50% of the lowest bids price for the 20 days prior to conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $150,000. During the period ended September 30, 2014, $19,050 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 6,047,749 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $1,425 (June 30, 2014 -$2,500) was accrued.

Effective February 28, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $125,500 with 15% prepaid interest per annum, resulting in $100,000 net proceeds to the Company due on August 28, 2015, with an effective interest rate of 227.33% . The note is convertible at the lower of 50% discount of the lowest closing price for the 20 days prior to date of the purchase agreement or the voluntary conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $200,000. During the period ended September 30, 2014, $22,500 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 5,384,616 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $3,750 (June 30, 2014 - $5,000) was accrued.

Effective February 28, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $110,000, at an issuance discount of $10,000; resulting in $100,000 net proceeds to the Company. The note is due on September 1, 2014 and carries a one-time interest rate of 12% over the term of the note, with an effective interest rate of 781.10% . The note is convertible at the lower of $0.075 or 50% of the lowest trade during the 25 consecutive trading days immediately prior to the conversion date of the Note. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $220,000. During the period ended September 30, 2014, $27,500 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 10,000,000 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $5,657 (June 30, 2014 - $7,543) was accrued.

27

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

6. Convertible Promissory Notes - Continued

Effective March 3, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $50,000 due on March 5, 2015 and carries an interest rate of 10% per annum over the term of the note, with an effective interest rate of 1303.72%. The convertible note is convertible at the investor’s option at any time after 180 days at a price equal to 50% of the lowest closing bid price for the 20 days prior to conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $100,000. During the period ended September 30, 2014, $52,596 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 8,497,555 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. The note was fully converted during the period.

Effective March 3, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $100,000 due on September 3, 2014 and carries an interest rate of 12% per annum over the term of the note, with an effective interest rate of 1220.64% . The note is convertible at a 50% discount of the lowest closing price for the 20 days prior to date of the purchase agreement or the voluntary conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $200,000. During the period ended September 30, 2014, $50,000 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 9,900,990 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $2,000 (June 30, 2014 - $4,000) was accrued.

28

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

6. Convertible Promissory Notes - Continued

Effective March 3, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $50,000 due on March 4, 2015 and carries an interest rate of 10% per annum over the term of the note, with an effective interest rate of 1303.72%. The convertible note is convertible at the investor’s option at any time after 180 days at a price equal to 50% of the lowest closing bid price for the 20 days prior to conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $100,000. During the period ended September 30, 2014, $47,405 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 10,453,998 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $43 (June 30, 2014 - $1,667) was accrued.

Effective March 3, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $115,000, at an issuance discount of $15,000; resulting in $100,000 net proceeds to the Company. The note is due on April 1, 2015 and carries an interest rate of 15% per annum over the term of the note, with an effective interest rate of 361.67% . The note is convertible at the lower of $0.06 or 50% of the lowest trade during the 20 consecutive trading days immediately prior to the conversion date of the Note. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $230,000. During the period ended September 30, 2014, an interest expense of $4,313 (June 30, 2014 - $5,750) was accrued.

Effective March 3, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $220,000, at an issuance discount of $20,000; resulting in $200,000 net proceeds to the Company. The note is due on September 3, 2014 and carries an interest rate of 12% per annum over the term of the note, with an effective interest rate of 1220.64% . The note is convertible at a 50% discount of the lowest closing price for the 20 trading days immediately prior to (i) date of the purchase agreement, or (ii) the voluntary conversion of the Note. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $440,000. During the period ended September 30, 2014, $58,200 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 15,175,067 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $4,400 (June 30, 2014 -$8,800) was accrued.

29

| Lithium Exploration Group, Inc. |

| Notes to Condensed Consolidated Interim Financial Statements |

| September 30, 2014 |

| (Unaudited) |

6. Convertible Promissory Notes - Continued

Effective March 15, 2014, the Company entered into another securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $550,000, at an issuance discount of $50,000; resulting in $500,000 net proceeds to the Company. The note is due on September 15, 2015 and carries an interest rate of 15% per annum over the term of the note, with an effective interest rate of 207.18% . The note is convertible at a 35% discount of the lowest closing price for the 20 trading days immediately prior to (i) date of the purchase agreement, or (ii) the voluntary conversion of the Note. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $846,154. During the period ended September 30, 2014, $5,000 (June 30, 2014 - $Nil) in face value of the note including interest was converted to 1,818,181 (June 30, 2014 - Nil) common shares in accordance with the terms of the agreement. During the period ended September 30, 2014, an interest expense of $20,438(June 30, 2014 - $24,063) was accrued.

Effective July 22, 2014, the Company entered into a securities purchase agreement with one investor. Pursuant to the terms of the agreement, the investor acquired a convertible promissory note with an aggregate face value of $600,000 due on January 22, 2016 and carries an interest rate of 12% per annum over the term of the note, with an effective interest rate of 230.27% .

As of September 30, 2014, total net proceeds of $300,000 were received. There is no guarantee the investor will make additional payments. The note is convertible at the lowerof 65% of the lowest reported sale price for the20 trading days immediately prior to (i) the closing date on July 22, 2014 or (ii) 65% of the lowest reported sale price for the 20 days prior the conversion date subject to various prescribed conditions. The convertible note has a fixed stated principal amount but is not convertible into a fixed number of shares, so the conversion feature is considered an imbedded derivative. However, the convertible note as a standalone instrument is to be measured at its fair value in accordance with ASC 480-10-25-14 rather than have its conversion feature bifurcated and reported separately. The fair value at issuance was $923,077. During the period ended September 30, 2014, an interest expense of $6,990 was accrued.