Exhibit 10.39

Dated 7 July 2015

(1) ELQ UK PROPERTIES LTD

- and -

(2) GUIDANCE SOFTWARE, INC.

COUNTERPART

LEASE RELATING TO FIFTH FLOOR (SOUTH

AND NORTH) THAMES CENTRAL, HATFIELD

ROAD, SLOUGH

Mishcon de Reya

Summit House

12 Red Lion Square

London WCIR 4QD

Tel: 020 7440 7000

Fax: 020 7404 5982

Ref: NK/42928.90

E-mail: nicholas.kirby@mishcon.com

TABLE OF CONTENTS

|

No. |

|

Heading |

|

Page |

|

|

|

|

|

|

|

1. |

|

MAIN DEFINITIONS |

|

4 |

|

2. |

|

OTHER DEFINITIONS AND INTERPRETATION |

|

4 |

|

3. |

|

BACKGROUND |

|

9 |

|

4. |

|

DEMISE AND RENT |

|

10 |

|

5. |

|

TENANT’S COVENANTS |

|

10 |

|

6. |

|

LANDLORD’S COVENANTS |

|

10 |

|

7. |

|

FORFEITURE |

|

10 |

|

8. |

|

MISCELLANEOUS |

|

12 |

|

9. |

|

VOID IF ORIGINAL LEASE DETERMINES |

|

13 |

|

10. |

|

EXCLUSION OF LANDLORD AND TENANT ACT 1954 |

|

14 |

|

11. |

|

TENANT’S BREAK CLAUSE |

|

14 |

|

12. |

|

GOVERNING LAW AND JURISDICTION |

|

14 |

|

13. |

|

EXECUTION |

|

15 |

|

SCHEDULE 1 - THE PREMISES |

|

16 | ||

|

SCHEDULE 2 |

|

17 | ||

|

|

|

PART A - RIGHTS GRANTED IN COMMON |

|

17 |

|

|

|

PART B - EXCLUSIVE RIGHT |

|

18 |

|

SCHEDULE 3 |

|

19 | ||

|

|

|

PART A - EXCEPTIONS AND RESERVATIONS |

|

19 |

|

|

|

PART B - TITLE MATTERS |

|

19 |

|

SCHEDULE 4 - INSURANCE |

|

21 | ||

|

SCHEDULE 5 - TENANT’S COVENANTS |

|

25 | ||

|

SCHEDULE 6 - LANDLORD’S COVENANTS |

|

37 | ||

|

SCHEDULE 7 - SERVICES AND SERVICE CHARGE |

|

39 | ||

|

SCHEDULE 8 - REGULATIONS |

|

45 | ||

|

LR1 |

Date of lease |

: |

7 July 2015 |

|

|

|

|

|

|

LR2. |

Title number(s) |

: |

LR2.1 Landlord’s title number(s) |

|

|

|

|

|

|

|

|

|

BK272505, BK159084 and BK259553 |

|

|

|

|

|

|

|

|

: |

LR2.2 Other title numbers |

|

|

|

|

|

|

|

|

|

BK397342 and BK417385 |

|

|

|

|

|

|

LR3. |

Parties to this lease |

: |

Landlord |

|

|

|

|

|

|

|

|

|

ELQ UK PROPERTIES LTD (company reg. no. 08773913) whose registered office is at Peterborough Court, 133 Fleet Street, London EC4A 2BB |

|

|

|

|

|

|

|

|

: |

Tenant |

|

|

|

|

|

|

|

|

|

GUIDANCE SOFTWARE, INC. a company incorporated under the laws of the State of California and registered at Companies House as a foreign company with registered number FC023582 whose registered office is at 215 North Marengo Avenue, Pasadena, California 91101 United States of America |

|

|

|

|

|

|

LR4. |

Property |

: |

In the case of a conflict between this clause and the remainder of this lease then, for the purposes of registration, this clause shall prevail. |

|

|

|

|

|

|

|

|

|

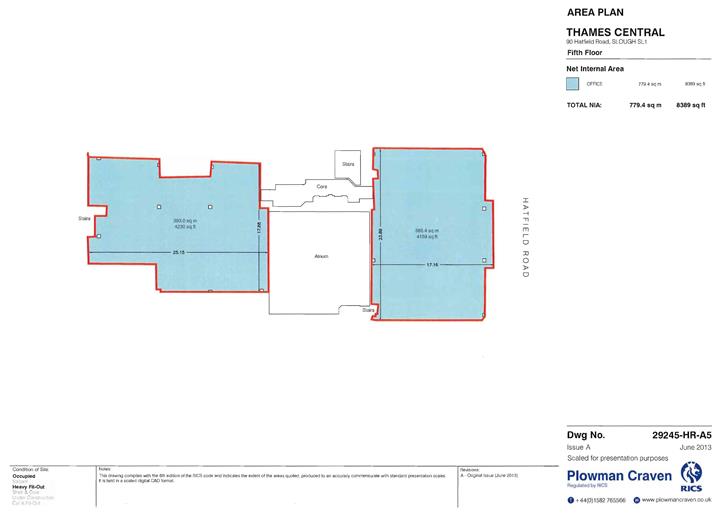

The property known as Fifth Floor North and South Thames Central, Hatfield Road, Slough as is shown edged red on the attached plans as more particularly described in Schedule 1 |

|

|

|

|

|

|

LR5. |

Prescribed statements etc. |

: |

None |

|

|

|

|

|

|

LR6. |

Term for which the Property is leased |

: |

5 years commencing on 9 January 2016 |

|

|

|

|

|

|

LR7. |

Premium |

: |

None |

|

|

|

|

|

|

LR8. |

Prohibitions or restrictions on disposing of this lease |

: |

This lease contains a provision that prohibits or restricts dispositions. |

|

|

|

|

|

|

LR9. |

Rights of acquisition etc. |

: |

LR9.1 Tenant’s contractual rights to |

|

|

|

|

renew this lease, to acquire the reversion or another lease of the Property, or to acquire an interest in other land |

|

|

|

|

|

|

|

|

|

None |

|

|

|

|

|

|

|

|

: |

LR9.2 Tenant’s covenant to (or offer to) surrender this lease |

|

|

|

|

|

|

|

|

|

None |

|

|

|

|

|

|

|

|

: |

LR9.3 Landlord’s contractual rights to acquire this lease |

|

|

|

|

|

|

|

|

|

None |

|

|

|

|

|

|

LR10. |

Restrictive covenants given in this Lease by the Landlord in respect of land other than the Property |

: |

None |

|

|

|

|

|

|

LR11. |

Easements |

: |

LR11.1 Easements granted by this lease for the benefit of the Property |

|

|

|

|

|

|

|

|

|

See Schedule 2 |

|

|

|

|

|

|

|

|

: |

LR11.2 Easements granted or reserved by this lease over the Property for the benefit of other property |

|

|

|

|

|

|

|

|

|

See Schedule 3 |

|

|

|

|

|

|

LR12. |

Estate rentcharge burdening the Property |

: |

None |

|

|

|

|

|

|

LR13. |

Application for standard form of restriction |

: |

None |

|

|

|

|

|

|

A. |

Basic Rent |

: |

£171,318.50 a year exclusive of Value Added Tax |

|

|

|

|

|

|

B. |

Rent Commencement Date |

: |

6 months from the Term Commencement Date |

|

|

|

|

|

|

C. |

Term Commencement Date |

: |

9 January 2016 |

|

|

|

|

|

|

D. |

Original Leases |

: |

a) the lease of the north side of the Property dated 9 January 2006 made between (1) TR Property Investment Trust Limited and (2) Guidance Software Inc (together with any deeds or documents supplemental to it) |

|

|

|

|

including a deed of variation dated on the same date as this Lease by which the north side of the Property was demised to the Tenant |

|

|

|

|

|

|

|

|

|

b) the lease dated 2 May 2006 made between (1) TR Property Investment Trust PLC and (2) Guidance Software Inc (together with any deeds or documents supplemental to it) including a deed of variation dated on the same date as this Lease by which the south side of the Property was demised to the Tenant |

|

|

|

|

|

|

E. |

Original Leases Expiry Date |

: |

8 January 2016 |

|

|

|

|

|

|

F. |

Original Licence for Alterations |

: |

the licences dated |

|

|

|

|

|

|

|

|

|

a) 9 January 2006 relating to Part 5th Floor (North Suite) made between (1) TR Property Investment Trust plc and (2) the Tenant; |

|

|

|

|

|

|

|

|

|

b) 20 July 2006 relating to Part 5th Floor (North Suite) made between (1) TR Property Investment Trust plc and (2) the Tenant; |

|

|

|

|

|

|

|

|

|

c) 20 July 2006 relating to Part 5th Floor (North Suite) made between (1) TR Property Investment Trust plc and (2) the Tenant; and |

|

|

|

|

|

|

|

|

|

and any other licences for alterations granted during the term of the Original Leases |

|

|

|

|

|

|

G. |

Permitted Use |

: |

Use as high class offices |

|

|

|

|

|

|

H. |

Interest Rate |

: |

Three per cent (3%) above the Base Rate |

|

|

|

|

|

|

I. |

Tenant’s Break Date |

: |

9 January 2019 |

THIS LEASE is dated 7 July 2015 between the parties named below as (1) the Landlord and (2) the Tenant

1. MAIN DEFINITIONS

1.1 The expressions Landlord, Tenant, Premises and Term have the meanings given to them in clauses LR3, LR4 and LR6.

1.2 The expressions Rent, Rent Commencement Date, Term Commencement Date, Original Leases, Original Leases Expiry Date, Original Licence for Alterations, Permitted Use and Interest Rate have the meanings given to them in clauses A to G.

2. OTHER DEFINITIONS AND INTERPRETATION

In this Lease unless the context otherwise requires the following expressions shall have the following meanings:

2.1 Additional Services means the Services listed in paragraph 2 of Schedule 7 as from time to time altered (if at all) under clause 8.8

2.2 Authorised Guarantee Agreement means an authorised guarantee agreement for the purposes of section 16 Landlord and Tenant (Covenants) Act 1995 made in respect of this Lease such agreement to be in accordance with the provisions of such section 16 and subject thereto to be in such terms as the Landlord may reasonably require

2.3 Authority means any statutory public local or other authority or any court of law or any government department or any of them or any of their duly authorised officers

2.4 Base Rate means the base lending rate from time to time of Lloyds Bank pic on such other bank being a member of the committee of London and Scottish Bankers as the Landlord may from time to time nominate or if that base lending rate cannot be ascertained then such other rate as the Landlord may reasonably specify

2.5 Basic Services means the Services listed in paragraph 1 of Schedule 7 as from time to time altered (if at all) under clause 8.8

2.6 Break Date means the date or dates described as the Break Date in the Prescribed Clauses

2.7 Building means the building and external areas now known as Thames Central (formerly called New Century House) (and of which the Premises forms part) for the purpose of identification only shown edged in red on the Site Plan as the same are registered at the Land Registry under title numbers BK272505, BK 159084 and BK259553 and any or every part of that building and everything attached to it or used for its benefit

2.8 Canopy Area means that part of the Premises coloured blue on the Premises Plan

2.9 Canopy Licence means a licence dated 12 May 1999 made between Slough Borough Council (1) and Edward Goodwin (2) the benefit of which is now vested in the Landlord

2.10 Car Park means the part of the Building from time to time set aside by the Landlord for the parking of vehicles

2.11 Car Park Plan means the attached plan marked as such

2.12 Common Parts means all parts of the Building from time to time provided for the common use of more than one of the tenants or occupiers of the Building and their visitors including without limitation any of the following which fall within this definition: vehicular and pedestrian accesses passages stairways circulation areas lifts escalators landscaped areas loading bays fire escapes toilet facilities storage areas refuse collection and disposal areas and parking areas

2.13 Conduits means sewers drains pipes wires cables ducts gutters fibres and any other medium for the passage or transmission of soil water gas electricity air smoke light information or other matters and includes where relevant ancillary equipment and structures

2.14 Connected Person means any person, firm or company which is connected with the Tenant for the purposes of section 839 Income and Corporation Taxes Act 1988

2.15 Consent means an approval permission authority licence or other relevant form of approval given by the Landlord in writing

2.16 Determination means the end of the Term however that occurs

2.17 Enactment means:

2.17.1 any Act of Parliament and

2.17.2 any European Community legislation or decree or other supranational legislation or decree having effect as law in the United Kingdom

and references (whether specific or general) to any Enactment include any statutory modification or re-enactment of it for the time being in force and any order instrument plan regulation permission or direction made or issued under it or under any Enactment replaced by it or deriving validity from it

2.18 Estimated Service Charge means the Landlord’s fair and reasonable estimate of the Service Charge which will be payable by the Tenant during a Service Charge Period

2.19 Group Company means any company of which the Tenant is a Subsidiary or which has the same Holding Company as the Tenant where Subsidiary and Holding Company have the meanings given to them by section 736 Companies Act 1985

2.20 Hazardous Material means any substance known to be harmful to human health or the environment and for that reason subject to statutory controls on production use storage or disposal

2.21 Insurance Charge means the Percentage of the cost to the Landlord of effecting and maintaining the Insurance Policies including where relevant the cost of assessing any insured amounts

2.22 Insurance Policies means the insurance policy or policies maintained by the Landlord or any Superior Landlord in respect of the Building covering damage by Insured Risks Loss of Rent public liability and other matters

2.23 Insured Risks means subject to paragraph 1.3 of Schedule 4 fire storm tempest lightning explosion earthquake riot civil commotion malicious damage impact flood bursting or overflowing of water tanks burst pipes discharge from sprinklers aircraft and other aerial

devices or articles dropped from them (other than war risks) and such other risks as the Landlord or any Superior Landlord may from time to time require to be covered

2.24 Insurers means the reputable underwriters or reputable insurance office with whom the Insurance Policies are effected

2.25 Interest Rate means the rate described as the Interest Rate in the Prescribed Clauses

2.26 Landlord includes the immediate reversioner to this Lease from time to time

2.27 Lease means this lease and includes where relevant any deed of variation licence Consent or other document supplemental to or associated with this Lease

2.28 Legal Obligation means any obligation from time to time created by any Enactment or Authority which relates to the Building or its use and includes without limitation obligations imposed as a condition of any Necessary Consents

2.29 Lettable Area means a part of the Building designed or intended for letting or exclusive occupation (except in connection with the management of the Building) the boundaries of any Lettable Area being determined in the same manner as the boundaries of the Premises under Schedule I whether or not it has actually been let by the Landlord

2.30 Loss of Rent means loss of all Basic Rent or other income from the Building due to damage or destruction by any of the Insured Risks for a period of three years having regard to potential increases in that income as a result of lettings rent reviews or other matters which may occur

2.31 Managing Agent means any party from time to time appointed by the Landlord to manage the Building (who may be an employee of the Landlord)

2.32 Necessary Consents means planning permission and all other consents licences permissions and approvals whether of a public or private nature which shall be relevant in the context

2.33 Outgoings means all rates taxes charges duties assessments impositions and outgoings of any sort which are at any time during the Term payable whether by the owner or occupier of property and includes charges for electricity gas water sewerage telecommunications and other services rendered to or consumed by the relevant property but excludes tax payable by the Landlord on the receipt of the Basic Rent or (other than output VAT) on any dealings with its reversion to this Lease and input VAT suffered by the Landlord in respect of the Building

2.34 Permitted Part means such part of the Property as is capable of separate independent beneficial occupation as approved by the Landlord (such approval not to be unreasonably withheld or delayed)

2.35 Percentage means a fair and reasonable proportion as determined by the Landlord (acting reasonably) but which in the absence of special circumstances will be substantially the same as the proportion which the net internal area of the Premises bears to the net internal area of all the Lettable Areas at the relevant time

2.36 Permissions means those permissions issued by Slough Borough Council under application reference P/024114/010 (dated 14 February 1994) and application reference P/024114/011 (dated 27 April 1998)

2.37 Permitted Use means the use described in the Prescribed Clauses as the Permitted Use

2.38 Plant means the plant equipment and machinery from time to time in or on the Building including without limitation lifts hoists generators and equipment for air-conditioning ventilation heating cooling fire alarm fire prevention or fire control communication and security

2.39 Policy means the Norwich Union Latent Defects Policy No 24050308FSD issued by CGU Insurance pic on 12 May 2005 to TR Property Investment Trust Plc and relating to the Building

2.40 Policy Cover Period means the period defined in the Policy as “the Period of Insurance”

2.41 Premises means the property briefly described in the Prescribed Clauses and more particularly described in Schedule 1 being part of the Building and all additions and improvements made to it and references to the Premises shall include reference to any part of them

2.42 Premises Plan means the attached plan marked as such

2.43 President means the President from time to time of the Royal Institution of Chartered Surveyors or any person authorised at the relevant time to act on his behalf

2.44 Quarter Days means 25 March 24 June 29 September and 25 December in each year

2.45 Rear Access Road means that part of the rear access road immediately to the north of the Building as is presently comprised in Land Registry title number BK397342 and shown edged red on the title plan to BK397342 a copy of which is attached hereto and marked “Rear Access Road Plan”

2.46 Rear Access Road Plan means the attached plan marked as such

2.47 Regulations means the Regulations in Schedule 8 and any others from time to time made by the Landlord in addition to or in substitution for those regulations which the Landlord reasonably considers appropriate having regard to the principles of good estate management and which are notified to the Tenant in writing

2.48 Rent means all sums reserved as rent by this Lease

2.49 Rent Commencement Date means the date described as the Rent Commencement Date in the Prescribed Clauses

2.50 Reserve Fund means the fund (if any) from time to time established under Schedule 7 to meet the cost of Reserve Fund Works which are expected to be required in the future

2.51 Reserve Fund Works means the works of repair maintenance and decoration of the Retained Property and the renewal or replacement of the Plant

2.52 Retained Property means all parts of the Building except for the Premises and the other Lettable Areas and includes without limitation the Common Parts the Conduits the foundations roof exterior and structure of the Building the Plant (except where part of the Premises or any Lettable Area) any external areas of the Building and any parts of the Building used for the management of the Building or the provision of services to it

2.53 Section 106 Agreement means those three section 106 Agreements identified as such and listed in Part B of Schedule 3

2.54 Service Charge means the Percentage of the Total Service Costs in any Service Charge Period

2.55 Service Charge Account Date means 29 September - 28 September in each year of the Term or such other date or dates in each year of the Term as the Landlord may by written notice to the Tenant stipulate

2.56 Service Charge Period means the period from and excluding one Service Charge Account Date up to and including the next Service Charge Account Date

2.57 Service Charge Statement means the statement to be provided to the Tenant under paragraph 4 of Schedule 7

2.58 Service Costs means the costs set out in paragraph 3 of Schedule 7

2.59 Services means the Basic Services and the Additional Services

2.60 Sign includes any sign hoarding showcase signboard bill plate fascia poster or advertisement

2.61 Signboard means a common signboard to be provided by the Landlord in the common entrance hall of the Building

2.62 Site Plan means the attached plan marked as such

2.63 Superior Landlord means any party having an interest in the Premises in reversion to the Superior Lease

2.64 Superior Lease means any lease under which the Landlord may from time to time hold the Building and includes any leases in reversion to that lease

2.65 Tenant includes its successors in title

2.66 Term means the term described as the Term in the Prescribed Clauses

2.67 Term Commencement Date means the date described as the Term Commencement Date in the Prescribed Clauses

2.68 Total Service Costs means the total of the Service Costs in any Service Charge Period

2.69 Title Matters means the matters set out in Part B of Schedule 3

2.70 Uninsured Risk means any risk against which the Landlord has actually insurance cover is obtainable on normal commercial terms in the London Insurance market today but which in the future ceases to be so obtainable other than by reason of the occupation by the Tenant or any undertenant or anyone else claiming an interest under any of them and/or use of the Property but an Insured Risk does not become an Uninsured Risk for the purposes of this Lease by reason only of:

2.70.1 normal exclusion provisions in relation to a level of excess liability; or

2.70.2 rejection by the insurer of liability, or some part of it, due to any act or default by either the Tenant or the Landlord.

2.71 VAT means Value Added Tax and any future tax of a like nature

2.72 In this Lease unless the context otherwise requires:

2.72.1 words importing any gender include every gender

2.72.2 words importing or references to the singular number only include the plural number and vice versa

2.72.3 words importing persons include firms companies and corporations and vice versa

2.72.4 references to numbered clauses and schedules are references to the relevant clause in or schedule to this Lease

2.72.5 reference in any schedule to numbered paragraphs are references to the numbered paragraphs of that schedule

2.72.6 where any obligation is undertaken by two or more persons jointly they shall be jointly and severally liable in respect of that obligation

2.72.7 any obligation on any party not to do or omit to do anything shall include an obligation not to allow or suffer that thing to be done or omitted to be done by any undertenant of that party of by any employee servant agent invitee or licensee of that party or its undertenant

2.72.8 where the Landlord or the Tenant covenant to do something they shall be deemed to fulfil that obligation if they procure that it is done

2.72.9 the headings to the clauses schedules and paragraphs shall not affect the interpretation

2.72.10 any sum payable by one party to the other shall be exclusive of VAT which shall where it is chargeable be paid in addition to the sum in question at the time when the sum in question is due to be paid and the charging party shall be required to produce a VAT invoice for the paying party as soon as reasonably practicable thereafter

2.72.11 an obligation in this Lease on the part of the Tenant to pay or indemnify the Landlord against any cost or expense shall include an obligation to pay and indemnify the Landlord against any VAT incurred in relation to the cost or expense in question except where the VAT is available for set-off by the Landlord as input tax

2.72.12 the expression “tenant covenants” has the meaning given to it by Landlord and Tenant (Covenants) Act 1995

2.73 The parties to this Lease do not intend that any of its terms will be enforceable by virtue of Contracts (Rights of Third Parties) Act 1999

3. BACKGROUND

3.1 The reversion immediately expectant on the term of the Original Leases is now vested in the Landlord.

3.2 The Original Leases remains vested in the Tenant.

3.3 The parties wish to enter into a further lease of the Property with the Term to take effect following the expiry of the Original Leases on similar terms and conditions to those contained in the Original Leases except as modified in this Lease.

4. DEMISE AND RENT

4.1 The Landlord demises the Premises to the Tenant together with the rights set out in Schedule 2 except and reserving to the Landlord the rights set out in Part A of Schedule 3 subject to the Title Matters to hold them to the Tenant for the Term paying during the Term by way of rent:

4.1.1 up to but excluding the Rent Commencement Date a peppercorn (if demanded) and from and including the Rent Commencement Date the Basic Rent which shall be paid yearly and proportionately for any part of a year by equal quarterly instalments in advance on the Quarter Days the first payment to be made on the Rent Commencement Date in respect of the period from and including the Rent Commencement Date to the next Quarter Day after the Rent Commencement Date and

4.1.2 the Insurance Charge which shall be paid as stated in paragraph 3 of Schedule 4 and

4.1.3 the Service Charge which shall be paid as stated in Schedule 7 and

4.1.4 any other sums which may become due from the Tenant to the Landlord under the provisions of this Lease

4.2 The Landlord’s right title and interest in that part of the Premises referred to as the Canopy Area is limited to those rights granted under the Canopy Licence. The demise of the Premises to the Tenant for the Term pursuant to clause 4.1 of this Lease shall in relation to the Canopy Area alone be limited to the grant of a sub-licence of the Landlord’s said right title and interest in the Canopy Area for the duration of the Term

5. TENANT’S COVENANTS

The Tenant covenants with the Landlord to observe and perform the covenants set out in Schedule 5 and those on its part contained in Schedule 4

6. LANDLORD’S COVENANTS

The Landlord covenants with the Tenant to observe and perform the covenants set out in Schedule 6 and those on its part contained in Schedule 4

7. FORFEITURE

7.1 Without prejudice to any other rights of the Landlord if:

7.1.1 the whole or part of the Rent remains unpaid twenty-one days after becoming due (whether demanded or not) or

7.1.2 any of the Tenant’s covenants in this Lease are not performed or observed or

7.1.3 the Tenant or any guarantor of the Tenant’s obligations under this Lease:

(a) enters into any composition or arrangement with its creditors generally or any class of its creditors or

(b) is the subject of any judgment or order made against it which is not complied with within seven days or is the subject of any execution distress sequestration or other process levied upon or enforced against any part of its undertaking property assets or revenue

7.1.4 the Tenant or any guarantor of the Tenant’s obligations under this Lease being a company

(a) is the subject of an order made or a resolution passed or analogous proceedings taken for winding up such company (save for the purpose of and followed within four months by an amalgamation or reconstruction which does not involve or arise out of insolvency or give rise to a reduction in capital and which is on terms previously approved by the Landlord) or

(b) an encumbrancer takes possession or exercises or attempts to exercise any power of sale or a receiver is appointed of the whole or any part of the undertaking property assets or revenues of such company or

(c) is the subject of an administration order or the giving of notice of intention to appoint an administrator or the filing at court of the prescribed documents in connection with the appointment of an administrator or

(d) stops payment or its directors take steps to declare a moratorium or becomes or is deemed to be insolvent or unable to pay its debts within the meaning of section 123 Insolvency Act 1986

7.1.5 the Tenant or any guarantor of the Tenant’s obligations under this Lease being an individual

(a) is the subject of a bankruptcy order or

(b) is the subject of an order or appointment under section 253 or section 273 or section 286 Insolvency Act 1986 or

(c) is unable to pay his debts within the meaning of sections 267 and 268 Insolvency Act 1986

7.1.6 any event occurs or proceedings are taken with respect to the Tenant or any guarantor of the Tenant’s obligations under this Lease in any jurisdiction to which it is subject which has an effect equivalent or similar to any of the events mentioned in clause 7.1.3

then and in any of such cases the Landlord may at any time (and notwithstanding the waiver of any previous right of re-entry) re-enter the Premises whereupon this Lease shall absolutely determine but without prejudice to any right of action of the Landlord in respect of any previous breach by the Tenant of this Lease

8. MISCELLANEOUS

8.1 Except to the extent that compensation may be payable by law notwithstanding any agreement to the contrary neither the Tenant nor any undertenant or any occupier of the Premises at any time shall be entitled to any compensation under any Enactment upon Determination or upon leaving the Premises

8.2 Except to the extent that the Landlord may be liable under its the covenants in Schedule 6 or by law notwithstanding any agreement to the contrary the Landlord shall not be liable in any way to the Tenant or any undertenant or any servant agent licensee or invitee of the Tenant or any undertenant by reason of:

8.2.1 any act neglect default or omission of any of the tenants or owners or occupiers of any adjoining or neighbouring premises (whether within the Building or not) or of any representative or employee of the Landlord (unless acting within the scope of the express authority of the Landlord) or

8.2.2 the defective working stoppage or breakage of or leakage or overflow from any Conduit or any of the Plant or

8.2.3 the obstruction by others of the Common Parts or the areas over which rights are granted by this Lease including the Rear Access Road

8.3 The Landlord shall be entitled to make such alterations to the Common Parts as are reasonably necessary or are in the interests of good estate management or to alter renew or replace any Plant and to obstruct the Common Parts while doing so but shall in so doing ensure that reasonable access to the Premises or reasonable alternative access to the Premises is always available and the rights of the Tenant as set out in this Lease shall (if a new access is being created in substitution for the former) attach to the new access mutatis mutandis

8.4 Nothing in this Lease shall imply or warrant that the Premises may lawfully be used for the Permitted Use and the Tenant acknowledges and admits that no such representation or warranty has ever been made by or on behalf of the Landlord

8.5 The Landlord and the Tenant shall not be liable to each other for breach of any covenant in this Lease to the extent that its performance or observance becomes impossible or illegal

8.6 The Landlord shall incur no liability to the Tenant or any undertenant or any predecessor in title of either of them by reason of any approval given to or inspection made of any drawings plans specifications or works prepared or carried out by or on behalf of any such party nor shall any such approval or inspection in any way relieve the Tenant from its obligations under this Lease

8.7 In the interests of security the Landlord:

8.7.1 may require anyone entering or leaving the Building to identify themselves and the party in the Building whom they are visiting and to record this information and their arrival and departure times in a book or other form of record kept for the purpose

8.7.2 may prevent anyone entering the Building for the purpose of visiting the Premises unless that person has a key to the Premises or is authorised by the Tenant or any other permitted occupier of the Premises

8.7.3 may require the Tenant or permitted occupier of the Premises to escort any person visiting them from the security or reception desk to the Premises (and back again when that person leaves)

8.7.4 may prevent anyone removing any items from the Building unless that person is authorised to do so by the Landlord or any tenant or permitted occupier of the Building

and in this regard:

(a) the rights of access and egress granted in Schedule 2 are subject to this clause and

(b) any authorisation required by this clause must be produced to the person requiring it or confirmed by a written or oral (or telephoned) statement from the person giving it

8.8 The Landlord may add to vary or discontinue any of the Services where the Landlord considers it appropriate to do so having regard to the principles of good estate management Provided that variations shall (unless reasonably necessary for reasons outside of the Landlord’s control) not prevent (in the reasonable opinion of the Landlord) the Tenant from beneficial use and occupation of the Premises

8.9 The Landlord shall not be liable in any way to the Tenant or any undertenant or any servant agent licensee or invitee of the Tenant or any undertenant by reason of the temporary stopping up or restriction of access across the Rear Access Road during works of repair maintenance and renewal to the same or by reason of any upgrading or renewal works carried out in anticipation of the Rear Access Road becoming a highway maintainable at the public expense Provided that the Landlord will use its reasonable endeavours to ensure that reasonable vehicular access to the Building is maintained during such works and where such works to the Rear Access Road prevent vehicular access to the Building provide reasonable alternative car parking arrangements reasonably proximate to the Building Provided Further that the Landlord shall have no liability in relation to or in connection with the Rear Access Road at all after it has become a highway maintainable at the public expense

8.10 The Tenant shall not be or become entitled to any easement right quasi-easement or quasi-right save as expressly set out in Schedule 2

8.11 This Lease does not pass to the Tenant the benefit of or the right to enforce any covenants which now benefit or which may in the future benefit the reversion to this Lease, and the Landlord shall be entitled in its sole discretion to waive, vary or release any such covenants

8.12 Section 196 Law of Property Act 1925 (as amended by the Recorded Delivery Service Act 1962) shall apply to all notices which may need to be served under this Lease

8.13 This Lease is a new tenancy for the purposes of the Landlord and Tenant (Covenants) Act 1995

9. VOID IF ORIGINAL LEASE DETERMINES

If the term of years granted by either the Original Leases is determined for any reason (other than by effluxion of time) this Lease shall become void.

10. EXCLUSION OF LANDLORD AND TENANT ACT 1954

10.1 The Landlord served a notice on the Tenant as required by section 38(A)(3)(a) of the Landlord and Tenant Act 1954 (“the 1954 Act”) and which applies to the tenancy created by this Lease before this Lease was entered into;

10.2 The Tenant or a person duly authorised by the Tenant to do so made a statutory declaration dated 29 July 2015 in accordance with the requirements of section 38(A)(3)(b) of the 1954 Act;

10.3 The parties agree that the provisions of sections 24 to 28 of the 1954 Act are excluded in relation to the tenancy created by this Lease.

11. TENANT’S BREAK CLAUSE

11.1 If the Tenant wishes to determine this Lease on the Tenant’s Break Date and the Tenant gives to the Landlord notice in writing to that effect such notice to be received by the Landlord not later than six months before the Tenant’s Break Date (as to which time shall be of the essence) and if on the Tenant’s Break Date:

11.1.1 there are no arrears of the Basic Rent; and

11.1.2 the Tenant delivers up possession of the Property free from occupation by any third parties and without any subsisting underleases

then this Lease shall determine and the Term shall end on the Tenant’s Break Date but without prejudice to the rights and remedies of the Landlord in respect of any antecedent breach non-observance or non-performance of any of the Tenant’s covenants or the conditions contained in this Lease.

11.2 The conditions in this clause 11 are for the benefit of the Landlord. If such notice is given but any such condition is not satisfied the Landlord may in its absolute discretion elect that such notice shall nevertheless have effect (without prejudice to any other rights of the Landlord).

11.3 If this Lease ends on the Break Date, the Landlord is to repay to the Tenant within ten working days after the Break Date any part of the Basic Rent that has been paid by the Tenant in advance under the Lease that relates to the period after (but not including) the Break Date.

12. GOVERNING LAW AND JURISDICTION

12.1 This Lease shall be governed by and construed in accordance with English Law.

12.2 The parties irrevocably submit to the non-exclusive jurisdiction of the English Courts to settle any disputes which may arise out of or in connection with this Lease and waive any objection to any legal action or proceedings in any such court on the grounds of venue or on the grounds that the action or proceedings have been brought in an inconvenient or inappropriate forum.

12.3 The bringing of any legal action or proceedings in any jurisdiction shall not preclude the Landlord from bringing any such legal action or proceedings in any other jurisdiction.

12.4 The Tenant appoints Eversheds LLP or such other firm of solicitors in England as may be notified in writing to the Landlord as its agents to accept the service of all proceedings on its behalf.

13. EXECUTION

This Lease has been executed by the parties to it as a deed and is delivered on the date described as the Date in the Prescribed Clauses

SCHEDULE I -THE PREMISES

That Lettable Area on the fifth floor of the Building which is shown edged red on the Premises Plan and extends from the upper side of the floor slab immediately below that Lettable Area to the underside of the floor slab immediately above that Lettable Area excluding:

(a) the walls bounding that Lettable Area other than those walls (if any) indicated as party walls on the Premises Plan and

(b) all load-bearing walls and pillars within that Lettable Area and

(c) all structural floor slabs within that Lettable Area and

(d) all Conduits and Plant within that Lettable Area which do not serve that Lettable Area exclusively

(e) the window frames fitted into the external elevations and/or the main internal atrium of the Building together with the glass in such window frames

but including:

(a) the plaster and other finishes on the inner sides of the walls bounding that Lettable Area and on all faces of all load-bearing walls and pillars wholly within that Lettable Area and

(b) all ceilings and other finishes applied to the floor slab immediately above that Lettable Area and to any floor slab within that Lettable Area and

(c) all floors floor screeds and other finishes applied to the floor slab immediately below that Lettable Area and to any floor slab within that Lettable Area and

(d) all doors of that Lettable Area together with the frames glass and furniture of them and

(e) the whole of all non-load-bearing walls or partitions wholly within that Lettable Area and the internal window frames within such walls or partitions and the glass in any such internal windows

(f) one half in thickness of all walls (if any) bounding that Lettable Area and indicated as party walls on the Premises Plan and

(g) all Conduits and Plant within that Lettable Area and which serve that Lettable Area exclusively

SCHEDULE 2

PART A - RIGHTS GRANTED IN COMMON

1. The right in common with the Landlord and all others for the time being authorised by the Landlord or otherwise entitled for the Tenant and any permitted undertenant or permitted occupier of the Premises:

1.1 at all times to connect to and use all Conduits and Plant from time to time serving the Premises or provided for the benefit of the Premises for (in relation to the Conduits) the passage of surface water and sewage from and water gas electricity telecommunications and other services to and from the Premises subject to the other rights granted in this Part A without any right of access to areas outside the Premises for this purpose

1.2 at all times together with its respective servants agents and visitors to pass and repass over the Common Parts and otherwise to use the Common Parts for the purpose for which they are designed

1.3 of subjacent and lateral support and protection for the Premises from the remainder of the Building as presently enjoyed

1.4 to pass and repass (in common with all persons authorised by the Landlord and his predecessors and successors in title) together with its respective servants agents and visitors with or without vehicles and for all purposes connected with the Tenant’s use and enjoyment of the Premises but not for any other purpose over and along the Rear Access Road until it is taken over as a highway maintainable at the public expense

1.5 in case of emergency only together with its respective servants agents and visitors to use such accessways within the Building as may be allocated from time to time by the Landlord

1.6 to display on the Signboard the Tenant’s name in the Tenant’s house-style

1.7 to enter upon adjoining or neighbouring parts of the Building at all reasonable times and (except in case of emergency) upon reasonable notice and prior appointment with the Landlord and (as the case may require) with the tenants and occupiers thereof (subject to compliance with any other conditions restrictions and provisions affecting the exercise of such rights notified to the Tenant) for the purpose of connecting into inspecting maintaining cleansing repairing renewing and replacing such of the Conduits and all connections thereto as exclusively serve the Premises provided that the Tenant in exercising such rights shall do so as expeditiously as possible with all due diligence causing as little damage and inconvenience as possible and not interfere with the Building and forthwith make good to the satisfaction in all respects of the Landlord and the tenants and occupiers of the Building or the owners of any other property and any Plant relating thereto (as the case may require) affected thereby all damage or disturbance thereby occasioned

2. To place and retain:

2.1 air conditioning plant and machinery at the Building; and

2.2 satellite dishes;

together with connecting apparatus and conduits with the existing risers of the Building of such size, number and in such location as the Landlord shall approve (such approval not to be unreasonably withheld or delayed) subject to the Tenant keeping such equipment in

good repair, complying with all legislation and it not causing a nuisance to other occupiers of the Building and neighbouring property and provided that the Landlord shall have the right at any time during the Term to relocate such designated area subject to:

2.2.1 the Landlord giving to the Tenant not less than three months’ prior written notice of its intention to relocate the designated area;

2.2.2 the relocated area:

(a) being as reasonably commodious to the tenant as the area designated prior to the relocation;

(b) not being materially smaller than the area prior to the relocation;

(c) being adequate so as to ensure a continuity of supply from the Tenant’s plant, machinery and equipment not materially less than the supply prior to the relocation and reasonably adequate for the Tenant’s use of the Premises.

PART B - EXCLUSIVE RIGHT

The exclusive right for the Tenant and any permitted undertenant or permitted occupier of the Premises together with its respective servants agents and visitors to park not more than fourteen private motor cars on the parking spaces shown numbered 1 and 2 and 46-57 on the Car Park Plan (the Initial Parking Spaces) or such other fourteen parking spaces within the Car Park as the Landlord may from time to time by written notice to the Tenant reasonably designate (for reasons of good estate management) in substitution for the Initial Parking Spaces

SCHEDULE 3

PART A - EXCEPTIONS AND RESERVATIONS

1. The rights for the Landlord and all others from time to time authorised by the Landlord of otherwise entitled and without any liability to pay compensation:

1.1 to carry out works to the Building or to any other property and to use them in whatever manner may be desired and to consent to others doing so whether or not in each case the access of light and air to the Premises or any other amenity from time to time enjoyed by them shall be affected in any way (save for the rights specifically granted by Schedule 2)

1.2 to connect to and use all Conduits and Plant within or forming part of the Premises

1.3 at all reasonable times and upon reasonable prior written notice to the Tenant (except in emergency when no notice need be given and entry may be at any time) to enter and remain on the Premises with or without tools appliances scaffolding and materials for the purposes of:

1.3.1 installing inspecting repairing renewing reinstalling cleaning maintaining removing or connecting up to any Conduits or Plant or

1.3.2 inspecting cleaning altering repairing maintaining renewing demolishing or rebuilding the remainder of the Building or any adjoining or adjacent premises or any other things used in common or

1.3.3 carrying out works under paragraphs 3.7 or 9.4 of Schedule 5

1.3.4 complying with the Landlord’s obligations under this Lease or with any other Legal Obligation of the Landlord

the person entering causing as little damage and inconvenience as reasonably possible and making good at its expense any damage caused to the Premises by such entry to the reasonable satisfaction of the Tenant

PART B - TITLE MATTERS

All rights of light and air and all easements rights covenants and other matters contained or referred to in the Property and Charges Registers of Title Numbers BK272505 BK159084 BK259553 BK397342 and BK417385 (or such title number(s) allocated to the aforesaid numbers if merged or amalgamated) and in the following documents:

|

Date |

|

Document |

|

Parties |

|

|

|

|

|

|

|

12 May 1999 |

|

Licence to erect canopy |

|

Slough Borough Council (1) and Edward Goodwin (2) |

|

|

|

|

|

|

|

12 May 1999 |

|

Licence for landscaping |

|

Slough Borough (1) Edward Goodwin (2) |

|

|

|

|

|

|

|

12 May 1999 |

|

Licence to construct foundations underneath |

|

Slough Borough Council (1) Edward Goodwin (2) |

|

Date |

|

Document |

|

Parties |

|

|

|

|

|

|

|

|

|

highway |

|

|

|

|

|

|

|

|

|

26 August 1964 |

|

Agreement |

|

London & Provincial Shop Centres (Holdings) Limited (1) The Mayor Aldermen & Burgesses of the Borough of Slough (2) |

|

|

|

|

|

|

|

13 May 1976 |

|

Letter Agreement |

|

Glowcorn Limited and Brandorpark Limited (1) and London & Provincial Shop Centres (Holdings) Limited (2) relating to 284 High Street Slough |

|

|

|

|

|

|

|

30 August 1977 |

|

Agreement |

|

London & Provincial Shop Centres (Holdings) Limited (1) Slough Borough Council (2) |

|

|

|

|

|

|

|

13 July 1976 |

|

Section 52 Agreement |

|

London & Provincial Shop Centres (Holdings) Limited (1) Glowcorn Limited (2) Brandorpark Limited (3) and Slough Borough Council (4) |

|

|

|

|

|

|

|

10 May 1990 |

|

Section 52 Agreement |

|

Slough Borough Council (1) Hill Samuel Life Assurance Limited (2) |

|

|

|

|

|

|

|

7 December 1992 |

|

Section 106 Agreement |

|

Slough Borough Council (1) Edward Richard Goodwin Christabel Sheila Scott-Balls and Rosalind Anne Goodwin (2) The Allied Trust Bank Limited (3) |

|

|

|

|

|

|

|

23 December 1993 |

|

Section 106 Agreement |

|

Slough Borough Council (1) Edward Richard Goodwin Christabel Sheila Scott-Balls and Rosalind Anne Goodwin (2) The Allied Trust Bank Limited (3) |

|

|

|

|

|

|

|

1 April 1998 |

|

Section 106 Agreement |

|

Slough Borough Council (1) Edward Richard Goodwin Christabel Sheila Scott-Balls and Rosalind Anne Goodwin (2) The Investec Bank (UK) Limited (3) |

SCHEDULE 4 - INSURANCE

1. LANDLORD’S INSURANCE OBLIGATIONS

1.1 The Landlord shall effect and maintain the following insurances with Insurers in respect of the Building:

1.1.1 Insurance against damage or destruction by the Insured Risks in a sum equal to the full reinstatement cost of the Building including:

(a) the cost of demolition shoring up and site clearance

(b) all architects’ surveyors’ and other professional fees and incidental expenses in connection with reinstatement

(c) any tax on those amounts to the extent applicable

1.1.2 Third party and public liability insurance

1.1.3 Insurance against liability under the defective premises act 1972 (and any other enactment in respect of which the landlord requires insurance)

1.2 The Landlord may but shall not be obliged to insure against Loss of Rent

1.3 The Landlord shall not be obliged to insure under paragraph 1.1 if and to the extent that:

1.3.1 Insurance is not available in the London insurance market or

1.3.2 Any normal excess exclusion or limitation imposed by Insurers applies or

1.3.3 The Insurance Policies have become void or voidable by reason of any act neglect or default of the Tenant or any undertenant or any predecessor in title of either of them or any employee servant agent licensee or invitee of any of them

1.3.4 And to the extent that any risk which would otherwise be an Insured Risk is not actually insured against as a result of any of the above matters, it shall not be treated as an Insured Risk

1.4 The Landlord will upon request from time to time produce to the Tenant a copy or full details of the Insurance Policies and evidence that they are in force

1.5 The Landlord will notify the Tenant in writing of any change in the Insurance Policies from time to time which is material to the Tenant

1.6 If the Landlord receives any commissions or other benefits for effecting or maintaining insurance under this Lease it shall not be obliged to pass the benefit of them on to the Tenant

1.7 If the Landlord is itself an insurance company it may self-insure in which case it shall be deemed to be doing so at its usual rates and on its usual terms for insuring a third party

2. REINSTATEMENT

2.1 If the Building is destroyed or damaged by the Insured Risks then the Landlord will use all reasonable endeavours to obtain all Necessary Consents required to reinstate the Building

and if these are obtained the Landlord will apply the insurance moneys received under the Insurance Policy maintained under paragraph 1.1.1 and all moneys received from the Tenant under paragraph 5 and any other contributors in reinstating the Building with all reasonable speed and will (save where the sums are insufficient as a result of a breach of the Tenant of paragraph 3.4.6) make up the shortfall out of its own resources

2.2 The Building (except for the Premises) need not be reinstated under paragraph 2.1 to the same state appearance or layout as before but following any reinstatement the Premises shall be no less commodious and enjoy substantially the same rights and amenities as before

3. TENANT’S INSURANCE OBLIGATIONS

3.1 The Tenant shall pay to the Landlord within 7 days of demand the Insurance Charge credit being given to the Tenant for any payments on account made by the Tenant

3.2 The Tenant shall pay to the Landlord within 7 days of demand being made by the Landlord within one month before any Insurance Policies are due to be effected or renewed the Landlord’s reasonable estimate of the Insurance Charge and any repayment which may become due from the Landlord to the Tenant shall be made forthwith upon the actual Insurance Charge becoming known

3.3 The Tenant shall pay to the Landlord on demand the Percentage of any normal excess which the Landlord is required to bear under any Insurance Policy

3.4 The Tenant shall:

3.4.1 not do or fail to do anything which causes any of the Insurance Policies to be void or voidable or increase the premiums payable under them

3.4.2 not insure or maintain insurance of the Building or the Premises against any of the Insured Risks (save to the extent that the Landlord has failed to do so)

3.4.3 notify the Landlord of the incidence of any Insured Risk or any other matter which ought reasonably to be notified to the Insurers

3.4.4 pay on demand the whole of any increase in any premium arising from a breach of paragraph 3.4.1

3.4.5 comply with all the conditions of the Insurance Policies and all requirements of the Insurers notified to the Tenant in writing

3.4.6 notify the Landlord in writing of the value of any alterations additions or improvements which the Tenant or any undertenant proposes to make before those works are commenced

4. RENT CESSER

4.1 If the Building is damaged or destroyed by any of the Insured Risks such that the Premises are unfit for occupation and use or incapable of reasonable access then (unless paragraph 5 applies) the Basic Rent and the Service Charge or a fair proportion of them according to the nature and extent of the damage in question shall be suspended until the earlier of:

4.1.1 the date three years after the date of such damage or destruction and

4.1.2 the date on which the Premises are again fit for occupation and use and capable of reasonable access

4.2 If payment of rent is suspended pursuant to clause 4.1, the Landlord is to repay to the Tenant, within ten working days after the date on which the rent is suspended, any part of the Basic Rent that has been paid by the Tenant in respect of the period from and including the date on which the rent is suspended.

5. VITIATION OF INSURANCE

5.1 If the insurance money under any of the Insurance Policies is wholly or partly irrecoverable (or where paragraph 1.7 applies if such money would under the Landlord’s usual terms of insurance be wholly or partly irrecoverable) by reason of any act neglect or default of the Tenant or any undertenant or any predecessor in title of either of them or any employee servant agent licensee or invitee of any of them or where the sum insured is inadequate as a result of a breach by the Tenant of paragraph 3.4.6 then the Tenant will pay to the Landlord the irrecoverable amount or the amount of such shortfall as the case may be

5.2 Subject to paragraph 5.4 payment under paragraph 5.1 shall be made on the later of 5 days after the date of demand by the Landlord and the date on which such insurance money (or the relevant part of it) would have been claimable under the Insurance Policies had they not been wholly or partly vitiated

5.3 In addition to any sum payable under paragraph 5.1 the Tenant shall pay interest at the Interest Rate on the relevant sum from the date on which that sum is due to the date of payment

5.4 The Tenant will if required by the Landlord in writing make the payment due under paragraph 5.1 before the Landlord becomes obliged under paragraph 2.1 to endeavour to obtain all Necessary Consents for reinstatement or to begin reinstatement

6. DETERMINATION

6.1 If the Building is destroyed or damaged by any of the Insured Risks such that the Premises are unfit for occupation and use or incapable of reasonable access and if the Premises are not made fit for occupation and use or capable of reasonable access within three years after that destruction or damage occurs then either the Landlord or the Tenant may by written notice to the other served at any time after that date (but before the Premises are again fit for occupation and use) determine this Lease and if such notice is served:

6.1.1 this Lease shall forthwith determine but the Determination shall be without prejudice to any right of action of either party in respect of any previous breach of this Lease by the other or to any obligation of the Tenant under paragraphs 3.3 or 5 (and any sums payable under those paragraphs shall be paid on Determination if they have not already become payable) and

6.1.2 all moneys payable under the Insurance Policies or by the Tenant under paragraphs 3.3 or 5 shall be paid to and belong to the Landlord absolutely

7. UNINSURED RISKS

7.1 In the event that the Building or any part of it is damaged or destroyed by an Uninsured Risk so that the Premises or a substantial part of it is inaccessible or unfit for occupation or use:

7.1.1 the Basic Rent and the Service Charge or a fair proportion of them according to the nature and the extent of the damage sustained (the amount of such proportion in case of dispute to be determined by the Surveyor acting as an expert and not as an arbitrator) shall be suspended and cease to be payable as from the date on which the destruction or damage occurred until the damage shall have been made good so that the Property is again accessible and fit for occupation and use;

7.1.2 at any time after the date on which the damage or destruction occurred the Landlord may (but is not obliged to) either:

(a) give the Tenant a written notice that the Landlord will be irrevocably bound to rebuild and reinstate the Building at its own cost in accordance with paragraph 7.2 of this Lease, or

(b) give the Tenant a written notice immediately determining this Lease (but no such notice shall be given after the Property has been rendered accessible and fit for occupation and use pursuant to paragraph 7.2).

7.2

7.2.1 if the Landlord gives the Tenant a notice under paragraph 7.1.2(a), then the damage shall be deemed to have been caused by an Insured Risk, the insurance monies shall be deemed to have been paid to the Landlord, and the provisions of paragraph 2 and 6 (excluding 6.1.2) shall apply save that all dates and periods referenced to the date of damage shall instead be referenced to the date of the notice and the period of three years in paragraph 6 shall be replaced with a period of four years.

7.2.2 if the Landlord gives the Tenant notice under paragraph 7.1.2(b), such notice shall be without prejudice to any claim by either party in respect of any antecedent breach of covenant by the other.

7.3 In the event that the whole or part of the Building is damaged or destroyed by an Uninsured Risk so that the Premises or a substantial part of it is inaccessible and/or unfit for occupation or use and the Landlord fails to give the Tenant any notice under paragraph 7.1.2 within 12 months of the damage or destruction occurring then the Tenant may immediately (but in any event not later than three months after the expiry of that period and as to which time is of the essence) give the Landlord a written notice determining this Lease with immediate effect (such notice being without prejudice to any claim by either party in respect of any antecedent breach of covenant by the other) but no such notice shall be given after the Property has been rendered accessible and fit for occupation and use.

8. ARBITRATION

8.1 Any dispute under paragraphs 4, 5 or 6 shall be determined by a sole arbitrator to be agreed upon by the Landlord and the Tenant or in default of agreement to be nominated at the request of either of them or both of them jointly by the President and in either case in accordance with the Arbitration Act 1996

SCHEDULE 5 - TENANT’S COVENANTS

1. TO PAY RENT

1.1 To pay the Rent at the times and in the manner required by this Lease to such address as the Landlord may from time to time require notified to the Tenant in writing and without deduction (save as required by any enactment) or set-off whether legal or equitable and if any deduction has to be made to account for it to the appropriate Authority

1.2 To pay the Basic Rent by banker’s standing order if required by the Landlord provided that for so long as the Tenant under this Lease is Guidance Software Inc. or a Group Company or a Connected Person of the same the Landlord shall accept payment by cheque alone

1.3 If the Basic Rent or any part of it is not paid within 7 days of the date on which it is due or if any other part of the Rent is not paid within seven days after becoming due (whether or not demanded except where a demand is required by this Lease) the sum in question shall carry interest at the Interest Rate for the period from the date on which it became due until the date of actual payment and that interest shall be paid by the Tenant on demand

1.4 If the Landlord refuses to accept Rent because an event referred to in clause 7.1 has occurred and the Landlord does not wish to waive its rights under that clause then such unpaid Rent shall nevertheless bear interest under paragraph 1.3 until the date the Rent in question is accepted

2. TO PAY OUTGOINGS

2.1 To pay and discharge all Outgoings relating to the Premises at the times when they become due

2.2 If at any time the Premises are not separately assessed for any Outgoings the Tenant shall pay to the Landlord on demand a fair and reasonable proportion of any assessment which includes the Premises

2.3 Not without Consent (which shall not be unreasonably withheld or delayed)to make any claim for relief in respect of any Outgoings where to do so might prejudice the Landlord’s own actual or potential entitlement to relief then or in the future

2.4 Not without Consent (which shall not be unreasonably withheld or delayed) to agree with the relevant Authority any rating or other assessment in respect of the Premises and to consult with (and have due regard to the representations of) the Landlord in the negotiations for any such assessment or any appeal against any such assessment

3. REPAIR AND DECORATION

3.1 To repair the Premises and to keep them in good repair and condition provided that:

3.1.1 nothing in this Lease shall oblige the Tenant to remedy a latent defect in the Premises which is:

(a) also a latent defect in the Retained Property; and

(b) for which the Landlord is entitled to make a claim under the Policy (whether or not the Landlord makes such a claim)

(a Defect)

3.1.2 the Landlord shall use all reasonable endeavours to remedy any Defect within the Premises of which the Tenant notifies it in writing within the Policy Period (save where the Policy has been vitiated by any act or default of the Tenant or any undertenant or their respective agents or visitors) and

3.1.3 where damage or destruction to the Premises by a Defect renders the Premises unfit for occupation and use or incapable of reasonable access the Premises shall be deemed, for the purposes of paragraph 6 of Schedule 4 to this Lease, to have been damaged by an Insured Risk

3.2 To replace any Landlord’s fixtures and fittings in the Premises that are beyond reasonable economic repair at any time during the Term or at Determination with new ones of a like quality and nature

3.3 To keep the Premises painted or otherwise decorated to a high standard and to redecorate them to a high standard at intervals of not more than three years and also during the last year prior to or at the termination of the Term (having on the last occasion first obtained Consent to the colour scheme which Consent shall not be unreasonably withheld or delayed)

3.4 Paragraphs 3.1, 3.2 and 3.3 shall not apply to the extent that any lack of repair or decoration is caused by damage by an Insured Risk (unless paragraph 5 of Schedule 4 applies)

3.5 To keep the Premises in a clean and tidy condition

3.6 To clean:

3.6.1 the inside of the glass of all windows comprised in the Premises; and

3.6.2 the inside of the glass of all windows in the walls (including the curtain wall comprising the front elevation to the Building) bounding the Premises

as often as shall be reasonably necessary but in any event at least once in every three months

3.7 If the Tenant is in breach of this paragraph 3 then in addition to any other rights which the Landlord may have:

3.7.1 the Landlord may serve on the Tenant written notice specifying the breach in question and

3.7.2 the Tenant shall as soon as practicable after receipt of that notice and in any event within two months (or sooner in emergency) commence and proceed with all due speed to remedy the breach and

3.7.3 if the Tenant fails to comply with paragraph 3.7.2 the Landlord may enter the Premises and carry out the relevant work and all proper and reasonable costs incurred by the Landlord in so doing shall be a debt from the Tenant to the Landlord which the Tenant shall pay within 7 days of demand with interest on them at the Interest Rate from the date of demand to the date of payment

3.8 The Tenant shall give written notice to the Landlord immediately on becoming aware of:

3.8.1 any damage to or destruction of the Building or

3.8.2 any defect or want of repair in the Building (including without limitation any relevant defect within the meaning of section 4 Defective Premises Act 1972) which the Landlord is liable to repair under this Lease

3.9 Any covenants given by the Tenant to repair, decorate and yield up the Property are to be construed as if they had been given at the date of the Original Leases.

3.10 All provisions relating to alterations in the Original Licences for Alterations and the Original Leases including any obligations to reinstate, will apply to this Lease as if any obligations to reinstate any alterations will apply at the end or sooner determination of the Term.

4. YIELDING UP ON DETERMINATION

4.1 On Determination the Tenant shall yield up the Premises to the Landlord with vacant possession in a state of repair condition and decoration which is consistent with the proper performance of the Tenant’s covenants in this Lease

4.2 If on Determination the Tenant leaves any fixtures fittings or other items in the Premises the Landlord may treat them as having been abandoned and may remove destroy or dispose of them as the Landlord wishes and the Tenant shall pay on demand to the Landlord any proper costs incurred in connection with such disposal

4.3 Immediately before Determination if and to the extent required by the Landlord the Tenant shall reinstate all alterations additions or improvements made to the Premises at any time during the Term (or pursuant to any agreement for lease made before the start of the Term) and where this involves the disconnection of Plant or Conduits the Tenant shall ensure that the disconnection is carried out properly and safely and that the Plant and Conduits are suitably sealed off or capped and left in a safe condition so as not to interfere with the continued functioning of the Plant or use of the Conduits elsewhere in the Building

4.4 The Tenant shall make good any damage caused in complying with paragraph 4.3 and shall carry out all relevant works (including the making good of damage) to the reasonable satisfaction of the Landlord

4.5 The Tenant shall at its own expense undertake such remediation clean up and restoration works are necessary to ensure to the reasonable satisfaction of the Landlord that on Determination the Premises are free from contamination caused by the Tenant or any undertenant or any predecessor in title of either of them or any employee servant agent or invitee of any of them

4.6 As soon as practicable on Determination the Tenant shall make an application to close the registered title of this Lease and shall ensure that any requisitions raised by HM Land Registry in connection with that application are dealt with within the prescribed time frames set by HM Land Registry and that the Landlord is informed of progress and completion of the application

4.7 On Determination the Tenant shall hand to the Landlord all records in its possession relating to any review or assessment or plan prepared pursuant to regulation 4 of Control of Asbestos Regulations 2002

5. USE

5.1 The Tenant shall not use the Premises for any purpose except the Permitted Use

5.2 For so long as the Tenant under this Lease is Guidance Software Inc. a Group Company or a Connected Person of the same the meaning given to the term Permitted Use in the Prescribed Clauses shall be amended by the addition of the words “and ancillary training classrooms if required”

5.3 The Tenant shall not use the Premises for any purpose or activity which is illegal immoral noisy noxious dangerous or offensive or which causes a nuisance to or damage or annoyance to the Landlord or any other tenant of the Building

5.4 The Tenant shall not use the Premises for the purpose or residing or sleeping nor for any sale by auction nor as a betting office

5.5 The Tenant shall not enter into any covenant in favour of any person (other than the Landlord) nor require a covenant from any person the effect of which is to restrict the use of the Premises further than it is already restricted by this Lease

6. ALTERATIONS

6.1 The Tenant shall make no alteration addition or improvement to the Premises or the Building whether structural or otherwise except as expressly permitted under paragraph 6.2 or 6.3

6.2 The Tenant may carry out alterations additions or improvements to the Premises which are wholly within the Premises and which do not affect any part of the exterior or structure of the Building and which do not interfere with or affect the Services or the heating, sprinkler or air conditioning systems or other Conduits within the Building where:

6.2.1 the Tenant has submitted to the Landlord detailed plans and specifications showing the works and

6.2.2 the Tenant has given to the Landlord such covenants relating to the carrying out of the works as the Landlord may reasonably require and

6.2.3 the Tenant has obtained Consent to the works (which shall not be unreasonably withheld or delayed)

6.3 Notwithstanding paragraph 6.2 the Tenant may carry out the erection or removal of internal non-structural demountable partitioning which does not affect any part of the exterior or structure of the Building and which does not interfere with or affect the Services or the heating sprinkler or air conditioning systems or other Conduits within the Building without firstly obtaining Landlord’s Consent provided:

6.3.1 The Tenant submits to the Landlord detailed plans and specifications showing the executed alterations within eight weeks of completing the works

6.3.2 The works of alterations are carried out with materials of suitable good quality in a proper and workmanlike manner and in compliance with all statutory requirements and consents

6.3.3 The Tenant reinstates the Premises at the Determination of the Term to the condition in which the same were prior to the making of the alterations and makes good any damage caused to the Premises by any such reinstatement or removal

6.4 If the Tenant is a provider of services within Disability Discrimination Act 1995 it may with Consent (which should not be unreasonably withheld or delayed) carry out alterations additions or improvements to the Premises which are necessary in order to comply with section 27 of Disability Discrimination Act 1995 and any Consent may be made subject to conditions which it is reasonable to impose but subject at all times to any statutory requirements

7. SIGNS

7.1 The Tenant shall not fix or display in or on the Premises any Sign which can be seen from outside the Premises without first obtaining Consent

7.2 The Landlord shall not unreasonably withhold or delay Consent under paragraph 7.1 to the Tenant placing on the entrance door to the Premises a non-illuminated non-moving Sign specifying the name of the Tenant or any permitted undertenant or occupier and the business carried on at the Premises

8. DEALINGS WITH THE PREMISES

8.1 Unless expressly permitted under paragraph 8.8 or by a Consent granted under paragraphs 8.2, 8.3 or 8.4 the Tenant shall not assign underlet charge part with or share possession or occupation of all or any part of the Premises nor hold the Premises on trust for any other person

8.2 The Landlord shall not unreasonably withhold or delay Consent to a legal charge of the whole of the Premises

8.3 The Landlord shall not unreasonably withhold or delay Consent to an assignment of the whole of the Premises but the Landlord and the Tenant agree for the purposes of section 19(1A) Landlord and Tenant Act 1927 (and without limiting the Landlord’s ability to withhold Consent where it is otherwise reasonable to do so or to impose other reasonable conditions) that the Landlord may withhold that Consent unless the following conditions are satisfied:

8.3.1 the prospective assignee is not a Group Company or a Connected Person (provided that this condition shall not apply for so long as Guidance Software Inc. (registered at Companies House as a foreign company with registered number FC023582) is the Tenant under this Lease, provided that the financial standing of the proposed assignee is not (in the opinion of the Landlord acting reasonably) equivalent to or better than the financial standing of Guidance Software Inc. (registered at Companies House as a foreign company with registered number FC023582) when assessed together with any guarantor of the ssame (other than pursuant to an authorised guarantee agreement)); and

8.3.2 the prospective assignee is a company incorporated in England and Wales or anywhere in the European Union and

8.3.3 in the reasonable opinion of the Landlord the prospective assignee is and will continue to be of sufficient financial standing to enable it to comply with the Tenant’s covenants in this Lease and

8.3.4 in the reasonable opinion of the Landlord the assignment to the proposed assignee will not have an adverse effect on the value of and would not otherwise adversely affect the Landlord’s reversion to the Premises and

8.3.5 if reasonably required, the Tenant (and any former Tenant who by virtue of there having been an “excluded assignment” as defined in Section 11 of the Landlord and Tenant (Covenants) Act 1995 has not been released from the Tenant’s covenants in this Lease) enters into an Authorised Guarantee Agreement with the Landlord

8.3.6 if the Landlord reasonably requires, up to a maximum of 2 guarantors acceptable to the Landlord acting reasonably has guaranteed to the Landlord the due performance of the prospective assignee’s obligations in such form as the Landlord may reasonably require and

8.3.7 if the Landlord reasonably requires, any security for the Tenant’s obligations under this Lease which the Landlord holds immediately before the assignment is continued or renewed in each case on such terms as the Landlord may reasonably require in respect of the Tenant’s liability under the Authorised Guarantee Agreement referred to in paragraph 8.3.5 (but this paragraph shall not apply to any Authorised Guarantee Agreement entered into by a former Tenant or by any guarantor of a former Tenant) and

8.3.8 any sum properly due from the Tenant to the Landlord under this Lease is paid and any other material subsisting breach of the Tenant’s covenants in this Lease is remedied

8.4 The Landlord shall not unreasonably withhold Consent to an underletting of the whole or a Permitted Part of the Premises where all of the following conditions are satisfied: