Table of Contents

As filed with the Securities and Exchange Commission on August 21, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MONTAGE TECHNOLOGY GROUP LIMITED

(Exact name of registrant as specified in its charter)

| Cayman Islands | 3674 | Not applicable | ||

| (State or other jurisdiction of Incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Room A1601, Technology Building, 900 Yi Shan Road

Xuhui District, Shanghai, 200233

People’s Republic of China

Tel: (86 21) 6128-5678

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark Voll

Chief Financial Officer

2025 Gateway Place, Suite 262

San Jose CA 95110

Tel: 408-982-2788

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of Communications to:

| Portia Ku Eric C. Sibbitt O’Melveny & Myers LLP 2765 Sand Hill Road Menlo Park, CA 94025 Tel: (650) 473-2600 |

James J. Masetti Heidi E. Mayon Pillsbury Winthrop Shaw Pittman LLP 2550 Hanover Street Palo Alto, California 94304 Tel: (650) 233-4500 |

Approximate date of commencement of proposed sale to public: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price (1)(2) |

Amount of registration fee | ||

| Ordinary shares, par value $0.005 per share |

$115,000,000 | $15,686 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes ordinary shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither we nor the selling shareholders are soliciting offers to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated August 21, 2013

shares

Montage Technology Group Limited

Ordinary shares

This is an initial public offering of ordinary shares of Montage Technology Group Limited. We are offering ordinary shares. The selling shareholders are offering ordinary shares and we will not receive any of the proceeds in connection with the shares to be sold by the selling shareholders from this offering. We will bear all of the offering expenses other than the underwriting discount.

Prior to this offering, there has been no public market for our ordinary shares. We have applied to list our ordinary shares on the NASDAQ Global Market under the symbol “MONT.”

It is currently estimated that the initial public offering price per share will be between $ and $ .

Investing in our ordinary shares involves a high degree of risk. See “Risk factors” beginning on page 11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholders |

$ | $ | ||||||

We have granted the underwriters an option for a period of 30 days to purchase up to additional ordinary shares.

The underwriters expect to deliver the shares to purchasers on , 2013.

| Deutsche Bank Securities | Barclays | |||||

Stifel

| Wells Fargo Securities | Needham & Company | |||||

Prospectus dated , 2013.

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 43 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 | |||

| 73 | ||||

| 90 | ||||

| 98 | ||||

| 103 | ||||

| 104 | ||||

| 107 | ||||

| 115 | ||||

| 117 | ||||

| 123 | ||||

| 129 | ||||

| 131 | ||||

| 131 | ||||

| 131 | ||||

| F-1 | ||||

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, nor the selling shareholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is current only as of its date.

For investors outside the United States: Neither we, nor the selling shareholders, nor the underwriters have done anything that would permit our initial public offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our ordinary shares and the distribution of this prospectus outside of the United States.

Table of Contents

Conventions That Apply to This Prospectus

In this prospectus,

| • | “CPU” refers to central processing unit; |

| • | “DDR” refers to DDR DRAM, or double data rate dynamic random-access memory, a class of memory integrated circuits used in servers; |

| • | “DDR2” refers to the second generation of DDR; |

| • | “DDR3” refers to the third generation of DDR; |

| • | “DDR4” refers to the fourth generation of DDR; |

| • | “DIMM” refers to dual in-line memory module; |

| • | “HDTV” refers to high-definition television; |

| • | “HKD” refers to the legal currency of the Hong Kong Special Administrative Region of the People’s Republic of China; |

| • | “JEDEC” refers to Joint Electron Devices Engineering Council, an independent semiconductor engineering trade organization to develop standards for semiconductor devices; |

| • | “LRDIMM” refers to load-reduced dual in-line memory module; |

| • | “MPEG” refers to Moving Picture Experts Group; |

| • | “preferred shares” refers to our Series A preferred shares, Series A-2 preferred shares, Series B preferred shares, Series B-1 preferred shares and Series B-2 preferred shares, each having par value of US$0.005 per share; |

| • | “RDIMM” refers to registered dual in-line memory module; |

| • | “RF” refers to radio frequency; |

| • | “RMB” or “Renminbi” refers to the legal currency of China; |

| • | “SDTV” refers to standard-definition television; |

| • | “shares” or “ordinary shares” refers to our ordinary shares, par value of US$0.005 per share; |

| • | “SoC” refers to system-on-chip, an integrated circuit that generally contains digital, analog, mixed-signal and radio-frequency functions on a single chip substrate; and |

| • | “we,” “us,” “our company” and “our” refer to Montage Technology Group Limited and its subsidiaries, as the context requires. |

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ordinary shares. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus and our consolidated financial statements and related notes appearing at the end of this prospectus, before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements. See “Special Note Regarding Forward-Looking Statements” for more information.

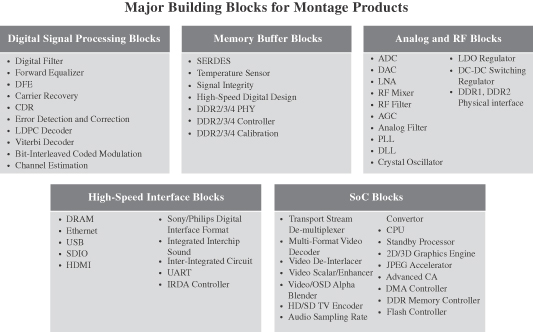

Our Company

We are a global fabless provider of analog and mixed-signal semiconductor solutions currently addressing the home entertainment and cloud computing markets. Our expertise in analog and radio frequency solutions, digital signal processors and high speed interfaces serves as the foundation for our technology platform. These technical capabilities enable us to design high performance, low power semiconductors. In the home entertainment market, our technology platform enables us to design highly integrated solutions with customized software and support for set-top boxes. Our solutions are designed to optimize signal processing performance under the challenging operating conditions typically found in emerging market environments, where often broadcast signals received by the set-top box may be weak, distorted or off-specification. Our solutions contain a number of different technologies that allow for enhanced signal processing, resulting in improved overall video quality under the typically limited existing broadband network infrastructure in emerging markets. In the cloud computing market, we offer high performance, low power memory interface solutions that enable memory-intensive server applications. Our technology platform approach allows us to provide integrated solutions that meet the expanding needs of our customers through our continuous innovation, cost- and power-efficient design and rapid product development. Since our inception in 2004, we have sold over 230 million integrated circuits, which have been shipped to over 150 end customers worldwide.

While analog and mixed-signal technology is applicable to a broad array of end markets, we have been highly selective in identifying our initial target end markets. We focus on markets which we believe have compelling long-term growth prospects and are also characterized by complex product design, long life cycles and stringent qualification requirements. We believe that these market characteristics coupled with our significant investment in our technology platform have created high barriers to entry for set-top box solutions in emerging markets. Initially, we developed commercial solutions for the home entertainment market to address the rapidly growing demand for television in China, Southeast Asia and other emerging markets. According to iSuppli Corporation, or iSuppli, in 2012, 154 million set-top boxes were sold by Chinese manufacturers. We believe that set-top boxes sold by Chinese manufacturers primarily target China and other emerging markets. The number of set-top boxes sold by Chinese manufacturers is expected to grow to over 243 million units in 2016 according to iSuppli. This would represent a compound annual growth rate of 12% from 2012 to 2016. A key to our success in addressing the characteristics of the home entertainment market in emerging markets is our ability to provide integrated solutions with customized software and support, which we develop through close collaboration with our end customers. Our collaborative approach allows us to develop extensive localized knowledge of a large, fragmented market with diverse technical and service requirements, deepening our customer relationships and yielding design wins across multiple product generations. Our end customers in the home entertainment market include nine of the ten largest set-top box manufacturers in China as measured by units sold in 2012.

More recently, we released our memory interface solutions to pursue opportunities arising from the rapid growth in the cloud computing market. Our close collaboration with key industry participants, including CPU manufacturers, memory module manufacturers and server original equipment manufacturers, or OEMs, has enabled us to successfully develop high performance, low power memory interface solutions for cloud computing

1

Table of Contents

environments. We sell our memory interface solutions to memory module manufacturers, which incorporate our memory interfaces into dual in-line memory modules, or DIMMs, which are devices used to add memory capacity to a CPU. The most advanced cloud computing data servers operating today currently use DDR3 memory technology and load-reduced DIMMs, or LRDIMMs, which require memory interfaces that buffer data signals in addition to command and address signals. Memory interface vendors like us are unable to sell their solutions to memory module manufacturers without those solutions first being validated by manufacturers of CPUs. We are currently one of two LRDIMM memory buffer suppliers validated by Intel Corporation for DDR3 technology, the most prevalent industry standard for memory integrated circuits used in servers. Our customers in the cloud computing market include the world’s four largest DRAM manufacturers and the world’s largest third-party DRAM module supplier.

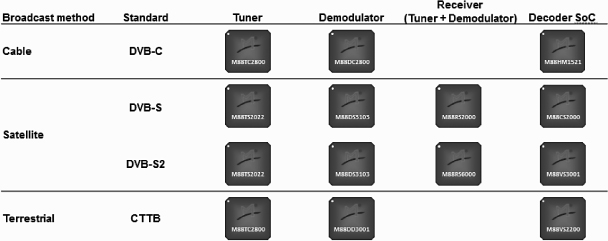

We offer ten solutions for use in the home entertainment market and two memory interface solutions for use in the cloud computing market. In 2012 and the six months ended June 30, 2013, 94% and 91%, respectively, of our revenue was generated from sales of set-top box solutions targeting the home entertainment market in emerging markets, while the remaining 6% and 9%, respectively, of our revenue was generated from sales of memory interface solutions targeting the cloud computing market. Our solutions are built upon our foundation of 37 issued patents and an additional 46 pending patent applications as of June 30, 2013. As of June 30, 2013, we had 290 engineers in our research and development organization, of which 141 hold post-graduate engineering degrees. Our revenue has grown from $29.1 million in 2010 to $78.2 million in 2012, representing a compound annual growth rate of 64%, and from $33.9 million in the six months ended June 30, 2012 to $45.4 million in the six months ended June 30, 2013, representing an annual growth rate of 34%. We had a net loss of $8.5 million in 2010 and net income of $5.0 million in 2011, $18.3 million in 2012 and $8.8 million in the six months ended June 30, 2013.

Our Target Markets

Our solutions primarily serve two large target markets, (i) the home entertainment market, in particular set-top boxes for emerging markets; and (ii) the cloud computing market, in particular memory interface solutions for data center servers.

Home Entertainment Market

In emerging markets, such as China, India, the Middle East, Latin and South America, Africa and Southeast Asia, television content is broadcast and accessed through satellite transmissions, cable network connections or terrestrial over-the-air transmissions. Viewers often access content from these three signal transmission systems using set-top boxes that are connected to televisions within the home. According to iSuppli, in 2012, 154 million set-top boxes were sold by Chinese manufacturers, primarily targeting emerging markets. Of the 154 million units sold, 66% were exported outside of China. The total number of set-top boxes sold by Chinese manufacturers is expected to grow to over 243 million units in 2016 according to iSuppli, with 58% of those units expected to be exported. This would represent a compound annual growth rate of 12% from 2012 to 2016. In addition, in some emerging markets, such as China, the broadcasting signal of television content is transitioning from analog to digital due to government- sponsored programs requiring the replacement or addition of television access equipment. For example, China has a goal of shutting down analog TV signals by 2015 and transitioning to digital TV in most regions. With improvements in content quality and increasing disposable income, we believe that viewers in China and other emerging markets are expected to increasingly purchase set-top boxes that can receive and display high-definition video content. While currently the satellite set-top box market is the largest market for China-manufactured set-top boxes in terms of total number of set-top boxes sold, the cable set-top box market is expected to represent an increasing proportion of China-manufactured set-top boxes from 2012 to 2016, according to iSuppli.

2

Table of Contents

In order to optimize for superior and robust system performance and deliver cost-efficient solutions to set-top box manufacturers, semiconductor providers are integrating multiple functions into a single silicon package. These integrated solutions also require customized embedded software and field application support to ensure proper functionality and system level performance. The demands for cost-effective yet high-performance solutions are particularly strong in emerging markets. According to iSuppli, the market for semiconductors addressing set-top boxes manufactured in China totaled $995 million in 2012 and is expected to grow to $1,316 million in 2016, with sales of integrated semiconductor solutions outpacing the growth of the overall market from 2012 to 2016. This would represent a compound annual growth rate of 7% from 2012 to 2016.

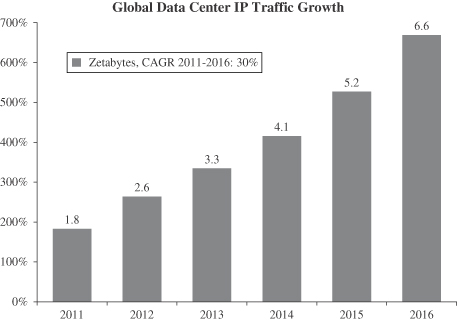

Cloud Computing Market

Global data center IP traffic is expected to increase from 1.8 zettabytes, or 1.8 billion terabytes, in 2011 to 6.6 zettabytes in 2016, according to the Cisco Global Cloud Index published by Cisco System, Inc., or Cisco. This would represent a compound annual growth rate of 30% from 2011 to 2016. The proliferation of mobile devices, cloud-based software applications and streaming video pose significant challenges for network data centers. In addition, the rate at which data is being consumed is growing much faster than the rate of mobile device growth. The limited memory and processing speed of mobile devices has led to a majority of content viewed on mobile devices being accessed using cloud computing technology.

To meet the rising demands being placed on networks, data center operators have increased the number of servers within their facilities. In cloud computing environments where a significant number of memory-intensive applications are simultaneously being run on a server, the processing performance of CPUs is limited by the amount of memory available to the CPU. Additional memory capacity is required to ensure servers perform at optimal levels, which is critical for on-demand applications like cloud computing and virtualization. As a result, memory capacity is added to a server through the use of dual in-line memory modules, or DIMMs, which house dynamic random access memory, or DRAM. Memory performance is enhanced through the use of interface devices called memory buffers that efficiently facilitate the rapid flow of data between the CPU and memory. As the number of cores in the CPU increases, the number of DIMMs required to achieve higher performance also increases. The need for greater amounts of DRAM to support high performance computing is expected to drive the development of higher capacity DIMMs, where a greater amount of gigabit storage is placed on a single DIMM. The memory content within the overall server market is expected to grow to $3,129 million in 2016, according to Gartner Inc., or Gartner. This would represent a compound annual growth rate of 22% from 2012 to 2016. In addition, memory is expected to become a larger percentage of the server semiconductor total addressable market, increasing from 13.8% in 2012 to 21.2% in 2016, according to Gartner. Based on our knowledge gained through qualification processes with CPU and memory module manufacturers, we believe higher capacity DIMMs with memory densities equal to or above 32 gigabits will require the use of LRDIMM technology to ensure the highest server performance. Furthermore, we expect that new server platforms will need to expand the capacity for the number of DIMMs to address the increasing amount of data being transmitted over public and private networks. The number of machines using LRDIMM is expected to grow from 2.3 million in 2014 to 3.1 million in 2016, while the average number of LRDIMMs used on a single machine is expected to grow from 4.8 in 2014 to 18.3 in 2016, according to Jon Peddie Research. The increase in number of machines using LRDIMMs and average number of LRDIMMs per machine is expected to drive rapid growth in the potential available market for LRDIMM chipsets, which Jon Peddie Research estimates will increase from up to $312 million in 2014 to as much as $1,958 million in 2016. This would represent a compound annual growth rate of 151% from 2014 to 2016.

The rise of computing power in a server also drives a significant increase in the energy costs required to operate the server. Therefore, data center operators are increasingly focused on the power efficiency of each component within a server system and ascribe significant value to low power solutions that can drive energy savings without compromising performance. Moreover, CPU manufacturers create technology platforms that

3

Table of Contents

server OEMs use as the basis for their server design. A CPU manufacturer sets the specifications for many of the key components to be used in each generation of its server platforms. In the case of memory interface solutions for DIMMs, CPU manufacturers impose strict guidelines and generally qualify only a few vendors to provide memory interface solutions for their server platforms. With each new server platform released by CPU manufacturers, providers of memory interface solutions must be validated for use on the new platform. As such, the increased technical requirements for memory interface solutions not only create higher degrees of complexity and greater requirements for performance, signal integrity and low power on the newer generation memory buffers, but also limit the number of participants in the market for memory interface solutions.

Key Requirements of Our Target Markets

Within the home entertainment market, set-top box manufacturers in emerging markets have the following critical needs which must be addressed when identifying semiconductor solutions for their products:

| • | integration; |

| • | high level of field support; |

| • | exceptional performance and signal processing in challenging environments; |

| • | embedded software and comprehensive system-level solutions; |

| • | cost effectiveness; and |

| • | ease of manufacture. |

Within the cloud computing market, server OEMs have the following critical needs which must be addressed when identifying memory interface solutions for their products:

| • | high performance and low power; |

| • | signal integrity; and |

| • | built-in self-test capability. |

To successfully compete in the home entertainment and cloud computing markets, semiconductor providers must possess strong design capabilities in both analog and mixed-signal technologies as well as system level design expertise. In addition, design solutions must effectively meet the foregoing requirements and offer an attractive value proposition for set-top box manufacturers, memory module manufacturers and server OEMs alike.

Our Solutions

We design, develop and market a range of analog and mixed-signal semiconductor solutions for set-top boxes targeting emerging markets as well as memory interface solutions for the cloud computing markets. Our solutions comprise one or more analog and mixed-signal semiconductors combined with field application and other support services.

We market a range of high performance and multi-standard compliant HDTV and SDTV semiconductor solutions for set-top boxes, including tuners, demodulators and decoders as well as integrated solutions with customized software and support. We provide an integrated solution by combining our RF and analog hardware design with customized software. Our integrated solutions can combine tuner, demodulator and decoding technology in a single semiconductor solution. We believe our set-top box solutions deliver high performance because we offer strong signal processing capabilities which address the challenges that are commonly found in emerging markets, where the limited and often substandard broadcast network infrastructure requires more robust

4

Table of Contents

signal processing and performance capabilities than required in developed markets. We support our solutions with our extensive team of field application engineers who are geographically close to our customers and work extensively to deepen our customer relationships. We offer set-top box solutions for satellite, cable and terrestrial broadcasts, with a particular strength in satellite and cable set-top boxes aimed at emerging markets.

By combining our expertise in high performance, low power mixed-signal semiconductor design technologies and other support services, we have designed and developed advanced memory interface solutions that provide high performance and low power consumption for use in data center servers for the cloud computing market. We design our memory interface solutions in close collaboration with our memory module manufacturer end customers as well as server OEMs and CPU manufacturers to meet required design specifications. We believe our memory interface solutions are high performance, because they can achieve better signal integrity than the competitors in our market, which allow our solutions to efficiently operate at higher speeds thereby increasing memory capacity and improving server performance. Additionally, our built-in self-test capabilities help our memory module manufacturer customers and server OEMs to rapidly validate memory performance.

Competitive Strengths

We believe the following strengths differentiate us from our competitors and are key drivers of our success:

| • | High performance, low power analog and mixed-signal technology platform. Our technology platform is built upon our foundation of high performance, low power expertise and consists of a versatile and comprehensive set of hardware and software building blocks that serve both our home entertainment and cloud computing markets. For example, in the cloud computing market, we are currently one of two LRDIMM memory buffer suppliers validated by Intel Corporation for DDR3 technology, the most prevalent industry standard for memory integrated circuits used in servers. |

| • | Deep technology expertise. Our research and development team of 290 professionals, of which 141 have advanced degrees, has extensive digital signal processing, radio frequency and analog and mixed-signal design experience and includes engineers who have participated in the development of key industry standards such as JEDEC and MPEG. Our core system-level expertise and understanding of system requirements enables us to optimize our product roadmap and identify attractive opportunities. |

| • | High levels of integration. We believe our integrated solutions result in superior performance and lower material and manufacturing costs for our customers, enhancing our attractive value proposition. Our integrated solutions have significant advantages over competing discrete products such as improving signal integrity, reducing size and ultimately driving superior system performance. We believe that the enhanced performance and cost-effectiveness created by the high level of integration in our solutions allows us to deliver increased value to our end customers, which increases customer loyalty and positions us to benefit from demand for future product upgrades from end customers. |

| • | Close collaboration and relationships with customers and industry participants. Our extensive customer interaction, in particular through support provided by our field application engineers, combined with our deep understanding of our customers’ needs, fosters customer loyalty and increases visibility of evolving customer requirements and market opportunities within our business. Our close proximity to our customers, which are primarily located in Asia, also provides us with a better understanding of local system requirements and allows us to achieve faster time to market with our solutions. |

| • | Broad customer base and attractive market opportunities in home entertainment. We have sold our solutions principally through distributors to over 150 set-top box manufacturers worldwide. Our key customers include nine of the ten largest set-top box manufacturers in China, who manufacture products optimized for end users in emerging markets. |

| • | Well positioned to capitalize on opportunities in cloud computing. We believe we offer the highest performance and lowest-power memory interface solutions for memory-intensive cloud computing |

5

Table of Contents

| applications. We are currently one of two LRDIMM suppliers validated by Intel Corporation for DDR3 technology, the most prevalent industry standard for memory integrated circuits used in servers, and have sold our memory interface solutions to the world’s four largest DRAM manufacturers and the world’s largest third-party DRAM module supplier. |

Growth Strategy

We believe we can continue to grow our revenue by executing on the following strategies:

| • | Invest to maintain technology leadership position across product lines. We intend to continue our focus on retaining and attracting high quality engineering staff and investing in our intellectual property portfolio to further extend our leading high performance, low power technologies in our markets. |

| • | Strengthen our relationships with customers and industry participants. We intend to continue to build upon and strengthen our collaborative relationships to increase our customers’ dependence on us and drive greater demand for our solutions, as well as to continue participating in the development of key industry standards to better align our future roadmap. |

| • | Expand product offering and market share in home entertainment for emerging markets. We will continue to leverage our engineering expertise to grow our market share in the globally fragmented home entertainment market. We also intend to continue to introduce solutions with higher levels of product functionality and integration, as we seek to increase our average selling price per set-top box by providing more integrated solutions. |

| • | Continue to position ourselves for growth in the cloud computing market. We intend to further penetrate our existing customer base and collaborate with new memory module partners to increase our revenue. We also intend to further develop our partnership with leading CPU manufacturers and remain aligned with their server and next generation technology roadmaps. |

Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider these risks, including all of the risks discussed in the section entitled “Risk Factors,” beginning on page 11 of this prospectus, before investing in our ordinary shares. Risks relating to our business relate to, among other things:

| • | Our ability to sustain our recent revenue growth rates; |

| • | Our ability to sustain or increase our profitability in the future; |

| • | Our ability to develop and maintain relationships with key industry and technology leaders to enhance our solution offerings and market position; |

| • | Changes to industry standards and technical requirements relevant to our solutions and markets; |

| • | The rapidly evolving and intensely competitive nature of our markets; |

| • | Our ability to continuously develop new and enhanced solutions to meet changing market conditions; |

| • | Our reliance on third parties to manufacture, package, assemble and test the semiconductor products comprising our solutions; |

| • | Our lengthy sales cycles, which could result in uncertainty and delays in generating revenue; |

| • | Our ability to adequately protect our intellectual property rights; and |

| • | Government policies that could have a material adverse effect on our results of operations. |

6

Table of Contents

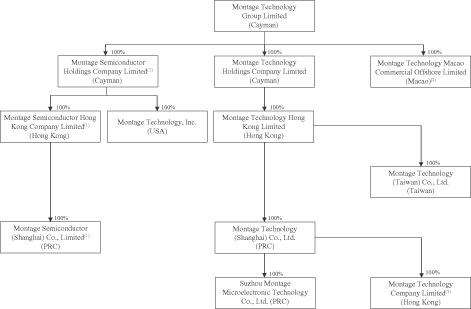

Corporate Information

We are a Cayman Islands company and conduct our business primarily through our wholly owned operating subsidiaries in China, Hong Kong and the United States. Our principal executive office is located at Room A1601, Technology Building, 900 Yi Shan Road, Xuhui District, Shanghai 200233, China and our telephone number is +86 (21) 6128-5678. Our website address is www.montage-tech.com. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus.

“Montage Technology” and our logo are our trademarks. All other trademarks and trade names appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

7

Table of Contents

THE OFFERING

| Ordinary shares offered by us |

shares | |

| Ordinary shares offered by the selling shareholders |

shares | |

| Ordinary shares outstanding immediately after this offering |

shares ( shares if the over-allotment option is exercised in full) | |

| Over-allotment option |

We have granted to the underwriters an option, exercisable within 30 days from the date of this prospectus, to purchase up to an aggregate of additional ordinary shares at the initial public offering price, less underwriting discounts and commissions, solely to cover over-allotments of ordinary shares, if any. | |

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including working capital and capital expenditures. See “Use of Proceeds.” | |

| Directed Share Program |

At our request, the underwriters have reserved for sale, at the public offering price, up to five percent of the shares offered by us to certain of our directors, officers, employees, business associates and related persons through a directed share program. We do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they make will reduce the number of shares available to the general public. | |

| Risk factors |

Investing in our ordinary shares involves a high degree of risk. You should carefully read the information set forth under “Risk Factors” beginning on page 11 of this prospectus, together with all of the other information set forth or incorporated by reference in this prospectus, before deciding to invest in our ordinary shares. | |

| Proposed NASDAQ Global Market Symbol |

“MONT” | |

The number of ordinary shares that will be outstanding immediately after this offering:

| • | is based upon 12,452,822 ordinary shares outstanding as of July 31, 2013; |

| • | assumes the conversion of all outstanding preferred shares as of the date of this prospectus into an aggregate of 40,408,994 ordinary shares immediately upon the completion of this offering; and |

| • | excludes 9,363,733 ordinary shares issuable upon the exercise of options granted under our 2006 Share Incentive Plan outstanding as of July 31, 2013. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table sets forth our summary consolidated financial data for the periods and as of the dates indicated. Our summary consolidated financial data for each of the years ended December 31, 2010, 2011 and 2012 have been derived from our audited consolidated financial statements, which are included elsewhere in this prospectus. Our summary consolidated financial data for the six months ended June 30, 2012 and 2013 and summary consolidated balance sheet data as of June 30, 2013 have been derived from our unaudited consolidated financial statements, which are included elsewhere in this prospectus. Our unaudited consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of management, reflect all adjustments, which consist only of normal recurring adjustments, necessary for the fair statement of those unaudited consolidated financial statements.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. The following summaries of our consolidated financial data for the periods presented should be read in conjunction with “Risk Factors,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, which are included elsewhere in this prospectus.

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| 2010 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||

| (in thousands, except share and per share data) | (unaudited) | |||||||||||||||||||

| Summary Statement of Operations Data: |

||||||||||||||||||||

| Revenue |

$ | 29,078 | $ | 50,338 | $ | 78,245 | $ | 33,937 | $ | 45,392 | ||||||||||

| Cost of revenue(1) |

(21,248 | ) | (22,840 | ) | (31,736 | ) | (13,691) | (16,589 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

7,830 | 27,498 | 46,509 | 20,246 | 28,803 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expense: |

||||||||||||||||||||

| Research and development(1) |

(11,078 | ) | (13,651 | ) | (17,568 | ) | (8,469) | (12,473 | ) | |||||||||||

| Sales, general and administrative(1) |

(5,046 | ) | (5,895 | ) | (9,792 | ) | (3,232) | (6,801 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expense |

(16,124 | ) | (19,546 | ) | (27,360 | ) | (11,701) | (19,274 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations |

(8,294 | ) | 7,952 | 19,149 | 8,545 | 9,529 | ||||||||||||||

| Interest income (expense), net |

(44 | ) | (36 | ) | 207 | 4 | 302 | |||||||||||||

| Fair value change in warrant liability |

(37 | ) | — | — | — | — | ||||||||||||||

| Other income (expense), net |

(114 | ) | (307 | ) | 153 | 233 | (87 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

(8,489 | ) | 7,609 | 19,509 | 8,782 | 9,744 | ||||||||||||||

| Provision for income tax |

(54 | ) | (2,637 | ) | (1,228 | ) | (553) | (972 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (8,543 | ) | $ | 4,972 | $ | 18,281 | $ | 8,229 | $ | 8,772 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to ordinary shareholders—Basic |

$ | (11,056 | ) | $ | 77 | $ | 3,114 | $ | 1,357 | $ | 1,558 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

$ | (1.06 | ) | $ | 0.01 | $ | 0.29 | $ | 0.13 | $ | 0.14 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | (1.06 | ) | $ | 0.01 | $ | 0.26 | $ | 0.12 | $ | 0.12 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average shares used in computing net income (loss) per share: |

||||||||||||||||||||

| Basic |

10,393,746 | 10,650,479 | 10,798,107 | 10,735,327 | 11,496,089 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

10,393,746 | 14,810,976 | 15,916,704 | 15,617,434 | 16,430,914 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

9

Table of Contents

| (1) | Includes share-based compensation as follows: |

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| 2010 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||

| (in thousands) | (unaudited) |

|||||||||||||||||||

| Cost of revenue |

$ | 31 | $ | 13 | $ | 19 | $ | 10 | $ | 28 | ||||||||||

| Research and development |

358 | 356 | 497 | 210 | 578 | |||||||||||||||

| Sales, general and administrative |

389 | 262 | 473 | 169 | 688 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total share-based compensation |

$ | 778 | $ | 631 | $ | 989 | $ | 389 | $ | 1,294 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The following summary consolidated balance sheet data table shows a summary of our balance sheet data as of June 30, 2013:

| • | on an actual basis; |

| • | on a pro forma basis, giving effect to the automatic conversion of all outstanding convertible preferred shares into 40,408,994 ordinary shares; and |

| • | on a pro forma as adjusted basis to reflect, in addition, the sale by us of ordinary shares in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range listed on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| As of June 30, 2013 | ||||||||||

| Actual | Pro Forma | Pro Forma as Adjusted | ||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||

| (in thousands) | ||||||||||

| Summary Balance Sheet Data: |

||||||||||

| Cash and cash equivalents |

$ | 13,921 | $ | 13,921 | ||||||

| Working capital |

42,124 | 42,124 | ||||||||

| Total assets |

64,592 | 64,592 | ||||||||

| Total liabilities |

20,660 | 20,660 | ||||||||

| Convertible preferred shares |

54,400 | — | ||||||||

| Total shareholders’ equity/(deficit) |

(10,468 | ) | 43,932 | |||||||

10

Table of Contents

An investment in our ordinary shares involves significant risks. You should carefully consider all of the information in this prospectus, including the risk factors described below, before making an investment in our ordinary shares. The following risk factors describe conditions, circumstances or uncertainties that create or enhance risks to our business, financial condition and results of operations or otherwise to the value of your investment in our ordinary shares. Any of these risks could result in a decline in the market price of our ordinary shares, in which case you could lose all or part of your investment.

Risk Factors Related to Our Business and Our Industry

We may be unable to sustain our recent revenue growth rates.

We experienced significant growth in revenue and profits in 2011 and 2012. Our revenue increased from $29.1 million in 2010 to $78.2 million in 2012, while our net income (loss) improved from a net loss of $8.5 million in 2010 to net income of $5.0 million in 2011 and to $18.3 million in 2012. In the six months ended June 30, 2013, we recorded $45.4 million in revenue and $8.8 million in net income, which increased from $33.9 million in revenue and $8.2 million in net income in the six months ended June 30, 2012. We may not achieve similar rates of growth in future periods. You should not rely on our results of operations for any prior quarterly or annual periods as an indication of our future performance. Our future revenue growth rate will depend in particular on the success of our memory interface solutions. In 2012 and the six months ended June 30, 2013, our memory interface solutions generated $4.6 million and $4.3 million in revenue and we may not be successful in growing our revenue from our memory interface solutions. If our revenue growth slows significantly or decreases, the market price of our ordinary shares may decline.

We have a history of losses, have only recently become profitable and may not sustain or increase profitability in the future which may cause the market price of our ordinary shares to decline.

We first became profitable on an annual basis in 2011. We incurred significant net losses prior to that year. As of June 30, 2013, we had an accumulated deficit of $15.6 million. We currently expect to increase our expense levels to support our business growth. Therefore, to sustain or increase profitability, we will need to grow our revenue. If our expenditures do not result in increased revenue growth or there is a significant time lag between these expenses and our revenue growth, we may experience net losses in the future. Because many of our expenses are fixed in the short term, or are incurred in advance of anticipated sales, we may not be able to decrease our expenses in a timely manner to offset any shortfall of revenue. Any incurrence of net losses in the future could cause the market price of our ordinary shares to decline.

We rely on our relationships with industry and technology leaders to enhance our solution offerings and market position, and our inability to continue to develop or maintain such relationships in the future would harm our ability to remain competitive.

We develop our semiconductor solutions for applications in systems that are driven by industry and technology leaders, in particular for our memory interface solutions. In the cloud computing market, CPU manufacturers create technology platforms that memory module manufacturers and server OEMs use as the basis for their products and solutions. A CPU manufacturer sets the specifications for many of the key components to be used on each generation of its server platforms. In the case of our memory interface solutions, CPU manufacturers impose strict guidelines and generally qualify only a few vendors to provide memory interface solutions for their server platforms. With each new server platform released by CPU manufacturers, providers of memory interface solutions must be validated for use on the new platform. In addition, we must work closely with memory module manufacturers to ensure our memory interface solutions become qualified for use with their memory modules. As a result, maintaining close relationships with leading CPU manufacturers and memory module manufacturers is crucial to the long-term success of our memory interface solutions business. If our relationships with key industry participants were to deteriorate or if our solutions were not qualified by CPU manufacturers, our market position and sales could be materially adversely affected.

11

Table of Contents

Changes to industry standards and technical requirements relevant to our solutions and markets could adversely affect our business, results of operations and prospects.

Our solutions comprise only a part of larger electronic systems. All solutions incorporated into these systems must comply with various industry standards and technical requirements created by regulatory bodies or industry participants in order to operate efficiently together. Industry standards and technical requirements in our markets are evolving and may change significantly over time. For our set-top box solutions, the industry standards are typically set by government regulators and vary by country. Such standards can sometimes change or additional standards may be added with limited advance notice. For memory interface solutions, the industry standards are developed by JEDEC, an industry trade organization. In addition, large industry-leading semiconductor and electronics companies play a significant role in developing standards and technical requirements for the product ecosystems within which our memory interface solutions can be used. Our end customers also may design certain specifications and other technical requirements specific to their products and solutions. These technical requirements may change as the end customer introduces new or enhanced products and solutions.

Our ability to compete in the future will depend on our ability to identify and ensure compliance with evolving industry standards and technical requirements. The emergence of new industry standards and technical requirements could render our solutions incompatible with solutions developed by other suppliers or make it difficult for our solutions to meet the requirements of certain of our end customers in both the home entertainment and cloud computing markets. As a result, we could be required to invest significant time and effort and to incur significant expense to redesign our solutions to ensure compliance with relevant standards and requirements. If our solutions are not in compliance with prevailing industry standards and technical requirements for a significant period of time, we could miss opportunities to achieve crucial design wins, our revenue may decline and we may incur significant expenses to redesign our solutions to meet the relevant standards, which could adversely affect our business, results of operations and prospects.

Our business would be adversely affected by the departure of existing members of our senior management team and other key personnel.

Our success depends, in large part, on the continued contributions of our senior management team, in particular, the services of Dr. Howard C. Yang, our Chairman of the Board and Chief Executive Officer, and Stephen Tai, our President and director, as well as other senior management. The loss of any member of our senior management team or key personnel could harm our ability to implement our business strategy and respond to the rapidly changing market conditions in which we operate.

Our results of operations can fluctuate from period to period, which could cause our share price to fluctuate.

Our results of operations have fluctuated in the past and may fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following factors, as well as other factors described elsewhere in this prospectus:

| • | the receipt, reduction, delay or cancellation of orders by customers; |

| • | the gain or loss of significant customers; |

| • | the timing and success of our launch of new solutions and launches of new solutions by our competitors; |

| • | market acceptance of our solutions and our customers’ products; |

| • | the timing and extent of research and development costs, and in particular tape-out costs; |

| • | fluctuations in sales by and inventory levels of module manufacturers who incorporate our semiconductor solutions in their products, such as memory modules; |

| • | cyclical and seasonal fluctuations in our markets; |

| • | the timing of receiving government subsidies; |

12

Table of Contents

| • | fluctuations in our manufacturing yields; |

| • | significant warranty claims, including those not covered by our contract manufacturer; |

| • | changes in our revenue mix; and |

| • | loss of key personnel or the inability to attract qualified engineers. |

The semiconductor industry has been highly cyclical in the past and our markets may experience significant cyclical fluctuations in demand as a result of changing economic conditions, budgeting and buying patterns of customers and others factors. As a result of the various potential factors affecting demand for our products and our results of operations in any given period, the results of any prior quarterly or annual periods should not be relied upon as indicative of our future revenue or operating performance. Fluctuations in our revenue and operating results could cause our share price to decline.

The markets for our semiconductor solutions are evolving, and changing market conditions, such as the introduction of new technologies or changes in customer preferences, may negatively affect demand for our solutions. If we fail to properly anticipate or respond to changing market conditions, our business prospects and results of operations will suffer.

Our solutions are used in the technologically advanced and rapidly evolving home entertainment and cloud computing markets. The technologies used in these markets are constantly being improved and new technologies that compete with existing technologies may be developed. Furthermore, the home entertainment market, and in particular the market for our set-top box solutions, is highly fragmented and subject to changes in viewer preferences, customer requirements and technical standards. In the cloud computing market, and in particular the market for our memory interface solutions, technology advancements are continuously underway, such as the advancements in memory technology from DDR2 to DDR3 and DDR4. Industry analysts have different opinions on how fast and how large these markets will grow. New technologies may be introduced that make the current technologies that our solutions utilize less competitive or obsolete. Due to the evolving nature of our markets, our future success depends on our ability to accurately anticipate and respond to changes in technologies, consumer preferences and other market conditions. Any decrease in demand for our set-top box and memory interface solutions, or set-top box and memory interface solutions in general, due to the emergence of competing technologies, changes in customer preferences and requirements or other factors, could adversely affect our business, results of operations and prospects.

We must continuously develop new and enhanced solutions, and if we are unable to successfully market our new and enhanced solutions that we have incurred significant expenses developing, our results of operations and financial condition will be materially adversely affected.

In order to compete effectively in our markets, we must continually design, develop and introduce new and improved solutions with improved features in a cost-effective manner in response to changing technologies and market demand. This requires us to devote substantial financial and other resources to research and development. In the home entertainment market, in response to market trends, we have focused on providing more integrated and customized solutions and are enhancing our offerings of HDTV solutions. In the memory interface market, we are developing next-generation DDR4 memory interface solutions, which we expect to be one of the drivers of our revenue growth in the future. However, we may not be successful developing and marketing these new and enhanced solutions. In particular in the memory interface market, we have generated limited revenue from sales of our memory interface solutions through 2012. While we expect revenue from our memory interface solutions to grow, we may not be able to increase our market share in this globally competitive market. Moreover, achieving and maintaining Intel validation for our advanced memory buffers, in particular our LRDIMM memory buffer for DDR4, is extremely important to our future market position and the prospects of our memory interface solutions business as the server OEMs who adopt Intel’s server platforms will only purchase components of their servers from Intel validated vendors. There is no assurance we will achieve or maintain such validations. If we are unable to successfully develop and market our new and enhanced solutions that we have incurred significant expenses developing, our results of operations and financial condition will be materially and adversely affected.

13

Table of Contents

Average selling prices of our solutions have historically decreased over time and will likely continue to do so, which could negatively affect our revenue and margins.

Historically, the semiconductor solutions that we sell have experienced declining average selling prices over their life cycle. The rate at which the average selling price declines may be affected by a number of factors, including relative supply and demand, the level of competition, production costs and technological changes. As a result of the general trend of decreasing average selling prices of our semiconductor solutions following their launch, our ability to grow or maintain our margins depends on our ability to introduce new or enhanced solutions with higher average selling prices and to reduce our per-unit cost of sales and operating costs. However, our new or enhanced solutions may not be as successful or enjoy as high margins as we expect. If we are unable to offset any reductions in the average selling prices by introducing new solutions with higher average selling prices or reducing our costs, our revenue and margins will be negatively affected and may decrease.

We face intense competition and expect competition to increase in the future. If we fail to compete effectively, our revenue growth and results of operations will be materially adversely affected.

The markets in which we operate are highly competitive. We compete with numerous domestic and international semiconductor companies, many of which have greater financial and other resources with which to pursue technology development, product design, manufacturing, marketing and sales and distribution of their products. Currently, our competitors range from large, international companies offering a wide range of semiconductor solutions to smaller companies specializing in set-top box or memory interface solutions. Our primary competitors in the set-top box market include semiconductor companies that sell to emerging markets such as HiSilicon Technologies Co., Ltd., ALi Corporation, RDA Microelectronics, Inc., Airoha Technology Corporation and STMicroelectronics NV, as well as smaller semiconductor design companies based in China. Our competitors in the memory interface market include Inphi Corporation, Integrated Device Technology, Inc. and Texas Instruments Inc. We expect that as the markets for our solutions grow, new entrants will enter these markets and existing competitors may make significant investments to compete more effectively against us. As the emerging markets to which we sell our set-top box solutions become developed markets, leading semiconductor companies focusing on developed markets may increasingly enter our target markets.

Our ability to compete successfully depends on factors both within and outside of our control, including:

| • | the functionality and performance of our solutions and those of our competitors; |

| • | our relationship with our end customers and other industry participants; |

| • | prices of our solutions and prices of our competitors’ products; |

| • | our reputation and ability to provide satisfactory customer support; |

| • | our research and development capabilities to provide innovative solutions; |

| • | our ability to retain high-level talent, including our management team and engineers; and |

| • | the actions of our competitors, including merger and acquisition activity, launches of new products and other actions that could change the competitive landscape. |

Intense competition could result in pricing pressure, reduced revenue and profitability and loss of market share, any of which could materially and adversely affect our business, results of operations and prospects. In the event of a market downturn, competition in the markets in which we operate may intensify as our customers reduce their purchase orders. During market downturns, our competitors that are significantly larger and have greater financial, technical, marketing, distribution, customer support and other resources or more established market recognition than us may be better positioned to accept lower prices and withstand adverse economic or market conditions.

14

Table of Contents

We rely on third parties to manufacture, package, assemble and test the semiconductor products comprising our solutions, which exposes us to a number of risks, including reduced control over manufacturing and delivery timing and potential exposure to price fluctuations, which could result in a loss of revenue or reduced profitability.

As a fabless semiconductor company, we outsource the manufacturing, packaging, assembly and certain testing of our semiconductor solutions to third-party foundries and assembly and testing service providers. We generally use a single foundry for the production of each semiconductor product comprising our set-top box and memory interface solutions. In 2012, we outsourced the manufacturing to three different foundries, Semiconductor Manufacturing International Corporation in China, Fujitsu Semiconductor Limited in Japan and United Microelectronics Corporation in Taiwan. Our assembly and testing contractors in 2012 were Siliconware Precision Industries Co., Ltd. in Taiwan and STATS ChipPAC Ltd. in Singapore and Korea.

Relying on third-party manufacturing, assembly and testing presents a number of risks, including but not limited to:

| • | capacity shortages during periods of high demand; |

| • | reduced control over delivery schedules, inventories and quality; |

| • | the unavailability of, or potential delays in obtaining access to, key process technologies; |

| • | the inability to achieve required production or test capacity and acceptable yields on a timely basis; |

| • | misappropriation of our intellectual property; |

| • | limited warranties on wafers or products supplied to us; and |

| • | potential increases in prices. |

We currently do not have long-term supply contracts with any of our third-party contract manufacturers, and we typically negotiate pricing on a per-purchase order basis. Therefore, they are not obligated to perform services or supply product to us for any specific period, in any specific quantities, or at any specific price, except as may be provided in a particular purchase order. During periods of high demand and tight inventories, our third-party foundries and assembly and testing contractors may allocate capacity to the production of other companies’ products while reducing deliveries to us, or significantly raise their prices. In particular, they may allocate capacity to other customers that are larger and better financed than us or that have long-term agreements, decreasing the capacity available to us. Shortages of capacity available to us may be caused by the actions of their other large customers that may be difficult to predict, such as major product launches. If we need another foundry or assembly and test contractor because of increased demand, or if we are unable to obtain timely and adequate deliveries from our providers, we might not be able to cost effectively and quickly retain other vendors to satisfy our requirements. In the event that we need to shift the production of a solution to a different contract manufacturer, it may take approximately nine to 12 months to allow a smooth transition from our current foundry or assembly services provider to the new provider. Such a transition might require a qualification process by our end customers.

We purchase from our manufacturing contractors based on our estimates of end customers’ demand, and if our estimates are incorrect our results of operations could be materially adversely impacted.

Our sales are made on the basis of purchase orders rather than long-term purchase contracts. We place orders with our third party foundries and service providers for manufacturing, assembling and testing our semiconductor products according to our estimates of customer demand several months prior to the anticipated delivery date to our distributor or end customer. This process requires us to make multiple demand forecast assumptions with respect to our end customers’ demands in advance of actual purchase orders. We might misestimate demand due to unforeseen changes in market conditions, incomplete or inaccurate customer and market information or other factors within and outside of our control. If we overestimate customer demand, we may purchase products from our third-party contractors that we may not be able to sell and may over-budget company operations, which could result in decreases in our prices or write-downs of unsold inventory.

15

Table of Contents

Conversely, if we underestimate customer demand or if sufficient manufacturing capacity were unavailable, we would lose out on sales opportunities and could lose market share or damage our customer relationships.

Our costs may increase substantially if our third-party manufacturing contractors do not achieve satisfactory product yields or quality.

The wafer fabrication process is an extremely complicated process where small changes in design, specifications or materials can result in material decreases in product yields or even the suspension of production. From time to time, the third-party wafer foundries that we contract to manufacture the semiconductor products comprising our solutions may experience manufacturing defects and reduced manufacturing yields related to errors or problems in their manufacturing processes or the interrelationship of their processes with our designs. In some cases, our third-party wafer foundries may not be able to detect these defects early in the fabrication process or determine the cause of such defects in a timely manner.

Generally, in pricing our solutions, we assume that manufacturing yields will continue to improve, even as the complexity of our solutions increases. Once our solutions are initially qualified with our third-party wafer foundries, minimum acceptable yields are established. We are responsible for the costs of the wafers if the actual yield is above the minimum. If actual yields are below the minimum we are not required to purchase the wafers. Typically, minimum acceptable yields for our new solutions are generally lower at first and gradually improve as we achieve full production. Unacceptably low product yields or other product manufacturing problems could substantially increase the overall production time and costs and adversely impact our operating results on sales of our solutions. Product yield losses will increase our costs and reduce our gross margin. In addition to significantly harming our operating results and cash flow, poor yields may delay shipment of our solutions and harm our relationships with existing and potential customers.

Our sales cycle can be lengthy, which could result in uncertainty and delays in generating revenue.

As we sell highly integrated solutions with customized software and support, our sales cycle for our set-top box solutions from initial engagement to volume production may take a prolonged period of time, typically several months to one year. For our memory interface solutions, our sales cycle can include working with our customers and other industry participants for up to two years or more on product development before we achieve design wins. Any delays in these lengthy sales cycles increase the risk that a customer will decide to cancel, curtail, reduce or delay its product plans or adopt a competing design or solution from one of our competitors, causing us to lose anticipated revenue. In addition, any delay or cancellation of an end customer’s plans could materially and adversely affect our financial results, as we may have incurred significant expense without generating any revenue. Finally, our end customers’ failure to successfully market and sell their products could reduce demand for our solutions and materially and adversely affect our business, results of operations and prospects. If we were unable to generate revenue after incurring substantial expenses during our sales efforts, our results of operations would suffer.

If we fail to achieve initial design wins for our solutions, we may lose the opportunity for sales to customers for a significant period of time and be unable to recoup our investments in our solutions.

We expend considerable resources in order to achieve design wins for our solutions, especially our new solutions and solution enhancements. Once a customer designs a semiconductor solution into its product, it is likely to continue to use the same semiconductor solution or enhanced versions of that solution from the same supplier across a number of similar and successor products for a lengthy period of time due to the significant costs associated with qualifying a new supplier and potentially redesigning the product to incorporate a different semiconductor solution. If we fail to achieve an initial design win in a customer’s qualification process, we may lose the opportunity for significant sales to that customer for a number of its products and for a lengthy period of time. This may cause us to be unable to recoup our investments in our solutions, which would harm our business.

16

Table of Contents

Our customers require our solutions and our third-party contractors to undergo a lengthy and expensive qualification process. If we are unsuccessful or delayed in qualifying any of our solutions with a customer, our business and operating results would suffer.

Prior to selecting and purchasing our solutions, our end customers typically require that our solutions undergo extensive qualification processes, which involve testing of our solutions in the customers’ systems, as well as testing for reliability. This qualification process may continue for several months for our set-top box solutions. Our memory interface solutions must obtain qualification with our memory module manufacturer customers as well as CPU manufacturers. The qualification process for our memory interface solutions can take multiple years. However, obtaining the requisite qualifications for a solution does not assure any sales of the solution. Even after successful qualification and sales of a solution to an end customer, a subsequent revision in our third party contractors’ manufacturing process or our selection of a new contract manufacturer may require a new qualification process, which may result in delays and in our holding excess or obsolete inventory. After our solutions are qualified and selected, it can take several months or more before the customer commences volume production of systems that incorporate our solutions. Despite these uncertainties, we devote substantial resources, including design, engineering, sales, marketing and management efforts, to qualifying our solutions with customers in anticipation of sales. If we are unsuccessful or delayed in qualifying any of our solutions with a customer, sales of those solutions to the customer may be precluded or delayed, which may impede our growth and cause our business to suffer.

We have generated a substantial majority of our revenue from sales through three independent distributors, which subjects us to a number of risks.

We have sold a substantial majority of our set-top box solutions to end customers through three independent distributors, LQW Technology Company Limited, Qinuo International Co., Ltd. and China Electronic Appliance Shenzhen Co., Ltd. Sales through these three distributors accounted for 50%, 18% and 9%, respectively, of our total revenue in 2012 and 67%, 11% and 8%, respectively, of our total revenue in the six months ended June 30, 2013. As of June 30, 2013, we had $8.3 million of accounts receivable, 78% of which was due from LQW Technology Company Limited. We typically collect the accounts receivable from each distributor within one month following billing. We typically enter into distribution agreements with our distributors, with each distributor covering a defined customer base and/or geographic area. In addition, our distribution agreements are typically negotiated and entered into on an annual basis and prohibit the distributor from selling products or solutions competing with ours. If any of our distributors were to default on its obligations and fail to pay our invoices or ship our products in a timely fashion, we may be unable to collect our accounts receivable, recover our inventory, or complete sales to the customers who had placed orders through that distributor, and we may find it difficult to replace that distributor. In addition, our operating results and financial condition could be significantly disrupted by the loss of one or more of these distributors, or various factors outside of our control such as order cancellations or delays in shipment by one or more of these distributors or the failure of any of these distributors to successfully sell our solutions.

The complexity of our solutions could result in undetected defects and we may be subject to warranty and product liability claims, which could result in a decrease in customers and revenue, unexpected expenses and loss of market share.

Our solutions are incorporated into larger electronic equipment sold by our end customers. A solution usually goes through an intense qualification and testing period performed by our customers before being used in production. We primarily outsource our solution testing to third parties and also perform some testing in our laboratories in Shanghai, Suzhou and Taiwan. We inspect and test parts, or have them inspected and tested in order to screen out parts that may be weak or potentially suffer a defect incurred through the manufacturing process. From time to time, we are may be subject to warranty or product liability claims that may require us to make significant expenditures to defend these claims or pay damage awards.

17

Table of Contents