Table of Contents

This draft registration statement has not been filed publicly with the Securities and Exchange Commission

and all information contained herein remains confidential.

As confidentially submitted to the Securities and Exchange Commission on April 5, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MONTAGE TECHNOLOGY GROUP LIMITED

(Exact name of registrant as specified in its charter)

| Cayman Islands | 3674 | Not applicable | ||

| (State or other jurisdiction of Incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Room A1601, Technology Building, 900 Yi Shan Road

Xuhui District, Shanghai, 200233

People’s Republic of China

Tel: (86 21) 6128-5678

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark Voll

Chief Financial Officer

2025 Gateway Place, Suite 262

San Jose CA 95110

Tel: 408-982-2788

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of Communications to:

| Portia Ku Ke Geng O’Melveny & Myers LLP 2765 Sand Hill Road Menlo Park, CA 94025 Tel: (650) 473-2600 |

James J. Masetti Heidi E. Mayon Pillsbury Winthrop Shaw Pittman LLP 2550 Hanover Street Palo Alto, California 94304 Tel: (650) 233-4500 |

Approximate date of commencement of proposed sale to public: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price (1)(2) |

Amount of registration fee | ||

| Ordinary shares, par value $0.005 per share |

$ | $ | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes ordinary shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither we nor the selling shareholders are soliciting offers to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated , 2013

shares

Montage Technology Group Limited

Ordinary shares

This is an initial public offering of ordinary shares of Montage Technology Group Limited. We are offering ordinary shares. The selling shareholders are offering ordinary shares and we will not receive any of the proceeds in connection with the shares to be sold by the selling shareholders from this offering. We will bear all of the offering expenses other than the underwriting discount.

Prior to this offering, there has been no public market for our ordinary shares. We intend to apply to list our ordinary shares on the NASDAQ Global Select Market under the symbol “MONT.”

It is currently estimated that the initial public offering price per share will be between $ and $ .

Investing in our ordinary shares involves a high degree of risk. See “Risk factors” beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholders |

$ | $ | ||||||

We have granted the underwriters an option for a period of 30 days to purchase up to additional ordinary shares.

The underwriters expect to deliver the shares to purchasers on , 2013.

| Deutsche Bank Securities | Barclays | |||||

| Stifel

| ||||||

| Wells Fargo Securities | Needham & Company | |||||

Prospectus dated , 2013.

Table of Contents

| Page | ||||

| 1 | ||||

| 10 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

|

|

38 40 |

| ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | |||

| 62 | ||||

| 76 | ||||

| 84 | ||||

| 89 | ||||

| 91 | ||||

| 94 | ||||

| 101 | ||||

| 103 | ||||

| 108 | ||||

|

|

114 115 |

| ||

| 115 | ||||

| 115 | ||||

| F-1 | ||||

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, nor the selling shareholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectuses we have prepared. We, and not the underwriters, have ultimate authority over the statements contained or incorporated by reference in this prospectus and in any free writing prospectus we have prepared, including the content of those statements and whether and how to communicate them. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is current only as of its date.

For investors outside the United States: Neither we, nor the selling shareholders, nor the underwriters have done anything that would permit our initial public offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our ordinary shares and the distribution of this prospectus outside of the United States.

Table of Contents

Conventions That Apply to This Prospectus

In this prospectus,

| • | “CPU” refers to central processing unit; |

| • | “DDR” refers to DDR DRAM, or double data rate dynamic random-access memory, a class of memory integrated circuits used in computers; |

| • | “DDR2” refers to the second generation of DDR; |

| • | “DDR3” refers to the third generation of DDR; |

| • | “DDR4” refers to the fourth generation of DDR; |

| • | “HDTV” refers to high-definition television; |

| • | “JEDEC” refers to Joint Electron Devices Engineering Council, an independent semiconductor engineering trade organization to develop standards for semiconductor devices; |

| • | “MPEG” refers to Moving Picture Experts Group; |

| • | “preferred shares” refers to our Series A preferred shares, Series A-2 preferred shares, Series B preferred shares, Series B-1 preferred shares and Series B-2 preferred shares, each having par value of US$0.005 per share; |

| • | “RMB” or “Renminbi” refers to the legal currency of China; |

| • | “SDTV” refers to standard-definition television; |

| • | “shares” or “ordinary shares” refers to our ordinary shares, par value of US$0.005 per share; |

| • | “SoC” refers to system-on-chip, an integrated circuit that generally contains digital, analog, mixed-signal and radio-frequency functions on a single chip substrate; and |

| • | “we,” “us,” “our company” and “our” refer to Montage Technology Group Limited and its subsidiaries, as the context requires. |

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ordinary shares. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus and our consolidated financial statements and related notes appearing at the end of this prospectus, before making an investment decision. Some of the statements in this prospectus constitute forward-looking statements. See “Special Note Regarding Forward-Looking Statements” for more information.

Our Company

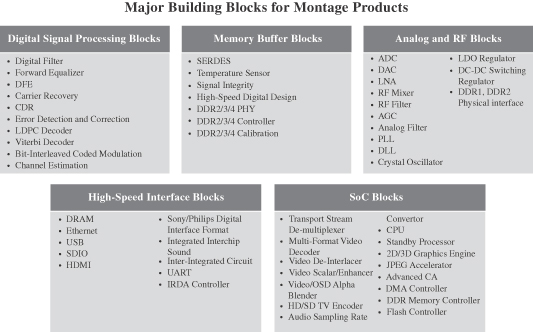

We are a global fabless provider of analog and mixed-signal semiconductor solutions currently addressing the home entertainment and cloud computing markets. Our expertise in analog and radio frequency solutions, digital signal processors and high speed interfaces serves as the foundation for our technology platform. These technical capabilities enable us to design high performance, low power semiconductors. In the home entertainment market, our technology platform enables us to design highly integrated end-to-end solutions with customized software and support for set-top boxes. Our solutions are designed to optimize signal processing performance under the challenging operating conditions typically found in emerging market environments. In the cloud computing market, we offer high performance, low power memory interface solutions that enable memory-intensive server applications. Our technology platform approach allows us to provide integrated solutions that meet the expanding needs of our customers through our continuous innovation, cost- and power-efficient design and rapid product development. Since our inception in 2004, we have sold over 230 million integrated circuits, which have been shipped to over 150 end customers worldwide.

While analog and mixed-signal technology is applicable to a broad array of end markets, we have been highly selective in identifying our initial target end markets. We focus on markets with compelling secular growth drivers that are also characterized by complex product design, long life cycles and stringent qualification requirements. We believe our significant investment in our technology platform has created high barriers to entry for set-top box solutions in emerging markets as well as memory interface solutions in the cloud computing market. Initially, we developed commercial solutions for the home entertainment market to address the rapidly growing demand for television in China, Southeast Asia and other emerging markets. According to iSuppli, in 2011, 118 million set-top boxes were sold by Chinese manufacturers, primarily targeting emerging markets. In 2016, the number of set-top boxes sold by Chinese manufacturers is expected to grow to over 243 million units in 2016, representing a compound annual growth rate of 16% from 2011 to 2016. A key to our success in the home entertainment market is our ability to provide integrated end-to-end solutions with customized software and support, which we develop through close collaboration with our end customers. Our collaborative approach allows us to develop extensive localized knowledge of a large, fragmented market with diverse requirements, deepening customer relationships and yielding design wins across multiple product generations. Our end customers in the home entertainment market include nine of the ten largest set-top box manufacturers in China as measured by units sold in 2012.

More recently, we released our memory interface solutions to pursue opportunities arising from the rapid growth in the cloud computing market. Our close collaboration with key ecosystem participants, including CPU manufacturers, memory module manufacturers and server OEMs, has enabled us to successfully develop high performance, low power memory interface solutions for cloud computing environments. We are currently one of two load-reduced dual in-line memory module, or LRDIMM, memory buffer suppliers validated by Intel Corporation for DDR3 technology, the most prevalent industry standard. Our customers in the cloud computing market include three of the world’s five largest memory module manufacturers as measured by revenue generated in 2011.

1

Table of Contents

We offer ten solutions for use in the home entertainment market and two memory interface solutions for use in the cloud computing market. Our solutions are built upon our foundation of 36 issued patents and an additional 44 pending patent applications. As of December 31, 2012, we had 270 engineers in our research and development organization, of which 132 hold post-graduate engineering degrees. Our revenue has grown from $29.1 million in 2010 to $78.2 million in 2012, representing a compound annual growth rate of 64%. In 2012, 94% of our revenue was generated from set-top box solutions and 6% was generated from memory interface solutions. We had a net loss of $8.5 million in 2010 and net income of $5.0 million in 2011 and $18.3 million in 2012.

Our Market Opportunity

Our solutions primarily serve two large target markets, (i) the home entertainment market, in particular set-top boxes for emerging markets; and (ii) the cloud computing market, in particular memory interface solutions for data center servers.

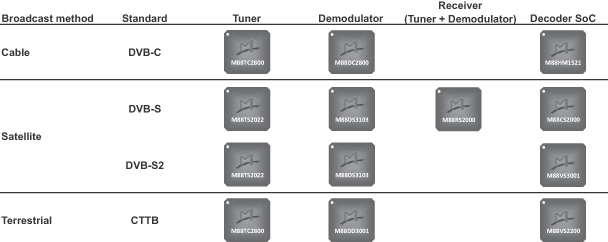

Home Entertainment Market

In emerging markets, such as China, India, the Middle East, Latin and South America, Africa and Southeast Asia, television content is broadcast and accessed through satellite transmissions, cable network connections or terrestrial over-the-air transmissions. Viewers often access content from these three signal transmission systems using set-top boxes that are connected to televisions within the home. According to iSuppli, in 2011, 118 million set-top boxes were sold by Chinese manufacturers, primarily targeting emerging markets. Of the 118 million units sold, 64% were exported outside of China. In 2016, the total number of units sold by Chinese manufacturers is expected to grow to over 243 million units, representing a compound annual growth rate of 16%, with 58% of those units expected to be exported, primarily to emerging markets. In addition, in some emerging markets, such as China, the broadcasting signal of television content is transitioning from analog to digital due to government- sponsored programs requiring the replacement or addition of television access equipment. For example, China has a goal to shut down analog TV signals by 2015 and transition to digital TV in most regions. With improvements in content quality, viewers in emerging markets are expected to increasingly purchase set-top boxes that can receive and display high-definition video content. While currently the satellite set-top box market is the largest market for China-manufactured set-top boxes in terms of total number of set-top boxes sold, the cable set-top box market is expected to represent an increasing proportion of China-manufactured set-top boxes from 2011 to 2016, according to iSuppli.

In order to optimize for superior and robust system performance and deliver cost-efficient solutions to set-top box manufacturers, semiconductor providers are integrating multiple functions into a single silicon package. These integrated solutions also require customized embedded software and field application support to ensure proper functionality and system level performance. The demands for cost-effective yet high-performance solutions are particularly strong in emerging markets. According to iSuppli, the market for semiconductors addressing set-top boxes manufactured in China totaled $828 million in 2011 and is expected to grow at a compound annual growth rate of 10% through 2016, with sales of integrated semiconductor solutions outpacing the growth of the overall market from 2011 to 2016.

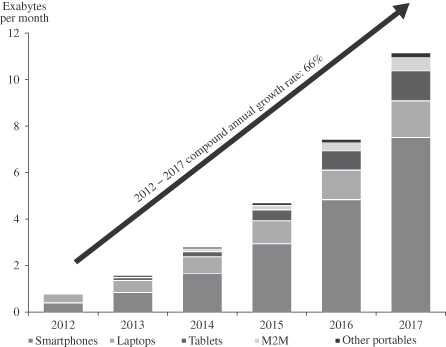

Cloud Computing Market

The proliferation of mobile devices, cloud-based software applications and streaming video pose significant challenges for network data centers. Furthermore, the rate at which data is being consumed is growing much faster than the rate of mobile device growth. The limited memory and processing speed of mobile devices has led to a majority of content viewed on mobile devices being accessed using cloud computing technology. According to the Cisco Global Cloud Index, global cloud IP traffic will increase from 0.7 zettabytes in 2011 to 4.3 zettabytes in 2016, representing a compound annual growth rate of 44%.

2

Table of Contents

To meet the rising demands being placed on networks, data center operators have increased the number of servers within their facilities. In cloud computing environments where a significant number of memory-intensive applications are simultaneously being run on a server, the processing performance of CPUs is limited by the amount of memory available to the CPU. Additional memory capacity is required to ensure servers perform at optimal levels, which is critical for on-demand applications like cloud computing and virtualization. As a result, memory capacity is added to a server through the use of dual in-line memory modules, or DIMMs, which house dynamic random access memory, or DRAM. Memory performance is enhanced through the use of interface devices called memory buffers that efficiently facilitate the rapid flow of data between the CPU and memory. As the number of cores in the CPU increases, the number of DIMMs required to achieve higher performance also increases. The need for greater amounts of DRAM to support high performance computing is expected to drive the development of higher capacity DIMMs, where a greater amount of gigabit storage is placed on a single DIMM. According to Gartner, the memory content within the overall server market is expected to grow at a compound annual growth rate of 22% from 2012 to 2016. In addition, memory is expected to become a larger percentage of the server semiconductor total addressable market, increasing from 13.4% in 2012 to 21.3% in 2016, according to Gartner.(1)

The rise of computing power in a server also drives a significant increase in the energy costs required to operate the server. Therefore, data center operators are increasingly focused on the power efficiency of each component within a server system and ascribe significant value to low power solutions that can drive energy savings without compromising performance. Moreover, CPU manufacturers create technology platforms that server original equipment manufacturers, or OEMs, use as the basis for their server design. A CPU manufacturer sets the specifications for many of the key components to be used in each generation of its server platforms. In the case of memory interface solutions for DIMMs, CPU manufacturers impose strict guidelines and generally qualify only a few vendors to provide memory interface solutions for their server platforms. With each new server platform released by CPU manufacturers, providers of memory interface solutions must be validated for use on the new platform. As such, the increased technical requirements for memory interface solutions not only create higher degrees of complexity and greater requirements for performance, signal integrity and low power on the newer generation memory buffers, but also limit the number of participants in the market for memory interface solutions.

Key Requirements of Our Target Markets

Within the home entertainment market, set-top box manufacturers in emerging markets have the following critical needs which must be addressed when identifying semiconductor solutions for their products:

| • | integration; |

| • | high level of field support; |

| • | exceptional performance and signal processing in challenging environments; |

| • | embedded software and comprehensive system-level solutions; |

| • | cost effectiveness; and |

| • | ease of manufacture. |

| (1) | Gartner, Inc. (“Gartner”), “Forecast: Electronic Equipment Production and Semiconductor Consumption by Application, Worldwide, 2010-2016, 4Q12 Update.” The Gartner Report described herein, (the “Gartner Report”) represent(s) data, research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, and are not representations of fact. The Gartner Report speaks as of its original publication date (and not as of the date of this filing) and the opinions expressed in the Gartner Report are subject to change without notice. |

3

Table of Contents

Within the cloud computing market, server OEMs have the following critical needs which must be addressed when identifying memory interface solutions for their products:

| • | high performance and low power; |

| • | signal integrity; and |

| • | built-in self-test capability. |

To successfully compete in the home entertainment and cloud computing markets, semiconductor providers must possess strong design capabilities in both analog and mixed-signal technologies as well as system level design expertise. In addition, design solutions must effectively meet the foregoing requirements and offer an attractive value proposition for set-top box manufacturers, memory module manufacturers and server OEMs alike.

Our Solutions

We market a range of high performance and multi-standard compliant HDTV and SDTV semiconductor solutions for set-top boxes, including tuners, demodulators and decoders as well as integrated end-to-end solutions with customized software and support. We provide an integrated end-to-end solution by combining our RF and analog hardware design with customized software. Our integrated solutions can combine tuner, demodulator and decoding technology in a single semiconductor solution. We support our solutions with our extensive team of field application engineers who are geographically close to our customers and work extensively to deepen our customer relationships. We offer set-top box solutions for satellite, cable and terrestrial broadcasts, with a particular strength in satellite and cable set-top boxes aimed at emerging markets.

By combining our expertise in high performance, low power mixed-signal semiconductor design technologies, we have designed and developed advanced memory interface solutions that provide high performance and low power consumption for use in data center servers for the cloud computing market. We believe our memory interface solutions can achieve better signal integrity than the competitors in our market, which allow our solutions to efficiently operate at higher speeds thereby increasing memory capacity and improving server performance. Additionally, our built-in self-test capabilities help our memory module manufacturer customers and server OEMs to rapidly validate memory performance.

Competitive Strengths

We believe the following strengths differentiate us from our competitors and are key drivers of our success:

| • | High performance, low power analog and mixed-signal technology platform. Our technology platform is built upon our foundation of high performance, low power expertise and consists of a versatile and comprehensive set of hardware and software building blocks that serve both our home entertainment and cloud computing markets. For example, in the cloud computing market, we are currently one of two LRDIMM memory buffer suppliers validated by Intel Corporation for DDR3 technology, the most prevalent industry standard. |

| • | Deep technology expertise. Our research and development team of 270 professionals, of which 132 have advanced degrees, has extensive digital signal processing, radio frequency and analog and mixed-signal design experience and includes engineers who have participated in the development of key industry standards such as JEDEC and MPEG. Our core system-level expertise and understanding of system requirements enables us to optimize our product roadmap and identify attractive opportunities. |

| • | High levels of integration. We believe our integrated solutions result in superior performance and lower material costs for our customers, enhancing our attractive value proposition. Our integrated |

4

Table of Contents

| solutions have significant advantages over competing discrete products such as improving signal integrity, reducing size and ultimately driving superior system performance. |

| • | Close collaboration and relationships with customers and ecosystem participants. Our extensive customer interaction, in particular through support provided by our field application engineers, combined with our deep understanding of our customers’ needs, fosters customer loyalty and increases visibility within our business. Our close proximity to our customers, which are primarily located in Asia, also provides us with a better understanding of local system requirements and allows us to achieve faster time to market with our solutions. |

| • | Broad customer base and attractive market opportunities in home entertainment. We have sold our solutions principally through distributors to over 150 set-top box manufacturers worldwide. Our key customers include nine of the ten largest set-top box manufacturers in China, who manufacture products optimized for end users in emerging markets. |

| • | Well positioned to capitalize on opportunities in cloud computing. We believe we offer the highest performance and lowest-power memory interface solutions for memory-intensive cloud computing applications. We are currently one of two LRDIMM suppliers validated by Intel Corporation for DDR3 technology, the most prevalent industry standard, and have sold our memory interface solutions to three of the world’s five largest memory module manufacturers. |

Growth Strategy

We believe we can continue to grow our revenue by executing on the following strategies:

| • | Invest to maintain technology leadership position across product lines. We intend to continue our focus on retaining and attracting high quality engineering staff and investing in our intellectual property portfolio to further extend our leading high performance, low power technologies in our markets. |

| • | Strengthen our relationships with customers and ecosystem participants. We intend to continue to build upon and strengthen our collaborative relationships to increase our customers’ dependence on us and drive greater demand for our solutions, as well as to continue participating in the development of key industry standards to better align our future roadmap. |

| • | Expand product offering and market share in home entertainment for emerging markets. We will continue to leverage our engineering expertise to grow our market share in the globally fragmented home entertainment market. We also intend to continue to introduce solutions with higher levels of product functionality and integration, as we seek to increase our average selling price per set-top box by providing more integrated solutions. |

| • | Continue to position ourselves for growth in the cloud computing market. We intend to further penetrate our existing customer base and collaborate with new memory module partners to increase our revenue. We also intend to further develop our partnership with leading CPU manufacturers and remain aligned with their server and next generation technology roadmaps. |

Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider these risks, including all of the risks discussed in the section entitled “Risk Factors,” beginning on page 10 of this prospectus, before investing in our ordinary shares. Risks relating to our business relate to, among other things:

| • | Our ability to sustain our recent revenue growth rates; |

| • | Our ability to sustain or increase our profitability in the future; |

5

Table of Contents

| • | Our ability to develop and maintain relationships with key industry and technology leaders to enhance our solution offerings and market position; |

| • | Changes to industry standards and technical requirements relevant to our solutions and markets; |

| • | The rapidly evolving and intensely competitive nature of our markets; |

| • | Our ability to continuously develop new and enhanced solutions to meet changing market conditions; |

| • | Our reliance on third parties to manufacture, package, assemble and test the semiconductor products comprising our solutions; |

| • | Our lengthy sales cycles, which could result in uncertainty and delays in generating revenue; |

| • | Our ability to adequately protect our intellectual property rights; and |

| • | Government policies that could have a material adverse effect on our results of operations. |

Corporate Information

We are a Cayman Islands company. We conduct our business primarily through our wholly owned operating subsidiaries in China, Hong Kong and the United States. Our principal executive office is located at Room A1601, Technology Building, 900 Yi Shan Road, Xuhui District, Shanghai 200233, China and our telephone number is +86 (21) 6128-5678. Our website address is www.montage-tech.com. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus.

“Montage Technology” and our logo are our trademarks. All other trademarks and trade names appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

6

Table of Contents

THE OFFERING

| Ordinary shares offered by us |

shares | |

| Ordinary shares offered by the selling shareholders |

shares | |

| Ordinary shares outstanding immediately after this offering |

shares ( shares if the over-allotment option is exercised in full) | |

| Over-allotment option |

We have granted to the underwriters an option, exercisable within 30 days from the date of this prospectus, to purchase up to an aggregate of additional ordinary shares at the initial public offering price, less underwriting discounts and commissions, solely to cover over-allotments of ordinary shares, if any. | |

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including working capital and capital expenditures. See “Use of Proceeds.” | |

| Risk factors |

Investing in our ordinary shares involves a high degree of risk. You should carefully read the information set forth under “Risk Factors” beginning on page 10 of this prospectus, together with all of the other information set forth or incorporated by reference in this prospectus, before deciding to invest in our ordinary shares. | |

| Proposed NASDAQ Global Select Market Symbol |

“MONT” | |

The number of ordinary shares that will be outstanding immediately after this offering:

| • | is based upon 52,037,816 ordinary shares outstanding as of March 31, 2013; |

| • | assumes the conversion of all outstanding preferred shares as of the date of this prospectus into an aggregate of ordinary shares immediately upon the completion of this offering; |

| • | excludes 7,540,084 ordinary shares issuable upon the exercise of options granted under our 2006 Share Incentive Plan outstanding as of March 31, 2013; and |

| • | excludes ordinary shares that will be available for future issuance under our 2006 Share Incentive Plan and 2013 Performance Incentive Plan. |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table sets forth our summary consolidated financial data for the periods and as of the dates indicated. Our summary consolidated financial data for each of the years ended December 31, 2010, 2011 and 2012 and the summary consolidated balance sheet data as of December 31, 2012 has been derived from our audited consolidated financial statements, which are included elsewhere in this prospectus.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. The following summaries of our consolidated financial data for the periods presented should be read in conjunction with “Risk Factors,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, which are included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2010 | 2011 | 2012 | ||||||||||

| (in thousands, except share and per share data) |

||||||||||||

| Summary Statement of Operations Data: |

||||||||||||

| Revenue |

$ | 29,078 | $ | 50,338 | $ | 78,245 | ||||||

| Cost of revenue(1) |

(21,248 | ) | (22,840 | ) | (31,736 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

7,830 | 27,498 | 46,509 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating expense: |

||||||||||||

| Research and development(1) |

(11,078 | ) | (13,651 | ) | (17,568 | ) | ||||||

| Sales, general and administrative(1) |

(5,046 | ) | (5,895 | ) | (9,792 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total operating expense |

(16,124 | ) | (19,546 | ) | (27,360 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from operations |

(8,294 | ) | 7,952 | 19,149 | ||||||||

| Interest income (expense), net |

(44 | ) | (36 | ) | 207 | |||||||

| Fair value change in warrant liability |

(37 | ) | — | — | ||||||||

| Other income (expense), net |

(114 | ) | (307 | ) | 153 | |||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

(8,489 | ) | 7,609 | 19,509 | ||||||||

| Provision for income tax |

(54 | ) | (2,637 | ) | (1,228 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | (8,543 | ) | $ | 4,972 | $ | 18,281 | |||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) attributable to ordinary shareholders—Basic |

$ | (11,056 | ) | $ | 77 | $ | 3,114 | |||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) per share: |

||||||||||||

| Basic |

$ | (1.06 | ) | $ | 0.01 | $ | 0.29 | |||||

|

|

|

|

|

|

|

|||||||

| Diluted |

$ | (1.06 | ) | $ | 0.01 | $ | 0.26 | |||||

|

|

|

|

|

|

|

|||||||

| Weighted-average shares used in computing net income (loss) per share: |

||||||||||||

| Basic |

10,393,746 | 10,650,479 | 10,798,107 | |||||||||

|

|

|

|

|

|

|

|||||||

| Diluted |

10,393,746 | 14,810,976 | 15,916,704 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Includes stock-based compensation as follows: |

| Year Ended December 31, | ||||||||||||

| 2010 | 2011 | 2012 | ||||||||||

| (in thousands) | ||||||||||||

| Cost of revenue |

$ | 31 | $ | 13 | $ | 19 | ||||||

| Research and development |

358 | 356 | 497 | |||||||||

| Selling, general and administrative |

389 | 262 | 473 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total stock-based compensation |

$ | 778 | $ | 631 | $ | 989 | ||||||

|

|

|

|

|

|

|

|||||||

8

Table of Contents

The following summary consolidated balance sheet data table shows a summary of our balance sheet data as of December 31, 2012:

| • | on an actual basis; |

| • | on a pro forma basis, giving effect to the automatic conversion of all outstanding convertible preferred shares into 40,408,994 ordinary shares; and |

| • | on a pro forma as adjusted basis to reflect, in addition, the sale by us of ordinary shares in this offering at an assumed initial public offering price of $ per share, the midpoint of the price range listed on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| As of December 31, 2012 | ||||||||

| Actual | Pro Forma | Pro Forma as Adjusted | ||||||

| (unaudited) | (unaudited) | |||||||

| (in thousands) | ||||||||

| Summary Balance Sheet Data: |

||||||||

| Cash and cash equivalents |

$ | 21,580 | ||||||

| Working capital |

33,496 | |||||||

| Total assets |

53,802 | |||||||

| Total liabilities |

20,208 | |||||||

| Convertible preferred shares |

54,377 | |||||||

| Total shareholders’ deficit |

(20,783 | ) | ||||||

9

Table of Contents

An investment in our ordinary shares involves significant risks. You should carefully consider all of the information in this prospectus, including the risk factors described below, before making an investment in our ordinary shares. The following risk factors describe conditions, circumstances or uncertainties that create or enhance risks to our business, financial condition and results of operations or otherwise to the value of your investment in our ordinary shares. Any of these risks could result in a decline in the market price of our ordinary shares, in which case you could lose all or part of your investment.

Risk Factors Related to Our Business and Our Industry

We may be unable to sustain our recent revenue growth rates.

We experienced significant growth in revenue and profits in 2011 and 2012. Our revenue increased from $29.1 million in 2010 to $78.2 million in 2012, while our net income (loss) improved from a net loss of $8.5 million in 2010 to net income of $5.0 million in 2011 and to $18.3 million in 2012. We may not achieve similar rates of growth in future periods. You should not rely on our results of operations for any prior quarterly or annual periods as an indication of our future performance. Our future revenue growth rate will depend in particular on the success of our memory interface solutions. In 2012, our memory interface solutions generated $4.6 million in revenue and we may not be successful in growing our revenue from our memory interface solutions. If our revenue growth slows significantly or decreases, the market price of our ordinary shares may decline.

We have a history of losses, have only recently become profitable and may not sustain or increase profitability in the future which may cause the market price of our ordinary shares to decline.

We first became profitable on an annual basis in 2011. We incurred significant net losses prior to that year. As of December 31, 2012, we had an accumulated deficit of $24.4 million. We currently expect to increase our expense levels to support our business growth. Therefore, to sustain or increase profitability, we will need to grow our revenue. If our expenditures do not result in increased revenue growth or there is a significant time lag between these expenses and our revenue growth, we may experience net losses in the future. Because many of our expenses are fixed in the short term, or are incurred in advance of anticipated sales, we may not be able to decrease our expenses in a timely manner to offset any shortfall of revenue. Any incurrence of net losses in the future could cause the market price of our ordinary shares to decline.

We rely on our relationships with industry and technology leaders to enhance our solution offerings and market position, and our inability to continue to develop or maintain such relationships in the future would harm our ability to remain competitive.

We develop our semiconductor solutions for applications in systems that are driven by industry and technology leaders, in particular for our memory interface solutions. In the cloud computing market, CPU manufacturers create technology platforms that memory module manufacturers and server OEMs use as the basis for their products and solutions. A CPU manufacturer sets the specifications for many of the key components to be used on each generation of its server platforms. In the case of our memory interface solutions, CPU manufacturers impose strict guidelines and generally qualify only a few vendors to provide memory interface solutions for their server platforms. With each new server platform released by CPU manufacturers, providers of memory interface solutions must be validated for use on the new platform. In addition, we must work closely with memory module manufacturers to ensure our memory interface solutions become qualified for use with their memory modules. As a result, maintaining close relationships with leading CPU manufacturers and memory module manufacturers is crucial to the long-term success of our memory interface solutions business. If our relationships with key ecosystem participants were to deteriorate, our market position and sales could be materially adversely affected.

10

Table of Contents

Changes to industry standards and technical requirements relevant to our solutions and markets could adversely affect our business, results of operations and prospects.

Our solutions comprise only a part of larger electronic systems. All solutions incorporated into these systems must comply with various industry standards and technical requirements created by regulatory bodies or industry participants in order to operate efficiently together. Industry standards and technical requirements in our markets are evolving and may change significantly over time. For our set-top-box solutions, the industry standards are typically set by government regulators and vary by country. Such standards can sometimes change or additional standards may be added with limited advance notice. For memory interface solutions, the industry standards are developed by JEDEC, an industry trade organization. In addition, large industry-leading semiconductor and electronics companies play a significant role in developing standards and technical requirements for the product ecosystems within which our memory interface solutions can be used. Our end customers also may design certain specifications and other technical requirements specific to their products and solutions. These technical requirements may change as the end customer introduces new or enhanced products and solutions.

Our ability to compete in the future will depend on our ability to identify and ensure compliance with evolving industry standards and technical requirements. The emergence of new industry standards and technical requirements could render our solutions incompatible with solutions developed by other suppliers or make it difficult for our solutions to meet the requirements of certain of our end customers in both the home entertainment and cloud computing markets. As a result, we could be required to invest significant time and effort and to incur significant expense to redesign our solutions to ensure compliance with relevant standards and requirements. If our solutions are not in compliance with prevailing industry standards and technical requirements for a significant period of time, we could miss opportunities to achieve crucial design wins, our revenue may decline and we may incur significant expenses to redesign our solutions to meet the relevant standards, which could adversely affect our business, results of operations and prospects.

Our business would be adversely affected by the departure of existing members of our senior management team and other key personnel.

Our success depends, in large part, on the continued contributions of our senior management team, in particular, the services of Dr. Howard C. Yang, our Chairman of the Board and Chief Executive Officer, and Stephen Tai, our President and director, as well as other senior management. The loss of any member of our senior management team or key personnel could harm our ability to implement our business strategy and respond to the rapidly changing market conditions in which we operate.

Our results of operations can fluctuate from period to period, which could cause our share price to fluctuate.

Our results of operations have fluctuated in the past and may fluctuate from period to period in the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include the following factors, as well as other factors described elsewhere in this prospectus:

| • | the receipt, reduction, delay or cancellation of orders by customers; |

| • | the gain or loss of significant customers; |

| • | the timing and success of our launch of new solutions and launches of new solutions by our competitors; |

| • | market acceptance of our solutions and our customers’ products; |

| • | the timing and extent of research and development costs, and in particular tape-out costs; |

11

Table of Contents

| • | fluctuations in sales by and inventory levels of module manufacturers who incorporate our semiconductor solutions in their products, such as memory modules; |

| • | cyclical and seasonal fluctuations in our markets; |

| • | fluctuations in our manufacturing yields; |

| • | significant warranty claims, including those not covered by our contract manufacturer; |

| • | changes in our revenue mix; and |

| • | loss of key personnel or the inability to attract qualified engineers. |

The semiconductor industry has been highly cyclical in the past and our markets may experience significant cyclical fluctuations in demand as a result of changing economic conditions, budgeting and buying patterns of customers and others factors. As a result of the various potential factors affecting demand for our products and our results of operations in any given period, the results of any prior quarterly or annual periods should not be relied upon as indicative of our future revenue or operating performance. Fluctuations in our revenue and operating results could cause our share price to decline.

The markets for our semiconductor solutions are evolving, and changing market conditions, such as the introduction of new technologies or changes in customer preferences, may negatively affect demand for our solutions. If we fail to properly anticipate or respond to changing market conditions, our business prospects and results of operations will suffer.

Our solutions are used in the technologically advanced and rapidly evolving home entertainment and cloud computing markets. The technologies used in these markets are constantly being improved and new technologies that compete with existing technologies may be developed. Furthermore, the home entertainment market, and in particular the market for our set-top-box solutions, is subject to changes in viewer preferences, customer requirements and technical standards. In the cloud computing market, and in particular the market for our memory interface solutions, technology advancements are continuously underway, such as the advancements in memory technology from DDR2 to DDR3 and DDR4. New technologies may be introduced that make the current technologies that our solutions utilize less competitive or obsolete. Due to the evolving nature of our markets, our future success depends on our ability to accurately anticipate and respond to changes in technologies, consumer preferences and other market conditions. Any decrease in demand for our set-top-box and memory interface solutions, or set-top-box and memory interface solutions in general, due to the emergence of competing technologies, changes in customer preferences and requirements or other factors, could adversely affect our business, results of operations and prospects.

We must continuously develop new and enhanced solutions, and if we are unable to successfully market our new and enhanced solutions that we have incurred significant expenses developing, our results of operations and financial condition will be materially adversely affected.

In order to compete effectively in our markets, we must continually design, develop and introduce new and improved solutions with improved features in a cost-effective manner in response to changing technologies and market demand. This requires us to devote substantial financial and other resources to research and development. In the home entertainment market, in response to market trends, we have focused on providing more integrated and customized solutions and are enhancing our offerings of HDTV solutions. In the memory interface market, we are developing next-generation DDR4 memory interface solutions. However, we may not be successful developing and marketing these new and enhanced solutions. In particular in the memory interface market, we have generated limited revenue from sales of our memory interface solutions through 2012. While we expect revenue from our memory interface solutions to grow, we may not be able to increase our market share in this globally competitive market. If we are unable to successfully market our new and enhanced solutions that we have incurred significant expenses developing, our results of operations and financial condition will be materially and adversely affected.

12

Table of Contents

Average selling prices of our solutions have historically decreased over time and will likely continue to do so, which could negatively affect our revenue and margins.

Historically, the semiconductor solutions that we sell have experienced declining average selling prices over their life cycle. The rate at which the average selling price declines may be affected by a number of factors, including relative supply and demand, the level of competition, production costs and technological changes. As a result of the general trend of decreasing average selling prices of our semiconductor solutions following their launch, our ability to grow or maintain our margins depends on our ability to introduce new or enhanced solutions with higher average selling prices and to reduce our per-unit cost of sales and operating costs. However, our new or enhanced solutions may not be as successful or enjoy as high margins as we expect. If we are unable to offset any reductions in the average selling prices by introducing new solutions with higher average selling prices or reducing our costs, our revenue and margins will be negatively affected and may decrease.

We face intense competition and expect competition to increase in the future. If we fail to compete effectively, our revenue growth and results of operations will be materially adversely affected.

The markets in which we operate are highly competitive. We compete with numerous domestic and international semiconductor companies, many of which have greater financial and other resources with which to pursue technology development, product design, manufacturing, marketing and sales and distribution of their products. Currently, our competitors range from large, international companies offering a wide range of semiconductor solutions to smaller companies specializing in set-top box or memory interface solutions. Our primary competitors in the set-top box market include semiconductor companies that sell to emerging markets such as HiSilicon Technologies Co., Ltd., ALi Corporation, RDA Microelectronics, Inc., Airoha Technology Corporation and STMicroelectronics NV, as well as smaller semiconductor design companies based in China. Our competitors in the memory interface market include Inphi Corporation, Integrated Device Technology, Inc. and Texas Instruments Inc. We expect that as the markets for our solutions grow, new entrants will enter these markets and existing competitors may make significant investments to compete more effectively against us. As the emerging markets to which we sell our set-top box solutions become developed markets, leading semiconductor companies focusing on developed markets may increasingly enter our target markets.

Our ability to compete successfully depends on factors both within and outside of our control, including:

| • | the functionality and performance of our solutions and those of our competitors; |

| • | our relationship with our end customers and other ecosystem participants; |

| • | prices of our solutions and prices of our competitors’ products; |

| • | our reputation and ability to provide satisfactory customer support; |

| • | our research and development capabilities to provide innovative solutions; |

| • | our ability to retain high-level talent, including our management team and engineers; and |

| • | the actions of our competitors, including merger and acquisition activity, launches of new products and other actions that could change the competitive landscape. |

Intense competition could result in pricing pressure, reduced revenue and profitability and loss of market share, any of which could materially and adversely affect our business, results of operations and prospects. In the event of a market downturn, competition in the markets in which we operate may intensify as our customers reduce their purchase orders. During market downturns, our competitors that are significantly larger and have greater financial, technical, marketing, distribution, customer support and other resources or more established market recognition than us may be better positioned to accept lower prices and withstand adverse economic or market conditions.

13

Table of Contents

We rely on third parties to manufacture, package, assemble and test the semiconductor products comprising our solutions, which exposes us to a number of risks, including reduced control over manufacturing and delivery timing and potential exposure to price fluctuations, which could result in a loss of revenue or reduced profitability.

As a fabless semiconductor company, we outsource the manufacturing, packaging, assembly and certain testing of our semiconductor solutions to third-party foundries and assembly and testing service providers. We generally use a single foundry for the production of each semiconductor product comprising our set-top box and memory interface solutions. In 2012, we outsourced the manufacturing to three different foundries, Semiconductor Manufacturing International Corporation in China, Fujitsu Semiconductor Limited in Japan and United Microelectronics Corporation in Taiwan. Our assembly and testing contractors in 2012 were Siliconware Precision Industries Co., Ltd. in Taiwan and STATS ChipPAC Ltd. in Singapore and Korea.

Relying on third-party manufacturing, assembly and testing presents a number of risks, including but not limited to:

| • | capacity shortages during periods of high demand; |

| • | reduced control over delivery schedules, inventories and quality; |

| • | the unavailability of, or potential delays in obtaining access to, key process technologies; |

| • | the inability to achieve required production or test capacity and acceptable yields on a timely basis; |

| • | misappropriation of our intellectual property; |

| • | limited warranties on wafers or products supplied to us; and |

| • | potential increases in prices. |

We currently do not have long-term supply contracts with any of our third-party contract manufacturers, and we typically negotiate pricing on a per-purchase order basis. Therefore, they are not obligated to perform services or supply product to us for any specific period, in any specific quantities, or at any specific price, except as may be provided in a particular purchase order. During periods of high demand and tight inventories, our third-party foundries and assembly and testing contractors may allocate capacity to the production of other companies’ products while reducing deliveries to us, or significantly raise their prices. In particular, they may allocate capacity to other customers that are larger and better financed than us or that have long-term agreements, decreasing the capacity available to us. If we need another foundry or assembly and test contractor because of increased demand, or if we are unable to obtain timely and adequate deliveries from our providers, we might not be able to cost effectively and quickly retain other vendors to satisfy our requirements. In the event that we need to shift the production of a solution to a different contract manufacturer, it may take approximately nine to 12 months to allow a smooth transition from our current foundry or assembly services provider to the new provider. Such a transition might require a qualification process by our end customers.

We purchase from our manufacturing contractors based on our estimates of end customers’ demand, and if our estimates are incorrect our results of operations could be materially adversely impacted.

Our sales are made on the basis of purchase orders rather than long-term purchase contracts. We place orders with our third party foundries and service providers for manufacturing, assembling and testing our semiconductor products according to our estimates of customer demand several months prior to the anticipated delivery date to our distributor or end customer. This process requires us to make multiple demand forecast assumptions with respect to our end customers’ demands in advance of actual purchase orders. We might misestimate demand due to unforeseen changes in market conditions, incomplete or inaccurate customer and market information or other factors within and outside of our control. If we overestimate customer demand, we may purchase products from our third-party contractors that we may not be able to sell and may over-budget company operations, which could result in decreases in our prices or write-downs of unsold inventory. Conversely, if we underestimate customer demand or if sufficient manufacturing capacity were unavailable, we would lose out on sales opportunities and could lose market share or damage our customer relationships.

14

Table of Contents

Our costs may increase substantially if our third-party manufacturing contractors do not achieve satisfactory product yields or quality.

The wafer fabrication process is an extremely complicated process where small changes in design, specifications or materials can result in material decreases in product yields or even the suspension of production. From time to time, the third-party wafer foundries that we contract to manufacture the semiconductor products comprising our solutions may experience manufacturing defects and reduced manufacturing yields related to errors or problems in their manufacturing processes or the interrelationship of their processes with our designs. In some cases, our third-party wafer foundries may not be able to detect these defects early in the fabrication process or determine the cause of such defects in a timely manner.

Generally, in pricing our solutions, we assume that manufacturing yields will continue to improve, even as the complexity of our solutions increases. Once our solutions are initially qualified with our third-party wafer foundries, minimum acceptable yields are established. We are responsible for the costs of the wafers if the actual yield is above the minimum. If actual yields are below the minimum we are not required to purchase the wafers. Typically, minimum acceptable yields for our new solutions are generally lower at first and gradually improve as we achieve full production. Unacceptably low product yields or other product manufacturing problems could substantially increase the overall production time and costs and adversely impact our operating results on sales of our solutions. Product yield losses will increase our costs and reduce our gross margin. In addition to significantly harming our operating results and cash flow, poor yields may delay shipment of our solutions and harm our relationships with existing and potential customers.

Our sales cycle can be lengthy, which could result in uncertainty and delays in generating revenue.

As we sell highly integrated end-to-end solutions with customized software and support, our sales cycle for our set-top box solutions from initial engagement to volume production may take a prolonged period of time, typically several months to one year. For our memory interface solutions, our sales cycle can include working with our customers and other ecosystem partners for up to two years or more on product development before we achieve design wins. Any delays in these lengthy sales cycles increase the risk that a customer will decide to cancel, curtail, reduce or delay its product plans or adopt a competing design or solution from one of our competitors, causing us to lose anticipated revenue. In addition, any delay or cancellation of an end customer’s plans could materially and adversely affect our financial results, as we may have incurred significant expense without generating any revenue. Finally, our end customers’ failure to successfully market and sell their products could reduce demand for our solutions and materially and adversely affect our business, results of operations and prospects. If we were unable to generate revenue after incurring substantial expenses during our sales efforts, our results of operations would suffer.

If we fail to achieve initial design wins for our solutions, we may lose the opportunity for sales to customers for a significant period of time and be unable to recoup our investments in our solutions.

We expend considerable resources in order to achieve design wins for our solutions, especially our new solutions and solution enhancements. Once a customer designs a semiconductor solution into its product, it is likely to continue to use the same semiconductor solution or enhanced versions of that solution from the same supplier across a number of similar and successor products for a lengthy period of time due to the significant costs associated with qualifying a new supplier and potentially redesigning the product to incorporate a different semiconductor solution. If we fail to achieve an initial design win in a customer’s qualification process, we may lose the opportunity for significant sales to that customer for a number of its products and for a lengthy period of time. This may cause us to be unable to recoup our investments in our solutions, which would harm our business.

15

Table of Contents

Our customers require our solutions and our third-party contractors to undergo a lengthy and expensive qualification process. If we are unsuccessful or delayed in qualifying any of our solutions with a customer, our business and operating results would suffer.

Prior to selecting and purchasing our solutions, our end customers typically require that our solutions undergo extensive qualification processes, which involve testing of our solutions in the customers’ systems, as well as testing for reliability. This qualification process may continue for several months for our set-top box solutions. Our memory interface solutions must obtain qualification with our memory module manufacturer customers as well as CPU manufacturers. The qualification process for our memory interface solutions can take multiple years. However, obtaining the requisite qualifications for a solution does not assure any sales of the solution. Even after successful qualification and sales of a solution to an end customer, a subsequent revision in our third party contractors’ manufacturing process or our selection of a new contract manufacturer may require a new qualification process, which may result in delays and in our holding excess or obsolete inventory. After our solutions are qualified and selected, it can take several months or more before the customer commences volume production of systems that incorporate our solutions. Despite these uncertainties, we devote substantial resources, including design, engineering, sales, marketing and management efforts, to qualifying our solutions with customers in anticipation of sales. If we are unsuccessful or delayed in qualifying any of our solutions with a customer, sales of those solutions to the customer may be precluded or delayed, which may impede our growth and cause our business to suffer.

We have generated a substantial majority of our revenue from sales through three independent distributors, which subjects us to a number of risks.

We have sold a substantial majority of our set-top box solutions to end customers through three independent distributors, LQW Technology Company Limited, Qinuo International Co., Ltd. and China Electronic Appliance Shenzhen Co., Ltd. Sales through these three distributors accounted for 50%, 18% and 9%, respectively, of our total revenue in 2012. We typically settle accounts receivables with our distributors after the products are sold to the end customers. As of December 31, 2012, we had $7.9 million of accounts receivable, 89% of which was due from LQW Technology Company Limited. We typically enter into distribution agreements with our distributors, with each distributor covering a defined customer base and/or geographic area. In addition, our distribution agreements are typically negotiated and entered into on an annual basis and prohibit the distributor from selling products or solutions competing with ours. If any of our distributors were to default on its obligations and fail to pay our invoices or ship our products in a timely fashion, we may be unable to collect our accounts receivable, recover our inventory, or complete sales to the customers who had placed orders through that distributor, and we may find it difficult to replace that distributor. In addition, our operating results and financial condition could be significantly disrupted by the loss of one or more of these distributors, or various factors outside of our control such as order cancellations or delays in shipment by one or more of these distributors or the failure of any of these distributors to successfully sell our solutions.

The complexity of our solutions could result in undetected defects and we may be subject to warranty and product liability claims, which could result in a decrease in customers and revenue, unexpected expenses and loss of market share.

Our solutions are incorporated into larger electronic equipment sold by our end customers. A solution usually goes through an intense qualification and testing period performed by our customers before being used in production. We primarily outsource our solution testing to third parties and also perform some testing in our laboratories in Shanghai, Suzhou and Taiwan. We inspect and test parts, or have them inspected and tested in order to screen out parts that may be weak or potentially suffer a defect incurred through the manufacturing process. From time to time, we are may be subject to warranty or product liability claims that may require us to make significant expenditures to defend these claims or pay damage awards.

Generally, our agreements seek to limit our liability to the replacement of the part or to the revenue received for the solution, but these limitations on liability may not be effective or sufficient in scope in all cases. In addition, we do

16

Table of Contents

not maintain any product liability insurance. If an end customer’s equipment fails in use, the end customer may incur significant monetary damages including an equipment recall or associated replacement expenses, as well as lost revenue. The end customer may claim that a defect in our solution caused the equipment failure and assert a claim against us to recover monetary damages. The process of identifying a defective or potentially defective solution in systems that have been widely distributed may be lengthy and require significant resources, and we may incur significant replacement costs and contract damage claims from our end customers as well as harm to our reputation. Defects in our solutions could harm our relationships with our customers and damage our reputation. Customers may be reluctant to buy our solutions, which could harm our ability to retain existing customers and attract new customers and our financial results. In addition, the cost of defending these claims and satisfying any arbitration award or judicial judgment with respect to these claims could harm our business prospects and financial condition.

We may not be able to adequately protect our intellectual property rights.

Our success depends in part upon our ability to protect our intellectual property. To accomplish this, we rely on a combination of intellectual property rights, including patents, copyrights, trademarks and trade secrets in the United States, China and other jurisdictions. Effective protection of our intellectual property rights may be unavailable, limited or not applied for in some countries. Some of our solutions and technologies are not covered by any patent or patent application, as we do not believe patent protection of these solutions and technologies is critical to our business strategy at this time. A failure to timely seek patent protection on solutions or technologies generally precludes us from seeking future patent protection on these solutions or technologies. We cannot guarantee that:

| • | any of our present or future patents or patent claims will not lapse or be invalidated, circumvented, challenged or abandoned; |

| • | our intellectual property rights will provide competitive advantages to us; |

| • | our ability to assert our intellectual property rights against potential competitors or to settle current or future disputes will not be limited by our agreements with third parties; |

| • | any of our pending or future patent applications will be issued or have the coverage originally sought; |

| • | our intellectual property rights will be enforced in jurisdictions where competition may be intense or where legal protection may be weak; |

| • | any of the trademarks, copyrights, trade secrets or other intellectual property rights that we presently employ in our business will not lapse or be invalidated, circumvented, challenged or abandoned; or |

| • | we will not lose the ability to assert our intellectual property rights against or to license our technology to others and collect royalties or other payments. |

In addition, our competitors or others may design around our protected patents or technologies. In addition to registered patents, we also rely on contractual protections with our customers, suppliers, distributors, employees and consultants, and we implement security measures designed to protect our trade secrets. However, we cannot assure you that these contractual protections and security measures will not be breached, that we will have adequate remedies for any such breach or that our suppliers, employees or consultants will not assert rights to intellectual property arising out of such contracts.

Monitoring unauthorized use of our intellectual property is difficult and costly. In addition, intellectual property rights and confidentiality protection in China is generally considered less effective as in the United States or other developed countries. Unauthorized use of our intellectual property may have occurred or may occur in the future. Although we have taken steps to minimize the risk of this occurring, any such failure to identify unauthorized use and otherwise adequately protect our intellectual property would adversely affect our business.

Moreover, if we are required to commence litigation, whether as a plaintiff or defendant, not only would this be time-consuming, but we would also be forced to incur significant costs and divert our attention and efforts of

17

Table of Contents

our employees, which could, in turn, result in lower revenue and higher expenses. If we pursue litigation to assert our intellectual property rights, an adverse decision in any of these legal actions could limit our ability to assert our intellectual property rights, limit the value of our technology or otherwise negatively impact our business, financial condition and results of operations.

We may face claims of intellectual property infringement, which could be time-consuming, costly to defend or settle, result in the loss of significant rights, harm our relationships with our customers and distributors, or otherwise materially adversely affect our business, financial condition and results of operations.

The semiconductor industry is characterized by companies that hold patents and other intellectual property rights and that vigorously pursue, protect and enforce intellectual property rights. From time to time, third parties may assert against us and our customers and distributors patent and other intellectual property rights to technologies that are important to our business.

Claims that our solutions, processes or technology infringe third-party intellectual property rights, regardless of their merit or resolution, could be costly to defend or settle and could divert the efforts and attention of our management and technical personnel. Infringement claims also could harm our relationships with our customers or distributors and might deter future customers from doing business with us. If any pending or future proceedings result in an adverse outcome, we could be required to:

| • | cease the manufacture, use or sale of the infringing solutions, processes or technology; |

| • | pay substantial damages for infringement; |

| • | expend significant resources to develop non-infringing solutions, processes or technology, which may not be successful; |

| • | license technology from the third-party claiming infringement, which license may not be available on commercially reasonable terms, or at all; |

| • | cross-license our technology to a competitor to resolve an infringement claim, which could weaken our ability to compete with that competitor; or |

| • | pay substantial damages to our customers or end users to discontinue their use of or to replace infringing technology sold to them with non-infringing technology, if available. |

Any of the foregoing results could have a material adverse effect on our business, financial condition and results of operations.

We incorporate third-party technologies for the development of our solutions and our inability to use such technologies in the future would harm our ability to remain competitive.

We rely on third parties for technologies that are integrated into our solutions, such as wafer fabrication and assembly and test technologies used by our contract manufacturers, as well as licensed software specifically designed for integrated circuit design. For example, substantially all of our existing semiconductor products comprising our set-top box solutions are designed based on CPUs designed by a third party. If we are unable to continue to use or license these technologies on reasonable terms, or if these technologies fail to operate properly, we may not be able to secure alternatives in a timely manner or at all, and our ability to remain competitive would be harmed. In addition, if we are unable to successfully license technology from third parties to develop future solutions, we may not be able to develop such solutions in a timely manner or at all.

If we are unable to attract, train and retain qualified design and technical personnel, we may not be able to execute our business strategy effectively.