UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.

(Exact Name of Registrant as Specified in Its Charter)

| ||

(State or other jurisdiction of | (I.R.S. Employer | |

Incorporation or organization) | Identification No.) |

(Address of Principal Executive Offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading symbol(s) |

| Name of each exchange on which registered |

The |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ☐ Yes ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer | ☐ | Accelerated filer | ☐ |

|

|

|

|

☒ | Smaller reporting company | ||

|

|

|

|

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐ Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2021 was approximately $

At July 3, 2022, there were

KIORA PHARMACEUTICALS, INC.

(formerly EyeGate Pharmaceuticals, Inc.)

Table of Contents

ANNUAL REPORT ON FORM 10-K/A

For the Year Ended December 31, 2021

INDEX

EXPLANATORY NOTE

References throughout this Amendment No. 1 to the Annual Report on Form 10-K/A to “we,” “us,” the “Company” or “our company” are to Kiora Pharmaceuticals, Inc., unless the context otherwise indicates.

This Amendment No. 1 (“Amendment No. 1”) to the Annual Report on Form 10-K/A amends the Annual Report on Form 10-K of Kiora Pharmaceuticals, Inc. for the fiscal years ended December 31, 2021 and 2020, as filed with the Securities and Exchange Commission (“SEC”) on April 15, 2022 (the “Original Report”), the Company’s previously issued unaudited condensed consolidated financial statements as of and for the three months ended March 31, 2021, and the three months and year to date periods ended June 30, 2021 and September 30, 2021, which were included in the Company’s Quarterly Reports on Form 10-Q as filed with the SEC on May 12, 2021, August 12, 2021 and November 15, 2021, respectively.

As previously disclosed in the Company’s Current Report on Form 8-K filed with the SEC on May 20, 2022, as part of preparing its condensed consolidated financial statements as of and for the quarter ended March 31, 2022, the Company identified inadvertent misstatements in the accounting for certain contingent consideration.

On May 20, 2022, management and the Audit Committee of the Board of Directors of the Company, after discussion with the Company’s financial and legal advisors, concluded that the previously issued consolidated financial statements of the Company as of and for the years ended December 31, 2021 and 2020, and the quarterly periods ended March 31, 2021, June 30, 2021 and September 30, 2021, (collectively, the “Affected Periods”), should no longer be relied upon. Similarly, the related press releases, the Report of the Independent Registered Public Accounting Firm on the consolidated financial statements as of and for the years ended December 31, 2021 and 2020, and the stockholder communications describing the relevant portions of the Company’s consolidated financial statements for the Affected Periods should no longer be relied upon.

The consolidated financial statements of the Company for the affected periods and the financial information contained in this Form 10-K/A have been adjusted to correct the following misstatements and to correct certain inconsequential clerical errors.

In connection with the Company’s acquisition of Panoptes Pharma Ges.m.b.H (“Panoptes”) in December 2020, shares of the Company’s common stock that were held back at closing and that will be issued on the 18-month anniversary of the acquisition, subject to deduction for any indemnification claims, post-closing adjustments and other specified matters (the “Holdback Shares”), were originally accounted for as contingent consideration and recorded as a liability of $1.353 million. Upon further evaluation, the Company determined that the Holdback Shares should not have been accounted for as contingent consideration and instead recorded as equity as the shares are issuable due to the passage of time. Additionally, upon acquisition, the Company classified an assumed loan payable within contingent consideration that should have been classified as a current liability of $0.212 million. The Company is correcting these misstatements as of December 18, 2020, the acquisition date, resulting in an increase in additional paid in capital of $1.500 million, an increase in goodwill of $0.147 million, and a decrease in contingent consideration of $1.353 million. The Company will be required to pay the former shareholders of Panoptes cash earnout payments in the event developmental milestones are achieved. Due to the effects of a re-evaluation of the probability of success and discount rate for the in-process research and development (“IPR&D”) assets acquired, the Company is recording a reduction in the estimated fair value of the contingent consideration for the year ended December 31, 2021, in the amount of $0.474 million. The fair value of the contingent consideration is re-assessed at each respective balance sheet date with a corresponding adjustment to earnings until the contingency is resolved.

In connection with the Company’s acquisition of Jade Therapeutics, Inc. (“Jade”) in March 2016, the Company is required to pay the former shareholders of Jade a cash earnout payment in the event any product developed by Jade prior to its acquisition, or derivative of such product, subsequently receives FDA approval. However, since a determination, which was made effective in the fourth quarter of fiscal 2020, the Company’s KIO-201 product candidate is now being developed as a drug rather than a device, and the expected development time for KIO-201 has been extended. As a result of that extended timeline, the Company is recording a reduction in the estimated fair value of the contingent consideration for KIO-201 as of December 31, 2020. This reduction in estimated probability weighted fair value resulted in a change in the carrying value of the liability and correspondingly to the change in fair value of contingent consideration as of and for each of the years ended December 31, 2021 and 2020 in the amount of $0.100 million and $1.230 million respectively. The fair value of the contingent consideration is re-assessed at each respective balance sheet date with the corresponding adjustment to earnings until the contingency is resolved. In addition, the Company is re-establishing the fair value of IPR&D for KIO-201 in the amount of $3.912 million by reversing the impairment originally recorded.

1

In connection with the Company’s acquisition of Bayon Therapeutics, Inc. (“Bayon”) in October 2021, the Company determined that the estimated fair value of in-process R&D initially recorded was misstated due to an error in utilizing outdated probability of success rates and discount rates. To correct the misstatement, the Company reevaluated the fair value assigned to the in-process R&D at the acquisition date and updated the probability of success as it relates to cash earnout payments in the event developmental milestones are achieved, updated the discount rate, and adjusted the expected future income. This resulted in an increase to the in-process R&D of $0.302 million and deferred tax liability of $0.076 million and a reduction to goodwill of $0.607 million, and contingent consideration of $0.381 million.

After reflecting the corrections above, the Company reperformed its impairment analysis of indefinite-lived intangible assets and goodwill. Goodwill was determined to be fully impaired and since goodwill is evaluated at the reporting unit level, this resulted in the impairment of the goodwill recently acquired in the acquisition of Bayon of $0.407 million.

Within the restated consolidated financial statements, the Company has also corrected immaterial errors related to the classification of the change in fair value of contingent consideration and gain on disposal of a foreign entity from other income to operating income within the accompanying consolidated statement of operations and comprehensive loss for the years ended December 31, 2021 and 2020.

See Note 2 - Restatement of previously issued consolidated financial statement to the Notes to Consolidated Financial Statements included in Part II, Item 8 of this Amendment No. 1 for additional information on the restatements and the related consolidated financial statement effects.

Items Amended in this Form 10-K/A

This Form 10-K/A presents the Original Report, amended, and restated with modifications as necessary to reflect the restatements. The following items have been amended to reflect the restatement:

Part I, Item 1A. Risk Factors

Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Part II, Item 8. Consolidated Financial Statements

Part II, Item 9A. Controls and Procedures

Part IV, Item 15. Exhibits and Consolidated Financial Statement Schedules

Further, in connection with the filing of this Form 10-K/A and pursuant to the rules of the SEC, the Company’s Chief Executive Officer has provided a new certification dated as of the date of this filing in connection with this Form 10-K/A. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications and to include the consent by EisnerAmper LLP, the Company’s Independent Registered Public Accounting Firm.

Except as described above, this Form 10-K/A does not amend, update, or change any other items or disclosures in the Original Report and does not purport to reflect any information or events after the filing thereof. As such, this Form 10-K/A speaks only as of the date the Original Report was filed, and we have not undertaken herein to amend, supplement or update any information contained in the Original Report to give effect to any subsequent events. Accordingly, this Form 10-K/A should be read in conjunction with our filings made with the SEC after the filing of the Original Report, including any amendment to those filings.

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K/A contains statements that are not statements of historical fact and are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The forward-looking statements are principally, but not exclusively, contained in “Item 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about management’s confidence or expectations, and our plans, objectives, expectations, and intentions that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “goals,” “sees,” “estimates,” “projects,” “predicts,” “intends,” “think,” “potential,” “objectives,” “optimistic,” “strategy,” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | the timing and success of preclinical studies and clinical trials conducted by us and our development partners; |

| ● | the ability to obtain and maintain regulatory approval of our product candidates, and the labeling for any approved products; |

| ● | the scope, progress, expansion, and costs of developing and commercializing our product candidates; |

| ● | the size and growth of the potential markets for our product candidates and the ability to serve those markets; |

| ● | our expectations regarding our expenses and revenue, the sufficiency of our cash resources and needs for additional financing; |

| ● | the rate and degree of market acceptance of any of our product candidates; |

| ● | our expectations regarding competition; |

| ● | our anticipated growth strategies; |

| ● | our ability to attract or retain key personnel; |

| ● | our ability to establish and maintain development partnerships; |

| ● | our expectations regarding federal, state and foreign regulatory requirements; |

| ● | regulatory developments in the U.S. and foreign countries; |

| ● | our ability to obtain and maintain intellectual property protection for our product candidates; |

| ● | the anticipated trends and challenges in our business and the market in which we operate; and |

| ● | the impact of the evolving COVID-19 pandemic and the global response thereto. |

We discuss many of these risks in detail under the heading “Item 1A. Risk Factors” beginning on page 21 of this Annual Report on Form 10-K/A. You should carefully review all of these factors, as well as other risks described in our public filings, and you should be aware that there may be other factors, including factors of which we are not currently aware, that could cause these differences.

Also, these forward-looking statements represent our estimates and assumptions only as of the date of this report. We may not update these forward-looking statements, even though our situation may change in the future, unless we have obligations under the federal securities laws to update and disclose material developments related to previously disclosed information.

Kiora Pharmaceuticals, Inc. is referred to herein as “we,” “our,” “us,” and “the Company.”

3

PART I

Item 1. Business.

Overview

We are a clinical-stage specialty pharmaceutical company developing and commercializing therapies for the treatment of ophthalmic diseases. We were formed as a Delaware corporation on December 26, 2004 under the name of EyeGate Pharmaceuticals, Inc., and changed our name to Kiora Pharmaceuticals, Inc. effective November 8, 2021. We were originally incorporated in 1998 under the name of Optis France S.A. in Paris, France.

Our lead product is KIO-301 with an initial focus on patients with later stages of disease progression due to Retinitis Pigmentosa (any and all sub-forms). KIO-301 is a potential vision-restoring small molecule that acts as a “photoswitch” specifically designed to restore vision in patients with inherited and age-related degenerative retinal diseases. The molecule is specifically designed to restore the eyes’ ability to perceive and interpret light in visually impaired patients. It selectively enters viable downstream retinal ganglion cells (no longer receiving electrical input due to degenerated rods and cones) and is intended to turn them into light sensing cells, capable of signaling the brain as to the presence or absence of light. We expect to initiate a Phase 1b clinical trial in the third quarter of 2022. On March 17, 2022, we were granted Orphan Drug Designation by the United States (“U.S.”) Food and Drug Administration (“FDA”) for the Active Pharmaceutical Ingredient (“API”) in KIO-301. KIO-301 (formerly known as B-203) was acquired through the Bayon Therapeutics, Inc. (“Bayon”) transaction which closed October 21, 2021.

KIO-101 is a product that focuses on patients with Ocular Presentation of Rheumatoid Arthritis (“OPRA”). KIO-101 is a next-generation, non-steroidal, immuno-modulatory, small-molecule inhibitor of Dihydroorotate Dehydrogenase (“DHODH”) with what we believe to be best-in-class picomolar potency and a validated immune modulating mechanism designed to overcome the off-target side effects and safety issues associated with commercially available DHODH inhibitors. In the fourth quarter of 2021, we reported top-line safety and tolerability data from a Phase 1b proof-of-concept (“POC”) study evaluating KIO-101 in patients with ocular surface inflammation. We expect to initiate a Phase 2 clinical trial in the second half of 2022. KIO-101 (formerly known as PP-001) was acquired through the acquisition of Panoptes Pharma Ges.m.b.H “Panoptes” in the fourth quarter of 2020.

In addition, we are developing KIO-201, for patients undergoing PRK surgery for corneal wound repair after refractive surgery. KIO-201 is a modified form of the natural polymer hyaluronic acid, designed to protect the ocular surface to permit re-epithelialization of the cornea and improve and maintain ocular surface integrity. KIO-201 has unique properties that help hydrate and protect the ocular surface.

Market Opportunity

Retinitis Pigmentosa Market Overview

More than 3.4 million patients globally are estimated to have an inherited retinal disease leading to significant or permanent vision loss. Retinitis Pigmentosa (“RP”), the largest family of these inherited diseases, had a global prevalence of 2.3 million in 2019. RP is a group of hereditary progressive disorders that may be inherited as autosomal recessive, autosomal dominant or X-linked recessive traits. Maternally inherited variants of RP transmitted via the mitochondrial DNA can also exist. About half of all RP cases are isolated (that is, they have no family history of the condition). RP may appear alone or in conjunction with one of several other rare disorders. Patients with RP have a progressive loss of photoreceptors (rods and cones) and therefore patients with late-stage RP have a substantial loss of peripheral and central visual function.

RP affects about 1 in 3,500 people worldwide. Thus, with a population of about 328 million in the United States as of December 2019, about 93,700 people in the U.S. have RP. With a worldwide population presently estimated at over 7.05 billion, it can be estimated that approximately 2 million people around the world have RP.

While no approved therapies are available for the treatment of RP, current therapeutics in development primarily rely on genetic approaches to introduce light sensing channels into viable downstream cells, a field termed optogenetics. KIO-301 is a small molecule photoswitch, that confers light sensitivity to downstream cells, specifically the Retinal Ganglion Cells (“RGC”s), potentially triggering the same phototransduction signaling as if the photoreceptors were present and viable.

4

Our Solution: KIO-301

KIO-301 is a novel small molecule with the potential to confer light sensitivity to patients with degenerated retinas due to either inherited or age-related diseases, which has received Orphan Drug Designation from the U.S. FDA. Many retinal diseases result in the death of the retinal photoreceptors, the light sensing cells in the retina. However, downstream retinal neurons, such as the bipolar and RGCs remain viable for long periods after photoreceptor death. KIO-301 selectively enters these cells and non-covalently resides on the intracellular domains of potassium and HCN voltage gated ion channels. As KIO-301 has an azobenzene core, visible light causes a rapid and reversible change in the isomeric state of the molecule, transforming from a linear molecule to an orthogonal molecule. When this happens, the voltage gated ion channels and current efflux are blocked, causing cellular depolarization and signaling to the brain as to the presence of light. When light is no longer touching the molecule, it reverts back to its linear state, allowing ion efflux from the cells and thus promoting repolarization and a turning “off” of the brain signaling.

This novel mechanism of action enables potential application to multiple diseases. RP is a group of inherited eye diseases that cause photoreceptor cell death. In the U.S., RP is considered an orphan disease with a prevalence of <200,000. This prevalence enables consideration for KIO-301 to qualify for Orphan Drug Designation (“ODD”) in the treatment of RP, conferring increased regulatory collaboration with the FDA and market exclusivity if clinical trials demonstrate safety and efficacy. On March 17, 2022, we were granted Orphan Drug Designation by the U.S. FDA for the active ingredient in KIO-301. Currently, no therapeutics are approved to treat patients with RP.

A possible market expansion from RP would be to evaluate KIO-301 in patients with Geographic Atrophy (“GA”), the late stage of age-related dry macular degeneration. There are about 1,000,000 patients in the U.S. with GA and to date, no therapeutics are approved to treat this disease.

Ocular Presentation of Rheumatoid Arthritis Market Overview:

Patients with systemic autoimmune diseases including Rheumatoid Arthritis (“RA”), are known to suffer from ocular presentation of their underlying autoimmune conditions. Secondary to inflammation and associated pathologies in the joint synovium, the eye carries significant morbidity and impact on eye health and quality of life. These ocular presentations can include signs and symptoms similar to keratoconjunctivitis sicca (“KCS”), episcleritis, scleritis, peripheral ulcerative keratitis (“PUK”), anterior uveitis, as well as retinal vasculitis. In patients with OPRA, the surface of the eye often has significant irritation accompanied by symptoms of soreness, grittiness, light sensitivity and dryness. Patients with RA suffer from ocular signs and symptoms at a rate reported to be 2-3X that of the general population. Furthermore, in those OPRA patients, up to 50% report moderate to severe signs and symptoms. Today, there are approximately 1.8 million RA patients in the USA. Approximately 1/3rd of these patients present with OPRA (~0.5 million in the USA), with >90% seeking prescription medication to address these ophthalmic manifestations. Unfortunately, todays ocular surface anti-inflammatory medicines are usually not sufficient to treat OPRA as they are broad and not targeted to the underlying pathophysiology.

As noted above, KIO-101 is a member of a family of DHODH inhibitors, known to be disease modifying agents in autoimmune diseases. RA, as well as OPRA, are t-cell mediated auto-inflammatory diseases and whilst rheumatologists are helping the systemic manifestations of this disease with approved targeted t-cell modulators, including DHODH inhibitors, ophthalmologists do not have the same toolbox of treatments designed specifically to help patients with ocular presentation.

Our Solution: KIO-101

KIO-101 is a third-generation small molecule DHODH inhibitor. DHODH is extensively exploited as potential drug targets for immunological disorders, oncology, and infectious diseases. DHODH is a key enzyme in the de novo pyrimidine synthesis pathway. This enzyme is located in the mitochondria and catalyzes the conversion of dihydroorotate (“DHO”) to orotate as the fourth step in the de novo synthesis of pyrimidines that are ultimately used in the production of nucleotides.

Nucleotides are required for cell growth and replication. Nucleotides are the activated precursors of nucleic acids and are necessary for the replication of the genome and the transcription of the genetic information into RNA. Nucleotides also serve as an energy source for a more select group of biological processes (ATP and GTP). They also play a role in the formation of glycogen, signal-transduction pathways, and as components of co-enzymes (NAD and FAD). An ample supply of nucleotides in the cell is essential for all cellular processes.

There are two pathways for the biosynthesis of nucleotides: salvage and de novo. The main difference is where the nucleotide bases come from. In the salvage pathway, the bases are recovered (salvaged) from RNA and DNA degradation. In the de novo pathway, the bases are assembled from simple precursor molecules (made from scratch).

5

One critical requirement of fast-growing or proliferating cells, such as the expansion of activated B and T-cells, cancer cells, and pathogen infected host cells, is the requirement of an abundance of nucleotide bases. These metabolic activities will predominately utilize the de novo pathway for nucleotide biosynthesis. A key advantage of DHODH inhibition is the selectivity towards metabolically activated cells (with a high need for RNA and DNA production), which should mitigate any negative impact on normal cells. Depletion of cellular pyrimidine pools through the selective inhibition of DHODH has been shown to be a successful approach for therapeutic development.

Currently, two first generation DHODH inhibitors have been approved in the U.S. and abroad and are marketed by Sanofi as leflunomide (Arava®) and the active metabolite teriflunomide (Aubagio®). These oral tablets are approved for the treatment of rheumatoid and psoriatic arthritis and multiple sclerosis (“MS”), respectively. These diseases are autoimmune disorders. One potential explanation for the therapeutic effects of Arava® in arthritis is the reduction in the numbers or reactivity of activated T-cells, which are involved in the pathogenesis of arthritis. The generally accepted view of human MS pathogenesis implicates peripheral activation of myelin-specific autoreactive T-cells that lead to inflammatory disease in the central nervous system (“CNS”). By blocking the de novo pyrimidine synthesis pathway via DHODH inhibition, it is suggested that Aubagio® reduces T-cell proliferation in the periphery. Arava® and Aubagio® are formulated as oral drugs and it is established that leflunomide will be metabolized in the liver to the active metabolite teriflunomide. Hepatotoxicity was reported as a major side effect after oral administration, possibly as a result of the extent of liver metabolism. Moreover, it was shown that apart from DHOHD, a series of protein kinases are inhibited by Arava® and Aubagio®.

Ocular Surgery Market Overview:

There are multiple surgical procedures involving the ocular surface that have long recovery, whereby acceleration of that period would benefit the patients. Photorefractive keratectomy (“PRK”) surgery is an efficacious alternative to patients seeking surgical correction of refractive errors who are not suitable candidates for LASIK due to inadequate corneal thickness, larger pupil size, history of KCS, or anterior basement membrane disease. PRK surgery involves controlled mechanical removal of corneal epithelium with subsequent excimer laser photoablation of the underlying Bowman’s layer and anterior stroma, including the subepithelial nerve plexus.

The military prefers PRK as a refractive procedure due to the stability of the PRK incision and the absence of risk for flap dislocation during military active duty. Although this procedure yields desirable visual acuity results, common complications of the procedure include post-operative pain secondary to the epithelial defects, risk of corneal infection prior to re-epithelization of the large epithelial defect, corneal haze formation, decreased contrast sensitivity, and slower visual recovery. The number of laser vision correction procedures is on the rise, estimated in 2021 at over 2.1 million in the USA, according to the literature. Whilst PRK comprises a fraction of these procedures, there are about 160,000 surgeries performed annually in the USA. These surgeries are heavily consolidated to a few corporate umbrellas, such as TLC Laser Eye Centers, enabling a targeted commercial campaign once a therapeutic is approved.

Keratoconus is an orphan disease of the ocular surface, affecting approximately 165,000 patients in the US alone. Keratoconus progression involves the structure of the cornea which bulges outward, directly affecting vision. Whilst the etiology of the disease is unknown, there are multiple approaches to helping these patients, involving the use of vision correction prothesis such as contact lenses and glasses, to surgical approaches involving collagen cross-linking the corneal surface to provide more rigidity and slow progression. One of these corneal cross-linking approaches, termed epi-off, involves the removal of about 8 mm of the epithelium on the cornea and a riboflavin solution is applied to the exposed corneal stroma. This procedure is not free of side effects, which often include as corneal infections, subepithelial haze, sterile infiltrates, reactivation of herpetic keratitis, and endothelial damage. Thus, accelerating the re-epithelialization would carry significant value.

Our Solution: KIO-201

KIO-201 is a synthetic modified hyaluronic acid (“HA”) capable of coating the ocular surface and designed to resist degradation under conditions present in the eye. This prolongs residence time of the bandage on the ocular surface, thereby addressing one of the limitations of current non-cross-linked hyaluronic acid formulations. Additionally, cross-linking allows the product’s viscosity to be modified to meet optimum ocular needs. The improved viscoelasticity and non-covalent muco-adhesive interfacial forces improve residence time in the tear film, thus providing a coating that aids re-epithelization of the ocular surface via physical protection. If KIO-201 is approved by the FDA, we expect that it will be the only wound healing prescription eye drop available in the U.S. based on HA.

6

KIO-201 exhibits significant shear thinning properties. This feature allows the modified HA to act as a more concentrated, viscous barrier at low shear rates in a resting tear film, but also as a lower resistance fluid (therefore thinned) during high shear events such as blinking. This property enables better residence time and a more favorable ocular surface coating with less optical blur. We have demonstrated in animal studies that KIO-201 remains on the ocular surface for up to two hours and further demonstrated in a human clinical study that KIO-201 does not cause blurriness while on the ocular surface. This enhances ocular surface protection and patient comfort, while maintaining good visual function.

KIO-201 has been shown to provide a mechanical barrier that aids in the management of corneal epithelial defects and re-epithelization in both preclinical studies and in clinical ophthalmic veterinary use. As such, PRK surgery was chosen as the subject population which is best suited to demonstrate this effect. PRK is an efficacious alternative to patients seeking surgical correction of refractive errors who are not suitable candidates for laser in situ keratomileusis (“LASIK”) due to inadequate corneal thickness, larger pupil size, history of keratoconjunctivitis sicca (“KCS”), or anterior basement membrane disease. KIO-201 has demonstrated statistical significance in a pivotal clinical study for its ability to accelerate wound healing against the current standard-of-care, a bandage contact lens.

A possible market expansion from PRK surgical recovery would be to evaluate KIO-201 in patients with keratoconus, an ocular disease that affects the structure of the cornea and can cause blindness. Currently patients undergo a mechanical reshaping of the cornea, however this approach causes significant damage to the epithelial layer. As KIO-201 has demonstrated the ability to accelerate wound healing to the ocular surface, the underlying mechanism of action would be a congruent fit. There are about 170,000 patients in the U.S. with keratoconus.

Our Strategy

Our goal is to develop products for treating disorders of the eye. The key elements of this strategy are to:

| ● | Development of Core Assets |

| ● | Initiate clinical development of KIO-301 in a Phase 1b clinical study in patients with later stage Retinitis Pigmentosa. |

| ● | Continue clinical development of KIO-101 for the treatment of the ocular manifestations of autoimmune diseases (e.g., rheumatoid arthritis). In the fourth quarter of 2021, we announced top-line safety and tolerability data from our Phase 1b study, which supports advancing KIO-101 to a Phase 2 study. |

| ● | Confirm regulatory path for KIO-201 in patients undergoing PRK surgery with the FDA. |

| ● | Expand Portfolio through Collaborations |

| ● | Pursue strategic collaborations to further the Company’s existing assets with respect to new indication potential and more detailed mechanism of action, which can result in new intellectual property. |

7

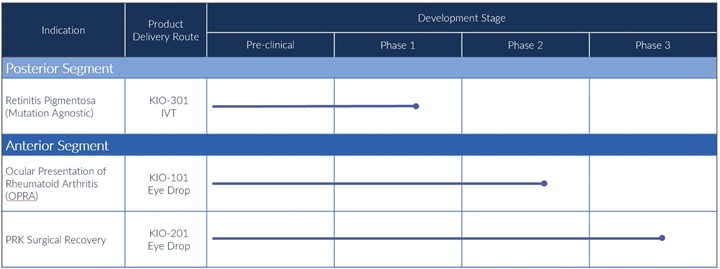

Our Development Pipeline

Clinical Development

KIO-101: Ocular Presentation of Rheumatoid Arthritis (OPRA)

Mechanism of Action

KIO-101 is a promising novel third generation DHODH inhibitor, with a half-maximal inhibitory concentration IC50-value of 0.3 nM. Based on internal work completed, we believe this means that 1,000-fold more potent than teriflunomide (IC50 DHODH 415 nM). Furthermore, KIO-101 suppresses the expression of key pro-inflammatory cytokines such as IL-17, IFN-g,VEGF and others, potentially as a consequence of inhibiting DHODH. IL-17 and IFN-g are the hallmark cytokines expressed by Th1 and Th17 T-cells, respectively, and play a crucial role in initiating the inflammatory processes in several ocular diseases, including dry eye disease (including the association with autoimmune conditions such as rheumatoid arthritis) and non-noninfectious uveitis. KIO-101 is structurally and mechanistically different from Arava®, a drug currently approved by the FDA for the treatment of rheumatoid arthritis. The IC50 of KIO-101 on selected tyrosine kinases, such as PI3K, AKT and JAK, is more than 10,000-fold above the IC50 of KIO-101 for DHODH. In general, side effects are not expected and have not been observed to date in animal and human studies after KIO-101 administration.

8

The postulated mode of action of KIO-101 is depicted below.

Phase 1b:

The results of a Phase 1b study of KIO-101 eye drops in adults with and without ocular surface inflammation were reported in the fourth quarter of 2021.

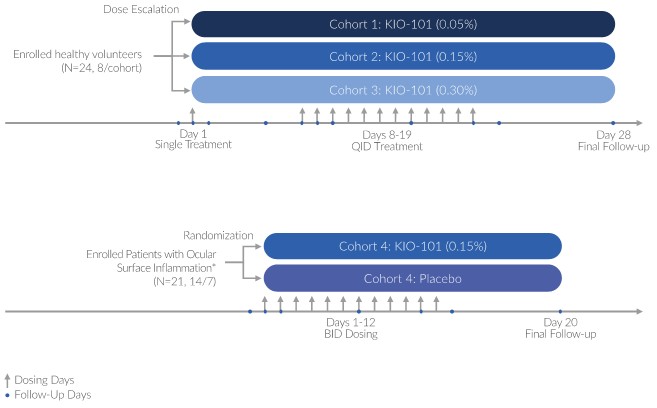

Design

The first part of this single center, randomized, double-masked study was to explore safety and tolerability of KIO-101 in a healthy population and the second part was to investigate a potential efficacy signal in patients with ocular surface inflammation and hyperemia. Part 1 (cohorts 1 through 3) consisted of healthy volunteers receiving dose escalating concentrations of KIO-101 as noted on the figure below. Specifically, healthy volunteers were repeatedly treated with ascending doses of KIO-101 (0.05%, 0.15%, 0.30%) and placebo eyedrops. Subjects receiving 0.05% and 0.15% eyedrops showed excellent tolerability. Both doses can be used for future studies in patients having an infection or inflammation on the ocular surface. No Severe Adverse Events (“SAE”s) or severe ocular Adverse Events (“AE”s) were reported in any patients. In the 0.3% group, two patients withdrew for epistaxis and further dosing in the entire 0.3% group was stopped. No lab abnormalities in these two or any patients were observed and further toxicology studies are ongoing, including the 0.3% dose.

In the second part (cohort 4) of this study, 21 patients diagnosed with ocular surface inflammation, a key driver of ocular surface disease including dry eye disease, were evaluated. These patients were treated BID for 12 days with 0.15% of KIO-101 (n=14) or vehicle (n=7). The key inclusion criteria were conjunctival hyperemia score >2 (on the Efron scale of 0-5) and an Ocular Surface Disease Index (OSDI) score of > 22. Primary endpoints included safety and tolerability. Secondary and exploratory endpoints included pharmacokinetics of KIO-101 as well as change from baseline in OSDI, conjunctival hyperemia, tear break up time (“TBUT”), corneal staining (Fluorescein), and conjunctival staining (Lissamine Green), ocular discomfort, lid edema, lid erythema.

9

Study Results

The results demonstrated favorable safety and tolerability of KIO-101, as well as statistically significant improvements in conjunctival hyperemia, a key inclusion criterion for the 21 patients enrolled with ocular surface inflammation and a recognized clinical sign in patients with ocular surface inflammation. At Day 13, 100% (Figure X below) of patients treated with KIO-101 (14/14) saw a reduction >1 from baseline, measured on the Efron scale (0-5), versus only 42.8% with vehicle control (3/7) (p < 0.006). The mean reduction in conjunctival hyperemia score from baseline to Day 13 demonstrated statistically significant difference in active treatment vs. vehicle control groups (-1.055 vs. -0.604; p = 0.0316). This apparent drug effect on conjunctival hyperemia was lost when patients were assessed at the Day 20 post-treatment follow-up, which occurred 8 days after the last dose was administered, further supporting a potential positive drug effect. There was a numerical trend favoring KIO-101 in ocular surface disease index (“OSDI”), but no statistically significant differences were observed in TBUT, corneal staining, conjunctival staining nor other exploratory endpoints. A larger sample size and dosing period longer than two weeks will likely be necessary to effectively evaluate a statistical drug effect on these additional efficacy endpoints.

10

Figure X: Percent of patients with reduction of >1

No Severe Adverse Events (SAEs) or severe ocular Adverse Events (AEs) were reported. In the 0.3% group, 2 patients withdrew for epistaxis (nose bleeds) and dosing was stopped, with no lab abnormalities in these 2 or any patients observed. In cohort 4, no difference was observed in the frequency of ocular AEs in active vs. control.

Clinical Development Plan

We expect to initiate a Phase 2 clinical trial with KIO-101 eye drops in the second half of 2022 in patients with ocular manifestations of systemic autoimmune conditions, including but may not be limited to dry eye disease associated with rheumatoid arthritis.

KIO-101: Non-Infectious Posterior Uveitis

Phase 1a/2b Safety Study:

A first in human clinical study to evaluate the safety of intravitreally applied KIO-101 in patients with chronic, non-infectious uveitis was conducted and the final study report was completed in 2021.

Design

KIO-101 was applied as a single, intravitreal injection of 300, 600 and 1,200 ng per eye. The primary objective of the study was to assess the safety and tolerability of ascending doses of KIO-101 in patients. The secondary objectives were to assess improvement of intraocular inflammation and to evaluate the pharmacokinetics of KIO-101 in patients. For this study, KIO-101 was formulated as a sterile, aqueous solution for intravitreal injection.

The purpose of this study was to assess safety, pharmacokinetic (“PK”), and efficacy data of 12 treated patients. KIO-101 showed an excellent safety profile and promising efficacy signals in improvement of inflammatory parameters and visual acuity in uveitis patients.

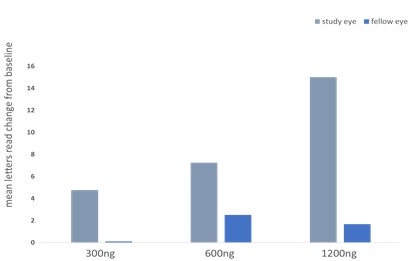

Study Results

The assessment of the evaluated efficacy parameters shows a clear dose dependent treatment effect in improvement of visual acuity at day 14 post dosing. Figure 1 shows the mean change in letters read from baseline for patients treated in cohorts 1, 2, and 3 (300, 600, and 1,200 ng per eye).

11

Figure 1: Improvement of visual acuity in cohorts 1, 2, and 3 at day 14 post dose

Upon analysing only the highest dose group (1,200 ng per eye, cohort 3), a fundamental mean improvement of visual acuity is seen in the patients, which started within the first week post injection (Day 7) and lasted beyond the last study visit (Day 28). Figure 2 shows the mean letters read change from baseline to study Days 7, 14, and 28 for patients treated in cohort 3.

Figure 2: Improvement of visual acuity in cohort 3 on study days 7, 14, and 28

Apart from improved visual acuity, improvements in vitreous haze and reduction in macular edema were observed in the patients treated with KIO-101. We have no current plan to develop KIO-101 further for this indication.

KIO-201: PRK Surgical Recovery Pivotal Study

Pivotal Study:

In the fourth quarter of 2019, we reported positive topline results from our corneal wound repair pivotal clinical trial of KIO-201 for the corneal re-epithelialization in patients having undergone PRK surgery.

12

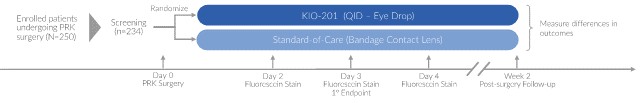

Design

The prospective, controlled study randomized 234 patients undergoing bilateral PRK surgery and was designed to assess safety and efficacy by comparing KIO-201 to the current standard- of-care, a bandage contact lens (“BCL”). The primary endpoint was the proportion of study eyes achieving complete wound closure on Day 3 (and remaining closed). This assessment was evaluated by an independent masked reading center, using digital slit-lamp photographs of fluorescein staining in all treated eyes, and a protocol-driven method to quantify the outcomes.

The enrolled patients were randomized into one of two study groups, with patients receiving the same treatment in both eyes:

| ● | Arm 1 (n=117) was comprised of KIO-201 QID for two weeks after surgery. |

| ● | Arm 2 (n=117) was comprised of BCL administered four times daily. |

Study Results

KIO-201 demonstrated superiority for the primary endpoint with a p-value of 0.0203. The statistical significance measurement was based on the number of patients in each arm that achieved complete corneal defect closure three days post refractive surgery. At Day 3, 80.2% of eyes receiving the KIO-201 treatment regimen were completely healed, compared with 67.0% for BCL. Additionally, at Day 2, the average wound size for all eyes treated with KIO-201 was 3.61 mm2, compared to 6.66 mm2 for eyes treated with BCL, which is 46% smaller than the standard-of-care as noted in the graph below. As described further, the use of KIO-201 resulted in smaller wounds in the acute healing phase after PRK surgery compared to the standard of care (bandage contact lenses, BCL). This data gives confidence that patients will be able to resume normal activities earlier when treated with KIO-201 compared to BCL.

13

Clinical Development Plan

We expect to determine regulatory status of KIO-201 through discussions with the FDA in the second half of 2022.

KIO-201: Punctate Epitheliopathies with a Focus on Dry Eye

Follow-On Pilot Study:

In the first quarter of 2020, we reported positive topline results from the follow-on clinical trial of KIO-201 evaluating the potential to help clinicians better manage patients with dry eye.

Design

This positive controlled, investigator masked study enrolled 20 patients, or 40 eyes, with dry eye. This study confirmed the ability of KIO-201 eye drops to demonstrate improvement of the ocular surface for several important ophthalmic endpoints. KIO-201 eye drops showed an improvement in central corneal region staining, high order ocular aberrations (“HOA”) and best corrected visual acuity (“BCVA”), outperforming the positive control, Allergan’s Refresh Plus Preservative-Free (“Refresh Plus”) lubricant eye drop.

Prior to randomization there was a one-week run in period where all patients took Refresh eye drops only in both eyes. Patients with a corneal staining score of ≥4, using the NEI scale, and a TBUT of ≤7 seconds at Day 0, or at the end of the 7-day run-in period, then entered the 14-day treatment phase. To be randomized at Day 0, both eyes had to qualify and have similar scores for staining and TBUT. The patient acted as their own control and one eye was treated with Refresh Plus eye drops and the other eye was treated with KIO-201 eye drops.

The twenty enrolled patients had one eye randomized to the KIO-201 treatment group and the other eye randomized to the Refresh Plus treatment group, for a total of 40 eyes randomized:

| ● | Arm 1 (n=20 eyes) received KIO-201 eye drops four times daily for four weeks. |

| ● | Arm 2 (n=20 eyes) received Refresh Plus eye drops four times daily for four weeks. |

The primary endpoint was based on corneal epithelial healing as measured by fluorescein staining. Punctate epithelial erosions are a sign of epithelial compromise (corneal barrier disruption) which is characterized by a breakdown of the epithelium of the cornea and an increased permeability to fluorescein dye. Thus, fluorescein dye is used to clinically evaluate the severity of corneal barrier disruption. The National Eye Institutes (“NEI”) scale was used, which divides the cornea into five different regions. Each region was scored on a scale from 0 to 3 for a total maximum score of 15 (a higher score represented a more severe disruption of the corneal barrier). To be randomized into the study, each eye had to have a minimum total score of 4.

14

Study Results

At all visits, all corneal regions were assessed, but of particular interest due to vision quality involvement and corneal sensitivity, is the central region of the cornea. All 20 patients randomized had a minimum scoring for the whole cornea (i.e., all 5 regions) of at least 4 (maximum score = 15) in both eyes, and 16 of these patients also had a minimum score of at least 1 (maximum score = 3) in the central region of the cornea in both eyes. KIO-201 demonstrated a positive treatment effect as compared to Refresh Plus at both Day 7 and Day 14. The overall improvement (i.e., reduction in staining) at Day 14 was approximately 27% from baseline versus only approximately 9% for the positive control, Refresh Plus eye drops. KIO-201 also showed improvement more quickly than Refresh Plus eye drops with an approximately 10% reduction in staining versus an increase in staining of approximately 7% for the Refresh Plus treatment group.

15

The uniqueness of KIO-201 is the combination of the high viscosity profile with a high shear rate. This means that with blinking or other sources of shearing or energy that the viscosity of KIO-201 temporarily drops. Thus, this clinical study was also used to confirm that KIO-201 does not result in blurriness of vision while on the eye. After all endpoint assessments were completed, one drop of KIO-201 and one drop of Refresh Plus was instilled onto each eye. This was completed in a masked fashion based on randomization of each eye per drop. BCVA measurements were taken at 30 and 60 minutes to determine if instillation of either KIO-201 or Refresh Plus caused blurriness or a change in vision. At all assessment time points there was essentially no change in BCVA for KIO-201 or Refresh Plus, but KIO-201 did perform better than Refresh Plus. At 30 minutes post instillation, KIO-201 saw a negative change of 0.4% versus a negative change of 1.0% for Refresh Plus. At 60 minutes, KIO-201 had a positive effect of 0.2% versus a negative effect of 0.3% for Refresh Plus. We have no current plan to develop KIO-201 further for this indication.

Intellectual Property and Proprietary Rights

Overview

We are building an intellectual property portfolio for our KIO-101, KIO-201, and KIO-301 platforms and any other product candidates that we may develop, as well as other devices and product candidates for treatment of ocular indications in the U.S. and abroad. We currently seek, and intend to continue to seek, patent protection in the U.S. and internationally for our product candidates, methods of use, and processes for manufacture, and for other technologies, where appropriate. Our current policy is to actively seek to protect our proprietary position by, among other things, filing patent applications in the U.S. and abroad relating to proprietary technologies that are important to the development of our business. We also rely on, and will continue to rely on, trade secrets, know-how, continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position. We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our technology.

Our success will depend significantly on our ability to obtain and maintain patent and other proprietary protection for the technologies that we consider important to our business, our ability to defend our patents, and our ability to preserve the confidentiality of our trade secrets and operate our business without infringing the patents and proprietary rights of third parties.

16

Patent Portfolio

Our patent portfolio includes drug delivery device patents directed to KIO-101 as composition-of-matter, formulations thereof and its therapeutic uses in the treatment of ocular disorders and diseases and more. In addition, KIO-301 holds a patent portfolio consisting of platform enabling IP, composition-of-matter, methods of use, and formulations thereof. These issued patents will expire between 2023 and 2036. Given the amount of time required for the development, testing and regulatory review of new product candidates, patents protecting such candidates might expire before or shortly after such candidates are commercialized. As a result, our owned and licensed patent portfolio may not provide us with sufficient rights to exclude others from commercializing products similar or identical to ours. In the future, we intend to apply for restorations of patent term for some of our currently owned or licensed patents to add patent life beyond their current expiration date, depending on the expected length of clinical trials and other factors involved in the submission of the relevant new drug application or NDA. See “Government Regulation—Patent Term Restoration and Marketing Exclusivity” below.

We hold seven U.S. patents and 40 international patents.

License Agreements

We are a party to seven license agreements as described below. These license agreements require us to pay or receive royalties or fees to or from the licensor based on revenue or milestones related to the licensed technology.

On July 2, 2013, we (through our subsidiary, Kiora Pharmaceuticals, GmbH) entered into a patent and know-how assignment agreement with 4SC Discovery GmbH (“4SC”) transferring to us all patent rights and know-how to the compound KIO-101. We are responsible for paying royalties of 3.25% on net sales of KIO-101.

On July 2, 2013, we (through our subsidiary, Kiora Pharmaceuticals, GmbH) entered into an out-license agreement with 4SC granting 4SC the exclusive worldwide right to commercialize the compound KIO-101 for rheumatoid arthritis and inflammatory bowel disease, including Crohn’s Disease and Ulcerative Colitis. We are eligible to receive milestone payments totaling up to 155 million euros, upon and subject to the achievement of certain specified developmental and commercial milestones. We have not received any milestones from 4SC. In addition, we are eligible to receive royalties of 3.25% on net sales of KIO-101.

On September 12, 2013, we (through our subsidiary, Jade Therapeutics, Inc.) entered into an agreement with Lineage Cell Therapeutics, Inc. (“Lineage”), formerly known as BioTime, Inc. granting to us the exclusive worldwide right to commercialize cross-linked thiolated carboxymethyl hyaluronic acid (“modified HA”) for ophthalmic treatments in humans. The agreement requires us to pay an annual fee of $30,000 and a royalty of 6% on net sales of KIO-201 to Lineage based on revenue relating to any product incorporating the modified HA technology. The agreement expires when patent protection for the modified HA technology lapses in August 2027.

On November 17, 2014, we (through our subsidiary Kiora Pharmaceuticals GmbH) entered into an intellectual property and know-how licensing agreement with Laboratoires Leurquin Mediolanum S.A.S. (“Mediolanum”) for the commercialization of KIO-101 (the “Mediolanum agreement”) in specific territories. Under the Mediolanum agreement, we out-licensed rights to commercialize KIO-101 for uveitis, dry eye and viral conjunctivitis in Italy, and France. This Agreement was amended on December 10, 2015 to also include Belgium and The Netherlands. Under the Mediolanum Agreement, Mediolanum is obligated to pay up to approximately $20.0 million EUROs in development and commercial milestones and a 7% royalty on net sales of KIO-101 in the territories through the longer of the expiry of the valid patents covering KIO-101 or 10 years from the first commercial sale. The royalty is reduced to 5% after patent expiry.

On September 26, 2018, we entered into an intellectual property licensing agreement (the “SentrX Agreement”) with SentrX, a veterinary medical device company that develops and manufactures veterinary wound care products. Under the SentrX Agreement, we in-licensed the rights to trade secrets and know-how related to the manufacturing of KIO-201. The SentrX Agreement enables us to pursue a different vendor with a larger capacity for manufacturing and an FDA-inspected facility for commercialization of a product for human use. Under the SentrX Agreement, SentrX is eligible to receive milestone payments totaling up to $4.75 million, upon and subject to the achievement of certain specified developmental and commercial milestones. The term of the agreement is until the Product is no longer in the commercial marketplace.

17

On May 1, 2020, we (through our subsidiary, Kiora Pharmaceuticals Pty Ltd) entered into an agreement with the University of California (“UC”) granting to us the exclusive rights to its pipeline of photoswitch molecules. The agreement requires us to pay an annual fee to UC of $5,000, as well as payments to UC upon the achievement of certain development milestone and royalties based on revenue relating to any product incorporating KIO-301. The Company is obligated to pay royalties on net sales of two percent (2%) of the first $250 million of net sales, one and a quarter percent (1.25%) of net sales between $250 million and $500 million, and one half of one percent (0.5%) of net sales over $500 million. The agreement expires on the date of the last-to-expire patent included in the licensed patent portfolio which is January 2030.

On May 1, 2020, we (through our subsidiary, Kiora Pharmaceuticals Pty Ltd) entered into an agreement with Photoswitch Therapeutics, Inc. (“Photoswitch”) granting to us access to certain patent applications and IP rights with last-to-expire patent terms of January 2030. The agreement calls for payments to Photoswitch upon the achievement of certain development milestones and upon first commercial sale of the product.

Confidential Information and Inventions Assignment Agreements

We currently require and will continue to require each of our employees and consultants to execute confidentiality agreements upon the commencement of such individual’s employment, consulting, or collaborative relationships with us. These agreements provide that all confidential information developed or made known during the course of the relationship with us be kept confidential and not disclosed to third parties except in specific circumstances.

In the case of employees, the agreements provide that all inventions resulting from such individual’s work performed for us, utilizing our property, or relating to our business and conceived or completed by the individual during employment shall be our exclusive property to the extent permitted by applicable law. Our consulting agreements also provide for assignment to us of any intellectual property resulting from services performed by a consultant for us.

Sales and Marketing

If KIO-101, KIO-201 or KIO-301 is approved by the FDA for commercial sale, we may enter into agreements with third parties to sell KIO-101, KIO-201 or KIO-301, or we may choose to market these directly to physicians in the United States or globally through our own sales and marketing force and related internal commercialization infrastructure. If we market KIO-101, KIO-201 or KIO-301 directly, we will need to incur significant additional expenses and commit significant additional management resources to establish and train an internal sales and marketing force to market and sell KIO-101, KIO-201 or KIO-301.

Manufacturing

We currently do not have an in-house manufacturing capability for our products and as a result, we will depend heavily on third-party contract manufacturers to produce and package our products. We currently do not have any contractual relationships with third-party manufacturers. We intend to rely on third-party suppliers that we have used in the past for the manufacturing of various components that comprise our KIO-101, KIO-201 or KIO-301 and other contemplated clinical trials.

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly advancing technologies, intense competition, and a strong emphasis on proprietary products. While we believe that our technologies, knowledge, experience, and scientific resources provide us with competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions and governmental agencies and public and private research institutions. Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future.

Our potential competitors include large pharmaceutical and biotechnology companies, and specialty pharmaceutical and generic drug companies. Many of our competitors have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, and marketing approved products than we do. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

18

The key competitive factors affecting the success of each of our product candidates, if approved for marketing, are likely to be its efficacy, safety, method of administration, convenience, price, the level of generic competition and the availability of coverage and adequate reimbursement from government and other third-party payors.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than any products that we may develop. Our competitors also may obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for ours, which could result in our competitors’ establishing a strong market position before we are able to enter the market. In addition, our ability to compete may be affected in many cases by insurers or other third-party payors seeking to encourage the use of generic products. Generic products currently being used for the indications that we may pursue, and additional products are expected to become available on a generic basis over the coming years. If our product candidates achieve marketing approval, we expect that they will be priced at a significant premium over competitive generic products.

Government Regulation

FDA Approval Process

In the U.S., pharmaceutical products are subject to extensive regulation by the FDA. The Food Drug and Cosmetic Act (“FDCA”) and other federal and state statutes and regulations, govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling, and import and export of pharmaceutical products. Failure to comply with applicable FDA or other requirements may subject a company to a variety of administrative or judicial sanctions, such as the FDA’s refusal to approve pending applications, a clinical hold, warning letters, recall or seizure of products, partial or total suspension of production, withdrawal of the product from the market, injunctions, fines, civil penalties, or criminal prosecution.

FDA approval is required before any new drug, can be marketed in the U.S. The process required by the FDA before a new drug product may be marketed in the U.S. generally involves:

| ● | completion of preclinical laboratory and animal testing and formulation studies in compliance with the FDA’s good laboratory practice or GLP, regulation; |

| ● | submission to the FDA of an Investigational New Drug or IND, for human clinical testing which must become effective before human clinical trials may begin in the U.S.; |

| ● | approval by an independent institutional review board or IRB, at each site where a clinical trial will be performed before the trial may be initiated at that site; |

| ● | performance of adequate and well-controlled human clinical trials in accordance with good clinical practices, or GCP, to establish the safety and efficacy of the proposed product candidate for each intended use; |

| ● | satisfactory completion of an FDA pre-approval inspection of the facility or facilities at which the product is manufactured to assess compliance with the FDA’s current Good Manufacturing Practice or cGMP regulations; |

| ● | submission to the FDA of a new drug application or NDA, which must be accepted for filing by the FDA; |

| ● | satisfactory completion of an FDA advisory committee review, if applicable; |

| ● | payment of user fees, if applicable; and |

| ● | FDA review and approval of the NDA. |

19

The preclinical and clinical testing and approval process requires substantial time, effort, and financial resources. Pre-clinical tests include laboratory evaluation of product chemistry, formulation, manufacturing and control procedures and stability, as well as animal studies to assess the toxicity and other safety characteristics of the product. The results of preclinical tests, together with manufacturing information, analytical data and a proposed clinical trial protocol and other information, are submitted as part of an IND to the FDA. Some preclinical testing may continue even after the IND is submitted. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, raises concerns or questions and places the clinical trial on a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. A clinical hold may occur at any time during the life of an IND and may affect one or more specific studies or all studies conducted under the IND.

All clinical trials must be conducted under the supervision of one or more qualified investigators in accordance with GCPs. They must be conducted under protocols detailing the objectives of the trial, dosing procedures, research subject selection and exclusion criteria and the safety and effectiveness criteria to be evaluated. Each protocol must be submitted to the FDA as part of the IND, and progress reports detailing the results of the clinical trials must be submitted at least annually. In addition, timely safety reports must be submitted to the FDA and the investigators for serious and unexpected adverse events. An institutional review board or IRB, at each institution participating in the clinical trial must review and approve each protocol before a clinical trial commences at that institution and must also approve the information regarding the trial and the consent form that must be provided to each trial subject or his or her legal representative, monitor the study until completed and otherwise comply with IRB regulations.

Sponsors of clinical trials generally must register and report, at the National Institutes of Health-maintained website ClinicalTrials.gov, the key parameters of certain clinical trials. For purposes of an NDA submission and approval, human clinical trials are typically conducted in the following sequential phases, which may overlap or be combined:

| ● | Phase 1: The product is initially introduced into healthy human patients and tested for safety, dose tolerance, absorption, metabolism, distribution and excretion and, if possible, to gain an early indication of its effectiveness. |

| ● | Phase 2: The product is administered to a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted indications and to determine dose tolerance and optimal dosage. Multiple Phase 2 clinical trials may be conducted by the sponsor to obtain information prior to beginning larger and more extensive clinical trials. |

| ● | Phase 3: These are commonly referred to as pivotal studies. When Phase 2 evaluations demonstrate that a dose range of the product appears to be effective and has an acceptable safety profile, trials are undertaken in large patient populations to further evaluate dosage, to obtain additional evidence of clinical efficacy and safety in an expanded patient population at multiple, geographically-dispersed clinical trial sites, to establish the overall risk-benefit relationship of the product and to provide adequate information for the labeling of the product. |

| ● | Phase 4: In some cases, the FDA may condition approval of an NDA for a product candidate on the sponsor’s agreement to conduct additional clinical trials to further assess the product’s safety and effectiveness after NDA approval. Such post-approval trials are typically referred to as Phase 4 studies. |

The results of product development, preclinical studies and clinical trials, along with descriptions of the manufacturing process, analytical tests conducted on the chemistry of the drug, proposed labeling, and other relevant information are submitted to the FDA as part of an NDA requesting approval to market the product. The submission of an NDA is subject to the payment of user fees; a waiver of such fees may be obtained under certain limited circumstances. The FDA reviews all NDAs submitted to ensure that they are sufficiently complete for substantive review before it accepts them for filing. The FDA may request additional information rather than accept an NDA for filing. In this event, the NDA must be resubmitted with the additional information. The resubmitted application also is subject to review before the FDA accepts it for filing. Once the submission is accepted for filing, the FDA begins an in-depth substantive review.

20

Orphan Drug Designation

Under the Orphan Drug Act, the FDA may grant orphan drug designation to a drug intended to treat a rare disease. A rare disease or condition is defined by the regulatory agency as one affecting fewer than 200,000 individuals in the United States or more than 200,000 individuals where there is no reasonable expectation that the product development cost will be recovered from product sales in the United States. The request form for orphan drug designation must be filed before submitting an NDA and does not convey any advantage in, or shorten the duration of, the regulatory review and approval process. On March 17, 2022, we were granted Orphan Drug Designation by the U.S. FDA for the Active Pharmaceutical Ingredient (“API”) in KIO-301.

If a product with orphan drug designation subsequently receives the first FDA approval for the disease for which it was studied, the sponsor will be entitled to seven years (7) of product marketing exclusivity. This means that the FDA may not approve any other applications to market the same drug for the same indication, except in very limited and rare circumstances, for seven years. If a competitor obtains approval of the same drug, as defined by the FDA, or if KIO-301 is determined to be contained within a competitor’s product for the same indication or disease, the competitor’s exclusivity could block the approval of KIO-301 in the designated orphan indication for seven years, unless superior safety or efficacy of our drug is demonstrated.

Post-Approval Requirements

Once an NDA is approved, a product will be subject to pervasive and continuing regulation by the FDA, including, among other things, requirements relating to product/device listing, recordkeeping, periodic reporting, product sampling and distribution, advertising and promotion and reporting of adverse experiences with the product.

In addition, drug manufacturers and other entities involved in the manufacture and distribution of approved drugs are required to register their establishments with the FDA and state agencies and are subject to periodic unannounced inspections by the FDA and these state agencies for compliance with cGMP requirements. Changes to the manufacturing process are strictly regulated and generally require prior FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations from cGMP and impose reporting and documentation requirements upon us and any third-party manufacturers that we may decide to use. Accordingly, manufacturers must continue to expend time, money, and effort in the area of production and quality control to maintain cGMP compliance.

Once an approval is granted, the FDA may withdraw the approval if compliance with regulatory requirements and standards is not maintained or if problems occur after the product reaches the market. Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with manufacturing processes, or failure to comply with regulatory requirements, may result in, among other things:

| ● | restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market or product recalls; |

| ● | fines, warning letters or holds on post-approval clinical trials; |

| ● | refusal of the FDA to approve pending applications or supplements to approved applications, or suspension or revocation of product license approvals; |

| ● | product seizure or detention, or refusal to permit the import or export of products; or |

| ● | injunctions or the imposition of civil or criminal penalties. |

The FDA strictly regulates marketing, labeling, advertising and promotion of products that are placed on the market. While physicians may prescribe for off label uses, manufacturers may only promote for the approved indications and in accordance with the provisions of the approved label. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off label uses, and a company that is found to have improperly promoted off label uses may be subject to significant liability, both at the federal and state levels.

21

Patent Term Restoration and Marketing Exclusivity

Depending upon the timing, duration and specifics of FDA approval of the use of our drug candidates, some of our U.S. patents may be eligible for limited patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, referred to as the Hatch-Waxman Act. The Hatch-Waxman Act permits a patent restoration term of up to five years (5) as compensation for patent term lost during product development and the FDA regulatory review process. However, patent term restoration cannot extend the remaining term of a patent beyond a total of fourteen (14) years from the product’s approval date. The patent term restoration period is generally one-half the time between the effective date of an IND, and the submission date of an NDA, plus the time between the submission date of an NDA and the approval of that application. Only one patent applicable to an approved drug is eligible for the extension and the application for extension must be made prior to expiration of the patent. The U.S. Patent and Trademark Office, in consultation with the FDA, reviews and approves the application for any patent term extension or restoration. In the future, we intend to apply for restorations of patent term for some of our currently owned or licensed patents to add patent life beyond their current expiration date, depending on the expected length of clinical trials and other factors involved in the submission of the relevant NDA.

Market exclusivity provisions under the FDCA also can delay the submission or the approval of certain applications. The FDCA provides a five-year period of non-patent marketing exclusivity within the U.S. to the first applicant to gain approval of an NDA for a new chemical entity. A drug is a new chemical entity if the FDA has not previously approved any other new drug containing the same active moiety, which is the molecule or ion responsible for the action of the drug substance. During the exclusivity period, the FDA may not accept for review an abbreviated new drug application or ANDA, or a 505(b)(2) NDA submitted by another company for another version of such drug where the applicant does not own or have a legal right of reference to all the data required for approval. However, an application may be submitted after four years if it contains a certification of patent invalidity or non-infringement. The FDCA also provides three years of marketing exclusivity for an NDA, 505(b)(2) NDA, or supplement to an approved NDA, if new clinical investigations, other than bioavailability studies, that were conducted or sponsored by the applicant are deemed by the FDA to be essential to the approval of the application, for example, for new indications, dosages or strengths of an existing drug. This three-year exclusivity covers only the conditions associated with the new clinical investigations and does not prohibit the FDA from approving ANDAs for drugs containing the original active agent. Five-year and three-year exclusivity will not delay the submission or approval of a full NDA; however, an applicant submitting a full NDA would be required to conduct or obtain a right of reference to all of the preclinical studies and adequate and well-controlled clinical trials necessary to demonstrate safety and effectiveness.

Manufacturing Requirements