As filed with the Securities and Exchange Commission on September 25, 2017

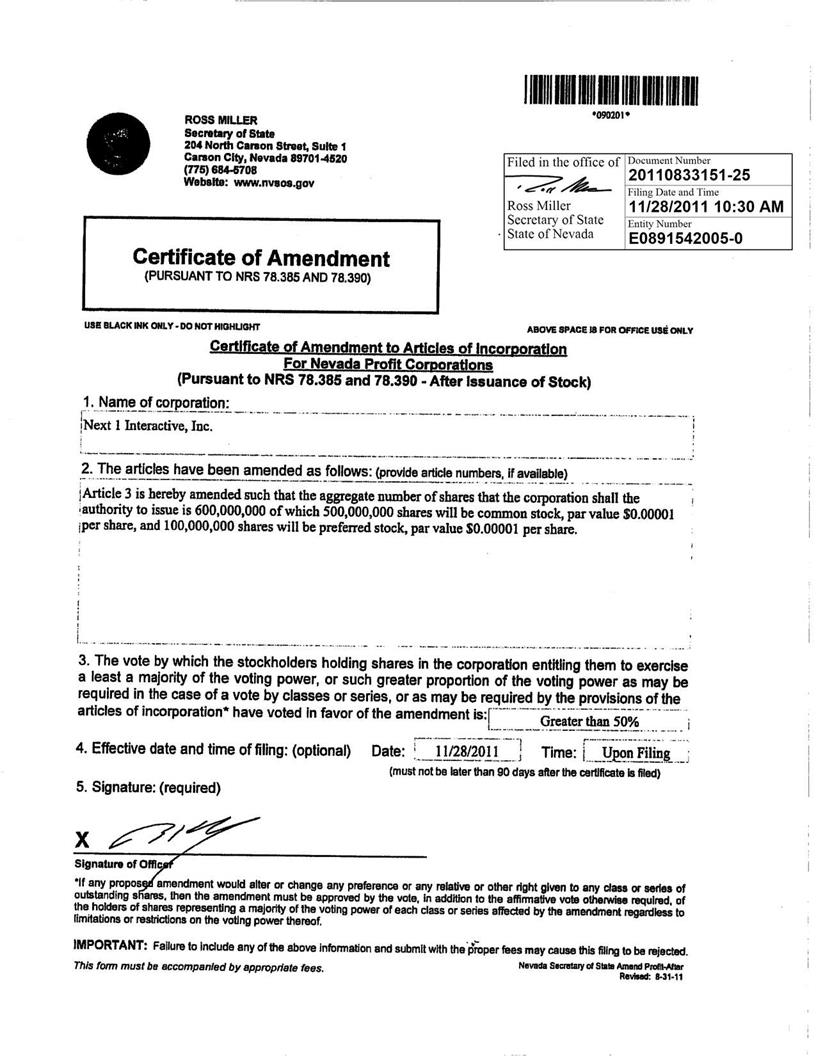

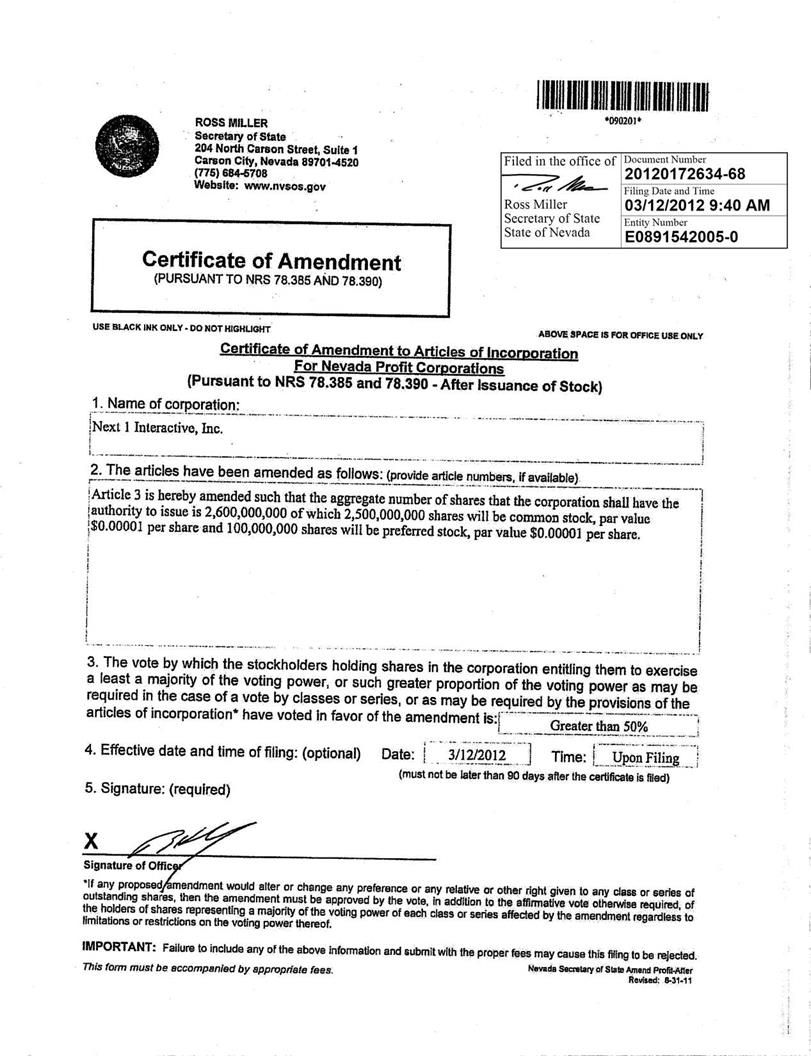

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

MONAKER GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 4700 | 26-3509845 |

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2690 Weston Road, Suite 200

Weston,

Florida 33331

(954) 888-9779

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

William

Kerby

Chief Executive Officer

Monaker Group, Inc.

2690 Weston Road, Suite 200

Weston, Florida 33331

(954) 888-9779

(Name, address, including zip code, and telephone number,

including area code, of agent for service of process)

Copies To:

David M. Loev, Esq.

John S. Gillies, Esq.

The Loev Law Firm, PC

6300 West Loop South, Suite 280

Bellaire, Texas 77401

Telephone: (713) 524-4110

Facsimile: (713) 524-4122

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities

to be |

Amount to be Registered(1) |

Proposed

Offering Price per Share(2) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Common Stock, par value $0.00001 per share | 1,532,500 (3) | $1.75 | $2,681,875 | $310.83 | ||||

| Common Stock, par value $0.00001 per share | 1,609,125 (4) | $1.75 | $2,815,969 | $326.37 | ||||

| TOTAL | 3,141,625 | $5,497,844 | $637.20(5) | |||||

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common stock that become issuable by reason of any stock split, stock dividends, recapitalization, or other similar transactions. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act based upon the last sale reported of the Registrant’s common stock as reported on the OTCQB Market on September 22, 2017. |

| (3) | Represents 1,532,500 shares of common stock of Monaker Group, Inc. |

| (4) | Represents 1,609,125 shares of common stock of Monaker Group, Inc. that are issuable in connection with the exercise of outstanding warrants to purchase 1,609,125 shares of common stock at an exercise price of $2.10 per share and held by the selling stockholders named in the prospectus which forms a part of this Registration Statement. |

| (5) | The Registrant hereby offsets the total registration fee due under this Registration Statement by the amount of the filing fee associated with the unsold securities from the Registrant’s Form S-1 Registration Statement, filed by the Registrant with the Securities and Exchange Commission (“SEC”) on September 23, 2016 (SEC File No 333-213753), registering a primary offering of securities to be sold by the Registrant for a maximum aggregate offering price of $23,750,000 (total registration fee of $2,391.63)(the “Withdrawn Registration Statement”), which Registration Statement was withdrawn by the Registrant before it became effective and before any securities were sold thereunder. A total of $637.20 of the aggregate associated filing fees of $2,391.63 associated with the Withdrawn Registration Statement are hereby used to offset the current registration fee due. Accordingly, the full amount of the $637.20 registration fee currently due for this Registration Statement is being paid by offset against a portion of the balance of the fee paid for the Withdrawn Registration Statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

Information contained herein is not complete and may be changed. These securities may not be sold until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 25, 2017

PROSPECTUS

3,141,625 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders named herein of 3,141,625 shares of common stock, par value $0.00001 per share, which we refer to as common stock, of Monaker Group, Inc., which we refer to as us, we, the Company, the Registrant or Monaker, representing (a) 1,532,500 outstanding shares of common stock, held by the selling stockholders named herein; and (b) 1,609,125 shares of common stock that are issuable in connection with the exercise of outstanding warrants to purchase 1,609,125 shares of common stock at an exercise price of $2.10 per share, held by the selling stockholders named herein. The shares of common stock being offered by the selling stockholders have been issued pursuant to the private offering transaction which closed on August 11, 2017, which is described in greater detail under “Private Placement of Common Stock and Warrants”, beginning on page 40. The selling stockholders are described in greater detail under “Selling Stockholders”, beginning on page 82.

The shares of common stock described in this prospectus may be offered for sale from time to time by the selling stockholders named herein. The selling stockholders may offer and sell the shares in a variety of transactions as described under the heading “Plan of Distribution” beginning on page 88, including transactions on any stock exchange, market or facility on which our common stock may be traded, in privately negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to such market prices or at negotiated prices. We have no basis for estimating either the number of shares of our common stock that will ultimately be sold by the selling stockholders or the prices at which such shares will be sold.

We are not selling any securities covered by this prospectus and will not receive any of the proceeds from the sale of such shares by the selling stockholders. However, in the event that the warrants are exercised for cash, we may receive up to a total of approximately $3,379,162.50 in proceeds. We are registering shares of common stock on behalf of the selling stockholders. We are bearing all of the expenses in connection with the registration of the shares of common stock, but all selling and other expenses incurred by the selling stockholders, including commissions and discounts, if any, attributable to the sale or disposition of the shares will be borne by them.

The selling stockholders and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation.

In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 of the Securities Act may be sold under Rule 144 rather than pursuant to this prospectus.

Our common stock is quoted on the OTCQB Market under the symbol “MKGI”. The closing price for our common stock on September 22, 2017, was $1.75 per share.

Investing in our securities involves risks. You should carefully consider the risk factors beginning on page 12 of this prospectus and set forth in the documents incorporated by reference herein before making any decision to invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is, 2017.

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC” or the “Commission”). This prospectus relates to the resale by the selling stockholders listed in this prospectus of up to 3,141,625 shares of our common stock. We will not receive any proceeds from the resale of any of the shares by the selling stockholders. However, in the event that the Warrants are exercised for cash, we may receive up to a total of approximately $3,379,162.50 in proceeds. We have agreed to pay for the expenses related to the registration of the shares being offered by the selling stockholders.

You should read this prospectus, including all documents incorporated herein by reference, together with additional information described under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference”, beginning on pages 90 and 91, respectively, before making an investment decision.

This prospectus does not contain all the information provided in the registration statement we filed with the SEC. For further information about us or our securities offered hereby, you should refer to that registration statement, which you can obtain from the SEC as described below under “Where You Can Find More Information”, beginning on page 90.

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell or the solicitation of an offer to buy any securities other than the securities to which it relates and is not an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make an offer or solicitation in that jurisdiction. You should assume that the information appearing in this prospectus, as well as information we have previously filed with the SEC and incorporated herein by reference, is accurate as of the date of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

We will disclose any material changes in our affairs in a post-effective amendment to the registration statement of which this prospectus is a part, or a prospectus supplement. We do not imply or represent by delivering this prospectus that Monaker Group, Inc., or its business, financial condition or results of operations, are unchanged after the date on the front of this prospectus or that the information in this prospectus is correct at any time after such date, provided that we will amend or supplement this prospectus to disclose any material events which occur after the date of such prospectus to the extent required by applicable law.

Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside of the United States.

Our logo and some of our trademarks and tradenames are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of others. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus may appear without the ®, ™ and SM symbols. References to our trademarks, tradenames and service marks are not intended to indicate in any way that we will not assert to the fullest extent under applicable law our rights or the rights of the applicable licensors if any, nor that respective owners to other intellectual property rights will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

1

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosure contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” beginning on page 11 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates. Some market and other data included herein, as well as the data of competitors as they relate to Monaker Group, Inc., is also based on our good faith estimates.

Unless the context otherwise requires, references in this prospectus to “we,” “us,” “our,” the “Registrant”, the “Company,” “Monaker” and “Monaker Group” refer to Monaker Group, Inc. and its subsidiaries. In addition, unless the context otherwise requires, “FYE” refers to fiscal year end; “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; and “Securities Act” refers to the Securities Act of 1933, as amended. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. You should read the entire prospectus before making an investment decision to purchase our securities.

2

3

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, especially the risks of investing in our securities as discussed under “Risk Factors” and the financial statements and notes thereto herein. The following summary is qualified in its entirety by the detailed information appearing elsewhere in this prospectus.

Summary

We and our subsidiaries operate an online marketplace for the alternative lodging rental industry. Alternative lodging rentals (ALRs) are whole unit vacation homes or timeshare resort units that are fully furnished, privately owned residential properties, including homes, condominiums, villas and cabins, that property owners and managers rent to the public on a nightly, weekly or monthly basis. As an added feature to our ALR offerings, we also provide access to airline, car rental, hotel and activities products along with concierge tours and activities, at the destinations, that are catered to the traveler through our Maupintour products.

We provide a vacation rental platform with auxiliary services so travelers can purchase vacations through our sites; our NextTrip.com, Maupintour.com or EXVG.com (or through distributors the Company provides ALRs) while providing inquiries and bookings to property owners and managers. NextTrip serves three major constituents: (1) property owners and managers, (2) travelers, and (3) other distributors. Property owners and managers provide detailed listings of their properties to the Company with the goal of reaching a broad audience of travelers seeking ALRs. The property owners and managers provide us their properties, at a preferential net rate for each booking and, in return, their properties are listed for free as an available ALR on NextTrip.com (as well as other distributors who the Company has provided ALRs). Travelers visit NextTrip.com (as well as other distributors who the Company has provided ALRs) and are able to search and compare our large and detailed inventory of listings to find ALRs meeting their needs.

We are a technology driven travel and logistics company with ALR products as our distinguishing niche. The ALRs are owned and leased by third parties and are available to rent through our websites as well as other distributors who we have provided ALRs. Our services include critical elements such as technology, an extensive film library, media distribution, trusted brands and established partnerships that enhance product offerings and reach. We have video content, media distribution, key industry relationships and a prestigious Travel Brand as cornerstones for the development and planned deployment of core-technology on both proprietary and partnership platforms.

Summary

We sell travel services to leisure and corporate customers around the world. The primary focus is providing ALR options as well as providing schedule, pricing and availability information for booking reservations for airlines, hotels, rental cars, cruises and other travel products such as sightseeing tours, show and event tickets and theme park passes. The Company sells these travel services both individually and as components of dynamically-assembled packaged travel vacations and trips. In addition, the Company provides content that presents travelers with information about travel destinations, maps and other travel details; this content information is the product of proprietary video-centered technology that allows the Company to create targeted travel videos from its film libraries. In April 2017, the Company introduced its new Travel Platform under the NextTrip brand. This platform continues to be improved with a focus on maximizing the consumer’s experience and assisting them in the decision and purchasing process.

The platform is a combination of proprietary and licensed technology that connects and searches large travel suppliers of alternative lodging inventories to present to consumers comprehensive and optimal alternatives at the most inexpensive rates to choose from.

The Company sells its travel services through various distribution channels. The primary distribution channel will be providing real-time bookable ALRs to other distributors (such as other travel companies’ websites and networks of third-party travel agents) who will sell the ALRs to their customers. The second distribution channel is through its own website at NextTrip.com and the NextTrip mobile application (“app”) as well as EXVG.com (which is anticipated to be operational prior to fiscal year end). The third distribution channel is selling travel services to customers through a toll-free telephone number designed to assist customers with complex or high-priced offerings of Maupintour.

4

Our core holdings include NextTrip.com, Maupintour.com and EXVG.com. NextTrip.com is the primary website, where travel services and products are booked. The travel services and products include ALRs, tours, activities/attractions, airline, hotel, and car rentals. Maupintour complements the Nextrip.com offering by providing high-end tour packages and activities/attractions. EXVG.com is the website where ALRs, that are not real-time bookable, will be promoted.

Overview

We are a technology driven Travel Company with multiple divisions and brands, leveraging its principals with more than 65 years of operation in leisure travel. The Company has structured its travel assets to focus on the burgeoning $100 billion Alternative Lodging Travel space (according to LeisureLink), expected to increase to $169 billion by 2019 (as discussed below), through its state-of-the-art flagship platform NextTrip.com. We have amassed contracts representing over 1.2 million vacation rental properties for listing and display on the Company’s NextTrip booking platform utilizing rich content, imagery and high-quality video. The platform is designed to maximize the traveler’s experience and assist in the search, decision and purchasing process of alternative lodging and other travel related products. The NextTrip platform is powered by our proprietary booking engine which features real-time booking on the entire alternative lodging (vacation home rentals, resort residences, rooms and unused timeshares) inventory, whereas the industry standard and peer company sites mostly require requesting availability directly from the homeowner and waiting for a response or acceptance communication.

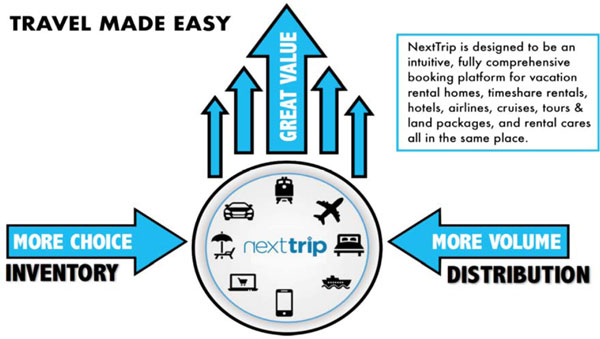

Additionally, the NextTrip platform has combined key features and functionality with advanced proprietary and licensed technology, to support vacationers travel needs with a vast array of airlines, hotels, rental cars, tours, activities, restaurants and alternative lodging suggestions thereby empowering consumers to search and create comprehensive vacation packages at one site – “Travel Made Easy!” The Company’s mission is to continue to expand the NextTrip offerings and to become the “one stop” vacation center, which we hope to achieve with key partnerships and established travel brands as cornerstones.

A January 2016 report by Research and Markets projected the global vacation rental market will reach $169 billion by 2019. In light of this projected remarkable growth, the Company recognized there would be significant opportunities in amassing ALR inventory into a real-time booking platform for supply to large and established OTA’s (“Online Travel Agent’s”) who, for the most part have not achieved access to this type of product and rapidly growing market segment. Our proprietary booking engine was designed and built to unlock these business-2-business (B2B) partnerships and handle significant transactional volumes. At present, the Company has negotiated contracts with travel channel partners that book over $2 Billion in traditional hotel bookings annually. By providing our ALR products with real-time booking capabilities to existing OTA customers, the Company believes it has positioned itself to capture a meaningful percentage of their bookings.

5

Competitive Advantages

Supplemented by a resourceful team of travel and technology professionals, we believe that we and our NextTrip platform are positioned as a first mover in the ALR vertical with strategic advantages including:

- ALR Inventory - Over 1.2 million contracted properties (making it one of the largest inventoried companies in the industry behind Airbnb and HomeAway).

- Real-time bookable properties - All ALR properties are real-time bookable to meet the needs of OTA’s to be able to purchase the ALR product in real time.

- B2C Comprehensive Travel Platform - Combining search and booking tools for all aspects of travel in one website.

- B2B Booking Engine - Allows quick entry into the ALR vertical for large OTA’s.

- Key Channel Partnerships - Allows access to a broad range of Travel products and services.

- Artificial Intelligence - The Company has signed an agreement to allow it to use artificial intelligence (“AI”) to facilitate the “right product for the right person”.

- Premiere Service - Allows homeowners to list properties into a real-time booking platform while managing their calendar and pricing to produce higher income.

The average ALR search and booking takes a few hours while the average vacation planning process typically involves the consumer visiting up to seven travel websites and spending over 10 hours to book their vacation (according to Susan Ho, Founder of Journy). We believe the NextTrip.com website using the above features should reduce ALR/Vacation planning time from hours to minutes all with the convenience of one site (truly “Travel Made Easy”).

6

Private Placement Offering

On August 11, 2017, the Company closed the transactions contemplated by the Common Stock and Warrant Purchase Agreement, entered into by the Company on July 31, 2017 (the “Purchase Agreement”), with certain accredited investors named therein (collectively, the “Purchasers”). Under the terms of the Purchase Agreement, the Company sold the Purchasers an aggregate of 1,532,500 shares of our common stock (the “Shares”) and 1,532,500 warrants to purchase one share of common stock (the “Offering Warrants” and together with the Shares, the “Securities”)(the “Private Placement Offering”). The combined purchase price for one Share and one Offering Warrant to purchase one share of common stock in the Private Placement Offering was $2.00.

Pursuant to a Placement Agency Agreement (the “Agent Agreement”) entered into with Northland Securities, Inc. (the “Agent”) on July 31, 2017, in connection with the Private Placement Offering, the Agent served as the Company’s exclusive placement agent for the Private Placement Offering. In consideration therewith, we paid the Agent 8% of the gross proceeds from the sale of the Securities ($245,200) and, for the consideration of $50, sold the Agent a warrant to purchase shares of common stock equal to 5% of the shares sold in the Private Placement Offering (i.e., warrants to purchase 76,625 shares of common stock)(the “Agent Warrants” and collectively with the Offering Warrants, the “Warrants”). The Company also agreed to reimburse up to $150,000 of the expenses of the Agent in connection with the Private Placement Offering. The Placement Agreement includes customary representations and warranties and includes indemnification rights of the Agent. The Agent is also entitled to the registration rights and liquidated damages associated therewith which the Purchasers have pursuant to the Purchase Agreement.

William Kerby, the Chief Executive Officer and Chairman of the Company purchased $50,000 of the Securities (25,000 Shares and Offering Warrants); Simon Orange, a member of the Board of Directors of the Company purchased $175,000 of the Securities (87,500 Shares and Offering Warrants); Donald Monaco, a member of the Board of Directors of the Company purchased $175,000 of the Securities (87,500 Shares and Offering Warrants); Pat LaVecchia, a member of the Board of Directors of the Company purchased $10,000 of the Securities (5,000 Shares and Offering Warrants); and Robert J. Post, a member of the Board of Directors of the Company purchased $25,000 of the Securities (12,500 Shares and Offering Warrants). Additionally, Stephen Romsdahl, a significant stockholder of the Company purchased $50,000 of the Securities (25,000 Shares and Offering Warrants) and another non-related party, who is a key distributor of the Company, purchased $100,000 of the Securities (50,000 Shares and Offering Warrants).

7

The exercise price of the Warrants is $2.10 per share, subject to adjustment as provided therein, and the Warrants are exercisable beginning on July 31, 2017 through July 30, 2022. The exercise price and number of shares of common stock issuable upon the exercise of the Warrants are subject to adjustment in the event of any stock dividends and splits, reverse stock split, recapitalization, reorganization or similar transaction, and will also be subject to anti-dilution adjustments in the event the Company issues or is deemed to have issued any securities below the then exercise price of the Warrants, subject to certain exceptions (i.e., the Exempt Issuances, described below), during the 12 months following the closing date, each as described in greater detail in the Warrants. If after February 11, 2018, a registration statement covering the issuance or resale of the shares of common stock issuable upon exercise of the Warrants (the “Warrant Shares”) is not available for the issuance or resale, as applicable, the Purchasers and the Agent, may exercise the Warrants by means of a “cashless exercise.”

The Purchase Agreement contains various restrictions, requirements and prohibitions governing the Company and its officers and directors, as described in greater detail under “Private Placement of Common Stock and Warrants” – “Covenants and Requirements of the Purchase Agreement”, beginning on page 41.

Pursuant to the terms of the Purchase Agreement, the Company agreed to use commercially reasonable efforts to file a registration statement on Form S-1 (or Form S-3, if available) with the Securities and Exchange Commission (the “Registration Statement”) within 45 days following the closing of the Private Placement Offering (which date is September 25, 2017) to register the resale of the Shares and Warrant Shares and to cause the Registration Statement to become effective within 120 days following the closing of the Private Placement Offering (which date is December 9, 2017), subject to penalties as described in the Purchase Agreement. This prospectus forms a part of the Registration Statement filed to register the resale of the Shares and Warrant Shares.

The aggregate net proceeds from the Private Placement Offering, after deducting the placement agent’s fees payable in cash (described above) and other estimated offering expenses, were approximately $2.7 million. The Company intends to use the aggregate net proceeds to expand its technology division, increase its alternative lodging rental count, and general corporate purposes.

A required term of the Private Placement Offering was that William Kerby, our Chief Executive Officer and Chairman, and Donald P. Monaco, our Director, on behalf of themselves and the entities which they control, convert 1,869,611 shares of Series A 10% Cumulative Convertible Preferred Stock (“Series A Preferred Stock”) beneficially owned by them into 3,789,222 shares of common stock of the Company, which conversion occurred shortly after the closing of the Private Placement Offering. As a result of the conversion, we no longer have any outstanding shares of preferred stock.

As additional consideration for Pacific Grove Capital LP (“Pacific Grove”), agreeing to participate in the Private Placement Offering as a Purchaser, the Company entered into a Board Representation Agreement with Pacific Grove. Pursuant to the Board Representation Agreement, Pacific Grove will be granted the right to designate one person to be nominated for election to the Company’s Board of Directors so long as (i) Pacific Grove together with its affiliates beneficially owns at least 4.99% of the Company’s common stock, or (ii) Pacific Grove together with its affiliates beneficially owns at least 75% of the Securities purchased in the Private Placement Offering. Notwithstanding its rights under the Board Representation Agreement, Pacific Grove has not provided us notice of any nominees for appointment to the Board of Directors to date.

Risks That We Face

An investment in our securities involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus. These risks include, but are not limited to, the following:

| ● | The price of our common stock may fluctuate significantly, and you could lose all or part of your investment; |

| ● | The officers and directors of the Company have the ability to exercise significant influence over the Company; |

| ● | Our business depends substantially on property owners and managers renewing their listings; |

8

●

|

Our long-term success depends, in part, on our ability to expand our property owner, manager and traveler bases outside of the United States and, as a result, our business is susceptible to risks associated with international operations; |

| ● | Unfavorable changes in, or interpretations of, government regulations or taxation of the evolving ALR, Internet and e-commerce industries could harm our operating results; |

| ● | The market in which we participate is highly competitive, and we may be unable to compete successfully with our current or future competitors; |

| ● | If we are unable to adapt to changes in technology, our business could be harmed; |

| ● | We may be subject to liability for the activities of our property owners and managers, which could harm our reputation and increase our operating costs; and |

| ● | We have incurred significant losses to date and require additional capital which may not be available on commercially acceptable terms, if at all. |

Corporate Information

Our principal executive offices are located at 2690 Weston Road, Suite 200, Weston, Florida 33331 and our telephone number is (954) 888-9779.

Additional information about us is available on our website at www.Monakergroup.com. We do not incorporate the information on or accessible through our websites into this prospectus, and you should not consider any information on, or that can be accessed through, our websites as part of this prospectus.

9

| Common Stock Offered by the Selling Stockholders | 3,141,625 shares1 | |||

| Common Stock Outstanding Before this Offering | 17,473,432 shares | |||

| Common Stock Outstanding After this Offering | 19,082,557 shares2 | |||

| Use of Proceeds | We will not receive any proceeds from the sale of shares in this offering by the selling stockholders. However, in the event that the Warrants are exercised for cash, we may receive up to a total of approximately $3,379,162.50 in proceeds. We cannot however predict the timing or the amount of the exercise of these securities. In the event the Warrants are exercised for cash, we plan to use the proceeds from such exercises for working capital and general corporate purposes, as described in greater detail under “Use of Proceeds”, provided that we will retain broad discretion over the use of these proceeds, if any. See “Use of Proceeds” beginning on page 37. | |||

| Risk Factors | An investment in our common stock involves a high degree of risk. Before making an investment decision, investors should carefully consider the “Risk Factors” discussed beginning on page 12. | |||

| OTCQB Market Symbol | MKGI | |||

In this prospectus, unless otherwise indicated, the number of shares of our common stock and other capital stock, and the other information based thereon, is as of September 25, 2017 and excludes:

| ● | shares issuable upon the exercise of the Warrants; and |

● |

3,010,745 shares of common stock issuable upon the exercise of outstanding warrants to purchase shares of common stock at a weighted-average exercise price of $4.08 per share. |

Additionally, unless otherwise stated, all information in this prospectus:

● |

assumes no exercise of outstanding warrants to purchase common stock; and | |

● |

reflects all currency in United States dollars. |

1 Representing (a) 1,532,500 outstanding shares of common stock, held by the selling stockholders named herein; and (b) 1,609,125 shares of common stock that are issuable in connection with the exercise of outstanding warrants to purchase 1,609,125 shares of common stock at an exercise price of $2.10 per share, held by the selling stockholders named herein.

2 Assuming the exercise of all the Warrants.

10

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this prospectus, including, but not limited to the fact that the officers and directors of the Company have the ability to exercise significant influence over the Company; our business depends substantially on property owners and managers renewing their listings; our long-term success depends, in part, on our ability to expand our property owner, manager and traveler bases outside of the United States and, as a result, our business is susceptible to risks associated with international operations; unfavorable changes in, or interpretations of, government regulations or taxation of the evolving ALR, Internet and e-commerce industries could harm our operating results; the market in which we participate is highly competitive, and we may be unable to compete successfully with our current or future competitors; if we are unable to adapt to changes in technology, our business could be harmed; we may be subject to liability for the activities of our property owners and managers, which could harm our reputation and increase our operating costs; our business has substantial indebtedness; and we have incurred significant losses to date and require additional capital which may not be available on commercially acceptable terms, if at all. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus and those documents which we have filed with the SEC as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

The forward-looking statements in this prospectus represent our views as of the date of this prospectus. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this prospectus.

You should also consider carefully the statements under “Risk Factors” and other sections of this prospectus, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as otherwise required by law.

11

Risks Relating to the Private Placement Offering

We face significant penalties and damages in the event the registration statement of which this prospectus forms a part is not declared effective within required time limits or such registration statement is subsequently suspended or terminated, or we fail to receive approval for the listing of our common stock on the NASDAQ Capital Market by the required deadlines set forth in the Purchase Agreement.

Pursuant to the terms of the Purchase Agreement, the Company agreed to use commercially reasonable efforts to file a registration statement on Form S-1 (or Form S-3, if available) with the Securities and Exchange Commission within 45 days following the closing of the Private Placement Offering (which date is September 25, 2017) to register the resale of the Shares and Warrant Shares and to cause the Registration Statement to become effective within 120 days following the closing of the Private Placement Offering (which date is December 9, 2017), subject to penalties as described in the Purchase Agreement. This prospectus forms a part of the Registration Statement filed to register the resale of the Shares and Warrant Shares. The Purchase Agreement also requires the Company to apply for listing of its common stock on the NASDAQ Capital Market (“NASDAQ”) within 60 days following the closing of the Private Placement Offering (which date is October 10, 2017) and to cause the Shares to be listed on the NASDAQ no later than 120 days following closing of the Private Placement Offering (which date is December 9, 2017). If the Registration Statement has not been filed by, or declared effective by the SEC, by the deadlines set forth above, or if the Company’s common stock is not approved for listing on the NASDAQ Capital Market by the deadline set forth above, we are required to provide each Purchaser (and the Agent), as partial liquidated damages for such delay, with additional Warrants equal to each Purchaser’s (and the Agent’s) pro rata share of 1% of the Warrants in the Private Placement Offering. Such liquidated damages continue to be due, each day that we fail to comply with the requirements above, up to a maximum of 100 days. That is, in no case are we required to issue additional Warrants in excess of 200% of the Warrants sold in the Private Placement Offering. Additionally, in the event that there occurs a suspension in the availability of the Registration Statement, after effectiveness thereof, subject to certain exceptions described in the Purchase Agreement, we are required to pay to each Purchaser (and the Agent), on the 30th day following the first day of such suspension, and on each 30th day thereafter, an amount equal to 1% of the purchase price paid for the Securities purchased by the Purchaser (and Agent) and not previously sold by the Purchaser with such payments to be prorated on a daily basis during each 30 day period, up to a maximum of 6% of the purchase price paid for the Securities.

In the event the registration statement of which this prospectus forms a part is not declared effective within the required time limits set forth above, or such registration statement is subsequently suspended or terminated, we fail to timely list our common stock on the NASDAQ Capital Market, or we otherwise fail to meet certain requirements set forth in the Purchase Agreement, we could be required to pay significant penalties which could adversely affect our cash flow and cause the value of our securities to decline in value.

The Warrants contain anti-dilution rights. The issuance and sale of common stock upon exercise of the Warrants may cause substantial dilution to existing stockholders and may also depress the market price of our common stock.

The exercise price of the Warrants is $2.10 per share, subject to adjustment as provided therein, and the Warrants are exercisable beginning on July 31, 2017 through July 30, 2022. The exercise price and number of shares of common stock issuable upon the exercise of the Warrants are subject to adjustment in the event of any stock dividends and splits, reverse stock split, recapitalization, reorganization or similar transaction, and are also subject to weighted average anti-dilution adjustments in the event the Company issues or is deemed to have issued any securities below the then exercise price of the Warrants, subject to certain exceptions (i.e., the Exempt Issuances, described below), during the 12 months following the closing date, each as described in greater detail in the Warrants. After the six month anniversary of the closing (February 11, 2018), if a registration statement covering the issuance or resale of the shares of common stock issuable upon exercise of the Warrants is not available for the issuance or resale, as applicable, the Purchasers and the Agent, may exercise the Warrants by means of a “cashless exercise.”

If exercises of the Warrants and sales of such shares issuable upon exercise thereof take place, the price of our common stock may decline. In addition, the common stock issuable upon exercise of the Warrants may represent overhang that may also adversely affect the market price of our common stock. Overhang occurs when there is a greater supply of a company’s stock in the market than there is demand for that stock. When this happens the price of the company’s stock will decrease, and any additional shares which stockholders attempt to sell in the market will only further decrease the share price. If the share volume of our common stock cannot absorb shares sold by the Warrant holders, then the value of our common stock will likely decrease.

12

Subject to certain limited exceptions, we are prohibited from issuing any additional securities until 90 days after the date the registration statement, of which this prospectus forms a part, is declared effective by the SEC. This may limit our ability to raise funds and operate our business.

Pursuant to the Purchase Agreement, we agreed that we will not, and we will ensure that our directors and officers and their affiliates will not, without the prior written consent of all Purchasers, from the date of execution of the Purchase Agreement and continuing to and including the date 90 days after the effective date of the registration statement, of which this prospectus forms a part (the “Lock-Up Period”), (A) offer, pledge, announce the intention to sell, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase or otherwise transfer or dispose of, directly or indirectly, any shares of common stock or any securities convertible into or exercisable or exchangeable for common stock or (B) enter into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of the common stock, whether any such transaction described in clause (A) or (B) above is to be settled by delivery of common stock or such other securities, in cash or otherwise, however, the Company may conduct an Exempt Issuance (as defined below) without the prior written consent of all Purchasers. “Exempt Issuance” means the issuance of (a) shares of common stock or options to employees, consultants, officers or directors of the Company pursuant to any stock or option plan duly adopted by a majority of the non-employee members of the board of directors of the Company or a majority of the members of a committee of non-employee directors established for such purpose, (b) securities upon the exercise of or conversion of any convertible securities, options or warrants issued and outstanding on the date of the Purchase Agreement, provided that such securities have not been amended since the date of the Purchase Agreement to increase the number of such securities or to decrease the exercise or conversion price of any such securities, and (c) securities issued pursuant to acquisitions or strategic transactions, provided any such issuance shall only be to a person which is, itself or through its subsidiaries, an operating company in which the Company receives benefits in addition to the investment of funds, but shall not include a transaction in which the Company is issuing securities primarily for the purpose of raising capital or to an entity whose primary business is investing in securities.

The restrictions and covenants in the Purchase Agreement, as well as any future financing agreements that we may enter into, may restrict our ability to finance our operations, engage in business activities or expand or fully pursue our business strategies. Our ability to comply with these covenants may be affected by events beyond our control and we may not be able to meet those covenants.

The Shares sold pursuant to the Purchase Agreement were granted anti-dilution rights for a period of twelve months following the closing.

Pursuant to the Purchase Agreement, we agreed that until the 12 month anniversary of the closing of the Offering, i.e., August 11, 2018, if the Company or any subsidiary thereof issues or agrees to issue any (i) common stock or (ii) any securities of the Company or the subsidiary that would entitle the holder thereof to acquire at any time common stock, including without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time directly or indirectly convertible into or exchangeable for, or otherwise entitles the holder thereof to receive, common stock, except for the Exempt Issuances, entitling any person or entity to acquire shares of common stock at an effective price per share less than $2.00, within three trading days of the date thereof the Company is required to issue to such Purchaser additional shares of common stock based on the formula set forth in the Purchase Agreement.

In the event we issue or are deemed to have issued additional securities for a value less than $2.00, and are required to issue the Purchaser additional shares of common stock, it could cause significant dilution to existing stockholders.

13

If the selling stockholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

Up to 3,141,625 shares of common stock may be resold by certain stockholder through this prospectus. Should the selling stockholders decide to sell their shares at a price below the market price as quoted on OTCQB, or any exchange on which our common stock might be listed in the future, the price may continue to decline. A steep decline in the price of our common stock upon being quoted on OTCQB, or any exchange on which our common stock might be listed in the future, would adversely affect our ability to raise additional equity capital, and even if we were successful in raising such capital, the terms of such raise may be substantially dilutive to current stockholders.

Risks Related to Our Operations, Business and Industry

In the future, we may need additional capital which may not be available on commercially acceptable terms, if at all.

As of May 31, 2017, the Company had an accumulated deficit of $101,458,219. We had a net loss of $798,587 for the three months ended May 31, 2017. Net loss for the year ended February 28, 2017, amounted to $7,097,275. The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern.

The growth and development of our business will require a significant amount of additional working capital, provided that we currently believe that the funds raised in the Offering, together with the revenues we anticipate receiving beginning at the end of October 2017, will be adequate to allow us to be self-sufficient and that we will not need to raise any additional funding in the near term to support our operations. Notwithstanding the above, in the event we need to raise additional funding in the future, such funding may not be available on terms that are acceptable to us and/or may have a dilutive effect on our existing stockholders. Additionally, if we are unable to achieve operational profitability, we will have to evaluate alternative actions to reduce our operating expenses and conserve cash.

In the event we require, and are unable to raise, adequate funding in the future for our operations and to pay our outstanding debt obligations, we may be forced to scale back our business plan and/or liquidate some or all of our assets (or our creditors may undertake a foreclosure of such assets in order to satisfy amounts we owe to such creditors) or may be forced to seek bankruptcy protection, which could result in the value of our outstanding securities declining in value or becoming worthless.

If we are unable to attract and maintain a critical mass of alternative lodging rental (ALR) listings and travelers, whether due to competition or other factors, our marketplace will become less valuable to property owners and managers and to travelers, and it could significantly decrease our ability to generate revenue and net income in the future.

We anticipate that moving forward, most of our revenue will be generated when ALRs are booked by either customers to our website or, by customers to distributors we provide ALRs. Our revenue will be the difference between the funds received from our customers and distributors versus the net amount owed to the property owner / manager at the time of booking. Accordingly, our success primarily depends on our ability to attract owners, managers and travelers to NextTrip com, Maupintour.com and to distributors we have provided ALRs. If property owners and managers choose not to market their ALRs through our websites, or instead list them with a competitor, we may be unable to offer a sufficient supply and variety of ALRs to attract travelers to our websites. Similarly, our volume of new and renewal listings may suffer if we are unable to attract travelers to our websites or, to the distributors we provide ALRs. As a result of any of these events, the perceived usefulness of our online marketplace and the relationships with distributors may decline, and, consequently, it could significantly decrease our ability to generate revenue and net income in the future. As a result, the value of our securities may decline in value or become worthless.

14

Currently pending or future litigation or governmental proceedings could result in material adverse consequences, including judgments or settlements.

From time to time, we are involved in lawsuits, regulatory inquiries and may be involved in governmental and other legal proceedings arising out of the ordinary course of our business. Many of these matters raise difficult and complicated factual and legal issues and are subject to uncertainties and complexities. The timing of the final resolutions to these types of matters is often uncertain. Additionally, the possible outcomes or resolutions to these matters could include adverse judgments or settlements, either of which could require substantial payments, adversely affecting our results of operations and liquidity.

Our business depends substantially on property owners and managers renewing their listings.

Our business depends substantially on property owners and managers renewing their listings. Significant declines in our listing renewals could harm our operating results. Property owners and managers generally market their vacation rentals on our websites with no obligation to renew. We may be unable to predict future listing renewal rates accurately, and our renewal rates may decline materially or fluctuate as a result of a number of factors. These factors include property owners’ decisions to sell or to cease renting their properties, their decisions to use the services of our competitors, or their dissatisfaction with our pricing, products, services or websites. Property owners and managers may not establish or renew listings if we cannot generate a large number of travelers who book vacation rentals through our marketplace and/or through our distributors. As a result, our revenue may decline and our results of operations may be negatively affected.

If distributors, we provide ALRs to, are unable to drive customers to their websites and/or we are unable to drive visitors to our websites, from search engines or otherwise, this could negatively impact transactions on the websites of our distributor websites as well as our websites and consequently cause our revenue to decrease.

Many visitors find the distributors and our websites by searching for vacation rental information through Internet search engines. A critical factor in attracting visitors to our websites, and those of our distributors, is how prominently our distributors and we are displayed in response to search queries. Accordingly, we utilize search engine marketing, or SEM, as a means to provide a significant portion of our visitor acquisition. SEM includes both paid visitor acquisition (on a cost-per-click basis) and unpaid visitor acquisition, which is often referred to as organic search.

One method we employ to acquire visitors via organic search is commonly known as search engine optimization, or SEO. SEO involves developing our websites in order to rank highly in relevant search queries. In addition to SEM and SEO, we may also utilize other forms of marketing to drive visitors to our websites, including branded search, display advertising and email marketing.

The various search engine providers, such as Google and Bing, employ proprietary algorithms and other methods for determining which websites are displayed for a given search query and how highly websites rank. Search engine providers may change these methods in a way that may negatively affect the number of visitors to our distributors’ websites as well as our own websites and may do so without public announcement or detailed explanation. Therefore, the success of our SEO and SEM strategy depends, in part, on our ability to anticipate and respond to such changes in a timely and effective manner.

In addition, websites must comply with search engine guidelines and policies. These guidelines and policies are complex and may change at any time. If we or our distributors fail to follow such guidelines and policies properly, the search engine may cause our content to rank lower in search results or could remove the content altogether. If we or our distributors fail to understand and comply with these guidelines and policies and ensure our websites’ compliance, our SEO and SEM strategy may not be successful.

If our distributors or if we are listed less prominently or fail to appear in search result listings for any reason, including as a result of our failure to successfully execute our SEO and SEM strategy, it is likely that we will acquire fewer visitors to our websites. Fewer visitors to our websites could lead to property owners and managers becoming dissatisfied with our websites, as well as fewer travelers inquiring and booking through our websites, either or both of which could adversely impact our revenue. We may not be able to replace this traffic in a cost-effective manner from other channels, such as cost-per-click SEM or display or other advertising, or even at all. Any attempt to replace this traffic through other channels may increase our sales and marketing expenditures, which could adversely affect our operating results.

15

Unfavorable changes in, or interpretations of, government regulations or taxation of the evolving alternative lodging rental (ALR), Internet and e-commerce industries could harm our operating results.

We have ALRs in markets throughout the world, in jurisdictions which have various regulatory and taxation requirements that can affect our operations or regulate the rental activity of property owners and managers.

Compliance with laws and regulations of different jurisdictions imposing different standards and requirements is very burdensome because each region in which we operate has different regulations with respect to licensing and other requirements for the listing of alternative lodging rental (ALR). Our online marketplace is accessed by property owners, managers and travelers in multiple states and foreign jurisdictions. Our business efficiencies and economies of scale depend on generally uniform treatment of property owners, managers and travelers across all jurisdictions in which we operate. Compliance requirements that vary significantly from jurisdiction to jurisdiction impose an added cost to our business and increased liability for compliance deficiencies. In addition, laws or regulations that may harm our business could be adopted, or reinterpreted in a manner that affects our activities, including but not limited to the regulation of personal and consumer information and real estate licensing requirements. Violations or new interpretations of these laws or regulations may result in penalties, negatively impact our operations and damage our reputation and business.

In addition, regulatory developments may affect the alternative lodging rental (ALR) industry and the ability of companies like us to list those vacation rentals online. For example, some municipalities have adopted ordinances that limit the ability of property owners and managers to rent certain properties for fewer than 30 consecutive days and other cities may introduce similar regulations. Some cities also have fair housing or other laws governing whether and how properties may be rented, which they assert apply to ALR. Many homeowners, condominium and neighborhood associations have adopted rules that prohibit or restrict short-term vacation rentals. In addition, many of the fundamental statutes and regulations that impose taxes or other obligations on travel and lodging companies were established before the growth of the Internet and e-commerce, which creates a risk of these laws being used, in ways not originally intended, that could burden property owners and managers or otherwise harm our business. These and other similar new and newly interpreted regulations could increase costs for, or otherwise discourage, owners and managers from listing their property with us, which could harm our business and operating results.

From time to time, we may become involved in challenges to, or disputes with government agencies regarding, these regulations. We may not be successful in defending against the application of these laws and regulations. Further, if we were required to comply with regulations and government requests that negatively impact our relations with property owners, managers and travelers, our business, operations and financial results could be adversely impacted.

Additionally, new, changed, or newly interpreted or applied tax laws, statutes, rules, regulations or ordinances could increase our property owners’ and managers’ and our compliance, operating and other costs. This, in turn, could deter property owners and managers from renting their ALR properties, negatively affect our new listings and renewals, or increase costs of doing business. Any or all of these events could adversely impact our business and financial performance.

Furthermore, as we expand or change the products and services that we offer or the methods by which we offer them, we may become subject to additional legal regulations, tax requirements or other risks. Regulators may seek to impose regulations and requirements on us even if we utilize third parties to offer the products or services. These regulations and requirements may apply to payment processing, insurance products or the various other products and services we may now or in the future offer or facilitate through our marketplace. Whether we comply with or challenge these additional regulations, our costs may increase and our business may otherwise be harmed.

16

The $2.9 million owed to us under the Secured Convertible Promissory Note due from Bettwork Industries, Inc., may not be repaid timely, if at all.

Effective on August 31, 2017, we entered into a Purchase Agreement with Bettwork Industries, Inc. (“Bettwork”), pursuant to which we sold Bettwork certain of our media assets in consideration for a Secured Convertible Promissory Note in the principal amount of $2.9 million (the “Secured Note”). The amount owed under the Secured Note accrues interest at a fluctuating interest rate, based on the prime rate, and is due and payable on August 31, 2020. The repayment of the Secured Note is secured by a first priority security interest in all of the acquired assets. Bettwork may prepay the Secured Note at any time, subject to its obligation to provide us 15 days prior written notice prior to any prepayment. The Secured Note is convertible into shares of Bettwork’s common stock, at our option, subject to a 4.99% beneficial ownership limitation. The conversion price of the Secured Note is $1.00 per share (the “Conversion Price”), unless, prior to the Secured Note being paid in full, Bettwork completes a capital raise or acquisition and issues common stock or common stock equivalents (including, but not limited to convertible securities) with a price per share (as determined in our reasonable discretion) less than the Conversion Price then in effect (each a “Transaction”), at which time the Conversion Price will be adjusted to match such lower pricing structure associated with the Transaction (provided such repricing shall continue to apply to subsequent Transactions which occur prior to the Secured Note being paid in full as well).

Bettwork may not timely pay, or may not pay at all, the amounts due pursuant to the terms of the Secured Note. In the event that Bettwork fails to pay the amount due under the Secured Note, we may be forced to attempt to foreclose on the assets securing the note and/or enter into litigation against Bettwork, seeking the payment of the amount due. In the event that Bettwork does not have sufficient capital to pay the amount due, we may be forced to accept a lesser amount of funding from Bettwork. Additionally, in the event that we are forced to foreclose on the assets securing the Secured Note, such assets may not have a value equal to the amount owed under the note and further, there may not be any other buyers for such assets. In the event we convert the amount due under the Secured Note into common stock of Bettwork, such conversion may be at a premium to the market value of Bettwork’s common stock and there may be no market or liquidity for Bettwork’s common stock. In the event of the occurrence of any of the above described events, we may not have sufficient cash flow for our operations, may be forced to expend significant resources in litigation and/or in attempting to enforce our security interest over the assets, which may have a material adverse effect on our results of operations, our ability to maintain any future listing we secure on a national stock exchange, and/or cause the value of our common stock to decline in value.

If we are not able to complete software interfaces with our property owners, managers and distributors, in a timely manner, our business is susceptible to shortfalls in revenues due to delays in remitting our ALRs to distributors and/or ALRs not being available for bookings or distribution.

The Company contracts with property owners and managers to list their ALRs on the Company’s system. Those ALRs are populated into the system through an application programming interface (API) from the property owner and/or manager to the Company. If the technology of the API is inadequate, erroneous or corrupted, the Company may incur delays in populating the ALRs into the Company’s system until the issues related to their API are corrected. These delays could cause delays in realizing revenues from bookings from those additional ALRs.

Also, the Company provides its ALRs to distributors who allow its customers to book those ALRs. The Company makes those ALRs available to distributors through its own API. If the technology of the distributor cannot write the correct program to request the ALRs from the Company’s operating system, the Company may incur delays in making the ALRs available to the distributor until the issues are resolved and the correct program is written by the distributor. These delays could cause delays in realizing revenues from bookings from those ALRs.

If we are not able to maintain and enhance our NextTrip brand and the brands associated with each of our websites, our reputation and business may suffer.

It is important for us to maintain and enhance our brand identity in order to attract and retain property owners, managers, distributors and travelers. The successful promotion of our brands will depend largely on our marketing and public relations efforts. We expect that the promotion of our brands will require us to make substantial investments, and, as our market becomes more competitive, these branding initiatives may become increasingly difficult and expensive. In addition, we may not be able to successfully build our NextTrip brand identity without losing value associated with, or decreasing the effectiveness of, our other brand identities. If we do not successfully maintain and enhance our brands, we could lose traveler traffic, which could, in turn, cause property owners and managers to terminate or elect not to renew their listings with us. In addition, our brand promotion activities may not be successful or may not yield revenue sufficient to offset their cost, which could adversely affect our reputation and business.

17

Our long-term success depends, in part, on our ability to expand our property owner, manager and traveler bases outside of the United States and, as a result, our business is susceptible to risks associated with international operations.

We have limited operating and e-commerce experience in many foreign jurisdictions and are making significant investments to build our international operations. We plan to continue our efforts to expand globally, including acquiring international businesses and conducting business in jurisdictions where we do not currently operate. Managing a global organization is difficult, time consuming and expensive and any international expansion efforts that we undertake may not be profitable in the near or long term or otherwise be successful. In addition, conducting international operations subjects us to risks that include:

● the cost and resources required to localize our services, which requires the translation of our websites and their adaptation for local practices and legal and regulatory requirements; | |

● adjusting the products and services we provide in foreign jurisdictions, as needed, to better address the needs of local owners, managers, distributors and travelers, and the threats of local competitors; | |

● being subject to foreign laws and regulations, including those laws governing Internet activities, email messaging, collection and use of personal information, ownership of intellectual property, taxation and other activities important to our online business practices, which may be less developed, less predictable, more restrictive, and less familiar, and which may adversely affect financial results in certain regions; | |

● competition with companies that understand the local market better than we do or who have pre-existing relationships with property owners, managers, distributors and travelers in those markets; | |

● legal uncertainty regarding our liability for the transactions and content on our websites, including online bookings, property listings and other content provided by property owners and managers, including uncertainty resulting from unique local laws or a lack of clear precedent of applicable law; | |

● lack of familiarity with and the burden of complying with a wide variety of other foreign laws, legal standards and foreign regulatory requirements, including invoicing, data collection and storage, financial reporting and tax compliance requirements, which are subject to unexpected changes; | |

● laws and business practices that favor local competitors or prohibit or limit foreign ownership of certain businesses; | |

● challenges associated with joint venture relationships and minority investments; | |

● adapting to variations in foreign payment forms; | |

● difficulties in managing and staffing international operations and establishing or maintaining operational efficiencies; | |

● difficulties in establishing and maintaining adequate internal controls and security over our data and systems; | |

● currency exchange restrictions and fluctuations in currency exchange rates; |

18

● potentially adverse tax consequences, which may be difficult to predict, including the complexities of foreign value added tax systems and restrictions on the repatriation of earnings; | |

● increased financial accounting and reporting burdens and complexities and difficulties in implementing and maintaining adequate internal controls; | |

● political, social and economic instability abroad, war, terrorist attacks and security concerns in general; | |

● the potential failure of financial institutions internationally; | |

● reduced or varied protection for intellectual property rights in some countries; and | |

● higher telecommunications and Internet service provider costs. |

Operating in international markets also requires significant management attention and financial resources. We cannot guarantee that our international expansion efforts in any or multiple territories will be successful. The investment and additional resources required to establish operations and manage growth in other countries may not produce desired levels of revenue or profitability and could instead result in increased costs.

The market in which we participate is highly competitive, and we may be unable to compete successfully with our current or future competitors.

The market to provide listing, search and marketing services for the alternative lodging rental (ALR) industry is very competitive and highly fragmented. In addition, the barriers to entry are low and new competitors may enter. All of the services that we provide to property owners, managers and travelers, including listing and search, are provided separately or in combination by current or potential competitors. Our competitors may adopt aspects of our business model, which could reduce our ability to differentiate our services. Additionally, current or new competitors may introduce new business models or services that we may need to adopt or otherwise adapt to in order to compete, which could reduce our ability to differentiate our business or services from those of our competitors. Furthermore, properties in the ALR industry are not typically marketed exclusively through any single channel, and our listing agreements are not typically exclusive. Accordingly, our competitors could aggregate a set of listings similar to ours. Increased competition could result in a reduction in revenue, rate of new listing acquisition, existing listings or market share.

There are thousands of vacation rental listing websites that compete directly with us for listings, travelers, or both, such as HouseTrips.com, Booking.com, HomeAway.com, Airbnb, @Leisure, InterHome, TripAdvisor and Wyndham Worldwide. Many of these competitors offer free or heavily discounted listings or focus on a particular geographic location or a specific type of rental property. Some of them also aggregate property listings obtained through various sources, including the websites of property managers some of whom also market their properties on our websites.

Competitors also operate websites directed at the wider fragmented travel lodging market, such as Airbnb, HomeAway and Wimdu, by listing either rooms or the owner’s primary home. These properties increase both the number of rental opportunities available to travelers and the competition for the attention of the traveler. Some vacation rental property owners and managers also list on these websites, and consequently these companies currently compete with us to some extent.