Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33314

POWERSHARES DB US DOLLAR INDEX BULLISH FUND

(A Series of PowerShares DB US Dollar Index Trust)

(Exact name of Registrant as specified in its charter)

| Delaware | 87-0778082 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| c/o Invesco PowerShares Capital Management LLC 3500 Lacey Road, Suite 700 Downers Grove, Illinois |

60515 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (800) 983-0903

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, an Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | x | Accelerated Filer | ¨ | |||

| Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of outstanding Shares as of September 30, 2015: 41,400,000 Shares.

Table of Contents

POWERSHARES DB US DOLLAR INDEX BULLISH FUND

(A SERIES OF POWERSHARES DB US DOLLAR INDEX TRUST)

QUARTER ENDED SEPTEMBER 30, 2015

| Page | ||||||

| PART I. |

1 | |||||

| ITEM 1. |

1 | |||||

| 10 | ||||||

| ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

19 | ||||

| ITEM 3. |

32 | |||||

| ITEM 4. |

34 | |||||

| PART II. |

34 | |||||

| Item 1. |

34 | |||||

| Item 1A. |

34 | |||||

| Item 2. |

34 | |||||

| Item 3. |

34 | |||||

| Item 4. |

34 | |||||

| Item 5. |

35 | |||||

| Item 6. |

37 | |||||

| 38 | ||||||

i

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS. |

PowerShares DB US Dollar Index Bullish Fund

Statements of Financial Condition

September 30, 2015 and December 31, 2014

(Unaudited)

| September 30, 2015 |

December 31, 2014 |

|||||||

| Assets |

||||||||

| United States Treasury Obligations, at fair value (cost $964,968,059 and $1,006,941,675, respectively) |

$ | 965,022,475 | $ | 1,006,974,568 | ||||

| Cash held by commodity broker |

— | 18,108,522 | ||||||

| Cash held by custodian |

70,656,338 | — | ||||||

| Net unrealized appreciation (depreciation) on Currency Futures Contracts |

— | 19,570,252 | ||||||

| Variation margin receivable |

5,251,321 | — | ||||||

|

|

|

|

|

|||||

| Total assets (of which $35,000,851 and $16,632,000, respectively is restricted for maintenance margin purposes) |

$ | 1,040,930,134 | $ | 1,044,653,342 | ||||

|

|

|

|

|

|||||

| Liabilities |

||||||||

| Payable for securities purchased |

$ | — | $ | 36,996,763 | ||||

| Management fee payable |

660,372 | 645,665 | ||||||

| Brokerage fee payable |

4,659 | 5,060 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

665,031 | 37,647,488 | ||||||

|

|

|

|

|

|||||

| Commitments and Contingencies (Note 9) |

||||||||

| Equity |

||||||||

| Shareholders’ equity—General Shares |

1,005 | 959 | ||||||

| Shareholders’ equity—Shares |

1,040,264,098 | 1,007,004,895 | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

1,040,265,103 | 1,007,005,854 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 1,040,930,134 | $ | 1,044,653,342 | ||||

|

|

|

|

|

|||||

| General Shares outstanding |

40 | 40 | ||||||

| Shares outstanding |

41,400,000 | 42,000,000 | ||||||

| Net asset value per share |

||||||||

| General Shares |

$ | 25.13 | $ | 23.98 | ||||

| Shares |

$ | 25.13 | $ | 23.98 | ||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

1

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Schedule of Investments

September 30, 2015

(Unaudited)

| Description |

Percentage of Shareholders’ Equity |

Fair Value |

Face Value |

|||||||||

| United States Treasury Obligations(a)(b) |

||||||||||||

| U.S. Treasury Bills, 0.015% due October 1, 2015 |

23.07 | % | $ | 240,000,000 | $ | 240,000,000 | ||||||

| U.S. Treasury Bills, 0.005% due October 8, 2015 |

14.42 | 150,000,600 | 150,000,000 | |||||||||

| U.S. Treasury Bills, 0.000% due October 15, 2015 |

12.02 | 125,002,750 | 125,000,000 | |||||||||

| U.S. Treasury Bills, 0.000% due October 29, 2015 |

9.61 | 100,001,600 | 100,000,000 | |||||||||

| U.S. Treasury Bills, 0.075% due November 5, 2015 |

9.61 | 100,002,300 | 100,000,000 | |||||||||

| U.S. Treasury Bills, 0.125% due November 12, 2015 |

6.25 | 65,001,300 | 65,000,000 | |||||||||

| U.S. Treasury Bills, 0.105% due November 19, 2015 |

1.02 | 10,600,328 | 10,600,000 | |||||||||

| U.S. Treasury Bills, 0.050% due November 27, 2015 |

1.39 | 14,400,317 | 14,400,000 | |||||||||

| U.S. Treasury Bills, 0.075% due December 10, 2015 |

15.38 | 160,013,280 | 160,000,000 | |||||||||

|

|

|

|

|

|||||||||

| Total United States Treasury Obligations (cost $964,968,059) |

92.77 | % | $ | 965,022,475 | ||||||||

|

|

|

|

|

|||||||||

| (a) | Security may be traded on a discount basis. The interest rate shown represents the discount rate at the most recent auction date of the security prior to period end. |

| (b) | A portion of United States Treasury Obligations are on deposit with the Commodity Broker and held as margin for open futures contracts. See Note 3 for additional information. |

| Description |

Unrealized Appreciation/ (Depreciation) as a Percentage of Shareholders’ Equity |

Unrealized Appreciation/ (Depreciation) (c) |

Notional Market Value |

|||||||||

| Currency Futures Contracts |

||||||||||||

| FNX-ICE Dollar Index (10,783 contracts, settlement date December 14, 2015) |

0.53 | % | $ | 5,520,902 | $ | 1,040,343,840 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Currency Futures Contracts |

0.53 | % | $ | 5,520,902 | $ | 1,040,343,840 | ||||||

|

|

|

|

|

|

|

|||||||

| (c) | Unrealized appreciation/(depreciation) is presented above, net by contract. |

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

2

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Schedule of Investments

December 31, 2014

(Unaudited)

| Description |

Percentage of Shareholders’ Equity |

Fair Value |

Face Value |

|||||||||

| United States Treasury Obligations (a)(b) |

||||||||||||

| U.S. Treasury Bills, 0.030% due January 2, 2015 |

3.67 | % | $ | 37,000,000 | $ | 37,000,000 | ||||||

| U.S. Treasury Bills, 0.040% due January 8, 2015 |

11.82 | 118,999,881 | 119,000,000 | |||||||||

| U.S. Treasury Bills, 0.020% due January 15, 2015 |

5.66 | 56,999,601 | 57,000,000 | |||||||||

| U.S. Treasury Bills, 0.010% due January 22, 2015 |

4.47 | 44,999,370 | 45,000,000 | |||||||||

| U.S. Treasury Bills, 0.015% due January 29, 2015 |

1.99 | 19,999,700 | 20,000,000 | |||||||||

| U.S. Treasury Bills, 0.010% due February 5, 2015 |

3.87 | 38,999,259 | 39,000,000 | |||||||||

| U.S. Treasury Bills, 0.025% due February 12, 2015 |

0.40 | 3,999,944 | 4,000,000 | |||||||||

| U.S. Treasury Bills, 0.025% due February 19, 2015 |

0.30 | 2,999,949 | 3,000,000 | |||||||||

| U.S. Treasury Bills, 0.020% due February 26, 2015 |

0.89 | 8,999,793 | 9,000,000 | |||||||||

| U.S. Treasury Bills, 0.025% due March 5, 2015 |

1.19 | 11,999,736 | 12,000,000 | |||||||||

| U.S. Treasury Bills, 0.025% due March 12, 2015 |

4.07 | 40,998,442 | 41,000,000 | |||||||||

| U.S. Treasury Bills, 0.035% due March 19, 2015 |

30.29 | 304,990,240 | 305,000,000 | |||||||||

| U.S. Treasury Bills, 0.055% due March 26, 2015 |

27.71 | 278,991,909 | 279,000,000 | |||||||||

| U.S. Treasury Bills, 0.040% due April 2, 2015 |

3.67 | 36,996,744 | 37,000,000 | |||||||||

|

|

|

|

|

|||||||||

| Total United States Treasury Obligations (cost $1,006,941,675) |

100.00 | % | $ | 1,006,974,568 | ||||||||

|

|

|

|

|

|||||||||

| (a) | Security may be traded on a discount basis. The interest rate shown represents the discount rate at the most recent auction date of the security prior to the period end. |

| (b) | A portion of United States Treasury Obligations are on deposit with the Commodity Broker and held as margin for open futures contracts. See Note 3 for additional information. |

| Description |

Unrealized Appreciation/ (Depreciation) as a Percentage of Shareholders’ Equity |

Unrealized Appreciation/ (Depreciation) (c) |

Notional Market Value |

|||||||||

| Currency Futures Contracts |

||||||||||||

| FNX-ICE Dollar Index (11,200 contracts, settlement date March 16, 2015) |

1.94 | % | $ | 19,570,252 | $ | 1,015,246,400 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Currency Futures Contracts |

1.94 | % | $ | 19,570,252 | $ | 1,015,246,400 | ||||||

|

|

|

|

|

|

|

|||||||

| (c) | Unrealized appreciation/(depreciation) is presented above, net by contract. |

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

3

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Statements of Income and Expenses

For the Three and Nine Months Ended September 30, 2015 and 2014

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Income |

||||||||||||||||

| Interest Income |

$ | 65,690 | $ | 54,576 | $ | 209,221 | $ | 238,577 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Expenses |

||||||||||||||||

| Management Fee |

2,250,634 | 1,473,456 | 6,854,486 | 4,022,139 | ||||||||||||

| Brokerage Commissions and Fees |

95,838 | 136,231 | 290,647 | 349,143 | ||||||||||||

| Interest Expense (a) |

10,546 | — | 19,776 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Expenses |

2,357,018 | 1,609,687 | 7,164,909 | 4,371,282 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net investment income (loss) |

(2,291,328 | ) | (1,555,111 | ) | (6,955,688 | ) | (4,132,705 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Realized and Net Change in Unrealized Gain (Loss) on United States Treasury Obligations and Currency Futures Contracts |

||||||||||||||||

| Net Realized Gain (Loss) on |

||||||||||||||||

| United States Treasury Obligations |

1,111 | 3,036 | 4,293 | 7,113 | ||||||||||||

| Currency Futures Contracts |

5,659,989 | 35,390,007 | 62,944,636 | 37,404,554 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized gain (loss) |

5,661,100 | 35,393,043 | 62,948,929 | 37,411,667 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Change in Unrealized Gain (Loss) on |

||||||||||||||||

| United States Treasury Obligations |

29,140 | (11,883 | ) | 21,523 | (9,564 | ) | ||||||||||

| Currency Futures Contracts |

13,637 | 22,160,527 | (14,049,350 | ) | 13,584,971 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net change in unrealized gain (loss) |

42,777 | 22,148,644 | (14,027,827 | ) | 13,575,407 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized and net change in unrealized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

5,703,877 | 57,541,687 | 48,921,102 | 50,987,074 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income (Loss) |

$ | 3,412,549 | $ | 55,986,576 | $ | 41,965,414 | $ | 46,854,369 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Interest expense for the periods ended September 30, 2015 represents interest expense on overdraft balances. These amounts are included in Interest income for the periods ended September 30, 2014. |

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

4

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Statement of Changes in Shareholders’ Equity

For the Three Months Ended September 30, 2015

(Unaudited)

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at July 1, 2015 |

40 | $ | 1,000 | 48,600,000 | $ | 1,215,593,060 | $ | 1,215,594,060 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Sale of Shares |

16,200,000 | 409,831,404 | 409,831,404 | |||||||||||||||||

| Redemption of Shares |

(23,400,000 | ) | (588,572,910 | ) | (588,572,910 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Increase (Decrease) due to Share Transactions |

(7,200,000 | ) | (178,741,506 | ) | (178,741,506 | ) | ||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(4 | ) | (2,291,324 | ) | (2,291,328 | ) | ||||||||||||||

| Net realized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

9 | 5,661,091 | 5,661,100 | |||||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

— | 42,777 | 42,777 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Income (Loss) |

5 | 3,412,544 | 3,412,549 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Change in Shareholders’ Equity |

— | 5 | (7,200,000 | ) | (175,328,962 | ) | (175,328,957 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at September 30, 2015 |

40 | $ | 1,005 | 41,400,000 | $ | 1,040,264,098 | $ | 1,040,265,103 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

5

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Statement of Changes in Shareholders’ Equity

For the Three Months Ended September 30, 2014

(Unaudited)

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at July 1, 2014 |

40 | $ | 851 | 33,400,000 | $ | 710,598,982 | $ | 710,599,833 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Sale of Shares |

6,200,000 | 135,647,651 | 135,647,651 | |||||||||||||||||

| Redemption of Shares |

(8,400,000 | ) | (188,980,957 | ) | (188,980,957 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Increase (Decrease) due to Share Transactions |

(2,200,000 | ) | (53,333,306 | ) | (53,333,306 | ) | ||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(2 | ) | (1,555,109 | ) | (1,555,111 | ) | ||||||||||||||

| Net realized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

40 | 35,393,003 | 35,393,043 | |||||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

25 | 22,148,619 | 22,148,644 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Income (Loss) |

63 | 55,986,513 | 55,986,576 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Change in Shareholders’ Equity |

— | 63 | (2,200,000 | ) | 2,653,207 | 2,653,270 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at September 30, 2014 |

40 | $ | 914 | 31,200,000 | $ | 713,252,189 | $ | 713,253,103 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

6

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Statement of Changes in Shareholders’ Equity

For the Nine Months Ended September 30, 2015

(Unaudited)

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at January 1, 2015 |

40 | $ | 959 | 42,000,000 | $ | 1,007,004,895 | $ | 1,007,005,854 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Sale of Shares |

62,000,000 | 1,565,254,163 | 1,565,254,163 | |||||||||||||||||

| Redemption of Shares |

(62,600,000 | ) | (1,573,960,328 | ) | (1,573,960,328 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Increase (Decrease) due to Share Transactions |

(600,000 | ) | (8,706,165 | ) | (8,706,165 | ) | ||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(8 | ) | (6,955,680 | ) | (6,955,688 | ) | ||||||||||||||

| Net realized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

69 | 62,948,860 | 62,948,929 | |||||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

(15 | ) | (14,027,812 | ) | (14,027,827 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Income (Loss) |

46 | 41,965,368 | 41,965,414 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Change in Shareholders’ Equity |

— | 46 | (600,000 | ) | 33,259,203 | 33,259,249 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at September 30, 2015 |

40 | $ | 1,005 | 41,400,000 | $ | 1,040,264,098 | $ | 1,040,265,103 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

7

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Statement of Changes in Shareholders’ Equity

For the Nine Months Ended September 30, 2014

(Unaudited)

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at January 1, 2014 |

40 | $ | 861 | 31,000,000 | $ | 666,987,258 | $ | 666,988,119 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Sale of Shares |

14,200,000 | 308,732,901 | 308,732,901 | |||||||||||||||||

| Redemption of Shares |

(14,000,000 | ) | (309,322,286 | ) | (309,322,286 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Increase (Decrease) due to Share Transactions |

200,000 | (589,385 | ) | (589,385 | ) | |||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(5 | ) | (4,132,700 | ) | (4,132,705 | ) | ||||||||||||||

| Net realized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

43 | 37,411,624 | 37,411,667 | |||||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

15 | 13,575,392 | 13,575,407 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net Income (Loss) |

53 | 46,854,316 | 46,854,369 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Change in Shareholders’ Equity |

— | 53 | 200,000 | 46,264,931 | 46,264,984 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at September 30, 2014 |

40 | $ | 914 | 31,200,000 | $ | 713,252,189 | $ | 713,253,103 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

.

8

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Statements of Cash Flows

For the Nine Months Ended September 30, 2015 and 2014

(Unaudited)

| Nine Months Ended September 30, |

||||||||

| 2015 | 2014 | |||||||

| Cash flows from operating activities |

||||||||

| Net Income (Loss) |

$ | 41,965,414 | $ | 46,854,369 | ||||

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: |

||||||||

| Cost of securities purchased |

(3,188,207,541 | ) | (2,130,831,724 | ) | ||||

| Proceeds from securities sold and matured |

3,193,397,863 | 2,128,997,458 | ||||||

| Net accretion of discount on United States Treasury Obligations |

(209,177 | ) | (238,665 | ) | ||||

| Net realized (gain) loss on United States Treasury Obligations |

(4,293 | ) | (7,113 | ) | ||||

| Net change in unrealized (gain) loss on United States Treasury Obligations and Currency Futures Contracts |

14,027,827 | (13,575,407 | ) | |||||

| Cash transfer to Commodity Broker to satisfy variation margin requirements (Note 4) |

55,249,567 | — | ||||||

| Cash received (paid) to Commodity Broker to satisfy open variation margin, net (Note 4) |

(49,728,664 | ) | — | |||||

| Change in operating receivables and payables: |

||||||||

| Variation margin receivable |

(5,251,321 | ) | — | |||||

| Management fee payable |

14,707 | 44,698 | ||||||

| Brokerage fee payable |

(401 | ) | 3,480 | |||||

|

|

|

|

|

|||||

| Net cash provided by (used for) operating activities |

61,253,981 | 31,247,096 | ||||||

|

|

|

|

|

|||||

| Cash flows from financing activities |

||||||||

| Proceeds from sale of Shares |

1,565,254,163 | 290,444,383 | ||||||

| Redemption of Shares |

(1,573,960,328 | ) | (236,909,429 | ) | ||||

| Change in deposits with transfer agent for shares redeemed |

— | (72,412,857 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by (used for) financing activities |

(8,706,165 | ) | (18,877,903 | ) | ||||

|

|

|

|

|

|||||

| Net change in cash held |

52,547,816 | 12,369,193 | ||||||

| Cash at beginning of period(a) |

18,108,522 | 12,100,937 | ||||||

|

|

|

|

|

|||||

| Cash at end of period(a)(b) |

$ | 70,656,338 | $ | 24,470,130 | ||||

|

|

|

|

|

|||||

| (a) | Cash at December 31, 2014 and prior reflects cash held by the Commodity Broker. |

| (b) | Cash at September 30, 2015 reflects cash held by the Custodian. |

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

9

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements

September 30, 2015

(1) Background

On October 24, 2014, DB Commodity Services LLC, a Delaware limited liability company (“DBCS”), DB U.S. Financial Markets Holding Corporation (“DBUSH”) and Invesco PowerShares Capital Management LLC (“Invesco”) entered into an Asset Purchase Agreement (the “Agreement”). DBCS is a wholly-owned subsidiary of DBUSH. DBCS agreed to transfer and sell to Invesco all of DBCS’ interest in PowerShares DB US Dollar Index Trust (the “Trust”), a Delaware statutory trust, and the Trust’s two separate series, one of which is PowerShares DB US Dollar Index Bullish Fund (the “Fund”), including the sole and exclusive power to direct the business and affairs of the Trust and the Fund, as well as certain other assets pertaining to the management of the Trust and the Fund, pursuant to the terms and conditions of the Agreement (the “Transaction”).

The Transaction was consummated on February 23, 2015 (the “Closing Date”). Invesco now serves as the managing owner (the “Managing Owner”), commodity pool operator and commodity trading advisor of the Trust and the Fund, in replacement of DBCS (the “Predecessor Managing Owner”).

(2) Organization

The Fund, a separate series of the Trust, a Delaware statutory trust organized in two separate series, was formed on August 3, 2006. The Predecessor Managing Owner seeded the Fund with a capital contribution of $1,000 in exchange for 40 General Shares of the Fund. The General Shares were sold to the Managing Owner by the Predecessor Managing Owner pursuant to the terms of the Agreement. The fiscal year end of the Fund is December 31st. The term of the Fund is perpetual (unless terminated earlier in certain circumstances) as provided for in the Fifth Amended and Restated Declaration of Trust and Trust Agreement of the Trust (the “Trust Agreement”). The Fund has an unlimited number of shares authorized for issuance.

The Fund offers common units of beneficial interest (the “Shares”) only to certain eligible financial institutions (the “Authorized Participants”) in one or more blocks of 200,000 Shares, called a Basket. The proceeds from the offering of Shares are invested in the Fund. The Fund commenced investment operations on February 15, 2007. The Fund commenced trading on the American Stock Exchange (which became the NYSE Alternext US LLC (the “NYSE Alternext”)) on February 20, 2007 and, as of November 25, 2008, is listed on the NYSE Arca, Inc. (the “NYSE Arca”).

This Report covers the three months ended September 30, 2015 and 2014 (hereinafter referred to as the “Three Months Ended September 30, 2015” and the “Three Months Ended September 30, 2014”, respectively) and the nine months ended September 30, 2015 and 2014 (hereinafter referred to as the “Nine Months Ended September 30, 2015” and the “Nine Months Ended September 30, 2014”, respectively). The Fund’s performance information from inception up to and excluding the Closing Date is a reflection of the performance associated with the Predecessor Managing Owner. The Managing Owner has served as managing owner of the Fund since the Closing Date, and the Fund’s performance information since the Closing Date is a reflection of the performance associated with the Managing Owner. Past performance of the Fund is not necessarily indicative of future performance.

The accompanying unaudited financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions for Form 10-Q and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). In the opinion of management, all material adjustments, consisting only of normal recurring adjustments, considered necessary for a fair statement of the interim period financial statements have been made. Interim period results are not necessarily indicative of results for a full-year period. These financial statements and the notes thereto should be read in conjunction with the Fund’s financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2014 as filed with the SEC on March 2, 2015.

(3) Fund Investment Overview

The Fund establishes long positions in certain futures contracts (the “DX Contracts”), with a view to tracking the changes, whether positive or negative, in the level of the Deutsche Bank Long US Dollar Index (USDX®) Futures Index–Excess Return (the “Long Index” or the “Index”), over time. The performance of the Fund also is intended to reflect the excess, if any, of its interest income from its holdings of United States Treasury Obligations over the expenses of the Fund. The Index is calculated to reflect the changes in market value over time, whether positive or negative, of long positions in DX Contracts. DX Contracts are traded through the currency markets of ICE Futures U.S. (formerly known as the New York Board of Trade®), under the symbol “DX.” The changes in market value over time, whether positive or negative, of the DX Contracts are related to the changes, whether positive or negative, in the level of the U.S. Dollar Index® (the “USDX®”). The Index provides a general indication of the international value of the U.S. dollar relative to the six major world currencies (each an “Index Currency,” and collectively, the “Index Currencies”), which comprise the USDX®–Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

10

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

The Fund holds United States Treasury Obligations for deposit with the Commodity Broker (as defined below) as margin. The Fund does not borrow money to increase leverage. As of September 30, 2015 and December 31, 2014, the Fund had $40,252,172 (or 3.87% of its total assets) and $1,044,653,342 (or 100.00% of its total assets), respectively, of its holdings of cash, United States Treasury Obligations and unrealized appreciation/depreciation on futures contracts on deposit with its Commodity Broker. Of this, $35,000,851 (or 3.36% of its total assets) and $16,632,000 (or 1.59% of its total assets) was required to be deposited to satisfy maintenance margin required by the Commodity Broker for the Fund’s open futures positions as of September 30, 2015 and December 31, 2014, respectively. All remaining cash and United States Treasury Obligations are on deposit with the Custodian (see Note 4). For additional information, please see the unaudited Schedules of Investments as of September 30, 2015 and December 31, 2014 for details of the Fund’s portfolio holdings.

(4) Service Providers and Related Party Agreements

The Trustee

Under the Trust Agreement, Wilmington Trust Company, the trustee of the Trust (the “Trustee”), has delegated to the Managing Owner the exclusive management and control of all aspects of the business of the Trust and the Fund. The Trustee will have no duty or liability to supervise or monitor the performance of the Managing Owner, nor will the Trustee have any liability for the acts or omissions of the Managing Owner.

The Managing Owner

The Managing Owner serves as the Fund’s commodity pool operator, commodity trading advisor and managing owner. The Fund pays the Managing Owner a management fee, monthly in arrears, in an amount equal to 0.75% per annum of the daily net asset value of the Fund (the “Management Fee”). From inception up to and excluding the Closing Date, all Management Fees were payable to the Predecessor Managing Owner. The Managing Owner has served as managing owner of the Fund since the Closing Date and all Management Fee accruals since the Closing Date have been paid to the Managing Owner.

During the Three Months Ended September 30, 2015 and 2014, the Fund incurred Management Fees of $2,250,634 and $1,473,456, respectively. During the Nine Months Ended September 30, 2015 and 2014, the Fund incurred Management Fees of $6,854,486 and $4,022,139, respectively. As of September 30, 2015 and December 31, 2014, Management Fees payable were $660,372 and $645,665, respectively.

The Commodity Broker

Deutsche Bank Securities Inc., a Delaware corporation, serves as the Fund’s clearing broker (the “Commodity Broker”). The Commodity Broker is an indirect wholly-owned subsidiary of Deutsche Bank AG and is an affiliate of the Predecessor Managing Owner. A variety of executing brokers execute futures transactions on behalf of the Fund. Such executing brokers give-up all such transactions to the Commodity Broker. In its capacity as clearing broker, the Commodity Broker may execute or receive transactions executed by others and clears all of the Fund’s futures transactions and performs certain administrative and custodial services for the Fund. The Commodity Broker is responsible, among other things, for providing periodic accountings of all dealings and actions taken by the Trust on behalf of the Fund during the reporting period, together with an accounting of all securities, cash or other indebtedness or obligations held by it or its nominees for or on behalf of the Fund.

During the Three Months Ended September 30, 2015 and 2014, the Fund incurred brokerage fees of $95,838 and $136,231, respectively. During the Nine Months Ended September 30, 2015 and 2014, the Fund incurred brokerage fees of $290,647 and $349,143, respectively. As of September 30, 2015 and December 31, 2014, brokerage fees payable were $4,659 and $5,060, respectively.

The Administrator, Custodian and Transfer Agent

The Bank of New York Mellon (the “Administrator” and “Custodian”) is the administrator, custodian and transfer agent of the Fund, and has entered into separate administrative, custodian, transfer agency and service agreements (collectively referred to as the “Administration Agreement”).

Pursuant to the Administration Agreement, the Administrator performs or supervises the performance of services necessary for the operation and administration of the Fund (other than making investment decisions), including receiving and processing orders from Authorized Participants to create and redeem Baskets, net asset value calculations, accounting and other fund administrative services. The Administrator retains certain financial books and records, including: Basket creation and redemption books and records, fund accounting records, ledgers with respect to assets, liabilities, capital, income and expenses, the registrar, transfer journals and related details, and trading and related documents received from the Commodity Broker and other unaffiliated futures commission merchants.

The Managing Owner pays the Administrator administrative services fees out of the Management Fee.

11

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

As of December 31, 2014, the Fund held $18,108,522 of cash and $1,006,974,568 of United States Treasury Obligations at the Commodity Broker. In conjunction with the Transaction, during the three-day period from February 24, 2015 to February 26, 2015, the Fund transferred $55,000,000 of cash and $1,074,986,895 of United States Treasury Obligations from the Commodity Broker to the Custodian. The Fund’s open positions of currency futures contracts remained with the Commodity Broker and accordingly, $55,249,567 of futures variation margin was credited to the Commodity Broker. $32,000,000 of United States Treasury Obligations also remained with the Commodity Broker to satisfy maintenance margin requirements. Effective February 26, 2015, the Managing Owner began transferring cash daily from the Custodian to the Commodity Broker to satisfy the previous day’s variation margin on open futures contracts. The cumulative amount of cash transferred to the Commodity Broker as of September 30, 2015 approximates the net unrealized appreciation (depreciation) on currency futures contracts. As a result, only the current day’s variation margin receivable or payable is disclosed on the Statement of Financial Condition.

As of September 30, 2015, the Fund had $1,000,677,962 (or 96.13% of total assets) of its holdings of cash and United States Treasury Obligations held with its Custodian. No assets were held at the Custodian on December 31, 2014.

The Distributor

ALPS Distributors, Inc. (the “Distributor”) provides certain distribution services to the Fund. Pursuant to the Distribution Services Agreement, the Distributor assists the Managing Owner and the Administrator with certain functions and duties relating to distribution and marketing services to the Fund including reviewing and approving marketing materials.

The Managing Owner pays the Distributor a distribution fee out of the Management Fee.

Index Sponsor

Effective as of the Closing Date, the Managing Owner, on behalf of the Fund, has appointed Deutsche Bank Securities Inc. to serve as the index sponsor (the “Index Sponsor”). Prior to the Closing Date, the index sponsor was Deutsche Bank AG London. The Index Sponsor calculates and publishes the daily index levels and the indicative intraday index levels. Additionally, the Index Sponsor also calculates the indicative value per Share of the Fund throughout each business day.

The Managing Owner pays the Index Sponsor a licensing fee and an index services fee out of the Management Fee for performing its duties.

Marketing Agent

Effective as of the Closing Date, the Managing Owner, on behalf of the Fund, has appointed Deutsche Bank Securities Inc. as the marketing agent (the “Marketing Agent”) to assist the Managing Owner by providing support to educate institutional investors about the DBIQ indices and to complete governmental or institutional due diligence questionnaires or requests for proposals related to the DBIQ indices.

The Managing Owner pays the Marketing Agent a marketing services fee out of the Management Fee.

The Marketing Agent will not open or maintain customer accounts or handle orders for the Fund. The Marketing Agent has no responsibility for the performance of the Fund or the decisions made or actions taken by the Managing Owner.

(5) Summary of Significant Accounting Policies

(a) Basis of Presentation

The Fund has determined that it meets the definition of an investment company and has prepared the unaudited financial statements in conformity with U.S. GAAP for investment companies in conformity with accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946—Investment Companies.

In August 2014, the FASB issued a new standard, Accounting Standards Update No. 2014-15 Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern, which will explicitly require management to assess an entity’s ability to continue as a going concern and to provide related footnote disclosure in certain circumstances. This new guidance is effective for all entities in the first annual reporting period ending after December 15, 2016. The Fund is currently evaluating this guidance and its impact on the Fund’s financial statement disclosures.

12

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

(b) Use of Estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses and related disclosure of contingent assets and liabilities during the reporting period of the financial statements and accompanying notes. Actual results could differ from those estimates. There were no significant estimates used in the preparation of these financial statements.

(c) Financial Instruments and Fair Value

United States Treasury Obligations and currency futures contracts are recorded in the Statements of Financial Condition on a trade date basis at fair value with changes in fair value recognized in earnings in each period. U.S. GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions.

U.S. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods or market conditions may result in transfers in or out of an investment’s assigned level:

Level 1: Prices are determined using quoted prices in an active market for identical assets.

Level 2: Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others.

Level 3: Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information.

United States Treasury Obligations are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as developments related to specific securities, yield, quality, type of issue, coupon rate, maturity, individual trading characteristics and other market data. All debt obligations involve some risk of default with respect to interest and/or principal payments.

The levels assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

The following is a summary of the tiered valuation input levels as of September 30, 2015:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| United States Treasury Obligations |

$ | — | $ | 965,022,475 | $ | — | $ | 965,022,475 | ||||||||

| Currency Futures Contracts(a) |

$ | 5,520,902 | $ | — | $ | — | $ | 5,520,902 | ||||||||

| (a) | Unrealized appreciation. |

The Fund’s policy is to recognize transfers in and out of the valuation levels as of the end of the reporting period. Effective on the Closing Date, the Managing Owner evaluated the classification of the Fund’s investments, and elected to reflect United States Treasury Obligations as Level 2. As a result, United States Treasury Obligations were transferred from Level 1 to Level 2.

The following is a summary of the tiered valuation input levels as of December 31, 2014:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| United States Treasury Obligations |

$ | 1,006,974,568 | $ | — | $ | — | $ | 1,006,974,568 | ||||||||

| Currency Futures Contracts(a) |

$ | 19,570,252 | $ | — | $ | — | $ | 19,570,252 | ||||||||

| (a) | Unrealized appreciation/(depreciation). |

13

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

(d) Deposits with Commodity Broker

The Fund deposits cash and United States Treasury Obligations with its Commodity Broker subject to CFTC regulations and various exchange and broker requirements. The combination of the Fund’s deposits with its Commodity Broker of cash and United States Treasury Obligations and the unrealized profit or loss on open futures contracts (variation margin) represents the Fund’s overall equity in its broker trading account. To meet the Fund’s initial margin requirements, the Fund holds United States Treasury Obligations. The Fund transfers cash to the Commodity Broker to satisfy variation margin requirements. The Fund earns interest on any excess cash deposited with the Commodity Broker and incurs interest expense on any deficit balance with the Commodity Broker.

(e) Deposits with Custodian

The combination of the Fund’s deposits with its Custodian of cash and United States Treasury Obligations represents the Fund’s overall assets held with its Custodian.

(f) United States Treasury Obligations

The Fund records purchases and sales of United States Treasury Obligations on a trade date basis. These holdings are marked to market based on evaluated mean prices provided by an independent pricing service. A portion of the Fund’s United States Treasury Obligations are held for deposit with the Commodity Broker to meet margin requirements. Interest income is recognized on an accrual basis when earned. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Premiums and discounts are amortized or accreted over the life of the United States Treasury Obligations. As of September 30, 2015, there were no payables or receivables outstanding for securities purchased or sold. The Fund purchased $37,000,000 face amount of United States Treasury Obligations valued at $36,996,763 which was recorded as payable for securities purchased as of December 31, 2014.

(g) Cash Held by Commodity Broker

The Fund’s arrangement with the Commodity Broker requires the Fund to meet its variation margin requirement related to the price movements on futures contracts held by the Fund by keeping cash on deposit with the Commodity Broker. The Fund assesses its variation margin requirements on a daily basis by recalculating the change in value of the futures contracts based on price movements. Subsequent cash payments are made or received by the Fund each business day depending upon whether unrealized gains or losses are incurred on the futures contracts. Effective February 24, 2015, only the current day’s variation margin receivable or payable is disclosed as an asset or liability on the Statement of Financial Condition.

The Fund defines cash and cash equivalents to be highly liquid investments, with original maturities of three months or less when purchased.

(h) Receivable/(Payable) for Shares Issued and Redeemed

On any business day, an Authorized Participant may place an order to create or redeem Shares of the Fund. Cash settlement occurs at the creation order settlement date or the redemption order settlement date as discussed in Note 7.

(i) Income Taxes

The Fund is classified as a partnership for U.S. federal income tax purposes. Accordingly, the Fund will not incur U.S. federal income taxes. No provision for federal, state, and local income taxes has been made in the accompanying financial statements, as investors are individually liable for income taxes, if any, on their allocable share of the Fund’s income, gain, loss, deductions and other items.

The Managing Owner has reviewed all of the Fund’s open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. On an ongoing basis, the Managing Owner will monitor the Fund’s tax positions taken under the interpretation (and consult with its tax counsel from time to time when appropriate) to determine if adjustments to conclusions are necessary based on factors including, but not limited to, on-going analysis of tax law, regulation, and interpretations thereof. The major tax jurisdiction for the Fund and the earliest tax year subject to examination: United States, 2012.

(j) Currency Futures Contracts

All currency futures contracts are held and used for trading purposes. Currency futures contracts are recorded on trade date. Open contracts are recorded in the Statements of Financial Condition at fair value on trade date and on each successive date as well as on the last business day of each of the periods presented. Currency futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Realized gains (losses) and changes in unrealized appreciation (depreciation) on open positions are determined on a specific identification basis and recognized in the Statements of Income and Expenses in the period in which the contract is closed or the changes occur, respectively.

14

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

The Fair Value of Derivative Instruments is as follows:

| September 30, 2015(a) | December 31, 2014(b) | |||||||||||||||

| Risk Exposure/Derivative Type |

Assets | Liabilities | Assets | Liabilities | ||||||||||||

| Currency risk |

||||||||||||||||

| Currency Futures Contracts |

$ | 5,520,902 | $ | — | $ | 19,570,252 | $ | — | ||||||||

| (a) | Includes cumulative appreciation (depreciation) of currency futures contracts. Only current day’s variation margin receivable (payable) is reported in the September 30, 2015 Statement of Financial Condition. |

| (b) | Values are disclosed on the December 31, 2014 Statement of Financial Condition under Net unrealized appreciation (depreciation) on Currency Futures Contracts. |

The Effect of Derivative Instruments on the Statements of Income and Expenses is as follows:

| Risk Exposure/Derivative Type |

Location of Gain or (Loss) on Derivatives |

For the Three Months Ended September 30, 2015 |

For the Three Months Ended September 30, 2014 |

|||||||

| Currency risk |

||||||||||

| Currency Futures Contracts |

Net Realized Gain (Loss) | $ | 5,659,989 | $ | 35,390,007 | |||||

| Net Change in Unrealized Gain (Loss) | 13,637 | 22,160,527 | ||||||||

|

|

|

|

|

|||||||

| Total |

$ | 5,673,626 | $ | 57,550,534 | ||||||

|

|

|

|

|

|||||||

| Risk Exposure/Derivative Type |

Location of Gain or (Loss) on Derivatives |

For the Nine Months Ended September 30, 2015 |

For the Nine Months Ended September 30, 2014 |

|||||||

| Currency risk |

||||||||||

| Currency Futures Contracts |

Net Realized Gain (Loss) | $ | 62,944,636 | $ | 37,404,554 | |||||

| Net Change in Unrealized Gain (Loss) | (14,049,350 | ) | 13,584,971 | |||||||

|

|

|

|

|

|||||||

| Total |

$ | 48,895,286 | $ | 50,989,525 | ||||||

|

|

|

|

|

|||||||

The table below summarizes the average monthly notional value of futures contracts outstanding during the period:

| Currency Futures Contracts | ||||||||||||||||

| For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Average Notional Value |

$ | 1,192,701,516 | $ | 769,599,705 | $ | 1,192,410,013 | $ | 716,681,609 | ||||||||

The Fund utilizes derivative instruments to achieve its investment objective. The brokerage agreement with the Commodity Broker provides for the net settlement of all financial instruments covered by the agreement in the event of default or termination of any one contract. The Managing Owner will utilize any excess cash held at the Commodity Broker to offset any realized losses incurred in the currency futures contracts, if available. To the extent that any excess cash held at the Commodity Broker is not adequate to cover any realized losses, a portion of the United States Treasury Obligations on deposit with the Commodity Broker will be sold to make additional cash available. For financial reporting purposes, the Fund offsets financial assets and financial liabilities that are subject to netting arrangements. In order for an arrangement to be eligible for netting, the Fund must have a basis to conclude that such netting arrangements are legally enforceable. The following table presents derivative instruments that are either subject to an enforceable netting agreement or offset by collateral arrangements as of September 30, 2015, net by contract:

| Gross Amounts Recognized(a) |

Gross Amounts Offset in the Statement of Financial Condition |

Net Amounts Presented in the Statement of Financial Condition |

Gross Amounts Not Offset in the Statement of Financial Condition |

|||||||||||||||||||||

| Financial Instruments(b) |

Cash

Collateral Pledged(b) |

Net Amount |

||||||||||||||||||||||

| Assets |

||||||||||||||||||||||||

| Currency Futures Contracts |

$ | 5,520,902 | $ | — | $ | 5,520,902 | $ | — | $ | — | $ | 5,520,902 | ||||||||||||

15

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

The following table presents derivative instruments that are either subject to an enforceable netting agreement or offset by collateral arrangements as of December 31, 2014, net by contract:

| Gross Amounts Recognized(a) |

Gross Amounts Offset in the Statement of Financial Condition |

Net Amounts Presented in the Statement of Financial Condition |

Gross Amounts Not Offset in the Statement of Financial Condition |

|||||||||||||||||||||

| Financial Instruments(b) |

Cash

Collateral Pledged(b) |

Net Amount | ||||||||||||||||||||||

| Assets |

||||||||||||||||||||||||

| Currency Futures Contracts |

$ | 19,570,252 | $ | — | $ | 19,570,252 | $ | — | $ | — | $ | 19,570,252 | ||||||||||||

| (a) | Includes cumulative appreciation of Currency Futures Contracts. |

| (b) | As of September 30, 2015 and December 31, 2014, a portion of the Fund’s cash and U.S. Treasury Obligations were required to be deposited as margin in support of the Fund’s futures positions as described in Note 3. |

(k) Brokerage Commissions and Fees

The Fund incurs all brokerage commissions, including applicable exchange fees, National Futures Association (“NFA”) fees, give-up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities by the Commodity Broker. These costs are recorded as Brokerage Commissions and Fees in the Statement of Income and Expenses. The Commodity Broker’s brokerage commissions and trading fees are determined on a contract-by-contract basis. On average, total charges paid to the Commodity Broker were less than $6.00 and $12.00 per round-turn trade during the Three and Nine Months Ended September 30, 2015 and 2014, respectively.

(l) Routine Operational, Administrative and Other Ordinary Expenses

After the Closing Date, the Managing Owner assumed all routine operational, administrative and other ordinary expenses of the Fund, including, but not limited to, computer services, the fees and expenses of the Trustee, legal and accounting fees and expenses, tax preparation expenses, filing fees and printing, mailing and duplication costs. Prior to the Closing Date, the Predecessor Managing Owner assumed all routine operational, administrative and other ordinary expenses of the Fund. Accordingly, such expenses are not reflected in the Statements of Income and Expenses of the Fund.

(m) Organizational and Offering Costs

All organizational and offering expenses (including continuous offering expenses for the offering of Shares) incurred by the Fund were assumed by either the Predecessor Managing Owner or the Managing Owner. The Fund is not responsible to either the Predecessor Managing Owner or the Managing Owner for the reimbursement of organizational and offering costs (including continuous offering expenses for the offering of Shares).

(n) Non-Recurring Fees and Expenses

The Fund pays all non-recurring and unusual fees and expenses (referred to as extraordinary fees and expenses in the Trust Agreement), if any, of itself, as determined by the Managing Owner. Non-recurring and unusual fees and expenses are fees and expenses which are non-recurring and unusual in nature, such as legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Such non-recurring and unusual fees and expenses, by their nature, are unpredictable in terms of timing and amount. For the Three and Nine Months Ended September 30, 2015 and 2014, the Fund did not incur such expenses.

(6) Financial Instrument Risk

In the normal course of its business, the Fund is a party to financial instruments with off-balance sheet risk. The term “off-balance sheet risk” refers to an unrecorded potential liability that, even though it does not appear on the balance sheet, may result in a future obligation or loss in excess of the amounts shown on the Statements of Financial Condition. The financial instruments used by the Fund are currency futures, whose values are based upon an underlying asset and generally represent future commitments that have a reasonable possibility of being settled in cash or through physical delivery. The financial instruments are traded on an exchange and are standardized contracts.

Market risk is the potential for changes in the value of the financial instruments traded by the Fund due to market changes, including fluctuations in currency prices. In entering into these futures contracts, there exists a market risk that such futures contracts may be significantly influenced by adverse market conditions, resulting in such futures contracts being less valuable. If the markets should move against all of the futures contracts at the same time, the Fund could experience substantial losses.

16

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

Credit risk is the possibility that a loss may occur due to the failure of the Commodity Broker and/or clearinghouse to perform according to the terms of a futures contract. Credit risk with respect to exchange-traded instruments is reduced to the extent that an exchange or clearing organization acts as a counterparty to the transactions. The Commodity Broker, when acting as the Fund’s futures commission merchant in accepting orders for the purchase or sale of domestic futures contracts, is required by CFTC regulations to separately account for and segregate as belonging to the Fund all assets of the Fund relating to domestic futures trading and the Commodity Broker is not allowed to commingle such assets with other assets of the Commodity Broker. In addition, CFTC regulations also require the Commodity Broker to hold in a secure account assets of the Fund related to foreign futures trading. The Fund’s risk of loss in the event of counterparty default is typically limited to the amounts recognized in the Statements of Financial Condition and not represented by the futures contract or notional amounts of the instruments.

The Fund has not utilized, nor does it expect to utilize in the future, special purpose entities to facilitate off-balance sheet financing arrangements and has no loan guarantee arrangements or off-balance sheet arrangements of any kind, other than agreements entered into in the normal course of business noted above.

(7) Share Purchases and Redemptions

(a) Purchases

On any business day, an Authorized Participant may place an order with the Administrator who serves as the Fund’s transfer agent (“Transfer Agent”) to create one or more Baskets. For purposes of processing both creation and redemption orders, a “business day” means any day other than a day when banks in New York City are required or permitted to be closed. Creation orders must be placed by 1:00 p.m., Eastern Time. The day on which the Transfer Agent receives a valid creation order is the creation order date. The day on which a creation order is settled is the creation order settlement date. As provided below, the creation order settlement date may occur up to three business days after the creation order date. By placing a creation order, and prior to delivery of such Baskets, an Authorized Participant’s DTC account is charged the non-refundable transaction fee due for the creation order.

Unless otherwise agreed to by the Managing Owner and the Authorized Participant as provided in the next sentence, Baskets are issued on the creation order settlement date as of 2:45 p.m., Eastern Time, on the business day immediately following the creation order date at the applicable net asset value per Share as of the closing time of the NYSE Arca or the last to close of the exchanges on which its futures contracts are traded, whichever is later, on the creation order date, but only if the required payment has been timely received. Upon submission of a creation order, the Authorized Participant may request the Managing Owner to agree to a creation order settlement date up to three business days after the creation order date. By placing a creation order, and prior to receipt of the Baskets, an Authorized Participant’s DTC account is charged the non-refundable transaction fee due for the creation order.

Creation orders may be placed either (i) through the Continuous Net Settlement (“CNS”) clearing processes of the National Securities Clearing Corporation (the “NSCC”) (the “CNS Clearing Process”) or (ii) if outside the CNS Clearing Process, only through the facilities of The Depository Trust Company (“DTC” or the “Depository”) (the “DTC Process”), or a successor depository.

(b) Redemptions

On any business day, an Authorized Participant may place an order with the Transfer Agent to redeem one or more Baskets. Redemption orders must be placed by 1:00 p.m., Eastern Time. The day on which the Managing Owner receives a valid redemption order is the redemption order date. The day on which a redemption order is settled is the redemption order settlement date. As provided below, the redemption order settlement date may occur up to three business days after the redemption order date. The redemption procedures allow Authorized Participants to redeem Baskets. Individual Shareholders may not redeem directly from the Fund. Instead, individual Shareholders may only redeem Shares in integral multiples of 200,000 and only through an Authorized Participant.

Unless otherwise agreed to by the Managing Owner and the Authorized Participant as provided in the next sentence, by placing a redemption order, an Authorized Participant agrees to deliver the Baskets to be redeemed through DTC’s book-entry system to the Fund not later than the redemption order settlement date as of 2:45 p.m., Eastern Time, on the business day immediately following the redemption order date. Upon submission of a redemption order, the Authorized Participant may request the Managing Owner to agree to a redemption order settlement date up to three business days after the redemption order date. By placing a redemption order, and prior to receipt of the redemption proceeds, an Authorized Participant’s DTC account is charged the non-refundable transaction fee due for the redemption order.

Redemption orders may be placed either (i) through the CNS Clearing Process or (ii) if outside the CNS Clearing Process, only through the DTC Process, or a successor depository, and only in exchange for cash. By placing a redemption order, and prior to receipt of the redemption proceeds, an Authorized Participant’s DTC account is charged the non-refundable transaction fee due for the redemption order.

17

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

The redemption proceeds from the Fund consist of the cash redemption amount. The cash redemption amount is equal to the net asset value of the number of Basket(s) of the Fund requested in the Authorized Participant’s redemption order as of the closing time of the NYSE Arca or the last to close of the exchanges on which the Fund’s futures contracts are traded, whichever is later, on the redemption order date. The Managing Owner will distribute the cash redemption amount at the redemption order settlement date as of 2:45 p.m., Eastern Time, on the redemption order settlement date through DTC to the account of the Authorized Participant as recorded on DTC’s book-entry system.

The redemption proceeds due from the Fund are delivered to the Authorized Participant at 2:45 p.m., Eastern Time, on the redemption order settlement date if, by such time, the Fund’s DTC account has been credited with the Baskets to be redeemed. If the Fund’s DTC account has not been credited with all of the Baskets to be redeemed by such time, the redemption distribution is delivered to the extent of whole Baskets received. Any remainder of the redemption distribution is delivered on the next business day to the extent of remaining whole Baskets received if the Transfer Agent receives the fee applicable to the extension of the redemption distribution date which the Managing Owner may, from time-to-time, determine and the remaining Baskets to be redeemed are credited to the Fund’s DTC account by 2:45 p.m., Eastern Time, on such next business day. Any further outstanding amount of the redemption order will be cancelled. The Managing Owner is also authorized to deliver the redemption distribution notwithstanding that the Baskets to be redeemed are not credited to the Fund’s DTC account by 2:45 p.m., Eastern Time, on the redemption order settlement date if the Authorized Participant has collateralized its obligation to deliver the Baskets through DTC’s book-entry system on such terms as the Managing Owner may determine from time-to-time.

(8) Profit and Loss Allocations and Distributions

Pursuant to the Trust Agreement, income and expenses are allocated pro rata to the Managing Owner as holder of the General Shares and to the Shareholders monthly based on their respective percentage interests as of the close of the last trading day of the preceding month. Distributions (other than redemption of units) may be made at the sole discretion of the Managing Owner on a pro rata basis in accordance with the respective capital balances of the shareholders.

No distributions were paid for the Three and Nine Months Ended September 30, 2015 or 2014.

(9) Commitments and Contingencies

The Managing Owner, either in its own capacity or in its capacity as the Managing Owner and on behalf of the Fund, has entered into various service agreements that contain a variety of representations, or provide indemnification provisions related to certain risks service providers undertake in performing services which are in the best interests of the Fund. As of September 30, 2015 and December 31, 2014, no claims had been received by the Fund. Further, the Fund has not had prior claims or losses pursuant to these contracts. Accordingly, the Managing Owner expects the risk of loss to be remote.

(10) Net Asset Value and Financial Highlights

The Fund is presenting the following net asset value and financial highlights related to investment performance for a Share outstanding for the Three and Nine Months Ended September 30, 2015 and 2014. The net investment income (loss) and total expense ratios are calculated using average net asset value. The net asset value presentation is calculated using average daily Shares outstanding. The total return is based on the change in net asset value of the Shares during the period. An individual investor’s return and ratios may vary based on the timing of capital transactions.

18

Table of Contents

PowerShares DB US Dollar Index Bullish Fund

Notes to Unaudited Financial Statements—(Continued)

September 30, 2015

Net asset value per Share is the net asset value of the Fund divided by the number of outstanding Shares at the date of each respective period presented.

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Net Asset Value |

||||||||||||||||

| Net asset value per Share, beginning of period |

$ | 25.01 | $ | 21.28 | $ | 23.98 | $ | 21.52 | ||||||||

| Net realized and change in unrealized gain (loss) on United States Treasury Obligations and Currency Futures Contracts |

0.17 | 1.62 | 1.29 | 1.46 | ||||||||||||

| Net investment income (loss) (a) |

(0.05 | ) | (0.04 | ) | (0.14 | ) | (0.12 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

0.12 | 1.58 | 1.15 | 1.34 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value per Share, end of period |

$ | 25.13 | $ | 22.86 | $ | 25.13 | $ | 22.86 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Market value per Share, beginning of period(b) |

$ | 25.02 | $ | 21.27 | $ | 23.98 | $ | 21.53 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Market value per Share, end of period(b) |

$ | 25.12 | $ | 22.87 | $ | 25.12 | $ | 22.87 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratio to average Net Assets* |

||||||||||||||||

| Net investment income (loss) |

(0.77 | )% | (0.79 | )% | (0.76 | )% | (0.77 | )% | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

0.79 | % | 0.82 | % | 0.78 | % | 0.82 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

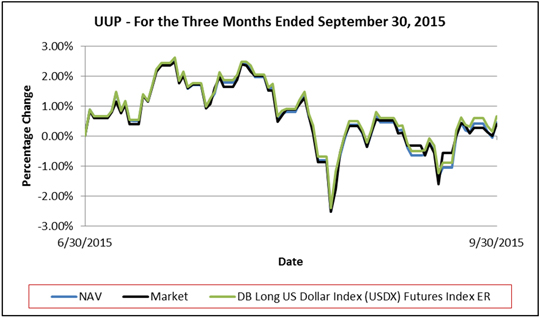

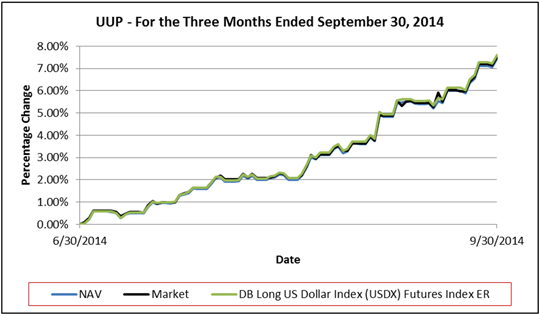

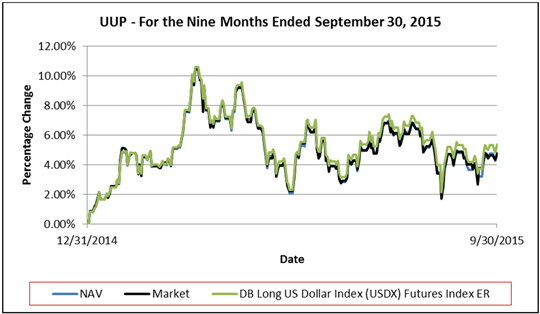

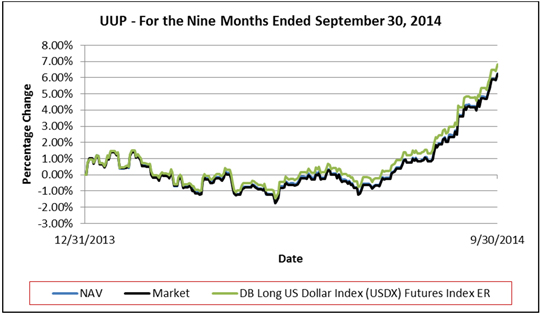

| Total Return, at net asset value ** |

0.48 | % | 7.42 | % | 4.79 | % | 6.23 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Return, at market value ** |

0.40 | % | 7.52 | % | 4.75 | % | 6.22 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask prices. |

| * | Percentages are annualized. |

| ** | Percentages are not annualized. |

| (11) | Subsequent Events |

The Fund evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosure and/or adjustment to the financial statements.

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Quarterly Report (the “Report”). The discussion and analysis which follows may contain trend analysis and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which reflect our current views with respect to future events and financial results. The matters discussed throughout this Report that are not historical facts are forward-looking statements. These forward-looking statements are based on the registrant’s current expectations, estimates and projections about the registrant’s business and industry and its beliefs and assumptions about future events. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate,” as well as similar words and phrases, signify forward-looking statements. PowerShares DB US Dollar Index Bullish Fund’s (the “Fund”) forward-looking statements are not guarantees of future results and conditions and important factors, risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the Federal securities laws, Invesco PowerShares Capital Management LLC (“Invesco”), undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Report, as a result of new information, future events or changed circumstances or for any other reason after the date of this Report.

Overview/Introduction

On October 24, 2014, DB Commodity Services LLC, a Delaware limited liability company (“DBCS”), DB U.S. Financial Markets Holding Corporation (“DBUSH”) and Invesco entered into an Asset Purchase Agreement (the “Agreement”). DBCS is a wholly-owned subsidiary of DBUSH. DBCS agreed to transfer and sell to Invesco all of DBCS’ interests in PowerShares DB US Dollar Index Trust (the “Trust”), a Delaware statutory trust, and the Trust’s two separate series, one of which is PowerShares DB US Dollar Index Bullish Fund (the “Fund”), including the sole and exclusive power to direct the business and affairs of the Trust and the Fund, as well as certain other assets of DBCS pertaining to the management of the Trust and the Fund, pursuant to the terms and conditions of the Agreement (the “Transaction”).

19

Table of Contents

The Transaction was consummated on February 23, 2015 (the “Closing Date”). Invesco now serves as the managing owner (the “Managing Owner”), commodity pool operator and commodity trading advisor of the Trust and the Fund, in replacement of DBCS (the “Predecessor Managing Owner”).