Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2013 |

||

Or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 001-33287

Information Services Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State of Incorporation) |

20-5261587 (I.R.S. Employer Identification Number) |

Two Stamford Plaza

281 Tresser Boulevard

Stamford, CT 06901

(Address of principal executive offices and zip code)

Registrant's telephone number, including area code: (203) 517-3100

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Shares of Common Stock, $0.001 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting common stock, par value $0.001 per share, held by non-affiliates of the registrant computed by reference to the closing sales price for the registrant's common stock on June 30, 2013, as reported on the NASDAQ Stock Market was approximately $62,057,467.

In determining the market value of the voting stock held by any non-affiliates, shares of common stock of the registrant beneficially owned by directors, officers and other holders of non-publicly traded shares of common stock of the registrant have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 21, 2014, the registrant had outstanding 37,394,364 shares of common stock, par value $0.001 per share.

Documents Incorporated by Reference

| Document Description | 10-K Part | |

|---|---|---|

| Portions of the Proxy Statement for the 2014 Annual Meeting of Stockholders (the "Proxy Statement"), to be filed within 120 days of the end of the fiscal year ended December 31, 2013, are incorporated by reference in Part III hereof. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part hereof. | III (Items 10, 11, 12, 13, 14) |

2

Information Services Group ("ISG") believes that some of the information in this Annual Report on Form 10-K constitutes forward-looking statements. You can identify these statements by forward-looking words such as "may," "expect," "anticipate," "contemplate," "believe," "estimate," "intends" and "continue" or similar words, but this is not an exclusive way of identifying such statements. You should read statements that contain these words carefully because they:

- •

- discuss future expectations;

- •

- contain projections of future results of operations or financial condition; or

- •

- state other "forward-looking" information.

These forward-looking statements include, but are not limited to, statements relating to:

- •

- ability to retain existing clients and contracts;

- •

- ability to win new clients and engagements;

- •

- ability to implement cost reductions and productivity improvements;

- •

- beliefs about future trends in the sourcing industry;

- •

- expected spending on sourcing services by clients;

- •

- growth of our markets;

- •

- foreign currency exchange rates;

- •

- effective tax rate; and

- •

- competition in the sourcing industry.

ISG believes it is important to communicate its expectations to its stockholders. However, there may be events in the future that ISG is not able to predict accurately or over which it has no control. The risk factors and cautionary language discussed in this Annual Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations in such forward-looking statements, including among other things:

- •

- the amount of cash on hand;

- •

- business strategy;

- •

- cost reductions and productivity improvements may not be fully realized or realized within the expected time frame;

- •

- continued compliance with government regulations;

- •

- legislation or regulatory environments, requirements or changes adversely affecting the business in which ISG is engaged;

- •

- fluctuations in client demand;

- •

- ability to grow the business and effectively manage growth and international operations while maintaining effective internal controls;

3

- •

- ISG's relative dependence on clients which operate in the financial services, manufacturing, automotive and public

services sectors;

- •

- ability to hire and retain enough qualified employees to support operations;

- •

- increases in wages in locations in which ISG has operations;

- •

- ability to retain senior management;

- •

- fluctuations in exchange rates between the U.S. dollar and foreign currencies;

- •

- ability to attract and retain clients and the ability to develop and maintain client relationships based on attractive

terms;

- •

- legislation in the United States or elsewhere that adversely affects the performance of sourcing services offshore;

- •

- increased competition;

- •

- telecommunications or technology disruptions or breaches, or natural or other disasters;

- •

- ability to protect ISG intellectual property and the intellectual property of others;

- •

- the international nature of ISG's business;

- •

- political or economic instability in countries where ISG has operations;

- •

- worldwide political, economic and business conditions; and

- •

- ability to source, successfully consummate or integrate strategic acquisitions.

All forward-looking statements included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. Except to the extent required by applicable laws and regulations, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

You should also review the risks and uncertainties we describe in the reports we will file from time to time with the SEC after the date of this Annual Report.

4

As used herein, unless the context otherwise requires, ISG, the registrant, is referred to in this Form 10-K annual report ("Form 10-K") as the "Company," "we," "us" and "our."

Our Company

Information Services Group, Inc. ("ISG") (NASDAQ: III) is a leading technology insights, market intelligence and advisory services company serving more than 500 clients around the world to help them achieve operational excellence. ISG supports private and public sector organizations to transform and optimize their operational environments through research, benchmarking, consulting and managed services with a focus on information technology, business process transformation, program management services and enterprise resource planning. Clients look to ISG for unique insights and innovative solutions for leveraging technology, our deep data source, and more than five decades of experience of global leadership in information and advisory services. Based in Stamford, Connecticut, the Company has approximately 800 employees and operates in 21 countries.

Our Company was founded in 2006 with the strategic vision to become a high-growth, leading provider of information-based advisory services. In 2007, ISG consummated its initial public offering and completed the acquisition of TPI Advisory Services Americas, Inc. ("TPI").

On January 4, 2011, we acquired Compass, a premier independent global provider of business and information technology benchmarking, performance improvement, data and analytics services. Headquartered in the United Kingdom, Compass was founded and had approximately 180 employees in 16 countries serving nearly 250 clients.

On February 10, 2011, we acquired Austin, Texas-based STA Consulting, a premier independent information technology advisor serving the public sector. STA Consulting advises clients on information technology strategic planning and the acquisition and implementation of new Enterprise Resource Planning (ERP) and other enterprise administration and management systems. STA Consulting was founded in 1997 and had approximately 40 professionals serving state and local government entities in the United States.

On January 10, 2012, we announced the merger of our individual corporate brands into one globally integrated go-to-market business under the ISG brand. TPI, the world's leading independent sourcing data and advisory firm; Compass, a premier independent provider of business and IT benchmarking; and STA Consulting, a premier independent technology advisory firm serving the North America public sector, have combined under the ISG brand. This merger offers clients one source of support to drive operational excellence in their organizations. The legacy brands of TPI and Compass remain as product and service descriptors, such as "TPI Sourcing" and "Compass Benchmarks".

We continue to believe that our vision will be realized through the acquisition, integration, and successful operation of market-leading brands within the data, analytics and advisory industry. With our three acquisitions, we operate in 21 countries and employ more than 800 professionals globally, delivering advisory, benchmarking and analytical insight to large, multinational corporations and governments in North America, Europe and Asia Pacific.

5

Our private and public sector clients continue to face significant technological, business and economic challenges that will continue to fuel demand for the professional services we provide. In the private sector, for example, we believe that companies will continue to face significant challenges associated with globalization and technological innovation, including the need to decrease operating costs, increase efficiencies and deal with increasing numbers of emerging and transformational technologies such as cloud computing. Similarly, public sector organizations at the national, regional and local levels increasingly must deal with the complex and converging issues of outdated technology systems, significantly impaired revenue sources and an aging workforce.

Overall, we believe that the global marketplace dynamics at work in both the private and public sectors mitigate in favor of the professional services, analytics and advice ISG can provide. In this dynamic environment, the strength of our client relationships greatly depends on the quality of our advice and insight, the independence of our thought leadership and the effectiveness of our people in assisting our clients to implement strategies that successfully address their most pressing operational challenges.

We are organized as a corporation under the laws of the State of Delaware. The current mailing address of the Company's principal executive office is: Information Services Group, Inc., Two Stamford Plaza, 281Tresser Boulevard, Stamford, CT 06901. Our telephone number is (203) 517-3100.

Our Services

During periods of expansion or contraction, for enterprises large or small, public or private, in North America, Europe or Asia Pacific, our services have helped organizations address their most complex operational issues. The functional domain experience of our experts and deep empirical data help clients better understand their strategic options. We provide three key lines of service:

- •

- Research. We utilize our extensive experience and

proprietary data assets to provide subscription and custom research services to both buyers and sellers of services in the outsourcing and managed services industries. Our combined data sources,

compiled from over 30 years of servicing global corporations, provide a rich source of benchmark data into the comparative cost and quality of operational alternatives. For enterprise clients,

we use these data sources to provide them with in-depth analysis into the implications of different service strategies, allowing them to compare and contrast and make informed decisions regarding

strategic change. For service providers, our views into the buying behaviors, needs and objectives of global corporations examining transformation of their operations provide unique insights that help

them tailor and market their offerings to these enterprises.

- •

- Consulting. We assist clients with envisioning, designing

and implementing change in their operational environments. We evaluate existing practices and operating costs of public and private enterprises, identifying potential improvement opportunities to

enhance service delivery, optimize operations or reduce costs. Solutions are customized by a client situation and may include internal transformation, the adoption of external strategies, or some

combination of both. In all cases, we assist with the selection, implementation and ongoing support for these strategic initiatives.

- •

- Managed Services. Our managed service offerings provide operational governance services to our clients to ensure seamless end-to-end service. This offering assists clients with monitoring and managing their supplier relationships, providing them with real-time accurate market intelligence

6

and insights into all aspects of provider performance and cost, allowing them to focus on the more strategic aspects of supplier management.

Our Competitive Advantages

We believe that the following strengths differentiate us from our competition:

- •

- Independence and Objectivity. We are not a service

provider. We are an independent, fact-based data, analytics and advisory firm with no material conflicting financial or other interests. This enables us to maintain a trusted advisor relationship with

our clients through our unbiased focus and ability to align our interests with those of our clients.

- •

- Domain Expertise. Averaging over 20 years of

experience, our strategic consulting teams bring a wealth of industry and domain-specific knowledge and expertise to address our clients' most complex transformational needs.

- •

- Strong Brand Recognition. ISG continues to gain

marketplace traction as a leading brand in our industry after merging its TPI, Compass and STA Consulting brands into one go-to-market brand: ISG. ISG offers an integrated product and service offering

for our clients as one, unified company. We have retained our legacy brands, in certain cases, as names of legal entities and to describe product and services offering that have legally registered

trademarks in certain jurisdictions, such as "The TPI Index", "TPI Sourcing" and "Compass benchmarks".

- •

- Proprietary Data Assets and Market Intelligence. We have

assembled a comprehensive and unique set of data, analytics and market intelligence built over more than thirty years of data collection and analysis, providing insight into the comparative cost and

quality of a variety of operational alternatives.

- •

- Global Reach. We possess practical experience in global business operations, and we understand the significance of interconnected economies and companies. Our resources in the Americas, Europe, Asia Pacific, China and India make us a truly global advisory firm able to consistently serve the strategic and implementation needs of our clients.

We believe that the strengths disclosed above are central to our ability to deal successfully with the challenges that we face.

Our Strategy

We intend to use our competitive strengths to develop new services and products, sustain our growth and strengthen our existing market position by pursuing the following strategies:

- •

- Preserve and Expand Our Market Share Positions. We expect

the trend toward globalization and greater operating efficiency and technological innovation to play an increasing role in the growth of demand for our services. We plan to leverage our combined

operating platform to serve the growing number of private and public enterprises utilizing outside advisors when undertaking transformational projects. In addition, we will seek to continue to expand

our products and services and the geographic markets we serve opportunistically as global competition spurs demand for cost savings and value creation.

- •

- Strengthen Our Industry Expertise. We have strengthened our market facing organization to drive increased revenue around five key areas—BFSI (Banking, Financial Services and Insurance);

7

- •

- Expand Geographically. Historically, we generated the

majority of our revenues in North America. Over the past several years, we have made significant investments in Europe and Asia Pacific to capitalize on emerging demand for advisory, benchmarking and

analytical insight in these geographic regions. We intend to continue to expand in Europe and Asia Pacific and maintain our revenue growth and market leading positions in those markets. The

acquisition of Compass expanded our geographic reach, particularly in Europe, and increased the amount of our revenues we generated internationally versus in North America.

- •

- Aggressively Expand Our Market Focus. We are seeking to

drive our service portfolio and relationships with clients further into white spaces—Business Advisory Services, Cloud Solutions, Project Management Services, Strategy, Assess, Transition

and Organization & Operations are all areas where we are investing additional focus to drive increased revenues and expanded relationships with clients.

- •

- Expand "Recurring Revenue Streams." This includes Managed

Services, Research and the U.S. Public Sector. As companies begin to recognize the importance of managing the post-sourcing-transaction period, managed services has emerged as a revenue driver for us

where our offerings are delivered through multi-year managed services contracts. We believe that our experience with outsourcing transactions and software implementation initiatives make us uniquely

equipped to provide research insights and direct support to help our clients manage their transformational projects or act as a third-party administrator. We will continue to pursue opportunities to

leverage our experience to make research and managed services an even greater revenue generator for us.

- •

- Consider Acquisition and Other Growth Opportunities. The

business services, information and advisory market is highly fragmented. We believe we are well-positioned to leverage our leading market positions and strong brand recognition to expand through

acquisitions. Acquiring firms with complementary services and products will allow us to further develop and broaden our service offerings and domain expertise. We will consider and may pursue

opportunities to enter into joint ventures and to buy or combine with other businesses.

- •

- Retool Our Resource and Delivery Model. The goal is to evolve our workforce to achieve a more efficient distribution of resources globally and a more flexible staffing model. This will provide ISG clients with better value for money while also improving ISG margins.

Manufacturing/Auto; Energy, Life Sciences and Healthcare; Technology, Retail and Enterprise Businesses; and Public Sector/Government.

Our Proprietary Data Assets and Market Intelligence

One of our core assets is the information, data, analytics, methodologies and other intellectual capital the Company possesses. This intellectual property underpins the independent nature of our operational assessments, strategy development, deal-structuring, negotiation and other consulting services we provide to our clients.

With each engagement we conduct, we enhance both the quantity and quality of the intellectual property we employ on behalf of our clients, thus providing a continuous, evolving and unique source of information, data and analytics.

8

This intellectual property is proprietary and we rely on multiple legal and contractual provisions and devices to protect our intellectual property rights. We recognize the value of our intellectual property and vigorously defend it. As a result, the Company maintains strict policies and procedures regarding ownership, use and protection with all parties, including our employees.

Clients

We operate in 21 countries and across numerous industries. Our private sector clients operate in the financial services, telecommunications, healthcare and pharmaceuticals, manufacturing, transportation and travel and energy and utilities industries. Our private sector clients are primarily large businesses ranked in the Forbes Global 2000 companies annually. Our public sector clients are primarily state and local governments (cities and counties) and authorities (airport and transit) in the United States and national and provincial government units in the United Kingdom, Canada and Australia.

Competition

Competition in the sourcing, data, information and advisory market is primarily driven by independence and objectivity, expertise, possession of relevant benchmarking data, breadth of service capabilities, reputation and price. We compete with other sourcing advisors, research firms, strategy consultants and sourcing service providers. A significant number of independent sourcing and advisory firms offer similar services. In our view, however, these firms generally lack the benchmarking data, scale and diversity of expertise that we possess. In addition, most research firms do not possess the data repository of recent, comparable transactions and benchmarking data. Management consultants bring strategic service capabilities to the sourcing and advisory market. However, they generally lack the depth of experience that sourcing, data and advisory firms such as ISG possess. In addition, management consultants do not possess the sourcing and technology implementation expertise nor the benchmarking data capabilities that are critical to implementing and managing successful transformational projects for businesses and governments. Other service providers often lack the depth of experience, competitive benchmarking data and independence critical to playing the role of "trusted advisor" to clients.

Employees

As of December 31, 2013, we employed 850 people worldwide.

Our employee base includes executive management, service leads, partners, directors, advisors, analysts, technical specialists and functional support staff.

We recruit advisors from service providers, consulting firms and clients with direct operational experience. These advisors leverage extensive practical expertise derived from experiences in corporate leadership, consulting, research, financial analysis, contract negotiations and operational service delivery.

All employees are required to execute confidentiality, conflict of interest and intellectual property agreements as a condition of employment. There are no collective bargaining agreements covering any of our employees.

Our voluntary advisor turnover rate ranged between 10% and 17% over the last three years.

9

Available Information

Our Internet address is www.isg-one.com. The content on our website is available for information purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference into this Form 10-K. We make available through our Internet website under the heading "Investor Relations," our annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K after we electronically file any such materials with the Securities and Exchange Commission. Copies of our key corporate governance documents, including our Code of Ethics and Business Conduct for Directors, Officers and Employees and charters for our Audit Committee, our Nominating and Corporate Governance Committee and our Compensation Committee are also on our website. Stockholders may request free copies of these documents including our Annual Report to Stockholders by writing to Information Services Group, Inc., Two Stamford Plaza, 281 Tresser Boulevard, Stamford CT 06901, Attention: David E. Berger, or by calling (203) 517-3100.

Our annual and quarterly reports and other information statements are available to the public through the SEC's website at www.sec.gov. In addition, the Notice of Annual Meeting of Stockholders, Proxy Statement and 2013 Annual Report to Stockholders are available free of charge at www.isg-one.com.

The loss of key executives could adversely affect our business.

The success of our business is dependent upon the continued service of a relatively small group of key executives, including Mr. Connors, Chairman and Chief Executive Officer; Mr. Berger, Executive Vice President, Chief Financial Officer; Mr. Cravens, Executive Vice President and Chief Human Resources and Communications Officer, and Mr. Whitmore, Vice Chairman and President, ISG Americas, among others.

Although we currently intend to retain our existing management, we cannot assure you that such individuals will remain with us for the immediate or foreseeable future. The unexpected loss of the services of one or more of these executives could adversely affect our business.

We have outstanding a substantial amount of debt, which may limit our ability to fund general corporate requirements and obtain additional financing, limit our flexibility in responding to business opportunities and competitive developments and increase our vulnerability to adverse economic and industry conditions and changes in our debt rating.

On May 3, 2013, the Company entered into a five year senior secured credit facility (the "2013 Credit Agreement") comprised of a $45.0 million term loan facility and a $25.0 million revolving credit facility. On May 3, 2013, we borrowed $55.0 million under the 2013 Credit Agreement to refinance our existing debt under our prior credit agreement and to pay transaction costs. As a result of the substantial fixed costs associated with the debt obligations, we expect that:

- •

- a decrease in revenues will result in a disproportionately greater percentage decrease in earnings;

- •

- we may not have sufficient liquidity to fund all of these fixed costs if our revenues decline or costs increase;

10

- •

- we may have to use our working capital to fund these fixed costs instead of funding general corporate requirements,

including capital expenditures;

- •

- we may not have sufficient liquidity to respond to business opportunities, competitive developments and adverse economic

conditions; and

- •

- our results of operations will be adversely affected if interest rates increase because, based on our current outstanding term loan borrowings in the amount of $53.3 million, a 1% increase in interest rates would result in a pre-tax impact on earnings of approximately $0.5 million per year.

These debt obligations may also impair our ability to obtain additional financing, if needed, and our flexibility in the conduct of our business. Our indebtedness under the senior secured revolving credit facility is secured by substantially all of our assets, leaving us with limited collateral for additional financing. Moreover, the terms of our indebtedness under the senior secured revolving credit facility restrict our ability to take certain actions, including the incurrence of additional indebtedness, mergers and acquisitions, investments and asset sales. Our ability to pay the fixed costs associated with our debt obligations will depend on our operating performance and cash flow, which in turn depend on general economic conditions and the advisory services market. A failure to pay interest or indebtedness when due could result in a variety of adverse consequences, including the acceleration of our indebtedness. In such a situation, it is unlikely that we would be able to fulfill our obligations under or repay the accelerated indebtedness or otherwise cover our fixed costs. As of December 31, 2013, the total principal outstanding under the term loan facility and revolving credit facility was $43.3 million and $10.0 million, respectively.

Failure to maintain effective internal controls over financial reporting could adversely affect our business and the market price of our Common Stock.

Pursuant to rules adopted by the SEC implementing Section 404 of the Sarbanes-Oxley Act of 2002, we are required to assess the effectiveness of our internal controls over financial reporting and provide a management report on our internal controls over financial reporting in all annual reports. This report contains, among other matters, a statement as to whether or not our internal controls over financial reporting are effective and the disclosure of any material weaknesses in our internal controls over financial reporting identified by management.

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) provides a framework for companies to assess and improve their internal control systems. Management's assessment of internal controls over financial reporting requires management to make subjective judgments and, some of the judgments will be in areas that are subject to interpretation.

While we currently believe our internal controls over financial reporting are effective, if in the future, we identify one or more material weaknesses in our internal controls over financial reporting during this continuous evaluation process, our management will be unable to assert such internal controls are effective. Although we currently anticipate being able to continue to satisfy the requirements of Section 404 in a timely fashion, we cannot be certain as to the timing of completion for our future evaluation, testing and any required remediation due in large part to the fact that there are limited precedents available by which to measure compliance with these requirements. Therefore, if we are unable to assert that our internal controls over financial reporting are effective in the future,

11

our investors could lose confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on our business and the market price of our Common Stock.

The market price of our common stock may fluctuate widely.

The market price of our common stock could fluctuate substantially due to:

- •

- future announcements concerning us or our competitors;

- •

- quarterly fluctuations in operating results;

- •

- announcements of acquisitions or technological innovations;

- •

- changes in earnings estimates or recommendations by analysts; or

- •

- current market volatility.

In addition, the stock prices of many business and technology services companies fluctuate widely for reasons which may be unrelated to operating results. Fluctuation in the market price of our common stock may impact our ability to finance our operations and retain personnel.

Our operating results have been, and may in the future be, adversely impacted by the worldwide economic crisis and credit tightening.

Our results of operations are affected by the level of business activity of our clients, which in turn is affected by the level of economic activity in the industries and markets that they serve. A decline in the level of business activity of our clients could have a material adverse effect on our revenue and profit margin. In particular, our exposure to certain industries currently experiencing financial difficulties, including the transportation and financial services industries, could have an adverse effect on our results of operations. Future economic conditions could cause some clients to reduce or defer their expenditures for consulting services. We have implemented and will continue to implement cost-savings initiatives to manage our expenses as a percentage of revenue. However, current and future cost-management initiatives may not be sufficient to maintain our margins if the economic environment should weaken for a prolonged period.

The rate of growth in the broadly defined business information services & advisory sector and/or the use of technology in business may fall significantly below the levels that we currently anticipate.

Our business is dependent upon continued growth in sourcing activity, the use of technology in business by our clients and prospective clients and the continued trend towards sourcing of complex information technology and business process tasks by large and small organizations. If sourcing diminishes as a management and operational tool, the growth in the use of technology slows down or the cost of sourcing alternatives rises, our business could suffer. Companies that have already invested substantial resources in developing in-house information technology and business process functions may be particularly reluctant or slow to move to a sourcing solution that may make some of their existing personnel and infrastructure obsolete.

Our engagements may be terminated, delayed or reduced in scope by clients at any time.

Our clients may decide at any time to abandon, postpone and/or to reduce our involvement in an engagement. Our engagements can therefore terminate, or the scope of our responsibilities may

12

diminish, with limited advance notice. If an engagement is terminated, delayed or reduced unexpectedly, the professionals working on the engagement could be underutilized until we assign them to other projects. Accordingly, the termination or significant reduction in the scope of a single large engagement, or multiple smaller engagements, could harm our business results.

Our operating results may fluctuate significantly from period to period as a result of factors outside of our control.

We expect our revenues and operating results to vary significantly from accounting period to accounting period due to factors including:

- •

- fluctuations in revenues earned on contracts;

- •

- commencement, completion or termination of contracts during any particular period;

- •

- additions and departures of key advisors;

- •

- transitioning of advisors from completed projects to new engagements;

- •

- seasonal trends;

- •

- introduction of new services by us or our competitors;

- •

- changes in fees, pricing policies or compensation arrangements by us or our competitors;

- •

- strategic decisions by us, our clients or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures,

strategic investments or changes in business strategy;

- •

- global economic and political conditions and related risks, including acts of terrorism; and

- •

- conditions in the travel industry that could prevent our advisors from traveling to client sites.

We depend on project-based advisory engagements, and our failure to secure new engagements could lead to a decrease in our revenues.

Advisory engagements typically are project-based. Our ability to attract advisory engagements is subject to numerous factors, including the following:

- •

- delivering consistent, high-quality advisory services to our clients;

- •

- tailoring our advisory services to the changing needs of our clients;

- •

- matching the skills and competencies of our advisory staff to the skills required for the fulfillment of existing or

potential advisory engagements; and

- •

- maintaining a global business operation.

Any material decline in our ability to secure new advisory arrangements could have an adverse impact on our revenues and financial condition.

We could lose money on our fixed-fee contracts.

As part of our strategy, from time to time, we enter into fixed fee contracts, in addition to contracts based on payment for time and materials. Because of the complexity of many of our client engagements, accurately estimating the cost, scope and duration of a particular engagement can be a

13

difficult task. If we fail to make accurate estimates, we could be forced to devote additional resources to these engagements for which we will not receive additional compensation. To the extent that an expenditure of additional resources is required on an engagement, this could reduce the profitability of, or result in a loss on, the engagement.

We may not be able to maintain our existing services and products.

We operate in a rapidly evolving market, and our success depends upon our ability to deliver high quality advice and analysis to our clients. Any failure to continue to provide credible and reliable information and advice that is useful to our clients could have a significant adverse effect on future business and operating results. Further, if our advice proves to be materially incorrect and the quality of service is diminished, our reputation may suffer and demand for our services and products may decline. In addition, we must continue to improve our methods for delivering our products and services in a cost-effective manner.

We may not have the ability to develop and offer the new services and products that we need to remain competitive.

Our future success will depend in part on our ability to offer new services and products. To maintain our competitive position, we must continue to enhance and improve our services and products, develop or acquire new services and products in a timely manner, and appropriately position and price new services and products relative to the marketplace and our costs of producing them. These new services and products must successfully gain market acceptance by addressing specific industry and business sectors and by anticipating and identifying changes in client requirements. The process of researching, developing, launching and gaining client acceptance of a new service or product, or assimilating and marketing an acquired service or product is risky and costly. We may not be able to introduce new, or assimilate acquired, services and products successfully. Any failure to achieve successful client acceptance of new services and products could have an adverse effect on our business results.

We have risks associated with potential acquisitions or investments.

Since our inception, we have expanded through acquisitions. In the future, we plan to pursue additional acquisitions and investments as opportunities arise. We may not be able to successfully integrate businesses which we may acquire in the future without substantial expense, delays or other operational or financial problems. We may not be able to identify, acquire or profitably manage additional businesses. If we pursue acquisition or investment opportunities, these potential risks could disrupt our ongoing business, result in the loss of key customers or personnel, increase expenses and otherwise have a material adverse effect on our business, results of operations and financial condition.

Difficulties in integrating businesses we acquire in the future may demand time and attention from our senior management.

Integrating businesses we acquire in the future may involve unanticipated delays, costs and/or other operational and financial problems. In integrating acquired businesses, we may not achieve expected economies of scale or profitability, or realize sufficient revenue to justify our investment. If we encounter unexpected problems as we try to integrate an acquired firm into our business, our

14

management may be required to expend time and attention to address the problems, which would divert their time and attention from other aspects of our business.

We may fail to anticipate and respond to market trends.

Our success depends in part upon our ability to anticipate rapidly changing technologies and market trends and to adapt our advice, services and products to meet the changing sourcing advisory needs of our clients. Our clients regularly undergo frequent and often dramatic changes. That environment of rapid and continuous change presents significant challenges to our ability to provide our clients with current and timely analysis, strategies and advice on issues of importance to them. Meeting these challenges requires the commitment of substantial resources. Any failure to continue to respond to developments, technologies, and trends in a manner that meets market needs could have an adverse effect on our business results.

We may be unable to protect important intellectual property rights.

We rely on copyright and trademark laws, as well as nondisclosure and confidentiality arrangements, to protect our proprietary rights in our methods of performing our services and our tools for analyzing financial and other information. There can be no assurance that the steps we have taken to protect our intellectual property rights will be adequate to deter misappropriation of our rights or that we will be able to detect unauthorized use and take timely and effective steps to enforce our rights. If substantial and material unauthorized uses of our proprietary methodologies and analytical tools were to occur, we may be required to engage in costly and time-consuming litigation to enforce our rights. There can be no assurance that we would prevail in such litigation. If others were able to use our intellectual property or were to independently develop our methodologies or analytical tools, our ability to compete effectively and to charge appropriate fees for our services may be adversely affected.

We face competition and our failure to compete successfully could materially adversely affect our results of operations and financial condition.

The business information services and advisory sector is competitive, highly fragmented and subject to rapid change. We face competition from many other providers ranging from large organizations to small firms and independent contractors that provide specialized services. Our competitors include any firm that provides sourcing or benchmarking advisory services, IT strategy or business process consulting, which may include a variety of consulting firms, service providers, niche advisors and, potentially, advisors currently or formerly employed by us. Some of our competitors have significantly more financial and marketing resources, larger professional staffs, closer client relationships, broader geographic presence or more widespread recognition than us.

In addition, limited barriers to entry exist in the markets in which we do business. As a result, additional new competitors may emerge and existing competitors may start to provide additional or complementary services. Additionally, technological advances may provide increased competition from a variety of sources. There can be no assurance that we will be able to successfully compete against current and future competitors and our failure to do so could result in loss of market share, diminished value in our products and services, reduced pricing and increased marketing expenditures. Furthermore, we may not be successful if we cannot compete effectively on quality of advice and analysis, timely

15

delivery of information, client service or the ability to offer services and products to meet changing market needs for information, analysis or price.

We rely heavily on key members of our management team.

We are dependent on our management team. We have entered into subscription and non-competition agreements with a number of these key management personnel. If any of the covenants contained in the subscription and non-competition agreements are violated, the key management personnel will forfeit their shares (or the after-tax proceeds if the shares have been sold). We issue restricted stock units ("RSUs") and stock appreciation rights ("SARs") from time to time to key employees. Vesting rights in the RSUs and SARs are subject to compliance with restrictive covenant agreements. Vested and unvested RSUs and SARs will be forfeited upon any violation of the restrictive covenant agreements. Despite the non-competition and restrictive covenant agreements, we may not be able to retain these managers and may not be able to enforce the non-competition and restrictive covenants. If we were to lose a number of key members of our management team and were unable to replace these people quickly, we could have difficulty maintaining our growth and certain key relationships with large clients.

We depend upon our ability to attract, retain and train skilled advisors and other professionals.

Our business involves the delivery of advisory and consulting services. Therefore, our continued success depends in large part upon our ability to attract, develop, motivate, retain and train skilled advisors and other professionals who have advanced information technology and business processing domain expertise, financial analysis skills, project management experience and other similar abilities. We do not have non-competition agreements with many non-executive advisors. Consequently, these advisors could resign and join one of our competitors or provide sourcing advisory services to our clients through their own ventures.

We must also recruit staff globally to support our services and products. We face competition for the limited pool of these qualified professionals from, among others, technology companies, market research firms, consulting firms, financial services companies and electronic and print media companies, some of which have a greater ability to attract and compensate these professionals. Some of the personnel that we attempt to hire may be subject to non-compete agreements that could impede our short-term recruitment efforts. Any failure to retain key personnel or hire and train additional qualified personnel as required supporting the evolving needs of clients or growth in our business could adversely affect the quality of our products and services, and our future business and operating results.

We may have agreements with certain clients that limit the ability of particular advisors to work on some engagements for a period of time.

We provide services primarily in connection with significant or complex sourcing transactions and other matters that provide potential competitive advantage and/or involve sensitive client information. Our engagement by a client occasionally precludes us from staffing certain advisors on new engagements because the advisors have received confidential information from a client who is a competitor of the new client. Furthermore, it is possible that our engagement by a client could preclude us from accepting engagements with such client's competitors because of confidentiality concerns.

16

In many industries in which we provide advisory services, there has been a trend toward business consolidations and strategic alliances that could limit the pool of potential clients.

Consolidations and alliances reduce the number of potential clients for our services and products and may increase the chances that we will be unable to continue some of our ongoing engagements or secure new engagements. When companies consolidate, overlapping services previously purchased separately are usually purchased only once by the combined entity, leading to loss of revenue. Other services that were previously purchased by one of the merged or consolidated entities may be deemed unnecessary or cancelled. If our clients consolidate with or are acquired by other entities that are not our clients, or that use fewer of our services, they may discontinue or reduce their use of our services. There can be no assurance as to the degree to which we may be able to address the revenue impact of such consolidation. Any of these developments could harm our operating results and financial condition.

We derive a significant portion of our revenues from our largest clients and could be materially and adversely affected if we lose one or more of our large clients.

Our 20 largest clients accounted for approximately 43% of revenue in 2013 and 40% in 2012. If one or more of our large clients terminate or significantly reduce their engagements or fail to remain a viable business, then our revenues could be materially and adversely affected. In addition, sizable receivable balances could be jeopardized if large clients fail to remain viable.

Our international operations expose us to a variety of risks that could negatively impact our future revenue and growth.

Approximately 46% of our revenues for both 2013 and 2012 were derived from sales outside of the Americas, respectively. Our operating results are subject to the risks inherent in international business activities, including:

- •

- tariffs and trade barriers;

- •

- regulations related to customs and import/export matters;

- •

- restrictions on entry visas required for our advisors to travel and provide services;

- •

- tax issues, such as tax law changes and variations in tax laws as compared to the United States;

- •

- cultural and language differences;

- •

- an inadequate banking system;

- •

- foreign exchange controls;

- •

- restrictions on the repatriation of profits or payment of dividends;

- •

- crime, strikes, riots, civil disturbances, terrorist attacks and wars;

- •

- nationalization or expropriation of property;

- •

- law enforcement authorities and courts that are inexperienced in commercial matters; and

- •

- deterioration of political relations with the United States.

17

Air travel, telecommunications and entry through international borders are all vital components of our business. If a terrorist attack were to occur, our business could be disproportionately impacted because of the disruption a terrorist attack causes on these vital components.

We intend to continue to expand our global footprint in order to meet our clients' needs. This may involve expanding into countries beyond those in which we currently operate. We may involve expanding into less developed countries, which may have less political, social or economic stability and less developed infrastructure and legal systems. As we expand our business into new countries, regulatory, personnel, technological and other difficulties may increase our expenses or delay our ability to start up operations or become profitable in such countries. This may affect our relationships with our clients and could have an adverse effect on our business.

We operate in a number of international areas which exposes us to significant foreign currency exchange rate risk.

We have significant international revenue, which is generally collected in local currency. We currently hold or issue forward exchange contracts for hedging purposes. We do enter into forward contracts for hedging of specific transactions. All are settled prior to quarter end. It is expected that our international revenues will continue to grow as European and Asian markets adopt sourcing solutions. The translation of our revenues into U.S. dollars, as well as our costs of operating internationally, may adversely affect our business, results of operations and financial condition.

We may be subject to claims for substantial damages by our clients arising out of disruptions to their businesses or inadequate service and our insurance coverage may be inadequate.

Most of our service contracts with clients contain service level and performance requirements, including requirements relating to the quality of our services. Failure to consistently meet service requirements of a client or errors made by our employees in the course of delivering services to our clients could disrupt the client's business and result in a reduction in revenues or a claim for damages against us. Additionally, we could incur liability if a process we manage for a client were to result in internal control failures or impair our client's ability to comply with our own internal control requirements.

Under our service agreements with our clients, our liability for breach of our obligations is generally limited to actual damages suffered by the client and is typically capped at the greater of an agreed amount or the fees paid or payable to us under the relevant agreement. These limitations and caps on liability may be unenforceable or otherwise may not protect us from liability for damages. In addition, certain liabilities, such as claims of third parties for which we may be required to indemnify our clients or liability for breaches of confidentiality, are generally not limited under those agreements. Although we have general commercial liability insurance coverage, the coverage may not continue to be available on acceptable terms or in sufficient amounts to cover one or more large claims. The successful assertion of one or more large claims against us that exceed available insurance coverage or changes in our insurance policies (including premium increases or the imposition of large deductible or co-insurance requirements) could have a material adverse effect on our business.

18

We could be liable to our clients for damages and subject to liability and our reputation could be damaged if our client data is compromised.

We may be liable to our clients for damages caused by disclosure of confidential information. We are often required to collect and store sensitive or confidential client data in order to perform the services we provide under our contracts. Many of our contracts do not limit our potential liability for breaches of confidentiality. If any person, including any of our current or former employees, penetrates our network security or misappropriates sensitive data or if we do not adapt to changes in data protection legislation, we could be subject to significant liabilities to our clients or to our clients' customers for breaching contractual confidentiality provisions or privacy laws. Unauthorized disclosure of sensitive or confidential client data, whether through breach of our processes, systems or otherwise, could also damage our reputation and cause us to lose existing and potential clients. We may also be subject to civil actions and criminal prosecution by government or government agencies for breaches relating to such data. Our insurance coverage for breaches or mismanagement of such data may not continue to be available on reasonable terms or in sufficient amounts to cover one or more large claims against us.

Client restrictions on the use of client data could adversely affect our activities.

The majority of the data we use to populate our databases comes from our client engagements. The insight sought by clients from us relates to the contractual data and terms, including pricing and costs, to which we have access in the course of assisting our clients in the negotiation of our sourcing agreements. Data is obtained through the course of our engagements with clients who agree to contractual provisions permitting us to consolidate and utilize on an aggregate basis such information. If we were unable to utilize key data from previous client engagements, our business, financial condition and results of operations could be adversely affected.

We may not be able to maintain the equity in our brand name.

We transitioned to the ISG brand with TPI, Compass and STA Consulting positioned as product and service descriptors which have legally registered trademarks in certain appropriate jurisdictions. There may be other entities providing similar services that use these names for their business. There can be no assurance that the resulting confusion and lack of brand-recognition in the marketplace created by this transition will not adversely affect our business.

We believe that the ISG brand and the related subsidiary brands including "TPI," "Compass" and "STA Consulting" remain critical to our efforts to attract and retain clients and staff and that the importance of brand recognition will increase as competition increases. We may expand our marketing activities to promote and strengthen our brands and may need to increase our marketing budget, hire additional marketing and public relations personnel, expend additional sums to protect the brands and otherwise increase expenditures to create and maintain client brand loyalty. If we fail to effectively promote and maintain the brands or incur excessive expenses in doing so, our future business and operating results could be adversely impacted.

Our actual operating results may differ significantly from our guidance.

From time to time, we release guidance regarding our future performance that represents our management's estimates as of the date of release. This guidance, which consists of forward-looking

19

statements, is prepared by our management and is qualified by, and subject to, the assumptions and the other information contained or referred to in the release. Our guidance is not prepared with a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and neither our independent registered public accounting firm nor any other independent expert or outside party compiles or examines the guidance and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. Guidance is based upon a number of assumptions and estimates that, while presented with numerical specificity, is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. The principal reason that we release this data is to provide a basis for our management to discuss our business outlook with analysts and investors. We do not accept any responsibility for any projections or reports published by any such persons. Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions of the guidance furnished by us will not materialize or will vary significantly from actual results. Accordingly, our guidance is only an estimate of what management believes is realizable as of the date of release. Actual results will vary from the guidance and the variations may be material. Investors should also recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the guidance in context and not to place undue reliance on it. Any failure to successfully implement our operating strategy or the occurrence of any of the events or circumstances set forth in this Annual Report on Form 10-K could result in the actual operating results being different than the guidance, and such differences may be adverse and material.

Item 1B. Unresolved Staff Comments

None.

We maintain our executive offices in Stamford, Connecticut. The lease on this premise covers 9,716 square feet and expires on July 31, 2018. The majority of our business activities are performed on client sites. We do not own offices or properties. We have leased offices in the United States, Australia, Canada, China, France, Germany, India, Italy, Japan, Netherlands, Singapore, Spain, Sweden and the United Kingdom.

From time to time, in the normal course of business, we are a party to various legal proceedings. We are not aware of any asserted or unasserted legal proceedings or claims that we believe would have a material adverse effect on our financial condition, results of operations or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

20

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The following table sets forth the high and low closing sales price of our common stock, as reported on The NASDAQ Stock Market LLC under the symbol "III" for the periods shown:

| |

Common Stock | ||||||

|---|---|---|---|---|---|---|---|

Quarter Ending

|

High | Low | |||||

March 31, 2013 |

$ | 2.02 | $ | 1.13 | |||

June 30, 2013 |

2.08 | 1.84 | |||||

September 30, 2013 |

4.38 | 1.90 | |||||

December 31, 2013 |

4.56 | 3.54 | |||||

| |

Common Stock | ||||||

|---|---|---|---|---|---|---|---|

Quarter Ending

|

High | Low | |||||

March 31, 2012 |

$ | 1.38 | $ | 1.03 | |||

June 30, 2012 |

1.45 | 1.21 | |||||

September 30, 2012 |

1.36 | 1.20 | |||||

December 31, 2012 |

1.28 | 0.99 | |||||

On February 21, 2014, the last reported sale price for our common stock on The Nasdaq Stock Market was $5.24 per share.

As of December 31, 2013, there were 379 holders of record of ISG common stock. The actual number of stockholders is significantly greater than this number of record holders and includes stockholders who are beneficial owners but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

Dividend Policy

We have not paid any dividends on our common stock to date. It is the current intention of our Board of Directors to retain all earnings, if any, for use in our business operations and, accordingly, our board does not anticipate declaring any dividends in the foreseeable future. Moreover, our Credit Agreement restricts our ability to pay dividends. The payment of dividends in the future will be within the discretion of our then Board of Directors and will be contingent upon our revenues and earnings, if any, capital requirements and general financial condition.

Issuer Purchases of Equity Securities

The Company's Board Of Directors has approved common share repurchase authorizations under which repurchases may be made from time to time in the open market, pursuant to pre-set trading plans meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, in private transactions or otherwise. The authorizations do not have a stated expiration date. The timing and actual number of shares to be repurchased in the future will depend on a variety of factors, including the Company's financial position, earnings, capital requirements of the Company's operating subsidiaries, legal requirements, regulatory constraints, share price, catastrophe losses, funding of the

21

Company's qualified pension plan, other investment opportunities (including mergers and acquisitions), market conditions and other factors.

The following table details the repurchases that were made during the three months ended December 31, 2013.

Period

|

Total Number of Securities Purchased (In thousands) |

Average Price per Securities |

Total Numbers of Securities Purchased as Part of Publicly Announced Plan (In thousands) |

Approximate Dollar Value of Securities That May Yet Be Purchased Under The Plan (In thousands) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

October 1 – October 31 |

80 shares | $ | 4.09 | 80 | $ | 4,126 | |||||||

November 1 – November 30 |

78 shares | $ | 3.88 | 78 | $ | 3,823 | |||||||

December 1 – December 31 |

116 shares | $ | 4.05 | 116 | $ | 3,353 | |||||||

Securities Authorized for Issuance under Equity Compensation Plan

Information regarding equity compensation plans required by Regulation S-K Item 201(d) is incorporated by reference in Item 12 of this annual report on Form 10-K from the Proxy Statement filed in connection with our 2014 Annual Meeting of Stockholders.

22

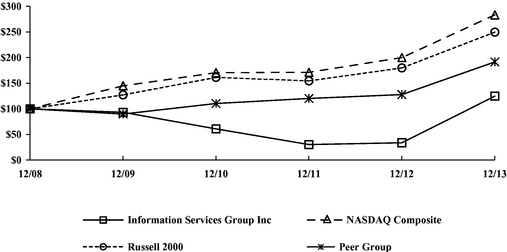

The following graph compares the 5 year cumulative total stockholder return on our Common Stock from December 31, 2008 through December 31, 2013, with the cumulative total return for the same period of (i) the NASDAQ Composite Index, (ii) the Russell 2000 Index and (iii) the Peer Group described below. The comparison assumes for the same period the investment of $100 on December 31, 2008 in our Common Stock and in each of the indices and, in each case, assumes reinvestment of all dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Information Services Group Inc, the NASDAQ Composite Index,

the Russell 2000 Index, and a Peer Group

- *

- $100

invested on 12/31/08 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

Measurement Periods

|

ISG | NASDAQ | Russell 2000 | Peer Group(a) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

December 31, 2009 |

$ | 93.24 | $ | 144.88 | $ | 127.17 | $ | 89.87 | |||||

December 31, 2010 |

$ | 60.88 | $ | 170.58 | $ | 161.32 | $ | 110.42 | |||||

December 31, 2011 |

$ | 30.29 | $ | 171.30 | $ | 154.59 | $ | 120.28 | |||||

December 31, 2012 |

$ | 33.82 | $ | 199.99 | $ | 179.86 | $ | 127.83 | |||||

December 31, 2013 |

$ | 124.71 | $ | 283.39 | $ | 249.69 | $ | 191.57 | |||||

- (a)

- The Peer Group consists of the following companies: CRA International Inc., Forrester Research Inc., FTI Consulting Inc., Gartner Group, Inc., Huron Consulting Group, Inc. and The Hackett Group, Inc. The Peer Group is weighted by market capitalization.

23

Item 6. Selected Financial Data

The following historical information was derived from our audited consolidated financial statements for the years ended December 31, 2013, 2012, 2011, 2010 and 2009. The information is only a summary and should be read in conjunction with the historical consolidated financial statements and related notes. The historical results included below are not indicative of our future performance.

| |

Years Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||

| |

(dollars in thousands, except per share data) |

|||||||||||||||

Statement of Comprehensive Income (Loss) Data: |

||||||||||||||||

Revenues |

$ | 210,982 | $ | 192,745 | $ | 184,426 | $ | 132,013 | $ | 132,744 | ||||||

Depreciation and amortization |

7,473 | 8,857 | 11,034 | 9,846 | 9,562 | |||||||||||

Operating income (loss) |

11,701 | 6,550 | (60,842) | (1) | (51,741) | (2) | 814 | (3) | ||||||||

Interest expense |

(2,712 | ) | (3,146 | ) | (3,458 | ) | (3,241 | ) | (4,550 | ) | ||||||

Interest income |

20 | 45 | 75 | 159 | 262 | |||||||||||

Foreign currency transaction loss |

(45 | ) | (209 | ) | (38 | ) | (268 | ) | (140 | ) | ||||||

Income tax provision (benefit) |

4,267 | 2,637 | (8,326 | ) | (1,926 | ) | (778 | ) | ||||||||

Net income (loss) |

4,776 | 603 | (55,937 | ) | (53,165 | ) | (2,836 | ) | ||||||||

Basic weighted average common shares |

36,810 | 36,205 | 36,258 | 32,050 | 31,491 | |||||||||||

Net income (loss) per common share—basic |

0.13 | 0.02 | (1.54 | ) | (1.66 | ) | (0.09 | ) | ||||||||

Diluted weighted average common shares |

38,687 | 37,626 | 36,258 | 32,050 | 31,491 | |||||||||||

Net income (loss) per common share—diluted |

0.13 | 0.02 | (1.54 | ) | (1.66 | ) | (0.09 | ) | ||||||||

Cash Flow Data: |

||||||||||||||||

Cash provided by (used in): |

||||||||||||||||

Operating activities |

$ | 23,055 | $ | 10,730 | $ | 871 | $ | 5,747 | $ | 4,056 | ||||||

Investing activities |

$ | (1,903 | ) | $ | (1,848 | ) | $ | (9,655 | ) | $ | (6,707 | ) | $ | (1,239 | ) | |

Financing activities |

$ | (9,398 | ) | $ | (10,179 | ) | $ | (6,903 | ) | $ | (1,698 | ) | $ | (22,080 | ) | |

Balance Sheet Data (at period end) |

||||||||||||||||

Total assets |

$ | 139,874 | $ | 135,985 | $ | 145,034 | $ | 184,564 | $ | 241,973 | ||||||

Debt |

$ | 56,746 | $ | 63,063 | $ | 70,063 | $ | 69,813 | $ | 71,813 | ||||||

Shareholders' equity |

$ | 43,243 | $ | 38,309 | $ | 35,884 | $ | 81,817 | $ | 131,625 | ||||||

- (1)

- As

a result of our goodwill and intangible asset impairment assessments, we recorded an impairment charge of $34.3 million during the fourth quarter

of 2011 associated with goodwill and $27.4 million related to intangible assets.

- (2)

- As

a result of our goodwill and intangible asset impairment assessments, we recorded an impairment charge of $46.6 million during the third quarter

of 2010 associated with goodwill and $5.9 million related to intangible assets.

- (3)

- As a result of our intangible asset impairment assessments, we recorded an impairment charge of $6.8 million during the third quarter of 2009 associated with intangible assets.

24

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion together with Item 6 "Selected Financial Data" and our audited consolidated financial statements and the related notes included in Item 8 "Financial Statements and Supplementary Data". In addition to historical consolidated financial information, this discussion contains forward-looking statements that reflect our plans, estimates and beliefs. These forward-looking statements are subject to numerous risks and uncertainties. Statements, other than those based on historical facts, which address activities, events or developments that we expect or anticipate may occur in the future are forward-looking statements. Such forward-looking statements are and will be, as the case may be, subject to many risks, uncertainties and factors relating to our operations and business environment that may cause actual results to be materially different from any future results, express or implied, by such forward-looking statements. These forward-looking statements must be understood in the context of numerous risks and uncertainties, including, but not limited to, those described previously in section 1A "Risk Factors."

BUSINESS OVERVIEW

Information Services Group, Inc. (ISG) (NASDAQ: III) is a leading technology insights, market intelligence and advisory services company serving more than 500 clients around the world to help them achieve operational excellence. We support private and public sector organizations to transform and optimize their operational environments through research, benchmarking, consulting and managed services with a focus on information technology, business process transformation, program management services and enterprise resource planning. Clients look to us for unique insights and innovative solutions for leveraging technology, our deep data source, and more than five decades of experience of global leadership in information and advisory services. Based in Stamford, Connecticut, we have approximately 800 employees and operate in 21 countries.

Our strategy is to strengthen our existing market position and develop new services and products to support future growth plans. As a result, we are focused on growing our existing service model, expanding geographically, developing new industry sectors, productizing market data assets, expanding our managed services offering and growing via acquisitions. Although we do not expect any adverse conditions that will impact our ability to execute against our strategy over the next twelve months, the more significant factors that could limit our ability to grow in these areas include global macro-economic conditions and the impact on the overall sourcing market, competition, our ability to retain advisors and reductions in discretionary spending with our top strategic accounts or other significant client events. Other areas that could impact the business would also include natural disasters, legislative and regulatory changes and capital market disruptions.

We derive our revenues from fees and reimbursable expenses for professional services. A majority of our revenues are generated under hourly or daily rates billed on a time and expense basis. Clients are typically invoiced on a monthly basis, with revenue recognized as the services are provided. There are also client engagements in which we are paid a fixed amount for our services, often referred to as fixed fee billings. This may be one single amount covering the whole engagement or several amounts for various phases or functions. From time to time, we earn incremental revenues, in addition to hourly or fixed fee billings, which are contingent on the attainment of certain contractual milestones or objectives. Such revenues may cause unusual variations in quarterly revenues and operating results.

25

Our results are impacted principally by our full-time consultants' utilization rate, the number of business days in each quarter and the number of our revenue-generating professionals who are available to work. Our utilization rate can be negatively affected by increased hiring because there is generally a transition period for new professionals that result in a temporary drop in our utilization rate. Our utilization rate can also be affected by seasonal variations in the demand for our services from our clients. The number of business work days is also affected by the number of vacation days taken by our consultants and holidays in each quarter. We typically have fewer business work days available in the fourth quarter of the year, which can impact revenues during that period. Time-and-expense engagements do not provide us with a high degree of predictability as to performance in future periods. Unexpected changes in the demand for our services can result in significant variations in utilization and revenues and present a challenge to optimal hiring and staffing. The volume of work performed for any particular client can vary widely from period to period.

EXECUTIVE SUMMARY

ISG had a breakout year in 2013, turning in our best overall operating performance since our inception and crossing a significant threshold when we passed the $200 million revenue mark for the first time. It was a year marked by growth—and innovation—as we developed a range of new products and services to meet the changing needs of our clients.

As we address perpetual change in information technology and business processes across a global marketplace that remains in constant flux, one thing remains a constant: our mission to serve our clients and enable them to achieve operational excellence.

The Shifting Marketplace

A lot has changed since ISG, through its predecessor company, TPI, pioneered the sourcing advisory industry more than two decades ago. Client requirements have evolved from pure economies-of-scale and labor-arbitrage propositions into complex technological and operational solutions aimed not only at lowering costs, but improving overall performance.

Companies, requiring flexibility and agility in large-scale global operations, are opting for mixed models of delivery. These models combine shorter-term deals with multiple providers, each offering specialized capabilities, with captive and internal shared-service operations. Increasing labor automation, shrinking technology costs, and the impact of SMAC (social, mobile, analytic, cloud) technologies are among the marketplace trends driving this shift.

In response, service providers are moving away from customized offerings and replacing them with standardized service models that rely more on automation and "as-a-service" (XaaS) solutions.