Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission File Number: 001-36537

TRUPANION, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 83-0480694 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

6100 4th Avenue S, Suite 200

Seattle, Washington 98108

(855) 727 - 9079

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | | Name of Exchange on Which Registered |

Common Stock, $0.00001 par value per share | | NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer | o | | Accelerated filer | x | |

Non-accelerated filer | o | (Do not check if smaller reporting company) | Smaller reporting company | o | |

| | | Emerging growth company | x | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $521,061,388 using the closing price on that day of $22.38.

As of February 7, 2018, there were approximately 30,128,277 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE Part III incorporates certain information by reference from the definitive proxy statement to be filed by the registrant in connection with the 2018 Annual Meeting of Stockholders (Proxy Statement). The Proxy Statement will be filed by the registrant with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the registrant’s fiscal year ended December 31, 2017.

TRUPANION, INC.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2017

TABLE OF CONTENTS

|

| | |

| | Page |

|

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

|

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

|

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

|

| | |

Item 15. | | |

Item 16. | | |

| | |

| | |

| | |

Note About Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and section 27A of the Securities Act of 1933, as amended (Securities Act). All statements contained in this Annual Report on Form 10-K other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “potentially,” “estimate,” “target,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan” and “expect,” and similar expressions that convey uncertainty of future events or outcomes, are intended to identify forward-looking statements.

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part I. Item 1A. “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report on Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason, except as required by law.

Unless otherwise stated or the context otherwise indicates, references to “we,” “us,” “our” and similar references refer to Trupanion, Inc. and its subsidiaries taken as a whole.

PART I

Item 1. Business

Our Mission

Our mission is to help the pets we all love receive the best veterinary care.

Our Company and Approach

We provide medical insurance for cats and dogs throughout the United States, Canada and Puerto Rico. Our data-driven, vertically-integrated approach enables us to provide pet owners with what we believe is the highest value medical insurance for their pets, priced specifically for each pet’s unique characteristics. Our growing and loyal member base provides us with highly predictable and recurring revenue. We operate our business similar to other subscription-based businesses, with a focus on maximizing the lifetime value of each pet while sustaining a favorable ratio of lifetime value relative to acquisition cost, based on our desired return on investment.

Our target market is large and under-penetrated. We have pioneered a unique solution that sits at the center of the pet medical ecosystem, meeting the needs of pets, pet owners and veterinarians, and we believe we are uniquely positioned to continue to drive market penetration. Our aggregate total pets enrolled grew from 31,207 pets on January 1, 2010 to 423,194 pets on December 31, 2017, which represents a compound annual growth rate of 39%.

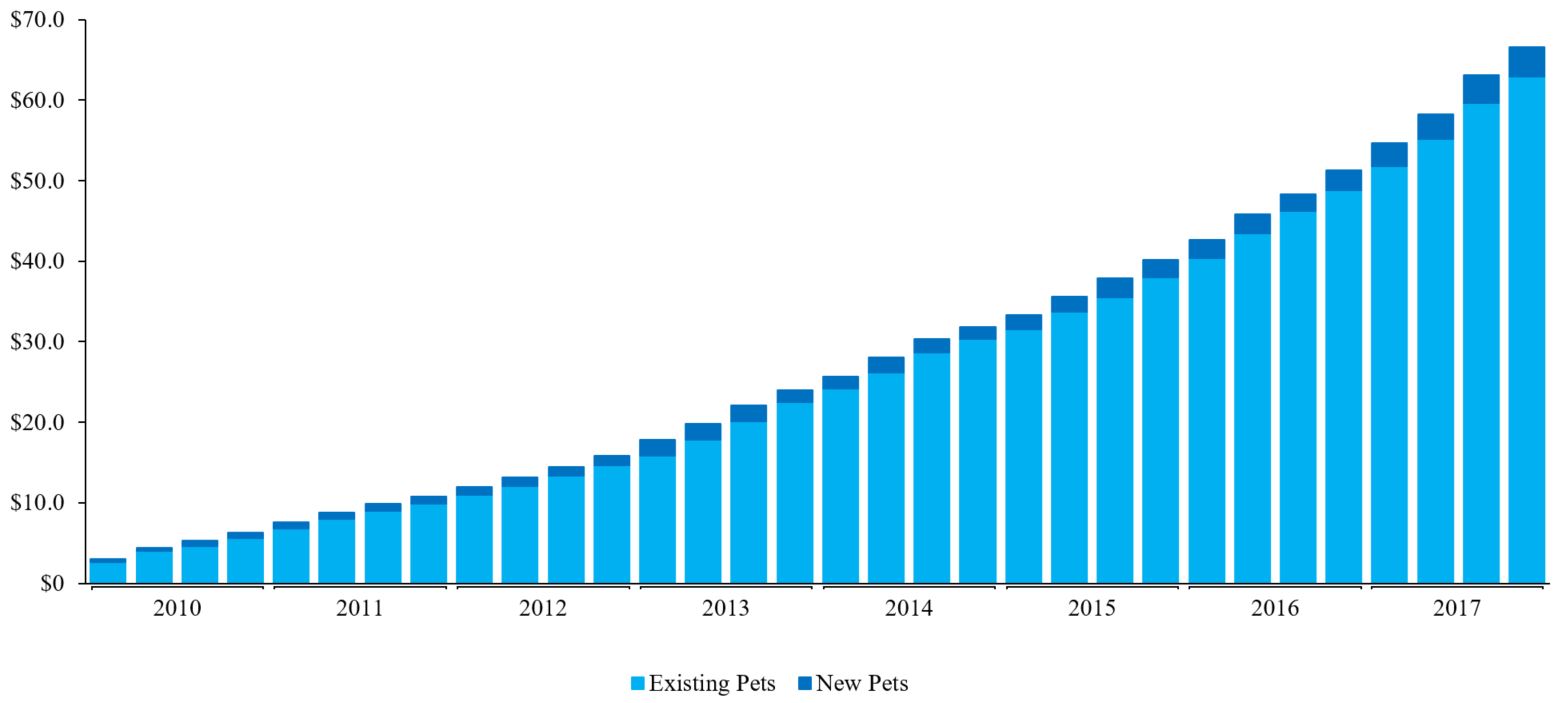

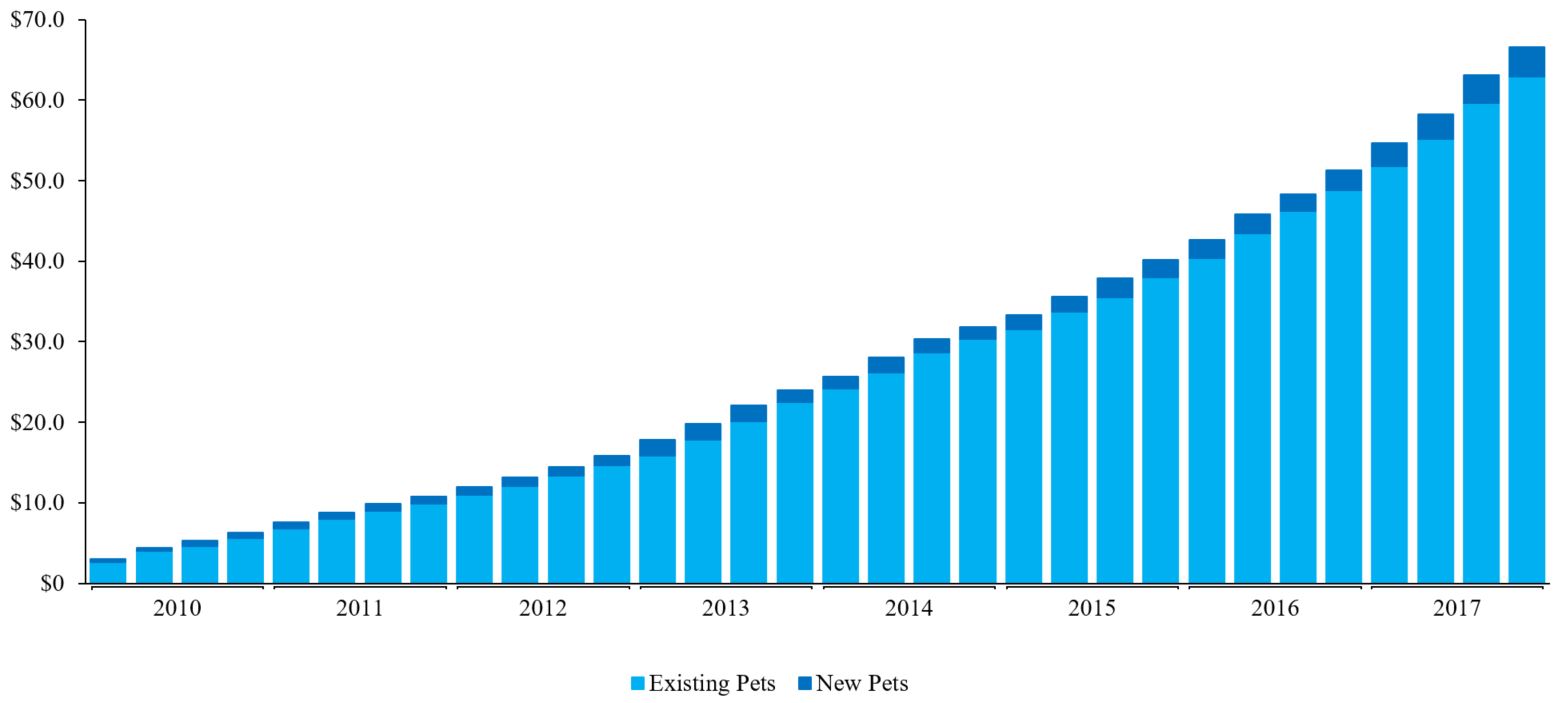

Total Revenue by New and Existing Pets Enrolled

(in millions)

It is very difficult for pet owners to budget for their pet becoming sick or injured when pet owners don't know whether their pet's health will be average, lucky, or unlucky, and the cost of medical care varies dramatically by geography and pet breed. A pet owner budgeting for average medical care costs is not an effective solution for an unlucky pet. Additionally, the timing of accidents or illnesses may not align with the owner's budgeting approach. Our cost-plus model is designed to spread the risk evenly within each category of pets. Our goal is to charge each pet the appropriate amount for their specific circumstances (e.g., breed, age at enrollment, geography, etc.) so that each pet receives the same value proposition, and, in aggregate, the extra amount paid by lucky pets covers the veterinary costs incurred by unlucky pets. To an informed, responsible, and loving pet owner, Trupanion is a hedge to help them budget for the unexpected cost and variable timing of necessary veterinary care.

We provide our members with a high-quality medical plan for the life of their cat or dog. Our product is simple, fair, and covers all unexpected illnesses and injuries, including those that are most likely to occur with particular breeds of pet, which other insurance providers may label as congenital or hereditary conditions. We pay 90% of actual veterinary costs if a pet becomes sick or injured, including all diagnostic tests, surgeries, and medications. In general, only certain taxes, examination fees, and medical issues existing prior to enrollment are not included. Once enrolled in our subscription, we pay for the veterinary costs for the pet's entire life, and pet owners are free to use any licensed veterinarian in the United States and Canada, including any referral or specialty hospital. We aim to pay veterinarians directly, within five minutes of the veterinary invoice being created and prior to the pet owner checking out, eliminating the traditional reimbursement model and providing our members the convenience of not having to pay out of pocket or confirm treatment.

Veterinarians are able to recommend treatment to Trupanion members without having their decisions dictated by costs or the financial burden of the pet owner. Veterinarians, as a result, are able to establish stronger relationships and better alignment with pet owners who are protected by Trupanion. Our members tend to visit veterinarians more frequently and select the best course of treatment for their pet regardless of cost.

We generate revenue primarily from our members' subscription fees. Fees are paid at the beginning of each subscription period, which automatically renews on a monthly basis. Since 2010, at least 88% of our subscription business revenue every quarter has come from existing members who had active subscriptions at the beginning of the quarter. Due to our focus on providing a superior value proposition and member experience, our members are very loyal, as evidenced by our 98.5% average monthly retention rate since 2010. For more information regarding average monthly retention, including an explanation of how we calculate this metric, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Metrics.”

We enrolled our first pet in Canada in 2000 and our first pet in the United States in 2008. Our revenue for the year ended December 31, 2017 was $242.7 million, representing a compound annual growth rate of 44% from our revenue of $19.1 million for the year ended December 31, 2010. We have made and expect to continue to make substantial investments in member acquisition and in expanding our operations to support our expected growth. For the year ended December 31, 2017, we had a net loss of $1.5 million and our accumulated deficit was $82.8 million at December 31, 2017.

Our Strategy

We are focused on attracting and retaining members by providing a best-in-class value and member experience by focusing on the following strategies:

Increase the number of referring veterinary practices. We intend to increase the number of veterinary practices that are actively introducing Trupanion to their clients.

Increase the number of referrals from active veterinary practices. We intend to continue increasing the number and quality of interactions that we have with veterinarians to accelerate the rate at which active veterinary practices refer us leads.

Increase the number of third-party referrals from members. We believe that it is critical to our long-term success that existing members add a pet or refer their friends and family to Trupanion, so we focus on improving the member experience. For example, Trupanion Express® is designed to directly pay veterinary invoices, eliminating the reimbursement model and transforming the payment process to simplify the administrative hassle for our members.

Improve online lead generation and conversion. We are investing in our online marketing capabilities, and intend to continue to do so in order to fully capture the online opportunity. Our online marketing initiatives have played an integral role in converting leads to enrolled pets and also in generating new leads.

Explore other member acquisition channels. We regularly evaluate new member acquisition channels. We intend to aggressively pursue those channels that we believe could, over time, generate an attractive ratio of lifetime value relative to acquisition cost, based on our desired return on investment.

Expand internationally. While we are currently focused on capturing the large opportunity in the U.S. and Canadian markets, we may choose to explore international expansion in the future.

Pursue other revenue opportunities. We may opportunistically engage in other revenue opportunities. For example, our wholly-owned insurance subsidiary, American Pet Insurance Company, has partnered with unaffiliated general agents offering pet insurance products since 2012.

Sales and Marketing

Marketing to Veterinarians

Veterinary practices represent our largest referral source, and combined with referrals from members, accounted for approximately 76% of our leads in 2017. Our Territory Partner model was designed to facilitate frequent, in-person, face-to-face communications with veterinarians and their staff about the benefits of Trupanion and high-quality medical insurance for the life of a pet. The most important job of a Territory Partner is to build strong relationships with each veterinarian hospital, so the staff can trust and recommend Trupanion. Alignment with veterinarians is critical for a positive member experience, long term retention, and pet owner referrals. We strongly believe that earning the trust of veterinarians and their staff is the first step to successfully capturing more of the North American market.

The current market for veterinary services is highly fragmented and includes many sole-owner veterinary practices and small veterinary practices that are difficult to reach. We believe that no pet insurance company has a referral group that compares in scale to our Territory Partners and that it would be extremely difficult, costly and time consuming to replicate. Our Territory Partners are independent contractors who market our product and are paid fees based on activity in their regions. We believe this structure aligns our interests and provides a platform that we can leverage over time.

Sales and Marketing to Pet Owners

We generate leads through a diverse set of third-party referrals and online member acquisition channels, which we then convert into members through our website and contact center.

| |

• | Referrals from third-parties. We actively promote the value of Trupanion to veterinarians, veterinary affiliates (including purchasing groups and other veterinary membership organizations), corporate employee benefit providers, and shelters and breeders so they can inform their clients on the benefits of Trupanion. For the year ended December 31, 2017, 67% of our new pet enrollments were generated from these third-party referrals (excluding referral from existing members). |

| |

• | Referrals from existing members. For the year ended December 31, 2017, 26% of our new pet enrollments were generated from existing members adding a pet or referring their friends and family. |

| |

• | Online. We believe many of our members spend some time researching options before deciding to purchase our subscription. A significant portion of the members we acquire from online leads come through our paid search marketing, email marketing, social media marketing and search engine optimization initiatives. |

Competition

We compete with consumers that self-fund veterinary costs with cash or credit, as well as traditional "pet insurance" providers and new entrants to our market. The vast majority of pet owners in the United States and Canada do not currently have medical insurance for their pets. We are primarily focused on expanding the overall size of the market by improving the value proposition for consumers. We view our primary competitive challenge as educating pet owners on why Trupanion is a better alternative to self-funding.

In addition, new entrants backed by large insurance companies with substantial financial resources have attempted to enter the market in the past and may do so again in the future. Further, traditional providers may consolidate, resulting in the emergence of new providers that are vertically integrated or able to create other operational efficiencies, which could lead to increased competition. We believe that we have competitive strengths that position us favorably related to existing and potential competitors. These include: a superior value proposition for pet owners due in part to our vertically integrated structure that reduces frictional costs, a unique member acquisition strategy that we have developed using Territory Partners, a proprietary database containing historical data since the year 2000 that provides actionable data insights, a powerful technology infrastructure, and an experienced management team.

Intellectual Property

We rely on federal, state, common law, and international rights, as well as contractual restrictions, to protect our intellectual property. We control access to our proprietary technology, software, and documentation by entering into confidentiality and invention assignment agreements with our employees and partners, and confidentiality agreements with third parties, such as service providers, vendors, individuals and entities that may be exploring a business relationship with us. We also rely on a combination of intellectual property rights, including trade secrets, patents, copyrights, trademarks, and domain names to establish and protect our intellectual property. We seek to protect our proprietary position by filing patent applications in the United States and in jurisdictions outside of the United States related to our technology, inventions, and improvements that are important to our business. We additionally rely on data and market exclusivity, and patent term extensions when available. Our ability to protect and enforce our intellectual property rights is subject to risk and may adversely impact our business.

Employees

We highly value our company culture. We are a mission-driven company and attract employees that share our passion for pets. Our culture enables our employees to channel that passion collectively toward our goals and is key to our success. As of December 31, 2017, we had 523 employees.

Regulation

Each U.S. state, the District of Columbia and U.S. territories and possessions, as well as all of the Canadian provinces, have insurance laws that apply to companies licensed to transact insurance business in the jurisdiction. The primary regulator of an insurance company, however, is located in its state of domicile. Our insurance subsidiary, American Pet Insurance Company (APIC), is domiciled in New York State and its primary regulator is therefore the New York Department of Financial Services (NY DFS). APIC is currently licensed to do business in all 50 states, Puerto Rico and the District of Columbia in the United States. As such, APIC is subject to comprehensive regulation and supervision under U.S. state and federal laws.

State insurance regulators have broad authority with respect to all aspects of the insurance industry, including the following:

| |

• | licensing to transact business, and approval and issuance of certificates of authority; |

| |

• | revoking or suspending previously issued certificates of authority; |

| |

• | assessing the officers and directors to ensure a minimum level of competency and trustworthiness; |

| |

• | licensing of individual producers and agents and business entities marketing and selling insurance products; |

| |

• | licensing of claims adjusters and third-party administrators; |

| |

• | penalizing for noncompliance with respect to licensing requirements and regulations; |

| |

• | admitting assets to statutory surplus and regulating the nature of investments; |

| |

• | regulating premium rate levels for the insurance products offered; |

| |

• | regulating claims practices; and |

| |

• | establishing reserve requirements and solvency standards. |

Regulators also have broad authority to perform on-site market conduct examinations of our management and operations, marketing and sales, underwriting, customer service, claims handling and licensing. Market conduct examinations can involve direct, on-site contact with a company to identify potential regulatory violations, discussion and correction of an identified problem, or obtaining a better understanding of how the company is operating in the marketplace.

State insurance laws and regulations in the United States require APIC to file financial statements with state insurance regulators everywhere it is licensed and its operations and accounts are subject to examination at any time. APIC’s statutorily required financial statements are available to the public. APIC prepares statutory financial statements in accordance with accounting practices and procedures prescribed or permitted by these regulators. The National Association of Insurance Commissioners (NAIC) has approved a series of uniform statutory accounting principles (SAP) that have been adopted, in some cases with minor modifications, by all state insurance regulators. As a basis of accounting, SAP was developed to monitor and regulate the solvency of insurance companies. In developing SAP, insurance regulators were primarily concerned with assuring an insurer’s ability to pay all its current and future obligations to policyholders. As a result, statutory accounting focuses on conservatively valuing the assets and liabilities of insurers, generally in accordance with standards specified by the insurer’s domiciliary state. The values for assets, liabilities and equity reflected in financial statements prepared in accordance with U.S. generally accepted accounting principles are usually different from those reflected in financial statements prepared under SAP.

In Canada, our medical insurance is written by an unaffiliated Canadian-licensed insurer, Omega General Insurance Company (Omega). Under the terms of our agreements with Omega, our subsidiary Trupanion Brokers Ontario acts as a general agent through a fronting and reinsurance agreement with Omega pursuant to which, we retain any financial risk associated with our Canadian business. Effective January 1, 2015, these agreements were restructured to include our segregated cell business, Wyndham Segregated Account AX (WICL), located in Bermuda. These restructured agreements automatically renew annually, but may be terminated by either party with one year’s written notice. Omega’s Canadian insurance operations are supervised and regulated by the Canadian federal, provincial and territorial governments. Omega is a fully licensed insurer in all of the Canadian provinces and territories in which we do business.

Though we are not directly regulated by the Bermuda Monetary Authority (BMA), WICL’s regulation and compliance impacts us as it could have an adverse impact on the ability of WICL to pay dividends. WICL is regulated by the BMA under the Insurance Act of 1978 (Insurance Act) and the Segregated Accounts Company Act of 2000. The Insurance Act imposes on Bermuda insurance companies solvency and liquidity standards, certain restrictions on the declaration and payment of dividends and distributions, certain restrictions on the reduction of statutory capital, and auditing and reporting requirements, and grants BMA the powers to supervise and, in certain circumstances, to investigate and intervene in the affairs of insurance companies. Under the Insurance Act, WICL as a class 3 insurer is required to maintain available statutory capital and surplus at a level equal to or in excess of a prescribed minimum established by reference to net written premiums and loss reserves.

Under the Bermuda Companies Act of 1981, as amended, a Bermuda company may not declare or pay a dividend or make a distribution out of contributed surplus if there are reasonable grounds for believing that: (a) the company is, or would be after the payment, unable to pay its liabilities as they become due; or (b) the realizable value of the company’s assets would thereby be less than its liabilities. The Segregated Accounts Company Act of 2000 further requires that dividends out of a segregated account can only be paid to the extent that the cell remains solvent. The value of its assets must remain greater than the aggregate of its liabilities, issued share capital, and share premium accounts. Per our contractual agreements with WICL, the allowable dividend to be paid by WICL is equivalent to the positive undistributed profit attributable to the shares.

Insurance Holding Company Regulation

APIC is subject to laws governing insurance holding companies in New York, its state of domicile. These laws impact us in a number of ways, including the following:

| |

• | We must file periodic information reports with the NY DFS, including information concerning our capital structure, ownership, financial condition and general business operations. |

| |

• | New York regulates certain transactions between APIC and our other affiliated entities, including the fee levels payable by APIC to affiliates that provide services to APIC. |

| |

• | New York law restricts the ability of any one person to acquire certain levels of our voting securities without prior regulatory approval. State insurance holding company regulations generally provide that no person, corporation or other entity may acquire control of an insurance company, or a controlling interest in any parent company of an insurance company, without the prior approval of such insurance company’s domiciliary state insurance regulator. Any person acquiring, directly or indirectly, 10% or more of the voting securities of an insurance company is presumed to have acquired “control” of the company. To obtain approval of any change in control, the proposed acquirer must file with the applicable insurance regulator an application disclosing, among other information, its background, financial condition, the financial condition of its affiliates, the source and amount of funds by which it will effect the acquisition, the criteria used in determining the nature and amount of consideration to be paid for the acquisition, proposed changes in the management and operations of the insurance company and other related matters. In considering an application to acquire control of an insurer, the insurance commissioner generally will consider such factors as the experience, competence and financial strength of the applicant, the integrity of the applicant’s board of directors and executive officers, the acquirer’s plans for the management and operation of the insurer and any anti-competitive results that may arise from the acquisition. |

| |

• | New York law restricts the ability of APIC to pay dividends to its holding company parent. These restrictions are based in part on the prior year’s statutory income and surplus. In general, dividends up to specified levels are considered ordinary and may be paid without prior approval, and dividends in larger amounts, or extraordinary dividends, are subject to approval by the NY DFS. An extraordinary dividend or distribution is defined as a dividend or distribution that, in the aggregate in any 12-month period, exceeds the lesser of (i) 10% of surplus as of the preceding December 31 or (ii) the insurer’s adjusted net investment income for such 12-month period, not including realized capital gains. |

Financial Regulation of Insurers

Risk-Based Capital Requirements

The NAIC has adopted risk-based capital requirements for life, health and property and casualty insurance companies. Refer to Item 1A. “Risk Factors” for details of these requirements.

NAIC Insurance Regulatory Information System Ratios

The NAIC has developed a set of financial relationships or tests known as the Insurance Regulatory Information System, or IRIS, to assist state regulators in monitoring the financial condition of U.S. insurance companies and identifying companies requiring special attention or action. IRIS consists of a statistical phase and an analytical phase whereby financial examiners review insurers’ annual statements and financial ratios. The statistical phase consists of 12 key financial ratios based on year-end data that are generated from the NAIC database annually; each ratio has a “usual range” of results. For IRIS ratio purposes, APIC submits data annually to state insurance regulators who then analyze our data using prescribed financial data ratios. A ratio falling outside the prescribed “usual range” is not considered a failing result. Rather, unusual values are viewed as part of the regulatory early monitoring system. In many cases, it is not unusual for financially sound companies to have one or more ratios that fall outside the usual range. As of December 31, 2017, APIC had three such ratios outside the usual range, relating to net premiums written to surplus, change in net premiums written, and investment yield.

Regulators may investigate or monitor an insurance company if its IRIS ratios fall outside the prescribed usual range. The inquiries made by state insurance regulators into an insurance company’s IRIS ratios can take various forms. In some instances, regulators may require the insurance company to provide a written explanation as to the causes of the particular ratios being outside the usual range, management’s actions to produce results that will be within the usual range in future years and what, if any, actions the insurance company’s domiciliary state insurance regulators have taken. Regulators are not required to take action if an IRIS ratio is outside the usual range, but, depending on the nature and scope of the particular insurance company’s exception, regulators may request additional information to monitor going forward and, as a consequence, may take additional regulatory action.

Insurance Guaranty Associations, Residual Markets, Wind Pools and State-specific Reinsurance Mechanisms

Most jurisdictions in which we operate have laws or regulations that require insurance companies doing business in the state to participate in various types of guaranty associations or other similar arrangements designed to protect policyholders from losses under insurance policies issued by insurance companies that become impaired or insolvent. Typically, these associations levy assessments, up to prescribed limits, on member insurers on the basis of the member insurer’s proportionate share of the business in the relevant jurisdiction in the lines of business in which the impaired or insolvent insurer is engaged. Some jurisdictions permit member insurers to recover assessments that they paid through full or partial premium tax offsets, usually over a period of years.

Some states in which APIC operates have residual markets, wind pools or state reinsurance mechanisms. The general intent behind these is to provide insurance to individuals and businesses that cannot find appropriate insurance in the private marketplace. The intent of state-specific reinsurance mechanisms generally is to stabilize the cost of, and ensure access to, reinsurance for admitted insurers writing business in the state. Historically, APIC has had minimal financial exposure to guaranty associations, residual markets, wind pools and state-specific reinsurance mechanisms; however there is no guarantee that these items will continue to be of low financial impact to APIC.

Federal Initiatives

The U.S. federal government generally does not directly regulate the insurance business. From time to time, various regulatory and legislative changes have been proposed in the insurance industry. Among the proposals that have in the past been, or are at present may be under consideration, are the possible introduction of federal regulation in addition to, or in lieu of, the current system of state regulation of insurers. There have also been proposals in various state legislatures (some of which have been enacted) to conform portions of their insurance laws and regulations to various model acts adopted by the NAIC. The NAIC has undertaken a Solvency Modernization Initiative focused on updating the U.S. insurance solvency regulation framework, including capital requirements, governance and risk management, group supervision, accounting and financial reporting and reinsurance. The NAIC Amendments are a result of these efforts. Additional requirements are also expected.

In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) established a Federal Insurance Office within the U.S. Department of the Treasury. The Federal Insurance Office initially is charged with monitoring all aspects of the insurance industry (other than health insurance, certain long-term care insurance and crop insurance), gathering data and conducting a study on methods to modernize and improve the insurance regulatory system in the United States. It is not possible to predict whether, in what form or in what jurisdictions any of these proposals might be adopted, or the effect federal involvement in insurance will have, if any, on us.

Privacy and Data Collection Regulation

There are numerous federal, state and foreign laws regarding privacy and the protection of member data. The regulatory environment in this area for online businesses is very unsettled in the United States and internationally and new legislation is frequently being proposed and enacted.

In the area of information security and data protection, many states have passed laws requiring notification to users when there is a security breach for personal data or requiring the adoption of minimum information security standards. In addition, our operations subject us to certain payment card association operating rules, certification requirements and rules, including the Payment Card Industry Data Security Standard, a security standard for companies that collect, store or transmit certain data regarding credit and debit cards, credit and debit card holders and credit and debit card transactions.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or obtain and use our technology or data to develop products that may compete with our offerings. Policing unauthorized use of our technology or data is difficult. The laws of other countries in which we operate may offer little or no effective protection of our proprietary technology. Our competitors could also independently develop technologies equivalent to ours, and our intellectual property rights may not be broad enough for us to prevent competitors from selling products incorporating those technologies.

Companies in our industry and in other industries may own a large number of patents, copyrights and trademarks and may frequently request license agreements, threaten litigation or file suit against us based on allegations of infringement or other violations of intellectual property rights. From time to time, we face, and we expect to face in the future, allegations that we have infringed the trademarks, copyrights, patents and other intellectual property rights of third parties, including our competitors. As we face increasing competition and as our business grows, we will likely face more claims of infringement.

Information About Segments and Geographic Revenue

We have two reportable business segments. See Note 12 of our audited consolidated financial statements included in this report for information about segments and geographic revenue. For financial information regarding our business, see Part II - Item 7 - "Management's Discussion and Analysis of Financial Condition and Results of Operations" of this report and our audited consolidated financial statements and related notes included elsewhere in this report.

Corporate Information

We were founded in Canada in 2000 as Vetinsurance Ltd. In 2006, we effected a business reorganization whereby Vetinsurance Ltd. became a consolidated subsidiary of Vetinsurance International, Inc., a Delaware corporation. In 2007, we began doing business as Trupanion. In 2013, we formally changed our name from Vetinsurance International, Inc. to Trupanion, Inc. Our principal executive offices are located at 6100 4th Avenue South, Seattle, Washington 98108, and our telephone number is (855) 727-9079. Our website address is www.trupanion.com. Information contained on, or that can be accessed through, our website is not incorporated by reference, and you should not consider information on our website to be part of, this Annual Report on Form 10-K.

Available Information

We are required to file annual, quarterly and other reports, proxy statements and other information with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934, as amended (Exchange Act). We also make available, free of charge on the investor relations portion of our website at investors.trupanion.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after they are filed electronically with the SEC. You can inspect and copy our reports, proxy statements and other information filed with the SEC at the offices of the SEC’s Public Reference Room located at 100 F Street, NE, Washington D.C 20549 on official business days during the hours of 10 a.m. to 3 p.m. Eastern time. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Rooms. The SEC also maintains an Internet website at www.sec.gov where you can obtain our SEC filings. You can also obtain paper copies of these reports, without charge, by contacting Investor Relations at InvestorRelations@Trupanion.com.

Investors and others should note that we may announce material financial information to our investors using our investor relations website, SEC filings, our annual stockholder meeting, press releases, public conference calls, investor conferences, presentations and webcasts. We use these channels, as well as social media, to communicate with our members and the public about our company, our services and other issues. It is possible that the information we post on these channels, such as social media, could be deemed to be material information.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this report, including our consolidated financial statements and related notes, as well as in our other filings with the SEC, in evaluating our business and before investing in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that are not expressly stated, that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, operating results, financial condition and prospects could be materially harmed. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We have incurred significant net losses since our inception and may not be able to achieve or maintain profitability in the future.

We have incurred significant net losses since our inception. We had a net loss of $1.5 million for the year ended December 31, 2017. Additionally, as of December 31, 2017, our accumulated deficit was $82.8 million. We have funded our operations through equity financings, borrowings under a revolving line of credit and term loans and, more recently, positive cash flows from operations. We may not be able to achieve or maintain profitability in the near future or at all. Our recent growth, including our growth in revenue and membership, may not be sustainable or may decrease, and we may not generate sufficient revenue to achieve or maintain profitability. Additionally, our expense levels are based, in significant part, on our estimates of future revenue and many of these expenses are fixed in the short term. As a result, we may be unable to adjust our spending in a timely manner if our revenue falls short of our expectations. Accordingly, any significant shortfall of revenue in relation to our estimates could have an immediate negative effect on our financial results.

We have made and plan to continue to make significant investments to grow our member base. Our average pet acquisition cost and the number of new pets we enroll depends on a number of factors, including the effectiveness of our sales execution and marketing initiatives, changes in costs of media, the mix of our sales and marketing expenditures and the competitive environment. Our average pet acquisition cost has in the past significantly varied and in the future may significantly vary period to period based upon specific marketing initiatives. We also regularly test new member acquisition channels and marketing initiatives, which often are more expensive than our traditional marketing channels and generally increase our average acquisition costs. We plan to expand the number of Territory Partners we use to reach veterinarians and other referral sources and to engage in other marketing activities, including direct to consumer advertising, which are likely to increase our acquisition costs.

We expect to continue to make significant expenditures to maintain and expand our business including expenditures relating to the acquisition of new members, retention of our existing members and development and implementation of our technology platforms. These increased expenditures will make it more difficult for us to achieve and maintain future profitability. Our ability to achieve and maintain profitability depends on a number of factors, including our ability to attract and service members on a profitable basis. If we are unable to achieve or maintain profitability, we may not be able to execute our business plan, our prospects may be harmed and our stock price could be materially and adversely affected.

We base our decisions regarding our member acquisition expenditures primarily on the projected lifetime value of the pets that we expect to acquire and the projected internal rate of return on marketing spend. Our estimates and assumptions may not accurately reflect our future results, we may overspend on member acquisition, and we may not be able to recover our member acquisition costs or generate profits from these investments.

We invest significantly in member acquisition. We spent $19.1 million on sales and marketing to acquire new members for the year ended December 31, 2017. We expect to continue to spend significant amounts to acquire additional members. We utilize Territory Partners, who are paid fees based on activity in their regions, to communicate the benefits of our subscription to veterinarians through in-person visits. Veterinarians then educate pet owners, who visit our website or call our contact center to learn more about, and potentially enroll in, our subscription. We also invest in other third-party referrals and direct to consumer member acquisition channels, though we have limited experience with some of them.

We base our decisions regarding our member acquisition expenditures primarily on the lifetime value of the pets that we project to acquire. This analysis depends substantially on estimates and assumptions based on our historical experience with pets enrolled in earlier periods, including our key operating metrics described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Metrics.”

If our estimates and assumptions regarding the lifetime value of the pets that we project to acquire and our related decisions regarding investments in member acquisition prove incorrect, or if the expected lifetime value of the pets that we project to acquire differs significantly from that of pets acquired in prior periods, we may be unable to recover our member acquisition costs or generate profits from our investment in acquiring new members. Moreover, if our member acquisition costs increase or we invest in member acquisition channels that do not ultimately result in any or an adequate number of new member enrollments, the return on our investment may be lower than we anticipate irrespective of the lifetime value of the pets that we project to acquire as a result of the new members. If we cannot generate profits from this investment, we may need to alter our growth strategy, and our growth rate and operating results may be adversely affected.

If we are unable to maintain high member retention rates, our growth prospects and revenue will be adversely affected.

We have historically experienced high average monthly retention rates. For example, our average monthly retention rate between 2010 and 2017 was 98.5%. If our efforts to satisfy our existing members are not successful or if new marketing initiatives result in enrolling more pets that inherently have a lower retention rate, we may not be able to maintain our retention rates. Members we obtain through aggressive promotions or other channels that involve relatively less meaningful contact between us and the member may be more likely to terminate their subscription. In the past, we have experienced reduced retention rates during periods of rapid member growth, as our retention rate generally has been lower during the first year of member enrollment. Members may choose to terminate their subscription for a variety of reasons, including perceived or actual lack of value, delays or other unsatisfactory experiences in how we review and process veterinary invoice payments, unsatisfactory member service, an economic downturn, increased subscription fees, loss of a pet, a more attractive offer from a competitor, changes in our subscription or other reasons, including reasons that are outside of our control. Our cost of acquiring a new member is substantially greater than the cost involved in maintaining our relationship with an existing member. If we are not able to successfully retain existing members and limit terminations, our revenue and operating margins will be adversely impacted and our business, operating results and financial condition would be harmed.

The prices of our subscriptions are based on assumptions and estimates and may be subject to regulatory approvals. If our actual experience differs from the assumptions and estimates used in pricing our subscriptions or if we are unable to obtain any necessary regulatory pricing approvals we need, at all or in a timely manner, our revenue and financial condition could be adversely affected.

The pricing of our subscriptions reflect amounts we expect to pay for a pet's medical care derived from assumptions that we make regarding a number of factors, including a pet’s species, breed, age, gender and location. Factors related to pet location include the current and assumed changes in the cost and availability of veterinary technology and treatments and local veterinary practice preferences. The prices of our subscriptions also include assumptions and estimates regarding our own operating costs and expenses. We monitor and manage our pricing and overall sales mix to achieve target returns. Profitability from new members emerges over a period of years depending on the nature and length of time a pet is enrolled, and is subject to variability as actual results may differ from pricing assumptions. If the subscription fees we collect are insufficient to cover actual costs, including veterinary invoice expense, operating costs and expenses within anticipated pricing allowances, or if our member retention rates are not high enough to ensure recovery of member acquisition costs, then our gross profit could be adversely affected, and our revenue may be insufficient to achieve profitability. Conversely, if our pricing assumptions differed from actual results such that we overpriced risks, our competitiveness and growth prospects could be adversely affected. Further, even if our pricing assumptions are accurate, we may not be able to obtain the necessary regulatory approvals for any pricing changes that we may determine are appropriate based on our pricing assumptions, which could prevent us from obtaining sufficient revenue from subscriptions to cover our costs, including veterinary invoice expense, processing costs, pet acquisition costs and other expenses in any such jurisdiction unless and until such regulatory approvals are obtained in appropriate amounts.

The anticipated benefits of our analytics platform may not be fully realized.

Our analytics platform draws upon our proprietary pet data to price our subscriptions. The assumptions we make about breeds and other factors in pricing may prove to be inaccurate and, accordingly, these pricing analytics may not accurately reflect the expense that we will ultimately incur. Furthermore, if any of our competitors develop similar or better data systems, adopt similar or better underwriting criteria and pricing models or receive our data, our competitive advantage could decline or be lost.

Our actual veterinary invoice expense may exceed our current reserve established for veterinary invoices and may adversely affect our operating results and financial condition.

Our recorded reserve for veterinary invoices is based on our best estimates of the amount of veterinary invoices we expect to pay, inclusive of an estimate for veterinary invoices we have not yet received, after considering known facts and interpretations of circumstances and the estimated cost to process and pay those veterinary invoices. We consider internal factors, including data from our proprietary data analytics platform, experience with similar cases, actual veterinary invoices paid, historical trends involving veterinary invoice payment patterns, patterns of receipt of veterinary invoices, seasonality, pending levels of unpaid veterinary invoices, veterinary invoice processing programs and contractual terms. We may also consider external factors, including changes in the law, court decisions, changes to regulatory requirements and economic conditions. Because reserves are estimates of veterinary invoices that have been incurred but are not yet submitted to us, the establishment of appropriate reserves is an inherently uncertain and complex process that involves significant subjective judgment. Further, we do not transfer or cede our risk as an insurer and, therefore, we maintain more risk than we would if we purchased reinsurance. The ultimate cost of paying veterinary invoices and the related administration may vary materially from recorded reserves, and such variance may result in adjustments to the reserve for veterinary invoices, which could have a material effect on our operating results.

We rely significantly on Territory Partners, veterinarians and other third parties to recommend us.

We rely significantly on Territory Partners and other third parties to cultivate direct veterinary relationships and build awareness of the benefits that we offer veterinarians and their clients. In turn, we rely on veterinarians to introduce and recommend Trupanion to their clients. We also rely significantly on other third parties, such as existing members, online and other businesses, animal shelters, breeders and veterinary affiliates, including veterinarian purchasing groups and associations, to help generate leads for our subscription. Veterinary referred leads represent our largest member acquisition channel. In the year ended December 31, 2017, approximately 76% of our enrollments came from referrals from veterinarians and existing members, as well as people adding pets to their existing subscription.

Many factors influence the success of our relationships with these referral sources, including:

| |

• | the continued positive market presence, reputation and growth of our company and of the referral sources; |

| |

• | the effectiveness of referral sources; |

| |

• | the decision of any such referral source to support one or more of our competitors; |

| |

• | the interest of the referral sources’ customers or clients in our subscription; |

| |

• | the relationship and level of trust between Territory Partners and veterinarians, and between us and the referral source; |

| |

• | the percentage of the referral sources’ customers or clients that submit applications or use trial certificates to enroll through our website or contact center; |

| |

• | our ability to implement or maintain any marketing programs, including trial certificates, in any jurisdiction; and |

| |

• | our ability to work with the referral source to implement any changes in our marketing initiatives, including website changes, infrastructure and technology and other programs and initiatives necessary to generate positive consumer experiences. |

In order for us to implement our business strategy and grow our revenue, we must effectively maintain and increase the number and quality of our relationships with Territory Partners, veterinarians and other referral sources, and continue to scale and improve our processes, programs and procedures that support them. Those processes, programs and procedures could become increasingly complex and difficult to manage. We expend significant time and resources attracting qualified Territory Partners and providing them with complete and current information about our business. Their relationship with us may be terminated at any time, and, if terminated, we may not recoup the costs associated with educating them about our subscription or be able to maintain any relationships they may have developed with veterinarians within their territories. Sometimes a single relationship may be used to cover multiple territories so that a terminated relationship could significantly impact our company. Further, if we experience an increase in the rate at which Territory Partner relationships are terminated, we may not develop or maintain relationships with veterinarians as quickly as we have in the past. If the financial cost to maintain our relationships with Territory Partners outweighs the benefits provided by Territory Partners, or if they feel unsupported or undervalued by us and terminate their relationship with us, our growth and financial performance could be adversely affected.

The success of our relationships with veterinary practices depends on the overall value we can provide to veterinarians. If the scope of our subscription is perceived to be inadequate or if our process for paying veterinary invoices is unsatisfactory to the veterinarians' clients because, for example, a service is not included in our subscription, member requests for reimbursement are denied or we fail to timely settle and pay veterinary invoices, veterinarians may be unwilling to recommend us to their clients and they may encourage their existing clients who have subscribed to stop or to purchase a competing product. If veterinarians determine our subscription is unreliable, cumbersome or otherwise does not provide sufficient value, they may terminate their relationship with us or begin recommending a competing product, which could negatively impact our ability to increase our member base and grow our business.

If we fail to establish or are unable to maintain successful relationships with Territory Partners, veterinarians and other referral sources, or experience an increase in the rate at which any of these relationships are terminated, it could negatively impact our ability to increase and retain our member base and our financial results. If we are unable to maintain our existing member acquisition channels and/or continue to add new member acquisition channels, if the cost of our existing sources increases or does not scale as we anticipate, or if we are unable to continue to use any existing channels or programs in any jurisdiction, including our trial certificate program, our member levels and sales and marketing expenses may be adversely affected.

Territory Partners are independent contractors and, as such, may pose additional risks to our business.

Territory Partners are independent contractors and, accordingly, we do not directly provide the same direction, motivation and oversight over Territory Partners as we otherwise could if Territory Partners were our own employees. Further, Territory Partners may themselves employ or engage others; we refer to these partners and their associates, collectively, as our Territory Partners. We do not control a Territory Partner’s employment or engagement of others, and it is possible that the actions of their employees and/or contractors could create threatened or actual legal proceedings against us.

Territory Partners may decide not to participate in our marketing initiatives and/or training opportunities, accept our introduction of new solutions or comply with our policies and procedures applicable to them, any of which may adversely affect our ability to develop relationships with veterinarians and grow our membership. Our sole recourse against Territory Partners who fail to perform is to terminate their contract, which could also trigger contractually obligated termination payments or result in disputes, including threatened or actual legal or regulatory proceedings.

We believe that Territory Partners are not and should not be classified as employees under existing interpretations of the applicable laws of the jurisdictions in which we operate. We do not pay or withhold any employment tax with respect to or on behalf of Territory Partners or extend any benefits to them that we generally extend to our employees, and we otherwise treat Territory Partners as independent contractors. Applicable authorities or the Territory Partners have in the past questioned and may in the future challenge this classification. Further, the applicable laws or regulations, including tax laws or interpretations, may change. If it were determined that we had misclassified any of our Territory Partners, we may be subjected to penalties and/or be required to pay withholding taxes, extend employee benefits, provide compensation for unpaid overtime, or otherwise incur substantially greater expenses with respect to Territory Partners.

Any of the foregoing circumstances could have a material adverse impact on our operating results and financial condition.

Our member base has grown rapidly in recent periods, and we may not be able to maintain the same rate of membership growth.

Our ability to grow our business and to generate revenue depends significantly on attracting new members. For the year ended December 31, 2017, we generated 90% of our revenue from subscriptions. In order to continue to increase our membership, we must continue to offer a superior value to our members. Our ability to continue to grow our membership will also depend in part on the effectiveness of our sales and marketing programs. Our member base may not continue to grow or may decline as a result of increased competition or the maturation of our business.

We may not maintain our current rate of revenue growth.

Our revenue has increased quickly and substantially in recent periods. We believe that our continued revenue growth will depend on, among other factors, our ability to:

| |

• | improve our market penetration through efficient and effective sales and marketing programs to attract new members; |

| |

• | maintain high retention rates; |

| |

• | increase the lifetime value per pet to, in turn, enable us to spend more on sales and marketing programs; |

| |

• | maintain positive relationships with veterinarians and other referral sources, and convince them to recommend our subscription; |

| |

• | maintain positive relationships with and increase the number and efficiency of Territory Partners; |

| |

• | continue to offer a superior value with competitive features and rates; |

| |

• | accurately price our subscriptions in relation to actual member costs and operating expenses and achieve required regulatory approval for pricing changes; |

| |

• | provide our members with superior member service, including timely and efficient payment of veterinary invoices, and by recruiting, integrating and retaining skilled and experienced personnel who can appropriately and efficiently review veterinary invoices and process payments; |

| |

• | generate new and maintain existing relationships and programs in our other business segment; |

| |

• | recruit, integrate and retain skilled, qualified and experienced sales department professionals who can demonstrate our value proposition to new and existing members; |

| |

• | react to changes in technology and challenges in the industry, including from existing and new competitors; |

| |

• | increase awareness of and positive associations with our brand; and |

| |

• | successfully respond to any regulatory matters and defend any litigation. |

You should not rely on our historical rate of revenue growth as an indication of our future performance.

Our use of capital may be constrained by risk-based capital regulations or contractual obligations.

Our subsidiary, American Pet Insurance Company, is subject to risk-based capital regulations that require us to maintain certain levels of surplus to support our overall business operations in consideration of our size and risk profile. We have in the past and may in the future fail to maintain the amount of risk-based capital required to avoid additional regulatory oversight, which was $22.2 million as of December 31, 2017. To comply with these regulations and our related contractual obligations, we may be required to maintain capital that we would otherwise invest in our growth and operations, which may require us to modify our operating plan or marketing initiatives, delay the implementation of new solutions or development of new technologies, decrease the rate at which we hire additional personnel and enter into relationships with Territory Partners, incur indebtedness or pursue equity or debt financings or otherwise modify our business operations, any of which could have a material adverse effect on our operating results and financial condition.

We are also subject to a contractual obligation related to our reinsurance agreement with Omega General Insurance Company (Omega). Under this agreement, we are required to fund a Canadian Trust account in accordance with Canadian regulations. As of December 31, 2017, the account held CAD $2.8 million.

Unexpected increases in the number or amounts of veterinary invoices received, or that we expect to receive, may negatively impact our operating results.

Unexpected changes in the number or amounts of veterinary invoices received, or that we expect to receive, may negatively impact our operating results. Rising costs of veterinary care and the increasing availability and usage of more expensive, technologically advanced medical treatments may increase the amounts of veterinary invoices we receive. Increases in the number of veterinary invoices we receive could arise from unexpected events that are inherently difficult to predict, such as a pandemic that spreads through the pet population, tainted pet food or supplies or an unusually high number of serious injuries or illnesses. We may experience volatility in the number of veterinary invoices we receive from time to time, and short-term trends may not continue over the longer term. The number of veterinary invoices may be affected by the level of care and attentiveness an owner provides to the pet, the pet’s breed and age and other factors outside of our control, as well as fluctuations in member retention rates and by new member initiatives that encourage an increase in veterinary invoices and other new member acquisition activities. A significant increase in the number or amounts of veterinary invoices could increase our cost of revenue and have a material adverse effect on our financial condition.

Our success depends on our ability to review, process, and pay veterinary invoices timely and accurately.

We must accurately evaluate and pay veterinary invoices timely in a manner that gives our members high satisfaction. Many factors can affect our ability to do this, including the training, experience and skill of our personnel, our ability to reduce the number of payment requests made for services not included in our subscription, the department’s culture and the effectiveness of its management, our ability to develop or select and implement appropriate procedures, supporting technologies and systems, and changes in our policy. Our failure to fairly pay veterinary invoices, accurately and in a timely manner, or to deploy resources appropriately, could result in unanticipated costs to us, lead to material litigation, undermine member goodwill and our reputation, and impair our brand image and, as a result, materially and adversely affect our competitiveness, financial results, prospects and liquidity.

We may not identify fraudulent or improperly inflated veterinary invoices.

It is possible that a member, or a third-party actually or purportedly on behalf of the member, could submit a veterinary invoice which we would then pay that appears authentic but in fact does not reflect services provided or products purchased for which the member paid. It is also possible that veterinarians will charge insured customers higher amounts than they would charge their non-insured clients for the same service or product. Such activity could lead to unanticipated costs to us and/or to time and expense to recover such costs. They could also lead to strained relationships with veterinarians and/or members, and could adversely affect our competitiveness, financial results and liquidity.

Changes in the Canadian currency exchange rate may adversely affect our revenue and operating results.

We offer our subscription in Canada, which exposes us to the risk of changes in the Canadian currency exchange rates. For the year ended December 31, 2017, approximately 20% of our total revenue was generated in Canada. Fluctuations in the relative strength of the Canadian economy and the Canadian dollar has in the past and could in the future adversely affect our revenue and operating results.

We are and will continue to be faced with many competitive challenges, any of which could adversely affect our prospects, operating results and financial condition.

We compete with pet owners that self-finance unexpected veterinary invoices with savings or credit, as well as traditional "pet insurance" providers and relatively new entrants into our market. The vast majority of pet owners in the United States and Canada do not currently have medical insurance for their pets. We are focused primarily on expanding our share of the overall market, and we view our primary competitive challenge as educating pet owners on why our subscription is a better alternative to self-financing.

Additionally, there are traditional insurance companies that provide pet insurance products, either as a stand-alone product or along with a broad range of other insurance products. In addition, new entrants backed by large insurance companies have attempted to enter the pet insurance market in the past and may do so again in the future. Further, traditional "pet insurance" providers may consolidate or take other actions to mimic the efficiencies from our vertically-integrated structure or create other operational efficiencies, which could lead to increased competition.

Some of our current and potential competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, technical, marketing and other resources than we do. Some of our competitors may be able to undertake more extensive marketing initiatives for their brands and services, devote more resources to website and systems development and make more attractive offers to potential employees, referral sources and third-party service providers.

To compete effectively, we will need to continue to invest significant resources in sales and marketing, in improving our member service levels, in the online experience and functionalities of our website and in other technologies and infrastructure. Failure to compete effectively against our current or future competitors could result in loss of current or potential members, subscription terminations or a reduction in member retention rates, which could adversely affect our pricing, lower our revenue and prevent us from achieving or maintaining profitability. We may not be able to compete effectively for members in the future against existing or new competitors, and the failure to do so could result in loss of existing or potential members, increased sales and marketing expenses or diminished brand strength, any of which could harm our business.

If we are not successful in cost-effectively converting visitors to our website and contact center into members, our business and operating results would be harmed.

Our growth depends in large part upon growth in our member base. We seek to convert consumers who visit our website and call our contact center into members. The rate at which consumers visiting our website and contact center seeking to enroll in our subscription are converted into members is a significant factor in the growth of our member base. A number of factors have influenced, and could in the future influence, the conversion rates for any given period, some of which are outside of our control. These factors include:

| |

• | the competitiveness of our subscription, including its perceived value, simplicity, and fairness; |

| |

• | changes in consumer shopping behaviors due to circumstances outside of our control, such as economic conditions and consumers’ ability or willingness to pay for our product; |

| |

• | the quality of and changes to the consumer experience when speaking with us on the phone or using our website; |

| |

• | regulatory requirements, including those that make the experience on our website cumbersome or difficult to navigate or that hinder our ability to speak with potential members quickly and in a way that is conducive to converting leads, enrolling new pets, and/or resolving member concerns; |

| |

• | system failures or interruptions in the operation of our abilities to write policies or operate our website or contact center; and |

| |

• | changes in the mix of consumers who are referred to us through various member acquisition channels, such as veterinary referrals, existing members adding a pet and referring their friends and family members and other third-party referrals and direct-to-consumer acquisition channels. |

Our ability to convert consumers into members can be impacted by a change in the mix of referrals received through our member acquisition channels. In addition, changes to our website or contact center, or other programs or initiatives we undertake, may adversely impact our ability to convert consumers into members at our current rate, or at all. These changes may have the unintended consequence of adversely impacting our conversion rates. A decline in the percentage of members who enroll in our subscription on our website or by calling our contact center also could result in increased member acquisition costs. To the extent the rate at which we convert consumers into members suffers, the growth rate of our member base may decline, which would harm our business, operating results and financial condition.

We have made and plan to continue to make substantial investments in features and functionality for our website and training and staffing for our contact center that are designed to generate traffic, increase member engagement and improve new and existing member service. These activities do not directly generate revenue, however, and we may never realize any benefit from these investments. If the expenses that we incur in connection with these activities do not result in sufficient growth in members to offset the cost, our business, operating results and financial condition will be adversely affected.

If we are unable to maintain and enhance our brand recognition and reputation, our business and operating results will be harmed.

We believe that maintaining and enhancing our brand recognition and reputation is critical to our relationships with existing members, Territory Partners, veterinarians and other referral sources, and to our ability to attract new members, new Territory Partners, additional supportive veterinarians and other referral sources. We also believe that the importance of our brand recognition and reputation will continue to increase as competition in our market continues to develop and mature. Our success in this area will depend on a wide range of factors, some of which are out of our control, including the following:

| |

• | the efficacy and viability of our sales and marketing programs; |

| |

• | the perceived value of our subscription; |

| |

• | quality of service provided, including the fairness, ease and timeliness of reviewing and paying veterinary invoices; |

| |

• | actions of our competitors, Territory Partners, veterinarians and other referral sources; |

| |

• | positive or negative publicity, including regulatory pronouncements and material on the Internet or social media; |

| |

• | regulatory and other government-related developments; and |

| |

• | litigation-related developments. |

The promotion of our brand may require us to make substantial investments, and we anticipate that, as our market becomes increasingly competitive, these branding initiatives may become increasingly difficult and expensive. Our brand promotion activities may not be successful or yield increased revenue, and to the extent that these activities result in increased revenue, the increased revenue may not offset the expenses we incur and our operating results could be harmed. If we do not successfully maintain and enhance our brand, our business may not grow and our relationships with veterinarians and other referral sources could be terminated, which would harm our business, operating results and financial condition.

Furthermore, negative publicity, whether or not justified, relating to events or activities attributed to us, our employees, our strategic partners, our affiliates, or others associated with any of these parties, may tarnish our reputation and reduce the value of our brands. Damage to our reputation and loss of brand equity may reduce demand for our services and have an adverse effect on our business, operating results, and financial condition. Moreover, any attempts to rebuild our reputation and restore the value of our brands may be costly and time consuming, and such efforts may not ultimately be successful.

Our business depends on our ability to maintain and scale the infrastructure necessary to operate our technology platform and could be adversely affected by a system failure.