x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Nevada | 98-06360182 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

1230 Columbia St. Suite 440 San Diego, CA | 92101 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: | 619-544-9177 | |

Large accelerated file ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company þ |

Page | ||

PART I - Financial Information | 1 | |

Item 1: Unaudited Interim Condensed Consolidated Financial Statements | 1 | |

Item 2: Management's Discussion and Analysis of Financial Condition and Results of Operations | 31 | |

Item 4: Controls and Procedures | 51 | |

PART II - Other Information | 51 | |

Item 1: Legal Proceedings | 51 | |

Item 1A: Risk Factors | 52 | |

Item 2: Unregistered Sales of Equity Securities and Use of Proceeds | 53 | |

Item 3: Defaults Upon Senior Securities | 53 | |

Item 4: Mine Safety Disclosures | 53 | |

Item 5: Other Information | 53 | |

Item 6: Exhibits | 53 | |

Signatures | 54 | |

March 31, 2012 | June 30, 2011 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 17,635 | $ | 1,096 | |||

Accounts receivable, trade, net | 28 | 1,347 | |||||

Accounts receivable, related party | 16,446 | 1,970 | |||||

Inventories | 33,828 | 55,026 | |||||

Refundable value added tax | 2,792 | 2,007 | |||||

Other current assets | 4,396 | 672 | |||||

Total current assets | 75,125 | 62,118 | |||||

Property and equipment, net | 17,605 | 16,745 | |||||

Farming concessions | 11,449 | 11,541 | |||||

Goodwill | 265 | 292 | |||||

Deferred income taxes | 410 | 445 | |||||

Deferred financing costs | — | 368 | |||||

Prepaid tuna quota and other assets | 1,988 | 209 | |||||

Total assets | $ | 106,842 | $ | 91,718 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Short-term borrowings | $ | 18,809 | $ | 24,002 | |||

Notes payable, related parties | — | 7,587 | |||||

Accounts payable, trade | 2,309 | 8,916 | |||||

Accounts payable, related parties | — | 556 | |||||

Accrued liabilities | 1,530 | 2,750 | |||||

Income taxes payable | 7,471 | 1,387 | |||||

Deferred income taxes | 734 | 750 | |||||

Total current liabilities | 30,853 | 45,948 | |||||

Long-term debt | 15,825 | 4,417 | |||||

Notes payable, related parties | — | 2,000 | |||||

Derivative stock warrants | 5,021 | 2,286 | |||||

Obligations under capital leases | 10 | 16 | |||||

Deferred income taxes | 2,214 | 2,214 | |||||

Other long-term liabilities | — | 803 | |||||

Total liabilities | 53,923 | 57,684 | |||||

Commitments and contingencies (Note 13) | |||||||

Stockholders’ equity: | |||||||

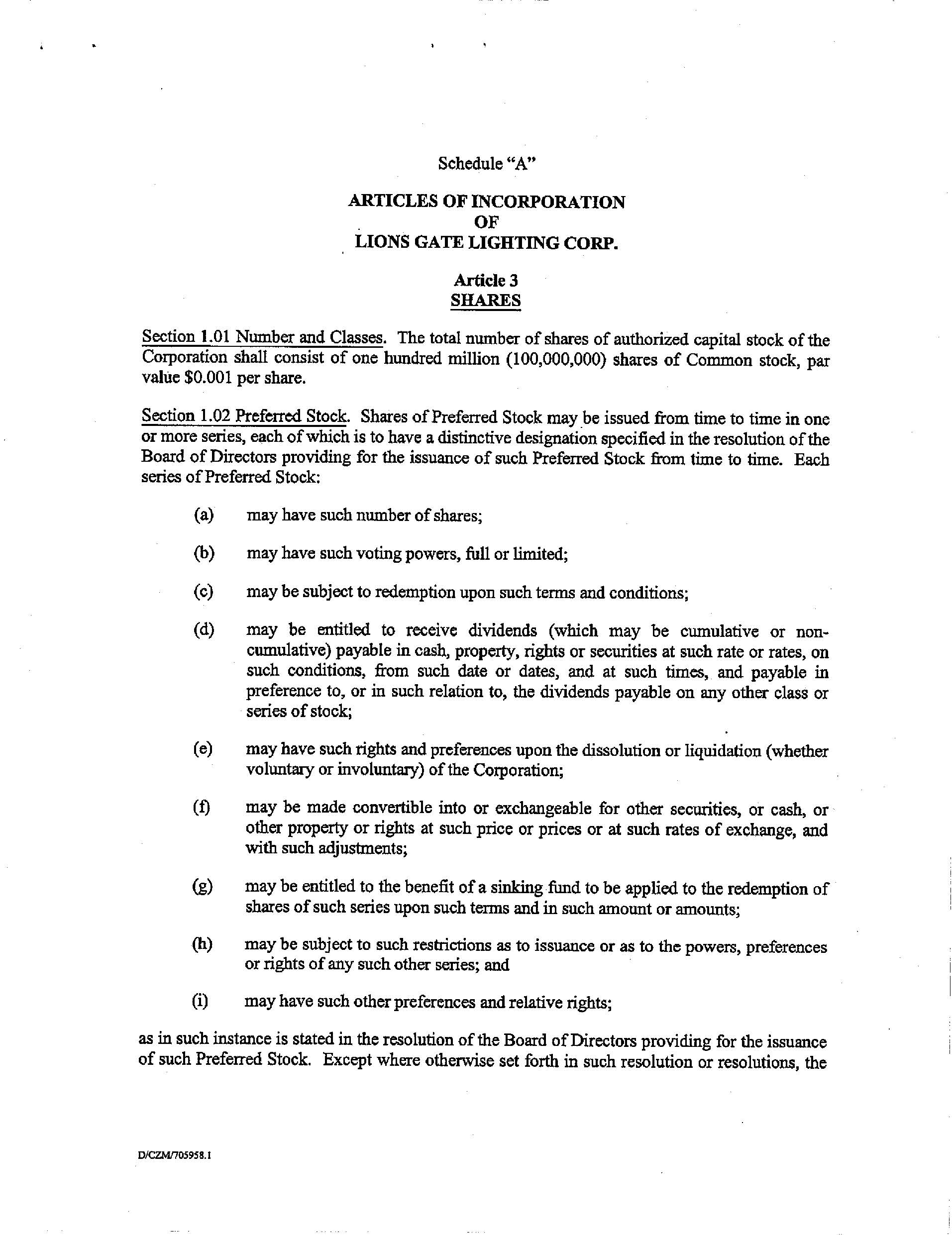

Common stock $0.001 par value, 100,000 shares authorized | |||||||

59,512 shares issued and outstanding at March 31, 2012 and June 30, 2011 | 60 | 60 | |||||

Additional paid-in capital | 24,719 | 23,566 | |||||

Retained earnings | 28,057 | 8,549 | |||||

Accumulated other comprehensive income | 3,648 | 4,636 | |||||

Total Umami Sustainable Seafood Inc. stockholders’ equity | 56,484 | 36,811 | |||||

Noncontrolling interests: | |||||||

Lubin | (3,328 | ) | (2,705 | ) | |||

Marpesca | (259 | ) | (99 | ) | |||

KTT | 22 | 27 | |||||

Total noncontrolling interests | (3,565 | ) | (2,777 | ) | |||

Total equity | 52,919 | 34,034 | |||||

Total liabilities and stockholders’ equity | $ | 106,842 | $ | 91,718 | |||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Net revenue | $ | 25,590 | $ | 42,338 | $ | 97,114 | $ | 56,712 | |||||||

Cost of goods sold | (12,524 | ) | (32,383 | ) | (49,944 | ) | (43,539 | ) | |||||||

Gross profit | 13,066 | 9,955 | 47,170 | 13,173 | |||||||||||

Selling, general and administrative expenses | (3,723 | ) | (3,485 | ) | (10,840 | ) | (7,042 | ) | |||||||

Research and development expenses | (44 | ) | (121 | ) | (150 | ) | (244 | ) | |||||||

Other operating income (expense), net | (26 | ) | 30 | 157 | 329 | ||||||||||

Total operating expenses | (3,793 | ) | (3,576 | ) | (10,833 | ) | (6,957 | ) | |||||||

Operating income | 9,273 | 6,379 | 36,337 | 6,216 | |||||||||||

Loss from foreign currency transactions and remeasurements | (1,943 | ) | (500 | ) | (1,586 | ) | (734 | ) | |||||||

Gain (loss) on derivative stock warrants | (2,258 | ) | (140 | ) | (2,462 | ) | 79 | ||||||||

Gain from investment in unconsolidated affiliates | — | — | — | 601 | |||||||||||

Bargain purchase on business combinations | — | 930 | — | 2,781 | |||||||||||

Interest expense, net | (1,110 | ) | (2,264 | ) | (5,978 | ) | (4,889 | ) | |||||||

Income before provision for income taxes | 3,962 | 4,405 | 26,311 | 4,054 | |||||||||||

Income tax provision | 1,405 | 1,675 | 7,857 | 2,104 | |||||||||||

Net income | 2,557 | 2,730 | 18,454 | 1,950 | |||||||||||

Add net (income) losses attributable to the non-controlling interests: | |||||||||||||||

Lubin | 184 | (10 | ) | 891 | 562 | ||||||||||

Marpesca | 103 | 87 | 160 | 131 | |||||||||||

KTT | 1 | 1 | 3 | 74 | |||||||||||

Net income attributable to Umami Sustainable Seafood Inc. stockholders | $ | 2,845 | $ | 2,808 | $ | 19,508 | $ | 2,717 | |||||||

Basic net income per share attributable to Umami Sustainable Seafood Inc. stockholders | $ | 0.05 | $ | 0.05 | $ | 0.33 | $ | 0.05 | |||||||

Weighted-average shares outstanding, basic | 59,512 | 59,412 | 59,512 | 52,541 | |||||||||||

Diluted net income per share attributable to Umami Sustainable Seafood Inc. stockholders | $ | 0.05 | $ | 0.05 | $ | 0.31 | $ | 0.05 | |||||||

Weighted-average shares outstanding, diluted | 62,979 | 59,942 | 63,507 | 52,691 | |||||||||||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Net income | $ | 2,557 | $ | 2,730 | $ | 18,454 | $ | 1,950 | |||||||

Unrealized foreign currency translation gain (loss) | 1,323 | 1,047 | (988 | ) | 1,645 | ||||||||||

Comprehensive income | 3,880 | 3,777 | 17,466 | 3,595 | |||||||||||

Comprehensive income (loss) attributable to non-controlling interests | (106 | ) | 78 | 266 | 767 | ||||||||||

Total comprehensive income attributable to Umami shareholders | $ | 3,774 | $ | 3,855 | $ | 17,732 | $ | 4,362 | |||||||

Common Stock | Additional Paid-In Capital | Retained Earnings | Accumulated Other Comprehensive Income | Total Umami Sustainable Seafood Inc. Stockholders' Equity | Non-Controlling Interests | Total Equity | ||||||||||||||||||||||||||||||||

Shares | Amount | Lubin | Marpesca | KTT | ||||||||||||||||||||||||||||||||||

Equity June 30, 2011 | 59,512 | $ | 60 | $ | 23,566 | $ | 8,549 | $ | 4,636 | $ | 36,811 | $ | (2,705 | ) | $ | (99 | ) | $ | 27 | $ | 34,034 | |||||||||||||||||

Issuance of warrants | 50 | 50 | 50 | |||||||||||||||||||||||||||||||||||

Stock-based compensation expense | 300 | 300 | 300 | |||||||||||||||||||||||||||||||||||

Placement agent settlement | 803 | 803 | 803 | |||||||||||||||||||||||||||||||||||

Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||

Net income (loss) | 19,508 | 19,508 | (891 | ) | (160 | ) | (3 | ) | 18,454 | |||||||||||||||||||||||||||||

Translation adjustments | (988 | ) | (988 | ) | 268 | — | (2 | ) | (722 | ) | ||||||||||||||||||||||||||||

Total comprehensive income (loss) | 18,520 | (623 | ) | (160 | ) | (5 | ) | 17,732 | ||||||||||||||||||||||||||||||

Equity March 31, 2012 | 59,512 | $ | 60 | $ | 24,719 | $ | 28,057 | $ | 3,648 | $ | 56,484 | $ | (3,328 | ) | $ | (259 | ) | $ | 22 | $ | 52,919 | |||||||||||||||||

Nine Months Ended March 31, | |||||||

2012 | 2011 | ||||||

Operating activities | |||||||

Net income | $ | 18,454 | $ | 1,950 | |||

Adjustments to reconcile to net cash used in operating activities: | |||||||

Depreciation and amortization | 1,176 | 1,259 | |||||

Gain on bargain purchase business combination | — | (2,781 | ) | ||||

Stock-based compensation | 300 | 120 | |||||

Deferred income tax | — | (134 | ) | ||||

Loss (gain) on stock warrants | 2,462 | (79 | ) | ||||

Income from investment in unconsolidated affiliates | — | (601 | ) | ||||

Amortization of deferred finance costs, debt discount and warrants included in interest expense | 3,419 | 1,641 | |||||

Foreign currency charges on foreign-denominated debt | 331 | — | |||||

Changes in assets and liabilities: | |||||||

Accounts receivable, trade | 1,216 | (624 | ) | ||||

Accounts receivable, related parties | (20,244 | ) | (12,253 | ) | |||

Inventories | 18,275 | 18,098 | |||||

Refundable value added tax | (938 | ) | (9 | ) | |||

Prepaid expenses and other assets | (5,567 | ) | (1,010 | ) | |||

Accounts payable, trade and accrued liabilities | (6,680 | ) | 3,210 | ||||

Income taxes payable | 6,232 | 1,561 | |||||

Accounts payable to related parties | (477 | ) | 796 | ||||

Net cash provided by operating activities | 17,959 | 11,144 | |||||

Investing activities | |||||||

Purchase of Baja and Oceanic | — | (19,109 | ) | ||||

Purchase of BTH joint venture assets | — | (1,629 | ) | ||||

Purchases of property and equipment | (3,680 | ) | (565 | ) | |||

Proceeds from sale of property and equipment | 25 | — | |||||

Net cash used in investing activities | (3,655 | ) | (21,303 | ) | |||

Financing activities | |||||||

Bank financing | 19,150 | 21,609 | |||||

Bank repayments | (12,468 | ) | (19,934 | ) | |||

Borrowings from unrelated parties | 11,908 | 14,750 | |||||

Repayments of borrowings from unrelated parties | (12,506 | ) | (8,750 | ) | |||

Borrowings from related parties | 1,315 | 4,099 | |||||

Repayments of borrowings from related parties | (6,027 | ) | (5,442 | ) | |||

Capital leases | (5 | ) | — | ||||

Offering costs paid | (452 | ) | (1,046 | ) | |||

Proceeds on the issuance of common stock and warrants | — | 4,641 | |||||

Funds released from escrow | — | 1,635 | |||||

Net cash provided by financing activities | 915 | 11,562 | |||||

Subtotal | 15,219 | 1,403 | |||||

Effect of exchange rate changes on the balances of cash held in foreign currencies | 1,320 | 2,951 | |||||

Cash and cash equivalents at beginning of year | 1,096 | 215 | |||||

Cash and cash equivalents at end of period | $ | 17,635 | $ | 4,569 | |||

Supplemental cash flow information | |||||||

Cash paid during the year for: | |||||||

Interest | $ | 2,196 | $ | 2,061 | |||

Income taxes | 2,453 | 562 | |||||

Non-cash activities | |||||||

Reclassification of derivative warrant liability | $ | — | $ | 1,290 | |||

Advances from shareholders for acquisition of Baja and Oceanic | — | 8,000 | |||||

Payment by BTH to Atlantis Group to offset against stockholder loan | — | 334 | |||||

Issuance of common stock in connection with acquisition of Baja and Oceanic | — | 12,050 | |||||

Settlement of related party accounts | 6,262 | 8,884 | |||||

1. | Description of business |

2. | Significant accounting policies |

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Numerator: Net income (loss) attributable to Umami stockholders | $ | 2,845 | $ | 2,808 | $ | 19,508 | $ | 2,717 | |||||||

Denominator: Weighted average shares outstanding (basic) | 59,512 | 59,412 | 59,512 | 52,541 | |||||||||||

Effect of dilutive securities | |||||||||||||||

Stock options and warrants | 3,467 | 530 | 3,995 | 150 | |||||||||||

Denominator: Weighted average shares outstanding (diluted) | 62,979 | 59,942 | 63,507 | 52,691 | |||||||||||

Net income (loss) per share (basic) | $ | 0.05 | $ | 0.05 | $ | 0.33 | $ | 0.05 | |||||||

Net income (loss) per share (diluted) | $ | 0.05 | $ | 0.05 | $ | 0.31 | $ | 0.05 | |||||||

Carrying Value as of | Fair Value Measurements at a Reporting Date Using: | ||||||||||||||||||

March 31, 2012 | Quoted Prices in Active Markets for Identical Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |||||||||||||||

Liabilities | |||||||||||||||||||

Derivative stock warrants | $ | 5,021 | $ | — | $ | — | $ | 5,021 | $ | 5,021 | |||||||||

Carrying Value as of | Fair Value Measurements at a Reporting Date Using: | ||||||||||||||||||

June 30, 2011 | Quoted Prices in Active Markets for Identical Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |||||||||||||||

Liabilities | |||||||||||||||||||

Derivative stock warrants | $ | 2,286 | $ | — | $ | — | $ | 2,286 | $ | 2,286 | |||||||||

Fair Value | Valuation Technique | Unobservable Input(s) | Range (Weighted Average | ||||||

Derivative stock warrants | $ | 5,021 | Binomial pricing model | Expected volatility | 22% - 62% (41%) | ||||

Exercise price for settlement warrants | $0.01 - $1.65 (0.94) | ||||||||

3. | Significant concentrations |

Nine Months Ended March 31, | |||

2012 | 2011 | ||

Atlantis Group and Subsidiaries | 30.3% | 72.0% | |

Global Seafoods Co., LTD | 7.1 | 9.3 | |

Sirius Ocean Inc. | 19.6 | 7.0 | |

Daito Gyorui Co., Ltd | 15.3 | — | |

Kyokuyo Co., LTD | 12.4 | — | |

Mitsubishi Corporation | 14.9 | 10.8 | |

4. | Inventories |

March 31, 2012 | June 30, 2011 | ||||||

Live stock inventories: | |||||||

under 30 kg. | $ | 14,773 | $ | 24,364 | |||

30-60 kg. | 9,936 | 10,156 | |||||

61-90 kg. | 3,896 | 12,647 | |||||

91+ kg. | 1,532 | 1,268 | |||||

30,137 | 48,435 | ||||||

Inventory in transit (fishing season in progress) | — | 4,611 | |||||

Fish feed and supplies | 3,691 | 1,980 | |||||

Total inventories | $ | 33,828 | $ | 55,026 | |||

5. | Other current assets |

March 31, 2012 | June 30, 2011 | ||||||

Prepaid fishing expenses | $ | 2,904 | $ | 111 | |||

Other receivables | 350 | 180 | |||||

Prepaid other expenses | 524 | 315 | |||||

Prepaid insurance | 618 | 66 | |||||

$ | 4,396 | $ | 672 | ||||

6. | Property and equipment |

March 31, 2012 | June 30, 2011 | ||||||

Cost: | |||||||

Land | $ | 451 | $ | 497 | |||

Buildings | 2,656 | 2,876 | |||||

Vessels | 16,526 | 14,387 | |||||

Machinery and equipment | 10,675 | 11,704 | |||||

Fixtures and office equipment | 381 | 313 | |||||

Construction in progress | 442 | 266 | |||||

31,131 | 30,043 | ||||||

Less accumulated depreciation: | |||||||

Buildings | 1,189 | 1,205 | |||||

Vessels | 5,977 | 5,569 | |||||

Machinery and equipment | 6,176 | 6,369 | |||||

Fixtures and office equipment | 184 | 155 | |||||

13,526 | 13,298 | ||||||

Property and equipment, net | $ | 17,605 | $ | 16,745 | |||

Asset | Estimated Useful Lives | |

Vessels | 10 - 20 years | |

Farm equipment | 2 - 6 years | |

Machinery | 4 - 10 years | |

Fixtures and office equipment | 2 - 10 years | |

7. | Acquisitions |

8. | Borrowings |

Borrowing Party | Facility | Interest Rate | Effective rate at March 31, 2012 | March 31, 2012 | June 30, 2011 | |||||||||

Non-related party borrowings: | ||||||||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | HRK 29,240 | 4.4% floating * | 5.74% | $ | 5,178 | $ | 5,708 | ||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | HRK 30,000 | 4.4% floating * | 5.65% | 5,313 | 5,856 | ||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | JPY 180,000 | 3M JPY LIBOR+6.5% | n/a | — | 2,219 | ||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | HRK 80,000 | 40% at HBOR 2.8% + 60% at 4.4% | 6.11% | 14,168 | — | ||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | EUR 550 | 3M EURIBOR+5% | 6.38% | 675 | 792 | ||||||||

Volksbank d.d. | Kali Tuna | HRK 10,000 | 40% at HBOR 3.8% + 60% at 5.9% | n/a | — | 1,627 | ||||||||

Privredna banka Zagreb d.d. | Kali Tuna | EUR 2,505 | 3M EURIBOR+4.75% | 6.29% | 2,543 | 3,593 | ||||||||

Bancomer | Baja Aqua Farms | MXN 50,000 | TIEE + 4.5% | n/a | — | 4,223 | ||||||||

Bancomer | Baja Aqua Farms | MXN 46,878 | TIEE + 5.0% | 9.78% | 784 | — | ||||||||

Amerra Capital Management, LLC | Umami | USD 8,500 | 11% + 1YR LIBOR | 11.82% | 5,965 | — | ||||||||

UTA Capital LLC | Umami | USD 3,125 | 9% | n/a | — | 3,387 | ||||||||

Private investors | Umami | USD 5,624 | Nil | n/a | — | 2,000 | ||||||||

Total obligations under capital leases | 18 | 37 | ||||||||||||

Less: Debt Discount | — | (1,007 | ) | |||||||||||

Total non-related party borrowings | $ | 34,644 | $ | 28,435 | ||||||||||

Related party borrowings: | ||||||||||||||

Atlantis Co., Ltd. | Umami | USD 15,000 | 1%/month | n/a | $ | — | $ | 4,274 | ||||||

Atlantis Co., Ltd. | Umami | USD 15,000 | 1%/month | n/a | — | — | ||||||||

Aurora Investments ehf | Umami | USD 8,000 | 1%/month | n/a | — | 5,313 | ||||||||

Total related party borrowings | $ | — | $ | 9,587 | ||||||||||

Total borrowings | $ | 34,644 | $ | 38,022 | ||||||||||

Made up of: | ||||||||||||||

Short-term borrowings, non-related party | $ | 18,809 | $ | 24,002 | ||||||||||

Short-term borrowing, related party | — | 7,587 | ||||||||||||

Long-term debt, non-related party | 15,825 | 4,417 | ||||||||||||

Long-term debt, related party | — | 2,000 | ||||||||||||

Long-term obligations under capital leases | 10 | 16 | ||||||||||||

Total borrowings | $ | 34,644 | $ | 38,022 | ||||||||||

9. | Variable interest entities |

Lubin | Lubin | ||||||||||||||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Rental income and sale of inventory | $ | 472 | $ | 496 | $ | 1,861 | $ | 1,425 | |||||||

March 31, 2012 | June 30, 2011 | ||||||

Unsecured loans | $ | 8,417 | $ | 6,290 | |||

Lubin | KTT | ||||||||||||||

March 31, 2012 | June 30, 2011 | March 31, 2012 | June 30, 2011 | ||||||||||||

Total assets | $ | 5,911 | $ | 5,739 | $ | 44 | $ | 55 | |||||||

Total liabilities | 9,423 | 8,683 | — | — | |||||||||||

Stockholders' equity (deficit) | $ | (3,512 | ) | $ | (2,944 | ) | $ | 44 | $ | 55 | |||||

Lubin | Lubin | ||||||||||||||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Net revenue | $ | 472 | $ | 496 | $ | 1,861 | $ | 1,489 | |||||||

Net loss | (184 | ) | 10 | (682 | ) | (562 | ) | ||||||||

KTT | KTT | ||||||||||||||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Net revenue | $ | — | $ | — | $ | — | $ | — | |||||||

Net loss | (1 | ) | (1 | ) | (3 | ) | (1 | ) | |||||||

Marpesca | Marpesca | ||||||||||||||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Net revenue | $ | 60 | $ | 64 | $ | 1,115 | $ | 128 | |||||||

Net loss | (202 | ) | (219 | ) | (392 | ) | (306 | ) | |||||||

Rental income and sale of inventory | $ | 60 | $ | — | $ | 1,115 | $ | — | |||||||

March 31, 2012 | June 30, 2011 | ||||||||||||||

Total assets | $ | 838 | $ | 923 | |||||||||||

Total liabilities | 1,714 | 1,335 | |||||||||||||

Stockholders' deficit | $ | (876 | ) | $ | (412 | ) | |||||||||

10. | Stock options and warrants |

January 5, 2012 Grant | January 31, 2012 Grant | March 1, 2012 Grants | |||

Exercise price | $1.60 | $1.82 | $2.29 | ||

Fair value of common stock | $1.95 | $2.25 | $2.35 | ||

Expected dividends | — | — | — | ||

Expected volatility | 32% | 44% | 43% | ||

Risk-free interest rate | 0.34% | 0.3% | 0.43% | ||

Expected term (in years) | 2.4 | 3.3 | 3.3 | ||

Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term | |||||

Outstanding as of June 30, 2011 | 1,100,000 | $1.00 | 4.0 years | ||||

Options granted | 1,475,000 | $1.79 | 3.8 years | ||||

Options exercised | — | ||||||

Options forfeited | — | ||||||

Outstanding as of March 31, 2012 | 2,575,000 | $1.45 | 3.4 years | ||||

Exercisable as of March 31, 2012 | 566,666 | $1.38 | 3.8 years | ||||

Vested as of March 31, 2012 | 566,666 | $1.38 | 3.8 years | ||||

Non-vested as of March 31, 2012 | 2,008,334 | $1.47 | 3.3 years | ||||

Warrants | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term | ||||

Balance at June 30, 2011 | 10,264 | $1.56 | 4.2 years | |||

Issued as placement agent compensation | 90 | $2.70 | 5 years | |||

Issued in connection with secured notes | 759 | $2.01 | 4.3 years | |||

Balance at March 31, 2012 | 11,113 | $1.60 | 3.5 years | |||

Balance at June 30, 2011 | $ | 2,286 | |

Fair value of new warrants issued | 273 | ||

Unrealized (gains) losses in fair value recognized in operating expenses | 2,462 | ||

Balance at March 31, 2012 | $ | 5,021 | |

March 31, 2012 | June 30, 2011 | ||||||

Exercise price | $1.00 - $1.65 | $1.00 - $1.80 | |||||

Fair value of common stock | $ | 2.20 | $ | 1.205 | |||

Expected dividends | — | — | |||||

Expected volatility | 41 | % | 57 | % | |||

Risk-free interest rate | 1.04 | % | 1.76 | % | |||

Expected term (in years) | 3.6 | 4.2 | |||||

11. | Related parties |

Balance Sheet | March 31, 2012 | June 30, 2011 | ||||||

Trade accounts receivable, related parties | $ | 16,446 | $ | 1,970 | ||||

Accounts payable, related parties | — | 556 | ||||||

Notes payable, related parties | ||||||||

Due to Atlantis - principal | — | 4,000 | ||||||

Due to Aurora - principal | — | 5,260 | ||||||

Accrued related party interest, expenses and fees | — | 327 | ||||||

Total notes payable, related parties | — | 9,587 | ||||||

Included in current portion | — | 7,587 | ||||||

Long-term portion | $ | — | $ | 2,000 | ||||

Three Months Ended March 31, | Nine Months Ended March 31, | |||||||||||||||

Statements of Operations | 2012 | 2011 | 2012 | 2011 | ||||||||||||

Sales to Atlantis and subsidiary – included in net revenue | $ | 10,403 | $ | 28,825 | $ | 29,390 | $ | 40,802 | ||||||||

Reimbursement of costs – included in selling, general and administrative expenses | — | 13 | 157 | 459 | ||||||||||||

Commission expense – included in selling, general and administrative expenses | 144 | 536 | 1,188 | 1,033 | ||||||||||||

Interest expense (including amortization of original issue discounts, deferred financing costs and warrants) | 229 | 557 | 840 | 1,364 | ||||||||||||

12. | Income Taxes |

13. | Commitments and contingencies |

• | Underpayment of value added taxes for calendar year 2006 and related interest, totaled approximately $1.5 million, relating to the sales of Kali Tuna’s inventory to its 50%-owned subsidiary, Kali Tuna Trgovina, at its (purchase) production cost. |

• | Unpaid taxes on profit for the year ended June 30, 2007 and related interest, totaled approximately $0.1 million, relating to sales of Kali Tuna’s inventory to Atlantis Resources ehf (an Icelandic subsidiary of Atlantis Group, which was Kali Tuna’s ultimate parent at the time). |

14. | Subsequent events |

• | customer demand for Bluefin Tuna and market prices; |

• | potential changes to Bluefin Tuna quotas, concessions and regulations; |

• | general economic conditions, particularly in Japan; |

• | our reliance on a few customers for substantially all of our sales; |

• | the intensity of competition; |

• | our ability to collect outstanding receivables; |

• | the amount of liquidity available at reasonable rates or at all for ongoing capital needs; |

• | our ability to raise additional capital if necessary to execute our business plan; |

• | our ability to attract and retain management, and to integrate and maintain technical information and management information systems; |

• | the outcome of legal proceedings affecting our business; and |

• | our insurance coverage being adequate to cover the potential risks and liabilities faced by our business. |

Nine Months Ended March 31, | |||||

2012 | 2011 | ||||

Beginning biomass (June 30) | 3,418 | 1,720 | |||

Acquired in Baja acquisition | — | 3,080 | |||

Growth, net of mortality | 1,194 | 1,064 | |||

Caught | 1,069 | — | |||

Purchased for farming | — | 150 | |||

Storm losses | (19 | ) | (228 | ) | |

Biomass sales | (3,744 | ) | (2,815 | ) | |

Ending | 1,918 | 2,971 | |||

Net biomass added from operations during period | 2,244 | 986 | |||

Three Months Ended | Nine Months Ended | ||||||

March 31, 2012 | March 31, 2012 | ||||||

Net revenue | $ | 25,590 | $ | 97,114 | |||

Cost of goods sold | (12,524 | ) | (49,944 | ) | |||

Gross profit | $ | 13,066 | $ | 47,170 | |||

Gross profit % | 51 | % | 49 | % | |||

Add back: estimated cost of goods sold in excess of catch and farming costs | $ | — | $ | 2,238 | |||

Estimated non-GAAP gross profit based on catch and farming costs | $ | 13,066 | $ | 49,408 | |||

Estimated non-GAAP gross profit % based on catch and farming costs | 51 | % | 51 | % | |||

Three Months Ended | Nine Months Ended | ||||||

March 31, 2012 | March 31, 2012 | ||||||

Net income attributable to Umami Stockholders | $ | 2,845 | $ | 19,508 | |||

Plus estimated cost of goods sold in excess of catch and farming costs | — | 2,238 | |||||

Estimated non-GAAP net income attributable to Umami stockholders using estimated catch and farming costs | 2,845 | 21,746 | |||||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

(in thousands) | |||||||||||||||

Revenue, net | $ | 25,590 | $ | 42,338 | $ | 97,114 | $ | 56,712 | |||||||

Cost of goods sold | (12,524 | ) | (32,383 | ) | (49,944 | ) | (43,539 | ) | |||||||

Total gross profit | 13,066 | 9,955 | 47,170 | 13,173 | |||||||||||

Research and development expense | (44 | ) | (121 | ) | (150 | ) | (244 | ) | |||||||

Selling cost | (144 | ) | (536 | ) | (1,188 | ) | (1,033 | ) | |||||||

General and administrative expense | (3,579 | ) | (2,949 | ) | (9,652 | ) | (6,009 | ) | |||||||

Total selling, general and administrative expense | (3,723 | ) | (3,485 | ) | (10,840 | ) | (7,042 | ) | |||||||

Other operating income, net | (26 | ) | 30 | 157 | 329 | ||||||||||

Operating income | $ | 9,273 | $ | 6,379 | $ | 36,337 | $ | 6,216 | |||||||

Three Months Ended March 31, | Nine Months Ended March 31, | ||||||||||||||

2012 | 2011 | 2012 | 2011 | ||||||||||||

Interest paid to banks | $ | 490 | $ | 515 | $ | 1,321 | $ | 1,119 | |||||||

Interest related to Atlantis and Aurora | 216 | 550 | 804 | 1,356 | |||||||||||

Interest paid to private investors (including amortization of original issue discounts) | 182 | 600 | 1,788 | 998 | |||||||||||

Amortization of transactional costs of loans | 214 | 206 | 1,185 | 543 | |||||||||||

Amortization of equity participation costs related to private investors and placement agents | 107 | 393 | 995 | 873 | |||||||||||

Less interest income | (99 | ) | — | (115 | ) | — | |||||||||

Total interest expense, net | $ | 1,110 | $ | 2,264 | $ | 5,978 | $ | 4,889 | |||||||

Nine Months Ended March 31, | |||||||

2012 | 2011 | ||||||

Total cash provided by (used in): | |||||||

Operating activities | $ | 17,959 | $ | 11,144 | |||

Investing activities | (3,655 | ) | (21,303 | ) | |||

Financing activities | 915 | 11,562 | |||||

Effects of exchange rate changes on cash balances | 1,320 | 2,951 | |||||

Increase in cash and cash equivalents | $ | 16,539 | $ | 4,354 | |||

Borrowing Party | Facility | Interest Rate | Effective rate at March 31, 2012 | March 31, 2012 | June 30, 2011 | |||||||||

Non-related party borrowings: | ||||||||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | HRK 29,240 | 4.4% floating * | 5.74% | $ | 5,178 | $ | 5,708 | ||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | HRK 30,000 | 4.4% floating * | 5.65% | 5,313 | 5,856 | ||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | JPY 180,000 | 3M JPY LIBOR+6.5% | n/a | — | 2,219 | ||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | HRK 80,000 | 40% at HBOR 2.8% + 60% at 4.4% | 6.11% | 14,168 | — | ||||||||

Erste&Steiermaerkische bank d.d. | Kali Tuna | EUR 550 | 3M EURIBOR+5% | 6.38% | 675 | 792 | ||||||||

Volksbank d.d. | Kali Tuna | HRK 10,000 | 40% at HBOR 3.8% + 60% at 5.9% | n/a | — | 1,627 | ||||||||

Privredna banka Zagreb d.d. | Kali Tuna | EUR 2,505 | 3M EURIBOR+4.75% | 6.29% | 2,543 | 3,593 | ||||||||

Bancomer | Baja Aqua Farms | MXN 50,000 | TIEE + 4.5% | n/a | — | 4,223 | ||||||||

Bancomer | Baja Aqua Farms | MXN 46,878 | TIEE + 5.0% | 9.78% | 784 | — | ||||||||

Amerra Capital Management, LLC | Umami | USD 8,500 | 11% + 1YR LIBOR | 11.82% | 5,965 | — | ||||||||

UTA Capital LLC | Umami | USD 3,125 | 9% | n/a | — | 3,387 | ||||||||

Private investors | Umami | USD 5,624 | Nil | n/a | — | 2,000 | ||||||||

Total obligations under capital leases | 18 | 37 | ||||||||||||

Less: Debt Discount | — | (1,007 | ) | |||||||||||

Total non-related party borrowings | $ | 34,644 | $ | 28,435 | ||||||||||

Related party borrowings: | ||||||||||||||

Atlantis Co., Ltd. | Umami | USD 15,000 | 1%/month | n/a | $ | — | $ | 4,274 | ||||||

Atlantis Co., Ltd. | Umami | USD 15,000 | 1%/month | n/a | — | — | ||||||||

Aurora Investments ehf | Umami | USD 8,000 | 1%/month | n/a | — | 5,313 | ||||||||

Total related party borrowings | $ | — | $ | 9,587 | ||||||||||

Total borrowings | $ | 34,644 | $ | 38,022 | ||||||||||

Made up of: | ||||||||||||||

Short-term borrowings, non-related party | $ | 18,809 | $ | 24,002 | ||||||||||

Short-term borrowing, related party | — | 7,587 | ||||||||||||

Long-term debt, non-related party | 15,825 | 4,417 | ||||||||||||

Long-term debt, related party | — | 2,000 | ||||||||||||

Long-term obligations under capital leases | 10 | 16 | ||||||||||||

Total borrowings | $ | 34,644 | $ | 38,022 | ||||||||||

1. | limited number of personnel with US GAAP and complex technical accounting expertise, which in turn prevented the financial statement close process from operating effectively; |

2. | insufficient policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and guidelines of the Securities and Exchange Commission; and |

3. | inadequate security and restricted access to computers, including insufficient disaster recovery plans. |

• | Underpayment of value added taxes for calendar year 2006 and related interest, totaling approximately $1.5 million, relating to the sales of Kali Tuna’s inventory to its 50%-owned subsidiary, Kali Tuna Trgovina, at its (purchase) production cost. |

• | Unpaid taxes on profit for the year ended June 30, 2007 and related interest, totaling approximately $0.1 million, relating to sales of Kali Tuna’s inventory to Atlantis Resources ehf (an Icelandic subsidiary of Atlantis Group, which was Kali Tuna’s ultimate parent at the time). |

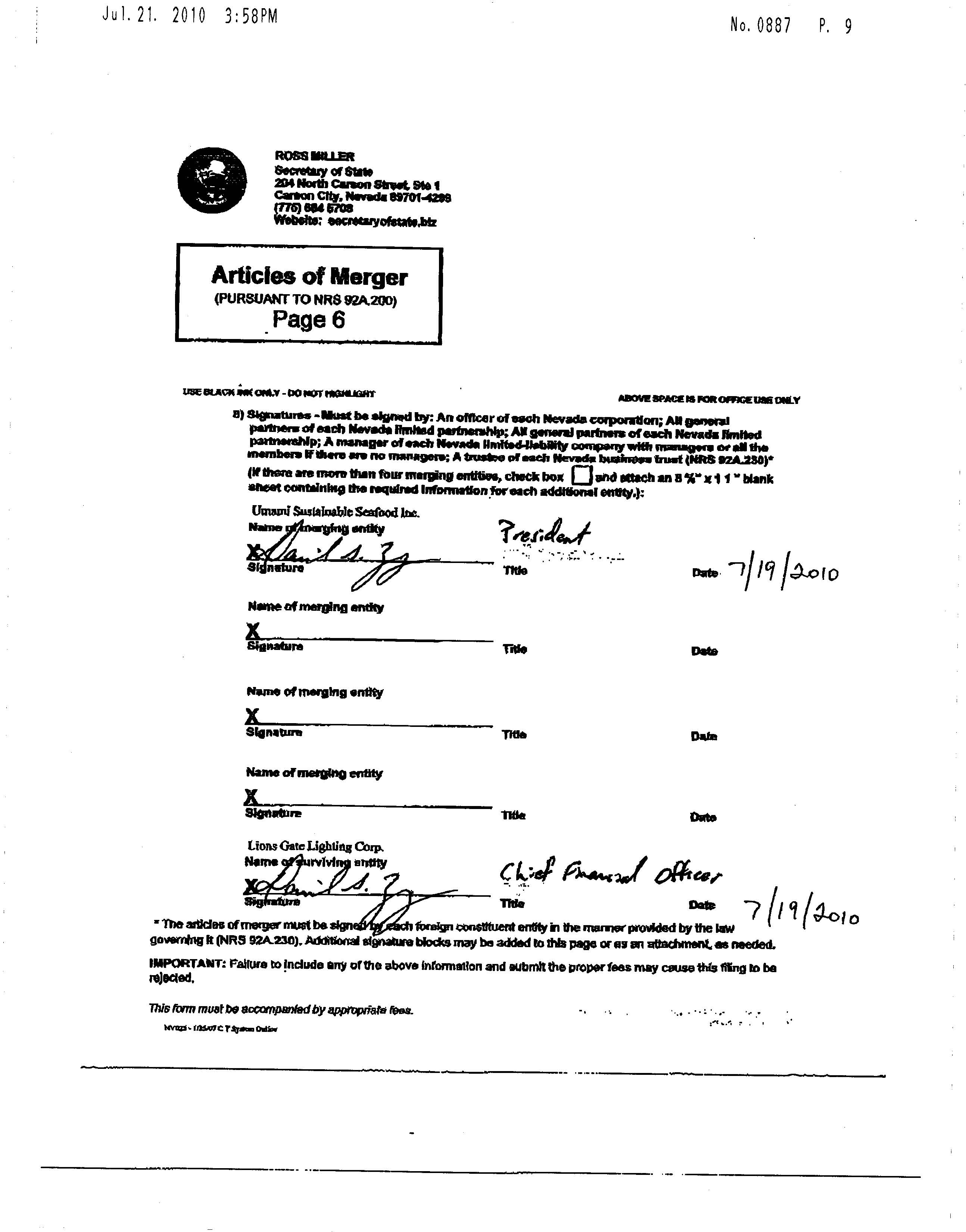

2.1 | Articles of Merger |

2.2 | Stock Purchase Agreement dated July 20, 2010 by and among the Company, Corposa, S.A. de C.V., Marpesca, S.A. de C.V., Holshyrna ehf, Vilhelm Mar Gudmundsson, Robert Gudfinnsson, Baja Aqua Farms, S.A. de C.V., and Oceanic Enterprises, Inc.* |

2.3 | Amendment dated September 24, 2010 to Stock Purchase Agreement dated July 20, 2010 |

2.4 | Option Agreement, dated July 20, 2010, by and among the Company, Baja Aqua-Farms, S.A. de C.V., Corposa, S.A. de C.V. and Holshyrna, ehf * |

2.5 | Amendment dated September 24, 2010 to Option Agreement dated July 20, 2010 |

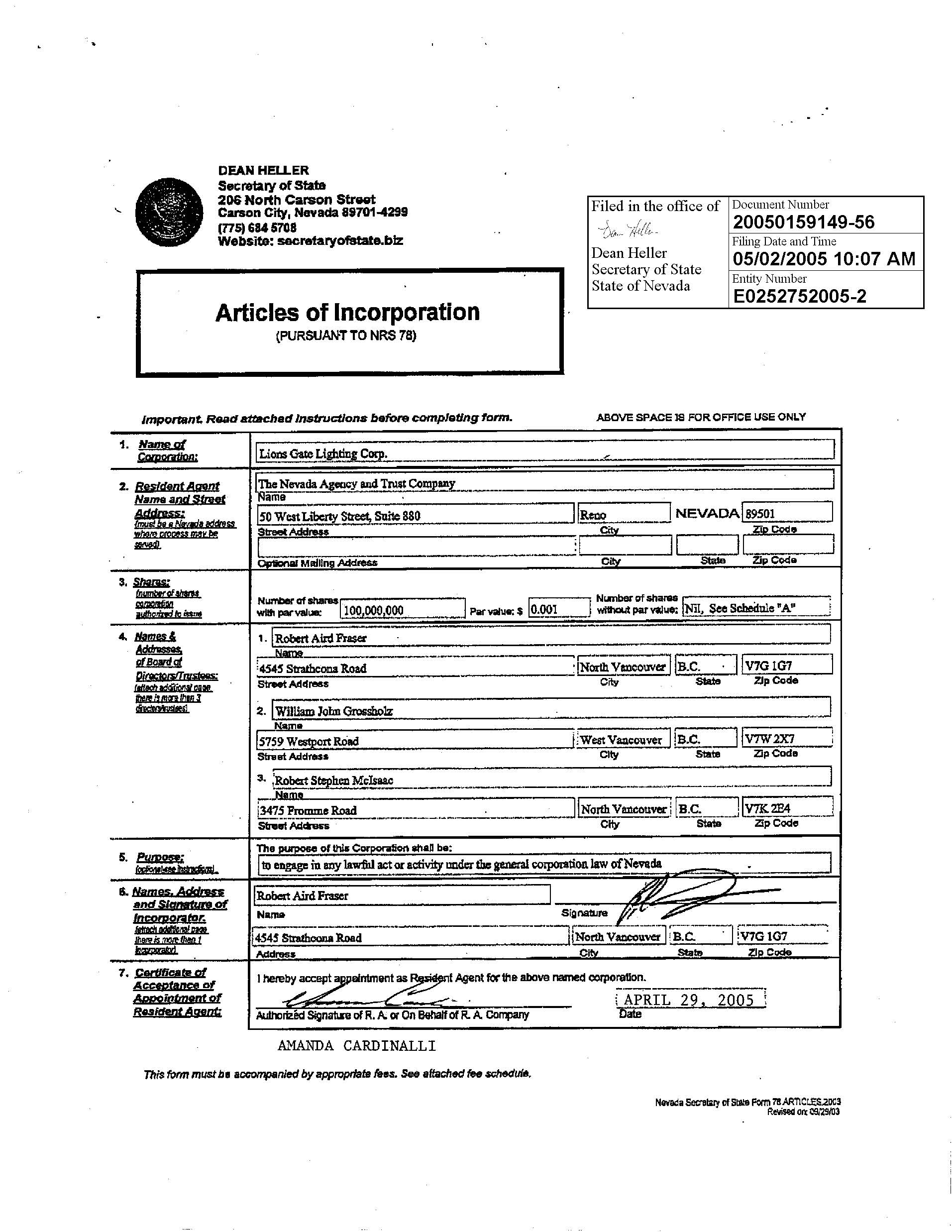

3.1 | Articles of Incorporation of Umami Sustainable Seafood Inc., as amended to date |

4.2 | Common Stock Purchase Warrant dated October 7, 2010 |

4.3 | Senior Secured Bridge Note in the Principal Amount of $3,125,000 dated October 7, 2010 |

4.4 | Senior Secured Bridge Note in the Principal Amount of $2,500,000 dated October 7, 2010 |

4.6 | Atlantis Credit Facility effective as of June 30, 2010 |

4.7 | Amendment No. 1 to Loan Agreement dated September 30, 2010 |

4.8 | Company Pledge and Security Agreement dated October 7, 2010 |

10.3 | Employment Agreement dated July 1, 2010 with Oli Valur Steindorsson |

10.4 | Employment Agreement dated July 1 2010 with Dan Zang |

10.33 | Independent Labor Contract Agreement dated January 2, 2011 between Baja Aqua Farms S.A. de C.V. and Servicios Administrativos BAF |

10.34 | Independent Labor Contract Agreement dated January 2, 2011 between Marpesca S.A. de C.V. and Servicios Administrativos BAF |

10.35 | Marpesca Sale Purchasing Agreement dated January 2, 2008, between Baja Aqua Farms S.A. de C.V. and Marpesca S.A. de C.V. |

10.36 | Amendment to Marpesca Sale Purchasing Agreement dated January 2, 2012, between Baja Aqua Farms S.A. de C.V. and Marpesca S.A. de C.V. |

31.1 | Certifications of the Principal Executive Officer furnished pursuant to Rule 13a-14(a) or Rule 15d-14(a) |

31.2 | Certifications of the Principal Financial Officer furnished pursuant to Rule 13a-14(a) or Rule 15d-14(a) |

32 | Certifications of Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

Umami Sustainable Seafood Inc. | ||

Date: | May 15, 2012 | /s/ Oli Valur Steindorsson |

President and | ||

Chief Executive Officer | ||

/s/ Tim Fitzpatrick | ||

Chief Financial Officer | ||

EXHIBITS | |

Option Agreement | |

DISCLOSURE SCHEDULES | |

Section 3.3 Ownership of Shares | 9 |

Section 3.4 Litigation | 9 |

Section 3.10 Organizational Matters | 10 |

Section 3.11 Capitalization | 10 |

Section 3.12 Subsidiaries | 11 |

Section 3.15 Financial Statements; Absence of Undisclosed Liabilities; Indebtedness | 11 |

Section 3.16 Tax matters | 11 |

Section 3.17 Absence of Certain Changes | 12 |

Section 3.18 Assets | 13 |

Section 3.19 Bank Accounts | 14 |

Section 3.21 Licenses and Permits | 15 |

Section 3.22 Material Contracts | 15 |

Section 3.23 (d) List of names, positions and current salary of directors, officers and employees of the Company | 16 |

Section 3.24 Employee benefit plan | 16 |

Section 3.25 Environmental Matters | 16 |

Section 3.26 List of Proprietary Rights | 17 |

Section 3.28 Inventories | 17 |

Section 3.29 Insurances | 17 |

Section 3.31 Accounts receivable | 18 |

Section 3.32 Certain interests | 18 |

Section 6.3 List of Consents and Approvals (buyers’ obligations) | 21 |

Section 7.4 List of Consents and Approvals (sellers’ obligations) | 22 |

A. | The total issued and outstanding capital stock of the Company consists of 191,301,125 common shares without par value, as follows: | |

Shareholder | Shares Series “A” Fixed Capital Stock | Shares Series “B” Variable Capital Stock | Shares Series “C” Variable Capital Stock | Total Shares | ||||||||||||||||

Corposa, S.A. de C.V. | -0- | 594,338 | 133,131,887 | 133,726,225 | ||||||||||||||||

Holshyrna ehf | 3,199 | 254,966 | 57,312,559 | 57,570,724 | ||||||||||||||||

Marpesca, S.A. de C.V. | 1 | 1 | 224 | 226 | ||||||||||||||||

Robert Brian Van Riter | 200 | 16 | 3,734 | 3,950 | ||||||||||||||||

Total | 3,400 | 849,321 | 190,448,404 | 191,301,125 | ||||||||||||||||

B. | The capital stock of the company has a value of $420,841,916.00 Pesos comprised as follows: (i) $170,000.00 Pesos corresponds to the fixed portion of the capital stock, and (ii) $420,671,916.00 Pesos corresponds to the variable portion of the capital stock of the Company. | |

C. | Corposa is the sole registered and beneficial owner of 594,338 Series “B” shares and 133,131,887 Series “C” shares without par value of the issued and outstanding variable portion of the capital stock of the Company. | |

D. | Holshyrna is the sole registered and beneficial owner of 3,199 Series “A” shares, 254,966 Series “B” shares and 57,312,559 Series “C” shares without par value of the issued and outstanding fixed portion of the capital stock of the Company. | |

E. | Marpesca is the sole registered and beneficial owner of 1 Series “A” share without par value of the issued and outstanding fixed portion of the capital stock of the Company and 225 Series “B” and Series “C” shares without par value of the outstanding variable portion of the capital stock of the Company. | |

F. | The shares owned by Corposa, Marpesca and Holshyrna collectively represent 99.99% of the issued and outstanding shares of common stock of the Company (the “Common Stock”). | |

G. | Holshyrna owns 10,000 shares of common stock, representing 100% of the issued and outstanding capital stock of Oceanic. | |

H. | Buyer desires to acquire initially shares of the Company and Oceanic representing 33% of the issued and outstanding capital stock of the Company and Oceanic, respectively. | |

I. | Buyer desires to have the option and the Company is willing to grant to the Buyer the option to purchase an additional 67% of the shares in the Company. | |

J. | Buyer desires to have the option and Holshyrna is willing to grant to the Buyer the option to purchase all remaining issued and outstanding shares of Oceanic. | |

Shareholder | Shares Series “A” Fixed Capital Stock | Shares Series “B” Variable Capital Stock | Shares Series “C” Variable Capital Stock | Total Shares | ||||||||||||||||

Corposa, S.A. de C.V. | -0- | 594,338 | -0- | 594,338 | ||||||||||||||||

Holshyrna ehf | 3,199 | -0- | -0- | 3,199 | ||||||||||||||||

Marpesca, S.A. de C.V. | 1 | 1 | 224 | 226 | ||||||||||||||||

Lions Gate Lighting | -0- | 296,367 | -0- | 296,367 | ||||||||||||||||

Robert Brian Van Riter | 200 | 16 | 3,734 | 3,950 | ||||||||||||||||

Total | 3,400 | 890,722 | 3,958 | 898,080 | ||||||||||||||||

(a) | The Buyer and certain affiliated parties (the “Advancing Parties”) have previously advanced an aggregate of Five Million Three Hundred Thousand Dollars ($5,300,000) (the “Advanced Funds”) to the Company. On the Closing Date, the Buyer will wire to the Company an amount of Three Hundred Seventy Thousand Dollars ($370,000) as a “Capital Contribution” and the Buyer will cause the Advancing Parties to convert the Advanced Funds into a “Capital Contribution” in payment partial payment of the Company Shares; | |

(b) | On the Closing Date the Buyer will pay Three Hundred Thirty Thousand ($330,000) to Holshyrna by wire transfer in payment of the Oceanic Shares; and | |

(c) | On July 31, 2010, the Buyer will pay Two Million Dollars ($2,000,000) by wire transfer as a “Capital Contribution” to complete the payment of the Company Shares. | |

Lions Gate Lighting Corp. | |

405 Lexington Avenue | |

26 th Floor, Suite 2640 | |

New York, NY 10174 | |

Attention: | Oli Valur Steindorsson |

Telephone: | (212) 907-6492 |

Facsimile: | (917) 368-8005 |

BAJA AQUA-FARMS, S.A. DE C.V. | ||

By: | /s/ Vilhem Mar Gudmundsson | |

OCEANIC ENTERPRISES INC. | ||

By: | /s/ Robert Gudfinnsson | |

CORPOSA S.A. DE C.V. | ||

By: | /s/ Vilhem Mar Gudmundsson | |

HOLSHYRNA ehf | ||

By: | /s/ Robert Gudfinnsson | |

/s/ Vilhem Mar Gudmundsson | ||

VILHELM MAR GUDMUNDSSON | ||

/s/ Robert Gudfinnsson | ||

ROBERT GUDFINNSSON | ||

LIONS GATE LIGHTING CORP. | ||

By: | /s/ Oli Valur Steindorsson | |

1.1. | As of the date hereof, Section 5.1 of the SPA shall be amended as follows: |

1.2. | In addition to the above amendments to the SPA, the Selling Parties and Buyer agree the following: |

(i) | Before November 30 th , 2010 the Shareholders and Buyer, as current shareholders of the Company, will hold and cause a shareholders’ meeting approving: (a) the reduction of the Company´s capital stock in an amount of three million Dollars (USD$3,000,000) or its equivalent in Mexican pesos at the exchange rate published by the Bank of Mexico in the Official Gazette of the Federation (Diario Oficial de la Federación) the date of the shareholder´s meeting, (b) the reimbursement by the Company of two million Dollars (USD$2,000,000) to Corposa and one million Dollars (USD$1,000,000) to Buyer as a result of the reduction of the capital stock approved, and (c) the cancellation of the shares held by Corposa and Buyer in the Company representing the stock reduced and cancelled. | |

(ii) | Buyer shall cause or guarantee that the Company is financed to meet its payments owed to Corposa and Holshyrna deriving from capital reimbursements resolved by the Company and its Board of Directors, as well as of debts owed by the Company to Corposa and Holshyrna and disclosed to Buyer. To perform the foregoing, Buyer shall also have full access to all unpledged assets of the Company to secure or obtain any funding required pursuant to the cash flow budget of the Company pre-approved by Buyer and Shareholders which will be in force until November 30, 2010. | |

BAJA AQUA-FARMS, S.A. DE C.V. | ||||||

By: | /s/ Vilhem Mar Gudmundsson | |||||

OCEANIC ENTERPRISES INC. | ||||||

By: | /s/ Robert Gudfinnsson | |||||

CORPOSA S.A. DE C.V. | ||||||

By: | /s/ Vilhem Mar Gudmundsson | |||||

HOLSHYRNA ehf | ||||||

By: | /s/ Robert Gudfinnsson | |||||

/s/ Vilhem Mar Gudmundsson | ||||||

VILHELM MAR GUDMUNDSSON | ||||||

/s/ Robert Gudfinnsson | ||||||

ROBERT GUDFINNSSON | ||||||

(UMAMI SUSTAINABLE SEAFOOD formerly named “LIONS GATE LIGHTING CORP.”) | ||||||

By: | /s/ Oli Valur Steindorsson | |||||

Lions Gate Lighting Corp. | |

405 Lexington Avenue | |

26 th Floor, Suite 2640 | |

New York, NY 10174 | |

Attention: | Oli Valur Steindorsson |

Telephone: | (212) 907-6492 |

Facsimile: | (917) 368-8005 |

BAJA AQUA-FARMS S.A. DE C.V. | ||

By: | /s/ Vilhem Mar Gudmundsson | |

LIONS GATE LIGHTING CORP. | ||

By: | /s/ Oli Valur Steindorsson | |

CORPOSA S.A. DE C.V. | ||

By: | /s/ Vilhem Mar Gudmundsson | |

HOLSHYRNA ehf | ||

By : | /s/ Robert Gudfinnsson | |

Shareholder | Shares Series “A” Fixed Capital Stock | Shares Series “B” Variable Capital Stock | Shares Series “C” Variable Capital Stock | Total Shares | ||||||||||||||||

Corposa, S.A. de C.V. | -0- | 594,338 | 133,131,887 | 133,726,225 | ||||||||||||||||

Holshyrna ehf | 3,199 | 254,966 | 57,312,559 | 57,570,724 | ||||||||||||||||

Dated: | By: | |

Name: | ||

Title: | ||

(signature must conform to name | ||

of holder as specified on the fact of the Warrant) | ||

Address: | ||

______ | Category 1 | An organization described in Section 501(c)(3) of the United States Internal Revenue Code, a corporation, a Massachusetts or similar business trust or partnership, not formed for the specific purpose of acquiring the Shares, with total assets in excess of US $5,000,000. |

______ | Category 2 | A natural person whose individual net worth, or joint net worth with that person’s spouse, on the date of purchase exceeds US $1,000,000. |

______ | Category 3 | A natural person who had an individual income in excess of US $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of US $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year. |

______ | Category 4 | A “bank” as defined under Section (3)(a)(2) of the 1933 Act or savings and loan association or other institution as defined in Section 3(a)(5)(A) of the 1933 Act acting in its individual or fiduciary capacity; a broker dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934 (United States); an insurance Corporation as defined in Section 2(13) of the 1933 Act; an investment Corporation registered under the Investment Corporation Act of 1940 (United States) or a business development Corporation as defined in Section 2(a)(48) of such Act; a Small Business Investment Corporation licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958 (United States); a plan with total assets in excess of $5,000,000 established and maintained by a state, a political subdivision thereof, or an agency or instrumentality of a state or a political subdivision thereof, for the benefit of its employees; an employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974 (United States) whose investment decisions are made by a plan fiduciary, as defined in Section 3(21) of such Act, which is either a bank, savings and loan association, insurance corporation or registered investment adviser, or if the employee benefit plan has total assets in excess of $5,000,000, or, if a self-directed plan, whose investment decisions are made solely by persons that are accredited investors. |

______ | Category 5 | A private business development corporation as defined in Section 202(a)(22) of the Investment Advisers Act of 1940 (United States). |

______ | Category 6 | A director or executive officer of the Company. |

______ | Category 7 | A trust with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the Shares, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) under the 1933 Act. |

______ | Category 8 | An entity in which all of the equity owners satisfy the requirements of one or more of the foregoing categories. |

Print of Type Name of Entity | |

Signature of Authorized Signatory | |

Type of Entity | |

1.1. | As of the date hereof, Section 1 of the Option Agreement shall be amended as follows: |

BAJA AQUA-FARMS, S.A. DE C.V. | |||||||||

By: | /s/ Vilhem Mar Gudmundsson | ||||||||

CORPOSA S.A. DE C.V. | |||||||||

By: | /s/ Vilhem Mar Gudmundsson | ||||||||

HOLSHYRNA ehf | |||||||||

By: | /s/ Robert Gudfinnsson | ||||||||

(UMAMI SUSTAINABLE SEAFOOD formerly named “LIONS GATE LIGHTING CORP.”) | |||||||||

By: | /s/ Oli Valur Steindorsson | ||||||||

Warrant No. UTA 2010 - 1 | Dated: October 7, 2010 |

X = Y [(A-B)/A] | |

Where: | |

X = the number of Warrant Shares to be issued to the Holder. | |

Y = the number of Warrant Shares with respect to which this Warrant is being exercised. | |

A = the average of the Closing Prices for the five Trading Days immediately prior to (but not including) the Exercise Date. | |

B = the Exercise Price. | |

UMAMI SUSTAINABLE SEAFOOD INC. | |

By: | /s/ Oli Valur Steindorsson |

Name: Oli Valur Steindorsson | |

Title: Chief Executive Officer | |

Address: | |

405 Lexington Avenue | |

26th Floor, Suite 2640 | |

New York, NY 10174 | |

Facsimile: 212-___-____ | |

Dated: , | |

(Signature must conform in all respects to name of holder as specified on the face of the Warrant) | |

Address of Transferee | |

In the presence of: | |

1 | The Warrant is currently exercisable to purchase a total of ______________ Warrant Shares. | |

2 | The undersigned Holder hereby exercises its right to purchase _________________ Warrant Shares pursuant to the Warrant. | |

3 | The Holder intends that payment of the Exercise Price shall be made as (check one): | |

4 | If the holder has elected a Cash Exercise, the holder shall pay the sum of $____________ to the Company in accordance with the terms of the Warrant. | |

5 | Pursuant to this exercise, the Company shall deliver to the holder _______________ Warrant Shares in accordance with the terms of the Warrant. | |

6 | Following this exercise, the Warrant shall be exercisable to purchase a total of ______________ Warrant Shares. | |

Dated: , | Name of Holder: | |

(Print) | ||

By: | ||

Name: | ||

Title: | ||

(Signature must conform in all respects to name of holder as specified on the face of the Warrant) | ||

DATE | NUMBER OF WARRANT SHARES AVAILABLE TO BE EXERCISED | NUMBER OF WARRANT SHARES EXERCISED | NUMBER OF WARRANT SHARES REMAINING TO BE EXERCISED | INITIALS OF AUTHORIZED REPRESENTATIVE | ||||

$3,125,000 | New York, New York October 7, 2010 |

BORROWER: | ||

UMAMI SUSTAINABLE SEAFOOD INC. | ||

By: | /s/ Oli Valur Steindorsson | |

Name: Oli Valur Steindorsson | ||

Title: Chief Executive Officer | ||

Address: | ||

405 Lexington Avenue | ||

26th Floor, Suite 2640 | ||

New York, NY 10174 | ||

Facsimile: 212-___-____ | ||

$2,500,000 | New York, New York October 7, 2010 |

BORROWER: | ||

UMAMI SUSTAINABLE SEAFOOD INC. | ||

By: | /s/ Oli Valur Steindorsson | |

Name: Oli Valur Steindorsson | ||

Title: President and Chief Executive Officer | ||

Address: | ||

405 Lexington Avenue | ||

26th Floor, Suite 2640 | ||

New York, NY 10174 | ||

Facsimile: 212 -___-____ | ||

Clause | Page | |

1 | DEFINITIONS AND INTERPRETATION | 2 |

2 | THE FACILITY | 4 |

3 | Purpose | 5 |

4 | Conditions of Utilisation | 5 |

5 | Utilisation – (Draw down request) | 6 |

6 | Repayment | 7 |

7 | Prepayment | 7 |

8 | Interest | 8 |

9 | Interest Periods | 9 |

10 | TAXES | 9 |

11 | Increased costs | 10 |

12 | Other indemnities | 10 |

13 | Mitigation by the Lender | 11 |

14 | Costs and expenses | 11 |

15 | Guarantee and indemnity | 11 |

16 | Representations AND WARRANTIES | 12 |

17 | Information undertakings | 13 |

18 | NEGATIVE undertakings | 15 |

19 | Events of Default | 18 |

20 | ASSIGNMENTS AND SUBSTITUTION | 20 |

21 | Changes to the Borrower | 20 |

22 | Conduct of business by the Lender | 21 |

23 | Payment mechanics | 21 |

24 | Set-off | 22 |

25 | Notices | 22 |

26 | Calculations and certificates | 23 |

27 | Partial invalidity | 23 |

28 | Remedies and waivers | 23 |

29 | Counterparts | 23 |

30 | Governing law | 24 |

31 | Enforcement | 24 |

SCHEDULE 1 | 26 | |

SCHEDULE 2 | 30 | |

SCHEDULE 3 | 31 | |

(1) | Umami Sustainable Seafood Inc. ( the “Borrower” or “Umami” ); and | |

(2) | Atlantis Group hf. a company formed under the laws of the republic of Iceland, registration no. 700805-1580, registered address at Stórhofda 15, 110 Reykjavik, Iceland (the "Lender"). | |

1 | DEFINITIONS AND INTERPRETATION |

1.1 | Definitions |

1.2 | Construction |

(a) | A provision of law is a reference to that provision as amended or re-enacted; | |

(b) | A clause on a Schedule is a reference to a clause or a schedule to this Agreement unless expressly set forth otherwise; | |

(c) | A reference to a person or entity includes its permitted successors, transferees and assigns; | |

(d) | Words importing the singular shall include the plural and vice versa. | |

2 | THE FACILITY |

(a) | a loan facility in the aggregate amount of USD 9,900,000, nine million and nine hundred USD (the "Term A Loan Facility" and | |

3 | PURPOSE |

4 | CONDITIONS OF UTILISATION |

4.1 | Initial conditions precedent |

a) | The Borrower acknowledges that this Credit Facility is extended to him by the Lender on the basis of current relations between the parties, i.e. that the Lender is holding more than 50% of the shares of the Borrower and is further handling the sale of his products according to a separate Agreement thereof. | |||

b) | It is understood by the parties that the Borrower is to seek a full financing of his operation and investments with other means than by a line of credit extended by Lender. | |||

c) | The Borrower may not deliver an Utilisation Request unless the Lender has received or waived its right to receive | |||

(i) | Security in the form of pledge of biomass, shares in the Borrowers subsidiaries or of fixed assets, all subject to acceptance by the Lender. | |||

(ii) | Weekly cash flow or monthly statement for the Borrower for all of his Tuna farming operations. | |||

(iii) | Monthly estimate of inventory | |||

(iv) | Update on new debts or encumbrances of the Borrower in the aggregated sum of USD one million, entered into after the date of signing of this Agreement. | |||

4.2 | Further conditions precedent |

(a) | each representation in Clause 16 (Representations and Warranties) is true and accurate or has been waived by the Lender; and | |

(b) | no Default is Continuing or would result from the proposed Loan. | |

4.3 | Conditions Subsequent |

(a) | If any of the condition precedent items referred to in Art. 4.1.c are expressly waived by the Lender, such conditions shall become conditions subsequent under this clause 4.3 and the Borrower will within 2 months deliver to the Lender in form and substance satisfactory to the Lender such documents. | |

4.4. | Lenders Acknowledgement. |

5 | UTILISATION – (DRAW DOWN REQUEST) |

5.1 | Delivery and process of an Utilisation Request |

(a) | The Borrower may utilise the Facility by delivery to the Lender of a duly completed Utilisation Request in the format provided for as Schedule 3. Such request shall be submitted to the Lender no less than 10 banking days prior to the requested payout date. | |

(b) | The Lender retains his undisputable right to decide whether he regards the conditions for a utilisation request is met and is not to be held liable in any way, should he decide to decline such an request. | |

(c) | In case the Lender declines to facilitate a utilisation request, he shall give a notice thereof to the Borrower no later than 24 hours prior to the requested date of execution. | |

5.2 | Completion of an Utilisation Request |

(a) | The Utilisation Request is irrevocable and will not be regarded as having been duly completed unless: | ||||

(i) | the proposed Utilisation Date is a Business Day within the Availability Period; | ||||

(ii) | the currency and amount of the Utilisation comply with Clause 5.3 (Currency and amount); and | ||||

(iii) | the proposed Interest Period complies with Clause 9 (Interest Periods). | ||||

(iv) | unless the payment instruction is given to a bank account held by the Lender. | ||||

5.3 | Currency and amount |

(a) | The currency specified in a Utilisation Request must be USD. | |

(b) | The amount of the proposed Loan must be an amount which is not more than the Available Facility. | |

5.4 | Note | |

(a) | the Note is intended to evidence its indebtedness under this Agreement; | |

(b) | the Note is issued subject to the terms of this Agreement which will in all circumstances override any provision of the Note which is inconsistent with any provision of this Agreement (as the case may be); | |

(c) | all payments under this Agreement (whether of principal, interest or otherwise) will be taken to be payments under the Note; | |

(d) | the Note signed by the Borrower shall be deemed to have been issued by and on behalf of the Borrower from time to time; | |

(e) | upon the making of the first Loan to the Borrower under this Agreement, the Lender shall be entitled to the Note in accordance with this Agreement. | |

5.5 | Utilisation Request |

(a) | The first Utilisation Request by the Borrower shall be accompanied by a Note corresponding to the initial amount of Loan requested under facility A. If the Borrower fails to complete the Note then it irrevocably authorises the Lender to complete and sign a Note in the appropriate amount on its behalf. | |

(b) | If, for any reason, a Utilisation is not made following the receipt by the Lender of a Utilisation Request, the Lender shall return the Note to the Borrower as soon as reasonably practicable. | |

(c) | Notes for additional draw downs shall be issued pursuant Clause 5.4. Note corresponding to loan granted under Facility B shall be issued on the date of signing of the Debt Assumption Agreement to be entered into on as a integrated part of the Borrower’s Acquisition of Target Company | |

6 | REPAYMENT |

6.1 | Repayment of Loans |

(a) | This Loan Facility Agreement is valid until December 31, 2010 which is the final repayment day. | |

(b) | The Borrower commits himself to utilise any cash that it will raise after the signing of this agreement, may it be by borrowing or from the proceeds from sale of shares of the Borrower under the terms of the offering, to pay the outstanding debt under this Credit facility to the Lender. | |

(c) | For the avoidance of doubt, any amounts then outstanding under the terms of this Agreement shall be repaid on the Final Repayment Date. | |

6.2 | Re-borrowing |

7 | PREPAYMENT |

7.1 | Illegality |

(a) | the Lender shall promptly notify the Borrower upon becoming aware of that event whereupon the Facility will be immediately cancelled; and | |

(b) | the Borrower shall repay the Loans on the last day of the Interest Period for each Loan occurring after the Lender has notified the Borrower or, if earlier, the date specified by the Lender in the notice delivered to the Borrower (being no earlier than the last day of any applicable grace period permitted by law) together with accrued interest to the date of actual payment and all other sums due to it. | |

7.2 | Change of control – asset sale - listing |

(a) | If any person or group of persons acting in concert gains control over the Borrower or if all or any material part of the business or assets of a Group company are disposed of in a trade sale; | |

(i) | the Borrower shall promptly notify the Lender upon becoming aware of that event; | |

(ii) | the Lender shall not be obliged to fund an Utilisation; and | ||

(iii) | the Lender may, by not less than 2 days prior notice to the Borrower, cancel the Facility and declare all outstanding Loans, together with accrued interest, immediately due and payable, whereupon the Facility will be cancelled and all such outstanding amounts will become immediately due and payable. | ||

(b) | For the purpose of sub-clause (a) above "control" means: | |

(i) | the power (whether by way of ownership of shares, proxy, contract, agency or otherwise) to: | ||||

1 | cast, or control the casting of, more than one-half of the maximum number of votes that might be cast at a general meeting of a Group Company; or | ||||

2 | appoint or remove all, or the majority, of the directors or other equivalent officers of a Group Company; or | ||||

3 | give directions with respect to the operating and financial policies of the Group Company, which the directors or other equivalent officers of a Group Company are obliged to comply with; or | ||||

(ii) | the holding of more than one-half of the issued share capital of a Group Company (excluding any part of that issued share capital that carries no right to participate beyond a specified amount in a distribution of either profits or capital). | ||||

(iii) | For the purpose of sub-clause (a) above "acting in concert" means, a group of persons who, pursuant to an agreement or understanding (whether formal or informal), actively co-operate, through the acquisition by any of them, either directly or indirectly, of shares in a Group Company, to obtain or consolidate control of a Group Company. | ||||

7.3 | Voluntary prepayment of Loans |

(a) | The Borrower may prepay all or only part of the Loan on any Business Day if: | ||||

(i) | it has given to the Lender not less than 2 Business Days' irrevocable notice of the date of the prepayment; and | ||||

(ii) | it pays the Break Costs and all appropriate breakage cost under Clause 12.1 (Miscellaneous indemnities); and | ||||

(iii) | the amount prepaid is at least USD 50,000 and, if greater, an integral multiple of USD 50,000. | ||||

(b) | Any prepayment shall be made with accrued interest on the amount prepaid and any other sums then due and payable to the Lender under this Agreement. | |

(c) | A notice of prepayment once given is irrevocable and the Borrower shall be bound, to the extent this Agreement permits, to prepay in accordance with that notice. | |

7.4 | Restrictions |

8 | INTEREST |

8.1 | Calculation of interest |

8.2 | Payment of interest |

8.3 | Default interest |

9 | INTEREST PERIODS |

9.1 | Interest Periods |

(a) | Each Interest Period (except the first one) shall be of one month duration. | |

(b) | The first Interest Period shall commence on the date the Utilization Date Loan and end on the last day of each month. | |

9.2 | Non-Business Days |

10 | TAXES |

(a) | without set-off or counterclaim; and | |

(b) | free and clear of and without deduction for or on account of any taxes unless the Borrower are compelled by law to make payment subject to such taxes. | |

11 | INCREASED COSTS |

11.1 | Increased Costs |

(a) | Subject to Clause 11.3 (Exceptions), the Borrower shall within three Business Days of a demand by the Lender, pay the Lender the amount of any reasonable increased cost incurred by it or any of its affiliated entities as a result of: | |||

(i) | the introduction of or any change in (or in the interpretation or application of) any law or regulation with which it is customary for, or expected of, banks generally (operating in the Relevant Interbank Market) to comply; or | |||

(ii) | compliance with any law or regulation made after the date of this Agreement; | |||

11.2 | Increased Cost claims |

11.3 | Exceptions |

12 | OTHER INDEMNITIES |

12.1 | Miscellaneous indemnities |

(a) | The Borrower shall indemnify on demand the Lender against any funding or other costs, loss, expense or liability sustained by the Lender (including on its termination of any hedging instrument) as a consequence of: (a) the occurrence or continuance of any Default or (b) its taking any steps under Clause 13.1 (Mitigation). | |

(b) | The Borrower shall promptly indemnify the Lender against any cost, loss or liability incurred by them as a result of: | ||||

(i) | its investigating any event which it reasonably believes to be a Default; or | ||||

(ii) | acting or relying on any notice which it believes to be genuine, correct and authorised. | ||||

(iii) | decline of a Utilisation request. | ||||

(iv) | decline of a request to extend the validity of the Credit Facility Loan Agreement cc. Clause 6.2 | ||||

12.2 | Financing Indemnity |

13 | MITIGATION BY THE LENDER |

13.1 | Mitigation |

13.2 | Limitation of liability |

14 | COSTS AND EXPENSES |

14.1 | Transaction expenses |

- | this Agreement and any other document referred to in this Agreement; and | |

- | any other Finance Document executed after the date of this Agreement. | |

14.2 | Enforcement Costs |

15 | GUARANTEE AND INDEMNITY |

15.1 | Guarantee and indemnity |

(a) | guarantees to the Lender punctual performance by the Borrower of all the Borrower's obligations under the Finance Documents; | |

(b) | indemnifies the Lender immediately on demand against any cost, loss or liability suffered by the Lender if any obligation guaranteed by it is or becomes unenforceable, invalid or illegal. The amount of the cost, loss or liability shall be equal to the amount which the Lender would otherwise have been entitled to recover. | |

15.2 | Appropriations |

(a) | refrain from applying or enforcing any other moneys, security or rights held or received by the Lender (or any trustee or agent on its behalf) in respect of those amounts, or apply and enforce the same in such manner and order as it sees fit (whether against those amounts or otherwise). | |

16 | REPRESENTATIONS AND WARRANTIES |

16.1 | Representations and Warranties |

(a) | Status: (in case of the Borrower) each Group Company is a US Corporation or a limited liability company duly incorporated, validly existing and registered under the applicable laws in its jurisdiction and has the power and all necessary governmental and other material consents, approvals, licences and authorities in any applicable jurisdiction to own its assets and carry on its business as it is being conducted; | |

(b) | Powers and authority: it has the power to enter into and perform the Finance Documents and the transaction contemplated hereby and has taken all necessary action to authorize the entry into and performance of the Finance Documents and the transaction contemplated hereby; | |

(c) | Obligation Binding: the Finance Documents constitute a legal, valid and binding obligation of it enforceable in accordance with its terms. The Finance Documents are in proper form to make it admissible in evidence for bringing an action on the same in such courts. Without limiting the generality of the above, each Security Document to which it is a party to creates the security which the Security Document purports to create and those security interests are valid effective; | |

(d) | Non-conflict with laws: The entry into and performance of the Finance Documents and the transactions contemplated hereby do not and will not conflict with (i) any law or regulation or any official or judicial order or treaty in any relevant jurisdiction or (ii) any agreement or document to which the Borrower are party to or which is binding upon or any of its assets, nor result in the creation or imposition of any Encumbrance on any of its assets pursuant to the provisions of any such agreement or document; | |

(e) | No Default: No Default has occurred which might have a material adverse change on its business or financial condition; | |

(f) | Consents: All authorizations, approvals, consents, licenses, exemptions, filings, registrations, notarizations and other matters, official or otherwise, required or advisable in connection with the entry into performance, validity and enforceability of the Finance Documents and the transactions contemplated hereby have been obtained or effected and are in full force and effect; | |

(g) | No filings required: It is not necessary to ensure the legality, validity, enforceability or admissibility in evidence of the Finance Documents that it be filed, recorded or enrolled with any governmental authority or agency in Iceland, USA or Croatia or that any stamp, registration or similar tax be paid on or in relation to this Agreement in Iceland, USA or Croatia; | |

(h) | Pari Passu Ranking: Under the laws of Iceland in force at the date hereof, the claims of the Lender under this Loan will rank at least pari passu with the claims of all its unsecured creditors to the extend it may not be covered with a security provided herein; | |

(i) | Full Disclosure: All information supplied by the Borrower in connection with this Loan is true, complete and accurate and it is not aware of any facts or circumstances that have not been disclosed to the Lender and which might, if disclosed, adversely affect the decision of a person considering whether or not to provide finance to the Borrower; | |

(j) | No Event of Default is Continuing or is reasonably likely to result from the execution of, or the performance of any transaction contemplated by the Finance Documents; | |

(k) | in respect of those Finance Documents subject to the law in respect of a particular jurisdiction (other than Icelandic law), the choice of that law as the governing law of those Finance Documents will be recognised and enforced in the relevant jurisdiction of those Finance Documents and any judgment obtained in the jurisdiction of such law will be recognised and enforced in the relevant jurisdiction of those Finance Documents; | |

(l) | notwithstanding the foregoing, in respect of those Finance Documents expressed to be governed by Icelandic law the choice of Icelandic law as the governing law of those Finance Documents will be recognised and enforced in all relevant jurisdictions and any judgment obtained in relation to a Finance Document subject to Icelandic law will be recognised and enforced in all relevant jurisdictions; | |

16.2 | Repetition |

17 | INFORMATION UNDERTAKINGS |

(a) | Borrower s information. The Lender is fully knowledgeable of all current processes at Kali Tuna and is satisfied with the level and quality of information he has been receiving thereof. He does not request any additional processes to be put in place at Kali Tuna but retains his right to have the same information thereof updated in line with the current schedule. Other paragraphs of this Clause 17 shall in the case of Kali Tuna be construed in coherence to this acceptance of current procedures. | |

(b) | General: Furnish the Lender with a copy from time to time with reasonable promptness of such financial and other information as to itself as the Lender may reasonably request. | |

(c) | Budget: Deliver to the Lender up on request and then not later than 30 days before the start of each financial year of the Lender, an itemized consolidated budget for the Group as a whole for the next financial year in the format approved by the Lender containing: | |

(i) | capital expenditure; | |

(ii) | trading and revenue forecast prepared on a month by month basis; | |

(iii) | proposed disposals where the forecast consideration exceeds on a month by month basis; | |

(iv) | a statement on revenue and cash flow and a balance sheet as it is forecasted to be at the end of the financial year; | |

(v) | the principal assumptions underlying the budget; and | |

(d) | Accounts: Deliver to the Lender up on request | |

(i) | audited annual accounts within one month of the same being prepared and in any event not later than 90 days after the end of the period to which such statements relate. Such accounts shall provide explanations of any material changes against the budget supplied under clause 20 (b) for that financial year; and | |

(ii) | management accounts of the Group for each month and cumulative management accounts of the Group for each month from the beginning of each financial year accounts within 14 days after the end of the period to which such statements relate. | |

(iii) | consolidated quarterly financial statements for the Group for the period ending every three months, within 45 days after the end of the period to which such statements relate, in a form consistent with the management accounts and also to include: | |

(e) | Other information. Such other information concerning the business or financial condition of the Group (or any part of it), including but not limited to information of any litigation or administrative proceedings current, pending or threatened against any Group Company, any Default, any changes or proposed or possible changes in the markets in which the Group operates which may have material effect on its business. | |

(f) | "Know your customer" checks : If: | ||||

(i) | the introduction of or any change in (or in the interpretation, administration or application of) any law or regulation made after the date of this Agreement; | ||||

(ii) | any change in the status of an Obligor or the composition of the shareholders of an Obligor after the date of this Agreement; or | ||||

(iii) | a proposed assignment by the Lender of any of its rights under this Agreement, obliges the Lender to comply with "know your customer" or similar identification procedures in circumstances where the necessary information is not already available to it, each Obligor shall promptly upon the request of the Lender supply, or procure the supply of, such documentation and other evidence as is reasonably requested by the Lender (for itself or, in the case of the event described in paragraph (iii) above, on behalf of any prospective new Lender) in order for the Lender or, in the case of the event described in paragraph (iii) above, any prospective new Lender to carry out and be satisfied it has complied with all necessary "know your customer" or other similar checks under all applicable laws and regulations pursuant to the transactions contemplated in this Agreement. | ||||

18 | NEGATIVE UNDERTAKINGS |

(a) | Authorisations: Promptly obtain, maintain and comply with the terms of any authorization required under any law or regulation to enable it to perform its obligations under, or for the validity, enforceability or admissibility in evidence of the Finance Documents; | |

(b) | Security: | |

(i) | take whatever steps and execute whatever documents the Lender may reasonably require in order to give effect to the Security Documents; | |

(ii) | grant such further security in favour of the Lender as may be required by the Lender at any time, and which the relevant Group Company can legally grant, from time to time and all such further security will secure the obligations of each Group Company under the Finance Documents; and | |

(iii) | take all actions necessary to, in every sense maintain, preserve, protect and defend the security interest granted under the Security Documents so long as the security is not already being used for some other obligation; | |

(c) | Ranking of Liabilities: Ensure that its liabilities under the Finance Documents will constitute its direct and unconditional obligations and rank in priority to all its other present and future indebtedness (except for indebtedness ranking equally or entitled to priority by operation of law | |

(d) | Insurance | |||

(i) | Maintain at all times, with insurance companies of good financial standing acceptable to the Lender acting reasonably, such policies of insurance in relation to its business and assets against such risks as are normally insured by prudent companies carrying on similar business and against such other risks as the Lender may from time to time require (including cover for public, product, environmental, terrorism and third party liability), to the full replacement value of such assets for the time being on the basis of a declared value with a reasonable inflation provision; | |||

(ii) | Comply with the terms of all insurance policies, including any stipulations or restrictions as to use or operation of any asset, and for the avoidance of doubt, observe every safety regulation as recorded and set out in the policies and/or schedules relating thereto, and shall not do or permit anything which may make any insurance policy void or voidable; | |

(iii) | If any default shall at any time be made by any Group Company in effecting or maintaining such insurance or in producing any such evidence to the Lender promptly or depositing any policy with the Lender, the Lender may take out or renew such insurances in such sums as the Lender may think expedient and all money expended by the Lender under this provision shall be recoverable by the Lender under the this Agreement; | |

(iv) | Procure that the Group Companies shall, if so required by the Lender, use their reasonable endeavours to cause the policies of insurance maintained by them as required by this clause to be forthwith amended to include clauses in form satisfactory to the Lender to ensure that the policies shall not be voidable by the insurers as a result of any misrepresentation, non-disclosure of material facts or breach of warranty provided that in each case there shall have been no fraud or willful deceit on the part of the insured Group Company; | |

(e) | Maintenance of licences: Protect and maintain (and take no action which could foreseeably imperil the continuation of) the licences and statutory authorisations, consents, approvals, intellectual property, trade names, franchises and contracts (the "Authorisations" ) which are material and necessary for the conduct and continuation of its business substantially as presently conducted and procure that all material conditions attaching to the Authorisations are complied with and that the Group's business is carried on within the terms of the Authorisations; | |

(f) | Access: On at least two day's notice being given to the Borrower by the Lender (except in the case of emergency), permit representatives of the Lenders or its advisers to have access to and inspect the property, assets, books and records of any Group Company during normal business hours at the risk and the cost of that Group Company; | |

(g) | Environmental Matters: Comply with all Environmental Laws and obtain, maintain and comply with any Environmental Permit where, in either case, failure to do so is to result in liability and/or costs in excess of two hundred and fifty thousand USD 250,000 or in the closure of any site or suspension of any of its operations or business; | |

(h) | Compliance with laws: Comply in all respects with all laws and regulations to which it is subject, non-compliance with which would have a Material Adverse Effect; | |