SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-52401

Umami Sustainable Seafood Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-06360182

|

|

(State or Other Jurisdiction of Incorporation)

|

(I.R.S. Employer Identification Number)

|

1230 Columbia Street

Suite 440

San Diego, CA 92101

(Address of principal executive offices) (zip code)

619-544-9177

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act: Common Stock, par value $.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of regulation S-K is not contained herein, and will not be contained, to the best of registrant knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

|

Large accelerated file ¨

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Approximate aggregate market value of the registrant’s common stock held by non-affiliates as of December 31, 2010: $42,485,000

The number of shares of common stock outstanding as of September 30, 2011 was 59,512,066.

FORWARD LOOKING STATEMENTS

Some of the statements contained in this Form 10-K that are not historical facts are “forward-looking statements” which can be identified by the use of terminology such as “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,” “intends,” or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. We urge you to be cautious of the forward-looking statements, in that such statements, which are contained in this Form 10-K, reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties, and other factors affecting our operations, market growth, services, products, and licenses. No assurances can be given regarding the achievement of future results, as actual results may differ materially as a result of the risks we face, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events. Such statements reflect our current view with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to our industry, operations and results of operations and any businesses that we may acquire, and include, without limitation:

1. our ability to attract and retain management, and to integrate and maintain technical information and management information systems;

2. our ability to generate customer demand for our products;

3. the intensity of competition; and

4. general economic conditions.

Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

All forward-looking statements made in connection with this Form 10-K that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to shares of our common stock. The following discussion should be read in conjunction with the audited annual financial statements and the related notes filed herein.

Unless otherwise indicated or the context otherwise requires, all references below in this current report on Form 10-K to “we”, “us”, “our”, and “the Company”, refer to Umami Sustainable Seafood Inc., a Nevada corporation, (“Umami”) and its wholly-owned subsidiaries, Bluefin Acquisition Group Inc. a New York corporation (“Bluefin”), Oceanic Enterprises, Inc. a California corporation (“Oceanic”), Kali Tuna d.o.o. a Croatian company (“Kali Tuna”) and its 99.98% owned subsidiary Baja Aqua-Farms S.A. de C.V. a Mexican corporation (“Baja”)

Item 1. BUSINESS

Company Overview

We raise sashimi grade Northern and Pacific Bluefin tuna for the high end consumer with a focus on environmentally sound practices and the long term sustainability of the species. Our growth strategy is based on consolidation within the sector to leverage scientific process and research knowledge through economies of scale. Our objective is to create a self-sustaining farm environment where the tuna spawn and the resultant eggs are hatched and grown to full size.

We catch and grow sashimi grade Bluefin tuna commercially in aquaculture farms located in Croatia and Mexico. We own and operate Kali Tuna, an established Croatian-based aquaculture operation, raising Northern Bluefin tuna in the Croatian part of the Adriatic Sea. We also own and operate Baja, an established Mexican-based aquaculture operation, raising Pacific Bluefin tuna off the northwest coast of Baja California, Mexico.

We are in the process of creating a self-sustaining farm environment where the tuna spawn and fertilized eggs are hatched and grown to full commercial size. Although we have achieved some successes in the area of spawning and hatching, we believe that commercialization of this propagation program is still a number of years away. Although, we do not believe that our success is reliant on the success of the propagation program, it is expected to enhance our long-term prospects.

Corporate Background

We were incorporated as Lions Gate Lighting Corp. (“Lions Gate”) in the state of Nevada on May 2, 2005. From August 31, 2007 until June 30, 2010, we were a shell company. On June 30, 2010 we completed the reverse merger described below.

2

In 2005, Kali Tuna, a limited liability company organized under the laws of the Republic of Croatia, was acquired by Atlantis Group hf (“Atlantis”), an Icelandic based holding company with its key market in Japan that seeks to produce, market and distribute sustainable seafood, with a focus on aquaculture. Atlantis is a major supplier of fresh and frozen premium sustainable fish and seafood in Australia and Europe and one of the largest importers of Bluefin tuna into Japan. It is our majority shareholder (and an affiliate of our Chief Executive Officer) and has been a major provider of capital to the Company. Atlantis, through its affiliates, also serves as our exclusive sales agent. In addition, for the year ended June 30, 2011, Atlantis Japan, and other Atlantis Group subsidiaries, purchased from us approximately $41.0 million worth of products, representing approximately 72% of our total sales for the year.

In March 2010, Atlantis created Bluefin, a wholly owned subsidiary of Atlantis, for the purpose of holding the shares of Kali Tuna. On May 3, 2010, Lions Gate entered into a share exchange agreement among Lions Gate, Kali Tuna, Bluefin and Atlantis, pursuant to which Lions Gate purchased from Atlantis all of the issued and outstanding shares of Bluefin in consideration for the issuance to Atlantis of 30.0 million shares of Lions Gate common stock (the “Share Exchange”) resulting in a change of control of Lions Gate. As a result, effective June 30, 2010, Kali Tuna became our indirect wholly owned subsidiary. As of the date hereof, Atlantis continues to be our majority shareholder.

On August 20, 2010 we changed our name to Umami Sustainable Seafood Inc. The stock symbol on the OTC Bulletin Board was changed to UMAM on the same date.

Acquisition of Baja Aqua Farms and Oceanic

On July 20, 2010, we entered into a Stock Purchase Agreement with Corposa, S.A. de C.V. (“Corposa”), Holshyrna ehf, (“Holshyrna”), Marpesca, S.A. de C.V, (“Marpesca”), Oceanic, Vilhelm Gudmundsson and Robert Gudfinnsson, providing for the sale from Corposa and Holshyrna of 33% of the equity of Baja and its affiliate Oceanic. Under the terms of the transaction, we paid $8.0 million, which included $4.9 million that had been advanced to Baja previously.

We also acquired the right to purchase all remaining Baja and Oceanic shares in consideration for the payment of $10.0 million in cash and the issuance of 10.0 million shares of our common stock, valued at $12.1 million. On November 30, 2010, we consummated the acquisition of Baja and Oceanic by paying cash in the amount of $7.8 million and the issuance of promissory notes in the aggregate principal amount of $2.2 million. These notes were paid in full on December 10, 2010. An additional $2.0 million had been paid in connection with the execution of certain amendments to the agreements. As a result, Baja became our 99.98% owned subsidiary and Oceanic became our wholly owned subsidiary.

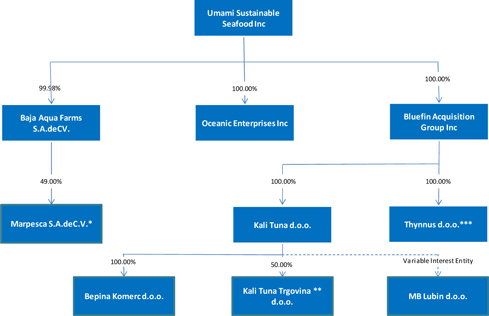

Following the completion of these acquisitions, our corporate structure is as follows:

* Marpesca’s remaining 51% is owned by Baja’s General Manager.

** The remaining 50% of Kali Tuna Trgovina is owned by Bluefin Tuna Hellas A.E., an unrelated third party.

*** Thynnus d.o.o. is an inactive Croatian company.

3

Kali Tuna d.o.o

Kali Tuna was organized in 1996 under the laws of the Republic of Croatia by individuals who had gained considerable experience in the area of tuna fishing, farming and trading in Southern Australia for approximately 30 years before moving their operations to Croatia. Kali Tuna owns and operates facilities and equipment in Croatia where it farms Northern (or Atlantic) Bluefin tuna for sale into the sushi and sashimi market. Most of its products are sold into Japanese trading houses for distribution to the high end sushi and sashimi market in Japan.

Kali Tuna’s activities consist of: (a) tuna farming and processing, (b) sales and exports of tuna products, and (c) storage and processing of fish feed for its tuna farming operations. Through an affiliated entity, MB Lubin d.o.o. (“MB Lubin”), it also operates a fleet of seven fishing vessels that typically catch Northern Bluefin tuna and small pelagic fish used for tuna feed in the Adriatic and transports the live tuna back to its farming sites off the Croatian coast for further growing.

Prior to October 31, 2010, Kali Tuna operated a joint venture, owned 50% by Kali Tuna and 50% by Bluefin tuna Hellas A.E., an unrelated third party. Under the terms of the joint venture, Bluefin tuna was acquired, farmed and sold at Kali Tuna’s site. Initially, the joint venture was operated through a separate entity, Kali Tuna Trgovina d.o.o. In January 2008, all activities of the joint venture were assumed by Kali Tuna. In October 2010, the joint venture was terminated, at which time the joint venture’s remaining assets, consisting primarily of Bluefin tuna biomass located at Kali Tuna’s farming sites were purchased by Kali Tuna at the fair market value of $1.6 million. We do not expect to enter into these types of arrangements in the future.

Kali Tuna also owns Bepina Komerc d.o.o., an inactive Croatian entity, that owns the right to use one of Kali Tuna’s concessions.

Baja Aqua Farms S.A. de C.V

Baja was organized in 1999 under the laws of the Republic of Mexico by individuals who were involved for many years in the tuna feed industry in Southern Australia before commencing operations in Mexico. Baja owns and operates facilities and equipment in Mexico where it farms Pacific Bluefin tuna for sale primarily into the Japanese sushi and sashimi market.

Baja’s activities consist of: (a) tuna farming and processing, (b) sales and exports of tuna products, and (c) processing of fish feed for its tuna farming operations. Baja leases a fleet of purse seiners and tow boats during the fishing season to catch the Pacific Bluefin tuna and transport them live back to its farming sites located off the Baja California, Mexico coast for further growing. Through Marpesca, an affiliated entity, it operates a fishing vessel that typically fishes for small pelagic fish used for tuna feed. Baja sells its fish through various Japanese importers primarily into the Japanese sushi and sashimi market.

Prior to our acquisition of Baja, its administrative functions were performed by Oceanic. These functions included accounting and employment related matters. Following our acquisition of Baja, most of these functions have been transferred to Baja and to Umami. We are considering the dissolution of Oceanic.

Industry Overview

Aquaculture Industry

Aquaculture is the farming of aquatic organisms including fish, mollusks, crustaceans and aquatic plants. Farming implies some form of intervention in the rearing process to enhance production, such as regular stocking, feeding, and protection from predators. Farming also implies individual or corporate ownership of the stock being cultivated. Aquaculture production specifically refers to output from aquaculture activities, which are designated for final harvest for consumption.

Aquaculture is the world’s fastest growing segment in the food production system and has been for the past two decades. According to a recent study by the Food and Agriculture Organization of the United Nations (the “FAO”),1 world fisheries production reached a high of 143.6 million metric tons in 2006. The contribution of aquaculture to the world fisheries production in 2006 was 51.7 million metric tons of fish, or 36% of world fisheries production, up from 3.6% in 1970. The FAO’s worldwide fisheries data are typically five or more years old.

A study covering the year in 2008, entitled “Blue Frontiers: Managing the Costs of Aquaculture”, and published in 2011 by the WorldFish Center (WFC) in Penang, Malaysia, using data from FAO FishStat, shows the growth continuing unabated. In 2008, world fisheries production grew to 158.1 million metric tons, of which aquaculture made up 65.8 million metric tons, representing almost 42% of world fisheries production. According to WFC, worldwide aquaculture production grew at an average annual rate of 8.4% from 1970 to 2008, which means that the growth in aquaculture has ‘significantly outpaced growth in world population.’2

1 The report may be viewed at http://www.fao.org/docrep/010/ai466e/ai466e10.htm.

2 The complete report is available at http://www.conservation.org/Documents/BlueFrontiers_aquaculture_report.pdf. (hereinafter “Blue Frontiers”)

4

Global aquaculture accounted for 6% of the fish available for human consumption in 1970. In 2008, global aquaculture accounted for 42% of the fish available for human consumption according to the FAO and WFC.3 The FAO report also describes that over half of the global aquaculture in 2008 was freshwater fin-fish. Based on the FAO’s projections, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach in excess of 80 million metric tons of fish by 2050. WFC’s projections are even more aggressive. WFC estimates world aquaculture production to rise to 75 million tons by 2020, and to 95 million tons by 2030.

According to the FAO, per capita supply from aquaculture increased from 0.7 kg in 1970 to 7.8 kg in 2006, an average annual growth rate of 6.9%.4 It is set to overtake capture fisheries as a source of food fish. From a production of less than 1 million metric tons per year in the early 1950s, production in 2008 was reported to be 52.5 million metric tons with a value of $98.4 billion, representing an annual growth rate of nearly 7%.

A good aquaculture site is made up of many factors, with the key ones being location, weather, water temperature, currents and predator risk. As the availability of sites for aquaculture is becoming increasingly limited due to licensing and environmental factors and the ability to develop non-agricultural land is restricted, the competition to develop additional aquaculture production systems is intensifying. As the intensification for aquaculture production systems increases, the demand for institutional support, services and skilled persons is anticipated to increase, along with the demand for more knowledge-based aquaculture education and training as aquaculture becomes more important worldwide.

According to the WFC, ‘aquaculture is among the fastest growing food production sectors in the world and this trend is set to continue’. Further, WFC states that ‘this future growth must be met in ways that do not erode natural biodiversity or place unacceptable demands on ecological services.”5

Tuna Industry

Tuna and tuna-like species are of great economic importance and represent a significant source of food. They include approximately forty species occurring in the Atlantic, Indian and Pacific Oceans and in the Mediterranean Sea. According to the FAO, their global production has increased from less than 0.6 million metric tons in 1950 to 6.5 million metric tons in 2009.6 Seven principal market species made up 4.4 million tons of the whole in 2009, with Bluefin tuna totaling 58,944 metric tons, or 1.3% of the global production of tuna.7

The so-called principal market tuna species are the most economically important among the tuna and tuna-like species. They are landed in numerous locations around the world, traded on a nearly global scale and also processed and consumed in many locations worldwide. According to the FAO, in 2007, their catch was approximately four million tons, which represents about 65% of the total catch of all tuna and tuna-like species. Most catches of the principal market tuna species are taken from the Pacific (69.0% of the total catch of principal market tuna species in 2007), with the Indian Ocean contributing much more (21.7% in 2007) than the Atlantic and the Mediterranean Sea (9.5% in 2007). 8

Approximate contributions of individual principal market tuna species to the 2008 total catch is given below.

|

Principal market tunas

|

||

|

Albacore (ALB)

|

4.7%

|

|

Atlantic bluefin tuna (BFT)

|

less than 1%

|

|

Bigeye tuna (BET)

|

9.6 %

|

|

Pacific bluefin tuna (PBF)

|

less than 1%

|

|

Southern bluefin tuna (SBF)

|

less than 1%

|

|

Skipjack tuna (SKJ)

|

57.5%

|

|

Yellowfin tuna (YFT)

|

27.1%

|

Source: http://www.fao.org/fishery/statistics/tuna-catches/en

3 This report is available at http://www.fao.org/docrep/013/i1820e/i1820e01.pdf. See page 3 of that report.

4 This report may be found at http://www.fao.org/fishery/topic/13540/en.

5 Blue Frontiers at page 2.

6 Source: http://www.fao.org/figis/servlet/SQServlet?file=/usr/local/tomcat/FI/5.5.23/figis/webapps/figis/temp/hqp_3281.xml&outtype=html.

7 Source: http://www.fao.org/figis/servlet/SQServlet?file=/usr/local/tomcat/FI/5.5.23/figis/webapps/figis/temp/hqp_3251.xml&outtype=html.

8 Ibid.

5

Bluefin Tuna Trade

The Bluefin trade includes three species of tuna: the Pacific Bluefin, the Southern Bluefin and the Northern (Atlantic) Bluefin. The Northern (Atlantic) Bluefin Tuna (Thunnus thynnus) is native to both the western and eastern Atlantic Ocean, the Mediterranean and the Black Sea. It can live up to 30 years and can reach weights of over 450 kilograms. The Pacific Bluefin Tuna (Thunnus orientalis) is native to both the western and eastern Pacific Ocean. It can live up to 25 years and weigh up to 500 kilograms.

We concentrate on the Atlantic Bluefin tuna trade for our Croatian operation, and on the Pacific Bluefin tuna trade for our Mexican operation.

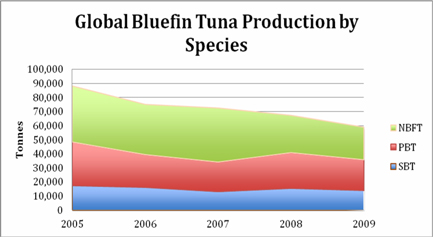

The following graph shows global production (catching and farming combined) for each species of Bluefin tuna in metric tons per year.

|

2005

|

2006

|

2007

|

2008

|

2009

|

||||||||||||||||

|

Southern Bluefin Tuna

|

17,439 | 16,225 | 13,159 | 15,515 | 13,979 | |||||||||||||||

|

Pacific Bluefin Tuna

|

30,943 | 23,174 | 20,942 | 25,308 | 21,761 | |||||||||||||||

|

Northern Bluefin Tuna

|

39,869 | 35,730 | 38,474 | 26,525 | 23,204 | |||||||||||||||

|

TOTALS

|

88,251 | 75,129 | 72,575 | 67,348 | 58,944 | |||||||||||||||

The graph and the table are based on data extracted from the following source:

http://www.fao.org/figis/servlet/SQServlet?file=/usr/local/tomcat/FI/5.5.23/figis/webapps/figis/temp/hqp_3048.xml&outtype=html.

Atlantic Bluefin Tuna

As concerns over depleting the natural stock of the Atlantic Bluefin tuna have increased in recent years, international organizations have increased regulation relating to and imposed strict quotas on Bluefin Tuna catches. The main international body that regulates fishing activities and trade in the Atlantic Bluefin is the International Commission for the Conservation of Atlantic Tunas or ICCAT. It describes itself as an inter-governmental fishery organization responsible for the conservation of tunas and tuna-like species in the Atlantic Ocean and its adjacent seas. Its primary tool in its conservation efforts is its ability to impose quotas. The organization was established in 1966, is headquartered in Madrid, Spain, and covers 30 species of tuna, including the Northern (Atlantic) Bluefin Tuna.

In the last five years great advancements have been made in the conservation of the Atlantic Bluefin tuna. In November 2006, members of the ICCAT reached an agreement to reduce the Bluefin tuna quota in the Mediterranean Sea from 32,000 metric tons in 2006 to 25,500 metric tons in 2007. In November 2007, the ICCAT set the annual quota for 2008 at 22,000 metric tons, reducing it to 18,500 tons in 2009. Various groups, including environmental groups, have claimed that this quota was set at an unsustainable level.

In 2008, the ICCAT adopted measures, which included a 15-year recovery plan for Bluefin tuna and included, among other things, a call for a 6-month off-season for specific types of boats, a ban on the use of aircraft in spotting tuna, prohibiting the capture of tuna under 30 kg except in certain specific circumstances and areas, and requiring extensive reporting of tuna catches. Furthermore, it only allows tuna to be offloaded at designated ports and obliges countries to place observers on fishing boats to monitor their adherence to regulations.

In 2009, strict additional control measures were agreed upon to accelerate the rebuilding of the stock to levels that will allow maximum catches at sustainable levels. These included:

|

|

·

|

Reductions in fishing capacity.

|

|

|

·

|

A limit on the number of joint fishing operations that could be carried out.

|

6

|

|

·

|

An observer program with 100% coverage of purse seine and farming activities.

|

|

|

·

|

Reporting of catches close to real-time, allowing for a closer monitoring of the quota.

|

Pacific Bluefin Tuna

Management of Pacific Bluefin tuna comes under various international organizations, such as the Western & Central Pacific Fisheries Commission (WCPFC) in the central and western Pacific and the Inter-American Tropical Tuna Commission (IATTC) in the eastern Pacific, which is based in La Jolla, California, and which was formed in 1949, making it the oldest regional fishery management organization (RFMO). According to the latest IATTC Fishery Status Report No. 8, Tunas and Billfishes in the Eastern Pacific Ocean in 2009, Bluefin tuna only made up 0.6% of total tuna catch (3,605 metric tons out of a total catch of 616,849 metric tons).9 As a result, no quota or regulations are imposed on the Pacific Bluefin tuna, although various governments have had preliminary discussions regarding measures to preserve Pacific Bluefin stock.

According to the IATTC, most of the catches of bluefin in the Eastern Pacific Ocean are taken by purse seiners. Nearly all of the purse-seine catches have been made west of Baja California and California, within about 100 nautical miles of the coast, between about 23°N and 35°N. Ninety percent of the catch is estimated to have been between about 60 and 100 cm in length, representing mostly fish 1 to 3 years of age. Aquaculture facilities for bluefin were established in Mexico in 1999, and some Mexican purse seiners began to direct their effort toward bluefin during that year. During recent years, most of the catches have been transported to holding pens, where the fish are held for fattening and later sale to sashimi markets. Lesser amounts of bluefin are caught by recreational, gillnet, and longline gear. Bluefin have been caught during every month of the year, but most of the fish are caught during May through October.10

At its seventh regular session, the WCPFC adopted a conservation measure for Pacific Bluefin tuna in their area, calling for a reduction in catch of juveniles (0-3 years of age) to below 2002-2004 levels. Since we don’t catch any of our Bluefin tuna from the central and western Pacific, we don’t see any impact on our operations from this conservation measure. The WCPFC is based in Kolonia, Pohnpei, Federated States of Micronesia, and is among the newest RFMOs, having come into effect in 2004.

Fish Supply

Japan has traditionally been one of the largest consumers of tuna, especially Bluefin tuna, which is used as a premium ingredient for sushi and sashimi. We believe that as a result of Atlantis’ and its affiliates’ solid ties in the Japanese fish market, which are built on strong personal relationships, Umami’s products are regarded by the Japanese as highly reputable and high-end fish products, as evidenced by our sales to repeat customers and their willingness to pay premium prices.

Kali Tuna

Kali Tuna procures live Bluefin tuna primarily through MB Lubin, an entity, which, pursuant to a series of agreements, is controlled by Kali Tuna. MB Lubin owns and operates a fleet of seven vessels that catch fish primarily off the coast of Croatia. Kali Tuna has also purchased live tuna from other local and foreign-based farms and suppliers including fishing companies operating off the coast of Malta and Libya and other Mediterranean locations. The tuna is deposited into special towing cages that are towed back to its farming sites off the Croatian coast for transfer into permanent holding cages. Fishing takes place during the months of May and June only as permitted by international regulations. Transport of the catch to Kali Tuna’s farms is a slow process that can take many weeks to complete with speeds of the transport rarely exceeding one mile per hour to maximize the survival rates of the live fish.

MB Lubin sells its live fish to Kali Tuna under an exclusive arrangement in a supply contract dated July 1, 2009. Under the terms of the agreement, MB Lubin has undertaken to sell all its Bluefin tuna catches to Kali Tuna. Under the agreement, which has a term of 20 years, all deliveries of tuna will be made at the market price prevailing at the time of delivery.

In addition, Kali Tuna has entered into an agreement with MB Lubin that provides for the sale and delivery by MB Lubin of small fish that are used for feeding the tuna. Kali Tuna may also purchase feed from other suppliers.

Since Kali Tuna operates on a long-term farming cycle, the Company believes that none of its suppliers of live tuna or fish feed are critical to its business. However, if for any reason Kali Tuna would be unable to procure fish from a particular supplier, this would likely lead to a temporary interruption in the supply of fish, at least until Kali Tuna found another entity that could provide it these services.

Following is a short summary of the most significant terms of the agreements pursuant to which Kali Tuna controls MB Lubin:

|

|

·

|

Business Cooperation Agreement. This agreement dated July 1, 2009, generally establishes the relationship between the parties and obligates them to enter into separate agreements that set forth the details of the relationship and the obligations of each of the parties resulting in the agreements discussed immediately below.

|

9 The complete report may be found at http://www.iattc.org/PDFFiles2/FisheryStatusReports/FisheryStatusReport8ENG.pdf

10 Ibid. at page 94.

7

|

|

·

|

Maritime/Fishery Services Contract. Under the terms of this agreement that was entered into July 1, 2009, MB Lubin is required on an exclusive basis to provide tuna farming and harvesting services to Kali Tuna, including controlling nets and equipment, cleaning of farms, transport of workers to and from the farms and harvesting, processing and transporting fish. The agreement has a term of 20 years. Fees payable by Kali Tuna are established under separate agreements from time to time.

|

|

|

·

|

Live Tuna Supply Contract. Under the terms of this agreement that was entered into July 1, 2009, MB Lubin is required to sell to Kali Tuna all of the Bluefin tuna that it catches. Prices to be paid are fixed by separate agreements to be entered into during each catching season. The agreement has a term of 20 years.

|

|

|

·

|

Small Pelagic Fish Supply Contract. Under the terms of this agreement that was entered July 1, 2009, MB Lubin is required to supply Kali Tuna with all small fish that it catches for the purpose of fish feed to be used for feeding its Bluefin tuna. Prices to be paid are fixed by separate agreements to be entered into during each catching season. The agreement has a term of 20 years.

|

Baja

Baja procures live Bluefin tuna primarily through its own fishing efforts. Baja leases fishing vessels (purse seiners) from reputable companies in Mexico. Baja catches fish primarily off the coast of Baja California, Mexico. The tuna is deposited into special towing cages that are towed back to its two farming sites off the Baja California coast for transfer into permanent holding cages. Fishing generally takes place during the months of May through August. Transport of the catch to its farms is a slow process that can take many weeks to complete with speeds of the transport rarely exceeding one mile per hour. This ensures that the Bluefin tuna will arrive in the best possible condition. Mexican law requires majority ownership by Mexican nationals of any local fish catching operation. Accordingly, Baja leases one of its vessels to an affiliate, Marpesca, which is 49% owned by Baja and 51% by Baja’s General Manager and, accordingly, is controlled by common management.

Although the Company does not believe that any of Baja’s suppliers of leased purse seiners are critical to its business, if for any reason Baja would be unable to procure vessels for lease from a particular supplier, this would likely lead to a temporary interruption in the supply of fish at least until Baja found another entity that could provide it these services or purchased its own purse seiners.

Sales and Customers

Sales

On June 30, 2010, Umami entered into a sales agency agreement with Atlantis pursuant to which Atlantis was granted the exclusive right to sell, on Kali Tuna’s behalf, all of its Bluefin tuna products into the Japanese market. Following the acquisition of Baja, Umami agreed to extend the sales agency agreement to most of Baja’s sales. Umami paid Atlantis an agency commission of 2% on all sales made under this agreement, resulting in payments of $1.0 million for the year ended June 30, 2011. In June 2011, the agreement was terminated.

In October 2011, we entered into a sales agency agreement with Atlantis Co., Ltd. (“Atlantis Japan”), giving Atlantis Japan exclusive rights to sell our Bluefin tuna in Japan. We will pay Atlantis Japan 2% for all sales up to 4.0 billion Japanese Yen (approximately $52.0 million) and 1.0% for all sales above that amount. Commissions under the agreement are payable quarterly. The agreement was effective retroactively to July 1, 2011 and expires March 31, 2012. Atlantis Japan is a wholly owned subsidiary of Atlantis.

It is contemplated that pricing of products sold through Atlantis Japan will be based on negotiation between Atlantis Japan and the customers based on criteria set by us. All sales are subject to our review and approval.

Customers

For the year ended June 30, 2011, Atlantis Japan, Atlantis’s wholly owned subsidiary, purchased from us approximately $40.6 million worth of products, representing approximately 71% of our total sales for the year. An additional 27% was sold to large Japanese importers.

The following table shows our principal customers and the amount purchased by each as a percentage of our total sales for the years ended June 30, 2011 and 2010.

|

Year Ended June 30

|

||||||||

|

2011

|

2010

|

|||||||

|

Atlantis Japan and other Atlantis Group Subsidiaries

|

71.9 | % | — | |||||

|

Mitsubishi Corporation

|

10.8 | % | — | |||||

|

Global Seafoods Co., LTD

|

9.3 | % | — | |||||

|

Sirius Ocean Inc.

|

6.9 | % | 16.5 | % | ||||

|

Daito Gyorui Co., Ltd

|

— | 82.6 | % | |||||

8

Frozen and Fresh Fish

Harvesting tuna from Kali Tuna occurs typically during the months of November to March when low water temperatures optimize the quality of tuna meat. Over 98% of our production at Kali Tuna is sold as frozen fish which typically will be picked up by the customer in its own specially equipped freezer vessels for transport to Japan. When selling fresh fish to a customer, Kali Tuna ships the processed fish by overnight delivery to the requested location. Kali Tuna does not intend to make significant sales of fresh fish during the current year.

Harvesting tuna from Baja occurs typically during the months from September through March when low water temperatures optimize the quality of tuna meat. When selling fresh fish, Baja will ship the processed fish by overnight delivery to the requested location.

Baja sells approximately 85% of its fish as frozen product. The remaining 15% is sold fresh where the fish is harvested, cooled, packed in ice and then sent via air-freight to Japan. Baja has sold frozen fish through both land-based (rented) containers and specially equipped freezer vessels. In the future we expect most frozen product will be sold utilizing freezer vessels as the freezer vessels are currently more efficient from a processing standpoint.

Raw Materials

Our raw materials consist primarily of bait, including sardines, anchovies, mackerel, and other small fish used as fish feed. We strive to catch as much as possible of the bait ourselves. Kali Tuna purchases most of the bait from third party vendors. Baja catches most of the bait itself with the balance being purchased from third parties. Raw materials may be subject to price fluctuations, as further explained in the Risk Factor beginning, “We may be adversely affected by fluctuations in raw material prices.”

Research and Development

Our subsidiary, Kali Tuna, conducts research and development in two specific areas: closed lifecycle bluefin tuna farming, known as the Propagation Program, and optimizing feed efficiencies by way of studying nutrition and feeding habits of fish.

Propagation Program

Through Kali Tuna, we have been conducting research and testing in the area of naturally spawning Bluefin tuna in captivity with the objective of closing the life cycle on a commercial scale utilizing existing and newly purchased low-cost infrastructure (i.e. farming Bluefin tuna that is born and raised in captivity). The Propagation Program is intended to produce self-sustaining quantities of Bluefin tuna juveniles ready for farm grow-out pending environmental factors and hatchery technologies.

The initial stage of the program involved the capture of young Bluefin tuna and keeping them in Kali Tuna’s cages until they reach sexual maturity (typically aged over three and a half years old), at which point they become known as “brood stock.” The spawned eggs from Kali Tuna’s specially nominated brood stock were collected and hatched over consecutive years. Eventually, we expect the Bluefin tuna hatched through this process to grow into sexually mature fish that will spawn to be come first generation fully closed life-cycle blue fin tuna. The program will accelerate as soon as we finalize customization of a hatching facility.

To that end, during the first half of 2011, Kali Tuna purchased a vessel for customization into the world’s first floating Bluefin tuna hatchery. Kali Tuna also contracted local dry dock and engineering service companies to paint and refurbish the vessel to ready it for hatchery customization. The floating hatchery facilitates the transport of the newly hatched fish to locales where the water temperatures are high enough for young fish transferred into sea cages located in that environment to survive. The hatchery is designed with a capacity to produce approximately 15,000 juveniles per hatching batch for ocean transfer. Multiple hatching runs may be possible should the brood stock spawn over a sufficient period to continue juvenile production.

Total funds spent to date on the procured vessel and refurbishment costs are approximately $0.4 million. Total project infrastructure cost, including hatchery equipment procurement and engineering customization, is estimated between $2.3 million to $2.7 million with an annual operational cost of approximately $0.3 million, excluding depreciation and financing costs. Hatchery customization work agreements are on hold until such time as we allocate funding expected to be available from sales proceeds.

We believe that the Propagation Program represents an important long-term research and development project that it is not expected to yield a commercially viable business opportunity during the first five years of the hatchery’s operation.

Major challenges to a successful completion of this research program include:

|

·

|

the lack of high quality fertilized eggs during the spawning season;

|

|

·

|

naturally high rate of mortality among juvenile fish exposed to varying water temperatures;

|

|

·

|

fatal collisions that occur when juvenile tuna fins are underdeveloped which prevents them from maneuvering and causes them to crash into tank walls and ocean nets; and

|

|

·

|

possible disease exposure among juveniles, although no diseases have been identified in any of our tuna farming locations.

|

In addition to closing the life cycle, increased spawning and hatching of our own propagated brood stock may reduce the need for catching fish in the wild. It may eventually result in a release of self-propagated live stock into the wild.

9

Fish Feeding Habits

Kali Tuna researches the feeding habits of the Bluefin tuna for the purpose of determining the optimal way of feeding the fish at its sites. Improving the Food Conversion Ratio or FCR, which represents the number of kilograms of feed needed to produce one kilogram of fish, facilitates achieving maximum feeding efficiencies and cost savings.

During the fiscal year ended June 30, 2011 we spent approximately $0.6 million on research and development projects. During the fiscal year ended June 30, 2010, our R&D expenditures were negligible.

Our Principal Competitive Strengths

We believe that we have the following competitive strengths:

We have the most seasoned operations in our geographic areas. Kali Tuna was the first commercial tuna farm in the Mediterranean and Adriatic areas. The farm was built by people who had previously been leaders in the tuna farming business in Port Lincoln, Australia. All farm operations were set up according to the high standards used in Australia. Most of the key crew members have been with Kali Tuna from inception. Baja was also founded by people who had previously been providers of feed and buyers in the tuna farming business in Australia. Many of the key crew members have been with Baja since its early years.

We have strong personal relationships within our target market. Following the acquisition of Kali Tuna by Atlantis Group in 2005, and our acquisition of Baja in 2010, both Kali Tuna and Baja were able to enhance their already considerable reputation in the Japanese fish market as a result of strong personal relationships between Atlantis executives and Japanese market leaders. Japanese business is generally built on personal trust, extensive knowledge regarding product quality assurance and a high level of expertise. Oli Steindorsson, our Chairman, CEO and President and a director of Atlantis, is fluent in Japanese and has spent extended periods of time residing in that country. This has allowed us to capitalize on his experience, together with the team at Atlantis’ Japanese subsidiary, and further solidify our position as a trusted source of high quality fish products.

We have a unique farming cycle. Following the catch of fish, they are transferred into cages where they are fed and nurtured for up to three and one-half years. As a result, our output is less impacted by quota reductions and each wild caught fish (between 10-120 kilograms) can be leveraged by a factor of up to 10 times given livestock gains over the period. Most of our competitors have shorter farming cycles (up to six months) or they practice “catch and kill”.

Full traceability. We also have full traceability on each of the tuna caught and the tuna feed, which means that every batch of tuna and feed brought in may be tracked from the area where it was caught, when it was caught, to the boat catching it and to any other intermediaries until its delivery to the farm sites.

We operate in unique farming environments. There are no predators, such as sea otters, sea lions or sharks, in Adriatic waters that might attack the fish in captivity. In the Pacific, where there are natural predators, we build the cages to keep the predators out. The waters where the farming sites are located are pristine with few cases of red or blue tide caused by the damaging build-up of algae. There is no industrial production nearby either area and there is exceptionally clean water in both places. With the islands surrounding the farm sites, they are sheltered naturally against most storms. In addition, the salt and oxygen levels and the water temperature offer a good combination of conditions for sustainable growth of our tuna.

We have an experienced and knowledgeable workforce and a very low employee turnover at each of the operations. Some of our employees have been working for us for more than 10 years. Kali Tuna employees have regularly been requested to assist in external operations worldwide as far as Australia and Mexico. All of the management in Croatia is fluent in English while a number of our key marketing people have multilingual skills that include Japanese. Most of the management in Mexico is fluent in English.

We have reached major breakthroughs in our research and development efforts to close the full circle farming process. If our success in spawning and hatching in captivity at Kali Tuna can be commercially implemented, we will become less dependent on wild catches of tuna for both subsidiaries.

We possess valuable government farming input quotas, permits and concessions at both locations. Kali Tuna has farming concession permits for up to 4,800 metric tons of holding capacity with an allowable input of 1,818 metric tons per annum granted by the government of Croatia. Baja has concessions in Mexico from the government of Mexico which are not based upon a total mass of tuna at any point in time, but instead on limits of the input of new fish. The concessions owned by Baja allow input of an additional 2,320 metric tons of new fish per annum.

Our Growth Strategies

International concerns have been mainly focused on over-catching and poaching of various tuna species, primarily concentrating on the Bluefin tuna’s stock situation in the Mediterranean Sea.

In response, ICCAT has been taking measures to regulate the catching of the Atlantic-Mediterranean territory covering the migration of Northern Bluefin tuna and looking at its “colleague organization”, the Commission for the Conservation of Southern Bluefin tuna or CCSBT, and its measures taken to promote the conservation of Southern Bluefin tuna in the southern hemisphere In addition, preliminary discussions are under way between governments concerning further measures to preserve the stock of the Pacific Bluefin.

10

We endorse the efforts of these organizations and believe that it is critical to create world-wide industry leadership that will regulate the fishing for all species. Otherwise, short-term profit considerations could result in a failure to act and conserve and lead to extinction of, among others, the Bluefin tuna, and thus the demise of our industry. We believe that we have an important role to play in the adoption of rules aimed at ensuring the long-term survival of the Bluefin tuna, creating a sustainability model that can be applied to other fish species as well. We further believe that we can be active in this area while generating profits for our shareholders, as reducing the supply of bluefin tuna will increase its price.

We believe that the following will be some of the critical elements in fulfilling our strategy to become the world leader in the Bluefin tuna trade:

|

|

·

|

Build up enough livestock to create carry-over inventories. Our objective has been to lengthen the farming cycle. This is expected to result in the greatest weight growth and an increase in the price paid per kilogram of fish by our buyers (the bigger the fish, the better the price per kilogram). In addition, it will mitigate the effects of short-term fluctuations in catching due to weather or other abnormal situations that may occur. Kali Tuna’s live stock inventories biomass increased from 1,315 metric tons at June 30, 2009 to 1,880 metric tons at June 30, 2011. Baja’s live stock inventories totaled 1,530 metric tons at June 30, 2011.

|

|

|

·

|

Strategic investments. We will seek to acquire stakes in tuna farming and fisheries with farming and/or fishing licenses in selected areas in countries with successful Bluefin tuna farming history that will synergize with our existing operations. We have identified a number of additional targets. However, progress in this area is dependent on available financing.

|

|

|

·

|

Cooperate closely with regulators. Based on scientific advice, we intend to assist regulators in formulating regulatory proposals aimed at the conservation of the Bluefin tuna. We might also lobby for distribution of individual transferable quotas, or ITQs, and monitoring systems based on the experiences of leading countries in the seafood industry that have historically had to rely on sustainable usage of their fishery by strictly regulating and controlling the volume of catching.

|

|

|

·

|

Consolidating and upgrading of the fleet. We intend to reduce the existing catching capacity to fewer and more efficient vessels as the quota system develops. One of the important factors in sustainable fisheries management is to avoid overcapacity of fleet, which is caused by underdevelopment in regulatory environments. We believe that a key part of sustainable resource management is to ensure that the harvesting of resources is done in the most efficient and economic way while at the same time, maximizing the value and quality of each fish. However, progress in this area is dependent on available financing.

|

|

|

·

|

Increase our research and development. We intend to increase our efforts on closing the Northern Bluefin tuna cycle in cooperation with leading research institutes in this field as well as enhancing feeding techniques to continue our efforts to minimize the food conversion ratio (FCR) of tuna. We also intend to establish and fund a research center in Kali, Croatia to focus on these issues. However, progress in this area is dependent on available financing.

|

|

|

·

|

Upgrade and invest in feed procurement. We intend to achieve greater cost efficiency in feed procurement by focusing on our catching and logistic activities. We expect this to result in greater profitability, especially in light of our efforts to lengthen the farming cycle.

|

We expect that these factors will enhance sustainability and traceability of the final products that we are offering to the market. These actions will also help prevent a collapse in the natural fish stocks and ensure food security for one of the most popular sashimi grade products of the world.

Sustainable Farming

The concept of sustainable development has been popularized by the 1987 World Commission on Environment and Development. It defined “sustainable development” as meeting the needs of the present generation, without compromising the needs of future generations. The idea of sustainability has caught up with aquaculture partly because of pressure from environmental groups. In 1998, the Holmenkollen Guidelines for Sustainable Aquaculture were formulated. These guidelines recommended, among other things, that new technologies and management procedures should be utilized so that the quality and quantity of aquaculture products is improved and the risk of adverse effects on the environment and on the livelihood of other people, including future generations, is reduced. The guidelines also recommended:

|

|

(1)

|

strict compliance with internationally agreed food safety, environmental safety and ethical criteria if genetically modified organisms or hormones are utilized in the production, as well as;

|

|

|

(2)

|

giving priority to the development of integrated fish farming and of sources for animal feed other than fish protein and fish lipid.

|

11

We fully endorse the idea of sustainable farming. Our scientists have achieved some encouraging results in the area of breeding tuna in captivity. Nevertheless, we believe that commercialization of this propagation program is still a number of years away. We are committed to continuing this research project with the ultimate goal of commercializing the full circle farming process. We have consistently worked closely with the local fisheries ministry in Croatia to formulate rules governing the industry and we are committed to working closely with the local fisheries for both operations.

Competition

In general, the aquaculture industry is intensely competitive and highly fragmented. We compete with various companies, many of which are producing products similar to ours. Some of our competitors may be – in certain parts of their business - more established and may have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors may have a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements, and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies.

Our competitors in the Adriatic and Mediterranean that produce Bluefin Tuna are Fuentes e Hijos (Spain), Aquadem (Turkey), Azzopardi (Malta), Sagun (Turkey) and Balfego (Spain). According to a report11 issued by ICCAT, Kali Tuna has the largest output in the area based on output licenses granted to individual companies. Kali Tuna at the present holds approximately 53% of all production licenses issued in Croatia, or 4,240 tons out of 7,880 totally issued. We are aware of competitors in the Mexican region that produce Bluefin Tuna, including Maricultura del Norte (Mexico). Baja Aqua Farms occupies 60 cages out of less than a total of 100 cages in the area of its operation.

Through our senior management and our largest shareholder, Atlantis Group, we maintain strong relationships with Japanese purchasers, which greatly enhances our ability to market and sell our products into the world’s largest market and maintain and expand our competitive position. We produce a premium, sashimi grade product “toro” tuna, which is a high fat content belly tuna commanding the highest prices at auctions in Tokyo. We will continue building on our reputation and personal relationships to ensure strong demand for our products in Japan.

With respect to potential new competitors, although there are no formal barriers to entry for engaging in similar aquaculture processing production and activities in Croatia and Mexico, we believe that it is difficult and costly to start an operation comparable in size to ours. The principal barriers to entry are the shortage of available sites for farms in the local Croatian waters and the reluctance of Mexican officials to grant new permits and concessions for farming in Mexico so as to discourage additional Bluefin fishing. As a result, concessions for such sites are difficult to obtain. In addition, our labor force is highly specialized and individuals with the requisite expertise who could manage this type of business are in short supply. Finally, to build a consistent farming cycle of two or three years, as we have already achieved, is highly capital intensive, time consuming and can only be done with high expertise, experience and research.

Regulation

Environmental Laws

We are subject to international quotas and to various national, provincial and local environmental protection laws and regulations, including certifications and inspections relating to the quality control of our production. During each of the years ended June 30, 2010 and June 30, 2011, we spent approximately $0.2 million on environmental law compliance, consisting primarily of various ICCAT inspection fees.

Croatian Environmental Law

Kali Tuna is subject to laws and rules that regulate the location, design and operation of its farming sites. Under Croatia’s Environment Protection Act of 2007, Kali Tuna is required to apply for location permits which are issued by the respective authority for each farming location and in accordance with local ordinances. Applications must be accompanied by an environmental impact assessment that will identify, describe and evaluate in an appropriate manner the impact of the relevant project on the environment, by establishing the possible direct and indirect effects of the project on the soil, water, sea, air, forest, climate, human beings, flora and fauna, landscape, material assets, cultural heritage, taking into account their mutual interrelations. Concession contracts (discussed below) relating to each site are entered into based on the relevant location permits.

Kali Tuna is also subject to ongoing environmental monitoring requirements, including testing the quality of the water and performing emission measurements for all its installations.

11 The report may be viewed at

(http://iccat.org/en/ffbres.aspcajaFlag=checkbox&cajaFFBName=checkbox&cajaOwna=checkbox&cajaOwad=checkbox&cajaReg=checkbox&cajaOpna=checkbox&cajaOpad=checkbox&selectOrder=1&selectOrder2=6&selectInterval=-1&Submit=Search).

12

Kali Tuna has obtained location permits for each farming location and each permit was approved by the Ministry of Environmental Protection and it believes that it is in material compliance with applicable environmental laws and regulations.

Mexican Environmental Law and Compliance

The Mexican General Act for Ecologic Balance and the Protection of the Environment of 1988 (the “General Act”) was influenced by U.S. environmental laws such as the Clean Water Act, Clean Air Act and National Environmental Policy Act. The General Act created for the first time specific criminal and administrative sanctions for failure to comply with regulations regarding hazardous materials. It further provides for a federal environmental agency to issue technological standards under which federal, state and local governments could impose sanctions for non-compliance.

Under the General Act, Baja is required to obtain a license for all its activities. It further provides that applications for a license must show that all activities for which a license is sought must be in compliance with national, state and municipal zoning programs as well as with applicable marine ecological land zoning programs. These programs are formulated by a central authority, or SEMARNAT, in accordance with the General Act. The application process requires the submission of an environmental impact statement. Upon review and approval of the application, the SEMARNAT will issue an authorization of environmental impact.

Baja is also subject to the National Waters Act and the General Act for Sustainable Fishing and Aquaculture, which among other things governs the grant of concessions for commercial fisheries. Baja is also required to monitor its activities on all its farming sites for ongoing compliance and it is subject to periodic inspections.

Baja has obtained permits for each farming location and it believes that it is in material compliance with applicable environmental laws and regulations.

International Quotas

Internationally, ICCAT regulates Atlantic Bluefin tuna quotas that are allocated to and enforced by individual countries, including Croatia.

Farming Concessions

Our farming sites are operated under concessions granted by the national authorities. These concessions are subject to renewal from time to time. Currently, Kali Tuna operates five sites with an input capacity of 1,818 metric tons of new fish per annum with a total farm holding capacity of 4,800 metric tons. These concessions expire between 2018 and December 2026 at which point they will be open for public bid. The concessions in Mexico are not based upon a total mass of tuna at any point in time, but instead on limits of the input of new fish. The concessions owned by Baja allow input of an additional 2,320 metric tons per annum. These concessions expire between April 2012 and December 2026. All four of these concessions are renewable through the department of fisheries in Mexico.

Following is a detailed breakdown of the Kali Tuna farming sites and the terms of its concessions:

|

Site

|

Capacity/Permit to

Farm (in metric tons)*

|

Surface (in m2)

|

Expiration Date

|

||||||

|

Mrdjina

|

1,240 | 160,000 |

February 28, 2026

|

||||||

|

Fulija-Kudica

|

500 | 120,000 |

December 23, 2018

|

||||||

|

Zverinac

|

1,500 | 140,000 |

December 14, 2026

|

||||||

|

Kluda

|

1,000 | 157,000 |

October 31, 2016

|

||||||

|

Ispred Morotove Glave

|

560 | 40,000 |

April 30, 2012

|

||||||

|

Total

|

4,800 | 617,500 | |||||||

* Based on maximum holding capacity at any given time.

All concession permits are awarded to Kali Tuna for the period until the indicated expiration dates, and are not subject to adjustment for any reason. Kali Tuna is required to conduct monitoring on a quarterly basis at all sites, which monitoring is conducted by an independent company. We are also obliged to have monthly sea water analyses performed pursuant to rules promulgated by the Institute for Public Health in Zadar.

13

Following is a detailed breakdown of the Baja farming sites and the terms of its concessions:

|

Site

|

Capacity/Permit to

Farm (in metric tons)*

|

Surface (in m2)

|

Expiration Date

|

||||||

|

Isla Coronado

|

720 | 1,470,000 |

November 23, 2020

|

||||||

|

Bahia Salsipuedes

|

400 | 500,000 |

May 2, 2012

|

||||||

|

Isla de Cedros

|

800 | 1,090,000 |

October 10, 2014

|

||||||

|

Bahia Salsipuedes

|

400 | 1,000,000 |

October 10, 2015

|

||||||

|

Total

|

2,320 | 4,060,000 | |||||||

* Based on maximum input per annum.

In addition, Croatian and Mexican governmental agencies require commercial fishing vessels to be licensed. Individual operators of the vessels are also subject to permit requirements.

We believe that Kali Tuna and Baja are currently in compliance with all material aspects of these quota and licensing requirements.

Staff

As of June 30, 2011, Umami employed 11 individuals, including executive and finance personnel. Kali Tuna had 97 employees (including 27 part-time employees) and MB Lubin had 47 employees (including one part-time employee). Baja had 360 full-time staff most of whom were employed by an independent labor contractor, including 19 administrative staff members, 200 farm workers, 121 fishermen and 20 employees active in other operations. Seasonal changes occur as a result of additional hires required during the fishing season. None of our staff is represented by a labor union, and both Kali Tuna and Baja consider their staff relations to be excellent.

Reports to Securityholders

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy and information statements and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended. You may read and copy these materials at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding us and other companies that file materials with the SEC electronically.

Item 1A. RISK FACTORS

An investor should carefully consider the risks described below, as well as other information contained in this Annual Report on Form 10-K and in our other filings with the Securities and Exchange Commission. Additional risk not presently known to us or that we currently deem immaterial may also adversely affect our business. If any of these events or circumstances occurs, our business, financial condition, results of operations or prospects could be materially harmed. In that case, the value of our securities could decline and an investor could lose part or all of his or her investment.

RISKS RELATED TO OUR BUSINESS

We will need additional financing in order to execute our business plan.

Sales of tuna typically occur during the winter when the sea temperature is lowest to maximize the quality and value of the product (October to March). There are generally no sales generated during the rest of the year. Accordingly, we need to finance our operations with available capital during the non-selling months. We believe we will have sufficient capital to maintain and grow our remaining biomass through the 2012-2013 harvest season which will take us through the next twelve months.

However, we will need to obtain additional capital in order to expand our operations, purchase additional biomass and to catch significant quantities of Bluefin tuna. We plan to pursue sources of additional capital by issuing securities through various financing transactions or arrangements, including joint ventures of projects, debt financing, equity financing or other means. We may also consider advance sales and/or outright sales of tuna to customers. There can be no assurance that any additional financing will be available when needed on commercially reasonable terms or at all. The inability to obtain additional capital may reduce our ability to continue to conduct business operations as currently contemplated. Any additional equity financing may involve substantial dilution to our then existing stockholders.

14

Ongoing liquidity issues may hamper our ability to operate our business.

Our business is highly seasonal. Our harvesting season extends primarily from October to March when the waters are coldest resulting in the firmest and highest quality meat. During this period we generate substantially all of our annual revenues. For the remainder of the year we have been reliant primarily on short-term bridge loans as a source of cash to fund our operations. In the past, we have been able to secure short-term loans to cover temporary cash needs. If for any reason we are unsuccessful in securing these types of financing arrangements and we are unable to find alternative sources of liquidity, we may be required to curtail our operations.

Regulation of our industry may have an adverse impact on our business.

For years, the international community has been aware of and concerned with the worldwide problem of depletion of natural fish stocks. In the past, these concerns have resulted in the imposition of quotas that subject individual countries to strict limitations on the amount of fish they are allowed to catch. Environmental groups have been lobbying to have additional limitations on fishing imposed and have even made suggestions that would limit the activities of fish farms. If international organizations or national governments were to impose additional limitations on fishing and fish farm operations, this could have a negative impact on our results of operations.

Concerns about the state of the Bluefin tuna population may lead some customers to look for alternatives.

In the Mediterranean Sea and the Pacific Ocean, large quantities of Bluefin tuna are caught for on-growing in fish cages. Statistics for culturing are even less accurate than official catch statistics. Experts estimated the total Atlantic Bluefin aquaculture production during 2006 between 20,000 and 30,000 metric tons and the Mexican Pacific Bluefin aquaculture production during 2006 between 3,000 and 5,000 metric tons.

Responding to fears of a collapse of Bluefin tuna stock in the Mediterranean and the Pacific Ocean, a number of tuna buyers have occasionally threatened boycotts unless drastic measures are taken to protect the tuna stock. In addition, some restaurants in Europe and the United States have stopped buying Mediterranean and Pacific Bluefin tuna and replaced the Bluefin with other tuna species, such as yellowfin, albacore and bigeye. If these boycotts become more widespread, they may have a negative impact on our results of operations.

The growth of our business depends on our ability to secure fishing licenses directly or through third parties and concessions for our farm locations.

Fish farming is a highly regulated industry. Our operations require licenses, permits and in some cases renewals of licenses and permits from various governmental authorities. For example, commercial fishing operations are subject to government license requirements that permit them to make their catch. In addition, our offshore farms that harbor the cages containing our tuna livestock are constructed pursuant to concessions granted by the local governments that have jurisdiction over the waters where our farms are located. Our ability to obtain, sustain or renew such licenses and permits on acceptable terms is subject to changes in regulations and policies and to the discretion of the applicable governments, among other factors. Our inability to obtain, or a loss or denial of extensions, to any of these licenses or permits could hamper our ability to produce revenues from our operations.

We are dependent on an affiliate and third parties for our fishing and towing operations.

A large portion of our Kali Tuna fishing and towing operations is conducted by MB Lubin, an affiliated entity that is majority owned by Dino Vidov, Kali Tuna’s General Manager. MB Lubin owns a fleet of seven fishing vessels that catch fish, typically in the Adriatic, store them in cages and tow those cages back to our farming locations where they are transferred into permanent holding pens. Kali Tuna does not have its own fishing vessels and, moreover, does not possess the requisite licenses to catch its own fish. If for any reason, MB Lubin became unable or unwilling to continue to provide its services to Kali Tuna, this would likely lead to a temporary interruption in the supply of fish at least until Kali Tuna found another entity that could provide these services for it. Failure to find a replacement for MB Lubin, even on a temporary basis, may have an adverse effect on our results of operations.

Similarly, our Baja fishing operations are currently conducted through third party leases of boats that have fishing licenses for Bluefin tuna and are capable of catching the fish live. If for any reason we are unable to obtain such leases along with the rights to acquire the Bluefin tuna in a given year we would likely have a temporary interruption in the supply of fish coming into the farm. Failure to find a replacement for MB Lubin in the case of Kali Tuna, or lease or acquire boats with the requisite ability and licenses in the case of Baja, even on a temporary basis, may have an adverse effect on our results of operations.

Almost all our products are sold to only a few customers.

Kali Tuna and Baja have derived, and over the near term expect to continue to derive, all of their sales from a small number of customers. Almost all of their products are sold to only a few trading houses for further sale into the Japanese market. The loss of any of these customers or non-payment of outstanding amounts due to Kali Tuna or Baja by any of them could materially and adversely affect our business in terms of results of operations, financial position and liquidity.

15

It may be difficult to effect service of process and enforcement of legal judgments upon our company and our officers and directors because some of them reside outside the United States.

A number of our key directors and officers, including Oli Valur Steindorsson, our Chairman, President and Chief Executive Officer, James White and Mike Gault, two of our directors, reside outside the United States, service of process on our key directors and officers may be difficult to effect within the United States. Also, substantially all of our assets are located outside the United States and any judgment obtained in the United States against us may not be enforceable outside the United States.

We may be adversely affected by fluctuations in raw material prices and selling prices of our products.

The products and raw materials we use may experience price volatility caused by events such as market fluctuations, weather conditions or changes in governmental programs. Raw materials consist primarily of bait, including sardines, anchovies, mackerel and other small fish. The market price of these raw materials may also experience significant upward adjustment, if, for instance, there is a material under-supply or over-demand in the market. These price changes may ultimately result in increases in the selling prices of our products, and may, in turn, adversely affect our sales volume, revenue and operating profit.

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy envisions expanding our business. If we fail to effectively manage our growth, our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

|

|

●

|

meet our capital needs;

|

|

|

●

|

expand our systems effectively or efficiently, or in a timely manner;

|

|

|

●

|

allocate our human resources optimally;

|

|

|

●

|

identify and hire qualified employees or retain valued employees; or

|

|

|

●

|

incorporate effectively the components of any business that we may acquire in our effort to achieve growth.

|

If we are unable to manage our growth, our operations and our financial results could be adversely affected by inefficiency, which could diminish our profitability.

Loss of Oli Steindorsson, our Chairman, could impair our ability to operate.

If we lose Oli Steindorsson, our Chairman, our business could suffer. He has extensive contacts in Japan where most of our revenues are generated and is fluent in Japanese. We have entered into an employment agreement with Mr. Steindorsson. The loss of Mr. Steindorsson could have some effect on our operations. If we were to lose our Chairman, we may experience temporary difficulties in competing effectively, developing our technology and implementing our business strategies. We do not have key man life insurance in place for any of our key personnel.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting the business of the Company. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact our business.

Our success depends on the ability of our management and employees to interpret market and aqua-biological data correctly and to interpret and respond to economic, market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Further, no assurance can be given that our key personnel will continue their association or employment with us or that replacement personnel with comparable skills can be found. We have sought to and will continue to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

Our management team has limited experience in public company matters in the United States, which could impair our ability to comply with legal and regulatory requirements.

Our management team has only limited public company management experience or responsibilities in the United States, which could impair our ability to comply with legal and regulatory requirements such as the Sarbanes-Oxley Act of 2002 and applicable federal securities laws including filing required reports and other information required on a timely basis. There can be no assurance that our management will be able to implement and effect programs and policies in an effective and timely manner that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and further result in the deterioration of our business.

16

Ineffective disclosure controls and procedures and internal control over financial reporting may result in material misstatements of our financial statements.