Exhibit 99.1

NORTH AMERICAN ENERGY PARTNERS INC.

ANNUAL INFORMATION FORM

June 10, 2013

NOA

Table of Contents

NOA

Annual Information Form

June 10, 2013

A. EXPLANATORY NOTES

The information in this Annual Information Form (AIF) is stated as at June 10, 2013, unless otherwise indicated. For an explanation of the capitalized terms and expressions and certain defined terms, please refer to the “Glossary of Terms” at the end of this AIF. All references in this AIF to “we”, “us”, “NAEPI” or the “Company”, unless the context otherwise specifies, mean North American Energy Partners Inc. and its Subsidiaries (as defined below). Except where otherwise specifically indicated, all dollar amounts are expressed in Canadian dollars. For additional information and details, readers are referred to the audited consolidated financial statements for the year ended March 31, 2013 and notes there to, as well as the accompanying annual Management’s Discussion and Analysis (“MD&A”) which are available on the Canadian Securities Administrators’ SEDAR System at www.sedar.com, the Securities and Exchange Commission’s website at www.sec.gov and our company website at www.nacg.ca.

Industry Data and Forecasts

This AIF includes industry data and forecasts that we have obtained from publicly available information, various industry publications, other published industry sources and our internal data and estimates. For example, information regarding actual and anticipated production as well as reserves and current and scheduled projects in the Canadian oil sands was obtained from the Energy Resources Conservation Board (“ERCB”) and the Canadian Energy Research Institute. Information regarding historical capital expenditures in the oil sands was obtained from the Canadian Association of Petroleum Producers (“CAPP”).

Industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Although we believe that these publications and reports are reliable, we have not independently verified the data. Our internal data, estimates and forecasts are based upon information obtained from our customers, trade and business organizations and other contacts in the markets in which we operate and our management's understanding of industry conditions. Although we believe that such information is reliable, we have not had such information verified by any independent sources. References to barrels of oil related to the oil sands in this document are quoted directly from source documents and refer to both barrels of bitumen and barrels of bitumen that have been upgraded into synthetic crude oil, which is considered synthetic because its original hydrocarbon mark has been altered in the upgrading process. We understand that there is generally some shrinkage of bitumen volumes through the upgrading process. The shrinkage is approximately 11% according to the Canadian National Energy Board. We have not made any estimates or calculations with regard to these volumes and have quoted these volumes as they appeared in the related source documents.

Caution Regarding Forward-Looking Information

Our AIF is intended to enable readers to gain an understanding of our current results and financial position. To do so, we provide material information and analysis about our company and our business at a point in time, in the context of our historical and possible future development. Accordingly, certain sections of this report contain forward-looking information that is based on current plans and expectations. This forward-looking information is affected by risks, assumptions and uncertainties that could have a material impact on future prospects. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks, assumptions and uncertainties related to such information. Readers are cautioned that actual events and results may vary.

Non-GAAP Financial Measures

The body of generally accepted accounting principles applicable to us is commonly referred to as "GAAP". A non-GAAP financial measure is generally defined by the Securities and Exchange Commission (SEC) and by the Canadian securities regulatory authorities as one that purports to measure historical or future financial performance, financial position or cash flows, but excludes or includes amounts that would not be so adjusted in the most comparable GAAP measures. In our MD&A, we use non-GAAP financial measures such as "net income before interest expense, income taxes, depreciation and amortization" (EBITDA) and "Consolidated EBITDA" (as defined in our fourth amended and restated credit agreement, our "credit agreement").

Consolidated EBITDA is defined as EBITDA, excluding the effects of unrealized foreign exchange gain or loss, realized and unrealized gain or loss on derivative financial instruments, non-cash stock-based compensation expense, gain or loss on disposal of plant and equipment, the impairment of goodwill, the amendment related to the

2013 Annual Information Form | 1 |

fiscal 2011 $42.5 million revenue writedown on the Canadian Natural1 overburden removal contract (described in the "Our Business - Significant Business Events" section of our MD&A) and certain other non-cash items included in the calculation of net income.

We believe that EBITDA is a meaningful measure of the performance of our business because it excludes interest, income taxes, depreciation and amortization that are not directly related to the operating performance of our business. Management reviews EBITDA to determine whether plant and equipment are being allocated efficiently. In addition, our credit facility requires us to maintain both a minimum interest coverage ratio and a maximum senior leverage ratio and also identifies limits to our annual capital spend, all of which are calculated using Consolidated EBITDA. Non-compliance with these financial covenants could result in a requirement to immediately repay all amounts outstanding under our credit facility.

As EBITDA and Consolidated EBITDA are non-GAAP financial measures, our computations of EBITDA and Consolidated EBITDA may vary from others in our industry. EBITDA and Consolidated EBITDA should not be considered as alternatives to operating income or net income as measures of operating performance or cash flows as measures of liquidity. EBITDA and Consolidated EBITDA have important limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of our results as reported under US GAAP. For example, EBITDA and Consolidated EBITDA do not:

• reflect our cash expenditures or requirements for capital expenditures or capital commitments or proceeds from capital disposals;

• reflect changes in our cash requirements for our working capital needs;

• reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt;

• include tax payments or recoveries that represent a reduction or increase in cash available to us; or

• reflect any cash requirements for assets being depreciated and amortized that may have to be replaced in the future.

Consolidated EBITDA excludes unrealized foreign exchange gains and losses and realized and unrealized gains and losses on derivative financial instruments, which, in the case of unrealized losses may ultimately result in a liability that may need to be paid and in the case of realized losses, represents an actual use of cash during the period.

Where relevant, particularly for earnings-based measures, we provide tables in this document that reconcile non-GAAP measures used to amounts reported on the face of the consolidated financial statements.

B. CORPORATE STRUCTURE

North American Energy Partners Inc.

The Company was amalgamated under the Canada Business Corporations Act on November 28, 2006, and was the entity continuing from the amalgamation of NACG Holdings Inc. with its wholly-owned subsidiaries, NACG Preferred Corp. and North American Energy Partners Inc. The amalgamated entity continued under the name North American Energy Partners Inc. (“NAEPI”).

1 Canadian Natural Resources Limited (Canadian Natural), owner and operator of the Horizon Oil Sands mine site.

2 | 2013 Annual Information Form |

NOA

Subsidiaries

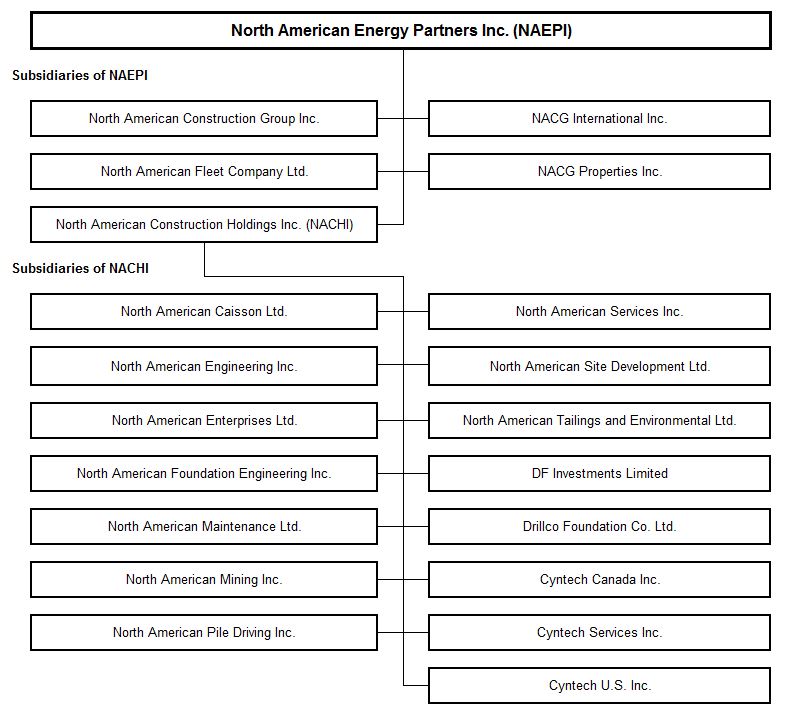

NAEPI includes its wholly-owned subsidiaries North American Construction Group Inc. (“NACGI”), North American Fleet Company Ltd., NACG International Inc., NACG Properties Inc. and North American Construction Holdings Inc. ("NACHI") along with the wholly-owned operating subsidiaries of NACHI. The chart below depicts our current corporate structure with respect to each of our direct subsidiaries and indirect subsidiaries (collectively the “Subsidiaries”):

NAEPI and the Subsidiaries are all corporations subsisting under the Business Corporations Act (Alberta), except NACGI, NACG International Inc. and North American Foundation Engineering Inc., which are corporations subsisting under the Canada Business Corporations Act, Drillco Foundation Co. Ltd. and DF Investments Limited, which are corporations subsisting under the Business Corporations Act (Ontario) and Cyntech U.S. Inc., which is a corporation subsisting under the Texas Business Organizations Code.

2013 Annual Information Form | 3 |

C. OUR BUSINESS

Business Overview

We provide a wide range of mining and heavy construction services to customers in the resource development and industrial construction sectors, primarily within Western Canada.

Our core market is the Canadian oil sands, where we provide construction and operations support services through all stages of an oil sands project's lifecycle. We have extensive construction experience in both mining and in situ oil sands projects and we have been providing operations support services to the five producers currently mining bitumen in the oil sands since inception of their respective projects: Syncrude2, Suncor3, Shell4, Imperial Oil5 and Canadian Natural. We focus on building long-term relationships with our customers and in the case of Syncrude and Suncor, these relationships span over 30 years. For a discussion on our revenue by source and revenue by end market refer to the "Our Business - Revenue by Source" and "Our Business - Revenue by End Market" sections of our most recent annual MD&A, which sections are expressly incorporated by reference into this AIF.

We believe that we operate the largest fleet of equipment of any contract resource services provider in the oil sands. Our total fleet (owned, leased and rented) includes approximately 516 pieces of diversified heavy construction equipment supported by over 455 pieces of ancillary equipment. We have a specific capability operating in the harsh climate and difficult terrain of northern Canada, particularly in the Canadian oil sands.t

While our services are primarily focused on the oil sands, we believe that we have demonstrated our ability to successfully apply our oil sands knowledge and technology and put it to work in other resource development projects. We believe we are positioned to respond to the needs of a wide range of other resource developers and we remain committed to continue expanding our operations outside of the Canadian oil sands.t

We believe that our excellent safety record, coupled with our significant oil sands knowledge, experience, long-term customer relationships, equipment capacity, scale of operations and broad service offering, differentiate us from our competition and provide significant value to our customers.t

Operations Overview

Our services are primarily focused on supporting the construction and operation of surface mines, particularly in the oil sands, with a focus on:

•site clearing and access road construction;

•site development and underground utility installation;

•construction and relocation of mine site infrastructure;

•stripping, muskeg removal and overburden removal;

•heavy equipment and labour supply;

•material hauling; and

•mine reclamation and tailings pond construction.

In addition, we provide site development services for plants and refineries, including in situ oil sands facilities.

We maintain our large diversified fleet of heavy equipment and ancillary equipment from our three significant maintenance and repair centers, two based in Fort McMurray, Alberta on our customer's mine sites and one based near Edmonton, Alberta. In addition, we operate running maintenance and repair facilities at each of our customer's oil sands mine sites.

2 Syncrude Canada Ltd. (Syncrude) - operator of the oil sands mining and extraction operations for the Syncrude Project, a joint venture amongst Canadian Oil Sands Limited (37%), Imperial Oil Resources (25%), Suncor Energy Oil and Gas Partnership (12%), Sinopec Oil Sands Partnership (9%), Nexen Oil Sands Partnership (7%), Murphy Oil Company Ltd. (5%) and Mocal Energy Limited (5%).

3 Suncor Energy Inc. (Suncor).

4 Shell Canada Energy (Shell), a division of Shell Canada Limited, which is the operator of the oil sands mining and extraction operations on behalf of Athabasca Oil Sands Project (AOSP), a joint venture amongst Shell Canada Limited (60%), Chevron Canada Limited (20%) and Marathon Oil Corporation (20%).

5 Imperial Oil Resources Limited. (Imperial Oil).

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

4 | 2013 Annual Information Form |

NOA

Competitive Strengths

We believe our competitive strengths are as follows:

Leading market position in contract mining services

We believe we are the largest provider of contract mining services in the Canadian oil sands. We have operated in Western Canada for over 60 years and have participated in every significant oil sands mining project since operators first began developing this resource over 30 years ago. This has given us extensive experience operating in the challenging working conditions created by the harsh climate and difficult terrain of the oil sands and Northern Canada. We have amassed what we believe is the most diverse fleet of any contract services provider in the oil sands. We believe the combination of our significant size, extensive experience and broad service offerings makes us one of only a few companies capable of taking on long-term, large-scale mining and heavy construction projects in the oil sands.t

Large, well-maintained equipment fleet

As of March 31, 2013, we had a heavy equipment fleet of approximately 675 owned, leased and rented units, made up of shovels, excavators, trucks and dozers as well as loaders, graders and scrapers. We believe we have an unmatched, modern fleet of equipment to service our clients' needs. Our fleet includes some of the largest shovels in the world, which are designed for use in some of the largest earthmoving and mining applications globally. Being the only contractor in the oil sands to operate shovels of this size and one of only a few contractors to operate trucks larger than 240 tons capacity gives us a competitive advantage with respect to both skill base and equipment availability. The size and diversity of our fleet provides us with the potential to respond on short notice and provide customized fleet solutions for each specific job.t

A well-maintained fleet is critical in the harsh climatic and environmental conditions we encounter. Our significant maintenance and repair center on one of our customers' oil sands sites is capable of accommodating the largest pieces of equipment in our fleet. Our major repair facility located near Edmonton, Alberta can perform similar major maintenance and repair activities as our facility in the oil sands and provides back-up maintenance and repair requirements for oil sands equipment. In addition, we operate running repair and maintenance facilities on each of our customer's oil sands sites. We believe our combination of onsite and offsite service capabilities increases our efficiency. This, in turn, reduces costs and increases our equipment utilization, thereby enhancing our competitive edge and profitability.t

Broad service offering across a project’s lifecycle

We are considered to be a “first-in, last-out” service provider in the oil sands because we provide services through the entire lifecycle of an oil sands project. Our work typically begins with the initial consulting services provided during the planning phase, including review of constructability, engineering and budgeting. This leads into the construction phase during which we provide a fuller range of services, including clearing, muskeg removal, site preparation, mine infrastructure construction and underground utility installation. As the mine moves into production, we support the preparation of the mine by providing ongoing site maintenance and upgrading, equipment and labour supply, overburden removal and land reclamation. Given the long-term nature of oil sands projects, we believe that our broad service offering has enabled us to establish ongoing relationships with our customers through a continuous supply of services as we transition from one stage of the project to the next.t

Long-term customer relationships

We have established strong, long-term relationships with major oil sands producers and conventional oil and gas producers. Our largest customers are producers mining bitumen in the oil sands and we have worked with each of these customers since they began operations in the oil sands. In the case of Syncrude and Suncor, our relationships date back over 30 years. The longevity of our customer relationships reflects our ability to deliver a strong safety and performance record, a well-maintained, highly capable fleet with specific equipment dedicated to individual customers and a staff of well-trained, experienced supervisors, operators and mechanics. In addition, our practice of maintaining offices and maintenance facilities directly on most of our oil sands customers' sites enhances the relationship. Our proximity and close working relationships typically result in advance notice of projects, enabling us to anticipate our customers' needs and align our resources accordingly.

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

2013 Annual Information Form | 5 |

NOA

Operational flexibility

The combination of our onsite fleets and relationships with multiple oil sands operators makes it possible for us to easily and cost-efficiently transfer equipment and other resources among projects. This keeps us highly responsive to customer needs and is essential in providing operational support services, where lead times are short and the work loads are highly variable. This also serves as a barrier to potential new competitors who may be unable to dedicate a fleet of equipment to the region without the security of a long-term contract. The fact that we work on every major site in the oil sands contributes to our flexibility, enhances the stability of our business model and enables us to continue bidding profitably on new contracts.

Our Strategy

Our strategy is to be an integrated service provider of choice for the developers and operators of resource-based industries in a broad and often challenging range of environments. We will implement this strategy with the following tactics:

• | Enhance safety culture: We are committed to elevating the standard of excellence in health, safety and environmental protection with continuous improvement along with greater accountability and compliance. Our aim is to have zero incidents. |

• | Increase customer satisfaction: We intend to continue strengthening our relationships with new and existing customers to win an increased share of the services outsourced in connection with their projects. |

• | Improve productivity and profitability: We plan to increase productivity and profitability by identifying operating efficiencies, reducing direct and indirect costs and right-sizing our equipment fleet. |

• | Improve cash flow: We expect to manage our profitability, working capital and capital investments to ensure positive cash flow generation. |

• | Strengthen the balance sheet: We intend to continue with our disciplined debt reduction program to increase financial capacity and support future growth. |

• | Increase our presence outside the oil sands: We intend to extend our services to other resource industries across Canada. Canada has significant natural resources and we believe that we have the equipment and the expertise to assist with extracting those resources. |

Significant Business Events

The following is a summary of the significant business events that have influenced our business over the past three years:

• | At the start of fiscal 2013, we established a set of strategic priorities to better serve our customers and restore shareholder confidence and value. These priorities are: |

1. | strengthen our balance sheet and liquidity; |

2. | significantly lower our cost structure; |

3. | improve the risk profile of our business; and |

4. | regain profitability. |

Our tactics to achieve these priorities included the investigation of a possible sale of our piling and pipeline businesses, fleet right-sizing, debt restructuring, organizational restructuring and cost-reduction initiatives. For a discussion of the achievements on our strategic initiatives see the “Significant Business Events” section of our annual MD&A, which section is expressly incorporated by reference into this AIF.

• | Demand for our services has been impacted by a more cautious approach by the oil sands industry to capital spending. In some cases, this has resulted in delayed project approvals and construction start dates. We have also seen our customers take a more disciplined approach to project engineering and construction in an effort to better control costs and we have seem a shift towards phased project construction, resulting in smaller contract awards. We have been successful, however, in securing a significant share of the construction contracts in the sector and maintaining a strong project backlog with awards at new and existing oil sands mines and various in situ projects. Over the past three years we have been awarded construction contracts with major oil sands customers including: |

•contracts for the shear key and MSE wall for the Mildred Lake Mine Relocation Project;

•the initial earthworks contract for the Joslyn North Mine Project;

6 | 2013 Annual Information Form |

NOA

• | the initial site development contract for the BlackGold steam assisted, gravity driven ("SAGD") Project; |

•the initial site development contract for the Kirby SAGD Project; and

•the initial site development contract for the MacKay River SAGD Project.

• | Overall industry demand for operations support services in the oil sands has remained relatively steady over the past three years, although we have seen a decline in our operations support services revenues as a result of increased competition and insourcing of certain services. Despite this, we have been awarded several new multi-year operations support services agreements over the past few years with major oil sands customers including: |

•a four-year master services agreement at the Mildred Lake Mine;

•a five-year master services agreement at the Millennium and Steepbank Mines; and

•a five-year master services agreement at the Kearl Mine

• | In addition to these master services contracts, we reached an agreement in 2012 on amendments to our 10-year overburden removal and tailings dyke construction services contract with Canadian Natural (“the Canadian Natural contract”). The amending agreement included a $34.1 million settlement of past claims under the original contract. The general terms of the original contract related to work scope remained in place; however, these services are now being performed under a revised payment structure that carries less risk to us than the unit-rate structure it replaces. The new payment structure carries a base margin and provides for the opportunity to enhance margins, by meeting mutually agreed upon performance targets. |

• | As part of our evaluation of operations, we made the decision to investigate the possible sale ("Piling Sale") of our piling related assets and liabilities and exit the piling, foundation, pipeline anchor and tank services businesses. On June 10, 2013, we reached an agreement with Keller Group plc (the "Keller Group" or the "Purchaser") to sell our piling assets for consideration of $227.5 million, plus or minus customary working capital adjustments, less approximately $5.0 million for the assumption of capital leases. In addition, we will receive up to $92.5 million in additional proceeds, contingent on the Purchaser achieving prescribed Consolidated EBITDA thresholds from the assets and liabilities sold. Closing costs for the Piling Sale are expected to be approximately $12.5 million.t |

The first part of the contingent proceeds of up to $57.5 million will be earned over the next two years based upon the Purchaser achieving annual results of $45.0 million in Consolidated EBITDA as follows:

• | A maximum of $30.0 million cash paid no later than September 30, 2014, with the full amount being paid in the event that the business earns annualized Consolidated EBITDA (“First Year Consolidated EBITDA”) of $45.0 million or more in the period from closing to June 30, 2014. The amount payable will be $2 for every $1 that First Year Consolidated EBITDA is greater than $30.0 million (with the maximum payment of $30.0 million where First Year Consolidated EBITDA is $45.0 million or greater). |

• | A maximum of $27.5 million cash paid no later than September 30, 2015, with the full amount being paid in the event that the business earns Consolidated EBITDA (“Second Year Consolidated EBITDA”) of $45.0 million or more in the period from July 1, 2014 to June 30, 2015. The amount payable will be $1.833 for every $1 that Second Year Consolidated EBITDA is greater than $30.0 million (with the maximum payment of $27.5 million where Second Year Consolidated EBITDA is $45.0 million or greater) |

The $45.0 million annual Consolidated EBITDA target is comparable to our fiscal 2013 Consolidated EBITDA level for the piling business, thus we anticipate that the Purchaser will achieve a minimum of $45.0 million in Consolidated EBITDA in each year. We further anticipate that the piling business will continue to grow under the management of the Purchaser, thus we expect to realize all of these contingent proceeds.t

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

2013 Annual Information Form | 7 |

The remaining contingent proceeds of up to $35.0 million, equal to $0.5 for every $1 by which cumulative Consolidated EBITDA in the period from closing to June 30, 2016 exceeds $135.0 million (with the maximum payment of $35.0 million where Consolidated EBITDA is $205.0 million or greater), will be calculated and paid as follows:

a. | no later than September 30, 2014, the Purchaser will pay the vendor an amount equal to $0.375 for every $1 by which First Year Consolidated EBITDA exceeds $45.0 million;; |

b. | no later than September 30, 2015, the Purchaser will pay the vendor an amount equal to $0.375 for every $1 by which the aggregate of First Year Consolidated EBITDA and Second Year Consolidated EBITDA exceeds $90.0 million, less any monies paid to the vendor under (a) above; and |

c. | no later than September 30, 2016, the Purchaser will pay the vendor an amount equal to $0.5 for every $1 by which the aggregate of First Year Consolidated EBITDA, Second Year Consolidated EBITDA and Consolidated EBITDA for the period from July 1, 2015 to June 30, 2016 exceeds $135.0 million, less any monies paid to the vendor under (a) and (b) above. |

The $45.0 million annual Consolidated EBITDA target is comparable to our fiscal 2013 Consolidated EBITDA level for the piling business. The cumulative two year $90.0 million target and the cumulative three year $135.0 million target are multiples of the one year target. We anticipate that the Purchaser will continue to grow the piling business, resulting in the payment of some or all of these contingent proceeds.t

These contingent proceeds will be recognized as the Consolidated EBITDA targets are achieved. We have retained the right to verify the Consolidated EBITDA reported by the Purchaser during the period for which the contingent proceeds are being calculated.

The Piling Sale is subject to the Purchaser obtaining final majority shareholder and certain anti-trust approvals. We expect these conditions to be met and the Piling Sale to close in the first half of fiscal 2014.t

The Piling Sale includes all piling related:

• | property, plant and equipment; |

• | intangible assets; |

• | working capital (excluding the outstanding accounts receivable and unbilled revenue on a certain customer contract); and |

• | capital and operating lease commitments. |

We expect to recognize a gain from the sale of assets, net of a $32.9 million reduction in goodwill, related to the piling business. For a discussion on the assets and liabilities held for sale as at March 31, 2013, see "Summary of Consolidated Financial Position", in our most recent MD&A.t

Upon closing the sale of the piling related assets and liabilities, a portion of the net proceeds will be used to repay the outstanding balance of the Term A Facility which, at March 31, 2013, was $17.2 million.t

For all periods presented, piling results are now reported within "Income (loss) from discontinued operations, net of tax" in our Consolidated Statements of Operations and Comprehensive Loss and "Cash provided by (used in) discontinued operations" in our Consolidated Statements of Cash Flows. The assets and liabilities associated with the Piling Sale have been classified as held for sale on our Consolidated Balance Sheet. Prior to the Piling Sale, activity in the piling business was reported as part of the Commercial and Industrial Construction segment.

For a discussion of our results from discontinued operations related to piling activity see "Financial Results - Net Gain (Loss) from Discontinued Operations" in our most recent MD&A.

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

8 | 2013 Annual Information Form |

NOA

D. PROJECTS, COMPETITION AND MAJOR SUPPLIERS

Active Projects

Canadian Natural: Horizon Mine

Canadian Natural completed construction of its Horizon Oil Sands Project and achieved first oil production in early 2009. This oil sands mining project has a targeted production capacity of 110,000 barrels per day (“bbl/d”) from Phase 1. Canadian Natural has plans to ultimately increase total production capacity to 500,000 bbl/d through future expansions. Phase 2 of the mine expansion plan is progressing under a staggered construction scenario and Phase 3 is currently in the planning stages.

We have been working at the Horizon mine since 2005 under a 10-year contract with Canadian Natural to remove approximately 400 million bank cubic meters (“BCM”) of overburden and use 300 million BCM of that material to build a tailings dyke at the site. Our contract was amended in March 2012 and expires June 30, 2015. For further description of the Canadian Natural contract and amendment, see “Significant Business Event - Canadian Natural Contract” in our annual MD&A, which section is expressly incorporated by reference into this AIF.

Shell: Muskeg River Mine and Jackpine Mine

Shell's operations at the Athabasca Oil Sands Project include the Muskeg River Mine, which has a target production capacity of 155,000 bbl/d and the Jackpine Mine, which has a target production capacity of 100,000 bbl/d. Future planned mining expansions, while not imminent, are expected to potentially increase total production capacity to 500,000 bbl/d.t

In June 2009, we were awarded a three-year earthmoving and mine support master services agreement with Shell, which was recently extended to September 2013 with a further extension currently being negotiated. The agreement covers the provision of operations support services including construction, earthmoving and mine support and replaced an expiring two-year master services agreement. This type of work is typically performed under a time-and-materials arrangement and is not reflected in our reported backlog.

Suncor: Steepbank Mine and Millennium Mine

Suncor's current mining operation includes the Steepbank and Millennium mines. Following their merger with Petro-Canada and a strategic alliance with Total, Suncor's mineral assets have expanded to include a 40.8% interest in the Fort Hills oil sands project and a 36.8% interest in the Total-operated Joslyn North Mine project. In July 2011, we were awarded a five-year master services agreement to provide reclamation, overburden removal, civil construction and mine services at Suncor's Steepbank and Millennium oil sands mines.

Syncrude: Base Mine and Aurora Mine

Syncrude's current mining operations include Base Mine (Mildred Lake) and Aurora Mine, which have a current combined production capacity of approximately 350,000 bbl/d. Further planned expansions include the development of a new mine, MLX, on the existing Base Plant lease by 2020 and Aurora South, which is expected to potentially increase total production capacity to 600,000 bbl/d by 2025.t

In November 2010, Syncrude awarded us a new four-year mining service contract, which enables us to execute various types of projects for this customer. Construction work authorizations are issued for each piece of work under both time-and-materials and unit-price arrangements and are generally not reflected in our reported backlog.

In 2012, we completed the shear key foundation as part of the first phase of the "Mildred Lake Mine Relocation" project at Syncrude's Base Mine. We are now working on the second phase of the relocation project, which includes construction of a mechanically stabilized earth (MSE) wall as well as significant corridor, haul road and other heavy civil scopes. We expect to complete this project in late 2013.t

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

2013 Annual Information Form | 9 |

Total E&P Canada6: Joslyn North Mine

The Joslyn North Mine Project is currently in the Front End Engineering Design (FEED) stage and is not expected to commence production until 2018.t

We are currently completing the initial earthworks at the Joslyn North Mine Project, including clearing the site, ditching and establishing access (roads, drainage etc.) in preparation for the planned future construction of the mine and extraction facility. Work under the current contract was awarded in November 2011 and is expected to be completed in December 2013.t

Imperial Oil: Kearl Mine

The Kearl oil sands project is jointly owned between Imperial Oil (operator) and ExxonMobil Canada with an initial target production capacity of approximately 110,000 bbl/d. The project has regulatory approval for up to 345,000 bbl/d of production.

In November 2012, we signed a five-year master services agreement to provide civil mine support services at the Kearl site.

Consumer's Co-operative Refinery Limited7: Tank Farm Project

In July 2009, we were awarded the Consumer's Co-operative Refinery Limited heavy oil upgrader revamp and expansion project in Regina, Saskatchewan. Work continues on this site as we complete tank farm earthworks construction, associated piping and pipelines and other heavy civil works as required by the client under an open services agreement.

Recently Completed Projects

Dover Operating Corp8: The MacKay River Commercial Project

The MacKay River Commercial Project is a SAGD project operated by Dover Operating Corp. Phase one is currently under construction and approved for 35,000 bbl/d of production capacity. This company is planning to eventually take production to 150,000 bbl/d barrels per day at this property.

In November 2011, we were awarded two separate contracts for the MacKay River SAGD project, located 60 kilometers northwest of Ft. McMurray, AB. The contract with Dover Operating Corp covers the plant site grading and gravel work, as well as construction of the water well road and well pads. Construction began in February 2012 and was completed in Fall 2012.

Thompson Creek9: Mt. Milligan Copper / Gold Mine Project

We completed facility construction work at the Mt. Milligan Copper/Gold Project in northern British Columbia in December 2012. The contract covered the erection of more than 7,000 tonnes of structural steel, as well as the installation of cladding and insulated roofing panels for new mill concentrator facilities at the mine.

Competition

The majority of our new business is secured through formal bidding processes in which we are required to compete against other suppliers. Factors that impact success on competitive bids include price, safety, reliability, scale of operations, equipment and labour availability and quality of service.

We have seen a change in our competitive environment and customer behavior in the oil sands over the past three years. As a result of the growing discount in the Alberta crude oil market price per barrel, oil sands operators shifted their focus from controlling schedules to controlling costs which has resulted in some of our customers delaying planned mine development and insourcing mine services activity that would previously have been exclusively outsourced. These cost saving measures by our customers have resulted in a noticeable reduction in tendered operations support services and an increase in competition on oil sands project bids during the year ended March 31, 2013.

6 Total E&P Canada Ltd. (Total), a wholly owned subsidiary of Total SA.

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

7 Consumers Co-operative Refinery Limited (CCRL) is a wholly owned subsidiary of Federation Co-operatives Limited.

8 Dover Operating Corp is a joint venture between Athabasca Oil Corp. and PetroChina Company Limited that was established in June 2010.

9 Thompson Creek Metals Company Inc., owner of the Mt. Milligan Copper / Gold project in central British Columbia.

10 | 2013 Annual Information Form |

NOA

Our principal competitors include Klemke Mining Corporation, Aecon Group Inc., Graham Construction Ltd, Ledcor Construction Limited (“Ledcor”), Peter Kiewit and Sons Co. Ltd., Sureway Construction Ltd. and Thompson Bros (Constr) Ltd. In underground utilities installation, Voice Construction Ltd., Ledcor and IGL Canada, KBR Inc., JV Driver Projects Inc. and PCL Constructors Inc. are our major competitors.

Major Suppliers

We have long-term relationships with the following equipment suppliers: Finning International Inc. (over 45 years), Wajax Corporation (over 20 years), Brandt Tractor Ltd. (over 30 years) and SMS Equipment (over 5 years). Finning is the Caterpillar heavy equipment supplier for Alberta and Caterpillar equipment and makes up the majority of our mining fleet. Wajax is the Hitachi equipment supplier of Excavators and Shovels for both mining and construction, Brandt Tractor is the Alberta supplier for John Deere construction Excavators, SMS Equipment is the Komatsu equipment supplier for Canada and supports a fleet of large mining trucks. In addition to the supply of new equipment, each of these companies is a major supplier for equipment rentals, parts and service labour. We are also actively working with these suppliers to identify cost savings opportunities, including opportunities to reduce our rental fleet and focus on parts management.

We have a Tire Agreement with Bridgestone plus additional allocation from Michelin and Goodyear which have allowed us to maintain tire inventories to keep our fleet fully operational. Tire availability has improved with the change in the global economy however this availability is considered to be short term. Our inventory is such that we do not anticipate a tire shortage.t

E. RESOURCES AND KEY TRENDS

Fleet and Equipment

We operate and maintain a heavy equipment fleet, including dozers, graders, loaders, mining trucks, shovels, compactors, scrapers and excavators. We also maintain a fleet of ancillary vehicles including various service and maintenance vehicles. Overall, the equipment is in good condition, subject to normal wear and tear. Our credit facility is secured by liens on substantially all of our equipment. We lease some of this equipment under lease terms that include purchase options.

We acquire our equipment in three ways: capital expenditures, capital leases and operating leases (for a discussion on our equipment additions see the “Summary of Consolidated Equipment Additions”, section of our annual MD&A, which section is expressly incorporated by reference into this AIF). The following table sets forth our owned and leased heavy equipment fleet (does not include rental equipment) as at March 31, 2013:

Category | Capacity Range | Horsepower Range | Number Owned | Number Leased | |||||||

Heavy Construction and Mining: | |||||||||||

Articulating trucks | 30 to 40 tons | 305 ‑ 406 | 19 | 10 | |||||||

Mining trucks | 40 to 330 tons | 476 ‑ 2,700 | 104 | 46 | |||||||

Shovels | 35‑80 cubic yards | 2,600 ‑ 3,760 | 4 | 2 | |||||||

Excavators | 1 to 29 cubic yards | 90 ‑ 1,944 | 84 | 14 | |||||||

Dozers | 20,741 lbs to 230,100 lbs | 96 - 850 | 71 | 38 | |||||||

Graders | 14 to 24 feet | 150 ‑ 500 | 17 | 8 | |||||||

Loaders | 1.5 to 16 cubic yards | 110‑ 690 | 50 | 2 | |||||||

Packers | 14,175 to 68,796 lbs | 216 ‑3 15 | 6 | — | |||||||

Articulating Water Trucks | 8,000 gallon | 406,000 | 3 | — | |||||||

Scraper Water Wagons | 10,000 gallon | 462,000 | 2 | — | |||||||

Float Trucks | 250 tons | 703,000 | 4 | — | |||||||

Heavy Oil Recovery Barge | 30,000 US gal per hour | 125,000 | 9 | — | |||||||

Tractors | 43,000 lbs | 460,000 | 2 | — | |||||||

Total | 375 | 120 | |||||||||

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

2013 Annual Information Form | 11 |

For the fiscal years ended March 31, 2013, 2012 and 2011 we incurred expenses of $193.8 million, $220.7 million and $234.9 million, respectively, to maintain our equipment.

Facilities

We own and lease a number of buildings and properties for use in our business, the locations of which were chosen for their geographic proximity to our major customers. Our corporate offices are located in Acheson, Alberta. Our primary administrative functions are carried out from offices in Edmonton, Alberta and Acheson, Alberta, where we also have a major equipment maintenance facility. Additional project management and equipment maintenance functions are carried out from leased and owned regional facilities in Fort McMurray, Alberta. The following table describes our primary facilities:

Location | Function | Owned or Leased | Lease Expiration Date | |||

Acheson, Alberta (Corporate Office) | Corporate head office, Administrative office and major equipment repair facility | Leased | 11/30/2017 | |||

Edmonton, Alberta (Mayfield) | Administrative and operations support office | Leased | 3/31/2017 | |||

Fort McMurray, Alberta (Timberlea) | Regional office for mining operations | Leased | 2/28/2022 | |||

Fort McMurray, Alberta (Canadian Natural site) | Site office and maintenance facility | Facility and land provided by customer | Term of CNRL contract (6/30/2014) | |||

Fort McMurray, Alberta (Syncrude Ruth Lake site) | Regional office and maintenance facility for all operations | Building owned, land provided | 8/31/2021 | |||

Credit Facilities

For a description of our credit facilities, see the “Credit Facilities” section of our annual MD&A, which section is expressly incorporated by reference into this AIF.

Variability of Results

A number of factors have the potential to contribute to variations in our quarterly financial results between periods, including:

• | the timing and size of capital projects undertaken by our customers on large oil sands projects; |

• | seasonal weather and ground conditions; |

• | the timing of equipment maintenance and repairs; |

• | claims and change-orders; and |

• | the accounting for unrealized non-cash gains and losses related to foreign exchange and derivative financial instruments. |

For a description of our variability of results, see the “Summary of Quarterly Results” section of our annual MD&A, which section is expressly incorporated by reference into this AIF.

F. LEGAL AND LABOUR MATTERS

Laws and Regulations and Environmental Matters

Many aspects of our operations are subject to various federal, provincial and local laws and regulations, including, among others:

• permit and licensing requirements applicable to contractors in their respective trades;

• building and similar codes and zoning ordinances;

• laws and regulations relating to consumer protection; and

• laws and regulations relating to worker safety and protection of human health.

12 | 2013 Annual Information Form |

NOA

We believe that we have all material required permits and licenses to conduct our operations and are in substantial compliance with applicable regulatory requirements relating to our operations. Our failure to comply with the applicable regulations could result in substantial fines or revocation of our operating permits.t

Our operations are subject to numerous federal, provincial and municipal environmental laws and regulations, including those governing the release of substances, the remediation of contaminated soil and groundwater, vehicle emissions and air and water emissions. Federal, provincial and municipal authorities, such as Alberta Environment, Saskatchewan Environment, the British Columbia Ministry of Environment, Ontario Ministry of the Environment and other governmental agencies, administer these laws and regulations. The requirements of these laws and regulations are becoming increasingly complex and stringent and meeting these requirements can be expensive.

The nature of our operations and our ownership or operation of property exposes us to the risk of claims with respect to environmental matters and there can be no assurance that material costs or liabilities will not be incurred in relation to such claims. For example, some laws can impose strict joint and several liability on past and present owners or operators of facilities at, from or to which a release of hazardous substances has occurred, on parties who generated hazardous substances that were released at such facilities and on parties who arranged for the transportation of hazardous substances to such facilities. If we were found to be a responsible party under these statutes, we could be held liable for all investigative and remedial costs associated with addressing such contamination, even though the releases were caused by a prior owner or operator or third party. We are not currently named as a responsible party for any environmental liabilities on any of the properties on which we currently perform or have performed services. However, our leases typically include covenants that obligate us to comply with all applicable environmental regulations and to remediate any environmental damage caused by us to the leased premises. In addition, claims alleging personal injury or property damage may be brought against us if we cause the release of or any exposure to harmful substances.

Our construction contracts require us to comply with environmental and safety standards set by our customers. These requirements cover such areas as safety training for new hires, equipment use on site, visitor access on site and procedures for dealing with hazardous substances.

Capital expenditures relating to environmental matters during the fiscal years ended March 31, 2011, 2012 and 2013 were not material. We do not currently anticipate any material adverse effect on our business or financial position because of future compliance with applicable environmental laws and regulations. Future events, however, such as changes in existing laws and regulations or their interpretation, more vigorous enforcement policies of regulatory agencies or stricter or different interpretations of existing laws and regulations may require us to make additional expenditures which may or may not be material.t

Legal Proceedings and Regulatory Actions

From time to time, we are a party to litigation and legal proceedings that we consider to be a part of the ordinary course of business. While no assurance can be given, we believe that, taking into account reserves and insurance coverage, none of the litigation or legal proceedings in which we are currently involved or know to be contemplated could reasonably be or could likely be considered important to a reasonable investor in making an investment decision, expected to have a material adverse effect on our business, financial condition or results of operations. We may, however, become involved in material legal proceedings in the future that could have such a material adverse effect.t

Employees and Labour Relations

As at March 31, 2013, we had approximately 390 salaried employees and approximately 1,450 hourly employees in our ongoing operations (approximately 110 salaried employees and approximately 350 hourly employees in our piling discontinued operations). Our hourly workforce fluctuates according to the seasonality of our business and the staging and timing of projects by our customers. The hourly workforce for our ongoing operations typically ranges in size from 1,000 employees to approximately 1,400 employees depending on the time of year and duration of awarded projects. We also utilize the services of subcontractors in our business. Subcontractors perform an estimated 7% to 10% of the work we undertake. As at March 31, 2013, approximately 1,000 of the hourly employees in our ongoing operations are members of various unions and work under collective bargaining agreements.

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

2013 Annual Information Form | 13 |

The majority of our work in our ongoing operations is carried out by employees governed by our mining overburden collective bargaining agreement with the International Union of Operating Engineers (IUOE) Local 955, the primary term of which expires on March 31, 2015. Other collective agreements in effect include the provincial Industrial, Commercial and Institutional (ICI) agreement in Alberta. The provincial collective agreement between the Operating Engineers in Alberta and the Alberta Roadbuilders and Heavy Construction Association (ARBHCA) expires February 28, 2015.

We believe that our relationships with all our employees, both union and non-union, are strong. We have not experienced a strike or lockout.

G. DESCRIPTION OF SECURITIES, RIGHTS PLANS AND AGREEMENTS

Some of the statements contained herein are summaries of the material provisions of our articles of amalgamation relating to dividends, distribution of assets upon dissolution, liquidation or winding up. A copy of our articles of amalgamation can be found on www.sedar.com.

Capital Structure

We are authorized to issue an unlimited number of Voting Common Shares and an unlimited number of Non-Voting Common Shares. As at June 10, 2013, there were 36,251,006 voting Common Shares outstanding. We had no Non-Voting Common Shares outstanding as at June 10, 2013.

Voting Common Shares

Each voting common share has an equal and ratable right to receive dividends to be paid from our assets legally available therefore when, as and if declared by our board of directors.

In the event of our dissolution, liquidation or winding up, the holders of common shares are entitled to share equally and ratably in the assets available for distribution after payments are made to our creditors. Holders of common shares have no pre-emptive rights or other rights to subscribe for our securities. Each common share entitles the holder thereof to one vote in the election of directors and all other matters submitted to a vote of shareholders, and holders of common shares have no rights to cumulate their votes in the election of directors.

Non-Voting Common Shares

Except as prescribed by Canadian law and except in limited circumstances, the non-voting common shares have no voting rights but are otherwise identical to the voting common shares in all respects. The non-voting common shares are convertible into voting common shares on a share-for-share basis at the option of the holder if it transfers, sells or otherwise disposes of the converted voting common shares: (i) in a public offering of our voting common shares; (ii) to a third party that, prior to such sale, controls us; (iii) to a third party that, after such sale, is a beneficial owner of not more than 2% of our outstanding voting shares; (iv) in a transaction that complies with Rule 144 under the Securities Act of 1933, as amended; or (v) in a transaction approved in advance by regulatory bodies.

Options

Other than the exercise of options under the stock option plan, there have been no issuances of shares.

Dividends

We have not declared or paid any dividends on our common shares since our inception, and we do not anticipate declaring or paying any dividends on our common shares for the foreseeable future. We currently intend to retain any future earnings to finance future growth. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements and other factors the board of directors considers relevant. In addition, our ability to declare and pay dividends is restricted by our governing statute, as well as the terms of our credit agreement and the indenture that governs our Series 1 Debentures (as defined herein).t

t This paragraph contains forward-looking information. Please refer to "Forward-Looking Information, Assumptions and Risk Factors" for a discussion of the risks and uncertainties related to such information.

14 | 2013 Annual Information Form |

NOA

Trading Price and Volume

The following tables summarize the highest trading price, lowest trading price and volume for our common shares on the Toronto Stock Exchange (“TSX”) (in Canadian dollars) and on the New York Stock Exchange (“NYSE”) (in US dollars) on a monthly basis from April 1, 2012 to May 31, 2013:

Toronto Stock Exchange | |||||||||

Date | High ($) | Low ($) | Volume | ||||||

May 2013 | 4.65 | 3.61 | 80,417 | ||||||

April 2013 | 4.69 | 4.00 | 120,755 | ||||||

March 2013 | 4.76 | 4.30 | 95,357 | ||||||

February 2013 | 4.63 | 3.72 | 349,366 | ||||||

January 2013 | 3.95 | 3.32 | 310,994 | ||||||

December 2012 | 3.88 | 3.17 | 143,304 | ||||||

November 2012 | 3.90 | 2.94 | 424,372 | ||||||

October 2012 | 3.26 | 2.76 | 405,636 | ||||||

September 2012 | 3.04 | 2.40 | 149,778 | ||||||

August 2012 | 3.12 | 2.37 | 396,734 | ||||||

July 2012 | 3.01 | 2.56 | 487,944 | ||||||

June 2012 | 3.15 | 2.47 | 606,506 | ||||||

May 2012 | 4.00 | 2.31 | 435,648 | ||||||

April 2012 | 5.03 | 3.85 | 143,430 | ||||||

New York Stock Exchange | |||||||||

Date | High ($) | Low ($) | Volume | ||||||

May 2013 | 4.50 | 3.57 | 1,239,979 | ||||||

April 2013 | 4.63 | 3.95 | 941,195 | ||||||

March 2013 | 4.70 | 4.30 | 1,933,723 | ||||||

February 2013 | 4.52 | 3.71 | 2,632,862 | ||||||

January 2013 | 3.94 | 3.37 | 1,738,401 | ||||||

December 2012 | 3.94 | 3.20 | 1,118,470 | ||||||

November 2012 | 3.84 | 2.92 | 1,017,193 | ||||||

October 2012 | 3.28 | 2.77 | 1,820,835 | ||||||

September 2012 | 3.04 | 2.40 | 1,411,346 | ||||||

August 2012 | 3.13 | 2.38 | 2,609,449 | ||||||

July 2012 | 3.00 | 2.52 | 1,900,925 | ||||||

June 2012 | 3.00 | 2.41 | 3,178,457 | ||||||

May 2012 | 4.06 | 2.23 | 2,314,440 | ||||||

April 2012 | 4.98 | 3.86 | 1,755,320 | ||||||

Shareholder Rights Plan

On October 7, 2011, our Board of Directors adopted a Shareholder Rights Plan Agreement, dated October 7, 2011 (the "Rights Plan") designed to encourage the fair and equal treatment of shareholders in connection with any takeover bid for our outstanding Common Shares. The Rights Plan was included as an exhibit to our Form 8-A, filed with the Securities and Exchange Commission on October 7, 2011. The Rights Plan terminated in accordance with its terms on April 7, 2012.

Registration Rights Agreement

We are party to a registration rights agreement with certain shareholders, including affiliates of each of the significant shareholders, Paribas North America, Inc. and Mr. William Oehmig, one of our directors. The shareholders party to the agreement and their permitted transferees are entitled, subject to certain limitations, to include their common shares in a registration of common shares we initiate under the Securities Act of 1933 (“Securities Act 1933”), as amended. In addition, after the 120th day following our IPO, any one or more

2013 Annual Information Form | 15 |

shareholders party to the agreement has the right to require us to effect the registration of all or any part of such shareholders’ common shares under the Securities Act 1933, referred to as a “demand registration,” so long as the amount of common shares to be registered has an aggregate fair market value of at least US$5.0 million and, at such time, the SEC has ordered or declared effective fewer than four demand registrations initiated by us pursuant to the registration rights agreement. If the aggregate number of common shares that the shareholders party to the agreement request us to include in any registration, together, in the case of a registration we initiate, with the common shares to be included in such registration, exceeds the number which, in the opinion of the managing underwriter, can be sold in such offering without materially affecting the offering price of such shares, the number of shares of each shareholder to be included in such registration will be reduced pro rata based on the aggregate number of shares for which registration was requested. The shareholders party to the agreement have the right to require, after four demand registrations, one registration in which their common shares will not be subject to pro rata reduction with others entitled to registration rights.

We may opt to delay the filing of a registration statement required pursuant to any demand registration for:

• | up to 120 days following a request for a demand registration if: |

• | we have decided to file a registration statement for an underwritten public offering of our common shares, from which we expect to receive net proceeds of at least US$20.0 million; or |

• | we have initiated discussions with underwriters in preparation for a public offering of our common shares from which we expect to receive net proceeds of at least US$20.0 million and the demand registration, in the underwriters’ opinion, would have a material adverse effect on the offering; or |

• | up to 90 days following a request for a demand registration if we are in possession of material information that we reasonably deem advisable not to disclose in a registration statement. |

Our right to delay the filing of a registration statement if we possess information that we deem advisable not to disclose does not obviate any disclosure obligations which we may have under The Securities Exchange Act of 1934 or other applicable laws; it merely permits us to avoid filing a registration statement if our management believes that such a filing would require the disclosure of information which otherwise is not required to be disclosed and the disclosure of which our management believes is premature or otherwise inadvisable.

The registration rights agreement contains customary provisions whereby we and the shareholders party to the agreement covenant to indemnify and contribute to each other with regard to losses caused by the misstatement of any information or the omission of any information required to be provided in a registration statement filed under the Securities Act 1933. The registration rights agreement requires us to pay the expenses associated with any registration other than sales discounts, commissions, transfer taxes and amounts to be borne by underwriters or as otherwise required by law.

9.125% Series 1 Debentures

On April 7, 2010, we closed a private placement of 9.125% Series 1 Debentures (as defined below) due 2017 (the "Series 1 Debentures") for gross proceeds of $225.0 million and net proceeds after commissions and related expenses of $218.1 million as part of a debt restructuring plan. Financing fees of $6.9 million were incurred in connection with the Series 1 Debentures and were recorded as deferred financing costs. A more detailed discussion on the debt restructuring can be found in the “Securities, Rights Plans and Agreements - Long-term debt restructuring” section of our annual MD&A.

The Series 1 Debentures are unsecured senior obligations and rank equally with all other existing and future unsecured senior debt and senior to any subordinated debt that may be issued by us or any of our subsidiaries. The Series 1 Debentures are effectively subordinated to all secured debt to the extent of the value of the collateral.

The Series 1 Debentures are redeemable at the option of us, in whole or in part, at any time on or after: April 7, 2014 at 103.042% of the principal amount; April 7, 2015 at 101.520% of the principal amount; April 7, 2016 and thereafter at 100% of the principal amount; plus, in each case, interest accrued to the redemption date.

If a change of control, as defined in the trust indenture, occurs we will be required to offer to purchase all or a portion of each holder's Series 1 Debentures at a purchase price in cash equal to 101% of the principal amount of the debentures offered for repurchase plus accrued interest to the date of purchase.

The Series 1 Debentures are also subject to covenants limiting our ability and the ability of most or all of our subsidiaries: to incur additional debt; pay dividends or distributions on our common shares or repurchase our common shares; make various investments; create liens on our assets to secure debt; enter into transactions with

16 | 2013 Annual Information Form |

NOA

affiliates; consolidate, merge or transfer all or substantially all of our property and assets and the property and assets of our subsidiaries on a consolidated basis; transfer and sell assets; and enter into sale and leaseback transactions. These covenants are subject to exceptions and qualifications that are detailed in the indenture governing the Series 1 Debentures.

We are also required to meet a financial covenant with respect to our Series 1 Debentures that restricts the amount of additional debt that we and our subsidiaries can incur. Specifically, on a pro forma basis taking such additional debt into account, on a consolidated basis our "Consolidated Fixed Charge Coverage Ratio" must be greater than 2.0 to 1.0. The "Consolidated Fixed Charge Coverage Ratio" is approximately the same calculation as the "Interest Coverage" covenant found in our Credit Facility.

The Series 1 Debentures were rated B- by Standard & Poor's and Caa1 by Moody's (see "Debt Ratings").

Debt Ratings

For a discussion of our debt ratings, see the “Debt Ratings” section of our annual MD&A, which section is expressly incorporated by reference in this AIF.

H. Material Contracts

We are party to the following material contracts, which are contracts other than those entered into in the ordinary course of our business, as the same have been amended from time to time:

• | Indemnity Agreement between NACG Holdings Inc., NACG Preferred Corp., North American Energy Partners Inc., North American Construction Group Inc. and their respective officers and directors. Please refer to the most recently filed Notice of Annual and Special Meeting and Management Information Circular (the "management information circular") for details; |

• | Indenture, dated as of April 7, 2010, among North American Energy Partners Inc., the guarantors named therein and CIBC Mellon Trust Company, as Trustee, and Supplemental Indenture dated as of April 7, 2010, among North American Energy Partners Inc., the guarantors named therein and CIBC Mellon Trust Company, as Trustee. Please refer to “Description of Certain Indebtedness – 9.125% Series 1 Debentures” for details; |

• | Registration Rights Agreement, dated as of November 26, 2003, among NACG Holdings Inc. and the shareholders party thereto. Please refer to “Interest of Management and Others in Material Transactions – Registration Rights Agreement” for details; |

• | Amended and Restated 2004 Share Option Plan dated November 3, 2006. Please refer to the most recently filed management information circular for details; |

• | Directors Deferred Share Unit plan, dated January 1, 2008. Please refer to the most recently filed management information circular for details; |

• | Restricted Share Unit plan dated April 1, 2008. Please refer to the most recently filed management information circular for details; |

• | Overburden Removal and Mining Services Contract, dated November 17, 2004, between Canadian Natural Resources Ltd. and Noramac Ventures Inc., with the latter’s interest having been assigned to North American Construction Group Inc. by an Assignment Agreement dated February 27, 2006, all as amended by an Amending Agreement dated March 19, 2012. Please see “Projects – Active Projects – Canadian Natural: Overburden Removal Project; |

• | Lease dated December 1, 1997, between NAR Group Holdings Ltd., as landlord, and North American Construction Group Inc., as tenant, as renewed by a Renewal Lease Agreement dated December 1, 2002, between Norama Inc. (successor to NAR Group Holdings Ltd.), as landlord, and North American Construction Group Inc., as tenant, as amended by a Lease Amendment and Consent Agreement dated November 26, 2003, between Acheson Properties Ltd. (successor to Norama Inc.), as landlord, and North American Construction Group Inc., as tenant, and as further amended by an Amending Agreement to Lease Amendment and Consent Agreement dated September 29, 2006, between Acheson Properties Ltd., as landlord, and North American Construction Group Inc., as tenant. This lease is for our offices in Acheson, Alberta. Please refer to “Resources and Key Trends—Facilities” for details; and |

• | Fourth Amended and Restated Credit Agreement dated as of April 30, 2010, among North American Energy Partners Inc., Canadian Imperial Bank of Commerce, HSBC Bank Canada, and the lenders party thereto from time to time, as amended by that First Amending Agreement dated June 8, 2011, that Second Amending |

2013 Annual Information Form | 17 |

Agreement dated September 30, 2011, that Third Amending Agreement dated March 27, 2012 and that Fourth Amending Agreement dated September 28, 2012. Please refer to “Liquidity – Credit facilities” in our annual MD&A for details.

I. DIRECTORS AND OFFICERS

Director and Officer Information

Each director is elected for a one-year term or until such person’s successor is duly elected or appointed, unless his office is earlier vacated. Unless otherwise indicated below, the business address of each of our directors and executive officers is Zone 3, Acheson Industrial Area, 2-53016 - Hwy. 60, Acheson, Alberta, T7X 5A7. As at June 10, 2013, the directors and executive officers of the Company, as a group, beneficially owned, directly or indirectly, or exercised control or direction over 1,493,316 common shares of the Company (representing approximately 4.1% of all issued and outstanding common shares).

The following table sets forth information about our directors and executive officers. Ages reflected are as at May 31, 2013.

Name and Municipality of Residence | Age | Position | In Role Since | |||

Martin R. Ferron | 56 | President and Chief Executive Officer | June 7, 2012 | |||

Edmonton, Alberta, Canada | ||||||

David Blackley | 52 | Chief Financial Officer | June 10, 2009 | |||

Sherwood Park, Alberta, Canada | ||||||

Joseph C. Lambert | 48 | Chief Operating Officer | June 1, 2013 | |||

St. Albert, Alberta, Canada | ||||||

Barry W. Palmer | 52 | Vice-President, Heavy Construction and Mining Operations | December 15, 2011 | |||

Morinville, Alberta, Canada | ||||||

Ronald A. McIntosh | 71 | Chairman of the Board | May 20, 2004 | |||

Calgary, Alberta, Canada | ||||||

George R. Brokaw | 45 | Director | June 28, 2006 | |||

New York, NY, United States | ||||||

Carl Giesler Jr. | 41 | Director | April 24, 2012 | |||

Houston, Texas United States | ||||||

William C. Oehmig | 63 | Director | May 20, 2004 | |||

Houston, Texas, United States | ||||||

Allen R. Sello | 73 | Director | January 26, 2006 | |||

West Vancouver, British Columbia, Canada | ||||||

Jay W. Thornton | 56 | Director | June 7, 2012 | |||

Calgary, Alberta, Canada | ||||||

Peter W. Tomsett | 55 | Director | September 19, 2006 | |||

West Vancouver, British Columbia, Canada | ||||||

K. Rick Turner | 55 | Director | November 26, 2003 | |||

Houston, Texas, United States | ||||||

Martin R. Ferron joined us as President and Chief Executive Officer and a Director of the Board on June 7, 2012. Previously, Mr. Ferron was Director, President and CEO of Helix Energy Solutions Inc. (Helix), an NYSE listed international energy services company, at which he successfully refocused the company on improved project execution, asset utilization and profit performance. He also transformed Helix through a combination of measured organic growth, acquisitions and divestures, achieving a compound annual EBITDA growth rate of approximately 38% during his tenure with the company. Prior to joining Helix, Mr. Ferron worked in successively more senior management positions with oil services and construction companies including McDermott Marine Construction, Oceaneering International and Comex Group. He holds a B.Sc. in Civil Engineering from City University, London, a M.Sc. in Marine Technology from Strathclyde University, Glasgow and a MBA from Aberdeen University.

18 | 2013 Annual Information Form |

NOA

David Blackley became Chief Financial Officer on June 11, 2009. Mr. Blackley joined us as Vice-President, Finance on January 14, 2008, bringing extensive experience leading accounting and financial reporting teams and overseeing the design and implementation of internal financial controls and processes. Previously Mr. Blackley served as Vice-President, Finance of Lafarge North America’s Aggregates and Concrete division. A Chartered Accountant, Mr. Blackley holds a Bachelor of Commerce from Rhodes University in South Africa.

Joseph C. Lambert became Chief Operating Officer on June 1, 2013. Mr. Lambert joined us as General Manager of Mining in April 2008 after an extensive career in the mining industry. Mr. Lambert was promoted to Vice President, Oil Sands Operations in September of 2010 and accepted the position of Vice President, Operations Support in January 2012. Prior to that, Mr. Lambert's career began in the gold industry where he spent 17 years in roles of increasing responsibility in engineering and operations both open pit and underground. Mr. Lambert's more recent contracting and oil sands experience included positions as General Manager with Ledcor and Mine Development Manager, Oil Sands with Shell. Mr. Lambert graduated from the South Dakota School of Mines and Technology with a B.S. in Mining Engineering in 1986.

Barry W. Palmer became Vice President, Heavy Construction and Mining Operations on December 15, 2011. Mr. Palmer joined us in 1982 as a Heavy Equipment Operator. Since then Mr. Palmer has advanced through the company holding positions of Operations Foreman, General Foreman, Superintendent, Project Manager, Operations Manager and General Manager of Heavy Construction and Mining. Over the course of his 34 years within the construction industry Mr. Palmer has worked in aggregate, road building, civil and heavy construction and mining. Before joining us, Mr. Palmer worked for PCL and Steels of Canada

Ronald A. McIntosh became Chairman of our Board of Directors on May 20, 2004. From January 2004 until August of 2006, Mr. McIntosh was Chairman of NAV Energy Trust, a Calgary-based oil and natural gas investment fund. Between October 2002 and January 2004, he was President and Chief Executive Officer of Navigo Energy Inc. and was instrumental in the conversion of Navigo into NAV Energy Trust. He was Senior Vice President and Chief Operating Officer of Gulf Canada Resources Limited from December 2001 to July 2002 and Vice President, Exploration and International of Petro-Canada from April 1996 through November 2001. Mr. McIntosh's significant experience in the energy industry includes the former position of Chief Operating Officer of Amerada Hess Canada. Mr. McIntosh is on the Board of Directors of Advantage Oil & Gas Ltd. and Alvopetro Inc., formerly known as Fortress Energy Inc.

George R. Brokaw became one of our Directors on June 28, 2006. Mr. Brokaw is a managing director at Highbridge Principal Strategies L.L.C. He was with Perry Capital L.L.C., an affiliate of Perry Corp., between August 2005 and November 2011, and was serving as a Managing Partner of Perry Corp. at the time of his departure. From January 2003 to May 2005, Mr. Brokaw was Managing Director (Mergers & Acquisitions) of Lazard Frères & Co. LLC, which he joined in 1996. Between 1994 and 1996, Mr. Brokaw was an investment banking associate for Dillon Read & Co. Mr. Brokaw received a Bachelor of Arts degree from Yale University and a Juris Doctorate and Masters of Business Administration from the University of Virginia. He is admitted to practice law in the State of New York.

Carl F. Giesler, Jr. became one of our Directors on April 24, 2012. Mr. Giesler is Managing Director of Investments at Harbinger Group Inc. (“HGI”) and previously served as Vice President and Director of Investments at Harbinger Capital Partners LLC (“Harbinger Capital”), an affiliate of HGI. Prior to joining Harbinger Capital in 2008, Mr. Giesler was a Managing Director at AIG Financial Products Corp. (“AIG FP”), where he held a leadership role in pursuing principal investment opportunities in the oil and gas sector. Prior to joining AIG FP, he worked as an investment banker in Morgan Stanley's Global Energy Group. Mr. Giesler is a CFA charter holder and a graduate of Harvard Law School and the University of Virginia.

William C. Oehmig served as Chairman of our Board of Directors from November 26, 2003 and until passing off this position and assuming the role of Director and chair of the Executive Committee on May 20, 2004. He now serves as chairman of the Risk Committee and on the Compensation Committee. Mr. Oehmig's career began at Texas Commerce Bank in Houston in 1974. Mr. Oehmig worked in banking, mergers and acquisitions, and represented foreign investors in purchasing and managing U.S. companies in the oilfield service, manufacturing, distribution, heavy equipment and real estate sectors until 1984, when he became a Partner with The Sterling Group, a private equity investment firm in Houston, Texas. As of July 1 2012, Mr. Oehmig is now an Advisory Partner to the Sterling Group.

Mr. Oehmig currently serves on the board of Universal Fibers Inc. In the past he has served as Chairman of Royster Clark, Purina Mills, Exopack and Sterling Diagnostic Imaging and has served on the board of several portfolio companies since joining Sterling. Mr. Oehmig serves or has served and Chaired on numerous other corporate non-profit boards. Mr. Oehmig received his Bachelor of Business Administration (B.B.A.) in Economics

2013 Annual Information Form | 19 |

from Transylvania University and his Masters of Business Administration (M.B.A.) from the Owen Graduate School of Management at Vanderbilt University.