| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

3001 Colorado Boulevard, Denton, Texas 76210

LETTER FROM OUR PRESIDENT AND CHIEF EXECUTIVE OFFICER

To our stockholders,

Our performance in Fiscal Year 2023 showed both the resilience and promise of our business. Despite macroeconomic headwinds, the core business delivered financial results in line with the expectations that we had set out at the beginning of the year. We were able to do this because of our strong engagement with our customers and the clear and advantageous value proposition that we offer. Of note, during the year, we reduced turnover in our store workforce which contributed to increased product expertise and service quality. In turn, our customers again awarded us with top quartile satisfaction scores. I am also pleased to report that we made significant strides in the advancement of our strategic priorities of enhancing customer centricity, driving innovation and growing our high margin owned brands and increasing the efficiency in our operations. A few notable examples of our work include launching our Studio by Sally and Happy Beauty Co. concepts; gaining or expanding professional brand distribution including brands such as Amika, Color Wow and Danger Jones; growing bondbar, our newest owned brand, to $10 million dollars in sales; and capturing cost efficiencies with our store and DC optimization programs. .

Our 2024 Core Initiatives

In Fiscal 2024, our strategic priorities remain the same. Each of Sally and Cosmo Prof continue to be focused on enhancing customer centricity through initiatives like our Licensed Colorist on Demand program, Studio by Sally, Happy Beauty Co. and Cosmo Prof Direct. We will see territory expansion with the recent acquisition of Goldwell NY and expect to have continued professional brand expansion in 2024, further deepening our support of our professional stylists. We also expect to drive growth through a robust pipeline of owned brand innovation, which includes the expansion of Inspired by Nature, Ion and bondbar. We expect significant efficiency savings as we refine our operating model and optimize our capabilities as part of our Fuel For Growth initiative. Taken together, these priorities will help us drive top line growth and profitability and remain focused on returning value to you, our stockholders.

Annual Meeting Details

You are invited to attend the annual meeting of stockholders of SBH, to be held virtually on Thursday, January 25, 2024 at 9:00 a.m., central time. Details of the business to be conducted at the annual meeting are given in the Official Notice of the Meeting, Proxy Statement, and form of proxy enclosed with this letter. We encourage you to vote in advance so that we will know that we have a quorum of stockholders for the meeting.

It is important that your shares be represented and voted whether you plan to attend the annual meeting. Your prompt vote over the Internet, by telephone via toll-free number or by mailing a written proxy will save us the expense and extra work of additional proxy solicitation. Voting by any of these methods at your earliest convenience will ensure your representation at the annual meeting.

On behalf of the SBH team, I would like to express our appreciation for your continued investment in SBH.

Denise Paulonis

Director, President and Chief Executive Officer

December 13, 2023

SALLY BEAUTY

HOLDINGS, INC.

3001 Colorado Boulevard, Denton, Texas 76210

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To our stockholders:

The annual meeting of stockholders of Sally Beauty Holdings, Inc. (the “Company”) will be held virtually on Thursday, January 25, 2024, at 9:00 a.m., central time, for the purpose of considering and acting upon the following:

| (1) | The election of the nine directors named in the accompanying Proxy Statement for a one-year term; |

| (2) | To approve an advisory (non-binding) resolution regarding the compensation of the Company’s named executive officers, including the Company’s compensation practices and principles and their implementation, as disclosed in the accompanying Proxy Statement; |

| (3) | The ratification of the selection of KPMG LLP as our independent registered public accounting firm for our 2024 fiscal year; and |

| (4) | To transact such other business as may properly come before the annual meeting or any adjournment thereof. |

Only stockholders of record at the close of business on November 27, 2023 will be entitled to receive notice of and to vote at the meeting and any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on

January 25, 2024:

The Proxy Statement and the 2023 Annual Report to stockholders are available at:

www.edocumentview.com/sbh

By Order of the Board of Directors,

John Henrich

Corporate Secretary

December 13, 2023

IMPORTANT:

We urge you to vote your shares at your earliest convenience to ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by telephone via toll-free number or by signing, dating, and returning the enclosed proxy card will save us the expense and extra work of additional solicitation. If your shares are held in street name by a bank, broker or other similar holder of record, your bank, broker or other similar holder of record is not permitted to vote on your behalf on Proposal 1 (election of directors) or Proposal 2 (approval of an advisory resolution regarding the compensation of the Company’s named executive officers, including the Company’s compensation practices and principles and their implementation) unless you provide specific instructions by completing and returning a voting instruction form or following the voting instructions provided to you by your bank, broker or other similar holder of record. Enclosed is an addressed, postage-paid envelope for those voting by mail in the United States. Because your proxy is revocable at your option, submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so. Please refer to the voting instructions included on your proxy card or the voting instructions forwarded by your bank, broker, or other similar holder of record if you hold your shares in street name.

TABLE OF CONTENTS

TABLE OF CONTENTS

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | PROPOSAL 2 – ADVISORY VOTE ON EXECUTIVE COMPENSATION | |||

| 46 | ||||

| 48 | ||||

| 48 | ||||

| 71 | ||||

| 72 | ||||

| 83 | ||||

| 84 | ||||

| 88 | PROPOSAL 3 – RATIFICATION OF SELECTION OF AUDITORS | |||

| 89 | ||||

| 90 | DEADLINES AND PROCEDURES FOR NOMINATIONS AND STOCKHOLDER PROPOSALS | |||

| 91 | ||||

| 96 | ||||

| A-1 | ||||

www.sallybeautyholdings.com 3

2023 PROXY STATEMENT SUMMARY

Proxies are being solicited by the Board of Directors of Sally Beauty Holdings, Inc. (NYSE: SBH) (“we,” “us,” or the “Company”) to be voted at our 2024 Annual Meeting. This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE | 9:00 a.m. Central Time, January 25, 2024 | |

| PLACE | This year’s annual meeting will be virtual and will be held solely online via live webcast. You will be able to attend and participate in the annual meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting meetnow.global/MW5HHF5 and following the instructions on your Notice, proxy card, or on the instructions that accompanied your proxy materials. Please refer to the Q&A section beginning on page 91 for instructions on how to attend the virtual meeting. | |

| RECORD DATE | November 27, 2023 | |

| VOTING | Stockholders as of the Record Date are entitled to notice of, and to vote at, the annual meeting. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. | |

On or about December 13, 2023, we will mail a Notice of Internet Availability of Proxy Materials to our stockholders of record as of the Record Date. The Notice contains instructions on how to access over the internet the Company’s Notice of Annual Meeting of Stockholders, Proxy Statement, form of proxy and Annual Report on Form 10-K for the fiscal year ended September 30, 2023 (FY23).

VOTING MATTERS

| PROPOSAL | BOARD VOTE RECOMMENDATION |

PAGE (for more detail) | ||

| Proposal 1: Elect nine directors | FOR each Nominee | 10 | ||

| Proposal 2: Approve, on an advisory basis, compensation of our named executive officers (NEOs) | FOR

|

45

| ||

| Proposal 3: Ratify KPMG LLP as our independent registered public accounting firm for fiscal 2024 | FOR

|

88

| ||

2023 Proxy Statement

2023 Proxy Statement

2023 PROXY STATEMENT SUMMARY

DIRECTOR NOMINEES

Nine directors are standing for election at the 2024 Annual Meeting for one-year terms. The following table provides summary information about each of the director nominees as well as their committee memberships. The table also discloses the Board’s determination as to the independence of each nominee under the listing standards of the New York Stock Exchange (“NYSE”) and relevant rules of the Securities and Exchange Commission (“SEC”). Additional information about each nominee’s background and experience can be found beginning on page 10. To be elected, each nominee must receive more votes cast “for” such nominee’s election than votes cast “against” such nominee’s election.

| Name | Age | Director Since | Occupation | Experience / Qualification |

Indep. | AC | CC | NG/ CR |

EC | |||||||||

| Denise Paulonis |

51 |

May 2018 | President & CEO, Sally Beauty Holdings, Inc. | Management, Finance, Audit, International Retail | • | |||||||||||||

| Rachel R. Bishop, Ph.D. |

50 |

July 2022 | President, Hefty Tableware, Reynolds Consumer Products | Consumer Products, Retail, ESG, M&A | ✓ | • | • | |||||||||||

| Jeffrey Boyer |

65 |

July 2022 | COO, Fossil Group | Management, Audit, Retail | ✓ | • | • | |||||||||||

| James Conroy |

54 |

n/a | CEO, Boot Barn Holdings Inc. | Management, Finance, Retail | ✓ | |||||||||||||

| Diana S. Ferguson (Board Chair) |

60 |

Jan. 2019 | Principal, Scarlett Investments LLC | Management, Finance |

✓ | C | • | |||||||||||

| Dorlisa K. Flur |

58 |

Jan. 2020 | Advisor, Former Chief Strategy & Transformation Officer, Southeastern Grocers | Management, Mass Market Retail Transformation | ✓ | • | • | |||||||||||

| James M. Head |

58 |

Jan. 2021 | EVP and CFO, MultiPlan Corporation | Finance, Strategy, M&A | ✓ | • | C | |||||||||||

| Lawrence “Chip” P. Molloy |

62 |

July 2022 | CFO, Sprouts Farmers Market | Management, Finance, Audit | ✓ | C | • | |||||||||||

| Erin Nealy Cox |

53 |

July 2021 (Also Aug. 2016 to Nov. 2017) | Partner, Kirkland & Ellis | Cyber Security, Governance, Legal | ✓ | C | • | |||||||||||

Committees:

AC = Audit CC = Compensation & Talent NG/CR = Nominating, Governance and Corporate Responsibility EC = Executive C = Chair

Each director nominee elected will serve until the 2025 annual meeting. The Board recommends a vote FOR each nominee.

www.sallybeautyholdings.com 5

2023 PROXY STATEMENT SUMMARY

BOARD NOMINEES SNAPSHOT

| Diversity

|

Independence

| |

| Age Mix

|

Tenure

| |

2023 Proxy Statement

2023 Proxy Statement

2023 PROXY STATEMENT SUMMARY

| FY23 PERFORMANCE

|

| (1) Please see “Executive Compensation — Compensation Discussion and Analysis — FY23 Executive Compensation Program — Annual Incentive” section for Comparable Sales and Adjusted Operating Income (“AOI”) definition. (2) Information in this Proxy Statement includes discussion of financial metrics that are not calculated in accordance with U.S. GAAP, including AOI, AOIM and Adjusted Diluted EPS. Please see Appendix 1 for a reconciliation of these measures to financial measures derived in accordance with U.S. GAAP. (3) 3-Year Average Return on Invested Capital (“ROIC”) is defined as net income plus after-tax interest expense divided by monthly invested capital over the three-year performance period.

|

| • Net Sales were $3.73 billion, a 2.3% decrease over the prior year. • Global E-Commerce Sales were $348 million and represented 9.3% of total net sales. • GAAP operating earnings of $325 million and GAAP operating margin of 8.7%, Adjusted Operating Earnings of $341 million and Adjusted Operating Margin of 9.1%. • Repurchased 1.5 million shares at an aggregate cost of $15 million. |

www.sallybeautyholdings.com 7

2023 PROXY STATEMENT SUMMARY

FY23 STRATEGIC OBJECTIVES AND ACCOMPLISHMENTS

| Enhancing Our Customer Centricity |

✓ Launched CosmoProf Direct, a customizable digital storefront platform that gives our stylists the ability to curate a product selection specifically for their customers – BSG provides an opportunity for stylists to create their own digital storefronts for their salon customers, BSG fulfills the orders, and the stylists earn a commission – Advanced marketing tools available to deliver personalized product recommendations and promotions

✓ Introduced our free Licensed Colorist on Demand at Sally – Active at 75 Sally stores at the end of our FY23 – Launched online in Q4 2023

✓ Launched Studio by Sally a concept store focused on educating customers how to color their own hair – Initial pilot in 6 stores in 2023 with the potential to roll out to more than 100 stores over the next 3-4 years

✓ Launched Happy Beauty Co., which targets savvy millennials, value seekers and discount beauty buyers – Opened pilot stores in the Dallas-Fort Worth and Phoenix areas – Product offerings priced under $10 and encompass 4 key categories: Cosmetics & Facial Care, Bath & Body, Nails, and Hair

| |

| Growing High Margin Own Brands and Amplifying Innovation |

✓ Increased Sally’s own brand penetration to 34% – Launched bondbar hair color and care – Expanded Strawberry Leopard hair color and launched hair care

✓ Increased BSG’s innovation pipeline – Launched Amika and Danger Jones, and expanded distribution with Color Wow

| |

| Increasing Operational Efficiency and Optimizing Our Capabilities |

✓ Building from a successful 90-store optimization pilot in FY22 where sales transfer rates exceeded internal targets, during Q1 FY23, successfully closed an additional ~350 locations; majority were Sally U.S. Stores ✓ Closed 2 of our smaller distribution centers in December 2022, transferring volume to larger, more efficient distribution centers ✓ Launching a Fuel for Growth initiative to support our long-term operating profit objectives

| |

| Progress on ESG |

Our Environmental, Social and Governance (“ESG”) strategy focuses primarily on the areas where we believe we can have a meaningful impact:

✓ Human Capital Management ✓ Diversity, Inclusion & Belonging ✓ Philanthropy & Community Engagement ✓ Environmental Sustainability & Responsible Sourcing ✓ Data Protection & Cybersecurity | |

2023 Proxy Statement

2023 Proxy Statement

2023 PROXY STATEMENT SUMMARY

FY23 CORPORATE GOVERNANCE HIGHLIGHTS

| • | Continued planned, orderly transition of Board leadership since FY22, thereby refreshing Board governance. |

| • | Appointed new Board Chair (Ferguson). |

| • | Appointed new Committee Chairs of Audit (Molloy), Nominating, Governance and Corporate Responsibility (Nealy Cox) and Executive (Head). |

| • | Current Director Nominee slate will result in gender-diverse Board with 56% women, 44% men. |

| • | Adopted SEC/NYSE-compliant Compensation Clawback Policy. |

| • | Continued integration of Company’s purpose and values across our ESG plans. |

FY23 SUSTAINABILITY HIGHLIGHTS – The Board continued its focus on advancing company-wide ESG and sustainability efforts, which are focused on the main areas where we can have a meaningful impact:

1) Employees – focused on key areas relevant to our team, especially:

| • | Safety, health and well-being |

| • | Input and feedback from team through surveys and other mechanisms |

| • | Engagement, retention, succession and talent development |

2) Diversity, Inclusion and Belonging – diversity and inclusion are at the heart of SBH:

| • | Continued multi-phase, year-round DIB leadership training |

| • | Scored 100 on the Human Rights Campaign’s Corporate Equality Index (CEI) |

| • | Established Employee Resource Groups (ERGs) for Women, LGBTQ+, Black and Hispanic associates |

| • | Awarded 5-star rating as one of America’s Greatest Workplaces for Diversity (Newsweek and Plant-A Insights Group) |

3) Philanthropy and Community Impact:

| • | SBH Inspires Foundation: |

| • | Identified core charitable cause: ending domestic violence and abuse, and supporting survivors. |

| • | Raised over $28,000 to support efforts against domestic violence and abuse. |

| • | In-kind Product: donated over $60,000 of SBH product to local and national shelters supporting those in transition. |

| • | Employee Disaster Relief Fund: raised over $31,000 to assist Company employees impacted by natural disasters. |

4) Environmental Sustainability, Responsible Sourcing (Supply Chain): Made progress towards reducing our environmental impact by reducing energy usage and increasing energy efficiency.

5) Data Privacy and Cybersecurity Oversight: Each quarter during FY23, our Chief Information Security Officer delivered detailed reports to the full Board on: risk identification and management strategies, cybersecurity strategy and governance structure, consumer data protection, risk mitigation activities, learnings from data security incidents of peer companies, results of third-party assessments and testing, and updates on employee training. In FY23 the Board named cybersecurity expert (Ms. Nealy Cox) Chair of the Nominating, Governance and Corporate Responsibility Committee.

FY23 STOCKHOLDER OUTREACH – During FY23, we engaged with investors and sell-side analysts by hosting numerous meetings, investor calls and attending investor conferences. We believe that listening to investors is essential to good governance and to the long-term sustainability of our company.

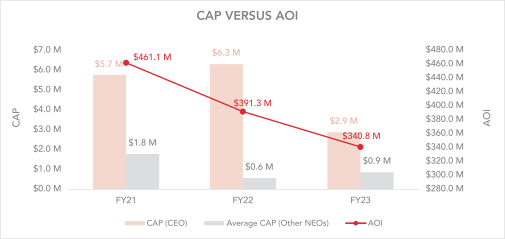

FY23 EXECUTIVE COMPENSATION HIGHLIGHTS – Highlights of our Named Executive Officer compensation program – including NEO Changes and Compensation Program Changes for FY23 and FY24 – are described in the CD&A section beginning on page 48.

www.sallybeautyholdings.com 9

PROPOSAL 1

ELECTION OF DIRECTORS

| Our current Board of Directors consists of nine individuals, eight of whom qualify as independent of us under the rules of the NYSE. Eight of our nine directors are standing for re-election. Our Certificate of Incorporation and our By-Laws provide for the annual election of each of our directors for one-year terms.

Following the recommendations of our Nominating, Governance and Corporate Responsibility Committee, our Board of Directors has nominated the following nine individuals for election to our Board of Directors: Ms. Paulonis, Ms. Bishop, Mr. Boyer, Mr. Conroy, Ms. Ferguson, Ms. Flur, Mr. Head, Mr. Molloy and Ms. Nealy Cox. Accordingly, this Proposal 1 seeks the election of these nine individuals to be directors, each with a one-year term that will expire at the annual meeting of stockholders in 2025.

Unless otherwise indicated, all proxies that authorize the proxy holders to vote for the election of directors will be voted “FOR” the election of the nominees listed below. If a nominee becomes unavailable for election as a result of unforeseen circumstances, it is the intention of the proxy holders to vote for the election of such substitute nominee, if any, as the Board of Directors may propose. As of the date of this Proxy Statement, each of the nominees has consented to serve and the Board is not aware of any circumstances that would cause a nominee to be unable to serve as a director.

Except for James Conroy who is standing for election to our Board for the first time, each director nominee is a current director with a term expiring at this annual meeting. Each director nominee has furnished to us the following information with respect to their principal occupation or employment and principal directorships: |

| Denise A. Paulonis | ||

|

Director, President and Chief Executive Officer, age 51

Ms. Paulonis has served on our Board of Directors since May 2018 and is the Company’s President and Chief Executive Officer, a role she has held since October 2021. Prior to being appointed to her current role, Ms. Paulonis served as Chief Financial Officer of Sprouts Farmers Market, Inc. Prior to joining Sprouts in February 2020, Ms. Paulonis was the Executive Vice President and Chief Financial Officer of The Michaels Companies, a position she held from August 2016 to January 2020. Ms. Paulonis joined Michaels in September 2014 and served as its Senior Vice President, Finance and Treasurer from November 2015 to August 2016 and as its Vice President, Corporate Finance, Investor Relations and Treasury from September 2014 to November 2015.

Prior to joining Michaels, Ms. Paulonis held various senior level positions with PepsiCo and McKinsey & Company, after starting her career at Procter & Gamble. She holds an M.B.A. from The Wharton School at the University of Pennsylvania and a Bachelors of Science in Finance and Economics from Miami University. Ms. Paulonis has served on the Conagra Brands Board of Directors since August 2022. We believe that Ms. Paulonis’ executive, management and finance experience well qualifies her to serve on our Board. |

2023 Proxy Statement

2023 Proxy Statement

PROPOSAL 1

ELECTION OF DIRECTORS

| Rachel R. Bishop, Ph.D. | ||

| Director, age 50

Ms. Bishop was elected to our Board of Directors in July 2022. Ms. Bishop brings more than 20 years of experience in consumer goods, manufacturing and retail. She currently serves as President, Hefty Tableware at Reynolds Consumer Products (NASDAQ: REYN), where she oversees a $1Bn portfolio of consumer products and leads Reynolds’ ESG programming. She was a member of the management team that led Reynolds through a successful IPO in January 2020. Prior to joining Reynolds in 2019, she held senior positions with Treehouse Foods, Inc., (NYSE: THS) from 2014 through 2018, including President, Snacks Division and SVP & Chief Strategy Officer. Her previous roles include GVP Retail Development and Global Merchandising at The Walgreen Co., now Walgreens Boots Alliance Inc., and started her business career with eight years at McKinsey & Company. Ms. Bishop holds a Ph.D. in Materials Science and Engineering from Northwestern University, and a Bachelor of Science in Materials Science and Engineering, and in Geophysics from Brown University. We believe that Ms. Bishop’s strong executive background in consumer products, retail, ESG, M&A and strategic planning well qualifies her to serve on our Board. |

| |

Jeffrey Boyer |

||

| Director, age 65

Mr. Boyer was elected to our Board of Directors in July 2022. Mr. Boyer is an experienced finance and operations executive and retail industry veteran. He currently serves as Chief Operating Officer of Fossil Group (NASDAQ: FOSL) after having held the roles of Chief Financial Officer and Treasurer from October 2017 to April 2020. Mr. Boyer also served as a director on Fossil Group’s Board from 2007 to 2017, including serving as Chair and a member of its Audit Committee. Prior to joining Fossil Group, Mr. Boyer held Chief Financial Officer roles at Pier 1 Imports, Tuesday Morning, and Michaels Stores, Inc., among others. He began his career at PricewaterhouseCoopers. Mr. Boyer holds a Bachelor of Science in Finance from the University of Illinois. We believe that Mr. Boyer’s extensive finance and operations experience, and his executive leadership in retail, well qualifies him to serve on our Board. |

|

www.sallybeautyholdings.com 11

PROPOSAL 1

ELECTION OF DIRECTORS

| James Conroy | ||

|

|

Director Nominee, age 54

Mr. Conroy is President, Chief Executive Officer and a director of Boot Barn Holdings Inc. (NYSE: BOOT). Prior to joining Boot Barn, Mr. Conroy was with Claire’s Stores, Inc. from 2007 to 2012 where he served as Chief Operating Officer and Interim Co Chief Executive Officer in 2012, President from 2009 to 2012 and Executive Vice President from 2007 to 2009. Prior to joining Claire’s Stores, Inc., Mr. Conroy was employed by Blockbuster Entertainment Group from 1996 to 1998, Kurt Salmon Associates from 2003 to 2005 and Deloitte Consulting in various capacities.

Mr. Conroy serves on the Foundation Board of Children’s Hospital of Orange County as well as the Foundation Board of Orange County School of the Arts. Mr. Conroy received a bachelor’s degree in business management and statistics and a master’s degree in business administration from Cornell University. | |

Diana S. Ferguson | ||

|

|

Director, age 60

Ms. Ferguson was elected to our Board of Directors in January 2019. Ms. Ferguson has served as a principal of Scarlett Investments, LLC, a private investment firm, since 2013. She formerly served as Chief Financial Officer to Cleveland Avenue, LLC, a venture capital investment firm, from September 2015 to December 2020. She also served as Chief Financial Officer of the Chicago Board of Education from February 2010 to May 2011 and as Senior Vice President and Chief Financial Officer of The Folgers Coffee Company from April 2008 to November 2008 when Folgers was sold. Prior to joining Folgers, she was Executive Vice President and Chief Financial Officer of Merisant Worldwide, Inc. Ms. Ferguson also served as the Chief Financial Officer of Sara Lee Foodservice, a division of Sara Lee Corporation, and in a number of leadership positions at Sara Lee Corporation, including Senior Vice President of Strategy and Corporate Development, as well as Treasurer.

She currently is a director of Mattel, Inc., where she serves on the Audit Committee and is also a director of Gartner, Inc. where she serves on the Audit Committee. We believe that Ms. Ferguson’s executive, management and finance experience well qualifies her to serve on our Board. |

2023 Proxy Statement

2023 Proxy Statement

PROPOSAL 1

ELECTION OF DIRECTORS

| Dorlisa K. Flur | ||

| Director, age 58

Ms. Flur has served on our Board of Directors since 2020. Ms. Flur is a corporate director and strategic advisor to companies in the retail industry. She currently serves as a director of Hibbett, Inc., where she is a member of its Compensation Committee and chairs its Nominating and Corporate Governance Committee. She also serves as a director of United States Cold Storage, a wholly-owned subsidiary of John Swire & Sons, Ltd., and chairs its Strategy Committee. She recently joined the Board of Trustees for BlueCross BlueShield of NC and serves on its Audit and Investments Committees. Ms. Flur has served as strategic advisor to Southeastern Grocers, Inc. since August 2018 and was previously its Chief Strategy and Transformation Officer from August 2016 to July 2018. Ms. Flur previously served as Executive Vice President, Omnichannel for Belk, Inc. from 2013 to 2016, where she integrated stores and eCommerce and also led supply chain. Prior to that she was Vice Chair, Strategy and Chief Administrative Officer at Family Dollar Stores, Inc. where she held a series of top operating roles including real estate, marketing and merchandising as the company scaled from 5000 to 7500 stores.

Ms. Flur is a former partner of McKinsey & Company, Inc. and co-led its Charlotte, North Carolina office. She is recognized by the National Association of Corporate Directors as NACD Directorship Certified™ (including its Climate Governance credential) and as an NACD Board Leadership Fellow. We believe that Ms. Flur’s governance, executive and management experience, including extensive work driving transformations within mass market retail, well qualifies her to serve on our Board. |

|

|

|

||

|

Director, age 58

Mr. Head was elected to our Board of Directors in January 2021. Mr. Head has served as the Executive Vice President and Chief Financial Officer of MultiPlan Corporation since November, 2021. Prior to being appointed to his current role he served as a Partner at BDT & Company, LLC from 2016 until June 2021 and, prior to that, worked at Morgan Stanley for 22 years where he held various executive leadership roles, including Co-Head of the Mergers, Acquisitions and Restructuring Group, Americas from 2013 to 2016; Co-Head of the Financial Institutions M&A Group, Americas from 2008 to 2013; and Managing Director from 2003 to 2016. We believe that Mr. Head’s financial, strategic, and transactional experience – including over 30 years as an investment banker involved in complex financial and strategic transactions – well qualifies him to serve on our Board. |

|

www.sallybeautyholdings.com 13

PROPOSAL 1

ELECTION OF DIRECTORS

| Lawrence “Chip” P. Molloy | ||

|

|

Director, age 62

Mr. Molloy was elected to our Board of Directors in July 2022. Mr. Molloy brings finance, private equity and board experience to Sally Beauty. He currently serves as Chief Financial Officer of Sprouts Farmers Market (NASDAQ: SFM) having served as a director and Chair of the Audit and Compensation Committees of Sprouts’ board from 2012 to 2021 and Interim Chief Financial Officer of Sprouts from June 2019 to February 2020. Previously, Mr. Molloy served as a director and Chair of Torrid’s Audit Committee from 2018 to 2021 and Interim Chief Executive Officer of Torrid from January 2018 through August 2018. His previous roles include serving as Senior Advisor at Roark Capital Group, a private equity firm focused predominately on the restaurant and retail sectors, as well as holding Chief Financial Officer roles at Under Armour and Petsmart. Prior to his business career, Chip served as a U.S. Navy fighter pilot for 10 years, later retiring from the Naval Reserve with the rank of Commander. Mr. Molloy holds an MBA from the University of Virginia and a Bachelor of Science in Computer Science from the US Naval Academy. We believe that Mr. Molloy’s extensive executive and finance experience well qualifies him to serve on our Board. | |

Erin Nealy Cox | ||

|

Director, age 53

Ms. Nealy Cox has served on our Board of Directors since July 2021 and is a partner in the Government, Regulatory and Internal Investigations Group at Kirkland & Ellis. Ms. Nealy Cox is a trial attorney, cybersecurity expert and former federal prosecutor who served as an independent director on our Board from August 2016 to November 2017. She resigned from the Board when she was nominated and confirmed as the U.S. Attorney for the Northern District of Texas. Ms. Nealy Cox served in this role until January 2021.

Prior to her appointment as the U.S. Attorney, she served briefly in 2017 as a senior advisor at McKinsey & Co. in the consulting firm’s cybersecurity and risk practice. From 2008 to 2016 Ms. Nealy Cox was executive managing director at Stroz Friedberg, a cybersecurity and investigations consulting firm. She began her career serving as an Assistant U.S. Attorney for ten years in the Northern District of Texas. We believe that Ms. Nealy Cox’s executive management, cybersecurity and legal experience well qualifies her to serve on our Board. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

2023 Proxy Statement

2023 Proxy Statement

BOARD NOMINEE QUALIFICATIONS

SKILLS TABLE

The following table summarizes the key knowledge, skills and experience that qualifies each nominee for our Board of Directors.

| Name |

CEO/Senior Executive Experience Experience as subsidiary, |

Public Board Governance Experience as director on publicly- company. |

Independence Satisfy the independence requirements. |

Financial Expertise Possess the knowledge and to be qualified as an “audit committee financial expert.” |

International Operations Executive- level experience working in organization with global operations. |

Marketing; Merchandising; Sales Experience in a position marketing, merchandising function. |

Retail Operations Experience in a senior management position responsible for managing retail operations. |

Legal or Consulting Background |

Cybersecurity Experience, | |||||||||

| Paulonis | ✓ | ✓ |

|

✓ | ✓ | ✓ | ✓ | ✓ |

| |||||||||

| Bishop | ✓ |

|

✓ |

|

✓ | ✓ | ✓ | ✓ |

| |||||||||

| Boyer | ✓ | ✓ | ✓ | ✓ | ✓ |

|

✓ |

|

✓ | |||||||||

| Conroy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| |||||||||

| Ferguson | ✓ | ✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ |

| |||||||||

| Flur | ✓ | ✓ | ✓ | ✓ |

|

✓ | ✓ | ✓ |

| |||||||||

| Head | ✓ | ✓ | ✓ | ✓ | ✓ |

|

|

✓ |

| |||||||||

| Molloy | ✓ | ✓ | ✓ | ✓ | ✓ |

|

✓ |

|

| |||||||||

| Nealy Cox | ✓ | ✓ | ✓ |

|

✓ |

|

|

✓ | ✓ | |||||||||

www.sallybeautyholdings.com 15

BOARD NOMINEE DIVERSITY

|

Gender Identity | ||||||||

|

|

Female | Male | Non-Binary | Did Not Disclose | ||||

| Director Nominees (9) | 5 | 4 | — | — | ||||

|

Demographic Background

| ||||||||

| Asian, South Asian, Southeast Asian or East Asian | — | — | — | — | ||||

| Native Hawaiian or Pacific Islander | — | — | — | — | ||||

| Middle Eastern | — | — | — | — | ||||

| Black or African American | 1 | — | — | — | ||||

| Hispanic or Latino | — | — | — | — | ||||

| Native American or Alaskan Native | — | — | — | — | ||||

| White | 4 | 4 | — | — | ||||

| Multiracial or Biracial | — | — | — | — | ||||

| LGBTQ+ | 1 | |||||||

| Did Not Disclose Demographic Background | — | |||||||

2023 Proxy Statement

2023 Proxy Statement

CORPORATE GOVERNANCE,

THE BOARD AND ITS COMMITTEES

BOARD PURPOSE AND STRUCTURE

The Board oversees, counsels, and directs management in the long-term interests of the Company and our stockholders. The Board’s responsibilities include:

| • | providing strategic guidance to our management; |

| • | overseeing the conduct of our business and the assessment of our business and other enterprise risks to evaluate whether the business is being properly managed; |

| • | selecting, evaluating the performance of, and determining the compensation of the CEO and other executive officers; |

| • | planning for succession with respect to the position of CEO and monitoring management’s succession planning for other executive officers; and |

| • | overseeing the processes for maintaining our integrity with regard to our financial statements and other public disclosures, and compliance with law and ethics. |

CORPORATE GOVERNANCE PHILOSOPHY

We are committed to conducting our business in a way that reflects best practices and high standards of legal and ethical conduct. To that end, our Board of Directors has approved and oversees a comprehensive system of corporate governance policies and programs. These documents meet or exceed the requirements established by the NYSE listing standards and by the SEC and are reviewed periodically and updated as necessary under the guidance of our Nominating, Governance and Corporate Responsibility Committee to reflect changes in regulatory requirements and evolving oversight practices.

Because our Board is committed to corporate governance best practices, we are committed to integrating responsible sustainability and corporate responsibility initiatives into our operations and strategic business objectives.

www.sallybeautyholdings.com 17

BOARD DIVERSITY

We value boardroom diversity as integral to effective corporate governance. We believe that board diversity – gender, race, age, insight, background, personality, and professional experience – is a necessity that improves the quality of strategic decision-making and long-term vision, and represents the kind of company we aspire to be.

Over the past five years the Board has made meaningful efforts to diversify board membership, increasing the percentage of women on our Board from 22 percent to 56 percent if the current slate of Director Nominees is elected. In addition, last year we began disclosing the demographic background and gender identity of each director nominee. This enhanced diversity has strengthened board-level expertise in critical areas such as: consumer goods and global retailing; corporate financial management; strategic planning and transaction execution; data protection and cybersecurity; and integrated marketing, digital experience, e-commerce and mobile.

|

Our Board’s leadership by example on diversity continues to be recognized. In November 2023 the Company became a three-time winner of a “Corporate Champions” award, bestowed by the Women’s Forum of New York, which promotes gender parity and diversity on corporate boards. The Women’s Forum named SBH as a “50% Plus Corporate Champion”, the highest tier awarded for S&P 500 and Fortune 1000 companies with board seats held by women. In FY23 Women Inc. magazine named our female directors to their celebrated list of “Most Influential Corporate Board Directors.” In FY22 the National Association of Corporate Directors (NACD) named SBH director Dorlisa Flur to the prestigious 2022 NACD Directorship 100™, which honors “those who have demonstrated exemplary board leadership and innovation in corporate governance.” The NACD also named our Board as a nominee for a 2023 NACD NXT™ Recognition Award.

These awards showcase board expertise and practices that promote greater diversity and inclusion.

Under our Corporate Governance Guidelines, the Nominating, Governance and Corporate Responsibility Committee recommends to the Board criteria for selection of directors and reviews periodically with the Board the criteria adopted by the Board. Although the Guidelines do not contain a specific policy on diversity, the Board demonstrates – by its own diverse composition – its commitment to diversity and inclusion.

|

Our Board recognizes that they play a crucial role in setting the tone for the Company’s workplace culture. The Board has encouraged leaders to hire exceptional employees that bring diversity of thought that allows us to better anticipate the needs and concerns of our various customers. By hiring people with diverse voices, listening to them, and responding accordingly, we believe that we are taking the necessary steps to maintain our long-term sustainability.

2023 Proxy Statement

2023 Proxy Statement

SUSTAINABILITY

| PURPOSE AND VALUES Every aspect of our sustainability program is integrally tied to and reflects our company purpose and values. Our purpose and values reflect and emphasize our commitment to being a good corporate citizen and inspiring a more sustainable world. We are committed to reflecting our purpose and core values in everything we do, especially in our Diversity, Inclusion and Belonging (DIB), and sustainability focus areas of responsible supply chain and energy management.

Our DIB initiatives are our commitments to strive to create a world that is more colorful (diverse) and welcoming (inclusive), where people can be themselves and where diversity is beautiful. Our ESG initiatives are our commitments to being part of something bigger, and caring for our people, customers, communities, and planet.

GOVERNANCE Our Board of Directors believes that sustainability issues are essential to our Company’s long-term performance and value creation. The Board is committed to corporate governance best practices and to integrating responsible sustainability initiatives into our operations and strategic business objectives. |

|

Board and the Nominating, Governance and Corporate Responsibility Committee have oversight of the Company’s sustainability plan. On a quarterly basis, this committee receives updates on management’s execution of sustainability initiatives. On an annual basis, this committee advises on the long-term design of the Company’s sustainability program. In 2020, the Compensation and Talent Committee was delegated oversight authority over the Company’s diversity and inclusion programs and goals. The charters for both Committees are available at http://investor.sallybeautyholdings.com. We have not incorporated by reference into this Proxy Statement the information included on or linked from our website, and you should not consider it to be part of this Proxy Statement.

Management of sustainability-related projects is jointly led by our General Counsel, our Chief Transformation and Business Services Officer, and our Chief Human Resources Officer. Together they coordinate a cross-functional team of subject matter experts to drive sustainability. Management reports quarterly to and engages with the Board and its Committees regarding progress against our sustainability goals.

ETHICS CODE Our Company’s core values regarding corporate responsibility are reflected in our Code of Business Conduct and Ethics (“Ethics Code”), which is the standard of conduct that applies to all of our employees, officers and directors. The Ethics Code reflects the Board’s beliefs about how we should conduct ourselves individually and as a company, and includes the following core principles relating to corporate responsibility and sustainability matters: we intend to operate our business as a good corporate citizen; conduct operations with regard to the welfare of our employees and for the protection of the environment; and provide equal opportunity to all employees.

Our Ethics Code is available on our website at http://investor.sallybeautyholdings.com and is available in print to any person, without charge, upon written request to our Vice President of Investor Relations. We intend to disclose on our website any substantive amendment to, or waiver from, a provision of the Ethics Code that applies to our principal executive officer, our principal financial officer, our principal accounting officer, or persons performing similar functions.

www.sallybeautyholdings.com 19

Our sustainability strategy is informed by the SASB standards for specialty retailers and focuses primarily on the following six areas where we believe we can continue to have a material, meaningful impact: Human Capital; Diversity, Inclusion and Belonging; Philanthropy and Community Impact; Environmental Sustainability; Responsible Sourcing and Supply Chain; and Data Protection and Cybersecurity.

HUMAN CAPITAL

OUR PEOPLE AND PURPOSE Our Company’s purpose is “To inspire a more colorful, confident, and welcoming world.” Our purpose represents the impact that we intend to have in the world. We believe that the most immediate impact our Company can have is how we support, engage with and value our employees. At SBH, we deeply appreciate and care for our associates and believe they are a material and essential part of our global operations and strategy.

OUR CULTURE AND VALUES Our Company values are the beating heart of our Company, and they embody how we intend to live up to and achieve our purpose. Our five core values form the bedrock of our culture, and are reflected in our greatest asset – our people. Very simply, our values underscore SBH’s commitment to building a diverse, inclusive company by helping each associate experience a genuine sense of belonging. They embody a culture where each associate can bring their full selves to work, and where everyone contributes to the conversation. Where each employee inspires their team and their customers with their passion and knowledge. Where employees are empowered to make decisions, to deliver for our customers, and to take ownership of their growth and development through education, training, and leadership opportunities. Where we take care of each other, our communities, and the planet.

TALENT OVERSIGHT/GOVERNANCE Our Board has made oversight of talent and culture a priority through its Compensation and Talent Committee, which oversees the Company’s human resource strategies and initiatives on compensation and benefits, diversity and inclusion, and associate engagement and well-being. The Compensation and Talent Committee regularly receives updates from SBH senior management regarding diversity and inclusion, demographics, talent development, retention and turnover, employee engagement and succession planning.

2023 Proxy Statement

2023 Proxy Statement

Our key human capital management objectives are to retain, develop and recruit a diverse group of highly qualified and dynamic employees and leaders throughout the Company. At SBH, we intend that our talent oversight policies and programs will create an inclusive environment and empower everyone at SBH to contribute to and share responsibility for our Company’s success.

TALENT AND CAREER DEVELOPMENT SBH is committed to encouraging the growth, well-being and career development of our associates through various methods, including training events, continuous learning opportunities online, independent development plans, and education financial assistance.

| • | We offer employees a streamlined learning and development platform (“Thrive”), which is designed to onboard, upskill, and communicate with our employees by connecting them with relevant content. Thrive helps our employees facilitate their career and job competency growth. |

| • | We also have a variety of Leadership Development programs and training available to leaders (and potential leaders) at various levels throughout our field, supply chain and support center teams. |

| • | We have a comprehensive Performance Management process, which includes opportunities for employees to receive feedback and to design for themselves an Individual Development Plan, which is a tool designed to help each employee grow as an individual and as a professional, and strengthen leadership competencies and succession pipelines. |

| • | Through our Education Assistance Program we offer financial assistance either for professional certification programs or courses in pursuit of an associate’s, bachelor’s or graduate degree through an accredited institution. |

| • | We have partnered with an external mentoring partner to provide opportunities for our high-potential employees to help them personally grow and progress their careers. |

| • | Using subject matter experts, we have designed and launched various Academies within SBH to help support career growth and grow key job skills and competencies to ensure that we can train and retain talent in a competitive labor market. |

COMMUNICATION AND ENGAGEMENT SBH’s senior leadership team strives to maintain consistent communication and an open-door policy with our associates. We encourage dialogue and transparency on a regular basis. Ways in which we communicate with and hear back from our teams include:

| • | Company-wide Town Hall Meetings. These are held at least 4 times per year. Each Town Hall consists of business updates from our CEO and other senior leaders, followed by open-ended Q&A in an “Ask Me Anything” format. Functional leaders also conduct Town Halls with their teams to update on key strategies and to have team-building events. |

| • | Podcasts. Short informal discussions to update the entire workforce on the progress of key business initiatives. |

| • | Live Streams and Virtual Meetings. Our leaders engage with our dispersed field and supply chain teams through both formal updates and more informal live sessions using tools such as WebEx, Zoom and Facebook Live. |

| • | Summits. Both of our Sally and Beauty Systems Group teams have conducted summits with field leadership teams every fall for a number of years, usually at the beginning of our fiscal year. These summits include everything from leadership development to systems training to product knowledge showcases, and everything in between. More recently, we have had more cross-functional summits in our Corporate Support Center focused on marketing, social media, technology and E-Commerce. |

| • | Associate Engagement Survey. We conduct an annual engagement survey open to all our employees in the U.S. and Canada. This has also been recently extended to our LATAM and European employees. From this, we identify key themes, needs and actions to be taken across our different departments and groups. The survey is conducted anonymously by an independent third party and is structured to allow employees to voice any concerns, questions and expectations. Results of the survey (which are entirely anonymized) are pushed upwards through to leaders, allowing transparency to the views of both direct and indirect reports, as well as to other departments. Each department holds meetings to address and respond to questions or concerns and to set action plans/priorities for making improvements. |

www.sallybeautyholdings.com 21

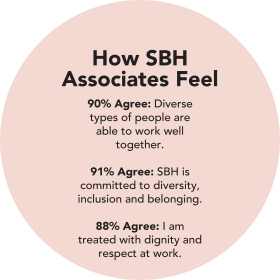

We continue to improve on our participation and build on our results from the previous year, detailed below from our FY23 engagement survey for SBH North America and Canada.

| • | Engagement on Diversity Issues. We continue to actively seek to engage with our employees globally on issues of diversity and inclusion. We use our engagement survey and other methods for our employees to tell us how we are doing and where and how we can improve. We are committed to listening to our employees about their experiences and concerns in this important area, and to responding with empathy and action in a responsible, proactive way. Over the last few years, we have conducted substantive, thoughtful training of SBH leaders and teams, focusing on building empathy and understanding of issues such as prejudice, discrimination, privilege, social identity, unconscious bias, use of preferred names and pronouns, and mental wellness. Over the past three years, we have provided a comprehensive set of e-learning training sessions, and the majority of new employees are required to take this training as part of their onboarding program. We also continue to design and implement a series of open dialogues between leaders and their teams about issues of Diversity, Inclusion, and Belonging (DIB). In the US/Canada, we also launched our first four Employee Resource Groups, providing resources and structure for the ERGs to implement strategies to drive initiatives for enhancing our culture, communication, community outreach, and commerce opportunities. These ERGs connect with our employees on a regular basis and are dedicated to supporting the community they support. Our company-wide Engagement Survey and dedicated DIB-focused Survey also provide all employees a voice on issues of diversity, inclusion and belonging, with questions specifically focused on those issues. |

2023 Proxy Statement

2023 Proxy Statement

| • | DIB/Inclusion: Our FY23 Engagement Survey continued to maintain the strong results shown in FY22. |

HEALTH, SAFETY, WELL-BEING SBH places a high value on the health, safety and well-being of our associates and this is reflected in our values and culture. As a company we evidence this commitment in many ways, including our compensation and benefits package; and our provision of safe, healthy working conditions.

| • | Compensation. Wage, Holiday, Leave Programs, Parental Leave: Our full-time employees receive vacation, sick time, 6 holidays and 3 floating holidays annually. SBH also provides medical leave for up to 6 weeks for all associates who do not otherwise qualify for leave under the U.S. Family and Medical Leave Act. In addition, we provide personal leave (up to 30 days) for employees who have been with SBH for at least 6 months with an average of 30 work hours per week. We recently added a paid parental leave program providing 6 weeks of fully paid leave for the birth, adoption or placement of a child. Bonuses and incentives: Our Annual Incentive Plan (AIP) provides annual incentive awards to participating associates based on company-wide sales and performance metrics established periodically by the Board. The AIP is designed to attract and retain key employees and motivate participants to achieve profitability and growth for our Company. We also provide a quarterly bonus program for field management teams – District Managers, Area Managers, Store Managers and Distribution Center Warehouse Managers and Supervisors. |

| • | Benefits. Healthcare and pension: SBH offers medical coverage, pharmacy coverage, telehealth coverage for minor medical needs, and preventive in-network care is covered 100% on all plans. Three medical plans are offered and the Company makes monthly contributions to each plan. We offer access to health and well-being resources through an employee assistance program and other resources. Beginning in 2022, many of these benefits – including fundamental medical benefits – were made available to our part-time associates. SBH also offers a 401(k) Retirement Savings Plan that gives employees an opportunity to save for retirement on a tax-advantaged basis, with company-funded match. Flexible working hours: we instituted a Flex Work Week Program at our Corporate Support Center and offer flexible scheduling in our distribution centers. Our stores also do their best to accommodate scheduling needs as much as possible. In our Corporate Support Center, we have instituted hybrid work arrangements for most positions, and expanded remote work opportunities based on the type of work performed. We will monitor and continue to evolve how this works over time. |

www.sallybeautyholdings.com 23

| • | Safe Working Conditions; Supplier Vendor Code of Conduct. We believe that every associate has the right to safe and humane working conditions and we require all our suppliers to understand and comply with our Supplier Code of Conduct. SBH values our partnerships with suppliers and vendors and understands the impact they can have on our associates. Thus, SBH has included rules governing their conduct, both with respect to expectations while interacting with our associates, and, with our foreign suppliers, assurances that they too are providing a safe and healthy working environment for their associates. Whistleblower Policy: We have an Employee Concern Line –operated by an independent company – which allows for complaints to be made securely and anonymously. To further strengthen the integrity and protections of this confidential reporting mechanism, complaints about any Vice President or above are reported to an independent ombudsperson. The Employee Concern Line is only one part of our broad-scope effort to provide employees with resources to safely deal with and report any harassment, discrimination, bullying, retaliation, etc. We have formalized these procedures in our Freedom from Discrimination and Harassment Policy and our SBH Cares Policy, each of which reflects our core values and is made available to all employees. Our Supplier Code of Conduct reflects our whistleblower policy; we require vendors and suppliers to provide their employees with whistleblower protection without fear of retaliation for calling attention to legal or ethical issues. Our commitment to the safety of our associates is also evidenced by our background check policy for new hires, training and policy communications related to handling both associate and customer incidents, partnerships to maintain the stores and make necessary repairs, as well as ongoing support in the field and at the Corporate Support Center. |

DIVERSITY, INCLUSION AND BELONGING

OUR VALUES At Sally Beauty Holdings we celebrate differences, inclusivity and self-expression. This fundamental aspect of SBH is rooted in our belief that beauty is for everyone and that everyone should find their own path to beauty.

Our employees and our customers care about celebrating diversity and self-expression. We want our company and our stores to be places where all of our employees and customers feel safe, valued for who they are, and experience a sense of belonging. We want to be aware of the importance of this issue – both internally with our employees and externally with customers and investors. Recently we provided the following signage for all our store locations:

Diversity, Inclusion and Belonging are core to our brand values and are at the heart of who we are as a Company – at the Board level, throughout our global workforce, and in our shared commitment to serving a diverse customer base and their communities.

OUR BOARD Our Board’s composition leads the Company’s commitment to Diversity, Inclusion and Belonging. Having diverse voices on our Board enhances the Board’s expertise, broadens its viewpoint, and sets the tone to

2023 Proxy Statement

2023 Proxy Statement

encourage leaders at all levels of the Company to listen to the concerns of our employees and customers alike. Our Compensation and Talent Committee provides regular hands-on oversight of our Diversity, Inclusion and Belonging initiatives. Our Board believes that listening to and understanding diverse voices is crucial to the Company’s success and long-term sustainability.

| OUR WORKFORCE One of our core values is “Be Yourself”, which to us means simply “Come as you are – everyone is welcome here.” Throughout our global workforce, this is something we take to heart and live out every day.

We are committed to fostering a diverse and inclusive workforce where everyone is welcome and each person can be authentic about who they are at work. We believe our culture of inclusion and acceptance fosters and directly enhances the diversity within our global workforce.

Our SBH team in the U.S. and Canada is over 90% women and over 48% racially/ethnically diverse. In 2019 and 2020, Forbes named our Company one of America’s Best Employers for Diversity. We recognize and celebrate the bedrock values of workforce diversity, inclusion, belonging and engagement within our teams. For us these are key drivers of the success of the business, as our associates should – and do – reflect the various qualities of our customers and what they desire and expect from SBH. To that end, we are committed to including a diverse slate of candidates for our job openings. |

|

OUR CUSTOMERS We have an incredibly diverse customer base that we serve in almost every community in the US, and we have an obligation to be accepting and inclusive of them and to serve them to our best ability. SBH customers span the entire continuum of gender, ethnic and economic diversity. We sell products to treat and style every kind of hair; we deliver a tailored assortment of beauty products that serve the local communities where our over 3,774 U.S. and Canadian stores are located. Serving the diverse demographics and needs of our customers drives a culture and workforce that embraces and reflects the communities we serve.

Some examples of customer-focused actions we have taken in the past few years include:

| • |

Our Beauty Systems Group segment launched its “MOVE Initiative,” which is focused on strengthening connections with textured hair-focused salons and stylists and the Black entrepreneurs that own those salons. |

| • |

For the last two years, we have hosted our “World of Texture Summit” with 8,200 stylists attending virtually. |

| • |

We have seen continued success with our accelerator program, Cultivate, which helps beauty entrepreneurs grow their business and has empowered female-owned beauty brands to bring their visions and business plans to life. Our most recent winner is LAMEL Makeup (founded by Natalia Iaromenko, CEO) – an international cosmetic brand. More information is available at www.sallybeauty.com/cultivate. |

| • |

April Holt, Group Vice President of Stores for Beauty Systems Group, was recently named “Corporate Ally of the Year” by Sadiaa Black Beauty Room & Awards! This award “recognizes an executive in the beauty, fashion and retail industries who has impacted beauty diversity, equity, and inclusion by providing groundbreaking education, resources, and marketing support. April was recognized “for the efforts she has led to bring more focus to textured hair and other relevant issues in the world of professional beauty.” |

www.sallybeautyholdings.com 25

MINORITY AND WOMEN-OWNED BRANDS SBH has a long history of partnering with women and minority-owned beauty brands, with SBH often providing their first major distribution point with a national or even international footprint. In the past year six minority-owned brands have launched new products that SBH distributes. As of the end of FY23, our assortment includes:

| • | 51 Female Owned or Founded Brands |

| • | 58 Black Owned or Founded Brands |

| • | 7 Hispanic Owned or Founded Brands |

| • | 16 Asian Owned or Founded Brands |

| • | 4 LGBTQ+ Owned or Founded Brands |

SBH intends to actively build off this legacy of success by maintaining and growing our assortment of minority and women owned or founded brands.

FY23 ACCOMPLISHMENTS In FY23, in addition to continuing many of the initiatives and programs already in place, we made progress on Diversity, Inclusion and Belonging in the following ways:

| • | We continued our multi-phase, year-round DIB leadership training focused on building an understanding of issues such as prejudice, discrimination, privilege, social identity, unconscious bias, preferred names and pronouns, and mental and emotional well-being, which were followed by leaders having open dialogues with their teams about these important issues. |

| • | We continued SBH’s Diversity, Inclusion and Belonging initiative, “One & All” communication campaigns on cultural awareness, providing short ‘10 minute’ chats to our field organization and introducing a quarterly DIB newsletter, sharing information and photographs |

| • | We established our first Employee Resource Groups (ERGs), which are associate-led groups organized around a common identity or passion. Our first four ERGs are Women, LGBTQ+, and Black and Hispanic associates. As we learn from our ERGs’ continuing work and interaction with the business, we plan to expand and add two additional ERGs later in the year. |

| • | We won the highly acclaimed Newsweek and Plant-A Insights Group 5-Star rating as one of America’s Greatest Workplaces for Diversity. |

| • | We continue to embed our DIB initiatives and strategies within our global LATAM and Sally Europe business units, adapting plans to accommodate local differences and measuring the impact. |

| • | In FY23, we improved our score again from 95 in 2022 to 100 out of 100 on the Human Rights Campaign’s annual Corporate Equality Index (CEI), which measures and rates workplaces based on LGBTQ+ equality with respect to policies and benefits. |

2023 Proxy Statement

2023 Proxy Statement

We will continue to develop and evolve how we enhance Diversity, Inclusion and Belonging throughout SBH. We recognize the value these initiatives bring to our Company, our associates, our customers and the communities we serve.

PHILANTHROPY AND COMMUNITY IMPACT

OUR VALUES We are guided in our philanthropy and volunteering strategy by our purpose and core values. To us this means we place a high value on sharing our passion with, and taking care of, our community and the planet. We are committed to positively impacting the growth and well-being of our associates, customers and the communities in which we live and work by supporting causes that reflect the passion of our associates and customers. We want our associates and customers to realize the power of taking action – as an individual and as a team – and how much change we can drive in the world from small actions that we choose to take together.

OUR PEOPLE SBH encourages employees to be aware of and involved in charitable works in their community. Our primary mechanism for accomplishing this has been our long-standing partnership with the United Way of Denton County in Denton, Texas where our Corporate Support Center is located. Currently we have one senior leader who sits on the local United Way Board of Directors. Each year we organize a pledge drive for employees and allow payroll deductions to be applied to the United Way or to another 501(c)(3)-qualified charity of their choice. And we organize other fundraising events to raise awareness and funds for the United Way.

OUR FOUNDATION In FY22, we established SBH Inspires Foundation to implement our charitable initiatives and facilitate ESG-related goals consistent with the company’s purpose, values and long-term vision. In FY23, we identified our core charitable cause: ending domestic violence and abuse, and supporting survivors. This decision is rooted in our commitment to engage, inspire and support our associates, customers and communities we serve.

It is our goal for the Foundation to have an immediate, meaningful impact that grows over time and partners with nonprofit organizations that work tirelessly to support the eradication of domestic violence and support of survivors. We partnered with two nonprofits, both locally and nationally, who have the expertise to support our philosophy, strategy and mission.

ACTIONS During FY23 we took the following steps to inspire our associates and customers, and to drive positive change through philanthropy:

| • | SBH Inspires Foundation: raised over $28,000 to support efforts against domestic violence and abuse. Continued developing the Foundation’s infrastructure and governance. |

| • | In-kind Product: donated over $60,000 of SBH product to local and national shelters supporting those in transition. |

| • | Employee Disaster Relief Fund: raised over $31,000 to assist Company employees impacted by hurricanes in Florida and Puerto Rico in 2022, and Maui fires in 2023. |

Going forward we will continue to develop and leverage the Foundation both to reflect and bring life to our purpose and values.

www.sallybeautyholdings.com 27

ENVIRONMENTAL SUSTAINABILITY

PURPOSE AND VALUES In FY23 we continued to build on the strong progress we have made to responsibly manage our environmental impact. This progress is consistent with our desire to inspire a more colorful, confident and welcoming world, and to ultimately be part of something bigger than ourselves. We believe we have a duty to take care of the communities in which we operate, and to take care of our planet. We will continue to focus on improving our long-term sustainability and reducing our environmental impact across our global footprint.

GOVERNANCE The Board and the Nominating, Governance and Corporate Responsibility Committee have strategic oversight over ESG matters and initiatives. Management of ESG-related projects is jointly led by our General Counsel, our Chief Transformation and Business Services Officer, and our Chief Human Resources Officer. Together they coordinate a cross-functional team of subject matter experts to drive sustainability. Management reports quarterly to and engages with the Board and its Committees regarding progress against our goals.

ACCOMPLISHMENTS In FY23, we continued to evolve our focus on our global sustainability efforts. Through our global cross-functional ESG Working Group, this year we focused on three key aspects of driving our sustainability across our global business: Own Brand - sustainable packaging; Own Brand - responsible supply chain and energy management; and Employee Engagement – educating employees about SBH’s global sustainable activities and creating interactive events on Earth Day.

Energy Management Progress:

| • | Retrofit 1650 stores with LED lights. The entire U.S. store fleet is now equipped with LED lighting. |

| • | Corporate Support Center (Denton, Texas): |

| • | Transitioned the interior lighting to LED. |

| • | Installed four EV charging stations. |

| • | Installed Energy Management System (EMS) modules on 500 U.S. and Canada store locations. These EMS modules provide centralized monitoring and remote adjustment of HVAC air and heating systems in our stores, reducing energy consumption, elongating lifecycle and reducing failure. |

| • | Mexico: retrofit 20 stores to LED technology; total of 190 (78%) stores with efficient equipment focused on energy reduction. Installed 50 new energy efficient HVAC inverter system units in stores. Testing an integrated facilities management solution in stores that targets maintenance labor efficiencies while reducing carbon emissions and lowering costs related to energy savings. |

Going forward we will continue to align environmental and sustainable initiatives with our purpose, values and core business strategies to create a more sustainable company across our global footprint. In FY23 we are planning to:

| • | Assess and better understand the data relating to our carbon footprint and to build out and refine our ESG strategy with a focus on sustainability; and |

| • | Identify sustainability opportunities and baseline measurements to inform our carbon neutrality commitments. |

2023 Proxy Statement

2023 Proxy Statement

RESPONSIBLE SOURCING AND SUPPLY CHAIN

At SBH we believe that we are part of something bigger, and have a responsibility to take care of our community and our planet; we want to look outside our company and seek out ways to contribute positively in the world. We believe that one way we can achieve our purpose and reflect core values in our global operations is to accelerate sustainability in product development, packaging and sourcing, and we are committed to doing that. We continue to make progress toward our long-term sustainability goals.

Our Merchandising and Sourcing teams are regularly in contact with our vendors and suppliers about using more sustainable, cleaner and greener products and packaging. We seek to lock arms with vendors on the approach to sustainability issues and products. All finished formulas in our owned-brand products are cruelty-free, i.e., not tested on animals. In addition, our Company strives to avoid product formulations that contain parabens and phthalates.

In FY20, we launched Inspired By Nature, a line of hair color and care under our Ion brand, that utilizes strict sustainability guidelines as it relates to packaging: hair color is filled in 100% recycled aluminum tubes; hair color caps are made from PCR; unit cartons for all hair color are produced with materials that are sourced from sustainably-managed forests; and hair care packaging is fully recyclable.

In Europe, we adopted new policies around eco-friendly owned brands development, and have (1) consistently altered packaging to sustainable solutions, and (2) offered products with eco-friendly ingredients and eco-friendly certification. We have also issued a “Green Magazine” to share our initiatives with outside stakeholders.

In Europe, we launched WUNDERBAR, a fully re-shaped Care and Styling range that includes sustainable packaging (plastic from the ocean), eco-friendly ingredients and eco-friendly certification.

| • | Launch of Sally Inspira social program with haircutting classes and courses that service vulnerable populations to develop new competencies and skills, allowing access to better job opportunities and supporting their economic independence. |

| • | Sally Beauty is the first retailer in Mexico to be certified by the Ministry of Labor and the Ministry of Education as a Haircolorist Evaluation Center to provide accredited education and diplomas to our associates. |

| • | Sally University bachelor´s degree education program was presented to the Ministry of Education and is under revision to obtain the official college accreditation by 2025. |

| • | In Latin America, we continue working to enhance our purpose and values, in FY23 we implemented our first engagement survey to better understand our culture, listen to our associates, measure our DIB progress and improve our engagement. |

Our commitment to sustained responsible sourcing and ethical practices throughout our supply chain is also reflected in our Supplier Code of Conduct and Code of Business Conduct and Ethics.

Our Supplier Code of Conduct (Supplier Code) applies to our vendors’ and suppliers’ business activities, including work performed through subcontractors. The Supplier Code requires suppliers to comply with our standards regarding “Ethical Sourcing” (e.g., forced labor, child labor, human trafficking, conflict minerals, land rights), “Employment Practices” (e.g., fair treatment, non-discrimination, wages and benefits, and freedom of association), and “Health and Safety” (e.g., occupational safety, occupational injury and illness, sanitation and housing).

In addition, we expect all suppliers to comply fully with all laws and regulations applicable to their business. Under our Supplier Code we may conduct an investigation or audit to confirm compliance and in some cases may terminate a business relationship due to non-compliance.

Our commitment to responsible sourcing and ethical business practices is also reflected in our Code of Business Conduct and Ethics (Ethics Code), which applies to all SBH employees. The Ethics Code makes clear that we intend to operate “with regard to the welfare of SBH employees and for the protection of the environment and the

www.sallybeautyholdings.com 29

general public.” Our Ethics Code requires employees to comply with our hazard communications program and to comply fully with all laws, rules and regulations affecting our business, including the national and local environmental and labor laws of our host nations and communities.

DATA PROTECTION AND CYBERSECURITY

Our Board of Directors understands the critical importance of managing evolving risks associated with cybersecurity threats. Our Company is committed to protecting the privacy and security of customer information and the integrity of our information technology systems.

The Board has responsibility for overseeing risks related to the cybersecurity threat landscape, including data protection and security breach readiness. Our Chief Information Security Officer (CISO) reports directly to the General Counsel. On at least a quarterly basis, the CISO delivers a detailed report to the full Board — including Erin Nealy Cox, a cybersecurity expert — on data protection and cybersecurity matters. The topics covered by these reports include risk identification and management strategies, cybersecurity strategy and governance structure, consumer data protection, the Company’s ongoing risk mitigation activities, learnings from data security incidents of peer companies, results of third-party assessments and testing, updates on annual associate training and other specific training initiatives.

We believe this accountability and reporting structure helps maintain the independence of the CISO while giving the Board direct and meaningful line-of-sight governance.

Numerous times per year, all employees receive simulated phishing attacks and are measured on how they interact with the attack and how quickly they report it. All employees participate in security awareness training throughout the year.

BOARD-LEVEL CYBERSECURITY EXPERTISE In FY22 Erin Nealy Cox was re-elected by Stockholders as an independent director of the Company’s Board. In January 2023 the Board appointed Ms. Nealy Cox Chair of the Nominating, Governance and Corporate Responsibility Committee. The addition of Ms. Nealy Cox strengthens the Board’s governance of cybersecurity matters and enhances overall Board-level subject-matter expertise and competency. Ms. Nealy Cox is a cybersecurity expert and former federal prosecutor with deep expertise in InfoSec issues and board governance. She is a partner at Kirkland & Ellis in their Government, Regulatory and Internal Investigations Group, and from 2003-2016 was executive managing director at Stroz Friedberg, a cybersecurity and investigation consulting firm, where she ultimately led the firm’s incident response business. In 2017 she served briefly as senior advisor to McKinsey & Co. in the firm’s cybersecurity and risk practice.

DIRECTOR INDEPENDENCE