UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31 , 2022

Commission File Number 001-33720

| State of Incorporation | IRS Employer Identification Number | |||||||||||||

Address, including zip code, of principal executive offices

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| ☑ | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of June 30, 2022, the aggregate market value of our voting and non-voting common equity held by non-affiliates was $43.7 million.

As of April 14, 2023, a total of 13,633,992 shares of our common stock were outstanding.

TABLE OF CONTENTS

| PART I | ||||||||

| Item 1. | Business | |||||||

| Item 1A. | Risk Factors | |||||||

| Item 1B. | Unresolved Staff Comments | |||||||

| Item 2. | Properties | |||||||

| Item 3. | Legal Proceedings | |||||||

| Item 4. | Mine Safety Disclosures | |||||||

| PART II | ||||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||||||

| Item 6. | Reserved | |||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

| Item 8. | Financial Statements and Supplementary Data | |||||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||||

| Item 9A. | Controls and Procedures | |||||||

| Item 9B. | Other Information | |||||||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |||||||

| PART III | ||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | |||||||

| Item 11. | Executive Compensation | |||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

| Item 13. | Certain Relationships and Related Transactions and Director Independence | |||||||

| Item 14. | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| Item 15. | Exhibits and Financial Statement Schedules | |||||||

| Exhibit Index | ||||||||

| Item 16. | Form 10-K Summary | |||||||

| Signatures | ||||||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The matters discussed in this Annual Report on Form 10-K (this “Form 10-K”) include “forward-looking statements” about the plans, strategies, objectives, goals or expectations of Remark Holdings, Inc. and subsidiaries (“Remark”, “we”, “us”, “our”). You will find forward-looking statements principally in the sections entitled Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations. Such forward-looking statements are identifiable by words or phrases indicating that Remark or management “expects,” “anticipates,” “plans,” “believes,” or “estimates,” or that a particular occurrence or event “will,” “may,” “could,” “should,” or “will likely” result, occur or be pursued or “continue” in the future, that the “outlook” or “trend” is toward a particular result or occurrence, that a development is an “opportunity,” “priority,” “strategy,” “focus,” that we are “positioned” for a particular result, or similarly-stated expectations. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report or such other report, release, presentation, or statement.

In addition to other risks and uncertainties described in connection with the forward-looking statements contained in this report and other periodic reports filed with the Securities and Exchange Commission (“SEC”), there are many important factors that could cause actual results to differ materially. Such risks and uncertainties include general business conditions, changes in overall economic conditions, our ability to integrate acquired assets, the impact of competition and other factors which are often beyond our control.

This should not be construed as a complete list of all of the economic, competitive, governmental, technological and other factors that could adversely affect our expected consolidated financial position, results of operations or liquidity. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial also may impair our business, operations, liquidity, financial condition and prospects. We undertake no obligation to update or revise our forward-looking statements to reflect developments that occur or information that we obtain after the date of this report.

PART I

ITEM 1. BUSINESS

OVERVIEW

Remark Holdings, Inc. and its subsidiaries (“Remark”, “we”, “us”, or “our”) constitute a diversified global technology business with leading artificial intelligence (“AI”) and data-analytics, as well as a portfolio of digital media properties.

Our innovative artificial intelligence (“AI”) and data analytics solutions continue to gain worldwide awareness and recognition through comparative testing, product demonstrations, media exposure, and word of mouth. We continue to see positive responses and increased acceptance of our software and applications in a growing number of industries. We intend to expand our business in three major regions, Asia-Pacific, North America, and Europe. The Asia-Pacific region has a fast-growth AI market with significant opportunities for our solutions. In North America, primarily in the United States, and in Europe, we see robust demand for AI products and solutions in a growing number of industries, including potential growth opportunities particularly in the workplace, schools, transportation and public safety markets. Despite such opportunities, the economic and geopolitical conditions, particularly in international markets, could adversely affect our business. We continue to pursue large business opportunities where we can quickly deploy our software solutions in the market segments we have identified, in which we may face a number of large, well-known competitors.

Our corporate headquarters and U.S. operations are based in Las Vegas, Nevada, and we also maintain operations in London, England and Chengdu, China. Our common stock, par value $0.001 per share, is listed on the Nasdaq Capital Market under the ticker symbol MARK.

On December 21, 2022, we effected a 1-for-10 reverse split of our common stock (the “Reverse Split”). All references made to share or per share amounts in this Form 10-K have been retroactively adjusted to reflect the effects of the Reverse Split.

OUR BUSINESS

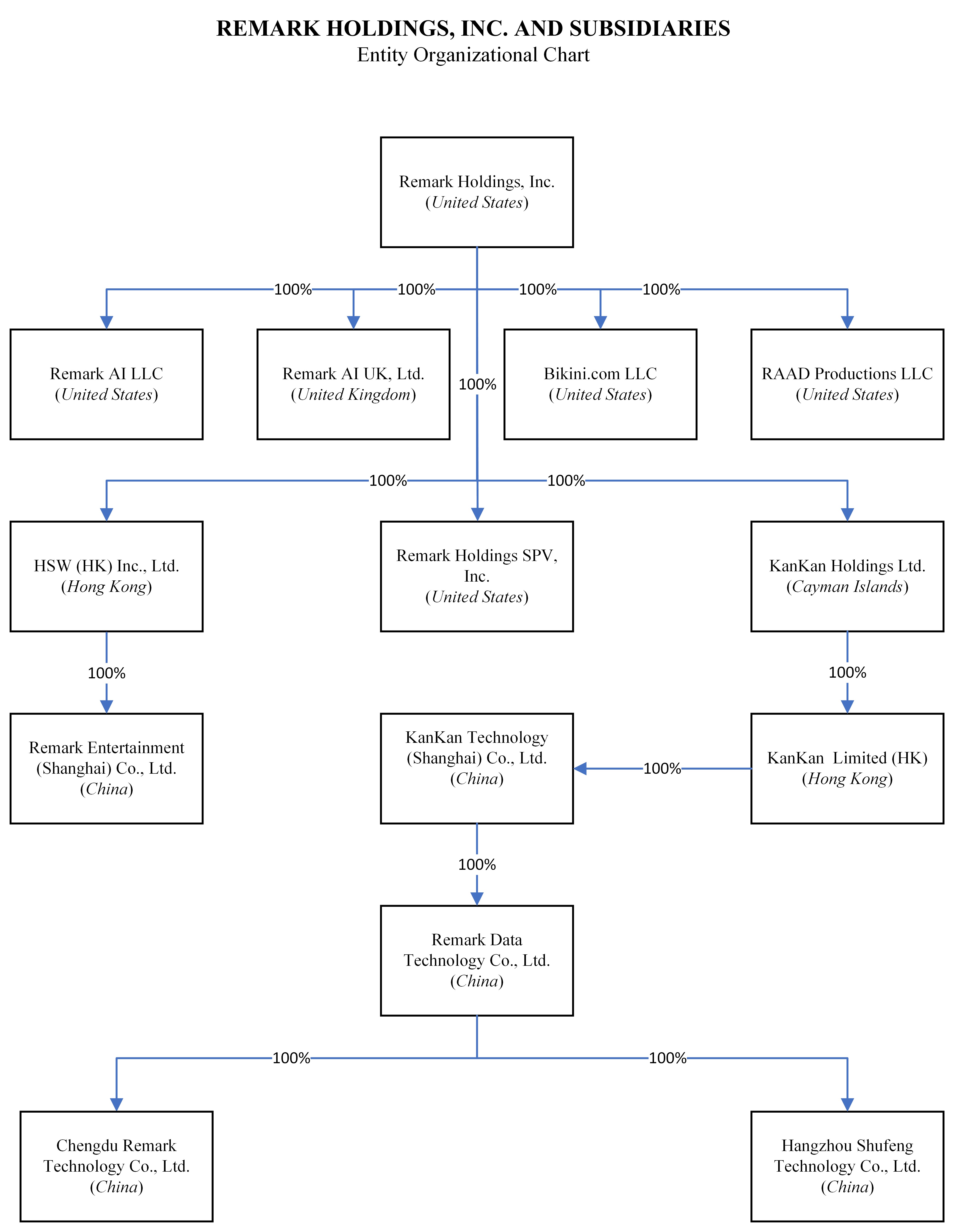

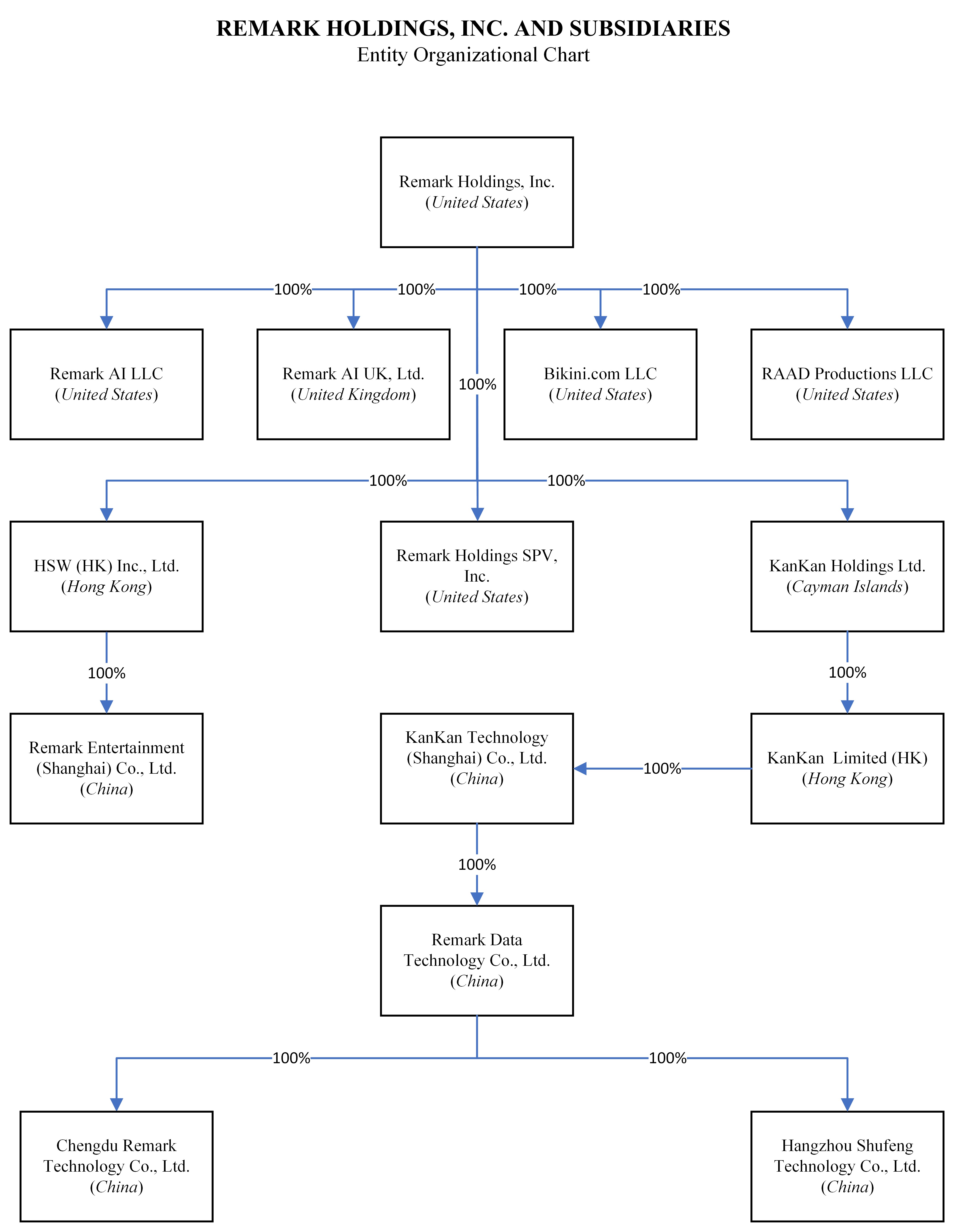

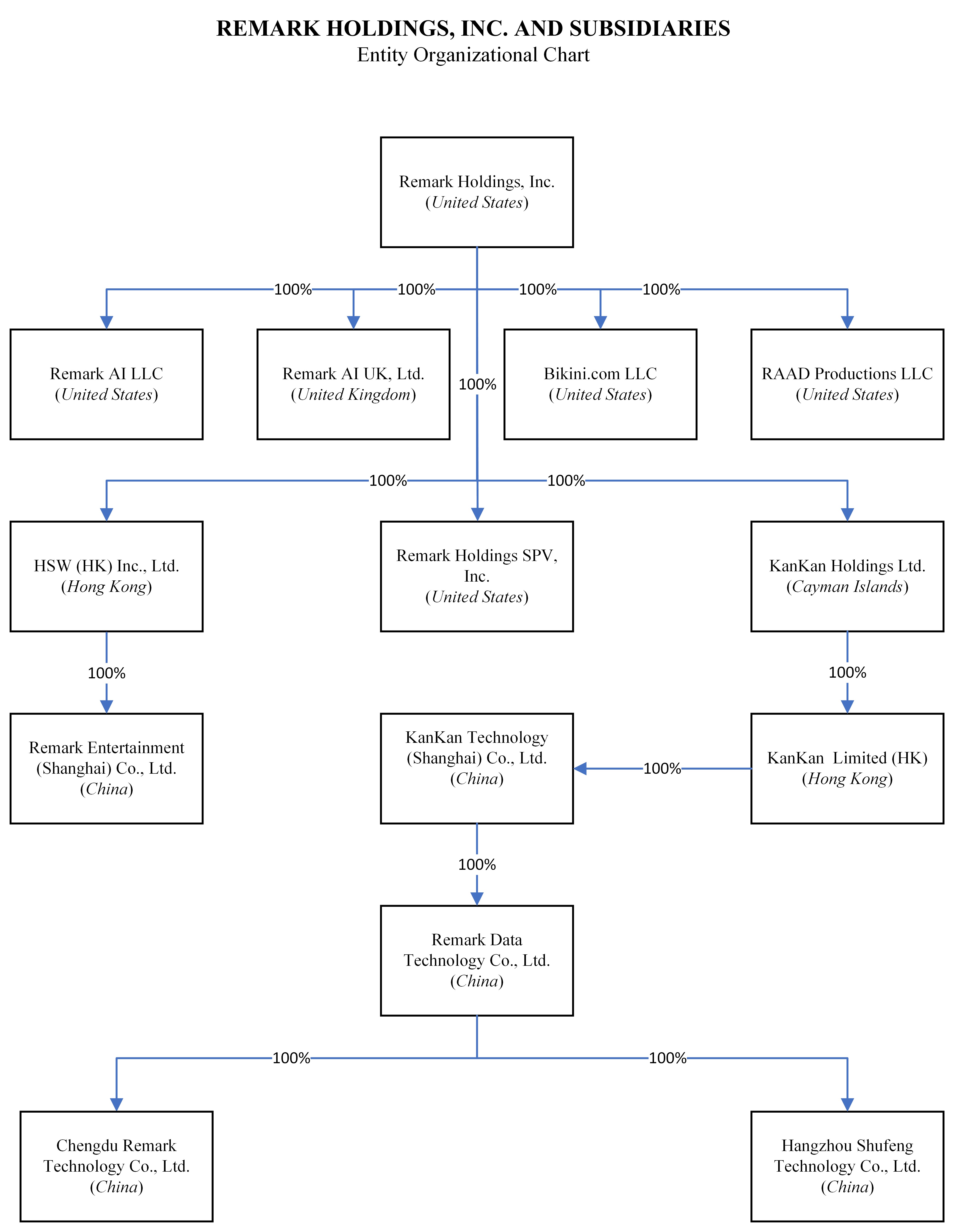

Corporate Structure

We are a holding company incorporated in Delaware and not a Chinese operating company. As a holding company, we conduct most of our operations through our subsidiaries, each of which is wholly owned. We have historically conducted a significant part of our operations through contractual arrangements between our wholly-foreign-owned enterprise (“WFOE”) and certain variable interest entities (“VIEs”) based in China to address challenges resulting from laws, policies and practices that may disfavor foreign-owned entities that operate within industries deemed sensitive by the Chinese government. We were the primary beneficiary of the VIEs because the contractual arrangements governing the relationship between the VIEs and our WFOE, which included an exclusive call option agreement, exclusive business cooperation agreement, a proxy agreement and an equity pledge agreement, enabled us to (i) exercise effective control over the VIEs, (ii) receive substantially all of the economic benefits of the VIEs, and (iii) have an exclusive call option to purchase, at any time, all or part of the equity interests in and/or assets of the VIEs to the extent permitted by Chinese laws. Because we were the primary beneficiary of the VIEs, we consolidated the financial results of the VIEs in our consolidated financial statements in accordance with generally accepted accounting principles (“GAAP”).

We terminated all of the contractual arrangements between the WFOE and the VIEs and exercised our rights under the exclusive call option agreements between the WFOE and the VIEs such that, effective as of September 19, 2022, we obtained 100% of the equity ownership of the entities we formerly consolidated as VIEs and which we now consolidate as wholly-owned subsidiaries.

The following diagram illustrates our corporate structure, including our significant subsidiaries, as of the date of this Form 10-K. The diagram omits certain entities which are immaterial to our results of operations and financial condition.

We are subject to certain legal and operational risks associated with having a significant portion of our operations in China. Chinese laws and regulations governing our current business operations, including the enforcement of such laws and regulations, are sometimes vague and uncertain and can change quickly with little advance notice. The Chinese government may intervene in or influence the operations of our China-based subsidiaries at any time and may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our securities. In addition, any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors and cause the value of such securities to

significantly decline or become worthless. In recent years, the Chinese government adopted a series of regulatory actions and issued statements to regulate business operations in China, including those related to the use of variable interest entities, cybersecurity, data security, export control and anti-monopoly concerns. As of the date of this Form 10-K, we have neither been involved in any investigations on cybersecurity review initiated by any Chinese regulatory authority, nor received any inquiry, notice or sanction. As of the date of this Form 10-K, no relevant laws or regulations in China explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) for any securities listing. As of the date of this Form 10-K, we have not received any inquiry, notice, warning or sanctions regarding our planned overseas listing from the CSRC or any other Chinese governmental authorities relating to securities listings. However, since these statements and regulatory actions are newly published, official guidance and related implementation rules have not all been issued. It is highly uncertain what potential impact such modified or new laws and regulations will have on our ability to conduct our business, accept investments or list or maintain a listing on a U.S. or foreign exchange.

As of the date of this Form 10-K, we are not required to seek permissions from the CSRC, the Cyberspace Administration of China (the “CAC”), or any other entity that is required to approve our operations in China. Nevertheless, Chinese regulatory authorities may in the future promulgate laws, regulations or implement rules that require us or our subsidiaries to obtain permissions from such regulatory authorities to approve our operations or any securities listing.

Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act (the “HFCA Act”) was enacted on December 18, 2020. The HFCA Act states that if the Securities and Exchange Commission (the “SEC”) determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the Public Company Accounting Oversight Board (the “PCAOB”) for three consecutive years beginning in 2021, the SEC shall prohibit such shares from being traded on a national securities exchange or in the over the counter trading market in the United States. On December 2, 2021, the SEC adopted amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in a foreign jurisdiction. The Consolidated Appropriations Act, 2023, which was signed into law on December 29, 2022, amended the HFCA Act to reduce the number of consecutive non-inspection years required to trigger the trading prohibition under the HFCA Act from three years to two years.

On December 16, 2021, the PCAOB issued a report on its determination that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong because of positions taken by Chinese and Hong Kong authorities in those jurisdictions.

On August 26, 2022, the CSRC, the Ministry of Finance of the PRC, and the PCAOB signed a Statement of Protocol, taking the first step toward opening access for the PCAOB to completely inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong.

On December 15, 2022, the PCAOB vacated its 2021 determination that the positions taken by authorities in mainland China and Hong Kong prevented it from inspecting and investigating completely registered public accounting firms headquartered in those jurisdictions. In view of the PCAOB’s decision to vacate its 2021 determination and until such time as the PCAOB issues any new adverse determination, the SEC has stated that there are no issuers at risk of having their securities subject to a trading prohibition under the HFCA Act. Each year, the PCAOB will reassess its determinations on whether it can inspect and investigation completely audit firms in China, and if, in the future, the PCAOB determines it cannot do so, or if Chinese authorities do not allow the PCAOB complete access for inspections and investigations for two consecutive years, companies engaging China-based public accounting firms would be delisted pursuant to the HFCA Act.

Our auditor, Weinberg & Company, an independent registered public accounting firm headquartered in the United States is currently subject to PCAOB inspections and has been inspected by the PCAOB on a regular basis. However, if the PCAOB is unable to inspect the work papers of our accounting firm in the future, such lack of inspection could cause trading in our common stock to be prohibited under the HFCA Act, and as a result, an exchange may determine to delist our common stock. The delisting and the cessation of trading of our common stock, or the threat of our common stock being delisted and prohibited from being traded, may materially and adversely affect the value of our common stock.

Business Model

We currently earn the majority of our revenue from sales of AI-based products and services. Excluding general and administrative expense, the primary costs we incur to earn the revenue described below include:

•software development costs, including licensing costs for third-party software

•cost of equipment related to customized AI products

•costs associated with marketing our brands

AI Business

We generate revenue by using the proprietary data and AI software platform we developed to deliver AI-based computer vision products, computing devices and software-as-a-service solutions for businesses in many industries. We continue to partner with top universities on research projects targeting algorithm, artificial neural network and computing architectures which we believe will keep us among the leaders in technology development.

The primary focus of our business is promoting and facilitating the safety of our customers and their customers through our Smart Safety Platform (the “SSP”). The SSP, having won numerous industry and government benchmark tests for accuracy and speed, is a leading software solution for using computer vision to detect persons, objects and behavior in video feeds. Real-time alerts from the SSP allow operations staff to respond rapidly to prevent any events or activities that can endanger public security or workplace safety.

We deploy the SSP to integrate with each customer’s IT infrastructure, including, in many cases, cameras already in place at the customer’s location(s). When necessary, we also sell and deploy hardware to create or supplement the customer’s monitoring capabilities. Such hardware includes, among other items, cameras, edge computing devices and/or our Smart Sentry units. The Smart Sentry is a large mobile camera unit with a telescoping mast on which a high-quality camera is mounted. Based upon customer needs, the camera may have either standard vision and/or thermal vision capability. The camera works in conjunction with an edge computing device that is also mounted to the unit. The Smart Sentry is an example of how we incorporate the SSP in modern IT architectural concepts, including edge computing and micro-service architectures. Edge computing, for example, allows the SSP to conduct expensive computing tasks at distributed locations without requiring large data transmission over the internet, thereby dramatically reducing costs while integrating numerous and varied sensors at distributed locations.

We customize and sell our innovative AI-based computer vision products and solutions, including the SSP, to customers in the retail, construction, public safety, workplace safety and public sector markets. We have also developed versions of our solutions for application in the transportation and energy markets.

Competition

We compete for business primarily on the basis of the quality and reliability of our products and services, and primarily in the AI marketplace, which is intensely competitive and rapidly evolving.

Our AI-based products and services represent a significant opportunity for us in the future. We offer AI products and we also build and deploy custom AI solutions. Our AI products compete with companies such as SenseTime, Face++, Google, GoGoVan, WeLab and others, while we compete with companies such as PricewaterhouseCoopers, Hewlett Packard, Baidu and others for business in the AI solutions market space.

Some of the companies we compete against, or may compete against in the future, may have greater brand recognition and may have significantly greater financial, marketing and other resources than we have. As a result of the potentially greater brand recognition and resources, some of our competitors may bring new products and services to market more quickly, and they may be able to adopt more aggressive pricing policies than we could adopt.

Intellectual Property

We rely upon trademark, copyright and trade secret laws in various jurisdictions, as well as confidentiality procedures and contractual provisions to protect our proprietary assets and brands. We own 33 copyright registrations and nine AI-related patents, with 27 AI-related patents pending in China.

Technology

Our technologies include software applications built to run on third-party cloud hosting providers including Amazon Web Services and Alibaba located in North America and Asia. We make substantial use of off-the-shelf available open-source technologies such as Linux, PHP, MySQL, Drupal, mongoDB, Memcache, Apache, Nginx, CouchBase, Hadoop, HBase, ElasticSearch, Lua, Java, Redis, Akka and Wordpress, in addition to commercial platforms such as Microsoft, including Windows Operating Systems, SQL Server, and .NET. Such systems are connected to the Internet via load balancers, firewalls, and routers installed in multiple redundant pairs. We also utilize third-party services to geographically deliver data using major content distribution network providers. We rely heavily on virtualization throughout our technology architecture, which enables the scaling of dozens of digital media properties in an efficient and cost-effective manner.

We use third-party cloud hosting providers to host most of our public-facing websites and applications, as well as many of our back-end business intelligence and financial systems. Each of our significant websites is designed to be fault-tolerant, with collections of application servers, typically configured in a load-balanced state, to provide additional resiliency. The infrastructure is equipped with enterprise-class security solutions to combat events such as large-scale distributed denial of service attacks. Our environment is staffed and equipped with a full-scale monitoring solution.

Governmental Regulation

The services we provide are subject to various laws and regulations. We are subject to a number of U.S. federal and state and foreign laws and regulations that affect companies conducting business on the Internet. These laws and regulations may involve privacy, rights of publicity, data protection, content regulation, intellectual property, competition, protection of minors, consumer protection, taxation or other subjects. Many of these laws and regulations are still evolving and being tested in courts and could be interpreted in ways that could harm our business. In addition, the application and interpretation of these laws and regulations often are uncertain, particularly in the new and rapidly evolving industry in which we operate. There are a number of legislative proposals pending before federal, state, and foreign legislative and regulatory bodies concerning data protection that may affect us. We incorporated the principles of the European Union (“EU”) General Data Protection Regulation (“GDPR”) into our internal data protection policy for our product development and solution implementation. In addition, we voluntarily hired an independent, authorized third party in Germany to conduct a GDPR audit of our privacy practices. The audit found that we are compliant with the GDPR principles.

We post our privacy policy and practices concerning the use and disclosure of any user data on our web properties and our distribution applications. Any failure by us to comply with posted privacy policies, federal and state regulatory requirements or foreign privacy-related laws and regulations could result in proceedings by governmental or regulatory bodies that could potentially harm our businesses, results of operations and financial condition.

Foreign data protection, privacy, and other laws and regulations can be more restrictive than those in the United States. The Chinese government has at times taken measures to restrict digital platforms, publishers or specific content themes from consumption by its citizens. We invest significant efforts into ensuring that our published content in China is consistent with our most current understanding of prevailing Chinese laws, regulations, and policies; and to date our published content in China has been met with successful distribution and no action or inquiry from the Chinese government. However, unforeseen regulatory restrictions or policy changes in China regarding digital content could have a material adverse effect on our business.

The Chinese government has not yet adopted a clear regulatory framework governing the new and rapidly-evolving artificial intelligence industry in which we operate. The Chinese government’s adoption of more stringent laws or enforcement protocols affecting participants in such industries (including, without limitation, restrictions on foreign investment, capital requirements and licensing requirements) could have a material adverse effect on our business.

Transfer of Cash or Assets

Dividend Distributions

As of the date of this Form 10-K, none of our subsidiaries have made any dividends or distributions to the parent company.

We have never declared or paid dividends or distributions on our common equity. We currently intend to retain all available funds and any future consolidated earnings to fund our operations and continue the development and growth of our business; therefore, we do not anticipate paying any cash dividends.

Under Delaware law, a Delaware corporation’s ability to pay cash dividends on its capital stock requires the corporation to have either net profits or positive net assets (total assets less total liabilities) over its capital. If we determine to pay dividends on any of our common stock in the future, as a holding company, we may rely on dividends and other distributions on equity from our subsidiaries for cash requirements, including the funds necessary to pay dividends and other cash contributions to our stockholders.

Our WFOE’s ability to distribute dividends is based upon its distributable earnings. Current Chinese regulations permit our WFOE to pay dividends to its shareholder only out of its registered capital amount, if any, as determined in accordance with Chinese accounting standards and regulations, and then only after meeting the requirement regarding statutory reserve. If our WFOE incurs debt in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us. Any limitation on the ability of our WFOE to distribute dividends or other payments to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business. In addition, any cash dividends or distributions of assets by our WFOE to its stockholder are subject to a Chinese withholding tax of as much as 10%.

The Chinese government also imposes controls on the conversion of Chinese Renminbi (“RMB”) into foreign currencies and the remittance of currencies out of China. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. If we are unable to receive all of the revenues from our operations through our China-based subsidiaries, we may be unable to pay dividends on our common stock.

Employees

We employed 88 people as of April 14, 2023, all of whom are full-time employees.

ADDITIONAL INFORMATION

We were originally incorporated in Delaware in March 2006 as HSW International, Inc., we changed our name to Remark Media, Inc. in December 2011, and as our business continued to evolve, we changed our name to Remark Holdings, Inc. in April 2017.

As soon as reasonably practicable after we electronically file such materials with, or furnish them to, the SEC, we provide free access through our website (www.remarkholdings.com) to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We do not incorporate any information found on our website into the materials we file with, or furnish to, the SEC; therefore, you should not consider any such information a part of any filing we make with the SEC. You may also obtain the reports noted above at the SEC’s website (www.sec.gov), which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information contained in this Form 10-K, including our consolidated financial statements and notes thereto, before deciding whether to invest in our common stock. Additional risks and uncertainties that we are unaware of may become important factors that affect us. If any of these risks actually occur, our business, financial condition or operating results may suffer, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risk Factor Summary:

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this summary. These risks include, among others, the following:

Risks Relating to Our Corporate Structure

•We have historically relied on contractual arrangements with the VIEs and their shareholders for a significant portion of our business operations. If the Chinese government determines that such contractual arrangements did not comply with Chinese regulations, or if these regulations change or are interpreted differently in the future, we could be subject to penalties, and our common stock may decline in value or even become worthless.

•Our contractual arrangements with the former VIEs may be subject to scrutiny by China’s tax authorities. Any adjustment of related party transaction pricing could lead to additional taxes, and therefore substantially reduce our consolidated net income and the value of your investment.

Risks Relating to Doing Business in China

•Changes in China’s economic, political, social or geopolitical conditions or in U.S.-China relations, as well as possible interventions and influences of any government policies and actions, could have a material adverse effect on our business and operations and the value of our common stock.

•Uncertainties with respect to the Chinese legal system could adversely affect us.

•We may be liable for improper use or appropriation of personal information provided by our customers and any failure to comply with Chinese laws and regulations over data security could result in materially adverse impact on our business, results of operations and the value of our common stock.

•Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or fully investigate our auditors, and as a result, Nasdaq may determine to delist our securities.

Risks Relating to Our Business and Industry

•The continuing impacts of COVID-19 are highly unpredictable and could be significant, and may have an adverse effect on our business and financial results.

•Laws and regulations concerning data privacy are continually evolving. Failure to comply with these laws and regulations could harm our business.

•Our continuous access to publicly-available data and to data from partners may be restricted, disrupted or terminated, which would restrict our ability to develop new products and services, or to improve existing products and services, which are based upon our AI platform.

•Our AI software and our application software are highly technical and run on very sophisticated third-party hardware platforms. If such software or hardware contains undetected errors, our AI solutions may not perform properly and our business could be adversely affected.

•The successful operation of our AI platform will depend upon the performance and reliability of the Internet infrastructure in China.

•Our outstanding senior secured loan agreements contain certain covenants that restrict our ability to engage in certain transactions and may impair our ability to respond to changing business and economic conditions.

•Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business.

•We may be subject to intellectual property infringement claims, which may force us to incur substantial legal expenses and, if determined adversely against us, materially disrupt our business.

•We face intense competition from larger, more established companies, and we may not be able to compete effectively, which could reduce demand for our services.

•If we do not effectively manage our growth, our operating performance will suffer and our financial condition could be adversely affected.

Risks Relating to our Company

•We have a history of operating losses and we may not generate sufficient revenue to support our operations.

•We may not have sufficient cash to repay our outstanding senior secured indebtedness.

•Our independent registered public accounting firm’s reports for the fiscal years ended December 31, 2022 and 2021 have raised substantial doubt regarding our ability to continue as a “going concern.”

•We continue to evolve our business strategy and develop new brands, products and services, and our future prospects are difficult to evaluate.

Risks Relating to Our Common Stock

•Our failure to meet the continued listing requirements of the Nasdaq Stock Market could result in a delisting of our common stock.

•Our stock price has fluctuated considerably and is likely to remain volatile, and various factors could negatively affect the market price or market for our common stock.

•Holders of our warrants will have no rights as a common stockholder until they exercise their warrants and acquire our common stock.

•The concentration of our stock ownership may limit individual stockholder ability to influence corporate matters.

•A significant number of additional shares of our common stock may be issued under the terms of existing securities, which issuances would substantially dilute existing stockholders and may depress the market price of our common stock.

•Provisions in our corporate charter documents and under Delaware law could make an acquisition of Remark more difficult, which acquisition may be beneficial to stockholders.

Risks Relating to Our Corporate Structure

We have historically relied on contractual arrangements with the VIEs and their shareholders for a significant portion of our business operations. If the Chinese government determines that such contractual arrangements did not comply with Chinese regulations, or if these regulations change or are interpreted differently in the future, we could be subject to penalties, and our common stock may decline in value or even become worthless.

Prior to the termination of our contractual arrangements with the VIEs, we relied on such contractual arrangements with the former VIEs to operate our business in China. The revenues contributed by the former VIEs constituted a majority of our total revenues for the fiscal years ended December 31, 2022 and 2021.

In recent years, the Chinese government adopted a series of regulatory actions and issued statements to regulate business operations in China, including those related to variable interest entities. These recent statements indicate an intent by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. As of the date of this Form 10-K, there are no relevant laws or regulations in China that prohibit our Company or any of our subsidiaries from listing or offering securities in the United States. However, official guidance and related implementation rules have not been issued. Future action taken by the Chinese government could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our common stock to significantly depreciate or become worthless. In addition, although we believe that our historical contractual arrangements with the former VIEs complied with applicable Chinese laws and regulations, the Chinese government may determine at any time that such contractual arrangements with the former VIEs did not apply with Chinese regulations, or such regulations may change or be interpreted differently in the future. If the Chinese government determines that our contractual arrangements with the former VIEs did not comply with Chinese regulations or if these regulations change or are interpreted differently in the future, we may be subject to penalties imposed by the Chinese government, and our common stock may decline in value or become worthless.

Our contractual arrangements with the former VIEs may be subject to scrutiny by China’s tax authorities. Any adjustment of related party transaction pricing could lead to additional taxes, and therefore substantially reduce our consolidated net income and the value of your investment.

The tax regime in China is rapidly evolving and there is significant uncertainty for Chinese taxpayers as Chinese tax laws may be interpreted in significantly different ways. China’s tax authorities may assert that we or the former VIEs or their shareholders are required to pay additional taxes on previous or future revenue or income. In particular, under applicable Chinese laws, rules and regulations, arrangements and transactions among related parties, such as the contractual arrangements with the former VIEs, may be subject to audit or challenge by China’s tax authorities. If China’s tax authorities determine that any contractual arrangements were not entered into on an arm’s length basis and therefore constitute a favorable transfer pricing, the China tax liabilities of the relevant subsidiaries, the former VIEs or the shareholders of the former VIEs could be increased, which could increase our overall tax liabilities. In addition, China’s tax authorities may impose interest on late payments. Our net income may be materially reduced if our tax liabilities increase. It is uncertain whether any new China laws, rules or regulations relating to VIE structures will be adopted or, if adopted, what they would provide.

If we or any of the former VIEs are found to be in violation of any existing or future China laws, rules or regulations, or if we fail to obtain or maintain any of the required permits or approvals, the relevant China regulatory authorities would have broad discretion to take action in dealing with these violations or failures, including revoking the business and operating licenses of the former VIEs, requiring us to discontinue or restrict our operations, restricting our right to collect revenue, blocking one or more of our websites, requiring us to restructure our operations or taking other regulatory or enforcement actions against us. The imposition of any of these measures could result in a material adverse effect on our ability to conduct all or any portion of our business operations. In addition, it is unclear what impact Chinese government actions would have on us and on our ability to consolidate the financial results of any of the former VIEs in our consolidated financial statements, if Chinese governmental authorities were to find our former corporate structure and historical contractual arrangements to be in violation of Chinese laws, rules and regulations. If the imposition of any governmental actions causes us to lose our right to direct the activities of any of the former VIEs or otherwise separate from any of these entities, and if we are not able to restructure our ownership structure and operations in a satisfactory manner, we would no longer be able to consolidate the financial results of the former VIEs in our consolidated financial statements. Any of these events would have a material adverse effect on our business, financial condition and results of operations.

Risks Relating to Doing Business in China

Changes in China’s economic, political, social or geopolitical conditions or in U.S.-China relations, as well as possible interventions and influences of any government policies and actions, could have a material adverse effect on our business and operations and the value of our common stock.

A significant portion of our operations are conducted through our China-based subsidiaries. Accordingly, our business, financial condition, results of operations and prospects may be influenced to a significant degree by political, economic, social conditions and government policies in China generally. The Chinese economy differs from the economies of most developed countries in many respects, including the level of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. The Chinese government also exercises significant control over China’s economic growth through allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, and providing preferential treatment to particular industries or companies.

While the Chinese economy has experienced significant growth over the past decades, growth has been uneven, both geographically and among various sectors of the economy. Any adverse changes in economic conditions in China, in the policies of the Chinese government or in the laws and regulations in China could have a material adverse effect on the overall economic growth of China. Such developments could adversely affect our business and operating results, lead to reduction in demand for our services and adversely affect our competitive position. The COVID-19 pandemic has had a severe and negative impact on the Chinese and global economy. In particular, the preventative measures in China as a result of the Chinese government’s “Zero-COVID” policy have significantly limited the operational capabilities of our China-based subsidiaries, caused a material adverse impact on our business and, though the preventative measures have been eased somewhat, may continue to have an adverse impact on our operations in China.

The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall Chinese economy, but may have a negative effect on us. In addition, in the past the Chinese government has implemented certain measures, including interest rate adjustment, to control the pace of economic growth. These measures may cause decreased economic activity in China, which may adversely affect our business and operating results.

Furthermore, we and our investors may face uncertainty about future actions by the government of China that could significantly affect the financial performance and operations of our China-based subsidiaries. Chinese laws and regulations, including the enforcement of such laws and regulations, can change quickly with little advance notice. The Chinese government may intervene or influence our operations at any time and may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our securities. As of the date of this Form 10-K, neither Remark nor any of its subsidiaries has received or was denied permission from Chinese authorities to list on U.S. exchanges or conduct U.S. securities offerings. However, there is no guarantee that we will receive or not be denied permission from Chinese authorities to list on U.S. exchanges or conduct U.S. securities offerings in the future. China’s economic, political and social conditions, as well as interventions and influences of any government policies, laws and regulations are uncertain and could have a material adverse effect on our business.

Uncertainties with respect to the Chinese legal system could adversely affect us.

The Chinese legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil law system may be cited for reference but have limited precedential value. Since these laws and regulations are relatively new and the Chinese legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and the enforcement of these laws, regulations and rules involves uncertainties.

In 1979, the Chinese government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly enhanced the

protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system, and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, the interpretation and enforcement of these laws and regulations involve uncertainties. Since Chinese administrative and court authorities have significant discretion in interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy. These uncertainties may affect our judgment on the relevance of legal requirements and our ability to enforce our contractual rights or tort claims. In addition, the regulatory uncertainties may be exploited through unmerited or frivolous legal actions or threats in attempts to extract payments or benefits from us.

Furthermore, the Chinese legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all and may have retroactive effect. As a result, we may not be aware of our violation of any of these policies and rules until sometime after the violation. In addition, any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources and management attention.

In addition, we are subject to risks and uncertainties of the interpretations and applications of Chinese laws and regulations, and any such interpretations and applications could lead to future actions of the Chinese government that are detrimental to us and/or our China-based subsidiaries, which would likely result in material adverse changes in our operations and cause the value of our common stock to potentially depreciate significantly or become worthless.

We may be liable for improper use or appropriation of personal information provided by our customers and any failure to comply with Chinese laws and regulations over data security could result in materially adverse impact on our business, results of operations and the value of our common stock.

Our business involves collecting and retaining certain internal and external data and information including that of our customers and suppliers. The integrity and protection of such information and data are crucial to us and our business. Owners of such data and information expect that we will adequately protect their personal information. We are required by applicable laws to keep strictly confidential the personal information that we collect, and to take adequate security measures to safeguard such information.

The PRC Criminal Law, as amended by its Amendment 7 (effective on February 28, 2009) and Amendment 9 (effective on November 1, 2015), prohibits institutions, companies and their employees from selling or otherwise illegally disclosing a citizen’s personal information obtained in performing duties or providing services or obtaining such information through theft or other illegal ways. On November 7, 2016, the Standing Committee of the PRC National People’s Congress issued the Cyber Security Law of the PRC (the “Cyber Security Law”), which became effective on June 1, 2017. Pursuant to the Cyber Security Law, network operators must not, without users’ consent, collect their personal information, and may only collect users’ personal information necessary to provide their services. Providers are also obliged to provide security maintenance for their products and services and shall comply with provisions regarding the protection of personal information as stipulated under the relevant laws and regulations.

The Civil Code of the PRC (issued by the PRC National People’s Congress on May 28, 2020 and effective from January 1, 2021) provides legal basis for privacy and personal information infringement claims under the Chinese civil laws. Chinese regulators, including the CAC, the Ministry of Industry and Information Technology, and the Ministry of Public Security, have been increasingly focused on regulation in data security and data protection.

On August 20, 2021, the Standing Committee of the 13th National People's Congress of China issued the final version of the Personal Information Protection Law (the “PIPL”), which became effective on November 1, 2021. The PIPL imposes on China-based data processers (such as our China-based subsidiaries) significant obligations with respect to, among other things, obtaining, processing and cross-border transferring personal information. The PIPL may subject a data processor to a penalty of as much as RMB50 million or 5% of the preceding year’s turnover.

The Chinese regulatory requirements regarding cybersecurity are evolving. For instance, various regulatory bodies in China, including the CAC, the Ministry of Public Security and the State Administration for Market Regulation, have enforced data privacy and protection laws and regulations with varying and evolving standards and interpretations.

In November 2021, the CAC and other related authorities released the amended Cybersecurity Review Measures which became effective on February 15, 2022. Under the amended Cybersecurity Review Measures:

•companies who are engaged in data processing are also subject to the regulatory scope;

•the CSRC is included as one of the regulatory authorities for purposes of jointly establishing the state cybersecurity review working mechanism;

•the operators (including both operators of critical information infrastructure and relevant parties who are engaged in data processing) holding more than one million users/users’ (which are to be further specified) individual information and seeking a listing outside China shall file for cybersecurity review with the Cybersecurity Review Office; and

•the risks of core data, material data or large amounts of personal information being stolen, leaked, destroyed, damaged, illegally used or transmitted to overseas parties and the risks of critical information infrastructure, core data, material data or large amounts of personal information being influenced, controlled or used maliciously shall be collectively taken into consideration during the cybersecurity review process.

As a result of the promulgation of the amended Cybersecurity Review Measures, we may become subject to enhanced cybersecurity review. Certain internet platforms in China have been reportedly subject to heightened regulatory scrutiny in relation to cybersecurity matters. As of the date of this Form 10-K, we have neither been subject to heightened regulatory scrutiny with respect to cybersecurity matters nor been informed by any Chinese governmental authority of any requirement that we file for a cybersecurity review. However, if we are deemed to be a critical information infrastructure operator or a company that is engaged in data processing and holds personal information of more than one million users, we could be subject to Chinese cybersecurity review.

As there remains significant uncertainty in the interpretation and enforcement of relevant Chinese cybersecurity laws and regulations, we could be subject to cybersecurity review, and if so, we may not be able to pass such review. In addition, we could become subject to enhanced cybersecurity review or investigations launched by Chinese regulators in the future. Any failure or delay in the completion of the cybersecurity review procedures or any other non-compliance with the related laws and regulations may result in fines or other penalties, including suspension of business, website closure, removal of our app from the relevant app stores, and revocation of prerequisite licenses, as well as reputational damage or legal proceedings or actions against us, which may have material adverse effect on our business, financial condition or results of operations. As of the date of this Form 10-K, we have neither been involved in any investigations on cybersecurity review initiated by the CAC or any other Chinese regulatory authority nor have we received any inquiry, notice or sanction in such respect. We believe that we are in compliance with the aforementioned regulations and policies that have been issued by the CAC.

On June 10, 2021, the Standing Committee of the National People’s Congress of China (the “SCNPC”) promulgated the PRC Data Security Law, which took effect on September 1, 2021. The PRC Data Security Law imposes data security and privacy obligations on entities and individuals carrying out data activities, and introduces a data classification and hierarchical protection system based on the importance of data in economic and social development, and the degree of harm it will cause to national security, public interests, or legitimate rights and interests of individuals or organizations when such data is tampered with, destroyed, leaked, illegally acquired or used. The PRC Data Security Law also provides for a national security review procedure for data activities that may affect national security and imposes export restrictions on certain data an information.

As of the date of this Form 10-K, we do not expect that the current Chinese laws on cybersecurity or data security or the PIPL would have a material adverse impact on our business operations. However, as uncertainties remain regarding the interpretation and implementation of these laws and regulations, we cannot assure you that we will comply with such regulations in all respects and we may be ordered to rectify or terminate any actions that are deemed illegal by regulatory authorities. We may also become subject to fines and/or other sanctions which may have material adverse effect on our business, operations and financial condition.

Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or fully investigate our auditors, and as a result, Nasdaq may determine to delist our securities.

The HFCA Act was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit such shares from being traded on a national securities exchange or in the over the counter trading market in the United States. On December 2, 2021, the SEC adopted amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in a foreign jurisdiction. The Consolidated Appropriations Act, 2023, which was signed into law on December 29, 2022, amended the HFCA Act to reduce the number of consecutive non-inspection years required to trigger the trading prohibition under the HFCA Act from three years to two years.

On December 16, 2021, the PCAOB issued a report on its determination that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong because of positions taken by Chinese and Hong Kong authorities in those jurisdictions.

On August 26, 2022, the CSRC, the Ministry of Finance of the PRC, and the PCAOB signed a Statement of Protocol, taking the first step toward opening access for the PCAOB to completely inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong.

On December 15, 2022, the PCAOB vacated its 2021 determination that the positions taken by authorities in mainland China and Hong Kong prevented it from inspecting and investigating completely registered public accounting firms headquartered in those jurisdictions. In view of the PCAOB’s decision to vacate its 2021 determination and until such time as the PCAOB issues any new adverse determination, the SEC has stated that there are no issuers at risk of having their securities subject to a trading prohibition under the HFCA Act. Each year, the PCAOB will reassess its determinations on whether it can inspect and investigation completely audit firms in China, and if, in the future, the PCAOB determines it cannot do so, or if Chinese authorities do not allow the PCAOB complete access for inspections and investigations for two consecutive years, companies engaging China-based public accounting firms would be delisted pursuant to the HFCA Act.

Our auditor, Weinberg & Company, an independent registered public accounting firm headquartered in the United States, is currently subject to PCAOB inspections and has been inspected by the PCAOB on a regular basis. However, if the PCAOB is unable to inspect the work papers of our accounting firm in the future, such lack of inspection could cause trading in our common stock to be prohibited under the HFCA Act, and as a result, an exchange may determine to delist our common stock. The delisting and the cessation of trading of our common stock, or the threat of our common stock being delisted and prohibited from being traded, may materially and adversely affect the value of our common stock.

These recent developments may result in prohibitions on the trading of our common stock on the Nasdaq Capital Market, if our auditors fail to meet the PCAOB inspection requirement in time.

Risks Relating to Our Business and Industry

The continuing impacts of COVID-19 are highly unpredictable and could be significant, and may have an adverse effect on our business and financial results.

The global outbreak of COVID-19 has impacted our business and could continue to have a significant impact on our business. The impact of COVID-19 on our business and future financial results could include, but may not be limited to:

•lack of revenue growth or decreases in revenue due to a lack of, or at least a decline in, customer demand and (or) deterioration in the credit quality of our customers;

•a significant increase in our need for external financing to maintain operations as a result of decreased revenue;

•significant decline in the debt and equity markets, thus impacting our ability to conduct financings on terms acceptable to us; and

•the rapid and broad-based shift to a remote working environment creates inherent productivity, connectivity, and oversight challenges. Preventative measures implemented by governmental authorities in China, such as travel restrictions, shelter-in-place orders and business closures, could significantly impact the ability of our employees and vendors to work productively. In addition, the changed environment under which we are operating could have an impact on our internal controls over financial reporting as well as our ability to meet a number of our compliance requirements in a timely or quality manner.

The extent of any ongoing impact of the pandemic on our business and financial results will depend largely on future developments, including the duration and severity of any outbreaks related to new variants of COVID-19, the length of the travel restrictions and business closures imposed by domestic and foreign governments, all of which can be highly uncertain and cannot be predicted. Though improving somewhat, the situation continues to evolve and additional impacts may arise that we are not aware of currently.

Laws and regulations concerning data privacy are continually evolving. Failure to comply with these laws and regulations could harm our business.

Our business involves collecting and retaining certain internal and external data and information including that of our customers and suppliers and third parties. The integrity and protection of such information and data are crucial to us and our business. Owners of such data and information expect that we will adequately protect their personal information. We are required by applicable privacy and data protection laws in the U.S. and internationally to keep strictly confidential the personal information that we collect, and to take adequate security measures to safeguard such information.

Our failure to comply with existing privacy or data protection laws and regulations could increase our costs, force us to change or limit the features of our AI solutions or result in proceedings or litigation against us by governmental authorities or others, any or all of which could result in significant fines or judgments against us, result in damage to our reputation, and result in negative effects on our financial condition and results of operations. Even if concerns raised by regulators, the media, or consumers about our privacy and data protection or consumer protection practices are unfounded, we could suffer damage to our reputation that causes significant negative effects on our financial condition and results of operations.

Privacy and data protection laws are rapidly changing and likely will continue to do so for the foreseeable future, which could have an impact on how we develop and customize our AI products and software. The growth and development of AI may prompt calls for more stringent consumer privacy protection laws that may impose additional burdens on companies such as ours. Any such changes would require us to devote legal and other resources to address such regulation.

For example, in the U.S., the California Consumer Privacy Act ("CCPA") became effective on January 1, 2020 and applies to processing of personal information of California residents. Other states, including Nevada, have enacted or are considering similar privacy or data protection laws that may apply to us. The U.S. government, including the Federal Trade Commission and the Department of Commerce, also continue to review the need for greater or different regulation over the collection of personal information and information about consumer behavior on the Internet and on mobile devices, and the U.S. Congress is considering a number of legislative proposals to regulate in this area. Various government and consumer agencies worldwide have also called for new regulation and changes in industry practices. For example, the GDPR became effective on May 25, 2018. GDPR would apply to us should we expand our AI business into member countries of the EU. Violations of the GDPR may result in significant penalties, and countries in the EU are still enacting national laws that correspond to certain portions of the GDPR.

Our continuous access to publicly-available data and to data from partners may be restricted, disrupted or terminated, which would restrict our ability to develop new products and services, or to improve existing products and services, which are based upon our AI platform.

The success of our AI-based solutions depends substantially on our ability to continuously ingest and process large amounts of data available in the public domain and provided by our partners, and any interruption to our free access to such

publicly-available data or to the data we obtain from our partners will restrict our ability to develop new products and services, or to improve existing products and services. While we have not encountered any significant disruption of such access to date, there is no guarantee that this trend will continue without costs. Public data sources may change their policies to restrict access or implement procedures to make it more difficult or costly for us to maintain access, and partners could decide to terminate our existing agreements with them. If we no longer have free access to public data, or access to data from our partners, our ability to maintain or improve existing products, or to develop new AI-based solutions may be severely limited. Furthermore, we may be forced to pay significant fees to public data sources or to partners to maintain access, which would adversely affect our financial condition and results of operations.

Our AI software and our application software are highly technical and run on very sophisticated third-party hardware platforms. If such software or hardware contains undetected errors, our AI solutions may not perform properly and our business could be adversely affected.

Our AI-based solutions and internal systems rely on software, including software developed or maintained internally or by third parties, that is highly technical and complex. In addition, our AI-based solutions and internal systems depend on the ability of such software to store, retrieve, process, and manage immense amounts of data. The software on which we rely has contained, and may now or in the future contain, undetected errors, bugs, or vulnerabilities. Some errors may only be discovered after the AI-based solution or application software has been released for external or internal use. Errors or other design defects within the software on which we rely may result in a negative experience for our customers, delay product introductions or enhancements, result in measurement or billing errors, or compromise our ability to protect our customers’ data or our intellectual property. Any errors, bugs, or defects discovered in the software on which we rely could result in damage to our reputation, loss of users, loss of revenue, or liability for damages, any of which could adversely affect our business and financial results.

The successful operation of our AI platform will depend upon the performance and reliability of the Internet infrastructure in China.

The successful operation of KanKan will depend on the performance and reliability of the Internet infrastructure in China. Almost all access to the Internet is maintained through state-owned telecommunication operators under the administrative control and regulatory supervision of the Ministry of Industry and Information Technology of China. In addition, the national networks in China are connected to the Internet through state-owned international gateways, which are the only channels through which a domestic user can connect to the Internet outside of China. We may not have access to alternative networks in the event of disruptions, failures or other problems with China’s Internet infrastructure. In addition, the Internet infrastructure in China may not support the demands associated with continued growth in Internet usage.

The failure of telecommunications network operators to provide us with the requisite bandwidth could also interfere with the speed and availability of KanKan. We have no control over the costs of the services provided by the national telecommunications operators. If the prices that we pay for telecommunications and Internet services rise significantly, our gross margins could be adversely affected. In addition, if Internet access fees or other charges to Internet users increase, our user traffic may decrease, which in turn may cause a decrease in our revenues.

Our outstanding senior secured loan agreements contain certain covenants that restrict our ability to engage in certain transactions and may impair our ability to respond to changing business and economic conditions.

On December 3, 2021, we entered into senior secured loan agreements (the “Original Mudrick Loan Agreements”) with certain of our subsidiaries as guarantors (the “Guarantors”) and certain institutional lenders affiliated with Mudrick Capital Management, LP (collectively, “Mudrick”), pursuant to which the Mudrick extended credit to us consisting of term loans in the principal amount of $30.0 million (the “Original Mudrick Loans”). On March 14, 2023, we entered into a Note Purchase Agreement with Mudrick (the “New Mudrick Loan Agreement”) pursuant to which all of the Original Mudrick Loans were cancelled in exchange for new notes payable to Mudrick (the “New Mudrick Notes”). The New Mudrick Notes require us to satisfy various covenants, including restrictions on our ability to engage in certain transactions without Mudrick’s consent, and may limit our ability to respond to changing business and economic conditions. The restrictions include, among other things, limitations on our ability and the ability of our subsidiaries to:

•change its name or corporate form or jurisdiction of organization;

•merge with another entity (other than an affiliate of Mudrick),consolidate, or sell or dispose of any material portion of our assets;

•sell, lease, license, convey, assign (by operation of law or otherwise), exchange or otherwise voluntarily or involuntarily transfer or dispose of any interest in any of its assets (other than upon receipt of fair consideration for obsolete assets, trade-ins and disposition, sales or licenses in the ordinary course of business) or any portion thereof or encumber, or hypothecate, or create, incur or permit to exist any pledge, mortgage, lien, security interest, charge, encumbrance or adverse claim upon or other interest in or with respect to any of its assets (other than permitted liens); and

•directly or indirectly enter into or permit to exist any transaction with any of our affiliates (other than a wholly-owned subsidiary).

Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business.

We regard our copyrights, service marks, trademarks, trade secrets and other intellectual property as critical to our success. Unauthorized use of our intellectual property by third parties may adversely affect our business and reputation. We rely on trademark and copyright law, trade secret protection and confidentiality agreements with our employees, customers, business partners and others to protect our intellectual property rights. Despite our precautions, it is possible for third parties to obtain and use our intellectual property without authorization. Furthermore, the validity, enforceability and scope of protection of intellectual property in Internet related industries are uncertain and still evolving. In particular, the laws of the People’s Republic of China are uncertain or do not protect intellectual property rights to the same extent as do the laws of the United States. Moreover, litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of the proprietary rights of others. Future litigation could result in substantial costs and diversion of resources.

We may be subject to intellectual property infringement claims, which may force us to incur substantial legal expenses and, if determined adversely against us, materially disrupt our business.

We cannot be certain that our brands and services will not infringe valid patents, copyrights or other intellectual property rights held by third parties. We cannot provide assurance that we will avoid the need to defend against allegations of infringement of third-party intellectual property rights, regardless of their merit. Intellectual property litigation is very expensive, and becoming involved in such litigation could consume a substantial portion of our managerial and financial resources, regardless of whether we win. Substantially greater resources may allow some of our competitors to sustain the cost of complex intellectual property litigation more effectively than us; we may not be able to afford the cost of such litigation.

Should we suffer an adverse outcome from intellectual property litigation, we may incur significant liabilities, we may be required to license disputed rights from third parties, or we may have to cease using the subject technology. If we are found to infringe upon third-party intellectual property rights, we cannot provide assurance that we would be able to obtain licenses to

such intellectual property on commercially reasonable terms, if at all, or that we could develop or obtain alternative technology. If we fail to obtain such licenses at a reasonable cost, such failure may materially disrupt the conduct of our business, and could consume substantial resources and create significant uncertainties. Any legal action against us or our collaborators could lead to:

•payment of actual damages, royalties, lost profits, potentially treble damages and attorneys’ fees if we are found to have willfully infringed a third party’s patent rights;

•injunctive or other equitable relief that may effectively block our ability to further develop, commercialize and sell our products;

•us or our collaborators having to enter into license arrangements that may not be available on commercially acceptable terms, if at all; or

•significant cost and expense, as well as distraction of our management from our business.

The negative outcomes discussed above could adversely affect our ability to conduct business, financial condition, results of operations and cash flows.

We face intense competition from larger, more established companies, and we may not be able to compete effectively, which could reduce demand for our services.

The market for the services we offer is increasingly and intensely competitive. Nearly all our competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we do. Our competitors may secure more favorable revenue arrangements with advertisers, devote greater resources to marketing and promotional campaigns, adopt more aggressive growth strategies and devote substantially more resources to website and systems development than we do. In addition, the Internet media and advertising industries continue to experience consolidation, including the acquisitions of companies offering travel and finance-related content and services and paid search services. Industry consolidation has resulted in larger, more established and well-financed competitors with a greater focus. If these industry trends continue, or if we are unable to compete in the Internet media and paid search markets, our financial results may suffer.

Additionally, larger companies may implement policies and/or technologies into their search engines or software that make it less likely that consumers can reach our websites and less likely that consumers will click-through on sponsored listings from our advertisers. The implementation of such technologies could result in a decrease in our revenues. If we are unable to successfully compete against current and future competitors, our operating results will be adversely affected.

If we do not effectively manage our growth, our operating performance will suffer and our financial condition could be adversely affected.