Q1 2024 Financial Results Update May 1, 2024 1

PROPRIETARY AND CONFIDENTIAL 2 Q1 2024 Update Introduction

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including statements regarding the future performance of the Company or any of our businesses, our business strategy, future operations, future financial position, future revenues and earnings, our ability to achieve the objectives of our restructuring initiatives, including our future results, projected costs, prospects, plans and objectives of management, are forward-looking statements. We generally identify forward-looking statements by using words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “goal,” “intend,” “may,” “plan,” “position,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements. Forward-looking statements are based on our current intentions, beliefs and expectations regarding future events based on information that is currently available. We cannot guarantee that any forward-looking statement will be accurate. Readers should realize that if underlying assumptions prove inaccurate or if known or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Readers are, therefore, cautioned not to place undue reliance on any forward-looking statement contained herein. Any such forward-looking statement speaks only as of the date of this presentation, and, except as required by law, we do not undertake any obligation to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including, among others, the availability of USG funding for contracts related to procurement of our medical countermeasure ("MCM") products, including CYFENDUS® (Anthrax Vaccine Adsorbed (AVA), Adjuvanted), BioThrax® (Anthrax Vaccine Adsorbed) and ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), among others, as well as contracts related to development of medical countermeasures; the availability of government funding for our other commercialized products, including EbangaTM (ansuvimab-zykl), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F,G)-(Equine)) and RSDL® (Reactive Skin Decontamination Lotion Kit); our ability to meet our commitments to quality and compliance in all of our manufacturing operations; our ability to negotiate additional USG procurement or follow-on contracts for our MCM products that have expired or will be expiring; the commercial availability and acceptance of over-the-counter NARCAN® (naloxone HCl) Nasal Spray; the impact of the generic marketplace on NARCAN® (naloxone HCI) Nasal Spray and future NARCAN® sales; our ability to perform under our contracts with the USG, including the timing of and specifications relating to deliveries; our ability to provide Bioservices for the development and/or manufacture of product and/or product candidates of our customers at required levels and on required timelines; the ability of our contractors and suppliers to maintain compliance with current good manufacturing practices and other regulatory obligations; our ability to negotiate further commitments related to the collaboration and deployment of capacity toward future commercial manufacturing under our existing Bioservices contracts; our ability to collect reimbursement for raw materials and payment of services fees from our Bioservices customers; the results of pending stockholder litigation and government investigations and their potential impact on our business; our ability to comply with the operating and financial covenants required by our senior secured credit facilities and the amended and restated credit agreement relating to such facilities, as amended from time to time, as well as our 3.875% Senior Unsecured Notes due 2028; our ability to maintain adequate internal control over financial reporting and to prepare accurate financial statements in a timely manner; our ability to resolve the going concern qualification in our consolidated financial statements and otherwise successfully manage our liquidity in order to continue as a going concern; the procurement of our product candidates by USG entities under regulatory authorities that permit government procurement of certain medical products prior to FDA marketing authorization, and corresponding procurement by government entities outside of the United States; our ability to realize the expected benefits of the sale of our travel health business to Bavarian Nordic; the impact of the organizational changes we announced in January 2023 and August 2023; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; the impact of cyber security incidents, including the risks from the unauthorized access, interruption, failure or compromise of our information systems or those of our business partners, collaborators or other third parties; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. Readers should consider this cautionary statement, as well as the risks identified in our periodic reports filed with the Securities and Exchange Commission, when evaluating our forward-looking statements. Trademarks Emergent®, BioThrax®, RSDL®, BAT®, Anthrasil®, CNJ-016®, ACAM2000®, NARCAN®, CYFENDUS®, TEMBEXA® and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners. 3 Safe Harbor Statement/Trademarks INTRODUCTION

Agenda 4 Q1 2024 Update INTRODUCTION Presenter Topic(s) Joseph C. Papa President and CEO • Transformation Plan Update Rich Lindahl EVP, CFO and Treasurer • Q1 2024 Financial Review • FY 2024 and Q2 2024 Guidance Joseph C. Papa President and CEO • Driving Profitable, Sustainable Long-Term Growth • Closing Remarks Q&A

PROPRIETARY AND CONFIDENTIAL Q1 2024 Update Transformation Plan Update Joseph C. Papa President and Chief Executive Officer 55

Transformation Plan Update 6 Transformation Plan Update Multi-year plan to stabilize, turnaround and transform. • Our mission is unchanged Q1 stabilization efforts and priorities: Continued focus on MCM and NARCAN® Nasal Spray as core business drivers • Strengthened engagement with U.S. government customer stakeholders • Clarity gained on anthrax procurement levels • New MCM contract awards and orders from the USG & DOD throughout 2024 ◦ VIGIV, BAT and ACAM2000 • Solid performance across public interest and retail channels for NARCAN® Nasal Spray Sharpened strategy on future growth drivers • Created and added new Chief Science Officer role, reporting to CEO • Refreshed LCM initiatives over 2+ years • 2024 catalysts and future drivers meets customer and patient needs Leading with integrity through a culture of quality and compliance across our enterprise. Addressed debt repayment; improved operating performance and profitability • Significant restructuring efforts • Reorganization expected to yield annualized savings of ~$80 million • Reduction in workforce (~300 filled roles) • New bank amendment executed on April 29 provides incremental runway to execute go-forward plan • Initiated efforts to divest certain products/ sites; already received multiple offers on one of our smaller sites

Rich Lindahl Executive Vice President and Chief Financial Officer Q1 2024 Update Financials

Key Financial Performance Metrics Q1 2024 vs. Q1 20231 8 Total Revenues Adjusted EBITDA2 Adjusted Net Income (Loss)2 FINANCIALS ($ in millions) Q1 2023 Q1 2024 1. All financial information incorporated within this presentation is unaudited. 2. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. $300.4 $164.3 Q1 2023 Q1 2024 Q1 2023 Q1 2024 Q1 2023 Q1 2024 Q1 2023 Q1 2024 $66.9 $(101.5) $31.1 $(163.5) $148.0 $7.2 5%51% Total Segment Adjusted Gross Margin2 --- Total Segment Adjusted Gross Margin %2

Notable Revenue Elements Q1 2024 vs. Q1 20231 9 FINANCIALS 1.All financial information incorporated within this presentation is unaudited. 2. Product sales, net are reported net of variable consideration including returns, rebates, wholesaler fees and prompt pay discounts in accordance with U.S. generally accepted accounting principles. ($ in millions) Q1 2024 Q1 2023 % Change Product sales, net (2): NARCAN® $ 118.5 $ 100.4 18 % Other Commercial Products — 5.8 (100) % Anthrax MCM 55.9 21.9 155 % Smallpox MCM 50.2 7.2 * Other Products 49.3 8.1 * Total Product sales, net $ 273.9 $ 143.4 91 % Bioservices: Services $ 18.3 $ 12.6 45 % Leases 0.2 1.8 (89) % Total Bioservices revenues $ 18.5 $ 14.4 28 % Contracts and grants $ 8.0 $ 6.5 23 % Total revenues $ 300.4 $ 164.3 83 % * % change is greater than +/- 200%

Key Financial Performance Metrics Q1 2024 vs. Q1 2023 1 10 SG&A $ --- SG&A Margin %2 FINANCIALS ($ in millions) 1.All financial information incorporated within this presentation is unaudited. 2. SG&A Margin is calculated as Gross SG&A Expense divided by total revenues. Q1 2023 Q1 2023 Q1 2023 Q1 2023 Q1 2023 Q1 2024 Q1 2024 Q1 2024 Q1 2024 Q1 2024 $15.1 $40.7 $84.7 $101.3 62%28% Cost of Commercial Product Sales Cost of MCM Product Sales Cost of Bioservices R&D $ Q1 2024 Q1 2023 $52.1 $45.8 $62.2 $55.4 $30.3 $51.7

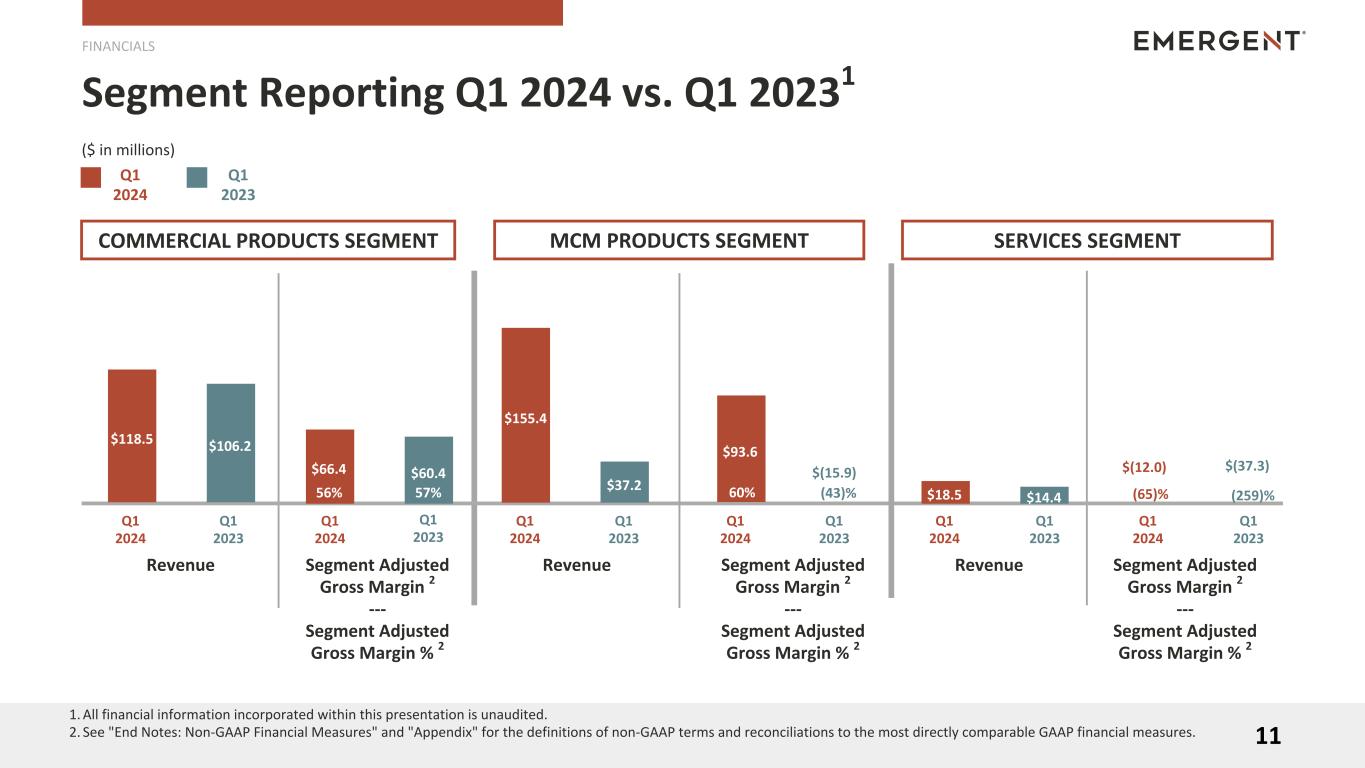

Segment Reporting Q1 2024 vs. Q1 20231 11 Revenue Segment Adjusted Gross Margin 2 --- Segment Adjusted Gross Margin % 2 Segment Adjusted Gross Margin 2 --- Segment Adjusted Gross Margin % 2 Revenue FINANCIALS ($ in millions) COMMERCIAL PRODUCTS SEGMENT MCM PRODUCTS SEGMENT 1.All financial information incorporated within this presentation is unaudited. 2. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. Q1 2023 Q1 2024 $118.5 $106.2 Q1 2023 $66.4 $60.4 Q1 2023 Q1 2023 Q1 2023 Q1 2024 Q1 2024 Q1 2024 $155.4 $37.2 Q1 2024 57%56% (43)% Segment Adjusted Gross Margin 2 --- Segment Adjusted Gross Margin % 2 Revenue SERVICES SEGMENT $18.5 $14.4 Q1 2023 Q1 2023 Q1 2024 Q1 2024 $(37.3)$(12.0) (259)%(65)% $93.6 $(15.9) 60%

Balance Sheet & Cash Flow Metrics 12 FINANCIALS As of March 31, 2024 For the Three Months Ended March 31, 2024 CASH $78.5 ACCOUNTS RECEIVABLE, NET $233.5 TOTAL DEBT $909.2 NET DEBT1,2, 3 $830.7 OPERATING CASH FLOW $(62.6) CAPITAL EXPENDITURES $10.8 ($ in millions) 1.Debt amount indicated on the Company’s balance sheet is net of unamortized debt issuance costs of $3.3M. 2.Net Debt is calculated as Total Debt minus Cash and cash equivalents ($909.2M - $78.5M = $830.7). 3. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures.

2024 Forecast – Updated as of 05/01/2024 13 FINANCIALS 1. See "End Notes: Non-GAAP Financial Measures" and "Appendix" for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. 2.Other Commercial products, which includes Vivotif® and Vaxchora®, which were sold to Bavarian Nordic as part of our travel health business in May 2023, are not included in the 2024 forecast. METRIC ($ in millions) Updated Range (as of 05/01/2024) Action Previous Range (as of 03/06/2024) Total revenues $1,000 - $1,100 REVISED $900 - $1,100 Net loss $(148) - $(98) REVISED $(183) - $(133) Adjusted net loss (1) $(65) - $(15) REVISED $(130) - $(80) Adjusted EBITDA (1) $125 - $175 REVISED $50 - $100 Total segment adjusted gross margin % (1) 44% - 47% REVISED 40% - 45% Segment Level Revenue (2) Commercial Products $460 - $500 UNCHANGED $460 - $500 MCM Products $440 - $490 REVISED $340 - $490 Services $70 - $80 UNCHANGED $70 - $80 METRIC ($ in millions) Q2 2024 Forecast Total revenues $160 - $210 Key Assumptions ($ and shares in millions) Updated Range (as of 05/01/2024) Interest expense ~$82 R&D ~6% of Revenue Weighted avg. fully diluted share count ~52 Capex ~$32 Depreciation & amortization ~$111

Driving Profitable, Sustainable Long- Term Growth

PROPRIETARY AND CONFIDENTIAL New Survey Findings Underscore Importance of Naloxone Access (n=1,005 survey )1 Approximately 90% of respondents/adults (18+) includes parents across the U.S. who agree: • The number of opioid deaths is unacceptable; and they would help save someone from an opioid overdose, given the opportunity • It’s important for NARCAN® Nasal Spray to be available and accessible to buy OTC without the need for a prescription • Opioid overdose is a concern for teenagers and college students • Schools, public libraries, dorms, and professionals who work with teenagers and college kids should have access to NARCAN® Nasal Spray 1515 NARCAN® Nasal Spray Q1 Highlights • Continued to meet demand through public interest distribution and widespread availability across major retailers and e-commerce sites • Pursuing additional channels to expand access, e.g. businesses, workplaces ◦ Launched NarcanWorkplace.com ◦ Partnered with National Safety Council on workplace outreach (contracted commercial partner • Engaged Emerson Group to help expand the reach of OTC retail program • Committed to White House Challenge to Save Lives from Overdose 1. Data on file. Online Survey conducted by Bryter Global on behalf of Emergent BioSolutions; April 24 through April 28, 2024. Widespread Support for Expanded Access to NARCAN® Nasal Spray

PROPRIETARY AND CONFIDENTIAL • Opioid settlement $54+B flowing into states over next 10-15 years • Demand for naloxone is expected to increase as the epidemic continues and federal/state programs continue to combat the crisis • Greater policy focus to stock naloxone in schools, as seen in many states, e.g. Colorado and Michigan • In terms of programs that facilitate access to naloxone, the following figures were allocated: ◦ Substance Use Prevention, Treatment, and Recovery Services Block Grant (SUBG): $1.928B ◦ State Opioid Response Grants: $1.575B • Ongoing opportunities in Canada • Product kits and line extensions • Exploring international markets, OTC partnering opportunities 2024 & Beyond -- Catalysts / Future Drivers for NARCAN® Nasal Spray 16

PROPRIETARY AND CONFIDENTIAL NARCAN® Nasal Spray Update Paul Williams SVP, Head of Products Business 17 Key MCM Business Highlights • Increasingly dangerous world / ongoing focus on CBRN threats remains vital ◦ Recent events across the EU have ignited greater preparedness efforts ◦ Mpox estimates up to 31 cases per month since 20231 ◦ Recently published 'Box the Pox' report by The Bipartisan Commission on Biodefense outlines preparedness plan and recommendations •New MCM contract awards and orders from the U.S. Government & DOD throughout 2024 ◦ Awarded Procurement Contract Valued up to $235.8 Million to Supply BioThrax® (Anthrax Vaccine Adsorbed) ◦ Greater clarity on 2024 CYFENDUS procurement levels ◦ VIGIV, BAT and ACAM2000 (notices of intent to procure) 17 1. CDC MMWR Report: https://www.cdc.gov/mmwr/volumes/72/wr/mm7220a2.htm

PROPRIETARY AND CONFIDENTIAL NARCAN® Nasal Spray Update Paul Williams SVP, Head of Products Business 18 2024 & Beyond -- Catalysts / Future Drivers for MCM Business •Continued high-risk threats; Final FY 2024 Congressional Funding Figures for key programs ◦ On the biodefense front, these programs received the following appropriations: ▪ Biomedical Advanced Research and Development Authority (BARDA): $1.015B ▪ Strategic National Stockpile (SNS): $980M ▪ Project BioShield Special Reserve Fund (SRF) $825M • International government opportunities ◦ Focus on EU-level stockpiling approach for MCMs to be used in health emergencies ◦ HERA engagement and collaboration •Anticipated ACAM2000 Mpox FDA approval for second half of 2024 18

Product Portfolio | Future Growth Drivers 19PROPRIETARY AND CONFIDENTIAL

Summary 20 FINANCIALS • First quarter results reflect mix of strong performance in certain core areas offset by ongoing challenges • New contract awards and orders from the U.S. Government & DOD throughout 2024 • Notable progress on strengthening our business fundamentals • Positioned for success, driven by our unique focus on protecting communities and addressing global health threats • Near-term priority is to focus on stabilizing the business • Strong performance for NARCAN® Nasal Spray; continuing to broaden access is critical to help save lives

PROPRIETARY AND CONFIDENTIAL 21 Q&A

In this presentation, we sometimes use information derived from consolidated and segment financial information that may not be presented in our financial statements or prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Certain of these financial measures are considered not in conformity with GAAP (“non-GAAP financial measures”) under the United States Securities and Exchange Commission (“SEC”) rules. Specifically, we have referred to the following non-GAAP financial measures: • Adjusted Net Income (Loss) • Adjusted EBITDA • Total Segment Revenues • Total Segment Gross Margin • Total Segment Gross Margin % • Total Segment Adjusted Gross Margin • Total Segment Adjusted Gross Margin % • Segment Adjusted Gross Margin • Segment Adjusted Gross Margin % • Net Debt We define Adjusted Net Income (Loss) which is a non-GAAP financial measure, as net income (loss) excluding the impact of changes in fair value of contingent consideration, acquisition and divestiture-related costs, severance and restructuring costs, other income (expense) items, and non-cash amortization charges. We believe that these non-GAAP financial measures, when considered together with our GAAP financial results and GAAP financial measures, provide management and investors with an additional understanding of our business operating results, including underlying trends. We define Adjusted EBITDA, which is a non-GAAP financial measure, as consolidated net income (loss) before income tax provision (benefit), interest expense, net, depreciation, amortization of intangible assets, changes in fair value of contingent consideration, severance and restructuring costs, other income (expense) items and acquisition and divestiture-related costs. We believe that this non-GAAP financial measure, when considered together with our GAAP financial results and GAAP financial measures, provides management and investors with a more complete understanding of our operating results, including underlying trends. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry, although it may be defined differently by different companies. Therefore, we also believe that this non-GAAP financial measure, considered along with corresponding GAAP financial measures, provides management and investors with additional information for comparison of our operating results with the operating results of other companies. We have included the definitions of Segment Gross Margin and Segment Gross Margin %, which are GAAP financial measures, below in order to more fully define the components of certain non-GAAP financial measures presented in this presentation. We define Segment Gross Margin, as a segment's revenues, less a segment's cost of sales or services. We define Segment Gross Margin %, as Segment Gross Margin as a percentage of a segments revenues. We define Segment Adjusted Gross Margin, which is a non-GAAP financial measure as Segment Gross Margin excluding the impact of restructuring costs and non-cash items related to changes in the fair value of contingent consideration. We define Segment Adjusted Gross Margin %, which is a non-GAAP financial measure, as Segment Adjusted Gross Margin as a percentage of a segment's revenues. We define Total Segment Revenues, which is a non-GAAP financial measure, as our total revenues, less contracts and grants revenue, which is also equal to the sum of the revenues of our reportable operating segments. We define Total Segment Gross Margin, which is a non-GAAP financial measure, as Total Segment Revenues less our aggregate cost of sales or services. We define Total Segment Gross Margin %, which is a non-GAAP financial measure, as Total Segment Gross Margin as a percentage of Total Segment Revenues. We define Total Segment Adjusted Gross Margin, which is a non-GAAP financial measure, as Total Segment Gross Margin, excluding the impact of restructuring costs and changes in the fair value of contingent consideration. We define Total Segment Adjusted Gross Margin %, which is a non-GAAP financial measure, as Total Segment Adjusted Gross Margin as a percentage of Total Segment Revenues. We define Net Debt, which is a non-GAAP financial measure, as our total debt less our cash and cash equivalents. We believe this non-GAAP financial measure, when considered together with our GAAP financial results, provides management and investors with an additional understanding of the Company's ability to pay its debts. Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable with other similarly titled measures of other companies. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. For additional information on the non- GAAP financial measures noted here, please refer to the reconciliation tables provide in the Appendix to this presentation as well as the associated press release which can be found on the Company’s website at www.emergentbiosolutions.com. 22 End Notes: Non-GAAP Financial Measures

23 Appendix 23

Streamlining the Emergent Network Update

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) 25 APPENDIX (unaudited, $ in millions) Three Months Ended March 31, 2024 2023 Source Net income (loss) $ 9.0 $ (186.2) Adjustments: Non-cash amortization charges $ 23.2 $ 18.0 Intangible Asset ("IA") Amortization, Other Income Changes in fair value of contingent consideration 0.5 0.3 MCM Product COGS Severance and restructuring costs (0.5) 9.7 COGS, SG&A and R&D Acquisition and divestiture costs — 1.1 SG&A Other income (expense), net items 3.1 — Other Income (Expense) Tax effect (4.2) (6.4) Total adjustments: $ 22.1 $ 22.7 Adjusted net income (loss) $ 31.1 $ (163.5)

Reconciliation of Net Income (Loss) to Adjusted EBITDA 26 APPENDIX (unaudited, $ in millions) Three Months Ended March 31, 2024 2023 Net income (loss) $ 9.0 $ (186.2) Adjustments: Depreciation & amortization $ 27.9 $ 34.6 Income taxes 3.1 25.6 Total interest expense, net 23.8 13.4 Changes in fair value of contingent consideration 0.5 0.3 Severance and restructuring costs (0.5) 9.7 Acquisition and divestiture costs — 1.1 Other income (expense), net items 3.1 — Total adjustments $ 57.9 $ 84.7 Adjusted EBITDA $ 66.9 $ (101.5)

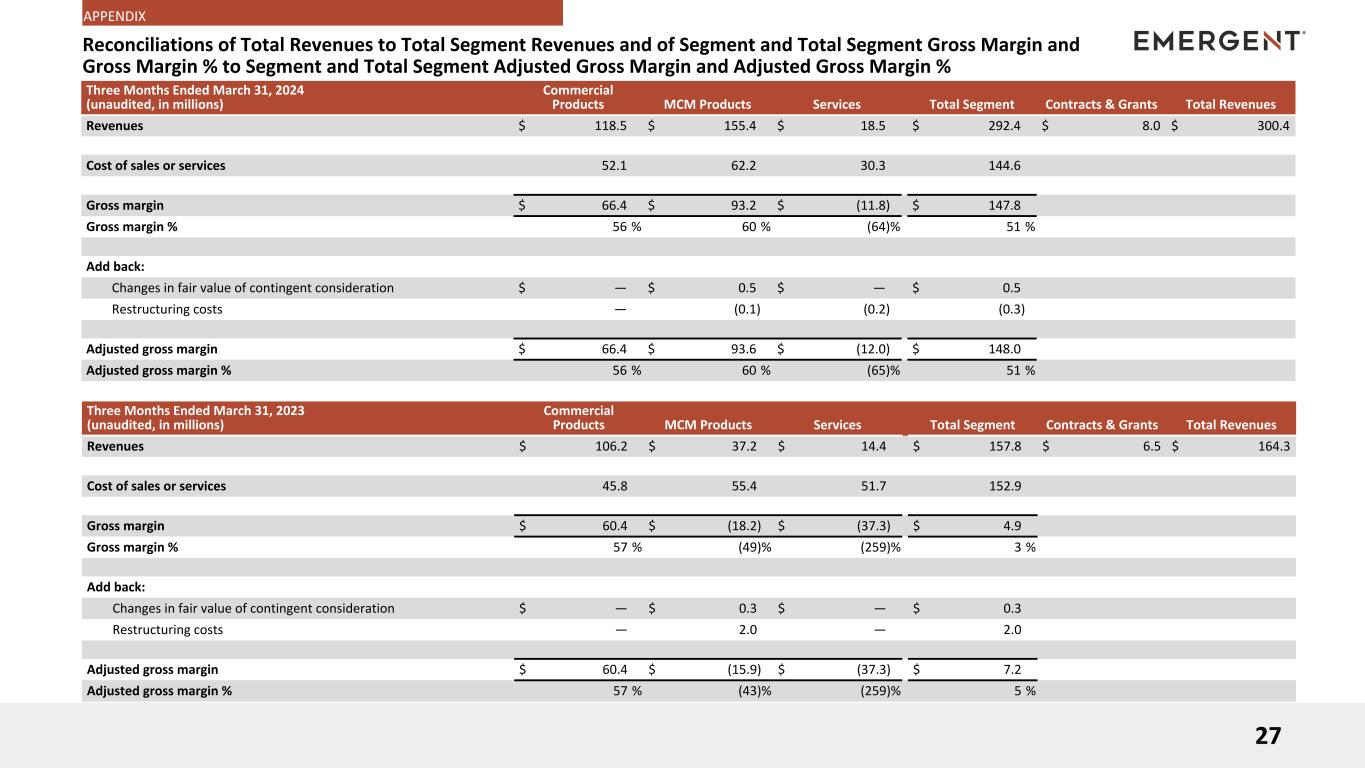

Reconciliations of Total Revenues to Total Segment Revenues and of Segment and Total Segment Gross Margin and Gross Margin % to Segment and Total Segment Adjusted Gross Margin and Adjusted Gross Margin % 27 APPENDIX Three Months Ended March 31, 2024 (unaudited, in millions) Commercial Products MCM Products Services Total Segment Contracts & Grants Total Revenues Revenues $ 118.5 $ 155.4 $ 18.5 $ 292.4 $ 8.0 $ 300.4 Cost of sales or services 52.1 62.2 30.3 144.6 Gross margin $ 66.4 $ 93.2 $ (11.8) $ 147.8 Gross margin % 56 % 60 % (64) % 51 % Add back: Changes in fair value of contingent consideration $ — $ 0.5 $ — $ 0.5 Restructuring costs — (0.1) (0.2) (0.3) Adjusted gross margin $ 66.4 $ 93.6 $ (12.0) $ 148.0 Adjusted gross margin % 56 % 60 % (65) % 51 % Three Months Ended March 31, 2023 (unaudited, in millions) Commercial Products MCM Products Services Total Segment Contracts & Grants Total Revenues Revenues $ 106.2 $ 37.2 $ 14.4 $ 157.8 $ 6.5 $ 164.3 Cost of sales or services 45.8 55.4 51.7 152.9 Gross margin $ 60.4 $ (18.2) $ (37.3) $ 4.9 Gross margin % 57 % (49) % (259) % 3 % Add back: Changes in fair value of contingent consideration $ — $ 0.3 $ — $ 0.3 Restructuring costs — 2.0 — 2.0 Adjusted gross margin $ 60.4 $ (15.9) $ (37.3) $ 7.2 Adjusted gross margin % 57 % (43) % (259) % 5 %

Reconciliation of Total Debt to Net Debt 28 APPENDIX (unaudited, $ in millions) As of March 31, 2024 Total Debt $ 909.2 Less: Cash and cash equivalents $78.5 Net debt $ 830.7

Reconciliation of Net Loss to Adjusted Net Loss – FY 2024 Forecast 29 APPENDIX ($ in millions) 2024 Full Year Forecast Source Net loss $(148) - $(98) Adjustments: Non-cash amortization charges $65 IA Amortization Other Income Changes in fair value of contingent consideration 2 MCM Product COGS Severance and restructuring costs 21 COGS, SG&A and R&D All Other 5 Acquisition/divestiture costs and non operating investment loss Tax effect (10) Total adjustments: $83 Adjusted net loss $(65) - $(15)

Reconciliation of Net Loss to Adjusted EBITDA – FY 2024 Forecast 30 APPENDIX ($ in millions) 2024 Full Year Forecast Net loss $(148) - $(98) Adjustments: Depreciation & amortization $111 Income taxes 52 Total interest expense, net 82 Changes in fair value of contingent consideration 2 Severance and restructuring costs 21 All other 5 Total adjustments $273 Adjusted EBITDA $125 - $175

Reconciliations of Forecasted Total Revenues to Forecasted Total Segment Revenues and of Forecasted Segment and Total Segment Gross Margin and Gross Margin % to Forecasted Segment and Total Segment Adjusted Gross Margin and Adjusted Gross Margin % 31 APPENDIX (in millions) 2024 Full Year Forecast Total revenues $1,000 - $1,100 Contracts & Grants (30) Total segment revenues $970 - $1070 Cost of sales or services $551 - $575 Total segment gross margin $419 - $495 Total segment gross margin % 43% - 46% Add back: Changes in fair value of contingent consideration $2 Severance and restructuring costs $5 Total segment adjusted gross margin $426 - $502 Total segment adjusted gross margin % 44% - 47%

www.emergentbiosolutions.com 32