Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33231

POWERSHARES DB GOLD FUND

(A Series of PowerShares DB Multi-Sector Commodity Trust)

(Exact name of Registrant as specified in its charter)

| Delaware | 87-0778067 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| c/o DB Commodity Services LLC 60 Wall Street New York, New York |

10005 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (212) 250-5883

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, an Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ¨ | Accelerated Filer | x | |||

| Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of outstanding Shares as of June 30, 2013: 4,000,000 Shares.

Table of Contents

POWERSHARES DB GOLD FUND

(A SERIES OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST)

QUARTER ENDED JUNE 30, 2013

| PART I. |

1 | |||||

| ITEM 1. |

1 | |||||

| 10 | ||||||

| ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

17 | ||||

| ITEM 3. |

28 | |||||

| ITEM 4. |

29 | |||||

| PART II. |

30 | |||||

| Item 1. |

30 | |||||

| Item 1A. |

30 | |||||

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds. |

30 | ||||

| Item 3. |

30 | |||||

| Item 4. |

30 | |||||

| Item 5. |

30 | |||||

| Item 6. |

33 | |||||

| 34 | ||||||

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS. |

PowerShares DB Gold Fund

Unaudited Statements of Financial Condition

June 30, 2013 and December 31, 2012

| June 30, 2013 |

December 31, 2012 |

|||||||

| Assets |

||||||||

| Equity in broker trading accounts: |

||||||||

| United States Treasury Obligations, at fair value (cost $160,993,791 and $495,451,201 respectively) |

$ | 160,997,414 | $ | 495,480,854 | ||||

| Cash held by broker |

71,380,437 | 30,812,601 | ||||||

| Net unrealized appreciation (depreciation) on futures contracts |

(66,818,850 | ) | (9,035,650 | ) | ||||

|

|

|

|

|

|||||

| Deposits with broker |

165,559,001 | 517,257,805 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 165,559,001 | $ | 517,257,805 | ||||

|

|

|

|

|

|||||

| Liabilities |

||||||||

| Management fee payable |

$ | 108,911 | $ | 315,008 | ||||

| Brokerage fee payable |

6,862 | 582 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

115,773 | 315,590 | ||||||

|

|

|

|

|

|||||

| Commitments and Contingencies (Note 9) |

||||||||

| Equity |

||||||||

| Shareholders’ equity—General Shares |

1,654 | 2,298 | ||||||

| Shareholders’ equity—Shares |

165,441,574 | 516,939,917 | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

165,443,228 | 516,942,215 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 165,559,001 | $ | 517,257,805 | ||||

|

|

|

|

|

|||||

| General Shares outstanding |

40 | 40 | ||||||

| Shares outstanding |

4,000,000 | 9,000,000 | ||||||

| Net asset value per share |

||||||||

| General Shares |

$ | 41.35 | $ | 57.45 | ||||

| Shares |

$ | 41.36 | $ | 57.44 | ||||

See accompanying notes to unaudited financial statements.

1

Table of Contents

PowerShares DB Gold Fund

Unaudited Schedule of Investments

June 30, 2013

| Description |

Percentage of Net Assets |

Fair Value |

Face Value |

|||||||||

| United States Treasury Obligations |

||||||||||||

| U.S. Treasury Bills, 0.04% due July 5, 2013 |

38.08 | % | $ | 62,999,937 | $ | 63,000,000 | ||||||

| U.S. Treasury Bills, 0.04% due July 11, 2013 |

13.90 | 22,999,908 | 23,000,000 | |||||||||

| U.S. Treasury Bills, 0.03% due July 25, 2013 |

1.21 | 1,999,980 | 2,000,000 | |||||||||

| U.S. Treasury Bills, 0.04% due August 8, 2013 |

7.25 | 11,999,748 | 12,000,000 | |||||||||

| U.S. Treasury Bills, 0.045% due August 15, 2013 |

9.07 | 14,999,625 | 15,000,000 | |||||||||

| U.S. Treasury Bills, 0.045% due August 29, 2013 |

3.02 | 4,999,835 | 5,000,000 | |||||||||

| U.S. Treasury Bills, 0.045% due September 5, 2013 |

16.92 | 27,999,104 | 28,000,000 | |||||||||

| U.S. Treasury Bills, 0.045% due September 12, 2013 |

2.42 | 3,999,880 | 4,000,000 | |||||||||

| U.S. Treasury Bills, 0.045% due September 19, 2013 |

5.44 | 8,999,397 | 9,000,000 | |||||||||

|

|

|

|

|

|||||||||

| Total United States Treasury Obligations (cost $160,993,791) |

97.31 | % | $ | 160,997,414 | ||||||||

|

|

|

|

|

|||||||||

A portion of the above United States Treasury Obligations are held as initial margin against open futures contracts, as described in Note 4(e).

| Description |

Percentage of Net Assets |

Unrealized Appreciation/ (Depreciation) |

Notional Value |

|||||||||

| Futures Contracts |

||||||||||||

| Gold (1,387 contracts, settlement date August 28, 2013) |

(40.39 | )% | $ | (66,818,850 | ) | $ | 169,727,190 | |||||

|

|

|

|

|

|

|

|||||||

| Total Futures Contracts |

(40.39 | )% | $ | (66,818,850 | ) | $ | 169,727,190 | |||||

|

|

|

|

|

|

|

|||||||

Net unrealized appreciation is comprised of unrealized losses of $66,818,850.

See accompanying notes to unaudited financial statements.

2

Table of Contents

PowerShares DB Gold Fund

Unaudited Schedule of Investments

December 31, 2012

| Description |

Percentage of Net Assets |

Fair Value |

Face Value |

|||||||||

| United States Treasury Obligations |

||||||||||||

| U.S. Treasury Bills, 0.06% due January 3, 2013 |

22.05 | % | $ | 114,000,000 | $ | 114,000,000 | ||||||

| U.S. Treasury Bills, 0.05% due January 10, 2013 |

5.61 | 28,999,826 | 29,000,000 | |||||||||

| U.S. Treasury Bills, 0.015% due January 17, 2013 |

2.52 | 12,999,909 | 13,000,000 | |||||||||

| U.S. Treasury Bills, 0.045% due January 24, 2013 |

2.22 | 11,499,874 | 11,500,000 | |||||||||

| U.S. Treasury Bills, 0.075% due January 31, 2013 |

4.26 | 21,999,560 | 22,000,000 | |||||||||

| U.S. Treasury Bills, 0.105% due February 7, 2013 |

2.32 | 11,999,664 | 12,000,000 | |||||||||

| U.S. Treasury Bills, 0.105% due February 14, 2013 |

4.84 | 24,999,175 | 25,000,000 | |||||||||

| U.S. Treasury Bills, 0.09% due February 21, 2013 |

2.32 | 11,999,544 | 12,000,000 | |||||||||

| U.S. Treasury Bills, 0.1% due February 28, 2013 |

4.84 | 24,999,000 | 25,000,000 | |||||||||

| U.S. Treasury Bills, 0.09% due March 7, 2013 |

7.35 | 37,997,986 | 38,000,000 | |||||||||

| U.S. Treasury Bills, 0.09% due March 14, 2013 |

11.99 | 61,996,032 | 62,000,000 | |||||||||

| U.S. Treasury Bills, 0.04% due March 21, 2013 |

12.38 | 63,995,520 | 64,000,000 | |||||||||

| U.S. Treasury Bills, 0.085% due March 28, 2013 |

13.15 | 67,994,764 | 68,000,000 | |||||||||

|

|

|

|

|

|||||||||

| Total United States Treasury Obligations (cost $495,451,201) |

95.85 | % | $ | 495,480,854 | ||||||||

|

|

|

|

|

|||||||||

A portion of the above United States Treasury Obligations are held as initial margin against open futures contracts, as described in Note 4(e).

| Description |

Percentage of Net Assets |

Unrealized Appreciation/ (Depreciation) |

Notional Value |

|||||||||

| Futures Contracts |

||||||||||||

| Gold (3,120 contracts, settlement date August 28, 2013) |

(1.75 | )% | $ | (9,035,650 | ) | $ | 533,819,650 | |||||

|

|

|

|

|

|

|

|||||||

| Total Futures Contracts |

(1.75 | )% | $ | (9,035,650 | ) | $ | 533,819,650 | |||||

|

|

|

|

|

|

|

|||||||

Net unrealized depreciation is comprised of unrealized losses of $9,151,570 and unrealized gains of $115,920.

See accompanying notes to unaudited financial statements.

3

Table of Contents

PowerShares DB Gold Fund

Unaudited Statements of Income and Expenses

For the Three Months Ended June 30, 2013 and 2012 and Six Months Ended June 30, 2013 and 2012

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2013 |

June 30, 2012 |

June 30, 2013 |

June 30, 2012 |

|||||||||||||

| Income |

||||||||||||||||

| Interest Income |

$ | 31,863 | $ | 67,807 | $ | 110,001 | $ | 92,966 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Expenses |

||||||||||||||||

| Management Fee |

354,612 | 658,765 | 1,143,810 | 1,437,686 | ||||||||||||

| Brokerage Commissions and Fees |

7,913 | 1,235 | 29,003 | 30,377 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Expenses |

362,525 | 660,000 | 1,172,813 | 1,468,063 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net investment income (loss) |

(330,662 | ) | (592,193 | ) | (1,062,812 | ) | (1,375,097 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Realized and Net Change in Unrealized Gain (Loss) on United States Treasury Obligations and Futures |

||||||||||||||||

| Net Realized Gain (Loss) on |

||||||||||||||||

| United States Treasury Obligations |

3,211 | 966 | 4,287 | 80 | ||||||||||||

| Futures |

(4,294,330 | ) | (47,150 | ) | (23,566,790 | ) | (18,155,540 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized gain (loss) |

(4,291,119 | ) | (46,184 | ) | (23,562,503 | ) | (18,155,460 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Change in Unrealized Gain (Loss) on |

||||||||||||||||

| United States Treasury Obligations |

(4,443 | ) | (9,233 | ) | (26,030 | ) | 7,984 | |||||||||

| Futures |

(48,518,350 | ) | (16,150,140 | ) | (57,783,200 | ) | 27,037,290 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net change in unrealized gain (loss) |

(48,522,793 | ) | (16,159,373 | ) | (57,809,230 | ) | 27,045,274 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized and net change in unrealized gain (loss) on United States Treasury Obligations and Futures |

(52,813,912 | ) | (16,205,557 | ) | (81,371,733 | ) | 8,889,814 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income (Loss) |

$ | (53,144,574 | ) | $ | (16,797,750 | ) | $ | (82,434,545 | ) | $ | 7,514,717 | |||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to unaudited financial statements.

4

Table of Contents

PowerShares DB Gold Fund

Unaudited Statement of Changes in Shareholders’ Equity

For the Three Months Ended June 30, 2013

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at April 1, 2013 |

40 | $ | 2,176 | 4,200,000 | $ | 228,488,066 | $ | 228,490,242 | ||||||||||||

| Sale of Shares |

200,000 | 9,267,150 | 9,267,150 | |||||||||||||||||

| Redemption of Shares |

(400,000 | ) | (19,169,590 | ) | (19,169,590 | ) | ||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(1 | ) | (330,661 | ) | (330,662 | ) | ||||||||||||||

| Net realized gain (loss) on United States Treasury Obligations and Futures |

(16 | ) | (4,291,103 | ) | (4,291,119 | ) | ||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Futures |

(505 | ) | (48,522,288 | ) | (48,522,793 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

(522 | ) | (53,144,052 | ) | (53,144,574 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at June 30, 2013 |

40 | $ | 1,654 | 4,000,000 | $ | 165,441,574 | $ | 165,443,228 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying notes to unaudited financial statements.

5

Table of Contents

PowerShares DB Gold Fund

Unaudited Statement of Changes in Shareholders’ Equity

For the Three Months Ended June 30, 2012

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at April 1, 2012 |

40 | $ | 2,316 | 7,200,000 | $ | 416,789,287 | $ | 416,791,603 | ||||||||||||

| Sale of Shares |

400,000 | 21,680,800 | 21,680,800 | |||||||||||||||||

| Redemption of Shares |

(1,400,000 | ) | (78,440,850 | ) | (78,440,850 | ) | ||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(2 | ) | (592,191 | ) | (592,193 | ) | ||||||||||||||

| Net realized gain (loss) on United States |

||||||||||||||||||||

| Treasury Obligations and Futures |

(9 | ) | (46,175 | ) | (46,184 | ) | ||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Futures |

(91 | ) | (16,159,282 | ) | (16,159,373 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

(102 | ) | (16,797,648 | ) | (16,797,750 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at June 30, 2012 |

40 | $ | 2,214 | 6,200,000 | $ | 343,231,589 | $ | 343,233,803 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying notes to unaudited financial statements.

6

Table of Contents

PowerShares DB Gold Fund

Unaudited Statement of Changes in Shareholders’ Equity

For the Six Months Ended June 30, 2013

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at January 1, 2013 |

40 | $ | 2,298 | 9,000,000 | $ | 516,939,917 | $ | 516,942,215 | ||||||||||||

| Sale of Shares |

200,000 | 9,267,150 | 9,267,150 | |||||||||||||||||

| Redemption of Shares |

(5,200,000 | ) | (278,331,592 | ) | (278,331,592 | ) | ||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(4 | ) | (1,062,808 | ) | (1,062,812 | ) | ||||||||||||||

| Net realized gain (loss) on United States Treasury Obligations and Futures |

(96 | ) | (23,562,407 | ) | (23,562,503 | ) | ||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Futures |

(544 | ) | (57,808,686 | ) | (57,809,230 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

(644 | ) | (82,433,901 | ) | (82,434,545 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at June 30, 2013 |

40 | $ | 1,654 | 4,000,000 | $ | 165,441,574 | $ | 165,443,228 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying notes to unaudited financial statements.

7

Table of Contents

PowerShares DB Gold Fund

Unaudited Statement of Changes in Shareholders’ Equity

For the Six Months Ended June 30, 2012

| General Shares | Shares | |||||||||||||||||||

| Shares | Total Equity |

Shares | Total Equity |

Total Shareholders’ Equity |

||||||||||||||||

| Balance at January 1, 2012 |

40 | $ | 2,181 | 8,400,000 | $ | 458,055,685 | $ | 458,057,866 | ||||||||||||

| Sale of Shares |

1,000,000 | 57,621,146 | 57,621,146 | |||||||||||||||||

| Redemption of Shares |

(3,200,000 | ) | (179,959,926 | ) | (179,959,926 | ) | ||||||||||||||

| Net Income (Loss) |

||||||||||||||||||||

| Net investment income (loss) |

(6 | ) | (1,375,091 | ) | (1,375,097 | ) | ||||||||||||||

| Net realized gain (loss) on United States Treasury Obligations and Futures |

(110 | ) | (18,155,350 | ) | (18,155,460 | ) | ||||||||||||||

| Net change in unrealized gain (loss) on United States Treasury Obligations and Futures |

149 | 27,045,125 | 27,045,274 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

33 | 7,514,684 | 7,514,717 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at June 30, 2012 |

40 | $ | 2,214 | 6,200,000 | $ | 343,231,589 | $ | 343,233,803 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See accompanying notes to unaudited financial statements.

8

Table of Contents

PowerShares DB Gold Fund

Unaudited Statements of Cash Flows

For the Six Months Ended June 30, 2013 and 2012

| Six Months Ended | ||||||||

| June 30, 2013 |

June 30, 2012 |

|||||||

| Cash flows from operating activities: |

||||||||

| Net Income (Loss) |

$ | (82,434,545 | ) | $ | 7,514,717 | |||

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: |

||||||||

| Cost of securities purchased |

(458,918,150 | ) | (730,872,439 | ) | ||||

| Proceeds from securities sold and matured |

793,490,246 | 839,995,060 | ||||||

| Net accretion of discount on United States Treasury Obligations |

(110,399 | ) | (93,319 | ) | ||||

| Net realized (gain) loss on United States Treasury Obligations |

(4,287 | ) | (80 | ) | ||||

| Net change in unrealized (gain) loss on United States Treasury Obligations and Futures |

57,809,230 | (27,045,274 | ) | |||||

| Change in operating receivables and liabilities: |

||||||||

| Management fee payable |

(206,097 | ) | (104,558 | ) | ||||

| Brokerage fee payable |

6,280 | (8,050 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by (used for) operating activities |

309,632,278 | 89,386,057 | ||||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from sale of Shares |

9,267,150 | 57,621,146 | ||||||

| Redemption of Shares |

(278,331,592 | ) | (179,959,926 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by (used for) financing activities |

(269,064,442 | ) | (122,338,780 | ) | ||||

|

|

|

|

|

|||||

| Net change in cash held by broker |

40,567,836 | (32,952,723 | ) | |||||

| Cash held by broker at beginning of period |

30,812,601 | 51,297,890 | ||||||

|

|

|

|

|

|||||

| Cash held by broker at end of period |

$ | 71,380,437 | $ | 18,345,167 | ||||

|

|

|

|

|

|||||

See accompanying notes to unaudited financial statements.

9

Table of Contents

Notes to Unaudited Financial Statements

June 30, 2013

(1) Organization

PowerShares DB Gold Fund (the “Fund”), a separate series of PowerShares DB Multi-Sector Commodity Trust (the “Trust”), a Delaware statutory trust organized in seven separate series, was formed on August 3, 2006. DB Commodity Services LLC, a Delaware limited liability company (“DBCS” or the “Managing Owner”), seeded the Fund with a capital contribution of $1,000 in exchange for 40 General Shares of the Fund. The fiscal year end of the Fund is December 31st. The term of the Fund is perpetual (unless terminated earlier in certain circumstances) as provided in the Fourth Amended and Restated Declaration of Trust and Trust Agreement of the Trust (the “Trust Agreement”).

The Fund offers common units of beneficial interest (the “Shares”) only to certain eligible financial institutions (the “Authorized Participants”) in one or more blocks of 200,000 Shares, called a Basket. The Fund commenced investment operations on January 3, 2007. The Fund commenced trading on the American Stock Exchange (now known as the NYSE Alternext US LLC (the “NYSE Alternext”)) on January 5, 2007 and, as of November 25, 2008, is listed on the NYSE Arca, Inc. (the “NYSE Arca”).

This Report covers the three months ended June 30, 2013 and 2012 (hereinafter referred to as the “Three Months Ended June 30, 2013” and the “Three Months Ended June 30, 2012”, respectively) and the six months ended June 30, 2013 and 2012 (hereinafter referred to as the “Six Months Ended June 30, 2013” and the “Six Months Ended June 30, 2012”, respectively).

The accompanying unaudited financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions for Form 10-Q and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). In the opinion of management, all material adjustments, consisting only of normal recurring adjustments, considered necessary for a fair statement of the interim period financial statements have been made. Interim period results are not necessarily indicative of results for a full-year period. These financial statements and the notes thereto should be read in conjunction with the Fund’s financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2012 as filed with the SEC on March 1, 2013.

(2) Fund Investment Overview

The Fund invests with a view to tracking the changes, whether positive or negative, in the level of the DBIQ Optimum Yield Gold Index Excess Return™ (“DBIQ-OY GC ER™”, or the “Index”) plus the excess, if any, of the Fund’s interest income from its holdings of United States Treasury Obligations and other high credit quality short-term fixed income securities over the expenses of the Fund.

The Index is intended to reflect the change in market value of the gold sector. The single commodity comprising the Index is gold (the “Index Commodity”).

The Fund also holds United States Treasury Obligations for deposit with the Fund’s commodity broker as margin.

The Commodity Futures Trading Commission (the “CFTC”) and/or commodity exchanges, as applicable, impose position limits on market participants trading in the commodity futures contracts included in the Index. The Index is comprised of futures contracts on the Index Commodity that expire in a specific month and trade on a specific exchange (the “Index Contracts”). If the Managing Owner determines in its commercially reasonable judgment that it has become impracticable or inefficient for any reason for the Fund to gain full or partial exposure to the Index Commodity by investing in the Index Contract, the Fund may invest in a futures contract referencing the Index Commodity other than the Index Contract or, in the alternative, invest in other futures contracts not based on the Index Commodity if, in the commercially reasonable judgment of the Managing Owner, such futures contracts tend to exhibit trading prices that correlate with the Index Commodity.

The Fund does not employ leverage. As of June 30, 2013 and December 31, 2012, the Fund had $165,559,001 (or 100%) and $517,257,805 (or 100%), respectively, of its holdings of cash, United States Treasury Obligations and unrealized appreciation/depreciation on futures contracts on deposit with its Commodity Broker. Of this, $12,205,600 (or 7.37%) and $23,166,000 (or 4.48%), respectively, of the Fund’s holdings of cash and United States Treasury Obligations are required to be deposited as margin in support of the Fund’s long futures positions as of June 30, 2013 and December 31, 2012, respectively. For additional information, please see the unaudited Schedule of Investments as of June 30, 2013 and the audited Schedule of Investments as of December 31, 2012 for details of the Fund’s portfolio holdings.

DBIQ™ is a trademark of Deutsche Bank AG London (the “Index Sponsor”). Trademark applications in the United States are pending with respect to both the Trust and aspects of the Index. The Trust, the Fund and the Managing Owner have been licensed by the Index Sponsor to use the above noted trademark. Deutsche Bank AG London is an affiliate of the Trust, the Fund and the Managing Owner.

10

Table of Contents

(3) Service Providers and Related Party Agreements

The Trustee

Under the Trust Agreement, Wilmington Trust Company, the trustee of the Fund (the “Trustee”), has delegated to the Managing Owner the exclusive management and control of all aspects of the business of the Trust and the Fund. The Trustee will have no duty or liability to supervise or monitor the performance of the Managing Owner, nor will the Trustee have any liability for the acts or omissions of the Managing Owner.

The Managing Owner

The Managing Owner serves as the Fund’s commodity pool operator, commodity trading advisor and managing owner, and is an indirect wholly-owned subsidiary of Deutsche Bank AG. During the Three Months Ended June 30, 2013 and 2012, the Fund incurred Management Fees of $354,612 and $658,765, respectively. Management Fees incurred during the Six Months Ended June 30, 2013 and 2012 by the Fund were $1,143,810 and $1,437,686, respectively. As of June 30, 2013 and December 31, 2012, Management Fees payable to the Managing Owner were $108,911 and $315,008, respectively.

The Commodity Broker

Deutsche Bank Securities Inc., a Delaware corporation, serves as the Fund’s futures clearing broker (the “Commodity Broker”). The Commodity Broker is also an indirect wholly-owned subsidiary of Deutsche Bank AG and is an affiliate of the Managing Owner. In its capacity as clearing broker, the Commodity Broker executes and clears the Fund’s futures transactions and performs certain administrative and custodial services for the Fund. As custodian of the Fund’s assets, the Commodity Broker is responsible, among other things, for providing periodic accountings of all dealings and actions taken by the Trust on behalf of the Fund during the reporting period, together with an accounting of all securities, cash or other indebtedness or obligations held by it or its nominees for or on behalf of the Fund. During the Three Months Ended June 30, 2013 and 2012, the Fund incurred brokerage fees of $7,913 and $1,235, respectively. Brokerage fees incurred during the Six Months Ended June 30, 2013 and 2012 by the Fund were $29,003 and $30,377, respectively. As of June 30, 2013 and December 31, 2012, brokerage fees payable were $6,862 and $582, respectively.

The Administrator, Custodian and Transfer Agent

The Bank of New York Mellon (the “Administrator”) has been appointed by the Managing Owner as the administrator, custodian and transfer agent of the Fund, and has entered into separate administrative, custodian, transfer agency and service agreements (collectively referred to as the “Administration Agreement”).

Pursuant to the Administration Agreement, the Administrator performs or supervises the performance of services necessary for the operation and administration of the Fund (other than making investment decisions), including receiving and processing orders from Authorized Participants to create and redeem Baskets, net asset value calculations, accounting and other fund administrative services. The Administrator retains certain financial books and records, including: Basket creation and redemption books and records, fund accounting records, ledgers with respect to assets, liabilities, capital, income and expenses, the registrar, transfer journals and related details, and trading and related documents received from the Commodity Broker and other unaffiliated futures commission merchants. As of June 30, 2013 and December 31, 2012, there were no Fund assets held by the Administrator.

The Distributor

ALPS Distributors, Inc. (the “Distributor”) provides certain distribution services to the Fund. Pursuant to the Distribution Services Agreement among the Managing Owner in its capacity as managing owner of the Fund and the Distributor, the Distributor assists the Managing Owner and the Administrator with certain functions and duties relating to distribution and marketing services to the Fund including reviewing and approving marketing materials.

Invesco PowerShares Capital Management LLC

Under the License Agreement among Invesco PowerShares Capital Management LLC (the “Licensor”) and the Managing Owner in its own capacity and in its capacity as managing owner of the Fund (the Fund and the Managing Owner, collectively, the “Licensees”), the Licensor granted to each Licensee a non-exclusive license to use the “PowerShares®” trademark (the “Trademark”) anywhere in the world, solely in connection with the marketing and promotion of the Fund and to use or refer to the Trademark in connection with the issuance and trading of the Fund as necessary.

11

Table of Contents

Invesco Distributors, Inc.

Through a marketing agreement between the Managing Owner and Invesco Distributors, Inc. (“Invesco Distributors”), an affiliate of Invesco PowerShares Capital Management LLC, the Managing Owner, on behalf of the Fund, has appointed Invesco Distributors as a marketing agent. Invesco Distributors assists the Managing Owner and the Administrator with certain functions and duties such as providing various educational and marketing activities regarding the Fund, primarily in the secondary trading market, which activities include, but are not limited to, communicating the Fund’s name, characteristics, uses, benefits, and risks, consistent with the prospectus. Invesco Distributors will not open or maintain customer accounts or handle orders for the Fund. Invesco Distributors engages in public seminars, road shows, conferences, media interviews, and distributes sales literature and other communications (including electronic media) regarding the Fund.

(4) Summary of Significant Accounting Policies

(a) Basis of Presentation

The financial statements of the Fund have been prepared using U.S. generally accepted accounting principles.

The presentation of Shareholders’ Equity in prior years has been updated to conform to the June 30, 2013 presentation. Total Shareholders’ Equity was not affected by these changes.

(b) Use of Estimates

The preparation of the financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses and related disclosure of contingent assets and liabilities during the reporting period of the financial statements and accompanying notes. Actual results could differ from those estimates.

(c) Financial Instruments and Fair Value

United States Treasury Obligations and commodity futures contracts are recorded in the statements of financial condition on trade date at fair value with changes in fair value recognized in earnings in each period. The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (the exit price).

Financial Accounting Standards Board (FASB) Accounting Standards Codification fair value measurement and disclosure guidance requires a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described below:

Basis of Fair Value Measurement

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2: Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly;

Level 3: Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

In determining fair value of United States Treasury Obligations and commodity futures contracts, the Fund uses unadjusted quoted market prices in active markets. United States Treasury Obligations and commodity futures contracts are classified within Level 1 of the fair value hierarchy. The Fund does not adjust the quoted prices for United States Treasury Obligations and commodity futures contracts.

(d) Deposits with Broker

The Fund deposits cash and United States Treasury Obligations with its Commodity Broker subject to CFTC regulations and various exchange and Commodity Broker requirements. The combination of the Fund’s deposits with its Commodity Broker of cash and United States Treasury Obligations and the unrealized profit or loss on open futures contracts (variation margin) represents the Fund’s overall equity in its Commodity Broker trading account. To meet the Fund’s initial margin requirements, the Fund holds United States Treasury Obligations. The Fund uses its cash held by the Commodity Broker to satisfy variation margin requirements. The Fund earns interest on its cash deposited with the Commodity Broker.

12

Table of Contents

(e) United States Treasury Obligations

The Fund records purchases and sales of United States Treasury Obligations on trade date. These holdings are marked to market based on quoted closing prices. The Fund holds United States Treasury Obligations for deposit with the Fund’s Commodity Broker to meet margin requirements and for trading purposes. Interest income is recognized on an accrual basis when earned. Premiums and discounts are amortized or accreted over the life of the United States Treasury Obligations. Included in the United States Treasury Obligations as of June 30, 2013 and December 31, 2012 were holdings of $12,205,600 and $23,166,000, respectively, which were restricted and held as initial margin of the open futures contracts.

(f) Cash Held by Broker

The Fund’s arrangement with the Commodity Broker requires the Fund to meet its variation margin requirement related to the price movements, both positive and negative, on futures contracts held by the Fund by keeping cash on deposit with the Commodity Broker. The Fund defines cash and cash equivalents to be highly liquid investments, with original maturities of three months or less when purchased. As of June 30, 2013, the Fund had cash held with the Commodity Broker of $71,380,437, of which $66,818,850 was on deposit to satisfy the Fund’s negative variation margin on open futures contracts. As of December 31, 2012, the Fund had cash held with the Commodity Broker of $30,812,601, of which $9,035,650 was on deposit to satisfy the Fund’s negative variation margin on open futures contracts. There were no cash equivalents held by the Fund as of June 30, 2013 and December 31, 2012.

(g) Income Taxes

The Fund is classified as a partnership for U.S. federal income tax purposes. Accordingly, the Fund will not incur U.S. federal income taxes. No provision for federal, state, and local income taxes has been made in the accompanying financial statements, as investors are individually liable for income taxes, if any, on their allocable share of the Fund’s income, gain, loss, deductions and other items.

The major tax jurisdiction for the Fund and the earliest tax year subject to examination: United States, 2009.

(h) Futures Contracts

All commodity futures contracts are held and used for trading purposes. Commodity futures are recorded on trade date and open contracts are recorded in the statement of financial condition at fair value on the last business day of the period, which represents market value for those commodity futures contracts for which market quotes are readily available. However, when market closing prices are not available, the Managing Owner may value an asset of the Fund pursuant to policies the Managing Owner has adopted, which are consistent with normal industry standards. Realized gains (losses) and changes in unrealized appreciation (depreciation) on open positions are determined on a specific identification basis and recognized in the statement of income and expenses in the period in which the contract is closed or the changes occur, respectively. As of June 30, 2013 and December 31, 2012, the futures contracts held by the Fund were in a net unrealized depreciation position of $66,818,850 and $9,035,650, respectively. Futures contracts held as of June 30, 2013 are indicative of the volume of derivative activity during the period.

(i) Management Fee

The Fund pays the Managing Owner a management fee (the “Management Fee”), monthly in arrears, in an amount equal to 0.75% per annum of the daily net asset value of the Fund.

(j) Brokerage Commissions and Fees

The Fund incurs all brokerage commissions, including applicable exchange fees, National Futures Association (“NFA”) fees, give-up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities by the Commodity Broker. These costs are recorded as brokerage commissions and fees in the statement of income and expenses as incurred. The Commodity Broker’s brokerage commissions and trading fees are determined on a contract-by-contract basis. On average, total charges paid to the Commodity Broker were less than $10.00 per round-turn trade for the Three Months Ended June 30, 2013 and 2012 and the Six Months Ended June 30, 2013 and 2012.

(k) Routine Operational, Administrative and Other Ordinary Expenses

The Managing Owner assumes all routine operational, administrative and other ordinary expenses of the Fund, including, but not limited to, computer services, the fees and expenses of the Trustee, legal and accounting fees and expenses, tax preparation expenses, filing fees and printing, mailing and duplication costs. Accordingly, all such expenses are not reflected in the statement of income and expenses of the Fund.

13

Table of Contents

(l) Organizational and Offering Costs

All organizational and offering expenses of the Fund are incurred and assumed by the Managing Owner. The Fund is not responsible to the Managing Owner for the reimbursement of organizational and offering costs. Expenses incurred in connection with the continuous offering of Shares are also paid by the Managing Owner.

(m) Non-Recurring and Unusual Fees and Expenses

The Fund pays all fees and expenses which are non-recurring and unusual in nature. Such expenses include legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Such fees and expenses, by their nature, are unpredictable in terms of timing and amount. For the Three Months Ended June 30, 2013 and 2012 and the Six Months Ended June 30, 2013 and 2012, the Fund did not incur such expenses.

(5) Fair Value Measurements

The Fund’s assets and liabilities recorded at fair value have been categorized based upon the fair value hierarchy discussed in Note 4(c).

Assets and Liabilities Measured at Fair Value were as follows:

| June 30, 2013 (unaudited) |

December

31, 2012 (unaudited) |

|||||||

| United States Treasury Obligations (Level 1) |

$ | 160,997,414 | $ | 495,480,854 | ||||

| Commodity Futures Contracts (Level 1) |

(66,818,850 | ) | (9,035,650 | ) | ||||

There were no Level 2 or Level 3 holdings as of June 30, 2013 and December 31, 2012.

(6) Financial Instrument Risk

In the normal course of its business, the Fund is a party to financial instruments with off-balance sheet risk. The term “off-balance sheet risk” refers to an unrecorded potential liability that, even though it does not appear on the balance sheet, may result in a future obligation or loss in excess of the amounts shown on the Statement of Financial Condition. The financial instruments used by the Fund are exchange-listed commodity futures, whose values are based upon an underlying asset and generally represent future commitments that have a reasonable possibility of being settled in cash or through physical delivery. The financial instruments are traded on an exchange and are standardized contracts.

Market risk is the potential for changes in the value of the financial instruments traded by the Fund due to market changes, including fluctuations in commodity prices. In entering into these futures contracts, there exists a market risk that such futures contracts may be significantly influenced by adverse market conditions, resulting in such futures contracts being less valuable. If the markets should move against all of the futures contracts at the same time, the Fund could experience substantial losses.

Credit risk is the possibility that a loss may occur due to the failure of the Commodity Broker and/or clearinghouse to perform according to the terms of a futures contract. Credit risk with respect to exchange-traded instruments is reduced to the extent that an exchange or clearing organization acts as a counterparty to the transactions. The Commodity Broker, when acting as the Fund’s futures commission merchant in accepting orders for the purchase or sale of domestic futures contracts, is required by CFTC regulations to separately account for and segregate as belonging to the Fund all assets of the Fund relating to domestic futures trading and the Commodity Broker is not allowed to commingle such assets with other assets of the Commodity Broker. In addition, CFTC regulations also require the Commodity Broker to hold in a secure account assets of the Fund related to foreign futures trading. The Fund’s risk of loss in the event of counterparty default is typically limited to the amounts recognized in the statement of financial condition and not represented by the futures contract or notional amounts of the instruments.

The Fund has not utilized, nor does it expect to utilize in the future, special purpose entities to facilitate off-balance sheet financing arrangements and has no loan guarantee arrangements or off-balance sheet arrangements of any kind, other than agreements entered into in the normal course of business noted above.

14

Table of Contents

(7) Share Purchases and Redemptions

(a) Purchases

Shares may be purchased directly from the Fund only by Authorized Participants in one or more blocks of 200,000 Shares, called a Basket. Upon submission of a creation order, the Authorized Participant may request that the Managing Owner agree to a creation order settlement date of up to 3 business days after the creation order date. Accordingly, the Fund issues Shares in Baskets to Authorized Participants within 3 business days immediately following the date on which a valid order to create a Basket is accepted by the Fund, at the net asset value of 200,000 Shares, which is determined as promptly as practicable following the publication of the Fund’s net asset value on the date that a valid order to create a Basket is accepted by the Fund.

(b) Redemptions

The redemption procedures allow only Authorized Participants to redeem Baskets. On any business day, an Authorized Participant may place an order with the Managing Owner to redeem one or more Baskets. Redemption orders must be placed by 10:00 a.m., Eastern Time. The day on which the Managing Owner receives a valid redemption order is the redemption order date. Redemption orders are irrevocable.

Redemption orders may be placed either (i) through the Continuous Net Settlement (“CNS”) clearing processes of the National Securities Clearing Corporation (the “NSCC”) or (ii) if outside the CNS Clearing Process, only through the facilities of The Depository Trust Company (“DTC” or the “Depository”) (the “DTC Process”), or a successor depository, and only in exchange for cash. By placing a redemption order, and prior to receipt of the redemption proceeds, an Authorized Participant’s DTC account is charged the non-refundable transaction fee due for the redemption order.

The redemption proceeds from the Fund consist of the cash redemption amount. Upon submission of a redemption order, the Authorized Participant may request the Managing Owner to agree to a redemption order settlement date up to 3 business days after the redemption order date. The cash redemption amount is equal to the net asset value of the number of Basket(s) requested in the Authorized Participant’s redemption order on the redemption order date (the “Settlement Time”). As agreed to between the Authorized Participant and the Managing Owner, the Fund will distribute the cash redemption amount within 3 business days immediately following the redemption order date. The redemption proceeds from the Fund will be credited to the Authorized Participant at the Settlement Time through the CNS system, assuming timely delivery of redemption Baskets and the transaction fee through the CNS system in accordance with the terms, conditions and guarantees as set forth in the CNS agreements to which the Custodian and the Authorized Participant have entered into. Through the DTC process, the redemption proceeds from the Fund will be delivered through the DTC to the account of the Authorized Participant as recorded on the book entry system of the DTC at the Settlement Time. If the Fund’s account has not been credited with all of the Baskets to be redeemed by such time, the redemption proceeds are delivered to the extent of whole Baskets received and any outstanding amount of the redemption order will be canceled.

(c) Share Transactions

Summary of Share Transactions for the Three Months Ended June 30, 2013 and 2012

and the Six Months Ended June 30, 2013 and 2012 (unaudited)

| Shares Three Months Ended |

Shareholders’ Equity Three Months Ended |

Shares Six Months Ended |

Shareholders’ Equity Six Months Ended |

|||||||||||||||||||||||||||||

| June 30, 2013 |

June 30, 2012 |

June 30, 2013 |

June 30, 2012 |

June 30, 2013 |

June 30, 2012 |

June 30, 2013 |

June 30, 2012 |

|||||||||||||||||||||||||

| Shares Sold |

200,000 | 400,000 | $ | 9,267,150 | $ | 21,680,800 | 200,000 | 1,000,000 | $ | 9,267,150 | $ | 57,621,146 | ||||||||||||||||||||

| Shares Redeemed |

(400,000 | ) | (1,400,000 | ) | (19,169,590 | ) | (78,440,850 | ) | (5,200,000 | ) | (3,200,000 | ) | (278,331,592 | ) | (179,959,926 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net Increase/ (Decrease) |

(200,000 | ) | (1,000,000 | ) | $ | (9,902,440 | ) | $ | (56,760,050 | ) | (5,000,000 | ) | (2,200,000 | ) | $ | (269,064,442 | ) | $ | (122,338,780 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

(8) Profit and Loss Allocations and Distributions

Pursuant to the Fourth Amended and Restated Declaration of Trust and Trust Agreement of the Trust, income and expenses are allocated pro rata to the Managing Owner as holder of the General Shares and to the Shareholders monthly based on their respective percentage interests as of the close of the last trading day of the preceding month. Any losses allocated to the Managing Owner (as the owner of the General Shares) which are in excess of the Managing Owner’s capital balance are allocated to the Shareholders in accordance with their respective interest in the Fund as a percentage of total shareholders’ equity. Distributions (other than redemption of units) may be made at the sole discretion of the Managing Owner on a pro rata basis in accordance with the respective capital balances of the shareholders.

15

Table of Contents

No distributions were paid for the Six Months Ended June 30, 2013 or 2012.

(9) Commitments and Contingencies

The Managing Owner, either in its own capacity or in its capacity as the Managing Owner and on behalf of the Fund, has entered into various service agreements that contain a variety of representations, or provide indemnification provisions related to certain risks service providers undertake in performing services which are in the best interests of the Fund. As of June 30, 2013, no claims had been received by the Fund and it was therefore not possible to estimate the Fund’s potential future exposure under such indemnification provisions.

(10) Net Asset Value and Financial Highlights

The Fund is presenting the following net asset value and financial highlights related to investment performance for a Share outstanding for the Three Months Ended June 30, 2013 and 2012 and for the Six Months Ended June 30, 2013 and 2012. The net investment income and total expense ratios are calculated using average net asset value during the respective period. The net asset value presentation is calculated using daily Shares outstanding. The net investment income and total expense ratios have been annualized. The total return is based on the change in net asset value of the Shares during the period. An individual investor’s return and ratios may vary based on the timing of capital transactions.

Net asset value per Share is the net asset value of the Fund divided by the number of outstanding Shares at the date of each respective period presented.

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2013 |

June 30, 2012 |

June 30, 2013 |

June 30, 2012 |

|||||||||||||

| Net Asset Value |

||||||||||||||||

| Net asset value per Share, beginning of period |

$ | 54.40 | $ | 57.89 | $ | 57.44 | $ | 54.53 | ||||||||

| Net realized and change in unrealized gain (loss) on United States Treasury Obligations and Futures |

(12.96 | ) | (2.44 | ) | (15.89 | ) | 1.03 | |||||||||

| Net investment income (loss) |

(0.08 | ) | (0.09 | ) | (0.19 | ) | (0.20 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

(13.04 | ) | (2.53 | ) | (16.08 | ) | 0.83 | |||||||||

| Net asset value per Share, end of period |

$ | 41.36 | $ | 55.36 | $ | 41.36 | $ | 55.36 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Market value per Share, beginning of period |

$ | 54.48 | $ | 57.78 | $ | 57.35 | $ | 54.45 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Market value per Share, end of period |

$ | 41.68 | $ | 55.18 | $ | 41.68 | $ | 55.18 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ratio to average Net Assets* |

||||||||||||||||

| Net investment income (loss) |

(0.70 | )% | (0.67 | )% | (0.70 | )% | (0.72 | )% | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

0.77 | % | 0.75 | % | 0.78 | % | 0.77 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Return, at net asset value ** |

(23.97 | )% | (4.37 | )% | (27.99 | )% | 1.52 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Return, at market value ** |

(23.49 | )% | (4.50 | )% | (27.32 | )% | 1.34 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | Percentages are annualized. |

| ** | Percentages are not annualized. |

(11) Subsequent Events

The Fund evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

16

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Quarterly Report (the “Report”). The discussion and analysis which follows may contain trend analysis and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) which reflect our current views with respect to future events and financial results. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate,” as well as similar words and phrases, signify forward-looking statements. PowerShares DB Gold Fund’s (the “Fund”) forward-looking statements are not guarantees of future results and conditions and important factors, risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the Federal securities laws, DB Commodity Services LLC (the “Managing Owner”), undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Report, as a result of new information, future events or changed circumstances or for any other reason after the date of this Report.

Overview/Introduction

The Fund seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Gold Index Excess Return™ (“DBIQ-OY GC ER™”, or the “Index”), over time, plus the excess, if any, of the Fund’s interest income from its holdings of United States Treasury Obligations and other high credit quality short-term fixed income securities over the expenses of the Fund. The Shares are designed for investors who want a cost-effective and convenient way to invest in commodity futures on U.S. and non-U.S. markets.

The Fund pursues its investment objective by investing in a portfolio of exchange-traded futures contracts that expire in a specific month and trade on a specific exchange (the “Index Contracts”) in the single commodity comprising the Index (the “Index Commodity”). The single Index Commodity is gold. The Index is composed of notional amounts of the Index Commodity. The Fund’s portfolio also includes United States Treasury Obligations and other high credit quality short-term fixed income securities for deposit with the Fund’s Commodity Broker as margin.

As of the date of this Report, Deutsche Bank Securities Inc., Merrill Lynch Professional Clearing Corp., Prudential Bache Securities, Newedge USA LLC, Citigroup Global Markets Inc., J.P. Morgan Securities Inc., Credit Suisse Securities USA LLC, Knight Clearing Services LLC, Timber Hill LLC, Morgan Stanley & Co. Incorporated, Jefferies & Co., Nomura Securities International Inc., RBC Capital Markets, LLC, UBS Securities LLC, Virtu Financial BD LLC and Virtu Financial Capital Markets, LLC (f/k/a EWT, LLC) have each executed a Participant Agreement and are the only Authorized Participants.

The Commodity Futures Trading Commission (the “CFTC”) and/or commodity exchanges, as applicable, impose position limits on market participants trading in certain commodities included in the Index. If the Managing Owner determines in its commercially reasonable judgment that it has become impracticable or inefficient for any reason for the Fund to gain full or partial exposure to the Index Commodity by investing in a specific Index Contract, the Fund may invest in a futures contract referencing the Index Commodity other than the Index Contract or, in the alternative, invest in other futures contracts not based on the Index Commodity if, in the commercially reasonable judgment of the Managing Owner, such futures contracts tend to exhibit trading prices that correlate with such Index Commodity. Please see http://www.dbxus.com with respect to the most recently available weighted composition of the Fund and the composition of the Index on the Base Date.

DBIQ™ is a trademark of Deutsche Bank AG London (the “Index Sponsor”). Trademark applications in the United States are pending with respect to both the Trust and aspects of the Index. The Trust, the Fund and the Managing Owner have been licensed by the Index Sponsor to use the above noted trademark. Deutsche Bank AG London is an affiliate of the Trust, the Fund and the Managing Owner.

The Index is composed of one underlying Index Commodity. The closing level of the Index is calculated on each business day by the Index Sponsor based on the closing price of the futures contracts for the underlying Index Commodity and the notional amount of such Index Commodity.

The composition of the Index may be adjusted in the event that the Index Sponsor is not able to calculate the closing price of the Index Commodity.

The Index includes provisions for the replacement of futures contracts as they approach maturity. This replacement takes place over a period of time in order to lessen the impact on the market for the futures contracts being replaced. With respect to the Index

17

Table of Contents

Commodity, the Fund employs a rule-based approach when it “rolls” from one futures contract to another. Rather than select a new futures contract based on a predetermined schedule (e.g., monthly), the Index Commodity rolls to the futures contract which generates the best possible “implied roll yield.” The futures contract with a delivery month within the next thirteen months which generates the best possible implied roll yield will be included in the Index. As a result, the Index Commodity is able to potentially maximize the roll benefits in backwardated markets and minimize the losses from rolling in contangoed markets.

In general, as a futures contract approaches its expiration date, its price will move towards the spot price in a contangoed market. Assuming the spot price does not change, this would result in the futures contract price decreasing and a negative implied roll yield. The opposite is true in a backwardated market. Rolling in a contangoed market will tend to cause a drag on the Index Commodity’s contribution to the Fund’s return while rolling in a backwardated market will tend to cause a push on the Index Commodity’s contribution to the Fund’s return.

The DBIQ Optimum Yield Gold Index is calculated in USD on both an excess return (unfunded) and total return (funded) basis.

The futures contract price for the Index Commodity will be the exchange closing price for the Index Commodity on each weekday when banks in New York, New York are open (the “Index Business Days”). If a weekday is not an Exchange Business Day (as defined in the following sentence) but is an Index Business Day, the exchange closing price from the previous Index Business Day will be used for the Index Commodity. “Exchange Business Day” means, in respect of the Index Commodity, a day that is a trading day for the Index Commodity on the relevant exchange (unless either an Index disruption event or force majeure event has occurred).

On the first New York business day (the “Verification Date”) of each month, the Index Commodity futures contract will be tested in order to determine whether to continue including it in the Index. If the Index Commodity futures contract requires delivery of the underlying commodity in the next month, known as the Delivery Month, a new Index Commodity futures contract will be selected for inclusion in the Index. For example, if the first New York business day is October 1, 2013, and the Delivery Month of the Index Commodity futures contract currently in such Index is November 2013, a new Index Commodity futures contract with a later Delivery Month will be selected.

For the underlying Index Commodity of the Index, the new Index Commodity futures contract selected will be the Index Commodity futures contract with the best possible “implied roll yield” based on the closing price for each eligible Index Commodity futures contract. Eligible Index Commodity futures contracts are any Index Commodity futures contracts having a Delivery Month (i) no sooner than the month after the Delivery Month of the Index Commodity futures contract currently in the Index, and (ii) no later than the 13th month after the Verification Date. For example, if the first New York business day is October 1, 2013 and the Delivery Month of an Index Commodity futures contract currently in the Index is November 2013, the Delivery Month of an eligible new Index Commodity futures contract must be between December 2013 and October 2014. The implied roll yield is then calculated and the futures contract on the Index Commodity with the best possible implied roll yield is then selected. If two futures contracts have the same implied roll yield, the futures contract with the minimum number of months prior to the Delivery Month is selected.

After the futures contract selection, the monthly roll for the Index Commodity subject to a roll in that particular month unwinds the old futures contract and enters a position in the new futures contract. This takes place between the 2nd and 6th Index Business Day of the month.

On each day during the roll period, new notional holdings are calculated. The calculations for the futures contracts on the old Index Commodity that are leaving the Index and the futures contracts on the new Index Commodity are then calculated.

On all days that are not monthly index roll days, the notional holdings of the Index Commodity future remains constant.

Under the Trust Agreement of the Trust, Wilmington Trust Company, the Trustee of the Trust, has delegated to the Managing Owner the exclusive management and control of all aspects of the business of the Trust and the Fund. The Trustee will have no duty or liability to supervise or monitor the performance of the Managing Owner, nor will the Trustee have any liability for the acts or omissions of the Managing Owner.

The Index Sponsor obtains information for inclusion in, or for use in the calculation of, the Index from sources the Index Sponsor considers reliable. None of the Index Sponsor, the Managing Owner, the Trust, Fund or any of their respective affiliates accepts responsibility for or guarantees the accuracy and/or completeness of the Index or any data included in the Index.

The Shares are intended to provide investment results that generally correspond to the changes, positive or negative, in the levels of the Index over time. The value of the Shares is expected to fluctuate in relation to changes in the value of the Fund’s portfolio. The market price of the Shares may not be identical to the net asset value per Share, but these two valuations are expected to be very close.

18

Table of Contents

Margin Calls

Like other futures and derivatives traders, the Fund will be subject to margin calls from time-to-time. The term “margin” has a different meaning in the context of futures contracts and other derivatives than it does in the context of securities. In particular, “margin” on a futures position does not constitute a borrowing of money or the collateralization of a loan. The Fund does not borrow money.

To establish a position in an exchange-traded futures contract, the Fund makes a deposit of “initial margin.” The amount of initial margin required to be deposited in order to establish a position in an exchange-traded futures contract varies from instrument to instrument depending, generally, on the historical volatility of the futures contract in question. Determination of the amount of the required initial margin deposit in respect of a particular contract is made by the exchange on which the contract is listed. To establish a long position in an over-the-counter instrument, the counterparty may require an analogous deposit of collateral, depending upon the anticipated volatility of the instrument and the creditworthiness of the person seeking to establish the position. The deposit of initial margin provides assurance to futures commission merchants and clearing brokers involved in the settlement process that sufficient resources are likely to be on deposit to enable a client’s position to be closed by recourse to the initial margin deposit should the client fail to meet a demand for variation margin, even if changes in the value of the contract in question, which are marked to market from day to day, continue to reflect the contract’s historical volatility. Collateral deposited in support of an over-the-counter instrument serves a similar purpose.

Once a position has been established on a futures exchange, “variation margin” generally is credited or assessed at least daily to reflect changes in the value of the position. In contrast to “initial margin,” “variation margin” represents a system of marking to market the futures contract’s value. Thus, traders in exchange-traded futures contracts are assessed daily in an amount equal to that day’s accumulated losses in respect of any open position (or are credited daily with accumulated gains in respect of such position). Collateral may move between the parties to an over-the-counter instrument in a similar manner as gains or losses accumulate in the instrument. As with initial margin, variation margin serves to secure the obligations of the investor under the contract and to protect those involved in the settlement process against the possibility that a client will have insufficient resources to meet its contractual obligations. Collateral deposited in support of an over-the-counter instrument serves a similar purpose. Like initial margin (or an equivalent deposit of collateral), variation margin (or an equivalent deposit of collateral) does not constitute a borrowing of money, is not considered to be part of the contract purchase price and is returned upon the contract’s termination unless it is used to cover a loss in the contract position. United States Treasury Obligations are used routinely to collateralize OTC derivative positions, and are deposited routinely as margin to collateralize futures positions. The Fund may liquidate United States Treasury Obligations to meet an initial or variation margin requirement.

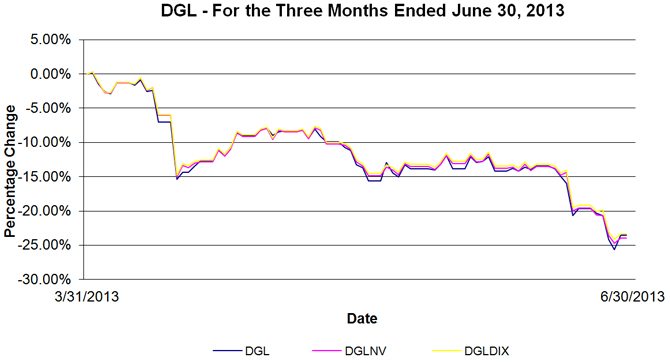

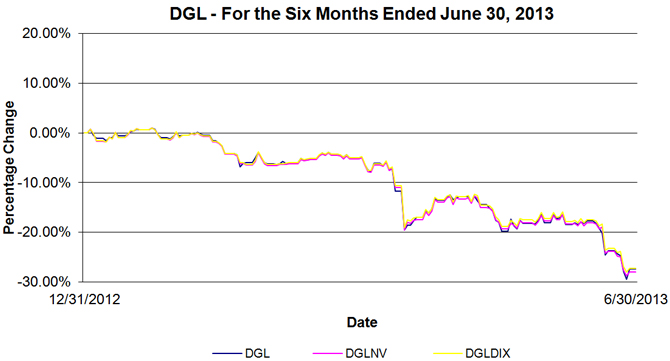

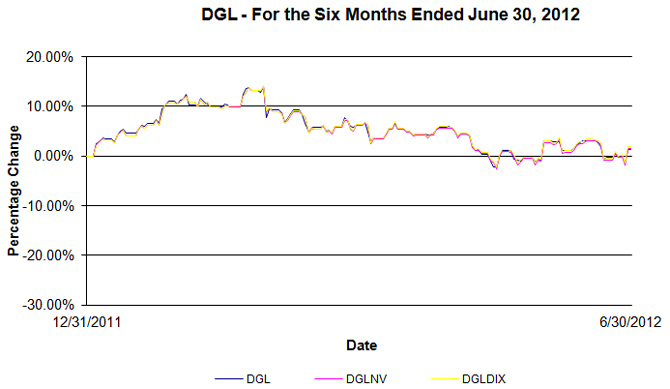

Performance Summary

This Report covers the three months ended June 30, 2013 and 2012 (hereinafter referred to as the “Three Months Ended June 30, 2013” and the “Three Months Ended June 30, 2012”, respectively) and the six months ended June 30, 2013 and 2012 (hereinafter referred to as the “Six Months Ended June 30, 2013” and the “Six Months Ended June 30, 2012”, respectively). The Fund commenced trading on the American Stock Exchange (now known as the NYSE Alternext US LLC (the “NYSE Alternext”)) on January 5, 2007, and, as of November 25, 2008, is listed on the NYSE Arca, Inc. (the “NYSE Arca”).

Performance of the Fund and the exchange traded Shares are detailed below in “Results of Operations”. Past performance of the Fund and the exchange traded Shares are not necessarily indicative of future performance.

The Index is intended to reflect the change in market value of the Index Commodity. In turn, the Index is intended to reflect the gold sector. The DBIQ Optimum Yield Gold Index Total Return™ (the “DBIQ-OY GC TR™”), consists of the Index plus 3-month United States Treasury Obligations returns. Past Index results are not necessarily indicative of future changes, positive or negative, in the Index closing levels.

The section “Summary of DBIQ-OY GC TR™ and Underlying Index Commodity Returns for the Three Months Ended June 30, 2013 and the Six Months Ended June 30, 2013 and the Three Months Ended June 30, 2012 and the Six Months Ended June 30, 2012” below provides an overview of the changes in the closing levels of the DBIQ-OY GC TR™ by disclosing the change in market value of the underlying component Index Commodity through a “surrogate” (and analogous) index plus 3-month United States Treasury Obligations returns. Please note also that the Fund’s objective is to track the Index (not the DBIQ-OY GC TR™), and the Fund does not attempt to outperform or underperform the Index. The Index employs the optimum yield roll method with the objective of mitigating the negative effects of contango, the condition in which distant delivery prices for futures exceed spot prices, and maximizing the positive effects of backwardation, a condition opposite of contango.

19

Table of Contents

Summary of DBIQ-OY GC TR™ and Underlying Index Commodity

Returns for the Three Months Ended June 30, 2013

and the Six Months Ended June 30, 2013

and the Three Months Ended June 30, 2012

and the Six Months Ended June 30, 2012

| Underlying Index |

Aggregate returns for index in the DBIQ-OY GC TR™ |

|||||||||||||||

| Three Months Ended June 30, 2013 |

Three Months Ended June 30, 2012 |

Six Months Ended June 30, 2013 |

Six Months Ended June 30, 2012 |

|||||||||||||

| DB Gold Indices |

(23.38 | )% | (4.14 | )% | (27.22 | )% | 1.92 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| AGGREGATE RETURN |

(23.38 | )% | (4.14 | )% | (27.22 | )% | 1.92 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

If the Fund’s interest income from its holdings of fixed income securities were to exceed the Fund’s fees and expenses, the aggregate return on an investment in the Fund is expected to outperform the Index and underperform the DBIQ-OY GC TR™. The only difference between (i) the Index and (ii) the DBIQ-OY GC TR™ is that the Index does not include interest income from a hypothetical basket of fixed income securities while the DBIQ-OY GC TR™ does include such a component. Thus, the difference between the Index and the DBIQ-OY GC TR™ is attributable entirely to the hypothetical interest income from this hypothetical basket of fixed income securities. If the Fund’s interest income from its holdings of fixed income securities exceeds the Fund’s fees and expenses, then the amount of such excess is expected to be distributed periodically. The market price of the Shares is expected to closely track the Index. The aggregate return on an investment in the Fund over any period is the sum of the capital appreciation or depreciation of the Shares over the period plus the amount of any distributions during the period. Consequently, the Fund’s aggregate return is expected to outperform the Index by the amount of the excess, if any, of its interest income over its fees and expenses but, as a result of the Fund’s fees and expenses, the aggregate return on the Fund is expected to underperform the DBIQ-OY GC TR™. If the Fund’s fees and expenses were to exceed the Fund’s interest income from its holdings of fixed income securities, the aggregate return on an investment in the Fund is expected to underperform the Index.

Net Asset Value

Net asset value means the total assets of the Fund, including, but not limited to, all futures, cash and investments less total liabilities of the Fund, each determined on the basis of U.S. generally accepted accounting principles, consistently applied under the accrual method of accounting. In particular, net asset value includes any unrealized appreciation or depreciation on open commodity futures contracts, and any other credit or debit accruing to the Fund but unpaid or not received by the Fund. All open commodity futures contracts will be calculated at their then current market value, which will be based upon the settlement price for that particular commodity futures contract traded on the applicable exchange on the date with respect to which net asset value is being determined; provided, that if a commodity futures contract could not be liquidated on such day, due to the operation of daily limits or other rules of the exchange upon which that position is traded or otherwise, the Managing Owner may value such futures contract pursuant to policies the Managing Owner has adopted, which are consistent with normal industry standards. The Managing Owner may in its discretion (and under circumstances, including, but not limited to, periods during which a settlement price of a futures contract is not available due to exchange limit orders or force majeure type events such as systems failure, natural or man-made disaster, act of God, armed conflict, act of terrorism, riot or labor disruption or any similar intervening circumstance) value any asset of the Fund pursuant to such other principles as the Managing Owner deems fair and equitable so long as such principles are consistent with normal industry standards. Interest earned on the Fund’s brokerage account is accrued monthly. The amount of any distribution is a liability of the Fund from the day when the distribution is declared until it is paid.

Net asset value per share is the net asset value of the Fund divided by the number of outstanding shares.

Critical Accounting Policies

The Fund’s critical accounting policies are as follows:

Preparation of the financial statements and related disclosures in conformity with U.S. generally accepted accounting principles requires the application of appropriate accounting rules and guidance, as well as the use of estimates, and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, revenue and expense and related disclosure of contingent assets and liabilities during the reporting period of the financial statements and accompanying notes. The Fund’s application of these policies involves judgments and actual results may differ from the estimates used.

The Fund holds a significant portion of its assets in futures contracts and United States Treasury Obligations, both of which are recorded on trade date at fair value in the financial statements, with changes in fair value reported in the statement of income and expenses.

20

Table of Contents

The use of fair value to measure financial instruments, with related unrealized gains or losses recognized in earnings in each period, is fundamental to the Fund’s financial statements. The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (the exit price).