UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number:

(A Series of Invesco DB Multi-Sector Commodity Trust)

(Exact name of registrant as specified in its charter)

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ |

|

|

|

|

☒ |

Smaller reporting company |

||

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Indicate the number of outstanding Shares as of June 30, 2023:

INVESCO DB BASE METALS FUND

(A SERIES OF INVESCO DB MULTI-SECTOR COMMODITY TRUST)

QUARTER ENDED JUNE 30, 2023

TABLE OF CONTENTS

|

|

|

|

Page |

PART I. |

|

|

1 |

|

|

|

|

|

|

ITEM 1. |

|

|

1 |

|

|

|

|

10 |

|

ITEM 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

20 |

ITEM 3. |

|

|

31 |

|

ITEM 4. |

|

|

33 |

|

|

|

|

|

|

PART II. |

|

|

34 |

|

|

|

|

|

|

Item 1. |

|

|

34 |

|

Item 1A. |

|

|

34 |

|

Item 2. |

|

|

34 |

|

Item 3. |

|

|

34 |

|

Item 4. |

|

|

34 |

|

Item 5. |

|

|

34 |

|

Item 6. |

|

|

34 |

|

|

|

|

|

|

|

36 |

|||

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

Invesco DB Base Metals Fund

Statements of Financial Condition

June 30, 2023 and December 31, 2022

(Unaudited)

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2023 |

|

|

2022 |

|

||

|

|

|

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

United States Treasury Obligations, at value (cost $ |

|

$ |

|

|

$ |

|

||

Affiliated investments, at value (cost $ |

|

|

|

|

|

|

||

Other investments: |

|

|

|

|

|

|

||

Unrealized appreciation on LME Commodity Futures Contracts |

|

|

— |

|

|

|

|

|

Deposits with brokers: |

|

|

|

|

|

|

||

Cash collateral - Commodity Futures Contracts |

|

|

|

|

|

|

||

Cash held by custodian |

|

|

— |

|

|

|

|

|

Receivable for: |

|

|

|

|

|

|

||

Dividends from affiliates |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities |

|

|

|

|

|

|

||

Other Investments: |

|

|

|

|

|

|

||

LME Commodity Futures Contracts payable |

|

|

|

|

|

|

||

Unrealized depreciation on LME Commodity Futures Contracts |

|

|

|

|

|

|

||

Payable for: |

|

|

|

|

|

|

||

Fund shares reacquired |

|

|

|

|

|

|

||

Management fees |

|

|

|

|

|

|

||

Brokerage commissions and fees |

|

|

|

|

|

|

||

Total liabilities |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|||

Equity |

|

|

|

|

|

|

||

Shareholder's equity—General Shares |

|

|

|

|

|

|

||

Shareholders' equity—Shares |

|

|

|

|

|

|

||

Total shareholders' equity |

|

|

|

|

|

|

||

Total liabilities and equity |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

General Shares outstanding |

|

|

|

|

|

|

||

Shares outstanding |

|

|

|

|

|

|

||

Net asset value per share |

|

$ |

|

|

$ |

|

||

Market value per share |

|

$ |

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

1

Invesco DB Base Metals Fund

Schedule of Investments

June 30, 2023

(Unaudited)

Description |

|

Percentage of |

|

|

Value |

|

|

Principal Value |

|

|||

United States Treasury Obligations (a) |

|

|

|

|

|

|

|

|

|

|||

U.S. Treasury Bills, |

|

|

% |

|

$ |

|

|

$ |

|

|||

U.S. Treasury Bills, |

|

|

|

|

|

|

|

|

|

|||

U.S. Treasury Bills, |

|

|

|

|

|

|

|

|

|

|||

Total United States Treasury Obligations (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Affiliated Investments |

|

|

|

|

|

|

|

Shares |

|

|||

Exchange-Traded Fund |

|

|

|

|

|

|

|

|

|

|||

Invesco Treasury Collateral ETF (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Money Market Mutual Fund |

|

|

|

|

|

|

|

|

|

|||

Invesco Government & Agency Portfolio, |

|

|

|

|

|

|

|

|

|

|||

Total Affiliated Investments (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Total Investments in Securities (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Open Commodity Futures Contracts(e) |

|

Number of Contracts |

|

|

Expiration Date |

|

Notional |

|

|

Value(f) |

|

|

Unrealized Appreciation (Depreciation)(f) |

|

||||

Long Futures Contracts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

LME Aluminum |

|

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|||

LME Copper |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|||

LME Zinc |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|||

Total Commodity Futures Contracts |

|

|

|

|

|

|

|

|

|

$ |

( |

) |

|

$ |

( |

) |

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

2

Invesco DB Base Metals Fund

Schedule of Investments

December 31, 2022

(Unaudited)

Description |

|

Percentage of |

|

|

Value |

|

|

Principal Value |

|

|||

United States Treasury Obligations (a) |

|

|

|

|

|

|

|

|

|

|||

U.S. Treasury Bills, |

|

|

% |

|

$ |

|

|

$ |

|

|||

U.S. Treasury Bills, |

|

|

|

|

|

|

|

|

|

|||

U.S. Treasury Bills, |

|

|

|

|

|

|

|

|

|

|||

U.S. Treasury Bills, |

|

|

|

|

|

|

|

|

|

|||

U.S. Treasury Bills, |

|

|

|

|

|

|

|

|

|

|||

Total United States Treasury Obligations (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Affiliated Investments |

|

|

|

|

|

|

|

Shares |

|

|||

Exchange-Traded Fund |

|

|

|

|

|

|

|

|

|

|||

Invesco Treasury Collateral ETF (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Money Market Mutual Fund |

|

|

|

|

|

|

|

|

|

|||

Invesco Government & Agency Portfolio, |

|

|

|

|

|

|

|

|

|

|||

Total Affiliated Investments (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Total Investments in Securities (cost $ |

|

|

% |

|

$ |

|

|

|

|

|||

Open Commodity Futures Contracts(e) |

|

Number of Contracts |

|

|

Expiration Date |

|

Notional |

|

|

Value(f) |

|

|

Unrealized Appreciation (Depreciation)(f) |

|

||||

Long Futures Contracts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

LME Aluminum |

|

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|||

LME Copper |

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|||

LME Zinc |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Total Commodity Futures Contracts |

|

|

|

|

|

|

|

|

|

$ |

( |

) |

|

$ |

( |

) |

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

3

Invesco DB Base Metals Fund

Statements of Income and Expenses

For the Three and Six Months Ended June 30, 2023 and 2022

(Unaudited)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest Income |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Dividends from Affiliates |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total Income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Management Fees |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Brokerage Commissions and Fees |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Less: Waivers |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net Investment Income (Loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Net Realized Gain (Loss) on |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commodity Futures Contracts |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Net Realized Gain (Loss) |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Net Change in Unrealized Gain (Loss) on |

|

|

|

|

|

|

|

|

|

|

|

|

||||

United States Treasury Obligations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Affiliated Investments |

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

) |

||

Commodity Futures Contracts |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Net Change in Unrealized Gain (Loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Net Realized and Net Change in Unrealized Gain (Loss) on |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net Income (Loss) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

4

Invesco DB Base Metals Fund

Statement of Changes in Shareholders’ Equity

For the Three Months Ended June 30, 2023

(Unaudited)

|

|

General Shares |

|

|

Shares |

|

|

Total |

|

|||||||||||

|

|

Shares |

|

|

Total |

|

|

Shares |

|

|

Total |

|

|

Shareholders' |

|

|||||

Balance at March 31, 2023 |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

||||||

Purchases of Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Redemption of Shares |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Increase (Decrease) due to Share Transactions |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Investment Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Realized Gain (Loss) on United States Treasury |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Change in Unrealized Gain (Loss) on United |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

||||

Net Income (Loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Change in Shareholders' Equity |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2023 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|||||

5

Invesco DB Base Metals Fund

Statement of Changes in Shareholders’ Equity

For the Three Months Ended June 30, 2022

(Unaudited)

|

|

General Shares |

|

|

Shares |

|

|

Total |

|

|||||||||||

|

|

Shares |

|

|

Total |

|

|

Shares |

|

|

Total |

|

|

Shareholders' |

|

|||||

Balance at March 31, 2022 |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

||||||

Purchases of Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Redemption of Shares |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Increase (Decrease) due to Share Transactions |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Investment Income (Loss) |

|

|

|

|

|

— |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Realized Gain (Loss) on United States Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Change in Unrealized Gain (Loss) on United States |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Income (Loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Change in Shareholders' Equity |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2022 |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

||||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

6

Invesco DB Base Metals Fund

Statement of Changes in Shareholders’ Equity

For the Six Months Ended June 30, 2023

(Unaudited)

|

|

General Shares |

|

|

Shares |

|

|

Total |

|

|||||||||||

|

|

Shares |

|

|

Total |

|

|

Shares |

|

|

Total |

|

|

Shareholders' |

|

|||||

Balance at December 31, 2022 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|||||

Purchases of Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Redemption of Shares |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Increase (Decrease) due to Share Transactions |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Investment Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Realized Gain (Loss) on United States Treasury |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Change in Unrealized Gain (Loss) on United States |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Income (Loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Change in Shareholders' Equity |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2023 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

7

Invesco DB Base Metals Fund

Statement of Changes in Shareholders’ Equity

For the Six Months Ended June 30, 2022

(Unaudited)

|

|

General Shares |

|

|

Shares |

|

|

Total |

|

|||||||||||

|

|

Shares |

|

|

Total |

|

|

Shares |

|

|

Total |

|

|

Shareholders' |

|

|||||

Balance at December 31, 2021 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|||||

Purchases of Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Redemption of Shares |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Increase (Decrease) due to Share Transactions |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

||

Net Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Investment Income (Loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Realized Gain (Loss) on United States Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net Change in Unrealized Gain (Loss) on United States |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Income (Loss) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net Change in Shareholders' Equity |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2022 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|||||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

8

Invesco DB Base Metals Fund

Statements of Cash Flows

For the Six Months Ended June 30, 2023 and 2022

(Unaudited)

|

|

Six Months Ended |

|

|||||

|

|

June 30, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net Income (Loss) |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating |

|

|

|

|

|

|

||

Cost of securities purchased |

|

|

( |

) |

|

|

( |

) |

Proceeds from securities sold and matured |

|

|

|

|

|

|

||

Cost of affiliated investments purchased |

|

|

( |

) |

|

|

( |

) |

Proceeds from affiliated investments sold |

|

|

|

|

|

|

||

Net accretion of discount on United States Treasury Obligations |

|

|

( |

) |

|

|

( |

) |

Net change in unrealized (gain) loss on United States Treasury Obligations, Affiliated |

|

|

( |

) |

|

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

||

Dividends from affiliates |

|

|

|

|

|

( |

) |

|

LME Commodity Futures Contracts |

|

|

( |

) |

|

|

|

|

Management fees |

|

|

( |

) |

|

|

( |

) |

Brokerage commissions and fees |

|

|

|

|

|

( |

) |

|

Net cash provided by (used in) operating activities |

|

|

|

|

|

|

||

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from purchases of Shares |

|

|

|

|

|

|

||

Redemption of Shares |

|

|

( |

) |

|

|

( |

) |

Net cash provided by (used in) financing activities |

|

|

( |

) |

|

|

( |

) |

Net change in Cash |

|

|

( |

) |

|

|

— |

|

Cash at beginning of period |

|

|

|

|

|

|

||

Cash at end of period |

|

$ |

|

|

$ |

|

||

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

|

|

$ |

|

||

See accompanying Notes to Unaudited Financial Statements which are an integral part of the financial statements.

9

Invesco DB Base Metals Fund

Notes to Unaudited Financial Statements

June 30, 2023

Note 1 - Organization

Invesco DB Base Metals Fund (the “Fund”), a separate series of Invesco DB Multi-Sector Commodity Trust (the “Trust”), a Delaware statutory trust organized in

Invesco Capital Management LLC (“Invesco”) has served as the managing owner (the “Managing Owner”), commodity pool operator and commodity trading advisor of the Trust and the Fund since

The Fund seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Industrial Metals Index Excess Return™ (the “Index”) over time, plus the excess, if any, of the sum of the Fund’s interest income from its holdings of United States Treasury Obligations (“Treasury Income”), dividends from its holdings in money market mutual funds (affiliated or otherwise) (“Money Market Income”) and dividends or distributions of capital gains from its holdings of T-Bill ETFs (as defined below) (“T-Bill ETF Income”) over the expenses of the Fund. The Fund invests in futures contracts in an attempt to track its Index. The Index is intended to reflect the change in market value of the base metals sector. The commodities comprising the Index are aluminum, zinc and copper—Grade A (each an “Index Commodity”, and collectively, the “Index Commodities”).

The Fund may invest directly in United States Treasury Obligations. The Fund may also gain exposure to United States Treasury Obligations through investments in exchange-traded funds (“ETFs”) (affiliated or otherwise) that track indexes that measure the performance of United States Treasury Obligations with a maximum remaining maturity of up to

The Commodity Futures Trading Commission (the “CFTC”) and certain futures exchanges impose position limits on futures contracts that reference Index Commodities (the “Index Contracts”). As the Fund approaches or reaches position limits with respect to an Index Commodity, the Fund may commence investing in Index Contracts that reference other Index Commodities. In those circumstances, the Fund may also trade in futures contracts based on commodities other than Index Commodities that the Managing Owner reasonably believes tend to exhibit trading prices that correlate with an Index Contract.

The Managing Owner may determine to invest in other futures contracts if at any time it is impractical or inefficient to gain full or partial exposure to an Index Commodity through the use of Index Contracts. These other futures contracts may or may not be based on an Index Commodity. When they are not, the Managing Owner may seek to select futures contracts that it reasonably believes tend to exhibit trading prices that correlate with an Index Contract.

The Fund offers common units of beneficial interest (the “Shares”) only to certain eligible financial institutions (the “Authorized Participants”) in

This Quarterly Report (the “Report”) covers the three and six months ended June 30, 2023 and 2022. The accompanying unaudited financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions for Form 10-Q and the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). In the opinion of management, all material adjustments, consisting only of normal recurring adjustments, considered necessary for a fair statement of the interim period financial statements have been made. Interim period results are not necessarily indicative of results for a full-year period. These financial statements and the notes thereto should be read in conjunction with the Fund’s financial statements included in its Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the SEC on February 24, 2023.

10

Note 2 - Summary of Significant Accounting Policies

A. Basis of Presentation

The financial statements of the Fund have been prepared using U.S. GAAP.

The Fund has determined that it meets the definition of an investment company and has prepared the financial statements in conformity with U.S. GAAP for investment companies in conformity with accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services — Investment Companies.

B. Accounting Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are issued.

C. Investment Valuations

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value (“NAV”) per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

United States Treasury Obligations are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as developments related to specific securities, yield, quality, type of issue, coupon rate, maturity, individual trading characteristics and other market data. All debt obligations involve some risk of default with respect to interest and/or principal payments.

Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith following procedures approved by the Managing Owner. Issuer-specific events, market trends, bid/asked quotes of brokers and information providers and other data may be reviewed in the course of making a good faith determination of a security’s fair value.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general market conditions which are not specifically related to the particular issuer, such as real or perceived adverse economic conditions, changes in the general outlook for revenues, changes in interest or currency rates, regional or global instability, natural or environmental disasters, widespread disease or other public health issues, war, acts of terrorism or adverse investor sentiment generally and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

D. Investment Transactions and Investment Income

Investment transactions are accounted for on a trade date basis. Realized gains or losses from the sale or disposition of securities or derivatives are determined on a specific identification basis and recognized in the Statements of Income and Expenses in the period in which the contract is closed or the sale or disposition occurs, respectively. Interest income on United States Treasury Obligations is recognized on an accrual basis when earned. Premiums and discounts are amortized or accreted over the life of the United States Treasury Obligations. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date.

E. Profit and Loss Allocations and Distributions

Pursuant to the Trust Agreement, income and expenses are allocated pro rata to the Managing Owner as holder of the General Shares and to the Shareholders monthly based on their respective percentage interests as of the close of the last trading day of the preceding month. Distributions (other than redemption of units) may be made at the sole discretion of the Managing Owner on a pro rata basis in accordance with the respective capital balances of the shareholders.

11

F. Routine Operational, Administrative and Other Ordinary Expenses

The Managing Owner is responsible for all routine operational, administrative and other ordinary expenses of the Fund, including, but not limited to, computer services, the fees and expenses of the Trustee, legal and accounting fees and expenses, tax preparation expenses, filing fees and printing, mailing and duplication costs. The Fund does not reimburse the Managing Owner for the routine operational, administrative and other ordinary expenses of the Fund. Accordingly, such expenses are not reflected in the Statements of Income and Expenses of the Fund.

G. Non-Recurring Fees and Expenses

The Fund pays all non-recurring and unusual fees and expenses, if any, of itself, as determined by the Managing Owner. Non-recurring and unusual fees and expenses include fees and expenses, such as legal claims and liabilities, litigation costs, indemnification expenses or other non-routine expenses. Non-recurring and unusual fees and expenses, by their nature, are unpredictable in terms of timing and amount. For the three and six months ended June 30, 2023 and 2022, the Fund did

H. Brokerage Commissions and Fees

The Fund incurs all brokerage commissions, including applicable exchange fees, National Futures Association (“NFA”) fees, give-up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities by the Commodity Broker (as defined below). These costs are recorded as Brokerage Commissions and Fees in the Statements of Income and Expenses. The Commodity Broker’s brokerage commissions and trading fees are determined on a contract-by-contract basis. On average, total charges paid to the Commodity Broker, as applicable were less than $

I. Income Taxes

The Fund is classified as a partnership for U.S. federal income tax purposes. Accordingly, the Fund will generally not incur U.S. federal income taxes. No provision for federal, state, and local income taxes has been made in the accompanying financial statements, as investors are individually liable for income taxes, if any, on their allocable share of the Fund’s income, gain, loss, deductions and other items.

The Managing Owner has reviewed all of the Fund’s open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain tax positions taken or expected to be taken in future tax returns. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The major tax jurisdiction for the Fund and the earliest tax year subject to examination: United States, 2019.

J. Commodity Futures Contracts

The Fund utilizes derivative instruments to achieve its investment objective. A commodity futures contract is an agreement between counterparties to purchase or sell a specified underlying commodity for a specified price, or to pay or receive a cash amount based on the value of an index or other reference instrument, at a future date. Initial margin deposits required upon entering into futures contracts are satisfied by the segregation of specific securities or cash as collateral with the Commodity Broker. During the period that the commodity futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by recalculating the value of the contracts on a daily basis. For LME contracts, subsequent or variation margin payments are not made and the value of the contracts is presented as net unrealized appreciation (depreciation) on the Statements of Financial Condition. When LME or non-LME contracts are closed or expire, the Fund recognizes a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transaction and the Fund’s basis in the contract. Realized gains (losses) and changes in unrealized appreciation (depreciation) on open positions are determined on a specific identification basis and recognized in the Statements of Income and Expenses in the period in which the contract is closed or the changes occur, respectively.

K. Receivable/(Payable) for LME Contracts

The Fund trades aluminum, copper and zinc commodity futures contracts on the LME. For settlement of futures contracts traded on the LME, cash is not transferred until the settled futures contracts expire. As of June 30, 2023, the Fund had a payable to the Commodity Broker of $

12

Note 3 - Financial Instrument Risk

In the normal course of its business, the Fund is a party to financial instruments with off-balance sheet risk. The term “off-balance sheet risk” refers to an unrecorded potential liability that, even though it does not appear on the balance sheet, may result in a future obligation or loss in excess of the amounts shown on the Statements of Financial Condition. The financial instruments used by the Fund are commodity futures contracts, the values of which are based upon an underlying asset and generally represent future commitments that have a reasonable possibility of being settled in cash or through physical delivery. The financial instruments are traded on an exchange and are standardized contracts.

Market risk is the potential for changes in the value of the financial instruments traded by the Fund due to market changes, including fluctuations in commodity prices. In entering into these futures contracts, there exists a market risk that such futures contracts may be significantly influenced by adverse market conditions, resulting in such futures contracts being less valuable. If the markets should move against all of the futures contracts at the same time, the Fund could experience substantial losses.

Credit risk is the possibility that a loss may occur due to the failure of the Commodity Broker and/or clearing house to perform according to the terms of a futures contract. Credit risk with respect to exchange-traded instruments is reduced to the extent that an exchange or clearing organization acts as a counterparty to the transactions. The Commodity Broker, when acting as the Fund’s futures commission merchant (“FCM”) in accepting orders for the purchase or sale of domestic futures contracts, is required by CFTC regulations to separately account for and segregate as belonging to the Fund all assets of the Fund relating to domestic futures trading. The Commodity Broker is not allowed to commingle such assets with other assets of the Commodity Broker. In addition, CFTC regulations also require the Commodity Broker to hold, in a secure account, assets of the Fund related to foreign futures trading. The Fund’s risk of loss in the event of counterparty default is typically limited to the amounts recognized in the Statements of Financial Condition and not represented by the futures contract or notional amounts of the instruments.

The Fund has not utilized, nor does it expect to utilize in the future, special purpose entities to facilitate off-balance sheet financing arrangements and has no loan guarantee arrangements or off-balance sheet arrangements of any kind, other than agreements entered into in the normal course of business noted above.

Note 4 – Service Providers and Related Party Agreements

The Trustee

Under the Trust Agreement, Wilmington Trust Company, the trustee of the Trust and the Fund (the “Trustee”), has the power and authority to execute and file certificates as required by the Delaware Statutory Trust Act and to accept service of process on the Fund in the State of Delaware. The Managing Owner has the exclusive management and control of all aspects of the business of the Trust and the Fund. The Trustee will serve in that capacity until such time as the Managing Owner removes the Trustee or the Trustee resigns and a successor is appointed by the Managing Owner. The Trustee will have no duty or liability to supervise or monitor the performance of the Managing Owner, nor will the Trustee have any liability for the acts or omissions of the Managing Owner.

The Managing Owner

The Managing Owner serves as the Fund’s commodity pool operator, commodity trading advisor and managing owner. The Fund pays the Managing Owner a management fee, monthly in arrears, in an amount equal to

The Managing Owner waived fees of $

The Distributor

Invesco Distributors, Inc. (the “Distributor”) provides certain distribution services to the Fund. Pursuant to the Distribution Services Agreement among the Managing Owner, the Fund and the Distributor, the Distributor assists the Managing Owner and the Fund’s administrator, The Bank of New York Mellon, with certain functions and duties relating to distribution and marketing services to the Fund including reviewing and approving marketing materials.

The Managing Owner pays the Distributor a distribution fee out of the Management Fee.

13

The Commodity Broker

Morgan Stanley & Co. LLC, a Delaware limited liability company, serves as the Fund’s futures clearing broker (the “Commodity Broker”). The Commodity Broker is registered with the CFTC as an FCM and is a member of the NFA in such capacity.

A variety of executing brokers execute futures transactions on behalf of the Fund. Such executing brokers give-up all such transactions to the Commodity Broker. In its capacity as clearing broker, the Commodity Broker may execute or receive transactions executed by others and clears all of the Fund’s futures transactions and performs certain administrative and custodial services for the Fund. The Commodity Broker is responsible, among other things, for providing periodic accountings of all dealings and actions taken by the Trust on behalf of the Fund during the reporting period, together with an accounting of all securities, cash or other indebtedness or obligations held by it or its nominees for or on behalf of the Fund.

The Administrator, Custodian and Transfer Agent

The Bank of New York Mellon (the “Administrator”, “Custodian” and “Transfer Agent”) is the administrator, custodian and transfer agent of the Fund. The Fund and the Administrator have entered into separate administrative and accounting, custodian, transfer agency and service agreements (collectively referred to as the “Administration Agreement”).

Pursuant to the Administration Agreement, the Administrator performs or supervises the performance of services necessary for the operation and administration of the Fund (other than making investment decisions), including receiving and processing orders from Authorized Participants to create and redeem Creation Units, NAV calculations, accounting and other fund administrative services. The Administrator maintains certain financial books and records, including: Creation Unit creation and redemption records; fund accounting records; ledgers with respect to assets, liabilities, capital, income and expenses; the registrar, transfer journals and related details; and trading and related documents received from the Commodity Broker. The Managing Owner pays the Administrator for its services out of the Management Fee.

Index Sponsor

The Managing Owner, on behalf of the Fund, has appointed Deutsche Bank Securities, Inc. to serve as the index sponsor (the “Index Sponsor”). The Index Sponsor calculates and publishes the daily index levels and the indicative intraday index levels. Additionally, the Index Sponsor also calculates the indicative value per Share of the Fund throughout each business day.

The Managing Owner pays the Index Sponsor a licensing fee and an index services fee out of the Management Fee for performing its duties.

Note 5 - Deposits with Commodity Broker and Custodian

The Fund defines cash as cash held by the Custodian. There were

The Fund may deposit cash, United States Treasury Obligations, T-Bill ETFs and money market mutual funds with the Commodity Broker as margin, to the extent permissible under CFTC rules. The combination of the Fund’s deposits with its Commodity Broker of cash and United States Treasury Obligations and the unrealized profit or loss on open futures contracts represents the Fund’s overall equity in its broker trading account. To meet the Fund’s maintenance margin requirements, the Fund holds United States Treasury Obligations with the Commodity Broker. The Fund transfers cash to the Commodity Broker to satisfy variation margin requirements. The Fund earns interest on any excess cash deposited with the Commodity Broker and incurs interest expense on any deficit balance with the Commodity Broker.

The brokerage agreement with the Commodity Broker provides for the net settlement of all financial instruments covered by the agreement in the event of default or termination of any one contract. The Managing Owner will utilize any excess cash held at the Commodity Broker to offset any realized losses incurred in the commodity futures contracts, if available. To the extent that any excess cash held at the Commodity Broker is not adequate to cover any realized losses, a portion of the United States Treasury Obligations and T-Bill ETFs, if any, on deposit with the Commodity Broker will be sold to make additional cash available. For financial reporting purposes, the Fund offsets financial assets and financial liabilities that are subject to legally enforceable netting arrangements.

The Fund’s remaining cash, United States Treasury Obligations, T-Bill ETFs and money market mutual fund holdings are on deposit with the Custodian. The Fund is permitted to temporarily carry a negative or overdrawn balance in its account with the Custodian. The Fund incurs interest expense on any overdraft balance with the Custodian. Such balances, if any at period-end, are shown on the Statements of Financial Condition under the payable caption Due to custodian.

Because the Fund’s assets are maintained with the Commodity Broker and Custodian, the distress, impairment or failure of the Commodity Broker or Custodian could result in the loss of or delay in access to Fund assets.

14

Note 6 - Additional Valuation Information

U.S. GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. U.S. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods or market conditions may result in transfers in or out of an investment’s assigned level:

Level 1: Prices are determined using quoted prices in an active market for identical assets.

Level 2: Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others.

Level 3: Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information.

The levels assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

The following is a summary of the tiered valuation input levels as of June 30, 2023:

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

Investments in Securities |

|

|

|

|

|

|

|

|

|

|

|

|

||||

United States Treasury Obligations |

|

$ |

— |

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

||

Exchange-Traded Fund |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Money Market Mutual Fund |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Total Investments in Securities |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|||

Other Investments - Liabilities (a) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commodity Futures Contracts |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Total Investments |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

|||

The following is a summary of the tiered valuation input levels as of December 31, 2022:

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

||||

Investments in Securities |

|

|

|

|

|

|

|

|

|

|

|

|

||||

United States Treasury Obligations |

|

$ |

— |

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

||

Exchange-Traded Fund |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Money Market Mutual Fund |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Total Investments in Securities |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|||

Other Investments - Assets (a) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commodity Futures Contracts |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Other Investments - Liabilities (a) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commodity Futures Contracts |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Total Other Investments |

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Total Investments |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

|||

15

Note 7 – Derivative Instruments

The Fair Value of Derivative Instruments is as follows:

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

||||||||||

Risk Exposure/Derivative Type (a) |

|

Assets |

|

|

Liabilities |

|

|

Assets |

|

|

Liabilities |

|

||||

Commodity risk |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commodity Futures Contracts |

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

( |

) |

|

The Effect of Derivative Instruments on the Statements of Income and Expenses is as follows:

|

|

|

For the Three Months Ended |

|

|||||

|

Location of Gain (Loss) on Derivatives |

|

June 30, |

|

|||||

Risk Exposure/Derivative Type |

Recognized in Income |

|

2023 |

|

|

2022 |

|

||

Commodity risk |

|

|

|

|

|

|

|

||

Commodity Futures Contracts |

Net Realized Gain (Loss) |

|

$ |

( |

) |

|

$ |

|

|

|

Net Change in Unrealized Gain (Loss) |

|

|

|

|

|

( |

) |

|

Total |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

|

|

For the Six Months Ended |

|

|||||

|

Location of Gain (Loss) on Derivatives |

|

June 30, |

|

|||||

Risk Exposure/Derivative Type |

Recognized in Income |

|

2023 |

|

|

2022 |

|

||

Commodity risk |

|

|

|

|

|

|

|

||

Commodity Futures Contracts |

Net Realized Gain (Loss) |

|

$ |

( |

) |

|

$ |

|

|

|

Net Change in Unrealized Gain (Loss) |

|

|

|

|

|

( |

) |

|

Total |

|

|

$ |

( |

) |

|

$ |

( |

) |

The table below summarizes the average monthly notional value of futures contracts outstanding during the period:

|

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Average Notional Value |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

16

Note 8 - Investments in Affiliates

The Invesco Treasury Collateral ETF is an investment company registered under the Investment Company Act of 1940, as amended, whose shares are primarily purchased and sold on a national securities exchange. In seeking its investment objective, the Invesco Treasury Collateral ETF primarily holds U.S. Treasury Obligations that: (i) are issued in U.S. Dollars; (ii) have a minimum remaining maturity of at least

The Invesco Government & Agency Portfolio and the Fund are advised by investment advisers under common control of Invesco Ltd., and therefore the Invesco Government & Agency Portfolio is considered to be affiliated with the Fund.

The following is a summary of the transactions in, and earnings from, investments in affiliates for the three and six months ended June 30, 2023.

|

|

Value 03/31/2023 |

|

|

Purchases at Cost |

|

|

Proceeds from Sales |

|

|

Change in Unrealized Appreciation (Depreciation) |

|

|

Realized Gain (Loss) |

|

|

Value 06/30/2023 |

|

|

Dividend Income |

|

|||||||

Invesco Treasury Collateral ETF |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

|

|

$ |

|

|||

Investments in Affiliated Money |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Invesco Government & Agency |

|

|

|

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||||

Total |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

|

|

$ |

|

||||

|

|

Value 12/31/2022 |

|

|

Purchases at Cost |

|

|

Proceeds from Sales |

|

|

Change in Unrealized Appreciation (Depreciation) |

|

|

Realized Gain (Loss) |

|

|

Value 06/30/2023 |

|

|

Dividend Income |

|

|||||||

Invesco Treasury Collateral ETF |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

||||

Investments in Affiliated Money |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Invesco Government & Agency |

|

|

|

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||||

Total |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|||||

The following is a summary of the transactions in, and earnings from, investments in affiliates for the three and six months ended June 30, 2022.

|

|

Value 03/31/2022 |

|

|

Purchases at Cost |

|

|

Proceeds from Sales |

|

|

Change in Unrealized Appreciation (Depreciation) |

|

|

Realized Gain (Loss) |

|

|

Value 06/30/2022 |

|

|

Dividend Income |

|

|||||||

Invesco Treasury Collateral ETF |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

||||

Investments in Affiliated Money |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Invesco Government & Agency |

|

|

|

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||||

Total |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

— |

|

|

$ |

|

|

$ |

|

|||||

|

|

Value 12/31/2021 |

|

|

Purchases at Cost |

|

|

Proceeds from Sales |

|

|

Change in Unrealized Appreciation (Depreciation) |

|

|

Realized Gain (Loss) |

|

|

Value 06/30/2022 |

|

|

Dividend Income |

|

|||||||

Invesco Treasury Collateral ETF |

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

|

|

$ |

|

|||

Investments in Affiliated Money |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Invesco Government & Agency |

|

|

|

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||||

Total |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

— |

|

|

$ |

|

|

$ |

|

||||

17

(a) Purchases

On any business day, an Authorized Participant may place an order with the Transfer Agent to create

Unless otherwise agreed to by the Managing Owner and the Authorized Participant as provided in the next sentence, Creation Units are issued on the creation order settlement date as of 2:45 p.m., Eastern Time, on the business day immediately following the creation order date at the applicable NAV per Share as of the closing time of the NYSE Arca or the last to close of the exchanges on which its futures contracts are traded, whichever is later, on the creation order date, but only if the required payment has been timely received. Upon submission of a creation order, the Authorized Participant may request the Managing Owner to agree to a creation order settlement date up to two business days after the creation order date.

(b) Redemptions

On any business day, an Authorized Participant may place an order with the Transfer Agent to redeem

Unless otherwise agreed to by the Managing Owner and the Authorized Participant as provided in the next sentence, by placing a redemption order, an Authorized Participant agrees to deliver the Creation Units to be redeemed through DTC’s book-entry system to the Fund no later than the redemption order settlement date as of 2:45 p.m., Eastern Time, on the business day immediately following the redemption order date. Upon submission of a redemption order, the Authorized Participant may request the Managing Owner to agree to a redemption order settlement date up to two business days after the redemption order date. By placing a redemption order, and prior to receipt of the redemption proceeds, an Authorized Participant’s DTC account is charged the non-refundable transaction fee due for the redemption order.

The redemption proceeds from the Fund consist of the cash redemption amount. The cash redemption amount is equal to the NAV of the number of Creation Unit(s) requested in the Authorized Participant’s redemption order as of the closing time of the NYSE Arca or the last to close of the exchanges on which the Fund’s futures contracts are traded, whichever is later, on the redemption order date. The Managing Owner will distribute the cash redemption amount at the redemption order settlement date as of 2:45 p.m., Eastern Time, on the redemption order settlement date through DTC to the account of the Authorized Participant as recorded on DTC’s book-entry system.

18

Note 10 - Commitments and Contingencies

The Managing Owner, either in its own capacity or in its capacity as the Managing Owner and on behalf of the Fund, has entered into various service agreements that contain a variety of representations, or provide indemnification provisions related to certain risks service providers undertake in performing services for the Fund. The Trust Agreement provides for the Fund to indemnify the Managing Owner and any affiliate of the Managing Owner that provides services to the Fund to the maximum extent permitted by applicable law, subject to certain exceptions for disqualifying conduct by the Managing Owner or such an affiliate. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Further, the Fund has not had prior claims or losses pursuant to these contracts. Accordingly, the Managing Owner expects the risk of loss to be remote.

Note 11 - Financial Highlights

The Fund is presenting the following NAV and financial highlights related to investment performance for a Share outstanding for the three and six months ended June 30, 2023 and 2022. An individual investor’s return and ratios may vary based on the timing of capital transactions.

NAV per Share is the NAV of the Fund divided by the number of outstanding Shares at the date of each respective period presented.

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Net Asset Value |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net asset value per Share, beginning of period |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Net realized and change in unrealized gain (loss) on |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net investment income (loss) (b) |

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

||

Net income (loss) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net asset value per Share, end of period |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Market value per Share, beginning of period (c) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Market value per Share, end of period (c) |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Ratio to average Net Assets (d) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net investment income (loss) |

|

|

% |

|

|

( |

)% |

|

|

% |

|

|

( |

)% |

||

Expenses, after waivers |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

Expenses, prior to waivers |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

Total Return, at net asset value (e) |

|

|

( |

)% |

|

|

( |

)% |

|

|

( |

)% |

|

|

( |

)% |

Total Return, at market value (e) |

|

|

( |

)% |

|

|

( |

)% |

|

|

( |

)% |

|

|

( |

)% |

19

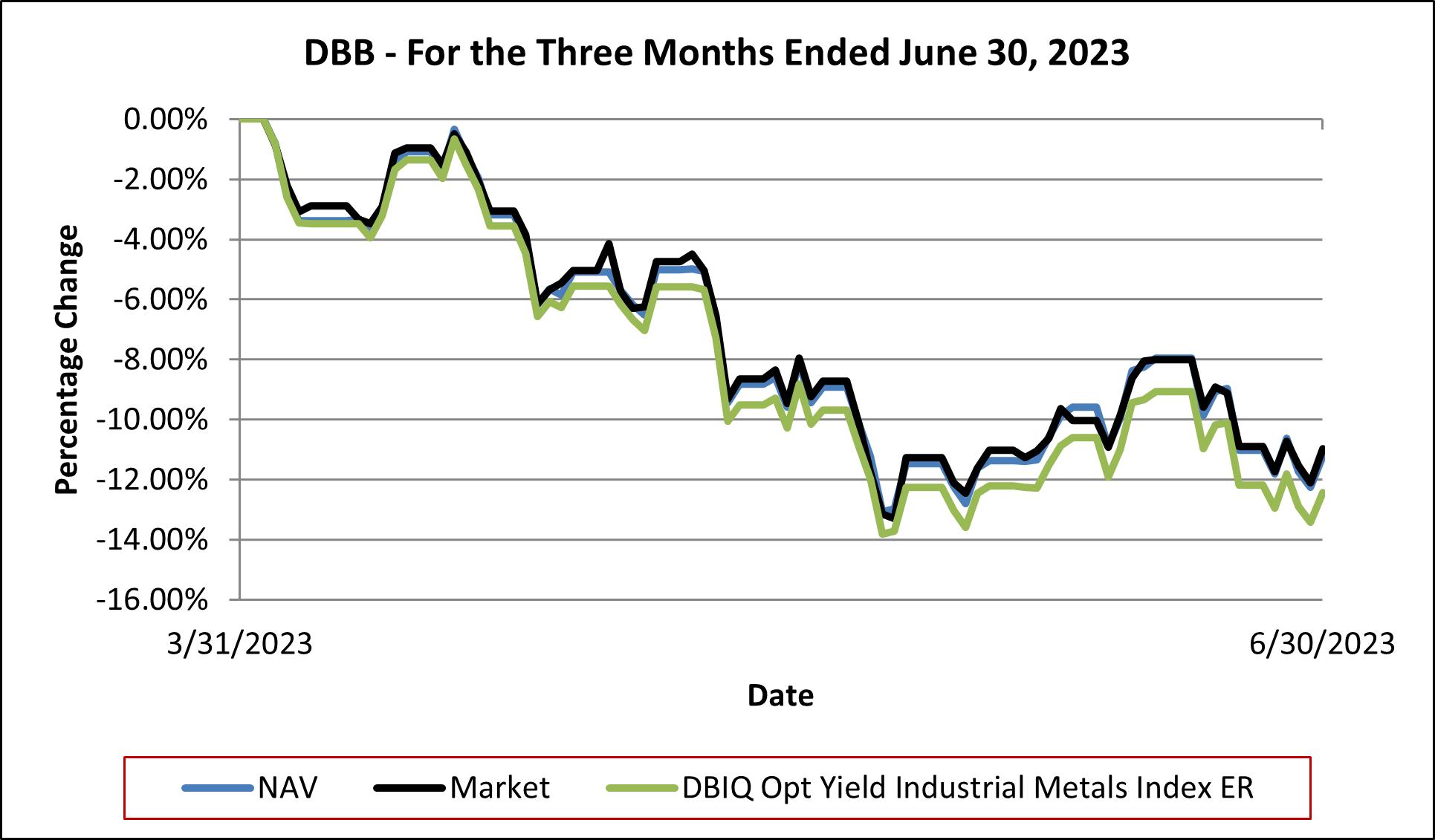

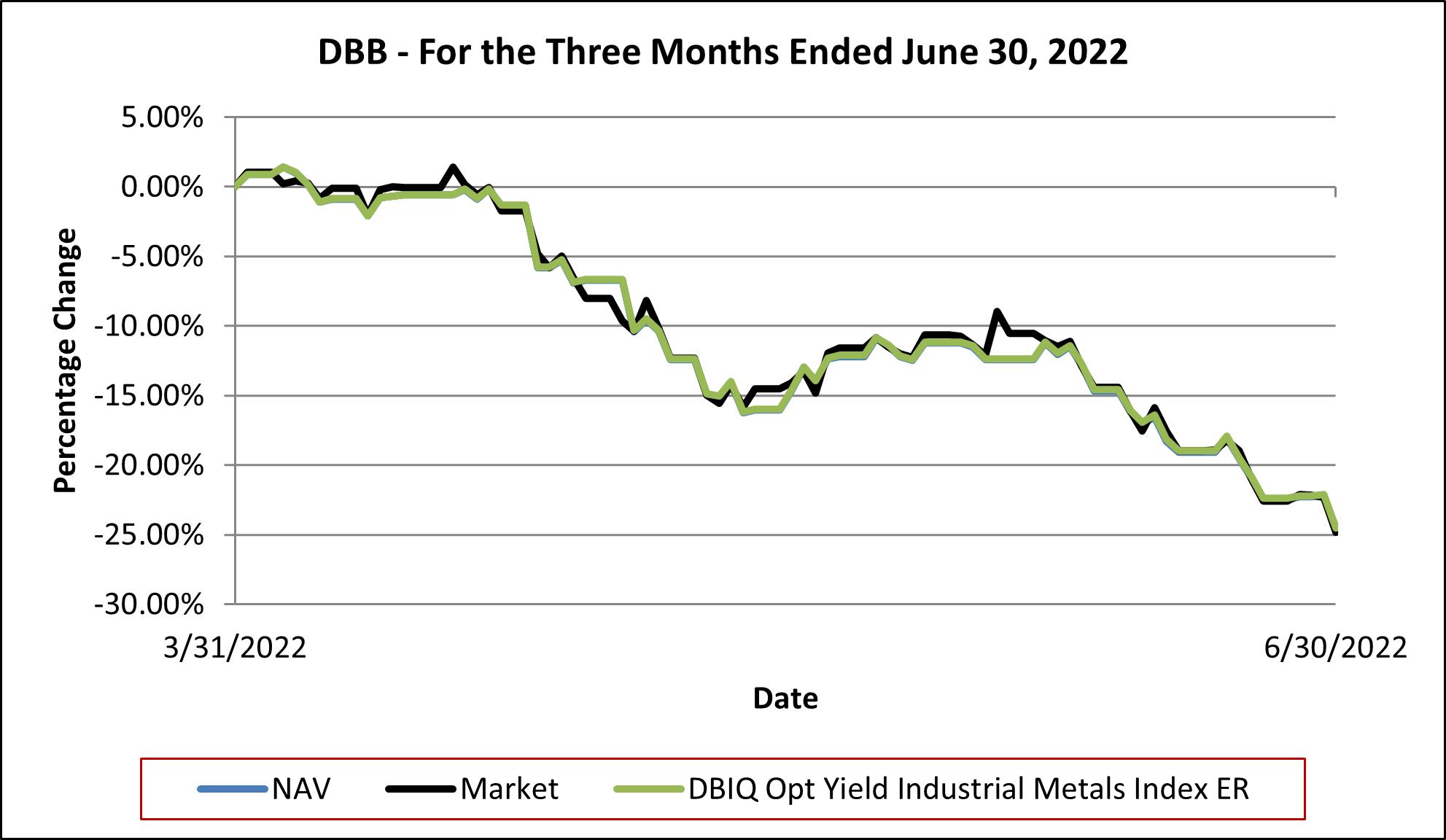

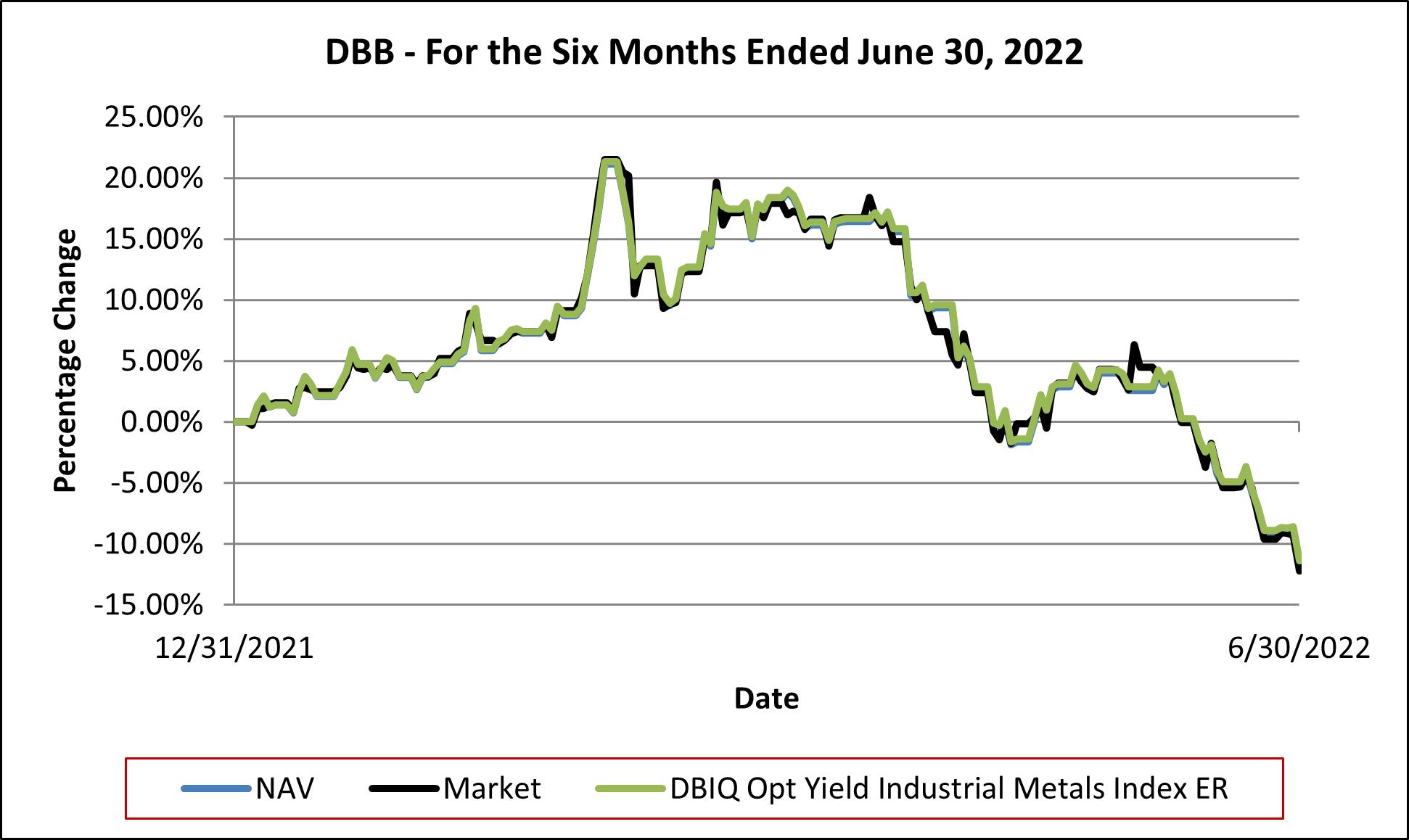

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.