Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2013

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 000-52062

Q THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-3708500 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| incorporation or formation) | identification number) |

Q Therapeutics, Inc.

615 Arapeen Drive, Suite 102

Salt Lake City, UT 84108

(Address of principal executive offices)

Issuer’s telephone number: (801) 582-5400

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class |

Name of each exchange where registered | |

| Common stock, par value $0.001 per share | N/A |

Securities registered under Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter.

As of June 28, 2013, the last business day of the registrant’s most recently completed second quarter, there was no established public market for the registrant’s common stock.

As of April 15, 2014, there were 29,367,363 shares of common stock, $0.0001 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

Table of Contents

Q THERAPEUTICS, INC.

(A Development Stage Company)

CERTIFICATIONS

Table of Contents

FORWARD-LOOKING STATEMENTS

Certain statements made in this Annual Report on Form 10-K are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Registrant to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Registrant. Although the Registrant believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Registrant or any other person that the objectives and plans of the Registrant will be achieved.

Overview

Q Therapeutics, Inc. (hereinafter Q Therapeutics, Q, we, us, our and similar expressions) conducts its business and operations through its wholly owned subsidiary, Q Therapeutic Products, Inc. (Q Products) and Q Products’ wholly owned subsidiary, NeuroQ Research, Inc. Q Therapeutics is a Salt Lake City, Utah-based biopharmaceutical company that is developing human cell-based therapies intended to treat degenerative diseases of the brain and spinal cord, the primary components of the central nervous system (CNS). Q Products was incorporated in the state of Delaware on March 28, 2002, and merged with Q Acquisition, Inc., a Delaware corporation and wholly owned subsidiary of Grace 2, Inc., on October 13, 2011. On November 2, 2011, Grace 2 changed its name to Q Holdings, Inc., and on December 10, 2012, it changed its name to Q Therapeutics, Inc.

The technology upon which these potential therapies are based was developed by Q’s co-founder Mahendra Rao, M.D., Ph.D., a leader in glial stem cell biology, during Dr. Rao’s tenure as a Professor at the University of Utah and as Head of the Stem Cell Section in the Laboratory of Neuroscience at the National Institutes of Health (NIH) Institute of Aging. Dr. Rao was one of the first scientists to identify and seek patent coverage on stem cells and their progeny cells found in the CNS. After licensing Dr. Rao’s technology from the University of Utah and NIH, Q commenced operations in the spring of 2004 to develop cell-based therapeutic products that can be sold as “off-the-shelf” pharmaceuticals.

Objectives of Q Therapeutics

Every year, hundreds of thousands of people suffer from debilitating and often fatal diseases of the brain and spinal cord. Q’s primary business objective is to develop and commercialize novel therapeutic products to treat these diseases as they represent areas of significant clinical need and commercial opportunity. Q is advancing its initial product, trademarked “Q-Cells®” to the market to treat Amyotrophic Lateral Sclerosis (Lou Gehrig’s disease or ALS), and eventually other indications, potentially including Multiple Sclerosis (MS), Transverse Myelitis (TM), Spinal Cord Injury (SCI), Stroke, Huntington’s disease, Parkinson’s disease and Alzheimer’s disease.

Initially, Q is targeting orphan diseases, where the U.S. Food and Drug Administration (FDA) can allow fast-track approvals and market exclusivity, and for which smaller, less-expensive clinical trials may be warranted. This approach can result in accelerated commercialization efforts while maintaining a financing approach focused on capital efficiency.

1

Table of Contents

The Problem of Neurodegenerative Diseases

Neurodegenerative diseases are by nature complex. For most such diseases, there is not just one “cause” nor just one “disease”; there can be multiple different causes with many factors and pathways contributing to the many disease symptoms. Despite much effort by the pharmaceutical/biotechnology industry, current approaches have not been effective. Traditional drugs have focused on single disease pathways. Due to the multi-factorial nature of neurodegenerative diseases, these drugs tend to fail to treat the nerve damage caused by these diseases as they do not fully address all of the disease factors or pathways. As a result, patients suffering from these diseases can, in many cases, only hope to slow the inexorable disease progression and the associated disabilities. We believe that a worldwide market measured in the tens of billions of dollars awaits those who are successful in addressing this substantial medical need.

Q’s Approach to the Problem

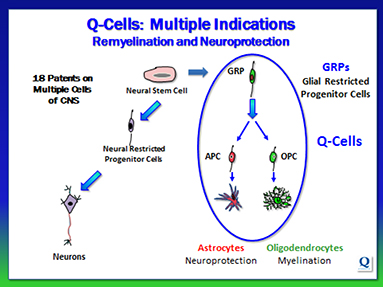

A new approach is needed for treating the multimodal nature of neurodegenerative disease. Q has identified and patented a new treatment modality that provides a multi-factorial approach, bypassing the need to address individual pathways. Specifically, Q is developing a cell-based therapeutic that employs a natural cell type found in the healthy CNS: human glial restricted progenitors and their progeny cells. We call them, Q-Cells. Q-Cells produce astrocytes and oligodendrocytes, the support cells that enable the normal function of neurons. We believe that Q-Cells may provide multiple and complementary mechanisms of action in the treatment of many neurodegenerative diseases. An advantage of this approach is that one need not fully understand the mechanistic aspects of these diseases, as we are tapping into the natural cellular machinery that enables healthy systems to function. We believe this is a more realistic approach than seeking a drug that affects a single disease pathway (although the addition of Q-Cell therapy may enhance benefits seen with such single drugs). Based on data in animal models, we believe that repairing damaged neurons is a faster, more realistic and easier approach than trying to replace them. In addition to using its proprietary cellular technology in a therapeutic mode, Q might also evaluate novel ways to use Q-Cells to screen for new drugs, such as small molecule compounds, that could also provide treatments for neurological diseases.

Q’s Initial Proprietary Product—Q-Cells; Summary of Preclinical Studies

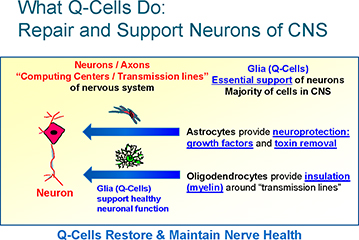

Disease arises when glial cells are damaged or destroyed, causing neurons to malfunction and eventually die. Q-Cells technology aims to treat neurodegenerative diseases by providing new, healthy glial cells to help maintain and/or restore neuron function to a more robust state.

Q-Cells achieve this through multimodal actions. They:

| • | Produce growth factors and nutrients needed by neurons as well as remove compounds that are toxic to them; and |

| • | Form the insulating myelin layer around the axons of neurons, enabling their normal function for signal transmission. |

Q-Cells accomplish these complementary functions in a process that is unique to stem and progenitor cells. They are administered into and act locally in the brain or spinal cord, where they differentiate into two mature Q-Cells glial cell subtypes found in the brain and spinal cord:

| • | Oligodendrocytes which provide the myelin “insulation” around the axons of neurons required for proper signal transmission by the conducting neurons as well as nutritional support. |

| • | Astrocytes, which provide support to neurons through production of growth factors and other trophic support mechanisms (Figure 1). |

This technology aims to restore health and function to neurons prior to their death by using the natural support mechanisms in the CNS. No current treatment can achieve this outcome.

2

Table of Contents

Figure 1. The majority of the cells in the brain and spinal cord are glia cells that provide support function for the neurons. Q-Cells support the health of neurons by producing astrocytes and oligodendrocytes.

Benefits and features of Q-Cells®

Advantages of Q-Cells, determined in animal models, include:

| • | Q-Cells can provide important growth factors and other trophic functions that support neuronal health, which may provide treatment options for diseases directly involving neuronal degeneration such as ALS and Parkinson’s disease. |

| • | Q-Cells can provide myelin repair functions for diseases or injuries involving demyelination such as MS, Transverse Myelitis, Cerebral Palsy, and Spinal Cord Injury. |

| • | When placed in the CNS, Q-Cells predictably replicate, migrate, and terminally differentiate into physiologically relevant glia cells: oligodendrocytes and astrocytes. |

| • | Q-Cells don’t give rise to appreciable numbers of neurons, reducing potential for unwanted effects due to aberrant neuronal connections. |

| • | The isolation process is readily scalable to good manufacturing practices (GMP). |

| • | Tissue-sourced Q-Cells spend little time in culture providing advantages in production. |

Many normal CNS cells remain viable through a person’s life. Our clinical trials are intended to ascertain whether transplanted Q-Cells function for significant periods of time, or if periodic (e.g., annual) treatments will be more appropriate. This cell replacement approach will build on the model of successful bone marrow transplants, where stem cells from donor bone marrow replace diseased blood cells. However, unlike bone marrow transplants, Q-Cells will be banked in vials containing the cells and shipped frozen to hospitals and clinics. Thus, Q plans to sell products following the model of a traditional specialty pharmaceutical company in that Q-Cells will be prepared and inventoried in advance, and will not be generated uniquely for each patient.

The CNS has a degree of immune privilege, and Q plans to use marketed immunosuppressants for a transient period, to mitigate potential for immune rejection associated with transplants.

Q-Cells are late-stage, lineage-restricted human progenitor cells. Q has confirmed that terminal differentiation of Q-Cells in animal models is naturally restricted to astrocytes and oligodendrocytes. In contrast, earlier-state CNS stem cells (neural stem cells or neuroepithelial precursor cells, see Figure 6) can produce neurons as well as glial cells. This less-restricted differentiation potential can produce neurons inappropriately, possibly forming aberrant synaptic connections that lead to neurological complications.

3

Table of Contents

All of the factors cited above lead us to believe that Q-Cells represent a desirable cell therapy approach to neurodegenerative disease.

The Science behind Q-Cells, Preclinical Results and their Application to Disease

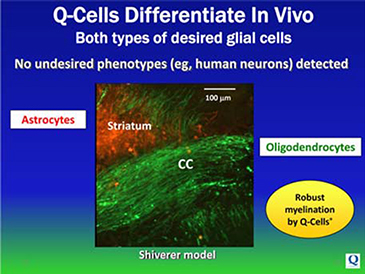

During normal development, glia are formed by a progenitor cell called the glial-restricted precursor (GRP). Q has trademarked the human GRPs, together with their progeny, under the name Q-Cells. Q-Cells have been shown to naturally replicate, migrate and differentiate into mature glial cells in their native CNS environment. The resulting differentiated cells (astrocytes and oligodendrocytes, shown in Figure 2) then perform the essential support functions as described above. Q Therapeutics is taking advantage of Q-Cells’ natural abilities to follow the local molecular cues present in the brain or spinal cord, and intends to transplant Q-Cells® into patients to treat certain diseases where glia are defective, damaged or destroyed.

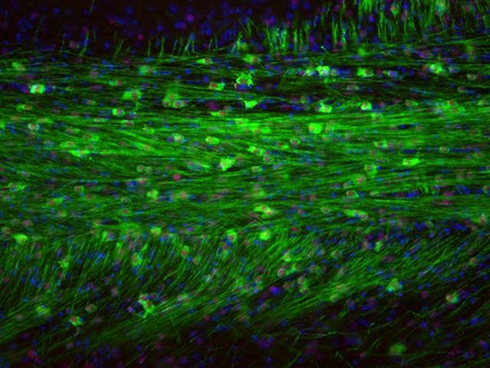

Figure 2. Q-Cells, when implanted in the brains of newborn “shiverer” mice, differentiate into both types of glial cells: Oligodendrocytes (green stain for myelin basic protein [MBP]) and astrocytes (red stain for human glial fibrillary acidic protein [GFAP]). Q-Cells Shiverer mice are genetically engineered to be born with defective myelin.

A. Diseases Involving Myelination

In demyelinating diseases such as Multiple Sclerosis and Transverse Myelitis, inflammatory attacks damage the oligodendrocytes, resulting in the loss of the insulating myelin sheath; this is the primary pathology that causes loss of proper neuronal function and can lead to neuron death. Q-Cells follow natural cues to replace the missing myelin on damaged neurons, providing restorative therapy for demyelinating diseases. Other drugs have not been able to achieve this result.

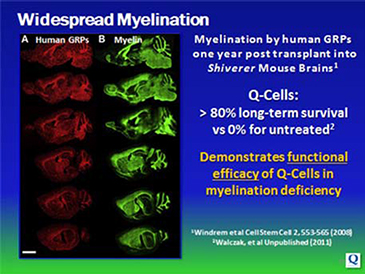

Windrem et al (Cell Stem Cell, published 2008) and Walczak with his colleagues at Johns Hopkins University (2012, unpublished data) demonstrated widespread migration of implanted human GRPs/Q-Cells and robust remyelination in the brains of “shiverer” mice (Figure 3), which are genetically engineered to be born with defective myelin. This treatment led to a substantially prolonged life span in a subset of treated mice, with many mice “cured “of the widespread dysmyelination in their brains.

4

Table of Contents

Figure 3. Transplanted human GRPs differentiate into myelinating oligodendrocytes in the shiverer mouse model. Human GRPs were implanted into brains of newborn shiv/rag2-/-mice and analyzed 12 months post-transplantation. Panel A shows the presence of human cells (stained in red) throughout the brain in treated mice, and Panel B shows the presence of myelin (green) formed by the resulting human oligodendrocytes. Shiverer mice lack the ability to form functional myelin, and untreated mice were all dead within five months. The human GRPs or Q-Cells resulted in functional benefits and mice that survived long-term were essentially cured.

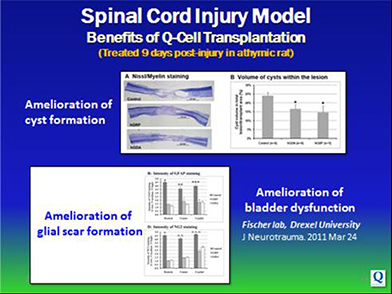

Sandrock et al (Regenerative Medicine, 2010) showed engraftment, migration, integration and differentiation of Q-Cells into myelin-forming oligodendrocytes and astrocytes as well as safety (no tumor formation) when implanted into newborn shiverer and shiverer/rag2-/-mice. Walczak et al (Glia, 2011) showed safety (no tumors), extensive migration, expansion into spinal cord lesions, and formation of a mature glial phenotype (in shiv/rag2-/-mice), and preservation of electrophysiological conduction across the spinal cord in rats with focal (inflammatory) spinal cord lesions. Jin et al (Journal of Neurotrauma, 2011) (Figure 4) working in rat models of traumatic spinal cord injury, showed that Q-Cells reduced cyst and scar formation at the injury site (cysts and scars can prevent healing and repair), and had beneficial effects on bladder function and did not increase sensitivity to pain (safety).

5

Table of Contents

Figure 4. Benefits of Q-Cell transplantation in models of traumatic spinal cord injury. Q-Cells were transplanted into the thoracic spinal cords of athymic rats 9 days after contusion spinal cord injury. Top graph, Q-Cells resulted in amelioration of cyst formation at the injury site. Bottom graph, Q-Cells reduced formation of glial scars at the injury site. Q-Cells also reduced bladder dysfunction (see figure in the publication).

B. Neurodegeneration and Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig’s Disease)

Neurodegenerative diseases are characterized by the death of neurons, generally due to the lack of supporting functions that healthy glial cells provide. These diseases include Parkinson’s disease, Alzheimer’s disease and ALS. ALS is a neurodegenerative disease characterized by the progressive deterioration and loss of motor neurons resulting in muscle atrophy, progressive weakness, paralysis and ultimately death. Most ALS cases have no apparent hereditary basis; of the approximately 10% of cases that are inherited, more than a dozen different genetic mutations have been implicated. The precise mechanism(s) underlying the disease is not understood, although hypotheses include glutamate excitotoxicity mitochondrial dysfunction, protein aggregation, aberrant RNA metabolism, and protein trafficking defects. This list and the varied presentation of disease have led to the idea that multiple pathways are involved in ALS, and that therapies focusing on a single target or pathway are likely to be of limited utility in disease amelioration. In contrast, a cellular therapeutic with multimodal activities targeting the underlying support of motor neuron health on several levels may provide neuroprotection and slow or halt disease progression, and potentially even improvement.

Studies in mouse models of ALS suggest that abnormalities in astrocytes and microglia in addition to motor neurons play a role in disease onset as well as progression. Healthy astrocytes play a prominent role in CNS health, including regulation of extracellular ionic environment, providing critical amino acids and metabolites to neurons (lactate, glutamine), and regulating glutamate neurotransmission. Loss of the glutamate transporter in astrocytes is common to both genetic and sporadic ALS in humans. In both ALS patients and in animal models, there is abundant evidence that astrocyte abnormalities and physiological dysfunction can be seen many months before motor neuron degeneration and precede clinical disease [literature references include Clement et al, Science 302, 113-117 (2003); Rothstein et al Neuron 18, 327-338 (1997); Lepore et al, Nature Neuroscience 11, 1294-1301 (2008); Yamanaka et al, Nature Neuroscience 11, 251-253 (2008); Wang et al, Human Molecular Genetics 20, 286-293 (2011)]. Further, the Maragakis lab recently demonstrated that transplanting rat astrocyte precursors carrying the SOD mutation (which gives rise to ALS in people who have this mutation) into healthy rats results in degeneration of motor

6

Table of Contents

neurons in the previously healthy rats [Proc Natl Acad Sci on-line edition Oct 2011 10.1073 (2011)]. Together, these data are consistent with the notion that diseased astrocytes in ALS (regardless of the cause of ALS) have a role in motor neuron pathology and death, while healthy astrocytes can be protective of diseased motor neurons. This altered physiology of CNS astrocytes contributes to disease progression by resulting in further susceptibility to motor neuron loss. Supplementing diseased astrocytes with healthy cells is a promising approach for slowing and/or halting the course of ALS.

While the role astrocyte dysfunction in ALS has been established, the role of oligodendrocytes has only begun to be appreciated. The lactate transporter (SLC16A1, expressed in oligodendrocytes) has been shown to be reduced in spinal cord of ALS patients and in mouse models of ALS. Given that oligodendrocytes appear to be the main supplier of energy-rich lactate to nerve cells, treatments that boost numbers of oligodendrocytes which can deliver this critical energy-rich metabolite may slow the progression of the disease (Lee et al., Nature, July 2012). Further, selective removal of mutant SOD1 from oligodendrocytes delayed disease onset and prolonged survival in SOD1 mice and demyelination is seen in gray matter in ALS mice and men (Kang et al., Nature Neuroscience, March 2013). Together, these findings are consistent with the notion that oligodendrocyte dysfunction also can contribute to ALS.

The involvement of glial dysfunction in motor neuron loss in ALS forms the basis for the therapeutic approach of introducing healthy glia via transplantation of glial restricted progenitors (Q-Cells) into ALS patients to slow and/or halt disease course. Q-Cells may be able to functionally replace diseased host glia (both astrocytes and oligodendrocytes) thereby reducing motor neuron death and slowing or halting disease progression. The glutamate transport capacity of Q-Cells may not be the only mechanism for neuroprotection; production of growth factors; lactate transport and trophic factor delivery may also play a protective role. Glial supplementation may positively affect multiple pathways of natural motor neuron support and could therefore represent an effective cell therapy approach to ALS.

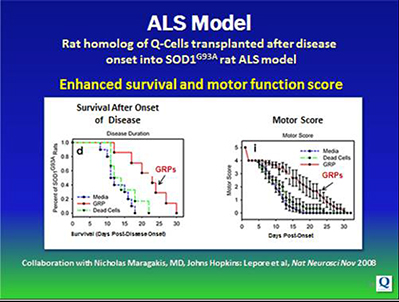

Dr. Maragakis and his colleagues have demonstrated the validity of this hypothesis, showing therapeutic benefits following transplantation of healthy rat GRPs into the SOD1 rate model (Lepore et al, Nature Neuroscience 11, 1294-1301 (2008)). Administration of rate GRPs (the rate cells homologous to human Q-Cells) into the cervical spinal cord after the onset of disease enhanced survival and motor function.

7

Table of Contents

Figure 5. Beneficial effects of GRPs in rat model of ALS. Healthy rat GRPs were transplanted into the cervical spinal cords of the rat SOD1 model of ALS after symptoms of disease onset. Left graph: Survival after disease onset approximately doubled in the group treated with rat GRPs. Right graph: Motor score increased significantly in rats treated with rat GRPs.

The above study in the rat ALS model (Figure 5), which targeted cervical motor neurons, documented that following GRP transplantation in this model of ALS, sparing of the motor neurons that innervate the diaphragm (the phrenic nerve) and hence control respiratory function occurred. Further GRP transplantation resulted in lifespan extension and improvement in grip strength. Importantly, these preclinical animal experiments have demonstrated clinically relevant improvements in diaphragmatic electrophysiology, resulting in the maintenance of diaphragmatic function. Using the same transplantation paradigm, robust survival and wide spread distribution of Q-Cells has been demonstrated following transplantation into the cervical spinal cord of SOD1 mice. In these studies, Q-Cells differentiated into mature glial cells but not unwanted neurons, one demonstration of safety (Lepore et al. 2011).

Initial Clinical Trial Plans in ALS patients

In January 2012, we held a productive pre-IND meeting with the FDA to discuss Q-Cells for the treatment of ALS during which we discussed preclinical animal study requirements, cell manufacturing and clinical trial design and protocol. The FDA is supportive of our approach and required that we complete definitive GLP safety studies in preparation for our first in man clinical trial. In December 2012, we initiated these studies to demonstrate the biodistribution of Q-Cells injected into the cervical spinal cord and the lack of tumor formation. Final data from these studies is expected during Q3 2014. To date, we have not seen any safety issues associated with Q-Cells. We plan to complete the in-life portion of all requisite GLP preclinical safety and device studies during the first half of 2014 with the intention of submitting our IND to the FDA during the latter part of the year.

The initial clinical sites for our planned Phase 1/2a study include Emory University School of Medicine and Johns Hopkins University School of Medicine, both institutions with a leadership position in ALS clinical research.

8

Table of Contents

We anticipate commencing enrollment in our Phase 1/2a clinical study in 12-15 ALS patients in late 2014 pending a favorable and timely review by the FDA. It is anticipated that the two site trial will be completed in 18-24 months pursuant to the initiation of enrollment, pending a favorable and timely review by the FDA. The end points of the Phase 1/2a clinical trial are safety of Q-Cells administration as a primary measure, with surrogate measures of biological activity and efficacy as secondary endpoints.

Upon completion of the initial 12-15 patients treated in the trial, we plan to meet with the FDA to discuss an extended Phase 2a trial consisting of 20 additional patients. We have ongoing discussions with investigators at the University of California at San Francisco and the University of California at San Diego who have demonstrated interest in participating in an expanded trial.

Subsequent Clinical Trials

We believe our proprietary Q-Cells will have broad applicability across myriad neurodegenerative diseases and injuries of the CNS beyond ALS. Potential therapeutic indications for our Q-Cells include Transverse Myelitis, Huntington’s disease, Multiple Sclerosis, Spinal Cord Injury, Stroke, Parkinson’s and Alzheimer’s disease.

Following the initiation of our clinical trial with Q-Cells in ALS, we plan to pursue additional orphan indications for Q-Cells that demonstrate their inherent broad capability and multiple mechanisms of action. This approach can result in accelerated commercialization efforts while maintaining a financing approach focused on capital efficiency. We believe that following this strategy will lead to partnerships with larger biotechnology, pharmaceutical, or cell therapy companies for larger indications which may include multiple sclerosis, stroke, Parkinson’s and Alzheimer’s disease where larger clinical trials and more substantial sales and marketing programs are necessary to access the markets. In addition, we intend to pursue improvements in manufacturing processes that lead to larger production runs as well as derivation of our product from multiple tissue sources. These efforts should, in turn, lead to more efficient and diversified manufacturing capabilities for Q Therapeutics and a broader patent portfolio, allowing for deeper penetration of both existing and new markets.

Q-Cells—Benefits of Localized Therapy

The ability of animal results to predict human results, and accordingly the drug development risk profile, depends on many factors including:

(1) The pharmacokinetic and metabolic profiles of a drug in animals vs. humans, which can greatly influence both efficacy and safety;

(2) How the drug affects the target diseased and disease-causing tissues; and

(3) What the drug does to non-target cells.

Many drug candidates fail in development because they affect not only their intended target but have toxic off-target effects in other organ systems, as well. For example, a drug intended to treat headache pain may fail to become a commercial product due to unacceptable toxic systemic effects in other organs, e.g., heart or kidneys. Q-Cells are a localized treatment in the CNS. Studies conducted by Windrem et.al. (Cell Stem Cell 2, 553-565(2008)) indicate that human GRPs stop at the boundary where the CNS meets the peripheral nervous system. Q anticipates that this localized nature of the planned Q-Cell therapy may reduce risk from systemic toxicity, which Q believes may reduce the risk of drug failure in early clinical trials due to systemic toxicities. Additional animal safety studies are being conducted to establish safety both locally in the spinal cord and brain as well as systemically before initiating clinical trials.

Validation of Q’s Technology and Approach

Q’s technology, approach and progress have been validated by several outside groups. In 2008, Invitrogen, Inc. (subsequently Life Technologies, Inc., now Thermo Fisher Scientific, Inc.) conducted diligence on Q prior to making an investment of $2.6 million. In 2009, Q received confirmation of notice of award of a $4 million milestone-driven NIH grant, which involved review by top scientists in the neurology, regenerative medicine, and ALS areas (at Harvard University, Columbia University, University of Wisconsin). To obtain each subsequent year of grant funding, NIH reviewed and confirmed the progress on developmental milestones. In 2011, Cephalon (now Teva), did extensive diligence prior to making an investment of $3.7 million into Q, following its 2010 investment

9

Table of Contents

in Mesoblast, another cell therapy company. The quality of our academic collaborations also attests to what we have been able to accomplish in our development of Q-Cells. Finally, the granting of multiple patents on our intellectual property validates the inventiveness and provides further value to the Company.

The funding received from these sources has enabled Q to characterize and develop manufacturing protocols for Q-Cells, transferring them to a GLP/GMP manufacturing facility, obtain animal data in multiple models of neurodegenerative disease (diseases of myelination- multiple sclerosis, transverse myelitis and general dysmyelination; spinal cord injury, ALS), generate much of the preclinical data package that will support IND filing, and obtain numerous patents.

Q Therapeutics’ Collaborative Business Model

Q Therapeutics uses a collaborative business model to develop its products. Q believes this type of business model to be capital efficient while allowing it to augment its own expertise and capabilities with those of its development partners at the time that outside resources are needed. Q’s collaborative business model includes utilizing third parties for certain functions and outsourced services. For example, Q utilizes outside collaborators and contractors to:

| • | Leverage its research and development resources by forming collaborations with outside scientists specialized in our areas of interest; |

| • | Contract Good Laboratory Practices (GLP) and Good Manufacturing Practices (GMP) manufacturing to facilities specialized in such production; |

| • | Utilize experienced regulatory consultants to work with the FDA; |

| • | Contract safety/toxicology studies to qualified GLP labs; |

| • | Conduct the clinical trials with physicians and institutions with relevant experience; |

| • | Enter into pharmaceutical company collaborations to maximize product sales. |

Collaborations and Grant Funding

Q Therapeutics pursues opportunities to obtain grant funding from government and private organizations when such grants are aimed at an area that augments Q’s internal development efforts. Generally, we seek opportunities that have the potential to provide funding over several years and that can advance programs into clinical development. We normally seek qualified academic collaborators to work with us on these programs to complement our internal developmental expertise. Grant funding is very competitive to obtain, and it is normal to apply for many grants for each one funded. As applying for grants requires expenditure of internal resources, Q is selective as to which grant opportunities it will pursue that are aligned with our corporate goals. To date, Q has been the beneficiary of:

1) Two SBIR Phase 1 grants (~$120,000 each);

2) A 4 year, $4 million (in direct costs) grant from National Institutes of Health (NIH) to help fund the preclinical studies of Q-Cells to result in submission of an IND to treat ALS patients;

3) An $850,000 grant from the Maryland Stem Cell Fund, to help fund preclinical studies with Johns Hopkins on Q-Cells for treatment of ALS; and

4) A $250,000 grant from the Neilsen Foundation to fund studies of Q-Cells in traumatic spinal cord injury.

Q Therapeutics works in conjunction and maintains collaborations with the highly respected laboratories of Dr. Nicholas Maragakis, Dr. Piotr Walczak and Dr. Itzhak Fischer. The collaborations with these laboratories do not involve any milestone or royalty payments or any form of agreement for compensation of any kind. Material transfer agreements cover the supply and use of cells from Q to the collaborators. To date, most of their research has been funded through grant funding from the NIH, Maryland Stem Cell Fund, and the Neilsen Foundation.

The NIH grant that has funded the collaboration with Dr. Maragakis’ laboratory is in its 3rd year, with renewal for the 4th pending achievement of certain milestones. Approximately $800,000 to $900,000 in direct costs was funded in each of year one and two, with a year three award of $1.0 million for direct costs. Year three funding was primarily devoted to Q-Cell production at the University of Utah, antibody production at Goodwin Biotechnology, Inc., and GLP safety studies at MPI Research to support the Company’s IND submission for ALS.

10

Table of Contents

Material Terms of the NIH Grant

The NIH grant is intended to fund work leading to an IND submission for use of Q-Cells in the treatment of ALS. The grant was issued directly to our collaborators and covers costs that would otherwise be borne by Q, including our collaboration with Dr. Maragakis’ laboratory, the University of Utah, MPI Research and Goodwin Biotechnology. In December 2012, the Company was notified of a sub-award as part of grant funding awarded to The Johns Hopkins University from the National Institute of Neurological Disorders and Stroke (NINDS) of the National Institutes of Health. The Company was notified of a sub-award for the 2012-2013 grant plan year for $631,383, of which the Company received $491,977 and the balance was paid directly to a third-party supplier.

Q Therapeutics has the proprietary rights to the cells that are the subject of all of these grants.

Agreement Terms of Maragakis Collaboration

With respect to the Maragakis collaboration, Q provides technical expertise as well as product for testing and actively assists with experimental design and analysis. The Maragakis Laboratory provides its technical expertise and carries out experiments as mutually agreed upon with Q Therapeutics. Q maintains all rights to the Q-Cells product. Upon the development of any new intellectual property in which technologies outside of Q-Cells are involved, Q Therapeutics has the right of first negotiation to obtain an exclusive license on such innovation with Johns Hopkins University.

Future Collaborations with Third Parties

We are in discussions with third parties about collaborating in the development of our Q-Cell® product and may, under the right terms, enter into one or more partnership(s) to advance the program.

Manufacturing

Q Therapeutics has developed manufacturing protocols to isolate Q-Cells® directly from somatic or fetal cadaver tissue, without the need for additional differentiation in vitro. Q has developed proprietary methods to expand the cells at this stage to enable treatment of many patients from each preparation. Q’s strategy is to start with the most straightforward path: isolate and characterize unmodified cells that are already, naturally, at the desired stage of differentiation, to achieve proof of activity in clinical trials. Q believes that this strategy enables development of Q-Cells and other cellular therapeutics in the most cost and time-effective manner.

Q Therapeutics will use a centralized laboratory (contract GMP cell production manufacturer) for cell isolation and expansion and to provide the necessary quality control. The clinical transplant sites will receive frozen cells, which they will subsequently thaw, wash and inject into the target site of the patient. Use of allogeneic cells (i.e., cells derived from tissue and not obtained from the patient), rather than autologous cells (cells derived from the patient’s own tissues) both enables use of what Q believes may be the most effective healthy cells as well as permits cell therapy to be an off-the-shelf treatment, promoting more widespread use. The manufacturing of the Q-Cells is done via a proprietary process developed by Q. This process can be shared with Q’s contract manufacturer of choice, or with several manufacturers to mitigate the risk of loss of any one manufacturing subcontractor.

Q Therapeutics is currently working with the GLP/GMP Cell Therapy and Regenerative Medicine Facility (CTRM) operated by the University of Utah. Q may seek other manufacturers as its development programs progress once Q-Cells® have been approved for commercial sale.

Manufacturing Agreement with the University of Utah

In December 2011, Q Therapeutics entered into a service and supply agreement with the University of Utah for an initial period of five years, with an option to renew the agreement on an annual basis. The basic terms of the agreement stipulate the pricing for the manufacturing and processing of batches of cells and the index to be used for any price modifications, the granting of non-exclusive rights to the CTRM work product, and a non-exclusive, non-transferable and royalty-free license to the University of Utah to manufacture Q-Cells for use by Q and by collaborators specified by Q, with payment of manufacturing costs to the University of Utah. Either party can terminate the agreement upon appropriate notice.

11

Table of Contents

Manufacturing Agreement with Goodwin Biotechnology

Q Therapeutics has an agreement with Goodwin Biotechnology (GBI) which specifies the contract research to achieve GMP production and conjugation of the antibody used in cell purification for manufacture of Q-Cells. Q maintains all rights to the products. The Agreement with GBI, which sets out obligations of GBI to provide process development and GMP manufacture and stability studies of the antibody originally provided by Q, is close to completion with stability studies ongoing. Q Therapeutics can terminate the project at any time, subject to a cancellation penalty.

Figure 6. Stem and progenitor cells of the brain and spinal cord. Q-Cells can be derived from pluripotent stem cells (e.g., ESCs or iPSCs) or isolated from somatic tissue sources (called Adult Stem Cells). Q Therapeutics’ strategy is to start with the more straightforward path: isolate and use unmodified cells that are already, naturally, at the desired cell type. Q believes that the restricted fate of Q-Cells lowers the chance of unwanted side effects, such as inappropriate production of neurons. NRP = neuronal restricted precursor, GRP = glial restricted precursor, APC = astrocyte precursor cell, OPC = oligodendrocyte precursor cell.

Q-Cells® Can Be Obtained from a Variety of Sources

Q-Cells® can be obtained from a variety of sources (Figure 6, including: (i) from somatic tissue (termed adult stem cells, isolated from fetal or adult tissue), (ii) differentiated from CNS stem cells [neuroepithelial stem cells (NEP) or neural stem cells (NSC)] which can be isolated from somatic tissue or derived from pluripotent cells), or (iii) differentiated from pluripotent cells (e.g., embryonic stem cells (ESC) or other pluripotent cells such as induced pluripotent stem cells (iPSC)). Q Therapeutics has intellectual property (IP) covering multiple sources, giving it a broad IP position. Because of this broad IP position, Q has the ability to follow a development path that enables cost and time-efficient development of its cellular therapeutics. For these reasons, Q has chosen to develop its initial Q-Cells® product by isolating the cells directly from somatic (fetal brain) tissue, followed by expansion in the production facility, as this provides cells that are at the desired cell type without the need for additional in vitro differentiation.

12

Table of Contents

Q Therapeutics’ Intellectual Property

Q Therapeutics has exclusive worldwide rights to its Q-Cells product, through an agreement with the University of Utah Research Foundation (UURF or the Foundation) and through owned, internally developed intellectual property. The Q patent portfolio encompasses five families of neural lineage progenitor or stem cell technologies. Currently, Q has rights to 18 issued patents plus U.S. and international patents pending encompassing composition of matter, methods of production and methods of use of multiple cell types of the CNS (including Q-Cells) as well as some of the peripheral nervous system, giving us a strong intellectual property position for Q-Cells as well as other neural lineage cells. Some of our patents are the subject of a license agreement with the University of Utah and the NIH. This license provides for royalties on Q Therapeutics’ and sublicensees’ sales and contains due diligence obligations and related provisions; a portion of the consideration to the University of Utah was equity in Q. In addition, Q has exclusive rights to internally developed patent applications on its glial cell products, as well a non-exclusive license to two patents on the delivery device.

Terms of License Agreement with the University of Utah Research Foundation

The License Agreement (the “Agreement”) with the Foundation obligates Q Therapeutics to diligently proceed with development, manufacture, sale and use of licensed products through the term of the Agreement.

Pursuant to the Agreement, Q Therapeutics has an obligation to make milestone payments to the University of Utah. More specifically, approximately $1.3 million in total milestone payments will be due to the Foundation for each product that receives market approval, with most of the payment weighted towards approval. Additionally, the Foundation is entitled to royalties resulting from the sale of products designated for human therapeutic use.

To date, less than $1,000,000 has been paid in aggregate pursuant to these contractual payment obligations. The term of the Agreement spans the life of the patents. The Foundation can terminate the Agreement for uncured default after a 30-day notice. Q Therapeutics may terminate the Agreement at any time without cause upon 90 days notice.

Trademarks

Q also holds a U.S. Trademark to its first product name, Q-Cells (serial number: 78869175; registration number: 3,385,490), and U.S. and International Trademarks/Service marks to: Q Therapeutics® (U.S. serial number: 78-415,125; U.S. registration number: 3,280,432; international registration number: 867,474).

Patents and Patent Applications

Q’s issued/granted patents and patent applications that are licensed or owned by Q include the following:

Common Neural Progenitor for the CNS and PNS

Mahendra S. Rao, Tahmina Mujtaba

ISSUED U.S. Patent 6,830,927

Generalization, Characterization, and Isolation of Neuroepithelial Stem Cells and Lineage Intermediate Precursor

Mahendra S. Rao, Margot Mayer-Proschel, Tahmina Mujtaba

PCT/US98/ 09630, Filed 5/7/98, published PCT application

Isolation of Lineage-Restricted Neuronal Precursors

Mahendra S. Rao, Margot Mayer-Proschel

ISSUED U.S. Patent 6,734,015

Lineage-Restricted Neuronal Precursors

Mahendra S. Rao, Margot Mayer-Proschel and Anjali J. Kalyani

ISSUED U.S. Patent 6,787,353

Lineage-Restricted Neuronal Precursors

Mahendra S. Rao, Margot Mayer-Proschel, Anjali J. Kalyani

PCT/US98/ 13875, filed, 7/3/98, published PCT application

13

Table of Contents

Lineage Restricted Glial Precursors from the Central Nervous System

Mahendra S. Rao, Mark Noble, Margot Mayer-Proschel

ISSUED U.S. Patent 6,235,527

Lineage Restricted Glial Precursors from the Central Nervous System

Mahendra S. Rao, Mark Noble, Margot Mayer-Proschel

PCT/US98/ 24456, filed, 11/17/98, published PCT application

Generation, Characterization, and Isolation of Neuroepithelial Stem Cells and Lineage Restricted Intermediate Precursor

Mahendra S. Rao, Margot Mayer-Proschel, Tahmina Mujtaba

GRANTED Canadian patent 2,289,021

Generation, Characterization, and Isolation of Neuroepithelial Stem Cells and Lineage Restricted Intermediate Precursor

Mahendra S. Rao, Margot Mayer-Proschel, Tahmina Mujtaba

GRANTED Israeli Patent, 132584

Lineage-Restricted Neuronal Precursors

Mahendra S. Rao, Margot Mayer-Proschel, Anjali J. Kalyani

GRANTED Israeli Patent, 133799

Lineage-Restricted Neuronal Precursors

Mahendra S. Rao, Margot Mayer-Proschel, Anjali J. Kalyani

ISSUED Japanese Patent 4,371,179

Lineage-Restricted Precursor Cells Isolated From Mouse Neural Tube and Mouse Embryonic Stem Cells

Tahmina Mujtaba and Mahendra S. Rao

PCT/US00/ 12446, filed 5/5/00, published PCT application

Lineage Restricted Glial Precursors from the Central Nervous System

Mahendra S. Rao, Mark Noble and Margot Mayer-Proschel

ISSUED U.S. Patent 6,900,054

Method of Isolating Human Neuroepithelial Precursor Cells from Human Fetal Tissue

Margot Mayer-Proschel, Mahendra S. Rao, Patrick A. Tresco and Darin J. Messina

ISSUED U.S. Patent 6,852,532

Isolation of Mammalian CNS Glial Restricted Precursor Cells

Mahendra S. Rao and Margot Mayer-Proschel

ISSUED U.S. Patent 7,037,720

Isolation of Mammalian CNS Glial-Restricted Precursor Cells

Mahendra S. Rao and Margot Mayer-Proschel

ISSUED U.S. Patent 7,595,194

Methods Using Lineage Restricted Glial Precursors from the Central Nervous System

Mahendra S. Rao, Mark Noble and Margot Mayer-Proschel

ISSUED U.S. Patent 7,214,372

Lineage Restricted Glial Precursors

Mahendra S. Rao and Tahmina Mujtaba

ISSUED U.S. Patent 7,795,021

Pure Populations of Astrocyte Restricted Precursor Cells

Mahendra S. Rao, Tahmina Mujtaba and YuanYuan Wu

PCT/US2003 /002356, filed 1/23/03, published PCT application

14

Table of Contents

Pure Populations of Astrocyte Restricted Precursor Cells

Mahendra S. Rao, Tahmina Mujtaba, YuanYuan Wu and Ying Liu

granted Canadian patent 2,473,749

Pure Populations of Astrocyte Restricted Precursor Cells

Mahendra S. Rao, Tahmina Mujtaba, YuanYuan Wu and Ying Liu

2004-7011381, filed 1/23/03, published South Korean patent application

Pure Populations of Astrocyte Restricted Precursor Cells

Mahendra S. Rao, Tahmina Mujtaba, YuanYuan Wu and Ying Liu

ISSUED U.S. patent 8,673,292

Method of Isolating Human Neuroepithelial Precursor Cells from Human Fetal Tissue

Margot Mayer-Proschel, Mahendra S. Rao, Patrick A. Tresco and Darin J. Messina

ISSUED U.S. Patent 7,517,521

Method of Isolating Human Neuroepithelial Precursor Cells from Human Fetal Tissue

Margot Mayer-Proschel, Mahendra S. Rao, Patrick A. Tresco and Darin J. Messina

ISSUED U.S. Patent 8,168,174

Method of Isolating Human Neuroepithelial Precursor Cells from Human Fetal Tissue

Margot Mayer-Proschel, Mahendra S. Rao, Patrick A. Tresco and Darin J. Messina

published U.S. Patent Application Serial No. 13/435,424

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein,

PCT/US2010/055956, filed November 2010, published PCT application

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein, pending

Australian Application No. 2010319680

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein, pending

Canadian Application No. 2780541

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein, pending

Chinese Application No. 201080051269.2

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein, pending

Hong Kong Application No, 13102272.0

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein, pending

EP Application No. 10830580.6

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein, pending

Japanese Application No. 2012-538881

Methods and Compositions for Expanding, Identifying, Characterizing and Enhancing Potency of Mammalian-

Derived Glial Restricted Progenitor Cells. Robert Sandrock, James Campanelli and Deborah A. Eppstein, pending

UA Application No. 13/508,803

In September 2012, Q Therapeutics entered into two non-exclusive sublicenses with Neuralstem, Inc. for the following patents related to the clinical delivery device that Q intends to use:

15

Table of Contents

U.S. Patent 8,092,495 relating to the development of a spinal platform and

U.S. Patent 7,833,217 relating to the development of a cannula.

The agreements with Neuralstem require an annual maintenance fee of $5,000 per year to maintain its perpetual irrevocable licenses of Neuralstem’s technology. Q can terminate the agreements at any time upon written notice to Neuralstem at least 90 days prior to the end of the calendar year.

In addition, Q has entered into out-license agreements with Life Technologies, Molecular Transfer, Inc., and XCell Science, Inc. (XCell), under which the licensees may develop, manufacture and sell certain cell products covered by Q’s IP for research and drug discovery use only, for which Q (or its subsidiary NeuroQ) is anticipated to receive royalty payments, and in the case of XCell, Q may provide certain payments for research activities.

CNS Therapeutic Market Overview

The global CNS therapeutics market is projected to be nearly US$133 billion by the year 2018. The primary market drivers are the increase in disease prevalence rates due to aging population, introduction to new classes of drugs, and increased expenditure on healthcare. (“CNS Therapeutics: A Global Strategic Business Report,” Global Industry Analysts Inc., February 2013). In addition, the reported incidence of CNS disorders is increasing due to better diagnostic techniques. The global CNS therapeutics market is comprised of three main segments:

| (1) | Neurology (e.g. Parkinson’s and Alzheimer’s diseases, MS, Spinal Cord Injury, ALS) |

| (2) | Psychiatry (e.g. Depression, ADHD, Schizophrenia) |

| (3) | Pain (e.g. Migraine) |

While the psychiatry market represents nearly half of all dollars spent on CNS drug therapies, the neurology segment of the market is the fastest growing. The United States represents approximately half of this global market and, until recently, was realizing the fastest growth rates. This is the result of three factors: higher prices charged for the drugs themselves compared to other markets; the larger volume of patients seeking treatment; and the higher rates of pharmacotherapy compared to other countries. The Asia/Pacific market for CNS drug therapy is now the most rapidly growing as these factors begin to make an impact on the worldwide market.

The Unmet Need in the CNS Therapeutic Market

The CNS therapeutic market is based primarily on traditional drug therapies (small molecules and biologics). While this growing market is large and represents nearly 25% of all dollars spent on prescription pharmaceuticals worldwide, there remains a high unmet need in the treatment of many neurological diseases where current therapies are inadequate or yet to be developed. Two examples are MS and ALS.

The annual worldwide pharmacotherapy market for MS is approximately $10 billion. MS is estimated to affect 2.5 million people worldwide. The vast majority of all approved MS therapies seek to slow disease progression by “knocking down” the autoimmune component of the disease, which causes the damage and destruction of the myelin sheath that surrounds the neurons. However there is no approved product that repairs this damage once it has occurred. Thus, while current therapies may slow or even halt the progression of the disease, once the damage is done, there is currently no means of repairing that damage. This represents a substantial unmet need in the MS disease space.

Similarly, there is only one approved drug for the treatment of ALS. This drug, Rilutek®, prolongs the life expectancy of ALS patients by approximately 60-90 days. ALS is always fatal, and there are no approved drugs that substantially slow or halt the progression of the disease, much less reverse its devastating effects. This represents another unmet need in the CNS therapeutic market. Given the estimated prevalence of ALS in the U.S. is approximately 30,000 patients; it is classified as an orphan disease.

Considering these and many other shortcomings in the approved pharmacopeia for injuries and diseases of the CNS, there is an opportunity to substantially expand the CNS therapeutic market with new technologies that address the unmet needs. Cell-based therapy holds the promise of significantly expanding the CNS market and satisfying the unmet needs that exist.

16

Table of Contents

The Potential of Cell-Based Therapy

Cell-based therapy is seen by many as the next great advance in the treatment of disease and injury. It holds the promise of better therapy for disorders which are currently not well treated and new therapies to meet currently unmet needs. Should this promise hold true, the currently available therapies could be displaced and the Pharmacotherapeutic market substantially expanded as new stem and progenitor cell therapies are approved for human use.

The immense promise of stem cell biology has prompted the formation of new companies seeking to exploit the therapeutic potential of stem cells. Approaches to creating stem cell therapies fall into two broad categories:

| 1. | Isolating (or generating) and purifying new populations of stem or progenitor cells from various tissues, expanding them as necessary and transplanting the cells into various target organs. One challenge with this approach is ensuring that the exact desired population can be reproducibly purified and expanded. This affects safety and efficacy as well as the ease of scaled-up manufacturing. |

| 2. | Stimulating existing stem cells to “wake up,” expand and differentiate inside the body at an accelerated rate. Challenges associated with this approach include manipulating complex interactions among multiple growth factors and endogenous signals to generate the desired outcomes, as well as complications due to malfunctioning or mutant endogenous cells in certain diseases. |

Q believes that the fastest route to a safe and effective product is through the first route, using therapy with well characterized, unmodified cells that perform their tasks as nature intended, functioning as “mini-factories” and playing roles appropriate to the specific disease state.

Several types of cells are under evaluation for use in cell therapy by several companies, including embryonic stem cells, human cord blood and placental stem cells, and fetal or adult tissue from various organ sites. Purified cell populations can be injected intravenously or transplanted directly into target organs such as brain, heart, pancreas, blood and bone. For most neurodegenerative diseases, Q believes that CNS cells, not hematopoietic or mesenchymal lineage cells, are needed for long-term benefits.

Market Opportunity for Q Therapeutics

Q Therapeutics aims to change the way medicine is practiced in the treatment of many debilitating and often fatal diseases of the brain and spinal cord by bringing to market a patented cell-based therapeutic that addresses substantial unmet needs in the CNS therapeutic market today. Q Therapeutics believes that its initial Q-Cells product could meet a variety of these needs across a number of CNS diseases. By demonstrating that Q-Cells are safe and effective first in smaller orphan indications and later in larger target markets, Q Therapeutics believes it can both augment and/or displace current therapeutic approaches as well as expand the therapeutic market in currently untreatable CNS conditions. Should this prove true, Q-Cells would address a multi-billion dollar market opportunity in treatment of neurodegenerative diseases for which there are no effective treatments.

Q intends to bring Q-Cells to the market first to treat ALS to demonstrate the safety and efficacy of its cell-based therapeutic. Q also intends that Q-Cells will be brought to other indications potentially including TM, MS, Spinal Cord Injury, Huntington’s disease, Stroke, Parkinson’s and Alzheimer’s diseases. Q estimates that the annual market opportunity for its initial orphan disease targets exceeds $1 billion worldwide. Application of its Q-Cells product to other larger market diseases such as MS would substantially expand the market available to Q.

Orphan Disease Strategy for Initial Commercialization

Q’s first commercial targets are orphan diseases with billion-dollar market potential. The Orphan Drug Act of 1983 (in this paragraph, the Act) defined an “orphan drug” as a therapy intended to treat rare “orphan” diseases, those affecting fewer than 200,000 Americans. The benefits provided by the Act may include more rapid regulatory timelines, tax benefits, and seven-year market exclusivity for the first product approved for an indication. Despite the smaller numbers of affected patients, orphan diseases often have highly motivated patient advocacy groups that are eager to assist companies with patient recruitment and therapeutic development. Moreover, substantial annual

17

Table of Contents

per-patient treatment prices effectively offset the relatively small patient populations. Due to the focused nature of marketing permitted by targeting orphan indications, Q might be able to capture a significant portion of the U.S. market for certain orphan diseases without need for a major marketing partner, provided that it has adequate financial resources. This ability to target patients suffering from orphan diseases also provides an incentive to potential Q development partners with interest in funding development costs and providing developmental expertise in exchange for marketing rights.

In September 2013, we received notice from the FDA that our orphan drug request of human glial progenitor cells and their progeny had been granted for the treatment of ALS patients in the U.S. We expect to file requests or similar designation in Europe and Japan.

Q Market Development Strategy – Orphan Indications First, Larger Markets Follow

By targeting orphan diseases first (ALS, TM and SCI), Q can continue its strategy of increasing the value of the Company in a capital efficient manner by taking advantage of the benefits of the Act. Evaluation of Q-Cells in these various neurodegenerative diseases provides multiple opportunities for success utilizing this single therapeutic product. We believe that such success will be very attractive to larger pharmaceutical and biotechnology companies who will want to partner with us in the application of Q-Cells to larger markets where the development and sales capacity of those partners can be advantageous. Q-Cells offer multiple repair mechanisms from one product due to Q-Cells’ ability to differentiate into both oligodendrocytes and astrocytes. We have broadly characterized the disease targets into three general but overlapping groups: diseases primarily of myelination deficiencies, diseases where neuronal loss is the dominant mechanism, and diseases where both of the above come into play. Evaluation of Q-Cells® in these various neurodegenerative diseases provides multiple opportunities for success utilizing this single therapeutic product.

Amyotrophic Lateral Sclerosis (ALS), also called Lou Gehrig’s Disease

ALS is diagnosed in 5,000-6,000 new individuals per year in the U.S., comparable in annual incidence to Multiple Sclerosis. Patient death generally occurs two to five years after diagnosis, resulting in an estimated U.S. prevalence of 30,000 with 450,000 people living with ALS worldwide (ALS Therapy Development Institute). ALS is a neurodegenerative disease causing progressive deterioration and loss of motor neurons, affecting both upper and lower motor neurons. The loss of nerve stimulus to specific muscles results in atrophy and progressive weakness that leads to paralysis. Death usually results from respiratory failure.

There is no curative treatment for ALS. The only drug approved for treatment for the disease—riluzole (Rilutek®)—is believed to reduce (but not reverse) damage to motor neurons by decreasing the release of glutamate, and prolongs survival by only 60-90 days. Costs for treating individuals with advanced ALS can cost an average of $200,000 a year.

The rationale for a clinical trial using Q-Cells to treat ALS patients has been described above.

Multiple Sclerosis and Transverse Myelitis

Q is also evaluating Q-Cells in animal studies for MS, a chronic autoimmune-triggered demyelinating neurodegenerative disease, and Transverse Myelitis (TM), a related but acute, localized inflammatory disease of the spinal cord. Multiple clinical and pathological studies suggest that there are many common features of the inflammation and neural injury between TM and MS, with a shared primary pathology of demyelination due to immune attack destroying the oligodendrocytes.

Multiple Sclerosis

The annual worldwide pharmacotherapy market for MS is approximately $10 billion. Diagnosis of MS typically occurs between 20 and 40 years of age with over 2.5 million people worldwide estimated to have been diagnosed (National MS Society). While MS is rarely fatal in the short term, individuals diagnosed with MS are usually required to implement both temporary and/or permanent modifications to their lifestyle as they experience the varying range of MS symptoms. Currently, the vast majority of all approved MS therapies seek to slow disease

18

Table of Contents

progression by “knocking down” the autoimmune component of the disease, which causes the damage and destruction of the myelin sheath that surrounds the neurons. However, there is no approved product that repairs this damage once it has occurred. Thus, while current therapies may slow or even halt the progression of the disease, once the damage is done, there is currently no means of repairing that damage.

Traverse Myelitis

It is estimated that approximately 1,400 new cases of TM are diagnosed each year in the U.S. with approximately 33,000 individuals currently suffering the effects of the disease (National Institute of Neurological Disorders and Stroke). Lack of treatment or incorrect treatment can leave the individual with a disability such as partial or complete paralysis resulting from the disorder. Researchers are currently uncertain of the primary causes and there are currently no effective cures for TM. Current treatment is targeted towards minimizing inflammation and pain. Estimated costs for diagnosing and treating TM are approximately $600,000 per patient in the U.S.

Due to the similarity of the lesion pathology in TM and MS, demonstration of efficacy of remyelination in the orphan disease TM may be an indicator for efficacy in the more prevalent disease of MS. The rationale for using Q-Cells in these indications is based on data obtained using both animal and human GRPs in models of disease.

Demonstration of remyelination in lesions in TM and MS patients may also be relevant for developing treatments of other diseases in which demyelination is a significant factor such as cerebral palsy, white-matter stroke and certain traumatic spinal cord injuries. Shiverer is an established myelin-deficiency model in which the entire CNS is defective in normal myelination. Q and its collaborators at Johns Hopkins have demonstrated that Q-Cells engrafted into shiverer (a) effectively compete with host (defective) oligodendrocytes, (b) myelinate host axons resulting in normal myelin and (c) demonstrate benefits in a focal inflammatory spinal cord lesion model (Figure 7, Q data; Walczak et al, GLIA 59 , 499-501 (2011)). Others have shown that human GRPs transplanted into shiverer/rag2 mice extended survival of a portion of the mice (Windrem et al, Cell Stem Cell 2, 553-565 (2008)). They also documented that the implanted human cells interacted effectively with the host proteins and did not leave the CNS. The efficacy of a localized treatment that does not produce toxicities in other organs is a significant finding. This is supported further by an extensive body of literature demonstrating remyelination by rodent glial precursors and related cells in multiple animal models [including publications from Blakemore (1999), Ben Hur (2006), Cummings (2005), Duncan (2004, 2005), Goldman (2008), Keirstead (2004, 2005), Whittemore (2010), Rao (1997-2010), Sandrock (2010), and Walczak (2011).] This myelination has occurred in both the presence and the absence of an ongoing inflammatory process.

19

Table of Contents

Figure 7. Myelination resulting from implanted Q-Cells production of oligodendrocytes.

Shiverer is a mouse with a mutation that produces defective myelin basic protein (MBP) and hence defective myelin. Q-Cells implanted in shiverer/rag2 brain mature into oligodendrocytes that produced normal MBP (green). All MBP seen here is produced by Q-Cells that matured into oligodendrocytes.

Traumatic Spinal Cord Injury

Approximately 12,000 people are paralyzed each year in the U.S. due to a traumatic spinal Cord Injury (SCI) and it is estimated that over 270,000 people are living with Spinal Cord Injury in the U.S. (National Spinal Cord Injury Statistical Center, Birmingham, Alabama). The average age of occurrence for SCI is 41. This has tremendous costs both in terms of patient care, lost productivity as well as quality of life. Average medical costs are estimated at between $15,000 - $30,000 a year with an estimated lifetime cost up to $3.0 million depending on the severity of the injury and the age at which the injury occurred. It has been projected that the U.S. could save up to $400 billion in future healthcare costs if there were effective therapies to treat and prevent spinal cord injuries (Christopher and Dana Reeve Foundation, Centers for Disease Control, University of Alabama National Spinal Cord Injury Statistical Center).

Q has collaborated with Itzhak Fischer, PhD, at Drexel University to test Q-Cells in animal models of traumatic Spinal Cord Injury. Recently published studies by Q and its collaborators at Drexel document the safety and statistically-significant, reproducible, disease modifying activity of Q-Cells transplanted into the injury site in an athymic rat model of thoracic contusion SCI (Jin et al., J Neurotrauma; 28(4):579-94; 2011).

Parkinson’s Disease

Parkinson’s Disease (PD) affects more than one million patients in the U.S., with approximately 60,000 new cases diagnosed each year (Parkinson’s Disease Foundation). Due to the increase in the aging population, it is anticipated

20

Table of Contents

that the number of individuals diagnosed with PD will continue to increase. PD involves the breakdown and death of vital nerve cells, or neurons, found in the substantia nigra of the brain. These neurons normally secrete dopamine, and lack of dopamine leads to symptoms such as shaking, rigidity, difficulty and slowness in movement, and postural instability. While the cause of PD is currently unknown and there is no cure, there are therapies available to manage its symptoms, but they become less effective as the disease progresses. Combined direct and indirect costs of treating PD in the U.S. alone are estimated to be $25 billion a year with medication costs averaging $2,500 a year. If surgery is needed, the costs can approach up to a $100,000 per patient.

Although patients initially respond to treatment with L-dopa or dopaminergic agonists, over time this response decreases. Several early trials have found that administration of single growth factors failed to provide meaningful clinical benefits in PD patients. Studies in animal PD models have suggested non-cell autonomous killing of neurons, with diseased astrocytes playing a critical initiating role. Astrocytes in culture exert a protective effect on neuronal cells in a setting where both cell-types are co-cultured. Studies in a primate model of PD showed functional benefits after implantation of neural cells. Upon autopsy, a large number of progeny astrocytes were found juxtaposed with the host nigrostriatal circuitry suggesting that the “homeostatic adjustments” to the microenvironment results in preservation of the remaining host nigrostriatal pathway (Redmond et al, Proceedings of National Academy of Sciences USA 104, 12175–12180 (2007)). As Q-Cells produce healthy astrocytes, this provides potential for protective effects including those via production of multiple growth factors and other trophic support, rather than relying on a single factor. Q anticipates that it will pursue studies of Q-Cells in Parkinson’s disease models upon availability of appropriate additional funding.

Other Disease Targets

Q-Cells provide a platform technology that may be useful to treat not only demyelinating diseases, but other neurodegenerative diseases that can benefit from the neuronal support provided by growth factors and other trophic support by Q-Cells. The patient populations and markets for Q’s follow-on therapeutic targets may be substantial, in addition to the opportunity in ALS, MS, TM, SCI and PD discussed above.

Alzheimer’s Disease

Alzheimer’s Disease (AD) is a progressive, neurodegenerative disease characterized by abnormal clumps (amyloid plaques) and tangled bundles of fibers (neurofibrillary tangles) in the brain. Symptoms include memory loss, language deterioration and confusion and eventually lead to loss of cognition and personality. Currently, there is not a way to prevent, cure or even delay its progression. It is the 6th leading cause of death in the U.S. and is estimated to affect about 5.2 million people in the U.S., with annual healthcare costs in excess of $200 billion. The number of patients is projected to reach 16 million by 2050 (Alzheimer’s Association, 2012).

Transplantation of neural cells that produce glial cells (both astrocytes and oligodendrocytes) as well as transplantation of astrocyte precursors, provided benefits in AD models, rescuing neurons and improving memory (Hampton et al, Journal of Neuroscience 30(3), 9973-9983 (2010); Blurton-Jones et al, PNAS 106(32), 13594-13599 (2009)). Since Q-Cells mature into glial cells after transplantation, Q believes there may be an opportunity for use of Q-Cells potentially to both slow decline and/or restore function for AD patients. Q will explore collaboration to further investigate the efficacy of Q-Cells in animal models once appropriate financing has been obtained.

Huntington’s Disease

Huntington’s disease is a fatal neurodegenerative disease caused by a hereditary mutation in the Huntington gene. Symptoms are normally manifested in adult life, resulting in decline in muscle coordination and cognitive function, as well as psychiatric problems, with death usually ensuing after 20 years from onset of visible symptoms. Approximately 30,000 people in the U.S. have been diagnosed with Huntington’s disease (Huntington’s Disease Society of America).

Traumatic Brain Injury

It is estimated that 1.7 million people in the U.S. sustain a Traumatic Brain Injury (TBI) each year with approximately 5.3 million Americans living with a TBI related injury (Centers for Disease Control and Prevention). In 2010, it was estimated that direct and indirect medical costs for those with TBI were approximately $76.5 billion.

21

Table of Contents

Other than acute phase treatments to prevent further injury (e.g., surgery to relieve pressure build-up), treatment of headaches, seizures and physical rehabilitation, there is no treatment for and nothing to reverse TBI. The multiple support functions of Q-Cells may be beneficial in achieving recovery from TBI.

Cerebral Palsy

Cerebral Palsy (CP) has a U.S. patient population of about 764,000 children and adults (United Cerebral Palsy) and refers to any of a number of neurological disorders that permanently affect muscle coordination and mobility. No cure currently exists, but the earlier the disease is diagnosed in an individual’s life, the higher likelihood there is of being able to improve muscle function and coordination. An initial target may be for spastic diplegia, which involves injury to the cerebral cortex and represents approximately 70% of CP. As Q-Cells can provide myelinating oligodendrocytes, they may provide benefits to CP patients.

Stroke

Stroke afflicts almost 800,000 people and is the fourth leading cause of death in the U.S, with total annual direct and indirect costs over $73.7 billion (National Stroke Association Fact Sheet). Market projections are significant even if only a small portion of these patients were treated. Q-Cells may be beneficial in treating stroke both for restoring myelination, as well as the support provided by astrocytes to restoring neuron function.

Leukodystrophies and CNS storage diseases

These are several inherited pediatric diseases for which the molecular cause is known to involve a single gene defect. There are no treatment options for most of these diseases, often resulting in death at a young age. Although a few companies including Genzyme/Sanofi and Biomarin have developed enzyme replacement therapies to successfully treat systemic manifestations of a few of these diseases, the systemically administered enzyme pharmaceuticals do not cross the blood-brain barrier to treat CNS targets. Such CNS diseases may provide future opportunity to Q as there are many storage disorders with severe CNS manifestations that involve destruction of oligodendrocytes with concomitant demyelination. Q-Cells, as they are transplanted directly into the CNS, may be able to provide both the missing enzyme in the CNS as well as replace the destroyed oligodendrocytes and thus provide remyelination.

Peripheral Neuropathies

Peripheral Neuropathies have no effective treatments. In addition to causing severe pain, they are a leading cause of amputations in the developed world. Eight million diabetes patients have neuropathy in the U.S. alone. Q has patents on cells that support the peripheral nervous system.

Competition