UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM

(Amendment No.1)

_________________

|

(Mark One) | |

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended | |

|

or | |

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number:

_________________

(Exact name of registrant as specified in its charter)

_________________

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

_________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Accelerated filer ☐ | |||

|

Non-accelerated filer ☐ |

Smaller reporting company | |||

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $

As of April 15, 2021, there were

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K of Glu Mobile Inc. (“Glu”) for the fiscal year ended December 31, 2020, originally filed with the Securities and Exchange Commission (the “SEC”) on February 26, 2021 (the “Original Filing”). We are filing this Amendment for the purpose of providing the information required by and not included in Part III of the Original Filing that was omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K because we no longer intend to file our definitive proxy statement for our 2021 Annual Meeting of Stockholders (the “Proxy Statement”) within 120 days after the end of our fiscal year ended December 31, 2020. Part IV of the Original Filing is being amended solely to add as exhibits certain new certifications in accordance with Rule 13a-14(a) promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

The reference on the cover of the Original Filing to the incorporation by reference of the Proxy Statement into Part III of the Original Filing is hereby deleted. Except as expressly set forth in this Amendment, we are not amending any other part of the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing. This Amendment should be read in conjunction with the Original Filing and with any of our filings made with the SEC subsequent to filing of the Original Filing on Form 10-K.

All references to “Company,” “Glu,” “Glu Mobile,” “we,” “us” or “our” are references to Glu Mobile Inc. and, where appropriate, its subsidiaries.

TABLE OF CONTENTS

|

1 | |

|

Item 10. Directors, Executive Officers and Corporate Governance |

1 |

|

7 | |

|

40 | |

|

Item 13. Certain Relationships and Related Transactions, and Director Independence |

43 |

|

44 | |

|

45 | |

|

45 | |

|

45 | |

|

46 |

PART III

Item 10. Directors, Executive Officers and Corporate Governance

OUR DIRECTORS

The following sets forth information regarding our current directors as of April 15, 2021. For information with respect to our executive officers, see “Executive Officers” at the end of Part I, Item 1 of the Original Filing.

Directors Continuing in Office Until the 2021 Annual Meeting of Stockholders

Eric R. Ball (Age 57)

General Partner, Impact Venture Capital

Dr. Ball has served as one of our directors since October 2013. Dr. Ball serves as General Partner of Impact Venture Capital, a technology investment firm, a position he has held since August 2016. Before joining Impact Venture Capital, Dr. Ball was Chief Financial Officer of C3, Inc. (doing business as C3 IoT), a full-stack development platform for the “Internet of Things,” from August 2015 to May 2016. Prior to then, Dr. Ball served as Senior Vice President and Treasurer of Oracle Corporation, a global computer technology company, from May 2005 to September 2015. Before joining Oracle, Dr. Ball worked in a variety of headquarters and operating finance roles at Flextronics, Inc., Cisco Systems, Inc., Avery Dennison, and AT&T Inc. Dr. Ball serves as an advisor to Geeq Inc., Kyriba Corporation and SineWave Ventures, and since February 2021 as a board member to Archimedes SPAC. Dr. Ball holds an B.A. in economics from the University of Michigan, an M.A in economics/finance and an M.B.A. from the University of Rochester and a Ph.D. in management from the Drucker-Ito School of Management.

Dr. Ball’s more than 20 years of experience in finance and operations with technology companies, particularly those larger than Glu, led the Board to conclude that he should serve as a director. In addition, our Board’s determination in light of his experience as a finance executive and director overseeing or assessing the performance of companies and public accountants, that Dr. Ball is an “audit committee financial expert” lends further support to his financial acumen and qualifications for serving on our Board.

Nick Earl (Age 55)

President and Chief Executive Officer, Glu Mobile Inc.

Mr. Earl has served as our President and Chief Executive Officer since November 2016 and prior to that was our President of Global Studios from November 2015 to November 2016. Before joining us, from November 2014 to September 2015, Mr. Earl served as President of Worldwide Studios at Kabam, a developer of mobile video games. From September 2001 to October 2014, Mr. Earl served in several management positions at Electronic Arts Inc., an interactive entertainment software company, including most recently as Senior Vice President & General Manager of EA Mobile. From 1999 to 2001, Mr. Earl served as VP Product Development at Eidos, a video game developer. From April 1993 to March 1999, Mr. Earl served as an executive producer / GM at The 3DO Company, a video game developer. Mr. Earl holds a B.A. in economics from the University of California at Berkeley.

Mr. Earl’s experience as our President and Chief Executive Officer, which gives him unique insights into our challenges, opportunities and operations, and his strong background of senior management in the mobile gaming sector led the Board to conclude that he should serve as a director.

1

Directors Continuing in Office Until the 2022 Annual Meeting of Stockholders

Niccolo M. de Masi (Age 40)

Chief Executive Officer and Director, dMY Technology Group, Inc. II, dMY Technology Group, Inc. III, and

dMY Technology Group, Inc. IV

Chairman, Glu Mobile Inc.

Mr. de Masi has served as our Chairman since July 2014 (from July 2014 to December 2014 as our interim Chairman, from December 2014 to November 2016 and then from November 2019 as our Chairman and from November 2016 to November 2019 as our Executive Chairman), as President and Chief Executive Officer from January 2010 to November 2016, and as one of our directors since January 2010. Since August 2020, November 2020 and March 2021, respectively, Mr. de Masi has served as the Chief Executive Officer and a director of each of dMY Technology Group II, dMY Technology Group III, and dMY Technology Group IV, blank check companies whose business purpose is to effect a business combination with one or more businesses. From February 2019 to March 2020, Mr. de Masi served as the Chief Innovation Officer of Resideo Technologies, Inc., a provider of residential comfort and security solutions, and previously Mr. de Masi also served as the President of the Products and Solutions segment of Resideo Technologies from February 2019 to January 2020. Prior to joining Resideo Technologies, Mr. de Masi served as the President of Essential, a mobile phone hardware company, from November 2016 to October 2018. Prior to joining Glu in January 2010, Mr. de Masi was the Chief Executive Officer and President of Hands-On Mobile, a mobile technology company and developer and publisher of mobile entertainment, from October 2009 to December 2009, and previously served as the President of Hands-On Mobile from March 2008 to October 2009. Prior to joining Hands-On Mobile, Mr. de Masi was the Chief Executive Officer of Monstermob Group PLC, a mobile entertainment company, from June 2006 to February 2007. Mr. de Masi joined Monstermob in 2004 and, prior to becoming its Chief Executive Officer, held positions as its Managing Director and as its Chief Operating Officer, where he was responsible for formulating and implementing Monstermob’s growth and product strategy. Prior to joining Monstermob, Mr. de Masi worked in a variety of corporate finance and operational roles within the technology, media and telecommunications (TMT) sector, beginning his career with JP Morgan on both the TMT debt capital markets and mergers and acquisitions teams in London. He has also worked as a physicist with Siemens Solar and within the Strategic Planning and Development divisions of Technicolor. Mr. de Masi has served as a director of Rush Street Interactive since December 2020 and of Jagex Limited since January 2021, and previously served as a director of Resideo Technologies from October 2018 to January 2020 and Xura, Inc. from November 2015 until its sale in August 2016. Mr. de Masi holds an M.A. degree in physics and an MSci. degree in electronic engineering—both from Cambridge University.

Mr. de Masi’s successful tenure as our President and Chief Executive Officer and current position as Chairman, which gives him unique insights into our challenges, opportunities and operations, and his strong background of senior management and executive experience in the mobile gaming and content sectors led the Board to conclude that he should serve as a director.

Greg Brandeau (Age 59)

Managing Partner, Paradox Strategies

Mr. Brandeau has served as one of our directors since August 2015. Since May 2014, Mr. Brandeau has served as Managing Partner of Paradox Strategies (fka Slices of Genius), a consulting organization founded by Mr. Brandeau. He served as President and Chief Operating Officer of Maker Media, Inc., a global platform for connecting makers with each other, with products and services, and with partner organizations, from September 2013 to April 2014. Prior to Maker Media, Mr. Brandeau served as Chief Technology Officer of The Walt Disney Studios, a motion picture studio, from November 2009 to April 2012. Prior to that, he served as Senior Vice President of Technology for Pixar Animation Studios, a computer animation studio, from February 2004 to November 2009. Mr. Brandeau is an Advisory Board Member for Infrascale, Inc. and the California Institute for Telecommunications and Information Technology, and a member of the Visiting Committee for the Humanities at the Massachusetts Institute of Technology. In addition to his prior technology management roles at Maker Media, The Walt Disney Studios and Pixar, he has served in various technology management roles for Walt Disney Animation Studios, Perlegen Sciences Inc., NeXT Computer, Inc. and Mountain Network Solutions, Inc. He is the co-author of Collective Genius: The Art and Practice of Leading Innovation. Mr. Brandeau holds B.S and M.S degrees in electronic engineering from the Massachusetts Institute of Technology, and an M.B.A. from Duke University.

Mr. Brandeau’s strong background in technology management, particularly through his experiences in senior technology management roles at dynamic and innovative companies like Disney, Pixar, and NeXT Computer, led the Board to conclude that he should serve as a director.

2

Gabrielle Toledano (Age 54)

Chief Operating Officer, Keystone Strategy LLC

Ms. Toledano has served as one of our directors since December 2017. Since March 2021 and from January 2020 to January 2021, Ms. Toledano has served as Chief Operating Officer at Keystone Strategy LLC, a strategy and economics consulting firm. From January 2021 to March 2021, Ms. Toledano served as Chief Talent Officer of ServiceNow, a software company. Prior to that, Ms. Toledano served as an Executive in Residence for Comcast Ventures, a corporate venture capital firm, from January 2019 to December 2019. From May 2017 to October 2018, Ms. Toledano served as the Chief People Officer of Tesla Inc., a manufacturer of electric vehicles and energy storage products. From December 2016 to May 2017, Ms. Toledano served as an Advisor to, and from February 2006 to December 2016 as the Chief Talent Officer and Executive Vice President at, Electronic Arts Inc. From February 2017 to March 2017, she served as a consultant to Slack Technologies, Inc., a software company. Prior to joining Electronic Arts, from 2002 to 2006, Ms. Toledano served as Chief Human Resources Officer at Siebel Systems, Inc., a supplier of customer software solutions and services. From 1991 to 2002, Ms. Toledano served in various human resources positions at Microsoft Corporation and Oracle Corporation. Ms. Toledano has served as a director of Namely, Inc. since March 2021 and from February 2019 to December 2020 and of Bose since June 2020, and previously served as a director of Visier Inc. from May 2014 to January 2021, TalentSky from January 2015 to January 2019, Jhana from November 2016 to July 2017, Jive Software from November 2015 to June 2017, Big City Mountaineers from May 2011 to September 2014, and the Society of Human Resource Management from February 2009 to July 2011. In addition, Ms. Toledano has advised several technology companies in the Human Capital Management space, including Collective Health, a healthcare platform company, Espresa, an employee programs automation platform provider, and Betterworks, an enterprise collaboration platform provider. Ms. Toledano holds a B.A. in modern thought and literature and an M.A. in education from Stanford University.

Ms. Toledano’s strong background in gaming and technology management, including her extensive experience as an executive in the Human Resources field of various public companies, and her broad experience as a director of technology companies led the Board to conclude that she should serve as a director.

Directors Continuing in Office Until the 2023 Annual Meeting of Stockholders

Darla Anderson (Age 61)

Movie Producer

Ms. Anderson has served as one of our directors since March 2019. In January 2019, Ms. Anderson signed a multi-year development and production deal with Netflix to develop and produce new animated and live-action projects. From 1993 until March 2018, Ms. Anderson held various positions at Pixar Animation Studios, a computer animation film studio, most recently as a Producer. While at Pixar, Ms. Anderson contributed to a number of Pixar’s hit movies, including A Bug’s Life, Monsters, Inc., Cars and Toy Story 3, and she produced Coco for which she earned an Academy Award for Best Animated Feature. Prior to joining Pixar, she served as the Executive Producer of the commercial division of Angel Studios, a video game developer. Since August 2020, November 2020 and March 2021, respectively, Ms. Anderson has served as a director of dMY Technology Group, Inc. II, dMY Technology Group, Inc. III, and dMY Technology Group, Inc. IV. Ms. Anderson holds a B.A. in art from San Diego State University.

Ms. Anderson’s proven track record in successfully producing high-caliber entertainment projects, her expertise in developing engaging and unique experiences to delight audiences and her ability to provide guidance to our creative leaders led the Board to conclude that she should serve as a director.

Ben Feder (Age 57)

President, International Partnerships (North America) of Tencent Holdings Limited

Mr. Feder has served as one of our directors since January 2017 and was appointed to our Board by Tencent Holdings Limited (“Tencent”) which is a leading Internet and gaming company in China. Since October 2016, Mr. Feder has served as President, International Partnerships (North America) of Tencent. In addition, Mr. Feder serves on the boards of several private gaming companies as a representative of Tencent. From 2001 to October 2016, Mr. Feder served in various positions at ZelnickMedia Corporation., a media investment and management firm, including as co-founder, partner and vice chairman. From April 2007 to April 2010, Mr. Feder served as a member of the board of directors of Take Two Interactive Software Inc., or Take Two, a leading developer and publisher of video games, and from April 2007 to December 2010 he also served as Chief Executive Officer of Take Two. Prior to co-founding ZelnickMedia in 2001, Mr. Feder was Chief Executive Officer of MessageClick, Inc., a leading provider of voice messaging technology for next-generation telephone networks, and held a senior position with News Corporation. Mr. Feder received a B.A. in history from Columbia University and an M.B.A. from the Harvard Business School.

3

Mr. Feder’s deep knowledge of the gaming industry, including his leadership experience at both Tencent and Take Two, led the Board to conclude that he should serve as a director.

Hany M. Nada (Age 52)

Co-Founder and Managing Partner, ACME Capital

Mr. Nada has served as one of our directors since April 2005. Mr. Nada co-founded ACME Capital, a venture capital firm, in January 2019 and serves as the firm’s Managing Partner. Prior to co-founding ACME Capital, Mr. Nada co-founded GGV Capital (formerly Granite Global Ventures) in 2000 and served as a Managing Director until October 2016 and as a Venture Partner from November 2016 until October 2018. Prior to co-founding GGV Capital, Mr. Nada served as Managing Director and Senior Research Analyst at Piper Jaffray & Co., specializing in Internet software and e-infrastructure. Mr. Nada is a director of DraftKings, Inc., a digital sports entertainment and gaming company, and also serves on the boards of directors of several privately held companies, including Arcbyt, Nordsense, and Symbio Robotics, and was previously on the board of directors of Phoenix Labs and WildTangent, Inc, which are privately held companies, and of Vocera Communications, Inc., a publicly traded company. In addition, Mr. Nada is an observer on the board of directors of Houzz, Inc., IonQ Inc. and Uhnder, Inc. Mr. Nada holds a B.S. in economics and a B.A. in political science from the University of Minnesota.

Mr. Nada’s experience in the venture capital industry, which includes a focus on software, wireless applications, and multimedia, his expertise and insights into high technology companies that he gained during his tenure as Managing Director and Senior Research Analyst at Piper Jaffray & Co., his experience as a director of high technology companies and his relationship with entities owning a significant percentage of our common stock led the Board to conclude that he should serve as a director.

Benjamin T. Smith, IV (Age 53)

Senior Partner and Director, A.T. Kearney

Mr. Smith has served as one of our directors since November 2010, interim co-Lead Independent Director from July 2014 to December 2014 and Lead Independent Director since April 2016. Mr. Smith has been a Senior Partner at the strategic consulting firm, A.T. Kearney, since October 2016 and prior to that served as the Chief Executive Officer of Wanderful Media, a new media shopping company, from April 2012 to June 2016. Prior to joining Wanderful Media, Mr. Smith served as an independent director of and advisor to technology companies, including in his role as a Venture Partner at Accelerator Venture Capital, where he has served since December 2011. Previously, Mr. Smith served as the Chairman and Chief Executive Officer of WYBS, Inc. d/b/a MerchantCircle, a leading social network of small business owners, from when he co-founded the company in August 2004 until the company was sold to Reply.com in May 2011. Mr. Smith served as the Senior Vice President of Corporate Development and a strategic advisor to Borland Software Corporation, a vendor of Open Application Lifecycle Management solutions, from March 2005 to October 2007 and the Chief Executive Officer of, and an advisor to, CodeGear, a division of Borland, from November 2006 to October 2007. Mr. Smith previously co-founded Spoke Software, Inc., a provider of social networking software that connects business professionals, in 2002, and served as its Chief Executive Officer from 2002 to 2004. Mr. Smith also served the Bush Administration as the Senior Advisor for Strategy and Planning to the Secretary of Transportation from 2001 to 2002. Prior to then, Mr. Smith was a Vice President and Partner at A.T. Kearney, and Vice President, Venture Development at Electronic Data Systems Corporation (EDS) after A.T. Kearney was purchased by EDS. In addition, Mr. Smith serves on the board of A.T. Kearney and as an advisor or investor in several other private companies and provides advisory services to a number of high-technology companies. He also advised and led the board of directors of Tapulous Inc., a mobile social gaming company, from its founding in 2009 until its sale to The Walt Disney Company in July 2010. Mr. Smith holds a B.S. in mechanical engineering from the University of California at Davis and an M.B.A. from Carnegie Mellon University’s Tepper School of Business.

Mr. Smith’s extensive operating and investment experience in the social networking and gaming industries, which includes having co-founded two social networking companies, and his experience as a director of and strategic consultant to high-technology companies led the Board to conclude that he should serve as a director.

There are no family relationships between any of our directors or executive officers.

4

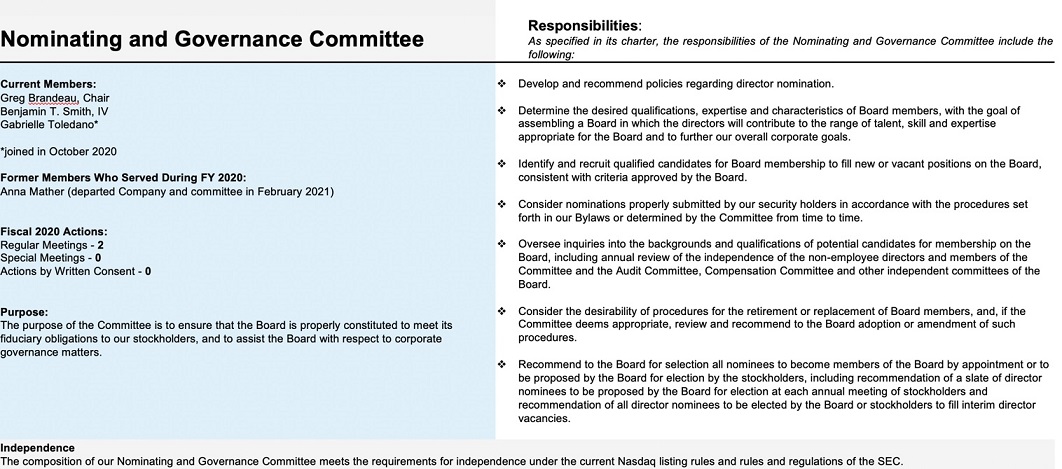

CORPORATE GOVERNANCE

Our Board has adopted Corporate Governance Principles that are designed to assist the Board in observing practices and procedures that serve the best interests of Glu and our stockholders. The Nominating and Governance Committee oversees these Corporate Governance Principles and periodically makes recommendations to the Board regarding any changes. These Corporate Governance Principles address, among other things, our policy on succession planning and senior leadership development, retirement, Board performance evaluations and committee structure, as well as Board diversity.

We maintain a corporate governance page on our company website that includes key information about corporate governance matters, including copies of our Corporate Governance Principles, our Code of Business Conduct and Ethics for all employees, including our senior executive and financial officers, and the charter for each Board committee. The link to this corporate governance page can be found at http://www.glu.com/investors (by clicking on the “corporate governance” link).

Board Recruitment

Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected identified candidates as appropriate. In conducting its review and evaluation, the Nominating and Governance Committee may solicit the views of management, other members of the Board and other individuals it believes may have insight into a candidate’s qualifications and the needs of the Board and its committees. Candidates for the Board are generally selected based on desired skills and experience in the context of the existing composition of the Board and needs of the Board and its committees at that time, including the requirements of applicable rules and regulations of the SEC and The Nasdaq Stock Market. The Nominating and Governance Committee will consider these needs and further evaluate each candidate’s qualifications based on their independence, integrity, collegiality, diversity, skills, financial, technical, operational and other expertise and experience, breadth of experience, practical wisdom, judgment, knowledge about our business or industry, personal and professional ethics, availability and commitment to representing and enhancing the long-term interests of our stockholders. The Nominating and Governance Committee may also identify and consider other factors that reflect our environment as it evolves or that it believes will otherwise contribute to the Board’s overall effectiveness and our success. In accordance with our Corporate Governance Principles and our Nominating and Governance Committee Charter, the Nominating and Governance Committee also considers nominees from diverse backgrounds who combine a broad spectrum of experience and expertise. The Nominating and Governance Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all candidates. The Nominating and Governance Committee will choose candidates to recommend for nomination based on the specific needs of the Board and Glu at that time. Although the Nominating and Governance Committee uses these and other criteria as appropriate to evaluate candidates, the Nominating and Governance Committee has no stated minimum criteria for candidates. All candidates, including those nominated by stockholders, are evaluated in the manner described above. Final approval of nominees to be presented for election is determined by the full Board.

Director Independence

Our Board currently includes six independent directors. To be considered independent under the rules of The Nasdaq Stock Market, referred to as the Nasdaq listing rules, a director may not be employed by Glu or engage in certain types of business dealings with us. In addition, as required by the Nasdaq listing rules, the Board has made a determination as to each independent director currently serving on the Board or who served on the Board during 2020 that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed information provided by the directors and by our management with regard to each director’s business and personal activities as they relate to Glu and our management. In assessing director independence under the Nasdaq listing rules, the Nominating and Governance Committee and the full Board reviewed relevant transactions, relationships and arrangements that may affect the independence of our Board members, including that Mr. Feder was during 2020, and currently is, an officer of Tencent, and a wholly-owned subsidiary of Tencent owned in the aggregate 11.91% of our outstanding capital stock as of April 1, 2021.

5

After reviewing these transactions and other relevant standards, the Board determined that each of Ms. Anderson, Dr. Ball, Mr. Brandeau, Mr. Nada, Mr. Smith and Ms. Toledano is an independent director.

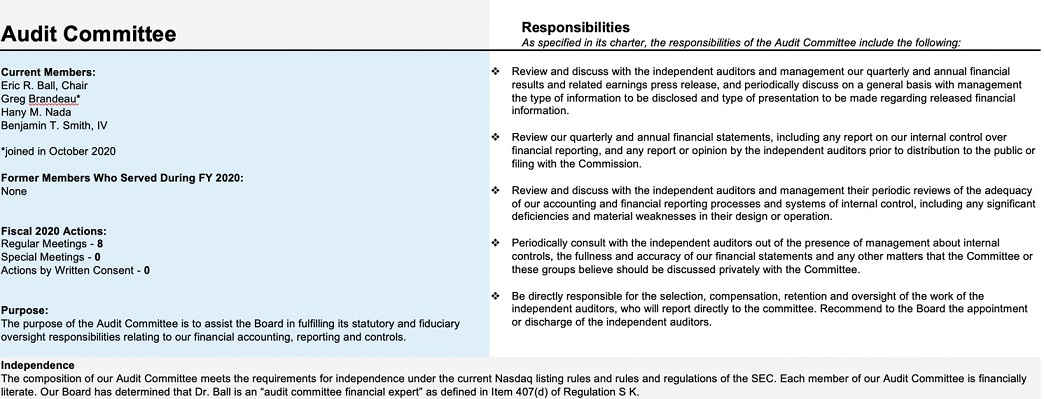

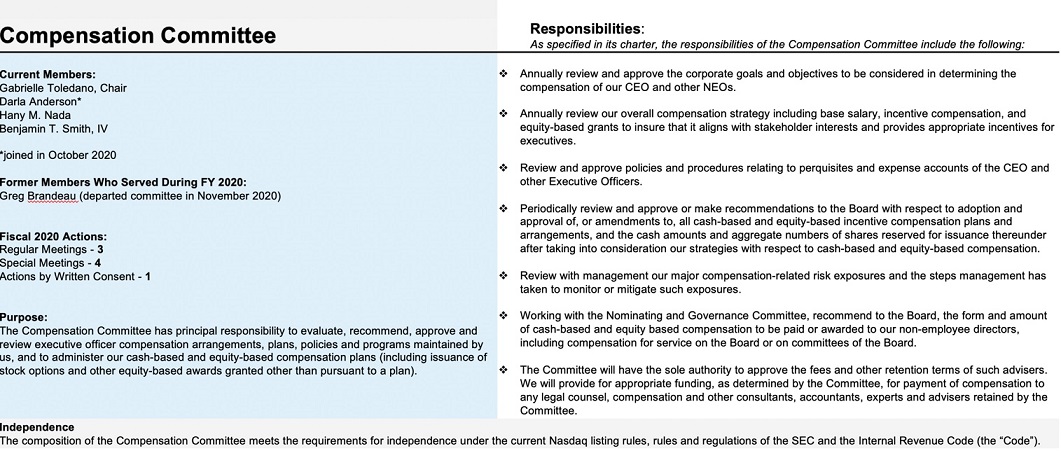

Board Committees and Charters

The Board currently has a standing Audit Committee, Compensation Committee, Nominating and Governance Committee and Strategy Committee. The members of each committee are appointed by the Board based on recommendations of the Nominating and Governance Committee. Each member of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee is an independent director as determined by the Board in accordance with the Nasdaq listing rules. On the Strategy Committee, each of Messrs. de Masi, Earl and Feder are considered non-independent under the Nasdaq listing. Each of the Audit Committee, Compensation Committee and Nominating and Governance Committee annually reviews its charter and makes recommendations to our Board for revision to reflect changes in laws and regulations and evolving best practices. Copies of each charter can be found on our website at http://www.glu.com/investors (by clicking on the “corporate governance” link). Current committee members are as follows:

|

Director |

Audit Committee |

Compensation Committee |

Nominating and Governance Committee |

Strategy Committee |

|

Darla Anderson |

— |

Member |

— |

Member |

|

Eric R. Ball |

Chair |

— |

— |

— |

|

Greg Brandeau |

Member |

— |

Chair |

— |

|

Niccolo M. de Masi |

— |

— |

— |

Chair |

|

Nick Earl |

— |

— |

— |

Member |

|

Ben Feder |

— |

— |

— |

Member |

|

Hany M. Nada |

Member |

Member |

— |

Member |

|

Benjamin T. Smith, IV |

Member |

Member |

Member |

Member |

|

Gabrielle Toledano |

— |

Chair |

Member |

— |

6

Strategy Committee

Our Strategy Committee assists the Board and senior management in refining our strategic vision and growth initiatives.

Item 11. Executive Compensation

Please see the section titled “Executive Officers” at the end of Item 1 of the Original Filing for the identity of our executive officers and their respective business experience.

Compensation Committee Interlocks and Insider Participation

During 2020, Messrs. Brandeau, Nada and Smith, Ms. Toledano and Ms. Anderson each served on the Compensation Committee. None of these individuals is or has been an officer or employee of Glu or any of our subsidiaries. There are no other relationships between committee members and Glu or any other company that are required by SEC regulations to be disclosed under this caption.

7

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) describes the philosophy, objectives and structure of our fiscal year 2020 executive compensation program. This CD&A is intended to be read in conjunction with the tables following this section which provide further historical compensation information for the executives identified below. We refer to these individuals collectively as our “Named Executive Officers.”

|

Name |

Position |

|

Nick Earl |

President and Chief Executive Officer |

|

Eric R. Ludwig |

Executive Vice President, Chief Operating Officer and Chief Financial Officer |

|

Chris Akhavan |

Senior Vice President, Business Development, Corporate Development and Advertising Revenue |

|

Becky Ann Hughes |

Senior Vice President, Growth |

|

Scott J. Leichtner |

Vice President, General Counsel and Corporate Secretary |

We also refer to Messrs. Earl, Ludwig and Akhavan and Ms. Hughes as our “Eligible Officers” to indicate that they were eligible to receive certain performance-based equity awards in lieu of performance-based cash incentive awards.

Executive Summary

Our executive compensation program is designed to align the interests of the Named Executive Officers and our other executives with our stockholders and to emphasize our pay-for-performance culture by rewarding our executives for strong company performance and financial results. Our executive compensation program is designed to focus and reward executives on performance which the Compensation Committee believes will drive the creation of sustainable long-term value for our stockholders, and our business results directly impact the compensation received by our executives. Highlights of our 2020 executive compensation program, as discussed and analyzed in detail in this CD&A, include the following:

•

With respect to the 2020 performance period, strong bookings and Adjusted EBITDA results led to maximum achievement for performance-based equity awards. The tranches of the long-term performance-based equity awards granted in prior years that were based on Glu’s 2020 performance and the performance-based equity awards granted in lieu of a 2020 cash bonus payout vested at the maximum amount. In addition, Mr. Leichtner received the maximum amount of his 2020 cash bonus target. In each of these cases, maximum payouts were achieved due to the level of bookings and Adjusted EBITDA that we generated in 2020.

•

Long-Term Strategy and Pay-for-Performance Culture. To support our pay-for-performance philosophy, align the interests of the Named Executive Officers with our stockholders, reinforce changes in our business strategy and provide meaningful compensation opportunities for delivering results that significantly exceed our strategic plan, the Compensation Committee awarded 50% of the long-term equity awards of Messrs. Earl, Ludwig, and Akhavan and Ms. Hughes and 25% of the equity awards of Mr. Leichtner in the form of performance-based equity.

8

2020 Compensation Highlights

Because of our strong pay for performance culture, and our focus on incentivizing and achieving results which will drive sustainable long-term value creation for our stockholders, we set high performance goals for our executive compensation program. In 2020, our company record bookings and Adjusted EBIDTA results led to a maximum achievement and payout of our performance-based equity awards and cash bonus payments.

We took the following actions related to 2020 executive compensation:

•

No Increases to Base Salaries: We did not increase base salaries for any of our Named Executive Officers during 2020.

•

Annual Incentive Payouts Achieved at Maximum: We achieved the Adjusted EBITDA threshold and exceeded the maximum bookings target established by the Compensation Committee for 2020 and, as a result, our Named Executive Officers received the maximum achievement of their equity awards granted in lieu of a 2020 cash bonus and, in the case of Mr. Leichtner, cash bonus payments.

•

Long-term Incentive Program Vested at 100% of the First Tranche of 2019 Performance Awards, the Second Tranche of 2018 Performance Awards and the Third Tranche of 2017 Performance Awards: We met our Adjusted EBITDA threshold and exceeded the maximum bookings goals that the Compensation Committee established in December 2019, October 2018 and October 2017 for 2020 performance and therefore the tranches of the performance awards granted in 2017, 2018 and 2019 that related to 2020 performance vested at 100%.

9

Components of Pay

|

Element |

Performance Period |

Objective |

Performance Measured/Rewarded for 2020 | ||||

|

Base Salary |

Annual |

Recognizes an individual’s role and responsibilities and serves as an important retention vehicle |

• Reviewed annually and set based on market competitiveness, individual performance and internal equity considerations | ||||

|

Annual Incentive Opportunity |

Annual |

Motivates executives to achieve our annual financial plan and strategic goals. For our Eligible Officers, annual incentive opportunities are delivered in performance-based equity to further align annual performance achievements with the creation of sustainable long-term value for stockholders. Mr. Leichtner’s annual incentive opportunity is in cash. |

• Bookings • Adjusted EBITDA | ||||

|

Time-based restricted stock units (“RSUs”) |

Long-Term |

Supports the achievement of strong share price growth. |

• Vesting 25% on the first anniversary of the grant date, 4.16% on February 15, 2021 and 6.25% quarterly thereafter, with the final vesting of 2.08% on February 15, 2024 | ||||

|

Performance-based restricted stock units (“PSUs”) |

Long-Term |

Aligns the interests of management and stockholders and serves an important retention vehicle while also incentivizing short- and long- term performance. |

• Adjusted EBITDA achievement and bookings thresholds are measured over a three-year period |

Target Pay Mix

To help retain and motivate our Named Executive Officers, our Compensation Committee aims to offer compensation competitive to our peers and industry through a mix of cash (base salaries and an annual performance-based cash bonus for Mr. Leichtner) and long-term incentives (annual performance-based equity awards for our Eligible Officers and long-term performance-based and time-based equity awards for all of our Named Executive Officers).

The Compensation Committee does not have any formal policies for allocating total compensation among the various components; instead, the committee uses its judgment, in consultation with Radford, an Aon company (“Radford”), to establish an appropriate balance of short-term and long-term compensation for each Named Executive Officer. The balance may change from year to year based on corporate strategy and objectives, among other considerations, but the majority of each executive’s potential total compensation is based solely on the achievement of certain performance goals.

10

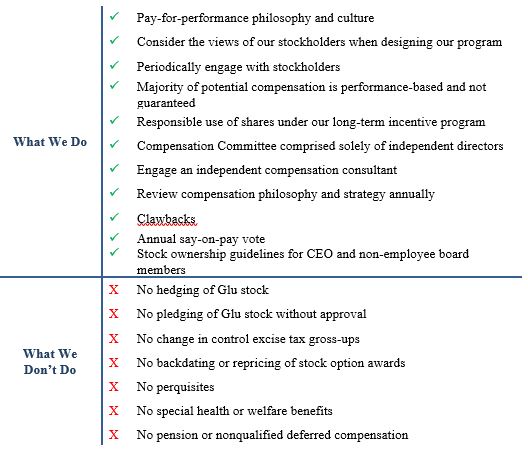

Governance of Our Pay Program

The Compensation Committee regularly reviews best practices in executive compensation and uses the following guidelines to design our compensation programs:

2020 Say on Pay Results and Consideration of Stockholder Support

At our 2020 Annual Meeting of Stockholders, we conducted a stockholder advisory vote, or say-on-pay vote, on the compensation of the Named Executive Officers. At that meeting, our stockholders approved the compensation of our Named Executive Officers, as disclosed in our 2020 annual proxy statement, with approximately 97.87% of the votes cast in favor of the proposal.

Our Compensation Committee noted the support of our stockholders in the 2020 say-on-pay vote and considered this result in their decision-making regarding our executive compensation. Given that the 2020 say-on-pay vote reflected strong support for our compensation practices, and that we did not receive any stockholder feedback requiring compensation changes during 2020, we have maintained our existing focus on performance-based compensation. We value the opinions of our stockholders and will continue to consider the outcome of future say-on-pay votes, as one element in the process, when making compensation decisions for our executive officers.

11

Compensation Philosophy and Objectives

The Compensation Committee has established a compensation program for executive officers designed to

•

Attract individuals with the skills necessary for us to achieve our performance objectives;

•

Motivate and reward those individuals fairly over time; and

•

Retain those individuals who continue to perform at or above the levels that we expect.

Our compensation program for executive officers is also designed to reinforce a sense of ownership, urgency, innovation and overall entrepreneurial spirit and to link rewards to measurable corporate and, where appropriate, individual performance.

We provide competitive pay opportunities. We reward the achievement of specific financial and strategic goals which we believe will drive the creation of sustainable long-term value for our stockholders. We use performance-based equity and multi-year goals to ensure that performance is sustained over a longer time horizon.

Process for Setting Executive Compensation

Role of the Compensation Committee

The Compensation Committee acts on behalf of the Board to oversee the compensation policies and practices applicable to all our employees, including the administration of our equity plans. Our Compensation Committee annually assesses the performance of our Chief Executive Officer, other executives and members of our senior leadership, and, based in part on the recommendations from our Chief Executive Officer (other than with respect to his own compensation), approves the compensation of these executives.

The Compensation Committee works within the framework of a pay-for-performance philosophy to determine each component of an executive officer’s compensation package based on numerous factors, including:

•

the individual’s particular background and circumstances, including training and prior relevant work experience;

•

the individual’s role with us and the compensation paid to similar persons in the companies represented in the compensation data that the Compensation Committee reviews;

•

the demand for personnel with the individual’s specific expertise and experience at the time of hire or review;

•

performance goals and other expectations for the position, where appropriate;

•

comparison to other executives within our company having similar levels of expertise and experience; and

•

compensation data of peer companies for similar positions.

The Compensation Committee performs a strategic review of our executive officers’ compensation levels to determine whether they provide adequate incentives and motivation and whether they are appropriately aligned with the competitive talent market. Historically, in making compensation decisions, the Compensation Committee has given significant weight to, among other things, our financial performance relative to our operating plan approved by the Board.

12

Role of the Compensation Consultant

The Compensation Committee’s charter provides that the committee has the authority to retain experts and advisors of its choice to assist the committee in performing its functions. In 2020, the Compensation Committee relied upon the advice and expertise of Radford. The Compensation Committee selected Radford based on its expertise in executive compensation, particularly with respect to compensation practices of technology companies in the San Francisco Bay Area. Radford provided the following services to the committee in 2020:

•

reviewed and provided recommendations regarding the composition of our peer group, and provided compensation data relating to executives at the selected peer group companies;

•

conducted a comprehensive review of the total compensation arrangements for our Named Executive Officers and other members of senior leadership and provided advice on our compensation of these individuals;

•

provided research and recommendations relating to the short- and long-term incentive plans applicable to our Named Executive Officers and other members of our senior leadership;

•

assisted the Compensation Committee in a comprehensive review of our equity strategy;

•

updated the Compensation Committee on emerging trends/best practices in the area of executive and Board compensation;

•

participated in Compensation Committee meetings, as requested, and provided ad hoc advice and support; and

•

assisted with our disclosure in this Compensation Discussion and Analysis.

In selecting Radford, the Compensation Committee reviewed Radford’s independence as required under SEC and Nasdaq rules. Based on this assessment, the Compensation Committee does not believe the retention of, and the work performed by, Radford creates any conflict of interest.

Role of Executive Officers in Compensation Decisions

To aid the Compensation Committee in its responsibilities, Messrs. Earl and Ludwig provide the Compensation Committee with recommendations relating to the performance and achievements for each of the Named Executive Officers. The Compensation Committee typically evaluates, discusses and modifies or approves these recommendations. The Compensation Committee does not consult with any other executive officer with regard to its decisions. No executive officer is involved in the deliberations or decisions regarding his or her own pay.

Use of Competitive Market Data

When considering executive compensation decisions, the Compensation Committee believes it is important to be informed as to current compensation practices of comparable publicly held companies, especially to understand the demand and competitiveness for attracting and retaining an individual with each Named Executive Officer’s specific expertise and experience.

Radford has historically provided the Compensation Committee competitive market data using the most recently approved peer group as well as with information from select sections of the Radford Global Technology Survey. Data from the Radford survey was filtered to reflect companies having similar industry and financial profiles as the companies included in our peer group. The committee uses the data as a reference point when making pay determinations, but does not benchmark pay to a specific level or percentile of the market.

Compensation decisions on annual and long-term equity incentives for our executives, including the magnitude of equity awards and the levels of cash compensation for the upcoming fiscal year, have historically been finalized at a meeting of the Compensation Committee in the fourth quarter. As described in more detail below, compensation data from a peer group established and approved in July 2019 was relied upon by the Compensation Committee to finalize cash compensation for the 2020 fiscal year, while the peer group identified in July 2020 and the related competitive assessment was relied upon by the Compensation Committee to finalize the executive equity awards granted in November 2020 for the 2021 fiscal year.

In addition to reviewing the market data contained in the Radford’s reports, the Compensation Committee also considered a number of additional factors in making executive compensation decisions, including our overall performance, each executive officer’s individual performance, the scope of responsibility of each executive officer, and the then-current compensation and equity holdings of each executive officer.

13

Determination of 2019 Peer Group (for 2020 Compensation Decisions)

In July 2019, the Compensation Committee, with input from Radford, reviewed the peer group that was used in in the fourth quarter of 2018 for establishing executive compensation for the 2019 fiscal year and approved changes to better reflect our then-current market capitalization and revenues. The peer group selection criteria for purposes of determining our 2019 peer group, which was used in guiding compensation decisions made in December 2019 for fiscal 2020, targeted companies with the following characteristics:

•

in the gaming sector as well as internet and application software and services sectors;

•

headquartered in the San Francisco Bay Area, as well as other high technology centers;

•

annual revenue between approximately $200 million and $1.2 billion (Glu’s revenue for the prior four quarters at the time the peer group was determined was approximately $381 million); and

•

market capitalization of between approximately $400 million and $4 billion (Glu’s trailing six-month average market capitalization at the time the peer group was determined was approximately $1.3 billion).

Based on the criteria above, the Compensation Committee approved the below peer companies in July 2019 (companies listed in bold were also included in the prior year’s set of peer companies), which were used in guiding compensation decisions made in December 2019. Compared to the 2018 peer group, one company was excluded due to the company having been acquired and three companies were added because they fit the peer group selection criteria. Zynga fell outside of the target revenue range, but the committee believed it was appropriate to include Zynga in the group of peer companies due to it being the most similar company to Glu in terms of it being a developer and publisher of mobile games located in San Francisco and thus a primary competitor for executive talent. In addition, the committee elected to retain in the peer group Care.com, Lending Tree and MobileIron even though they did not meet one of the criteria (Care.com and MobileIron were slightly below the revenue range and Lending Tree was slightly above the market capitalization range) in order to maintain year-over-year consistency. Companies listed in bold were included in the 2018 peer group.

|

• A10 Networks • Blucora • Box • Carbonite • Care.com |

• Chegg • Eventbrite • Lending Tree • LivePerson • MobileIron |

• Monotype Imaging Holdings • PROS Holdings • QAD • QuinStreet |

• Quotient Technology • Rapid7 • Shutterstock • TrueCar • Zynga |

Determination of 2020 Peer Group (for 2021 Compensation Decisions)

In July 2020, the Compensation Committee, with input from Radford, reviewed the peer group that was used during the fourth quarter of 2019 for establishing executive compensation for the 2020 fiscal year and approved changes to better reflect our then-current market capitalization and revenues. The peer group selection criteria for purposes of determining our 2020 peer group, which was used in guiding compensation decisions made in December 2020 for fiscal 2021, targeted companies with the following characteristics:

•

in the gaming as well as internet and application software and services sectors;

•

headquartered in the San Francisco Bay Area, as well as other high technology centers;

•

annual revenue between approximately $250 million and $1.5 billion (Glu’s revenue for the prior four quarters at the time the peer group was determined was approximately $422.8 million); and

•

market capitalization of between approximately $400 million and $4 billion (Glu’s trailing six-month average market capitalization at the time the peer group was determined was approximately $1.5 billion).

14

Based on the criteria above, the Compensation Committee approved the below peer companies in July 2020, which were used in guiding compensation decisions made in November 2020. Compared to the 2019 peer group, (1) Blucora and TrueCar were excluded for market capitalization reasons and because they are not located in the Bay Area, (2) SciPlay was added due to it being a gaming company with a similar business model to Glu with revenues within the desired range, despite it not meeting the market capitalization criteria, (3) Five9 and Yelp were added because they were local Bay Area companies who were included in the ISS and Glass Lewis peer groups and (4) Carbonite, Care.com and Monotype Imaging were excluded because they had been acquired. Zynga fell outside of the target market capitalization range, but the Compensation Committee believed it was appropriate to continue to include Zynga in the group of peer companies for the same reasons noted above. In addition, the committee elected to retain in the peer group A10 Networks, Chegg and MobileIron even though they did not meet one of the criteria (A10 Networks and MobileIron were slightly below the revenue range and Chegg was above the market capitalization range) in order to maintain year-over-year consistency and because they are located in the Bay Area, Companies listed in bold were included in the 2019 peer group.

|

• A10 Networks • Box • Chegg • Eventbrite • Five9 |

• Lending Tree • LivePerson • MobileIron • PROS Holdings |

• QAD • QuinStreet • Quotient Technology • Rapid7 |

• SciPlay • Shutterstock • Yelp • Zynga |

2020 Elements of Compensation

Base Salary

Base salaries provide fixed compensation to executive officers for performing their ongoing responsibilities. The Compensation Committee generally fixes executive officer base salaries at levels it believes will enable us to hire and retain individuals in a competitive environment and to reward individual performance and a level of contribution that is in-line with and in furtherance of our overall business goals.

The Compensation Committee reviews executive salaries annually, typically in the fourth quarter, and adjusts them as appropriate. Such adjustments are based on factors that may include promotions, the assumption of increased responsibilities or to address competitive pressure or retention issues, should they arise.

The table below sets forth the annual base salaries for each of the Named Executive Officers as of December 31, 2019 and 2020.

|

Component |

2019 Salary ($) |

2020 Salary ($) |

% Increase |

|

Nick Earl |

475,000 |

475,000 |

0% |

|

Eric R. Ludwig |

375,000 |

375,000 |

0% |

|

Chris Akhavan |

400,000 |

400,000 |

0% |

|

Becky Ann Hughes |

360,000 |

360,000 |

0% |

|

Scott J. Leichtner |

345,000 |

345,000 |

0% |

_______________________________

Annual Incentives Opportunity for 2020: PSUs for the Eligible Officers and Cash Bonus for Mr. Leichtner

Consistent with prior years, the Compensation Committee determined that for 2020 it would not provide the Eligible Officers with a cash-based bonus plan, but instead would provide them with the opportunity to earn an equivalent value of performance-based equity, in this case PSUs (the “2020 Annual PSUs”), to the extent that Glu achieved certain bookings (defined as revenues, excluding any changes in deferred revenue) and Adjusted EBITDA (defined as GAAP net income adjusted for change in deferred revenue, change in deferred platform commissions and change in deferred royalties, and excluding amortization of intangibles, stock-based compensation, transitional costs, restructuring charges, depreciation/amortization, interest and other income and income tax provision) targets during 2020 (the “2020 Targets”). The committee selected PSUs instead of performance share options, or PSOs, that we granted in 2017 and 2018 to better align with market practice and to conserve shares in our equity plan. Additionally, the committee determined that it was the performance goals of the program, rather than the vehicle used to deliver the award, which served as the primary factor when considering whether or not the awards created a strong incentive to achieve objectives aligned with driving sustainable long-term value.

15

The Compensation Committee selected bookings and Adjusted EBITDA as the performance metrics for the annual incentive program because it believed that these measures would best reflect whether we had achieved financial performance that would lead to company success. The committee believed that significantly increasing bookings from the prior year would be the best way to increase stockholder value, but that we needed to achieve that growth while generating meaningful positive Adjusted EBITDA for the year.

Consistent with prior years, the committee decided to use bookings rather than revenue because GAAP accounting rules require that we recognize our in-app purchase revenue over four to eight months, depending on the game, and defer such amounts into future periods, and the committee believed that bookings would be a better indicator of our success during 2020. The committee decided to use Adjusted EBITDA, rather than GAAP profit/(loss), because GAAP accounting rules require that we take into account non-cash expenses, such as stock-based compensation, and certain other expenses that are not reflective of Glu’s core business and operating results during 2020.

The Compensation Committee determined the maximum number of 2020 Annual PSUs that the Eligible Officers could potentially earn by calculating the maximum cash bonus that each of these Eligible Officers could have otherwise received in 2020, based on the historical maximum bonus percentages and annual base salaries for each Eligible Officer, and then converting such maximum bonus value into a maximum number of 2020 Annual PSUs using a conversion ratio that took into account Glu’s 90-day average stock price from September 14, 2019 to December 13, 2019, as illustrated in the table below.

|

Named Executive Officer |

2020 Threshold Bonus Percentage |

2020 Target Bonus Percentage |

2020 Maximum Bonus Percentage |

Base Salary for Determining # of 2020 Annual PSUs |

2020 Target Bonus Value |

2020 Maximum Bonus Value |

Target Bonus Value Converted into 2020 Annual PSUs |

Maximum Bonus Value Converted into 2020 Annual PSUs |

Actual Earned 2020 Annual PSUs |

|

Nick Earl |

30% |

100% |

200% |

$475,000 |

$475,000 |

$950,000 |

85,500 |

171,000 |

171,000 |

|

Eric Ludwig |

30% |

100% |

200% |

$375,000 |

$375,000 |

$750,000 |

67,500 |

135,000 |

135,000 |

|

Chris Akhavan |

24.3% |

81% |

162% |

$400,000 |

$324,000 |

$648,000 |

58,500 |

117,000 |

117,000 |

|

Becky Ann Hughes |

27% |

90% |

180% |

$360,000 |

$324,000 |

$648,000 |

58,500 |

117,000 |

117,000 |

_______________________________

Given constraints in the number of shares available for issuance under Glu’s 2007 Equity Incentive Plan, the Compensation Committee again decided that Mr. Leichtner, together with Glu’s other corporate vice presidents, would not receive 2020 Annual PSUs but would instead be eligible for a cash-based bonus for 2020 performance, which bonus would be determined based on the achievement of the same 2020 Targets as applied to the Eligible Officers.

|

Named Executive Officer |

2020 Threshold Bonus Percentage |

2020 Target Bonus Percentage |

2020 Maximum Bonus Percentage |

2020 Target Cash Bonus |

2020 Maximum Cash Bonus |

2020 Actual Earned Cash Bonus |

|

Scott Leichtner |

15% |

50% |

100% |

$172,500 |

$345,000 |

$345,000 |

16

The Eligible Officers could have only earned the maximum amount of 2020 Annual PSUs, and Mr. Leichtner could have only earned the maximum cash bonus, if Glu both (1) achieved a minimum Adjusted EBITDA threshold for 2020 (the “Adjusted EBITDA Threshold”) and (2) generated bookings for 2020 that equaled or exceeded a specified maximum level of performance (the “Maximum Bookings Goal”). If Glu did not achieve the Maximum Bookings Goal, the Eligible Officers could have earned (1) 15% of the maximum amount of 2020 Annual PSUs or, for Mr. Leichtner, 15% of the maximum bonus, if Glu achieved the Adjusted EBITDA Threshold in 2020 and generated 2020 bookings that were approximately 12% below the Maximum Bookings Goal (the “Minimum Bookings Goal”) and (2) 50% of the maximum amount of 2020 Annual PSUs or, for Mr. Leichtner, 50% of the maximum bonus, if Glu achieved the Adjusted EBITDA Threshold in 2020 and generated 2020 bookings that were approximately 4% below the Maximum Bookings Goal (the “Target Bookings Goal”). If Glu did not achieve the Adjusted EBITDA Threshold or the Minimum Bookings Goal, no 2020 Annual PSUs or, for Mr. Leichtner, no cash bonus would have been earned. To the extent that Glu achieved the Adjusted EBITDA Threshold in 2020 and generated bookings between the Minimum Bookings Goal and the Maximum Bookings Goal, the number of 2020 Annual PSUs earned or, for Mr. Leichtner, the amount of the cash bonus, would have been calculated on a linear basis.

The table below illustrates the number of 2020 Annual PSUs that each of the Eligible Officers could have potentially earned based on Glu’s Adjusted EBITDA and bookings for 2020:

|

Named Executive Officer |

2020 Annual PSUs Earned if Glu Achieved Adjusted EBITDA Threshold and Maximum Bookings Goal |

2020 Annual PSUs Earned if Glu Achieved Adjusted EBITDA Threshold and Target Bookings Goal |

2020 Annual PSUs Earned if Glu Achieved Adjusted EBITDA Threshold and Minimum Bookings Goal |

2020 Annual PSUs Earned if Glu Failed to Achieve Adjusted EBITDA Threshold or Minimum Bookings Goal |

|

Nick Earl |

171,000 |

85,500 |

25,650 |

0 |

|

Eric Ludwig |

135,000 |

67,500 |

20,250 |

0 |

|

Chris Akhavan |

117,000 |

58,500 |

17,550 |

0 |

|

Becky Ann Hughes |

117,000 |

58,500 |

17,550 |

0 |

The 2020 Annual PSUs were granted on December 17, 2019 and at such time the Compensation Committee established the following bookings-based 2020 Targets, provided that we generated at least a minimum Adjusted EBITDA threshold of $41 million:

|

Performance Metric |

Threshold (MMs) |

Target (MMs) |

Maximum (MMs) |

|

Bookings |

$442 |

$484.1 |

$505 |

The target and maximum bookings targets represented a significant increase over our 2019 bookings results of $423.3 million. In 2020, we met the Adjusted EBITDA threshold and exceeded the maximum bookings target, as we generated $76.3 million of Adjusted EBITDA and $560.6 million of bookings. As a result, the Eligible Officers received the maximum amount of their annual incentive-based compensation for 2020 performance and Mr. Leichtner received the maximum amount of his 2020 cash bonus.

Annual Incentives Opportunity for 2021: PSUs for Messrs. Earl and Ludwig and Cash Bonuses for Messrs. Akhavan and Leichtner and Ms. Hughes

Consistent with the prior year, the Compensation Committee determined that for 2021 it would not provide Messrs. Earl and Ludwig with a cash-based bonus plan, but instead would provide them with the opportunity to earn an equivalent value of PSUs (the “2021 Annual PSUs”), to the extent that Glu achieves certain combined goals consisting of the sum of annual bookings growth and profit margin (the “Combined Goal”). Bookings growth is the quotient, expressed as a percentage, obtained by dividing (1) (a) Glu’s bookings for fiscal year 2021, minus (b) Glu’s bookings for 2020, by (2) Glu’s bookings for 2020. Profit margin is defined to mean the quotient, expressed as a percentage, obtained by dividing (1) Glu’s Adjusted EBITDA for fiscal year 2021, by (2) Glu’s bookings for fiscal year 2021.

17

The Compensation Committee determined the maximum number of 2021 Annual PSUs that Messrs. Earl and Ludwig can potentially earn by calculating the maximum cash bonus that each of them could have otherwise received in 2021, based on their maximum bonus percentages and annual base salaries, and then converting such maximum bonus value into a maximum number of 2021 Annual PSUs using a conversion ratio that took into account Glu’s 90 day average stock price from August 10, 2020 to November 6, 2020, as illustrated in the table below.

|

Named Executive Officer |

2021 Minimum Bonus Percentage |

2021 Threshold Bonus Percentage |

2021 Target Bonus Percentage |

2021 Maximum Bonus Percentage |

Base Salary for Determining # of 2021 Annual PSUs |

2021 Target Bonus Value |

2021 Maximum Bonus Value |

Maximum Bonus Value Converted into 2021 Annual PSUs |

|

Nick Earl |

15% |

25% |

50% |

100% |

$475,000 |

$475,000 |

$950,000 |

123,700 |

|

Eric Ludwig |

15% |

25% |

50% |

100% |

$375,000 |

$375,000 |

$750,000 |

97,660 |

The table below illustrates the number of 2021 Annual PSUs that each of Mr. Earl and Mr. Ludwig could potentially earn based on the achievement of the Combined Goal:

|

Named Executive Officer |

2021 Annual PSUs Earned if Glu Fails to Achieve the Minimum Combined Goal |

2021 Annual PSUs Earned if Glu Achieves the Minimum Combined Goal |

2021 Annual PSUs Earned if Glu Achieves the Threshold Combined Goal |

2021 Annual PSUs Earned if Glu Achieves the Target Combined Goal |

2021 Annual PSUs Earned if Glu Achieves the Maximum Combined Goal | |||||

|

Nick Earl |

0 |

18,555 |

30,925 |

61,850 |

123,700 | |||||

|

Eric Ludwig |

0 |

14,649 |

24,415 |

48,830 |

97,660 |

Given constraints in the number of shares available for issuance under Glu’s 2007 Equity Incentive Plan, the Compensation Committee decided that Mr. Akhavan and Ms. Hughes, in addition to Mr. Leichtner, would not receive 2021 Annual PSUs but would instead be eligible for a cash-based bonus for 2021 performance, which bonus would be determined based on the achievement of the same Combined Goal.

The table below illustrates the amount of the 2021 cash bonuses that each of Messrs. Akhavan and Leichtner and Ms. Hughes could potentially earn based on achievement of the Combined Goal:

|

Named Executive Officer |

2021 Minimum Bonus Percentage |

2021 Threshold Bonus Percentage |

2021 Target Bonus Percentage |

2021 Maximum Bonus Percentage |

2021 Minimum Cash Bonus |

2021 Threshold Cash Bonus |

2020 Target Cash Bonus |

2020 Maximum Cash Bonus |

|

Chris Akhavan |

12% |

20% |

40% |

80% |

$48,000 |

$80,000 |

$160,000 |

$320,000 |

|

Becky Ann Hughes |

27% |

45% |

90% |

180% |

$97,200 |

$162,000 |

$324,000 |

$648,000 |

|

Scott Leichtner |

15% |

25% |

50% |

100% |

$51,750 |

$86,250 |

$172,500 |

$345,000 |

18

The Named Executive Officers will only earn the maximum amount of 2021 Annual PSUs or the cash bonuses, as applicable, if Glu achieves the Combined Goal at or above a specified maximum level of performance (the “Maximum Combined Goal”). If Glu does not achieve the Maximum Combined Goal, the number of PSUs that will vest or the amount of the cash bonuses that will be paid, if any, will depend on the extent to which Glu achieves the Combined Goal in FY 2021 as set forth in the table below:

|

Percent of Award Vested Or Amount of Cash Bonus | |

|

Maximum Combined Goal |

100% |

|

Target Combined Goal |

50% |

|

Threshold Combined Goal |

25% |

|

Minimum Combined Goal |

15% |

|

Below Minimum Combined Goal |

0% |

To the extent that Glu achieves a Combined Goal between two targets, the number of 2021 Annual PSUs earned or the amount of the cash bonuses, as applicable, will be calculated on a linear basis.

The 2021 Annual PSUs were granted on November 23, 2020. Glu will determine the extent to which it achieved its 2021 Combined Goal in early 2022, and to the extent that the Named Executive Officers earn any 2021 Annual PSUs or cash bonuses, such 2021 Annual PSUs will fully vest on February 15, 2022, and such cash bonuses will be paid in February 2022 (consistent with the timing of when Glu historically paid cash bonuses to executive officers).

If Glu is acquired prior to the last day of the 2021 fiscal year, the performance achievement for fiscal year 2021 with respect to Messrs. Earl and Ludwig’s 2021 Annual PSUs will be deemed to be the Target Combined Goal and the award (at the Target Combined Goal level) will convert to a time-based vesting RSU award, vesting as of February 15, 2022 (the “CIC Unvested RSUs”), provided Mr. Earl or Mr. Ludwig, as applicable, continues to provide services to Glu through such date except as set forth below. As noted below, it is currently expected that the acquisition of Glu by Electronic Arts Inc. (“Electronic Arts”) will close on or around April 29, 2021, such that it is expected that the 2021 Annual PSUs will be converted into CIC Unvested RSUs as described in this paragraph.

If Mr. Earl or Mr. Ludwig is terminated by Glu or the successor or acquiring corporation (if any) of the Company without Cause (as defined in each such officer’s Change of Control Severance Agreement with Glu (each, a “CIC Agreement”)) or such officer terminates his employment with Glu as result of an Involuntary Termination (as defined in the CIC Agreement) and such termination or resignation, as applicable, occurs (i) on, or within 12 months following, a Change of Control (as defined in the CIC Agreement) and (ii) prior to the Vesting Date (a “CIC Qualifying Termination”), the CIC Unvested RSUs shall automatically expire and be forfeited and, provided the officer satisfies the conditions of the CIC Agreement, the officer shall instead receive a cash payment equal to his annual cash incentive bonus for fiscal year 2021 payable at 100% of target, which is equal to $475,000 for Mr. Earl and $375,000 for Mr. Ludwig (the “FY2021 Target Bonus”), as provided under, and subject to the terms and conditions of, the CIC Agreement.

Long-Term Incentives

Philosophy Regarding Equity Grants

We use equity awards to reward long-term performance, with strong corporate performance and extended executive officer tenure producing potentially significant value for each executive officer.

19

In November 2020, the Compensation Committee decided to continue our existing equity program to emphasize our pay-for-performance culture, conservatively manage our equity burn utilization rate, and align with market practice, which consisted of:

(1)

50% PSUs for the Eligible Officers (25% PSUs in the case of Mr. Leichtner and our other corporate Vice Presidents) with three-year performance vesting goals tied to the goals described below; and

(2)

50% of time-based RSUs for the Eligible Officers (75% in the case of Mr. Leichtner and our other corporate Vice Presidents) with a four-year vesting schedule.

The Compensation Committee selected annual bookings growth and profit margin as the appropriate metrics given the importance of these factors on driving sustainable long-term stockholder value creation. The committee believes that Glu’s executive compensation program aligns the interests of our executive officers with Glu’s stockholders and is consistent with Glu’s strategic goals of realizing significant annual bookings growth and profit margin in 2021 and beyond. The Compensation Committee chose a combination of annual bookings growth and profit margin for 2021 and beyond because it wanted to provide our management with greater flexibility to balance growth and profitability over a longer term compared to its prior approach of payout based on bookings growth subject to the Company meeting a certain EBITDA threshold. For example, our management team now has the flexibility to focus on high growth compared to profit in one year and then change this focus in the next year, if needed to maximize value for our stockholders. The Committee also felt that this program aligns better with stockholder interests because it focuses on balanced growth compared with the prior approach of assigning greater weigh to bookings growth rather than profitability.

The size of executive equity awards is generally set at a level that the Compensation Committee deems appropriate to create a meaningful opportunity for significant compensation if we achieve the applicable performance goals and our stock price appreciates. The amounts are also based upon market data presented by the applicable Compensation Committee Consultant, the individual’s position with us and the individual’s potential for future responsibility and promotion. The relative weight given to each of these factors varies from individual to individual at the committee’s discretion.

2020 Long-Term Equity Grants

In November 2020, the Compensation Committee determined the value of each Named Executive Officer’s annual long-term equity awards by considering market data provided by Radford (including the compensation of similarly situated executives at Glu’s peer companies), past performance and future potential performance of each executive, as well as each Named Executive Officer’s current equity holdings.

With respect to the Named Executive Officers 2020 long-term equity grants, the Compensation Committee determined to award 50% of the value of each of Messrs. Earl’s, Ludwig’s and Akhavan’s and Ms. Hughes’ and 25% of the value of Mr. Leichtner’s awards in PSUs, with the balance of their 2020 long-term equity grant in the form of time vesting RSUs. In addition, each of the Named Executive Officers was provided the ability to earn additional PSUs up to 50% of the target PSU award if the Maximum Combined Goal were to be achieved. The table below sets forth for each Named Executive Officer the value of his or her 2020 long-term equity awards and the number of PSU and time vesting RSUs received:

|

Executive |

Equity Value ($) |

RSUs (#) |

Maximum PSUs (#) if Maximum Combined Goal is met |

|

Nick Earl |

6,980,010 |

292,970 |

439,455 |

|

Eric Ludwig |

3,322,396 |

139,450 |

209,175 |

|

Chris Akhavan |

891,770 |

37,430 |

56,145 |

|

Becky Ann Hughes |

1,527,897 |

64,130 |

96,195 |

|

Scott Leichtner |

977,254 |

68,360 |

34,185 |

20

Each RSU will vest over four years, with 25% of the total number of shares subject to the RSUs vesting on November 23, 2021 (the “First Vesting Date”), with the remaining 75% of the underlying shares vesting in equal quarterly installments over the next three years following the First Vesting Date on the same day of each third month (e.g., the next quarterly vesting date will be February 15, 2022, then May 15, 2022, etc.), subject to earlier termination of vesting due to the termination of the RSU holder’s employment with, or arrangements to provide services to, Glu or a Glu subsidiary; provided, however, that if any portion of the RSU vests on a date that is a non-trading day on The Nasdaq Stock Market, then the RSU will vest on the next trading day.

Each PSU is earned based upon the achievement of rigorous multi-year (2021, 2022 and 2023) Combined Goals, consisting of the sum of annual bookings growth and profit margins for the applicable year.

The number of PSUs that will vest, if any, on each February 15, 2022, 2023 and 2024 will depend on the extent to which we achieve the Combined Goal in each of the fiscal years 2021, 2022 and 2023 as set forth in the table below (with no more than 33.34% of each PSU eligible to vest in each fiscal year):

|

Percent of Award Vested (FY 21 Tranche) |

Percent of Award Vested (FY 22 Tranche) |

Percent of Award Vested (FY 23 Tranche) | |

|

Max Combined Goal |

33.33% |

33.33% |

33.34% |

|

Target Combined Goal |

22.22% |

22.22% |

22.22% |

|

Threshold Combined Goal |

11.11% |

11.11% |

11.11% |

|

Below Threshold Combined Goal |

0% |

0% |

0% |

The Threshold Combined Goal and the Target Combined Goal are approximately 33% and 20% below the Maximum Combined Goal, respectively. To the extent that Glu achieves a Combined Goal between two thresholds, the number of PSUs earned will be calculated on a linear basis. If Glu does not achieve the Maximum Combined Goal in any year and less than the full amount of shares are earned for such year, these shares cannot be recaptured through overachievement of the Maximum Combined Goal in subsequent years.

With respect to these PSUs, in the event Glu is acquired (as determined by the Board in its sole discretion) prior to the last day of the applicable fiscal year, the performance achievement for the current fiscal year and any remaining fiscal years (through fiscal year 2023) will be deemed to be the Target Combined Goal and the award (at the Target Combined Goal level) will convert to a time-based vesting RSU award, with an equal portion of the RSUs vesting as of February 15, 2022, 2023 and 2024, as applicable, provided the officer continues to provide services to Glu through such vesting dates.