SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

227 West Monroe Street, Chicago, 60606

(Name and address of agent for service)

... YOUR ROAD TO THE LATEST, MOST UP-TO-DATE INFORMATION

|

•

|

Daily and historical fund pricing, fund returns, portfolio holdings and characteristics, and distribution history.

|

|

•

|

Investor guides and fund fact sheets.

|

|

•

|

Regulatory documents including a prospectus and copies of shareholder reports.

|

|

Contents

|

|

|

Dear Shareholder

|

3

|

|

Economic and Market Overview

|

4

|

|

Management Discussion of Fund Performance

|

6

|

|

Risks and Other Considerations

|

13

|

|

Performance Report and Fund Profile

|

14

|

|

About Shareholders' Fund Expenses

|

27

|

|

Schedule of Investments

|

29

|

|

Statement of Assets and Liabilities

|

49

|

|

Statement of Operations

|

51

|

|

Statements of Changes in Net Assets

|

53

|

|

Financial Highlights

|

57

|

|

Notes to Financial Statements

|

64

|

|

Report of Independent Registered Public

|

|

|

Accounting Firm

|

71

|

|

Supplemental Information

|

72

|

|

Report of the Claymore Exchange-Traded Fund Trust 2

|

|

|

Contracts Review Committee

|

76

|

|

Trust Information

|

83

|

|

About the Trust Adviser

|

Back Cover

|

|

(Unaudited)

|

May 31, 2016

|

President and Chief Executive Officer

Claymore Exchange-Traded Fund Trust 2

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 3

|

|

ECONOMIC AND MARKET OVERVIEW (Unaudited)

|

May 31, 2016

|

|

4 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

ECONOMIC AND MARKET OVERVIEW (Unaudited) continued

|

May 31, 2016

|

All indices described below are unmanaged and reflect no expenses. It is not possible to invest directly in any index.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 5

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

|

May 31, 2016

|

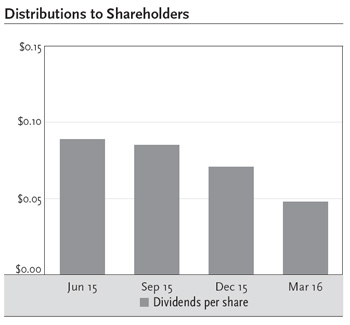

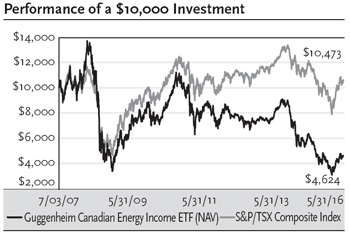

The Guggenheim Canadian Energy Income ETF, NYSE Arca ticker: ENY (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the S&P/TSX High Income Energy Index (the "Index"). The Index includes the constituent stocks of the S&P/TSX Composite Index that are classified as energy companies, according to the Global Industry Classification Standard (GICS), and that also meet specific yield requirements.

All Fund returns cited–whether based on net asset value ("NAV") or market price–assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2016.

Since more than 95% of the Fund's portfolio is invested in the energy sector, the return of this sector was the main determinant of the Fund's return, and it was the major source of the Fund's negative return for the 12-month period ended May 31, 2016.

|

6 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

May 31, 2016

|

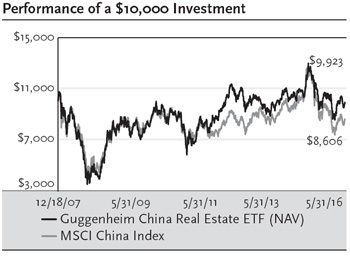

The Guggenheim China Real Estate ETF, NYSE Arca ticker: TAO (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the AlphaShares China Real Estate Index (the "Index").

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2016.

Nearly all of the Fund's investments are in the financials sector. For the 12-month period ended May 31, 2016, that sector was a large detractor from return.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 7

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

May 31, 2016

|

The Guggenheim China Small Cap ETF, NYSE Arca ticker: HAO (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the AlphaShares China Small Cap Index (the "Index").

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2016.

For the six-month period ended May 31, 2016, all sectors detracted from return. The industrials sector was the largest detractor, followed by the financials sector. The telecommunications services sector detracted least.

|

8 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

May 31, 2016

|

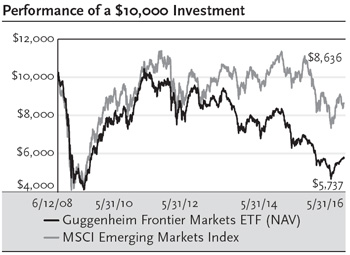

The Guggenheim Frontier Markets ETF, NYSE Arca ticker: FRN (the "Fund"), seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of the BNY Mellon New Frontier Index (the "Index").

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual period ended May 31, 2016.

For the 12-month period ended May 31, 2016, the utilities sector was the largest contributor to return, followed by the consumer staples sector. The energy sector detracted the most from the Fund's return, followed by the financials sector.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 9

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

May 31, 2016

|

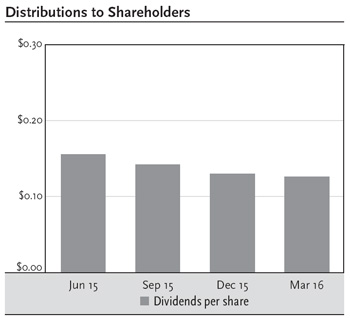

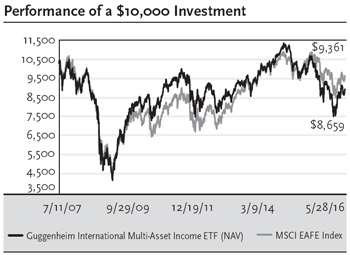

The Guggenheim International Multi-Asset Income ETF, NYSE Arca ticker: HGI (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an index called the Zacks International Multi-Asset Income Index (the "Index").

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2016.

For the 12-month period ended May 31, 2016, the information technology sector was the only contributor to the Fund's return. The energy sector detracted the most from the Fund's return, followed by the financials sector.

|

10 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

May 31, 2016

|

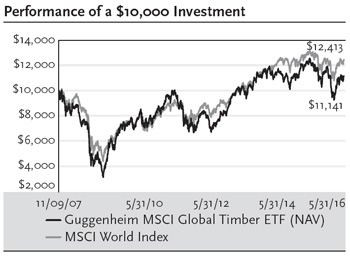

The Guggenheim MSCI Global Timber ETF, NYSE Arca ticker: CUT (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the MSCI ACWI IMI Timber Select Capped Index (the "Index"). The Fund's previous index, the Beacon Global Timber Index, was discontinued on May 20, 2016. The Fund's name was also changed on May 20, 2016, to reflect use of the new index.

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2016.

Most of the Fund's portfolio is invested in the materials sector, and it was the major detractor from the Fund's return for the 12-month period ended May 31, 2016. The Fund also has positions in the financials sector, which contributed to return for the period.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 11

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

May 31, 2016

|

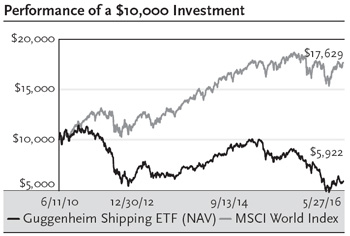

The Guggenheim Shipping ETF, NYSE Arca ticker: SEA (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the Dow Jones Global Shipping IndexSM (the "Index").

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended May 31, 2016.

Most of the Fund's portfolio is invested in the energy and the industrials sectors; both were detractors from return for the period.

|

12 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

(Unaudited)

|

May 31, 2016

|

The views expressed in this report reflect those of the portfolio managers and Guggenheim Investments only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward-looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 13

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)

|

May 31, 2016

|

|

Fund Statistics

|

|||

|

Share Price

|

$

|

8.33

|

|

|

Net Asset Value

|

$

|

8.35

|

|

|

Discount to NAV

|

-0.24%

|

||

|

Net Assets ($000)

|

$

|

29,374

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

||||

|

PERIOD ENDED MAY 31, 2016

|

||||

|

Since

|

||||

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(07/03/07)

|

|

|

Guggenheim Canadian

|

||||

|

Energy Income ETF

|

||||

|

NAV

|

-19.34%

|

-14.08%

|

-15.00%

|

-8.29%

|

|

Market

|

-19.90%

|

-13.99%

|

-15.05%

|

-8.32%

|

|

Sustainable Canadian

|

||||

|

Energy Income

|

||||

|

Index S&P/TSX/

|

||||

|

Canadian High

|

||||

|

Income Energy

|

||||

|

Index1

|

-18.95%

|

-13.79%

|

-14.58%

|

-7.29%

|

|

S&P/TSX Composite

|

||||

|

Index

|

-7.99%

|

-1.27%

|

-2.62%

|

0.52%

|

|

Portfolio Breakdown

|

% of Net Assets

|

|

Energy

|

94.8%

|

|

Basic Materials

|

4.4%

|

|

Total Common Stocks

|

99.2%

|

|

Securities Lending Collateral

|

33.5%

|

|

Total Investments

|

132.7%

|

|

Other Assets & Liabilities, net

|

-32.7%

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

Crescent Point Energy Corp.

|

5.8%

|

|

Peyto Exploration & Development Corp.

|

5.4%

|

|

Pembina Pipeline Corp.

|

5.2%

|

|

ARC Resources Ltd.

|

5.2%

|

|

TransCanada Corp.

|

5.2%

|

|

Vermilion Energy, Inc.

|

5.0%

|

|

Canadian Natural Resources Ltd.

|

5.0%

|

|

Suncor Energy, Inc.

|

4.8%

|

|

Inter Pipeline Ltd.

|

4.8%

|

|

PrairieSky Royalty Ltd.

|

4.7%

|

|

Top Ten Total

|

51.1%

|

|

1

|

Benchmark returns reflect the blended return of the Sustainable Canadian Energy Income Index from 7/3/07 - 7/31/13 and the return of the S&P/TSX Canadian High Income Energy Index, net of foreign withholding taxes, from 8/1/13 - 5/31/16.

|

|

14 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 15

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

Fund Statistics

|

|||

|

Share Price

|

$

|

18.83

|

|

|

Net Asset Value

|

$

|

18.92

|

|

|

Discount to NAV

|

-0.48%

|

||

|

Net Assets ($000)

|

$

|

12,490

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

||||

|

PERIOD ENDED MAY 31, 2016

|

||||

|

Since

|

||||

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(12/18/07)

|

|

|

Guggenheim China

|

||||

|

Real Estate ETF

|

||||

|

NAV

|

-19.05%

|

-1.57%

|

1.46%

|

-0.09%

|

|

Market

|

-19.53%

|

-1.14%

|

1.45%

|

-0.15%

|

|

AlphaShares China

|

||||

|

Real Estate

|

||||

|

Index

|

-18.60%

|

-1.21%

|

1.91%

|

0.59%

|

|

MSCI China

|

||||

|

Index

|

-28.45%

|

0.54%

|

-1.46%

|

-1.76%

|

|

Portfolio Breakdown

|

% of Net Assets

|

|

Financial

|

86.3%

|

|

Diversified

|

12.2%

|

|

Consumer, Cyclical

|

1.1%

|

|

Total Common Stocks

|

99.6%

|

|

Securities Lending Collateral

|

1.2%

|

|

Total Investments

|

100.8%

|

|

Other Assets & Liabilities, net

|

-0.8%

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

Link REIT

|

5.5%

|

|

Sino Land Company Ltd.

|

5.3%

|

|

Wharf Holdings Ltd.

|

5.3%

|

|

Sun Hung Kai Properties Ltd.

|

5.2%

|

|

Cheung Kong Property Holdings Ltd.

|

5.1%

|

|

China Overseas Land & Investment Ltd.

|

4.8%

|

|

Swire Pacific Ltd. – Class A

|

4.8%

|

|

China Resources Land Ltd.

|

4.6%

|

|

Hongkong Land Holdings Ltd.

|

4.6%

|

|

Henderson Land Development Company Ltd.

|

4.5%

|

|

Top Ten Total

|

49.7%

|

|

16 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

Fund Statistics

|

|||

|

Share Price

|

$

|

22.04

|

|

|

Net Asset Value

|

$

|

22.06

|

|

|

Discount to NAV

|

-0.09%

|

||

|

Net Assets ($000)

|

$

|

94,879

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

||||

|

PERIOD ENDED MAY 31, 2016

|

||||

|

Since

|

||||

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(01/30/08)

|

|

|

Guggenheim China

|

||||

|

Small Cap ETF

|

||||

|

NAV

|

-34.14%

|

-1.05%

|

-3.07%

|

0.60%

|

|

Market

|

-33.75%

|

-0.57%

|

-3.04%

|

0.59%

|

|

AlphaShares China

|

||||

|

Small Cap

|

||||

|

Index

|

-36.07%

|

-3.11%

|

-3.96%

|

0.53%

|

|

MSCI China

|

||||

|

Index

|

-28.45%

|

0.54%

|

-1.46%

|

-0.15%

|

|

Portfolio Breakdown

|

% of Net Assets

|

|

Consumer, Cyclical

|

18.7%

|

|

Financial

|

18.1%

|

|

Consumer, Non-cyclical

|

16.9%

|

|

Industrial

|

16.1%

|

|

Communications

|

7.9%

|

|

Basic Materials

|

7.5%

|

|

Technology

|

5.0%

|

|

Other

|

9.1%

|

|

Total Long-Term Investments

|

99.3%

|

|

Securities Lending Collateral

|

13.3%

|

|

Total Investments

|

112.6%

|

|

Other Assets & Liabilities

|

-12.6%

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

TAL Education Group ADR

|

1.3%

|

|

Sunny Optical Technology Group Company Ltd.

|

1.3%

|

|

Fullshare Holdings Ltd.

|

1.1%

|

|

Qunar Cayman Islands Ltd. ADR

|

1.1%

|

|

Minth Group Ltd.

|

1.0%

|

|

China Huishan Dairy Holdings Company Ltd.

|

1.0%

|

|

TravelSky Technology Ltd. — Class H

|

1.0%

|

|

Xinyi Glass Holdings Ltd.

|

0.9%

|

|

Sinopec Shanghai Petrochemical Company Ltd. — Class H

|

0.9%

|

|

China Everbright Ltd.

|

0.9%

|

|

Top Ten Total

|

10.5%

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 17

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

18 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

Fund Statistics

|

|||

|

Share Price

|

$

|

11.33

|

|

|

Net Asset Value

|

$

|

11.48

|

|

|

Discount to NAV

|

-1.31%

|

||

|

Net Assets ($000)

|

$

|

39,481

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

||||

|

PERIOD ENDED MAY 31, 2016

|

||||

|

Since

|

||||

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(06/12/08)

|

|

|

Guggenheim Frontier

|

||||

|

Markets ETF

|

||||

|

NAV

|

-11.59%

|

-10.37%

|

-10.28%

|

-6.74%

|

|

Market

|

-13.39%

|

-10.33%

|

-10.29%

|

-6.89%

|

|

BNY Mellon

|

||||

|

New Frontier

|

||||

|

Index

|

-10.00%

|

-8.92%

|

-9.01%

|

-5.70%

|

|

MSCI Emerging

|

||||

|

Markets

|

||||

|

Index

|

-17.63%

|

-4.95%

|

-4.83%

|

-1.82%

|

|

Country Diversification

|

|

|

% of Long-Term

|

|

|

Country

|

Investments

|

|

Kuwait

|

14.3%

|

|

Nigeria

|

12.9%

|

|

Argentina

|

10.5%

|

|

Pakistan

|

10.3%

|

|

Morocco

|

9.7%

|

|

Kenya

|

8.3%

|

|

Romania

|

6.0%

|

|

Oman

|

5.4%

|

|

Other

|

22.6%

|

|

Total Long-Term Investments

|

100.0%

|

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

Guaranty Trust Bank plc

|

4.8%

|

|

MercadoLibre, Inc.

|

4.6%

|

|

Nigerian Breweries plc

|

4.1%

|

|

National Bank of Kuwait SAKP

|

4.0%

|

|

VanEck Vectors Vietnam ETF

|

3.9%

|

|

YPF S.A. ADR

|

3.7%

|

|

Attijariwafa Bank

|

3.7%

|

|

Zenith Bank plc

|

3.6%

|

|

Maroc Telecom

|

2.9%

|

|

Kuwait Finance House KSCP

|

2.9%

|

|

Top Ten Total

|

38.2%

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 19

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

20 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

Fund Statistics

|

|||

|

Share Price

|

$

|

14.66

|

|

|

Net Asset Value

|

$

|

14.75

|

|

|

Discount to NAV

|

-0.61%

|

||

|

Net Assets ($000)

|

$

|

16,229

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

||||

|

PERIOD ENDED MAY 31, 2016

|

||||

|

Since

|

||||

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(07/11/07)

|

|

|

Guggenheim

|

||||

|

International

|

||||

|

Multi-Asset

|

||||

|

Income ETF

|

||||

|

NAV

|

-13.30%

|

-1.45%

|

-1.89%

|

-1.61%

|

|

Market

|

-13.54%

|

-1.51%

|

-2.04%

|

-1.68%

|

|

Zacks International

|

||||

|

Multi-Asset

|

||||

|

Income

|

||||

|

Index

|

-13.38%

|

-1.42%

|

-1.64%

|

-1.26%

|

|

MSCI EAFE

|

||||

|

Index

|

-9.68%

|

2.00%

|

2.12%

|

-0.74%

|

|

Country Diversification

|

|

|

% of Long-Term

|

|

|

Country

|

Investments

|

|

United States

|

19.9%

|

|

United Kingdom

|

11.4%

|

|

Japan

|

9.5%

|

|

Hong Kong

|

6.9%

|

|

China

|

5.1%

|

|

Bermuda

|

4.3%

|

|

Switzerland

|

3.5%

|

|

Other

|

39.4%

|

|

Total Long-Term Investments

|

100.0%

|

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

China Petroleum & Chemical Corp. ADR

|

2.0%

|

|

Devon Energy Corp.

|

1.9%

|

|

Murphy Oil Corp.

|

1.8%

|

|

ICICI Bank Ltd. ADR

|

1.6%

|

|

Apache Corp.

|

1.5%

|

|

Canadian Natural Resources Ltd.

|

1.4%

|

|

Crescent Point Energy Corp

|

1.4%

|

|

Anadarko Petroleum Corp.

|

1.4%

|

|

Huaneng Power International, Inc. ADR

|

1.4%

|

|

China Life Insurance Company Ltd. ADR

|

1.3%

|

|

Top Ten Total

|

15.7%

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 21

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

22 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

Fund Statistics

|

|||

|

Share Price

|

$

|

23.59

|

|

|

Net Asset Value

|

$

|

23.63

|

|

|

Discount to NAV

|

-0.17%

|

||

|

Net Assets ($000)

|

$

|

163,060

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

||||

|

PERIOD ENDED MAY 31, 2016

|

||||

|

Since

|

||||

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(11/09/07)

|

|

|

Guggenheim MSCI

|

||||

|

Global Timber ETF

|

||||

|

NAV

|

-8.72%

|

4.07%

|

2.96%

|

1.27%

|

|

Market

|

-8.80%

|

4.15%

|

2.94%

|

1.24%

|

|

MSCI ACWI IMI Timber

|

||||

|

Select Capped

|

||||

|

Index/Beacon Global

|

||||

|

Timber Index1

|

-8.26%

|

4.83%

|

3.83%

|

2.33%

|

|

MSCI World Index

|

-3.96%

|

6.46%

|

6.53%

|

2.56%

|

|

S&P Global Timber &

|

||||

|

Forestry Index

|

-8.47%

|

3.47%

|

2.64%

|

-0.37%

|

|

STOXX® Europe

|

||||

|

TMI Forestry &

|

||||

|

Paper Index

|

-3.12%

|

16.99%

|

5.61%

|

2.26%

|

|

Portfolio Breakdown

|

% of Net Assets

|

|

Basic Materials

|

49.2%

|

|

Industrial

|

37.3%

|

|

Financial

|

8.6%

|

|

Consumer, Non-cyclical

|

4.0%

|

|

Energy

|

0.2%

|

|

Total Long-Term Investments

|

99.3%

|

|

Securities Lending Collateral

|

1.1%

|

|

Total Investments

|

100.4%

|

|

Other Assets & Liabilities, net

|

-0.4%

|

|

Total Net Assets

|

100.0%

|

|

1

|

Benchmark returns reflect the blended return of the Beacon Global Timber Index from 11/09/07 – 5/19/16 and the return of the MSCI ACWI IMI Timber Select Capped Index from 5/20/16 – 5/31/16.

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 23

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

Weyerhaeuser Co.

|

5.7%

|

|

International Paper Co.

|

5.4%

|

|

WestRock Co.

|

5.4%

|

|

Amcor Ltd.

|

5.2%

|

|

UPM-Kymmene Oyj

|

4.9%

|

|

Sealed Air Corp.

|

4.6%

|

|

Mondi plc

|

4.1%

|

|

Avery Dennison Corp.

|

3.9%

|

|

Packaging Corporation of America

|

3.8%

|

|

Smurfit Kappa Group plc

|

3.7%

|

|

Top Ten Total

|

46.7%

|

|

24 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

Fund Statistics

|

|||

|

Share Price

|

$

|

12.00

|

|

|

Net Asset Value

|

$

|

12.01

|

|

|

Discount to NAV

|

-0.08%

|

||

|

Net Assets ($000)

|

$

|

37,225

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE

|

||||

|

PERIOD ENDED MAY 31, 2016

|

||||

|

Since

|

||||

|

One

|

Three

|

Five

|

Inception

|

|

|

Year

|

Year

|

Year

|

(06/11/10)

|

|

|

Guggenheim Shipping ETF

|

||||

|

NAV

|

-32.56%

|

-7.17%

|

-9.36%

|

-8.40%

|

|

Market

|

-32.44%

|

-7.05%

|

-9.36%

|

-8.42%

|

|

Dow Jones Global Shipping

|

||||

|

IndexSM

|

-33.57%

|

-7.74%

|

N/A

|

N/A

|

|

Delta Global Shipping Index/

|

||||

|

Dow Jones Global

|

||||

|

Shipping

|

||||

|

IndexSM,1

|

-33.57%

|

-7.74%

|

-9.65%

|

-8.60%

|

|

MSCI World

|

||||

|

Index

|

-3.96%

|

6.46%

|

6.53%

|

9.96%

|

|

Portfolio Breakdown

|

% of Net Assets

|

|

Industrial

|

94.0%

|

|

Consumer, Non-cyclical

|

4.8%

|

|

Total Long-Term Investments

|

98.8%

|

|

Securities Lending Collateral

|

23.8%

|

|

Total Investments

|

122.6%

|

|

Other Assets & Liabilities, net

|

-22.6%

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

|

|

(% of Total Net Assets)

|

|

|

AP Moeller - Maersk A/S — Class B

|

18.0%

|

|

Nippon Yusen K.K.

|

7.7%

|

|

Kawasaki Kisen Kaisha Ltd.

|

6.0%

|

|

COSCO Pacific Ltd.

|

4.8%

|

|

Nordic American Tankers Ltd.

|

4.7%

|

|

Matson, Inc.

|

4.3%

|

|

Teekay Offshore Partners, LP

|

3.9%

|

|

Ship Finance International Ltd.

|

3.8%

|

|

Teekay LNG Partners, LP

|

3.6%

|

|

Golar LNG Partners, LP

|

3.4%

|

|

Top Ten Total

|

60.2%

|

|

1

|

The benchmark return reflects the blended return of the Delta Global Shipping Index from 6/11/10 - 7/26/11 and the return of the Dow Jones Global Shipping IndexSM from 7/27/11 - 5/31/16.

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 25

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

May 31, 2016

|

|

26 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

ABOUT SHAREHOLDERS' FUND EXPENSES (Unaudited)

|

May 31, 2016

|

|

Expense

Ratio1 |

Fund Return

|

Beginning

account value November 30, 2015 |

Ending

Account Value May 31, 2016 |

Expenses Paid

During Period2 |

||||||||||||

|

Table 1. Based on actual Fund return3

|

||||||||||||||||

|

Guggenheim Canadian Energy Income ETF

|

0.69

|

%

|

10.54

|

%

|

$

|

1,000.00

|

$

|

1,105.38

|

$

|

3.63

|

||||||

|

Guggenheim China Real Estate ETF

|

0.70

|

%

|

-3.21

|

%

|

1,000.00

|

967.95

|

3.44

|

|||||||||

|

Guggenheim China Small Cap ETF

|

0.75

|

%

|

-9.63

|

%

|

1,000.00

|

903.67

|

3.57

|

|||||||||

|

Guggenheim Frontier Markets ETF

|

0.70

|

%

|

5.46

|

%

|

1,000.00

|

1,054.64

|

3.60

|

|||||||||

|

Guggenheim International Multi-Asset Income ETF

|

0.70

|

%

|

-0.37

|

%

|

1,000.00

|

996.27

|

3.49

|

|||||||||

|

Guggenheim MSCI Global Timber ETF

|

0.60

|

%

|

-5.67

|

%

|

1,000.00

|

943.29

|

2.91

|

|||||||||

|

Guggenheim Shipping ETF

|

0.65

|

%

|

-16.27

|

%

|

1,000.00

|

837.34

|

2.99

|

|||||||||

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 27

|

|

ABOUT SHAREHOLDERS' FUND EXPENSES (Unaudited) continued

|

May 31, 2016

|

|

Expense

Ratio1 |

Fund Return

|

Beginning

account value November 30, 2015 |

Ending

Account Value May 31, 2016 |

Expenses Paid

During Period2 |

||||||||||||

|

Table 2. Based on hypothetical 5% return (before expenses)

|

||||||||||||||||

|

Guggenheim Canadian Energy Income ETF

|

0.69

|

%

|

5.00

|

%

|

$

|

1,000.00

|

$

|

1,021.55

|

$

|

3.49

|

||||||

|

Guggenheim China Real Estate ETF

|

0.70

|

%

|

5.00

|

%

|

1,000.00

|

1,021.50

|

3.54

|

|||||||||

|

Guggenheim China Small Cap ETF

|

0.75

|

%

|

5.00

|

%

|

1,000.00

|

1,021.25

|

3.79

|

|||||||||

|

Guggenheim Frontier Markets ETF

|

0.70

|

%

|

5.00

|

%

|

1,000.00

|

1,021.50

|

3.54

|

|||||||||

|

Guggenheim International Multi-Asset Income ETF

|

0.70

|

%

|

5.00

|

%

|

1,000.00

|

1,021.50

|

3.54

|

|||||||||

|

Guggenheim MSCI Global Timber ETF

|

0.60

|

%

|

5.00

|

%

|

1,000.00

|

1,021.88

|

3.02

|

|||||||||

|

Guggenheim Shipping ETF

|

0.65

|

%

|

5.00

|

%

|

1,000.00

|

1,021.75

|

3.29

|

|||||||||

|

1

|

Annualized and excludes expenses of the underlying funds in which the Funds invest, if any.

|

|

2

|

Expenses are equal to the Fund's annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

|

|

3

|

Actual cumulative return at net asset value for the period November 30, 2015 to May 31, 2016.

|

|

28 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

SCHEDULE OF INVESTMENTS

|

May 31, 2016

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS† - 99.2%

|

|||||||

|

Canada - 99.2%

|

|||||||

|

Crescent Point Energy Corp.

|

99,654

|

$

|

1,691,247

|

||||

|

Peyto Exploration & Development Corp.

|

59,887

|

1,573,974

|

|||||

|

Pembina Pipeline Corp.1

|

52,070

|

1,531,329

|

|||||

|

ARC Resources Ltd.1

|

92,720

|

1,528,912

|

|||||

|

TransCanada Corp.

|

36,650

|

1,522,484

|

|||||

|

Vermilion Energy, Inc.1

|

44,645

|

1,480,886

|

|||||

|

Canadian Natural Resources Ltd.

|

49,453

|

1,473,269

|

|||||

|

Suncor Energy, Inc.

|

50,901

|

1,409,399

|

|||||

|

Inter Pipeline Ltd.1

|

68,935

|

1,404,417

|

|||||

|

PrairieSky Royalty Ltd.1

|

71,508

|

1,387,412

|

|||||

|

Enbridge, Inc.

|

34,188

|

1,366,370

|

|||||

|

Keyera Corp.

|

45,082

|

1,348,221

|

|||||

|

Cameco Corp.

|

111,229

|

1,299,273

|

|||||

|

AltaGas Ltd.1

|

53,512

|

1,239,927

|

|||||

|

Veresen, Inc.1

|

137,021

|

1,074,716

|

|||||

|

Whitecap Resources, Inc.

|

137,512

|

1,065,952

|

|||||

|

Enbridge Income Fund Holdings, Inc.1

|

35,159

|

833,753

|

|||||

|

Parkland Fuel Corp.

|

43,131

|

764,626

|

|||||

|

ShawCor Ltd.

|

29,610

|

712,351

|

|||||

|

Gibson Energy, Inc.

|

57,843

|

679,205

|

|||||

|

Enerplus Corp.

|

94,706

|

517,658

|

|||||

|

Mullen Group Ltd.1

|

41,938

|

461,026

|

|||||

|

Pason Systems, Inc.

|

32,565

|

448,108

|

|||||

|

Secure Energy Services, Inc.

|

55,552

|

394,525

|

|||||

|

TORC Oil & Gas Ltd.

|

52,796

|

329,344

|

|||||

|

Ensign Energy Services, Inc.

|

56,770

|

311,604

|

|||||

|

Freehold Royalties Ltd.1

|

34,893

|

309,158

|

|||||

|

Enerflex Ltd.1

|

36,294

|

301,595

|

|||||

|

Bonterra Energy Corp.

|

11,705

|

235,066

|

|||||

|

Bonavista Energy Corp.

|

91,074

|

229,060

|

|||||

|

Surge Energy, Inc.1

|

101,324

|

195,196

|

|||||

|

Total Canada

|

29,120,063

|

||||||

|

Total Common Stocks

|

|||||||

|

(Cost $35,237,485)

|

29,120,063

|

||||||

|

SECURITIES LENDING COLLATERAL†,2 - 33.5%

|

|||||||

|

BNY Mellon Separately Managed Cash Collateral

|

|||||||

|

Account, 0.3026%

|

9,850,194

|

9,850,194

|

|||||

|

Total Securities Lending Collateral

|

|||||||

|

(Cost $9,850,194)

|

9,850,194

|

||||||

|

Total Investments - 132.7%

|

|||||||

|

(Cost $45,087,679)

|

$

|

38,970,257

|

|||||

|

Other Assets & Liabilities, net - (32.7)%

|

(9,595,795

|

)

|

|||||

|

Total Net Assets - 100.0%

|

$

|

29,374,462

|

|

†

|

Value determined based on Level 1 inputs — See Note 4.

|

|

|

1

|

All or portion of this security is on loan at May 31, 2016 — See Note 2.

|

|

|

2

|

Securities lending collateral — See Note 2.

|

|

Country Diversification

|

|

|

% of Long-Term

|

|

|

Country

|

Investments

|

|

Canada

|

100.0%

|

|

Currency Denomination

|

|

|

% of Long-Term

|

|

|

Currency

|

Investments

|

|

Canadian Dollar

|

100.0%

|

|

Level 2

|

Level 3

|

||||||||||||

|

Significant

|

Significant

|

||||||||||||

|

Level 1

|

Observable

|

Unobservable

|

|||||||||||

|

Quoted Prices

|

Inputs

|

Inputs

|

Total

|

||||||||||

|

Assets

|

|||||||||||||

|

Common Stocks

|

$

|

29,120,063

|

$

|

—

|

$

|

—

|

$

|

29,120,063

|

|||||

|

Securities Lending

Collateral |

9,850,194

|

—

|

—

|

9,850,194

|

|||||||||

|

Total

|

$

|

38,970,257

|

$

|

—

|

$

|

—

|

$

|

38,970,257

|

|

See notes to financial statements.

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 29

|

|

SCHEDULE OF INVESTMENTS continued

|

May 31, 2016

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS† - 99.6%

|

|||||||

|

Financial - 86.3%

|

|||||||

|

Link REIT

|

111,136

|

$

|

683,141

|

||||

|

Sino Land Company Ltd.

|

433,474

|

664,036

|

|||||

|

Sun Hung Kai Properties Ltd.

|

55,195

|

649,423

|

|||||

|

Cheung Kong Property Holdings Ltd.

|

101,500

|

635,669

|

|||||

|

China Overseas Land & Investment Ltd.

|

200,992

|

604,155

|

|||||

|

China Resources Land Ltd.

|

242,513

|

580,047

|

|||||

|

Hongkong Land Holdings Ltd.

|

95,400

|

576,216

|

|||||

|

Henderson Land Development Company Ltd.

|

91,620

|

556,102

|

|||||

|

New World Development Company Ltd.

|

487,648

|

460,771

|

|||||

|

Dalian Wanda Commercial Properties Company Ltd. —

|

|||||||

|

Class H1

|

64,078

|

406,254

|

|||||

|

Hang Lung Properties Ltd.

|

194,934

|

372,395

|

|||||

|

Wheelock & Company Ltd.

|

74,149

|

334,084

|

|||||

|

Country Garden Holdings Company Ltd.

|

735,559

|

294,483

|

|||||

|

Evergrande Real Estate Group Ltd.

|

436,822

|

292,409

|

|||||

|

China Vanke Company Ltd. — Class H

|

119,991

|

286,070

|

|||||

|

Swire Properties Ltd.

|

96,196

|

263,147

|

|||||

|

Hysan Development Company Ltd. — Class A

|

57,495

|

247,946

|

|||||

|

Hang Lung Group Ltd.

|

79,415

|

222,354

|

|||||

|

Fullshare Holdings Ltd.

|

498,947

|

186,267

|

|||||

|

Longfor Properties Company Ltd.

|

111,631

|

150,889

|

|||||

|

Shimao Property Holdings Ltd.

|

110,797

|

140,348

|

|||||

|

Kerry Properties Ltd.

|

56,131

|

140,325

|

|||||

|

Fortune Real Estate Investment Trust

|

123,536

|

137,083

|

|||||

|

Sino-Ocean Land Holdings Ltd.

|

308,152

|

124,956

|

|||||

|

Guangzhou R&F Properties Company Ltd. — Class H

|

92,308

|

122,631

|

|||||

|

Shenzhen Investment Ltd.

|

262,113

|

105,950

|

|||||

|

Champion REIT

|

200,224

|

104,904

|

|||||

|

China Jinmao Holdings Group Ltd.

|

358,713

|

103,438

|

|||||

|

Sunac China Holdings Ltd.

|

164,122

|

102,046

|

|||||

|

Chinese Estates Holdings Ltd.

|

42,886

|

98,380

|

|||||

|

Great Eagle Holdings Ltd.

|

22,799

|

93,184

|

|||||

|

Shui On Land Ltd.

|

314,758

|

79,417

|

|||||

|

KWG Property Holding Ltd.

|

122,847

|

77,173

|

|||||

|

SOHO China Ltd.

|

170,719

|

74,941

|

|||||

|

Yuexiu Property Company Ltd.

|

565,617

|

72,084

|

|||||

|

Agile Property Holdings Ltd.

|

131,470

|

64,820

|

|||||

|

CIFI Holdings Group Company Ltd.

|

250,000

|

58,894

|

|||||

|

China South City Holdings Ltd.

|

291,549

|

55,171

|

|||||

|

Renhe Commercial Holdings Company Ltd.*,2

|

1,763,929

|

52,908

|

|||||

|

Yuexiu Real Estate Investment Trust

|

95,335

|

52,158

|

|||||

|

Sunlight Real Estate Investment Trust

|

94,044

|

51,089

|

|||||

|

Hopson Development Holdings Ltd.

|

57,031

|

50,364

|

|||||

|

K Wah International Holdings Ltd.

|

103,225

|

50,362

|

|||||

|

Joy City Property Ltd.

|

362,000

|

49,397

|

|||||

|

Poly Property Group Company Ltd.2

|

177,177

|

46,301

|

|||||

|

E-House China Holdings Ltd. ADR*,2

|

6,769

|

43,592

|

|||||

|

Yanlord Land Group Ltd.

|

48,063

|

42,591

|

|||||

|

Greentown China Holdings Ltd.*

|

57,073

|

40,041

|

|||||

|

Tian An China Investment Company Ltd.

|

70,427

|

36,355

|

|||||

|

China Overseas Grand Oceans Group Ltd.

|

80,416

|

24,638

|

|||||

|

Glorious Property Holdings Ltd.*

|

227,300

|

21,360

|

|||||

|

Total Financial

|

10,782,759

|

||||||

|

Diversified - 12.2%

|

|||||||

|

Wharf Holdings Ltd.

|

121,306

|

656,645

|

|||||

|

Swire Pacific Ltd. — Class A

|

55,394

|

597,570

|

|||||

|

Swire Pacific Ltd. — Class B

|

90,185

|

174,608

|

|||||

|

Goldin Properties Holdings Ltd.*,2

|

117,506

|

52,187

|

|||||

|

Carnival Group International Holdings Ltd.*

|

347,945

|

46,583

|

|||||

|

Total Diversified

|

1,527,593

|

||||||

|

Consumer, Cyclical - 1.1%

|

|||||||

|

Red Star Macalline Group Corporation Ltd. — Class H1

|

96,878

|

109,622

|

|||||

|

China New City Commercial Development Ltd.*

|

42,047

|

23,762

|

|||||

|

Total Consumer, Cyclical

|

133,384

|

||||||

|

Total Common Stocks

|

|||||||

|

(Cost $16,253,221)

|

12,443,736

|

||||||

|

SECURITIES LENDING COLLATERAL†,3 - 1.2%

|

|||||||

|

BNY Mellon Separately Managed Cash Collateral

|

|||||||

|

Account, 0.3261%

|

144,638

|

144,638

|

|||||

|

Total Securities Lending Collateral

|

|||||||

|

(Cost $144,638)

|

144,638

|

||||||

|

Total Investments - 100.8%

|

|||||||

|

(Cost $16,397,859)

|

$

|

12,588,374

|

|||||

|

Other Assets & Liabilities, net - (0.8)%

|

(98,476

|

) | |||||

|

Total Net Assets - 100.0%

|

$

|

12,489,898

|

|

*

|

Non-income producing security.

|

|

|

†

|

Value determined based on Level 1 inputs — See Note 4.

|

|

|

1

|

Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) securities is $515,876 (cost $491,567), or 4.1% of total net assets. These securities have been determined to be liquid under guidelines established by the Board of Trustees.

|

|

|

2

|

All or portion of this security is on loan at May 31, 2016 — See Note 2.

|

|

|

3

|

Securities lending collateral — See Note 2.

|

|

|

ADR

|

American Depositary Receipt

|

|

|

REIT

|

Real Estate Investment Trust

|

|

See notes to financial statements.

|

|

30 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

SCHEDULE OF INVESTMENTS continued

|

May 31, 2016

|

|

Country Diversification

|

|

|

% of Long-Term

|

|

|

Country

|

Investments

|

|

China

|

98.6%

|

|

Singapore

|

1.4%

|

|

Total Long-Term Investments

|

100.0%

|

|

Currency Denomination

|

|

|

% of Long-Term

|

|

|

Currency

|

Investments

|

|

Hong Kong Dollar

|

94.7%

|

|

United States Dollar

|

5.0%

|

|

Singapore Dollar

|

0.3%

|

|

Total Long-Term Investments

|

100.0%

|

|

Level 2

|

Level 3

|

||||||||||||

|

Significant

|

Significant

|

||||||||||||

|

Investments in

|

Level 1

|

Observable

|

Unobservable

|

||||||||||

|

Securities

|

Quoted Prices

|

Inputs

|

Inputs

|

Total

|

|||||||||

|

Common Stocks

|

$

|

12,443,736

|

$

|

—

|

$

|

—

|

$

|

12,443,736

|

|||||

|

Securities Lending

Collateral |

144,638

|

—

|

—

|

144,638

|

|||||||||

|

Total

|

$

|

12,588,374

|

$

|

—

|

$

|

—

|

$

|

12,588,374

|

|

Transfer from Level 2 to Level 1

|

|

$

|

635,669

|

|

See notes to financial statements.

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 31

|

|

SCHEDULE OF INVESTMENTS continued

|

May 31, 2016

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS† - 99.3%

|

|||||||

|

Consumer, Cyclical - 18.7%

|

|||||||

|

Qunar Cayman Islands Ltd. ADR*,1

|

31,107

|

$

|

1,010,355

|

||||

|

Minth Group Ltd.

|

337,064

|

991,474

|

|||||

|

Xinyi Glass Holdings Ltd.

|

1,280,334

|

891,667

|

|||||

|

Intime Retail Group Company Ltd.1

|

863,724

|

783,874

|

|||||

|

Shanghai Pharmaceuticals Holding Company Ltd. — Class H

|

354,114

|

764,922

|

|||||

|

Air China Ltd. — Class H

|

967,563

|

640,214

|

|||||

|

Red Star Macalline Group Corporation Ltd. — Class H*,2

|

540,261

|

611,329

|

|||||

|

Fuyao Glass Industry Group Company Ltd. — Class H*,2

|

258,021

|

601,861

|

|||||

|

Skyworth Digital Holdings Ltd.

|

996,323

|

601,527

|

|||||

|

Weichai Power Company Ltd. — Class H1

|

491,041

|

573,966

|

|||||

|

China Southern Airlines Company Ltd. — Class H

|

897,030

|

526,568

|

|||||

|

China Lodging Group Ltd. ADR1

|

14,360

|

486,947

|

|||||

|

China Eastern Airlines Corporation Ltd. — Class H*,1

|

900,957

|

481,321

|

|||||

|

Imperial Pacific International Holdings Ltd.*

|

22,883,034

|

433,025

|

|||||

|

BAIC Motor Corporation Ltd. — Class H2

|

547,384

|

383,330

|

|||||

|

Digital China Holdings Ltd.

|

464,595

|

382,769

|

|||||

|

China Travel International Investment Hong Kong Ltd.

|

1,203,483

|

354,779

|

|||||

|

Li Ning Company Ltd.*

|

803,334

|

322,652

|

|||||

|

Pou Sheng International Holdings Ltd.*,1

|

1,057,001

|

296,629

|

|||||

|

China Jicheng Holdings Ltd.*,2

|

9,551,010

|

288,935

|

|||||

|

China Dongxiang Group Company Ltd.1

|

1,687,489

|

286,746

|

|||||

|

Baoxin Auto Group Ltd.1

|

442,583

|

280,882

|

|||||

|

Golden Eagle Retail Group Ltd.

|

248,014

|

266,910

|

|||||

|

BEP International Holdings Ltd.

|

4,168,625

|

246,850

|

|||||

|

Shanghai Jin Jiang International Hotels Group Co.

|

|||||||

|

Ltd. — Class H1

|

624,469

|

237,950

|

|||||

|

Xtep International Holdings Ltd.

|

449,147

|

237,636

|

|||||

|

Cosmo Lady China Holdings Company Ltd.1,2

|

317,193

|

227,845

|

|||||

|

China Harmony New Energy Auto Holding Ltd.

|

384,084

|

225,462

|

|||||

|

C.banner International Holdings Ltd.*

|

517,489

|

217,171

|

|||||

|

Xinhua Winshare Publishing and Media Company

|

|||||||

|

Ltd. — Class H*

|

220,665

|

213,332

|

|||||

|

500.com Ltd. ADR*,1

|

11,874

|

205,776

|

|||||

|

Yestar International Holdings Company Ltd.

|

442,906

|

189,292

|

|||||

|

Dah Chong Hong Holdings Ltd.1

|

409,599

|

181,912

|

|||||

|

Haichang Ocean Park Holdings Ltd.*,2

|

815,633

|

180,595

|

|||||

|

NewOcean Energy Holdings Ltd.

|

503,100

|

178,102

|

|||||

|

Neo Telemedia Ltd.*

|

3,202,222

|

177,257

|

|||||

|

Zhongsheng Group Holdings Ltd.

|

315,305

|

169,258

|

|||||

|

Weiqiao Textile Co. — Class H

|

209,642

|

159,765

|

|||||

|

China ZhengTong Auto Services Holdings Ltd.

|

426,490

|

155,374

|

|||||

|

Sinotruk Hong Kong Ltd.

|

335,836

|

151,313

|

|||||

|

TCL Multimedia Technology Holdings Ltd.*

|

257,322

|

149,064

|

|||||

|

China Lilang Ltd.

|

238,387

|

140,243

|

|||||

|

China New City Commercial Development Ltd.*

|

243,053

|

137,356

|

|||||

|

Jinmao Investments and Jinmao China Investments

|

|||||||

|

Holdings Ltd.

|

241,546

|

133,706

|

|||||

|

361 Degrees International Ltd.

|

406,735

|

129,851

|

|||||

|

Ajisen China Holdings Ltd.

|

305,447

|

128,971

|

|||||

|

China Yongda Automobiles Services Holdings Ltd.

|

261,548

|

125,586

|

|||||

|

Qingling Motors Company Ltd. — Class H

|

377,940

|

124,064

|

|||||

|

Cabbeen Fashion Ltd.

|

334,216

|

119,176

|

|||||

|

Kandi Technologies Group, Inc.*,1

|

16,596

|

115,674

|

|||||

|

Bosideng International Holdings Ltd.

|

1,459,648

|

114,620

|

|||||

|

Hengdeli Holdings Ltd.*

|

1,167,004

|

103,658

|

|||||

|

Jumei International Holding Ltd. ADR*,1

|

18,926

|

97,658

|

|||||

|

Hisense Kelon Electrical Holdings Company Ltd. — Class H*

|

201,825

|

91,973

|

|||||

|

China Animation Characters Company Ltd.*

|

221,744

|

91,059

|

|||||

|

Welling Holding Ltd.

|

439,641

|

74,706

|

|||||

|

Springland International Holdings Ltd.

|

499,515

|

64,946

|

|||||

|

Xinchen China Power Holdings Ltd.*

|

447,867

|

59,960

|

|||||

|

Parkson Retail Group Ltd.

|

637,296

|

59,889

|

|||||

|

Universal Health International Group Holding Ltd.

|

483,091

|

35,448

|

|||||

|

Total Consumer, Cyclical

|

17,715,180

|

||||||

|

Financial - 18.1%

|

|||||||

|

Fullshare Holdings Ltd.

|

2,854,852

|

1,065,770

|

|||||

|

China Everbright Ltd.

|

442,665

|

850,211

|

|||||

|

Far East Horizon Ltd.

|

1,101,918

|

835,501

|

|||||

|

Guangzhou R&F Properties Company Ltd. — Class H

|

515,414

|

684,728

|

|||||

|

Chongqing Rural Commercial Bank Company Ltd. — Class H

|

1,275,050

|

653,270

|

|||||

|

Shenzhen Investment Ltd.

|

1,463,212

|

591,452

|

|||||

|

China Jinmao Holdings Group Ltd.

|

2,002,129

|

577,328

|

|||||

|

Sunac China Holdings Ltd.

|

912,265

|

567,219

|

|||||

|

Shanghai Industrial Holdings Ltd.

|

235,680

|

531,544

|

|||||

|

Credit China Holdings Ltd.*

|

1,289,067

|

512,763

|

|||||

|

Shui On Land Ltd.

|

1,752,434

|

442,161

|

|||||

|

KWG Property Holding Ltd.

|

684,393

|

429,940

|

|||||

|

Shengjing Bank Company Ltd. — Class H2

|

361,215

|

419,890

|

|||||

|

SOHO China Ltd.

|

950,877

|

417,408

|

|||||

|

Harbin Bank Company Ltd. — Class H2

|

1,534,373

|

402,943

|

|||||

|

Yuexiu Property Company Ltd.

|

3,152,183

|

401,725

|

|||||

|

Guotai Junan International Holdings Ltd.1

|

1,235,704

|

394,501

|

|||||

|

Agile Property Holdings Ltd.

|

739,728

|

364,715

|

|||||

|

CIFI Holdings Group Company Ltd.

|

1,389,705

|

327,383

|

|||||

|

China South City Holdings Ltd.

|

1,631,118

|

308,663

|

|||||

|

Noah Holdings Ltd. ADR*,1

|

11,708

|

296,681

|

|||||

|

Renhe Commercial Holdings Company Ltd.*,1

|

9,826,453

|

294,737

|

|||||

|

Zall Development Group Ltd.

|

824,667

|

287,694

|

|

See notes to financial statements.

|

|

32 l CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

SCHEDULE OF INVESTMENTS continued

|

May 31, 2016

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS† - 99.3% (continued)

|

|||||||

|

Financial - 18.1% (continued)

|

|||||||

|

Hopson Development Holdings Ltd.*

|

316,043

|

$

|

279,095

|

||||

|

Joy City Property Ltd.

|

2,021,775

|

275,881

|

|||||

|

Poly Property Group Company Ltd.1

|

988,764

|

258,387

|

|||||

|

Bank of Chongqing Company Ltd. — Class H

|

327,314

|

247,335

|

|||||

|

E-House China Holdings Ltd. ADR*,1

|

37,664

|

242,556

|

|||||

|

Yanlord Land Group Ltd.

|

267,278

|

236,847

|

|||||

|

Central China Securities Company Ltd. — Class H

|

520,121

|

224,971

|

|||||

|

Greentown China Holdings Ltd.*

|

319,842

|

224,396

|

|||||

|

Logan Property Holdings Company Ltd.

|

646,748

|

217,299

|

|||||

|

Yida China Holdings Ltd.

|

496,261

|

199,318

|

|||||

|

Huishang Bank Corporation Ltd. — Class H

|

400,000

|

181,253

|

|||||

|

Yuzhou Properties Company Ltd.*

|

621,704

|

179,273

|

|||||

|

Sunshine 100 China Holdings Ltd.*,2

|

396,141

|

178,484

|

|||||

|

Beijing Enterprises Medical & Health Group Ltd.*

|

2,478,864

|

172,318

|

|||||

|

China Financial International Investments Ltd.*,††

|

2,267,447

|

172,215

|

|||||

|

China SCE Property Holdings Ltd.

|

731,589

|

161,986

|

|||||

|

Redco Properties Group Ltd.2

|

215,294

|

150,215

|

|||||

|

Beijing Capital Land Ltd. — Class H

|

431,436

|

145,512

|

|||||

|

China Aoyuan Property Group Ltd.

|

734,205

|

141,772

|

|||||

|

China Overseas Grand Oceans Group Ltd.

|

450,773

|

138,108

|

|||||

|

Guorui Properties Ltd.

|

359,579

|

137,478

|

|||||

|

Shanghai Industrial Urban Development Group Ltd.1

|

706,358

|

136,395

|

|||||

|

CNinsure, Inc. ADR*,1

|

19,166

|

132,245

|

|||||

|

Glorious Property Holdings Ltd.*

|

1,259,023

|

118,315

|

|||||

|

China Overseas Property Holdings Ltd.*

|

710,000

|

104,195

|

|||||

|

Mingfa Group International Company Ltd.*,†††,3

|

563,025

|

102,920

|

|||||

|

Colour Life Services Group Company Ltd.

|

137,338

|

100,774

|

|||||

|

National Agricultural Holdings Ltd.*

|

500,352

|

99,192

|

|||||

|

Future Land Development Holdings Ltd.

|

797,332

|

98,536

|

|||||

|

Ping An Securities Group Holdings Ltd.*

|

6,566,272

|

87,064

|

|||||

|

Fantasia Holdings Group Company Ltd.

|

724,814

|

86,774

|

|||||

|

Hydoo International Holding Ltd.

|

670,445

|

83,718

|

|||||

|

Wuzhou International Holdings Ltd.*

|

773,940

|

79,704

|

|||||

|

Wanda Hotel Development Company Ltd.*,1

|

692,887

|

66,897

|

|||||

|

Jun Yang Financial Holdings Ltd.*

|

1,113,019

|

37,969

|

|||||

|

Total Financial

|

17,157,624

|

||||||

|

Consumer, Non-cyclical - 16.9%

|

|||||||

|

TAL Education Group ADR*

|

23,029

|

1,230,209

|

|||||

|

China Huishan Dairy Holdings Company Ltd.1

|

2,463,610

|

970,455

|

|||||

|

Jiangsu Expressway Company Ltd. — Class H

|

614,589

|

841,801

|

|||||

|

Shenzhen International Holdings Ltd.

|

540,007

|

820,283

|

|||||

|

Zhejiang Expressway Company Ltd. — Class H

|

731,330

|

685,373

|

|||||

|

Tsingtao Brewery Company Ltd. — Class H

|

169,582

|

610,160

|

|||||

|

Uni-President China Holdings Ltd.

|

655,294

|

595,557

|

|||||

|

Shandong Weigao Group Medical Polymer Company

|

|||||||

|

Ltd. — Class H

|

952,000

|

546,581

|

|||||

|

Luye Pharma Group Ltd.*,1

|

843,536

|

521,228

|

|||||

|

Shanghai Fosun Pharmaceutical Group Company

|

|||||||

|

Ltd. — Class H

|

189,658

|

493,179

|

|||||

|

Tong Ren Tang Technologies Company Ltd. — Class H

|

301,210

|

490,115

|

|||||

|

Universal Medical Financial & Technical Advisory

|

|||||||

|

Services Company Ltd.*,2

|

540,365

|

382,589

|

|||||

|

China Agri-Industries Holdings Ltd.*,1

|

1,119,436

|

374,676

|

|||||

|

CP Pokphand Company Ltd.

|

3,304,555

|

357,334

|

|||||

|

Fu Shou Yuan International Group Ltd.

|

486,192

|

348,614

|

|||||

|

SSY Group Ltd.

|

991,747

|

324,278

|

|||||

|

Shenzhen Expressway Company Ltd. — Class H

|

357,905

|

307,310

|

|||||

|

China Modern Dairy Holdings Ltd.1

|

1,453,955

|

263,908

|

|||||

|

Goodbaby International Holdings Ltd.

|

427,935

|

258,916

|

|||||

|

Biostime International Holdings Ltd.*

|

83,061

|

253,947

|

|||||

|

Phoenix Healthcare Group Company Ltd.

|

177,830

|

251,356

|

|||||

|

Tibet Water Resources Ltd.1

|

741,860

|

239,705

|

|||||

|

Guangzhou Baiyunshan Pharmaceutical Holdings

|

|||||||

|

Company Ltd. — Class H

|

104,190

|

236,328

|

|||||

|

Vinda International Holdings Ltd.

|

132,158

|

233,756

|

|||||

|

Hua Han Health Industry Holdings Ltd.

|

2,367,911

|

225,569

|

|||||

|

China Shengmu Organic Milk Ltd.*,2

|

1,033,199

|

222,118

|

|||||

|

Qingdao Port International Company Ltd. — Class H2

|

435,267

|

214,603

|

|||||

|

Yuexiu Transport Infrastructure Ltd.1

|

330,665

|

213,685

|

|||||

|

Livzon Pharmaceutical Group, Inc. — Class H

|

43,722

|

199,807

|

|||||

|

Dalian Port PDA Company Ltd. — Class H

|

441,790

|

184,834

|

|||||

|

Lifetech Scientific Corp.*

|

1,007,041

|

181,492

|

|||||

|

Anhui Expressway Company Ltd. — Class H

|

231,845

|

176,089

|

|||||

|

Shandong Luoxin Pharmaceutical Group Stock

|

|||||||

|

Company Ltd. — Class H

|

85,442

|

156,626

|

|||||

|

China Shineway Pharmaceutical Group Ltd.

|

143,999

|

153,302

|

|||||

|

Dawnrays Pharmaceutical Holdings Ltd.

|

190,750

|

151,507

|

|||||

|

Sichuan Expressway Company Ltd. — Class H

|

429,427

|

145,940

|

|||||

|

Consun Pharmaceutical Group Ltd.

|

282,797

|

145,619

|

|||||

|

Sinovac Biotech Ltd*,1

|

24,511

|

144,125

|

|||||

|

China Foods Ltd.*

|

369,290

|

132,158

|

|||||

|

United Laboratories International Holdings Ltd.*

|

309,630

|

126,751

|

|||||

|

Golden Meditech Holdings Ltd.

|

988,940

|

126,033

|

|||||

|

Shanghai Fudan-Zhangjiang Bio-Pharmaceutical

|

|||||||

|

Company Ltd. — Class H

|

127,054

|

115,144

|

|||||

|

Microport Scientific Corp.*

|

220,557

|

110,731

|

|||||

|

China Yurun Food Group Ltd.*

|

706,751

|

109,176

|

|||||

|

China Distance Education Holdings Ltd. ADR

|

10,065

|

108,199

|

|||||

|

PW Medtech Group Ltd.*

|

369,197

|

97,906

|

|

See notes to financial statements.

|

|

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT l 33

|

|

SCHEDULE OF INVESTMENTS continued

|

May 31, 2016

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS† - 99.3% (continued)

|

|||||||

|

Consumer, Non-cyclical - 16.9% (continued)

|

|||||||

|

Xiamen International Port Company Ltd. — Class H

|

499,142

|