UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21910

Claymore Exchange-Traded Fund Trust 2

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: August 31

Date of reporting period: September 1, 2014 - August 31, 2015

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM

. . . YOUR ROAD TO THE LATEST, MOST UP-TO-DATE INFORMATION

The shareholder report you are reading right now is just the beginning of the story. Online at guggenheiminvestments.com, you will find:

• Daily and historical fund pricing, fund returns, portfolio holdings and characteristics, and distribution history.

• Investor guides and fund fact sheets.

• Regulatory documents including a prospectus and copies of shareholder reports.

Guggenheim Funds Distributors, LLC is constantly updating and expanding shareholder information services on each Fund's website, in an ongoing effort to provide you with the most current information about how your Fund's assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment.

|

Contents

|

|

|

Dear Shareholder

|

3

|

|

Economic and Market Overview

|

4

|

|

Management Discussion of Fund Performance

|

6

|

|

Performance Report and Fund Profile

|

14

|

|

About Shareholders' Fund Expenses

|

26

|

|

Schedule of Investments

|

27

|

|

Statement of Assets and Liabilities

|

41

|

|

Statement of Operations

|

43

|

|

Statements of Changes in Net Assets

|

45

|

|

Financial Highlights

|

48

|

|

Notes to Financial Statements

|

54

|

|

Report of Independent Registered Public Accounting Firm

|

61

|

|

Supplemental Information

|

62

|

|

Approval of Advisory Agreement – Claymore Exchange Traded Fund Trust 2

|

65

|

|

Trust Information

|

71

|

|

About the Trust Adviser

|

Back Cover

|

|

August 31, 2015

|

DEAR SHAREHOLDER

Guggenheim Funds Investment Advisors, LLC (the "Investment Adviser"), is pleased to present the annual shareholder report for several of our exchange-traded funds ("ETFs" or "Funds"). This report covers performance of the Funds for the annual fiscal period ended August 31, 2015.

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC ("Guggenheim"), a global diversified financial services firm.

Guggenheim Funds Distributors, LLC, the distributor of the Funds, is committed to providing investors with innovative investment solutions. We have built on the investment management strengths of Guggenheim Investments and worked with a diverse group of index providers to create some of the most distinctive ETFs available.

To learn more about economic and market conditions over the last year and the objective and performance of each ETF, we encourage you to read the Economic and Market Overview section of the report, which follows this letter, and the Management Discussion of Fund Performance for each ETF, which begins on page 6.

Sincerely,

Donald Cacciapaglia

President, Chief Executive Officer and Trustee

Claymore Exchange-Traded Fund Trust 2

President, Chief Executive Officer and Trustee

Claymore Exchange-Traded Fund Trust 2

September 30, 2015

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 3

|

|

ECONOMIC AND MARKET OVERVIEW

|

August 31, 2015

|

The U.S. economic expansion is beginning to approach its late stages, but the underlying fundamentals of the economy remain strong. Growth mid-year bounced back from a weather-induced slowdown in the first quarter, with GDP increasing 3.7% for the third quarter. The labor and housing markets continue to strengthen, and consumption has benefited from low energy prices.

Markets have been anticipating a rate hike by the U.S. Federal Reserve (the "Fed") sometime before the end of 2015, but the Fed's insistence on being data dependent provides it with significant flexibility. Among measures being watched closely is wage growth, an indicator of inflationary pressure, which has been subdued. Once the Fed begins its tightening process, the terminal value of the Fed funds rate may be lower than expected.

Overseas, growth in the Chinese economy continues to slow, with a recent devaluation a government attempt to stimulate exports. Policymakers are likely to continue to do whatever is necessary to maintain growth at an acceptable level, but turbulence is expected to persist. The Japanese economy's long-term prospects also remain weak, with continued monetary accommodation leading to more capital being exported. In Europe, economic data have also slipped recently, and export growth may suffer due to falling demand from China. Events in Greece are likely to remain unsettled.

Responsible for much of this international turbulence is the massive misalignment of exchange rates, which finds its roots in quantitative easing. Japan, for example, has weakened its currency by over 50% against the U.S. dollar while China, Japan's largest trading partner, has basically pegged the renminbi to the dollar. Strains on the terms of trade between countries that have devalued and those that have not have built to the point that perpetuating these disparities is destabilizing to the countries that have staunchly fought devaluation. Witness China's recent move to devalue the renminbi versus the dollar, proving that artificial equilibrium is not only impossible to maintain, but ultimately disruptive to markets and economic growth.

Now we are facing the turbulent path to a new equilibrium, including the potential for several months of volatility for risk assets. In such a challenging period, many take comfort in governments' willingness to use the printing press. It is a handy tool to prop up asset prices and temporarily spur economic growth, which is the main reason a recession does not appear to be on the horizon for either the G-7 nations or China. It's also worth noting that there has never been a recession in the post-war period without the Fed first raising interest rates, after which it typically takes several years for a recession to be induced.

For the 12 months ended August 31, 2015, the Standard & Poor's 500® ("S&P 500") Index returned 0.48%. The Morgan Stanley Capital International ("MSCI") Europe-Australasia-Far East ("EAFE") Index returned -7.47%. The return of the MSCI Emerging Markets Index was -22.95%.

In the bond market, the Barclays U.S. Aggregate Bond Index posted a 1.56% return for the period, while the Barclays U.S. Corporate High Yield Index returned -2.93%. The return of the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index was 0.03% for the 12-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

|

4 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

August 31, 2015

|

Index Definitions

All indices described below are unmanaged and reflect no expenses. It is not possible to invest directly in any index.

All indices described below are unmanaged and reflect no expenses. It is not possible to invest directly in any index.

The Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or "MBS" (agency fixed-rate and hybrid adjustable-rate mortgage, or "ARM", pass-throughs), asset-backed securities ("ABS"), and commercial mortgage-backed securities ("CMBS").

The Barclays U.S. Corporate High Yield Index measures the market of U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody's, Fitch, and S&P is Ba1/BB +/BB + or below.

The Dow Jones Global Utilities Index includes those companies in the Dow Jones Global Index associated with generating and distributing electricity through the burning of fossil fuels such as coal, petroleum and natural gas, and through nuclear energy; alternative electricity companies generating and distributing electricity from a renewable source; distributors of gas to end users; and multi-utility and water companies.

The FTSE EPRA/NAREIT Global Real Estate Index is an unmanaged portfolio of approximately 423 constituents from 37 countries, including both developed and emerging markets.

The MSCI (Morgan Stanley Capital International) China Index is a capitalization-weighted index that measures the performance of large- and mid-cap securities in the Chinese equity markets and includes representation across China H shares, B shares, Red chips and P chips.

The MSCI EAFE Index is a capitalization-weighted measure of stock markets in Europe, Australasia, and the Far East.

The MSCI Emerging Markets Index is a free float-adjusted market-capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

The MSCI World Index measures performance from a diverse range of global stock markets, including the U.S., Canada, Europe, Australia, New Zealand, and the Far East.

The Standard and Poor's 500 Index (S&P 500®) is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity and industry group representation.

The Standard & Poor's Global BMI (Broad Market Index), which comprises the S&P Developed BMI and S&P Emerging BMI, is a comprehensive, rules-based index measuring global stock market performance.

Industry Sectors

Comments about industry sectors in these fund commentaries are based on Bloomberg industry classifications.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 5

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

|

August 31, 2015

|

YAO Guggenheim China All-Cap ETF

Fund Overview

The Guggenheim China All-Cap ETF, NYSE Arca ticker: YAO (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the AlphaShares China All-Cap Index (the "Index").

The Guggenheim China All-Cap ETF, NYSE Arca ticker: YAO (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the AlphaShares China All-Cap Index (the "Index").

The Index is designed to measure and monitor the performance of the investable universe of publicly traded companies based in mainland China. The Index was created by AlphaShares, LLC ("AlphaShares") and is maintained by Standard & Poor's. The Index includes equity securities of companies of all capitalizations, as defined by AlphaShares, subject to certain minimum capitalization requirements. The Fund will invest at least 80% of its total assets in common stock, American depositary receipts ("ADRs"), American depositary shares ("ADSs"), global depositary receipts ("GDRs"), and international depositary receipts ("IDRs") that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs, and IDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2015.

On a market price basis, the Fund generated a total return of -13.42%, which included a decrease in market price over the period to $24.13 as of August 31, 2015, from $28.52 as of August 31, 2014. On an NAV basis, the Fund generated a total return of -12.51%, which included a decrease in NAV over the period to $24.42 as of August 31, 2015, from $28.56 as of August 31, 2014. At the end of the period, the Fund's shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflects fees and expenses of the Fund.

For comparison, the Index returned -13.10% and the MSCI China Index returned -9.34% for the same period.

The Fund made an annual income distribution of $0.6450 per share on December 31, 2014, to shareholders of record on December 29, 2014.

Performance Attribution

For the 12-month period ended August 31, 2015, the financial sector contributed the most to the Fund's return, followed by the industrial sector. The energy sector detracted the most from return, followed by the communications sector.

For the 12-month period ended August 31, 2015, the financial sector contributed the most to the Fund's return, followed by the industrial sector. The energy sector detracted the most from return, followed by the communications sector.

Positions that contributed the most to the Fund's return included Ping An Insurance Group Company of China Ltd., a provider of insurance services in China (2.7% of the Fund's long-term investments at period end); China Life Insurance Co. Ltd., which provides life insurance and annuity products (3.0% of the Fund's long-term investments at period end); and Tech Pro Technology Development Ltd., which makes and sells electrolytic capacitors (not held at period end).

Positions that detracted the most from the Fund's return included Alibaba Group Holding Ltd., ADR, which operates as a holding company providing internet infrastructure, e-commerce, online financial, and Internet content services through its subsidiaries PetroChina Co. Ltd., an oil and gas company; and CNOOC Ltd., a producer of oil and natural gas (2.9%, 2.1%, and 2.3%, respectively, of the Fund's long-term investments at period end).

|

6 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

August 31, 2015

|

CQQQ Guggenheim China Technology ETF

Fund Overview

The Guggenheim China Technology ETF, NYSE Arca ticker: CQQQ (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the AlphaShares China Technology Index (the "Index").

The Index is designed to measure and monitor the performance of the universe of publicly traded companies that are based in mainland China, Hong Kong, or Macau, are in the Information Technology Sector, as defined by Standard & Poor's Global Industry Classification Standard, and are open to foreign investment. The Index was created by AlphaShares, LLC ("AlphaShares") and is maintained by Standard & Poor's. The Index includes equity securities of companies of all categories of market capitalizations, as defined by AlphaShares (subject to certain minimum capitalization requirements).

The Index may include Hong Kong-listed securities, including China H-shares and Red Chips. China H-shares are issued by companies incorporated in mainland China and listed on the Hong Kong Stock Exchange. Red Chip shares are issued by companies with controlling Chinese shareholders that are incorporated outside mainland China and listed on the Hong Kong Stock Exchange. The Index may also include N-shares, which are issued by companies based in mainland China and listed on the NYSE Arca, Inc. or NASDAQ Stock Market. The Index does not include China A-Shares (which are subject to substantial restrictions on foreign investment) or China B-Shares (which offer a generally smaller market and limited liquidity), each of which trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

The Fund will invest at least 80% of its total assets in common stock, American depositary receipts ("ADRs"), American depositary shares ("ADSs"), global depositary receipts ("GDRs"), and international depositary receipts ("IDRs") that comprise the Index and depositary receipts or shares representing common stocks included in the Index (or underlying securities representing ADRs, ADSs, GDRs, and IDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index.

Fund Performance

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2015.

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2015.

On a market price basis, the Fund generated a total return of -21.85%, which included a decrease in market price over the period to $29.31 as of August 31, 2015, from $37.88 as of August 31, 2014. On an NAV basis, the Fund generated a total return of -21.62%, which included a decrease in NAV over the period to $29.55 as of August 31, 2015, from $38.09 as of August 31, 2014. At the end of the period, the Fund's shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflects fees and expenses of the Fund.

For comparison, the Index returned -23.56% and the MSCI China Index returned -9.34% for the same period.

The Fund made an annual income distribution of $0.3450 per share on December 31, 2014, to shareholders of record on December 29, 2014.

Performance Attribution

For the 12-month period ended August 31, 2015, all sectors detracted from the Fund's return. The diversified sector and the consumer, cyclical sector detracted the least from the Fund's return. The communications sector and the energy sector detracted the most.

For the 12-month period ended August 31, 2015, all sectors detracted from the Fund's return. The diversified sector and the consumer, cyclical sector detracted the least from the Fund's return. The communications sector and the energy sector detracted the most.

Positions that contributed the most to the Fund's return included NetEase, Inc., ADR, a Chinese Internet company (8.1% of the Fund's long-term investments at period end); Tech Pro Technology Development Ltd., which makes and sells electrolytic capacitors (not held at period end) and Tencent Holdings Ltd., whose sub-sidiaries provide medin, entertainment, Internet, and Mobile services (13.2% of the Fund's long-term holdings at period end).

Positions that detracted the most from the Fund's return included Baidu, Inc., ADR, which operates an Internet search engine; Lenovo Group Ltd., which, through its subsidiaries, sells and manufactures personal computers and handheld devices; and Qihoo 360 Technology Company Ltd., ADR, an Internet security service provider (10.0%, 5.4%, and 4.9%, respectively, of the Fund's long-term investments at period end).

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 7

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

August 31, 2015

|

EMRE Guggenheim Emerging Markets Real Estate ETF

Fund Overview

The Guggenheim Emerging Markets Real Estate ETF, NYSE Arca ticker: EMRE (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the AlphaShares Emerging Markets Real Estate Index (the "Index"). EMRE invests in publicly traded emerging markets real estate securities that seek to benefit from the growth of the real estate industry across nearly two dozen emerging market countries and the income typically generated by real estate investments.

The Guggenheim Emerging Markets Real Estate ETF, NYSE Arca ticker: EMRE (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the AlphaShares Emerging Markets Real Estate Index (the "Index"). EMRE invests in publicly traded emerging markets real estate securities that seek to benefit from the growth of the real estate industry across nearly two dozen emerging market countries and the income typically generated by real estate investments.

The Index is designed to measure and monitor the performance of the investable universe of publicly traded companies and real estate investment trusts (REITs) deriving a majority of their revenues from real estate development, management, and/or ownership of property in the countries of the S&P BMI Emerging Markets Index. The S&P Emerging BMI captures all companies domiciled in the emerging markets within the S&P Global BMI with a float-adjusted market capitalization of at least $100 million and a minimum annual trading liquidity of $50 million. The index is segmented by country/region, size (large, mid, and small), style (value and growth), and GICS (sectors/industry groups).

A substantial portion of the Index may consist of the securities of Chinese issuers. The Index may include Hong Kong-listed securities, including China H-shares (which are issued by companies incorporated in mainland China), Red Chip shares (which are issued by companies with controlling Chinese shareholders that are incorporated outside mainland China), and N-Shares (which are issued by companies based in mainland China and listed on the NYSE Arca or NASDAQ). The Index will not include China A-Shares or China B-Shares, each of which trade on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

The Fund will invest at least 80% of its total assets in common stocks, American depositary receipts ("ADRs"), American depositary shares ("ADSs"), global depositary receipts ("GDRs"), and international depositary receipts ("IDRs") that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs, ADSs, GDRs, and IDRs included in the Index).

Fund Performance

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the abbreviated annual fiscal period beginning at the Fund's inception of September 29, 2014, through August 31, 2015.

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the abbreviated annual fiscal period beginning at the Fund's inception of September 29, 2014, through August 31, 2015.

On a market price basis, the Fund generated a total return of -14.22%, which included a decrease in market price over the period to $20.73 on August 31, 2015, from $25.00 at inception. On an NAV basis, the Fund generated a total return of -14.61%, which included a decrease in NAV over the period to $20.64 on August 31, 2015, from $24.99 at inception. At the end of the period the Fund's shares were trading at a market price premium to NAV, which is to be expected from time to time. NAV performance data reflects fees and expenses of the Fund.

For comparison, the Index returned -11.26% since inception. There were a number of factors that contributed to the underperformance of the NAV return vs. the Index. These factors included complexities with investing the initial proceeds of the Fund, the relatively small asset size of the Fund, and the lack of liquidity of certain securities held within the Index. The FTSE EPRA/NAREIT Global Real Estate Index returned 0.36% since inception.

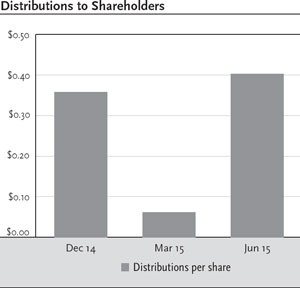

The Fund made the following quarterly income distributions for the abbreviated annual fiscal period ended August 31, 2015:

|

Payable Date

|

Amount

|

|||

|

December 31, 2014

|

$

|

0.3580

|

||

|

March 31, 2015

|

$

|

0.0615

|

||

|

June 30, 2015

|

$

|

0.4032

|

||

|

Total

|

$

|

0.8227

|

Performance Attribution

For the abbreviated annual fiscal period ended August 31, 2015, the financial sector composed 97% of the Fund and accounted for most of the Fund's negative performance.

For the abbreviated annual fiscal period ended August 31, 2015, the financial sector composed 97% of the Fund and accounted for most of the Fund's negative performance.

Positions that contributed the most to the Fund's return included Evergrande Real Estate Group Ltd., an integrated residential property developer in China; Resilient Property Income Fund Ltd., a property investment company in South Africa; and China Resources Land Ltd., which through its subsidiaries develops and invests in properties (2.4%, 2.0%, and 3.9%, respectively, of the Fund's long-term investments at period end).

Positions that detracted the most from the Fund's return included BR Malls Participacoes S.A., a service provider for Brazilian shopping malls; Fibra Uno Administracios S.A. De CV, a real estate investment trust focusing on Mexican properties; and Emaar Properties PJSC, a Dubai-based real estate development company (1.3%, 4.0%, and 5.8%, respectively, of the Fund's long-term investments at period end).

|

8 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

August 31, 2015

|

TAN Guggenheim Solar ETF

Fund Overview

The Guggenheim Solar ETF, NYSE Arca ticker: TAN (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the MAC Global Solar Energy Index (the "Index").

The Guggenheim Solar ETF, NYSE Arca ticker: TAN (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the MAC Global Solar Energy Index (the "Index").

As of August 31, 2015, the Index is comprised of approximately 26 securities selected based on the relative importance of solar power within the company's business model, as determined by MAC Indexing LLC (the "Index Provider"). As of such date, the median market capitalization of securities included in the Index was $400 million. The Index is designed to track companies within the following business segments of the solar energy industry: companies that produce solar power equipment and products for end users; companies that produce fabrication products (such as the equipment used by solar cell and module producers to manufacture solar power equipment) or services (such as companies specializing in the solar cell manufacturing or the provision of consulting services to solar cell and module producers) for solar power equipment producers; companies that supply raw materials or components to solar power equipment producers or integrators; companies that derive a significant portion of their business (as defined in the Fund prospectus under "Index Methodology") from solar power system sales, distribution, installation, integration, or financing; and companies that specialize in selling electricity derived from solar power.

The Index is generally comprised of equity securities, including American depositary receipts ("ADRs"), and global depositary receipts ("GDRs"), traded in developed markets, as defined by the Index Provider. While the equity securities comprising the Index are traded in developed markets, the issuers of such securities may be located in emerging markets. Emerging market countries are countries that major international financial institutions, such as the World Bank, generally consider to be less economically mature than developed nations. The Fund will invest at least 90% of its total assets in common stock, ADRs, and GDRs that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs and GDRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index. The Fund will concentrate its investments (i.e., hold 25% or more of its assets) in a particular industry or group of industries to the extent the Index is so concentrated.

Fund Performance

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2015.

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2015.

On a market price basis, the Fund generated a total return of -30.57%, which included a decrease in market price over the period to $29.57 as of August 31, 2015, from $43.39 as of August 31, 2014. On an NAV basis, the Fund generated a total return of -30.51%, which included a decrease in NAV over the period to $29.72 as of August 31, 2015, from $43.58 as of August 31, 2014. At the end of the period, the Fund's shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflects fees and expenses of the Fund.

For comparison, the Index returned -34.20% and the MSCI World Index returned -4.13% for the same period.

The Fund made an annual income distribution of $0.6400 per share on December 31, 2014, to shareholders of record on December 29, 2014.

Performance Attribution

The Fund's holdings are mostly in the energy, technology, and industrial sectors. The technology sector contributed the most to the Fund's return for the 12-month period ended August 31, 2015. The energy sector detracted the most from return, followed by the industrial sector.

The Fund's holdings are mostly in the energy, technology, and industrial sectors. The technology sector contributed the most to the Fund's return for the 12-month period ended August 31, 2015. The energy sector detracted the most from return, followed by the industrial sector.

Positions that contributed the most to the Fund's return included Hanwha Q Cells Co. Ltd., which manufactures photovoltaic (PV) cells and modules and provides PV cell processing services in China (2.3% of the Fund's long-term investments at period end); SMA Solar Technology AG, which manufactures solar inverters (6.0% of the Fund's long-term investments at period end) and Advanced Energy Industries, Inc., which makes power conversion, solar inverters and control systems used in plasma-based thin film production equipment (4.1% of the Fund's long-term investments at period end).

Positions that detracted most from the Fund's return included GCL-Poly Energy Holdings Ltd., which provides power and heat via cogeneration, incineration, and wind power (5.2% of the Fund's long-term investments at period end); Shunfeng International Clean Energy Ltd., which develops and operates solar power plants (2.0% of the Fund's long-term investments at period end); and GT Advanced Technologies, Inc., a provider of crystal growth equipment (not held at period end).

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 9

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

August 31, 2015

|

CGW Guggenheim S&P Global Water Index ETF

Fund Overview

The Guggenheim S&P Global Water Index ETF, NYSE Arca ticker: CGW (the "Fund"), seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the S&P Global Water Index (the "Index").

The Guggenheim S&P Global Water Index ETF, NYSE Arca ticker: CGW (the "Fund"), seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of an equity index called the S&P Global Water Index (the "Index").

The Index is comprised of approximately 50 equity securities selected, based on investment and other criteria, from a universe of companies listed on global developed market exchanges. Standard & Poor's Financial Services LLC, a division of McGraw Hill Financial ("S&P"), generally defines "developed markets" as the capital markets of those countries with high levels of per capita income and strict market regulation resulting in greater transparency. The universe of companies includes all companies classified by Standard & Poor's Global Industry Classifications as being associated (in a manner representing a major component of such companies' business) with the global demand for water, including water utilities, infrastructure, equipment, instruments, and materials. Total market capitalization and float-adjusted market capitalization of securities in the Index must be at least $250 million and $100 million, respectively, at the time of each reconstitution, which includes small-, mid-, and large-capitalization securities as defined by S&P. The companies in the universe are selected using criteria as identified by S&P. The Fund will invest at least 90% of its total assets in common stock and American depositary receipts ("ADRs") that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing ADRs included in the Index). The Fund generally will invest in all of the securities comprising the Index in proportion to their weightings in the Index. The Fund will concentrate its investments (i.e., hold 25% or more of its assets) in a particular industry or group of industries to the extent the Index is so concentrated.

Fund Performance

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2015.

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the annual fiscal period ended August 31, 2015.

On a market price basis, the Fund generated a total return of -6.77%, which included a decrease in market price over the period to $26.64 as of August 31, 2015, from $29.08 as of August 31, 2014. On an NAV basis, the Fund generated a total return of -6.47%, which included a decrease in NAV over the period to $26.67 as of August 31, 2015, from $29.02 as of August 31, 2014. At the end of the period, shares of the Fund at NAV were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflects fees and expenses of the Fund.

For comparison, the Index returned -6.25%, the MSCI World Index returned -4.13%, and the Dow Jones Global Utilities Index returned -8.56% for the same period.

The Fund made an annual income distribution of $0.4980 per share on December 31, 2014, to shareholders of record on December 29, 2014.

Performance Attribution

For the 12-month period ended August 31, 2015, the Fund was invested mostly in the utilities and industrial sectors. Both of those sectors detracted from performance.

For the 12-month period ended August 31, 2015, the Fund was invested mostly in the utilities and industrial sectors. Both of those sectors detracted from performance.

Positions that contributed the most to the Fund's return included Veolia Environnement S.A., a France-based operator of utility and public transportation businesses; Danaher Corp., which makes and markets products and services for the medical, industrial, and commercial sectors; and American Water Works Co., Inc., which provides drinking water, wastewater, and other water-related services in multiple U.S. states and Ontario, Canada (6.1%, 5.6%, and 6.0%, respectively, of the Fund's long-term investments at period end).

Positions that detracted the most from the Fund's return included Pentair plc, a U.K.-based provider of services related to water and other fluids, thermal management, and equipment protection; Cia de Saneamento Basico de Estado de Sao Paulo, ADR, a Brazilian company that collects, treats, and distributes water; and Alfa Laval AB, a Swedish company that provides equipment and systems for heating, cooling, separation, and transportation of various foods, chemicals, and liquids (5.9%, 1.0%, and 3.1%, respectively, of the Fund's long-term investments at period end).

|

10 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited) continued

|

August 31, 2015

|

GHII Guggenheim S&P High Income Infrastructure ETF

Fund Overview

The Guggenheim S&P High Income Infrastructure ETF, NYSE Arca ticker: GHII (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of the S&P High Income Infrastructure Index (the "Index"). The Fund, using a "passive" or "indexing" investment approach, seeks to replicate, before the Fund's fees and expenses, the performance of the Index.

The Guggenheim S&P High Income Infrastructure ETF, NYSE Arca ticker: GHII (the "Fund") seeks investment results that correspond generally to the performance, before the Fund's fees and expenses, of the S&P High Income Infrastructure Index (the "Index"). The Fund, using a "passive" or "indexing" investment approach, seeks to replicate, before the Fund's fees and expenses, the performance of the Index.

The Index is designed to measure and monitor the performance of 50 high-yielding global equity securities of companies that engage in various infrastructure-related sub-industries. Index constituents must meet size, listing, and liquidity requirements and also be part of the S&P Global BMI Index, which is a rules-based index that measures global stock market performance.

The Fund will invest at least 80% of its total assets in common stocks, American depositary receipts ("ADRs"), American depositary shares ("ADSs"), global depositary receipts ("GDRs"), and international depositary receipts ("IDRs") that comprise the Index and depositary receipts representing common stocks included in the Index (or underlying securities representing the ADRs, ADSs, GDRs, and IDRs included in the Index).

Fund Performance

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the abbreviated annual fiscal period beginning at the Fund's inception of February 11, 2015, through August 31, 2015.

All Fund returns cited—whether based on net asset value ("NAV") or market price—assume the reinvestment of all distributions. This report discusses the abbreviated annual fiscal period beginning at the Fund's inception of February 11, 2015, through August 31, 2015.

On a market price basis, the Fund generated a total return of -8.37%, which included a decrease in market price over the period to $22.56 on August 31, 2015, from $25.05 at inception. On an NAV basis, the Fund generated a total return of -7.06%, which included a decrease in NAV over the period to $22.87 on August 31, 2015, from $25.05 at inception. At the end of the period the Fund's shares were trading at a market price discount to NAV, which is to be expected from time to time. NAV performance data reflects fees and expenses of the Fund.

For comparison, the Index returned -5.91% since inception, and the S&P Global BMI Index returned -3.62% for the same period.

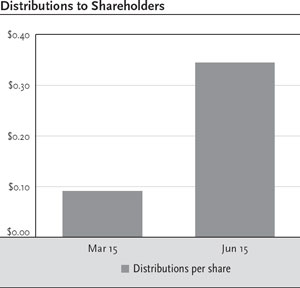

The fund made the following quarterly income distributions for the abbreviated annual fiscal period ended August 31, 2015:

|

Payable Date

|

Amount

|

|||

|

March 31, 2015

|

$

|

0.0915

|

||

|

June 30, 2015

|

$

|

0.3447

|

||

|

Total

|

$

|

0.4362

|

Performance Attribution

For the abbreviated annual fiscal period ended August 31, 2015, the industrial sector contributed the most to the Fund's performance. The utilities sector detracted the most, followed by the energy sector.

For the abbreviated annual fiscal period ended August 31, 2015, the industrial sector contributed the most to the Fund's performance. The utilities sector detracted the most, followed by the energy sector.

Positions that contributed the most to the Fund's return included Williams Cos., Inc., a leading energy infrastructure company in North America (not held at period end); Hutchison Port Holdings Trust, the first publicly traded container port business trust that is affiliated with Hutchison Port Holdings and a subsidiary of Hutchison Whampoa Ltd. (4.0% of the Fund's long-term investments at period end); and Sydney Airport, a company that operates the airport in the Australian city (4.8% of the Fund's long-term investments at period end).

Positions that detracted the most from the Fund's return included TransCanada Corp., a leading energy infrastructure company in North America; Kinder Morgan, Inc., a provider of pipeline transportation and energy storage; and Fortum OYJ, a Finland-based provider of energy related products and services (3.9%, 4.2%, and 2.0%, respectively, of the Fund's long-term investments at period end).

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 11

|

|

August 31, 2015

|

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers and Guggenheim Funds Investment Advisors, LLC only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass.

The views expressed in this report reflect those of the portfolio managers and Guggenheim Funds Investment Advisors, LLC only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass.

This information does not represent an offer to sell securities of the Funds and it is not soliciting an offer to buy securities of the Funds. An investment in the various Guggenheim ETFs is subject to certain risks and other considerations. Below are some general risks and considerations associated with investing in a Fund, which may cause you to lose money, including the entire principal that you invest. Please refer to each individual ETF prospectus for a more detailed discussion of Fund-specific risks and considerations.

Investment Risk. An investment in a Fund is subject to investment risk, including the possible loss of the entire principal amount that you invest.

Equity Risk. The value of the securities held by each Fund may fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by each Fund participate, or factors relating to specific companies in which such Fund invests.

Foreign Investment Risk. A Fund's investments in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers, including, among others, greater market volatility than U.S. securities and less complete financial information than for U.S. issuers. In addition, adverse political, economic, or social developments could undermine the value of such Fund's investments or prevent such Fund from realizing the full value of its investments. Financial reporting standards for companies based in foreign markets differ from those in the U.S. Finally, the value of the currency of the country in which a Fund has invested could decline relative to the value of the U.S. dollar, which may affect the value of the investment to U.S. investors. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities.

Emerging Markets Risk. Investment in securities of issuers based in developing or "emerging market" countries entails all of the risks of investing in securities of non-U.S. issuers, as previously described, but to a heightened degree.

Micro-, Small-, and Medium-Sized Company Risk. Investing in securities of these companies involves greater risk as their stocks may be more volatile and less liquid than investing in more established companies. These stocks may have returns that vary, sometimes significantly, from the overall stock market. Micro-cap companies may be newly formed, less developed, and there may be less available information about the company.

Replication Management Risk. The Funds are not "actively" managed. Therefore, a Fund would not necessarily sell a security because the stock's issuer was in financial trouble unless that stock is removed from such Fund's Index.

Non-Correlation Risk. A Fund's return may not match the return of such Fund's index for a number of reasons. For example, the Fund incurs a number of operating expenses not applicable to the Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund's securities holdings to reflect changes in the composition of the Index. A Fund may not be fully invested at times, either as a result of cash flows into such Fund or reserves of cash held by a Fund to meet redemptions and expenses. If a Fund utilizes a sampling approach or futures or other derivative positions, its return may not correlate as well with the return on the Index, as would be the case if it purchased all of the securities in the Index with the same weightings as the Index.

Issuer-Specific Changes. The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. The value of securities of smaller issuers can be more volatile than that of larger issuers.

Non-Diversified Fund Risk. Certain Funds are considered non-diversified and can invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Concentration Risk. If the Index concentrates in an industry or group of industries, the Fund's investments will be concentrated accordingly. In such event, the value of the Fund's shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries.

China Investment Risk (YAO CQQQ and EMRE). Investing in securities of Chinese companies involves additional risks, including, but not limited to: the economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources, and capital reinvestment, among others; the central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership; and actions of the Chinese central and local government authorities continue to have a substantial effect on economic conditions in China.

Guggenheim Emerging Markets Real Estate ETF may not be suitable for all investors. Investments in the real estate industry, including REITS, subjects the Fund to the same risks as direct investments in real estate, which are particularly sensitive to economic downturns. Investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political, or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). Investments in Chinese companies may also involve additional risks. Investments in small- or medium-sized companies may involve greater risk than investing in larger, more established companies. Investments in securities of smaller issuers can be more volatile than that of larger issuers. Investments in micro-cap stocks involve substantially greater risks of loss and price fluctuations because their earnings and revenues tend to be less predictable and their shares tend to be more volatile and their markets less liquid than companies with larger market capitalizations.

|

12 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

August 31, 2015

|

Recent Market Developments Risk. Global and domestic financial markets have experienced periods of unprecedented turmoil. Recently, markets have witnessed more stabilized economic activity as expectations for an economic recovery increased. However, risks to a robust resumption of growth persist. Continuing uncertainty as to the status of the euro and the European Monetary Union has created significant volatility in currency and financial markets generally. A return to unfavorable economic conditions or sustained economic slowdown could adversely impact the Funds' portfolios. Financial market conditions, as well as various social and political tensions in the U.S. and around the world, have contributed to increased market volatility and may have long-term effects on the U.S. and worldwide financial markets and cause further economic uncertainties or deterioration in the U.S. and worldwide. The Investment Adviser does not know how long the financial markets will continue to be affected by these events and cannot predict the effects of these or similar events in the future on the U.S. and global economies and securities markets.

There is no assurance that the requirements of the NYSE Arca necessary to maintain the listing of the Funds will continue to be met or will remain unchanged.

In addition to the risks described, there are certain other risks related to investing in the Funds. These risks are described further in each Fund's Prospectus and Statement of Additional Information and at guggenheiminvestments.com.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 13

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)

|

August 31, 2015

|

YAO Guggenheim China All-Cap ETF

|

Fund Statistics

|

|||

|

Share Price

|

$

|

24.13

|

|

|

Net Asset Value

|

$

|

24.42

|

|

|

Discount to NAV

|

-1.19%

|

||

|

Net Assets ($000)

|

$

|

29,308

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR

|

||||||||

|

THE PERIOD ENDED AUGUST 31, 2015

|

||||||||

|

Since

|

||||||||

|

One

|

Three

|

Five

|

Inception

|

|||||

|

Year

|

Year

|

Year

|

(10/19/09)

|

|||||

|

Guggenheim China All-Cap ETF

|

||||||||

|

NAV

|

-12.51%

|

6.29%

|

1.90%

|

1.44%

|

||||

|

Market

|

-13.42%

|

5.68%

|

1.66%

|

1.22%

|

||||

|

AlphaShares China

|

||||||||

|

All Cap Index

|

-13.10%

|

6.56%

|

2.36%

|

1.95%

|

||||

|

MSCI China Index

|

-9.34%

|

6.73%

|

2.14%

|

1.41%

|

||||

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor's shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.82 per share for share price returns or initial net asset value (NAV) of $24.82 per share for NAV returns. Returns for periods of less than one year are not annualized.

The MSCI China Index is a capitalization-weighted index that measures the performance of large- and mid-cap securities in the Chinese equity markets and includes representation across China H shares, B shares, Red chips and P chips.

The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

The Fund's annual operating expense ratio of 0.70% is expressed as a unitary fee and covers all expenses of the Fund, except for distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

|

Portfolio Breakdown

|

% of Net Assets

|

|

|

Investments:

|

||

|

Financial

|

36.6%

|

|

|

Communications

|

24.8%

|

|

|

Energy

|

9.1%

|

|

|

Consumer, Non-cyclical

|

8.6%

|

|

|

Industrial

|

6.6%

|

|

|

Consumer, Cyclical

|

5.9%

|

|

|

Utilities

|

3.7%

|

|

|

Other

|

4.6%

|

|

|

Total Common Stocks

|

99.9%

|

|

|

Securities Lending Collateral

|

14.0%

|

|

|

Total Investments

|

113.9%

|

|

|

Other Assets & Liabilities, net

|

-13.9%

|

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

||

|

(% of Total Net Assets)

|

||

|

Tencent Holdings Ltd.

|

6.6%

|

|

|

China Mobile Ltd.

|

5.8%

|

|

|

China Construction Bank Corp. — Class H

|

4.9%

|

|

|

Industrial & Commercial Bank of China Ltd. — Class H

|

4.8%

|

|

|

Baidu, Inc. ADR

|

3.7%

|

|

|

Bank of China Ltd. — Class H

|

3.7%

|

|

|

China Life Insurance Company Ltd. — Class H

|

3.0%

|

|

|

Alibaba Group Holding Ltd. ADR

|

2.9%

|

|

|

Ping An Insurance Group Company of China Ltd. — Class H

|

2.7%

|

|

|

CNOOC Ltd.

|

2.3%

|

|

|

Top Ten Total

|

40.4%

|

"Ten Largest Holdings" exclude any temporary cash or derivative investments.

|

14 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

YAO Guggenheim China All-Cap ETF continued

This graph compares a hypothetical $10,000 investment in the Fund,made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The MSCI China Index is a capitalization-weighted index that measures the performance of large- and mid-cap securities in the Chinese equity markets and includes representation across China H shares, B shares, Red chips and P chips. The referenced index is unmanaged and not available for direct investment. The index is unmanaged. It is not possible to invest directly in the MSCI China Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed,may be worth more or less than their original investment.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 15

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

CQQQ Guggenheim China Technology ETF

|

Fund Statistics

|

|||

|

Share Price

|

$

|

29.31

|

|

|

Net Asset Value

|

$

|

29.55

|

|

|

Discount to NAV

|

-0.81%

|

||

|

Net Assets ($000)

|

$

|

45,804

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR

|

||||||||

|

THE PERIOD ENDED AUGUST 31, 2015

|

||||||||

|

Since

|

||||||||

|

One

|

Three

|

Five

|

Inception

|

|||||

|

Year

|

Year

|

Year

|

(12/08/09)

|

|||||

|

Guggenheim China Technology ETF

|

||||||||

|

NAV

|

-21.62%

|

15.25%

|

5.38%

|

4.16%

|

||||

|

Market

|

-21.85%

|

15.06%

|

5.17%

|

4.01%

|

||||

|

AlphaShares China

|

||||||||

|

Technology

|

||||||||

|

Index

|

-23.56%

|

14.61%

|

5.11%

|

3.98%

|

||||

|

MSCI China Index

|

-9.34%

|

6.73%

|

2.14%

|

0.55%

|

||||

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor's shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $25.06 per share for share price returns or initial net asset value (NAV) of $25.06 per share for NAV returns. Returns for periods of less than one year are not annualized.

The MSCI China Index is a capitalized-weighted index that measures the performance of large- and mid-cap securities in the Chinese equity markets and includes representation across China H shares, B shares, Red chips, and P chips.

The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

The Fund's annual operating expense ratio of 0.70% is expressed as a unitary fee and covers all expenses of the Fund, except for distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

|

Portfolio Breakdown

|

% of Net Assets

|

|

|

Investments:

|

||

|

Communications

|

55.7%

|

|

|

Technology

|

25.2%

|

|

|

Industrial

|

9.4%

|

|

|

Energy

|

5.4%

|

|

|

Basic Materials

|

1.8%

|

|

|

Consumer, Cyclical

|

1.3%

|

|

|

Consumer, Non-cyclical

|

0.9%

|

|

|

Diversified

|

0.2%

|

|

|

Total Common Stocks

|

99.9%

|

|

|

Securities Lending Collateral

|

22.7%

|

|

|

Total Investments

|

122.6%

|

|

|

Other Assets & Liabilities, net

|

-22.6%

|

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

||

|

(% of Total Net Assets)

|

||

|

Tencent Holdings Ltd.

|

12.1%

|

|

|

Baidu, Inc. ADR

|

9.1%

|

|

|

Alibaba Group Holding Ltd. ADR

|

8.7%

|

|

|

NetEase, Inc. ADR

|

7.3%

|

|

|

AAC Technologies Holdings, Inc.

|

5.3%

|

|

|

Lenovo Group Ltd.

|

4.9%

|

|

|

Qihoo 360 Technology Company Ltd. ADR

|

4.5%

|

|

|

Semiconductor Manufacturing International Corp.

|

2.9%

|

|

|

SINA Corp.

|

2.9%

|

|

|

Youku Tudou, Inc. ADR

|

2.4%

|

|

|

Top Ten Total

|

60.1%

|

"Ten Largest Holdings" exclude any temporary cash or derivative investments.

|

16 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

CQQQ Guggenheim China Technology ETF continued

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI China Index. Results include the reinvestment of all distributions and capital gains. Past performance is no guarantee of future results. The MSCI China Index is a capitalization-weighted index that measures the performance of large- and mid-cap securities in the Chinese equity markets and includes representation across China H shares, B shares, Red chips and P chips. The referenced index is unmanaged. It is not possible to invest directly in the MSCI China Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 17

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

EMRE Guggenheim Emerging Markets Real Estate ETF

|

Fund Statistics

|

|||

|

Share Price

|

$

|

20.73

|

|

|

Net Asset Value

|

$

|

20.64

|

|

|

Premium to NAV

|

0.44%

|

||

|

Net Assets ($000)

|

$

|

2,064

|

|

TOTAL RETURN FOR

|

||

|

THE PERIOD ENDED AUGUST 31, 2015

|

||

|

Since

|

||

|

Inception

|

||

|

(09/29/14)

|

||

|

(non-annualized)

|

||

|

Guggenheim Emerging Market Real Estate ETF

|

||

|

NAV

|

-14.61%

|

|

|

Market

|

-14.22%

|

|

|

AlphaShares Emerging

|

||

|

Markets Real Estate

|

||

|

Index

|

-11.26%

|

|

|

FTSE EPRA/NAREIT Global Real Estate Index

|

0.36%

|

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor's shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $24.99 per share for share price returns or initial net asset value (NAV) of $24.99 per share for NAV returns. Returns for periods of less than one year are not annualized.

FTSE EPRA/NAREIT Global Real Estate Index is an unmanaged portfolio of approximately 423 constituents from 37 countries, including both developed and emerging markets.

The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

The Fund's annual operating expense ratio of 0.65% is expressed as a unitary fee and covers all expenses of the Fund, except for distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses.

|

Portfolio Breakdown

|

% of Net Assets

|

|

|

Investments:

|

||

|

Financial

|

97.1%

|

|

|

Consumer, Cyclical

|

1.1%

|

|

|

Industrial

|

1.0%

|

|

|

Diversified

|

0.8%

|

|

|

Total Common Stocks

|

100.0%

|

|

|

Securities Lending Collateral

|

3.7%

|

|

|

Total Investments

|

103.7%

|

|

|

Other Assets & Liabilities, net

|

-3.7%

|

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

||

|

(% of Total Net Assets)

|

||

|

China Overseas Land & Investment Ltd.

|

6.0%

|

|

|

Emaar Properties PJSC

|

5.8%

|

|

|

Fibra Uno Administracion S.A. de CV

|

4.0%

|

|

|

China Resources Land Ltd.

|

3.9%

|

|

|

Ayala Land, Inc.

|

3.5%

|

|

|

Growthpoint Properties Ltd.

|

3.3%

|

|

|

SM Prime Holdings, Inc.

|

3.1%

|

|

|

Evergrande Real Estate Group Ltd.

|

2.4%

|

|

|

Redefine Properties Ltd.

|

2.4%

|

|

|

China Vanke Company Ltd. — Class H

|

2.3%

|

|

|

Top Ten Total

|

36.7%

|

"Ten Largest Holdings" exclude any temporary cash or derivative investments.

|

18 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

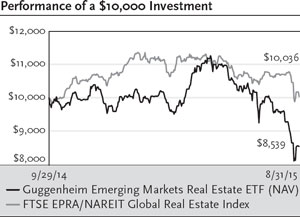

EMRE Guggenheim Emerging Markets Real Estate ETF continued

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the FTSE EPRA/NAREIT Global Real Estate Index. Results include the reinvestment of all dividends and capital gains. Past performance is no guarantee of future results. The FTSE EPRA/NAREIT Global Real Estate Index is an unmanaged portfolio of approximately 423 constituents from 37 countries, including both developed and emerging markets. It is not possible to invest directly in the FTSE EPRA/NAREIT Global Real Estate Index . Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 19

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

TAN Guggenheim Solar ETF

|

Fund Statistics

|

|||

|

Share Price

|

$

|

29.57

|

|

|

Net Asset Value

|

$

|

29.72

|

|

|

Discount to NAV

|

-0.50%

|

||

|

Net Assets ($000)

|

$

|

266,545

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR

|

||||||||

|

THE PERIOD ENDED AUGUST 31, 2015

|

||||||||

|

Since

|

||||||||

|

One

|

Three

|

Five

|

Inception

|

|||||

|

Year

|

Year

|

Year

|

(04/15/08)

|

|||||

|

Guggenheim Solar ETF

|

||||||||

|

NAV

|

-30.51%

|

25.99%

|

-13.04%

|

-23.01%

|

||||

|

Market

|

-30.57%

|

25.83%

|

-13.03%

|

-23.06%

|

||||

|

MAC Global Solar

|

||||||||

|

Energy Index

|

-34.20%

|

22.30%

|

-16.04%

|

-24.39%

|

||||

|

MSCI World Index

|

-4.13%

|

10.95%

|

11.07%

|

3.94%

|

||||

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV performance data reflects fees and expenses of the Fund. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor's shares, when redeemed, may be worth more or less than their original cost.

Since inception returns assume a purchase of the Fund at the initial share price of $251.30* per share for share price returns or initial net asset value (NAV) of $251.30* per share for NAV returns. Returns for periods of less than one year are not annualized.

The Morgan Stanley Capital International (MSCI) World Index measures performance from a diverse range of global stock markets, including the U.S., Canada, Europe, Australia, New Zealand, and the Far East.

The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

Per the most recent prospectus, the Fund's annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.76%. In the Financial Highlights section of this Annual Report, the Fund's annualized net operating expense ratio was 0.70% while the Fund's annualized gross operating expense ratio, gross of any fee waivers or expense reimbursements, was 0.73%. There is a contractual fee waiver currently in place for this Fund through December 31, 2018, to the extent necessary in keeping the Fund's operating expense ratio from exceeding 0.65% of average net assets per year. Some expenses fall outside of this expense cap and actual expenses may be higher than 0.65%. Without this expense cap, actual returns would be lower.

|

Portfolio Breakdown

|

% of Net Assets

|

|

|

Investments:

|

||

|

Energy

|

60.0%

|

|

|

Industrial

|

24.5%

|

|

|

Technology

|

9.6%

|

|

|

Utilities

|

3.3%

|

|

|

Basic Materials

|

2.1%

|

|

|

Total Common Stocks

|

99.5%

|

|

|

Securities Lending Collateral

|

43.1%

|

|

|

Total Investments

|

142.6%

|

|

|

Other Assets & Liabilities, net

|

-42.6%

|

|

|

Net Assets

|

100.0%

|

|

Ten Largest Holdings

|

||

|

(% of Total Net Assets)

|

||

|

First Solar, Inc.

|

8.5%

|

|

|

SolarCity Corp.

|

7.2%

|

|

|

SMA Solar Technology AG

|

6.0%

|

|

|

SunPower Corp. — Class A

|

5.4%

|

|

|

GCL-Poly Energy Holdings Ltd.

|

5.2%

|

|

|

Xinyi Solar Holdings Ltd.

|

5.1%

|

|

|

Meyer Burger Technology AG

|

4.9%

|

|

|

Trina Solar Ltd. ADR

|

4.3%

|

|

|

Advanced Energy Industries, Inc.

|

4.1%

|

|

|

TerraForm Power, Inc. — Class A

|

3.9%

|

|

|

Top Ten Total

|

54.6%

|

"Ten Largest Holdings" exclude any temporary cash or derivative investments.

*Reflects 1 for 10 reverse stock split that occurred on February 15, 2012.

|

20 | CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

TAN Guggenheim Solar ETF continued

This graph compares a hypothetical $10,000 investment in the Fund, made at its inception, with a similar investment in the MSCI World Index. Results include the reinvestment of all distributions and capital gains. Past performance is no guarantee of future results. The MSCI World Index measures performance from a diverse range of global stock markets, including the U.S., Canada, Europe, Australia, New Zealand, and the Far East. The referenced index is unmanaged. It is not possible to invest directly in the MSCI World Index. Investment return and principal value will fluctuate with changes in market conditions and other factors and Fund shares, when redeemed, may be worth more or less than their original investment.

|

CLAYMORE EXCHANGE-TRADED FUND TRUST 2 ANNUAL REPORT | 21

|

|

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) continued

|

August 31, 2015

|

CGW Guggenheim S&P Global Water Index ETF

|

Fund Statistics

|

|||

|

Share Price

|

$

|

26.64

|

|

|

Net Asset Value

|

$

|

26.67

|

|

|

Discount to NAV

|

-0.11%

|

||

|

Net Assets ($000)

|

$

|

346,709

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR

|

||||||||

|

THE PERIOD ENDED AUGUST 31, 2015

|

||||||||

|

Since

|

||||||||

|

One

|

Three

|

Five

|

Inception

|

|||||

|

Year

|

Year

|

Year

|

(05/14/07)

|

|||||

|

Guggenheim S&P Global

|

||||||||

|

Water Index ETF

|

||||||||

|

NAV

|

-6.47%

|

10.13%

|

11.37%

|

3.27%

|

||||

|

Market

|

-6.77%

|

10.21%

|

11.50%

|

3.25%

|

||||

|

S&P Global

|

||||||||

|

Water Index

|

-6.25%

|

10.46%

|

11.73%

|

3.79%

|

||||

|

MSCI World Index

|

-4.13%

|

10.95%

|

11.07%

|

2.53%

|

||||

|

Dow Jones Global

|

||||||||

|

Utilities Index

|

-8.56%

|

6.16%

|

2.83%