UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

BLACKROCK, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

BlackRock 2023 Executive Compensation Supplement May 3, 2024 BlackRock, Inc. (“BlackRock” or the “Company”) is providing the following supplemental information regarding the Compensation Discussion and Analysis provided in the Company’s proxy statement for the 2024 Annual Meeting of Shareholders to be held on May 15, 2024. In light of the rationale and outcomes described in our proxy statement, and the additional information set forth in this supplement, the Board of Directors reiterates its recommendation to vote FOR the approval, in a non-binding advisory vote, of the compensation of BlackRock’s named executive officers (“NEOs”).

BlackRock’s Executive Compensation Program Reflects a Commitment to Best-in-Class Corporate Governance BlackRock’s longstanding NEO Compensation Framework reflects its pay-for-performance philosophy. The Management Development and Compensation Committee (“MDCC”), aided by management, engages in a rigorous annual compensation and performance assessment process to guide the allocation of a balanced mix of incentives to NEOs. The compensation program has resulted in disciplined executive pay outcomes. BlackRock's financial and stock price growth over time has meaningfully outpaced growth in its executive pay levels. NEO Total Annual Compensation Program Features 94% of 2023 NEO total annual compensation (“TAC”) is performance-based (“variable pay”), using incentives aligned to BlackRock's Shareholder Value Framework ~50% of NEO variable pay awarded through equity-based BlackRock Performance Incentive Plan (BPIP) awards that pay out based on rigorous pre-set financial goals that are disclosed upfront Key Compensation Program Results Variable pay determined using robust, holistic Annual Incentive Award assessment process that balances pre-set financial and operational objectives to measure and reward for key drivers of shareholder value that management has influenced Financial and stock performance that has far outpaced pay growth Growth since 2014 (10 years):1 +75% Revenue (5x > CEO pay growth) +128% EPS2 (8.5x > CEO pay growth) +231% Total Shareholder Return (outperforming S&P 500 and peers; 15x > CEO pay growth) +15% CEO Pay Since 2014 (+1.4%/year) Attraction and retention of best-in-class leadership team driving this performance ~20 years average tenure for executive officers (25 years for NEOs) Consistently strong Say on Pay support Average of 93% (with a minimum of 89% support) over past ten years 1. For a reconciliation with GAAP, please see Annex A. Results shown are measured from year-end 2013 outcomes. 2. Diluted, as-adjusted.

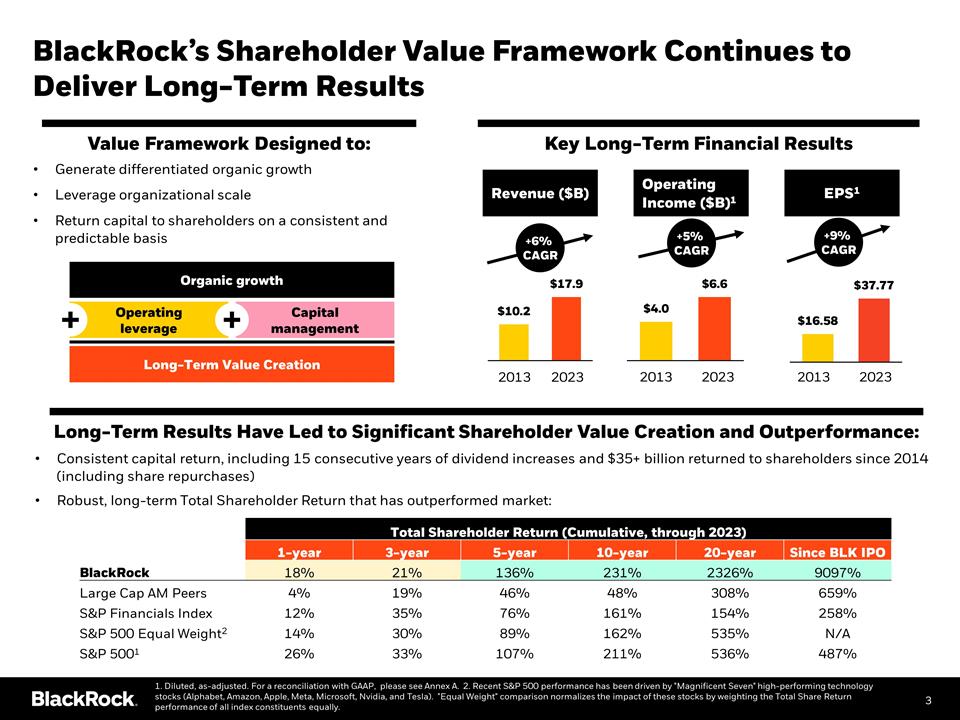

BlackRock’s Shareholder Value Framework Continues to Deliver Long-Term Results Generate differentiated organic growth Leverage organizational scale Return capital to shareholders on a consistent and predictable basis +6% CAGR Revenue ($B) +5% CAGR Operating Income ($B)1 +9% CAGR EPS1 Consistent capital return, including 15 consecutive years of dividend increases and $35+ billion returned to shareholders since 2014 (including share repurchases) Robust, long-term Total Shareholder Return that has outperformed market: Total Shareholder Return (Cumulative, through 2023) 1-year 3-year 5-year 10-year 20-year Since BLK IPO BlackRock 18% 21% 136% 231% 2326% 9097% Large Cap AM Peers 4% 19% 46% 48% 308% 659% S&P Financials Index 12% 35% 76% 161% 154% 258% S&P 500 Equal Weight2 14% 30% 89% 162% 535% N/A S&P 5001 26% 33% 107% 211% 536% 487% Long-Term Value Creation Operating leverage Capital management Organic growth Value Framework Designed to: Long-Term Results Have Led to Significant Shareholder Value Creation and Outperformance: Key Long-Term Financial Results 1. Diluted, as-adjusted. For a reconciliation with GAAP, please see Annex A. 2. Recent S&P 500 performance has been driven by "Magnificent Seven" high-performing technology stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla). "Equal Weight" comparison normalizes the impact of these stocks by weighting the Total Share Return performance of all index constituents equally.

Financial goals disclosed upfront and require differentiated performance (vs. Market) to return target-level payouts Average payout since BPIP inception in 2015: 107% of target Cliff vests after three years; vesting value tied to stock price Far Exceeds: 110%-125% Meets/Exceeds: 90%-110% Partially Meets: 60%-90% Does Not Achieve: 0%-60% Compensation Framework Reinforces Shareholder Value Framework and Aligns Pay Outcomes with Business Outcomes Discretion in holistic pay and performance assessment process is guided by objective structural elements, including weighted performance categories, pre-set performance measures and capped payout ranges BPIP uses rigorous, pre-set, 3-year financial goals aligned to Shareholder Value Framework: Organic revenue growth measures growth in baseline revenue from client mandates Operating margin (as-adj.) measures ability to efficiently leverage organizational scale 1. For reconciliation with GAAP, please see Annex A. 2. Total annual incentive includes the NEO’s annual cash award, deferred equity award and long-term equity award. 3. 2023 total incentive compensation is calculated using 2022 total incentive compensation multiplied by applicable performance incentive percentage. BlackRock Performance % of Award Opportunity Measures include (peer comparisons, multi-year results and internal BlackRock metrics are also considered) Financial Performance Business Strength Organizational Strength Holistic, structured performance assessments using Framework below determine Annual Incentive Awards ("Variable Pay"; 94% of NEO pay): Net New Base Fees Net New Business Organic Revenue Growth Operating Income, as adjusted(1) Operating Margin, as adjusted1 Diluted EPS, as adjusted1 Total Shareholder Return and P/E Multiple Deliver on commitments to clients (e.g., investment performance and protecting client interests) Grow with clients’ needs and evolve how we serve clients Lead in a changing world (e.g., thought leadership and stewardship of better financial futures across the globe) Deliver sustainable solutions for clients (e.g., lead the industry in meeting clients’ needs for sustainable investing and analytics) Talent pipeline and development (e.g., attracting, developing and retaining talent and continuing to fortify executive succession plans) Diversity, equity and inclusion Purpose and culture (e.g., employee engagement, wellness, and connectivity to the BlackRock principles) Corporate sustainability Assessment / Total Incentive Percentage Outcome (% of prior year’s award)2,3 50%+ of Resulting Annual Incentive Award is Delivered in Long-Term, Formulaic BPIP Awards: Additional 19% of Annual Incentive Award delivered through time-based RSUs

Purpose of Structured, Discretionary Performance and Pay Assessment Process in NEO Compensation Framework The MDCC believes that the disciplined and judicious use of discretion in assessing performance, leading to the determination of NEO incentive awards, is in the best interest of BlackRock and its shareholders. Structured discretion allows MDCC to consider individual contributions and quality of results in context of global market and industry conditions While proxy advisors favor incentive plans tied formulaically to short-term financial targets, such a program would not as accurately reflect and reward for NEO influence on results, given the impact of capital markets on our financial results Actual performance results and individual NEO achievements (attributable to pre-set measures approved by the MDCC) are disclosed for shareholders in detail in BlackRock's proxy statement, in lieu of short-term financial targets Reward management appropriately in a business impacted in part by global capital market dynamics Structured discretion enables decision-making that is long-term in nature, unhindered by an overreliance on short-term, rigid financial goals Motivates critical leadership behaviors: Horizontal leadership and collaboration Strategic agility and innovation in response to market opportunities Long-term, transformational investments in the business that may have a multi-year payback period (e.g., acquisition of GIP) Motivate leadership behaviors that create long-term shareholder value We use structured discretion to help set our annual incentive compensation levels, resulting in the disciplined pay outcomes and performance results highlighted in this supplement

Compensation Framework continues to drive consistent and responsible outcomes, demonstrated by 2023 pay totals below 2020 pay despite financial growth over the trailing three-year period: MDCC considered multi-year pay and performance trajectories in determining 2023 NEO pay, including the 30%+ declines in NEO compensation determined for 2022 pay following a historically difficult year for the industry 2023 CEO TAC is 8% lower than 2020 despite financial and share price growth over the period TAC is 23% below 2021 high watermark ($36m) when Say on Pay approval was 95% Track record of multi-year financial outperformance Includes remaining an above-median performer in ISS’ and Glass Lewis’ relative, 3-year weighted financial performance analyses relative to proxy advisor-selected peer groups Pay-for-Performance Alignment (3-Year CEO Pay) Key Recent Results: 3-Year Growth (cumulative since 2020 year-end) CEO TAC Revenue Operating Income (as-adj.)1 EPS (as-adj.)1 AUM TSR Total Capital Return (8%) 10% 2% 9% 15% 21% $14 billion Financial Performance ($M) AUM ($B) (left scale) (left scale) (right scale) 93% 95% 92% -- Say on Pay Support Following Year-End +21% (30%) +9% Strong Alignment Between CEO Pay and Financial Growth 2023 Pay Determination: Multi-Year Context 1. For reconciliation with GAAP, please see Annex A.

Appendix

Compensation Framework has Led to Disciplined Pay Outcomes Over the Long-Term 15% CEO Pay (+1.4% / year) 75% Revenue 64% Operating Income, as adj.1 128% EPS, as adj.1 131% AUM 231% Total Shareholder Return $35.3 billion Capital Returned Disciplined Pay Outcomes CEO Pay vs. Financial Growth Growth since 2014 (i.e., end of 2013): 1. For a reconciliation with GAAP, please see Annex A. +8% +0% (2%) +10% (14%) +5% +18% +21% (30%) +9% Operating Income (left scale) Revenue (left scale) AUM (right scale) CEO Pay (bar chart) 98% 91% 90% 89% 96% 94% 93% 95% 92% -- Say on Pay Support Following Year-End

Compensation Program is Driven by Pay-for-Performance and Aligned with Shareholder Interests 66% Equity Base Salary (Cash) Annual Incentive (Cash) Annual Incentive (Deferred Equity) Long-Term Incentive (BPIP); grant size determined by Annual Incentive Framework 1. Includes stock-based incentives (66% of TAC) and 50% of cash bonus given 50% weighting to financial performance (14% of TAC). 2023 CEO Pay Mix 95% Variable / At-Risk 80% Tied to BLK performance1 Historical BPIP Outcomes 3-year organic revenue growth 3-year operating margin (as-adj.) Tied to two key drivers of shareholder value:

Annex A Non-GAAP Reconciliation

($mm) Reconciliation between GAAP and as adjusted Note: For additional information on the non–GAAP expense adjustments and explanations on the use of non–GAAP measures, see BlackRock's Form 10–K for the applicable period. 2013 to 2015 information reflects accounting guidance prior to the adoption of the new revenue recognition standard. For further information, refer to Note 2, Significant Accounting Policies, in the consolidated financial statements in our 2018 Form 10–K. Beginning in the first quarter of 2022, the BlackRock updated its definition of operating income, as adjusted, operating margin, as adjusted, and net income attributable to BlackRock, Inc., as adjusted, to include adjustments related to amortization of intangible assets, other acquisition–related costs, including compensation costs for nonrecurring retention–related deferred compensation, and contingent consideration fair value adjustments incurred in connection with certain acquisitions. Information from 2018 to 2022 reflects updated definitions. 2013 to 2017 does not reflect updated definitions. For further information, please see pages 37–38 of our 2022 Form 10-K.. Beginning in the first quarter of 2023, BlackRock updated the definitions of its non-GAAP financial measures to exclude the impact of market valuation changes on certain deferred cash compensation plans which the Company began economically hedging in 2023. For further information see pages 41-43 of the 2023 Form 10-K.

Note: For additional information on the non–GAAP expense adjustments and explanations on the use of non–GAAP measures, see BlackRock's Form 10–K for the applicable period. 2013 to 2015 information reflects accounting guidance prior to the adoption of the new revenue recognition standard. For further information, refer to Note 2, Significant Accounting Policies, in the consolidated financial statements in our 2018 Form 10–K. Beginning in the first quarter of 2022, the BlackRock updated its definition of operating income, as adjusted, operating margin, as adjusted, and net income attributable to BlackRock, Inc., as adjusted, to include adjustments related to amortization of intangible assets, other acquisition–related costs, including compensation costs for nonrecurring retention–related deferred compensation, and contingent consideration fair value adjustments incurred in connection with certain acquisitions. Information from 2018 to 2022 reflects updated definitions. 2013 to 2017 does not reflect updated definitions. For further information, please see pages 37–38 of our 2022 Form 10-K.. Beginning in the first quarter of 2023, BlackRock updated the definitions of its non-GAAP financial measures to exclude the impact of market valuation changes on certain deferred cash compensation plans which the Company began economically hedging in 2023. For further information see pages 41-43 of the 2023 Form 10-K. Non-GAAP adjustments, excluding income tax matters, are net of tax. ($mm, except per share data) Reconciliation between GAAP and as adjusted