UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________________________

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013 | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-33139

HERTZ GLOBAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 20-3530539 (I.R.S. Employer Identification Number) | |

225 Brae Boulevard Park Ridge, New Jersey 07656-0713 (201) 307-2000 (Address, including Zip Code, and telephone number, including area code, of registrant's principal executive offices) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, Par Value $0.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | o | Non-accelerated filer | o | Smaller reporting company | o |

(Do not check if a smaller reporting company) | |||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 28, 2013, the last business day of the registrant's most recently completed second fiscal quarter, based on the closing price of the stock on the New York Stock Exchange on such date was $10,530,523,399.

As of March 17, 2014, 447,677,308 shares of the registrant's common stock were outstanding.

Documents incorporated by reference:

Portions of the Registrant's Proxy Statement for its Annual Meeting of Stockholders scheduled for May 14, 2014 are incorporated by reference into Part III.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

Page | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

ITEM 15. | ||

INTRODUCTORY NOTE

Unless the context otherwise requires, in this Annual Report on Form 10-K, or “Annual Report,” (i) “Hertz Holdings” means Hertz Global Holdings, Inc., our top-level holding company, (ii) “Hertz” means The Hertz Corporation, our primary operating company and a direct wholly-owned subsidiary of Hertz Investors, Inc., which is wholly-owned by Hertz Holdings, (iii) “we,” “us” and “our” mean Hertz Holdings and its consolidated subsidiaries, including Hertz and Dollar Thrifty Automotive Group, Inc. or "Dollar Thrifty," (iv) “HERC” means Hertz Equipment Rental Corporation, Hertz's wholly-owned equipment rental subsidiary, together with our various other wholly-owned international subsidiaries that conduct our industrial, construction, material handling and entertainment equipment rental business, (v) “cars” means cars, crossovers and light trucks (including sport utility vehicles and, outside North America, light commercial vehicles), (vi) “program cars” means cars purchased by car rental companies under repurchase or guaranteed depreciation programs with car manufacturers, (vii) “non-program cars” means cars not purchased under repurchase or guaranteed depreciation programs for we are exposed to residual risk and (viii) “equipment” means industrial, construction and material handling equipment.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained or incorporated by reference in this Annual Report and in reports we subsequently file with the United States Securities and Exchange Commission, or the “SEC,” on Forms 10-K, 10-Q and file or furnish on Form 8-K, and in related comments by our management, include “forward-looking statements.” Forward-looking statements include information concerning our liquidity and our possible or assumed future results of operations, including descriptions of our business strategies. These statements often include words such as “believe,” “expect,” “project,” "potential," “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. We believe these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and our actual results could differ materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on SEC Forms 10-K, 10-Q and 8-K. Some important factors that could affect our actual results include, among others, those that may be disclosed from time to time in subsequent reports filed with the SEC, those described under “Risk Factors” set forth in Item 1A of this Annual Report, and the following, which were derived in part from the risks set forth in Item 1A of this Annual Report:

• | our ability to integrate the car rental operations of Dollar Thrifty and realize operational efficiencies from the acquisition; |

• | the operational and profitability impact of the divestitures that we agreed to undertake in order to secure regulatory approval for the acquisition of Dollar Thrifty; |

• | the effect of our proposed separation of HERC and ability to obtain the expected benefits of any related transaction; |

• | levels of travel demand, particularly with respect to airline passenger traffic in the United States and in global markets; |

• | significant changes in the competitive environment, including as a result of industry consolidation, and the effect of competition in our markets, including on our pricing policies or use of incentives; |

• | an increase in our fleet costs as a result of an increase in the cost of new vehicles and/or a decrease in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs; |

• | occurrences that disrupt rental activity during our peak periods; |

• | our ability to achieve cost savings and efficiencies and realize opportunities to increase productivity and profitability; |

• | our ability to accurately estimate future levels of rental activity and adjust the size and mix of our fleet accordingly; |

• | our ability to maintain sufficient liquidity and the availability to us of additional or continued sources of financing for our revenue earning equipment and to refinance our existing indebtedness; |

1

INTRODUCTORY NOTE (Continued)

• | safety recalls by the manufacturers of our vehicles and equipment; |

• | a major disruption in our communication or centralized information networks; |

• | financial instability of the manufacturers of our vehicles and equipment; |

• | any impact on us from the actions of our franchisees, dealers and independent contractors; |

• | our ability to maintain profitability during adverse economic cycles and unfavorable external events (including war, terrorist acts, natural disasters and epidemic disease); |

• | shortages of fuel and increases or volatility in fuel costs; |

• | our ability to successfully integrate acquisitions and complete dispositions; |

• | our ability to maintain favorable brand recognition; |

• | costs and risks associated with litigation and investigations; |

• | risks related to our indebtedness, including our substantial amount of debt, our ability to incur substantially more debt and increases in interest rates or in our borrowing margins; |

• | our ability to meet the financial and other covenants contained in our Senior Credit Facilities, our outstanding unsecured Senior Notes and certain asset-backed and asset-based arrangements; |

• | changes in accounting principles, or their application or interpretation, and our ability to make accurate estimates and the assumptions underlying the estimates, which could have an effect on earnings; |

• | changes in the existing, or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations where such actions may affect our operations, the cost thereof or applicable tax rates; |

• | changes to our senior management team; |

• | the effect of tangible and intangible asset impairment charges; |

• | the impact of our derivative instruments, which can be affected by fluctuations in interest rates and commodity prices; |

• | our exposure to fluctuations in foreign exchange rates; and |

• | other risks described from time to time in periodic and current reports that we file with the SEC. |

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

2

PART I

ITEM 1. BUSINESS

Our Company

Hertz operates its car rental business through the Hertz, Dollar, Thrifty and Firefly brands from approximately 11,555 corporate and franchisee locations in North America, Europe, Latin and South America, Asia, Australia, Africa, the Middle East and New Zealand. Hertz is the largest worldwide airport general use car rental brand, operating from approximately 10,090 corporate and franchisee locations in approximately 145 countries. Our Dollar and Thrifty brands have approximately 1,400 corporate and franchisee locations in approximately 75 countries and our Firefly brand has approximately 65 corporate and franchisee locations in seven countries. Our Hertz brand name is one of the most recognized in the world, signifying leadership in quality rental services and products. We are one of the only car rental companies that has an extensive network of company-operated rental locations both in the United States and in all major European markets. We believe that we maintain the leading airport car rental brand market share, by overall reported revenues, in the United States and at approximately 130 major airports in Europe where we have company-operated locations and where data regarding car rental concessionaire activity is available. We believe that we also maintain the second largest market share, by overall reported revenues, in the off-airport car rental market in the United States. In our equipment rental business segment, we rent equipment through approximately 335 branches in the United States, Canada, France, Spain, China and Saudi Arabia, as well as through our international franchisees. We and our predecessors have been in the car rental business since 1918 and in the equipment rental business since 1965. We also own Donlen Corporation, or "Donlen," based in Northbrook, Illinois, which is a leader in providing fleet leasing and management services. We have a diversified revenue base and a highly variable cost structure and are able to dynamically manage fleet capacity, the most significant determinant of our costs. Our revenues have grown at a compound annual growth rate of 6.9% over the last 20 years, with year-over-year growth in 17 of those 20 years.

Corporate History

Hertz Holdings was incorporated in Delaware in 2005 to serve as the top-level holding company for the consolidated Hertz business. Hertz was incorporated in Delaware in 1967. Hertz is a successor to corporations that have been engaged in the car and truck rental and leasing business since 1918 and the equipment rental business since 1965. Ford Motor Company acquired an ownership interest in Hertz in 1987. Prior to this, Hertz was a subsidiary of United Continental Holdings, Inc. (formerly Allegis Corporation), which acquired Hertz's outstanding capital stock from RCA Corporation in 1985.

On December 21, 2005, investment funds associated with or designated by:

• | Clayton, Dubilier & Rice, Inc., which was succeeded by Clayton, Dubilier & Rice, LLC, or “CD&R,” |

• | The Carlyle Group, or “Carlyle,” and |

• | Merrill Lynch & Co., Inc., or "Merrill Lynch," |

or collectively the “Sponsors,” acquired all of Hertz's common stock from Ford Holdings LLC. We refer to the acquisition of all of Hertz's common stock by the Sponsors as the “Acquisition.”

On September 1, 2011, Hertz completed the acquisition of Donlen Corporation, or "Donlen," a leading provider of fleet leasing and management services. See Note 4 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the caption "Item 8—Financial Statements and Supplementary Data."

In December 2011, Hertz purchased the noncontrolling interest of Navigation Solutions, L.L.C., thereby increasing its ownership interest from 65% to 100%.

On November 19, 2012, Hertz completed the acquisition of Dollar Thrifty, a car rental business. See Note 4 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the caption "Item 8—Financial Statements and Supplementary Data."

On December 12, 2012, Hertz completed the sale of Simply Wheelz LLC, a wholly-owned subsidiary of Hertz that operated our Advantage Rent A Car business. See Note 4 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the caption "Item 8—Financial Statements and Supplementary Data."

In December 2012, the Sponsors sold 50,000,000 shares of their Hertz Holdings common stock to J.P. Morgan as the sole underwriter in the registered public offering of those shares.

3

In March 2013, the Sponsors sold 60,050,777 shares of their Hertz Holdings common stock to Citigroup Global Markets Inc. and Barclays Capital Inc. as the underwriters in the registered public offering of those shares. In connection with the offering, Hertz Holdings repurchased from the underwriters 23,200,000 of the 60,050,777 shares of common stock sold by the Sponsors.

In May 2013, the Sponsors sold 49,800,405 shares of their remaining Hertz Holdings common stock to Goldman Sachs & Co. and J.P. Morgan Securities LLC as the underwriters in the registered public offering of those shares.

After giving effect to our initial public offering in November 2006, subsequent offerings and a March 2013 share repurchase, the Sponsors do not own any of the outstanding shares of common stock of Hertz Holdings, other than de minimus amounts held from time to time by the Sponsors and their affiliates in the ordinary course of business.

In May 2013, we announced plans to relocate our worldwide headquarters to Estero, Florida from Park Ridge, New Jersey over a two-year period.

Our Markets

We are engaged principally in the global car rental industry and equipment rental industry.

U.S. Car Rental

We believe that the global car rental industry exceeds $49.4 billion in annual revenues. According to Auto Rental News, car rental industry revenues in the United States were estimated to be approximately $24.5 billion for 2013 and grew in 2013 by 4.0%.

Rentals by airline travelers at or near airports, or ‘‘airport rentals,’’ are influenced by developments in the travel industry and particularly in airline passenger traffic, or ‘‘enplanements,’’ as well as the Gross Domestic Product, or ‘‘GDP.’’

The off-airport portion of the industry has rental volume primarily driven by local business use, leisure travel and the replacement of cars being repaired. However, we believe that in recent years, industry revenues from off-airport car rentals in the United States have grown faster than revenues from airport rentals.

International Car Rental

We believe car rental industry revenues in Europe account for over $13.4 billion in annual revenues, with the airport portion of the industry comprising approximately 38% of the total. Because Europe has generally demonstrated a lower historical reliance on air travel, the European off-airport car rental market is significantly more developed than it is in the United States. Within Europe, the largest markets are Germany, France, Spain, Italy and the United Kingdom. We believe total rental revenues for the car rental industry in Europe in 2013 were approximately $11.1 billion in 10 countries—Germany, the United Kingdom, France, Italy, Spain, the Netherlands, Belgium, the Czech Republic, Luxembourg and Slovakia—where we have company-operated rental locations and approximately $2.3 billion in 11 other countries—Ireland, Sweden, Portugal, Greece, Denmark, Austria, Poland, Finland, Malta, Hungary and Romania—where our Hertz brand is present through our franchisees.

We believe car rental industry revenues in Asia Pacific account for over $11.5 billion in annual revenues, with the airport portion of the industry comprising approximately 20% of the total. Within Asia Pacific, the largest markets are China, Australia, Japan and South Korea—where we have company-operated rental locations or where our Hertz brand is present through our franchisees.

Worldwide Equipment Rental

We estimate the size of the North American equipment rental industry, which is highly fragmented with few national competitors and many regional and local operators, increased to approximately $38.0 billion in annual revenues for 2013 from $35.7 billion in annual revenues for 2012, but the portion of the rental industry dealing with equipment of the type HERC rents is somewhat smaller than that. Other market data indicates that the equipment rental industries in China, France, Spain and Saudi Arabia generate approximately $5.1 billion, $4.4 billion, $1.7 billion and $0.5 billion in annual revenues, respectively, although the portions of those markets in which HERC competes are smaller.

The equipment rental industry serves a broad range of customers from small local contractors to large industrial national accounts and encompasses a wide range of rental equipment from small tools to heavy earthmoving equipment.

All Other Operations

In addition to car rental and equipment rental, we also operate our third party claim management services as well as Donlen, of which we acquired a 100% equity interest on September 1, 2011, a leading provider of fleet leasing and management services for corporate fleets.

4

We provide commercial fleet leasing and management services to corporate customers throughout the United States and Canada through Donlen, a wholly owned subsidiary of Hertz. Donlen is a fully integrated fleet management services provider with a comprehensive suite of product offerings ranging from leasing and managing vehicle fleets to providing other fleet management services to reduce fleet operating costs.

Our wholly-owned subsidiary, Hertz Claim Management Corporation, or “HCM,” provides claim administration services to us and, to a lesser extent, to third parties. These services include investigating, evaluating, negotiating and disposing of a wide variety of claims, including third-party, first-party, bodily injury, property damage, general liability and product liability, but not the underwriting of risks.

Our Business Segments

We have identified four reportable segments, which are organized based on the products and services provided by our operating segments and the geographic areas in which our operating segments conduct business, as follows: rental of cars, crossovers and light trucks in the United States, or "U.S. car rental,” rental of cars, crossovers and light trucks internationally, or “international car rental," rental of industrial, construction, material handling and other equipment, or "worldwide equipment rental" and "all other operations," which includes our Donlen operating segment.

We historically aggregated our U.S., Europe, Other International and Donlen car rental operating segments together to produce a worldwide car rental reportable segment. We have revised our segment results presented herein to reflect this new segment structure, including for prior periods.

U.S. Car Rental: Our “company-operated” rental locations are those through which we, or an agent of ours, rent cars that we own or lease. We maintain a substantial network of company-operated car rental locations in the United States and what we believe to be the largest number of company-operated airport car rental locations in the United States, enabling us to provide consistent quality and service. Our franchisees and associates also operate rental locations in the United States.

International Car Rental: We maintain a substantial network of company-operated car rental locations internationally. Our franchisees and associates also operate rental locations in approximately 140 countries and jurisdictions, including most of the countries in which we have company-operated rental locations.

Worldwide Equipment Rental: We believe that HERC is one of the largest equipment rental companies in the United States and Canada combined. HERC rents a broad range of earthmoving equipment, material handling equipment, aerial and electrical equipment, air compressors, generators, pumps, small tools, compaction equipment and construction-related trucks. HERC also derives revenues from the sale of new equipment and consumables as well as through its Hertz Entertainment Services division, which rents lighting and related aerial products used primarily in the U.S. entertainment industry.

All Other Operations: Donlen is a leading provider of fleet leasing and management services for corporate fleets. For the years ended December 31, 2013, 2012 and for the four months ended December 31, 2011 (the period during which Donlen was owned by Hertz), Donlen had an average of approximately 169,600, 150,800 and 137,000 vehicles under lease and management, respectively. Donlen's fleet management programs provide outsourcing solutions to reduce fleet operating costs and improve driver productivity. These programs include administration of preventive maintenance, advisory services, and fuel and accident management along with other complementary services. Additionally, Donlen brings to Hertz a specialized consulting and technology expertise that will enable us to model, measure and manage fleet performance more effectively and efficiently.

5

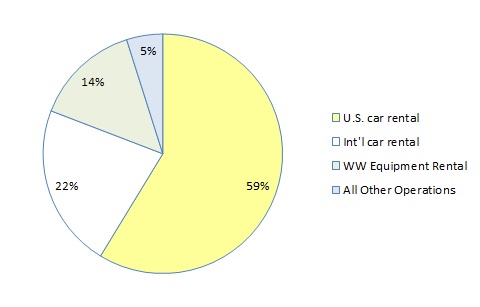

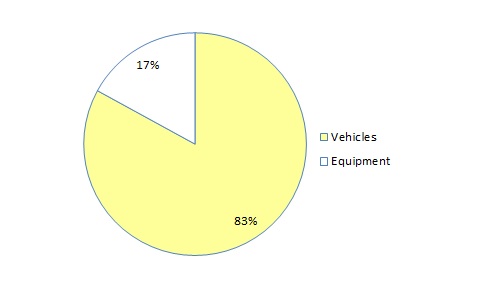

Set forth below are charts showing revenues by reportable segment, and revenues by geographic area, both for the year ended December 31, 2013 and revenue earning equipment at net book value as of December 31, 2013 (the majority of our international operations are in Europe).

Revenues by Segment for Year Ended December 31, 2013(1) $10.8 billion | Revenues by Geographic Area for Year Ended December 31, 2013 $10.8 billion |

|  |

Revenue Earning Equipment at net book value as of December 31, 2013 $14.2 billion | |

| |

_______________________________________________________________________________

(1) | Segment revenues includes fees and certain cost reimbursements from franchisees. See Note 11 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the caption “Item 8—Financial Statements and Supplementary Data.” |

For further information on our business segments, including financial information for the years ended December 31, 2013, 2012 and 2011, see Note 11 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the caption “Item 8—Financial Statements and Supplementary Data.”

U.S. and International Car Rental

Our U.S. and international car rental segments generated $6,324.4 million and $2,382.5 million, respectively, in revenues during the year ended December 31, 2013.

Our Brands

Our U.S. and international car rental businesses are primarily operated through four brands - Hertz, Dollar, Thrifty and Firefly. Each of our brands generally maintains separate airport counters, reservations and reservation systems, marketing and all other customer contact activities, however a single management team manages all four brands. As we integrate the Dollar and Thrifty brands into our operations, we expect to eliminate many of the duplicative functions previously performed separately by Dollar Thrifty and identify synergies through combined fleet management, insurance, information technology functions, back office processing and procurement.

6

The Hertz brand is one of the most recognized brands in the world. Our customer surveys, in the United States, indicate that Hertz is the car rental brand most associated with the highest quality service. This is consistent with numerous published best-in class car rental awards that we have won, both in the United States and internationally, over many years. We have sought to support our reputation for quality and customer service in car rental through a variety of innovative service offerings, such as our customer loyalty program and our global expedited rental program (Gold Plus Rewards), our one-way rental program (Rent-it-Here/Leave-it-There), our national-scale luxury rental program (Prestige Collection), our sports car rental program (Adrenaline Collection), our environmentally friendly rental program (Green Traveler Collection), our elite sports and luxury rental car program (Dream Cars), our car sharing service (Hertz 24/7TM) and our in-car navigational services (Hertz NeverLost). We intend to maintain our position as a premier provider of rental services through an intense focus on service, quality and product innovation.

Dollar and Thrifty are positioned as value car rental brands in the travel industry. The Dollar brand's main focus is serving the airport vehicle rental market, which is comprised of business and leisure travelers. The majority of its locations are on or near airport facilities. Dollar operates primarily through company-owned locations in the United States and Canada, and also licenses to independent franchisees which operate as a part of the Dollar brand system. Thrifty serves both the airport and off-airport markets through company-owned locations in the United States and Canada and licenses to independent franchisees which operate as part of the Thrifty brand system.

In April 2009, we acquired certain assets of Advantage Rent A Car, or “Advantage” a brand focused on price-oriented customers at key leisure travel destinations, and began operating the Advantage brand as part of our business. On December 12, 2012, we divested the Simply Wheelz subsidiary, which owned and operated the Advantage brand, together with selected Dollar Thrifty airport concession to Adreca Holdings Corp., a subsidiary of Macquarie Capital which was later merged into a subsidiary of Franchise Services of North America Inc. Immediately prior to the divestiture, Advantage was operating at 62 U.S. locations, including 35 on-airport locations where Advantage held concessions. For more information about our divestiture of Advantage see “Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources,” in this Annual Report

In March 2013, we launched our Firefly brand, which is a deep value brand for price conscious leisure travelers, in Europe. In August 2013, we announced the expansion of our Firefly brand into the U.S. The Company plans to have Firefly locations servicing local area airports in select U.S. and international leisure markets where other deep value brands have a significant presence. Firefly will enable the company to re-enter the deep value, leisure car rental market in the U.S. which it temporarily exited after divesting the Advantage brand in December 2012. The addition of Firefly will generate incremental fleet sharing, systems and operational synergies. Adding Firefly is part of a strategic objective to offer multiple brands to provide customers a full range of rental services at different pricing points. As of December 31, 2013, there were approximately 20 Firefly locations in the U.S. and 45 Firefly locations internationally. These locations consisted of both corporate and franchisee locations in the U.S., Mexico, Spain, France, Italy, Switzerland and Portugal.

Operations

Locations

Airport Locations

As of December 31, 2013, we had approximately 3,575 staffed rental locations in the United States, of which approximately one-fifth were airport locations and four-fifths were off-airport locations, and we regularly rent cars from approximately 1,980 other locations that are not staffed. As of December 31, 2013, we had approximately 1,285 staffed rental locations internationally, of which approximately one-fifth were airport locations and four-fifths were off-airport locations, and we regularly rent cars from approximately 160 other locations that are not staffed. Our international car rental operations have company-operated locations in France, Australia, Italy, the United Kingdom, Germany, Spain, Canada, Brazil, the Netherlands, New Zealand, Belgium, Puerto Rico, the Czech Republic, Luxembourg, Slovakia and the U.S. Virgin Islands. We believe that our extensive U.S. and international network of company-operated locations contributes to the consistency of our service, cost control, fleet utilization, yield management, competitive pricing and our ability to offer one-way rentals.

In order to operate airport rental locations, we have obtained concessions or similar leasing, licensing or permitting agreements or arrangements, or “concessions,” granting us the right to conduct a car rental business at all major, and many other airports in each country where we have company-operated rental locations, except for airports where our franchisees operate rental locations. Our concessions were obtained from the airports' operators, which are typically governmental bodies or authorities, following either negotiation or bidding for the right to operate a car rental business there. The terms of an airport concession typically require us to pay the airport's operator concession fees based upon

7

a specified percentage of the revenues we generate at the airport, subject to a minimum annual guarantee. Under most concessions, we must also pay fixed rent for terminal counters or other leased properties and facilities. Most concessions are for a fixed length of time, while others create operating rights and payment obligations that are terminable at any time.

The terms of our concessions typically do not forbid us from seeking, and in a few instances actually require us to seek, reimbursement from customers of concession fees we pay; however, in certain jurisdictions the law limits or forbids our doing so. Where we are required or permitted to seek such reimbursement, it is our general practice to do so. Certain of our concession agreements require the consent of the airport's operator in connection with material changes in our ownership. A growing number of larger airports are building consolidated airport rental car facilities to alleviate congestion at the airport. These consolidated rental facilities may eliminate certain competitive advantages among the brands as competitors operate out of one centralized facility for both customer rental and return operations, share consolidated busing operations and maintain image standards mandated by the airports. See “Item 1A—Risk Factors” in this Annual Report.

Off-Airport Locations

In addition to our airport locations, we operate off-airport locations offering car rental services to a variety of customers. Our off-airport rental customers include people wishing to rent cars closer to home for business or leisure purposes, as well as those needing to travel to or from airports. Our off-airport customers also include people who have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance companies following accidents in which their cars were damaged, those expecting to lease cars that are not yet available from their leasing companies and those needing cars while their vehicle is being repaired or is temporarily unavailable for other reasons; we call these customers “replacement renters.”

When compared to our airport rental locations, an off-airport rental location typically services the same variety of customers, uses smaller rental facilities with fewer employees, conducts pick-up and delivery services and deals with replacement renters using specialized systems and processes. In addition, on average, off-airport locations generate fewer transactions per period than airport locations. At the same time, though, our airport and off-airport rental locations employ common car fleets, are supervised by common country, regional and local area management, use many common systems and rely on common maintenance and administrative centers. Moreover, airport and off-airport locations, excluding replacement rentals, benefit from many common marketing activities and have many of the same customers. As a consequence, we regard both types of locations as aspects of a single, unitary, car rental business.

We believe that the off-airport portion of the car rental market offers opportunities for us on several levels. First, presence in the off-airport market can provide customers a more convenient and geographically extensive network of rental locations, thereby creating revenue opportunities from replacement renters, non-airline travel renters and airline travelers with local rental needs. Second, it can give us a more balanced revenue mix by reducing our reliance on air travel and therefore limiting our exposure to external events that may disrupt airline travel trends. Third, it can produce higher fleet utilization as a result of the longer average rental periods associated with off-airport business, compared to those of airport rentals. Fourth, replacement rental volume is far less seasonal than that of other business and leisure rentals, which permits efficiencies in both fleet and labor planning. Finally, cross-selling opportunities exist for us to promote off-airport rentals among frequent airport Hertz Gold Plus Rewards program renters and, conversely, to promote airport rentals to off-airport renters. In view of those benefits, along with our belief that our market share for off-airport rentals is generally smaller than our market share for airport rentals, we intend to seek profitable growth in the off-airport rental market, both in the United States and internationally.

Since January 1, 2009, we increased the number of our off-airport rental locations in the United States by 69% to approximately 2,785 locations. Our strategy includes selected openings of new off-airport locations, the disciplined evaluation of existing locations and the pursuit of same-store sales growth. We anticipate that same-store sales growth will be driven by our traditional leisure and business traveler customers and by increasing our market share in the insurance replacement market, in which we currently have a relatively low market share. As we move forward, our determination of whether to continue to expand our U.S. off-airport network will be based upon a combination of factors, including, commercial activity and potential profitability as well as the concentration of target insurance company policyholders, car dealerships and auto body shops. We also intend to increase the number of our staffed off-airport rental locations internationally based on similar criteria.

Rates

We rent a wide variety of makes and models of cars. We rent cars on an hourly (in select markets), daily, weekend, weekly, monthly or multi-month basis, with rental charges computed on a limited or unlimited mileage rate, or on a time

8

rate plus a mileage charge. Our rates vary at different locations depending on local market conditions and other competitive and cost factors. While cars are usually returned to the locations from which they are rented, we also allow one-way rentals from and to certain locations. In addition to car rentals and franchisee fees, we generate revenues from reimbursements by customers of airport concession fees and vehicle licensing costs, fueling charges, and charges for ancillary customer products and services such as supplemental equipment (child seats and ski racks), loss or collision damage waiver, theft protection, liability and personal accident/effects insurance coverage, premium emergency roadside service, Hertz NeverLost navigation systems and satellite radio services.

Reservations

We accept reservations for our cars on a brand-by-brand basis, with each of our brands maintaining, and accepting reservations through, an independent Internet site. Our brands generally accept reservations only for a class of vehicles, although Hertz accepts reservations for specific makes and models of vehicles in our Prestige Collection, our Adrenaline Collection, our Green Traveler Collection, our Dream Cars collection and a limited number of models in high-volume, leisure-oriented destinations. Beginning in December 2010, we made the next generation of electric vehicles available to the general public, initially through our Hertz 24/7TM car sharing service. Electric vehicles have been added to our fleet and are available at various cities across the U.S. such as New York, Washington D.C. and San Francisco, in Europe and in China. We plan continued deployment of electric vehicles and plug-in hybrid electric vehicles in both the U.S. and other countries throughout 2014.

When customers reserve cars for rental from us and our franchisees, they may seek to do so through travel agents or third-party travel websites. In many of those cases, the travel agent or website will utilize a third-party operated computerized reservation system, also known as a Global Distribution System, or “GDS,” to contact us and make the reservation.

In major countries, including the United States and all other countries with company-operated locations, customers may also reserve cars for rental from us and our franchisees worldwide through local, national or toll-free telephone calls to our reservations center, directly through our rental locations or, in the case of replacement rentals, through proprietary automated systems serving the insurance industry. Additionally, we accept reservations for rentals worldwide through our websites, for us and our franchisees. We also offer the ability to reserve cars through our smartphone apps for the Hertz, Dollar and Thrifty brands.

For the year ended December 31, 2013, approximately 32% of the worldwide reservations we accepted came through our websites, while 27% through travel agents using GDSs, 14% through phone calls to our reservations center, 20% through third-party websites and 7% through local booking sources and tour reservations.

Customer Service Offerings

At our major airport rental locations, as well as at some smaller airport and off-airport locations, customers participating in our Hertz Gold Plus Rewards program are able to rent vehicles in an expedited manner. In the United States, participants in our Hertz Gold Plus Rewards program often bypass the rental counter entirely and proceed directly to their vehicles upon arrival at our facility. Participants in our Hertz Gold Plus Rewards program are also eligible to earn Gold Plus Rewards points that may be redeemed for free rental days. For the year ended December 31, 2013, rentals by Hertz Gold Plus Rewards members accounted for approximately 40% of our worldwide rental transactions. We believe the Hertz Gold Plus Rewards program provides a significant competitive advantage to us, particularly among frequent travelers, and we have targeted such travelers for participation in the program.

Hertz has introduced a number of customer service offerings in recent years in order to further differentiate itself from the competition. The most significant new offering was Gold Choice. Hertz Gold Choice now offers Gold Plus Rewards members an option to choose the car they drive. Members' cars are still preassigned but Gold Choice allows the member the option to choose a different model and color from those cars available at the new Gold Choice area. This service is free of charge to Hertz Gold Plus Rewards members who book a midsize class or above. The Gold Choice program was launched during August 2011 and rolled out to 53 U.S. airport locations and 8 locations in Europe by December 2013. Hertz also offers a Mobile Gold Alerts service, also known as "Carfirmations™," through which an SMS text message and/or email is sent with the vehicle information and location, with the option to choose another vehicle from their smart phone prior to arrival. It is available to participating Gold customers approximately 30 minutes prior to their arrival and Hertz e-Return, which allows customers to drop off their car and go at the time of rental return. Additionally, in select locations customers can bypass the rental line through our ExpressRent Kiosks.

9

Global Car-Sharing

In late 2008, we introduced a global car-sharing service, now referred to as Hertz 24/7TM, which rents cars by the hour and/or by the day, at various locations in the U.S., Canada and Europe. Hertz 24/7TM allows customers to sign up for free for the service and to rent cars by the hour or by the day. Members reserve vehicles online, then pick up the vehicles at various locations throughout a city, at a university or a corporate campus without the need to visit a Hertz rental office. Customers are charged an hourly or daily car-rental fee which includes fuel, insurance, 24/7 roadside assistance, in-car customer service and an allowance to drive 180 miles per 24 hour period.

Customers and Business Mix

We categorize our car rental business based on two primary criteria: the purpose for which customers rent from us (business or leisure) and the type of location from which they rent (airport or off-airport). The table below sets forth, for the year ended December 31, 2013, the percentages of rental revenues and rental transactions in our U.S. and international operations derived from business and leisure rentals and from airport and off-airport rentals.

Year ended December 31, 2013 | |||||||||||

U.S. | International | ||||||||||

Revenues | Transactions | Revenues | Transactions | ||||||||

Type of Car Rental | |||||||||||

By Customer: | |||||||||||

Business | 35 | % | 40 | % | 46 | % | 46 | % | |||

Leisure | 65 | 60 | 54 | 54 | |||||||

100 | % | 100 | % | 100 | % | 100 | % | ||||

By Location: | |||||||||||

Airport | 74 | % | 76 | % | 56 | % | 57 | % | |||

Off-airport | 26 | 24 | 44 | 43 | |||||||

100 | % | 100 | % | 100 | % | 100 | % | ||||

Customers who rent from us for “business” purposes include those who require cars in connection with commercial activities, the activities of governments and other organizations or for temporary vehicle replacement purposes. Most business customers rent cars from us on terms that we have negotiated with their employers or other entities with which they are associated, and those terms can differ substantially from the terms on which we rent cars to the general public. We have negotiated arrangements relating to car rental with many large businesses, governments and other organizations, including most Fortune 500 companies.

Customers who rent from us for “leisure” purposes include not only individual travelers booking vacation travel rentals with us but also people renting to meet other personal needs. Leisure rentals, generally, are longer in duration and generate more revenue per transaction than do business rentals, although some types of business rentals, such as rentals to replace temporarily unavailable cars, have a long average duration. Also included in leisure rentals are rentals by customers of U.S. and international tour operators, which are usually a part of tour packages that can also include air travel and hotel accommodations. Business rentals and leisure rentals have different characteristics and place different types of demands on our operations. We believe that maintaining an appropriate balance between business and leisure rentals is important to the profitability of our business and the consistency of our operations.

Our business and leisure customers rent from both our airport and off-airport locations. Demand for airport rentals is correlated with airline travel patterns, and transaction volumes generally follow enplanement and GDP trends on a global basis. Customers often make reservations for airport rentals when they book their flight plans, which make our strong relationships with travel agents, associations and other partners (e.g., airlines) a key competitive advantage in generating consistent and recurring revenue streams.

Off-airport rentals typically involve people wishing to rent cars closer to home for business or leisure purposes, as well as those needing to travel to or from airports and replacement renters. This category also includes people who have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance companies because their cars have been damaged. In order to attract these renters, we must establish agreements with the referring insurers establishing the relevant rental terms, including the arrangements made for billing and payment. While we estimate our share of the insurance replacement rental market was approximately 14% of the estimated insurance rental revenue volume in the U.S. for the year ended December 31, 2013, we have identified approximately 200

10

insurance companies, ranging from local or regional carriers to large, national companies, as our target insurance replacement market. As of December 31, 2013, we were a preferred or recognized supplier of 182 of these approximately 200 insurance companies and a co-primary at 37 of these approximately 200 insurance companies.

We conduct active sales and marketing programs to attract and retain customers. Our commercial and travel industry sales force calls on companies and other organizations whose employees and associates need to rent cars for business purposes. In addition, our sales force works with membership associations, tour operators, travel companies and other groups whose members, participants and customers rent cars for either business or leisure purposes. A specialized sales force calls on companies with replacement rental needs, including insurance and leasing companies and car dealers. We also advertise our car rental offerings through a variety of traditional media channels, such as television and newspapers, direct mail and the Internet. In addition to advertising, we also conduct a variety of other forms of marketing and promotion, including travel industry business partnerships and press and public relations activities.

In almost all cases, when we rent a car, we rent it directly to an individual who is identified in a written rental agreement that we prepare. Except when we are accommodating someone who cannot drive, the individual to whom we rent a car is required to have a valid driver's license and meet other rental criteria (including minimum age and creditworthiness requirements) that vary on the basis of location and type of rental. Our rental agreements permit only licensed individuals renting the car, people signing additional authorized operator forms and certain defined categories of other individuals (such as fellow employees, parking attendants and in some cases spouses or domestic partners) to operate the car.

With rare exceptions, individuals renting cars from us are personally obligated to pay all amounts due under their rental agreements. They typically pay us with a charge, credit or debit card issued by a third party, although certain customers use a Hertz charge account that we have established for them, usually as part of an agreement between us and their employer. For the year ended December 31, 2013, all amounts charged to Hertz charge accounts established in the United States and by our international subsidiaries, were billed directly to a company or other organization or were guaranteed by a company. We also issue rental vouchers and certificates that may be used to pay rental charges, mostly for prepaid and tour-related rentals. In addition, where the law requires us to do so, we rent cars on a cash basis. For the year ended December 31, 2013, no customer accounted for more than 6.0% of our car rental revenues.

In the United States for the year ended December 31, 2013, 80% of our car rental revenues came from customers who paid us with third-party charge, credit or debit cards, 10% came from customers using rental vouchers or another method of payment, while 9% came from customers using Hertz charge accounts or direct billing and 1% came from cash transactions. For the year ended December 31, 2013, bad debt expense represented 0.3% of car rental revenues for our U.S. operations.

In our international operations for the year ended December 31, 2013, 46% of our car rental revenues came from customers who paid us with third-party charge, credit or debit cards, while 27% came from customers using Hertz charge accounts, 26% came from customers using rental vouchers or another method of payment and 1% came from cash transactions. For the year ended December 31, 2013, bad debt expense represented 0.3% of car rental revenues for our international operations.

Fleet

We believe we are one of the largest private sector purchasers of new cars in the world. During the year ended December 31, 2013, we operated a peak rental fleet in the United States of approximately 524,500 cars and a combined peak rental fleet in our international operations of approximately 179,500 cars, and in each case exclusive of our franchisees' fleet and Donlen's leasing fleet. During the year ended December 31, 2013, our approximate average holding period for a rental car was eighteen months in the United States and thirteen months in our international operations.

Under our repurchase programs, the manufacturers agree to repurchase cars at a specified price or guarantee the depreciation rate on the cars during established repurchase or auction periods, subject to, among other things, certain car condition, mileage and holding period requirements. Repurchase prices under repurchase programs are based on either a predetermined percentage of original car cost and the month in which the car is returned or the original capitalized cost less a set daily depreciation amount. Guaranteed depreciation programs guarantee on an aggregate basis the residual value of the cars covered by the programs upon sale according to certain parameters which include the holding period, mileage and condition of the cars. These repurchase and guaranteed depreciation programs limit our residual risk with respect to cars purchased under the programs and allow us to determine depreciation expense in advance, however, typically the acquisition cost is higher for these program cars.

11

Program cars as a percentage of all cars purchased by our U.S. and international operations were as follows:

Years ended December 31, | ||||||||||||||

2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||

U.S. | 18 | % | 19 | % | 45 | % | 54 | % | 48 | % | ||||

International | 57 | % | 53 | % | 55 | % | 56 | % | 57 | % | ||||

We have purchased a significant percentage of our car rental fleet from the following vehicle manufacturers:

For the year ended December 31, 2013 | |||||

U.S. | International | ||||

General Motors Company | 28 | % | 15 | % | |

Toyota Motor Company | 11 | % | 10 | % | |

Ford Motor Company | 13 | % | 22 | % | |

Nissan Motor Company | 16 | % | 4 | % | |

Purchases of cars are financed through cash from operations and by active and ongoing global borrowing programs. See “Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources,” in this Annual Report.

We maintain automobile maintenance centers at certain airports and in certain urban and off-airport areas, which provide maintenance facilities for our car rental fleet. Many of these facilities, which include sophisticated car diagnostic and repair equipment, are accepted by automobile manufacturers as eligible to perform and receive reimbursement for warranty work. Collision damage and major repairs are generally performed by independent contractors.

We dispose of non-program cars, as well as program cars that become ineligible for manufacturer repurchase or guaranteed depreciation programs, through a variety of disposition channels, including auctions, brokered sales, sales to wholesalers and dealers and, to a lesser extent and primarily in the United States, sales at retail through a network of approximately 65 company-operated car sales locations dedicated to the sale of used cars from our rental fleet.

During 2009, we launched Rent2Buy, an innovative program designed to sell used rental cars. The program was licensed to operate in 34 states as of December 31, 2013. Customers have an opportunity for a three-day test rental of a competitively priced car from our rental fleet. If the customer purchases the car, he or she is credited with up to three days of rental charges, and the purchase transaction is completed through the internet and by mail in those states where permitted.

During the year ended December 31, 2013, of the cars in our U.S. car rental operations that were not repurchased by manufacturers, we sold approximately 47% at auction, 39% through dealer direct and 14% through our Rent2Buy program or at retail locations. During the year ended December 31, 2013, of the cars in our international car rental operations that were not repurchased by manufacturers, we sold approximately 83% through dealer direct, 12% at auction and 5% through our Rent2Buy program or at retail locations.

Franchisees Under Our Hertz Brand

We believe that our extensive worldwide ownership of car rental operations contributes to the consistency of our high-quality service, cost control, fleet utilization, yield management, competitive pricing and our ability to offer one-way rentals. However, in certain U.S. and international markets, we have found it more efficient to utilize independent franchisees, which rent cars that they own. Our franchisees operate locations in approximately 140 countries, including most of the countries where we have company-operated locations. See “Item 1A—Risk Factors” in this Annual Report.

We believe that our franchisee arrangements are important to our business because they enable us to offer expanded national and international service and a broader one-way rental program. Licenses are issued principally by our wholly-owned subsidiaries, under franchise arrangements to independent franchisees and affiliates who are engaged in the car rental business in the United States and in many other countries.

Franchisees generally pay fees based on a percentage of their revenues or the number of cars they operate. The operations of all franchisees, including the purchase and ownership of vehicles, are financed independently by the franchisees, and we do not have any investment interest in the franchisees or their fleets. Franchisees in the U.S.

12

share in the cost of our U.S. advertising program, reservations system, sales force and certain other services. Our European and other international franchisees also share in the cost of our reservations system, sales force and certain other services. In return, franchisees are provided the use of the Hertz brand name, management and administrative assistance and training, reservations through our reservations channels, the Gold Plus Rewards and #1 Club Gold programs, our “Rent-it-Here/Leave-it-There” one-way rental program and other services. In addition to car rental, certain franchisees outside the United States engage in car leasing, chauffeur-driven rentals and renting camper vans under the Hertz name.

U.S. franchisees ordinarily are limited as to transferability without our consent and are terminable by us only for cause or after a fixed term. Franchisees in the United States may generally terminate for any reason on 90 days' notice. In Europe and certain other international jurisdictions, franchisees typically do not have early termination rights. Initial license fees or the price for the sale to a franchisee of a company-owned location may be payable over a term of several years. We continue to issue new licenses and, from time to time, purchase franchisee businesses.

Franchisees Under Our Dollar Thrifty Brands

Both Dollar and Thrifty sell U.S. franchises on an exclusive basis for specific geographic areas, generally outside the top 75 U.S. airport markets. Most franchisees are located at or near airports that generate a lower volume of vehicle rentals than the airports served by company-owned locations. In Canada, Dollar and Thrifty sell franchises in markets generally outside the top eight airport markets. The typical length of a franchise is five to ten years with a renewal option for five years if certain conditions are met. The franchisee may terminate the franchise for convenience upon 90 to 120 days written notice and Dollar and Thrifty may terminate upon breach of the agreement or for cause as defined in the agreement.

Dollar and Thrifty offer franchisees the opportunity to dual franchise in smaller U.S. and Canadian markets. Under a dual franchise, one franchisee can operate both the Dollar and the Thrifty brand, thus allowing them to generate more business in their market while leveraging fixed costs.

Dollar and Thrifty license to franchisees the use of their respective brand service marks in the vehicle rental and leasing and parking businesses. Franchisees of Dollar and Thrifty pay an initial franchise fee generally based on the population, number of airline passengers, total airport vehicle rental revenues and the level of any other vehicle rental activity in the franchised territory, as well as other factors. Dollar and Thrifty offer their respective franchisees a wide range of products and services which may not be easily or cost effectively available from other sources.

System Fees in the U.S.

Dollar - In addition to an initial franchise fee, each Dollar U.S. franchisee generally pays a system fee as a percentage of rental revenue at airport locations and off-airport operations.

Thrifty - In addition to an initial franchise fee, each Thrifty U.S. franchisee generally pays a fee as a percentage of rental revenue.

System Fees in Canada

All Dollar and Thrifty Canadian franchisees, whether operating a single-brand or co-brand location, pay a monthly fee generally based on a percentage of rental revenue.

Franchisee Services and Products

Dollar and Thrifty provide their U.S. and Canadian franchisees a wide range of products and services, including reservations, marketing programs and assistance, branded supplies, image and standards, rental rate management analysis and customer satisfaction programs. Additionally, Dollar and Thrifty offer their respective franchisees centralized corporate account and tour billing and travel agent commission payments.

Other International

Dollar and Thrifty offer master franchises outside the U.S. and Canada, generally on a countrywide basis. Each master franchisee is permitted to operate within its franchised territory directly or through subfranchisees. At December 31, 2013, exclusive of the U.S. and Canada, Dollar had franchised locations in 55 countries and Thrifty had franchised locations in 69 countries. These locations are in Latin America, Europe, the Middle East, Africa and the Asia-Pacific regions. Dollar and Thrifty offer franchisees the opportunity to license the rights to operate either the Dollar or the Thrifty brand or both brands in certain markets on a dual franchise or co-brand basis.

13

Competition

In the United States, in addition to local and regional vehicle rental companies, our principal car rental industry competitors are Avis Budget Group, Inc., or “ABG,” which currently operates the Avis, Budget, ZipCar and Payless brands and Enterprise Holdings, which operates the Enterprise Rent-A-Car Company, or "Enterprise," National Car Rental and Alamo brands.

In Europe, in addition to us, the principal pan-European participants in the car rental industry are ABG, operating the Avis and Budget brands, and Europcar. Europcar also operates the National Car Rental and Alamo brands in the United Kingdom and Germany, and through franchises in Spain, Italy and France. In certain European countries, there are also other companies and brands with substantial market shares, including Sixt AG (operating the Sixt brand) in Germany, France, Spain, the United Kingdom, Switzerland, Belgium, Netherlands and Luxembourg; and Enterprise (operating the Enterprise brand) in the United Kingdom, Ireland and Germany. Apart from Enterprise-branded operations, all of which Enterprise owns, the other major car rental brands are present in European car rental markets through a combination of company-operated and franchisee-operated locations.

Competition among car rental industry participants is intense and is primarily based on price, vehicle availability and quality, service, reliability, rental locations and product innovation. We believe, however, that the prominence and service reputation of the Hertz brand, our extensive worldwide ownership of car rental operations and our commitment to innovation and service provide us with a competitive advantage. Our acquisition of Dollar and Thrifty brands adds two popular value leisure brands enabling us to compete across multiple market segments.

Worldwide Equipment Rental

Our worldwide equipment rental segment generated $1,538.0 million in revenues during the year ended December 31, 2013.

Operations

Product Offerings

We, through HERC, operate an equipment rental business in the United States, Canada, France, Spain, China and Saudi Arabia. On the basis of total revenues, we believe HERC is one of the largest equipment rental companies in the United States and Canada combined. HERC has operated in the United States since 1965.

HERC's principal business is the rental of equipment. HERC offers a broad range of equipment for rental; major categories include earthmoving equipment, material handling equipment, aerial and electrical equipment, lighting, air compressors, pumps, generators, small tools, compaction equipment and construction-related trucks.

Ancillary to its rental business, HERC is also a dealer of certain brands of new equipment in the United States, and sells consumables such as gloves and hardhats at many of its rental locations globally.

HERC's comprehensive line of equipment enables it to supply equipment to a wide variety of customers from local contractors to large industrial plants. The fact that many larger companies, particularly those with industrial plant operations, now require single source vendors, not only for equipment rental, but also for management of their total equipment needs fits well with HERC's core competencies. Arrangements with such companies may include maintenance of the tools and equipment they own, supplies and rental tools for their labor force and custom management reports. HERC supports this through its dedicated in-plant operations, tool trailers and plant management systems.

Locations

As of December 31, 2013, 2012 and 2011, HERC had a total of approximately 335, 340 and 320 branches, respectively, in the U.S., Canada, France, Spain, China and Saudi Arabia. HERC's rental locations generally are located in industrial or commercial zones.

HERC's broad equipment line in the United States and Canada also includes equipment with an acquisition cost of under $10,000 per unit, ranging from air compressors and generators to small tools and accessories, in order to supply customers who are local contractors with a greater proportion of their overall equipment rental needs. As of December 31, 2013, these activities, referred to as “general rental activities,” were conducted at approximately 32% of HERC's U.S. and Canadian rental locations.

Business Initiatives

In early 2010, Hertz launched Hertz Entertainment Services, a division which provides single-source car and equipment rental solutions to the entertainment and special events industries. Hertz Entertainment Services provides customized

14

vehicle and equipment rental solutions to movie, film and television productions, live sports and entertainment events, and all-occasion special events, such as conventions, and fairs. Hertz Entertainment Services are tailored to fit the needs of large and small productions alike with competitive pricing and customized, monthly billing. Hertz delivers vehicles and equipment to production locations and a dedicated staff is available 24/7 to address specific client needs. Productions can also rent equipment for use at special events such as lighting, generators and other machinery.

In February 2010, HERC entered into a joint venture with Saudi Arabia based Dayim Holdings Company, Ltd. to set up equipment rental operations in the Kingdom of Saudi Arabia. The joint venture entity rents and sells equipment and tools to construction and industrial markets throughout the Kingdom of Saudi Arabia.

Customers

HERC's customers consist predominantly of commercial accounts and represent a wide variety of industries, such as construction, petrochemical, automobile manufacturing, railroad, power generation, shipbuilding and entertainment and special events. Serving a number of different industries enables HERC to reduce its dependence on a single or limited number of customers in the same business and somewhat reduces the seasonality of HERC's revenues and its dependence on construction cycles. HERC primarily targets customers in medium to large metropolitan markets. For the year ended December 31, 2013, no customer of HERC accounted for more than 3% of HERC's worldwide rental revenues. Of HERC's combined U.S. and Canadian rental revenues for the year ended December 31, 2013, approximately 38% were derived from customers operating in the construction industry (the majority of which were in the non-residential sector) and approximately 26% were derived from customers in the industrial business, while the remaining revenues were derived from rentals to governmental and other types of customers.

Unlike in our car rental business, where we enter into rental agreements with the end-user who will operate the cars being rented, HERC ordinarily enters into a rental agreement with the legal entity-typically a company, governmental body or other organization-seeking to rent HERC's equipment. Moreover, unlike in our car rental business, where our cars are normally picked up and dropped off by customers at our rental locations, HERC delivers much of its rental equipment to its customers' job sites and retrieves the equipment from the job sites when the rentals conclude. HERC extends credit terms to many of its customers to pay for rentals. Thus, for the year ended December 31, 2013, 95% of HERC's revenues came from customers who were invoiced by HERC for rental charges, while 5% came from customers paying with third-party charge, credit or debit cards, cash or used another method of payment. For the year ended December 31, 2013, bad debt expense represented 0.4% of HERC's revenues.

Fleet

HERC acquires its equipment from a variety of manufacturers. The equipment is typically new at the time of acquisition and is not subject to any repurchase program. The per-unit acquisition cost of units of rental equipment in HERC's fleet varies from over $200,000 to under $100. As of December 31, 2013, the average per-unit acquisition cost (excluding small equipment purchased for less than $5,000 per unit) for HERC's fleet in the United States was approximately $39,300. As of December 31, 2013, the average age of HERC's worldwide rental fleet was 43 months.

HERC disposes of its used equipment through a variety of channels, including private sales to customers and other third parties, sales to wholesalers, brokered sales and auctions.

Franchisees

HERC licenses the Hertz name to equipment rental businesses in seven countries in Europe, one country in the Middle East, two countries in Central Asia and two countries in Central and South America. The terms of those licenses are broadly similar to those we grant to our international car rental franchisees.

Competition

HERC's competitors in the equipment rental industry range from other large national companies to small regional and local businesses. In each of the six countries where HERC operates, the equipment rental industry is highly fragmented, with large numbers of companies operating on a regional or local scale. The number of industry participants operating on a national scale is, however, much smaller. HERC is one of the principal national-scale industry participants in the U.S., Canada and France. HERC's operations in the United States represented approximately 71% of our worldwide equipment rental revenues during the year ended December 31, 2013. In the United States and Canada, the other top national-scale industry participants are United Rentals, Inc., or “URI,” Sunbelt Rentals, Home Depot Rentals and Aggreko North America. A number of individual Caterpillar, Inc., or “CAT,” dealers also participate in the equipment rental market in the United States, Canada, France and Spain. In France, the other principal national-scale industry participants are Loxam, Kiloutou and Laho. Aggreko also participates in the power generation rental markets in France and Spain. In China, the other principal national-scale industry participants are Zicheng Corporation, Aggreko, Jin He

15

Yuan, Lei Shing Hong and Far East Rental. In Saudi Arabia, the other principal national-scale industry participants are Bin Quraya, Al Zahid Tractors (CAT), Saudi Diesel, Rapid Access, Eastern Arabia and Rental Solutions & Services (RSS) Saudi Ltd.

Competition in the equipment rental industry is intense, and it often takes the form of price competition. HERC's competitors, some of which may have access to substantial capital, may seek to compete aggressively on the basis of pricing. To the extent that HERC matches downward competitor pricing without reducing our operating costs, it could have an adverse impact on our results of operations. We believe that HERC's competitive success has been primarily the product of its approximately 50 years of experience in the equipment rental industry, its systems and procedures for monitoring, controlling and developing its branch network, its capacity to maintain a comprehensive rental fleet, the quality of its sales force and its established national accounts program.

All Other Operations

Our all other operations segment generated $527.0 million in revenues during the year ended December 31, 2013.

Our all other operations segment consists of our Donlen subsidiary, together with other business activities, such as our third party claim management services. On September 1, 2011, Hertz acquired 100% of the equity of Donlen, a leading provider of fleet leasing and management services for corporate fleets, based in Northbrook, Illinois.

Our wholly-owned subsidiary, Hertz Claim Management Corporation, or “HCM,” provides claim administration services to us and, to a lesser extent, to third parties. These services include investigating, evaluating, negotiating and disposing of a wide variety of claims, including third-party, first-party, bodily injury, property damage, general liability and product liability, but not the underwriting of risks. HCM conducts business at five regional offices in the United States. Separate subsidiaries of ours conduct similar operations in seven countries in Europe.

Donlen provides a comprehensive array of fleet leasing, financing, telematics, and management services to commercial fleets in the U.S. and Canada. Products offered by Donlen include:

• | Vehicle financing, acquisition and remarketing; |

• | License, title, and registration; |

• | Maintenance consultation; |

• | Fuel management; |

• | Accident management; |

• | Telematics-based location, driver performance and scorecard reporting; and |

• | Equipment financing |

Donlen’s primary product for car and light to medium truck fleets is an open-ended terminal rental adjustment clause, or "TRAC," lease. For most customers, vehicle must be leased for a minimum of 12 months, after which the lease converts to a month-to-month lease allowing the vehicle to be surrendered any time thereafter. Our sale of the vehicle following the termination of the lease may result in a TRAC adjustment, through which the customer is credited or charged with the surplus or loss on the vehicle. Approximately 80% of Donlen’s lease portfolio consists of floating-rate leases which allow lease charges to be adjusted based on benchmark indices.

Donlen offers financing solutions for heavier-duty trucks and equipment. Lease financing is provided through syndication arrangements with lending institutions. Donlen originates the leases, acquires the assets, and services the lease throughout the term.

Donlen provides services to leased and non-leased fleets. Services consist of fuel purchasing and management, preventive maintenance, repair consultation, and accident management. Additionally, Donlen manages license and title, vehicle registration, and regulatory compliance. Donlen’s telematics products provide enhanced visibility and reporting over driver and vehicle performance.

Fleet

Donlen’s leased fleet consists primarily of passenger cars, cargo vans and light-duty trucks. Vehicles are acquired directly from domestic and foreign manufacturers, as well as dealers. More than half of Donlen’s leased fleet is 2012 model year or newer.

For the years ended December 31, 2013, 2012 and for the four months ended December 31, 2011 (period it was owned by Hertz), Donlen had an average of approximately 169,600, 150,800 and 137,000 vehicles under lease and management, respectively.

16

Customers

Donlen’s relationships include some of the world’s most recognized brands among its diverse portfolio of customers. Donlen’s services customers in a wide variety of industries, with the lease portfolio not concentrated in any single type of industry.

Competitors

The commercial fleet market is one of the largest segments of the U.S. automotive industry, primarily consisting of cars, light-duty and medium-duty trucks utilized in a sales, service, or delivery application. The fleet management industry has experienced significant consolidation over the years and today our principal fleet management competitors in the U.S. and Canada are GE Capital, Automotive Resources International, PHH Corporation, Wheels, Inc. and LeasePlan Corporation N.V.

Seasonality

Generally, car rental and equipment rental are seasonal businesses, with decreased levels of business in the winter months and heightened activity during spring and summer. To accommodate increased demand, we increase our available fleet and staff during the second and third quarters of the year. As business demand declines, fleet and staff are decreased accordingly. However, certain operating expenses, including real estate taxes, rent, insurance, utilities, maintenance and other facility-related expenses, the costs of operating our information technology systems and minimum staffing costs, remain fixed and cannot be adjusted for seasonal demand. Revenues related to our fleet management services are generally not seasonal. See “Item 1A—Risk Factors” in this Annual Report. The following tables set forth this seasonal effect by providing quarterly revenues for each of the quarters in the years ended December 31, 2013, 2012 and 2011 (in millions of dollars).

______________________________________________________________________________